industrial lcd business pricelist

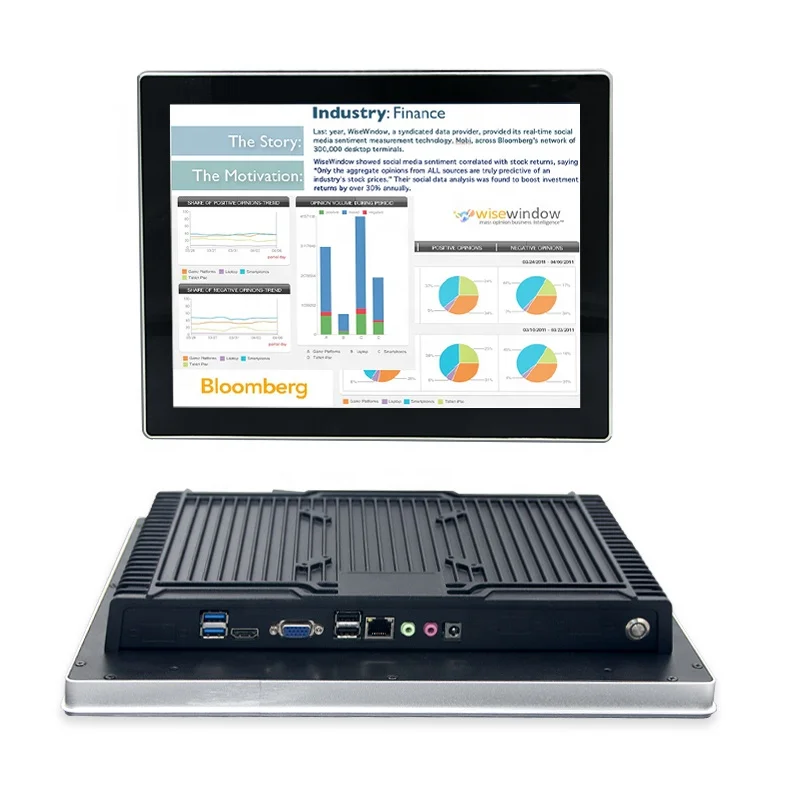

We offer the largest selection of LCD industrial monitors and touch screens in the world. We have an impressive line of over 75 off-the-shelf large industrial displays screen sizes up to 75″. In Addition, we can include even more custom and OEM designs. View our Sunlight Readable, waterproof, panel mount displays, or 16:9 aspect ratio, open frame, 1920 x 1080 full HD, outdoor, and optically bonded monitors. We have a huge variety of the same types in touch screens video displays.

Industrial LCD monitors offer many advantages over commercial-grade displays. Most importantly, they are more rugged than consumer grade monitors! Our industrial displays feature higher shock and vibration resistance. Furthermore, use our wide operating temperature options in challenging climate conditions. Robust enclosures are a must in most industrial settings. Additionally, we back them with a full 3-year warranty. Likewise, industrial monitors are available longer than consumer and commercial-grade models. But, Retail models often discontinue within 6 to 18 months.

We can modify TRU-Vu industrial-grade large industrial LCD monitors with a long list of available options to best meet your needs. Moreover, we provide custom monitor purpose-built solutions. We will design them and build to your specifications. Most importantly, these are often for the same cost as off-the-shelf solutions.

Receive a free consultation to learn more about our indoor and outdoor industrial LCD monitor computer productsand touch screensand other accessories.

Choose a product category from our diverse selection of industrial LCD products. To help you decide which category best suits your LCD monitor needs, mouse over the images for a popup description of each product family.

The price of LCD display panels for TVs is still falling in November and is on the verge of falling back to the level at which it initially rose two years ago (in June 2020). Liu Yushi, a senior analyst at CINNO Research, told China State Grid reporters that the wave of “falling tide” may last until June this year. For related panel companies, after the performance surge in the past year, they will face pressure in 2022.

LCD display panel prices for TVs will remain at a high level throughout 2021 due to the high base of 13 consecutive months of increase, although the price of LCD display panels peaked in June last year and began to decline rapidly. Thanks to this, under the tight demand related to panel enterprises last year achieved substantial profit growth.

According to China State Grid, the annual revenue growth of major LCD display panel manufacturers in China (Shentianma A, TCL Technology, Peking Oriental A, Caihong Shares, Longteng Optoelectronics, AU, Inolux Optoelectronics, Hanyu Color Crystal) in 2021 is basically above double digits, and the net profit growth is also very obvious. Some small and medium-sized enterprises directly turn losses into profits. Leading enterprises such as BOE and TCL Technology more than doubled their net profit.

TCL explained that the major reasons for the significant year-on-year growth in revenue and profit were the significant year-on-year growth of the company’s semiconductor display business shipment area, the average price of major products and product profitability, and the optimization of the business mix and customer structure further enhanced the contribution of product revenue.

“There are two main reasons for the ideal performance of domestic display panel enterprises.” A color TV industry analyst believes that, on the one hand, under the effect of the epidemic, the demand for color TV and other electronic products surges, and the upstream raw materials are in shortage, which leads to the short supply of the panel industry, the price rises, and the corporate profits increase accordingly. In addition, as Samsung and LG, the two-panel giants, gradually withdrew from the LCD panel field, they put most of their energy and funds into the OLED(organic light-emitting diode) display panel industry, resulting in a serious shortage of LCD display panels, which objectively benefited China’s local LCD display panel manufacturers such as BOE and TCL China Star Optoelectronics.

Liu Yushi analyzed to reporters that relevant TV panel enterprises made outstanding achievements in 2021, and panel price rise is a very important contributing factor. In addition, three enterprises, such as BOE(BOE), CSOT(TCL China Star Optoelectronics) and HKC(Huike), accounted for 55% of the total shipments of LCD TV panels in 2021. It will be further raised to 60% in the first quarter of 2022. In other words, “simultaneous release of production capacity, expand market share, rising volume and price” is also one of the main reasons for the growth of these enterprises. However, entering the low demand in 2022, LCD TV panel prices continue to fall, and there is some uncertainty about whether the relevant panel companies can continue to grow.

According to Media data, in February this year, the monthly revenue of global large LCD panels has been a double decline of 6.80% month-on-month and 6.18% year-on-year, reaching $6.089 billion. Among them, TCL China Star and AU large-size LCD panel revenue maintained year-on-year growth, while BOE, Innolux, and LG large-size LCD panel monthly revenue decreased by 16.83%, 14.10%, and 5.51% respectively.

Throughout Q1, according to WitsView data, the average LCD TV panel price has been close to or below the average cost, and cash cost level, among which 32-inch LCD TV panel prices are 4.03% and 5.06% below cash cost, respectively; The prices of 43 and 65 inch LCD TV panels are only 0.46% and 3.42% higher than the cash cost, respectively.

The market decline trend is continuing, the reporter queried Omdia, WitsView, Sigmaintel(group intelligence consulting), Oviriwo, CINNO Research, and other institutions regarding the latest forecast data, the analysis results show that the price of the TV LCD panels is expected to continue to decline in April. According to CINNO Research, for example, prices for 32 -, 43 – and 55-inch LCD TV panels in April are expected to fall $1- $3 per screen from March to $37, $65, and $100, respectively. Prices of 65 – and 75-inch LCD TV panels will drop by $8 per screen to $152 and $242, respectively.

In the first quarter of this year, the retail volume of China’s color TV market was 9.03 million units, down 8.8% year on year. Retail sales totaled 28 billion yuan, down 10.1 percent year on year. Under the situation of volume drop, the industry expects this year color TV manufacturers will also set off a new round of LCD display panel prices war.

a line of extreme and ultra-narrow bezel LCD displays that provides a video wall solution for demanding requirements of 24x7 mission-critical applications and high ambient light environments

Through improvements in LCD parts and materials, monitor weight has been reduced over earlier models, making it easier to transport and install the display.

iTechLCD founded in 2004 is a worldwide company with the objective of designing, developing, and manufacturing complete all weather proof outdoor/semi outdoor high brightness, sunlight readable, full HD LCD with sealed IP65/NEMA4 enclosures. We have references all around the globe with almost hundreds of screens installed in harsh coldest and hottest outdoor environment from Las Vegas, USA to Montreal/Quebec, Canada. Our outdoor screens providing the real world proofing of reliability for many years to come.

Prices for all TV panel sizes fluctuated and are forecast to fluctuate between 2020 and 2022. The period from March 2020 to July 2021 saw the biggest price increases, when a 65" UHD panel cost between 171 and 288 U.S. dollars. In the fourth quarter of 2021, such prices fell and are expected to drop to an even lower amount by March 2022.Read moreLCD TV panel prices worldwide from January 2020 to March 2022, by size(in U.S. dollars)Characteristic32" HD43" FHD49"/50" UHD55" UHD65" UHD------

DSCC. (January 10, 2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph]. In Statista. Retrieved March 13, 2023, from https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars)." Chart. January 10, 2022. Statista. Accessed March 13, 2023. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. (2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars). Statista. Statista Inc.. Accessed: March 13, 2023. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "Lcd Tv Panel Prices Worldwide from January 2020 to March 2022, by Size (in U.S. Dollars)." Statista, Statista Inc., 10 Jan 2022, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC, LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) Statista, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/ (last visited March 13, 2023)

LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph], DSCC, January 10, 2022. [Online]. Available: https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

I’m hearing from some industry friends that LCD display panel prices are rising – which on the surface likely seems incongruous, given the economic slowdown and widespread indications that a lot of 2020 and 2021 display projects went on hold because of COVID-19.

On the other hand, people are watching a lot more TV, and I saw a guy at Costco the other day with two big-ass LCD TVs on his trolley. And a whole bunch of desktop monitors were in demand in 2020 to facilitate Work From Home. So demand for LCD displays is up outside of commercial purposes.

The Korean business portal BusinessKorea says one explanation was a power outage that shut down a big glass substrate factory in Japan, which was serious enough that the plant will only get back to normal sometime in this quarter.

Continuing strong demand and concerns about a glass shortage resulting from NEG’s power outage have led to a continuing increase in LCD TV panel prices in Q1. Announcements by the Korean panel makers that they will maintain production of LCDs and delay their planned shutdown of LCD lines has not prevented prices from continuing to rise.

Panel prices increased more than 20% for selected TV sizes in Q3 2020 compared to Q2, and by 27% in Q4 2020 compared to Q3, and we now expect that average LCD TV panel prices in Q1 2021 will increase by another 9%.

LG takes pride as the leading provider of innovative, flexible and feature-packed Commercial Display Products in the market. Boasting the cutting-edge features and modern design, LG Commercial Displays redefines a whole new way of delivering an ultimate viewing experience to enhance engagement with the audience. From Ultra UD OLED monitors for a digital signage network to hospitality TVs for in-room entertainment solutions, LG Commercial Displays offer a variety of display products to meet the demands of every business environment including:

Digital Signage: Raise your sales with LG Digital Signage and discover our collection of LED Backlit Displays, DS Media Players, Stretch and Touch Screen Displays. Our digital signage displays are available in different sizes and specifications to match the requirements of your business.

Many customers do not like the design of TFT LCD modules and prefer the flexibility of open cell TFT glass panel and CDS is assisting them with that by working with our major suppliers such as Samsung etc. to give our customers exactly what they want.

As before, SAMSUNG,BOE and other famous suppliers of LCD panel supply complete finished LCD panels, which can be relatively expensive and as customer requirements have become more specific which led to the Open Cell solution offering the right companies with the right capabilities the opportunity to decrease their material costs. The use of the Open Cell solution is growing as companies can decrease costs but also thickness of the final solution which is becoming more critical for certain applications. The Open Cell Solution products are becoming a significant trend in the LCD industry now, but clearly the company must have the handling and integration capability for these more fragile Displays!

In 2021, LCD panel prices are expected to climb in 1Q, remain flat in 2Q, and decline from 3Q. Backed by ongoing facility expansions, Chinese LCD panel makers should see a continuing rise in M/S. In addition, a recent blackout at the Japanese factory of NEG, a glass substrate maker, should also benefit Chinese firms.

LCD panel prices, which ended high in 2020, are expected to continue rising in 1Q21 on an anticipated decrease in glass substrate supply. On Dec 10, a power outage occurred at NEG’s Takatsuki plant in Japan. With normalization at the Takatsuki plant expected in 1Q21, domestic and Taiwanese panel makers’ sourcing of glass substrate is unlikely to proceed smoothly in the near future. In 2Q21, an acceleration in panel production alongside normalized supply of glass substrate should prevent LCD panel price growth. The rate of glass substrate supply excess is forecast to widen from 0.5% in 1Q21 to 3.6% in 2Q21.

LCD panel prices are forecast to decline from 3Q21, as supply should exceed demand. We expect supply excess for LCD panels to reach 3.2% in 3Q21 and 3.4% in 4Q21 on the back of ongoing production expansion at Chinese manufacturers.

Chinese LCD panel makers are to continue expanding their production capacity, centering on 8G-and-above facilities, in a bid to increase M/S. Given Korea’s withdrawal from the LCD arena, we expect the global number of LCD production facilities (8G or higher) to fall from 32 in 2020 to 31 in 2021 to 30 in 2022. On the other hand, with Chinese panel makers ramping up investment, the portion of Chinese manufacturers is to increase from 63% in 2020 to 68% in 2021 to 78% in 2022, with China coming to claim a market-leading position.

LONDON, Sept 27 (Reuters) - International prices for indium, used in LCD screens, hit two-year highs this month as investors on a Chinese exchange for the metal built up stocks, hoping a growing world economy will spur sales of consumer electronics.

Prices in yuan in China, which produces 60 percent of the annual world indium supply of 670 tonnes and also manufactures many liquid crystal display (LCD) screens, now stand 40 percent above those abroad - a disparity partly explained by controls on the Chinese currency and restricted access to the exchange.

Traders put Chinese demand down to speculation on a rise in industrial demand, and to the growing use of indium, along with other metals, as collateral for financial credits in China.

But evidence that the soft, rare metal, hauled from obscurity by the rise of the LCD, is becoming used to underpin a ballooning credit market that Chinese authorities want to hold back has raised concerns about a sudden reverse in prices.

He said some industrial buyers were, however, hesitating to lock in longer-term purchases in case prices turn downward, especially given the large tonnages now held in warehouses:

SEOUL, Aug 25 (Reuters) - Samsung Electronicsand LG Display Co Ltd, the world"s top two LCD panel makers, will supply each other with monitor panels, marking the first time they have cooperated in the LCD business, a government statement said.

According to the preliminary agreement, Samsung, the world"s top maker of LCD panels, would receive 17-inch computer monitor screens from smaller rival LG Display, while LG Electronicswould get 22-inch monitor panels from Samsung, South Korea"s Ministry of Knowledge Economy said in a statement.

The Ministry said it expected the scope of the deal to be expanded to include other types of LCD screen, although an immediate deal involving television panels would be difficult as the two sides used different technologies.

The outlook for South Korean and Taiwanese LCD makers has brightened recently as fears of a second-half oversupply have faded because of a shortage in glass substrates.

As people emerge from their Covid-19 hideouts, demand for screens is likely to drop, and this is happening as Chinese makers dominate the business and threaten to dump screens and wreck the market.

For LCD panels for 65-inch UHD TVs, the average price has increased 4 percent from $274 to $285 month-on-month. When compared to a year ago, that price surged 72 percent from $165.

According to market research company DSCC, the first quarter revenue of 13 LCD companies globally is estimated at $34.8 billion. That’s a 52 percent increase over the same period in 2020.

The possibility of a drop coming with the end of the pandemic brings back memories of the nightmare of two years ago, when the average price of LCD panels dropped from $143 to $100 in nine months as Chinese makers dumped product into the market.

“Because of Covid-19, LCD panels unexpectedly became a hot item,” said an industry official, who requested anonymity. “But as more people are inoculated and spending time outdoors, TV demand is dropping, and this could result in supply exceeding demand.”

Samsung Display CEO Choi Joo-sun said the company is currently reviewing whether to continued LCD production in an e-mail recently sent to employees in the LCD department.

LG Display, which initially planned to fold its LCD TV panel business by end of 2020, is currently running the production plant but without any additional investment or new equipment being installed.

“Already LCD prices when compared to a year ago have more than doubled,” said an industry insider, who wished to remain anonymous. “With China already completely dominating the market, it is unlikely they would repeat low-cost mass production similar to 2019.”

“It is possible that the LCD panel price could fall between the second half of this year and through the first half of next year as demand falls,” said Kim Hyun-soo, Hana Financial Investment analyst. “But as the likelihood of Chinese companies playing a game of chicken is reduced, the prices will likely stabilize in the second half of next year.”

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey