lcd panel makers hope in stock

According to TrendForce"s latest panel price report, TV panel pricing is expected to arrest its fall in October after five consecutive quarters of decline and the prices of certain panel sizes may even be poised to move up. The price decline of IT panels, whether notebook panels or LCD monitor panels, has also begun showing signs of easing and overall pricing of large-size panels is developing towards bottoming out.

TrendForce indicates, with panel makers actively implementing production reduction plans, TV inventories have also experienced a period of adjustment, with pressure gradually being alleviated. At the same time, the arrival of peak sales season at year’s end has also boosted demand marginally. In particular, Chinese brands are still holding out hope for Double Eleven (Singles’ Day) Shopping Festival promotions and have begun to increase their stocking momentum in turn. Under the influence of strictly controlled utilization rate and marginally stronger demand, TV panel pricing, which are approaching the limit of material costs, is expected to halt its decline in October. Prices of panels below 75 inches (inclusive) are expected to cease their declines. The strength of demand for 32-inch products is the most obvious and prices are expected to increase by US$1. As for other sizes, it is currently understood that PO (Purchase Order) quotations given by panel manufacturers in October have are all increased by US$3~5. Currently China"s Golden Week holiday is ongoing but, after the holiday, panel manufacturers and brands are expected to wrestle with pricing. Based on prices stabilizing, whether pricing can actually be increased still depends on the intensity of demand generated by branded manufacturers for different sized products.

TrendForce observes that current demand for monitor panels is weak, and brands are poorly motivated to stock goods. At the same time, the implementation of production cuts by panel manufacturers has played a role and room for price negotiation has gradually narrowed. At present, the decline in panel pricing has slowed. Prices of small-size TN panels below 21.5 inches (inclusive) are expected to cease declining in October due to reduced supply and flat demand. As for mainstream sizes such as 23.8 and 27-inch, price declines are expected to be within US$1.5. The current demand for notebook panels is also weak and customers must still face high inventory issues and are relatively unwilling to buy panels. Panel makers are also trying to slow the decline in panel prices through their implementation of production reduction plans. Declining panel prices are currently expected to continue abating in October. Pricing for 14-inch and 15.6-inch HD TN panels are expected to drop by US$0.2~0.3, falling from a 1.8% drop in September to 0.7%, while pricing for 14-inch and 15.6-inch FHD IPS panels are expected to fall by US$1~1.2, falling from a 3.4% drop in September to 2.4%.

Compared with past instances when TV panels drove a supply/demand reversal through a sharp increase in demand and spiking prices, this current period of lagging TV panel pricing has been halted and reversed through active control of utilization rates by panel manufacturers and a slight increase in demand momentum. The basis for this break in decline and subsequent price increase is relatively weak. Therefore, in order to maintain the strength of this price backstop and eventual escalation and move towards a healthier supply/demand situation, panel manufacturers must continue to strictly and prudently control the utilization rate of TV production lines, in addition to observing whether sales performance from the forthcoming Chinese festivals beat expectations, allowing stocking momentum to continue, and laying a solid foundation for TV panels to completely escape sluggish market conditions.

The price of IT panels has also adhered to the effect of production reduction and the magnitude of its price drops has gradually eased. TrendForce believes, since the capacity for supplying IT panels is still expanding into the future, it is difficult to see declines in mainstream panel prices halt completely when demand remains weak. Even if new production capacity from Chinese panel factories is gradually completed starting from 2023, price competition in the IT panel market will intensify once products are verified by branded clients, so potential downward pressure in pricing still exists.

Back in 2016, to determine if the TV panel lottery makes a significant difference, we bought three different sizes of the Samsung J6300 with panels from different manufacturers: a 50" (version DH02), a 55" (version TH01), and a 60" (version MS01). We then tested them with the same series of tests we use in all of our reviews to see if the differences were notable.

Our Samsung 50" J6300 is a DH02 version, which means the panel is made by AU Optronics. Our 55" has an original TH01 Samsung panel. The panel in our 60" was made by Sharp, and its version is MS01.

Upon testing, we found that each panel has a different contrast ratio. The 50" AUO (DH02) has the best contrast, at 4452:1, followed by the 60" Sharp (MS01) at 4015:1. The Samsung 55" panel had the lowest contrast of the three: 3707:1.

These results aren"t really surprising. All these LCD panels are VA panels, which usually means a contrast between 3000:1 and 5000:1. The Samsung panel was quite low in that range, leaving room for other panels to beat it.

The motion blur results are really interesting. The response time of the 55" TH01 Samsung panel is around double that of the Sharp and AUO panels. This is even consistent across all 12 transitions that we measured.

For our measurements, a difference in response time of 10 ms starts to be noticeable. All three are within this range, so the difference isn"t very noticeable to the naked eye, and the Samsung panel still performs better than most other TVs released around the same time.

We also got different input lag measurements on each panel. This has less to do with software, which is the same across each panel, and more to do with the different response times of the panels (as illustrated in the motion blur section). To measure input lag, we use the Leo Bodnar tool, which flashes a white square on the screen and measures the delay between the signal sent and the light sensor detecting white. Therefore, the tool"s input lag measurement includes the 0% to 100% response time of the pixel transition. If you look at the 0% to 100% transitions that we measured, you will see that the 55" takes about 10 ms longer to transition from black to white.

All three have bad viewing angles, as expected for VA panels. If you watch TV at an angle, most likely none of these TVs will satisfy you. The picture quality degrades at about 20 degrees from the side. The 60" Sharp panel is worse than the other ones though. In the video, you can see the right side degrading sooner than the other panels.

It"s unfortunate that manufacturers sometimes vary the source of their panels and that consumers don"t have a way of knowing which one they"re buying. Overall though, at least in the units we tested, the panel lottery isn"t something to worry about. While there are differences, the differences aren"t big and an original Samsung panel isn"t necessarily better than an outsourced one. It"s also fairly safe to say that the same can be said of other brands. All panels have minute variations, but most should perform within the margin of error for each model.

[Introduction]: This paper analyzes the competitive pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes.

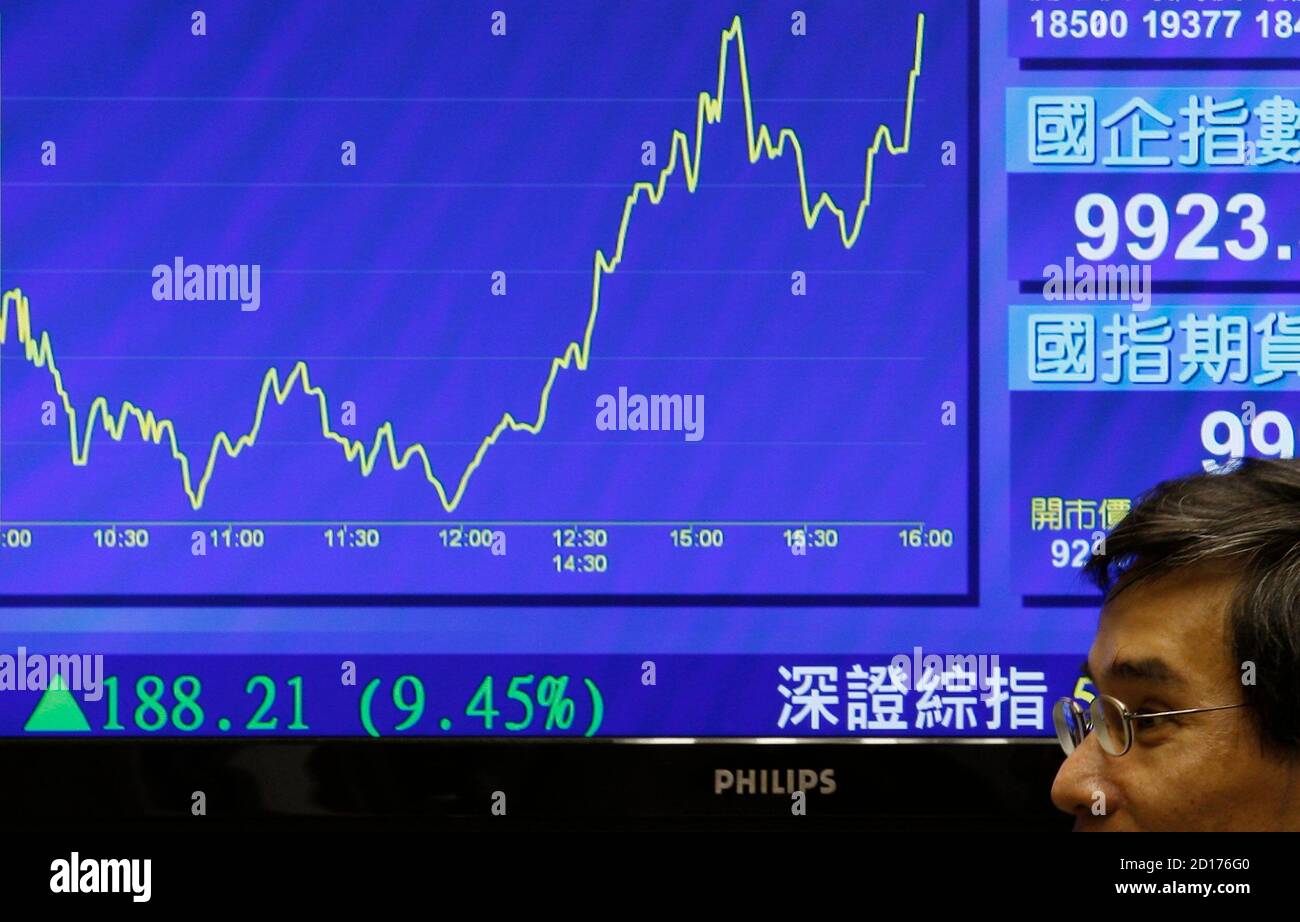

Since April 2020, the display device sector rose 4.81%, ranking 11th in the electronic subsectors, 3.39 percentage points behind the SW electronic sector, 0.65 percentage points ahead of the Shanghai and Shenzhen 300 Index. Of the top two domestic panel display companies, TCL Technology is up 11.35 percent in April and BOE is up 4.85 percent.

Specific to the panel display plate, we still do the analysis from both ends of supply and demand: supply-side: February operating rate is insufficient, especially panel display module segment grain rate is not good, limited capacity to boost the panel display price. Since March, effective progress has been made in the prevention and control of the epidemic in China. Except for some production lines in Wuhan that have been delayed, other domestic panels show that the production lines have returned to normal. In South Korea, Samsung announced recently that it would accelerate its withdrawal from all LCD production lines. This round of output withdrawal exceeded market expectations both in terms of pace and amplitude. We will make a detailed analysis of it in Chapter 2.

Demand-side: We believe that people spend more time at home under the epidemic situation, and TV, as an important facility for family entertainment, has strong demand resilience. In our preliminary report, we have interpreted the pick-up trend of domestic TV market demand in February, which also showed a good performance in March. At present, the online market in China maintains a year-on-year growth of about 30% every week, while the offline market is still weak, but its proportion has been greatly reduced. At present, people are more concerned about the impact of the epidemic overseas. According to the research of Cinda Electronics Industry Chain, in the first week, after Italy was closed down, local TV sales dropped by about 45% from the previous week. In addition, Media Markt, Europe’s largest offline consumer electronics chain, also closed in mid-March, which will affect terminal sales to some extent, and panel display prices will continue to be under pressure in April and May. However, we believe that as the epidemic is brought under control, overseas market demand is expected to return to the pace of China’s recovery.

From a price perspective, the panel shows that prices have risen every month through March since the bottom of December 19 reversed. However, according to AVC’s price bulletin of TV panel display in early April, the price of TV panel display in April will decrease slightly, and the price of 32 “, 39.5 “, 43 “, 50 “and 55” panels will all decrease by 1 USD.65 “panel shows price down $2; The 75 “panel shows the price down by $3.The specific reasons have been described above, along with the domestic panel display production line stalling rate recovery, supply-side capacity release; The epidemic spread rapidly in Europe and the United States, sports events were postponed, local blockades were gradually rolled out, and the demand side declined to a certain extent.

Looking ahead to Q2, we think prices will remain under pressure in May, but prices are expected to pick up in June as Samsung’s capacity is being taken out and the outbreak is under control overseas. At the same time, from the perspective of channel inventory, the current all-channel inventory, including the inventory of all panel display factories, has fallen to a historical low. The industry as a whole has more flexibility to cope with market uncertainties. At the same time, low inventory is also the next epidemic warming panel show price foreshadowing.

In terms of valuation level, due to the low concentration and fierce competition in the panel display industry in the past ten years, the performance of sector companies is cyclical to a certain extent. Therefore, PE, PB, and other methods should be comprehensively adopted for valuation. On the other hand, the domestic panel shows that the leading companies in the past years have sustained large-scale capital investment, high depreciation, and a long period of poor profitability, leading to the inflated TTM PE in the first half of 2014 to 2017. Therefore, we will display the valuation level of the sector mainly through the PB-band analysis panel in this paper.

In 2017, due to the combined impact of panel display price rise and OLED production, the valuation of the plate continued to expand, with the highest PB reaching 2.8 times. Then, with the price falling, the panel shows that PB bottomed out at the end of January 2019 at only 1.11 times. From the end of 2019 to February, the panel shows that rising prices have driven PB all the way up, the peak PB reached 2.23 times. Since entering March, affected by the epidemic, in the short term panel prices under pressure, the valuation of the plate once again fell back to 1.62 times. In April, the epidemic situation in the epidemic country was gradually under control, and the valuation of the sector rebounded to 1.68 times.

We believe the sector is still at the bottom of the stage as Samsung accelerates its exit from LCD capacity and industry inventories remain low. Therefore, once the overseas epidemic is under control and the domestic demand picks up, the panel shows that prices will rise sharply. In addition, the plate will also benefit from Ultra HD drive in the long term. Panel display plate medium – and long-term growth logic is still clear. Coupled with the optimization of the competitive pattern, industry volatility will be greatly weakened. The current plate PB compared to the historical high has sufficient space, optimistic about the plate leading company’s investment value.

Revenue at Innolux and AU Optronics has been sluggish for several months and improved in March. Since the third quarter of 2017, Innolux’s monthly revenue growth has been negative, while AU Optronics has only experienced revenue growth in a very few months.AU Optronics recorded a record low revenue in January and increased in February and March. Innolux’s revenue returned to growth in March after falling to its lowest in recent years in February. However, because the panel display manufacturers in Taiwan have not put in new production capacity for many years, the production process of the existing production line is relatively backward, and the competitiveness is not strong.

On March 31, Samsung Display China officially sent a notice to customers, deciding to terminate the supply of all LCD products by the end of 2020.LGD had earlier announced that it would close its local LCDTV panel display production by the end of this year. In the following, we will analyze the impact of the accelerated introduction of the Korean factory on the supply pattern of the panel display industry from the perspective of the supply side.

The early market on the panel display plate is controversial, mainly worried about the exit of Korean manufacturers, such as LCD display panel price rise, or will slow down the pace of capacity exit as in 17 years. And we believe that this round of LCD panel prices and 2017 prices are essentially different, the LCD production capacity of South Korean manufacturers exit is an established strategy, will not be transferred because of price warming. Investigating the reasons, we believe that there are mainly the following three factors driving:

(1) Under the localization, scale effect, and aggregation effect, the Chinese panel leader has lower cost and stronger profitability than the Japanese and Korean manufacturers. In terms of cost structure, according to IHS data, material cost accounts for 70% of the cost displayed by the LCD panel, while depreciation accounts for 17%, so the material cost has a significant impact on it. At present, the upstream LCD, polarizer, PCB, mold, and key target material line of the mainland panel display manufacturers are fully imported into the domestic, effectively reducing the material cost. In addition, at the beginning of the factory, manufacturers not only consider the upstream glass and polarizer factory but also consider the synergy between the downstream complete machine factory, so as to reduce the labor cost, transportation cost, etc., forming a certain industrial clustering effect. The growing volume of shipments also makes the economies of scale increasingly obvious. In the long run, the profit gap between the South Korean plant and the mainland plant will become even wider.

(2) The 7 and 8 generation production lines of the Korean plant cannot adapt to the increasing demand for TV in average size. Traditionally, the 8 generation line can only cut the 32 “, 46 “, and 60” panel displays. In order to cut the other size panel displays economically and effectively, the panel display factory has made small adjustments to the 8 generation line size, so there are the 8.5, 8.6, 8.6+, and 8.7 generation lines. But from the cutting scheme, 55 inches and above the size of the panel display only part of the generation can support, and the production efficiency is low, hindering the development of large size TV. Driven by the strong demand for large-size TV, the panel display generation line is also constantly breaking through. In 2018, BOE put into operation the world’s first 10.5 generation line, the Hefei B9 plant, with a designed capacity of 120K/ month. The birth of the 10.5 generation line is epoch-making. It solves the cutting problem of large-size panel displays and lays the foundation for the outbreak of large-size TV. From the cutting method, one 10.5 generation line panel display can effectively cut 18 43 inches, 8 65 inches, 6 75 inches panel display, and can be more efficient in hybrid mode cutting, with half of the panel display 65 inches, the other half of the panel display 75 inches, the yield is also guaranteed. Currently, there are a total of five 10.5 generation lines in the world, including two for domestic panel display companies BOE and Huaxing Optoelectronics. Sharp has a 10.5 generation line in Guangzhou, which is mainly used to produce its own TV. Korean manufacturers do not have the 10.5 generation line. In the context of the increasing size of the TV, Korean manufacturers are obviously at a disadvantage in competitiveness.

(3) As the large-size OLED panel display technology has become increasingly mature, Samsung and LGD hope to transfer production to large-size OLED with better profit prospects as soon as possible. Apart from the price factor, the reason why South Korean manufacturers are exiting LCD production is more because the large-size OLED panel display technology is becoming mature, and Samsung and LGD hope to switch to large-size OLED production as soon as possible, which has better profit prospects. At present, there are three major large-scale OLED solutions including WOLED, QD OLED, and printed OLED, while there is only WOLED with a mass production line at present.

According to statistics, shipments of OLED TVs totaled 2.8 million in 2018 and increased to 3.5 million in 2019, up 25 percent year on year. But it accounted for only 1.58% of global shipments. The capacity gap has greatly limited the volume of OLED TV.LG alone consumes about 47% of the world’s OLED TV panel display capacity, thanks to its own capacity. Other manufacturers can only purchase at a high price. According to the industry chain survey, the current price of a 65-inch OLED panel is around $800-900, while the price of the same size LCD panel is currently only $171.There is a significant price difference between the two.

Samsung and LGD began to shut down LCD production lines in Q3 last year, leading to the recovery of the panel display sector. Entering 2020, the two major South Korean plants have announced further capacity withdrawal planning. In the following section, we will focus on its capacity exit plan and compare it with the original plan. It can be seen that the pace and magnitude of Samsung’s exit this round is much higher than the market expectation:

(1) LGD: LGD currently has three large LCD production lines of P7, P8, and P9 in China, with a designed capacity of 230K, 240K, and 90K respectively. At the CES exhibition at the beginning of this year, the company announced that IT would shut down all TV panel display production capacity in South Korea in 2020, mainly P7 and P8 lines, while P9 is not included in the exit plan because IT supplies IT panel display for Apple.

(2) Samsung: At present, Samsung has L8-1, L8-2, and L7-2 large-size LCD production lines in South Korea, with designed production capacities of 200K, 150K, and 160K respectively. At the same time in Suzhou has a 70K capacity of 8 generation line.

Global shipments of TV panel displays totaled 281 million in 2019, down 1.06 percent year on year, according to Insight. In fact, TV panel display shipments have been stable since 2015 at between 250 and 300 million units. At the same time, from the perspective of the structure of sales volume, the period from 2005 to 2010 was the period when the size of China’s TV market grew substantially. Third-world sales also leveled off in 2014. We believe that the sales volume of the TV market has stabilized and there is no big fluctuation. The impact of the epidemic on the overall demand may be more optimistic than the market expectation.

In contrast to the change in volume, we believe that the core driver of the growth in TV panel display demand is actually the increase in TV size. According to the data statistics of Group Intelligence Consulting, the average size of TV panel display in 2014 was 0.47 square meters, equivalent to the size of 41 inches screen. In 2019, the average TV panel size is 0.58 square meters, which is about the size of a 46-inch screen. From 2014 to 2019, the average CAGR of TV panel display size is 4.18%. Meanwhile, the shipment of TV in 2019 also increased compared with that in 2014. Therefore, from 2014 to 2019, the compound growth rate of the total area demand for TV panel displays is 6.37%.

It is assumed that 4K screen and 8K screen will accelerate the penetration and gradually become mainstream products in the next 2-3 years. The pace of screen size increase will accelerate. We have learned through industry chain research that the average size growth rate of TV will increase to 6-8% in 2020. Driven by the growth of the average size, the demand area of global TV panel displays is expected to grow even if TV sales decline, and the upward trend of industry demand remains unchanged.

Meanwhile, the global LCDTV panel display demand will increase significantly in 2021, driven by the recovery of terminal demand and the continued growth of the average TV size. In 2021, the whole year panel display will be in a short supply situation, the mainland panel shows that both males will enjoy the price elasticity.

This paper analyzes the competition pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes. Overall, we believe that the current epidemic has a certain impact on demand, and the panel shows that prices may be under short-term pressure in April or May. But as Samsung’s exit from LCD capacity accelerates, industry inventories remain low. So once the overseas epidemic is contained and domestic demand picks up, the panel suggests prices will surge. We are firmly optimistic about the A-share panel display plate investment value, maintain the industry “optimistic” rating. Suggested attention: BOE A, TCL Technology.

Currently, invisibility cloaks” possible may lead to next-generation “metasurface” displays roughly 1/100 the thickness of the average human hair that could offer 10 times the resolution and consume half as much energy as LCD screens.

LCD technology depends on liquid crystal cells that are constantly lit by a backlight. Polarizers in front and behind the pixels filter light waves based on their polarity, or the direction in which they vibrate, and the liquid crystal cells can rotate the way these filters are oriented to switch light transmissions on and off.

LCD screens do continue to see advances by improving the liquid crystals, the display technology or the backlight. “However, improvement on LCD technologies are now mostly just incremental,” says Eric Virey, senior display analyst at market research firm Yole Intelligence in Lyon, France.

The researchers say the new metasurfaces can replace the liquid crystal layer in LCD displays. At the same time, they would not require the polarizers that liquid crystals do, which are responsible for half of the wasted light intensity and energy use in these displays.

Current production lines for LCD displays can, with minimal modifications, be updated to replace liquid crystal pixels with metasurface ones, Rahmani notes. “There is no need for significant investments in brand-new production lines to get this technology integrated,” he says.

As promising as metasurface displays are, Virey cautions that organic LED (OLED) displays, which are currently the main rivals of LCDs, are strong competitors, and do not need liquid crystal layers.

“OLEDs are already used in about half of smartphones,” Virey says. “Adoption in TV is finally taking off, so is adoption in notebook. LCD won’t disappear and will likely remain the technology of choice for the bulk of entry-level to midrange displays, but their space is shrinking. As a result, while they’re planning on keeping their LCD manufacturing infrastructure, display makers have, for the most, stopped investing in new LCD fabs.”

In the hopes of breaking into the display market, the researchers now hope to optimize their device by tinkering with the heater dimensions, electrical input, and cooling approaches. Artificial intelligence and machine-learning techniques could also help design smaller, thinner, and more efficient metasurface displays, they add. Alù, of the City University of New York, notes smaller pixel sizes are also desirable.

The scientists aim to build a large-scale prototype that can generate images within the next five years. They hope to integrate their technology into flat screens available to the public within the next 10 years.

Given how LCD manufacturers have spent more than a $100 billion on current fabs, “display makers might be happy to find a new technology that could give their aging LCD fabs a second life,” Virey says. “The researchers should make all efforts possible to ensure that it’s as compatible as possible with existing LCD manufacturing infrastructure. Can the same thin-film transistor process be used? Can you integrate the technology in an existing LCD fab with minimum change and investments?”

With our G5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, we provide various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

Analysts said Friday that the firm"s organic light-emitting diode (OLED) panel business is also expected to grow further, noting that investors need to watch the firm"s share prices from a long-term point of view.Hana Financial Investment raised its target price for LG Display from 23,000 won ($20) to 28,000 won, while NH Investment & Securities increased its target price from 21,000 won to 24,000 won. KTB Investment & Securities raised its target price from 22,000 won to 28,000 won."LG Display"s share prices have been undervalued due to expectation that the LCD market was going to degenerate rapidly," said Kim Hyun-soo, an analyst from Hana Financial Investment. "But in March and April, prices of LCD panels have remained stable, and are even expected to increase."Analysts attributed stabilization of LCD panel prices partially to production cuts by Chinese and Taiwanese panel makers.Shares of LG Display increased for five consecutive business days until Thursday when the shares closed at 22,100 won, up from 19,500 won on March 29. On Friday, the share price fell slightly to 21,850 won.A rally in stocks is notable, given that the firm was expected to post an operating loss during the first quarter of the year.Shinhan Investment said the display maker would post an operating loss of 23 billion won during the January-March period.But the security company noted that LG Display may be able to turn around in the second quarter."Prices of LCD panels are expected to increase in the second quarter of the year," said So Hyun-cheol, an analyst from Shinhan Investment. "LG Display is also expected to improve its performance further in the small and medium-sized OLED panel business."So said prices of the 32-inch LCD panel for televisions increased 4.9 percent in March compared to the previous month, saying LG Display is expected to post a 103 billion won operating profit in the second quarter.Analysts added the display maker is also expected to begin supply of flexible OLED panels in earnest to the North American market this year.

The Hisense U8H matches the excellent brightness and color performance of much pricier LCD TVs, and its Google TV smart platform is a welcome addition. But it’s available in only three screen sizes.

The Hisense U8H is the best LCD/LED TV for most people because it delivers the performance of a much pricier TV yet starts at under $1,000, for the smallest (55-inch) screen size. This TV utilizes quantum dots, a full-array backlight with mini-LEDs, and a 120 Hz refresh rate to deliver a great-looking 4K HDR image. It’s compatible with every major HDR format. And it’s equipped with two full-bandwidth HDMI 2.1 inputs to support 4K 120 Hz gaming from the newest Xbox and PlayStation consoles. Add in the intuitive, fully featured Google TV smart-TV platform, and the U8H’s price-to-performance ratio is of inarguable value.

Chief among the U8H’s many strengths is its impressive peak brightness. When sending it HDR test patterns, I measured an average brightness of 1,500 nits, with peaks just north of 1,800 nits (a measurement of luminance; see TV features, defined for more info). To put that into perspective, consider that the 65-inch version of our budget 4K TV pick (the TCL 5-Series) typically costs around half as much as the 65-inch U8H but achieves only around 30% to 40% of its brightness. On the other side of the coin, the 65-inch version of our upgrade pick (the Samsung QN90B) costs almost twice as much as the 65-inch U8H, but it achieves only nominally higher brightness. Adequate light output creates convincing highlights and image contrast and (when necessary) combats ambient light from lamps or windows. It is a necessity for any TV worth buying—especially if you hope to watch HDR movies or play HDR games—and the U8H simply outpaces most TVs in its price range (and some in the next price bracket up, too).

In terms of design, the Hisense U8H is not as svelte as our upgrade pick, but it’s plenty sturdy and doesn’t look or feel cheap. Two narrow, metal feet jut out from beneath the panel and steadily hold the TV. They can be attached in two separate spots, either closer in toward the middle of the panel or out toward the edges, to account for different-size TV stands. The feet are also equipped with cable organization clasps—a nice touch for keeping your TV stand free of cable clutter. Though the TV is primarily plastic, its bezels are lined with metal strips, providing a bit more durability in the long run. I moved it around my home, and it was no worse for wear, but we’ll know more after doing some long-term testing.

The Hisense U8H has some difficulties with banding, or areas of uneven gradation, where transitions that should appear smooth instead look like “bands” of color (sometimes also called posterization). Like many current 4K HDR TVs, the U8H uses an 8-bit panel rather than a 10-bit panel, which affects the color decoding and color presentation process. This is usually relevant only with HDR video and games. When playing games on the PlayStation 5 and Xbox Series X, I saw a few instances where the content wasn’t rendered correctly and displayed ugly splotches of color on the screen. However, this almost always occurred during static screens (such as a pause menu or loading screen); I rarely spotted it during actual gameplay. Hisense has stated that it would address the problem in a future firmware update, but at the time of writing it was still present. This is a flaw that may give dedicated gamers pause, but we don’t consider it to be a dealbreaker for most people.

Finally, like most TVs that use vertical alignment (VA) LCD panels, the U8H has a limited horizontal viewing angle, which may be a bit annoying if you’re hoping to entertain a large crowd. Our upgrade pick uses a special wide-angle technology to address this.

First of all, don’t be afraid of the word “custom” in front of LCD display. The idea of getting exactly what you need is very exciting, but your enthusiasm could be quickly deflated by all of the misconceptions of this process and not being able to meet your budget or schedule. At Phoenix Display International, we don’t want this to happen to you. In fact, our mission is to never let our customers go line-down. In other words, we want your display to be the one thing you don’t have to worry about.

Mass production manufacturing lead times are typically 8 weeks. The long lead-time component is typically the LCD glass at 6 weeks with 2 weeks available to manufacture the components into the complete LCD module. So, 8 weeks manufacturing with 4 weeks shipping, gives the standard and most economical 12-week lead time. With a simple expedited shipping this can easily be sped up to 8 weeks.

So with shipping accounted for, we’ll usually estimate eight to 12 weeks for your production LCD displays in total. An eight-week time frame if we’ll be shipping your display via air, and more of a 12-week time frame if it’ll be going by ocean.

Alternately, we canorder components or full displays based on forecasts, which allows our customers to order releases and get them the next day. One example of this would be TFT glass panels, which sometimes have as much as a 26-week lead time. By keeping an inventory of these, we greatly expedite the whole manufacturing process.

So, there you have it. If you’re interested in a custom or standard LCD displays, we hope you’ll consider Phoenix Display International. We’ll turn around the highest quality product to you, and we’ll make sure we meet your timing and never leave you line down.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey