hs code for lcd monitors factory

Flexport’s import and export data is sourced from US Census statistical records. Figures represent imports to the United States from other countries and exports from the United States to other countries. Read more about HS Codes here.

Nov192016SCREEN PROTECTOR - COMPONENT , ACCESORRIES & PARTS FOR MANUFACTURING OF MOBILE HANDSET 2.4 INCH LCD SIZE MODEL NO- (K28,ChinaNhava Sheva SeaPCS42,0002,9190

Nov192016SCREEN PROTECTOR - COMPONENT , ACCESORRIES & PARTS FOR MANUFACTURING OF MOBILE HANDSET 2.4 INCH LCD SIZE MODEL NO- ( M52ChinaNhava Sheva SeaPCS20,0001,3900

Nov172016IEI 19 LCD MONITOR WITH POS-H61, PENTIUM DUAL COREGXXT ( ABOVE 2.2 GHZ ) PSU ACE-A622A, TOUCH SCREEN ROHS COMMUNITaiwanBombay Air CargoPCS153,67653,676

Nov052016SCREEN PROTECTOR - COMPONENT , ACCESORRIES & PARTS FOR MANUFACTURING OF MOBILE HANDSET 2.4 INCH LCD SIZE MODEL NO- (K28,ChinaNhava Sheva SeaPCS31,0002,1170

Oct282016SCREEN PROTECTOR - COMPONENT , ACCESORRIES & PARTS FOR MANUFACTURING OF MOBILE HANDSET 2.4 INCH LCD SIZE MODEL NO- ( M52ChinaNhava Sheva SeaPCS20,0001,3650

Nov222016DM-F24A/PC-R10 24 250 CD/M FHD LCD MONITOR ALUMINIUM FRON PANEL BLACK COLOR WI/USB PROJECTED CAPACITIVE TOUCH SCREEN 3TaiwanBombay Air CargoPCS151,99351,993

Nov2120162200221 - D10 LCD DISPLAY/TOUCH SCREEN (PARTS FOR D10 HEMOGLOBIN TESTINGSYSTEM) - FOR CAPTIVE CONSUMPTIONFranceDelhi Air CargoNOS112,90312,903

Nov172016TOUCH SCREEN LCD DISPLAY WITH INTERNAL FRAME EF10TFT-S11376 ITEM NO. 81391(PART FOR CHECK WEIGHER)(FOR CAPTIVE CONSUMPTIItalyDelhi Air CargoNOS50380,0637,601

Oct29201610.1 MULTIREADER SCREENS 10.1WXGA COLOUR HD LCD OFFICE INFORMATION DISPLAY 1280 X 800 SCREEN RESOLUTIONChinaDelhi Air CargoPCS40955,15723,879

Easily access our database via a web-based interface that speeds and simplifies trade data research, delivering the information you need for successful marketing, prospecting and sourcing strategies.

This is in response to your letter, dated December 02, 2008, to the National Commodity Specialists Division of U.S. Customs and Border Protection (“CBP”) in which you requested a binding ruling, on behalf of Optrex America, Inc., on the tariff classification of certain liquid crystal display (“LCD”) modules under the Harmonized Tariff Schedule of the United States (“HTSUS”). Your request was forwarded to this office for a response. In reaching this decision, we reviewed the product samples and schematics included with the submission.

The “A” prefix modules are LCD character displays used in automobiles. They contain drive circuitry capable of illuminating segments, characters or icons, but require an external microprocessor to instruct the drive circuitry to turn on or off. Model A-55362GZU-T-ACN is an automotive LCD radio display with message center capacity for Bluetooth connection status, climate control, a clock, and a compass. It contains approximately 25 segment-style characters, most of which display a full range of numbers and letters, and 50 permanently etched icons. The display measures approximately 7 inches in length, 2.5 inches in height, and 1 mm in thickness. Model A-55361GZU-T-ACN is an automotive LCD message display with radio, climate, and other limited display capabilities. It contains approximately 72 segment-style characters, most of which are capable of displaying a full range of numbers and letters, and 60 permanently etched icons. The display measures approximately 7 inches in length, 2.75 inches in height, and 1 mm in thickness.

The “T” prefix modules are thin-film transistor (“TFT”) LCD graphic displays for monitors of various types. As imported, the devices are not complete monitors; they contain drive circuitry, but lack a controller chip or card required to process signals. Models T-51863D150J-FW-A-AA and T-55336D175J-FW-A-AAN also lack an external power supply. Model T-51440GL070H-FW-AF is a 7 inch, 480 x 234 color display for automobile entertainment monitors. It is composed of a TFT cell, driver integrated circuits (“ICs”), a timing controller IC, a backlight unit, an inverter DC/DC converter, and a video circuit. Model T-51863D150J-FW-A-AA, is a 15 inch, 1034 x 768 XGA color display for monitors used in aviation and marine applications. It is composed of a TFT cell, driver ICs, a control circuit, a backlight unit, and a DC/DC converter. Model T-55336D175J-FW-A-AAN, is a 17.5 inch, 1280 x 768 WXGA color display for monitors used in medical and aviation applications. It is composed of a TFT cell, driver ICs, a control circuit, a backlight unit, and a DC/DC converter.

The classification of merchandise under the HTSUS is governed by the General Rules of Interpretation ("GRIs"). GRI 1 provides, in part, that "for legal purposes, classification shall be determined according to terms of the headings and any relative section or chapter notes[.]" In the event that the goods cannot be classified solely on the basis of GRI 1, and if the headings and legal notes do not otherwise require, the remaining GRIs may then be applied in order.

8531Electric sound or visual signaling apparatus (for example, bells, sirens, indicator panels, burglar or fire alarms), other than those of heading 8512 or 8530; parts thereof:

9013Liquid crystal devices not constituting articles provided for more specifically in other headings; lasers, other than laser diodes; other optical appliances and instruments, not specified or included elsewhere in this chapter; parts and accessories thereof:

LCDs are prima facie classifiable in the following HTSUS headings: 8528, which provides for monitors and projectors not incorporating television reception apparatus; 8531, which provides for electric sound or visual signaling apparatus; and 9013, which provides for liquid crystal devices not provided for more specifically in other headings. By the terms of heading 9013, HTSUS, CBP first considers classification in headings 8528 and 8531, HTSUS. If an LCD does not meet the terms of those headings, it is classified in heading 9013, HTSUS. See Sharp Microelectronics Technology, Inc. v. United States, 932 F.Supp. 1499 (Ct. Int’l. Trade 1996), aff’d, 122 F.3d 1446 (Fed. Cir. 1997). See also Headquarters Ruling Letter (“HQ”) 959175, dated November 25, 1996.

You submit that the “A” prefix LCD character modules are classified in subheading 8531.20.00, HTSUS, as “Electric sound or visual signaling apparatus …: Indicator panels incorporating liquid crystal devices (LCD’s).”

Heading 8531, HTSUS, provides, in relevant part, for “Electric sound or visual signaling apparatus … other than those of heading 8512 or 8530.” The heading is a “use provision” subject to Additional U.S. Rule of Interpretation 1(a), which states that “[a] tariff classification controlled by use (other than actual use) is to be determined in accordance with the use in the United States at, or immediately prior to, the date of importation, of goods of that class or kind to which the imported goods belong, and the controlling use is the principal use.” See HQ 951288, dated July 7, 1992.

It is well established that only those LCDs which are limited by design and/or principal use to “signaling” are classifiable in heading 8531, HTSUS. See Optrex America, Inc. v. United States, 427 F. Supp. 2d 1177 (Ct. Int’l Trade 2006), aff’d, 475 F.3d 1367 (Fed. Cir. 2007) (“Optrex”). See also, HQ H02661, dated July 8, 2008, HQ H012694, dated August 31, 2007, and HQ H003880, dated March 27, 2007. In Optrex, the Court of International Trade (“CIT”) explained that to be classified as an indicator panel incorporating LCDs under heading 8531, HTSUS, “the article must belong to the class or kind of merchandise that is principally used to display limited information that is easily understood by the person viewing it.” Optrex, 427 F. Supp. 2d at 1198. Further, the CIT accorded the “80 character rule” – guidance developed by CBP to determine whether a character display module is principally used for signaling – “some deference” under Skidmore v. Swift & Co., 323 U.S. 134 (1944), as a reasonable interpretation. According to the 80 character rule, if a character display module can display no more than 80 characters, then, in the absence of any information to the contrary, it is deemed to belong to the class or kind of merchandise that is principally used for signaling. Optrex, at 1199.

In addition, the Harmonized Commodity Description and Coding System Explanatory Notes (“ENs”) to heading 8531 are fairly descriptive and restrictive as to the type of “signaling” indicator panels and the like must perform in order to be classified in that provision. EN 85.31 states, in relevant part:

(D) Indicator panels and the like. These are used (e.g., in offices, hotels and factories) for calling personnel, indicating where a certain person or service is required, indicating whether a room is free or not. They include:

In Optrex, the court classified LCD segmented character modules with permanently etched icons capable of displaying no more than 80 characters, and containing drive circuitry, in heading 8531, HTSUS, as signaling apparatus. See Optrex, 427 F. Supp. 2d at 1199, aff’d, 475 F.3d 1367 (Fed. Cir. 2007). The instant “A” prefix LCD character modules are similarly operationally limited to performing signaling functions. They contain permanently etched icons that display, in 80 characters or less, limited information of the type an automobile driver would easily understand, e.g., velocity in miles per hour, the time, the temperature, music controls, etc. Moreover, they include the drive circuitry necessary to illuminate a particular segment, character or icon in the LCD based on signals transmitted from an external microprocessor. The functions performed by these modules are akin to those performed by the products listed as exemplars in the ENs to heading 8531. As such, we conclude that the “A” prefix modules are classified in heading 8531, HTSUS, as signaling apparatus.

You submit that the “T” prefix TFT graphic display modules are classified in subheading 9013.80.70, HTSUS, as “Liquid crystal devices not constituting articles provided for more specifically in other headings; …: Other devices, appliances and instruments: Flat panel displays other than for articles of heading 8528, except subheadings 8528.51 or 8528.61 [of a kind solely or principally used in an automatic data processing (“ADP”) system of heading 8471].” As noted above, an LCD can only be classified in 9013, HTSUS, if it is not more specifically described elsewhere, namely, in heading 8528, HTSUS, as monitors, or in heading 8531, HTSUS, as signaling apparatus.

Heading 8528, HTSUS, provides, in pertinent part, for “Monitors and projectors, not incorporating television reception apparatus.” To be classified as a monitor, a device must be capable of accepting, processing, and transmitting video or ADP signals. The subject modules cannot be classified as monitors because, as imported, they lack the necessary circuitry to accept, process, and transmit a video or ADP signal. The modules are also beyond the scope of heading 8531, HTSUS, which provides for signaling apparatus, because their use is not limited to that of signaling. That is, if connected to the appropriate controller circuitry, they can display an unlimited number of images. Accordingly, we turn to heading 9013, HTSUS.

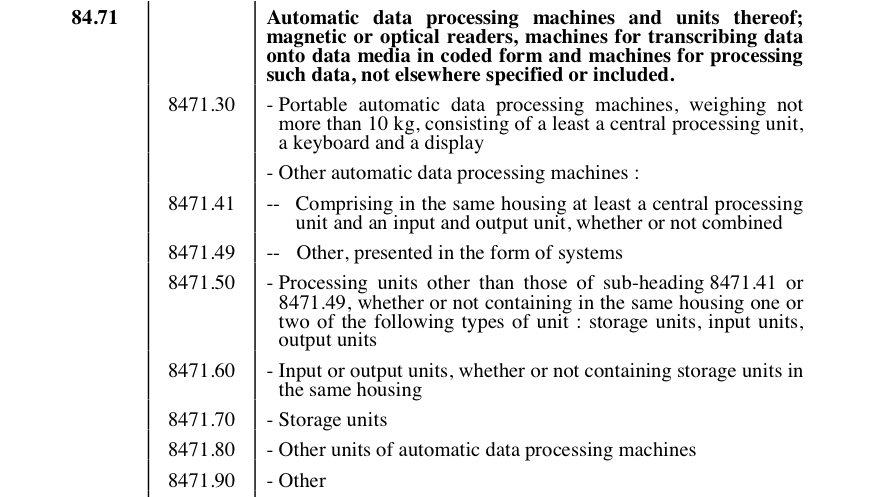

Heading 9013, HTSUS, provides, in pertinent part, for “Liquid crystal devices not constituting articles provided more specifically in other headings.” LCDs of heading 9013, HTSUS, can be classified under one of two subheadings: 9013.80.70 or 9013.80.90. Subheading 9013.80.70, HTSUS, provides for: “Other devices, appliances and instruments: Flat panel displays other than for articles of heading 8528, except subheadings 8528.51 or 8528.61 [of a kind solely or principally used in ADP system of heading 8471].”

The “T” prefix modules are flat panel displays for use in monitors of heading 8528, HTSUS. You did not provide sufficient evidence to show that the modules are “for” articles of subheadings 8528.51 (of a kind solely or principally used with an ADP system) or 8528.61 (projection monitors). Accordingly, the exception to subheading 9013.80.70, HTSUS, does not apply. We conclude that the modules are classified in subheading 9013.80.90, HTSUS, as: “Liquid crystal devices not constituting articles provided for more specifically in other headings; …: Other devices, appliances and instruments: Other.”

By application of GRI 1, the “A” prefix LCD modules, models A-55362GZU-T-ACN, A-55361GZU-T-ACN, are classified in heading 8531, specifically in subheading 8531.20.00, HTSUS, which provides for “Electric sound or visual signaling apparatus (for example, bells, sirens, indicator panels, burglar or fire alarms), other than those of heading 8512 or 8530; parts thereof: Indicator panels incorporating liquid crystal devices (LCD’s) for light emitting diodes (LED’s).” The 2009 column one, general rate of duty is Free.

By application of GRI 1, the “T” prefix TFT graphic display modules, models T-51440GL070H-FW-AF, T-51863D150J-FW-A-AA, and T-55336D175J-FW-A-AAN, are classified in heading 9013, specifically in subheading 9013.80.90, HTSUS, which provides for “Liquid crystal devices not constituting articles provided for more specifically in other headings; lasers, other than laser diodes; other optical appliances and instruments, not specified or included elsewhere in this chapter; parts and accessories thereof: Other devices, appliances and instruments: Other.” The 2009 column one, general rate of duty is 4.5 percent ad valorem.

Duty rates are provided for convenience only and are subject to change. The text of the most recent HTSUS and the accompanying duty rates are provided on the World Wide Web at www.usitc.gov/tata/hts/.

All the information, data and documents are provided by ETCN only for your reference. ETCN promises to collect and edit them in due care but shall not be liable for their correction and accuracy. In case of any discrepancy, official versions and interpretations shall prevail.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

30/Mar/202085285910HMI TP700 COMFORT human machine interface screen set supports synchronous education: monitor, installation disc, cable (6AV2133-4AF00-0AA0). 100% brand new, manufactured by siemens.Germanyset4.001,391.60347.90

30/Mar/202085285200Monitor 24 inch, IPS dedicated for X-ray machine. Model: MX242W. Manufacturer: Eizo Corporation. Origin: Japan. New 100%.Japanpiece/pcs2.002,000.001,000.00

28/Mar/20208528520055 inch LCD wall monitor computer connected to the tree computer, just to display the content on the machine. Product code: DS-D2055NH-E / G. Manufacturer Hikvision.Chinapiece/pcs5.008,800.001,760.00

25/Mar/202085285920Screen of spraying machine control (Monochrome) without touch, Brand: PRAY TECH, 43cm x 7cm x 30cm; 21.5 inch (MONITOR HAXTEEL 21.5 INCH FOR PLC 1200)Korea (Republic)piece/pcs1.001,344.981,344.98

23/Mar/20208528591019 inch color LCD display screen for CT machine (CT Use Eizo 19inch LCD Monitor FlexScan S1923-black) - New productJapanpiece/pcs1.00571.80571.80

16/Mar/202085285200ViewSonic VX2476-smhd computer monitor, 24 "wide, 23.8" display area, LCD Monitor 1920x1080, capable of direct connection, designed for 100% new, automatic data processing machine. ViewsonicChinapiece/pcs72.007,776.00108.00

16/Mar/202085285200ViewSonic VA2419-sh computer monitor, 24 "wide, 23.8" display area 16: 9 LCD Monitor 1920x1080, capable of direct connection, designed for automatic data processing machine, 100% new. NSX: ViewsonicChinapiece/pcs400.0034,000.0085.00

16/Mar/202085285200Monitor used for automatic data processing machine, 7 inch, model MY-TFT070CV2. Manufacturer MYIR Tech. New 100%Chinapiece/pcs1.0089.0089.00

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Approximately 90 percent of all LCD modules are manufactured in mainland China. The remaining 10 percent are manufactured primarily between Japan and Taiwan, and some in Korea. China’s clear stronghold in manufacturing, coupled with its large volume of imports to the U.S., mean these tariffs will definitely impact the industry.

China uses joint venture requirements, foreign investment restrictions, and administrative review and licensing processes to require or pressure technology transfer from U.S. companies.

China conducts and supports cyber intrusions into U.S. commercial computer networks to gain unauthorized access to commercially valuable business information.

Unfortunately, while the USTR works to rectify inequities in these unfair practices, many American manufacturers will have to pay higher prices for their components. That works its way up the supply chain and can ultimately lead to higher prices for American consumers.

The USITC (Office of Tariff Affairs and Trade Agreements) is responsible for publishing the Harmonized Tariff Schedule of the United States Annotated (HTSA). The HTSA provides the applicable tariff rates and statistical categories for all merchandise imported into the United States; it is based on the international Harmonized System, the global system of nomenclature that is used to describe most world trade in goods. Although the USITC publishes and maintains the HTSA in its various forms, Customs and Border Protection is the only agency that can provide legally binding advice or rulings on classification of imports.

Many people are asking about using alternate HTC codes with lower burden implications. Unfortunately, these codes are abundant and complicated. There should be exactly one code that properly categorizes your product.

When a display is designed and built for a single application, it may be more appropriate to use a harmonized tariff code for the end-product instead of the display component. An LCD in a cellphone is a good example of this.

A popular way to do this is to reevaluate your current HTC codes and make sure they’re correct. This can be done with in-house council or the use of a consultant specializing in this area of the government. Ultimately, however, you need get a ruling from the government to be certain you are using the correct code.

Finding a tariff code by perusing the USTR HTC tariff code list can be overwhelming and risky. If the code is chosen incorrectly, it can lead to fines and penalties from the USTR.

Some companies are searching for key suppliers outside of the China region and working towards qualifications of those factories. Others are exploring having key components of the purchased assembly outsourced outside of China so it still satisfies the correct definition of Country of Origin. Again, violating these definitions can lead to costly fines and penalties.

You’ll also discover if any tariff or anti-dumping duties apply. For example, a quick search of HS code 0203.29.023 will reveal that fresh, chilled, or frozen swine exported to Japan is subject to a tariff under the Japan-Australia Economic Partnership Agreement (JAEPA).

The Consignee or Importer is responsible for determining the HS Code suitable for the country of import. It may be that the shipper defines the HS Code for export, but this is not the most appropriate code for the customs entry on the import. A good customs broker, such as ICE, will be able to advise appropriate HS Codes for your cargo. Alternatively, you can visit the following website to classify your cargo: https://ftaportal.dfat.gov.au/

As the HS Code system is used by over 200 countries, there are variations of how the Code is used. This is why using the correct digits can sometimes be difficult. It is a good idea to consult customs authorities directly or engage an expert freight forwarder and customs broker for advice as to the correct code.

Different countries, however, may add further digits to detail commodities in more detail without amending the first six digits. In the United States, for instance, ten-digit codes are used in what they call the Harmonized Tariff Code Schedule (HTS). They use an additional four-digit code referred to as the ‘Schedule B number’, thereby creating a 10-digit code.

The shipping industry is currently experiencing restrictions due to the 2021-22 stink bug season (see our stink bug season guide for further information).

Certain HS Codes are affected during this time. This is because the regulations around this season are designed to target high-risk cargo whilst avoiding perishables or items that may be damaged by fumigation. Goods affected during this season are classified into three sections, namely:

It is important to identify the categories of goods by reference to the HS Codes. Even if your goods are exported from a non-risk country, but manufactured in a country that is affected, your goods will need to be treated.

The Harmonised System is governed by international conventions, administered by the WCO. This is an intergovernmental organisation headquartered in Belgium established to discuss, develop and promote modern systems of customs. The WCO has attempted to provide a uniform interpretation of the HS Code in its Explanatory Notes.

The Harmonised Systems Committee represents States who’ve signed up to use the HS Code system. They make decisions on how to classify items, settle disputes and update the HS system every five to six years. The WCO have resolved disputes such as;

For the first time in Australian legal history, the HS Code was looked at by the High Court of Australia in February 2020 in its examination of customs tariff law.

In 2017, a company called Pharm-A-Care Laboratories applied for a review of a decision made by the Australian Customs Service in relation to the classification of pastilles or gummies containing vitamins and certain weight loss gummies. Pharm-A-Care argued that these kinds of gummies should be classified as “medicaments” under HS Code 3004. But Customs argued they should be classified as “food preparations” under 2106 or “sugar confectionary” under code 1704.

This case study demonstrates how important tariff classifications can be for importers. Vitamins and weight loss supplements that were marketed as chewable gummies are classified as “medicaments”. The result is these goods can now be imported duty-free.

It is important to engage expert customs brokers to determine if the HS Code on your commercial invoice is correct. Our in-house customs brokers at ICE Cargo can determine if:

Should you have any further questions regarding HS Codes and how they are used, please contact an ICE team member on 1300 227 461 or request a quote below.

01LIVE ANIMALS0101horses, asses, mules and hinnies, live0102bovine animals, live0103swine, live0104sheep and goats, live0105chickens, ducks, geese, turkeys, and guineas, live0106animals, live, nesoi Nesoi - not elsewhere specified of indicated.02MEAT & EDIBLE MEAT OFFAL0201meat of bovine animals, fresh or chilled0202meat of bovine animals, frozen0203meat of swine (pork), fresh, chilled or frozen0204meat of sheep or goats, fresh, chilled or frozen0205meat of horses, asses, mules, hinnies fr, chld, fz0206ed offal, bovine, swine, sheep, goat, horse, etc.0207meat & ed offal of poultry, fresh, chill or frozen0208meat & edible offal nesoi, fresh, chilled or frozen0209pig & poultry fat fresh chld frzn salted dried smkd0210meat & ed offal salted, dried etc. & flour & meal03FISH & CRUSTACEANS0301fish, live0302fish, fresh or chilled (no fillets or other meat)0303fish, frozen (no fish fillets or other fish meat)0304fish fillets & other fish meat, fresh, chill or froz0305fish, dried, salted etc, smoked etc, ed fish meal0306crustaceans, live, fresh etc, and cooked etc.0307molluscs & aquatic invertebrates nesoi, live etc04DAIRY, EGGS, HONEY, & ED. PRODUCTS0401milk and cream, not concentrated or sweetened0402milk and cream, concentrated or sweetened0403buttermilk, yogurt, kephir etc, flavored etc or not0404whey & milk products nesoi, flavored etc. or not0405butter and other fats and oils derived from milk0406cheese and curd0407birds" eggs, in the shell, fresh, preserved or cooked0408birds" eggs, not in shell & yolks, fresh, dry, etc0409honey, natural0410edible products of animal origin, nesoi05PRODUCTS OF ANIMAL ORIGIN0501human hair, unworked and waste of human hair0502hogs" hair etc, badger hair etc, waste hair etc.0503horsehair and horsehair waste0504animal (not fish) guts, bladders, stomachs & parts0505bird skins & other feathered parts and down0506bones & horn cores, unworked etc, powder & waste0507ivory, tortoise-shell, whalebone, horns etc, unwrk0508coral, shell of molluscs etc unworked powder/waste0509natural sponges of animal origin0510ambergris, castoreum etc, glands etc for pharmacy0511animal products nesoi, dead animals, inedible etc.

Lenses, prisms, mirrors and other optical elements, mounted, of any material, being parts of or fittings for instruments or apparatus (excl. objective lenses for cameras, projectors or photographic enlargers or reducers, such elements of glass not optically worked, and filters)

Spectacles, goggles and the like, corrective, protective or other (excl. spectacles for testing eyesight, sunglasses, contact lenses, spectacle lenses and frames and mountings for spectacles)

Monoculars, astronomical and other optical telescopes and other astronomical instruments (excl. binoculars, instruments for radio-astronomy and other instruments or apparatus specified elsewhere)

Parts and accessories, incl. mountings, for binoculars, monoculars, astronomical and other optical telescopes, and other astronomical instruments, n.e.s.

Cameras specially designed for underwater use, for aerial survey or for medical or surgical examination of internal organs; comparison cameras for forensic or criminological laboratories

With a through-the-lens viewfinder [single lens reflex "SLR"] cameras for roll film of a width of <= 35 mm (excl. instant print cameras and special camereas of subheading 9006.10, 9006.20 or 9006.30)

Cameras for roll film of a width of < 35 mm (excl. instant print cameras, single lens reflex "SLR" cameras and special cameras of subheading 9006.10, 9006.20 or 9006.30)

Cameras for roll film of a width of 35 mm (excl. instant print cameras, single lens reflex cameras and special cameras of subheading 9006.10, 9006.20 or 9006.30)

Cameras for roll film of a width of > 35 mm or for film in the flat (excl. instant print cameras and special cameras of subheading 9006.10, 9006.20 or 9006.30)

Apparatus and equipment for automatically developing photographic or cinematographic film or paper in rolls or for automatically exposing developed film to rolls of photographic paper

Apparatus for the projection or drawing of circuit patterns on sensitised semiconductor materials (excl. direct write-on wafer apparatus and step and repeat aligners)

Optical microscopes (excl. for photomicrography, cinephotomicrography or microprojection, stereoscopic microscopes, binocular microscopes for ophthalmology and instruments, appliances and machines of heading 9031)

Telescopic sights for fitting to arms; periscopes; telescopes designed to form parts of machines, appliances, instruments or apparatus of chapter 90 or Section XVI, chapters 84 and 85

Parts and accessories for instruments and appliances used in geodesy, topography, photogrammetrical surveying, hydrography, oceanography, hydrology, meteorology or geophysics, and for rangefinders, n.e.s.

Parts and accessories for drawing, marking-out or mathematical calculating instruments and instruments for measuring length for use in the hand, n.e.s.

Electro-diagnostic apparatus, incl. apparatus for functional exploratory examination or for checking physiological parameters (excl. electro-cardiographs, ultrasonic scanning apparatus, magnetic resonance imaging apparatus and scintigraphic apparatus)

Needles, catheters, cannulae and the like, used in medical, surgical, dental or veterinary sciences (excl. syringes, tubular metal needles and needles for sutures)

Articles and appliances, which are worn or carried, or implanted in the body, to compensate for a defect or disability (excl. artificial parts of the body, complete hearing aids and complete pacemakers for stimulating heart muscles)

X-ray generators other than X-ray tubes, high tension generators, control panels and desks, screens, examination or treatment tables, chairs and the like, and general parts and accessories for apparatus of heading 9022, n.e.s.

Instruments, apparatus and models designed for demonstrational purposes, e.g. in education or exhibitions, unsuitable for other uses (excl. ground flying trainers of heading 8805, collectors" pieces of heading 9705 and antiques of an age > 100 years of heading 9706)

Parts and accessories for hydrometers, areometers and similar floating instruments, thermometers, pyrometers, barometers, hygrometers and psychrometers, n.e.s.

Parts and accessories for instruments and apparatus for measuring or checking the flow, level, pressure or other variables of liquids or gases, n.e.s.

Instruments and apparatus for physical or chemical analysis, using UV, visible or IR optical radiations (excl. spectrometers, spectrophotometers, spectrographs, and gas or smoke analysis apparatus)

Instruments and apparatus for physical or chemical analysis, or for measuring or checking viscosity, porosity, expansion, surface tension or the like, or for measuring or checking quantities of heat, sound or light, n.e.s.

Microtomes; parts and accessories of instruments and apparatus for physical or chemical analysis, instruments and apparatus for measuring or checking viscosity, porosity, expansion, surface tension or the like, instruments and apparatus for measuring or checking quantities of heat, sound or light, and of microtomes, n.e.s.

Parts and accessories for revolution counters, production counters, taximeters, mileometers, pedometers and the like, speed indicators and tachometers, and stroboscopes, n.e.s.

Instruments and apparatus for measuring or checking voltage, current, resistance or electrical power (excl. recording device, multimeters, and cathode-ray oscilloscopes and oscillographs)

Instruments and apparatus for measuring or checking electrical quantities, specifically for telecommunications, e.g. cross-talk meters, gain measuring instruments, distortion factor meters, psophometers

Instruments and appliances for measuring or checking electrical quantities, with recording device (excl. appliances specially designed for telecommunications, cathode-ray oscillographs and apparatus for measuring or checking semiconductor wafers or devices)

Optical instruments and appliances for inspecting semiconductor wafers or devices or for inspecting photomasks or reticles used in manufacturing semiconductor devices

Analyze your business competition through Turkey import data of used computer under HS Code 847141009000. Monitor import export competitors of used computer under HS Code 847141009000 imports.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey