lcd panel makers hope factory

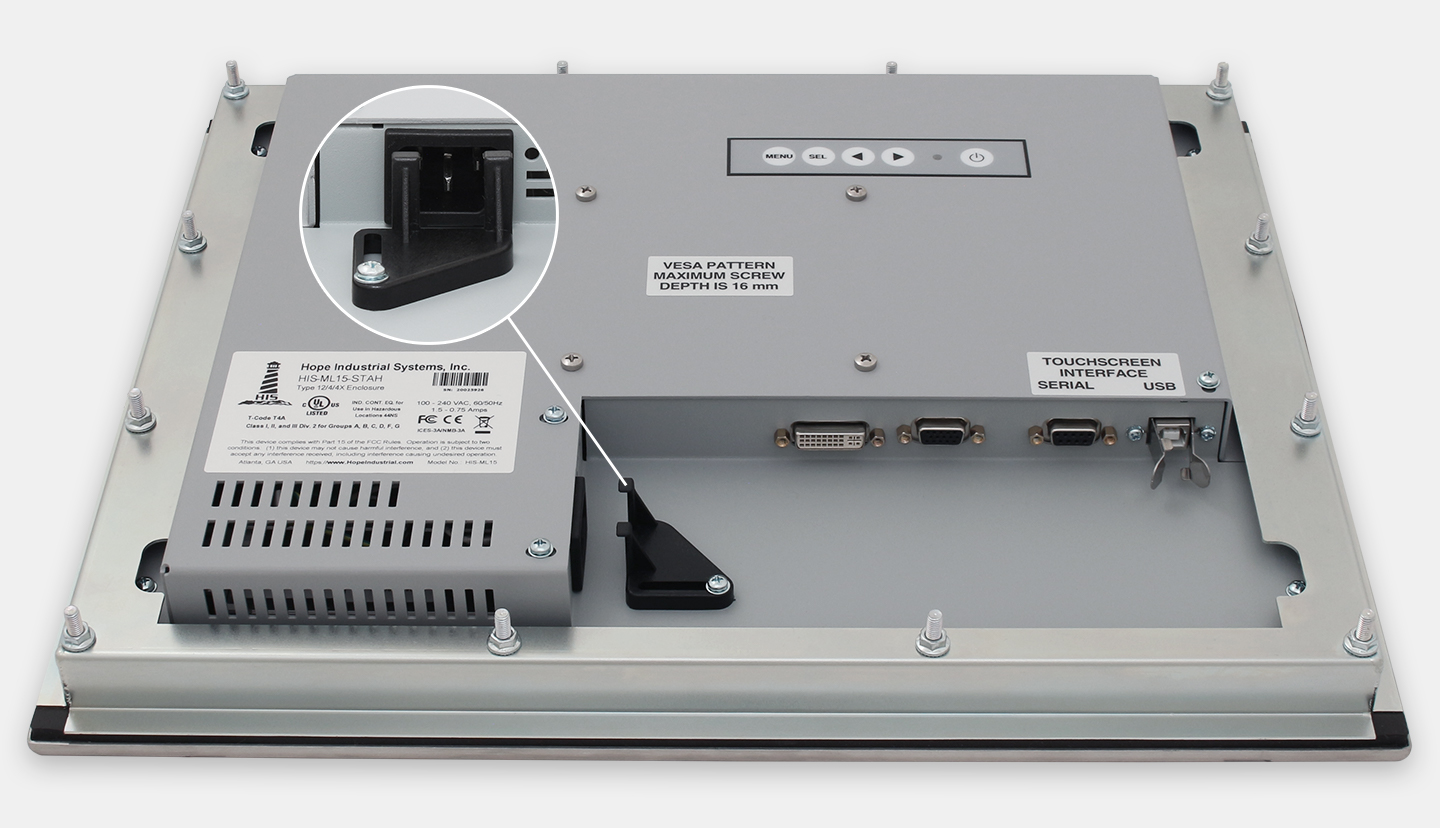

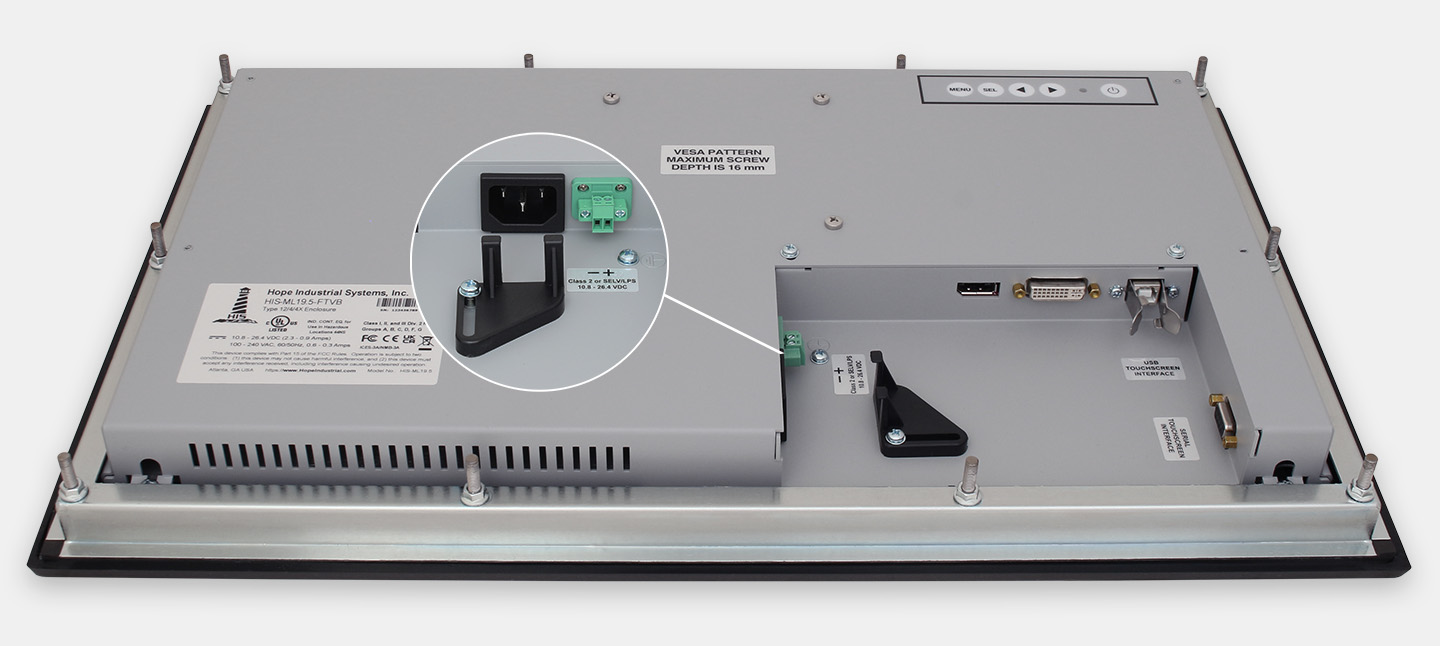

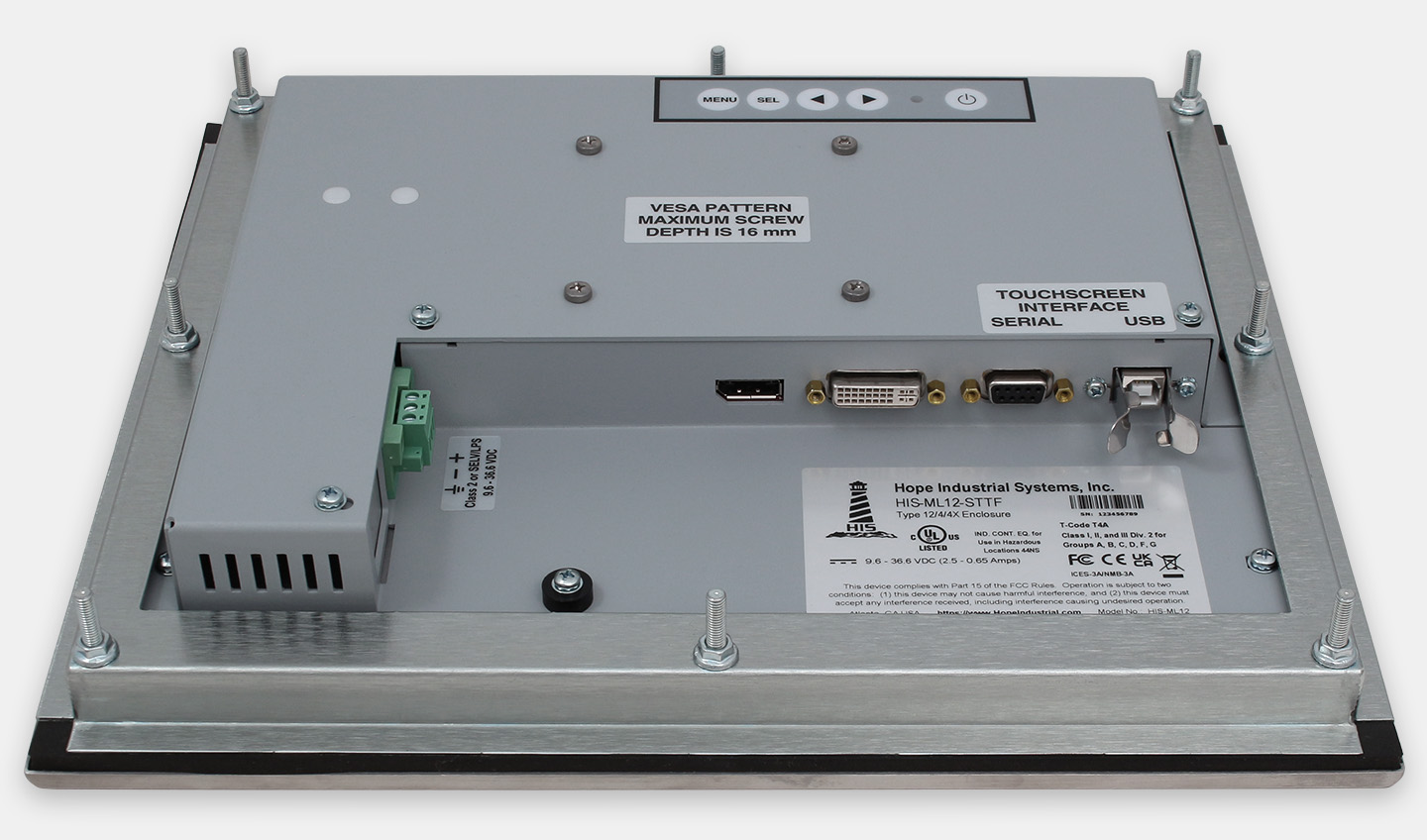

Hope Industrial 15″ Panel Mount Monitors are designed to provide superior picture quality and state-of-the-art features in a rugged enclosure, ensuring years of reliable operation in any factory environment.

With South Korean rivals stretching their lead in unveiling substantial capacity expansion plans in China, Taiwanese liquid-crystal-display (LCD) panel makers are scrambling to follow suit to defend their Chinese turf and play catch-up before the imminent emergence of the world’s most populous nation as the biggest market for flat-screen TVs.

In October, South Korean LCD panel maker Samsung Electronics Co signed a memorandum of understanding with the Suzhou Industrial Park Administration Committee to collaborate on building a cost-efficient 7.5-generation TV display factory in China for about US$2.25 billion. LG Display Co has also struck a deal to build a 8.5G plant to cut LCD glass panels in China.

Limited by Taiwanese government restrictions, local LCD panel makers have lagged behind their South Korean rivals in mapping out plans for China. Two weeks ago, however, the government lifted long-standing restrictions on local panel companies, allowing them to build production lines in China in a bid to reduce the risk of Taiwanese manufacturers losing even more of their market share to South Korean competitors. In the past, Taiwanese manufacturers had to export panels to Chinese clients.

“Under such circumstances, we have to be pragmatic [about limiting investment in China] and lend a hand to local enterprises,” Minister of Economic Affairs Shih Yen-shiang (施顏祥) told a media briefing earlier this month, unveiling the government’s decision to ease bans on local LCD panel makers building factories in China.

Despite repeated calls from local companies, the government had previously been unwilling to relax restrictions on China-bound investments by flat-panel makers for fear of losing core technologies to China.

Taiwanese LCD-panel manufacturers are now allowed to build more cost-efficient 7.5G and 8.5G factories for cutting 40-inch or 52-inch TV panels from glass substrates, the Ministry of Economic Affairs said in a statement.

Next year, China is expected to surpass North America as the world’s biggest LCD TV market with projected sales of 37.2 million units, which would make up 21 percent of global LCD TV, projected at 174.6 million, according to a forecast by Austin, Texas-based DisplaySearch.

AU Optronics Corp (友達光電) chief executive Chen Lai-juh (陳來助) said China has been making its influence on the panel industry felt in view of rising demand for slim-screen TVs during the Lunar New Year holidays.

“If Taiwanese LCD-panel suppliers can start smoothly ramping up Chinese plants in 2012 [at the same time that Samsung and LG Display are expected to do so], they will be able to safeguard their current market position. Or even better, they may be able to narrow the gap with [South] Korean rivals,” said Corwin Lee (李秋緯), a flat-panel industry analyst with Topology Research Institute (拓墣產業研究所) in Taipei.

In a statement released right after the government made the announcement, AU Optronics, the nation’s top flat-panel maker, welcomed the relaxation of China-bound investment policy, saying it would help make the local LCD industry more competitive.

AU Optronics has more to gain by expanding its manufacturing capacity in China than some of its local rivals, as it supplied only about 26 percent of the TV panels purchased by Chinese TV makers last year, compared with more than 50 percent supplied by Chi Mei Optoelectronics Corp (奇美電子).

“It would be an effective solution to reverse local panel makers’ disadvantageous market position by supplying panels to Chinese customers from on-site production lines, coupled with the successful business model built last year between Taiwanese LCD panel suppliers and their Chinese TV partners,” said Roger Yu (游智超), a LCD industry analyst with Polaris Securities Co (寶來證券).

Last year, inflows of fresh orders from major Chinese TV makers such as Haier Group (海爾) and TCL have helped cushion the blow for local LCD suppliers as the global economic recession froze consumption of almost all kinds of electronics in the US and European markets, Lee said.

That also helped Taiwanese panel companies recoup some of the market share they had lost to South Korean competitors in other global markets last year, Lee added.

“To some extent, Chinese TV customers can provide a buffer for Taiwanese LCD-panel makers against an overcapacity-driven downturn as reflected in the industry’s severest slump last year,” Yu said.

Local players were disadvantaged by not having own-brand TV businesses that could digest excessive production when demand slackens, while Samsung and LG Display, for example, suffered less during the downturn by selling panels to their brand operations and reducing panel purchases from rivals like AU Optronics, Yu added.

Highlighting the crucial role the Chinese market plays for local panel companies, Lee said the relaxation of restrictions “could be the last chance for local firms to win back market dominance, if they can succeed in holding a bigger share in China, which will soon replace the US and Europe as the new driving force for TV panel makers.”

AU Optronics has formed a joint venture with Chang-hong Electric Co (長虹) to assemble TV panel modules in Sichuan, China, while Chi Mei Optoelectronics is collaborating with Hisense Group (海信), one of China’s biggest TV makers.

Hope Industrial Systems, Inc. based in Roswell, Georgia, pro-vides industrial flat panel monitors and touchscreens that have superior quality and up-to-date features that are relevant to industrial applications. Hope Industrial houses this advanced technology in a variety of rugged enclosures that allow the user to place their displays wherever they are needed in the factory.This is a critical component in assuring its customers have high reliability.The company provides its monitors through systems integrators and OEMs; as well as directly to brand-name companies in an array of industries including aerospace, food and beverage, chemical, metal and electronics.

As part of its mission to find the right technology solutions, Hope Industrial sought a KVM (keyboard, video, and mouse) extender that would allow the computer to be placed as far away as possible from the industrial monitor.The benefit of such a distance is that a non-industrial computer can be placed in a secure, climate-controlled environment leaving only the rugged industrial flat panel monitors exposed to factory conditions.

Hope Industrial chose the AdderLink X Series X-2 Silver Dual-Access KVM extender. The KVM Extender allows placement of an industrial monitor, keyboard, mouse and serial touchscreen up to 1,000 feet away from the computer or server using a single CATx cable.The dual version allows computer access both locally and remotely.The company designed the extender into its products which are used by many Hope Industrial customers including Georgia Pacific, General Mills, Pfizer, Proctor & Gamble and Nestle.

�There are several advantages to using Adder�s products,� said John McGraw, Director of Operations, Hope Industrial Systems. �In addition to the signal extension of up to 1,000 feet, which is two times the length that competitors offered,Adder�s extender provides a rugged metal industrial enclosure.�

Samsung Display will stop producing LCD panels by the end of the year. The display maker currently runs two LCD production lines in South Korea and two in China, according to Reuters. Samsung tells The Verge that the decision will accelerate the company’s move towards quantum dot displays, while ZDNetreports that its future quantum dot TVs will use OLED rather than LCD panels.

The decision comes as LCD panel prices are said to be falling worldwide. Last year, Nikkei reported that Chinese competitors are ramping up production of LCD screens, even as demand for TVs weakens globally. Samsung Display isn’t the only manufacturer to have closed down LCD production lines. LG Display announced it would be ending LCD production in South Korea by the end of the 2020 as well.

Last October Samsung Display announced a five-year 13.1 trillion won (around $10.7 billion) investment in quantum dot technology for its upcoming TVs, as it shifts production away from LCDs. However, Samsung’s existing quantum dot or QLED TVs still use LCD panels behind their quantum dot layer. Samsung is also working on developing self-emissive quantum-dot diodes, which would remove the need for a separate layer.

Samsung’s investment in OLED TVs has also been reported by The Elec. The company is no stranger to OLED technology for handhelds, but it exited the large OLED panel market half a decade ago, allowing rival LG Display to dominate ever since.

Although Samsung Display says that it will be able to continue supplying its existing LCD orders through the end of the year, there are questions about what Samsung Electronics, the largest TV manufacturer in the world, will use in its LCD TVs going forward. Samsung told The Vergethat it does not expect the shutdown to affect its LCD-based QLED TV lineup. So for the near-term, nothing changes.

One alternative is that Samsung buys its LCD panels from suppliers like TCL-owned CSOT and AUO, which already supply panels for Samsung TVs. Last year The Elec reported that Samsung could close all its South Korean LCD production lines, and make up the difference with panels bought from Chinese manufacturers like CSOT, which Samsung Display has invested in.

LANSING, Mich. (AP) — Taiwanese electronics maker Foxconn"s plan to build a display panel factory in the U.S. has sparked a flurry of lobbying by states vying to land what some economic development officials say is a once-in-a-generation prize.

The hunt for Foxconn is fluid and largely secretive, with Rust Belt governors and state officials declining to even confirm their interest due to non-disclosure agreements and Foxconn not elaborating much on why it will expand its U.S. footprint. But Foxconn, the biggest contract assembler of smartphones and other devices for Apple and other brands, has listed seven states with which it hopes to work. It"s expected to announce plans to develop operations in at least three states by early August.

In two, the wooing of Foxconn has spilled into public view. Michigan lawmakers this month passed job-creation tax incentives, including one for companies that add at least 3,000 jobs that pay the average regional wage. Wisconsin legislators are considering new incentives, too.

WISCONSIN: Republican Gov. Scott Walker has close ties to the White House, and President Donald Trump said during a visit to Wisconsin that "we were negotiating with a major, major incredible manufacturer of phones and computers and televisions and I think they"re going to give the governor a very happy surprise very soon." House Speaker Paul Ryan met with Foxconn officials and hopes the company will build its big plant in his southeastern Wisconsin district, which isn"t far from Chicago. Right-to-work Wisconsin has a manufacturing incentive that provides a dollar-for-dollar tax credit equal to 7.5 percent of reported income, nearly eliminating all corporate tax liability. Like some other states, it struggles to provide enough trained workers for available jobs.

MICHIGAN: Republican Gov. Rick Snyder has made Michigan more business-friendly by slashing business taxes, eliminating a machinery tax and boosting trades training. The auto state boasts the most engineers, per capita, and tax changes and loosened union requirements help it compete. But a decision to reduce tax incentives has kept it out of the mix for large-scale business expansions, say economic developers. The new "Good Jobs" incentives worth $200 million annually will let qualified companies keep employees" state income tax withholdings for 10 years. High electricity rates may be a detriment, and some lawmakers have criticized the working conditions at Foxconn"s factories in China.

ILLINOIS: Illinois has no tax incentive program, but lawmakers hope to adopt one soon that would be similar to one the state used to have and would give tax breaks for creating and retaining jobs. Illinois has a central geographic location and an enviable transportation network, with international access by air from Chicago airports, a solid rail network and water access to both the Atlantic Ocean and the Gulf of Mexico. The state"s finances, however, are a mess. After two years without a state budget due to an impasse between Republican Gov. Bruce Rauner and the Democratic-led Legislature, legislators finally passed one this month by overriding the governor"s vetoes. It included increases in the income and corporate taxes.

Moving into 2H22, terminal brands continue to adjust their inventory, not only weakening panel demand, but also inducing a sustained drop in panel quotations. The sharp increase in operating pressure affecting panel manufacturers has forced the display industry to restrain production. According to TrendForce"s "Monthly Panel Supplier Utilization Report," utilization rate (calculated by the volume of glass input) in 3Q22 is expected to fall to 70%, a substantial decrease of nearly 7.3 percentage points from 2Q22.

Since this type of situation applied not only to a single application, utilization rate is reduced whether it is Gen5, primarily used in producing laptops, or large-size LCD monitors and TVs. None of the large generational fabs were spared. TrendForce indicates that the utilization rate of Gen5 to Gen7.5 is expected to decrease by 7.7% percentage points to 63.7% and the utilization rate of Gen8 to Gen10.5 will decrease by 7 percentage points to 75% in 3Q22. More than 90% of the Gen10.5 utilization rate used to produce TVs is expected to drop by 17.8 percentage points QoQ, which also highlights the continuing pessimistic demand for TV panels in 3Q22.

As far as panel makers are concerned, depreciation and amortization pressure on Chinese panel makers is more severe than that of other panel makers due to the construction of new factories. In addition, looking at total shipments of larger-sized applications (TVs, monitor panels, and notebooks), Chinese panel makers account for more than half the market, so when the bottom drops out, impact on these companies will be greater than on competitors. Looking at the three leading Chinese panel manufacturers, although BOE’s capacity allocation is very flexible, a drop of 4 percentage points in overall utilization rate cannot be ruled out in 3Q22. At the same time, China Star Optoelectronics (CSOT) and Huike Optoelectronics (HKC) will not only readjust their older factories in 3Q22 but also slow the rate at which new factories ramp up. The overall operating watermark of these two panel manufacturers is estimated to decrease by 13.3 and 7.4 percentage points, respectively.

Although the pressure of depreciation and amortization on Taiwanese manufacturer AUO is small, in response to changes in market demand, the company had already started production adjustment in 2Q22. It is expected to continue implementing this strategy in 3Q22 with overall utilization rate falling to 50%. On the other hand, Innolux expects overall utilization to drop by 6.7 percentage points QoQ. Japanese panel manufacturer Sharp is at a relative disadvantage in terms of overhead, and its customer concentration is too high. Its major branded clients have canceled orders, allowing inventory to stack up quickly. Therefore, Sharp has only just announced that it will begin to aggressively scale-down in its Japanese production line in July. In turn, the company’s overall utilization rate decreased by 26.3 percentage points to 59.3% in 3Q22. LG Display, a Korean panel maker, is expected to maintain a similar operating level as in 2Q22 after a sustained contraction in LCD production capacity due to a strategic shift.

TrendForce indicates, if panel makers do not wish to face the risk of high inventories at the beginning of 2023, they should maintain reduced operations in 4Q22 in order to eliminate existing panel inventory. Therefore, it cannot be ruled out that the utilization rate of LCD Gen5 (including) and above large generational fabs will maintain the same level of operation as in 3Q22. In the past, production cuts were the main response whenever the market was oversupplied. However, with future production capacity still growing, the speed at which brands deplete their inventories and global political and economic trends will be key factors affecting the future display market. If market conditions continue to deteriorate, it cannot be ruled out that the industry will face another reshuffle, setting off a further wave of mergers and acquisitions.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

Beijing STONE Technology co., ltd was established in 2010 and devoted itself to manufacturing and developing high-quality intelligent TFT LCD display modules.

Our core TFT LCD display modules integrate a CPU, flash memory, and touch screen in the hardware unit. Paired with an easy-to-use free GUI design software and complete instruction set, customers can avoid time-consuming accessories selection and system integration tasks. These units greatly reduce the workload in HMI development and make the entire process faster and easier.

Each TFT display LCD module has a wide range of applications, such as automated system control, vending machine functionality, intelligent lockers, electricity equipment (oiling machine, EV charger), elevators, smart home and office, precision instruments, and much more.

To date, we have delivered custom display solutions to over 3000 customers around the world. Our TFT LCD modules have been widely praised for their quality and performance and that is in large part thanks to our partners, including NI, Siemens, ThyssenKrupp, and many others. These long-term cooperative relationships have been mutually beneficial and we hope to continue a long history of success.

Just about every member from our large efficiency income crew values customers" wants and enterprise communication for Big Lcd Panel, Wide Temperature Bar Tft Lcd Module, Lcd Graphic Module, Customize Ips Lcd Module,Single Color Lcd Panel. Our Lab now is "National Lab of diesel engine turbo technology " , and we own a professional R&D team and complete testing facility. The product will supply to all over the world, such as Europe, America, Australia,Turkey, Plymouth,Netherlands, Spain.By continuous innovation, we will present you with more valuable items and services, and also make a contribution for the development of the automobile industry at home and abroad. Both domestic and foreign merchants are strongly welcomed to join us to grow together.

BANGALORE (Reuters) - Sharp Corp will partner with Taiwanese firm Chimei Innolux Corp to produce television-use LCD panels, the Nikkei business daily reported.

Sharp will provide key technology for reducing power consumption of LCD TVs to Chimei, a unit of Taiwan’s Hon Hai Precision Industry Co or Foxconn International Holdings Ltd, and then outsource production of 20- to 39-inch panels, the paper said.

Sharp will provide panels 40 inches and larger to Chimei. The two firms have already signed a deal regarding the technology transfer and hope to start supplying panels to each other by year-end, the Nikkei reported.

TOKYO, Nov 17 (Reuters) - Japan"s Sharp Corpsaid it is considering cutting LCD panel production as a global downturn hits LCD TV demand, but will press ahead with plans to spend $3.9 billion to build a cutting-edge panel factory.

By lowering output, the world"s third-largest LCD TV maker would join its rivals including market leader Samsung Electronics Co Ltd, which said last month it was "adjusting" production amid sluggish demand for TV and monitor screens.

Sharp said on Monday details have not been decided, but the Nikkei business daily reported on Saturday the company will start output reduction in mid-December, and utilisation rates at its two flagship plants in Japan could fall below 90 percent. The plants, which are currently running at full capacity, have combined capability to make about 22 million units of 32-inch LCD panels a year.

A Sharp spokeswoman said, however, nothing has been changed in its plan to invest 380 billion yen ($3.94 billion) to build an advanced LCD panel plant in western Japan by March 2010.

The new factory will use cost-efficient glass substrates that yield more panels per glass than existing, smaller glass substrates, helping it offer LCD panels and TVs at competitive prices. Shares in Sharp were up 3.9 percent at 696 yen in early afternoon trade. The benchmark Nikkei averagewas up 3.1 percent. ($1=96.41 Yen) (Reporting by Kiyoshi Takenaka; Editing by Michael Watson)

With our G5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, we provide various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

First of all, don’t be afraid of the word “custom” in front of LCD display. The idea of getting exactly what you need is very exciting, but your enthusiasm could be quickly deflated by all of the misconceptions of this process and not being able to meet your budget or schedule. At Phoenix Display International, we don’t want this to happen to you. In fact, our mission is to never let our customers go line-down. In other words, we want your display to be the one thing you don’t have to worry about.

Mass production manufacturing lead times are typically 8 weeks. The long lead-time component is typically the LCD glass at 6 weeks with 2 weeks available to manufacture the components into the complete LCD module. So, 8 weeks manufacturing with 4 weeks shipping, gives the standard and most economical 12-week lead time. With a simple expedited shipping this can easily be sped up to 8 weeks.

So with shipping accounted for, we’ll usually estimate eight to 12 weeks for your production LCD displays in total. An eight-week time frame if we’ll be shipping your display via air, and more of a 12-week time frame if it’ll be going by ocean.

Alternately, we canorder components or full displays based on forecasts, which allows our customers to order releases and get them the next day. One example of this would be TFT glass panels, which sometimes have as much as a 26-week lead time. By keeping an inventory of these, we greatly expedite the whole manufacturing process.

So, there you have it. If you’re interested in a custom or standard LCD displays, we hope you’ll consider Phoenix Display International. We’ll turn around the highest quality product to you, and we’ll make sure we meet your timing and never leave you line down.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey