apple lcd display manufacturer

The problems faced by tertiary Apple display supplier BOE appear to have gone from bad to worse, according to a new report. The company is now in danger of losing all orders for the iPhone 14.

Too many of the company’s displays were failing to pass quality control checks, and BOE reportedly tried to solve this by quietly changing the specs – without telling Apple …

Chinese display manufacturer BOE was only ever third-placed in Apple’s supply chain, behind Samsung and LG, but was still hoping to make as many as 40M OLED screens this year for a range of iPhone models.

BOE hit two problems, however, which put this number in doubt. First, it was struggling to buy enough display driver chips. As we noted previously, these are one of the worst-hit components in the global chip shortage.

The biggest issue is not with CPUs and GPUs, but far more mundane chips like display drivers and power management systems. These relatively low-tech chips are used in a huge number of devices, including Apple ones.

Yield rates are always a challenge for Apple suppliers, as the company’s specs are often tighter than those set by other smartphone makers. Even Samsung Display, which has the most-advanced OLED manufacturing capabilities, has at times had yield rates as low as 60% for iPhone displays.

The Chinese display panel sent a C-level executive and employees to Apple’s headquarters following the incident to explain why they changed the circuit width of the transistors.

They also asked the iPhone maker to approve the production of OLED panels for iPhone 14, but didn’t receive a clear response from Apple, they also said.

Cupertino seems poised to give the order for around 30 million OLED panels it intended to give BOE before the incident to Samsung Display and LG Display instead.

Chinese display manufacturer Beijing Oriental Electronics (BOE) could lose out on 30 million display orders for the upcoming iPhone 14 after it reportedly altered the design of the iPhone 13’s display to increase yield rate, or the production of non-defective products, according to a report from The Elec (via 9to5Mac).

Apple tasked BOE with making iPhone 13 displays last October, a short-lived deal that ended earlier this month when Apple reportedly caught BOE changing the circuit width of the iPhone 13’s display’s thin-film transistors without Apple’s knowledge. (Did they really think Apple wouldn’t notice?).

This decision could continue to haunt BOE, however, as Apple may take the company off the job of making the OLED display for the iPhone 14 as well. According to The Elec, BOE sent an executive to Apple’s Cupertino headquarters to explain the incident and says it didn’t receive an order to make iPhone 14 displays. Apple is expected to announce the iPhone 14 at an event this fall, but The Elec says production for its display could start as soon as next month.

In place of BOE, The Elec expects Apple to split the 30 million display order between LG Display and Samsung Display, its two primary display providers. Samsung will likely produce the 6.1 and 6.7-inch displays for the upcoming iPhone 14 Pro, while LG is set to make the 6.7-inch display for the iPhone 14 Pro Max.

According to MacRumors, BOE previously only manufactured screens for refurbished iPhones. Apple later hired the company to supply OLED displays for the new iPhone 12 in 2020, but its first batch of panels failed to pass Apple’s rigorous quality control tests. Since the beginning of this year, BOE’s output has also been affected by a display driver chip shortage.

While Samsung will continue to supply approximately 80 per cent of iPhone displays, rumours claim that a little-known company called BOE looks set to become Apple’s second-largest OLED supplier. Not only is this a sign that Apple’s lowest-cost iPhone 12 model will likely make the leap from LCD to OLED this year, but it’s also a sign that Apple is looking to diversify which manufacturers it uses, and potentially looking to ready itself for a move into the display market itself.

You, like many of us when we first read the rumours, are probably wondering who the hell BOE is, and how it managed to score such a big deal despite its relatively unknown status. However, BOE is, in fact, the largest display manufacturer in China, supplying screens for smartphones, TVs and other electronic devices and home appliances.

The company, which was founded in Bejing in 1993 and acquired SK Hynix"s STN-LCD and OLED businesses back in 2001, is ranked second in the world when it comes to flexible OLED shipments, holding a market share of 11 per cent during the first quarter of this year. It, naturally, is still a long way behind market leader Samsung, which owned 81 per cent market share of the OLED market in the same quarter. Still, with a sizable chunk of the OLED market already under its belt, it perhaps won’t come as too much of a surprise – now, at least – that the firm already has some big-name allies.

BOE’s display technology is currently being utilised in Huawei"s most popular smartphone models, including the high-end P and Mate series, and it reportedly will manufacturer the palm-stretching screen set to appear on this year’s Huawei Mate 40.

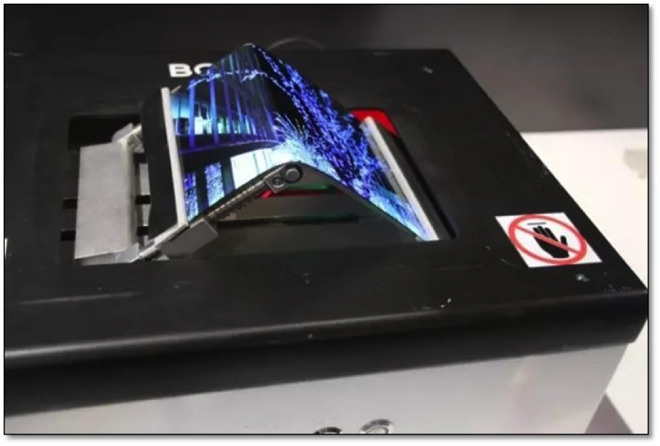

BOE even provided the flexible OLED used in the foldable Huawei Mate X, which has proven way more reliable than Samsung’s flexible OLED efforts. Perhaps, then, it’s somewhat unsurprising that Samsung is reportedly considering using BOE screens for its future devices, likely at the expense of its own industry-dominating Samsung Display unit.

BOE’s surprising alliance with Apple isn’t the only time the two companies have worked together, either; the Chinese manufacturer already makes LCD screens for Apple"s older iPhones, and its tiny OLED panels are currently used in some Apple Watch models. It’s unclear how much BOE and Apple’s latest deal is worth, but it’s likely in the billions. According to online reports, Samsung’s deal with the iPhone maker is thought to be worth around $20 billion annually, so if BOE manages to secure 20 per cent of Apple’s display orders going forward, such a deal could be worth as much as $4bn.

Although BOE has managed to muscle its way into Apple’s exclusive list of OLED suppliers, and has invested heavily in facilities and equipment in order to meet the firm’s demands, the new partnership hasn’t got off to a flying start. According to reports, the company’s flexible OLED panels have not yet passed Apple’s final validation. This means, according to rumours, that BOE’s screens might not show up in the first batch of iPhone 12 models, and will instead start shipping on handsets at the beginning of 2021, with Apple instead set to re-increase its reliance on LG in the short term.

Scenarios like this, along with the fact that Apple is clearly looking to lessen its reliance on big-name display makers, makes us think that it won’t be long until the company ultimately stops relying on others altogether; after all, it’s no secret that Apple wants to control every aspect of its hardware development.

The display market could be Apple’s next target. Not only does the company already manufacturer screen technology in the form of its Pro Display XDR, but a recent Bloomberg report claims that Apple is “designing and producing its own device displays” and is making a “significant investment” in MicroLED panels. This technology utilises newer light-emitting compounds that make them brighter, thinner and less power-intense than the current OLED displays.

Apple’s efforts in MicroLED are reportedly in the “advanced stages”; the company has applied for more than 30 patents, and recent rumours suggest the firm is also considering investing over $330 million in a secretive MicroLED factory with the goal of bringing the technology to its future devices.

For most customers, visiting a professional repair provider with certified technicians who use genuine Apple parts is the safest and most reliable way to get a repair. These providers include Apple and Apple Authorized Service Providers, and Independent Repair Providers, who have access to genuine Apple parts.* Repairs performed by untrained individuals using nongenuine parts might affect the safety of the device or functionality of the display. Apple displays are designed to fit precisely within the device. Additionally, repairs that don"t properly replace screws or cowlings might leave behind loose parts that could damage the battery, cause overheating, or result in injury.

Depending on your location, you can get your iPhone display replaced—in or out of warranty—by visiting an Apple Store or Apple Authorized Service Provider, or by shipping your iPhone to an Apple Repair Center. Genuine Apple parts are also available for out-of-warranty repairs from Independent Repair Providers or through Self Service Repair.*

The iPhone display is engineered together with iOS software for optimal performance and quality. A nongenuine display might cause compatibility or performance issues. For example, an issue might arise after an iOS software update that contains display updates.

* Independent Repair Providers have access to genuine Apple parts, tools, training, service guides, diagnostics, and resources. Repairs by Independent Repair Providers are not covered by Apple"s warranty or AppleCare plans, but might be covered by the provider"s own repair warranty. Self Service Repair provides access to genuine Apple parts, tools, and repair manuals so that customers experienced with the complexities of repairing electronic devices can perform their own out-of-warranty repair. Self Service Repair is currently available in certain countries or regions for specific iPhone models introduced in 2021 or later. To view repair manuals and order parts for eligible models, go to the Self Service Repair page.

Samsung Display is once again dominating the panel shipment for iPhones, reported Ross Young from DSCC (Display Supply Chain Consultants). According to internal info, Apple procured 82% of panels from Samsung, 12% from the Korean company LG Display and the other 6% from the Chinese BOE.

The Chinese maker BOE is on the other end - it is capable of manufacturing in great volumes but Apple has limited the purchases to the iPhone 14 series, with no Pro in sight. Samsung’s share is similar to what it was in the iPhone 13 series when it provided 83% of all panels.

Detailed info from Young, shipments from display factories to assembling plants were 1.8 million in June, 5.35 million in July, over 10 million in August and over 16.5 million in September. This means Apple is preparing to have at least 34 million units for the first three months of iPhone 14 sales.

The problems faced by tertiary Apple display supplier BOE appear to have gone from bad to worse, according to a new report. The company is now in danger of losing all orders for the iPhone 14.

Too many of the company’s displays were failing to pass quality control checks, and BOE reportedly tried to solve this by quietly changing the specs – without telling Apple …

Chinese display manufacturer BOE was only ever third-placed in Apple’s supply chain, behind Samsung and LG, but was still hoping to make as many as 40M OLED screens this year for a range of iPhone models.

BOE hit two problems, however, which put this number in doubt. First, it was struggling to buy enough display driver chips. As we noted previously, these are one of the worst-hit components in the global chip shortage.

The biggest issue is not with CPUs and GPUs, but far more mundane chips like display drivers and power management systems. These relatively low-tech chips are used in a huge number of devices, including Apple ones.

Yield rates are always a challenge for Apple suppliers, as the company’s specs are often tighter than those set by other smartphone makers. Even Samsung Display, which has the most-advanced OLED manufacturing capabilities, has at times had yield rates as low as 60% for iPhone displays.

The Chinese display panel sent a C-level executive and employees to Apple’s headquarters following the incident to explain why they changed the circuit width of the transistors.

They also asked the iPhone maker to approve the production of OLED panels for iPhone 14, but didn’t receive a clear response from Apple, they also said.

Cupertino seems poised to give the order for around 30 million OLED panels it intended to give BOE before the incident to Samsung Display and LG Display instead.

As CBN reports, after Sharp acquired the Hakusan factory of Japan Display Corporation (JDI) at the end of last month, yesterday Apple asked Sharp to increase the production of iPhone panels. So the Hakusan factory will restart within this year.

Chen Jun, chief analyst of Qunzhi Consulting, said today that Sharp will become the largest supplier of LCD (liquid crystal) screens for iPhones in the future and continue to increase its B2B business.

Apple’s latest iPhone 11 series currently uses LCD and OLED screens. The 5.8-inch iPhone 11 Pro and the 6.5-inch iPhone 11 Pro Max use OLED screens, while the 6.1-inch iPhone 11 use LCD panels.

As we have reported for many times, Apple’s next-generation iPhone 12 series will include four models. According to the current news, all four models in the series will use OLED screens.

Currently LGD, JDI and Sharp are the main LCD screen suppliers for Apple iPhones. However, LGD will supply OLED screens to Apple next year, thus exiting the list of LCD screen suppliers.

Prior to this, we also reported that the LCD screen required by Apple’s new SE series iPhone is currently exclusively supplied by its previous major LCD screen supplier, Japan Display Company (JDI). However, Sharp, which was acquired by Hon Hai Precision in 2016, subsequently also will supply LCD screens to Apple’s new iPhone SE.

Before the iPhone adopted the OLED screen, JDI was a major supplier of LCD panels for Apple smartphones. And Apple was also the main source of income for JDI. However, after Apple turned to OLED screens, JDI, which was not in time for transition, also fell into trouble. Apple has also rescued from multiple levels. In 2019, JDI still has 61% of revenue from Apple.

As I had hinted, Apple ended uptapping BOE Technologyfor their iPhone 13 OLED screens.BOE will initially split orders for the 6.1-inch iPhone 13 displays with Samsung Display, with the Chinese company"s share accounting for up to 20% of the total, sources said. Under the most optimistic scenario, BOE aims to grab 40% of orders for this model from the South Korean display giant, the people added.

Taiwanese and Japanese display makers have lost market share to the Chinese. Right now, the OLED space is between the South Korean players - LG and Samsung - and BOE.

With $19 billion in revenue, they are the world’s second largest OLED vendor and the biggest seller of flat panel displays. They are China"s most advanced display technologies company - the only one equipped to produce LCDs in the 6th generation category or above.

They are a serious challenger to Samsung and LG Display and might supply the next iPhone. In this video I want to take a look at BOE’s development and how they are challenging the current display incumbents.

BOE started off far behind in the display industry, and sought foreign technology transfers to catch up. They reached out to various companies in the display industry, offering their cheap labor in a joint venture.

BOE got a good foothold in the market from this joint venture. But the display field is a competitive one, and BOE feared someone else coming in with a better thing. They sought to differentiate their offerings from the rest of the industry by breaking into and commercializing the latest in display technology.

Compared to their predecessors, TFT-LCDs are capable of delivering better contrast ratios and refresh rates. Today, they are widely used in televisions, laptops displays, monitors, and mobile phones.

The TFT-LCD product is at its heart a semiconductor like those made by TSMC and Intel. Which means being subjected to the same brutal up and down business cycles every 1.5 to 2 years that frequently overwhelm other semiconductor sectors. Building up supply capacity is extremely capital-intensive and takes years of lead time. And margins are tight - BOE makes less than 15% gross margin.

Vendors can easily swap out one display for another and thus constantly pit suppliers against each other on the basis of price and features. There always is another competitor willing to cut into your share, so accumulating scale, IP walls, and feature differentiation is crucial.

Today, the industry is extremely mature with multiple vendors all competing against each other. Many of these vendors - AUO, LG Display, Samsung Display, Innolux, and Sharp - have "big brothers" backing their P&L, making the industry kind of like a tech proxy war.

Now cut off from its profit-making siblings Hyundai Motors and Hyundai Heavy Industry, Hynix needed to lose weight and pay back its debt while preserving its core semiconductor businesses. Thus Hynix progressively sold its display technologies subsidiaries to BOE to get that money.

First, the STN-LCD and OLED businesses in 2001. These were not that strategically important. STN-LCD was an older technology even then. More power-efficient and cheaper to manufacture than TFT-LCD, but with the drawback of lower image quality and slower response times. OLED screens for their part were still at the prototype stage at the time.

A year later, Hynix sold its valuable TFT-LCD display arm to BOE for $350 million. Crucially, the sale included Hynix"s comprehensive intellectual property and patents for its 4th and 5th-generation TFT-LCD technologies. Hynix had been doing TFT-LCD research in the US for years by then so this was excellent stuff.

These acquisitions, criticized at the time, would turn out to be a seminal moment in Chinese display technology history. A classic story of excellent timing. They immediately vaulted BOE into being the 13th largest company in China - up from 41st a few years earlier.

As expected, BOE absorbed Hynix"s display technologies and capacity to rapidly catch up to the market incumbents. Backed by the Beijing city government"s financial firepower, the company invested over a billion dollars to build its first cutting edge LCD factory.

TPV"s upstream and downstream experience helped BOE turn a rare profit in 2003. By 2006, it was China"s leading TFT-LCD maker and ninth largest in the world. As the stars of Chinese tech companies like Xiaomi and Huawei have risen, BOE as a core displays supplier has also risen alongside them.

BOE"s core business lines are in display technology. They run factories in nine cities, including their leading edge 10.5 generation TFT-LCD production lines in the cities of Beijing and Hefei, Anhui.

They are especially prolific in the OLED space, with the third most patents in OLED technologies behind Samsung Display and LG Display. The whole ranking is dominated by East Asian companies, with Kodak the only American on the list.

The company is also making moves into the IoT and health spaces. IoT items like intelligent windows and smart TVs, kind of makes sense. But medical? I know, it seems a little weird that a display company should expand into hospitals and medical research.

In 2019, the whole company turned a negative net loss of $181 million USD before "exceptional gains and losses". The company"s core displays division - called Interface Devices on its annual report - lost $237 million USD. Its gross margin was just 13%, hardly better than your average fast food restaurant.

BOE is certainly a semiconductor national champion to be proud of, but it achieved this status only through a great deal of struggle. And it seems to me that the company is trying a whole lot of things in order to grow beyond its core TFT-LCD business. They have bet a whole lot on OLED being that thing.

While BOE has provided OLED panels for some of Huawei"s flagship Mate phones, its market share still lags behind Samsung and LG Display. The same dynamics that kept BOE out of the TFT-LCD market also apply to OLEDs. This is critical as it seems inevitable that OLED will be the dominant display technology going forward.

Perhaps that will change with the rumors that BOE"s OLED screens have finally passed Apple"s quality control checks. Joining the ranks of Apple"s iPhone suppliers can help send the company forward towards getting the same type dominance in OLED panels that it now has in other display markets.

Economic Daily News, Apple will start using OLED screens from the Chinese supplier BOE in the late-2021 iPhone models, in addition to screens supplied by Samsung and LG.

BOE is the world’s largest manufacturer of LCD panels for TVs, but for some time now has also manufactured OLED screens for Huawei and other mobile phone manufacturers.

Retina Display is a brand name used by Apple for its series of IPS LCD and OLED displays that have a higher pixel density than traditional Apple displays.trademark with regard to computers and mobile devices with the United States Patent and Trademark Office and Canadian Intellectual Property Office.

The Retina display debuted in 2010 with the iPhone 4 and the iPod Touch (4th Generation), and later the iPad (3rd generation) where each screen pixel of the iPhone 3GS, iPod touch (3rd generation), iPad 2 was replaced by four smaller pixels, and the user interface scaled up to fill in the extra pixels. Apple calls this mode HiDPI mode. In simpler words, it is one logical pixel = four physical pixels. The scale factor is tripled for devices with even higher pixel densities, such as the iPhone 6 Plus and iPhone X.

The Retina display has since expanded to most Apple product lines, such as Apple Watch, iPhone, iPod Touch, iPad, iPad Mini, iPad Air, iPad Pro, MacBook, MacBook Air, MacBook Pro, iMac, and Pro Display XDR, some of which have never had a comparable non-Retina display.marketing terms to differentiate between its LCD and OLED displays having various resolutions, contrast levels, color reproduction, or refresh rates. It is known as Liquid Retina display for the iPhone XR, iPad Air 4th Generation, iPad Mini 6th Generation, iPad Pro 3rd Generation and later versions,Retina 4.5K display for the iMac.

Apple"s Retina displays are not an absolute standard for display sharpness, but vary depending on the size of the display on the device, and at what distance the user would typically be viewing the screen. Where on smaller devices with smaller displays users would view the screen at a closer distance to their eyes, the displays have more PPI (Pixels Per Inch), while on larger devices with larger displays where the user views the screen further away, the screen uses a lower PPI value. Later device versions have had additional improvements, whether an increase in the screen size (the iPhone 12 Pro Max), contrast ratio (the 12.9” iPad Pro 5th Generation, and iMac with Retina 4.5K display), and/or, more recently, PPI count (OLED iPhones); as a result, Apple uses the names “Retina HD display", "Retina 4K/5K display", “Retina 4.5K display", "Super Retina HD display", “Super Retina XDR display”, and "Liquid Retina display" for each successive version.

When introducing the iPhone 4, Steve Jobs said the number of pixels needed for a Retina display is about 300 PPI for a device held 10 to 12 inches from the eye.skinny triangle with a height equal to the viewing distance and a top angle of one degree will have a base on the device"s screen that covers 57 pixels. Any display"s viewing quality (from phone displays to huge projectors) can be described with this size-independent universal parameter. Note that the PPD parameter is not an intrinsic parameter of the display itself, unlike absolute pixel resolution (e.g. 1920×1080 pixels) or relative pixel density (e.g. 401 PPI), but is dependent on the distance between the display and the eye of the person (or lens of the device) viewing the display; moving the eye closer to the display reduces the PPD, and moving away from it increases the PPD in proportion to the distance.

In practice, thus far Apple has converted a device"s display to Retina by doubling the number of pixels in each direction, quadrupling the total resolution. This increase creates a sharper interface at the same physical dimensions. The sole exception to this has been the iPhone 6 Plus, 6S Plus, 7 Plus, and 8 Plus, which renders its display at triple the number of pixels in each direction, before down-sampling to a 1080p resolution.

The displays are manufactured worldwide by different suppliers. Currently, the iPad"s display comes from Samsung,LG DisplayJapan Display Inc.twisted nematic (TN) liquid-crystal displays (LCDs) to in-plane switching (IPS) LCDs starting with the iPhone 4 models in June 2010.

Apple markets the following devices as having a Retina display, Retina HD display, Liquid Retina display, Liquid Retina XDR display, Super Retina HD display, Super Retina XDR display or Retina 4K/5K/6K display:

Reviews of Apple devices with Retina displays have generally been positive on technical grounds, with comments describing it as a considerable improvement on earlier screens and praising Apple for driving third-party application support for high-resolution displays more effectively than on Windows.T220 and T221 had been sold in the past, they had seen little take-up due to their cost of around $8400.

Writer John Gruber suggested that the arrival of Retina displays on computers would trigger a need to redesign interfaces and designs for the new displays:

Raymond Soneira, president of DisplayMate Technologies, has challenged Apple"s claim. He says that the physiology of the human retina is such that there must be at least 477 pixels per inch in a pixelated display for the pixels to become imperceptible to the human eye at a distance of 12 inches (305 mm).Phil Plait notes, however, that, "if you have [better than 20/20] eyesight, then at one foot away the iPhone 4S"s pixels are resolved. The picture will look pixelated. If you have average eyesight [20/20 vision], the picture will look just fine... So in my opinion, what Jobs said was fine. Soneira, while technically correct, was being picky."

Apple fan website CultOfMac hosts an article by John Brownlee"Apple"s Retina Displays are only about 33% of the way there."visual acuity in the population saying "most research suggests that normal vision is actually much better than 20/20" when in truth the majority have worse than 20/20 vision,WHO considers average vision as 20/40.presbyopia

The first smartphone following the iPhone 4 to ship with a display of a comparable pixel density was the Nokia E6, running Symbian Anna, with a resolution of 640 × 480 at a screen size of 62.5mm. This was an isolated case for the platform however, as all other Symbian-based devices had larger displays with lower resolutions. Some older Symbian smartphones, including the Nokia N80 and N90, featured a 2.1 inch display at 259 ppi, which was one of the sharpest at the time. The first Android smartphones with the same display - Meizu M9 was launched a few months later in beginning of 2011. In October of the same year Galaxy Nexus was announced, which had a display with a better resolution. By 2013 the 300+ ppimark was found on midrange phones such as the Moto G.Samsung Galaxy S4 and HTC One (M8) had 1080p (FHD) screens around 5-inches for a 400+ PPI which surpassed the Retina density on the iPhone 5. The second major redesign of the iPhone, the iPhone 6, has a 1334 × 750 resolution on a 4.7-inch screen, while rivals such as the Samsung Galaxy S6 have a QHD display of 2560 × 1440 resolution, close to four times the number of pixels found in the iPhone 6, giving the S6 a 577 PPI that is almost twice that of the iPhone 6"s 326 PPI.

The larger iPhone 6 Plus features a "Retina HD display", which is a 5.5-inch 1080p screen with 401 PPI. Aside from resolution, all generations of iPhone Retina displays receive high ratings for other aspects such as brightness and color accuracy, compared to those of contemporary smartphones, while some Android devices such as the LG G3 have sacrificed screen quality and battery life for high resolution. Ars Technica suggested the "superfluousness of so many flagship phone features—the move from 720p to 1080p to 1440p and beyond...things are all nice to have, but you’d be hard-pressed to argue that any of them are essential".

The Apple Studio Display (stylized and marketed as Studio Display) is a 27-inch flat panel computer monitor developed and sold by Apple Inc.Mac Studio desktop and was released on March 18, 2022. It is Apple"s consumer display, sitting below the Pro Display XDR.

The Studio Display is the first Apple-branded consumer display released since the Apple Thunderbolt Display, which was released in 2011 and discontinued in 2016.LG to design the Thunderbolt 3-enabled UltraFine line, consisting of a 21.5-inch 4K and a 27-inch 5K display.

The Studio Display features a 27-inch, 5K LED-backlit panel, with 5120×2880 resolution at 218 pixels per inch and 600 nits of brightness, an increase from the 500 nits panel used in the LG UltraFine and 27-inch iMac.P3 wide color and True Tone technology.HDR content.spatial audio and Dolby Atmos, and a three-microphone array that supports "Hey Siri".Thunderbolt 3 port that supports DisplayPort 1.4 with Display Stream Compression (DSC) 1.2 and provides up to 96 W of host charging for connected laptops, and three downstream 10 Gbit/s USB-C ports.

The Studio Display includes an Apple A13 Bionic system on a chip to power audio and webcam processing. The built-in webcam supports Center Stage, introduced with the iPad Pro (5th generation), which pinpoints the positions of the users and automatically tracks the camera view accordingly to perspectively center them.iPhone 11.

The Studio Display comes with three mounting options: a tilt-adjustable stand, a tilt- and height-adjustable stand similar to the Pro Display XDR, and a VESA mount. The mounts are built into the display and are not user interchangeable, but can be reconfigured by an Apple Store or authorized service provider after purchase."nano-texture" glass finish to reduce glare.

The Studio Display works with other systems supporting DisplayPort, including Windows-based systems, but only supported Macs have access to features beyond display, speakers and webcam.Boot Camp are supported with version 6.1.17.

After it switched its iPhones to OLED displays completely, Apple may be planning to apply the technology to its devices with larger screens, such as MacBooks, iPads, or monitors. Both LG and Samsung are reportedly working on displays for the first OLED iPads that are rumored to be launched in 2024, based on the current 6-Gen OLED panel production method.

LG is slightly ahead in the OLED MacBook panels" development as it has more experience with larger OLED screens and is a pioneer of the frugal dual-stack OLED technology that Apple allegedly prefers. LG and Samsung, however, will indeed use the current 6-Gen display technology for Apple"s first OLED iPads, reports Korean media today, while they are hard at work on developing 8.5-Gen OLEDs for larger laptop screens like those on Apple"s MacBooks.

The 8.5-Gen substrate sheets are larger and more economical to cut screens with display diagonals larger than 10 inches from. Samsung has started the development of its two-track 8.5-Gen OLED technology last year, and LG has apparently followed with a half-cut horizontal deposition tryout in December, with the aim to win Apple"s approval and wiggle into the future OLED MacBooks supply chain. There is, however, a third option that Apple may pursue now, larger 8.5-Gen OLED panels made by BOE.

The screen maker has reportedly approached the Japanese from Canon Tokki for the development of the evaporator technique needed, and plans to start mass production of 8.5-Gen OLED displays on its B16 line in Chengdu by the end of 2024. Thus, starting in 2025, Apple may be able to choose from three 8.5-Gen screen suppliers - LG, Samsung, and BOE - for its future MacBooks, iPads, or maybe even monitors with OLED display technology.

Sources in the supply chain say that BOE will provide 45 million OLED display panels for the iPhone, making it second only to Samsung, and exceeding LG.

Appleis reportedly planning to order OLED screens from China"s BOE during 2020. It"s not clear whether those will be an initial test run or actually used in the 2020 "iPhone 12." However, Apple is then believed to ramp up to buying 45 million panels in time to use for 2021"s iPhone.

RPRNA has no clear track record in reporting Apple-related rumors. Monday"s claim lines up with previous reports of BOE"s ambitions to become an iPhone OLED manufacturer.

BOE is not confining itself to Apple, though, having also become a supplier for Huawei. Apple has also been looking to diversify which manufacturers it uses. It originally used only Samsung for OLED displays but, partly to avoid dependence on a sole supplier, and partly with the aim of competition reducing costs, Apple added LG Display in 2018.

This may also be why Apple has reportedly been investing in the ailing Japan Display company, which was a leading LCD manufacturer but has been slow to pivot to OLED.

Separately, the RPRNA report also repeats the information that "iPhone 12" will use "Apple"s A14" processor which is believed to go into trial production early in 2020.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey