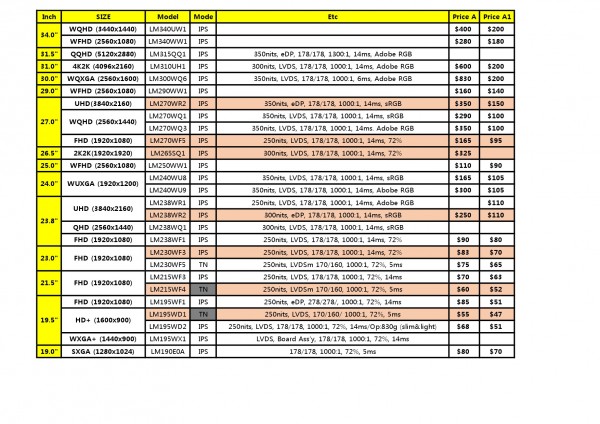

home lcd panel pricelist

Prices for all TV panel sizes fluctuated and are forecast to fluctuate between 2020 and 2022. The period from March 2020 to July 2021 saw the biggest price increases, when a 65" UHD panel cost between 171 and 288 U.S. dollars. In the fourth quarter of 2021, such prices fell and are expected to drop to an even lower amount by March 2022.Read moreLCD TV panel prices worldwide from January 2020 to March 2022, by size(in U.S. dollars)Characteristic32" HD43" FHD49"/50" UHD55" UHD65" UHD------

DSCC. (January 10, 2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph]. In Statista. Retrieved December 12, 2022, from https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars)." Chart. January 10, 2022. Statista. Accessed December 12, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. (2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars). Statista. Statista Inc.. Accessed: December 12, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "Lcd Tv Panel Prices Worldwide from January 2020 to March 2022, by Size (in U.S. Dollars)." Statista, Statista Inc., 10 Jan 2022, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC, LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) Statista, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/ (last visited December 12, 2022)

After the two months with the fastest price declines in the history of the industry in September and October, LCD TV panel prices continued to fall in November, but the pace of price decreases is slowing, and we expect that pattern to continue into 2022. After two months where the average decline in LCD TV panel prices exceeded 15%, the average decline in November among the seven TV sizes we track was “only” 6.4%. LCD TV panel prices have now lost most of the gains that they achieved in the long up-cycle from May 2020 to June 2021.

Continuing strong demand and concerns about a glass shortage resulting from NEG’s power outage have led to a continuing increase in LCD TV panel prices in Q1. Announcements by the Korean panel makers that they will maintain production of LCDs and delay their planned shutdown of LCD lines has not prevented prices from continuing to rise. Panel prices increased more than 20% for selected TV sizes in Q3 2020 compared to Q2, and by 27% in Q4 2020 compared to Q3, and we now expect that average LCD TV panel prices in Q1 2021 will increase by another 9%.

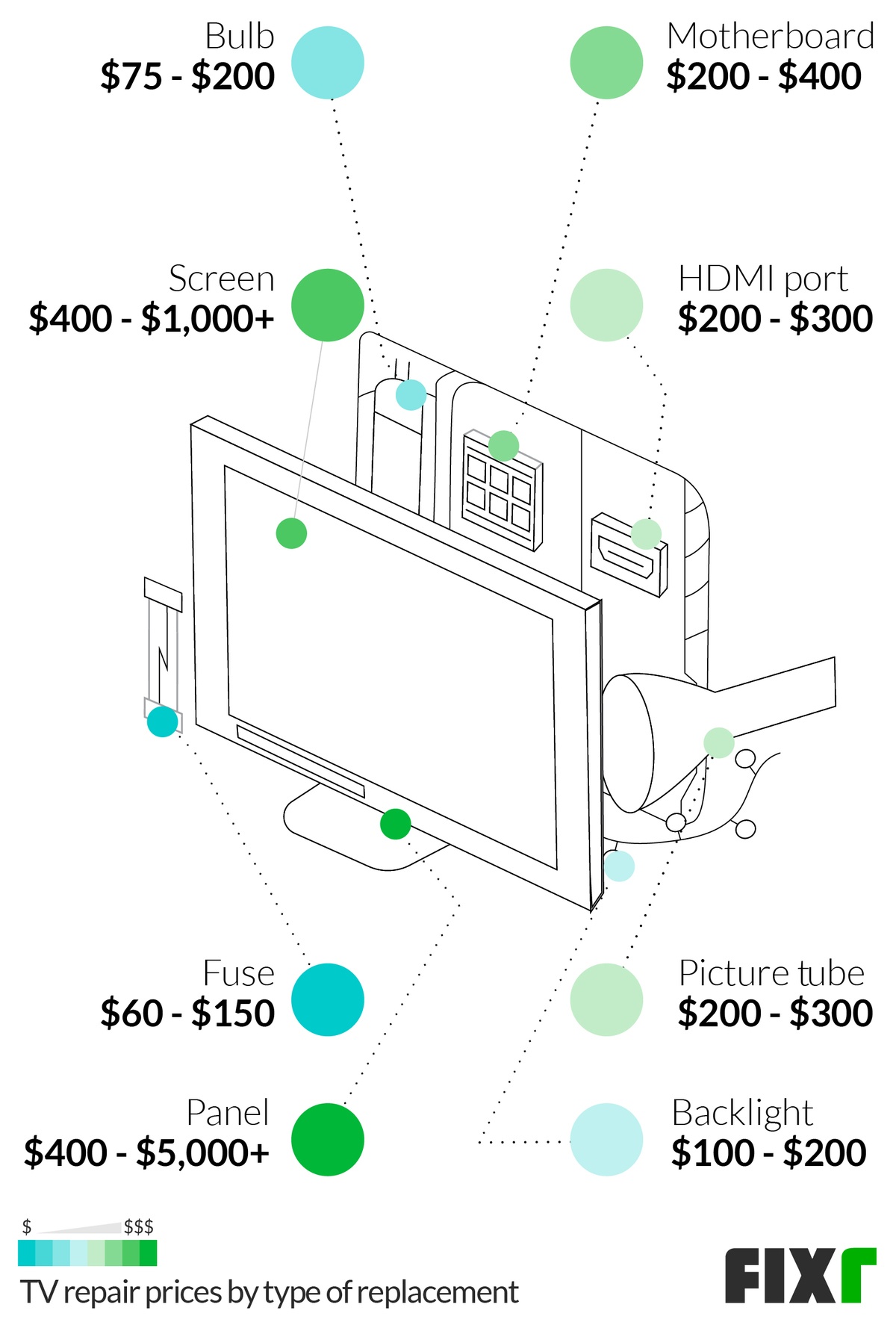

TV repair costs between $60 and $350 with most spending $207 on average for LCD, LED, plasma, and 4K TVs; costs are higher if repairing older DLP, projection, and HD TVs. TV problems like display issues, powering-on problems, or sound issues can be fixed. Pickup and delivery fees may apply.

The cost to repair a TV will include the price of parts and labor costs, plus other associated costs. Additional charges include a trip fee for a technician to come to your home, a fee to transport your TV to and from a repair shop, and the diagnostic fee to determine what needs to be replaced.

For example, the price of a new Samsung 40-inch LED TV is about $400, yet the cost of a replacement display panel for this model is about $380. This price is only for the replacement part and does not cover diagnostic costs, labor costs, or travel or shipping fees.

Unless you are trying to fix a TV from the ’80s or earlier, cracked TV screen repair is not feasible; the entire display panel must be replaced instead. The cost of a replacement TV display panel is more than the cost of buying a new TV, and that’s before labor and other service costs.

TV manufacturers do keep replacement TV screen panels on hand to support products under warranty in case the screen malfunctions, due to manufacturer defect.

If you still want to replace a damaged or malfunctioning TV screen, your best option is to find a used replacement panel or a broken TV of the same model on which the screen is still functional. You might find one on eBay, and you can hire a technician to change out the panel.

The cost of a used replacement TV panel ranges from $50 to $350 or more, excluding shipping, depending on the brand and size. Note that the chances of finding exactly the part you need in excellent condition are slim, and the cost excludes the cost of installation by a repair shop.

Whether your TV is LCD, LED, plasma screen, or 4K (Ultra HD), the cost to fix common problems ranges from $60 to $350, depending on the repair type and the brand of TV being repaired.

A flat-screen TV bulb replacement costs between $60 to $115, with most homeowners spending $84 for parts and labor. The price for replacement bulbs ranges from $18.50 to $80.

If an older model LCD TV or projection TV powers on and has sound but no picture, this may be due to lamp burnout, which is both common and expected. In this case, replacing the bulb will fix the problem. An experienced technician should be able to replace the bulb quickly and easily.

Flat screen replacement glass is not available. The only option for flat-screen TV glass repair is to try optical glass glue, which costs $1.70 for a 5-ml. tube. This may be an option for TV glass repair if the crack is only a few inches or less. TV panels are built as one unit at the factory, with the glass adhered to the display panel.

In-home CRT repair ranges from $199 to $249. The cost of repairing a CRT picture tube ranges from $199 for a TV that is 27 inches or smaller to $249 for a TV that is 28 inches or larger.

LCD flat-panel repair is not considered cost-effective. If the glass is cracked or the display is physically damaged, it is cheaper to replace the entire TV than to repair or replace the display panel.

The cost of flat-screen TV repair ranges from $42 to $359. You cannot fix a broken screen, but the price of a new flat-panel TV starts from around $249 for a 1080-mp (non-4K) LED TV from LG to as much as $14,999 for an 85-inch 8K LED TV from Samsung. A TV referred to as a “flat TV” or “flat-screen” TV might be any of the following:

LCD TV repair typically costs $60 to $85 for diagnostics testing, and $200 to $300 to perform repairs. LCD TVs use backlighting, which may fail. Newer LCD TVs use LED strips for backlighting. Older ones might use CCFL. If CCFL backlighting fails, a technician can replace it with LED backlighting.

An LED TV is just an LCD TV that uses LED backlighting, which all newer models do (older models use CCFL backlighting). The cost to replace one LED backlighting strip ranges from $100 to $122, including parts and labor.

Best Buy TV repair is provided through the Geek Squad TV & home theater service. Geek Squad TV repair starts at a base cost of $100 for a diagnostic fee. TV repair is covered under Best Buy’s protection plan, which costs $280 per year when you purchase a TV from Best Buy at the time of purchase, or within the return period printed on your receipt.

The cost of labor to fix a TV ranges from $60 to $125 per hour, or a flat rate of $90 to $299. If the work is performed in your home, the cost ranges from $25 to $125 per hour plus the trip fee. Most TV repairs take 1 to 3 hours if the repair specialist has the parts already.

Many TV repair shops charge a diagnostic fee that ranges from $20 to $60, depending on whether it is done in your home or the repair shop. Some shops charge a flat fee that ranges from $50 to $250that covers both the diagnostic cost and labor cost. In many cases, the initial diagnostic fee will be applied to the repair cost if you have the shop do the repair.

Circuit breaker - Check the circuit breaker for the power outlet that the TV plugs into. You can check the breakers by opening the door to your breaker panel and looking for circuit breakers that are in the OFF position.

Power cable - Check the power cable. If it is a removable cable, you can test it by substituting a power cable from another piece of equipment in your home, or you can buy a replacement cable for this test. The cost for a replacement TV power cable ranges from $2.50 to $10.

Lamp burnout -In a projection TV or older LCD TV, no picture may be caused by lamp burnout. In this case, a technician can replace the bulb quickly and easily.

In most cases, a flat-screen TV can be fixed. The exception is a physically damaged display panel or screen. Most other issues including failing speakers, backlights, or power supply. Burned out fuses and damaged input ports can also be repaired.

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

Now, one more note before I start breaking down options and prices. When I talk about video walls, I’m not referring to buying four TVs from a big box store and hanging them together. TVs are problematic as video walls for a number of reasons. Their bezels are usually larger and have logos, they’re usually not bright enough to serve as commercial displays, and they can’t meet the demand of 24/7 usage. You’ll hear me discuss LCDs and LEDs, but when I do, I’ll be referring to monitors, not TVs. It’s an important distinction.

While blended front projections and rear projection cubes are viable options for video walls, LED and LCDs are the most common display technology used for video walls.

Generally, LEDs are more expensive than LCDs (for models that deliver the same image quality), making the latter the budget-friendly choice. The major tradeoff is the LCD’s bezel lines for the line-free LED array.

For simple video walls, a basic 2×2 high-quality LCD unit can cost as little as $4800, while larger, more elaborate setups with more advanced features (touchscreen capabilities) can go as high as $30,000.

A 1.2mm pixel pitch LED video wall costs approximately $2K sq./ft. This figure translates into $200K for a video wall with 160” x 90” outside dimensions. This includes the mounts, panels and installation costs without taking into account the cost of infrastructure, installation and programming and other ancillary costs (like tax and shipping).

While LEDs are more expensive than LCDs, they lend themselves to more customization in terms of size and shape, with the added benefit of being bezel-less.

It’s best not to scrimp on mounts. You should choose a mount that is sufficiently rigid to prevent sagging and able to provide alignment adjustments in all axes when needed. Most importantly, use mounts that permit front serviceability of individual panels. This prevents the need to remove other panels to service just one failed panel, thus reducing the cost of maintenance and repairs.

Also, custom content needs to be created (or scaled to fit) for video walls that don’t come in standard resolutions like 1080P, 2K,4K, etc. You might want to avoid such non-standard walls since it can be quite expensive to create such custom content. Instead, try to use a video wall layout that maintains standard aspect ratios. For LED walls, this means a 16:10, 16:9, or other cinema aspect ratios while LCD arrays should come in 2×2, 3×3, 4×4, and other standard array sizes.

I’m hearing from some industry friends that LCD display panel prices are rising – which on the surface likely seems incongruous, given the economic slowdown and widespread indications that a lot of 2020 and 2021 display projects went on hold because of COVID-19.

On the other hand, people are watching a lot more TV, and I saw a guy at Costco the other day with two big-ass LCD TVs on his trolley. And a whole bunch of desktop monitors were in demand in 2020 to facilitate Work From Home. So demand for LCD displays is up outside of commercial purposes.

Continuing strong demand and concerns about a glass shortage resulting from NEG’s power outage have led to a continuing increase in LCD TV panel prices in Q1. Announcements by the Korean panel makers that they will maintain production of LCDs and delay their planned shutdown of LCD lines has not prevented prices from continuing to rise.

Panel prices increased more than 20% for selected TV sizes in Q3 2020 compared to Q2, and by 27% in Q4 2020 compared to Q3, and we now expect that average LCD TV panel prices in Q1 2021 will increase by another 9%.

Prices increased in Q4 for all sizes of TV panels, with massive % increases in sizes from 32” to 55” ranging from 28% to 38%. Prices for 65” and 75” increased at a slower rate, by 19% and 8% respectively, as capacity has continued to increase on those sizes with Gen 10.5 expansions.

Prices for every size of TV panel will increase in Q1 at a slower rate, ranging from 4% for 75” to 13% for 43”. Although we continue to expect that the long-term downward trend will resume in the second quarter of 2021, we no longer expect that panel prices will come close to the all-time lows seen earlier this year. The situation remains dynamic, and the pandemic may continue to affect both supply and demand.

TV panel prices however, continued to rise at an ‘unprecedented’ rate again, far ahead of our expectations, and panel producers do not seem to be hesitant about continuing to push prices further.

Given that TV set demand continues to outstrip production capacity, panel producers are already expecting to raise prices again in 1Q, typically a sequentially weaker quarter. There is a breaking point at which TV set brands will forego requested panel price increases in order to preserve what is left of margins, and with the increasing cost of TV set panel inventory, we expect TV set producers to become unprofitable relatively quickly.

Does that mean they will stop buying and face losing market share to those that are willing to pay higher prices to see unit volume growth? Eventually, but heading into the holidays it doesn’t seem likely this year, so we expect TV panel prices to rise again in December.

2Purchase an LG Refrigerator or Laundry product and receive Free Installation and Haul-Away. Available only on LG.com November 2 - January 4, 2023. To receive the free installation and haul-away the "In-Home Delivery with Installation & Haul-Away" shipping option must be selected during checkout . If any of the qualifying items are removed from the cart or part of the order is cancelled or returned, the promotional savings will be void. Prices and offers are non-redeemable for cash and non-transferable. Availability, prices and terms of offer are subject to change without notice.

Designed with you in mind, LG products offer innovative solutions to make life good. With intuitive, responsive controls, sleek, stylish designs, and eco-friendly features, our collection gives you the power to do more at home and on the go. It includes:

From the very first note, our collection will transform your living room into a stunning home theater Explore our complete collection of LG electronics, mobile devices, appliances and home entertainment solutions -- and find everything you need to connect with your friends and family, no matter where they are.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey