large format lcd displays market pricelist

Planar® CarbonLight™ VX Series is comprised of carbon fiber-framed indoor LED video wall and floor displays with exceptional on-camera visual properties and deployment versatility, available in 1.9 and 2.6mm pixel pitch (wall) and 2.6mm (floor).

From cinema content to motion-based digital art, Planar® Luxe MicroLED Displays offer a way to enrich distinctive spaces. HDR support and superior dynamic range create vibrant, high-resolution canvases for creative expression and entertainment. Leading-edge MicroLED technology, design adaptability and the slimmest profiles ensure they seamlessly integrate with architectural elements and complement interior décor.

From cinema content to motion-based digital art, Planar® Luxe Displays offer a way to enrich distinctive spaces. These professional-grade displays provide vibrant, high-resolution canvases for creative expression and entertainment. Leading-edge technology, design adaptability and the slimmest profiles ensure they seamlessly integrate with architectural elements and complement interior decor.

From cinema content to motion-based digital art, Planar® Luxe MicroLED Displays offer a way to enrich distinctive spaces. HDR support and superior dynamic range create vibrant, high-resolution canvases for creative expression and entertainment. Leading-edge MicroLED technology, design adaptability and the slimmest profiles ensure they seamlessly integrate with architectural elements and complement interior décor.

Planar® CarbonLight™ VX Series is comprised of carbon fiber-framed indoor LED video wall and floor displays with exceptional on-camera visual properties and deployment versatility, available in 1.9 and 2.6mm pixel pitch (wall) and 2.6mm (floor).

Carbon fiber-framed indoor LED video wall and floor displays with exceptional on-camera visual properties and deployment versatility for various installations including virtual production and extended reality.

a line of extreme and ultra-narrow bezel LCD displays that provides a video wall solution for demanding requirements of 24x7 mission-critical applications and high ambient light environments

Since 1983, Planar display solutions have benefitted countless organizations in every application. Planar displays are usually front and center, dutifully delivering the visual experiences and critical information customers need, with proven technology that is built to withstand the rigors of constant use.

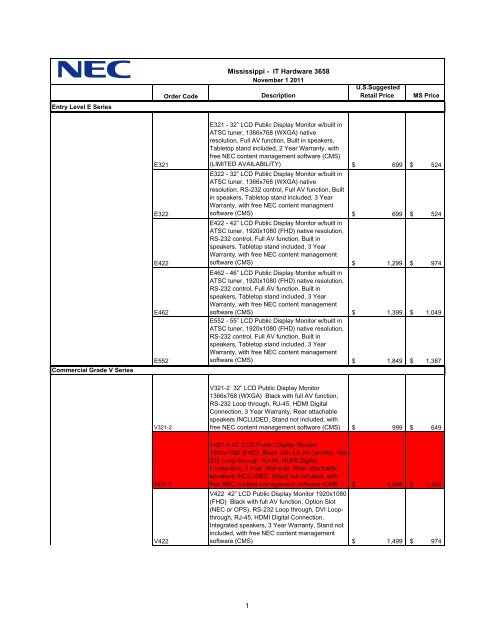

Order CodeMississippi - IT Hardware 3658November 1 2011DescriptionU.S.SuggestedRetail PriceMS PriceEntry Level E SeriesCommercial Grade V SeriesE321E322E422E462E552E321 - 32” LCD Public Display Monitor w/built inATSC tuner, 1366x768 (WXGA) nativeresolution, Full AV function, Built in speakers,Tabletop stand included, 2 Year Warranty, withfree NEC content management software (CMS)(LIMITED AVAILABILITY) $ 699 $ 524E322 - 32” LCD Public Display Monitor w/built inATSC tuner, 1366x768 (WXGA) nativeresolution, RS-232 control, Full AV function, Builtin speakers, Tabletop stand included, 3 YearWarranty, with free NEC content managmentsoftware (CMS) $ 699 $ 524E422 - 42” LCD Public Display Monitor w/built inATSC tuner, 1920x1080 (FHD) native resolution,RS-232 control, Full AV function, Built inspeakers, Tabletop stand included, 3 YearWarranty, with free NEC content managementsoftware (CMS) $ 1,299 $ 974E462 - 46” LCD Public Display Monitor w/built inATSC tuner, 1920x1080 (FHD) native resolution,RS-232 control, Full AV function, Built inspeakers, Tabletop stand included, 3 YearWarranty, with free NEC content managementsoftware (CMS) $ 1,399 $ 1,049E552 - 55” LCD Public Display Monitor w/built inATSC tuner, 1920x1080 (FHD) native resolution,RS-232 control, Full AV function, Built inspeakers, Tabletop stand included, 3 YearWarranty, with free NEC content managementsoftware (CMS) $ 1,849 $ 1,387V321-2V321-2 32” LCD Public Display Monitor1366x768 (WXGA) Black with full AV function,RS-232 Loop through, RJ-45, HDMI DigitalConnection, 3 Year Warranty, Rear attachablespeakers INCLUDED, Stand not included, withfree NEC content management software (CMS) $ 999 $ 649V421-2V422V421-2 42” LCD Public Display Monitor1920x1080 (FHD) Black with full AV function, RS-232 Loop through, RJ-45, HDMI DigitalConnection, 3 Year Warranty, Rear attachablespeakers INCLUDED, Stand not included, withfree NEC content management software (CMS $ 1,699 $ 1,104V422 42” LCD Public Display Monitor 1920x1080(FHD) Black with full AV function, Option Slot(NEC or OPS), RS-232 Loop through, DVI Loopthrough,RJ-45, HDMI Digital Connection,Integrated speakers, 3 Year Warranty, Stand notincluded, with free NEC content managementsoftware (CMS) $ 1,499 $ 9741

Order CodeMississippi - IT Hardware 3658November 1 2011DescriptionU.S.SuggestedRetail PriceMS PriceV422-AVTV462V422 42” LCD Public Display Monitor 1920x1080(FHD) Black with full AV function and ATSCTuner, Option Slot (NEC or OPS), RS-232 Loopthrough, DVI Loop-through, RJ-45, HDMI DigitalConnection, Integrated speakers, 3 YearWarranty, Stand not included, with free NECcontent management software (CMS) $ 1,599 $ 1,039V462 46” LCD Public Display Monitor 1920x1080(FHD) Black with full AV function, Option Slot(NEC or OPS), RS-232 Loop through, DVI Loopthrough,RJ-45, HDMI Digital Connection,Integrated speakers, 3 Year Warranty, Stand notincluded, with free NEC content managementsoftware (CMS) $ 1,999 $ 1,299V462-AVTV651V462 46” LCD Public Display Monitor 1920x1080(FHD) Black with full AV function and ATSCTuner, Option Slot (NEC or OPS), RS-232 Loopthrough, DVI Loop-through, RJ-45, HDMI DigitalConnection, Integrated speakers, 3 YearWarranty, Stand not included, with free NECcontent management software (CMS) $ 2,099 $ 1,364V651 65” LCD Public Display Monitor 1920x1080(FHD) Black with full AV function, Option Slot(NEC or OPS), RS-232 Loop through, DVI Loopthrough,RJ-45, HDMI Digital Connection,Integrated speakers, 3 Year Warranty, Stand notincluded, with free NEC content managementsoftware (CMS) $ 6,999 $ 4,549Professional Grade X SeriesV651-AVTV651 65” LCD Public Display Monitor 1920x1080(FHD) Black with full AV function and ATSCTuner, Option Slot (NEC or OPS), RS-232 Loopthrough, DVI Loop-through, RJ-45, HDMI DigitalConnection, Integrated speakers, 3 YearWarranty, Stand not included, with free NECcontent management software (CMS) $ 7,099 $ 4,614X461SX461S, 46" Super Slim Depth LCD Public DisplayMonitor, 1920x1080 (FHD), with AV function,Professional Grade w/24x7 operation, Edge litLED back lit unit, Tilt free operation, 1.70" unitdepth, 41.7 lbs, SMNP support, 3yr warranty, withfree NEC content management software (CMS) $ 3,499 $ 2,449X551SX551S, 55" Super Slim Depth LCD Public DisplayMonitor, 1920x1080 (FHD), with AV function,Professional Grade w/24x7 operation, Tilt freeoperation, 1.70" unit depth, 55.1 lbs, SMNPsupport, 3yr warranty, with free NEC contentmanagement software (CMS) $ 5,499 $ 3,8492

Order CodeX462UNX462UN-TMX4DX461UNVX461UNV-TMX4DX551UNX551UN-TMX4DX461HBX462HBX431BTLCD8205Mississippi - IT Hardware 3658November 1 2011DescriptionU.S.SuggestedRetail PriceMS PriceX462UN, 46" Ultra Narrow Bezel LCD PublicDisplay Monitor, 1366x768 (WXGA), with AVfunction, Edge Comp., SNMP support, 3 YearWarranty, with free NEC content managementsoftware (CMS) $ 5,299 $ 3,709Four X462UN bundled with four OnSiteOn-46,Four SB-L008WU (DVI Daisy Chain cards withDVI cable), 5M DVI cable, Three Null ModemCables, Chief 2 x 2 mounting system, and TrippLite ISOBAR6 Surge Suppressor, OverframeBezel Kit, IR/Remote Kit, FREE Standard GroundFreight, with free NEC content managementsoftware (CMS) $ 21,999 $ 15,399X461UNV, 46" Ultra Narrow Bezel LCD PublicDisplay Monitor, 1366x768 (WXGA), 450 cd/m2max brightness, with AV function, SNMP support,3 Year Warranty, with free NEC contentmanagement software (CMS) $ 5,299 $ 3,709Four X461UNV bundled with four OnSiteOn-46,Four SB-L008WU (DVI Daisy Chain cards withDVI cable), 5M DVI cable, Three Null ModemCables, Chief 2 x 2 mounting system, and TrippLite ISOBAR6 Surge Suppressor, OverframeBezel Kit, IR/Remote Kit, FREE Standard GroundFreight, with free NEC content managementsoftware (CMS) $ 19,999 $ 13,999X551UN, 55" Ultra Narrow Bezel LCD PublicDisplay Monitor, 1920x1080 (FHD), Direct LEDback light unit, AV function, SNMP support, DVIloop through, DisplayPort loop through, 3 YearWarranty, with free NEC content managementsoftware (CMS) $ 9,999 $ 6,999Four X551UN bundled with four OnSiteOn-55,Four DVI Loop-through cables, 5M DVI cable,Four 2M DVI Loop-through cables, Three NullModem Cables, 2 x 2 mounting system, andTripp Lite ISOBAR6 Surge Suppressor,Overframe Bezel Kit, IR/Remote Kit, FREEStandard Ground Freight, with free NEC contentmanagement software (CMS) $ 36,999 $ 25,899X461HB 46" High Bright LCD Public DisplayMonitor 1366 X 768 (WXGA), 1500 cd/m2, Blackwith full AV, Thin Bezel, Feet Optional, with freeNEC content management software (CMS)(LIMITED AVAILABILITY) $ 4,999 $ 3,499X462HB 46" High Bright LCD Public DisplayMonitor 1920x1080 (FHD), 1500 cd/m2, Blackwith full AV, Thin Bezel, Feet Optional, with freeNEC content management software (CMS) $ 4,999 $ 3,499X431BT 43" Half Height LCD Public DisplayMonitor 1920 x 480, 700cd/m2 max, Black withfull AV, Thin Bezel, 3 Year warranty (Build toorder, 120 day lead time), with free NEC contentmanagement software (CMS) 4,799$ $ 3,359LCD8205 82" LCD Display Monitor, 1920 x 1080(1080p, FHD), Black with full AV function, 3 yearwarranty, with free NEC content managementsoftware (CMS) $ 54,999 $ 38,4993

Order CodeP551-AVTMississippi - IT Hardware 3658November 1 2011DescriptionU.S.SuggestedRetail PriceMS PriceP551 - 55" LCD Public Display Monitor 1920 X1080 (FHD) Black with full AV Function andATSC Tuner, Thin Bezel, 3 Year Warranty, FeetOptional, with free NEC content managementsoftware (CMS) $ 5,649 $ 3,672Commercial Grade S SeriesP551-TMX4DP701P701-AVTFour P551 bundled with four OnSiteOn-46, 4DVI loop-through cables, 4M DVI cable, ThreeNull Modem Cables, Digital Factory PerfectAlign2 x 2 mounting system, and Tripp Lite ISOBAR6Surge Suppressor, FREE Standard GroundFreight, with free NEC content managementsoftware (CMS) (Drop Ship Only Sku) $ 19,999 $ 12,999P701 - 70" LCD Public Display Monitor 1920 X1080 (FHD) Black with full AV Function, OptionSlot, Standard Bezel, 3 Year Warranty, FeetOptional , with free NEC content managementsoftware (CMS) $ 13,999 $ 9,099P701 - 70" LCD Public Display Monitor 1920 X1080 (FHD) Black with full AV Function andATSC Tuner, Standard Bezel, 3 Year Warranty,Feet Optional , with free NEC contentmanagement software (CMS) $ 14,199 $ 9,229S401S401 - 40" Public Display Monitor 1920x1080(FHD) with AV Function, Option Slot, StandardBezel Width, 3 Year Warranty, Feet Optional,with free NEC content management software(CMS) (LIMITED AVAILABILITY) $ 2,199 $ 1,429S401-AVTS401 - 40" Public Display Monitor 1920x1080(FHD) with AV Function and ATSC Tuner,Standard Bezel Width, 3 Year Warranty, FeetOptional, with free NEC content managementsoftware (CMS) (LIMITED AVAILABILITY) $ 2,299 $ 1,494Large Format LCD OptionsS461S461-AVTKT-46UN-OFKT-RCKT-46UN-CCS461 - 46" Public Display Monitor 1920x1080(FHD) with AV Function, Option Slot, StandardBezel Width, 3 Year Warranty, Feet Optional,with free NEC content management software(CMS) (LIMITED AVAILABILITY) $ 3,399 $ 2,209S461 - 46" Public Display Monitor 1920x1080(FHD) with AV Function and ATSC Tuner,Standard Bezel Width, 3 Year Warranty, FeetOptional, with free NEC content managementsoftware (CMS) (LIMITED AVAILABILITY) $ 3,499 $ 2,274X462UN, X461UNV OverFrame Bezel Kit; Matchkit number to highest dimension in the tile matrix $ 459 $ 413X462UN, X461UNV, X551UN Remote Controland Ambient Light Sensor Kit. Recommended:One kit per tile matrix $ 199 $ 179Display Wall Calibrator Kit includes sensor,software $ 599 $ 5395

Order CodeMississippi - IT Hardware 3658November 1 2011DescriptionU.S.SuggestedRetail PriceMS PriceKT-55UN-OFWM-46UN-LX551UN OverFrame Bezel Kit; Match kit numberto highest dimension in the TileMatrix. $ 559 $ 503Wall Mount, X462UN, X461UNV ModularLandscape for Video Wall Tiling. Order one perdisplay. $ 399 $ 359WM-46UN-PWall Mount, X462UN, X461UNV Modular Portraitfor Video Wall Tiling. Order one per display. $ 399 $ 359WM-46UN-2x2X462UN, X461UNV 2x2 Tile Matrix Wall MountKit $ 799 $ 719SB-L007KKInternal card that provides an HD-SDI loopwithout using additional space or power.Designed for use with NEC’s S and P Serieslarge-screen LCD displays as well as theX461HB, X462UN, X431BT, V462 and V651 $ 1,500 $ 1,350SB-L008WU NEC DVI Daisy Chain Board $ 149 $ 134N8000-8830NEC"s OPS PC with Intel Core i5, 320GB HardDrive, Windows Embedded Standard 7 $ 1,580 $ 1,422OPS-PCAF-WHNEC"s OPS PC with AMD Dual Core FusionAPU, 160GB hard drive disk and Windows 7Professional license $ 949 $ 854OPS-PCAF-WSNEC"s OPS PC with AMD Dual Core FusionAPU, 32GB solid state drive and Windows 7Professional license $ 949 $ 854OPS-PCAF-HNEC"s OPS PC with AMD Dual Core FusionAPU, 160GB hard drive disk and no OS $ 800 $ 720OPS-PCAF-SNEC"s OPS PC with AMD Dual Core FusionAPU, 32GB solid state drive and no OS $ 800 $ 720SB-02AMOpen Pluggable Specification PC Adaptor forP402, P462, V422, V462, and V651 when usingan OPS-based card $ 30 $ 27NET-SBC-01NET-SBC-02NET-SBC-03TNETPC-IONWMK-32571.6 GHz Dual Core Atom Single Board Computerw/ 2GB RAM, 120 GB HDD, Nvidia 9400 GPUand WXPe. Compatible with the expansion slotfound within NEC S, P, V422, V462, V651 and Xseries (excluding the LCD8205, X461S, X551S) $ 899 $ 8091.6 GHz Dual Core Atom Single Board Computerw/ 2GB RAM, 120 GB HDD, Nvidia 9400 GPUand NO OS. Compatible with the expansion slotfound within NEC S, P, V422, V462, V651 and Xseries (excluding the LCD8205, X461S, X551S) $ 749 $ 6741.6 GHz Dual Core Atom Single Board Computerw/ 2GB RAM, 16 GB SSD, Nvidia 9400 GPU andWXPe. Compatible with the expansion slot foundwithin NEC S, P, V422, V462, V651 and X series(excluding the LCD8205, X461S, X551S) $ 899 $ 8091.6 GHz Dual Core Atom External Single BoardComputer w/ 2GB RAM, 160 GB HDD, Nvidia9400 GPU and WXP. Compatible with all NECLarge Format Displays $ 799 $ 719Wall Mount Kit for most large format displays 32"to 57" in portrait and landscape. 200x200 up to400x400. Maximum weight is up to 200 lbs. $ 150 $ 1356

Order CodeMississippi - IT Hardware 3658November 1 2011DescriptionU.S.SuggestedRetail PriceMS PriceWMK-E551Wall Mount Kit for the NEC E551 display andanything up to 600x400 VESA hole pattern.Maximum weight is up to 200 lbs $ 150 $ 135WMK-4655SSuperslim wall mount for units up to 700x400VESA hole pattern $ 249 $ 224AMK-V462 Adaptor Kit for V462 $ 30 $ 27AMK-P4046 Adaptor Kit for P402, P462 $ 30 $ 27MPD-AVAV Module for NEC M-Series and 20-SeriesLarge Screen Models $ 250 $ 225SP-3215 Speaker for LCD3215 and V321, V321-2 $ 69 $ 62SP-P4046Speakers for LCD4020, P401, P401-AVT,LCD4620, P461, P461-AVT, X461HB, LCD4215,V421, V421-2 $ 179 $ 161SP-S4046Speakers for the S401, S401-AVT and S461,S461-AVT $ 219 $ 197SP-4046PVExternal speaker attachment for P402, P402-AVT, P462, P462-AVT, V422, V422-AVT, V462and V462-AVT $ 179 $ 161SP-4615 Speakers for the LCD4615 and the V461, V461-2 $ 179 $ 161SP-57Speaker 57", speaker attachment for theLCD5710-BK /LCD5710-BK. Contains 2Speakers $ 450 $ 405SP-5220 Speakers for all versions of the LCD5220 $ 430 $ 387SP-PS52Speakers for the LCD5220, P521, P521-AVT ,S521, S521-AVT $ 349 $ 314SP-6520 Speaker for LCD6520 $ 480 $ 432SP-RM1Side facing rear mounted speaker for the P701,P551 (P701-AVT and P551-AVT as well) $ 249 $ 224ST-3215 Stand for LCD3215 and V321, V321-2 $ 80 $ 72ST-4020Stand for LCD4020, P401, P401-AVT, P402,P402-AVT, S401, S401-AVT, LCD4215, V421,V421-2, LCD4615, V461, V461-2, X461S, V422and V422-AVT $ 100 $ 90ST-4620Stand for LCD4620, P461, P461-AVT, P462,P462-AVT, X461UN, X462UN, X462UNV,X461HB, S461, S461-AVT, V462 and V462-AVT $ 100 $ 90ST-5220Stand for all versions of the LCD5220, P521,S521, P551, X551S and X551UN $ 125 $ 112ST-5710 Stand for LCD5710 $ 145 $ 130ST-651 Stand for the V651 and V651-AVT $ 140 $ 126ST-701 Feet for P701 and P701-AVT $ 150 $ 135HWCNTRLHWDSPLYHWSTRMControl Node – This software allows for theprogramming of the Hiperwall. This utility is usesto organize content on the screen, set schedules,and communicate with the remote displays. $ 2,598 $ 2,338Display Node – This software allows for thecommunication and playback of content on thescreens within a Hiperwall. $ 1,299 $ 1,169Streamer Node – The software allows for certainfile formats and devices (video conferencingcameras, TV tuner capture cards, etc.) to be sentto the Hiperwall Controller for playback on theHiperwall. $ 1,299 $ 1,1697

Alibaba.com features an exciting range of large format display that are suitable for all types of residential and commercial requirements. These fascinating large format display are of superior quality delivering unmatched viewing experience and are vibrant when it comes to both, picture quality and aesthetic appearances. These products are made with advanced technologies offering clear patterns with long serviceable lives. Buy these incredible large format display from leading suppliers and wholesalers on the site for unbelievable prices and massive discounts.

The optimal quality large format display on the site are made of sturdy materials that offer higher durability and consistent performance over the years. These top-quality displays are not only durable but are sustainable against all kinds of usages and are eco-friendly products. The large format display accessible here are made with customized LED modules for distinct home appliances and commercial appliances, instruments, and have elegant appearances. These wonderful large format display are offered in distinct variations and screen-ratio for optimum picture quality.

Alibaba.com has a massive stock of durable and proficient large format display at your disposal that are worth every penny. These spectacular large format display are available in varied sizes, colors, shapes, screen patterns and models equipped with extraordinary features such as being waterproof, heatproof and much more. These are energy-efficient devices and do not consume loads of electricity. The large format display you can procure here are equipped with advanced LED chips, dazzling HD quality, and are fully customizable.

Save money by browsing through the distinct large format display ranges at Alibaba.com and get the best quality products delivered. These products are available with after-sales maintenance and are also available as OEM orders. The products are ISO, CE, ROHS, REACH certified.

Sharp NEC Display Solutions incorporates both Sharp and NEC brands of display products. Including desktop, 4K and 8K UHD large format, video wall, dvLED, collaboration and interactive products, Sharp/NEC offers the widest portfolio of displays available. Understanding that every market and environment has unique requirements, Sharp/NEC prides itself on being your partner, delivering customized solutions to match your needs.

At present, TFT LCD touch panel prices rebounded, after six months of continuous decline, TFT LCD touch panel prices began to rebound at the end of July. Global TFT LCD panel prices have rebounded since August, according to Displaysearch, an international market-research firm. The price of a 17-inch LCD touch panel rose 6.6% to $112 in August, up from $105 in July, and fell from $140 in March to $105 in July. At the same time, 15 – inch, 19 – inch LCD touch panel prices also showed a different range of recovery. The price of a 17-inch LCD touch panel rose 5.8 percent, to $110, from $104 in late July, according to early August quotes from consulting firm with a view. Analysts believe the rebound will continue through the third quarter; LCDS will see seasonal growth in the third quarter, driven by back-to-school sales in us and the completion of inventory liquidation in the first half of the year. Dell and Hewlett-Packard (HPQ) started placing orders for monitors in the third quarter, and display makers Samsungelectronics (SXG) and TPV (TPV) are expected to increase production by 25% and 18% respectively.

It seems that due to the increasing demand in the market, the production capacity of the display panel production line has been released. Domestic TFT-LCD touch panel makers boe and Shanghai guardian said their production schedules have been set for September, and their production capacity may reach full capacity by the end of the year. Jd will produce 85,000 glass substrates per month (with a designed capacity of 90,000), according to boe and Shanghai guardian. Previously, panel makers have been hit by falling prices, with boe, SFT, and even international panel giant LG Philips all reporting losses. If the rebound continues into the fourth quarter, boe, Shanghai radio and television and other panel makers will use the rebound to reverse the decline, according to industry analysts.

It is understood that the first quarter of the boe financial results show that the company’s main business income of 2.44 billion yuan, a loss of 490 million yuan.Jd.com attributed the loss to a drop in the price of 17-inch TFT-LCD displays made by its Beijing TFT-LCD fifth-generation production line of Beijing boe photoelectric technology co., LTD., a subsidiary. Boe has issued the announcement of pre-loss in the first half of the year in April. Due to the influence of the off-season of TFT-LCD business operation in the first quarter of 2006, the company has suffered a large operating loss, and the low price in the TFT-LCD market has continued till now. Therefore, it is expected that the operating loss will still occur in the first half of 2006.LG Philips, the world’s largest TFT LCD maker, reported a won322bn ($340m) loss in July, compared with a won41.1bn profit a year earlier.LG Philips attributed the loss to fierce price competition and market demand did not meet expectations.

Large-area TFT LCD panel shipments decreased by 10% Month on Month (MoM) and 5% Year on Year (YoY) in April, to 74.1million units, representing historically low shipment performance since May 2020. Omdia defines large-area TFT LCD displays as larger than 9 inches.

"With continued ramifications from the pandemic, demand for IT panels for monitors and notebook PCs remained strong in 4Q21. But as the market became saturated starting in 2022, IT panel shipments started slowing in 1Q22 and early 2Q22," said Robin Wu, Principal Analyst for Large Area Display & Production, Omdia.

While TV panel prices have decreased noticeably since 3Q21, TV LCD panel shipments increased to a peak of 23.4 million in December 2021, driven by low prices. But rising inflation, the Ukraine crisis and continued lockdowns in China have slowed demand. As a result, TV panel shipments posted a 9% MoM decline in April, to 21.7million units.

"IT LCD panels could still deliver positive cash flow for panel makers. But with prices dropping dramatically, panel makers will soon start to lose money in their IT panel business," Wu said. "Maybe only then will panel makers reduce their glass input and the overall supply/demand situation will return to balance."

About OmdiaOmdia is a leading research and advisory group focused on the technology industry. With clients operating in over 120 countries, Omdia provides market-critical data, analysis, advice, and custom consulting.

It may seem odd in the face of stalled economies and stalled AV projects, but the costs of LCD display products are on the rise, according to a report from Digital Supply Chain Consulting, or DSCC.

Demand for LCD products remains strong , says DSCC, at the same time as shortages are deepening for glass substrates and driver integrated circuits. Announcements by the Korean panel makers that they will maintain production of LCDs and delay their planned shutdown of LCD lines has not prevented prices from continuing to rise.

I assume, but absolutely don’t know for sure, that panel pricing that affects the much larger consumer market must have a similar impact on commercial displays, or what researchers seem to term public information displays.

Panel prices increased more than 20% for selected TV sizes in Q3 2020 compared to Q2, and by 27% in Q4 2020 compared to Q3, we now expect that average LCD TV panel prices in Q1 2021 will increase by another 12%.

All that said, LCD panels are way less costly, way lighter and slimmer, and generally look way better than the ones being used 10 years ago, so prices is a relative problem.

I’m hearing from some industry friends that LCD display panel prices are rising – which on the surface likely seems incongruous, given the economic slowdown and widespread indications that a lot of 2020 and 2021 display projects went on hold because of COVID-19.

On the other hand, people are watching a lot more TV, and I saw a guy at Costco the other day with two big-ass LCD TVs on his trolley. And a whole bunch of desktop monitors were in demand in 2020 to facilitate Work From Home. So demand for LCD displays is up outside of commercial purposes.

Continuing strong demand and concerns about a glass shortage resulting from NEG’s power outage have led to a continuing increase in LCD TV panel prices in Q1. Announcements by the Korean panel makers that they will maintain production of LCDs and delay their planned shutdown of LCD lines has not prevented prices from continuing to rise.

Panel prices increased more than 20% for selected TV sizes in Q3 2020 compared to Q2, and by 27% in Q4 2020 compared to Q3, and we now expect that average LCD TV panel prices in Q1 2021 will increase by another 9%.

Does that mean they will stop buying and face losing market share to those that are willing to pay higher prices to see unit volume growth? Eventually, but heading into the holidays it doesn’t seem likely this year, so we expect TV panel prices to rise again in December.

With a lot of the buyer market for digital signage technology financial wheezing its way into 2021, rising hardware prices are likely even less welcomed than in more normal times. But the prices for display hardware, in particular, are dramatically lower they were five years ago, and even more so looking back 10-15 years.

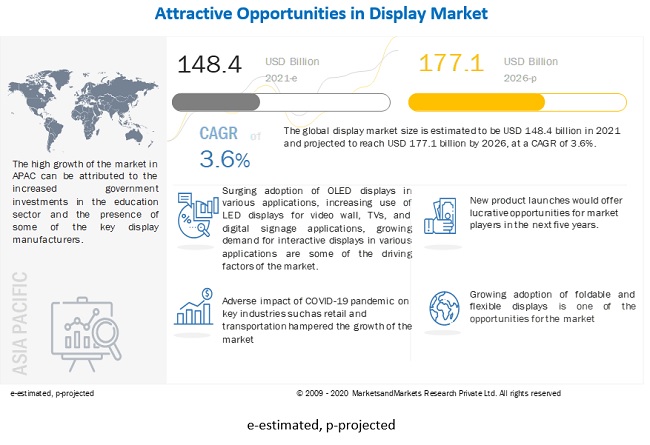

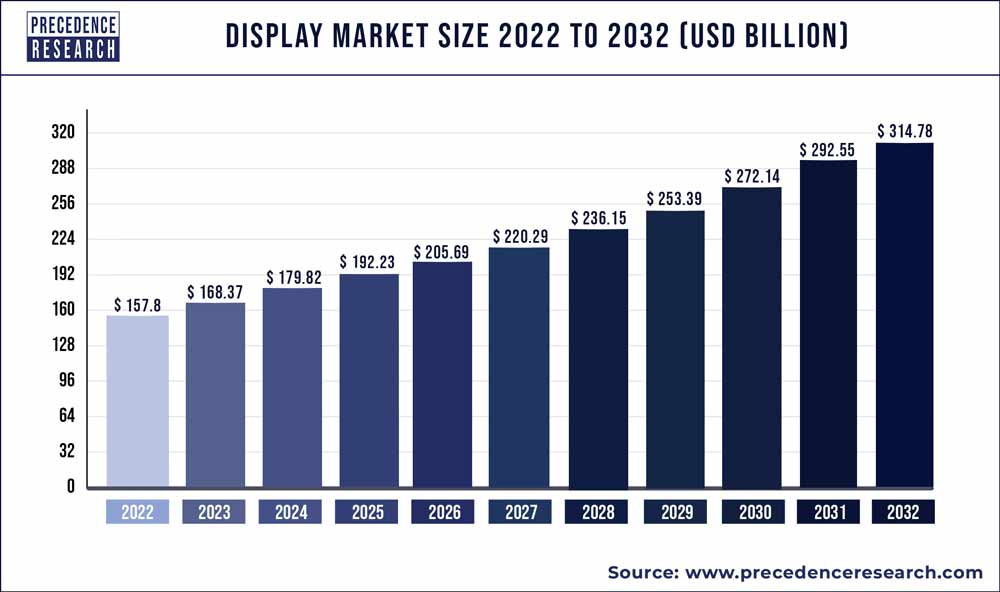

The global display market size was USD 155.20 Billion in 2022 and is expected to register a revenue CAGR of 3.6% during the forecast period. Steady market revenue growth can be attributed to increasing popularity of Organic Light Emitting Diode (OLED) displays. OLED displays can be found in wearable technology, light panels, smartphones, tablets, and Televisions (TVs) and monitors. Since their initial release in 2013, OLED products for computer monitors and televisions have dominated the market for high-end displays. Currently, a wide variety of OLED products, including flat and curved panel TVs and so-called OLED wallpaper, are offered in commercial display marketplaces. It took longer for Organic Light Emitting Diodes (OLEDs) to become widely used in mobile devices, but as of 2016, the majority of innovative smartphones and tablets are made with Active-Matrix OLEDs (AMOLEDs). These achieve exceptional levels of activation speed, a requirement for Ultra-High Definition (UHD) portable devices with high pixel counts, by using an extra semiconducting film underneath the main screen.

Rising applications of Light Emitting Diode (LED), such as video walls, is another factor driving revenue growth of the market. LED display video walls are quite popular and useful in most sectors right now. As a result, it aids in driving consumer involvement for the company. With use of Active LED displays, there are countless options and marketing opportunities in the current increasingly modern corporate world. Conventional company strategies are becoming increasingly outmoded as a result of rising challenges and increased use of innovation. All types of businesses can benefit from marketing. LED display need the ideal combination of creativity and motivation to capture the interest of each potential business client.

Increasing popularity of online advertising and shopping could restrain revenue growth of the market. Digital advertising is now more sophisticated, tailored, and relevant. As a result, online advertising has become more commonplace recently. In addition, increasing use of the Internet among people across the globe, coupled with rising trend of using social media platforms by various companies are factors resulting in high adoption of digital advertising. Increased use of the Internet advertising is also largely due to bigger businesses such as Facebook and Google spending more money on it. Use of automated algorithms and data to choose media without human intervention is known as programmatic advertising, and it is also gaining popularity. As a result, need for displays, which were formerly used to advertise goods and companies in stores and other public spaces, has decreased significantly.

In addition, fluctuating prices of the displays and high cost of technologies such as quantum dot display, leading to high cost on the end product are some other factors that could hamper revenue growth of the market to some extent.

One of the recent trends observed in the global market is increasing use of flexible displays. Flexible displays are an intriguing technological advancement as they can support slim, lightweight, and distinctive form. Flexible displays are used in wearables, vehicle Head-Up Displays (HUDs), and smartphones as they also offer low-cost roll-to-roll production. A rollable display can be constructed using a variety of technologies, such as electronic ink, gyricon, Organic LCD (OLCD), and OLED. In addition, these displays are less likely to break compared to rigid glass substrate-based displays. Foldable phones and electronic paper for dynamic posters and signs are two common applications for flexible displays.

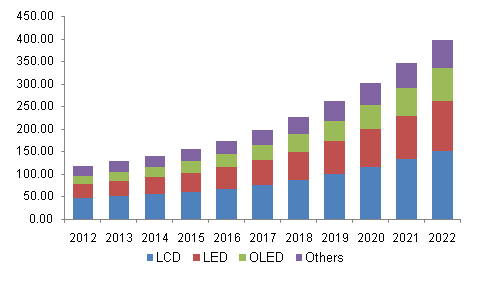

Based on display technology, the display market is segmented into Liquid Crystal Display (LCD), OLED, micro-LED, direct-view LED, and others. The LCD segment is expected to account for largest revenue share in the global market over the forecast period. An LCD operates primarily using liquid crystals. LCD offers a wide range of applications for consumers and enterprises due to its frequent use in TVs, computers, instrument panels, and cellphones. LCDs represented a significant innovation compared to Light-Emitting Diode (LED) and gas-plasma displays. LCDs permitted screens to be far thinner compared to Cathode Ray Tube (CRT) technology. As opposed to LED and gas-display displays, LCDs operate on the idea of blocking light rather than emitting it, which results in a significant reduction in power consumption. The liquid crystals in an LCD use a backlight to form an image where an LED emits light.

The OLED segment is expected to register a steady revenue growth rate during the forecast period owing to its rising demand. OLED is a device that emits light when an electric current is supplied between the anode and cathode of each of its small picture components, or pixels, formed of organic chemical compounds. This procedure functions similarly to a typical LED, which emits light by recombining electrons and holes from the cathode and anode. OLEDs and LCDs are both employed in display devices; however, they present information on the screen very differently. An OLED is a form of emissive display, which means it is self-illuminating. However, an LCD uses transmissive or transflective technologies to display information, which implies that picture lighting is provided by various means such as a backlight, ambient light, or the sun.

Based on product type, the display market is segmented into smartphones, television sets, Personal Computer (PC) monitors & laptops, display/large format displays, automotive displays, tablets, smart wearables, and others. The smartphones segment is expected to account for largest revenue share in the global market over the forecast period. Smartphones use a variety of display technologies, including LCD, OLED, AMOLED, Super AMOLED, Thin Film Transistor (TFT), In-plane Switching (IPS), and a few less common ones such as TFT-LCD. The IPS-LCD is currently one of the most common display types on mid- to high-end phones. In a nutshell, LCD and OLED are the two types of display technology now on the market for smartphones. Similar to televisions and their various ranges such as LED, QLED, and miniLED - which are all essentially versions of LCD technology - each of them has a number of modifications and generations.

The television sets segment is expected to register steady revenue growth rate during the forecast period owing to its rising demand. The landscape of TV display technology has significantly changed in recent years. There were several new technologies, ranging from OLED to QLED and 4K to 8K. It complicates the decision to purchase a TV. There are several possibilities for TV display technology, which becomes difficult to choose them. Customers are inundated with technical terms, including QLED, OLED, LED, Nano Cell, LCD, etc. when they go to any electronics store to buy a new TV.

Based on vertical, the global display market is segmented into consumer, automotive, sports & entertainment, transportation, retail, hospitality, & Banking, Financial Services and Insurance (BFSI), industrial & enterprise, education, healthcare, defense & aerospace, and others. The consumer segment is expected to account for largest revenue share in the global market over the forecast period. Big box retailers and common department stores both carry consumer displays. It is the typical home television. For convenience of use, speakers are incorporated into the visual component. They can also feature a table stand and a tuner. These displays are intended for use in the home. An average consumer can use its display for a few hours per day. These displays can be up for much more hours in a professional setting, sometimes longer than the average 8-hour workday. Certain consumer displays are capable of ‘automatic power’ or ‘auto-switching.’ However, these features vary between manufacturers and even within their own models.

The automotive segment is expected to register a steady revenue growth rate during the forecast period. Since the outset, LCD screens in automobiles have been flat, rectangular, and poor resolution. But as the cockpit evolves into a sophisticated mobile digital assistant, demand for larger, higher-resolution, and more immersive screens becomes high. Future cockpit screens will be curved and have far higher resolutions than existing monitors. Mobile devices have had an impact on display requirements in all spheres of life and raised consumer expectations, including those for cars. More and more, consumer-market technological advancements are being incorporated into automobiles.

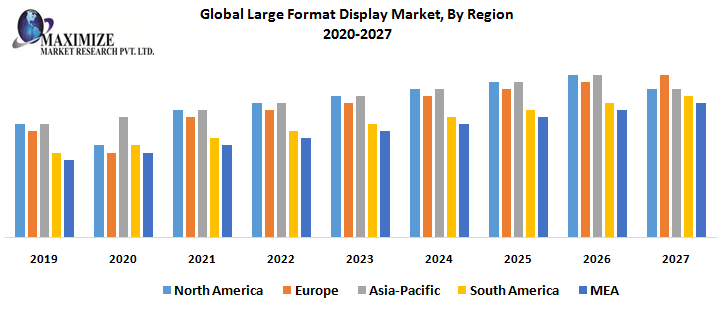

The market in North America is expected to account for largest revenue share during the forecast period, which is attributed to increasing activities by key market players in various countries in the region. For instance, a new foldable display that is intended to be crack-resistant was unveiled via Apple"s most recent patent. The new patent has the patent number U.S.-20230011092-A1 and was issued by the U.S. Patent and Trademark Office. One of the major problems with foldable devices is their fragility, and the product is more durable, it can assist with fragility of foldable devices. Multiple layers, including a flexible substrate, a thin-film transistor layer, and a protective layer, are present in the display created by the new technique. Since the flexible substrate is the area of the display that is most vulnerable to harm, the protective layer seeks to stop cracks from forming there. A patent for a self-healing display has also been issued to the iPhone manufacturer.

The market in Asia Pacific is expected to register fastest revenue CAGR over the forecast period. This is owing to increasing initiatives in various countries in the region. For instance, in 2022, China replaced South Korea as the market leader in the display sector, which it had held for many years. The Chinese display panel industry reached a significant turning point in 2021. According to research, Chinese display panel manufacturers, led by companies such as BOE Technology Group Co, Shenzhen China Star Optoelectronics Technology Co, Tianma, and Visionox, accounted for a combined 40.4% of the global market share in turnover, surpassing South Korea"s 36.3%. In 2020, South Korean companies led with a market share of 39.8%, 4.8% points higher than China. It was the first time that Chinese companies owned a larger market share than its South Korean rivals, primarily Samsung Display and LG Display.

The market in Europe is expected to register a steady revenue growth rate over the forecast period, which is attributed to rising innovations by key market players in various countries in the region. On 28 November 2022 for instance, the Find N Fold and Find N Flip names were trademarked by Oppo with the European Union (EU) Intellectual Property Office. According to the company, Flip and Foldable phones are the future, and Europe will get the next generation of Oppo"s foldable phones.

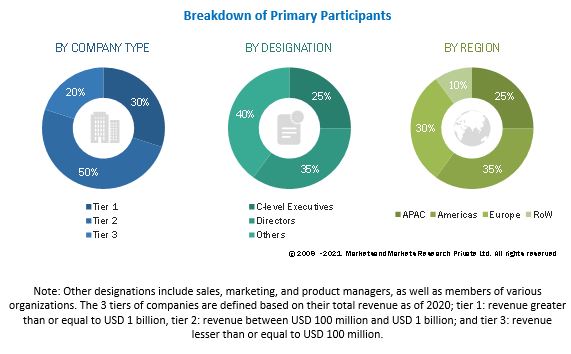

The global display market is fragmented, with many large and medium-sized players accounting for the majority of market revenue. Major companies are deploying various strategies, entering into mergers & acquisitions, strategic agreements & contracts, developing, testing, and introducing more effective displays. Some major players included in the global display market report are:

For the purpose of this report, Emergen Research has segmented the global display market on the basis of resolution, display technology, panel size, product type, vertical, and region:

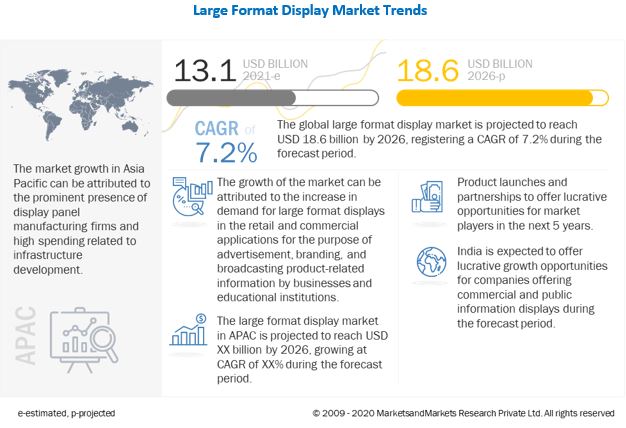

The growing use of LED and LCD units for video walls and digital signage applications is one of the key factors driving the market. Furthermore, the growing usage of Organic Light Emitting Diode (OLED) displays in a number of applications, as well as increased creation of Super High Definition (HD) material by advertising organizations for a variety of marketing purposes, are likely to propel market growth. Growing demand for interactive screens on commercial unit walls or tables, the creation of a high-resolution screen, and the availability of displays at lower or affordable prices are key drivers driving the market growth. Furthermore, rising demand from various commercial organizations for large-format and industrial-grade panels for advertising, trade shows, seminars, and other celebrity endorsements is likely to boost the market growth.

High power consumption and high display maintenance costs are major constraints that can hamper market progress. In addition to that, COVID-19 and its detrimental impact, which has halted display production worldwide, are a serious hindrance to market expansion. Apart from this, increased use of commercial displays in areas such as hospitality, entertainment, banking, healthcare, education, and transportation is expected to drive market expansion. Key companies" technological innovation and R&D expenditure in order to create novel displays with sophisticated features are providing significant market expansion opportunities.

In terms of product, the digital signage segment held the greatest market share in 2021. The rising popularity of technologically enhanced promotional or commercial efforts, notably in the retail and entertainment industries, is driving up demand for digital signage. A digital signage platform is a centralized media distribution network that allows information to be presented on several display screens at once. It uses content management software (CMS) and a back-end operating computer linked to a media player to display advertisements or messages to a specified audience. It uses LCD, LED, projectors, and plasma displays to project or display information such as live news, weather forecasts, television programs, menus, flight schedules, directories, and advertisements.

The LCD category is predicted to account for the lion"s share of the commercial display market in 2021, due to the extensive usage of LCD panels in banks and corporate offices worldwide. The reduction of LCD production costs is one of the key factors driving the widespread adoption of LCD technology. LCD displays frequently have higher resolution than LED displays. However, a consumer can get a closer look at the screen without seeing the pixels. As a result, the consumption of LCD screens is expanding segment"s growth.

Based on the component, the hardware segment is estimated to increase significantly in the market in the coming years. This expansion might be attributed to the increased demand for hardware as a result of its high wear when compared to the software segment. The market for these things is likely to raise in the coming years as demand for these items, such as accessories, extenders, and band cables grow across various industrial sectors.

In terms of type, flat panels will account for more than half of the market in 2021. Flat-panel displays are widely utilized in a variety of end-use sectors, including digital posters, video walls, monitors, and televisions. The flat panel display segment is growing due to increased demand for OLED display devices in mobile phones and tablets, rising demand for automotive display technology, and greater use of engaging touch-based technologies in the education industry.

In terms of size, the below-32-inch and 32-to-52-inch categories will account for a significant portion of the global market in 2021. Furthermore, as a result of features such as greater clarity and the adoption of energy-efficient technologies like as micro-LED and OLED, demand for larger screens is expected to surge in the future years. As a result, the 52-75-inch category is likely to see increased demand in the coming years. Furthermore, the appropriate digital display size has the potential to transform any commercial space. Whether it"s an office at a large corporation or a small local business, a retailer, a pub, or a casino, they all have one thing in common: they all want to engage their customers and provide a memorable and distinctive experience.

Based on the application, the retail segment will hold significant market shares in 2021 due to the increased necessity for commercial displays for activities such as branding and promotion services and products. Retail displays are an important aspect of every business since they serve to attract customers, maintain their attention, and increase sales. Window displays may help retail establishments stand out from the crowd by providing them with a distinct look and feel. Effective retail marketing entices potential customers to visit the store. However, good commercial displays appeal to consumers" heads as well as their hearts.

Westford,USA, Oct. 19, 2022 (GLOBE NEWSWIRE) -- The primary factors driving the growth of the Display Market are increasing demand from smartphone and tablet manufacturers, rising expenditure on smart Infra-Red (IR) sensors, and rapid expansion of digital media content. Smartphones are becoming more sophisticated and are using larger screens that require higher resolutions for better user experience. Tablets are also becoming increasingly popular as they offer a single device that can serve as both a computer and a mobile phone. This increase in demand for high-resolution displays is expected to drive the adoption of LED displays in the coming years.

Manufacturers in the global display market are starting to see the potential in displays as an important part of their product lines. Device manufacturers are looking for displays that can be used on a variety of devices, from laptops to smartphones and even cars. In addition, developers are creating more applications that require high-quality displays.

One key challenge facing manufacturers is making sure that their displays meet the requirements of multiple market segments. They need to make sure that their displays are suitable for usage on tablets as well as laptops, yet they also need to create displays that look good on smaller devices like smartphones and digital assistants.

The growth in demand for display market across various verticals such as healthcare, retail, automotive, appliance and others has led to an increasing demand for large sizes screens which can be cost effective owing to their mass production capabilities. Display manufacturers are also exploring new technologies such as flexible displays that can be rolled up like a traditional newspaper

Our report considers several factors such as market size estimation techniques, product segmentation analysis, expenditure Breakdown by Country and region; Porter"s Five Forces Analysis; and price trends analysis to give you a comprehensive view of the global display market.

Some of the key players in the global display market include LG Display Co., Ltd., Samsung Electronics Co., Ltd., and Sharp Corporation. These companies are focused on developing innovative products that meet the needs of various consumers in the marketplace. They also strive to improve their competitiveness by expanding their product lines into new markets and by creating partnerships with other companies to share technology and manufacturing resources.

Among global display market leaders, Samsung is presently dominating the industry with a share of 38% of the market. However, Apple is looming large as one of the largest competitors in smartphone sector. Other prominent players in this segment include LG Display, Sony Corp, and Toshiba Corporation. Among these companies, LG Display has been fastest expanding its business over recent years owing to its focus on emerging markets such as China and India.

But Samsung doesn"t just make screens; it makes everything from the organic light-emitting diodes that power digital displays to the materials used in screens themselves. This breadth gives Samsung an edge over other display makers and gives it an advantage over rivals when it comes to developing new technologies.

For one, it"s heavily invested in research and development in the display market. According to analysts at SkyQuest, Samsung spends more than $13.7 billion a year on R&D, more than any other company in the world. That investment has paid off: The company"s displays are consistently among the best on the market.

Samsung also makes good use of its deep pockets. The company has poured money into forming joint ventures with major chipmakers like Qualcomm and Intel, which allows it to quickly bring new technologies to market. It doesn"t just rely on partnerships; Samsung also invests in its own technology centers, such as the foundry that produces screens for its smartphones.

One important technology that Samsung is investing in is AMOLED and QLED screens. QLEDs are generally considered to be more environmentally friendly than LCDs, since they use less power and create fewer byproducts.

The main drivers for Samsung"s strong performance in the display market are its diversification across product lines, continuous innovation across product categories, and excellent execution capabilities. The company has been able to expand into new markets such as automotive displays and smart watches, while continuing to focus on profitable core products.

Samsung has also been successful in pushing down prices for OLED displays over the past few years. This has made OLED panels more accessible to a wider range of customers, supporting growth at rival companies such as LG Electronics and Sony.

In recent years, there has been a shift in display technology as manufacturers across the global display market experiment with new and more innovative ways to create displays. The trend observed by SkyQuest worldwide is that display technologies are moving towards OLEDs and quantum dots, both of which have a number of advantages.

OLEDs offer superior brightness and contrast, are immune to burn-in, and have a long lifetime due to their low power consumption. They are also flexible and can be curved or rolled up for easy installation. Compared to micro-LEDs, OLEDs offer a brighter display with higher resolution with the same power consumption, making them a preferred choice for displays that need to be high-quality and energy efficient.

Quantum dots or QLED offer many advantages over traditional LCDs in the display market, such as better color reproduction, enhanced viewing angles, better response time, and lower power consumption. Their small size also makes them ideal for applications where sliding or tilting LCD panels are not possible or desirable. Quantum dot displays have already begun appearing in consumer electronics and will eventually replace traditional LCDs as the predominant type of display in devices like smartphones and tablets.

SkyQuest Technology is leading growth consulting firm providing market intelligence, commercialization and technology services. It has 450+ happy clients globally.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey