lcd module technology comparison supplier

Asia has long dominated the display module TFT LCD manufacturers’ scene. After all, most major display module manufacturers can be found in countries like China, South Korea, Japan, and India.

However, the United States doesn’t fall short of its display module manufacturers. Most American module companies may not be as well-known as their Asian counterparts, but they still produce high-quality display products for both consumers and industrial clients.

In this post, we’ll list down 7 best display module TFT LCD manufacturers in the USA. We’ll see why these companies deserve recognition as top players in the American display module industry.

STONE Technologies is a leading display module TFT LCD manufacturer in the world. The company is based in Beijing, China, and has been in operations since 2010. STONE quickly grew to become one of the most trusted display module manufacturers in 14 years.

Now, let’s move on to the list of the best display module manufacturers in the USA. These companies are your best picks if you need to find a display module TFT LCD manufacturer based in the United States:

Planar Systems is a digital display company headquartered in Hillsboro, Oregon. It specializes in providing digital display solutions such as LCD video walls and large format LCD displays.

Microtips Technology is a global electronics manufacturer based in Orlando, Florida. The company was established in 1990 and has grown into a strong fixture in the LCD industry.

What makes Microtips a great display module TFT LCD manufacturer in the USA lies in its close ties with all its customers. It does so by establishing a good rapport with its clients starting from the initial product discussions. Microtips manages to keep this exceptional rapport throughout the entire client relationship by:

Displaytech is an American display module TFT LCD manufacturer headquartered in Carlsbad, California. It was founded in 1989 and is part of several companies under the Seacomp group. The company specializes in manufacturing small to medium-sized LCD modules for various devices across all possible industries.

The company also manufactures embedded TFT devices, interface boards, and LCD development boards. Also, Displaytech offers design services for embedded products, display-based PCB assemblies, and turnkey products.

Displaytech makes it easy for clients to create their own customized LCD modules. There is a feature called Design Your Custom LCD Panel found on their site. Clients simply need to input their specifications such as their desired dimensions, LCD configuration, attributes, connector type, operating and storage temperature, and other pertinent information. Clients can then submit this form to Displaytech to get feedback, suggestions, and quotes.

A vast product range, good customization options, and responsive customer service – all these factors make Displaytech among the leading LCD manufacturers in the USA.

Products that Phoenix Display offers include standard, semi-custom, and fully-customized LCD modules. Specifically, these products comprise Phoenix Display’s offerings:

Clients flock to Phoenix Display because of their decades-long experience in the display manufacturing field. The company also combines its technical expertise with its competitive manufacturing capabilities to produce the best possible LCD products for its clients.

True Vision Displays is an American display module TFT LCD manufacturing company located at Cerritos, California. It specializes in LCD display solutions for special applications in modern industries. Most of their clients come from highly-demanding fields such as aerospace, defense, medical, and financial industries.

The company produces several types of TFT LCD products. Most of them are industrial-grade and comes in various resolution types such as VGA, QVGA, XGA, and SXGA. Clients may also select product enclosures for these modules.

All products feature high-bright LCD systems that come from the company’s proprietary low-power LED backlight technology. The modules and screens also come in ruggedized forms perfect for highly-demanding outdoor industrial use.

LXD Incorporated is among the earliest LCD manufacturers in the world. The company was founded in 1968 by James Fergason under the name International Liquid Xtal Company (ILIXCO). Its first headquarters was in Kent, Ohio. At present, LXD is based in Raleigh, North Carolina.

All of their display modules can be customized to fit any kind of specifications their clients may require. Display modules also pass through a series of reliability tests before leaving the manufacturing line. As such, LXD’s products can withstand extreme outdoor environments and operates on a wide range of temperature conditions.

We’ve listed the top 7 display module TFT LCD manufacturers in the USA. All these companies may not be as well-known as other Asian manufacturers are, but they are equally competent and can deliver high-quality display products according to the client’s specifications. Contact any of them if you need a US-based manufacturer to service your display solutions needs.

We also briefly touched on STONE Technologies, another excellent LCD module manufacturer based in China. Consider partnering with STONE if you want top-of-the-line smart LCD products and you’re not necessarily looking for a US-based manufacturer. STONE will surely provide the right display solution for your needs anywhere you are on the globe.

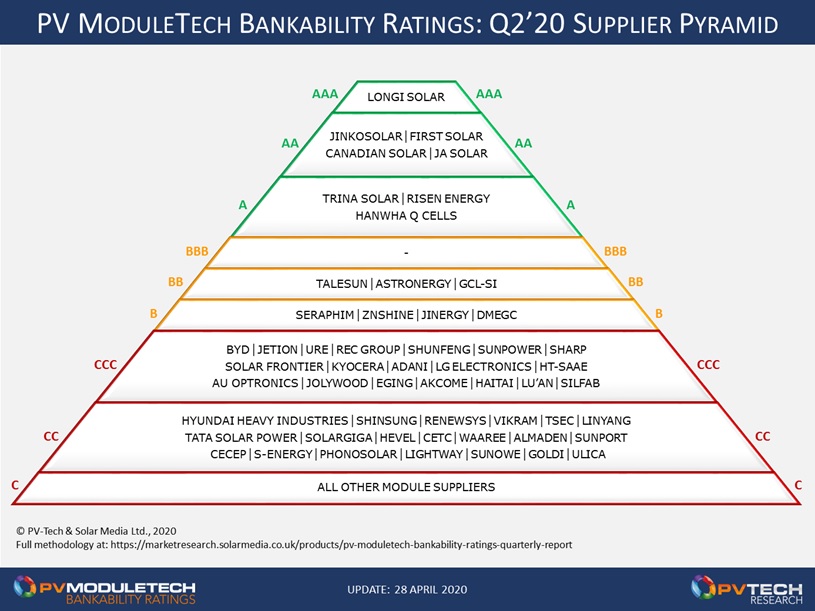

Finlay Colville, head of market research at Solar Media, ranks the top 50 module suppliers in the PV industry today, using the proprietary methodology developed at PV Tech, on the back of analysing several hundred companies supplying PV modules over the past 15 years.

Three years on from the first release of the PV ModuleTech Bankability Ratings, I reflect in this article on what makes a PV module supplier bankable, and what the most common red flags are when undertaking due diligence on supplier selection for large-scale utility-based solar projects.

During 2019, I explained how the PV Tech market research team went about benchmarking the 100-plus module suppliers that accounted for >98% of all module shipments globally. This included six feature articles: the first appeared on PV Tech in July 2019, here. The final one, here, was published in August 2019.

Before we released the bankability ratings analysis, we considered it essential to explain the underlying methodology and the accuracy of the validation processes. For a decade prior to this, it was clear that the PV industry was lacking any credible means of benchmarking module suppliers.

Benchmarking is everything: understanding the relative strengths and weaknesses of companies, at any given time, regardless of the industry’s condition. For example, when there is a downturn in the sector – oversupply, valuation of the renewables sector, trade issues, technology change – individual company assessment can only be done in relation to other companies’ performance. Conversely, when there is an upturn, everyone tends to benefit, typically accompanied by an increase in module shipments, profitability and entity valuation.

Understanding the importance of benchmarking at any given time is key. But the underlying methodology has to be forward-looking. This brings us to the second key issue – validation. Once a set of input conditions is established, alongside an analytical methodology framework, it should be possible to go back in time and see which metrics (manufacturing or financial) ultimately led to an upturn or downturn in fortunes as they relate specifically to PV module supply activities. This allows us to assess risk better in today’s market; or to be more specific, what are the ‘red flags’ to keep under review for each module supplier (or parent entity, where the PV module business is not the main contributor to revenues). I will return to this later in the article.

Our definition of ‘bankability’, as outlined in the articles back in 2019, remains the most comprehensive one in the PV sector today. For sure, other rankings lists exist for PV module suppliers, but they tend to be over-simplified or lacking knowledge of the sector itself or the individual company’s standing in the market. I will touch first on why these can in fact be misleading, before revealing the latest bankability pyramid hierarchy at the start of 2022.

Top 10 module supplier rankings (based purely on module shipments) are useful to some extent, as you can see which companies are shipping the greatest volumes annually, and how suppliers’ rankings go up and down over the years. People like to read these top 10 charts; marketing departments tend to like them if they show their company favourably compared to their peers. But they say nothing about geographic shipment splits (e.g. were more than half the modules made in China and stayed in China?); they don’t say anything about profitability or parent company financial health (how many top 10 module suppliers have gone bankrupt over the years by accumulating excessive debt?); they don’t give an indication of parent company desire to retain manufacturing operations (think of Sharp, Kyocera, Bosch, BP, Panasonic and countless others in the past 20 years); and finally, they don’t inform as to the company’s ability to deliver quality products that work reliably in the field.

Rankings of module suppliers by specific financial metrics is also somewhat misleading, unless the context is clearly explained. Is the analysis purely for existing shareholders or short-sellers, or to inflate the enterprise value prior to selling off the business (as a whole or just the PV manufacturing part)? Some observers just pull out an Altman-Z score, while conveniently ignoring all the privately-held module suppliers in the industry at any given time. The Altman-Z score is of value, but not the way in which it is scantily used in the PV sector today in isolation.

The Altman-Z analysis is a statistically derived number based on adding a list of accounting ratios, each term having a weighted product factor. The final number (or score) used in isolation should be taken with great caution. What’s important is how the individual metrics (especially those related to liquidity, debt and profitability) are trending. As the analysis (in its original format) relates specifically to PV module suppliers (or parent entities today), market capitalisation is over-emphasised and turnover is under-prioritised. Put another way: some companies consistently have market caps way above any reasonable valuation; and module suppliers that are bankrolled by state-owned entities or US$100 billion-plus conglomerates tend to be pretty good bets in terms of parent entity guarantor when purchasing modules. It is unclear even if some of the stand-alone Altman-Z graphics used for PV module suppliers actually involve the people citing the numbers doing the financial analysis; anyone can pull a number off the internet.

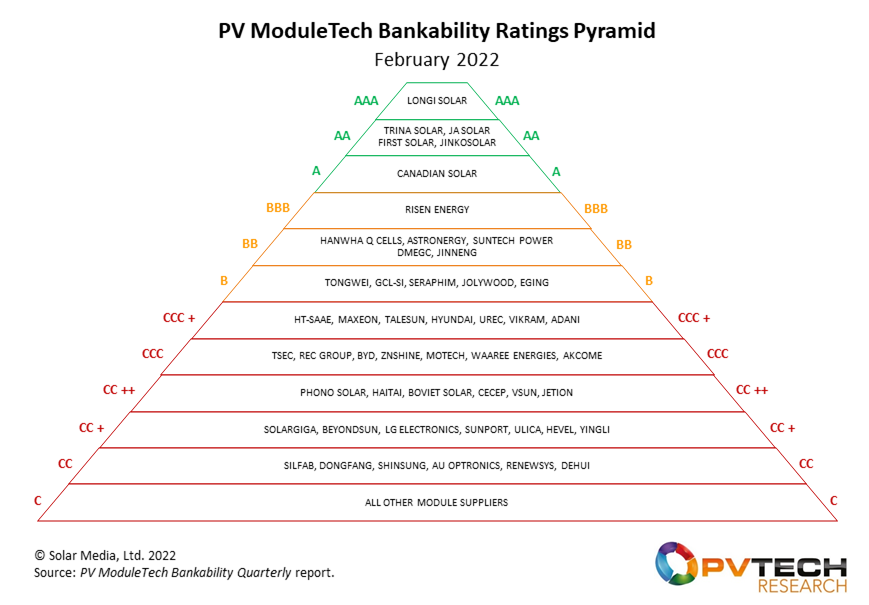

Let’s look now at the PV ModuleTech Bankability Ratings pyramid at the start of 2022. For simplicity, think of it as you would with any credit ratings analysis. AAA-Rated is top, and C-Rated is the lowest. A pyramid-type representation works perfect for this, as there are always fewer companies at the top, and most others hover around the lower bands. Indeed, for the first time, we have split out sub-bands in the CCC and CC ratings, as most of the Top 50 fall into CCC or CC. This is shown below.

It just happens that there are exactly 50 suppliers rated CC or above; hence the use of ‘top 50’ for this article. These 50 companies make up more than 98% of global module supply today. To scupper any thoughts of ‘consolidation’, it should be remembered that there are more companies in the lowest rating band (C) than in all the ratings bands collectively above. Most of the (pure-play) OEMs fall into the ‘C’ band, in addition to ‘distributors’ that often like to call themselves module suppliers with GW-plus ‘capacity’. Making product should be king; more later on this subject.

Beyond anything else, consistently shipping multi-GW of modules annually to global utility-scale solar farms is key when it comes to manufacturing metrics feeding into the overall bankability ratings.

When we devised the methodology back in 2019, we decided to remove residential and small commercial shipment volumes from each module supplier’s shipment totals. Three years on, and I still consider this essential when it comes to bankability. If a company ships only to global residential markets (often through a network of low-volume sub-MW-scale distributors/installers), this makes the company’s ‘bankability’ for large utility-scale ground-mount projects negligible. Not having product availability – or simply deciding not to compete in large-scale utility business – is a major red flag in terms of being a bankable module supplier today for utility development. The PV industry is a 200GW engine today, fuelled by utility-scale projects; it is no longer a (European) residential FiT-driven sector.

Having a diversified global module supply footprint helps, but today it is not as essential as was previously the case. This is because there are now individual countries (or sales regions if you group, say Europe, together) that are so big that individual companies can supply multi-GW of product there alone each year. Also, solar PV now plays in a world that is smitten with renewables and awash with finance from the private sector. This de-risks legacy industry concerns relating to cyclic government policies or administrations, where market demand was based entirely on lucrative incentives or grants that could be taken away as quickly as introduced.

Firstly, it remains the case that the companies consistently at the top of the bankability ratings are the ones that make most of what they ship. Certainly cells and modules, but generally having control of in-house production from ingots to modules characterises industry leaders. The reasons for this are fairly obvious; controlling production costs, in-house quality control, the ability to manage each value chain stage when introducing new technologies/products, decoupling from supply chain bottlenecks and avoiding having to rely upon your module supply competitors that may be dominant suppliers of wafers or cells.

Secondly, having diversified manufacturing locations is vital to be in the very top ratings bands. This is the only way to mitigate against trade restrictions that may come and go at any given point. And linked to the above issue, making both cells and modules at overseas locations tends to be a key factor for long-term bankability success.

Most c-Si module suppliers have dipped their toes in and out of OEM supply, some more than others. What started as a Japanese PV tactic ten years ago spread to Chinese companies when EU and US duties were imposed. Today we have Korean PV module suppliers having their products made in China or Southeast Asia and EU/US companies buying in modules made in China and Southeast Asia and rebranding them (acting more like distributors than manufacturers).

Surely, anyone buying OEM product (often from companies that are highly unlikely to exist in a few years) is taking a punt, or has no other choice to get product on time. Looking back over the bankability analysis, module suppliers that start to increase their reliance on OEM product usually have other problems waiting to surface. It tends to be one of the key leading indicators of pending non-competitiveness. And like their customers buying their module products, maybe at the end of the day, these module suppliers had no other choice if they wanted to play in any given market (e.g. in the US today).

Capex is an incredibly important metric and is a key leading indicator for module supplier bankability. Companies that are constantly investing in capex – especially during any downturn – routinely end up in a good space in the future. Moreover, and linked to the above in-house value chain discussion, companies that invest each year across ingot, wafer, cell and module stages tend to be the minority in the industry. But these companies also are the ones driving the sector, from a module supply standpoint and also technology leadership. Conversely, companies that minimise capex are usually overly dependent on outsourcing and can be considered as laggards with regards to any technology adoption cycle. (A good reference point here is the article I wrote on PV Tech last week: Which PV manufacturers will really drive n-type industry adoption?)

R&D spending is an altogether different proposition, and one of the most misunderstood metrics in the PV industry; at least, until now. For starters, there is no consistency in how companies assign R&D spending when they report numbers in audited accounts. And while industry R&D spending has grown from US$1 billion to US$2 billion over the past few years, the numbers cannot be correlated with module supplier bankability ratings. It could be that R&D investment is being seen somewhat as a marketing-driven accolade, rather than an indication of true technology leadership. Maybe this will change in the future.

It turns out that a far better method of tracking R&D activity is looking at company-specific cell technology roadmap trends. Again, this highlights the importance of module suppliers that actually make their own solar cells (better still wafers and cells). This is much more important now than ever before in the industry, as technology is changing rapidly and more often. Basically, it is now possible to be left behind in technology very quickly.

Therefore, it is the combination of capex and cell technology roadmap for each PV module supplier that matters. Looking across the 100-plus companies supplying modules to the industry today, just four companies consistently meet the wafer-to-module capex and cell technology roadmap (or thin-film equivalent) criteria listed above; First Solar, JA Solar, JinkoSolar and LONGi Solar. It should come as no surprise then these companies are right at the top of the bankability pyramid shown above.

Benchmarking PV module suppliers by manufacturing metrics is easy: benchmarking across financial metrics or ratios is much harder. Not because numbers are hard to come by, but due to the differences in accounting methods used, market listing region (or if listed at all), and – most notably – how much PV module business matters to the holding/parent entity (or what I tend to refer to as module ‘guarantor’).

Before looking at typical leading indicators of pending supplier fortunes from a financial standpoint, it is interesting to look at the correlation between PV module supplier bankability status and how much of the parent entity’s turnover is coming from the module sales (whether external or internal sales). In fact, this is a fascinating metric to look at.

It turns out the most bankable (least risk of being around, say, in 5-10 years) module suppliers have been operating in a sweet spot where module revenue contributions are not extremely high (more than 95% of turnover) or extremely low (less than 5% of turnover). The best case appears to be when module revenues contribute about 60-80% of parent company turnover. This is relatively easy to explain.

Where module revenues are the only form of income then effectively you can have a billion-dollar-plus company selling one product. For any business in any sector – anywhere in the world – that is a risky proposition. Great in good times; potentially disastrous when confronted by any unforeseen issue (company-specific or industry-wide), unless there is tons of money in the bank. Basically, there is no other revenue stream for these companies to fall back on, if module sales are not profitable. Time and again, the PV industry has seen leading module suppliers go from hero to zero essentially because there was no ‘plan B’ in place. While no one can predict the future, the only certainty is that there will be uncertainty at some point.

The other extreme turns out to be just as risky; where the module business is so small it doesn’t really matter (and by default can operate with whopping losses so long as the parent company can write these off at some point). Probably the most striking example of this was seen in Japan, and the time it took companies such as Sharp, Kyocera and Panasonic to recognise that being a PV module supplier was a tough proposition.

You really don’t want to be a module supplier where module sales are lost in the noise compared to your parent company’s turnover. Almost certainly, at some point, PV manufacturing is stopped and recognised to be a distraction.

Korea has gone down a slightly different route here than Japan, although it was looking for a while like Korean PV module supply had ‘Japan’ written all over it but with a 5-10 year phase lag. Hyundai and Hanwha decided to establish separately listed (albeit still held) entities, within which module sales had an appreciable contribution. It is impossible to tell today if LG will move in this direction. For each of the Korean entities, it is a fairly easy way of writing off consolidated debt from legacy PV manufacturing and re-start a listed spin-out with apparently healthy-looking financial credentials. Time will tell if this turns out a smart move.

The sweet spot is where module sales are the most important part of the business, but not all of the business. It has to be the most important part, or else investment (capex) and technology does not get prioritised.

Until now, there is really not a PV module supplier that has got this right long-term. LONGi has wafer sales, but this is still PV and would collapse under similar conditions that could harm module sales. First Solar has drifted in and out of downstream activities, but is now at risk of having one product almost entirely sold in one country. Canadian Solar’s diversification into project development (flipping post build) actually became so successful that the module business suffered in the past few years, and ultimately the spin-out into the China-listed CSI Solar was more for the benefit of the reshaped US-listed Canadian Solar (projects) than for the new manufacturing entity in China (CSI Solar).

In fact, it is very hard to operate a profitable PV module business (making and selling products in a factory) alongside a PV projects business (project planning, investment, trading energy). The skill sets are somewhat mutually exclusive. Just because you can make a PV module does not qualify you to develop, build and operate sites. This is exactly the trap Canadian Solar ended up in, and also was behind other spectacular declines of module supply activities within the holding entities of Shunfeng and GCL, for example.

I actually think that the ideal PV module supplier is yet to exist in this regard. Maybe it will in the next few years, say from having two to three different revenues streams (such as PV modules, storage batteries, and something else). Each would benefit from the core strength of volume manufacturing, alongside a diversified global sales model; business units could stand alone, but also have some kind of synergy in manufacturing and selling. Interestingly, this does seem to be the Hanwha/Hyundai approach with their new spin-out operations; but it’s hard though to see either being a top three global player though when it comes to PV module sales (far less a top 10 player in the long run).

So – what else matters from a financial health perspective, in terms of module supplier risk? This is not rocket science: keep clear of liquidity problems (cash flow), don’t accumulate long-term debt faster than accumulating assets, and make money selling modules. The most common red flag for PV module suppliers is cash flow. Again, if you have one product (making/selling modules), and you know routinely that there will be periods where costs and higher than income from selling this one product, then of course, working capital is going to take a hit routinely. It is amazing how often this is the first sign of bigger problems with PV module suppliers, and it is not a surprise at all.

I wrote this article now, as the next few weeks sees our in-house market research team at PV Tech flat-out in preparation for the next quarterly release of our flagship PV ModuleTech Bankability Ratings Quarterly report on 1 March 2022.

Three years into the report, and it is fascinating how much has been learned by doing all the analysis across basically every PV module supplier that matters. The benchmarking is constantly evolving, and we are now doing calendar-year-end forecasting (all manufacturing and financial metrics) for all module suppliers; so, right now through to the end of Q4’22.

The entire report is now written as if we were indeed buying or financing 300MW worth of PV modules for 2023 delivery, and our livelihoods depended on it. This seems to be where all our report users are today!

To understand how to subscribe to the PV ModuleTech Bankability Ratings Quarterly report, please complete your contact details at the report landing page, here.

Liquid Crystal Display (LCD) screens are a staple in the digital display marketplace and are used in display applications across every industry. With every display application presenting a unique set of requirements, the selection of specialized LCDs has grown to meet these demands.

LCD screens can be grouped into three categories: TN (twisted nematic), IPS (in-plane switching), and VA (Vertical Alignment). Each of these screen types has its own unique qualities, almost all of them having to do with how images appear across the various screen types.

This technology consists of nematic liquid crystal sandwiched between two plates of glass. When power is applied to the electrodes, the liquid crystals twist 90°. TN (Twisted Nematic) LCDs are the most common LCD screen type. They offer full-color images, and moderate viewing angles.

TN LCDs maintain a dedicated user base despite other screen types growing in popularity due to some unique key features that TN display offer. For one,

Displays with VA screens deliver wide viewing angles, high contrast, and good color reproduction. They maintain high response rates similar to TN TFTs but may not reach the same sunlight readable brightness levels as comparable TN or IPS LCDs. VA displays are generally best for applications that need to be viewed from multiple angles, like digital signage in a commercial setting.

IPS (In-Plane Switching) technology improves image quality by acting on the liquid crystal inside the display screen. When voltage is applied, the crystals rotate parallel (or “in-plane”) rather than upright to allow light to pass through. This behavior results in several significant improvements to the image quality of these screens.

Based on current trends, IPS and TN screen types will be expected to remain the dominant formats for some time. As human interface display technology advances and new product designs are developed, customers will likely choose IPS LCDs to replace the similarly priced TN LCDs for their new projects.

The most basic LCD introduced above is called passive matrix LCDs which can be found mostly in low end or simple applications like, calculators, utility meters, early time digital watches, alarm clocks etc. Passive matrix LCDs have a lot of limitations, like the narrow viewing angle, slow response speed, dim, but it is great for power consumption.

In order to improve upon the drawbacks, scientists and engineers developed active matrix LCD technology. The most widely used is TFT (Thin Film Transistor) LCD technology. Based on TFT LCD, even more modern LCD technologies are developed. The best known is IPS (In Plane Switching) LCD. It has super wide viewing angle, superior image picture quality, fast response, great contrast, less burn-in defects etc.

IPS LCDs are widely used in LCD monitors, LCD TVs, Iphone, pads etc. Samsung even revolutionized the LED backlighting to be QLED (quantum dot) to switch off LEDs wherever light is not needed to produce deeper blacks.

– Twisted Nematic Display: The TN (Twisted Nematic) LCDs production can be done most frequently and used different kinds of displays all over the industries. These displays are most frequently used by gamers as they are cheap & have quick response time as compared with other displays. The main disadvantage of these displays is that they have low quality as well as partial contrast ratios, viewing angles & reproduction of color. But, these devices are sufficient for daily operations.

– In-Plane Switching Display:IPS displays are considered to be the best LCD because they provide good image quality, higher viewing angles, vibrant color precision & difference. These displays are mostly used by graphic designers & in some other applications, LCDs need the maximum potential standards for the reproduction of image & color.

– Vertical Alignment Panel: The vertical alignment (VA) panels drop anywhere in the center among Twisted Nematic and in-plane switching panel technology. These panels have the best viewing angles as well as color reproduction with higher quality features as compared with TN type displays. These panels have a low response time. But, these are much more reasonable and appropriate for daily use.

– Advanced Fringe Field Switching (AFFS): AFFS LCDs offer the best performance & a wide range of color reproduction as compared with IPS displays. The applications of AFFS are very advanced because they can reduce the distortion of color without compromising on the broad viewing angle. Usually, this display is used in highly advanced as well as professional surroundings like in the viable airplane cockpits.

– Passive and Active Matrix Displays: The Passive-matrix type LCDs works with a simple grid so that charge can be supplied to a specific pixel on the LCD. One glass layer gives columns whereas the other one gives rows that are designed by using a clear conductive material like indium-tin-oxide. The passive-matrix system has major drawbacks particularly response time is slow & inaccurate voltage control. The response time of the display mainly refers to the capability of the display to refresh the displayed image.

– Active-matrix type LCDs mainly depend on TFT (thin-film transistors). These transistors are small switching transistors as well as capacitors which are placed within a matrix over a glass substrate. When the proper row is activated then a charge can be transmitted down the exact column so that a specific pixel can be addressed, because all of the additional rows that the column intersects are switched OFF, simply the capacitor next to the designated pixel gets a charge.

LCD technologies have great advantages of light, thin, low power consumption which made wall TVs, laptops, smartphones, pad possible. On its way to progress, it wiped out the competition of many display technologies. We don’t see CRT monitors on our desks and plasma displays TV at our home anymore. LCD Technologies dominant the display market now. But any technology has the limitations.

LCD technologies have slow response times especially at low temperature, limited viewing angles, backlighting is needed. Focus on LCD drawbacks, OLED (Organic Light Emitting Diodes) technology was developed. Some high-end TV and mobile phones start to use AMOLED (Active Matrix Organic Light Emitting Diodes) displays.

This cutting-edge technology provides even better color reproduction, clear image quality, better color gamut, less power consumption when compared to LCD technology. Please note, OLED displays include AMOLED and PMOLED (Passive Matrix Organic Light Emitting Diodes). What you need to choose is AMOLED for your TV and mobile phones instead of PMOLED.

In market, LCD means passive matrix LCDs which increase TN (Twisted Nematic), STN (Super Twisted Nematic), or FSTN (Film Compensated STN) LCD Displays. It is a kind of earliest and lowest cost display technology.

LCD screens are still found in the market of low cost watches, calculators, clocks, utility meters etc. because of its advantages of low cost, fast response time (speed), wide temperature range, low power consumption, sunlight readable with transflective or reflective polarizers etc. Most of them are monochrome LCD display and belong to passive-matrix LCDs.

TFT LCDs have capacitors and transistors. These are the two elements that play a key part in ensuring that the TFT display monitor functions by using a very small amount of energy without running out of operation.

Normally, we say TFT LCD panels or TFT screens, we mean they are TN (Twisted Nematic) Type TFT displays or TN panels, or TN screen technology. TFT is active-matrix LCDs, it is a kind of LCD technologies.

Actually, IPS technology is a kind of TFT display with thin film transistors for individual pixels. But IPS displays have superior high contrast, wide viewing angle, color reproduction, image quality etc. IPS screens have been found in high-end applications, like Apple iPhones, iPads, Samsung mobile phones, more expensive LCD monitors etc.

Both TFT LCD displays and IPS LCD displays are active matrix displays, neither of them can produce color, there is a layer of RGB (red, green, blue) color filter in each LCD pixels to make LCD showing colors. If you use a magnifier to see your monitor, you will see RGB color. With switch on/off and different level of brightness RGB, we can get many colors.

Neither of them can’t release color themselves, they have relied on extra light source in order to display. LED backlights are usually be together with them in the display modules as the light sources. Besides, both TFT screens and IPS screens are transmissive, it will need more power or more expensive than passive matrix LCD screens to be seen under sunlight. IPS screens transmittance is lower than TFT screens, more power is needed for IPS LCD display.

There are two main competing display technologies in the market today: LCD and OLED. The mature and dominant technology is the Liquid Crystal Display (LCD), while the up-and-coming challenger is the Organic Light Emitting Diode Display (OLED display). The main difference between LCD and OLED displays is how they create the light and the colors of the image being displayed. This leads to application dependent strengths and weaknesses of either technology.

OLEDs operate via a solid-state technology, where the individual pixels can emit light in various colors and intensity without the need for an additional light source or color filter. The light-emitting portion of an OLED display is comprised of multiple layers of very specific organic semiconductor materials which can be adjusted to emit light in specific wavelengths. These organic layers have a typical thickness in the order of 100nm. In addition, no backlight is required, allowing for a very thin display module.

In LCD display technology, the individual pixels modulate light. An applied voltage changes the orientation of liquid crystal molecules that – in conjunction with a pair of polarizers – function as a light shutter by either blocking or allowing light to pass through. LCD displays, therefore, require an additional light source, either from reflected ambient light or more commonly from a “backlight” (an array of LEDs arranged behind or next to the LCD panel). LCD color can be created by adding color filters to the individual pixels. Because OLED displays don’t require the additional backlight, polarizers, or color filter components of an LCD module, they can be made much thinner than LCD displays of equivalent size and resolution.

OLED display technology can offer power-saving advantages over LCDs, which is important, especially for battery-powered applications such as mobile phones. An OLED’s power consumption will vary with image content and brightness, as light is generated only at the individual pixels needed to display the image. A dark image or a graphic on a black background will consume much less power than bright images or graphics. In contrast, LCD backlights must be ON while the display operates. It’s possible to control individual zones of the backlight separately to save power, but this added complexity is usually only applied in larger displays.

OLEDs can achieve a much higher contrast ratio if reflections from the front surface are carefully controlled. If no current flows through an OLED pixel, it does not emit any light. In contrast the shutter effect of an LCD pixel does not block 100% of the light. Depending on the specific LCD technology used and the angle of observation, a small percentage of the light generated in the backlight can escape. This can wash out dark areas of an image. It is possible but expensive to limit this light leakage to a point where the contrast of an LCD and OLED display become perceptually equivalent.

RGB OLEDs naturally generate a narrow bandwidth of light. This leads to very saturated primary colors and a wide color gamut. This enables OLED technology to display colors which are not easily accessible to LCDs unless RGB backlights or quantum dots are used. Often OLED colors are used “as is”, however, for very high image color fidelity, such high color saturation needs to be electronically ‘tuned down’, to match the color bandwidth of the rendering chain.

LCDs offer an advantage over OLEDs in applications where a continuous static image is required. The light emitting materials in OLEDs are affected by luminance decay as a function of the total amount of current that has passed through the pixel. This decay differs for red, green and blue. The dimming effect is subtle, but when adjacent pixels are illuminated at the same time it can become noticeable as an undesired brightness variation or color shift. LCDs don’t suffer from this dimming effect, which makes them a more suitable solution for applications with static images or images with static elements.

Another advantage of LCD technology is the wide variety of different variations to choose from. Depending on the application certain trade-offs can be very attractive. An example is much lower cost for a laptop display compared to a tablet. This is achieved by allowing poor image performance when viewed from the direction the is usually blocked by the keyboard. In a tablet where good viewing performance is required from any direction, much higher cost LCDs or OLEDs must be used.

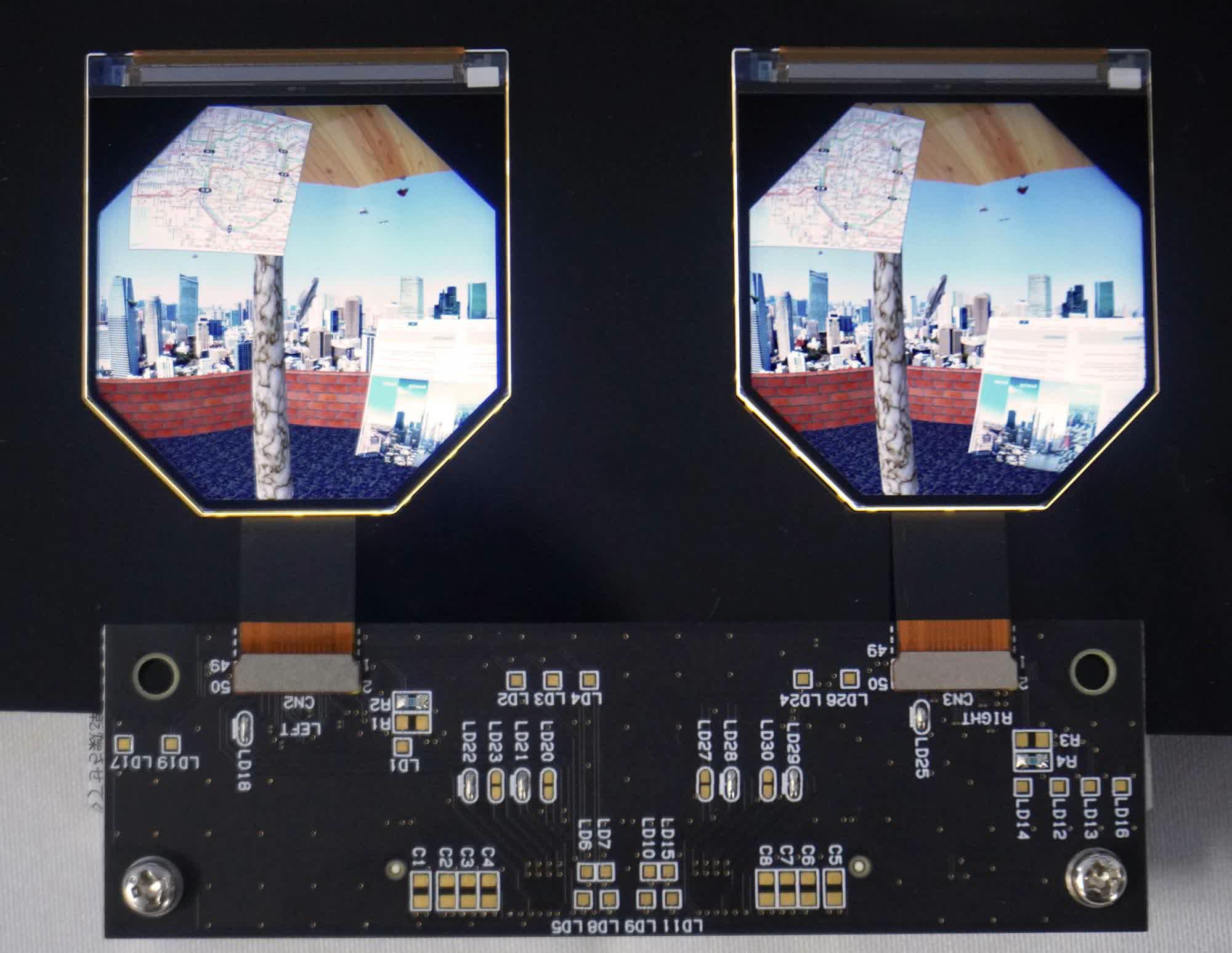

They can be used to replace old TN LCDs or add dynamic push buttons on industrial equipment. They can be customized to various resolutions, FPC configurations, colors, custom shaped OLED displays (e.g. octagonal, round, etc.) and can even be made into flexible and transparent displays. Thanks to their versatility, OLED display panel suppliers can offer some exciting capabilities for their customers – things that were previously impossible with LCDs.

As an experienced LCD and OLED panel supplier, New Vision Display can help you find the right technology for your application. Contact us via the below form to discuss your project.

There are plenty of new and confusing terms facing TV shoppers today, but when it comes down to the screen technology itself, there are only two: Nearly every TV sold today is either LCD or OLED.

The biggest between the two is in how they work. With OLED, each pixel provides its own illumination so there"s no separate backlight. With an LCD TV, all of the pixels are illuminated by an LED backlight. That difference leads to all kinds of picture quality effects, some of which favor LCD, but most of which benefit OLED.

LCDs are made by a number of companies across Asia. All current OLED TVs are built by LG Display, though companies like Sony and Vizio buy OLED panels from LG and then use their own electronics and aesthetic design.

So which one is better? Read on for their strengths and weaknesses. In general we"ll be comparing OLED to the best (read: most expensive) LCD has to offer, mainly because there"s no such thing as a cheap OLED TV (yet).

The better LCDs have local dimming, where parts of the screen can dim independently of others. This isn"t quite as good as per-pixel control because the black areas still aren"t absolutely black, but it"s better than nothing. The best LCDs have full-array local dimming, which provides even finer control over the contrast of what"s onscreen -- but even they can suffer from "blooming," where a bright area spoils the black of an adjacent dark area.

One of the main downsides of LCD TVs is a change in picture quality if you sit away from dead center (as in, off to the sides). How much this matters to you certainly depends on your seating arrangement, but also on how much you love your loved ones.

A few LCDs use in-plane switching (IPS) panels, which have better off-axis picture quality than other kinds of LCDs, but don"t look as good as other LCDs straight on (primarily due to a lower contrast ratio).

OLED doesn"t have the off-axis issue LCDs have; its image looks basically the same, even from extreme angles. So if you have a wide seating area, OLED is the better option.

Nearly all current TVs are HDR compatible, but that"s not the entire story. Just because a TV claims HDR compatibility doesn"t mean it can accurately display HDR content. All OLED TVs have the dynamic range to take advantage of HDR, but lower-priced LCDs, especially those without local-dimming backlights, do not. So if you want to see HDR content it all its dynamic, vibrant beauty, go for OLED or an LCD with local dimming.

In our tests comparing the best new OLED and LCD TVs with HDR games and movies, OLED usually looks better. Its superior contrast and lack of blooming win the day despite LCD"s brightness advantage. In other words LCD TVs can get brighter, especially in full-screen bright scenes and HDR highlights, but none of them can control that illumination as precisely as an OLED TV.

The energy consumption of LCD varies depending on the backlight setting. The lower the backlight, the lower the power consumption. A basic LED LCD with its backlight set low will draw less power than OLED.

LG has said their OLED TVs have a lifespan of 100,000 hours to half brightness, a figure that"s similar to LED LCDs. Generally speaking, all modern TVs are quite reliable.

Does that mean your new LCD or OLED will last for several decades like your parent"s last CRT (like the one pictured). Probably not, but then, why would you want it to? A 42-inch flat panel cost $14,000 in the late 90"s, and now a 65-inch TV with more than 16x the resolution and a million times better contrast ratio costs $1,400. Which is to say, by the time you"ll want/need to replace it, there will be something even better than what"s available now, for less money.

OLED TVs are available in sizes from 48 to 88 inches, but LCD TVs come in smaller and larger sizes than that -- with many more choices in between -- so LCD wins. At the high end of the size scale, however, the biggest "TVs" don"t use either technology.

You can get 4K resolution, 50-inch LCDs for around $400 -- or half that on sale. It"s going to be a long time before OLEDs are that price, but they have come down considerably.

LCD dominates the market because it"s cheap to manufacture and delivers good enough picture quality for just about everybody. But according to reviews at CNET and elsewhere, OLED wins for overall picture quality, largely due to the incredible contrast ratio. The price difference isn"t as severe as it used to be, and in the mid- to high-end of the market, there are lots of options.

This technology utilizes liquid crystal fluid to rotate light from passing through polarizing films. The simplistic structure allows for usage of ambient light reflection or in conjunction with a backlight for low-light situations.

TFT is an LCD Technology which adds a thin-film transistor at each pixel to supply common voltages to all elements. This voltage improves video content frame rates. Displays are predominantly utilizing color filter layers and white LED backlighting.

IPS TFT is a deviation of a traditional TN TFT Display. The most fundamental difference is that light is not rotated in plane and passing through polarizer films, but instead perpendicular to shutter the light. This approach to the technology improves contrast and enables symmetrical viewing angles from all directions.

Touchscreens have changed the way people expect to interact with their devices. When it comes to smartphones and tablets, touch is the way to go. Even handheld game consoles, laptops, and car navigation systems are moving towards touch. Manufacturers of these devices need to give their respective consumers the responsiveness these consumers are looking for. Selecting the right TFT-LCD display to use for different devices is important.

For touch-sensitive displays, two types of technologies are used: resistive and capacitive. The main difference is in how they respond to touch. Mobile phone comparison site Omio indicates that resistive technology is more accurate but capacitive technology is more responsive.

To elaborate on that, resistive touchscreens allow input from fingers and non-finger objects, like a stylus. A stylus has a smaller point than a finger and makes interaction on a resistive screen more accurate. This makes the technology suitable for devices whose applications require high accuracy, like sketching and pinpoint games. Mobile devices that use a stylus typically have resistive touchscreens.

As you can see, capacitive screens get general usage while resistive screens cater to more specific applications. With this, TFT-LCD module manufacturers, like Microtips Technology, focus on continuously improving capacitive screen technology.

Electronic Design states that many technological advances can be used to integrate touch sensors directly into the display. In some, manufacturers stack-up the touch sensors and integrate the controller with the display driver ICs. These advances allowed thinner and smarter capacitive touchscreens – a trend that you see in many devices today. For example, Windows phones originally worked exclusively with resistive touchscreen technology but later on moved over to capacitive. If the continuous development of capacitive touchscreen technology becomes successful, these screens may soon have abilities they don’t possess at the moment, such as hover support, non-finger support, and many more.

Microtips Technology is a leading custom lcd module manufacturer and we offer a full array of products and services. We have the most advances display technologies available to use in your design and if there is anything you want to change about one of our displays, we can make it happen. All of our displays are fully customizable to your specification and can include extra features like a capacitive touchscreen, an anti-reflective or anti-glare coating, or custom cover glass. Our sales and engineering staff will be with you through the entire process and will ensure our custom lcd display and your end product look their very best.

![]()

Mobile display technology is firmly split into two camps, the AMOLED and LCD crowds. There are also phones sporting OLED technology, which is closely associated with the AMOLED panel type. AMOLED and LCD are based on quite different underlying technologies, leading manufacturers to tout a number of different benefits depending on which display type they’ve opted for. Smartphone manufacturers are increasingly opting for AMOLED displays, with LCD mostly reserved for less expensive phones.

We’ll start alphabetically with AMOLED, although to be a little broader we should probably start with a little background about OLED technology in general.

Finally, the AM part in AMOLED stands in for Active Matrix, rather than a passive matrix technology. This tells us how each little OLED is controlled. In a passive matrix, a complex grid system is used to control individual pixels, where integrated circuits control a charge sent down each column or row. But this is rather slow and can be imprecise. Active Matrix systems attach a thin film transistor (TFT) and capacitor to each LED. This way, when a row and column are activated to access a pixel, the capacitor at the correct pixel can retain its charge in between refresh cycles, allowing for faster and more precise control.

The use of LEDs and minimal substrates means that these displays can be very thin. Furthermore, the lack of a rigid backlight and innovations in flexible plastic substrates enables flexible OLED-based displays. Complex LCD displays cannot be built in this way because of the backlight requirement. Flexy displays were originally very promising for wearables. Today, premium-tier smartphones make use of flexible OLED displays. Although, there are some concerns over how many times a display can flex and bend before breaking.

LCD stands for Liquid Crystal Display and reproduces colors quite differently from AMOLED. Rather than using individual light-emitting components, LCD displays rely on a backlight as the sole light source. Although multiple backlights can be used across a display for local dimming and to help save on power consumption, this is more of a requirement in larger TVs.

Scientifically speaking, there’s no individual white light wavelength. White light is a mixture of all other visible colors in the spectrum. Therefore, LCD backlights have to create a pseudo white light as efficiently as possible, which can then be filtered into different colors in the liquid crystal element. Most LCDs rely on a blue LED backlight which is filtered through a yellow phosphor coating, producing a pseudo white light.

All combined, this allows an LCD display to control the amount of RGB light reaching the surface by culling a backlight, rather than producing colored light in each pixel. Just like AMOLED, LCD displays can either be active or passive matrix devices, but most smartphones are active these days.

This wide variation in the way that light is produced has quite a profound difference to the user experience. Color gamut is often the most talked-about difference between the two display types, with AMOLED providing a greater range of color options than LCD, resulting in more vibrant-looking images.

OLED displays have been known for additional green and blue saturation, as these tend to be the most powerful colors in the sub-pixel arrangement, and very little green is required for white light. Some observers find that this extra saturation produces results that they find slightly unnatural looking. Although color accuracy has improved substantially in the past few years and tends to offer better accuracy for wider color gamuts like DCI-P3 and BT-2020. Despite not possessing quite such a broad gamut, LCD displays typically offer 100% sRGB gamut used by most content and can cover a wide gamut and most of the DCI-P3 color space too.

As we mentioned before, the lack of a backlight and filtering layers weighs in favor of OLED over LCD. LCD displays often suffer from light bleed and a lower contrast ratio as the backlight doesn’t switch off even when pixels are supposed to be black, while OLED can simply switch off its pixels. LCD’s filtering layer also inherently blocks some light and the additional depth means that viewing angles are also reduced compared to OLED.

One downside of AMOLED is that different LEDs have different life spans, meaning that the individual RBG light components eventually degrade at slightly different rates. As well as the dreaded but relatively rare burn-in phenomenon, OLED display color balance can drift very slightly over time, while LED’s single backlight means that color balance remains more consistent across the display. OLED pixels also often turn off and on slower, meaning that the highest refresh rate displays are often LCD. Particularly in the monitor market where refresh rates exceed 120Hz. That said, plenty of OLED smartphones offer 90, 120, and even 144Hz support.

Major display manufacturers, such as LG Display and Samsung Display, are betting big on OLED technology for the future, making major investments into additional production facilities. Particularly when it comes to its use in flexible display technology. The AMOLED panel market is expected to be worth close to $30 billion in 2022, more than double its value in 2017 when this article was first published.

That said, developments in Quantum Dot and mini LED displays are closing the already small performance gap between LCD and OLED, so certainly don’t count LCD out of the race just yet.

One of the most important aspects of any display you can understand is the panel technology being used. Specifications alone won’t give you the full picture of a displays performance, and we all know that manufacturers can exaggerate specs on paper to suit their marketing. With an understanding of the panel technology being used you will get a feel for the overall performance characteristics of the display and how it should perform in real terms. Our extensive panel search database helps you identify the panel technology (and manufacturer and part number where known) of many screens in the market. This article which follows will help you understand what the different panel technologies can offer you. A lot of manufacturers now list the panel technology as well in their specs, something which wasn’t included a in the past.

TN Film panels are the mostly widely used in the desktop display market and have been for many years since LCD monitors became mainstream. Smaller sized screens (15″, 17″ and 19″) are almost exclusively limited to this technology in fact and it has also extended into larger screen sizes over the last 7 years or so, now being a popular choice in the 20 – 28″ bracket as well. The TN Film panels are made by many different manufacturers, with the big names all having a share in the market (Samsung, LG.Display, AU Optronics) and being backed up by the other companies including most notably Innolux and Chunghwa Picture Tubes (CPT). You may see different generations of TN Film being discussed, but over the years the performance characteristics have remained similar overall.

TN Film has always been so widely used because it is comparatively cheap to produce panels based on this technology. As such, manufacturers have been able to keep costs of their displays down by using these panels. This is also the primary reason for the technology to be introduced into the larger screen sizes, where the production costs allow manufacturers to drive down retail costs for their screens and compete for new end-users.

The other main reason for using TN Film is that it is fundamentally a responsive technology in terms of pixel latency, something which has always been a key consideration for LCD buyers. It has long been the choice for gaming screens and response times have long been, and still are today, the lowest out of all the technologies overall. Response times typically reach a limit of around 5ms at the ISO quoted black > white > black transition, and as low as 1ms across grey to grey transitions where Response Time Compensation (overdrive) is used. TN Film has also been incorporated into true 120Hz+ refresh rate desktop displays, pairing low response times with high refresh rates for even better moving picture and gaming experiences, improved frame rates and adding 3D stereoscopic content support. Modern 120Hz+ refresh rate screens normally also support NVIDIA 3D Vision 2 and their LightBoost system which brings about another advantage for gaming. You can use the LightBoost strobed backlight system in 2D gaming to greatly reduce the perceived motion blur which is a significant benefit. Some screens even include a native blur reduction mode instead of having to rely on LightBoost ‘hacks’, providing better support for strobing backlights and improving gaming experiences when it comes to perceived motion blur. As a result, TN Film is still the choice for gamer screens because of the low response times and 120Hz+ refresh rate support.

The main problem with TN Film technology is that viewing angles are pretty restrictive, especially vertically, and this is evident by a characteristic severe darkening of the image if you look at the screen from below. Contrast and colour tone shifts can be evident with even a slight movement off-centre, and this is perhaps the main drawback in modern TN Film panels. Some TN Film panels are better than others and there have been improvements over the years to some degree, but they are still far more restrictive with fields of view than other panel technologies. The commonly quoted 170/160 viewing angles are an unfair indication of the actual real-life performance really, especially when you consider the vertical contrast shifts. Where viewing angles are quoted by a manufacturer as 160/160 or 170/160 that is a clear sign that the panel technology will be TN Film incidentally.

Movie playback is often hampered by ‘noise’ and artifacts, especially where overdrive is used. Black depth was traditionally quite poor on TN Film matrices due to the crystal alignment, however, in recent years, black depth has improved somewhat and is generally very good on modern screens, often surpassing IPS based screens and able to commonly reach contrast ratios of ~1000:1. TN Film is normally only a true 6-bit colour panel technology, but is able to offer a 16.7 million colour depth thanks to dithering and Frame Rate Control methods (6-bit + FRC). Some true 8-bit panels have become available in recent years (2014 onwards) but given the decent implementation of FRC on other 6-bit+FRC panels, the real-life difference is not something to concern yourself with too much.

VA technology was first developed by Fujitsu in 1996. However the limited viewing angles were its main disadvantage, and so further investment focused on addressing this problem. It was eventually solved by dividing each pixel into domains which worked synchronously. This lead the birth of the following technologies:

MVA technology, was later developed by Fujitsu in 1998 as a compromise between TN Film and IPS technologies. On the one hand, MVA provided a full response time of 25 milliseconds (that was impossible at the time with IPS, and not easily achievable with TN), and on the other hand, MVA matrices had wide viewing angles of 160 – 170 degrees, and thus could better compete with IPS in that parameter. The viewing angles were also good in the vertical field (an area where TN panels suffer a great deal) as well as the horizontal field. MVA technology also provided high contrast ratios and good black depth, which IPS and TN Film couldn’t quite meet at the time.

While some improvements have been made, the color-reproduction properties of these modern MVA technologies can still be problematic in some situations. Such panels give you vivid and bright colors, but due to the peculiarities of the domain technology many subtle color tones (dark tones often) are lost when you are looking at the screen strictly perpendicularly. When you deflect your line of sight just a little, the colors are all there again. This is a characteristic “VA panel contrast shift” (sometimes referred to as ‘black crush’ due to the loss of detail in dark colours) and some users pick up on this and might find it distracting. Thus, MVA matrices are somewhere between IPS and TN technologies as concerns color rendering and viewing angles. On the one hand, they are better than TN matrices in this respect, but on the other hand the above-described shortcoming prevents them from challenging IPS matrices, especially for colour critical work.

AU Optronics have more recently (around 2005) been working on their latest generation of MVA panel technology, termed ‘Advanced Multi Domain Vertical Alignment’ (AMVA). This is still produced today although a lot of their focus has moved to the similarly named, and not to be confused AHVA (Advanced Hyper Viewing Angle, IPS-type) technology. Compared with older MVA generations, AMVA is designed to offer improved performance including reduced colour washout, and the aim to conquer the significant problem of colour distortion with traditional wide viewing angle technology. This technology creates more domains than conventional multi-domain vertical alignment (MVA) LCD’s and reduces the variation of transmittance in oblique angles. It helps improve colour washout and provides better image quality in oblique angles than conventional VA LCD’s. Also, it has been widely recognized worldwide that AMVA technology is one of the few ways to provide optimized image quality through multiple domains.

AMVA still has some limitations however in practice, still suffering from the off-centre contrast shift you see from VA matrices. Viewing angles are therefore not as wide as IPS technology and the technology is often dismissed for colour critical work as a result. As well as this off-centre contrast shift, the wide viewing angles often show more colour and contrast shift than competing IPS-type panels, although some recent AMVA panel generations have shown improvements here (see BenQ GW2760HS for instance with new “Color Shift-free” technology). Responsiveness is better than older MVA offerings certainly, but remains behind TN Film and IPS/PLS in practice. The Anti-Glare (AG) coating used on most panels is light, and sometimes even appears “semi glossy” and so does not produce a grainy image.

AUO developed a series of vertical-alignment (VA) technologies over the years. This is specifically for the TV market although a lot of the changes experienced through these generations applies to monitor panels as well over the years. Most recent

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey