jdi tft display manufacturer

Japan Display Inc.(株式会社ジャパンディスプレイ, Kabushiki-gaisha Japan Disupurei), commonly called by its abbreviated name, JDI, is the Japanese display technology joint venture formed by the merger of the small and medium-sized liquid crystal display businesses of Sony, Toshiba, and Hitachi.

JDI had accumulated consecutive losses since its IPO, a restructuring plan was announced in 2017, including closing down a production line in Japan and layoffs of approximately a third of its workforce.

A newly-created entity INCJ, Ltd. had become the largest shareholder of JDI with 25,29 % of total shares since September 21, 2018 as a result of a corporate split of the old INCJ.

On June 12, 2019, JDI disclosed that major changes are to be implemented due to sluggish sales in the Mobile Business Division. It announced one plant would be closed and another has suspended operation. A major reduction of the workforce was also planned.Apple, boosting the stock price of JDI by 32 percent at the time.

On December 26, it officially entered talks to sell its plant in Hakusan, Ishikawa to Sharp Corporation for 80 to 90 billion yen which is about US$800 million, with a plan to avail the profit to the repayment of the loan made by Apple whose investment partially funded the construction of the plant.OLED displays.

Due to the financial trouble caused by its late decision to manufacture OLED displays and the loan from Apple, the company"s OLED affiliate, JOLED, has not yet been able to compete with other manufacturers, whilst more than half of JDI"s revenue still came from the shrinking IPS LCD panel sales to Apple.

In February 2020, Ichigo Asset management, a multinational private investment fund, gained control of JDI in exchange for US$715 million of investment. In turn, the memorandum signed with Suwa a year before was terminated.

In April 2020, in accordance with the talks held in December, JDI began to sell LCD production equipment valued at US$200 million to Apple, with plans to sell the real estate of the Hakusan plant to Sharp. This will allow JDI to focus on its remaining product demand and factories. The sales have been completed by October.

In July 2020, the CEO of JDI revealed the company"s plan to start mass production of OLED display panels for smartphones "as early as 2022" with a novel manufacturing technology, adding that it would require new funding.

JDI has produced active-matrix displays driven by TFTs based on a In-Plane-Switching technology developed by Hitachi also has been used. The company has developed an improvement for darker black pixels (true-black appearance), called "IPS-NEO", which reduces the light shining through from the backlighting.

Its "Pixel Eyes" technology incorporates the touch function into the LCD panel itself; combined with the company"s transparent display technology, a transparent fingerprint reader that could be featured in smartphones was announced in 2018.

For reflective LCDs without backlighting, JDI has developed an addressing technique using a thin-film memory device SRAM in addition to the conventional TFT for each pixel, so that a still image can be stored consuming a low amount of energy.

In December 2019, it announced that it has developed a 1.6-inch microLED display module with a pixel density of 265 ppi and a peak brightness of 3,000 nits, which can be assembled to form a large screen.

We develop, design, manufacture, and sell displays where it is necessary for the interface that deliver a lot of information at an instant and deliver it to the global market. We create interactive spaces that go beyond the expected, elevate everyday lives, and move people"s hearts. From bases in major cities in Asia, Europe, and North America, we build strong customer relationships by developing products that respond to market needs.

Japan Display Inc. (JDI) has successfully developed the world"s first backplane technology to radically improve the properties of conventional oxide semiconductor thin film transistors (OS-TFT) at its G6 Plant in Mobara, Japan, and will begin immediate commercialization of this new technology.

JDI"s new OS-TFT technology generates high-mobility oxide semiconductors (HMO), which have 2X the field-effect mobility of conventional OS-TFTs, and ultra-high mobility oxide semiconductors (UHMO), which have 4X higher field-effect mobility than conventional OS-TFT (hereafter, HMO/UHMO collectively referred to as "HMO"). UHMO"s field-effect mobility on JDI"s G6 mass production line is 52cm2/Vs, an extraordinarily high level. More broadly, HMO enables the same level of on-current flow as LTPS, while maintaining low off-leak current.

Transistor I-V Characteristic ComparisonJDI believes HMO will drastically accelerate display technology innovation and contribute to significant improvements in both OLED and LCD display performance, including:

・ For Metaverse VR/AR displays, higher resolutions and higher refresh rates, driving deeper immersion and reality integration for users in the Metaverse;

Conventional OS-TFTs have a problem of bias temperature stress (BTS), which causes poor reliability and image deterioration when trying to obtain high field-effect mobility.

However, by leveraging the manufacturing process know-how JDI has developed over many years, JDI has overcome these challenges with HMO, which is a new, breakthrough OS-TFT with superior characteristics. HMO achieves both high field-effect mobility and stable BTS to concurrently realize OS-TFT"s low off-leak current and LTPS"s image driving stability.

JDI believes that HMO is a breakthrough technology that has extremely broad application across display types and customer applications. As one use case, JDI plans to combine HMO with JDI"s next-generation OLED technology to expand G6 wearable display production, with a sales target for this use case of c. JPY 25 billion in FY26/3 and JPY 50 billion in FY27/3.

HMO builds upon JDI"s core capabilities in backplane technology built over many years. Thus, additional expenses required for HMO commercialization will be less than JPY 1 billion.

While HMO will have minimal impact on JDI"s current FY22/3 consolidated earnings, JDI believes it will reinforce JDI"s global display technology leadership and drive JDI"s long-term, sustainable growth.

Japan Display Inc. is a Japanese company that manufactures and supplies LCD panels for smartphones, tablets, automotive applications and laptops. The company was founded in 2010 and is headquartered in Tokyo, Japan. As of March 2016, the company had a market capitalization of US$2.4 billion.

Japan Display Inc."s products are used in a variety of electronic devices including smartphones, tablets, automotive applications and laptops. The company"s panels are used by major electronics manufacturers such as Apple Inc., Samsung Electronics Co., Ltd., LG Electronics Inc., HTC Corporation and Huawei Technologies Co., Ltd.

Japan Display Inc. (JDI) is a leading display panel manufacturer based in Tokyo, Japan. The company was formed in 2011 as a joint venture between Sony, Hitachi and Toshiba. JDI supplies LCD panels to some of the world’s largest electronics manufacturers, including Apple, LG and Samsung.

JDI’s cutting-edge technology has made it one of the leaders in the global display market. The company’s products are used in a wide range of devices, from smartphones and tablets to TVs and laptops. JDI has a strong R&D team that is constantly developing new display technologies. The company is publicly listed on the Tokyo Stock Exchange and had a revenue of US$5.6 billion in 2018.

Japan Display Inc. is a leading display panel manufacturer that designs, develops, and manufactures cutting-edge display panels and systems for smartphones, tablets, notebooks, automotive applications, digital cameras, camcorders and digital signage. The company has over 8,000 employees and operates 13 factories in 9 countries around the world.

Japan Display Inc. offers a wide range of products and services that are designed to meet the needs of its customers. The company’s product portfolio includes: LCD panels, OLED panels, touch panels, flexible displays and integrated modules. Japan Display Inc. also provides a variety of value-added services such as: design support, engineering support, production support and after-sales service. The company’s products are used in a variety of market segments including consumer electronics, automotive, industrial and medical. Japan Display Inc.

Japan Display Inc. (JDI) is a leading display manufacturer that designs, develops, and manufactures LCDs for smartphones, tablets, automotive applications, and other consumer electronics. The company went public in 2010 and is listed on the Tokyo Stock Exchange. JDI reported a net loss of ¥23.4 billion ($205 million) in the fiscal year ended March 31, 2016, compared to a net profit of ¥10.3 billion in the previous fiscal year. This was primarily due to lower sales of LCD panels for smartphones and increased competition from Chinese manufacturers.

Looking at Japan Display"s financial performance over the past few years, it"s clear that the company has been struggling to maintain profitability. In the fiscal year ended March 31, 2016, JDI reported a net loss of ¥23.4 billion ($205 million), compared to a net profit of ¥10.

One of the biggest challenges that Japan Display Inc. (JDI) is facing is the competition from South Korean and Chinese display manufacturers. JDI has been losing market share to these companies in recent years, and it is becoming increasingly difficult for JDI to compete on price. Additionally, JDI is also facing challenges from new technologies such as OLED and quantum dot displays. While JDI has developed its own OLED technology, it has yet to commercialize it on a large scale. And while quantum dot displays are not yet widely used in smartphones, they are expected to gain popularity in the coming years.

Another challenge for JDI is its reliance on Apple Inc. for a significant portion of its revenue. In 2017, Apple accounted for approximately 60% of JDI’s revenue.

Japan Display Inc. (JDI) has developed the world’s first flexible tactile sensor that enables high-precision measurement over a wide area using a matrix of LTPS TFTs (lowtemperature polysilicon thin-film transistors).

Highly accurate tactile measurement is required for the development of a number of new technologies and products, as well as for advanced sports and medical research. JDI’s flexible tactile sensor is suitable for a wide range of applications, such as measuring the grip strength of a robot grasping an object or the pressure distribution on the sole...

In response to strong customer demand, Japan Display Inc. (JDI) has further developed its breakthrough transparent Rælclear display technology and expects to begin mass production of a new 20.8-inch Rælclear display with 2X brightness in the fall of 2023.

With the world’s highest display transparency, Rælclear is a revolutionary display technology with glass-like transparency and sharp and vivid images fully visible from both the display’s front and back. Rælclear’s name was born from its unique two-way transparency: starting from t...

Accelerating the development of new display technologies is the goal for worldwide display manufacturers and some of them have decided to sell or buy new facilities as a move to approach their target.

Samsung Display has sold its LCD factory in China to Chinese display maker CSOT, a company under TCL group, to further cut down its LCD capacity, which goes in line with Samsung’s plan to quit LCD business. By ending its LCD panel production, Samsung aims to expand its development in QD displays and OLED displays. The Korean giant has also reportedly t...

Japan Display (JDI) is going to sell its LCD plant in Hakusan, Japan, to Sharp and Apple, so that the Japanese display maker can pay off its debt to Apple. The total transfer price is estimated to be JPY 71 billion (US$ 672 million).

The plant will be transferred to Sharp, who is also a display supplier of Apple, by the end of September. With the transaction, Sharp will take over most of the debt of JDI which JDI borrowed from Apple when building the plant. The plant was originally built for supplying LCD panels for iPhone. But S...

Sharp, one of the panel providers of Apple, is reportedly developing small size Micro LED displays and will mass produce the products by 2023 for eye-wear smart devices, reported Nikkan Kogyo Shimbun.

According to the report, Sharp Fukuyama Semiconductor, a subsidiary of Sharp, has developed Micro LED prototypes including a 0.38-inch full color panel featuring 1053 PPI and a 0.13-inch blue display with 3000 PPI. The company deploys its proprietary color conversion technology to achieve full color display and aims to mass produce the products in 2023 to 2024 for A...

Japan Display announced that the company has been involved in improper accounting treatment with a total padded operating profit of JPY 8.2 billion (US$ 76.12 million) in the past six years since 2014, when the company was listed on the first section of the Tokyo Stock Exchange. The company was investigated by a third-party committee and revealed the results on April 13, 2020.

The investigation showed that JDI recorded fictitious inventory of JPY 10 billion (US$92.86 million) in total since the fourth quarter of fiscal 2013. The investigation also...

Japan Display (JDI) announced the development of a Micro LED display. The prototype Micro LED display will be presented at “FINTECH JAPAN 2019,” which is taking place in Makuhari Messe from December 4 to 6, 2019. The 1.6-inch Micro LED display of JDI is based on LTPS backplane developed by the company and Micro LED chips from glō, a Micro LED technology provider. The display achieves a resolution of 265 ppi with a pixel number of 300*300. (Image: JDI) JDI also noted that the Micro LED display has a wide viewin...

Mini LED backlight solution seems to be a “must have” technology for all the panel exhibitors at this year’s Display Week. Despite that adopting Mini LED backlight to consumer electronic products is rather difficult due to high production cost; panel makers still proactively demonstrated related products. Therefore, Mini LED backlight might not be a flash in the pan. LEDinside noticed that almost every display maker participated in Display Week disclosed the focus on automotive display incorporating LCD panel and Mini LED backlight. The solut...

Japan Display Inc. (JDI) has been negotiating with Chinese companies and investors to receive financial supports of JPY 50 billion (US$ 440.65 million), reported NHK. The potential investors include mobile component producer Ofilm, automotive component manufacturer Minth Group and the Silk Road Fund.

With the support, the Chinese investors will hold 33 percent or more of the share of JDI, suppressing the current major shareholder INCJ, who owns 25.29 percent of the share. In addition to the investment, the Chinese investors were also reportedly offering a ...

LEDinside forecasts that the development of Mini LED will accelerate in 2019 and 2020 and its market value will reach US$ 1699 million by 2022. Several industry players including San’an, HC Semitek, Epistar, NationStar, Harvatek, and Macroblock have reported their progress of Mini LED development. Meanwhile, panel producers such as AUO, BOE, Innolux and JDI have also unveiled applications adopting Mini LED technology.

During Display Week 2018, many big giants have been simultaneously releasing Mini LED backlight products. LEDinside found those Mini LED panels majorly adopt direct-type local dimming and support HDR mode, making the vivid contract ratio, which can compete with OLED panel.

Japan Display Inc. (JDI) announced that it has developed a transparent glass-based capacitive fingerprint sensor by applying the company"s capacitive multi-touch technology used in its other liquid crystal displays (LCDs). JDI plans to start commercial shipments within its 2018 fiscal year, which ends March of 2019.

Appearing to be strapped for cash, smartphone screen manufacturer Japan Display (JDI) is currently in talks with Chinese panel makers, including BOE, Tianma, and CSOT, over an investment more than USD 1.8 billion. The Japanese company hopes to seal the deal by the end of March 2018, reported Kyodo News.

The Japanese digital panel giant Japan Display Inc. (JDI) had a struggle revamping its liquid crystal display (LCD) panel business. To make the recovery happen, JDI planned to accept fundings from outside investors. Not only that, JDI will restructure LCD panel production sites, and lay off employees at a large scale, slashing about 4,000 jobs, according to Nikkei"s report on August 8.

It has been spreading like crazy that in 2H17 three iPhone models- the high-end iPhone 8 featuring an OLED display, iPhone 7s and iPhone 7s Plus that continue to use LCD displays- will hit the shelves. Latest sources leaked Apple might increase OLED display use in its products and all the three new iPhones to roll out in 2018 are likely to sport OLED displays. That possibly implies orders Apple places with LCD display providers Sharp and Japan Display Inc. (JDI) would plummet. It will be much of a shock to JDI which earns over 50% of its revenue from Apple’s phone screen demand.

Sumitomo Chemical, the Japan-based chemical giant, is reported to have successfully developed new technologies to facilitate more cost efficient OLED display manufacture. According to Nikkei, the new materials and equipment the company introduced could possibly bring down the current production cost of OLED panels by 50%, which is able to further reduce the selling prices of OLED TVs and expand the penetration of OLED products.

Japan Display Inc. (JDI) announced the commencement of mass production at its newly-constructed low temperature poly-silicon (LTPS) LCD line in its Hakusan Plant, located in Hakusan City, Ishikawa Prefecture, Japan. JDI had been preparing for mass production since Dec. 1, and commenced mass production on Dec. 23.

Small to mid-sized display manufacturer Japan Display Inc. (JDI) third quarter financial results were in the red, due to lower demands than expected from Chinese clients and its largest client Apple, reported Chinese-language media Money DJ.

LCD display manufacturer Japan Display Inc. (JDI) developed an ultra-thin bezel LCD that is merely millimeters thick, which could greatly increase smartphone makers design flexibility, reported Nikkei.

Sharp President Tai Jeng-wu told The Nikkei and other reporters that it intended to collaborate with Japan Display Inc. (JDI) in the development of OLED displays to catch up with Korean competitors Samsung.

Japan Display Inc. (JDI), a manufactuerr of small to mid-sized LCD displays issued a statement on Saturday refuting claims made by Nikkeiand other media that it was seeking financial support from INCJ.

Innovation Network Corporation of Japan (“INCJ”), Japan Display Inc. (“JDI”), Sony Corporation (“Sony”), and Panasonic Corporation (“Panasonic”) announced hat they have executed a definitive agreement to establish a new company, JOLED Inc. (“JOLED”), to integrate Sony and Panasonic’s R&D functions for organic light-emitting diode (“OLED”) display panels. Through this collaboration, the companies aim to accelerate the development and early commercialization of OLED display panels. JOLED is scheduled to be launched in January 2015, subject to receipt of any necessary approvals.

Different displays have different characteristics, just tell Panox Display your application, and operating environment, Panox Display will suggest a suitable display for you.

But Panox Display is not a school, if customers don`t know the basic knowledge to design circuit boards, we suggest using our controller board to drive the display.

First, you need to check whether this display has On-cell or In-cell touch panel, if has, it only needs to add a cover glass on it. If not, it needs an external touch panel.

If you don`t know or don`t want to write a display program on Raspberry Pi, it`s better to get an HDMI controller board from us, and Panox Display will send a config.txt file for reference.

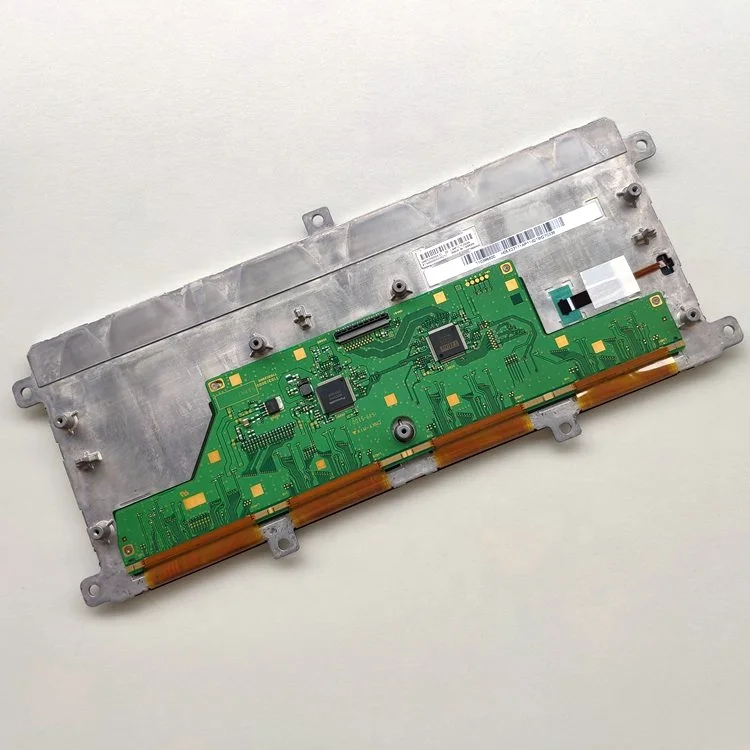

Kaohsiung Opto-Electronics (KOE), a subsidiary of Japan Display Inc. (JDI), has been formed to design, develop and manufacture TFT LCD display modules previously made by Hitachi Display Products.

Japan Display Inc. is the consolidated display business of Hitachi, Sony and Toshiba—creating the world’s largest manufacturer of small to medium sized LCD modules. The business merger resulted from the formation of a subsidiary named Kaohsiung Opto-Electronics, which is charged with the development and production of high quality, high performance TFT display modules for high-end applications and industrial markets.

In the Americas, a new organization, Kaohsiung Opto Electronics Americas Inc. (KOE Americas) will replace Hitachi Electronic Devices (USA) Inc. for LCD sales, design support and light manufacturing. KOE Americas will supply and support a wide range of standard passive STN and color TFT displays from 3.5-inches to 21.3-inches.

“KOE Americas will support its Americas customer base through an established Manufacturer’s Rep and distribution sales channels and regional sales management. Building upon the legacy established over 40 years at Hitachi Displays, KOE Americas to enter the market as a strong and confident, premium brand display supplier,” said Keith Brown, vice president of operations and sales of KOE Americas.

Kaohsiung Opto-Electronics has design and manufacturing facilities in Taiwan, including house design, production and procurement of key components such as LCD glass, color filters, LCD drivers and backlights. The company plans to increase its product portfolio to capture a greater market share in both TFT and custom STN displays.

JDI Europe manufactures LTPS LCD panels for the automotive, smartphones, tablets, wearables devices, and industrial products. The company has developed a 21.3-inch high resolution (5 MP) monochrome TFT display for medical diagnostic equipment. It has also developed Center Information Display (CID) and head-up displays for (HUD) for application in automobiles. In addition, it has developed Memory-in-Pixel solutions for smartphone applications.

Japan Display Inc. (JDI) announced the development of a 3.25-inch 1001ppi low temperature polysilicon (LTPS) TFT LCD specifically-designed for virtual reality (VR) head mount display (HMD) applications.

JDI plans to start commercial shipments by the end of March in 2019, and will accelerate the design of even higher resolution displays for VR-HMD applications in the future.

In order to achieve natural and realistic motion pictures in VR-HMD devices, the desired display characteristics are: high pixel density, improved motion blur, and low latency. JDI announced the development of a high-pixel-density 803ppi LCD last year, which helped to alleviate problems associated with users noticing pixel grid lines (i.e., pixelation). However, even more compact-size LCDs and higher magnification lenses are required to decrease the size and weight of HMD devices. 800ppi is not sufficient for this purpose. Instead, display resolution over 1000ppi is anticipated from the market.

JDI’s new 1001ppi LTPS TFT LCD not only features high pixel density, but also has improved LC response time from 4.5msec to 2.2msec (gray-to-gray, worst case) which helps to reduce motion blur. In addition to these features, the 1001ppi LTPS TFT LCD is able to operate at 120Hz refresh rate, though most displays for VR-HMD applications operate below 90Hz. This 120Hz refresh rate contributes to minimize system latency.

JDI will continue to strive to maintain its leading position in high-pixel-density displays for VR-dedicated HMD devices by leveraging it’s core technological competency in the development of LTPS TFT LCDs.

1001ppi LTPS TFT LCD will be demonstrated in JDI"s booth #917 at The Society of Information Display (SID) "Display Week", at the Los Angeles Convention Center, May 22 - May 24, 2018, in Los Angeles, California, USA.

SID"s Display Week is the premier international event for the electronic display industry, where breakthrough technologies are introduce. Display Week offers synergies unparalleled by any other display event, comprised of attendees and exhibitors representing the foremost display-engineering talent from all over the world, as well as leaders representing both the commercial and consumer markets.

Japan Display Inc. (JDI) is the leading global manufacturer of advanced small- and medium-sized LTPS LCD panels. By leveraging its advanced technologies and the world"s largest LTPS production capacity, JDI provides high resolution, low power consumption and thin displays for smartphones, tablets, automotive electronics, digital cameras, medical equipment and other electronic devices. JDI, which commenced operations in April 2012, was formed through the consolidation of the display panel businesses of Sony, Hitachi and Toshiba. The company"s common stock is traded on the Tokyo Stock Exchange with the securities code number 6740. For more information please visit: http://www.j-display.com/english/.

JDI was founded in 2012 by merging the three largest manufacturers of Sony, Toshiba, and Hitachi LCDs, and based on its technology, produces the highest quality products in the mobile, automotive, medical and industrial markets.

Idemitsu Kosan Co., Ltd. (“Idemitsu Kosan,” Head Office: Chiyoda-ku, Tokyo; President and Chief Executive Officer: Shunichi Kito), and Japan Display Inc. (“JDI,” Head Office: Minato-ku, Tokyo; Chairman and Chief Executive Officer: Scott Callon) have successfully co-developed an innovative poly-crystalline oxide semiconductor, Poly-OS, for use in a wide variety of displays, including wearable devices, smartphones, metaverse devices such as VR, Notebook PCs, and large-display TVs.

By integrating Idemitsu Kosan"s newly developed proprietary poly-crystalline oxide1 semiconductor material and JDI"s proprietary backplane2 technology, the new Poly-OS semiconductor contributes significantly to improving display performance by achieving both high mobility and low off-leak current3 on Gen 6 mass production lines. Poly-OS can also be deployed to large-size Gen 8 lines and above, significantly reducing display manufacturing costs. Both JDI and Idemitsu Kosan are committed to actively promoting this innovative technology globally.

Idemitsu Kosan started the development of a poly-crystalline oxide semiconductor material IGO (Indium Gallium Oxide) for flat panel displays as part of its electronic materials business in 2006. IGO has high mobility equivalent to low temperature polysilicon (LTPS)4, which could not be achieved with existing oxide semiconductors, along with stable thin-film transistor (TFT)5 characteristics that can be applied to Gen 8 and larger substrate lines.

JDI has succeeded in developing the world"s first practical application of Poly-OS on a Gen 6 mass production line at its Mobara Plant (Mobara City, Chiba Prefecture), using its proprietary backplane technology. JDI’s HMO (High Mobility Oxide) Poly-OS implementation achieves 4X higher field-effect mobility than conventional OS-TFTs. JDI announced this HMO technology breakthrough on March 30, 2022. (JDI release: "JDI Develops World’s First G6 Oxide Semiconductor TFT with 4X Improvement in Field-Effect Mobility – Breakthrough in Display Performance – ").

Both Idemitsu Kosan and JDI are supporting the ongoing development of Poly-OS technology so that it can be widely applied in diverse applications across the global display industry. JDI and Idemitsu Kosan are committed to contributing to a low-carbon society through display performance improvements, the evolution of the global display industry, and lower display power consumption.

Like a-Si6, conventional oxide semiconductor transistors can be easily manufactured on large areas and have low power consumption due to low off-leak current. However, their mobility is lower than that of LTPS, a high-performance technology mainly used in small- and medium-sized displays. The innovative Poly-OS semiconductor technology developed by JDI and Idemitsu Kosan significantly improves and resolves the challenges of conventional oxide’s low field-effect mobility, while enabling higher performance equivalent to LTPS. Poly-OS thus makes it possible to create products that bring together the best features of existing backplane technologies (Fig. 1).

Oxide materials with high electron mobility typically have difficulty controlling charge carriers and cannot be operated as transistors without modification. By integrating JDI’s proven process know-how in CVD8, sputter9, annealing10, and etching, Poly-OS makes possible stable operation with both high mobility and low off-leak current (Fig. 3 & 4). In addition, by adopting an optimal top-gate self-align structure11 (Fig. 5) to increase on-current12, stable characteristics that are independent of the channel width can be obtained even at 2 µm (the minimum channel length). The current driving capability is also equivalent to that of LTPS (Fig. 6).

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey