lcd panel makers hope supplier

Hope Industrial Systems is always looking for ways to improve our products and lower our costs so the savings can be passed along to you. Sometimes the changes we make result in the release of a new monitor revision letter.

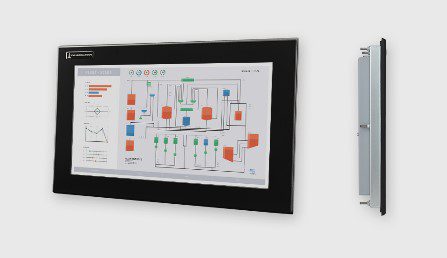

Hope Industrial Systems is excited to announce new versions of our widescreen 19.5″ Panel Mount and Universal Mount industrial monitors and touch screens. The new 19.5″ monitors feature an edge-to-edge flush front window that extends across the entire front of the display. Window options include our new multi-touch projected capacitive (PCAP) touch screen and food protection windows, as well as our single-touch resistive touch screen and strengthened glass windows.

Hope Industrial Systems is pleased to announce our new 23.8″ line of industrial monitors and touch screens, the first of our next generation widescreen product line!

As our customers know, HIS takes pride in our 22-year history of assuring our customers of long-term product continuity. After shipping thousands of our 23.0″ product family for over 8 years, the worldwide panel fabricators discontinued the 23.0″ size, so about 18 months ago we acquired a large quantity of them and began a development effort to introduce a new product line that would be as close in form, fit and function as practical and at the same time incorporate an LCD panel that is expected to be available for an extended time.

Hope Industrial Systems was recently awarded the Readers’ Choice Award for panel displays by Control Magazine. This is a significant achievement, as it shows that you and your peers view HIS as one of the premier manufacturers of industrial computer monitors on the worldwide stage.

Hope Industrial offers 3 different varieties of monitor and touch screens to suit the needs of each individual customer. We offer Panel Mount, fully enclosed Universal Mount, and Rack Mount monitors, all with a standard 5-year warranty and 30-day total satisfaction guarantee. All of our monitors are designed to provide superior picture quality in a rugged enclosure, ensuring years of reliable operation in any factory environment. Read More

With South Korean rivals stretching their lead in unveiling substantial capacity expansion plans in China, Taiwanese liquid-crystal-display (LCD) panel makers are scrambling to follow suit to defend their Chinese turf and play catch-up before the imminent emergence of the world’s most populous nation as the biggest market for flat-screen TVs.

In October, South Korean LCD panel maker Samsung Electronics Co signed a memorandum of understanding with the Suzhou Industrial Park Administration Committee to collaborate on building a cost-efficient 7.5-generation TV display factory in China for about US$2.25 billion. LG Display Co has also struck a deal to build a 8.5G plant to cut LCD glass panels in China.

Limited by Taiwanese government restrictions, local LCD panel makers have lagged behind their South Korean rivals in mapping out plans for China. Two weeks ago, however, the government lifted long-standing restrictions on local panel companies, allowing them to build production lines in China in a bid to reduce the risk of Taiwanese manufacturers losing even more of their market share to South Korean competitors. In the past, Taiwanese manufacturers had to export panels to Chinese clients.

“Under such circumstances, we have to be pragmatic [about limiting investment in China] and lend a hand to local enterprises,” Minister of Economic Affairs Shih Yen-shiang (施顏祥) told a media briefing earlier this month, unveiling the government’s decision to ease bans on local LCD panel makers building factories in China.

Despite repeated calls from local companies, the government had previously been unwilling to relax restrictions on China-bound investments by flat-panel makers for fear of losing core technologies to China.

Taiwanese LCD-panel manufacturers are now allowed to build more cost-efficient 7.5G and 8.5G factories for cutting 40-inch or 52-inch TV panels from glass substrates, the Ministry of Economic Affairs said in a statement.

Next year, China is expected to surpass North America as the world’s biggest LCD TV market with projected sales of 37.2 million units, which would make up 21 percent of global LCD TV, projected at 174.6 million, according to a forecast by Austin, Texas-based DisplaySearch.

AU Optronics Corp (友達光電) chief executive Chen Lai-juh (陳來助) said China has been making its influence on the panel industry felt in view of rising demand for slim-screen TVs during the Lunar New Year holidays.

“If Taiwanese LCD-panel suppliers can start smoothly ramping up Chinese plants in 2012 [at the same time that Samsung and LG Display are expected to do so], they will be able to safeguard their current market position. Or even better, they may be able to narrow the gap with [South] Korean rivals,” said Corwin Lee (李秋緯), a flat-panel industry analyst with Topology Research Institute (拓墣產業研究所) in Taipei.

In a statement released right after the government made the announcement, AU Optronics, the nation’s top flat-panel maker, welcomed the relaxation of China-bound investment policy, saying it would help make the local LCD industry more competitive.

AU Optronics has more to gain by expanding its manufacturing capacity in China than some of its local rivals, as it supplied only about 26 percent of the TV panels purchased by Chinese TV makers last year, compared with more than 50 percent supplied by Chi Mei Optoelectronics Corp (奇美電子).

“It would be an effective solution to reverse local panel makers’ disadvantageous market position by supplying panels to Chinese customers from on-site production lines, coupled with the successful business model built last year between Taiwanese LCD panel suppliers and their Chinese TV partners,” said Roger Yu (游智超), a LCD industry analyst with Polaris Securities Co (寶來證券).

Last year, inflows of fresh orders from major Chinese TV makers such as Haier Group (海爾) and TCL have helped cushion the blow for local LCD suppliers as the global economic recession froze consumption of almost all kinds of electronics in the US and European markets, Lee said.

That also helped Taiwanese panel companies recoup some of the market share they had lost to South Korean competitors in other global markets last year, Lee added.

“To some extent, Chinese TV customers can provide a buffer for Taiwanese LCD-panel makers against an overcapacity-driven downturn as reflected in the industry’s severest slump last year,” Yu said.

Local players were disadvantaged by not having own-brand TV businesses that could digest excessive production when demand slackens, while Samsung and LG Display, for example, suffered less during the downturn by selling panels to their brand operations and reducing panel purchases from rivals like AU Optronics, Yu added.

Highlighting the crucial role the Chinese market plays for local panel companies, Lee said the relaxation of restrictions “could be the last chance for local firms to win back market dominance, if they can succeed in holding a bigger share in China, which will soon replace the US and Europe as the new driving force for TV panel makers.”

AU Optronics has formed a joint venture with Chang-hong Electric Co (長虹) to assemble TV panel modules in Sichuan, China, while Chi Mei Optoelectronics is collaborating with Hisense Group (海信), one of China’s biggest TV makers.

Our company aims to operating faithfully, serving to all of our customers , and working in new technology and new machine constantly for Ips Lcd Panel, Lcd Module, Tft Panel Display, Vehicle Touch Displays,Lcd Touch Panel. If possible, be sure to send your needs with a detailed list including the style/item and quantity you require. We will then deliver our greatest price ranges to you. The product will supply to all over the world, such as Europe, America, Australia,Greece, Brunei,Benin, Israel.We"ve a good reputation for stable quality solutions, well received by customers at home and abroad. Our company would be guided by the idea of "Standing in Domestic Markets, Walking into International Markets". We sincerely hope that we could do business with customers both at home and abroad. We expect sincere cooperation and common development!

If you want to keep a long-term relationship with us, you can find more manufacturers’ information on Google, LinkedIn, or Instagram through Google’s search engine or social media. For example, use “product keywords(TFT LCD display) + manufacturers + countries” and talk to them.

If you want to develop your new products, you should find LCD display manufacturers with engineering development capabilities and LCD display manufacturing experience.

We could find manufacturers’ information from some reliable B2B websites or popular enterprise directory websites. And Google is the most common and useful tool. You can contact manufacturers on Google and get a quick response. Use “product keywords(TFT LCD display) + manufacturer + country. Clicking directly from the search results and start typing.

Leave a message on the website and establish contact with the company. This process can be a very helpful experience and it can test the after-sales service of LCD display manufacturers, a good communication experience, which can save us a lot of communication costs in the later stage.

Many companies will put some cases of cooperation with customers on the website to increase the trust of customers. We can browse the past cooperation cases of LCD display manufacturers on the website.

Whether the manufacturer is in China, India, or anywhere, go to the factory in person if possible. It’s different when obtaining information from the LCD display factory or remotely.

Chinese display manufacturers are chasing their South Korean rivals closely by planning to release a larger volume of liquid-crystal panels over 32 inches this year, said a market researcher Sunday.

According to a report on the 2017 shipment strategies of Chinese TV panel makers by IHS Markit, Chinese LCD panel suppliers are forecast to ship out a total of 320,000 large-size panels larger than 32 inches by the end of this year, a 33 percent surge from last year.

In the report, Wu mentioned the plans of major Chinese panel firms such as BOE, CSOT, CEC-Panda and HKC to focus on expanding production of 43, 55 and 58-inch panels, adding that demand for 32-inch panels will gradually decrease.

“By the end of 2018, China will be the largest region for TFT LCD capacity, and larger-sized products may make their factories more efficient and profitable than they have been when producing 32-inch panels,” he said.

The strategy shift of the Chinese players suggests that they might outstrip Korean display makers in the global large-size display market, the analyst said.

“The strategies of Chinese panel makers will significantly influence global supply and demand,” Wu said. “In 2015 and 2016, the Chinese companies shipped 33.2 percent of worldwide LCD TV panel, trailing only Korean panel makers at 36.4 percent.”

The competition structure has been advantageous for the Korean players, since their Chinese rivals had been focusing on small LCD panels until last year. But now the Korean firms are facing fiercer competition in prices.

Although demand for organic-light emitting diode panels in the TV market is gradually rising, dominance of LCD panels is projected to continue for the foreseeable future.

“While OLEDs are expected to post sharp growth, they will not be able to usurp LCD as the panels of choice for upper-end TVs,” another report by IHS Markit said.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

BOE will invest 29 billion yuan ($4 billion) in the 600,000 sq. meter factory, according to Sunday"s announcement, with an eye toward expanding into markets for new technologies, such as panels for virtual reality (VR) devices, and a new type of high-end panel called mini-LED.

With TV set sales slumping and more competition increasingly coming into the market from overseas countries, LCD TV panel manufacturers are planning less aggressive business strategies for 2013 as demand for LCD panels slows. That’s according to the latest NPD DisplaySearch Quarterly LCD TV Value Chain Report.

LCD TV panel manufacturers hope that by moving to larger screen sizes, they can decrease unit shipments while increasing the size of panels, thus boosting their bottom lines.

“Consumers are focused on TV prices, while brands have been focused on TV features. This disconnect has resulted in reduced demand and profits for TV supply chain participants in 2012,” said Deborah Yang, NPD DisplaySearch Research director. “A misalignment in panel size portfolios between buyers and sellers could result in supply constraints. Panel makers and TV brands are trying to strengthen their business portfolios and enhance their bargaining power with supply chain participants in order to improve profitability and gain a competitive edge.”

Taking these factors into account, along with the aggressive TV shipment plans of some TV brands (in particular the top two Korean TV brands and Chinese TV makers), NPD DisplaySearch forecasts four percent year-to-year growth in LCD TV panel shipments for 2013 and 11 percent year-to-year growth in TV shipments planned by surveyed TV brands.

“Some TV brands’ 2013 shipment plans reflect their strategy to set higher targets and secure sufficient panel supply, but they may also be too aggressive,” Yang said. “The TV supply chain is evolving, with Taiwanese panel makers leading the development of new panel sizes and ties with TV brands. Meanwhile, panel and set makers are adopting new business models around open cell and backlight-module-systems (BMS) assembly. Other TV manufacturers may be forced to follow suit — changing the TV value chain over the long term.”

The DisplaySearch Quarterly LCD TV Value Chain Report maps the relationships between LCD TV brands, OEMs and panel suppliers with actual shipment information.

With our G5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, we provide various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

According to TrendForce"s latest panel price report, TV panel pricing is expected to arrest its fall in October after five consecutive quarters of decline and the prices of certain panel sizes may even be poised to move up. The price decline of IT panels, whether notebook panels or LCD monitor panels, has also begun showing signs of easing and overall pricing of large-size panels is developing towards bottoming out.

TrendForce indicates, with panel makers actively implementing production reduction plans, TV inventories have also experienced a period of adjustment, with pressure gradually being alleviated. At the same time, the arrival of peak sales season at year’s end has also boosted demand marginally. In particular, Chinese brands are still holding out hope for Double Eleven (Singles’ Day) Shopping Festival promotions and have begun to increase their stocking momentum in turn. Under the influence of strictly controlled utilization rate and marginally stronger demand, TV panel pricing, which are approaching the limit of material costs, is expected to halt its decline in October. Prices of panels below 75 inches (inclusive) are expected to cease their declines. The strength of demand for 32-inch products is the most obvious and prices are expected to increase by US$1. As for other sizes, it is currently understood that PO (Purchase Order) quotations given by panel manufacturers in October have are all increased by US$3~5. Currently China"s Golden Week holiday is ongoing but, after the holiday, panel manufacturers and brands are expected to wrestle with pricing. Based on prices stabilizing, whether pricing can actually be increased still depends on the intensity of demand generated by branded manufacturers for different sized products.

TrendForce observes that current demand for monitor panels is weak, and brands are poorly motivated to stock goods. At the same time, the implementation of production cuts by panel manufacturers has played a role and room for price negotiation has gradually narrowed. At present, the decline in panel pricing has slowed. Prices of small-size TN panels below 21.5 inches (inclusive) are expected to cease declining in October due to reduced supply and flat demand. As for mainstream sizes such as 23.8 and 27-inch, price declines are expected to be within US$1.5. The current demand for notebook panels is also weak and customers must still face high inventory issues and are relatively unwilling to buy panels. Panel makers are also trying to slow the decline in panel prices through their implementation of production reduction plans. Declining panel prices are currently expected to continue abating in October. Pricing for 14-inch and 15.6-inch HD TN panels are expected to drop by US$0.2~0.3, falling from a 1.8% drop in September to 0.7%, while pricing for 14-inch and 15.6-inch FHD IPS panels are expected to fall by US$1~1.2, falling from a 3.4% drop in September to 2.4%.

Compared with past instances when TV panels drove a supply/demand reversal through a sharp increase in demand and spiking prices, this current period of lagging TV panel pricing has been halted and reversed through active control of utilization rates by panel manufacturers and a slight increase in demand momentum. The basis for this break in decline and subsequent price increase is relatively weak. Therefore, in order to maintain the strength of this price backstop and eventual escalation and move towards a healthier supply/demand situation, panel manufacturers must continue to strictly and prudently control the utilization rate of TV production lines, in addition to observing whether sales performance from the forthcoming Chinese festivals beat expectations, allowing stocking momentum to continue, and laying a solid foundation for TV panels to completely escape sluggish market conditions.

The price of IT panels has also adhered to the effect of production reduction and the magnitude of its price drops has gradually eased. TrendForce believes, since the capacity for supplying IT panels is still expanding into the future, it is difficult to see declines in mainstream panel prices halt completely when demand remains weak. Even if new production capacity from Chinese panel factories is gradually completed starting from 2023, price competition in the IT panel market will intensify once products are verified by branded clients, so potential downward pressure in pricing still exists.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey