how to build an lcd display pricelist

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

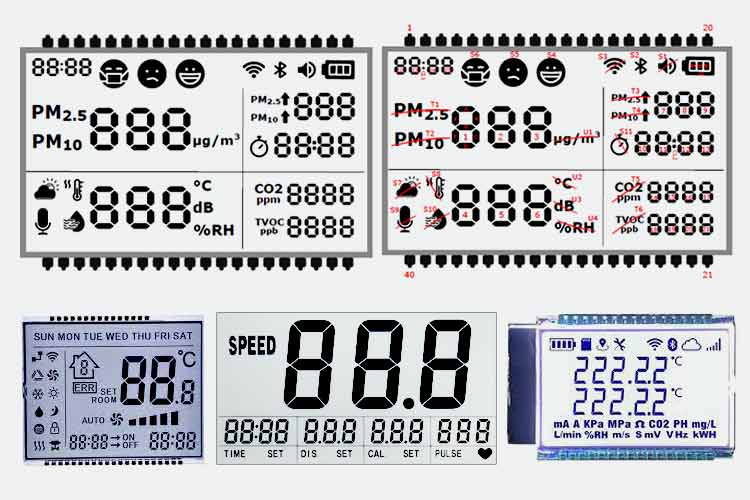

Looking to take your project to the next level in terms of functionality and appearance? A custom LCD display might be the thing that gets you there, at least compared to the dot-matrix or seven-segment displays that anyone and their uncle can buy from the usual sources for pennies. But how does one create such a thing, and what are the costs involved? As is so often the case these days, it’s simpler and cheaper than you think, and [Dave Jones] has a great primer on designing and specifying custom LCDs.

The video below is part of an ongoing series; a previous video covered the design process, turning the design into a spec, and choosing a manufacturer; another discussed the manufacturer’s design document approval and developing a test plan for the module. This one shows the testing plan in action on the insanely cheap modules – [Dave] was able to have a small run of five modules made up for only $138, which included $33 shipping. The display is for a custom power supply and has over 200 segments, including four numeric sections, a clock display, a bar graph, and custom icons for volts, amps, millijoules, and watt-hours. It’s a big piece of glass and the quality is remarkable for the price. It’s not perfect – [Dave] noted a group of segments on the same common lines that were a bit dimmer than the rest, but was able to work around it by tweaking the supply voltage a bit.

We’re amazed at how low the barrier to entry into custom electronics has become, and even if you don’t need a custom LCD, at these prices it’s tempting to order one just because you can. Of course, you can also build your own LCD display completely from scratch too.

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The 43 inches and 55 inches rose more than double digits in August, reaching 13.7% each, and rose another $7 and $13, respectively, to $91 and $149, respectively, in September.

For larger sizes, overseas stocks remained strong, with prices for 65 inches and 75 inches rising $10 on average to $200 and $305 respectively in September.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

This kind of price correction is in line with the law of industrial development. Only with reasonable profit space can the whole industry be stimulated to move forward.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

Video walls deliver the wow factor and imbue commercial office space with that modern look associated with cutting-edge companies. Video walls display content in a way that is unique and captures the attention of target audiences.

However, the high cost (or at least the perception of a high cost), typically associated with such display technology has prevented many businesses from building their dream video wall.

You can absolutely still create such displays on a budget without breaking the bank, though. This article will provide you with a general overview of what a video wall for a commercial enterprise might cost, from a very simple video wall to a much more elaborate setup. This will help you narrow down the size, style, and price range that fits your needs and budget.

The overall costs of a video wall depend largely on size, processor, type of display technology and quality of video mounts, as well as ancillary costs like installation, making video walls one of the most customizable pieces of technology you can install.

Now, one more note before I start breaking down options and prices. When I talk about video walls, I’m not referring to buying four TVs from a big box store and hanging them together. TVs are problematic as video walls for a number of reasons. Their bezels are usually larger and have logos, they’re usually not bright enough to serve as commercial displays, and they can’t meet the demand of 24/7 usage. You’ll hear me discuss LCDs and LEDs, but when I do, I’ll be referring to monitors, not TVs. It’s an important distinction.

While blended front projections and rear projection cubes are viable options for video walls, LED and LCDs are the most common display technology used for video walls.

Generally, LEDs are more expensive than LCDs (for models that deliver the same image quality), making the latter the budget-friendly choice. The major tradeoff is the LCD’s bezel lines for the line-free LED array.

When viewed from a distance, LED displays deliver a large seamless image presentation that’s ideal for stage presentation screens, corporate branding, and digital signage use cases. Using the correct pixel pitch makes LED display deliver a picture-perfect image that’s free of bezels or lines; however, they are not great for close viewing, though that is improving.

For simple video walls, a basic 2×2 high-quality LCD unit can cost as little as $4800, while larger, more elaborate setups with more advanced features (touchscreen capabilities) can go as high as $30,000.

You also need to consider the cost of mounting hardware and installation. A 2×2 mounting kit costs around $650, freestanding mounting kits go for $2,500 while complex sliding rails for very large displays can cost as much as $100,000. There are cost-effective options for enterprises on a budget as well as elaborate setups for companies who want to pull out all the stops.

A 1.2mm pixel pitch LED video wall costs approximately $2K sq./ft. This figure translates into $200K for a video wall with 160” x 90” outside dimensions. This includes the mounts, panels and installation costs without taking into account the cost of infrastructure, installation and programming and other ancillary costs (like tax and shipping).

While LEDs are more expensive than LCDs, they lend themselves to more customization in terms of size and shape, with the added benefit of being bezel-less.

It’s best not to scrimp on mounts. You should choose a mount that is sufficiently rigid to prevent sagging and able to provide alignment adjustments in all axes when needed. Most importantly, use mounts that permit front serviceability of individual panels. This prevents the need to remove other panels to service just one failed panel, thus reducing the cost of maintenance and repairs.

There is also a new motorized video wall mount that allows monitors to be serviced without even touching them. I’ll discuss this more in a future post.

Video processors handle video rotation, layering, or windowing of content and other custom effects. Depending on the content to be displayed and how it will be displayed, video processors can easily become the most expensive component of the video wall. The cost depends largely on the number of simultaneous layers displayed on the wall at a given time and the number of physical inputs and outputs required. Processors can range from $15k to $80K, depending on complexity.

For very simple video walls, you can purchase processors that cost far less. However, you should always go for good quality processors since low-quality ones may produce slow videos that will ruin the effect of your displays.

Now, some video wall monitors actually have tiling built in, so basic functionality already exists within the displays themselves. So if what you are displaying is very simple and straightforward, you may not even need a processor.

Also, custom content needs to be created (or scaled to fit) for video walls that don’t come in standard resolutions like 1080P, 2K,4K, etc. You might want to avoid such non-standard walls since it can be quite expensive to create such custom content. Instead, try to use a video wall layout that maintains standard aspect ratios. For LED walls, this means a 16:10, 16:9, or other cinema aspect ratios while LCD arrays should come in 2×2, 3×3, 4×4, and other standard array sizes.

With the wide range in prices of video wall components, processors, mounts and other ancillary fees, companies can afford to build a video wall, no matter their budget constraints. While DIY installation costs can help reduce costs, it isn’t advisable. You should always look for reliable, high-quality vendors and installation experts to help you create the ideal video wall for your business.

Prices for all TV panel sizes fluctuated and are forecast to fluctuate between 2020 and 2022. The period from March 2020 to July 2021 saw the biggest price increases, when a 65" UHD panel cost between 171 and 288 U.S. dollars. In the fourth quarter of 2021, such prices fell and are expected to drop to an even lower amount by March 2022.Read moreLCD TV panel prices worldwide from January 2020 to March 2022, by size(in U.S. dollars)Characteristic32" HD43" FHD49"/50" UHD55" UHD65" UHD------

DSCC. (January 10, 2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph]. In Statista. Retrieved March 03, 2023, from https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars)." Chart. January 10, 2022. Statista. Accessed March 03, 2023. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. (2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars). Statista. Statista Inc.. Accessed: March 03, 2023. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "Lcd Tv Panel Prices Worldwide from January 2020 to March 2022, by Size (in U.S. Dollars)." Statista, Statista Inc., 10 Jan 2022, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC, LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) Statista, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/ (last visited March 03, 2023)

LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph], DSCC, January 10, 2022. [Online]. Available: https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

I’m hearing from some industry friends that LCD display panel prices are rising – which on the surface likely seems incongruous, given the economic slowdown and widespread indications that a lot of 2020 and 2021 display projects went on hold because of COVID-19.

On the other hand, people are watching a lot more TV, and I saw a guy at Costco the other day with two big-ass LCD TVs on his trolley. And a whole bunch of desktop monitors were in demand in 2020 to facilitate Work From Home. So demand for LCD displays is up outside of commercial purposes.

Organizations that pay attention to supply chains and pricing confirm prices ended high in 2020 and are expected to climb again this quarter and flatten out later in the year.

The Korean business portal BusinessKorea says one explanation was a power outage that shut down a big glass substrate factory in Japan, which was serious enough that the plant will only get back to normal sometime in this quarter.

Continuing strong demand and concerns about a glass shortage resulting from NEG’s power outage have led to a continuing increase in LCD TV panel prices in Q1. Announcements by the Korean panel makers that they will maintain production of LCDs and delay their planned shutdown of LCD lines has not prevented prices from continuing to rise.

Panel prices increased more than 20% for selected TV sizes in Q3 2020 compared to Q2, and by 27% in Q4 2020 compared to Q3, and we now expect that average LCD TV panel prices in Q1 2021 will increase by another 9%.

Prices increased in Q4 for all sizes of TV panels, with massive % increases in sizes from 32” to 55” ranging from 28% to 38%. Prices for 65” and 75” increased at a slower rate, by 19% and 8% respectively, as capacity has continued to increase on those sizes with Gen 10.5 expansions.

Prices for every size of TV panel will increase in Q1 at a slower rate, ranging from 4% for 75” to 13% for 43”. Although we continue to expect that the long-term downward trend will resume in the second quarter of 2021, we no longer expect that panel prices will come close to the all-time lows seen earlier this year. The situation remains dynamic, and the pandemic may continue to affect both supply and demand.

TV panel prices however, continued to rise at an ‘unprecedented’ rate again, far ahead of our expectations, and panel producers do not seem to be hesitant about continuing to push prices further.

Given that TV set demand continues to outstrip production capacity, panel producers are already expecting to raise prices again in 1Q, typically a sequentially weaker quarter. There is a breaking point at which TV set brands will forego requested panel price increases in order to preserve what is left of margins, and with the increasing cost of TV set panel inventory, we expect TV set producers to become unprofitable relatively quickly.

Does that mean they will stop buying and face losing market share to those that are willing to pay higher prices to see unit volume growth? Eventually, but heading into the holidays it doesn’t seem likely this year, so we expect TV panel prices to rise again in December.

With a lot of the buyer market for digital signage technology financial wheezing its way into 2021, rising hardware prices are likely even less welcomed than in more normal times. But the prices for display hardware, in particular, are dramatically lower they were five years ago, and even more so looking back 10-15 years.

The power consumption of computer or tv displays vary significantly based on the display technology used, manufacturer and build quality, the size of the screen, what the display is showing (static versus moving images), brightness of the screen and if power saving settings are activated.

Click calculate to find the energy consumption of a 22 inch LED-backlit LCD display using 30 Watts for 5 hours a day @ $0.10 per kWh. Check the table below and modify the calculator fields if needed to fit your display.

Hours Used Per Day: Enter how many hours the device is being used on average per day, if the power consumption is lower than 1 hour per day enter as a decimal. (For example: 30 minutes per day is 0.5)

Price (kWh): Enter the cost you are paying on average per kilowatt hour, our caculators use the default value of 0.10 or 10 cents. To find an exact price check your electricity bill or take a look at Global Electricity Prices.

LED & LCD screens use the same TFT LCD (thin film transistor liquid crystal display) technology for displaying images on the screen, when a product mentions LED it is referring to the backlighting. Older LCD monitors used CCFL (cold cathode fluorescent) backlighting which is generally 20-30% less power efficient compared to LED-backlit LCD displays.

The issue in accurately calculating the energy consumption of your tv or computer display comes down to the build quality of the screen, energy saving features which are enabled and your usage patterns. The only method to accurately calculate the energy usage of a specific model is to use a special device known as an electricity usage monitor or a power meter. This device plugs into a power socket and then your device is plugged into it, electricity use can then be accurately monitored. If you are serious about precisely calculating your energy use, this product is inexpensive and will help you determine your exact electricity costs per each device.

In general we recommend LED displays because they offer the best power savings and are becoming more cheaper. Choose a display size which you are comfortable with and make sure to properly calibrate your display to reduce power use. Enable energy saving features, lower brightness and make sure the monitor goes into sleep mode after 5 or 10 minutes of inactivity. Some research studies also suggest that setting your system themes to a darker color may help reduce energy cost, as less energy is used to light the screen. Also keep in mind that most display will draw 0.1 to 3 watts of power even if they are turned off or in sleep mode, unplugging the screen if you are away for extended periods of time may also help.

Computer monitors are a must-have for PC users and hardcore gamers. Consumers may be looking at computer monitor buying guides and wondering just how much a typical computer monitor costs and the overall price range of displays.

Modern computer monitors can fluctuate wildly when it comes to price, with some models as cheap as $50 and others costing $1000 or more. In the past, the first computer with a screen was astronomically expensive, but thankfully monitor technology become more accessible, bringing the price down throughout the decades. The average computer monitor costs around $200 – $300. There are some features and functionalities that can severely impact the price so be sure to do some research so you make sure you’re getting the best cheap monitor if you have a lower budget.

There are a number of features and functionalities that can increase the overall price of a computer monitor, and that’s without adding accessories to your monitor like a webcam or monitor arm if you know how to mount a monitor.

Generally speaking, LCD displays are the cheapest type of modern computer monitor. LED displays, which are based on the same technology as their LCD cousins, tend to be slightly more expensive while OLED displays are the most expensive of all. The latter being due to the high-priced components that make up the OLED technology.

Modern computer monitors can boast resolutions as high as 8K, offering stunning and true-to-life visuals and graphics. 8K, and even 4K, displays feature newly adopted technological advancements. As such, the higher the resolution, the costlier the monitor. If you are looking to snag a high-quality monitor on the cheap, go for an HD display with a 1080p resolution.

If you are using your PC to stream content or to play graphically intensive games, then the refresh rate is an incredibly important consideration. The refresh rate indicates how often your monitor refreshes the screen. As for price, monitors with ultra-high refresh rates, above 120Hz, tend to be more expensive than displays with refresh rates of 75Hz or less.

The overall size of a computer monitor, and its width, can impact the overall price. Typically, ultrawide monitors and displays that are larger than 34-inches tend to be on the expensive side. This price continues to increase as the monitor size increases. Get the size that may cater better to your needs if you need the monitor for a specific task, like the best size monitor for gaming should help make your gameplay more efficient. Ultrawide monitors and larger-than-average monitors can significantly increase the viewing angle, which can be a useful benefit.

Size plays a huge part in getting the right viewing distance and angles, which you can learn more about in our resource article about how far to sit from a monitor, especially if it’s an Ultrawide monitor.

Certain monitors include additional features that can impact the price, like these great monitors with a webcam. These can include USB hubs, integrated stereo speakers, microphones, ergonomically designed frames, and more. Some monitors also include robust cable management systems, making for a tidy setup. We recommend making a “must-have” list of features before settling on your final purchase.

So, if the price is a problem for you and you’d rather have a better resolution without the high price tag, you may be interested in learning how to build a PC monitor. It’s easier than it sounds.

To attract the price-conscious, Sony introduced its “M” line of televisions, designed for big box stores that “want to buy Sony without all the bells and whistles,” Mr. Waynick said.

To cut costs, the company uses 720p resolution, rather than 1080p, and less sophisticated color processing, offering a lower contrast ratio than in its more expensive sets. “Our contrast ratio is on a par with the rest of the marketplace,” Mr. Waynick said. If price is your main consideration, here are several tips on how to keep costs down and still get the best television for your money.

720P VS. 1080P If you are considering a television that is 40 inches or smaller, a less-expensive 720p resolution set is likely to produce a picture that looks as good as one from a 1080p set.

A television that can display a higher resolution is more important in bigger screen sizes, where the difference can be seen at normal viewing distances. (Only Blu-ray players can actually deliver a 1080p signal. The set will “upconvert” other program sources, like television broadcasts, to near-1080p quality.)

VIEWING ANGLELCD televisions tend to have smaller viewing angles than plasma sets. So if your friends are over to watch the game, those sitting on the left and right of the screen will see an image with blacks that look gray; whites that are darker; reduced contrast; and colors that have shifted.

To counter that effect, Mr. Merson said, consumers should look for LCD televisions that use I.P.S., or in-plane switching technology. I.P.S. is available on Hitachi and Panasonic sets; Samsung and Sony have a similar technology called S-PVA.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey