are tft lcd screens the future manufacturer

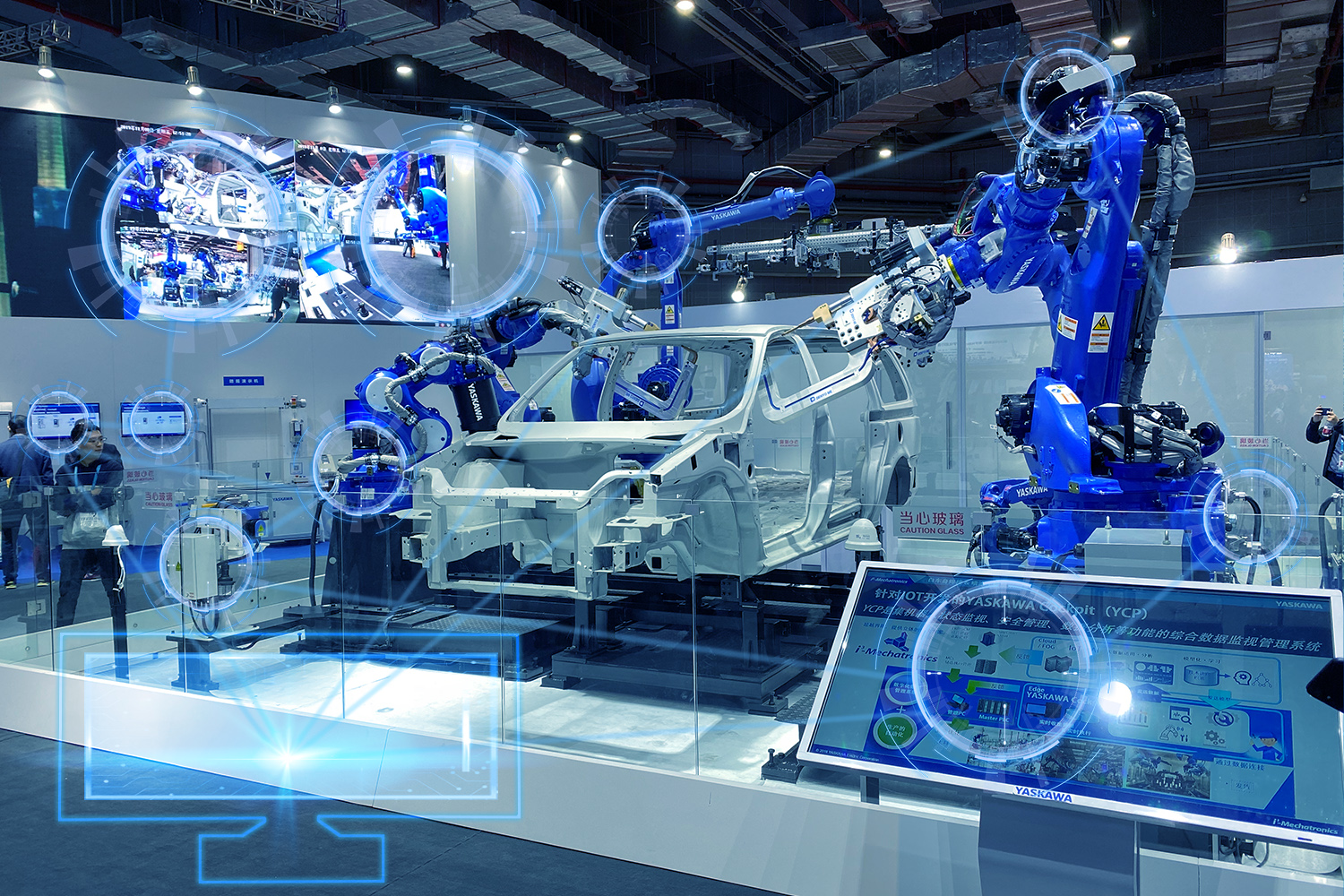

Due to its high performance ratio and low cost, TFT liquid crystal displays are used more and more in automotive configurations, and have become the mainstream of automotive audio and video systems and automotive navigation system displays. With the development of artificial intelligence, the content of vehicle display will continue to be enriched, and the specifications of vehicle LCD panels will also increase day by day. High-definition display quality, high brightness, large size, wide viewing angle, thinning, light weight, high reliability, low power consumption, etc. will become the future development trend of on-board displays.

The central control area of some cars is still dominated by traditional structural solid buttons, and the high-end version of some cars uses a touch screen. The design concept of physical buttons greatly limits the interior design, and the space utilization rate is low, which hinders the passenger space in the front row. At the same time, the central control needs to set up corresponding functional areas, such as the central control screen, air conditioning area, vehicle control area, etc., which will complicate the central control area and is not conducive to user operations. Users must find the corresponding button operation among the numerous buttons, and must also adapt to the arrangement of the central control buttons of different models. Compared with the touch screen used in the consumer electronics field, the touch screen used in the automotive field should have the following characteristics:

Among them, large-scale and multi-touch are mainly to meet the user"s experience, which is the same as the trend of electronic consumer goods. At the same time, the automotive field has put forward higher requirements for touch screens, which require high reliability and high durability. These characteristics embody the specific requirements of the automotive field for the central control touch screen of the TFT liquid crystal display.

With the development of intelligence, the touch screen in the car has also become the mainstream. In response to this trend, panel manufacturers have developed new technologies in the field of in-vehicle displays to occupy a favorable market position. Large-size, high-definition multi-function integrated vehicle touch panels will become a standard configuration. At the same time, the vehicle panel needs to be able to be affected by the driving environment, outdoor strong light and high temperature, and the vehicle navigator with resistive or capacitive touch screen has strong anti-interference ability.

We truly apologize that this error has occurred. We take these matters very seriously and ask for your help in notifying us of the problem. Please email us at DIGITAL-SECURITY@avnet.com, using Reference Number:

A not-for-profit organization, IEEE is the world"s largest technical professional organization dedicated to advancing technology for the benefit of humanity.

A not-for-profit organization, IEEE is the world"s largest technical professional organization dedicated to advancing technology for the benefit of humanity.

www.electronicdesign.com is using a security service for protection against online attacks. An action has triggered the service and blocked your request.

Please try again in a few minutes. If the issue persist, please contact the site owner for further assistance. Reference ID IP Address Date and Time 72f34325e42ecb179a2ad5981afc8831 63.210.148.230 12/11/2022 06:51 PM UTC

Lacking cutting-edge R&D capabilities, as well as strong brands and channels, Taiwan"s wide-ranging contract manufacturers find themselves facing a familiar dilemma in the flat panel industry. In addition, Taiwan"s "five tigers" are small compared to South Korea, whose Samsung and LG share nearly 40% of the global market. Their consequent lack of economies of scale has become an increasing concern over the past two years. With numerous industries shifting their manufacturing operations offshore, Taiwan"s flat panel makers are naturally moving to China as well. However, restricted by government policies, most of their China factories are mainly focused on assembly. The technologically more demanding front-end processes remain in Taiwan.

It is forecast that by the end of 2005, Taiwan"s share of the global flat panel market will approach 40%, adding yet another world #1 ranking to its collection.

"Senior engineers with more than three to five years of experience with LCD technology are scarce worldwide," Lin points out. "And this talent is concentrated in Taiwan, Japan, and Korea, making it difficult to lure them away." Eugene Verdon, president of Corning Display Technologies Taiwan, the world"s leading supplier of glass substrates, also believes that the short supply of brainpower is the biggest worry for Taiwan"s flat panel industry.

"It"s not that Taiwanese are not smart enough or industrious enough. It"s simply that this industry is extremely demanding on people, and that applies to both quality and quantity," Verdon says. "Looking at Taiwan"s population growth rate and related figures, and it certainly looks like there may be a steep falloff in the availability of needed skilled workers in the future."

In the current phase, Taiwan"s biggest rival is of course Korea," says PIDA vice president Ma. "Korea entered this industry six years before Taiwan. It has greater upstream and downstream integration, and greater self-sufficiency. Korea also benefits from the brands and global channels of market leader Samsung and of Philips LG. These factors make Korea"s flat panel industry far more complete than Taiwan"s."

Besides South Korea with the breadth of its downstream and upstream integration, and Japan with its cutting-edge technology and strong brands, China has been making moves in recent years. China will likely turn the flat panel industry into a four-way battle.

In 2003, China"s largest CRT manufacturer, BOE Technology Group, seeing that the CRT market was in decline, decided to develop LCDs. Later, BOE purchased Korean company Hydis" LCD panel manufacturing division and immediately became China"s biggest flat panel manufacturer.

Like Taiwan, Japan, and Korea, China has designated display devices and liquid crystal devices as explicit targets for attracting foreign investment and fostering technological development. The Chinese approach of acquisitions and technological cooperation with Japan or Korea is highly reminiscent of the course pursued by Taiwanese firms six years ago.

After much Taiwanese desktop and notebook computer manufacturing moved to China, flat panel assembly plants are following their customers across the Taiwan Strait. If the LCD TV industry cannot gain traction in Taiwan, another wave of manufacturing relocations to China is likely to take place.

With Japan and China intent on joining a competitive fray that has been largely focused on Taiwan and Korea, the two-way battle for supremacy may at any time develop into a four-way tangle, further complicating the scenario.

Can the light from liquid crystal screens also show Taiwan"s high-tech industry the way to another golden decade? The answer may very well soon be revealed.

From tiny cellphones to big-screen TVs, the low weight, low power consumption, and high resolution of LCD screens, along with their low radiation levels and longevity, have made them the focus of a new generation of technology.

Walking by the Chi Mei compound in the Southern Taiwan Science Park, it"s hard to miss the statues of the Greek gods that stand around. This replica of the Louvre"s statue of Nike, goddess of victory, helps create an aesthetic balance in this sprawling compound.

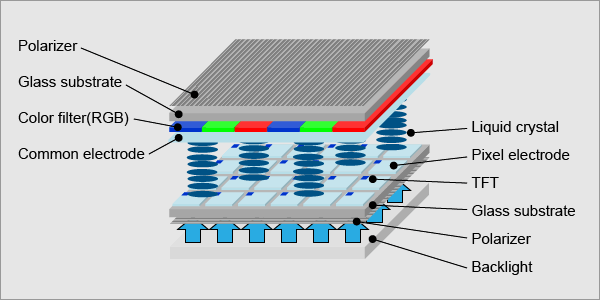

A thin-film-transistor liquid-crystal display (TFT LCD) is a variant of a liquid-crystal display that uses thin-film-transistor technologyactive matrix LCD, in contrast to passive matrix LCDs or simple, direct-driven (i.e. with segments directly connected to electronics outside the LCD) LCDs with a few segments.

In February 1957, John Wallmark of RCA filed a patent for a thin film MOSFET. Paul K. Weimer, also of RCA implemented Wallmark"s ideas and developed the thin-film transistor (TFT) in 1962, a type of MOSFET distinct from the standard bulk MOSFET. It was made with thin films of cadmium selenide and cadmium sulfide. The idea of a TFT-based liquid-crystal display (LCD) was conceived by Bernard Lechner of RCA Laboratories in 1968. In 1971, Lechner, F. J. Marlowe, E. O. Nester and J. Tults demonstrated a 2-by-18 matrix display driven by a hybrid circuit using the dynamic scattering mode of LCDs.T. Peter Brody, J. A. Asars and G. D. Dixon at Westinghouse Research Laboratories developed a CdSe (cadmium selenide) TFT, which they used to demonstrate the first CdSe thin-film-transistor liquid-crystal display (TFT LCD).active-matrix liquid-crystal display (AM LCD) using CdSe TFTs in 1974, and then Brody coined the term "active matrix" in 1975.high-resolution and high-quality electronic visual display devices use TFT-based active matrix displays.

The liquid crystal displays used in calculators and other devices with similarly simple displays have direct-driven image elements, and therefore a voltage can be easily applied across just one segment of these types of displays without interfering with the other segments. This would be impractical for a large display, because it would have a large number of (color) picture elements (pixels), and thus it would require millions of connections, both top and bottom for each one of the three colors (red, green and blue) of every pixel. To avoid this issue, the pixels are addressed in rows and columns, reducing the connection count from millions down to thousands. The column and row wires attach to transistor switches, one for each pixel. The one-way current passing characteristic of the transistor prevents the charge that is being applied to each pixel from being drained between refreshes to a display"s image. Each pixel is a small capacitor with a layer of insulating liquid crystal sandwiched between transparent conductive ITO layers.

The circuit layout process of a TFT-LCD is very similar to that of semiconductor products. However, rather than fabricating the transistors from silicon, that is formed into a crystalline silicon wafer, they are made from a thin film of amorphous silicon that is deposited on a glass panel. The silicon layer for TFT-LCDs is typically deposited using the PECVD process.

Polycrystalline silicon is sometimes used in displays requiring higher TFT performance. Examples include small high-resolution displays such as those found in projectors or viewfinders. Amorphous silicon-based TFTs are by far the most common, due to their lower production cost, whereas polycrystalline silicon TFTs are more costly and much more difficult to produce.

The twisted nematic display is one of the oldest and frequently cheapest kind of LCD display technologies available. TN displays benefit from fast pixel response times and less smearing than other LCD display technology, but suffer from poor color reproduction and limited viewing angles, especially in the vertical direction. Colors will shift, potentially to the point of completely inverting, when viewed at an angle that is not perpendicular to the display. Modern, high end consumer products have developed methods to overcome the technology"s shortcomings, such as RTC (Response Time Compensation / Overdrive) technologies. Modern TN displays can look significantly better than older TN displays from decades earlier, but overall TN has inferior viewing angles and poor color in comparison to other technology.

Most TN panels can represent colors using only six bits per RGB channel, or 18 bit in total, and are unable to display the 16.7 million color shades (24-bit truecolor) that are available using 24-bit color. Instead, these panels display interpolated 24-bit color using a dithering method that combines adjacent pixels to simulate the desired shade. They can also use a form of temporal dithering called Frame Rate Control (FRC), which cycles between different shades with each new frame to simulate an intermediate shade. Such 18 bit panels with dithering are sometimes advertised as having "16.2 million colors". These color simulation methods are noticeable to many people and highly bothersome to some.gamut (often referred to as a percentage of the NTSC 1953 color gamut) are also due to backlighting technology. It is not uncommon for older displays to range from 10% to 26% of the NTSC color gamut, whereas other kind of displays, utilizing more complicated CCFL or LED phosphor formulations or RGB LED backlights, may extend past 100% of the NTSC color gamut, a difference quite perceivable by the human eye.

The transmittance of a pixel of an LCD panel typically does not change linearly with the applied voltage,sRGB standard for computer monitors requires a specific nonlinear dependence of the amount of emitted light as a function of the RGB value.

In-plane switching was developed by Hitachi Ltd. in 1996 to improve on the poor viewing angle and the poor color reproduction of TN panels at that time.

Initial iterations of IPS technology were characterised by slow response time and a low contrast ratio but later revisions have made marked improvements to these shortcomings. Because of its wide viewing angle and accurate color reproduction (with almost no off-angle color shift), IPS is widely employed in high-end monitors aimed at professional graphic artists, although with the recent fall in price it has been seen in the mainstream market as well. IPS technology was sold to Panasonic by Hitachi.

Most panels also support true 8-bit per channel color. These improvements came at the cost of a higher response time, initially about 50 ms. IPS panels were also extremely expensive.

IPS has since been superseded by S-IPS (Super-IPS, Hitachi Ltd. in 1998), which has all the benefits of IPS technology with the addition of improved pixel refresh timing.

In 2004, Hydis Technologies Co., Ltd licensed its AFFS patent to Japan"s Hitachi Displays. Hitachi is using AFFS to manufacture high end panels in their product line. In 2006, Hydis also licensed its AFFS to Sanyo Epson Imaging Devices Corporation.

It achieved pixel response which was fast for its time, wide viewing angles, and high contrast at the cost of brightness and color reproduction.Response Time Compensation) technologies.

Less expensive PVA panels often use dithering and FRC, whereas super-PVA (S-PVA) panels all use at least 8 bits per color component and do not use color simulation methods.BRAVIA LCD TVs offer 10-bit and xvYCC color support, for example, the Bravia X4500 series. S-PVA also offers fast response times using modern RTC technologies.

When the field is on, the liquid crystal molecules start to tilt towards the center of the sub-pixels because of the electric field; as a result, a continuous pinwheel alignment (CPA) is formed; the azimuthal angle rotates 360 degrees continuously resulting in an excellent viewing angle. The ASV mode is also called CPA mode.

A technology developed by Samsung is Super PLS, which bears similarities to IPS panels, has wider viewing angles, better image quality, increased brightness, and lower production costs. PLS technology debuted in the PC display market with the release of the Samsung S27A850 and S24A850 monitors in September 2011.

TFT dual-transistor pixel or cell technology is a reflective-display technology for use in very-low-power-consumption applications such as electronic shelf labels (ESL), digital watches, or metering. DTP involves adding a secondary transistor gate in the single TFT cell to maintain the display of a pixel during a period of 1s without loss of image or without degrading the TFT transistors over time. By slowing the refresh rate of the standard frequency from 60 Hz to 1 Hz, DTP claims to increase the power efficiency by multiple orders of magnitude.

Due to the very high cost of building TFT factories, there are few major OEM panel vendors for large display panels. The glass panel suppliers are as follows:

External consumer display devices like a TFT LCD feature one or more analog VGA, DVI, HDMI, or DisplayPort interface, with many featuring a selection of these interfaces. Inside external display devices there is a controller board that will convert the video signal using color mapping and image scaling usually employing the discrete cosine transform (DCT) in order to convert any video source like CVBS, VGA, DVI, HDMI, etc. into digital RGB at the native resolution of the display panel. In a laptop the graphics chip will directly produce a signal suitable for connection to the built-in TFT display. A control mechanism for the backlight is usually included on the same controller board.

The low level interface of STN, DSTN, or TFT display panels use either single ended TTL 5 V signal for older displays or TTL 3.3 V for slightly newer displays that transmits the pixel clock, horizontal sync, vertical sync, digital red, digital green, digital blue in parallel. Some models (for example the AT070TN92) also feature input/display enable, horizontal scan direction and vertical scan direction signals.

New and large (>15") TFT displays often use LVDS signaling that transmits the same contents as the parallel interface (Hsync, Vsync, RGB) but will put control and RGB bits into a number of serial transmission lines synchronized to a clock whose rate is equal to the pixel rate. LVDS transmits seven bits per clock per data line, with six bits being data and one bit used to signal if the other six bits need to be inverted in order to maintain DC balance. Low-cost TFT displays often have three data lines and therefore only directly support 18 bits per pixel. Upscale displays have four or five data lines to support 24 bits per pixel (truecolor) or 30 bits per pixel respectively. Panel manufacturers are slowly replacing LVDS with Internal DisplayPort and Embedded DisplayPort, which allow sixfold reduction of the number of differential pairs.

Backlight intensity is usually controlled by varying a few volts DC, or generating a PWM signal, or adjusting a potentiometer or simply fixed. This in turn controls a high-voltage (1.3 kV) DC-AC inverter or a matrix of LEDs. The method to control the intensity of LED is to pulse them with PWM which can be source of harmonic flicker.

The bare display panel will only accept a digital video signal at the resolution determined by the panel pixel matrix designed at manufacture. Some screen panels will ignore the LSB bits of the color information to present a consistent interface (8 bit -> 6 bit/color x3).

With analogue signals like VGA, the display controller also needs to perform a high speed analog to digital conversion. With digital input signals like DVI or HDMI some simple reordering of the bits is needed before feeding it to the rescaler if the input resolution doesn"t match the display panel resolution.

The statements are applicable to Merck KGaA as well as its competitors JNC Corporation (formerly Chisso Corporation) and DIC (formerly Dainippon Ink & Chemicals). All three manufacturers have agreed not to introduce any acutely toxic or mutagenic liquid crystals to the market. They cover more than 90 percent of the global liquid crystal market. The remaining market share of liquid crystals, produced primarily in China, consists of older, patent-free substances from the three leading world producers and have already been tested for toxicity by them. As a result, they can also be considered non-toxic.

Kawamoto, H. (2012). "The Inventors of TFT Active-Matrix LCD Receive the 2011 IEEE Nishizawa Medal". Journal of Display Technology. 8 (1): 3–4. Bibcode:2012JDisT...8....3K. doi:10.1109/JDT.2011.2177740. ISSN 1551-319X.

Richard Ahrons (2012). "Industrial Research in Microcircuitry at RCA: The Early Years, 1953–1963". 12 (1). IEEE Annals of the History of Computing: 60–73. Cite journal requires |journal= (help)

K. H. Lee; H. Y. Kim; K. H. Park; S. J. Jang; I. C. Park & J. Y. Lee (June 2006). "A Novel Outdoor Readability of Portable TFT-LCD with AFFS Technology". SID Symposium Digest of Technical Papers. AIP. 37 (1): 1079–82. doi:10.1889/1.2433159. S2CID 129569963.

Global TFT LCD Display Modules Market Report (114 Pages) provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

Due to the COVID-19 pandemic and Russia-Ukraine War Influence, the global market for TFT LCD Display Modules estimated at USD million in the year 2022, is projected to reach a revised size of USD million by 2028, growing at a growing CAGR during the forecast period 2022-2028.

The USA market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The China market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The Europe market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The global key manufacturers of TFT LCD Display Modules include Panasonic Corporation, Schneider Electric, Siemens AG, LG Display, HannStar Display Corporation, AU Optronics Corp., Chi Mei Corporation, SAMSUNG Display and SHARP CORPORATION, etc. In 2021, the global top five players had a share approximately % in terms of revenue.

In terms of production side, this report researches the TFT LCD Display Modules production, growth rate, market share by manufacturers and by region (region level and country level), from 2017 to 2022, and forecast to 2028.

In terms of sales side, this report focuses on the sales of TFT LCD Display Modules by region (region level and country level), by company, by Type and by Application. from 2017 to 2022 and forecast to 2028.

This report aims to provide a comprehensive presentation of the global market for TFT LCD Display Modules, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding TFT LCD Display Modules.

The TFT LCD Display Modules market size, estimations, and forecasts are provided in terms of output/shipments (K Units) and revenue (USD millions), considering 2021 as the base year, with history and forecast data for the period from 2017 to 2028. This report segments the global TFT LCD Display Modules market comprehensively. Regional market sizes, concerning products by types, by application, and by players, are also provided. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

In this section, the readers will gain an understanding of the key players competing. This report has studied the key growth strategies, such as innovative trends and developments, intensification of product portfolio, mergers and acquisitions, collaborations, new product innovation, and geographical expansion, undertaken by these participants to maintain their presence. Apart from business strategies, the study includes current developments and key financials. The readers will also get access to the data related to global revenue, price, and sales by manufacturers for the period 2017-2022. This all-inclusive report will certainly serve the clients to stay updated and make effective decisions in their businesses.

Global markets are presented by TFT LCD Display Modules type, along with growth forecasts through 2028. Estimates on production and value are based on the price in the supply chain at which the TFT LCD Display Modules are procured by the manufacturers.

This report has studied every segment and provided the market size using historical data. They have also talked about the growth opportunities that the segment may pose in the future. This study bestows production and revenue data by type, and during the historical period (2017-2022) and forecast period (2023-2028).

This report has provided the market size (production and revenue data) by application, during the historical period (2017-2022) and forecast period (2023-2028).

This report also outlines the market trends of each segment and consumer behaviors impacting the TFT LCD Display Modules market and what implications these may have on the industry"s future. This report can help to understand the relevant market and consumer trends that are driving the TFT LCD Display Modules market.

High-impact rendering factors and drivers have been studied in this report to aid the readers to understand the general development. Moreover, the report includes restraints and challenges that may act as stumbling blocks on the way of the players. This will assist the users to be attentive and make informed decisions related to business. Specialists have also laid their focus on the upcoming business prospects.

The readers in the section will understand how the TFT LCD Display Modules market scenario changed across the globe during the pandemic, post-pandemic and Russia-Ukraine War. The study is done keeping in view the changes in aspects such as demand, consumption, transportation, consumer behavior, supply chain management, export and import, and production. The industry experts have also highlighted the key factors that will help create opportunities for players and stabilize the overall industry in the years to come.

Reasons to Buy This Report: ● This report will help the readers to understand the competition within the industries and strategies for the competitive environment to enhance the potential profit. The report also focuses on the competitive landscape of the global TFT LCD Display Modules market, and introduces in detail the market share, industry ranking, competitor ecosystem, market performance, new product development, operation situation, expansion, and acquisition. etc. of the main players, which helps the readers to identify the main competitors and deeply understand the competition pattern of the market.

● This report will help stakeholders to understand the global industry status and trends of TFT LCD Display Modules and provides them with information on key market drivers, restraints, challenges, and opportunities.

● This report will help stakeholders to understand competitors better and gain more insights to strengthen their position in their businesses. The competitive landscape section includes the market share and rank (in volume and value), competitor ecosystem, new product development, expansion, and acquisition.

This section of the report provides key insights regarding various regions and the key players operating in each region. Economic, social, environmental, technological, and political factors have been taken into consideration while assessing the growth of the particular region/country. The readers will also get their hands on the revenue and sales data of each region and country for the period 2017-2028.

The market has been segmented into various major geographies, including North America, Europe, Asia-Pacific, South America. Detailed analysis of major countries such as the USA, Germany, the U.K., Italy, France, China, Japan, South Korea, Southeast Asia, and India will be covered within the regional segment.

Chapter 1:Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2:Detailed analysis of TFT LCD Display Modules manufacturers competitive landscape, price, output and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 3:Production/output, value of TFT LCD Display Modules by region/country. It provides a quantitative analysis of the market size and development potential of each region in the next six years.

Chapter 4:Consumption of TFT LCD Display Modules in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 5:Provides the analysis of various market segments according to product type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 6:Provides the analysis of various market segments according to application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 7:Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product production/output, revenue, , price, gross margin, product introduction, recent development, etc.

Chapter 10:Introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Chapter 13:Forecast by type and by application. It provides a quantitative analysis of the market size and development potential of each market segment in the next six years.

Is there a problem with this press release? Contact the source provider Comtex at editorial@comtex.com. You can also contact MarketWatch Customer Service via our Customer Center.

According to a recently released report by SEMI, thin-film transitor-LCD manufacturing capacity in China is expected to show 35 percent growth in 2007 and 50 percent growth in 2008, as new fab capacity begins to come online.

The report also predicts that investment in display production facilities will cool for the rest of the world, but China may eventually account for 20 to 30 percent of the total world market.

At present, China has two fifth generation (G5) TFT-LCD fabs in production, one coming online, one existing G5 fab expansion, one G1 plant and three Chinese-owned G2-G3 lines in Korea.

Some new investments in planning stages include a Truly Semiconductor G2.5 project, a Shanghai Tianma G4.5 line, plus an additional 60,000 sheets of G5 capacity per month by IVO. A Shenzhen Jiulong G6 plant and a G6 Shainghai SVA-NEC plant are awaiting environmental approvals.

“To date, there has been very little production of TFT-LCD materials or components in China,” said Mark Ding, president of SEMI China. “However, the influx of both Chinese and foreign-owned companies that are beginning to establish these local facilities is helping to significantly grow this market, and will ultimately help establish China as a global panel making market center of TFT-LCD materials and components.”

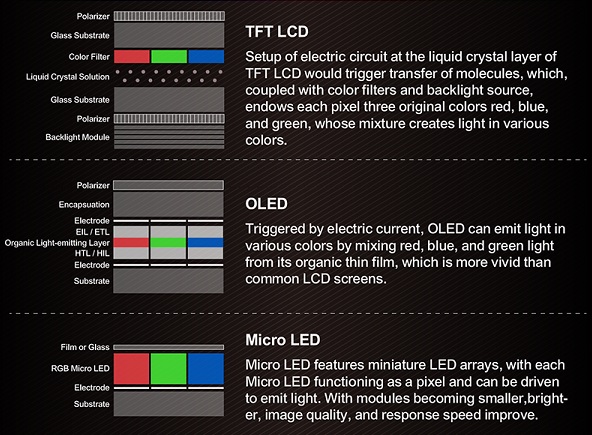

OLED is increasingly used in smartphones and televisions, but supply is tightening due to size issues and high production costs, making TFT LCD module demand stronger for the next 3 to 5 years. An organic light-emitting diode (OLED) refers to organic LED materials which light up in the presence of electric currents. OLED uses passive-matrix (PMOLED) or active-matrix (AMOLED). Most manufacturers use AMOLED.

OLED creates the deepest black, generating higher color quality than LCD displays. However, organic elements have lower lifespans than LCDs and AMOLED is not suitable for brightly-lit environments. Apple’s high demand has an impact on AMOLED production, among other factors, which has a subsequent positive effect on TFT LCD module demand.

AMOLED demands gets stronger, due to the pursuit for the best color in smartphones and televisions, but its supply is limited because of production factors. Apple is projected to require 100 million AMOLED panels annually for the next three years. Apple’s requirement creates high AMOLED demand in the small and medium display market. Displays are 9-inch in size, which creates a dent on AMOLED supply.

OLED is particularly harder to make than LCD modules because of the complexity in involved in creating substrate materials. OLED manufacturing is costlier than LCD modules, which may also create long-term production issues.

As AMOLED supply remains uncertain, numerous consumer product manufacturers would rather rely on TFT LCD modules. Innovations in TFT LCD can make them more competitive, especially as they cost less than OLED. Stronger TFT LCD demand will come from high-resolution smartphones and consumer electronics with short life cycles.

Though some say that the demand for TFT LCD is likely to contract, they are not considering the increasing use of OLED which already puts greater pressure on its suppliers. Without reducing OLED production costs, they might experience bottleneck problems in the future. Uncertain of OLED supply, some manufacturers of automotive, smartphone, and medical monitors would still prefer TFT LCD over OLED.

While OLED promises deeper colors, TFT LCD module can offer a more reliable, cost-efficient supply. As a result, companies that do not emphasize the demand for high color saturation would opt for TFT LCD. For the next 3 to 5 years, unless OLED vastly improves manufacturing costs and speed, TFT LCD makers are poised for higher demand.

Reports suggest that Apple is getting closer to implementing MicroLED in its future product releases, including the Apple Watch, with the display technology potentially offering a number of benefits compared to other methods. AppleInsider explains how the current TFT and OLED display technologies work, and how MicroLED differs.

MicroLED shows promise as a display technology, potentially offering power savings and a reduced screen thickness when put beside current-generation display panels. Apple has recognized the potential, and has invested heavily into developing the technology over the last few years, with a view to using it in the company"s future products.

To understand fully how MicroLED can benefit Apple, it is worth understanding how the commonly-used display technologies work in the first place, before examining how different MicroLED really is in a comparison.

The most common display technology used by consumer products today, and the oldest of the technologies examined in this article, TFT"s full name of TFT LCD stands for Thin-film-transistor liquid-crystal display. This technology is extensively used by Apple in its products, found in iPads, iPhones, MacBooks, and iMac lines.

The LCD part relates to the concept of defining small translucent or transparent areas in a thin and flexible liquid crystal-filled panel, like the displays used in calculators. Passing current through the segment changes the molecular properties of the defined segment area, allowing it to switch between being see-through or opaque.

TFT takes this a stage further, by effectively covering an entire panel with a grid of isolated liquid crystal segments, which again can vary between opaque and transparent based on the level of electrical current. In this case, there are far more segments needed to make up the display than with a normal calculator.

Three neighboring segments can be used to create a single pixel, with color filters used to change the light passing through to red, blue, or green. By varying the charge applied to each liquid crystal segment, the three combined can be used to generate a wide variety of colors and at different brightnesses.

Polarizing filters on either side of the TFT display sandwich are used to prevent light from passing through directly, with the liquid crystal reaction of each segment affecting polarized light passing through the first filter to go through the second.

Sometimes these types of display are known as "LED," but this somewhat of a misnomer, as this actually refers to the use of Light Emitting Diodes as a light source. The LED backlight shines light through the various layers making up the TFT LCD.

Displays that use collections of LEDs as individual pixels do exist, but it isn"t usually found in consumer products. LED screens are commonly used for billboards, in attractions, and as a large-scale display for events.

TFT LCD screens continue to be widely used in production for a number of reasons. Manufacturers have spent a long time perfecting the production of the display panels to make it as cheap as possible, while its high usage allows it to benefit from economies of scale.

Used in consumer devices in a similar way to TFT LCD, OLED (Organic Light-Emitting Diode) is a display technology that is similar in the basic concept, but differs considerably in its execution. Again, the idea is for a thin panel to be divided up into segments, with charge applied to each section to alter its molecular properties, but that"s where the techniques diverge.

As the name implies, OLED uses an organic compound film that is put between two electrodes, which are used to provide charge. Instead of the charge changing how light passes through, the current instead causes the emissive electroluminescent layer to emit light, without the need for a rear light source.

These self-emitting pixels gives OLED a considerable advantage over LCD-based systems in a number of areas. Most obviously, by not needing a backlight, OLED panels can be made far thinner than an equivalent LCD-based display, allowing for the production of thinner devices or more internal area for other components, like a larger battery.

The power efficiency of OLED panels can be far greater, as while a TFT screen requires an always-on backlight, the brightness of OLED pixels themselves determine power usage, with a black pixel consuming no power at all. OLED screens are also faster to respond than LCD displays, making them more useful for VR displays, where response time needs to be as rapid as possible.

This also allows OLED to provide superior contrast ratios compared to TFT, as the lack of backlight bleed-through that occurs in TFT simply doesn"t happen in OLED.

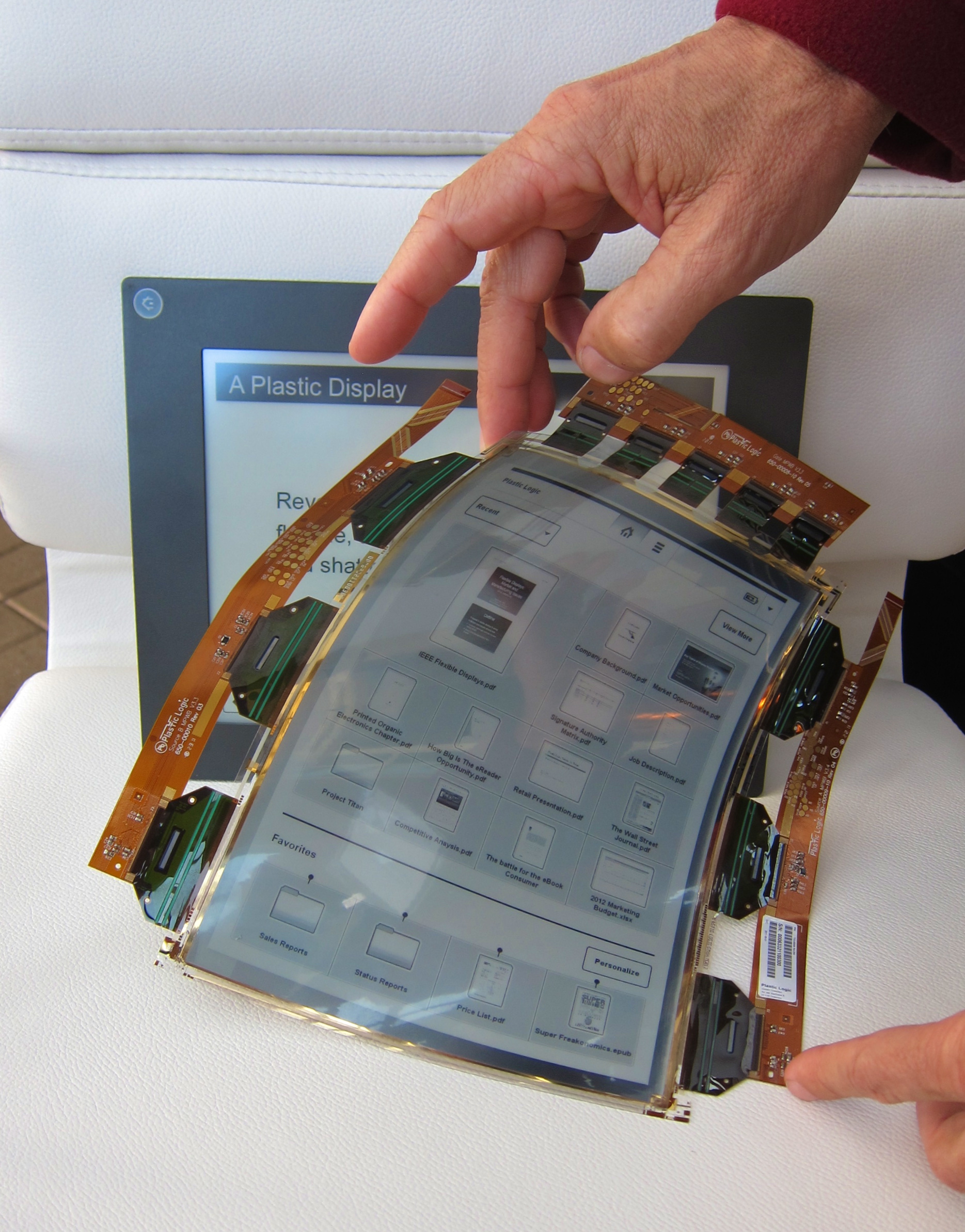

OLED also can be produced on plastic substrates instead of glass, allowing it to be used to create flexible displays. While this is currently embodied in curved and other non-flat screens in some devices, it has the potential to be employed in foldable smartphones or rolled up for storage, an area Apple is also allegedly examining.

Despite the advantages, OLED is still lagging behind TFT in terms of adoption. The cost of production is far higher, in part due to the need for extremely clean environments, as a single speck of dust can potentially ruining a display during fabrication.

OLED panels are also affected by the presence of water, both in production and in use. Small amounts of water contacting the organic substrate can cause immediate damage to the display, rendering parts of the screen useless.

So far, Apple"s usage of OLED consists of the premium iPhone X and the Apple Watch. As the cost of production drops down, it is plausible for Apple to use OLED in more future products, providing a better screen for customers to use.

Thought to be the next big thing in display technology, MicroLED basically takes the idea of using LEDs for pixels in a large stadium-style screen and miniaturizes it all.

Using extremely small LEDs, three MicroLEDs are put together to create each pixel, with each subpixel emitting a different color from the usual red, blue, and green selection. As each LED emits light, there is no need for a backlight as used in TFT screens.

MicroLED doesn"t use an organic compound to produce light, making it less susceptible to failure compared to OLED. Just like OLED, it can be applied onto a flexible material, allowing it to be used for curved displays or non-stationary components, like a watch strap, and can result in an extremely thin display panel.

MicroLED offers the same lower power consumption and high contrast ratio benefits as OLED when compared to TFT. However, MicroLED is also capable of producing a far brighter image than OLED, up to 30 times brighter, and is in theory more efficient in converting electricity into light.

As a relatively new and in-development technology, the cost of MicroLED production is extremely high in comparison to the more established OLED and TFT mass production lines, in part due to lower than required yields. Manufacturing equipment vendors have produced hardware for MicroLED production that cuts defects in half and reduces deposition deviance from 3 nanometers down to 1 nanometer, but it is unclear if this is enough to help mass production move forward.

While MicroLED is an attractive proposition for Apple, it is not the only technology under development by the company"s engineers. Apple has previously filed patent applications for a technology described as "Quantum Dot LED and OLED Integration for High Efficiency Displays."

Quantum Dots are photoluminescent particles included in an LED-backed TFT display that can produce brighter and more vibrant colors, with the colors produced depending on their size. While available in current QLED televisions, the technology is only really being used to enhance the backlight, rather than being used to illuminate individual pixels.

Under Apple"s implementation, thought to be a "true quantum dot" (QD) system, the dot will emit light on demand without needing a backlight. For true QD, the photoluminescent dots are instead replaced by electroluminescent nanoparticles which are capable of such emissions.

The technology in theory can create an even thinner display than OLED, along with a more streamlined manufacturing process. True QD displays are also capable of high pixel densities of up to 1,000ppi, multiple times the density required to be called a Retina-quality display, and based on Apple"s hybrid invention, will also boast the response times of OLED technology.

As is usually the case, Apple does produce a considerable number of patent applications every week that are filed with the US Patent and Trademark Office, and not everything it files will be fully commercialized.

The QD patent application certainly shows Apple is thinking about display technology in multiple ways, and how it can be applied to future devices, but short of getting firm supply chain information or an official announcement from Apple directly, it is difficult to confirm which direction it will be heading.

Apple has been interested in using the technology for some time now, with the first notable sign being its acquisition of LuxVue in May 2014, alongside assorted related patents. A MicroLED specialist, LuxVue was rumored to have been the display producer for the ill-fated Google Glass headset, but was also the holder of assorted patents in the LED display field, including MicroLED.

At the time, the acquisition was thought to be an attempt by Apple to bring part of its display technology development in-house, with suggestions the MicroLED technology would be used in another rumored-at-the-time device, the Apple Watch. A more recent report suggests Apple is working with TSMC to make small panels for a future premium Apple Watch, potentially starting mass production by the end of the year.

Apple has also reportedly set up a secret facility just 15 minutes away from Apple Park, believed to be used for developing MicroLED. The 62,000 square-foot facility is thought to house around 300 engineers on a project named "T159," relating directly to the technology"s development.

The facility is also claimed to be sufficient in size to perform small scale manufacturing of display panels, allowing the company to keep development and testing in-house without involving third-parties. Considering Apple"s previous history in developing technologies before issuing information to manufacturing partners, it is possible that Apple is trying to work out the kinks in production before suppliers even attempt to make MicroLED panels.

The rumored small screen production may be for the Apple Watch now, but it may also benefit another often-rumored device, namely the VR or AR headset. This type of hardware relies on light components to keep the weight off the user"s head and neck, as well as displays with a high refresh rate and as close to perfect color reproduction as possible.

Apple is also apparently planning to use the technology in larger displays, said to be bigger in size than those in the MacBook Pro lines. This could be an iMac or iMac Pro, or even an external display, but ultimately there"s no real indication of Apple"s plans at this point, regardless of the scale of the screen.

Reports from last year also suggest Apple"s investment in MicroLED was a cause for concern for Samsung, LG, and other South Korean suppliers who provide display panels for the company"s products. Owning the process for MicroLED manufacturing could allow Apple to migrate away from its existing display suppliers in the coming years, reducing revenues and profits.

Aside from Apple"s development, there has been little in the way of announcements from other firms for products using the technology that could be bought by consumers in the coming months. The exception is Samsung, Apple"s main rival in the mobile marketplace and a major supplier of display panels, but its usage of MicroLED is not aimed at producing smaller screens.

At CES 2018, Samsung introduced The Wall, a 148-inch TV claimed to be the "world"s first consumer modular MicroLED" television. According to the South Korean electronics giant, The Wall"s modularity meant consumers would be able to customize their television"s size and shape to suit their needs.

Samsung claimed at the show it will be available to buy from August, but declined to advise how much it will cost. Given the technology"s allegedly expensive production using current methods, and the usual high cost associated with the company"s televisions headlining at the tradeshow, it will probably be prohibitive for the vast majority of potential buyers.

The impending use of the technology in a high-priced consumer product could be considered proof that MicroLED display technology is maturing enough for use in devices. If the reports claiming Apple is getting close to mass producing panels is true, the inclusion of MicroLED in the Apple Watch could end up being the first mainstream usage of the technology.

In recent years, China and other countries have invested heavily in the research and manufacturing capacity of display technology. Meanwhile, different display technology scenarios, ranging from traditional LCD (liquid crystal display) to rapidly expanding OLED (organic light-emitting diode) and emerging QLED (quantum-dot light-emitting diode), are competing for market dominance. Amidst the trivium strife, OLED, backed by technology leader Apple"s decision to use OLED for its iPhone X, seems to have a better position, yet QLED, despite still having technological obstacles to overcome, has displayed potential advantage in color quality, lower production costs and longer life.

Which technology will win the heated competition? How have Chinese manufacturers and research institutes been prepared for display technology development? What policies should be enacted to encourage China"s innovation and promote its international competitiveness? At an online forum organized by National Science Review, its associate editor-in-chief, Dongyuan Zhao, asked four leading experts and scientists in China.

Zhao: We all know display technologies are very important. Currently, there are OLED, QLED and traditional LCD technologies competing with each other. What are their differences and specific advantages? Shall we start from OLED?

Huang: OLED has developed very quickly in recent years. It is better to compare it with traditional LCD if we want to have a clear understanding of its characteristics. In terms of structure, LCD largely consists of three parts: backlight, TFT backplane and cell, or liquid section for display. Different from LCD, OLED lights directly with electricity. Thus, it does not need backlight, but it still needs the TFT backplane to control where to light. Because it is free from backlight, OLED has a thinner body, higher response time, higher color contrast and lower power consumption. Potentially, it may even have a cost advantage over LCD. The biggest breakthrough is its flexible display, which seems very hard to achieve for LCD.

Liao: Actually, there were/are many different types of display technologies, such as CRT (cathode ray tube), PDP (plasma display panel), LCD, LCOS (liquid crystals on silicon), laser display, LED (light-emitting diodes), SED (surface-conduction electron-emitter display), FED (filed emission display), OLED, QLED and Micro LED. From display technology lifespan point of view, Micro LED and QLED may be considered as in the introduction phase, OLED is in the growth phase, LCD for both computer and TV is in the maturity phase, but LCD for cellphone is in the decline phase, PDP and CRT are in the elimination phase. Now, LCD products are still dominating the display market while OLED is penetrating the market. As just mentioned by Dr Huang, OLED indeed has some advantages over LCD.

Huang: Despite the apparent technological advantages of OLED over LCD, it is not straightforward for OLED to replace LCD. For example, although both OLED and LCD use the TFT backplane, the OLED’s TFT is much more difficult to be made than that of the voltage-driven LCD because OLED is current-driven. Generally speaking, problems for mass production of display technology can be divided into three categories, namely scientific problems, engineering problems and production problems. The ways and cycles to solve these three kinds of problems are different.

At present, LCD has been relatively mature, while OLED is still in the early stage of industrial explosion. For OLED, there are still many urgent problems to be solved, especially production problems that need to be solved step by step in the process of mass production line. In addition, the capital threshold for both LCD and OLED are very high. Compared with the early development of LCD many years ago, the advancing pace of OLED has been quicker.While in the short term, OLED can hardly compete with LCD in large size screen, how about that people may change their use habit to give up large screen?

Liao: I want to supplement some data. According to the consulting firm HIS Markit, in 2018, the global market value for OLED products will be US$38.5 billion. But in 2020, it will reach US$67 billion, with an average compound annual growth rate of 46%. Another prediction estimates that OLED accounts for 33% of the display market sales, with the remaining 67% by LCD in 2018. But OLED’s market share could reach to 54% in 2020.

Huang: While different sources may have different prediction, the advantage of OLED over LCD in small and medium-sized display screen is clear. In small-sized screen, such as smart watch and smart phone, the penetration rate of OLED is roughly 20% to 30%, which represents certain competitiveness. For large size screen, such as TV, the advancement of OLED [against LCD] may need more time.

Xu: LCD was first proposed in 1968. During its development process, the technology has gradually overcome its own shortcomings and defeated other technologies. What are its remaining flaws? It is widely recognized that LCD is very hard to be made flexible. In addition, LCD does not emit light, so a back light is needed. The trend for display technologies is of course towards lighter and thinner (screen).

But currently, LCD is very mature and economic. It far surpasses OLED, and its picture quality and display contrast do not lag behind. Currently, LCD technology"s main target is head-mounted display (HMD), which means we must work on display resolution. In addition, OLED currently is only appropriate for medium and small-sized screens, but large screen has to rely on LCD. This is why the industry remains investing in the 10.5th generation production line (of LCD).

Xu: While deeply impacted by OLED’s super thin and flexible display, we also need to analyse the insufficiency of OLED. With lighting material being organic, its display life might be shorter. LCD can easily be used for 100 000 hours. The other defense effort by LCD is to develop flexible screen to counterattack the flexible display of OLED. But it is true that big worries exist in LCD industry.

LCD industry can also try other (counterattacking) strategies. We are advantageous in large-sized screen, but how about six or seven years later? While in the short term, OLED can hardly compete with LCD in large size screen, how about that people may change their use habit to give up large screen? People may not watch TV and only takes portable screens.

Some experts working at a market survey institute CCID (China Center for Information Industry Development) predicted that in five to six years, OLED will be very influential in small and medium-sized screen. Similarly, a top executive of BOE Technology said that after five to six years, OLED will counterweigh or even surpass LCD in smaller sizes, but to catch up with LCD, it may need 10 to 15 years.

Xu: Besides LCD, Micro LED (Micro Light-Emitting Diode Display) has evolved for many years, though people"s real attention to the display option was not aroused until May 2014 when Apple acquired US-based Micro LED developer LuxVue Technology. It is expected that Micro LED will be used on wearable digital devices to improve battery"s life and screen brightness.

Micro LED, also called mLED or μLED, is a new display technology. Using a so-called mass transfer technology, Micro LED displays consist of arrays of microscopic LEDs forming the individual pixel elements. It can offer better contrast, response times, very high resolution and energy efficiency. Compared with OLED, it has higher lightening efficiency and longer life span, but its flexible display is inferior to OLED. Compared with LCD, Micro LED has better contrast, response times and energy efficiency. It is widely considered appropriate for wearables, AR/VR, auto display and mini-projector.

However, Micro LED still has some technological bottlenecks in epitaxy, mass transfer, driving circuit, full colorization, and monitoring and repairing. It also has a very high manufacturing cost. In short term, it cannot compete traditional LCD. But as a new generation of display technology after LCD and OLED, Micro LED has received wide attentions and it should enjoy fast commercialization in the coming three to five years.

Peng: It comes to quantum dot. First, QLED TV on market today is a misleading concept. Quantum dots are a class of semiconductor nanocrystals, whose emission wavelength can be continuously tuned because of the so-called quantum confinement effect. Because they are inorganic crystals, quantum dots in display devices are very stable. Also, due to their single crystalline nature, emission color of quantum dots can be extremely pure, which dictates the color quality of display devices.

Interestingly, quantum dots as light-emitting materials are related to both OLED and LCD. The so-called QLED TVs on market are actually quantum-dot enhanced LCD TVs, which use quantum dots to replace the green and red phosphors in LCD’s backlight unit. By doing so, LCD displays greatly improve their color purity, picture quality and potentially energy consumption. The working mechanisms of quantum dots in these enhanced LCD displays is their photoluminescence.

For its relationship with OLED, quantum-dot light-emitting diode (QLED) can in certain sense be considered as electroluminescence devices by replacing the organic light-emitting materials in OLED. Though QLED and OLED have nearly identical structure, they also have noticeable differences. Similar to LCD with quantum-dot backlighting unit, color gamut of QLED is much wider than that of OLED and it is more stable than OLED.

Another big difference between OLED and QLED is their production technology. OLED relies on a high-precision technique called vacuum evaporation with high-resolution mask. QLED cannot be produced in this way because quantum dots as inorganic nanocrystals are very difficult to be vaporized. If QLED is commercially produced, it has to be printed and processed with solution-based technology. You can consider this as a weakness, since the printing electronics at present is far less precision than the vacuum-based technology. However, solution-based processing can also be considered as an advantage, because if the production problem is overcome, it costs much less than the vacuum-based technology applied for OLED. Without considering TFT, investment into an OLED production line often costs tens of billions of yuan but investment for QLED could be just 90–95% less.

Given the relatively low resolution of printing technology, QLED shall be difficult to reach a resolution greater than 300 PPI (pixels per inch) within a few years. Thus, QLED might not be applied for small-sized displays at present and its potential will be medium to large-sized displays.

Zhao: Quantum dots are inorganic nanocrystal, which means that they must be passivated with organic ligands for stability and function. How to solve this problem? Second, can commercial production of quantum dots reach an industrial scale?

Peng: Good questions. Ligand chemistry of quantum dots has developed quickly in the past two to three years. Colloidal stability of inorganic nanocrystals should be said of being solved. We reported in 2016 that one gram of quantum dots can be stably dispersed in one milliliter of organic solution, which is certainly sufficient for printing technology. For the second question, several companies have been able to mass produce quantum dots. At present, all these production volume is built for fabrication of the backlighting units for LCD. It is believed that all high-end TVs from Samsung in 2017 are all LCD TVs with quantum-dot backlighting units. In addition, Nanosys in the United States is also producing quantum dots for LCD TVs. NajingTech at Hangzhou, China demonstrate production capacity to support the Chinese TV makers. To my knowledge, NajingTech is establishing a production line for 10 million sets of color TVs with quantum-dot backlighting units annually.China"s current demands cannot be fully satisfied from the foreign companies. It is also necessary to fulfill the demands of domestic market. That is why China must develop its OLED production capability.

Huang: Based on my understanding of Samsung, the leading Korean player in OLED market, we cannot say it had foresight in the very beginning. Samsung began to invest in AMOLED (active-matrix organic light-emitting diode, a major type of OLED used in the display industry) in about 2003, and did not realize mass production until 2007. Its OLED production reached profitability in 2010. Since then, Samsung gradually secured a market monopoly status.

So, originally, OLED was only one of Samsung"s several alternative technology pathways. But step by step, it achieved an advantageous status in the market and so tended to maintain it by expanding its production capacity.

Another reason is customers’ demands. Apple has refrained itself from using OLED for some years due to various reasons, including the patent disputes with Samsung. But after Apple began to use OLED for its iPhone X, it exerted a big influence in the whole industry. So now Samsung began to harvest its accumulated investments in the field and began to expand the capacity more.

Also, Samsung has spent considerable time and efforts on the development of the product chain. Twenty or thirty years ago, Japan owned the most complete product chain for display products. But since Samsung entered the field in that time, it has spent huge energies to cultivate upstream and downstream Korean firms. Now the Republic of Korea (ROK) manufacturers began to occupy a large share in the market.

Liao: South Korean manufacturers including Samsung and LG Electronics have controlled 90% of global supplies of medium and small-sized OLED panels. Since Apple began to buy OLED panels from Samsung for its cellphone products, there were no more enough panels shipping to China. Therefore, China"s current demands cannot be fully satisfied from the foreign companies. On the other hand, because China has a huge market for cellphones, it would be necessary to fulfill the demands through domestic efforts. That is why China must develop its OLED production capability.

Huang: The importance of China"s LCD manufacturing is now globally high. Compared with the early stage of LCD development, China"s status in OLED has been dramatically improved. When developing LCD, China has adopted the pattern of introduction-absorption-renovation. Now for OLED, we have a much higher percentage of independent innovation.

Then it is the scale of human resources. One big factory will create several thousand jobs, and it will mobilize a whole production chain, involving thousands of workers. The requirement of supplying these engineers and skilled workers can be fulfilled in China.

The third advantage is the national supports. The government has input huge supports and manufacturers’ technological capacity is improving. I think Chinese manufacturers will have a great breakthrough in OLED.

Although we cannot say that our advantages triumph over ROK, where Samsung and LG have been dominating the field for many years, we have achieved many significant progresses in developing the material and parts of OLED. We also have high level of innovation in process technology and designs. We already have several major manufacturers, such as Visionox, BOE, EDO and Tianma, which h

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey