are tft lcd screens the future made in china

According to a recently released report by SEMI, thin-film transitor-LCD manufacturing capacity in China is expected to show 35 percent growth in 2007 and 50 percent growth in 2008, as new fab capacity begins to come online.

The report also predicts that investment in display production facilities will cool for the rest of the world, but China may eventually account for 20 to 30 percent of the total world market.

At present, China has two fifth generation (G5) TFT-LCD fabs in production, one coming online, one existing G5 fab expansion, one G1 plant and three Chinese-owned G2-G3 lines in Korea.

Some new investments in planning stages include a Truly Semiconductor G2.5 project, a Shanghai Tianma G4.5 line, plus an additional 60,000 sheets of G5 capacity per month by IVO. A Shenzhen Jiulong G6 plant and a G6 Shainghai SVA-NEC plant are awaiting environmental approvals.

“To date, there has been very little production of TFT-LCD materials or components in China,” said Mark Ding, president of SEMI China. “However, the influx of both Chinese and foreign-owned companies that are beginning to establish these local facilities is helping to significantly grow this market, and will ultimately help establish China as a global panel making market center of TFT-LCD materials and components.”

LCD manufacturers are mainly located in China, Taiwan, Korea, Japan. Almost all the lcd or TFT manufacturers have built or moved their lcd plants to China on the past decades. Top TFT lcd and oled display manufactuers including BOE, COST, Tianma, IVO from China mainland, and Innolux, AUO from Tianwan, but they have established factories in China mainland as well, and other small-middium sizes lcd manufacturers in China.

China flat display revenue has reached to Sixty billion US Dollars from 2020. there are 35 tft lcd lines (higher than 6 generation lines) in China,China is the best place for seeking the lcd manufacturers.

The first half of 2021, BOE revenue has been reached to twenty billion US dollars, increased more than 90% than thesame time of 2020, the main revenue is from TFT LCD, AMoled. BOE flexible amoled screens" output have been reach to 25KK pcs at the first half of 2021.the new display group Micro LED revenue has been increased to 0.25% of the total revenue as well.

Established in 1993 BOE Technology Group Co. Ltd. is the top1 tft lcd manufacturers in China, headquarter in Beijing, China, BOE has 4 lines of G6 AMOLED production lines that can make flexible OLED, BOE is the authorized screen supplier of Apple, Huawei, Xiaomi, etc,the first G10.5 TFT line is made in BOE.BOE main products is in large sizes of tft lcd panel,the maximum lcd sizes what BOE made is up to 110 inch tft panel, 8k resolution. BOE is the bigger supplier for flexible AM OLED in China.

As the market forecast of 2022, iPhone OLED purchasing quantity would reach 223 million pcs, more 40 million than 2021, the main suppliers of iPhone OLED screen are from Samsung display (61%), LG display (25%), BOE (14%). Samsung also plan to purchase 3.5 million pcs AMOLED screen from BOE for their Galaxy"s screen in 2022.

Technology Co., Ltd), established in 2009. CSOT is the company from TCL, CSOT has eight tft LCD panel plants, four tft lcd modules plants in Shenzhen, Wuhan, Huizhou, Suzhou, Guangzhou and in India. CSOTproviding panels and modules for TV and mobile

three decades.Tianma is the leader of small to medium size displays in technologyin China. Tianma have the tft panel factories in Shenzhen, Shanhai, Chendu, Xiamen city, Tianma"s Shenzhen factory could make the monochrome lcd panel and LCD module, TFT LCD module, TFT touch screen module. Tianma is top 1 manufactures in Automotive display screen and LTPS TFT panel.

Tianma and BOE are the top grade lcd manufacturers in China, because they are big lcd manufacturers, their minimum order quantity would be reached 30k pcs MOQ for small sizes lcd panel. price is also top grade, it might be more expensive 50%~80% than the market price.

Panda electronics is established in 1936, located in Nanjing, Jiangshu, China. Panda has a G6 and G8.6 TFT panel lines (bought from Sharp). The TFT panel technologies are mainly from Sharp, but its technology is not compliance to the other tft panels from other tft manufactures, it lead to the capacity efficiency is lower than other tft panel manufacturers. the latest news in 2022, Panda might be bougt to BOE in this year.

Established in 2005, IVO is located in Kunsan,Jiangshu province, China, IVO have more than 3000 employee, 400 R&D employee, IVO have a G-5 tft panel production line, IVO products are including tft panel for notebook, automotive display, smart phone screen. 60% of IVO tft panel is for notebook application (TOP 6 in the worldwide), 23% for smart phone, 11% for automotive.

Besides the lcd manufacturers from China mainland,inGreater China region,there are other lcd manufacturers in Taiwan,even they started from Taiwan, they all have built the lcd plants in China mainland as well,let"s see the lcd manufacturers in Taiwan:

Chimei Innolux Corporation was the successor company, and it initially preserved the Chimei name. In order to differentiate itself from the ChiMei brand, the company was renamed "Innolux Corporation" in December 2012.

Innolux"s 14 plants in Taiwan possess a complete range of 3.5G, 4G, 4.5G, 5G, 6G, 7.5G, and 8.5G-8.6G production line in Taiwan and China mainland, offering a full range of large/medium/small LCD panels and touch-control screens.including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch-control solutions,full range of TFT LCD panel modules and touch panels, including TV panels, desktop monitors, notebook computer panels, small and medium-sized panels, and medical and automotive panels.

AUO is the tft lcd panel manufacturers in Taiwan,AUO has the lcd factories in Tianma and China mainland,AUOOffer the full range of display products with industry-leading display technology,such as 8K4K resolution TFT lcd panel, wide color gamut, high dynamic range, mini LED backlight, ultra high refresh rate, ultra high brightness and low power consumption. AUO is also actively developing curved, super slim, bezel-less, extreme narrow bezel and free-form technologies that boast aesthetic beauty in terms of design.Micro LED, flexible and foldable AMOLED, and fingerprint sensing technologies were also developed for people to enjoy a new smart living experience.

Hannstar was found in 1998 in Taiwan, Hannstar display hasG5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, providing various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

driver, backlight etc ,then make it to tft lcd module. so its price is also more expensive than many other lcd module manufacturers in China mainland.

Maclight is a China based display company, located in Shenzhen, China. ISO9001 certified, as a company that more than 10 years working experiences in display, Maclight has the good relationship with top tft panel manufacturers, it guarantee that we could provide a long term stable supply in our products, we commit our products with reliable quality and competitive prices.

Maclight products included monochrome lcd, TFT lcd module and OLED display, touch screen module, Maclight is special in custom lcd display, Sunlight readable tft lcd module, tft lcd with capacitive touch screen. Maclight is the leader of round lcd display. Maclight is also the long term supplier for many lcd companies in USA and Europe.

If you want tobuy lcd moduleorbuy tft screenfrom China with good quality and competitive price, Maclight would be a best choice for your glowing business.

Introduction: Global LCD industry shift and automotive intelligence together to promote the rapid development of China’s LCD panel industry, which will bring a continuous increase in demand for backlight modules, China’s backlight module industry has greater potential for development.

LCD panel backlight module consists of a backlight light source, light guide, optical film, and a plastic frame, which is an important component of LCD display panel. As the backlight module has technology-intensive and labor-intensive attributes, with abundant high-skilled labor advantage China is attracting the global LCD panel industry to the domestic rapid transfer.

From LCD application to the present, the global LCD panel industry capacity transfer has gone through three periods, 2000 Japan dominated the global LCD industry; 2000 – 2010, Japan’s production capacity to South Korea and Taiwan; 2010 to the present, Japanese manufacturers gradually withdraw from the LCD panel industry, production capacity began to transfer to mainland China, so far, mainland China LCD production capacity has occupied the global half of the world.

In recent years, South Korea’s Samsung and LG display will shift their business focus to OLED, and will gradually shut down their LCD production lines and withdraw from the LCD panel industry; at the time of South Korean manufacturers’ withdrawal, domestic enterprises are stepping up new construction to expand LCD production capacity.

BOE, Huaxing photoelectric, Huike, CEC in 2020 – 2021, a total of eight 7 generation LCD production lines completed and put into operation, and domestic panel manufacturers have further expansion plans, the next few years domestic LCD production capacity will continue to increase.

LCD panel manufacturers tend to choose the nearby supporting module suppliers for the safety of the key component supply chain and cost reduction considerations. LCD panel production capacity transfer to China will bring opportunities to domestic backlight module manufacturers and drive the development of the domestic backlight module industry.

The future of the car will pay more attention to the human driving experience, to the intelligent development, which will bring the increasing demand for car display. On the one hand, the number of car displays gradually increased, for example, the instrument panel, rearview mirror, central control platform more to display the way, the passenger and rear position with entertainment display. On the other hand, the car display is constantly to a large screen, multi-screen development, especially in high-end models, the large display has become standard, for example, Tesla Model S screen size of 17 inches, Mercedes-Benz A-class car configuration of two 10.5-inch display.

At the same time, there is also a huge demand for new cars in China. Although China’s car sales have reached 25 million, the current per capita car ownership in China is only a quarter of the developed countries, the future potential for new car demand is still very large. Therefore, China’s car display market growth potential is large, which will directly drive the domestic backlight module demand continues to increase.

According to the terminal application size, backlight module can be divided into large, medium, and small size, of which small size backlight module is mainly used in smartphones, wearable devices, and other terminals, the medium size used in notebook computers, tablet PCs, car screens and other terminals, the large size is mainly used in LCD TV.

From the market competition pattern, the domestic backlight module enterprises are deeply plowed in their respective competitive advantage in the field of segmentation, including Baoming technology, Longli technology mainly layout small size cell phone display field, Hanbo high-tech, Weishi electronics mainly layout in the size of car display and notebook computer field, Rui Yi photoelectric and photoelectric in each field have layout.

From the industry development trend, smartphone display is transitioning to OLED, LCD TV market is gradually saturated, the future of large size and small size backlight module market potential is relatively small; and the future of the car display market potential is huge, by the backlight module manufacturers are unanimously optimistic, are currently accelerating the layout ( see Table 2 ). Focusing on the traditional medium-sized backlight module field, Hanbo Hi-Tech and Weishi Electronics have significant advantages in core technology patents, downstream customer resources, process experience accumulation, production costs, etc., and have more development advantages in the future.

The current global LCD display panel industry is rapidly moving to China, which brings development opportunities to China’s backlight module industry. In addition, automotive intelligence will also bring a continuous increase in demand for medium-sized car displays, the first to enter the field of medium-sized backlight module manufacturers with its customer resources, core technology, scale efficiency, and other advantages will be more beneficial.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Attendees visit the booth of TV panel maker Shenzhen China Star Optoelectronics Technology during an international exhibition in Shanghai on July 11, 2019. [Photo by Lyu Liang/For China Daily]

Chinese companies have gained a competitive edge in the large-screen display industry and the exit of South Korean counterparts such as Samsung Electronics and LG Display from the liquid crystal display market will bring opportunities for China"s panel makers despite the challenges posed by the COVID-19 pandemic.

Market research firm Sigmaintell said BOE Technology Group Co Ltd-a leading Chinese supplier of display products and solutions-became the world"s largest shipper of LCD TV panels for the first time in 2019.

The Beijing-based company shipped 53.3 million units of LCD panels in 2019, with production capacity increasing by more than 20 percent on a yearly basis.

The consultancy said the LCD TV panel production area of Chinese manufacturers will account for more than 50 percent of the global total this year, surpassing South Korean competitors who are accelerating the shutdown of large-sized LCD panel production capacity due to competition from Chinese manufacturers.

It estimated the production capacity of large-sized LCD panels will continue to increase in China over the next three years. In addition, global LCD TV panel shipments stood at 283 million pieces last year, a slight decrease of 0.2 percent year-on-year. Meanwhile, the shipment area was 160 million square meters, an increase of 6.3 percent year-on-year.

"Chinese companies have gained an upper hand in large-screen LCD displays. Samsung and LG"s decision to exit from the LCD sector means Chinese panel makers will take a dominant position in this field," said Li Dongsheng, founder and chairman of Chinese tech giant TCL Technology Group Corp.

Li said South Korean firms will focus on organic LED screens and quantum dot LED displays, while Chinese TV panel makers are catching up at a rapid pace.

The pandemic will accelerate reshuffling in the display industry as supply has surpassed demand in the past few years and competition has become very fierce, he added.

"The outbreak has caused a periodic drop in demand in the global display market and sped up the restructuring of the entire industry. Chinese enterprises are in a favorable position, and I believe that they will further enhance their competitiveness," Li said.

Data consultancy Digitimes Research said it comes as little surprise that Samsung has opted to withdraw from the LCD panel sector as its LCD business was losing money in every quarter of 2019 due to challenges from Chinese competitors.

"China"s semiconductor display industry has made large advances in the past decade, changing the display industry"s global competitive landscape. China has transformed into the world"s largest consumer market and manufacturing base for display terminals, with huge market potential," said BOE Vice-President Zhang Yu.

BOE said its Gen 10.5 TFTLCD production line achieved mass production in Hefei, Anhui province, in March 2018. The plant mainly produces high-definition LCD screens of 65 inches and above. With a total investment of 46 billion yuan ($6.5 billion), the company"s second Gen 10.5 TFT-LCD production line launched operations in Wuhan, Hubei province, in December.

The Gen 11 TFT-LCD and active-matrix OLED production line of Shenzhen China Star Optoelectronics Technology, a subsidiary of TCL, officially entered operations in November 2018, producing 43-inch, 65-inch and 75-inch LCD screens.

Chen Lijuan, an analyst at Sigmaintell, said panel manufacturers should not just invest in production lines, but also pay more attention to the establishment of the whole supply chain, including raw materials, equipment and technology.

Bian Zheng, deputy director of research at AVC Revo, a unit of market consultancy firm AVC, said China will have a 51 percent market share in global TV shipments in 2020, while South Korea will have 25 percent, adding that large-screen TV panels will bolster healthy development of the industry.

Bian said the OLED and QLED will be the next-generation flat-panel display technologies to be in the spotlight. LG Display is currently the world"s only supplier of large-screen OLED TV panels.

OLED is a relatively new technology and part of recent display innovation. It has a fast response rate, wide viewing angles, super high-contrast images and richer colors. It is much thinner and can be made flexible, compared with traditional LCD display panels.

Li Yaqin, general manager of Sigmaintell, said 65-inch TVs will become the mainstream in people"s living rooms in the future, but OLED TVs will not be able to immediately spur customer purchases at this time though the future trend is for higher-tech options.

China"s first 8.5-generation TFT-LCD production line was launched in Bengbu, East China"s Anhui province, on June 18, 2019, representing a breakthrough in the production of high-definition LCD screen, Science and Technology Daily reported.

TFT-LCD, or Thin Film Transistor Liquid Crystal Display, is key strategic material of the electronic information display industry. The Gen 8.5 TFT-LCD production line, launched by the Bengbu Glass Industry Design and Research Institute of the China National Building Material Group, will produce high-definition LCD screens of 55 inches, the report said.

According to the Liquid Crystal Branch of the China Optics and Optoelectronics Manufactures Association, the demand for TFT-LCD in the Chinese mainland was about 260 million square meters in 2018, including 233 million square meters" Gen 8.5 TFT-LCD. However, the annual supply of domestically made TFT-LCD is less than 40 million square meters, with all of them Gen 6 or below, which cannot meet the demand in scale and quantity.

The association predicted that China"s market demand for Gen 8.5 TFT-LCD or above will exceed 300 million square meters by 2020, accounting for 49.6 percent of the total global demand.

The production and control precision of Gen 8.5 TFT-LCD is comparable to that of the semiconductor industry, representing a higher level of large-scale manufacturing of modern glass industry.

The institute in Bengbu, with 60 years of expertise in glass, has finally made a breakthrough in the production of Gen 8.5 TFT-LCD, and will provide key raw material guarantee for China"s LCD panel industry after it goes into mass production in September, the report said.

China has become the world"s largest LCD panel manufacturing base and is investing in a complete Mini/Micro-LED industry chain. Li Leiguang, JW Insights" chief analyst of the display industry, shared this information at a Mini/Micro-LED industry forum held in Shenzhen in late October.

With over 16 years of experience in the display industry, Li Leiguang has a deep understanding of China"s domestic display industry from materials and panel technologies to industrial policies. He has written industrial research and planning reports for various government departments in Shenzhen, Zhaoqing, Meishan, and Chengdu as well as customized reports for corporate clients in the display industry chain. This article is an excerpt from his speech.

China had long depended on imports of IC and display screens in the manufacturing of display products. IC and display screens are the two pillar sectors of the ICT Industry. The trend has been changing. With the continuous increase of high-generation production lines and capacity of domestic panel manufacturers and the gradual closure of LCD production lines by South Korean manufacturers, China"s LCD panel market share has increased year by year.

In 2020, China achieved a trade surplus in LCD panels for the first time. Meanwhile, the TFT-LCD has become a mainstream choice in the display panel industry after nearly 30 years of development.

JW Insights data shows that China has invested a total of RMB1.2 trillion($187.56 billion) in TFT-LCD and AMOLED panel production lines; Some 50 TFT-LCD and AMOLED panel production lines have been built, with 197 million m2/year TFT-LCD production capacity, 8.9 million m2/year AMOLED production capacity.

China"s LCD production capacity accounted for 50% of the global production capacity in 2020, becoming the world"s largest LCD panel production center; It will reach more than 75% of the world"s total by 2025.

China"s mainland is currently the only region that maintains continuous growth in LCD panel production capacity. With Japanese and South Korean manufacturers gradually withdrawing from the LCD panel, China is becoming the dominant player.

Chinese domestic display panel manufacturers are also embracing new display technologies such as Mini LED, Mirco LED, OLED and Micro OLED (silicon-based OLED), which are in an explosive market growth phase.

Chinese screen manufacturers plan to invest nearly RMB 30 billion($4.7 billion) in silicon-based OLED products lines, with more than 15 planned production lines and the total production capacity equivalent to 95 million units 1-inch screen, according to JW Insights statistics.

Meanwhile, China is leading the world in Micro LED research and development. Chinese players have actively invested in the Mini/Micro-LED, geared up for a new round of capacity ramps. The total investments in this field have amounted to RMB100 billion($15.6 billion), expected to accelerate Mini/Micro LED commercialization.

Unlike LCD technology that originated overseas, China has kept pace with the world in Mini/Micro-LED and has established a relatively complete industrial chain in it. Currently, the Mini LED is mainly used for LCD panel backlighting; It will be an inevitable trend for the direct LED display with Mini LED in large-screen in the future.

Regarding the Micro-LED technological progress choices, Chinese display manufacturers are facing challenges in mass transfer and full-color display. They are exploring and verifying multiple technical routes.

However, TFT-LCD technology will remain the mainstay for a long time in the future, because of its maturity and competitive prices. Multiple display technologies will coexist in the future; Micro-LED panels mass production will not be achieved in the short term.

Lacking cutting-edge R&D capabilities, as well as strong brands and channels, Taiwan"s wide-ranging contract manufacturers find themselves facing a familiar dilemma in the flat panel industry. In addition, Taiwan"s "five tigers" are small compared to South Korea, whose Samsung and LG share nearly 40% of the global market. Their consequent lack of economies of scale has become an increasing concern over the past two years. With numerous industries shifting their manufacturing operations offshore, Taiwan"s flat panel makers are naturally moving to China as well. However, restricted by government policies, most of their China factories are mainly focused on assembly. The technologically more demanding front-end processes remain in Taiwan.

It is forecast that by the end of 2005, Taiwan"s share of the global flat panel market will approach 40%, adding yet another world #1 ranking to its collection.

"Senior engineers with more than three to five years of experience with LCD technology are scarce worldwide," Lin points out. "And this talent is concentrated in Taiwan, Japan, and Korea, making it difficult to lure them away." Eugene Verdon, president of Corning Display Technologies Taiwan, the world"s leading supplier of glass substrates, also believes that the short supply of brainpower is the biggest worry for Taiwan"s flat panel industry.

"It"s not that Taiwanese are not smart enough or industrious enough. It"s simply that this industry is extremely demanding on people, and that applies to both quality and quantity," Verdon says. "Looking at Taiwan"s population growth rate and related figures, and it certainly looks like there may be a steep falloff in the availability of needed skilled workers in the future."

In the current phase, Taiwan"s biggest rival is of course Korea," says PIDA vice president Ma. "Korea entered this industry six years before Taiwan. It has greater upstream and downstream integration, and greater self-sufficiency. Korea also benefits from the brands and global channels of market leader Samsung and of Philips LG. These factors make Korea"s flat panel industry far more complete than Taiwan"s."

Besides South Korea with the breadth of its downstream and upstream integration, and Japan with its cutting-edge technology and strong brands, China has been making moves in recent years. China will likely turn the flat panel industry into a four-way battle.

In 2003, China"s largest CRT manufacturer, BOE Technology Group, seeing that the CRT market was in decline, decided to develop LCDs. Later, BOE purchased Korean company Hydis" LCD panel manufacturing division and immediately became China"s biggest flat panel manufacturer.

Like Taiwan, Japan, and Korea, China has designated display devices and liquid crystal devices as explicit targets for attracting foreign investment and fostering technological development. The Chinese approach of acquisitions and technological cooperation with Japan or Korea is highly reminiscent of the course pursued by Taiwanese firms six years ago.

After much Taiwanese desktop and notebook computer manufacturing moved to China, flat panel assembly plants are following their customers across the Taiwan Strait. If the LCD TV industry cannot gain traction in Taiwan, another wave of manufacturing relocations to China is likely to take place.

With Japan and China intent on joining a competitive fray that has been largely focused on Taiwan and Korea, the two-way battle for supremacy may at any time develop into a four-way tangle, further complicating the scenario.

Can the light from liquid crystal screens also show Taiwan"s high-tech industry the way to another golden decade? The answer may very well soon be revealed.

From tiny cellphones to big-screen TVs, the low weight, low power consumption, and high resolution of LCD screens, along with their low radiation levels and longevity, have made them the focus of a new generation of technology.

Walking by the Chi Mei compound in the Southern Taiwan Science Park, it"s hard to miss the statues of the Greek gods that stand around. This replica of the Louvre"s statue of Nike, goddess of victory, helps create an aesthetic balance in this sprawling compound.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

With this motto in mind, we"ve come to be one of quite possibly the most technologically innovative, cost-efficient, and price-competitive manufacturers for Meaning Of Tft Display, Serial Tft Display, Lcd Industrial Monitor, Lcd Screen Tester,Lcd Flat Panel Display. Sincere cooperation with you, altogether will create happy tomorrow! The product will supply to all over the world, such as Europe, America, Australia,Accra, Bhutan,Cairo, Belgium.On today, we"ve got customers from all over the world, including USA, Russia, Spain, Italy, Singapore, Malaysia, Thailand, Poland, Iran and Iraq. The mission of our company is to deliver the highest quality products with best price. We"ve been looking forward to doing business with you!

![]()

Cluster and center console display research: how Chinese manufacturers scramble for Mini LED/Micro LE market. The surging demand for intelligent and connected vehicles, in-vehicle infotainment systems and navigation systems among others gives a big boost to the automotive display market.

New York, Jan. 24, 2022 (GLOBE NEWSWIRE) -- Reportlinker.com announces the release of the report "Global and China Automotive LCD Cluster and Center Console Industry Report, 2021" - https://www.reportlinker.com/p06219667/?utm_source=GNW

The statistics from our automotive database show that in 2020 China shipped more than 35 million sets of passenger car displays (cluster, center console, entertainment display, HUD, etc.), up over 4% more than in the previous year.

Automotive display is a key booster to the digital transformation of automotive cockpits. The better performance of on-board computers enables the central computing unit to support LCD cluster, high-resolution infotainment display, HUD, electronic rearview mirror and other display systems, and provides technical support for multi-display systems.

From the new models launched in recent two years, it can be seen that large-size display and multi-screen display have been trends for automotive displays. High-end models have begun to pack at least 4 displays. Products like co-pilot seat entertainment display, control display, rear row entertainment display and streaming media rearview mirror have started finding application, and the demand for large-size displays has been soaring.

The installation of clusters shows that about 60% of new vehicles carry LCD clusters. In the first three quarters of 2021, 6.544 million LCD clusters were installed in passenger cars, a like-on-like spurt of 44.5%, of which 12.0-inch (incl.) to 13.0-inch (excl.) LCD clusters were most installed, up to 2.512 million units, up by 35.0%, and 10.0-inch (incl.) to 12.0-inch (excl.) LCD clusters grew at the fastest pace with the installations rocketing by 173.8% to 1.186 million units.

From center console displays, it can be seen that the installations of large-size ones have surged. In the first three quarters of 2021, 8.0-inch to 9.0-inch center console displays were most installed, up to 4.016 million units, up by 4.3% from the prior-year period, but with the proportion of the total center console display installations down 4.2 percentage points; the installations of 13.0-inch to 15.0-inch center console displays proliferated by 250.6%; that of 15.0-inch and above center console displays multiplied by 204.0%.

Cockpit electronics are heading in the direction of multi-display integration. Early in 2019, emerging carmakers have rolled out mass-produced models like LiXiang One and ENOVATE ME7 with 4 and even 5-screen displays. Traditional OEMs also step up efforts to deploy, having introduced multi-screen display products since 2020.

FAW Hongqi H9 unveiled in August 2020 bears dashboard, center console, and co-pilot seat entertainment displays, 2 rear row entertainment displays, and HUD. In addition, it also packs an electronic image acquisition and display system (i.e., streaming media rearview mirror) which consists of digital camera, image processing and high-definition digital display. The system uses the rear camera to project images onto the display, and displays them on the rearview mirror in digital format.

Great Wall Mecha Dragon introduced in November 2021 is equipped with 10.25-inch dashboard, 27-inch 4K center console display, 25-inch head-up display, two 1.6-inch touch bars, and two rear row capacitive touch screens, as well as external display technology at the rear.

In the future, as standards and regulations are improved, more vehicle displays will be used. For example, in June 2021, Zhejiang Society of Automotive Engineers was approved for release of group standard, the Performance Requirements and Test Methods of Passenger Car Digital Perspective A-pillar System. Neta Auto under Hozon Auto introduced its “transparent A-pillar”-enabled mass-production models with OLED flexible screens as display interfaces. The issuance of this standard will accelerate the application of “transparent A-pillar”.

The soaring demand for vehicle displays give impetus to development of new vehicle display technologies. In current stage, a-Si TFT LCD still prevail in vehicle display market, but advanced display technologies such as LTPS TFT LCD, OLED, mini LED backlight and micro LED are making their way into the market.

The year of 2020 saw the start of production of automotive OLED. Due to high cost, OLED, often larger than 7.2 inches, is largely used in high-end models, with applications including cluster, center console and copilot seat entertainment displays. Suppliers are led by LGD, Samsung Display and BOE.

2021 Mercedes-Benz S-Class sedans differ greatly from the previous generations in application of displays, changing the original siamesed center console display into a large waterfall display, a 12.8-inch vertical waterfall OLED screen with resolution of 1888×1728. They also pack a glasses-free 3D full LCD dashboard, HUD and rear row entertainment display, which connect with each other.

2021 Cadillac Escalade is equipped with an OLED AR perspective curved display with three screens total – a 7.2-inch driver information display, a 14.2-inch digital dashboard, and a 16.9-inch infotainment screen. Wherein, the cluster option features a large speedometer displaying temperature and time at the left and dynamics at the right. In addition, the display is in night mode where infrared technology is used to observe farther than human eyes.

In November 2021, Mecha Dragon, the first model of SL, a high-end brand of Great Wall Motor made a debut at Auto Guangzhou. The Mini-LED external display technology at the rear of this model enables display of user-defined content, the first attempt to apply Mini-LED in cars.

Automotive displays head in the direction of large size and multi-screen integration, and the surging demand creates huge room to grow. Various suppliers are therefore trying hard to deploy innovative technologies such as Mini LED and Micro LED.

Tianma Microelectronics: in 2020 it first outran JDI and became the world’s largest vehicle display company in terms of shipments. The company supplies through Tier1s, covering 92% of global customers (top 24 Tier1s) and 100% of Chinese brands (top 10).

Tianma Microelectronics works to deploy Mini LED and Micro LED technologies. Following the on-site exhibition of its self-developed LTPS AM Mini LED HDR display at annual meeting of Society for Information Display (SID) early in 2019, the company showcased its Micro LED technologies online at SID 2021, including 5.04" Splitting ultra-narrow bezel Micro LED, the world’s first 7.56" transparent Micro LED, and innovative technology applications combined with electronic paper.

Moreover, its self-developed Hybrid TFT Display (HTD) technology is in the phase of verification for mass production. The company has deployed HTD on its flexible AMOLED production lines, and will achieve mass production based on the advanced drive and backplane technologies with lower power consumption.

HGC Lighting Solutions: the new-generation white light Mini LED vehicle backlight display module features automotive-grade reliability, ultra-thin display body, multi-zone dynamic control, and million-level ultra-high contrast.

This white light Mini LED display module uses automotive chip and self-developed superior ACSP chip-scale packaging technology. By removing the cost of QD and DBEF and upgrading the production process, it not only delivers automotive-grade reliability but cuts 15-25% production cost. The company have spawned and delivered white light Mini LED vehicle display series products and partnered with several well-known automakers.

TCL CSOT: in November 2021, TCL CSOT joined hands with Yanfeng to roll out the industry’s first under-screen camera-based automotive intelligent display. Combining TCL CSOT’s blind-hole optical design with the smoked black processing method and Yanfeng’s HMI design, the product embeds a camera into backlight hole to enable an integrated under-screen camera solution, that is, the DMS camera is hidden in the display.

China automotive display market (installation of LCD/HUD/center console/rear seat entertainment displays, display technologies of major suppliers, vehicle display installation schemes of major OEMs, etc.);

ReportLinker is an award-winning market research solution. Reportlinker finds and organizes the latest industry data so you get all the market research you need - instantly, in one place.

Samsung Display, one of the leading amorphous silicon (a-Si) TFT LCD manufacturers for the past 20 years, is shutting down its first G7 line, Line 7-1, from as early as the end of July and there are rumors of a few more fab closures to come. Its a-Si TFT LCD footprint is expected to shrink dramatically over the next few years with potentially just one a-Si fab in operation in 2018 to serve its market-leading TV business.

Panasonic LCD is also rumored to be shutting down most or all of its G8.5 line. Based on the near term decline in a-Si TFT LCD capacity, Credit Suisse upgraded AUO and Innolux on this news and their shares surged.

Samsung’s Line 7-1, which began operation in October 2004 and production in May 2005, is rumored to be shutting down from the 30th July through the end of the year. It has a unique glass size (1,870 x 2,200mm), which was the largest in the world at the time of its introduction and is optimized for both 40” and 46” LCD TV panel production. It was also the site of the Samsung-Sony joint venture, S-LCD, established in April 2004. This line enabled Samsung and Sony to rapidly take share from smaller G6 fabs optimized for 32” and 37” panels. During that time, the two companies competed aggressively in retail while establishing 40” and 46” as mainstream sizes. The JV with Sony ended in 2011. S-LCD also built an 8th gen fab that began production in Q3’07, and Samsung built a second G7 line (L7-2) on its own, with even more capacity at over 170,000 substrates per month. L7-2 began production in Q3’08.

Displays are already a weak spot in Samsung’s financial performance. The category caused the device solutions division to be the only one to suffer a loss among all major divisions within Samsung in Q1’16, and its revenues of KRW6 trillion ($5.2 billion) were the lowest in two years. The display division alone posted an operating loss of KRW270 billion ($233 million) in Q1’16 resulting in an operating margin of -4.4%. While Samsung has a number of technology and capacity advantages in OLEDs for mobile displays, its a-Si TFT LCD business has matured and is increasingly becoming commoditized, as new entrants from China with government support are taking share. In addition, most of the a-Si TFT LCD market segments have become stagnant or are in decline, which points to more losses given the growing Chinese competition. On the other hand, OLEDs and flexible OLEDs are poised for rapid growth as they take share. As a result, it makes good business sense for Samsung to exit much of the a-Si TFT LCD market.

Line 7-2, newer and larger than 7-1, is also rumored to be for sale and is expected to be shut down in 2017, but probably depends on profitability. Line 7-2 has been producing 3-4 million 40” panels and 300,000 75” panels annually, as well as monitor panels. Twinstar is also a potential customer for the manufacturing equipment and this line may also be utilized for OLED production in the future.

Samsung is expected to begin shipping for the first OLED iPhone in volume from Q3’17, with input capacity from the modified Line 7 ramping up to between 90,000 and 120,000 substrates per month. Apple is expected to purchase 70 million OLED panels in 2017, according to sources.

That is not all, however. Line 6, Samsung"s last 5th gen line with 1,100 x 1,300mm substrates and around 190,000 substrate per month capacity, is also expected to be shut down, according to industry insiders. That line, which features a-Si and oxide TFT LCD production, has been producing tablet, notebook PC and LCD monitor panels. Those markets have also been hit by stagnant demand, growing competition from China, commoditization and declining margins. This line is expected to be shut down between the end of 2016 and 2017. Line 6 is predicted to be converted to a semiconductor facility, making application processors for smartphones and tablets.

If Samsung closes down Line 6 and Lines 7-1 and 7-2, its a-Si production will be down to just two G8.5 fabs: one in Suzhou, China and one in Tangjong, Korea. The Suzhou fab, ramping to over 100,000 substrates per month, is also rumored to be a candidate for sale with Chinese and Indian TFT LCD suppliers as potential customers. If Samsung licenses its latest a-Si TFT LCD or oxide TFT LCD technology, that would certainly make the sale more attractive. This means Samsung would have just one a-Si TFT LCD fab: Line 8.

I believe Line 8 will be sufficient for Samsung to support its internal TV brand with leading edge panels for the TV market as it has a monthly capacity of 400,000 2,200 x 2,500mm (G8.5) substrates. Samsung’s TV business would likely continue to outsource its low-end panels for its TVs to other LCD manufacturers and focus this fab on higher margin products such as 8k, HDR, QD WCG, etc. I cannot see Samsung abandoning LCD TV panel production until it believes OLEDs are cost effective enough to takeover the mid-range high end of the TV market. This likely means not until OLED materials can be inkjet printed, Samsung is still likely to focus all of its TV panel production on LCDs.

If this occurs as described, Samsung Display"s output of 42" and larger panels would be LCD, and sub-42" would be OLED, although it may not have much production between 15" and 40". This would be an amazing, but expected, transformation given the supply/demand and profitability outlook for the a-Si market.

Panasonic is also following Samsung’s lead. It is expected to reduce the glass input of its G8.5 line from around 50,000 per month to just 10,000 per month by September. Given the limited scale and cost effectiveness of this Japanese factory and the loss of share of Panasonic"s TV brand in many regional TV markets, the company is better off purchasing panels from LG and lower cost Chinese suppliers. Otherwise it would be trying to run a high cost fab in Japan, in a market where commoditization is becoming increasingly common and a large wave of new, lower cost capacity from China is on its way. The company may keep 10,000 of capacity for some period for Panasonic-branded products, but it is hard to imagine operating a fab at just 10,000 per month for long, as the lack of volume will further increase costs relative to other higher volume players.

Interestingly, with both Samsung and Panasonic reducing their a-Si capacity in the near term, Credit Suisse has upgraded its outlook for AUO and Innolux to outperform, and both companies have seen significant share price increases as a result. Credit Suisse indicated that the closure of L7-1 will reduce supply by 12 million 40” panels - or 1/3 of the 40” market - which will tighten supply in the 40”-43” market and produce a better pricing environment. AUO’s earnings per share (EPS) was raised from NT$10.20 to NT$13 ($0.32 - $0.40), while Innolux’s EPS was raised from NT$10.10 to NT$14 ($0.31 - $0.43). Both companies" stock prices have taken off, with AUO’s stock price rising by 22% in the US in three days.

As Japanese and Korean players take more a-Si capacity offline, it will create a better environment for the Taiwanese and Chinese suppliers, enabling the market to better digest all the new capacity being brought online in China. However, there is a tremendous amount of capacity coming and much of this older capacity from Samsung and Panasonic may get sold and reintroduced. As pointed out at SID 2016, by 2019 China is expected to have:

2016 and 2017 are expected to be back-to-back years of over $12 billion in LCD/OLED equipment spending. Unless these fabs struggle with their ramp and their yields, the a-Si market will continue to be oversupplied although conditions should improve in the 40”-43” market in the second half of 2016.

Rather than battle it out with government-subsidized Chinese players, Samsung appears to be accelerating its exit of the increasingly commoditized a-Si TFT LCD market. This should please its shareholders, especially if it can sell all its old equipment and license its a-Si technology for a royalty, but will be harmful to some of its suppliers. It is also likely to protect its TV business by holding onto its most competitive fab, but will increasingly become an OLED company. Interesting questions as a result of these moves include:

Will LG Display follow Samsung’s lead and accelerate the closure of its older a-Si lines, or will it slug it out against the new wave of Chinese capacity?

A couple of days after this article was originally posted, it was claimed - and later denied by a company official - that Samsung will move its a-Si TFT LCD operations out of Samsung Display and into Samsung Electronics. Such a move aligns perfectly with its intention, indicated above, to close its a-Si fabs as in a couple of years its a-Si TFT LCD operations may be limited to providing panels to its TV business. - Ross Young

Ross Young is the CEO and Founder of Display Supply Chain Consultants. He also serves on the Board of Directors of publicly traded touch sensor manufacturer UniPixel and diamond semiconductor developer Akhan Technologies. He previously founded DisplaySearch and served as its CEO from 1996 - 2007 where he launched most of their categories of coverage. He has also held executive positions at Samsung LCD and IMS Research.

In recent years, China and other countries have invested heavily in the research and manufacturing capacity of display technology. Meanwhile, different display technology scenarios, ranging from traditional LCD (liquid crystal display) to rapidly expanding OLED (organic light-emitting diode) and emerging QLED (quantum-dot light-emitting diode), are competing for market dominance. Amidst the trivium strife, OLED, backed by technology leader Apple"s decision to use OLED for its iPhone X, seems to have a better position, yet QLED, despite still having technological obstacles to overcome, has displayed potential advantage in color quality, lower production costs and longer life.

Which technology will win the heated competition? How have Chinese manufacturers and research institutes been prepared for display technology development? What policies should be enacted to encourage China"s innovation and promote its international competitiveness? At an online forum organized by National Science Review, its associate editor-in-chief, Dongyuan Zhao, asked four leading experts and scientists in China.

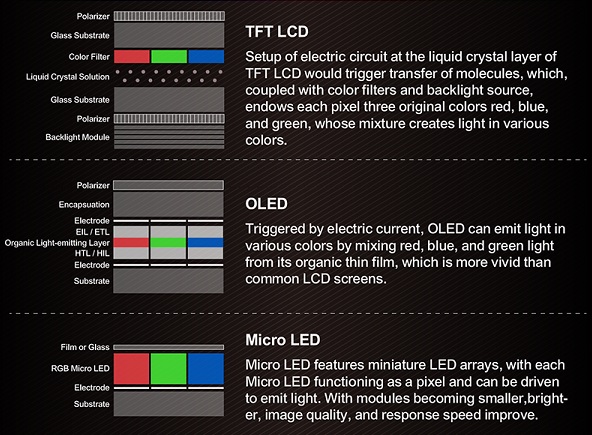

Zhao: We all know display technologies are very important. Currently, there are OLED, QLED and traditional LCD technologies competing with each other. What are their differences and specific advantages? Shall we start from OLED?

Huang: OLED has developed very quickly in recent years. It is better to compare it with traditional LCD if we want to have a clear understanding of its characteristics. In terms of structure, LCD largely consists of three parts: backlight, TFT backplane and cell, or liquid section for display. Different from LCD, OLED lights directly with electricity. Thus, it does not need backlight, but it still needs the TFT backplane to control where to light. Because it is free from backlight, OLED has a thinner body, higher response time, higher color contrast and lower power consumption. Potentially, it may even have a cost advantage over LCD. The biggest breakthrough is its flexible display, which seems very hard to achieve for LCD.

Liao: Actually, there were/are many different types of display technologies, such as CRT (cathode ray tube), PDP (plasma display panel), LCD, LCOS (liquid crystals on silicon), laser display, LED (light-emitting diodes), SED (surface-conduction electron-emitter display), FED (filed emission display), OLED, QLED and Micro LED. From display technology lifespan point of view, Micro LED and QLED may be considered as in the introduction phase, OLED is in the growth phase, LCD for both computer and TV is in the maturity phase, but LCD for cellphone is in the decline phase, PDP and CRT are in the elimination phase. Now, LCD products are still dominating the display market while OLED is penetrating the market. As just mentioned by Dr Huang, OLED indeed has some advantages over LCD.

Huang: Despite the apparent technological advantages of OLED over LCD, it is not straightforward for OLED to replace LCD. For example, although both OLED and LCD use the TFT backplane, the OLED’s TFT is much more difficult to be made than that of the voltage-driven LCD because OLED is current-driven. Generally speaking, problems for mass production of display technology can be divided into three categories, namely scientific problems, engineering problems and production problems. The ways and cycles to solve these three kinds of problems are different.

At present, LCD has been relatively mature, while OLED is still in the early stage of industrial explosion. For OLED, there are still many urgent problems to be solved, especially production problems that need to be solved step by step in the process of mass production line. In addition, the capital threshold for both LCD and OLED are very high. Compared with the early development of LCD many years ago, the advancing pace of OLED has been quicker.While in the short term, OLED can hardly compete with LCD in large size screen, how about that people may change their use habit to give up large screen?

Liao: I want to supplement some data. According to the consulting firm HIS Markit, in 2018, the global market value for OLED products will be US$38.5 billion. But in 2020, it will reach US$67 billion, with an average compound annual growth rate of 46%. Another prediction estimates that OLED accounts for 33% of the display market sales, with the remaining 67% by LCD in 2018. But OLED’s market share could reach to 54% in 2020.

Huang: While different sources may have different prediction, the advantage of OLED over LCD in small and medium-sized display screen is clear. In small-sized screen, such as smart watch and smart phone, the penetration rate of OLED is roughly 20% to 30%, which represents certain competitiveness. For large size screen, such as TV, the advancement of OLED [against LCD] may need more time.

Xu: LCD was first proposed in 1968. During its development process, the technology has gradually overcome its own shortcomings and defeated other technologies. What are its remaining flaws? It is widely recognized that LCD is very hard to be made flexible. In addition, LCD does not emit light, so a back light is needed. The trend for display technologies is of course towards lighter and thinner (screen).

But currently, LCD is very mature and economic. It far surpasses OLED, and its picture quality and display contrast do not lag behind. Currently, LCD technology"s main target is head-mounted display (HMD), which means we must work on display resolution. In addition, OLED currently is only appropriate for medium and small-sized screens, but large screen has to rely on LCD. This is why the industry remains investing in the 10.5th generation production line (of LCD).

Xu: While deeply impacted by OLED’s super thin and flexible display, we also need to analyse the insufficiency of OLED. With lighting material being organic, its display life might be shorter. LCD can easily be used for 100 000 hours. The other defense effort by LCD is to develop flexible screen to counterattack the flexible display of OLED. But it is true that big worries exist in LCD industry.

LCD industry can also try other (counterattacking) strategies. We are advantageous in large-sized screen, but how about six or seven years later? While in the short term, OLED can hardly compete with LCD in large size screen, how about that people may change their use habit to give up large screen? People may not watch TV and only takes portable screens.

Some experts working at a market survey institute CCID (China Center for Information Industry Development) predicted that in five to six years, OLED will be very influential in small and medium-sized screen. Similarly, a top executive of BOE Technology said that after five to six years, OLED will counterweigh or even surpass LCD in smaller sizes, but to catch up with LCD, it may need 10 to 15 years.

Xu: Besides LCD, Micro LED (Micro Light-Emitting Diode Display) has evolved for many years, though people"s real attention to the display option was not aroused until May 2014 when Apple acquired US-based Micro LED developer LuxVue Technology. It is expected that Micro LED will be used on wearable digital devices to improve battery"s life and screen brightness.

Micro LED, also called mLED or μLED, is a new display technology. Using a so-called mass transfer technology, Micro LED displays consist of arrays of microscopic LEDs forming the individual pixel elements. It can offer better contrast, response times, very high resolution and energy efficiency. Compared with OLED, it has higher lightening efficiency and longer life span, but its flexible display is inferior to OLED. Compared with LCD, Micro LED has better contrast, response times and energy efficiency. It is widely considered appropriate for wearables, AR/VR, auto display and mini-projector.

However, Micro LED still has some technological bottlenecks in epitaxy, mass transfer, driving circuit, full colorization, and monitoring and repairing. It also has a very high manufacturing cost. In short term, it cannot compete traditional LCD. But as a new generation of display technology after LCD and OLED, Micro LED has received wide attentions and it should enjoy fast commercialization in the coming three to five years.

Peng: It comes to quantum dot. First, QLED TV on market today is a misleading concept. Quantum dots are a class of semiconductor nanocrystals, whose emission wavelength can be continuously tuned because of the so-called quantum confinement effect. Because they are inorganic crystals, quantum dots in display devices are very stable. Also, due to their single crystalline nature, emission color of quantum dots can be extremely pure, which dictates the color quality of display devices.

Interestingly, quantum dots as light-emitting materials are related to both OLED and LCD. The so-called QLED TVs on market are actually quantum-dot enhanced LCD TVs, which use quantum dots to replace the green and red phosphors in LCD’s backlight unit. By doing so, LCD displays greatly improve their color purity, picture quality and potentially energy consumption. The working mechanisms of quantum dots in these enhanced LCD displays is their photoluminescence.

For its relationship with OLED, quantum-dot light-emitting diode (QLED) can in certain sense be considered as electroluminescence devices by replacing the organic light-emitting materials in OLED. Though QLED and OLED have nearly identical structure, they also have noticeable differences. Similar to LCD with quantum-dot backlighting unit, color gamut of QLED is much wider than that of OLED and it is more stable than OLED.

Another big difference between OLED and QLED is their production technology. OLED relies on a high-precision technique called vacuum evaporation with high-resolution mask. QLED cannot be produced in this way because quantum dots as inorganic nanocrystals are very difficult to be vaporized. If QLED is commercially produced, it has to be printed and processed with solution-based technology. You can consider this as a weakness, since the printing electronics at present is far less precision than the vacuum-based technology. However, solution-based processing can also be considered as an advantage, because if the production problem is overcome, it costs much less than the vacuum-based technology applied for OLED. Without considering TFT, investment into an OLED production line often costs tens of billions of yuan but investment for QLED could be just 90–95% less.

Given the relatively low resolution of printing technology, QLED shall be difficult to reach a resolution greater than 300 PPI (pixels per inch) within a few years. Thus, QLED might not be applied for small-sized displays at present and its potential will be medium to large-sized displays.

Zhao: Quantum dots are inorganic nanocrystal, which means that they must be passivated with organic ligands for stability and function. How to solve this problem? Second, can commercial production of quantum dots reach an industrial scale?

Peng: Good questions. Ligand chemistry of quantum dots has developed quickly in the past two to three years. Colloidal stability of inorganic nanocrystals should be said of being solved. We reported in 2016 that one gram of quantum dots can be stably dispersed in one milliliter of organic solution, which is certainly sufficient for printing technology. For the second question, several companies have been able to mass produce quantum dots. At present, all these production volume is built for fabrication of the backlighting units for LCD. It is believed that all high-end TVs from Samsung in 2017 are all LCD TVs with quantum-dot backlighting units. In addition, Nanosys in the United States is also producing quantum dots for LCD TVs. NajingTech at Hangzhou, China demonstrate production capacity to support the Chinese TV makers. To my knowledge, NajingTech is establishing a production line for 10 million sets of color TVs with quantum-dot backlighting units annually.China"s current demands cannot be fully satisfied from the foreign companies. It is also necessary to fulfill the demands of domestic market. That is why China must develop its OLED production capability.

Huang: Based on my understanding of Samsung, the leading Korean player in OLED market, we cannot say it had foresight in the very beginning. Samsung began to invest in AMOLED (active-matrix organic light-emitting diode, a major type of OLED used in the display industry) in about 2003, and did not realize mass production until 2007. Its OLED production reached profitability in 2010. Since then, Samsung gradually secured a market monopoly status.

So, originally, OLED was only one of Samsung"s several alternative technology pathways. But step by step, it achieved an advantageous status in the market and so tended to maintain it by expanding its production capacity.

Another reason is customers’ demands. Apple has refrained itself from using OLED for some years due to various reasons, including the patent disputes with Samsung. But after Apple began to use OLED for its iPhone X, it exerted a big influence in the whole industry. So now Samsung began to harvest its accumulated investments in the field and began to expand the capacity more.

Also, Samsung has spent considerable time and efforts on the development of the product chain. Twenty or thirty years ago, Japan owned the most complete product chain for display products. But since Samsung entered the field in that time, it has spent huge energies to cultivate upstream and downstream Korean firms. Now the Republic of Korea (ROK) manufacturers began to occupy a large share in the market.

Liao: South Korean manufacturers including Samsung and LG Electronics have controlled 90% of global supplies of medium and small-sized OLED panels. Since Apple began to buy OLED panels from Samsung for its cellphone products, there were no more enough panels shipping to China. Therefore, China"s current demands cannot be fully satisfied from the foreign companies. On the other hand, because China has a huge market for cellphones, it would be necessary to fulfill the demands through domestic efforts. That is why China must develop its OLED production capability.

Huang: The importance of China"s LCD manufacturing is now globally high. Compared with the early stage of LCD development, China"s status in OLED has been dramatically improved. When developing LCD, China has adopted the pattern of introduction-absorption-renovation. Now for OLED, we have a much higher percentage of independent innovation.

Then it is the scale of human resources. One big factory will create several thousand jobs, and it will mobilize a whole production chain, involving thousands of workers. The requirement of supplying these engineers and s

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey