large format lcd displays market brands

Large Format LCD Displays Market Size is projected to Reach Multimillion USD by 2028, In comparison to 2022, at unexpected CAGR during the forecast Period 2023-2028.

Browse Detailed TOC, Tables and Figures with Charts which is spread across 92 Pages that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

1. Does this report consider the impact of COVID-19 and the Russia-Ukraine war on the Large Format LCD Displays market?Yes. As the COVID-19 and the Russia-Ukraine war are profoundly affecting the global supply chain relationship and raw material price system, we have definitely taken them into consideration throughout the research, and in Chapters, we elaborate at full length on the impact of the pandemic and the war on the Large Format LCD Displays Industry

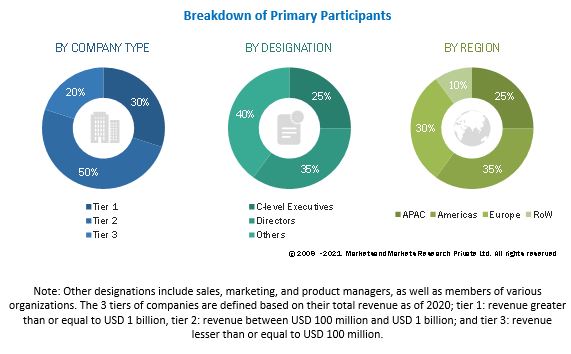

This research report is the result of an extensive primary and secondary research effort into the Large Format LCD Displays market. It provides a thorough overview of the market"s current and future objectives, along with a competitive analysis of the industry, broken down by application, type and regional trends. It also provides a dashboard overview of the past and present performance of leading companies. A variety of methodologies and analyses are used in the research to ensure accurate and comprehensive information about the Large Format LCD Displays Market.

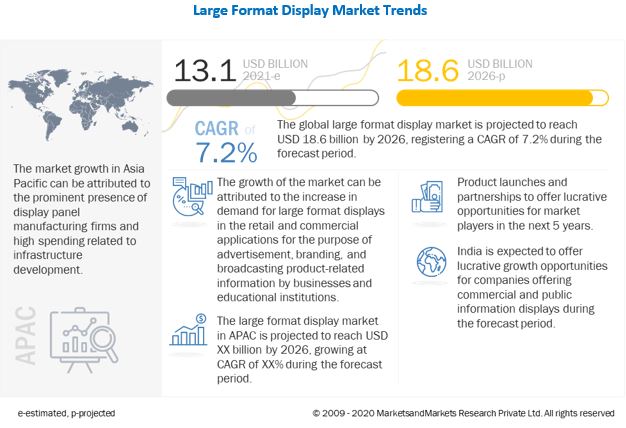

The Global Large Format LCD Displays market is anticipated to rise at a considerable rate during the forecast period, between 2022 and 2028. In 2021, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Due to the COVID-19 pandemic, the global Large Format LCD Displays market size is estimated to be worth USD million in 2022 and is forecast to a readjusted size of USD million by 2028 with a Impressive CAGR during the forecast period 2022-2028. Fully considering the economic change by this health crisis, 32-58 Inch accounting for Percent of the Large Format LCD Displays global market in 2021, is projected to value USD million by 2028, growing at a revised Percent CAGR from 2022 to 2028. While Business segment is altered to an Percent CAGR throughout this forecast period.

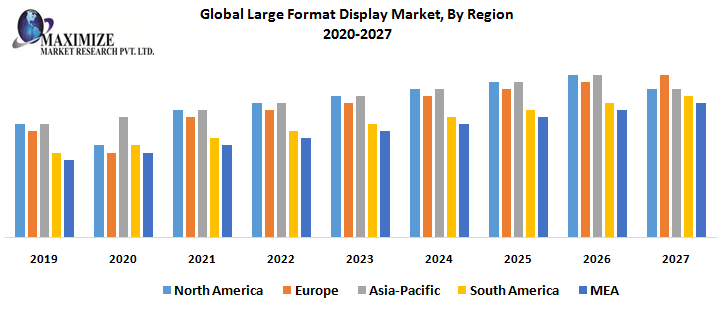

North America Large Format LCD Displays market is estimated at USD million in 2021, while Europe is forecast to reach USD million by 2028. The proportion of the North America is Percent in 2021, while Europe percentage is Percent, and it is predicted that Europe share will reach Percent in 2028, trailing a CAGR of Percent through the analysis period 2022-2028. As for the Asia, the notable markets are Japan and South Korea, CAGR is Percent and Percent respectively for the next 6-year period.

The global major manufacturers of Large Format LCD Displays include AG Neovo, Planar Systems (Leyard), Sharp (NEC), Sony, Sumsung, LG Electronics, Philips, Smart Technologies and ViewSonic and etc. In terms of revenue, the global 3 largest players have a Percent market share of Large Format LCD Displays in 2021.

The research report has incorporated the analysis of different factors that augment the marketâs growth. It constitutes trends, restraints, and drivers that transform the market in either a positive or negative manner. This section also provides the scope of different segments and applications that can potentially influence the market in the future. The detailed information is based on current trends and historic milestones. This section also provides an analysis of the volume of production about the global market and about each type from 2017 to 2028. This section mentions the volume of production by region from 2017 to 2028. Pricing analysis is included in the report according to each type from the year 2017 to 2028, manufacturer from 2017 to 2022, region from 2017 to 2022, and global price from 2017 to 2028.

A thorough evaluation of the restrains included in the report portrays the contrast to drivers and gives room for strategic planning. Factors that overshadow the market growth are pivotal as they can be understood to devise different bends for getting hold of the lucrative opportunities that are present in the ever-growing market. Additionally, insights into market expertâs opinions have been taken to understand the market better.

The research report includes specific segments by region (country), by manufacturers, by Type and by Application. Each type provides information about the production during the forecast period of 2017 to 2028. by Application segment also provides consumption during the forecast period of 2017 to 2028. Understanding the segments helps in identifying the importance of different factors that aid the market growth.

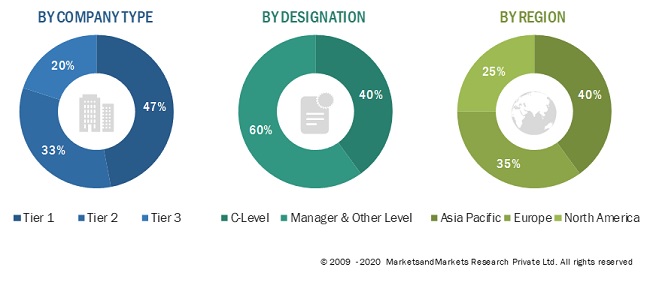

Primary sources include extensive interviews of key opinion leaders and industry experts (such as experienced front-line staff, directors, CEOs, and marketing executives), downstream distributors, as well as end-users.Secondary sources include the research of the annual and financial reports of the top companies, public files, new journals, etc. We also cooperate with some third-party databases.

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2017-2028) of the following regions are covered in Chapter 4 and Chapter 7: ● North America (United States, Canada and Mexico)

This Large Format LCD Displays Market Research/Analysis Report Contains Answers to your following Questions ● What are the global trends in the Large Format LCD Displays market? Would the market witness an increase or decline in the demand in the coming years?

● What is the estimated demand for different types of products in Large Format LCD Displays? What are the upcoming industry applications and trends for Large Format LCD Displays market?

● What Are Projections of Global Large Format LCD Displays Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about Import and Export?

● What are the factors contributing to the final price of Large Format LCD Displays? What are the raw materials used for Large Format LCD Displays manufacturing?

● How big is the opportunity for the Large Format LCD Displays market? How will the increasing adoption of Large Format LCD Displays for mining impact the growth rate of the overall market?

Yes. Customized requirements of multi-dimensional, deep-level and high-quality can help our customers precisely grasp market opportunities, effortlessly confront market challenges, properly formulate market strategies and act promptly, thus to win them sufficient time and space for market competition.

360 Research Reports is the credible source for gaining the market reports that will provide you with the lead your business needs. At 360 Research Reports, our objective is providing a platform for many top-notch market research firms worldwide to publish their research reports, as well as helping the decision makers in finding most suitable market research solutions under one roof. Our aim is to provide the best solution that matches the exact customer requirements. This drives us to provide you with custom or syndicated research reports.For More Related Reports Click Here :

Is there a problem with this press release? Contact the source provider Comtex at editorial@comtex.com. You can also contact MarketWatch Customer Service via our Customer Center.

Two types of backlight technologies are currently deployed in the global large format display market – LED Backlit and CCFL. Of these, LED Backlit is the most preferred technology, being implemented across most large format display devices across the globe. In terms of value, the LED Backlit segment is expected to increase 2.2X during the forecast period.

From an estimated market valuation of about US$ 9.5 Bn in 2017, the LED Backlit segment is expected to reach a market value of more than US$ 20 Bn by 2027, registering a CAGR of 8.1% over the forecast period. In terms of value, the CCFL segment is expected to increase 1.2X during the forecast period. The LED Backlit segment is projected to register high Y-o-Y growth rates throughout the period of study.

Introduction of laser phosphor displays: Technological advancements in display technologies have led to the introduction of laser phosphor displays. Owing to several enhanced features such as better image quality and less power consumption, laser phosphor displays are expected to replace LED and LCD displays in the near future.

Simultaneous remote control of multiple large format displays: Owing to increasing consumer demand for advanced features such as remote control functionality along with ease of use, companies manufacturing large format displays have started incorporating features such as simultaneous remote control of multiple large format displays that enable operators to simultaneously control multiple displays remotely using devices like personal computers.

Ambient light sensors in large format displays:As large format displays have outdoor applications at various government and public places and outside retail stores, there is an issue witnessed because of the differences in working conditions during different times of the day i.e., day and night. Manufacturers have started installing ambient light sensors in their large format displays, which enables these displays to automatically adjust the brightness according to outdoor conditions.

Augmented viewing technology with both portrait and landscape modes: With advancements in technology, a transition in viewing orientation is being observed as consumers demand displays that can provide both landscape and portrait viewing orientation. Top market vendors have started introducing large format displays that can be installed in such a way so as to facilitate both landscape and portrait views.

CCFL to be replaced by LED Backlit Technology: Innovations in backlighting technology has led to a transition from cold-cathode fluorescent (CCFL) backlighting to LED backlighting. The advantages associated with LED backlit technology include brighter display, longer product life, reduced thickness, less energy consumption, and elimination of mercury. Most of the leading companies operating in the global large format display market are now implementing LED backlit technology in their large format displays. However, adoption of CCFL technology is still being observed owing to its low costs.

Introduction of interactive (touchscreen) large format displays: Advancements in technology have led to the incorporation of touchscreen large format displays that offer enhanced end user experience. Major applications of touchscreen large format displays are in control rooms, corporate meetings, educational institutes and retail stores. Manufacturers of large format displays are now introducing touchscreen displays to cater to the rising consumer demand.

Use of large format displays in the educational sector: Large display formats are increasingly being used in the educational sector. Interactive large format displays enable several individuals to participate and view simultaneously, making it suitable for exhibiting presentations and lectures.

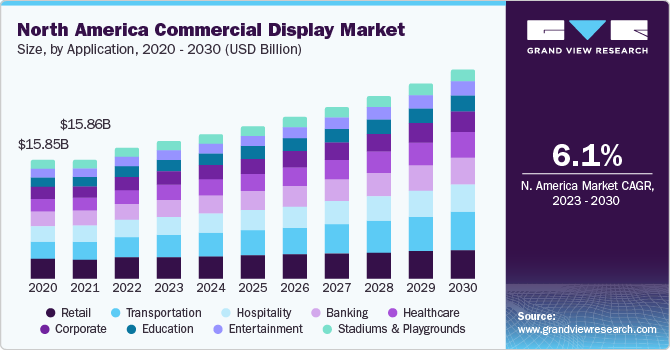

The U.S. large screen display market size was valued at $2.91 billion in 2020, and is projected to reach $8.45 billion by 2030, registering a CAGR of 11.0% from 2021 to 2030. Large screen displays are a class of large display screen formats, which improve the visual experience with its professional-grade image quality and are mostly used for endorsing and advertising. These displays have replaced the traditional small and micro-display screens with large wall-sized LED and LCD displays, used across various industries. They are designed for applications that require the vendors to engage their customers/audiences with its wider viewing angle and to extract maximum effectiveness from the marketing messages. In addition, these displays ensure higher durability and enhanced performance as against traditional display screens. Large screen displays are mostly suited for retail store, lobby, control room, or other professional application.

In the current business scenario, it is crucial to employ efficient systems for advertising, owing to the development of numerous user engagement devices and applications. Large screen displays are a cost-effective medium of promoting and branding any product or service; this advantage drives the U.S. large screen display market growth.

In addition, these displays provide high wavelength uniformity for fine pixel pitch displays. Further, they consume less power and deliver increased brightness, ultrahigh definition picture quality, improved color saturation, and faster response rate as compared to small OLEDs and LCDs, and thus, are suited for both indoor and outdoor displays.

Rise in demand for bright and power-efficient display panels and rapid digitalization and decline in demand for traditional billboards are the factors that drive the growth of theU.S. large screen display market.However, deployment of widescreen alternatives such as projectors and screenless displays, hampers the market growth to a certain extent. Furthermore, emerging display technology such as MicroLED and quantum dots and increase in preference of electronic giants toward large-screen displays offer lucrative opportunities for the U.S. large screen display market.

The U.S. large screen display market is segmented on the basis of screen size, application, product, location, end user, and region. By screen size, the market is classified into 80 Inch to 99 Inch, 100 inch to 149-inch, 150 inch to 199-inch, 200 inch to 300 inch, and above 300-inch segments. In 2020, the 80 Inch to 99 Inch segment secured highest revenue share and is expected to follow same trend during forecast period. Based on application, the market is divided into B to B and B to C applications, among which B to B segment is expected to dominate the U.S. large screen display market share.

By product, the U.S. large screen display market is categorized into single screen, video wall and projector. Based on location, it is segregated into indoor and outdoor. By end user, it is categorized into retail, education, healthcare, corporate, stadiums, media & entertainment, government, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The corporate segment was the highest contributor to the market in 2020, owing to increase in adoption of large screen displays in conference rooms, cafeterias, and work floors help engage their employees, visitors, and create good environment.

The notable factors positively affecting the U.S. Large Screen Display Market include rise in demand for bright and power-efficient display panels, rapid digitalization, and decline in demand for traditional billboards. However, deployment of widescreen alternatives such as projectors and screenless displays, is expected to hinder the market growth. Moreover, emerging display technologies such as MicroLED & quantum dots and increase in preference of electronic giants toward large screen displays are expected to offer huge market opportunities in the coming years. Each of these factors is anticipated to have a definite impact on the U.S. large screen display market during the forecast period.

The key players profiled in the U.S. large screen display market report include iSEMC, Koninklijke Philips N.V., LG Electronics Inc., NEC Corporation, Panasonic Corporation, Planar Systems, Samsung Electronics Co. Ltd., Sony Corporation, ViewSonic Corporation, and Volanti Displays. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their position in the U.S. large screen display industry. In 2019, Planer Systems launched 100-inch 4K LCD display with Ultra HD resolution (3840 x 2160), which offers high brightness of 700 nits and wide color gamut for stunning image quality and deep, rich color reproduction.

The global outbreak of COVID-19 has significantly affected the growth of the U.S. large screen display market in 2020, and the market is estimated to witness relatively slow growth till the end of 2021. Further, the global selling market was primarily hit by several obstacles due to COVID-19 in the manufacturing and selling industries such as lack of availability of raw material and skill workforce, contractual obligations, and project delays or cancellations. Furthermore, the negative impact on outdoor advertisement solution in 2020 decreased the demand for large screen displays from commercial sector. However, rise in demand for VR gaming solutions is expected to witness relatively high growth by the end of 2021.

Key Benefits For StakeholdersThis study comprises analytical depiction of the U.S. large screen display market opportunities along with the current trends and future estimations to depict the imminent investment pockets.

Planar® CarbonLight™ VX Series is comprised of carbon fiber-framed indoor LED video wall and floor displays with exceptional on-camera visual properties and deployment versatility, available in 1.9 and 2.6mm pixel pitch (wall) and 2.6mm (floor).

From cinema content to motion-based digital art, Planar® Luxe MicroLED Displays offer a way to enrich distinctive spaces. HDR support and superior dynamic range create vibrant, high-resolution canvases for creative expression and entertainment. Leading-edge MicroLED technology, design adaptability and the slimmest profiles ensure they seamlessly integrate with architectural elements and complement interior décor.

From cinema content to motion-based digital art, Planar® Luxe Displays offer a way to enrich distinctive spaces. These professional-grade displays provide vibrant, high-resolution canvases for creative expression and entertainment. Leading-edge technology, design adaptability and the slimmest profiles ensure they seamlessly integrate with architectural elements and complement interior decor.

From cinema content to motion-based digital art, Planar® Luxe MicroLED Displays offer a way to enrich distinctive spaces. HDR support and superior dynamic range create vibrant, high-resolution canvases for creative expression and entertainment. Leading-edge MicroLED technology, design adaptability and the slimmest profiles ensure they seamlessly integrate with architectural elements and complement interior décor.

Planar® CarbonLight™ VX Series is comprised of carbon fiber-framed indoor LED video wall and floor displays with exceptional on-camera visual properties and deployment versatility, available in 1.9 and 2.6mm pixel pitch (wall) and 2.6mm (floor).

Carbon fiber-framed indoor LED video wall and floor displays with exceptional on-camera visual properties and deployment versatility for various installations including virtual production and extended reality.

a line of extreme and ultra-narrow bezel LCD displays that provides a video wall solution for demanding requirements of 24x7 mission-critical applications and high ambient light environments

Since 1983, Planar display solutions have benefitted countless organizations in every application. Planar displays are usually front and center, dutifully delivering the visual experiences and critical information customers need, with proven technology that is built to withstand the rigors of constant use.

Not only do the best large format displays you"ll find on this page help you display adverts and branding for your company, they can be used to display information for your customers, and this can be especially important if that information changes regularly, which makes large format displays a wiser investment than traditional printed posters.

So what are large format displays? They aren"t just super-sized monitors, but high definition displays that range from 32-inches to over 100-inches, and they often have super-thin bezels that surround the screens. This allows single LFDs to show off images, footage and more without wasting any space, and it also allows you to link together multiple LFDs to create one super-large display as well.

Most of the best large format displays aren"t cheap, but they offer a premium experience that brings out the best of content thanks to dazzling panels, a wide range of connectivity options and useful integrated online services.

We picked out the best large format displays for companies that won’t want to compromise, and for those that do, we’ve also thrown in a few budget or two.

We"ve compared these large format displays on various points, from their resolution and size to their design and connectivity. We also examined their design, brightness, and color quality, and checked whether they featured touchscreen capabilities, among other things.

Download Installation 2021 Pro AV Tech report for free(opens in new tab)Professional AV magazine, Installation, has just released a market outlook report on the application of AV systems and tech in the corporate, education, residential, and retail & hospitality sectors, (plus an audio tech focus) which is aimed at both integrators and users. Download it now for free for in-depth analysis and insights.

Spanning 85 inches, this mammoth large format display is pretty while also costing a pretty penny. It justifies its premium price tag as it uses the latest 8K screen tech, which flaunts four times the number of pixels as 4K and 16 times that of a regular 1080p TV.

Boasting a giant 98-inch display, this model opts for a more sensible 4K resolution rather than 8K, which lends it a greater degree of compatibility with content that’s out in the wild. Designed for use in control rooms or large training rooms where ultra-high definition is required, it is also compatible with a range of NEC solutions.

They include the company’s NEC MultiPresenter Stick, its wireless presentation solution for NEC Displays, and it also supports multiple simultaneous connections on Windows, macOS, iOS, and Android.

If you are looking for a large format display that doubles down on image quality, this sizeable screen sports high color gamut coverage which makes it ideal for streaming video services.

LG has been making top-tier displays for years, many of which have appeared on smartphones and, more recently, virtual reality headsets. This 84-inch 4K large format carries over that quality to deliver high-contrast, true-to-life images.

There aren"t many large format displays that have multitouch, which makes the NEC MultiSync E905 SST an interesting option. It"s hardly a small screen at 90-inches across the diagonal, but it can be interacted with up to 10 simultaneous touch points thanks to NEC’s ShadowSense technology. The setup is swift and simple with no need to install additional drivers.

Samsung’s QM85D is a large format display that sports an impressive 120Hz refresh rate, which makes movements across the display - whether that is dragging windows and other content or watching a video - appear much smoother while reducing stutter.

This ProLite model is a large format display with a sharp 4K resolution. It features a slim design with hardly any noticeable bezel, which allows content on its IPS LED panel to shine when combined with its exceptional colors and image performance.

More than a display, the BenQ CP8601K DuoBoard IFP is unlike any other meeting room display on the market. It features all the hardware and tools meeting participants need — HD video camera, speakers, a six-microphone array, video conferencing, and cloud-based screen sharing, annotation, and collaboration features — without hassling with separate, incompatible software and systems.

We queried Claire Mc Lin, Senior Product Manager for Enterprise Collaboration Solutions & Google Jamboard at BenQ America Corp, about the ubiquitous Interactive Flat Panel and how it differs from other large format display on the market.An interactive flat panel (IFP) is to the meeting place what the smart device is to everyday life: convenient, easy to use, and a veritable Swiss Army knife of capabilities. These displays are engineered to bring more interactivity and collaboration to meetings. Meetings joined from an IFP allow participants — whether they’re remote or in person— promote the smooth, unlimited exchange of ideas.

The appeal of these displays is that they parallel the ease at which people use smart devices such as a cell phone or a tablet, while providing a large enough picture to be visible to everyone. Leading models range from 55 inches up to 86 inches and feature up to 20 points of touch allowing more than one person to work at the screen simultaneously.

IFPs are also designed with IT and technology management advantages. Centralized remote control and monitoring capabilities lower the cost of ownership and energy consumption. Updates that can be done over-the-air (OTA) are an efficient way to roll out new firmware and keep them running smoothly. What are IFPs? They’re the future of meetings and collaboration.How to choose the best large format displays for you?When selecting the best large format displays for you, you"ll want to keep the following factors in mind.

To test the best large format displays, we evaluated them across numerous aspects, from their display size and resolution to the brightness and connectivity ports.

We first checked how large the displays were and whether they offered Full HD, 4K, or 8K resolution. We assessed the contrast and color reproduction on the displays, along with the refresh rate.

We considered the display brightness to judge which ones would be best suited for bright, outdoor use. We also looked at the number and types of connectivity ports the displays had, their design, weight, panel type, and other features.

Large Format Display (LFD) Market size was valued at USD 11.25 Billion in 2019 and is projected to reach USD 18.02 Billion by 2027, growing at a CAGR of 6.54% from 2020 to 2027.

The growth of the Large Format Display (LFD) Market can be credited to the growth of professional displays include increasing innovation in direct-view LED displays and their technological advantages.The Global Large Format Display (LFD) Market report provides a holistic evaluation of the market. The report comprises various segments as well as an analysis of the trends and factors that are playing a substantial role in the market.

Large-format displays are flat-screen displays that are sleek and have a very minimal design. This allows businesses to display messages and presentations to customers and visitors. They have very thin bezels and are usually mounted onto walls and are the prime focus of the room. The size of large format displays ranges from 32” to 90” and is available in 90” plus sizes. The large-format display can be used independently or grouped for a multi-screen display, to act as a storyboard.

The LFDs usually have an array of ports and adapters to play various types of media. Depending upon the business perspective each large-format display screen is different and offers various advantages. Some LFDs are also an available touch screen. With the help of LFDs businesses can display posters, averts, or general messages. LFDs can also be for outside applications such as outdoor sports.

The growth global Large Format Display (LFD) Market can be attributed to the rising international and sports events across the globe. Rapid global urbanization and modernization are also aiding the growth of the market. The technological advancements and innovations in the field of LFDs are the key factors that are fueling the growth of the Large Format Display (LFD) Market. The latest LFDs consume less power and provide better image quality. The laser phosphorous displays are the new edge technology that is anticipated to replace LCD and LFD displays in near future.

The companies which are manufacturing large format displays have started to include features such as simultaneous remote control of multiple large-format displays that enable operators to simultaneously control multiple displays remotely utilizing devices like personal computers. Owing to rising consumer demand the companies are always trying to innovate and woo the customers.

However, some restraints are limiting the growth of the Large Format Display (LFD) Market. The cost associated with the purchase of these smart TVs is very high and in case of some issue with the displays then the repair costs are also high. Furthermore, the consumers are also moving to low-cost alternatives such as projectors and screen displays as they provide the same widescreen viewing experience.

The Global Large Format Display (LFD) Market is segmented on the basis of Display Type, Offering, Application, Display Brightness, Vertical, and Geography.

Based on Display Type, the market is segmented into Video Wall and Standalone Display. The video wall display technology is bifurcated into Narrow Bezel LED-Backlit LCD, OLED, Direct-View Fine-Pixel LED, Direct-View Large-Pixel LED, and Projection Cube. The standalone display technology is bifurcated into LED-Backlit LCD, OLED, and E-Paper. The display size segment is bifurcated into 32–40 Inches, 41–60 Inches, 61–70 Inches, 71–80 Inches, and More Than 80 Inches. The video wall segment is anticipated to dominate the market over the forecast period.

There have been many technological developments in the field of LFD since the last decade. The bulky and space-consuming devices have evolved into slim and bezel fewer devices. Owing to these technological advancements in direct view fine pixel LEDs the market for the same is growing exponentially. Furthermore, the huge competition in the market drives the innovation and development of these devices. These devices have almost no bezels and can be tilted together to form a completely seamless and limitless video wall.

Based on Offering, the market is segmented into Displays, Controllers, Mounts, and Other Accessories and Consulting and Other Services. The display segment is anticipated to dominate the market over the forecast period. The display contributes largely to the LFD market compared to other services and accessories.

Based on Application, the market is segmented into Indoor and Outdoor. The large-format displays for the indoor application segment contributed to three times the market share compared with large format displays for the outdoor application segment. The large contribution of indoor applications can be credited to the use of more costly displays such as LCD and OLEDs.

Based on Display Brightness, the market is segmented into Up to 500 Nits, 501–1000 Nits, 1001–2000 Nits, 2001–3000 Nits, and More Than 3000 Nits. The high brightness LCDs and video walls are anticipated to dominate the market owing to high brightness. The traditional flat panel and video walls when used for outdoor applications are subjected to high ambient life which disturbs the viewing experience and hence the high brightness displays are much more preferred. However, depending upon the application one may choose a different type of display.

Based on Vertical, the market is segmented into Commercial, Infrastructural, Institutional, and Industrial. The Commercial segment is further bifurcated into Retail, Government, and Command and Control Centers, Corporate and Broadcast, Hospitality, and Healthcare. The infrastructural segment is further bifurcated into Sports and Entertainment and Transportation and Public Places.

The institutional segment is further bifurcated into Education, Banking, Financial Services, and Insurance (BFSI). The commercial industry segment held the largest market share in 2016 however the infrastructure segment like sports and entertainment industries are anticipated to witness rapid growth over the forecast period. The direct-view fine pixel LED displays have a huge demand in transportation, public places, sports, and entertainment venues.

Based on Geography, the Global Large Format Display (LFD) Market is classified into North America, Europe, Asia Pacific, and the Rest of the world. The largest share in the market will be dominated by the Asia Pacific. The dominance of this region can be credited to the presence of major display panel manufacturers, various brand product manufacturers in the said region. In North America, the newer and high-cost displays such as OLED will have huge demand.

The “Global Large Format Display (LFD) Market” study report will provide valuable insight with an emphasis on the global market. The major players in the market are Samsung Electronics Co., Ltd, LG Display Co., Ltd., NEC Corp., Sharp Corp. (Foxconn), Leyard Optoelectronic Co., Ltd., Barco NV, Sony Corp., TPV Technology Ltd., E Ink Holdings, Inc., Au Optronics Corp.The competitive landscape section also includes key development strategies, market share, and market ranking analysis of the above-mentioned players globally.

• On July 2, 2021, South Korean battery makers Samsung SDI are considering investing in the US to meet the growing demand for electric vehicles, industry sources said on Friday, almost speculating about possible partnerships with major car manufacturers. Samsung Electronics’ battery arm reviewed various options to build a new battery factory in the U.S. to provide potential customers but remain vigilant with its system despite rising market expectations.

To know more about the Research Methodology and other aspects of the research study, kindly get in touch with our Sales Team at Verified Market Research.

• Analysis by geography highlighting the consumption of the product/service in the region as well as indicating the factors that are affecting the market within each region

• Competitive landscape which incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled

• The current as well as the future market outlook of the industry with respect to recent developments which involve growth opportunities and drivers as well as challenges and restraints of both emerging as well as developed regions

Large Format Display (LFD) Market was valued at USD 11.25 Billion in 2019 and is projected to reach USD 18.02 Billion by 2027, growing at a CAGR of 6.54% from 2020 to 2027.

The growth of the Large Format Display (LFD) Market can be credited to the growth of professional displays include increasing innovation in direct-view LED displays and to its technological advantages.

The Global Large Format Display (LFD) Market is Segmented on the basis of Display Type, Offering, Application, Display Brightness, Vertical, and Geography.

The sample report for the Large Format Display (LFD) Market can be obtained on demand from the website. Also, the 24*7 chat support & direct call services are provided to procure the sample report.

Technavio has announced its latest market research report titled Commercial Large Format Display Signage Market by Application and Geography - Forecast and Analysis 2022-2026

The commercial large format display signage market size is expected to grow by USD 2.90 billion from 2021 to 2026. Moreover, the growth momentum of the market will accelerate at a CAGR of 4.82% during the forecast period.

AU Optronics Corp., Barco NV, Daktronics Inc., Deepsky Corp. Ltd., Delta Electronics Inc., Hyundai IT Co. Ltd., LG Electronics Inc., Mitsubishi Electric Corp., Panasonic Corp., Planar Systems Inc., Qisda Corp., Retop LED Display Co. Ltd., Samsung Electronics Co. Ltd., Sharp Corp., Shenzhen AOTO Electronics Co. Ltd., Sony Group Corp., TPV Technology Co. Ltd., Vtron Group Co. Ltd., YFY Inc., and Zhejiang Dahua Technology Co. Ltd. are among some of the major market participants. The key offerings of some of these vendors are listed below:

AU Optronics Corp. - The company offers commercial large format display signage such as Smart Shelf Display, Stretched Display, UHD Super Slim Signage, Open Frame Display, Window Facing Digital Signage, and LED Video Wall.

Barco NV - The company offers commercial large format display signage such as Barco UniSee 500, OverView LVD 5521C, OverView KVD 5521C, XT0.9 Q, XT0.9, XT1.2, XT1.5, and XT1.2 E.

Daktronics Inc. - The company offers commercial large format display signage such as Outdoor and Indoor LED Video Displays, Freeform LED Displays, and MediaMesh Displays.

LG Electronics Inc. - The company offers commercial large format display signage such as LED Backlit Displays, Stretched Displays, and Touch Screen Displays.

Mitsubishi Electric Corp. - The company offers commercial large format display signage such as Diamond Vision display which features Real Black LED, Wide Viewing Angle, and High Contrast.

Market DynamicsParent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and future consumer dynamics, market condition analysis for the forecast period,

4 Five Forces Analysis4.1 Five forces summary4.2 Bargaining power of buyers4.3 Bargaining power of suppliers4.4 Threat of new entrants4.5 Threat of substitutes4.6 Threat of rivalry4.7 Market condition

5 Market Segmentation by Application5.1 Market segments5.2 Comparison by Application5.3 Indoor - Market size and forecast 2021-20265.4 Outdoor - Market size and forecast 2021-20265.5 Market opportunity by Application

7 Geographic Landscape7.1 Geographic segmentation7.2 Geographic comparison7.3 North America - Market size and forecast 2021-20267.4 APAC - Market size and forecast 2021-20267.5 Europe - Market size and forecast 2021-20267.6 Middle East and Africa - Market size and forecast 2021-20267.7 South America - Market size and forecast 2021-20267.8 US - Market size and forecast 2021-20267.9 Japan - Market size and forecast 2021-20267.10 Germany - Market size and forecast 2021-20267.11 China - Market size and forecast 2021-20267.12 UK - Market size and forecast 2021-20267.13 Market opportunity by geography

10 Vendor Analysis10.1 Vendors covered10.2 Market positioning of vendors10.3 AU Optronics Corp.10.4 Barco NV10.5 Daktronics Inc.10.6 LG Electronics Inc.10.7 Mitsubishi Electric Corp.10.8 Panasonic Corp.10.9 Qisda Corp10.10 Samsung Electronics Co. Ltd.10.11 Shenzhen AOTO Electronics Co. Ltd.10.12 Sony Group Corp.

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio"s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio"s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

North America is expected to hold a significant share in the market studied over the forecast period, due to the presence of some significant players in the region, coupled with the extensive R&D activities resulted in the full-scale adoption of the large format displays in the region.

The major factor driving the growth of this regional market is rising outdoor advertisements. According to the Out of Home Advertising Association of America, the OOH advertising revenue rose by 7.7% in 2019, over 2018. This includes digital out of home and is comprised of billboards, street furniture, transit advertising, and place-based media. With such a positive outlook showcased by the industry, the market studied is expected to grow at a steady pace in the region over the forecast period.

The players present in the ecosystem, through strategic partnerships, are working closely to introduce new technologies into the market studied. This is expected to fuel the demand for large format displays over the forecast period.

For instance, in September 2019, Captivate, North America’s leading location-based digital video network, announced a strategic partnership with location-based martech company Hivestack to launch programmatic channels for digital advertising, thereby, to enable programmatic buying of Captivate’s system of premier office media inventory, through Hivestack’s private marketplace (PMP) and ad exchange.

In May 2020, Prysm Inc., a major display and visual collaboration solutions provider, created a new category in the display market by unveiling its largest seamless interactive display, the Prysm Laser Phosphor Display (LPD) 6K Series, 225“, which is 20ft wide and 5ft high. The Prysm LPD 6K Series is an interactive large-format display that offers a panoramic image uninterrupted by seams or bezels. The newly developed LPD is an extremely energy-efficient interactive touch display that is shatter-resistant, flexible, and offers rollability for transport.

The market has also observed a significant number of strategic merger-acquisition instances, which may further boost the growth of the market. For instance, in September 2020, Sahara Presentation Systems PLC (which includes Sahara AV Solutions, Clevertouch and Sedao) was acquired by Boxlight Corporation. The acquisition by Boxlight is set to benefit Sahara AV’s, Sedao’s, and Clevertouch’s partners across the world, with an even greater range of audio-visual solutions for greater collaboration, classroom, and workspace technology.

Some prominent players in the region are launching campaigns that use billboards to promote ad campaigns among the people of the region. Thus, this increasing use of technology is expected to boost the market studied over the forecast period.

This year, CIbroadens its offering of Deep Dive reports with a dedicated story on the large-format display market. Thus, in our upcoming April issue, we’ll explore not only DVLED technology but also large-format projection and tiled LCD videowalls. The goal is to apprise AV integrators of burgeoning trends so they can deliver on client expectations and optimize their businesses. CIis asking you — our audience — to take a short, five-minute survey regarding how your business deploys large-format display technology. Will you please add your voice to this one-of-a-kind industry study?

The Large-Format Display Deep Dive will offer a breadth and depth of coverage that no other technology journalism outlet delivers. The article will touch on the following topics:

Moreover, since CIrecognizes that the business climate is somewhat challenging, we go beyond the technology. We also will explore factors that have diminished AV integrators’ ability to close and integrate large-format display applications.

Please take the survey now and share your voice with your industry colleagues. All responses will remain strictly anonymous and will only be used for statistical analysis. No identifying information is requested.

Be sure to check out Commercial Integrator’sLarge-Format Display Deep Dive in April! We will also feature exclusive video Q&As and other supplemental content throughout the month.

The research firm IHS Markit says OLED display costs are expected to drop as technology that effectively prints the displays matures and production capacity …

Via Display Daily OLED displays have tended to generate a couple of uniform reactions from onlookers:1) they look amazing and 2) they’re amazingly expensive. …

LOTS of interesting stuff in the new IHS Markit Digital Signage & Professional Displays Market Analysis, this one for Q2 2017. Here’s the top-line stuff …

The latest Digital Signage & Professional Displays Market Analysis from IHS Markit – which the company makes available to Digital Signage Federation members – has …

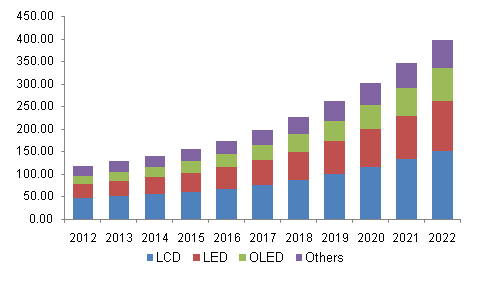

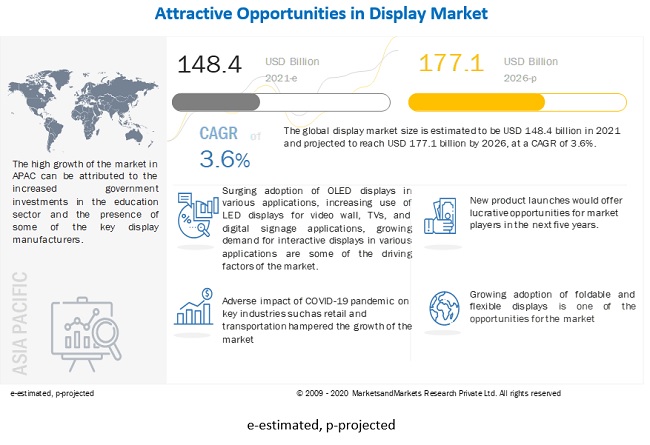

The global displays marketsize was estimated at USD 156.9 billion in 2021 and is expected to be worth around USD 297.1 billion by 2030 and anticipated to expand at a CAGR of 7.35% during the forecast period 2022 to 2030.

Screens that project information like pictures, movies, and messages are referred to as displays. Numerous technologies, including light-emitting diodes (LEDs), liquid crystal displays (LCDs), organic light emitting diodes (OLEDs), and others, are used in these display panels. Additionally, it plays a significant role in

Furthermore, display technologies like organic light-emitting diode (OLED) have become more crucial in items like televisions, smart clothing, cell phones, and other gadgets. In order to draw customers, smartphone makers also want to use flexible OLED screens. In addition, the market is also developing energy-saving gadgets, mainly for

The worldwide display market is expanding as a result of advancements in flexible displays, rising OLED display device demand, and the growing popularity of touch-based devices. However, barriers to market expansion include the expensive cost of cutting-edge display technologies like quantum dot and transparent displays, as well as the stalling growth of desktop, notebook, and tablet PCs. In addition, substantial development possibilities for the global display market are anticipated from new applications in flexible display technologies.

One of the key reasons fuelling the growth of the display market is the rise in demand for digital product and service promotion to get the attention of the target audience. The emergence of smart wearable gadgets, technical developments, and rising demand for OLED-based goods are all contributing to the market further.

Innovative items like leak detecting systems, home monitoring systems, and complex financial solutions are starting to appear, which has an additional impact on the industry. The industry is growing thanks to the use of organic light-emitting diode panels in televisions and smartphones. Additionally, the display market benefits from rising urbanisation, a shift in lifestyle, an increase in expenditures, and higher consumer spending.

The adoption of automated equipment by many industries for a variety of uses has a significant influence on displays, which are available with high efficiency at cheap cost and are anticipated to accelerate market expansion. Because they offer a long lifespan, great scalability, high intensity, high brightness, and more, embedded devices are widely utilised. The organic light emitting diode and liquid crystal display markets are supported by aspects like reasonable pricing, effective brightness, and longer life and are expected to expand at the quickest rate in the industry over the projected period. The increased usage of Displays by the healthcare, educational, and automotive sectors is anticipated to fuel market expansion.

The usage of Displays in 3D systems is another factor boosting the market"s expansion. The user can employ the sophisticated technologies in Displays for the 3 systems due to their quick development. The market is anticipated to increase significantly as a result of the adoption of 3D systems in the consumer, industrial, medical, automotive, and other sectors. These systems require displays to project the dimensions.

The flexible display technology has several benefits over rigid standard displays, which are often heavier. These benefits include light weight, flexibility, brightness, low power consumption, and shatter proofness. There are several consumer electronics products that employ these screens. The consumer electronics industry is expanding due to rising demand for products including smartphones, TVs, laptops, smart wearables, and other display devices.

Since touch-based gadgets are more accessible, the number of devices with touch sensors has grown tremendously in recent years. The proliferation of display devices is aided by the fact that touch-based gadgets need a display panel to function. As a result, a broad variety of home appliances, including the refrigerator, washing machine, microwave, etc., are enabled with the help of touch screens. The provision of cutting-edge display devices in automobiles, like the navigation system, heads-up display, digital rear-view mirrors, digital dashboard, and others, has also increased in the automotive sector. As a result, the market for displays is expanding due to the move toward touch-based technology.

Innovations in flexible displays, a growth in the demand for OLED display products, and a rise in the popularity of touch-based gadgets are what are driving the worldwide display market. However, the market is constrained by the expensive cost of cutting-edge display technologies like quantum dot and transparent displays, as well as the slow expansion of desktop, laptop, and tablet computers.Additionally, new applications for flexible display technologies, which are anticipated to produce profitable growth possibilities, are likely to boost the worldwide display market.

LCD technology has been widely utilised in display items during the preceding several decades. Currently, a number of settings, including retail, corporate offices, and banks, employ LCD-based gadgets. But it"s anticipated that LED technology will advance quickly throughout the course of the predicted period. The development of LED technology and its energy-efficiency are what are driving the demand for it. A disturbance in the supply-demand ratio, a decline in LCD display panel ASPs, and intense competition from emerging technologies are anticipated to push the LCD display sector into negative growth during the course of the projection period.

LED technology is predicted to drive market expansion because to its high pixel-pitch, brightness, improved efficiency, high light intensity, improved power efficiency, extended lifespan, and high scalability. Due to increased usage of displays in the automotive and medical sectors, where LED Displays are being utilised increasingly, the LED display market is anticipated to develop at a large and rapid 6.5% between 2022 and 2030.

The smartphones will make up a large percentage of the market. This rise will be fueled by the growing use of OLED and flexible displays by smartphone manufacturers. Shipments of expensive flexible OLED displays are growing quickly, and the forecast year is expected to see this trend continue. The market"s new development path has been identified as the smart wearables category. The demand for these gadgets is expected to soar throughout the projected period due to the fast-growing market for these products and the widespread use of AR/VR technology.

At 68%, the fixed device is anticipated to have the biggest market share over the projection period. Fixed devices are more widely accepted on the market than portable ones because of their low pricing, high scalability, longer life, contrast, and pixel quality, among other factors.

The aforementioned factors have increased the market adoption of fixed device, which is projected to drive the Display market. Both LED displays and Organic Light Emitting Diode are frequently used in these stationary devices.

In 2021, APAC will hold a 41% share of the global display market, followed by Europe. The industry-level research and development efforts in North America are constantly growing and advancing automated embedded device technology, which is raising the adoption rate of Display devices in industries including as healthcare, automotive, industrial, defence, and others. The market is anticipated to be stimulated by the huge number of end device makers in APAC. Since emerging nations like India, Japan, China, and others are constantly expanding the use of displays in a variety of industrial verticals, including wearables, smartphones, digital signage, medical, automotive, and other areas, the APAC region is thought to have the fastest growth for liquid crystal displays.

Other factors contributing to the market"s growth in the area include the expansion of display panel production facilities and the quick uptake of OLED displays. APAC has low labour expenses, which lowers the overall cost of producing display panels. The market is also being supported by the increasing use of display devices across a variety of sectors, particularly in China, India, and South Korea.

Samsung Electronics launched the first 15.6-inch OLED panel in the notebook industry in January 2019. Additionally, compared to 4K LCD-based displays, the panel will produce richer colours and deeper blacks.

Global Large Format Display (LFD) Market, By Offering (Displays, Controllers, Mounts and Other Accessories, Consulting and Other Services), Display Type (Video Wall, Standalone Display), Display Size (32–40 Inches, 41–60 Inches, 61–70 Inches, 71–80 Inches, More Than 80 Inches), Display Brightness (Less than 500 Nits, 501-1000 Nits, 1001-2000 Nits, 2001-3000 Nits, More than 3000 Nits), Application (Indoor, Outdoor), End User (Commercial, Infrastructural, Institutional, Industrial), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028.

Large format display (LFD) market size is valued at USD 20.67 billion by 2028 is expected to grow at a compound annual growth rate of 6.73% in the forecast period of 2021 to 2028. Data Bridge Market Research report on large format display (LFD) provides analysis and insights regarding the various factors expected to be prevalent throughout the forecasted period while providing their impacts on the market’s growth.

Large-format display (LFD) is a type of an output screens used for different purposes in numerous businesses and facilitate various advantages. The large screen display entails a format where information is displayed. These screens generally consist of LED, LCD, and plasma which are later connected to the television with the help of digital signage or HDMI.

The easy availability of highly bright HD LFDs offering better flexibility, stability, sustainability and environment resistance is expected to influence the growth of large format display (LFD) market over the forecast period of 2021 to 2028. Also the rapid innovation in direct-view fine-pixel led displays and their technological advantages are also anticipated to flourish the growth of the large format display (LFD) market. Furthermore, the high demand for Brighter and power-efficient LFDs in several applications and rise in the applications for digital signage are also likely to positively impact the growth of the market. Moreover, the implementation in the healthcare sector and low operational cost are also expected create a huge demand for large format display (LFD) as well as lifting the growth of the large format display (LFD) market.

However, the increased online or broadcast advertisement and use of wide screen alternatives such as projectors and screen-less displays are expected to act as the major limitations for the growth of large format display (LFD) in the above mentioned forecasted period, whereas the high product cost and fluctuation in the average selling price of display panels can challenge the large format display (LFD) market growth in the forecast period of 2021 to 2028.

Likewise, the rapid rise in the applications for flexible displays and rapid development of OLED and direct-view fine-pixel LED displays are expected to create various new opportunities that will lead to the growth of the large format display (LFD) market in the above mentioned forecasted period.

This large format display (LFD) market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on large format display (LFD) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Large format display (LFD) market is segmented on the basis of offering, display type, display size, display brightness, application and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Large format display (LFD) market is segmented on the basis of offering into displays, controllers, mounts and other accessories and consulting and other services.

On the basis of display type, the large format display (LFD) market is segmented into video wall and standalone display. Video wall has further been segmented into narrow bezel LED-backlit LCD, OLED, direct-view fine-pixel LED, direct-view large-pixel led and projection cube. Standalone display has further been segmented into LED-backlit LCD, OLED and e-paper.

Based on display size, the large format display (LFD) market is segmented into 32–40 inches, 41–60 inches, 61–70 inches, 71–80 inches and more than 80 inches.

The display brightness segment of the large format display (LFD) market is segmented into less than 500 nits, 501-1000 nits, 1001-2000 nits, 2001-3000 nits and more than 3000 nits.

Based on end user, the large format display (LFD) market is segmented into commercial, infrastructural, institutional and industrial. Commercial has further been segmented into retail, government, and command and control centers, corporate and broadcast, hospitality and healthcare. Infrastructural has further been segmented into sports and entertainment and transportation and public places. Institutional has further been segmented into education and banking, financial services, and insurance (BFSI).

Large format display (LFD) market is analyzed and market size, volume information is provided by country,offering, display type, display size, display brightness, application and end user as referenced above.

The countries covered in the large format display (LFD) market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA)as a part of Middle East and Africa (MEA).

North America leads the large format display (LFD) market because of the increase in investments for technological products and rise in the implementation in the healthcare sector and low operational cost. Asia-Pacific is expected to expand at a significant growth rate of over the forecast period of 2021 to 2028 owing to elevation in the manufacturing hub and execution of technological solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter"s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Large format display (LFD) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to large format display (LFD) market.

The major players covered in the large format display (LFD) market report are Samsung, LG Display Co. Ltd., NEC Corporation India Private Limited, Sharp NEC Display Solutions, Leyard Europe, Barco, Sony Corporation, E Ink Holdings Inc., AU Optronics Corp., DEEPSKY CORPORATION LTD., VTRON TECHNOLOGIES LTD, Shenzhen AOTO Electronics, Unilumin, ViewSonic Corporation, Koninklijke Philips N.V., Panasonic Corporation, Planar Systems Inc., PERVASIVE DISPLAYS, INC., Seiko Epson Corporation and CLEARink Displays, Inc., among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Sharp NEC Display Solutions incorporates both Sharp and NEC brands of display products. Including desktop, 4K and 8K UHD large format, video wall, dvLED, collaboration and interactive products, Sharp/NEC offers the widest portfolio of displays availabl

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey