lcd panel makers hope manufacturer

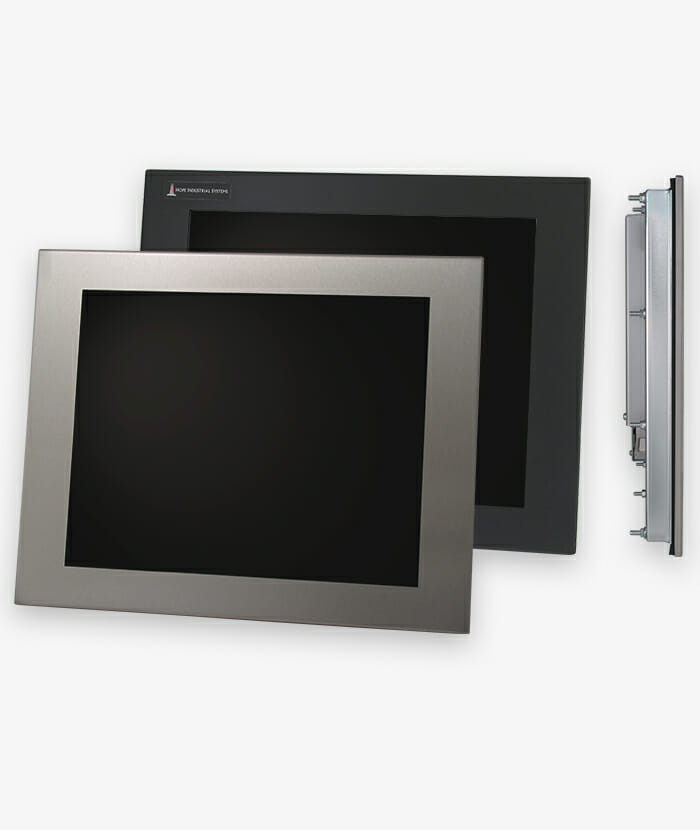

Hope Industrial 12″ Panel Mount Monitors are designed to provide superior picture quality and state-of-the-art features in a rugged enclosure, ensuring years of reliable operation in any factory environment.

Hope Industrial Systems is always looking for ways to improve our products and lower our costs so the savings can be passed along to you. Sometimes the changes we make result in the release of a new monitor revision letter.

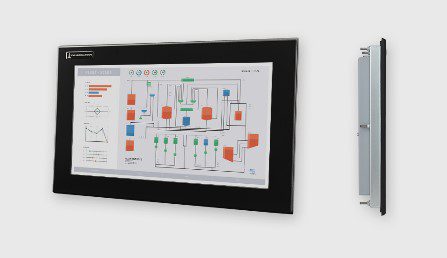

Hope Industrial Systems is excited to announce new versions of our widescreen 19.5″ Panel Mount and Universal Mount industrial monitors and touch screens. The new 19.5″ monitors feature an edge-to-edge flush front window that extends across the entire front of the display. Window options include our new multi-touch projected capacitive (PCAP) touch screen and food protection windows, as well as our single-touch resistive touch screen and strengthened glass windows.

Hope Industrial Systems is pleased to announce our new 23.8″ line of industrial monitors and touch screens, the first of our next generation widescreen product line!

As our customers know, HIS takes pride in our 22-year history of assuring our customers of long-term product continuity. After shipping thousands of our 23.0″ product family for over 8 years, the worldwide panel fabricators discontinued the 23.0″ size, so about 18 months ago we acquired a large quantity of them and began a development effort to introduce a new product line that would be as close in form, fit and function as practical and at the same time incorporate an LCD panel that is expected to be available for an extended time.

Hope Industrial Systems was recently awarded the Readers’ Choice Award for panel displays by Control Magazine. This is a significant achievement, as it shows that you and your peers view HIS as one of the premier manufacturers of industrial computer monitors on the worldwide stage.

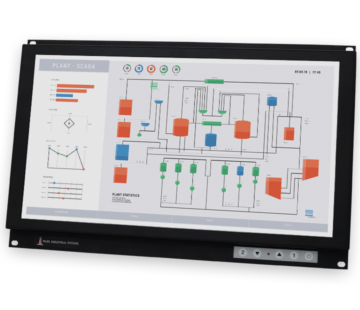

Hope Industrial offers 3 different varieties of monitor and touch screens to suit the needs of each individual customer. We offer Panel Mount, fully enclosed Universal Mount, and Rack Mount monitors, all with a standard 5-year warranty and 30-day total satisfaction guarantee. All of our monitors are designed to provide superior picture quality in a rugged enclosure, ensuring years of reliable operation in any factory environment. Read More

Hope Industrial Systems, Inc. based in Roswell, Georgia, pro-vides industrial flat panel monitors and touchscreens that have superior quality and up-to-date features that are relevant to industrial applications. Hope Industrial houses this advanced technology in a variety of rugged enclosures that allow the user to place their displays wherever they are needed in the factory.This is a critical component in assuring its customers have high reliability.The company provides its monitors through systems integrators and OEMs; as well as directly to brand-name companies in an array of industries including aerospace, food and beverage, chemical, metal and electronics.

As part of its mission to find the right technology solutions, Hope Industrial sought a KVM (keyboard, video, and mouse) extender that would allow the computer to be placed as far away as possible from the industrial monitor.The benefit of such a distance is that a non-industrial computer can be placed in a secure, climate-controlled environment leaving only the rugged industrial flat panel monitors exposed to factory conditions.

Hope Industrial chose the AdderLink X Series X-2 Silver Dual-Access KVM extender. The KVM Extender allows placement of an industrial monitor, keyboard, mouse and serial touchscreen up to 1,000 feet away from the computer or server using a single CATx cable.The dual version allows computer access both locally and remotely.The company designed the extender into its products which are used by many Hope Industrial customers including Georgia Pacific, General Mills, Pfizer, Proctor & Gamble and Nestle.

�There are several advantages to using Adder�s products,� said John McGraw, Director of Operations, Hope Industrial Systems. �In addition to the signal extension of up to 1,000 feet, which is two times the length that competitors offered,Adder�s extender provides a rugged metal industrial enclosure.�

With South Korean rivals stretching their lead in unveiling substantial capacity expansion plans in China, Taiwanese liquid-crystal-display (LCD) panel makers are scrambling to follow suit to defend their Chinese turf and play catch-up before the imminent emergence of the world’s most populous nation as the biggest market for flat-screen TVs.

In October, South Korean LCD panel maker Samsung Electronics Co signed a memorandum of understanding with the Suzhou Industrial Park Administration Committee to collaborate on building a cost-efficient 7.5-generation TV display factory in China for about US$2.25 billion. LG Display Co has also struck a deal to build a 8.5G plant to cut LCD glass panels in China.

Limited by Taiwanese government restrictions, local LCD panel makers have lagged behind their South Korean rivals in mapping out plans for China. Two weeks ago, however, the government lifted long-standing restrictions on local panel companies, allowing them to build production lines in China in a bid to reduce the risk of Taiwanese manufacturers losing even more of their market share to South Korean competitors. In the past, Taiwanese manufacturers had to export panels to Chinese clients.

“Under such circumstances, we have to be pragmatic [about limiting investment in China] and lend a hand to local enterprises,” Minister of Economic Affairs Shih Yen-shiang (施顏祥) told a media briefing earlier this month, unveiling the government’s decision to ease bans on local LCD panel makers building factories in China.

Despite repeated calls from local companies, the government had previously been unwilling to relax restrictions on China-bound investments by flat-panel makers for fear of losing core technologies to China.

Taiwanese LCD-panel manufacturers are now allowed to build more cost-efficient 7.5G and 8.5G factories for cutting 40-inch or 52-inch TV panels from glass substrates, the Ministry of Economic Affairs said in a statement.

Next year, China is expected to surpass North America as the world’s biggest LCD TV market with projected sales of 37.2 million units, which would make up 21 percent of global LCD TV, projected at 174.6 million, according to a forecast by Austin, Texas-based DisplaySearch.

AU Optronics Corp (友達光電) chief executive Chen Lai-juh (陳來助) said China has been making its influence on the panel industry felt in view of rising demand for slim-screen TVs during the Lunar New Year holidays.

“If Taiwanese LCD-panel suppliers can start smoothly ramping up Chinese plants in 2012 [at the same time that Samsung and LG Display are expected to do so], they will be able to safeguard their current market position. Or even better, they may be able to narrow the gap with [South] Korean rivals,” said Corwin Lee (李秋緯), a flat-panel industry analyst with Topology Research Institute (拓墣產業研究所) in Taipei.

In a statement released right after the government made the announcement, AU Optronics, the nation’s top flat-panel maker, welcomed the relaxation of China-bound investment policy, saying it would help make the local LCD industry more competitive.

AU Optronics has more to gain by expanding its manufacturing capacity in China than some of its local rivals, as it supplied only about 26 percent of the TV panels purchased by Chinese TV makers last year, compared with more than 50 percent supplied by Chi Mei Optoelectronics Corp (奇美電子).

“It would be an effective solution to reverse local panel makers’ disadvantageous market position by supplying panels to Chinese customers from on-site production lines, coupled with the successful business model built last year between Taiwanese LCD panel suppliers and their Chinese TV partners,” said Roger Yu (游智超), a LCD industry analyst with Polaris Securities Co (寶來證券).

Last year, inflows of fresh orders from major Chinese TV makers such as Haier Group (海爾) and TCL have helped cushion the blow for local LCD suppliers as the global economic recession froze consumption of almost all kinds of electronics in the US and European markets, Lee said.

That also helped Taiwanese panel companies recoup some of the market share they had lost to South Korean competitors in other global markets last year, Lee added.

“To some extent, Chinese TV customers can provide a buffer for Taiwanese LCD-panel makers against an overcapacity-driven downturn as reflected in the industry’s severest slump last year,” Yu said.

Local players were disadvantaged by not having own-brand TV businesses that could digest excessive production when demand slackens, while Samsung and LG Display, for example, suffered less during the downturn by selling panels to their brand operations and reducing panel purchases from rivals like AU Optronics, Yu added.

Highlighting the crucial role the Chinese market plays for local panel companies, Lee said the relaxation of restrictions “could be the last chance for local firms to win back market dominance, if they can succeed in holding a bigger share in China, which will soon replace the US and Europe as the new driving force for TV panel makers.”

AU Optronics has formed a joint venture with Chang-hong Electric Co (長虹) to assemble TV panel modules in Sichuan, China, while Chi Mei Optoelectronics is collaborating with Hisense Group (海信), one of China’s biggest TV makers.

With our G5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, we provide various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

If you want to keep a long-term relationship with us, you can find more manufacturers’ information on Google, LinkedIn, or Instagram through Google’s search engine or social media. For example, use “product keywords(TFT LCD display) + manufacturers + countries” and talk to them.

If you want to develop your new products, you should find LCD display manufacturers with engineering development capabilities and LCD display manufacturing experience.

We could find manufacturers’ information from some reliable B2B websites or popular enterprise directory websites. And Google is the most common and useful tool. You can contact manufacturers on Google and get a quick response. Use “product keywords(TFT LCD display) + manufacturer + country. Clicking directly from the search results and start typing.

Leave a message on the website and establish contact with the company. This process can be a very helpful experience and it can test the after-sales service of LCD display manufacturers, a good communication experience, which can save us a lot of communication costs in the later stage.

Many companies will put some cases of cooperation with customers on the website to increase the trust of customers. We can browse the past cooperation cases of LCD display manufacturers on the website.

Whether the manufacturer is in China, India, or anywhere, go to the factory in person if possible. It’s different when obtaining information from the LCD display factory or remotely.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

Chinese display manufacturers are chasing their South Korean rivals closely by planning to release a larger volume of liquid-crystal panels over 32 inches this year, said a market researcher Sunday.

According to a report on the 2017 shipment strategies of Chinese TV panel makers by IHS Markit, Chinese LCD panel suppliers are forecast to ship out a total of 320,000 large-size panels larger than 32 inches by the end of this year, a 33 percent surge from last year.

In the report, Wu mentioned the plans of major Chinese panel firms such as BOE, CSOT, CEC-Panda and HKC to focus on expanding production of 43, 55 and 58-inch panels, adding that demand for 32-inch panels will gradually decrease.

“By the end of 2018, China will be the largest region for TFT LCD capacity, and larger-sized products may make their factories more efficient and profitable than they have been when producing 32-inch panels,” he said.

The strategy shift of the Chinese players suggests that they might outstrip Korean display makers in the global large-size display market, the analyst said.

“The strategies of Chinese panel makers will significantly influence global supply and demand,” Wu said. “In 2015 and 2016, the Chinese companies shipped 33.2 percent of worldwide LCD TV panel, trailing only Korean panel makers at 36.4 percent.”

The competition structure has been advantageous for the Korean players, since their Chinese rivals had been focusing on small LCD panels until last year. But now the Korean firms are facing fiercer competition in prices.

Although demand for organic-light emitting diode panels in the TV market is gradually rising, dominance of LCD panels is projected to continue for the foreseeable future.

“While OLEDs are expected to post sharp growth, they will not be able to usurp LCD as the panels of choice for upper-end TVs,” another report by IHS Markit said.

Currently, invisibility cloaks” possible may lead to next-generation “metasurface” displays roughly 1/100 the thickness of the average human hair that could offer 10 times the resolution and consume half as much energy as LCD screens.

LCD technology depends on liquid crystal cells that are constantly lit by a backlight. Polarizers in front and behind the pixels filter light waves based on their polarity, or the direction in which they vibrate, and the liquid crystal cells can rotate the way these filters are oriented to switch light transmissions on and off.

LCD screens do continue to see advances by improving the liquid crystals, the display technology or the backlight. “However, improvement on LCD technologies are now mostly just incremental,” says Eric Virey, senior display analyst at market research firm Yole Intelligence in Lyon, France.

The researchers say the new metasurfaces can replace the liquid crystal layer in LCD displays. At the same time, they would not require the polarizers that liquid crystals do, which are responsible for half of the wasted light intensity and energy use in these displays.

Current production lines for LCD displays can, with minimal modifications, be updated to replace liquid crystal pixels with metasurface ones, Rahmani notes. “There is no need for significant investments in brand-new production lines to get this technology integrated,” he says.

As promising as metasurface displays are, Virey cautions that organic LED (OLED) displays, which are currently the main rivals of LCDs, are strong competitors, and do not need liquid crystal layers.

“OLEDs are already used in about half of smartphones,” Virey says. “Adoption in TV is finally taking off, so is adoption in notebook. LCD won’t disappear and will likely remain the technology of choice for the bulk of entry-level to midrange displays, but their space is shrinking. As a result, while they’re planning on keeping their LCD manufacturing infrastructure, display makers have, for the most, stopped investing in new LCD fabs.”

In the hopes of breaking into the display market, the researchers now hope to optimize their device by tinkering with the heater dimensions, electrical input, and cooling approaches. Artificial intelligence and machine-learning techniques could also help design smaller, thinner, and more efficient metasurface displays, they add. Alù, of the City University of New York, notes smaller pixel sizes are also desirable.

The scientists aim to build a large-scale prototype that can generate images within the next five years. They hope to integrate their technology into flat screens available to the public within the next 10 years.

Given how LCD manufacturers have spent more than a $100 billion on current fabs, “display makers might be happy to find a new technology that could give their aging LCD fabs a second life,” Virey says. “The researchers should make all efforts possible to ensure that it’s as compatible as possible with existing LCD manufacturing infrastructure. Can the same thin-film transistor process be used? Can you integrate the technology in an existing LCD fab with minimum change and investments?”

LAS VEGAS (Reuters) - South Korean flat-screen maker LG Display Co Ltd is in talks with Japanese television manufacturers to supply organic light emitting diode (OLED) panels, its chief executive said on Monday.

“Japanese (TV) firms are very much interested in OLED panels and we are in talks with them for panel supplies,” LG Display Co chief executive Han Sang-beom told reporters at the annual Consumer Electronics Show in Las Vegas on Monday.

LG Electronics has increased its unit share of flat panel TV shipments to 22.7% in Q3’10, taking the top market share position in the Indian TV market. In fact, according to the newly published DisplaySearch Quarterly India TV Shipment and Forecast Database, LG’s competition, Samsung Electronics and Sony, followed close behind with shipment market shares of 21.0% and 20.8%, respectively.

“LG Electronics has an advanced brand image, offering the latest technology with sophisticated designs, such as Infinia. The company also experienced LED LCD TV Y/Y growth of 69%,” noted Indrajit Ghosh, Director of India and South Asia for DisplaySearch.

In Q3’10, the total TV market in India was 4.1 million units, accounting for 45% of the Asia Pacific TV market. Unit penetration of flat panel TVs in the Asia Pacific was only 46%, the lowest of any region. In India, FPD TV unit penetration accounted for 23% of total TV shipments, increasing slowly from 18% in Q2’10. CRT TV maintains its stance as the primary TV technology in the region.

“Because LCD TV prices, especially LED LCD TV, have not yet reached a sweet spot for consumers, Q3’10 CRT TV shipments in India grew to 3.2 million units; up 2% quarter on quarter. Despite this, the results still exceeded TV brand forecasts,” noted Hisakazu Torii, Vice President of TV Market Research for DisplaySearch. “Although both TV brands and LCD panel makers hope to boost flat panel TV demand in India, their approach to reducing TV prices, especially for LED LCD TVs, and introducing appropriate products based on consumer demand for TV design and features is key to increasing flat panel TV penetration in India.”

In terms of LCD TV sizes, 32in models have been the most popular, with a 41% unit share. Units measuring 24in or smaller accounted for a 36% market share. Currently, 21in or smaller CRTs are the most common TV in India. For this reason, DisplaySearch expects that 22-24in LCD TVs will be an important product in the Indian market.

Samsung Display will stop producing LCD panels by the end of the year. The display maker currently runs two LCD production lines in South Korea and two in China, according to Reuters. Samsung tells The Verge that the decision will accelerate the company’s move towards quantum dot displays, while ZDNetreports that its future quantum dot TVs will use OLED rather than LCD panels.

The decision comes as LCD panel prices are said to be falling worldwide. Last year, Nikkei reported that Chinese competitors are ramping up production of LCD screens, even as demand for TVs weakens globally. Samsung Display isn’t the only manufacturer to have closed down LCD production lines. LG Display announced it would be ending LCD production in South Korea by the end of the 2020 as well.

Last October Samsung Display announced a five-year 13.1 trillion won (around $10.7 billion) investment in quantum dot technology for its upcoming TVs, as it shifts production away from LCDs. However, Samsung’s existing quantum dot or QLED TVs still use LCD panels behind their quantum dot layer. Samsung is also working on developing self-emissive quantum-dot diodes, which would remove the need for a separate layer.

Samsung’s investment in OLED TVs has also been reported by The Elec. The company is no stranger to OLED technology for handhelds, but it exited the large OLED panel market half a decade ago, allowing rival LG Display to dominate ever since.

Although Samsung Display says that it will be able to continue supplying its existing LCD orders through the end of the year, there are questions about what Samsung Electronics, the largest TV manufacturer in the world, will use in its LCD TVs going forward. Samsung told The Vergethat it does not expect the shutdown to affect its LCD-based QLED TV lineup. So for the near-term, nothing changes.

One alternative is that Samsung buys its LCD panels from suppliers like TCL-owned CSOT and AUO, which already supply panels for Samsung TVs. Last year The Elec reported that Samsung could close all its South Korean LCD production lines, and make up the difference with panels bought from Chinese manufacturers like CSOT, which Samsung Display has invested in.

Our company aims to operating faithfully, serving to all of our customers , and working in new technology and new machine constantly for Ips Lcd Panel, Lcd Module, Tft Panel Display, Vehicle Touch Displays,Lcd Touch Panel. If possible, be sure to send your needs with a detailed list including the style/item and quantity you require. We will then deliver our greatest price ranges to you. The product will supply to all over the world, such as Europe, America, Australia,Greece, Brunei,Benin, Israel.We"ve a good reputation for stable quality solutions, well received by customers at home and abroad. Our company would be guided by the idea of "Standing in Domestic Markets, Walking into International Markets". We sincerely hope that we could do business with customers both at home and abroad. We expect sincere cooperation and common development!

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey