large format lcd displays market made in china

China’s share of the world"s large display market is expected to exceed 50 percent for the first time ever. This year, Samsung Display and LG Display pull the plug on their LCD panel businesses due to declining profitability, letting China further strengthened its LCD market dominance.

Large-area display shipments this year are estimated at 894 million units, down 8 percent from 976 million units in the previous year, said market research firm Omdia on Dec. 16. Shipments based on display areas are also expected to decrease by 3 percent on year.

Omdia said IT displays, such as those for tablet PCs, notebook PCs and monitors, led the decline in shipments this year. TV manufacturers have also reduced panel procurement since the second quarter.

Chinese companies are strengthening their stranglehold on the large-size display market. China’s large-size display shipments are projected to account for 55.2 percent this year, outdistancing 24.9 percent of Taiwanese display makers and 14.7 percent of Korean display makers. In area-based shipments, China’s share is expected to reach 61.3 percent. During the same period, only 17.1 percent was projected for Taiwan and 15.4 percent for Korea.

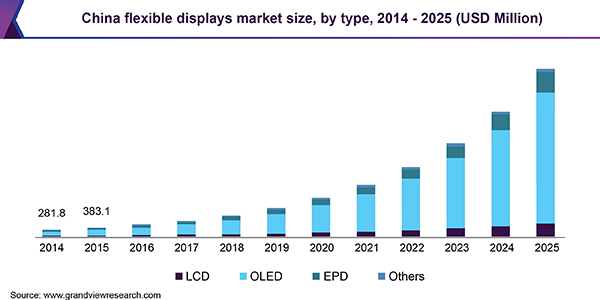

Chinese display makers are in hot pursuit of Korean display makers in the OLED panel domain, where Korean display makers have technological prowess. DSCC, a market research firm, predicted that China will account for 47 percent of OLED panel production in 2025, running shoulder to shoulder with Korea.

China’s new display industry has become the largest in the world, with an annual production capability reaching 200 million square meters, making it a vital force in upgrading information consumption and strengthening the digital economy, according to the Ministry of Industry and Information Technology (MIIT).

In 2021, the output value of China’s display industry reached about 586.8 billion yuan, a figure nearly eight times that of 10 years ago, data from the China Optics and Optoelectronics Manufactures Association LCB, or CODA, showed. The area of the country’s display panel shipments stood at about 160 million square meters, over seven times larger than 10 years ago. The size of China’s display industry and the area of its display panel shipments both ranked first in the world.

China has made breakthroughs in some core technologies in key fields. Chinese liquid crystal display (LCD) enterprises have broken technical barriers and taken 70 percent of the global market share. Chinese companies have also acquired key technologies in organic light emitting diode (OLED) and rapidly expanded their production scale. China is also catching up in new-generation display technologies.

According to CODA, China"s proportion of industry scale and display panel delivered area in the global market has increased to 36.9 percent and 63.3 percent respectively, ranking first in the world.

As for the organic light-emitting diode (OLED), domestic enterprises have mastered the core technologies and are making technological innovations in high refresh rate and pixel geometry and other fields. Meanwhile, production scale has expanded rapidly, and the market share of small- and medium-sized OLED increased.

Statistics show that in the third quarter of 2022, the market share of OLED panels for domestic smart phones accounted for 30 percent of the global market, an increase of 10 percent over the same period last year.

Los Angeles, Dec. 09, 2022 (GLOBE NEWSWIRE) -- The displays market size will reach at USD 180.82 billion in 2023. Text and images are shown on a screen, a computer output surface, and a projection surface using cathode ray tubes, LEDs, liquid crystal displays, or other technologies. It may be utilized in many different places, such as television, mobile devices, tablets, computers, automobiles, public transportation, and a lot more. The development of smart wearable technology, the rising demand for OLED-based goods, and the expansion of the display market are all major market drivers. However, businesses in the target market may see improved revenue possibilities as smart mirrors and smart displays become more prevalent in several end-use industries.

The growth of the display market is being fuelled by the use of organic light-emitting diode panels in smartphones and televisions. The usage of displays that are more advanced technologically, lighter, thinner, and more energy-efficient is another factor influencing target market expansion. In addition, it is anticipated that the rising customer preference for smart wearable’s would fuel the expansion of the display market in the near future. The high cost of technologically advanced display panels and fluctuating display panel costs, however, are impeding the growth of the worldwide display market.

Report highlights Over the course of the forecast period, it is anticipated that the display market will expand significantly, driven largely by an increase in the usage of displays by the automation, medical, wearable, and other industries.

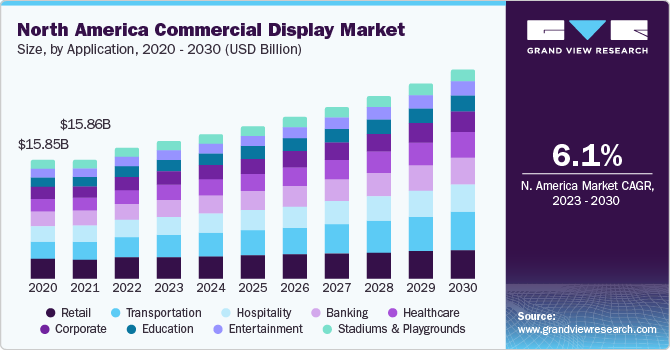

Increased market acceptance of automated embedded devices has a significant influence on the expansion of the displays industry. The Displays break into the market thanks to their affordable price and high-quality display. A market for displays is being created as a result of the recent increase in research and development for displays in North America, which has a significant influence on their acceptance by the automation and medical industries.

APAC leads the display market, followed by Europe. Due to the expansion of automation and other industries in nations like China, India, and others, the APAC area is also regarded as having the quickest development. of innovative skin products, which has an impact on the growth of the market.

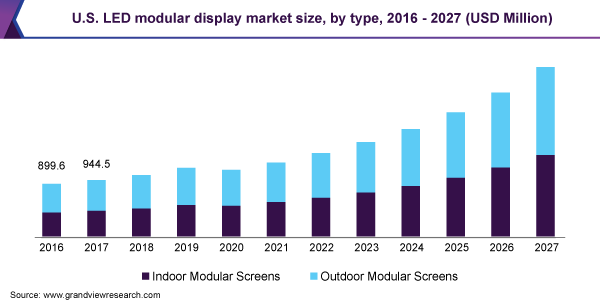

The rising use of OLED displays in smartphones, as well as significant investments in and government assistance for the establishment of new OLED and LCD panel production facilities, are the main reasons predicted to boost the targeted market. Other drivers promoting market growth include rising HUD, centre stack display, and instrument cluster deployment in automotive vehicles, as well as rising demand for 4K and 8K displays due to the availability of UHD content. For many purposes, LED displays are one of the most popular types of display technology. Compared to other technologies, it has a bigger share of the market. The LED display market has developed recently, although not in terms of innovation. The shrinking of the components required to construct an LED screen is one of the most recent developments in LED displays. LED screens can now be manufactured in ultra-thin and enormous sizes thanks to miniaturisation, enabling them to be placed on any indoor or outdoor surface. Applications for LEDs have increased significantly as a result of technical developments, including improved resolution, increased brightness capabilities, product diversity, and the creation of micro and harder surface LEDs. In order to make companies stand out from the competition, LED displays are also often utilised in digital signage applications, such as for advertising and digital billboards. For instance, the Samsung curved LED digital signage video wall was installed at the Peppermill Casino in Reno, Nevada, in August 2018. LED screens are therefore commonly utilised to enhance customer experience.

The increased usage of internet advertising is also largely due to increased investment on it by a number of significant firms, like Facebook and Google. The popularity of programmatic advertising is also rising. The term "programmatic advertising" refers to the use of data and automated systems to select media without the involvement of humans. As a result, the need for displays, which were formerly used to advertise goods and companies in stores and other public spaces, has decreased considerably.

Opportunities In recent years, tablets, smartphones, and laptops have all embraced foldable screens. Because they are made from flexible substrates, flexible display panels may be bent. Plastic, metal, or flexible glass can all be used as the flexible substrate. Metal and plastic panels are particularly strong, lightweight, and shatterproof. Flexible display technology, which is based on OLED panels, provides the foundation for foldable phones. Flexible OLED display panels are being produced in large quantities by businesses like Samsung and LG for use in smartphones, televisions, and smartwatches.

However, producers bend or twist these display panels and employ them in finished goods, making these displays less than flexible from the viewpoint of end users.

To stop the spread of COVID-19, many nations have imposed or are still enforcing lockdowns. The display market"s supply chain has been impacted by this, among other markets. Obstacles in the supply chain make it difficult for display makers to build and deliver their goods. The COVID-19 outbreak has had the greatest impact on display production in China. In contrast to the typical rate of 90 to 95 percent, the manufacturers were only permitted to use 70 to 75 percent of their capacity. For instance, Omdia Display, a Chinese maker of displays, forecasts a 40–50% decline in overall display output as a result of manpower, logistical, and quarantine shortages.

From January 7 to January 10, 2020, in Las Vegas, the CES 2020, LG Display presented its most recent displays and technological advancements. The business will release a 55-inch Full HD (FHD) Transparent OLED panel and a 65-inch Ultra HD (UHD) Bendable OLED display.

To create 10 million large-size OLED panels annually, LG Display stated in August 2019 that its 8.5th generation (2,200mm x 2,500mm) OLED panel production facility would open in Guangzhou, China.

Precedence Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Chinese companies have gained a competitive edge in the large-screen display industry and the exit of South Korean counterparts such as Samsung Electronics and LG Display from the liquid crystal display market will bring opportunities for China"s panel makers despite the challenges posed by the COVID-19 pandemic.

Market research firm Sigmaintell said BOE Technology Group Co Ltd-a leading Chinese supplier of display products and solutions-became the world"s largest shipper of LCD TV panels for the first time in 2019.

The Beijing-based company shipped 53.3 million units of LCD panels in 2019, with production capacity increasing by more than 20 percent on a yearly basis.

The consultancy said the LCD TV panel production area of Chinese manufacturers will account for more than 50 percent of the global total this year, surpassing South Korean competitors who are accelerating the shutdown of large-sized LCD panel production capacity due to competition from Chinese manufacturers.

It estimated the production capacity of large-sized LCD panels will continue to increase in China over the next three years. In addition, global LCD TV panel shipments stood at 283 million pieces last year, a slight decrease of 0.2 percent year-on-year. Meanwhile, the shipment area was 160 million square meters, an increase of 6.3 percent year-on-year.

"Chinese companies have gained an upper hand in large-screen LCD displays. Samsung and LG"s decision to exit from the LCD sector means Chinese panel makers will take a dominant position in this field," said Li Dongsheng, founder and chairman of Chinese tech giant TCL Technology Group Corp.

Li said South Korean firms will focus on organic LED screens and quantum dot LED displays, while Chinese TV panel makers are catching up at a rapid pace.

"The outbreak has caused a periodic drop in demand in the global display market and sped up the restructuring of the entire industry. Chinese enterprises are in a favorable position, and I believe that they will further enhance their competitiveness," Li said.

Data consultancy Digitimes Research said it comes as little surprise that Samsung has opted to withdraw from the LCD panel sector as its LCD business was losing money in every quarter of 2019 due to challenges from Chinese competitors.

"China"s semiconductor display industry has made large advances in the past decade, changing the display industry"s global competitive landscape. China has transformed into the world"s largest consumer market and manufacturing base for display terminals, with huge market potential," said BOE Vice-President Zhang Yu.

BOE said its Gen 10.5 TFTLCD production line achieved mass production in Hefei, Anhui province, in March 2018. The plant mainly produces high-definition LCD screens of 65 inches and above. With a total investment of 46 billion yuan ($6.5 billion), the company"s second Gen 10.5 TFT-LCD production line launched operations in Wuhan, Hubei province, in December.

The Gen 11 TFT-LCD and active-matrix OLED production line of Shenzhen China Star Optoelectronics Technology, a subsidiary of TCL, officially entered operations in November 2018, producing 43-inch, 65-inch and 75-inch LCD screens.

Bian Zheng, deputy director of research at AVC Revo, a unit of market consultancy firm AVC, said China will have a 51 percent market share in global TV shipments in 2020, while South Korea will have 25 percent, adding that large-screen TV panels will bolster healthy development of the industry.

Bian said the OLED and QLED will be the next-generation flat-panel display technologies to be in the spotlight. LG Display is currently the world"s only supplier of large-screen OLED TV panels.

OLED is a relatively new technology and part of recent display innovation. It has a fast response rate, wide viewing angles, super high-contrast images and richer colors. It is much thinner and can be made flexible, compared with traditional LCD display panels.

The global displays marketsize was estimated at USD 156.9 billion in 2021 and is expected to be worth around USD 297.1 billion by 2030 and anticipated to expand at a CAGR of 7.35% during the forecast period 2022 to 2030.

Screens that project information like pictures, movies, and messages are referred to as displays. Numerous technologies, including light-emitting diodes (LEDs), liquid crystal displays (LCDs), organic light emitting diodes (OLEDs), and others, are used in these display panels. Additionally, it plays a significant role in

Furthermore, display technologies like organic light-emitting diode (OLED) have become more crucial in items like televisions, smart clothing, cell phones, and other gadgets. In order to draw customers, smartphone makers also want to use flexible OLED screens. In addition, the market is also developing energy-saving gadgets, mainly for

The worldwide display market is expanding as a result of advancements in flexible displays, rising OLED display device demand, and the growing popularity of touch-based devices. However, barriers to market expansion include the expensive cost of cutting-edge display technologies like quantum dot and transparent displays, as well as the stalling growth of desktop, notebook, and tablet PCs. In addition, substantial development possibilities for the global display market are anticipated from new applications in flexible display technologies.

One of the key reasons fuelling the growth of the display market is the rise in demand for digital product and service promotion to get the attention of the target audience. The emergence of smart wearable gadgets, technical developments, and rising demand for OLED-based goods are all contributing to the market further.

Innovative items like leak detecting systems, home monitoring systems, and complex financial solutions are starting to appear, which has an additional impact on the industry. The industry is growing thanks to the use of organic light-emitting diode panels in televisions and smartphones. Additionally, the display market benefits from rising urbanisation, a shift in lifestyle, an increase in expenditures, and higher consumer spending.

The adoption of automated equipment by many industries for a variety of uses has a significant influence on displays, which are available with high efficiency at cheap cost and are anticipated to accelerate market expansion. Because they offer a long lifespan, great scalability, high intensity, high brightness, and more, embedded devices are widely utilised. The organic light emitting diode and liquid crystal display markets are supported by aspects like reasonable pricing, effective brightness, and longer life and are expected to expand at the quickest rate in the industry over the projected period. The increased usage of Displays by the healthcare, educational, and automotive sectors is anticipated to fuel market expansion.

The usage of Displays in 3D systems is another factor boosting the market"s expansion. The user can employ the sophisticated technologies in Displays for the 3 systems due to their quick development. The market is anticipated to increase significantly as a result of the adoption of 3D systems in the consumer, industrial, medical, automotive, and other sectors. These systems require displays to project the dimensions.

The flexible display technology has several benefits over rigid standard displays, which are often heavier. These benefits include light weight, flexibility, brightness, low power consumption, and shatter proofness. There are several consumer electronics products that employ these screens. The consumer electronics industry is expanding due to rising demand for products including smartphones, TVs, laptops, smart wearables, and other display devices.

Since touch-based gadgets are more accessible, the number of devices with touch sensors has grown tremendously in recent years. The proliferation of display devices is aided by the fact that touch-based gadgets need a display panel to function. As a result, a broad variety of home appliances, including the refrigerator, washing machine, microwave, etc., are enabled with the help of touch screens. The provision of cutting-edge display devices in automobiles, like the navigation system, heads-up display, digital rear-view mirrors, digital dashboard, and others, has also increased in the automotive sector. As a result, the market for displays is expanding due to the move toward touch-based technology.

Innovations in flexible displays, a growth in the demand for OLED display products, and a rise in the popularity of touch-based gadgets are what are driving the worldwide display market. However, the market is constrained by the expensive cost of cutting-edge display technologies like quantum dot and transparent displays, as well as the slow expansion of desktop, laptop, and tablet computers.Additionally, new applications for flexible display technologies, which are anticipated to produce profitable growth possibilities, are likely to boost the worldwide display market.

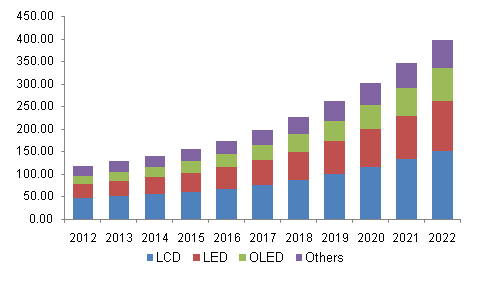

LCD technology has been widely utilised in display items during the preceding several decades. Currently, a number of settings, including retail, corporate offices, and banks, employ LCD-based gadgets. But it"s anticipated that LED technology will advance quickly throughout the course of the predicted period. The development of LED technology and its energy-efficiency are what are driving the demand for it. A disturbance in the supply-demand ratio, a decline in LCD display panel ASPs, and intense competition from emerging technologies are anticipated to push the LCD display sector into negative growth during the course of the projection period.

LED technology is predicted to drive market expansion because to its high pixel-pitch, brightness, improved efficiency, high light intensity, improved power efficiency, extended lifespan, and high scalability. Due to increased usage of displays in the automotive and medical sectors, where LED Displays are being utilised increasingly, the LED display market is anticipated to develop at a large and rapid 6.5% between 2022 and 2030.

The smartphones will make up a large percentage of the market. This rise will be fueled by the growing use of OLED and flexible displays by smartphone manufacturers. Shipments of expensive flexible OLED displays are growing quickly, and the forecast year is expected to see this trend continue. The market"s new development path has been identified as the smart wearables category. The demand for these gadgets is expected to soar throughout the projected period due to the fast-growing market for these products and the widespread use of AR/VR technology.

At 68%, the fixed device is anticipated to have the biggest market share over the projection period. Fixed devices are more widely accepted on the market than portable ones because of their low pricing, high scalability, longer life, contrast, and pixel quality, among other factors.

The aforementioned factors have increased the market adoption of fixed device, which is projected to drive the Display market. Both LED displays and Organic Light Emitting Diode are frequently used in these stationary devices.

In 2021, APAC will hold a 41% share of the global display market, followed by Europe. The industry-level research and development efforts in North America are constantly growing and advancing automated embedded device technology, which is raising the adoption rate of Display devices in industries including as healthcare, automotive, industrial, defence, and others. The market is anticipated to be stimulated by the huge number of end device makers in APAC. Since emerging nations like India, Japan, China, and others are constantly expanding the use of displays in a variety of industrial verticals, including wearables, smartphones, digital signage, medical, automotive, and other areas, the APAC region is thought to have the fastest growth for liquid crystal displays.

Other factors contributing to the market"s growth in the area include the expansion of display panel production facilities and the quick uptake of OLED displays. APAC has low labour expenses, which lowers the overall cost of producing display panels. The market is also being supported by the increasing use of display devices across a variety of sectors, particularly in China, India, and South Korea.

Samsung Electronics launched the first 15.6-inch OLED panel in the notebook industry in January 2019. Additionally, compared to 4K LCD-based displays, the panel will produce richer colours and deeper blacks.

Chinese companies have gained a competitive edge in the large-screen display industry and the exit of South Korean counterparts such as Samsung Electronics and LG Display from the liquid crystal display market will bring opportunities for China"s panel makers despite the challenges posed by the COVID-19 pandemic.

Market research firm Sigmaintell said BOE Technology Group Co Ltd-a leading Chinese supplier of display products and solutions-became the world"s largest shipper of LCD TV panels for the first time in 2019.

The Beijing-based company shipped 53.3 million units of LCD panels in 2019, with production capacity increasing by more than 20 percent on a yearly basis.

The consultancy said the LCD TV panel production area of Chinese manufacturers will account for more than 50 percent of the global total this year, surpassing South Korean competitors who are accelerating the shutdown of large-sized LCD panel production capacity due to competition from Chinese manufacturers.

It estimated the production capacity of large-sized LCD panels will continue to increase in China over the next three years. In addition, global LCD TV panel shipments stood at 283 million pieces last year, a slight decrease of 0.2 percent year-on-year. Meanwhile, the shipment area was 160 million square meters, an increase of 6.3 percent year-on-year.

"Chinese companies have gained an upper hand in large-screen LCD displays. Samsung and LG"s decision to exit from the LCD sector means Chinese panel makers will take a dominant position in this field," said Li Dongsheng, founder and chairman of Chinese tech giant TCL Technology Group Corp.

Li said South Korean firms will focus on organic LED screens and quantum dot LED displays, while Chinese TV panel makers are catching up at a rapid pace.

"The outbreak has caused a periodic drop in demand in the global display market and sped up the restructuring of the entire industry. Chinese enterprises are in a favorable position, and I believe that they will further enhance their competitiveness," Li said.

Data consultancy Digitimes Research said it comes as little surprise that Samsung has opted to withdraw from the LCD panel sector as its LCD business was losing money in every quarter of 2019 due to challenges from Chinese competitors.

"China"s semiconductor display industry has made large advances in the past decade, changing the display industry"s global competitive landscape. China has transformed into the world"s largest consumer market and manufacturing base for display terminals, with huge market potential," said BOE Vice-President Zhang Yu.

BOE said its Gen 10.5 TFTLCD production line achieved mass production in Hefei, Anhui province, in March 2018. The plant mainly produces high-definition LCD screens of 65 inches and above. With a total investment of 46 billion yuan ($6.5 billion), the company"s second Gen 10.5 TFT-LCD production line launched operations in Wuhan, Hubei province, in December.

The Gen 11 TFT-LCD and active-matrix OLED production line of Shenzhen China Star Optoelectronics Technology, a subsidiary of TCL, officially entered operations in November 2018, producing 43-inch, 65-inch and 75-inch LCD screens.

Bian Zheng, deputy director of research at AVC Revo, a unit of market consultancy firm AVC, said China will have a 51 percent market share in global TV shipments in 2020, while South Korea will have 25 percent, adding that large-screen TV panels will bolster healthy development of the industry.

Bian said the OLED and QLED will be the next-generation flat-panel display technologies to be in the spotlight. LG Display is currently the world"s only supplier of large-screen OLED TV panels.

OLED is a relatively new technology and part of recent display innovation. It has a fast response rate, wide viewing angles, super high-contrast images and richer colors. It is much thinner and can be made flexible, compared with traditional LCD display panels.

Introduction: Global LCD industry shift and automotive intelligence together to promote the rapid development of China’s LCD panel industry, which will bring a continuous increase in demand for backlight modules, China’s backlight module industry has greater potential for development.

LCD panel backlight module consists of a backlight light source, light guide, optical film, and a plastic frame, which is an important component of LCD display panel. As the backlight module has technology-intensive and labor-intensive attributes, with abundant high-skilled labor advantage China is attracting the global LCD panel industry to the domestic rapid transfer.

From LCD application to the present, the global LCD panel industry capacity transfer has gone through three periods, 2000 Japan dominated the global LCD industry; 2000 – 2010, Japan’s production capacity to South Korea and Taiwan; 2010 to the present, Japanese manufacturers gradually withdraw from the LCD panel industry, production capacity began to transfer to mainland China, so far, mainland China LCD production capacity has occupied the global half of the world.

In recent years, South Korea’s Samsung and LG display will shift their business focus to OLED, and will gradually shut down their LCD production lines and withdraw from the LCD panel industry; at the time of South Korean manufacturers’ withdrawal, domestic enterprises are stepping up new construction to expand LCD production capacity.

BOE, Huaxing photoelectric, Huike, CEC in 2020 – 2021, a total of eight 7 generation LCD production lines completed and put into operation, and domestic panel manufacturers have further expansion plans, the next few years domestic LCD production capacity will continue to increase.

LCD panel manufacturers tend to choose the nearby supporting module suppliers for the safety of the key component supply chain and cost reduction considerations. LCD panel production capacity transfer to China will bring opportunities to domestic backlight module manufacturers and drive the development of the domestic backlight module industry.

The future of the car will pay more attention to the human driving experience, to the intelligent development, which will bring the increasing demand for car display. On the one hand, the number of car displays gradually increased, for example, the instrument panel, rearview mirror, central control platform more to display the way, the passenger and rear position with entertainment display. On the other hand, the car display is constantly to a large screen, multi-screen development, especially in high-end models, the large display has become standard, for example, Tesla Model S screen size of 17 inches, Mercedes-Benz A-class car configuration of two 10.5-inch display.

At the same time, there is also a huge demand for new cars in China. Although China’s car sales have reached 25 million, the current per capita car ownership in China is only a quarter of the developed countries, the future potential for new car demand is still very large. Therefore, China’s car display market growth potential is large, which will directly drive the domestic backlight module demand continues to increase.

According to the terminal application size, backlight module can be divided into large, medium, and small size, of which small size backlight module is mainly used in smartphones, wearable devices, and other terminals, the medium size used in notebook computers, tablet PCs, car screens and other terminals, the large size is mainly used in LCD TV.

From the market competition pattern, the domestic backlight module enterprises are deeply plowed in their respective competitive advantage in the field of segmentation, including Baoming technology, Longli technology mainly layout small size cell phone display field, Hanbo high-tech, Weishi electronics mainly layout in the size of car display and notebook computer field, Rui Yi photoelectric and photoelectric in each field have layout.

From the industry development trend, smartphone display is transitioning to OLED, LCD TV market is gradually saturated, the future of large size and small size backlight module market potential is relatively small; and the future of the car display market potential is huge, by the backlight module manufacturers are unanimously optimistic, are currently accelerating the layout ( see Table 2 ). Focusing on the traditional medium-sized backlight module field, Hanbo Hi-Tech and Weishi Electronics have significant advantages in core technology patents, downstream customer resources, process experience accumulation, production costs, etc., and have more development advantages in the future.

The current global LCD display panel industry is rapidly moving to China, which brings development opportunities to China’s backlight module industry. In addition, automotive intelligence will also bring a continuous increase in demand for medium-sized car displays, the first to enter the field of medium-sized backlight module manufacturers with its customer resources, core technology, scale efficiency, and other advantages will be more beneficial.

The global industrial display market is expected to register a CAGR of 6.7% during 2022-2030, propelled by an increased focus on real-time monitoring of manufacturing facilities by various end-use industries such as automotive and transportation.

New York, Feb. 02, 2023 (GLOBE NEWSWIRE) -- As per the research report “Industrial Displays Market” published by Reports Insights, the market was worth USD 5.23 Billion in 2022 and is projected to reach over USD 8.79 Billion by the year 2030, growing at a CAGR of 6.7%.

Industrial Display Market Size, Share & Trends Analysis, By Display Type (LCD, LED, OLED and IPS) Product (Rugged, Scaler Board, Multi-touch (P-cap), Open Frame, Panel Mount, PoE Touch Monitor, USB Type-C, Rear Mount, Curved Monitor, Digital Signage Displays), Application (Human Machine Interface (HMI), Graphic/Signage, Industrial, Interactive Display (Kiosk), Imaging and Others), End Use (Manufacturing, Energy & Power, Automotive & Transportation, Oil & Gas, Metals & Mining and Others), By Region and Segment, Forecast Period 2022 – 2030.

Industrial displays are referred to as electronic displays that are specifically designed for use in various industrial environments, typically in manufacturing, process control, and automation applications. Such displays are mainly adopted by manufacturers due to their rugged construction, wide temperature range, high brightness, and compatibility with industrial control systems. The displays are also built to meet specific requirements such as protection against harsh environments, shock, vibration, and electromagnetic interference. Thus, such industrial displays are used for various purposes such as displaying process information, machine status, or operator instructions.

Further, industrial displays are designed to display information about performance and settings to provide a user interface for machine operators. Thus, such displays for monitoring several industrial processes such as manufacturing, material handling, and assembly. Moreover, industrial displays are used to display security cameras and alarms along with safety warnings and alerts to track and control access to industrial sites. However, one of the most crucial aspects of industrial requirements is data visualization. Manufacturers integrate such industrial displays within manufacturing facilities to display real-time data from sensors such as temperature, pressure, and flow, and create analysis and reporting in terms of historical data. Also, several industrial displays are used as digital signage to display advertising, information, and other content in public areas such as airports, shopping centers, and transportation hubs.

The current market for industrial displays is expected to witness sudden growth due to rising demand from various industries. Increased demand for high-resolution and high-brightness displays is mainly driven by the need for more detailed and accurate information displays in industrial environments. Moreover, advancements in display technologies in terms of new display technologies such as OLED and micro-LED are largely being adopted among consumers. Such increased demand is mainly due to the need for higher contrast, better color accuracy, and longer lifespan as compared to conventional LCDs.

By ProductRugged, , Multi-Touch (P-Cap), Scaler Board, Open Frame, Panel Mount, Poe Touch Monitor, Digital Signage Displays USB Type-C, Rear Mount, Curved Monitor,

Report CoverageGrowth Factors, Regional Competitive Landscape, Company Ranking and Market Share, Total Revenue Forecast, Business Strategies, and more.

Key Market HighlightsThe global industrial display market size is projected to surpass USD 8.79 billion by 2030 and grow at a CAGR of 6.7% during the forecast period (2022-2030).

In the context of the product, the market is divided into rugged, scaler board, multi-touch (P-cap), open frame, panel mount, PoE touch monitor, USB type-C, rear mount, curved monitor, and digital signage displays.

The market is also categorized by application: human-machine interface (HMI), graphic/signage, industrial, interactive display (kiosk), imaging, and others.

In the context of end users, the market is categorized as manufacturing, energy & power, automotive & transportation, oil & gas, metals & mining, and others.

North America and Asia Pacific are anticipated to support the market growth during the forecast period in terms of the growing adoption of technology advancements by market players within manufacturing facilities.

Based on display type,the LCD segment contributed the largest shares to the market growth in 2021. A large number of market players offer industrial displays as LCD type. Major industries opt for LCD as industrial displays as a reliable and cost-effective solution for various industrial applications such as machine control panels, process control systems, digital signage, and others. Moreover, the technology has advanced significantly over the years, with advancements in resolution, color accuracy, brightness, and durability. Thus, with the increasing demand for compact and energy-efficient displays, established firms are continuing to invest in the development of new LCD technologies to meet such requirements.

Based on the product,the open-frame segment is anticipated to contribute the largest shares to the market growth in terms of volume. An open frame display is a display module that is offered without an enclosure or bezel. Such a frameless interface allows easy integration into a custom system. Thus, such displays are typically used in automation and control systems, medical equipment, point-of-sale systems, and others which require highly versatile display alternatives as per the evolving requirements.

Based on application,the human-machine interface (HMI) segment is contributed substantial shares to the market growth. The growing integration of industrial displays within HMI is due to the need for a graphical interface between an operator and a machine or process. Such interfaces offer users real-time monitoring and control of the production line. HMI displays are used in various manufacturing applications such as production line management systems, process control systems, and machine control panels, among others.

Based on end use, the manufacturing segment contributed the largest market share over 34.6% to the market growth. Such largest segment contribution is mainly attributed to the growing focus on technology advancements by manufacturers. Such high adoption of technologies is due to the growing need for consumer goods and electronics among the population. Thus, several manufacturing facilities rely on such industrial displays embedded within HMIs to gain access to real-time industrial activities in terms of raw material input, ongoing processing units, labor management, and others.

Based on region, North America is anticipated to contribute the largest shares to the market growth during the forecast period. The emerging adoption of technology advancements such as IIoT and HMI within manufacturing facilities supports the demand for industrial displays. Also, the strong presence of market players in this region fuels the market demand. This is also facilitated by the growing rate of mergers and acquisitions among industry players for joint ventures for introducing product innovations.

The market research report examines several market parameters to identify the major market drivers, restraints, and opportunities currently being considered by market players. Further, other factors such as SWOT analysis, regional evaluation, and segmental estimation provide a detailed overview of market circumstances. Thus, such evaluation helps in identifying several growth opportunities across several adoptions of technologies, product applications, business strategies, and new product launches. Listed are key players currently functioning in the market —Litemax

Optical Sorter Market Size, Share & Trends Analysis, By Product Type: (Cameras, Lasers, NIR Sorters, Hyperspectral Cameras & Combined Sorters, and Others) End Use (Food & Beverage, Recycling Industry, Mining Industry, Pharmaceutical, and Others), By Region, Forecast Period 2022 - 2030

Precision Resistor Market Size, Share & Trends Analysis, By Type: (Metal Film Precision Resistors, Wire Wound Precision Resistors, Metal Foil Precision Resistors), Application (Test & Measurement Equipment, Medical Equipment, Semiconductors, Telecommunication, Industrial Automation, Military Equipment, and Others), By Region, Forecast Period 2022 - 2030

In-Home Display Market Size, Regional Trends, Growth, By Regions (North America, Europe, Asia Pacific, South America, Middle East And Africa), Segment Analysis, Key Technology Landscape, Market Dynamics, and Forecast (2023-2030)

Micro and Mini LED display Market Size By Types( Micro LED, Mini LED), By Application( Consumer Electronics, Automotive, Aerospace and Defence, Other End Users), By Regional(North America, Europe, South America, Asia Pacific, Middle East And Africa), Post COVID-19 Impact Analysis, Price Trends, Competitive Shares, Market Statistics and Forecast 2022 - 2030

Surgical Loupes Market Size, Share & Trends Analysis Report by Loupe Type (Galilean Type, Prismatic Type), by Loupe Design (Through-The-Lens, Flip Up), by End-Use (Hospitals, Ambulatory Surgical Centers), and Region, Forecast Period-2022 – 2028CONTACT: About Reports Insights Consulting Pvt Ltd ReportsInsights Consulting Pvt Ltd. is the leading research industry that offers contextual and data-centric research services to its customers across the globe. The firm assists its clients to strategize business policies and accomplish sustainable growth in their respective market domains. The industry provides consulting services, syndicated research reports, and customized research reports. Topnotch research organizations and institutions to comprehend the regional and global commercial status use the data produced by ReportsInsights Consulting Pvt Ltd. Our reports comprise in-depth analytical and statistical analysis on various industries in foremost countries around the globe. Contact: Email: sales@reportsinsights.com USA: +1-214-272-0393 Europe: +44-20-8133-9198

The global display market size was USD 155.20 Billion in 2022 and is expected to register a revenue CAGR of 3.6% during the forecast period. Steady market revenue growth can be attributed to increasing popularity of Organic Light Emitting Diode (OLED) displays. OLED displays can be found in wearable technology, light panels, smartphones, tablets, and Televisions (TVs) and monitors. Since their initial release in 2013, OLED products for computer monitors and televisions have dominated the market for high-end displays. Currently, a wide variety of OLED products, including flat and curved panel TVs and so-called OLED wallpaper, are offered in commercial display marketplaces. It took longer for Organic Light Emitting Diodes (OLEDs) to become widely used in mobile devices, but as of 2016, the majority of innovative smartphones and tablets are made with Active-Matrix OLEDs (AMOLEDs). These achieve exceptional levels of activation speed, a requirement for Ultra-High Definition (UHD) portable devices with high pixel counts, by using an extra semiconducting film underneath the main screen.

Rising applications of Light Emitting Diode (LED), such as video walls, is another factor driving revenue growth of the market. LED display video walls are quite popular and useful in most sectors right now. As a result, it aids in driving consumer involvement for the company. With use of Active LED displays, there are countless options and marketing opportunities in the current increasingly modern corporate world. Conventional company strategies are becoming increasingly outmoded as a result of rising challenges and increased use of innovation. All types of businesses can benefit from marketing. LED display need the ideal combination of creativity and motivation to capture the interest of each potential business client.

Increasing popularity of online advertising and shopping could restrain revenue growth of the market. Digital advertising is now more sophisticated, tailored, and relevant. As a result, online advertising has become more commonplace recently. In addition, increasing use of the Internet among people across the globe, coupled with rising trend of using social media platforms by various companies are factors resulting in high adoption of digital advertising. Increased use of the Internet advertising is also largely due to bigger businesses such as Facebook and Google spending more money on it. Use of automated algorithms and data to choose media without human intervention is known as programmatic advertising, and it is also gaining popularity. As a result, need for displays, which were formerly used to advertise goods and companies in stores and other public spaces, has decreased significantly.

In addition, fluctuating prices of the displays and high cost of technologies such as quantum dot display, leading to high cost on the end product are some other factors that could hamper revenue growth of the market to some extent.

One of the recent trends observed in the global market is increasing use of flexible displays. Flexible displays are an intriguing technological advancement as they can support slim, lightweight, and distinctive form. Flexible displays are used in wearables, vehicle Head-Up Displays (HUDs), and smartphones as they also offer low-cost roll-to-roll production. A rollable display can be constructed using a variety of technologies, such as electronic ink, gyricon, Organic LCD (OLCD), and OLED. In addition, these displays are less likely to break compared to rigid glass substrate-based displays. Foldable phones and electronic paper for dynamic posters and signs are two common applications for flexible displays.

Based on display technology, the display market is segmented into Liquid Crystal Display (LCD), OLED, micro-LED, direct-view LED, and others. The LCD segment is expected to account for largest revenue share in the global market over the forecast period. An LCD operates primarily using liquid crystals. LCD offers a wide range of applications for consumers and enterprises due to its frequent use in TVs, computers, instrument panels, and cellphones. LCDs represented a significant innovation compared to Light-Emitting Diode (LED) and gas-plasma displays. LCDs permitted screens to be far thinner compared to Cathode Ray Tube (CRT) technology. As opposed to LED and gas-display displays, LCDs operate on the idea of blocking light rather than emitting it, which results in a significant reduction in power consumption. The liquid crystals in an LCD use a backlight to form an image where an LED emits light.

The OLED segment is expected to register a steady revenue growth rate during the forecast period owing to its rising demand. OLED is a device that emits light when an electric current is supplied between the anode and cathode of each of its small picture components, or pixels, formed of organic chemical compounds. This procedure functions similarly to a typical LED, which emits light by recombining electrons and holes from the cathode and anode. OLEDs and LCDs are both employed in display devices; however, they present information on the screen very differently. An OLED is a form of emissive display, which means it is self-illuminating. However, an LCD uses transmissive or transflective technologies to display information, which implies that picture lighting is provided by various means such as a backlight, ambient light, or the sun.

Based on product type, the display market is segmented into smartphones, television sets, Personal Computer (PC) monitors & laptops, display/large format displays, automotive displays, tablets, smart wearables, and others. The smartphones segment is expected to account for largest revenue share in the global market over the forecast period. Smartphones use a variety of display technologies, including LCD, OLED, AMOLED, Super AMOLED, Thin Film Transistor (TFT), In-plane Switching (IPS), and a few less common ones such as TFT-LCD. The IPS-LCD is currently one of the most common display types on mid- to high-end phones. In a nutshell, LCD and OLED are the two types of display technology now on the market for smartphones. Similar to televisions and their various ranges such as LED, QLED, and miniLED - which are all essentially versions of LCD technology - each of them has a number of modifications and generations.

The television sets segment is expected to register steady revenue growth rate during the forecast period owing to its rising demand. The landscape of TV display technology has significantly changed in recent years. There were several new technologies, ranging from OLED to QLED and 4K to 8K. It complicates the decision to purchase a TV. There are several possibilities for TV display technology, which becomes difficult to choose them. Customers are inundated with technical terms, including QLED, OLED, LED, Nano Cell, LCD, etc. when they go to any electronics store to buy a new TV.

Based on vertical, the global display market is segmented into consumer, automotive, sports & entertainment, transportation, retail, hospitality, & Banking, Financial Services and Insurance (BFSI), industrial & enterprise, education, healthcare, defense & aerospace, and others. The consumer segment is expected to account for largest revenue share in the global market over the forecast period. Big box retailers and common department stores both carry consumer displays. It is the typical home television. For convenience of use, speakers are incorporated into the visual component. They can also feature a table stand and a tuner. These displays are intended for use in the home. An average consumer can use its display for a few hours per day. These displays can be up for much more hours in a professional setting, sometimes longer than the average 8-hour workday. Certain consumer displays are capable of ‘automatic power’ or ‘auto-switching.’ However, these features vary between manufacturers and even within their own models.

The automotive segment is expected to register a steady revenue growth rate during the forecast period. Since the outset, LCD screens in automobiles have been flat, rectangular, and poor resolution. But as the cockpit evolves into a sophisticated mobile digital assistant, demand for larger, higher-resolution, and more immersive screens becomes high. Future cockpit screens will be curved and have far higher resolutions than existing monitors. Mobile devices have had an impact on display requirements in all spheres of life and raised consumer expectations, including those for cars. More and more, consumer-market technological advancements are being incorporated into automobiles.

The market in North America is expected to account for largest revenue share during the forecast period, which is attributed to increasing activities by key market players in various countries in the region. For instance, a new foldable display that is intended to be crack-resistant was unveiled via Apple"s most recent patent. The new patent has the patent number U.S.-20230011092-A1 and was issued by the U.S. Patent and Trademark Office. One of the major problems with foldable devices is their fragility, and the product is more durable, it can assist with fragility of foldable devices. Multiple layers, including a flexible substrate, a thin-film transistor layer, and a protective layer, are present in the display created by the new technique. Since the flexible substrate is the area of the display that is most vulnerable to harm, the protective layer seeks to stop cracks from forming there. A patent for a self-healing display has also been issued to the iPhone manufacturer.

The market in Asia Pacific is expected to register fastest revenue CAGR over the forecast period. This is owing to increasing initiatives in various countries in the region. For instance, in 2022, China replaced South Korea as the market leader in the display sector, which it had held for many years. The Chinese display panel industry reached a significant turning point in 2021. According to research, Chinese display panel manufacturers, led by companies such as BOE Technology Group Co, Shenzhen China Star Optoelectronics Technology Co, Tianma, and Visionox, accounted for a combined 40.4% of the global market share in turnover, surpassing South Korea"s 36.3%. In 2020, South Korean companies led with a market share of 39.8%, 4.8% points higher than China. It was the first time that Chinese companies owned a larger market share than its South Korean rivals, primarily Samsung Display and LG Display.

The market in Europe is expected to register a steady revenue growth rate over the forecast period, which is attributed to rising innovations by key market players in various countries in the region. On 28 November 2022 for instance, the Find N Fold and Find N Flip names were trademarked by Oppo with the European Union (EU) Intellectual Property Office. According to the company, Flip and Foldable phones are the future, and Europe will get the next generation of Oppo"s foldable phones.

The global display market is fragmented, with many large and medium-sized players accounting for the majority of market revenue. Major companies are deploying various strategies, entering into mergers & acquisitions, strategic agreements & contracts, developing, testing, and introducing more effective displays. Some major players included in the global display market report are:

For the purpose of this report, Emergen Research has segmented the global display market on the basis of resolution, display technology, panel size, product type, vertical, and region:

Large Format Display (LFD) Market size was valued at USD 11.25 Billion in 2019 and is projected to reach USD 18.02 Billion by 2027, growing at a CAGR of 6.54% from 2020 to 2027.

The growth of the Large Format Display (LFD) Market can be credited to the growth of professional displays include increasing innovation in direct-view LED displays and their technological advantages.The Global Large Format Display (LFD) Market report provides a holistic evaluation of the market. The report comprises various segments as well as an analysis of the trends and factors that are playing a substantial role in the market.

Large-format displays are flat-screen displays that are sleek and have a very minimal design. This allows businesses to display messages and presentations to customers and visitors. They have very thin bezels and are usually mounted onto walls and are the prime focus of the room. The size of large format displays ranges from 32” to 90” and is available in 90” plus sizes. The large-format display can be used independently or grouped for a multi-screen display, to act as a storyboard.

The LFDs usually have an array of ports and adapters to play various types of media. Depending upon the business perspective each large-format display screen is different and offers various advantages. Some LFDs are also an available touch screen. With the help of LFDs businesses can display posters, averts, or general messages. LFDs can also be for outside applications such as outdoor sports.

The growth global Large Format Display (LFD) Market can be attributed to the rising international and sports events across the globe. Rapid global urbanization and modernization are also aiding the growth of the market. The technological advancements and innovations in the field of LFDs are the key factors that are fueling the growth of the Large Format Display (LFD) Market. The latest LFDs consume less power and provide better image quality. The laser phosphorous displays are the new edge technology that is anticipated to replace LCD and LFD displays in near future.

The companies which are manufacturing large format displays have started to include features such as simultaneous remote control of multiple large-format displays that enable operators to simultaneously control multiple displays remotely utilizing devices like personal computers. Owing to rising consumer demand the companies are always trying to innovate and woo the customers.

However, some restraints are limiting the growth of the Large Format Display (LFD) Market. The cost associated with the purchase of these smart TVs is very high and in case of some issue with the displays then the repair costs are also high. Furthermore, the consumers are also moving to low-cost alternatives such as projectors and screen displays as they provide the same widescreen viewing experience.

The Global Large Format Display (LFD) Market is segmented on the basis of Display Type, Offering, Application, Display Brightness, Vertical, and Geography.

Based on Display Type, the market is segmented into Video Wall and Standalone Display. The video wall display technology is bifurcated into Narrow Bezel LED-Backlit LCD, OLED, Direct-View Fine-Pixel LED, Direct-View Large-Pixel LED, and Projection Cube. The standalone display technology is bifurcated into LED-Backlit LCD, OLED, and E-Paper. The display size segment is bifurcated into 32–40 Inches, 41–60 Inches, 61–70 Inches, 71–80 Inches, and More Than 80 Inches. The video wall segment is anticipated to dominate the market over the forecast period.

There have been many technological developments in the field of LFD since the last decade. The bulky and space-consuming devices have evolved into slim and bezel fewer devices. Owing to these technological advancements in direct view fine pixel LEDs the market for the same is growing exponentially. Furthermore, the huge competition in the market drives the innovation and development of these devices. These devices have almost no bezels and can be tilted together to form a completely seamless and limitless video wall.

Based on Offering, the market is segmented into Displays, Controllers, Mounts, and Other Accessories and Consulting and Other Services. The display segment is anticipated to dominate the market over the forecast period. The display contributes largely to the LFD market compared to other services and accessories.

Based on Application, the market is segmented into Indoor and Outdoor. The large-format displays for the indoor application segment contributed to three times the market share compared with large format displays for the outdoor application segment. The large contribution of indoor applications can be credited to the use of more costly displays such as LCD and OLEDs.

Based on Display Brightness, the market is segmented into Up to 500 Nits, 501–1000 Nits, 1001–2000 Nits, 2001–3000 Nits, and More Than 3000 Nits. The high brightness LCDs and video walls are anticipated to dominate the market owing to high brightness. The traditional flat panel and video walls when used for outdoor applications are subjected to high ambient life which disturbs the viewing experience and hence the high brightness displays are much more preferred. However, depending upon the application one may choose a different type of display.

Based on Vertical, the market is segmented into Commercial, Infrastructural, Institutional, and Industrial. The Commercial segment is further bifurcated into Retail, Government, and Command and Control Centers, Corporate and Broadcast, Hospitality, and Healthcare. The infrastructural segment is further bifurcated into Sports and Entertainment and Transportation and Public Places.

The institutional segment is further bifurcated into Education, Banking, Financial Services, and Insurance (BFSI). The commercial industry segment held the largest market share in 2016 however the infrastructure segment like sports and entertainment industries are anticipated to witness rapid growth over the forecast period. The direct-view fine pixel LED displays have a huge demand in transportation, public places, sports, and entertainment venues.

Based on Geography, the Global Large Format Display (LFD) Market is classified into North America, Europe, Asia Pacific, and the Rest of the world. The largest share in the market will be dominated by the Asia Pacific. The dominance of this region can be credited to the presence of major display panel manufacturers, various brand product manufacturers in the said region. In North America, the newer and high-cost displays such as OLED will have huge demand.

The “Global Large Format Display (LFD) Market” study report will provide valuable insight with an emphasis on the global market. The major players in the market are Samsung Electronics Co., Ltd, LG Display Co., Ltd., NEC Corp., Sharp Corp. (Foxconn), Leyard Optoelectronic Co., Ltd., Barco NV, Sony Corp., TPV Technology Ltd., E Ink Holdings, Inc., Au Optronics Corp.The competitive landscape section also includes key development strategies, market share, and market ranking analysis of the above-mentioned players globally.

• On July 2, 2021, South Korean battery makers Samsung SDI are considering investing in the US to meet the growing demand for electric vehicles, industry sources said on Friday, almost speculating about possible partnerships with major car manufacturers. Samsung Electronics’ battery arm reviewed various options to build a new battery factory in the U.S. to provide potential customers but remain vigilant with its system despite rising market expectations.

To know more about the Research Methodology and other aspects of the research study, kindly get in touch with our Sales Team at Verified Market Research.

• Analysis by geography highlighting the consumption of the product/service in the region as well as indicating the factors that are affecting the market within each region

• Competitive landscape which incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled

• The current as well as the future market outlook of the industry with respect to recent developments which involve growth opportunities and drivers as well as challenges and restraints of both emerging as well as developed regio

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey