lcd panel makers hope pricelist

LCD monitors outsold CRT monitors for the first time in 2003. By 2007, LCD monitors consistently outsold CRT monitors, and became the most prominent type of computer monitor.

Touch screen LCD monitors started to become cheaper, more affordable for the average consumer in 2017. Prices for 20 to 22-inch touch screen monitors dropped below $500.

[Introduction]: This paper analyzes the competitive pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes.

Since April 2020, the display device sector rose 4.81%, ranking 11th in the electronic subsectors, 3.39 percentage points behind the SW electronic sector, 0.65 percentage points ahead of the Shanghai and Shenzhen 300 Index. Of the top two domestic panel display companies, TCL Technology is up 11.35 percent in April and BOE is up 4.85 percent.

Specific to the panel display plate, we still do the analysis from both ends of supply and demand: supply-side: February operating rate is insufficient, especially panel display module segment grain rate is not good, limited capacity to boost the panel display price. Since March, effective progress has been made in the prevention and control of the epidemic in China. Except for some production lines in Wuhan that have been delayed, other domestic panels show that the production lines have returned to normal. In South Korea, Samsung announced recently that it would accelerate its withdrawal from all LCD production lines. This round of output withdrawal exceeded market expectations both in terms of pace and amplitude. We will make a detailed analysis of it in Chapter 2.

Demand-side: We believe that people spend more time at home under the epidemic situation, and TV, as an important facility for family entertainment, has strong demand resilience. In our preliminary report, we have interpreted the pick-up trend of domestic TV market demand in February, which also showed a good performance in March. At present, the online market in China maintains a year-on-year growth of about 30% every week, while the offline market is still weak, but its proportion has been greatly reduced. At present, people are more concerned about the impact of the epidemic overseas. According to the research of Cinda Electronics Industry Chain, in the first week, after Italy was closed down, local TV sales dropped by about 45% from the previous week. In addition, Media Markt, Europe’s largest offline consumer electronics chain, also closed in mid-March, which will affect terminal sales to some extent, and panel display prices will continue to be under pressure in April and May. However, we believe that as the epidemic is brought under control, overseas market demand is expected to return to the pace of China’s recovery.

From a price perspective, the panel shows that prices have risen every month through March since the bottom of December 19 reversed. However, according to AVC’s price bulletin of TV panel display in early April, the price of TV panel display in April will decrease slightly, and the price of 32 “, 39.5 “, 43 “, 50 “and 55” panels will all decrease by 1 USD.65 “panel shows price down $2; The 75 “panel shows the price down by $3.The specific reasons have been described above, along with the domestic panel display production line stalling rate recovery, supply-side capacity release; The epidemic spread rapidly in Europe and the United States, sports events were postponed, local blockades were gradually rolled out, and the demand side declined to a certain extent.

Looking ahead to Q2, we think prices will remain under pressure in May, but prices are expected to pick up in June as Samsung’s capacity is being taken out and the outbreak is under control overseas. At the same time, from the perspective of channel inventory, the current all-channel inventory, including the inventory of all panel display factories, has fallen to a historical low. The industry as a whole has more flexibility to cope with market uncertainties. At the same time, low inventory is also the next epidemic warming panel show price foreshadowing.

In terms of valuation level, due to the low concentration and fierce competition in the panel display industry in the past ten years, the performance of sector companies is cyclical to a certain extent. Therefore, PE, PB, and other methods should be comprehensively adopted for valuation. On the other hand, the domestic panel shows that the leading companies in the past years have sustained large-scale capital investment, high depreciation, and a long period of poor profitability, leading to the inflated TTM PE in the first half of 2014 to 2017. Therefore, we will display the valuation level of the sector mainly through the PB-band analysis panel in this paper.

In 2017, due to the combined impact of panel display price rise and OLED production, the valuation of the plate continued to expand, with the highest PB reaching 2.8 times. Then, with the price falling, the panel shows that PB bottomed out at the end of January 2019 at only 1.11 times. From the end of 2019 to February, the panel shows that rising prices have driven PB all the way up, the peak PB reached 2.23 times. Since entering March, affected by the epidemic, in the short term panel prices under pressure, the valuation of the plate once again fell back to 1.62 times. In April, the epidemic situation in the epidemic country was gradually under control, and the valuation of the sector rebounded to 1.68 times.

We believe the sector is still at the bottom of the stage as Samsung accelerates its exit from LCD capacity and industry inventories remain low. Therefore, once the overseas epidemic is under control and the domestic demand picks up, the panel shows that prices will rise sharply. In addition, the plate will also benefit from Ultra HD drive in the long term. Panel display plate medium – and long-term growth logic is still clear. Coupled with the optimization of the competitive pattern, industry volatility will be greatly weakened. The current plate PB compared to the historical high has sufficient space, optimistic about the plate leading company’s investment value.

Revenue at Innolux and AU Optronics has been sluggish for several months and improved in March. Since the third quarter of 2017, Innolux’s monthly revenue growth has been negative, while AU Optronics has only experienced revenue growth in a very few months.AU Optronics recorded a record low revenue in January and increased in February and March. Innolux’s revenue returned to growth in March after falling to its lowest in recent years in February. However, because the panel display manufacturers in Taiwan have not put in new production capacity for many years, the production process of the existing production line is relatively backward, and the competitiveness is not strong.

On March 31, Samsung Display China officially sent a notice to customers, deciding to terminate the supply of all LCD products by the end of 2020.LGD had earlier announced that it would close its local LCDTV panel display production by the end of this year. In the following, we will analyze the impact of the accelerated introduction of the Korean factory on the supply pattern of the panel display industry from the perspective of the supply side.

The early market on the panel display plate is controversial, mainly worried about the exit of Korean manufacturers, such as LCD display panel price rise, or will slow down the pace of capacity exit as in 17 years. And we believe that this round of LCD panel prices and 2017 prices are essentially different, the LCD production capacity of South Korean manufacturers exit is an established strategy, will not be transferred because of price warming. Investigating the reasons, we believe that there are mainly the following three factors driving:

(1) Under the localization, scale effect, and aggregation effect, the Chinese panel leader has lower cost and stronger profitability than the Japanese and Korean manufacturers. In terms of cost structure, according to IHS data, material cost accounts for 70% of the cost displayed by the LCD panel, while depreciation accounts for 17%, so the material cost has a significant impact on it. At present, the upstream LCD, polarizer, PCB, mold, and key target material line of the mainland panel display manufacturers are fully imported into the domestic, effectively reducing the material cost. In addition, at the beginning of the factory, manufacturers not only consider the upstream glass and polarizer factory but also consider the synergy between the downstream complete machine factory, so as to reduce the labor cost, transportation cost, etc., forming a certain industrial clustering effect. The growing volume of shipments also makes the economies of scale increasingly obvious. In the long run, the profit gap between the South Korean plant and the mainland plant will become even wider.

(2) The 7 and 8 generation production lines of the Korean plant cannot adapt to the increasing demand for TV in average size. Traditionally, the 8 generation line can only cut the 32 “, 46 “, and 60” panel displays. In order to cut the other size panel displays economically and effectively, the panel display factory has made small adjustments to the 8 generation line size, so there are the 8.5, 8.6, 8.6+, and 8.7 generation lines. But from the cutting scheme, 55 inches and above the size of the panel display only part of the generation can support, and the production efficiency is low, hindering the development of large size TV. Driven by the strong demand for large-size TV, the panel display generation line is also constantly breaking through. In 2018, BOE put into operation the world’s first 10.5 generation line, the Hefei B9 plant, with a designed capacity of 120K/ month. The birth of the 10.5 generation line is epoch-making. It solves the cutting problem of large-size panel displays and lays the foundation for the outbreak of large-size TV. From the cutting method, one 10.5 generation line panel display can effectively cut 18 43 inches, 8 65 inches, 6 75 inches panel display, and can be more efficient in hybrid mode cutting, with half of the panel display 65 inches, the other half of the panel display 75 inches, the yield is also guaranteed. Currently, there are a total of five 10.5 generation lines in the world, including two for domestic panel display companies BOE and Huaxing Optoelectronics. Sharp has a 10.5 generation line in Guangzhou, which is mainly used to produce its own TV. Korean manufacturers do not have the 10.5 generation line. In the context of the increasing size of the TV, Korean manufacturers are obviously at a disadvantage in competitiveness.

(3) As the large-size OLED panel display technology has become increasingly mature, Samsung and LGD hope to transfer production to large-size OLED with better profit prospects as soon as possible. Apart from the price factor, the reason why South Korean manufacturers are exiting LCD production is more because the large-size OLED panel display technology is becoming mature, and Samsung and LGD hope to switch to large-size OLED production as soon as possible, which has better profit prospects. At present, there are three major large-scale OLED solutions including WOLED, QD OLED, and printed OLED, while there is only WOLED with a mass production line at present.

According to statistics, shipments of OLED TVs totaled 2.8 million in 2018 and increased to 3.5 million in 2019, up 25 percent year on year. But it accounted for only 1.58% of global shipments. The capacity gap has greatly limited the volume of OLED TV.LG alone consumes about 47% of the world’s OLED TV panel display capacity, thanks to its own capacity. Other manufacturers can only purchase at a high price. According to the industry chain survey, the current price of a 65-inch OLED panel is around $800-900, while the price of the same size LCD panel is currently only $171.There is a significant price difference between the two.

Samsung and LGD began to shut down LCD production lines in Q3 last year, leading to the recovery of the panel display sector. Entering 2020, the two major South Korean plants have announced further capacity withdrawal planning. In the following section, we will focus on its capacity exit plan and compare it with the original plan. It can be seen that the pace and magnitude of Samsung’s exit this round is much higher than the market expectation:

(1) LGD: LGD currently has three large LCD production lines of P7, P8, and P9 in China, with a designed capacity of 230K, 240K, and 90K respectively. At the CES exhibition at the beginning of this year, the company announced that IT would shut down all TV panel display production capacity in South Korea in 2020, mainly P7 and P8 lines, while P9 is not included in the exit plan because IT supplies IT panel display for Apple.

(2) Samsung: At present, Samsung has L8-1, L8-2, and L7-2 large-size LCD production lines in South Korea, with designed production capacities of 200K, 150K, and 160K respectively. At the same time in Suzhou has a 70K capacity of 8 generation line.

Global shipments of TV panel displays totaled 281 million in 2019, down 1.06 percent year on year, according to Insight. In fact, TV panel display shipments have been stable since 2015 at between 250 and 300 million units. At the same time, from the perspective of the structure of sales volume, the period from 2005 to 2010 was the period when the size of China’s TV market grew substantially. Third-world sales also leveled off in 2014. We believe that the sales volume of the TV market has stabilized and there is no big fluctuation. The impact of the epidemic on the overall demand may be more optimistic than the market expectation.

In contrast to the change in volume, we believe that the core driver of the growth in TV panel display demand is actually the increase in TV size. According to the data statistics of Group Intelligence Consulting, the average size of TV panel display in 2014 was 0.47 square meters, equivalent to the size of 41 inches screen. In 2019, the average TV panel size is 0.58 square meters, which is about the size of a 46-inch screen. From 2014 to 2019, the average CAGR of TV panel display size is 4.18%. Meanwhile, the shipment of TV in 2019 also increased compared with that in 2014. Therefore, from 2014 to 2019, the compound growth rate of the total area demand for TV panel displays is 6.37%.

It is assumed that 4K screen and 8K screen will accelerate the penetration and gradually become mainstream products in the next 2-3 years. The pace of screen size increase will accelerate. We have learned through industry chain research that the average size growth rate of TV will increase to 6-8% in 2020. Driven by the growth of the average size, the demand area of global TV panel displays is expected to grow even if TV sales decline, and the upward trend of industry demand remains unchanged.

Meanwhile, the global LCDTV panel display demand will increase significantly in 2021, driven by the recovery of terminal demand and the continued growth of the average TV size. In 2021, the whole year panel display will be in a short supply situation, the mainland panel shows that both males will enjoy the price elasticity.

This paper analyzes the competition pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes. Overall, we believe that the current epidemic has a certain impact on demand, and the panel shows that prices may be under short-term pressure in April or May. But as Samsung’s exit from LCD capacity accelerates, industry inventories remain low. So once the overseas epidemic is contained and domestic demand picks up, the panel suggests prices will surge. We are firmly optimistic about the A-share panel display plate investment value, maintain the industry “optimistic” rating. Suggested attention: BOE A, TCL Technology.

There are many “brand” names that are familiar to many of us like Chauvet, Absen, Aeson, PixelFlex, Elation, ADJ, and others who sell LED panels, and many new names popping up all over the place. If I may – take all these names and they are analogous to Buick, Chevrolet as to General Motors. You don’t walk into a specific General Motors dealer to buy a GM car, but GM makes them for Buick, Chev and the rest of the brands. Just like that, there are a few factories in Shenzhen that make the products for the many brand names. And just like a car is made up of many parts from multiple suppliers – the LED wall panel is the same, where you have a power supply, receiving card, chassis, circuit boards, IC driver chips and LED’s themselves. So some brand names are assemblers who buy each of the components and other brand names actually manufacturer several of the parts and then assemble the wall.

The same can be said for an American DJ LED 6mm wall panel that had an advertised price of $999 and an Elation Professional 4.81mm panel that is advertised for $1999 and another brand which may be even more expensive. Both will display video, but the fit, finish, expected lifespan, durability, and video performance is greatly different. To get to the $999 price ADJ had made a panel with much more plastic parts and has value engineered the electronics to be able to sell it at that price. When you look at a panel that is $2000 it will have higher grade parts. (at least you hope so, right?)

So for a general range, the LED wall panels will be anywhere from about $1000-3000++ per panel – and the most typical size being a 500X500mm panel. There are various other sizes – like 500X1000mm (which is essentially two 500mm 2 panels in one assembly) and many others.

The pricing also does depend greatly on the pixel pitch of the LED panel. The most commonly quoted pitch today is probably the 4mm or 3.91mm. Last year and before it was more in the 6mm and we are now seeing panels with a pixel pitch of 1mm and even tighter. The cost for the 2mm and tighter is much higher, and that pixel pitch would only be needed if you have extreme close viewing or you require very high resolution at a small screen size.

So I took and added up all the costs for the LED panels, controller, and cabling (not installation) for the various brands and then divided it out into the cost per square foot as a level playing field. Brand names have been left off as to not promote any of them. So here are my old numbers:

So I hope this is helpful to just give you an idea of what the numbers looked like a year ago – today they are different. And based on the size of your LED wall – the cost per square foot will vary due to the parts you need for a large or small wall. Typically, larger walls will have a lower cost per square foot, but not always.

For example, recently I went online and found a retailer that sells the ADJ brand 6mm LED wall and did the math to see that it is priced around the low $300 per square foot range. Keep in mind that it is a very entry level panel. So this price would be one of the lowest cost LED panel out on the market – and from there, prices go up based on quality and pixel density.

In January 2010, Taiwanese AU Optronics Corporation (AUO) announced that it had acquired assets from Sony"s FET and FET Japan, including "patents, know-how, inventions, and relevant equipment related to FED technology and materials".Nikkei reported that AUO plans to start mass production of FED panels in the fourth quarter of 2011, however AUO commented that the technology is still in the research stage and there are no plans to begin mass production at this moment.

Many expect that quantum dot display technology can compete or even replace liquid crystal displays (LCDs) in near future, including the desktop and notebook computer spaces and televisions. These initial applications alone represent more than a $8-billion addressable market by 2023 for quantum dot-based components. Other than display applications, several companies are manufacturing QD-LED light bulbs; these promise greater energy efficiency and longer lifetime.

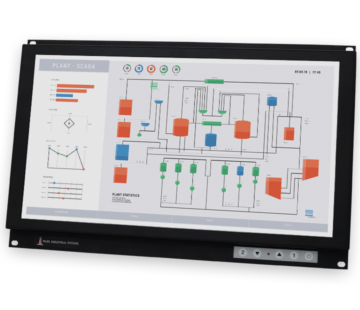

Looking to take your project to the next level in terms of functionality and appearance? A custom LCD display might be the thing that gets you there, at least compared to the dot-matrix or seven-segment displays that anyone and their uncle can buy from the usual sources for pennies. But how does one create such a thing, and what are the costs involved? As is so often the case these days, it’s simpler and cheaper than you think, and [Dave Jones] has a great primer on designing and specifying custom LCDs.

We’re amazed at how low the barrier to entry into custom electronics has become, and even if you don’t need a custom LCD, at these prices it’s tempting to order one just because you can. Of course, you can also build your own LCD display completely from scratch too.

A promotional image of a quantum-dot LED TV (Samsung Electronics)Samsung Display, the display making arm of Samsung Electronics, is poised to fully shut down its unprofitable liquid crystal display panel business for televisions in June, after over 30 years of operation.

“(Samsung Display) will terminate its supply of LCD panels in June,” an industry source said Monday. The company has been manufacturing its lower-end panels in Asan, South Chungcheong Province.

The long-awaited move came as LCD TV panel prices have been on a constant decline. This led to greater losses for Samsung Display, while Chinese competitors have been ramping up their dominance in the global industry supported by state subsidies and tax breaks.

LCD TVs are considered lower-end when compared to those using cutting-edge TV components such as organic light-emitting diode panels and quantum dot display panels.

According to market intelligence firm Omdia‘s estimate compiled by Daishin Securities, 43-inch LCD panel prices fell 46 percent from September 2021 to May this year, while that of 55-inch panels and 65-inch panels both declined 34 percent over the cited period.

This marks the end of Samsung’s three-decade LCD TV panel business. Once the largest LCD TV panel supplier in the world, Samsung Display‘s market share has gradually shrunk from 22 percent in 2014 to around 2 percent this year.

Samsung Display had sought to exit the business from before 2021, but has been hanging on in part due to Samsung Electronics’ LCD panel supply shortage.

Choi Kwon-young, executive vice president of Samsung Display, confirmed the company’s full exit from the LCD TV panel business within this year in a first-quarter conference call in April.

Given that Samsung’s LCD TV panel exit has long been anticipated and carried out gradually, Samsung Electronics will “unlikely be affected by Samsung Display‘s LCD panel exit” in terms of its continuity in the LCD TV set business, noted Kim Hyun-soo, an analyst at Hana Financial Investment on Monday.

Samsung looks to pivot to quantum dot display technologies for its TV panel business, using quantum dot light-emitting diodes or quantum dot organic light-emitting diodes.

As for the anticipated collaboration between TV maker Samsung Electronics and the world‘s sole white-OLED TV panel supplier LG Display, Kim of Hana said the launch of Samsung’s OLED TV is unlikely within this year due to prolonged negotiations.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey