large format lcd displays market quotation

Large Format LCD Displays Market Size is projected to Reach Multimillion USD by 2028, In comparison to 2022, at unexpected CAGR during the forecast Period 2023-2028.

Browse Detailed TOC, Tables and Figures with Charts which is spread across 92 Pages that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

1. Does this report consider the impact of COVID-19 and the Russia-Ukraine war on the Large Format LCD Displays market?Yes. As the COVID-19 and the Russia-Ukraine war are profoundly affecting the global supply chain relationship and raw material price system, we have definitely taken them into consideration throughout the research, and in Chapters, we elaborate at full length on the impact of the pandemic and the war on the Large Format LCD Displays Industry

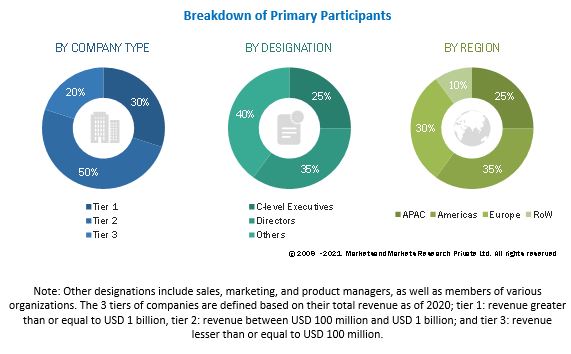

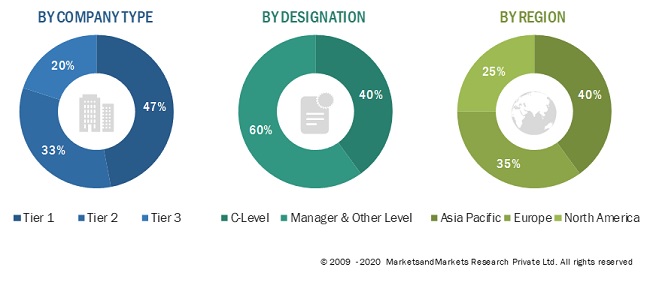

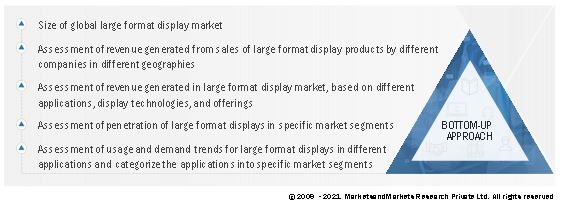

This research report is the result of an extensive primary and secondary research effort into the Large Format LCD Displays market. It provides a thorough overview of the market"s current and future objectives, along with a competitive analysis of the industry, broken down by application, type and regional trends. It also provides a dashboard overview of the past and present performance of leading companies. A variety of methodologies and analyses are used in the research to ensure accurate and comprehensive information about the Large Format LCD Displays Market.

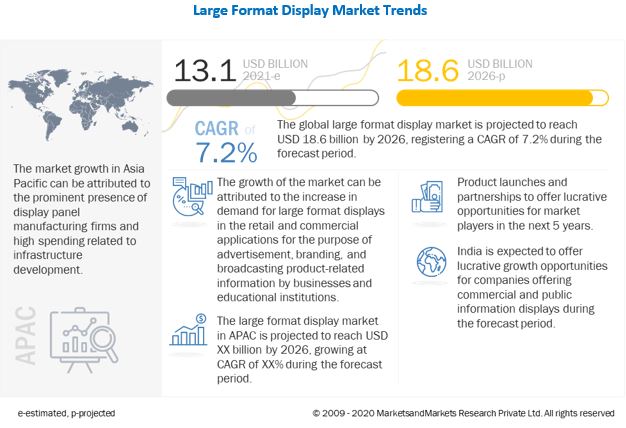

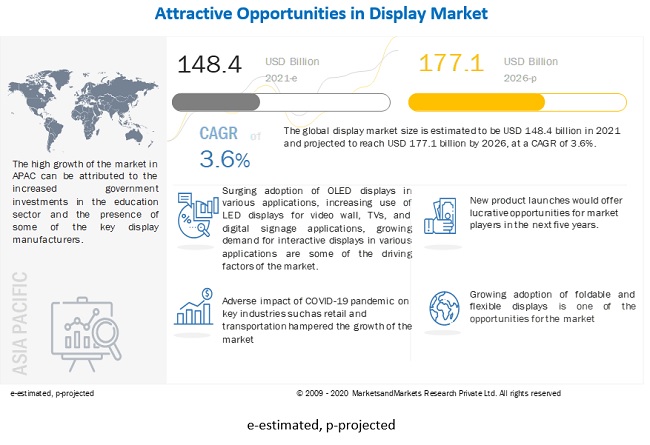

The Global Large Format LCD Displays market is anticipated to rise at a considerable rate during the forecast period, between 2022 and 2028. In 2021, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Due to the COVID-19 pandemic, the global Large Format LCD Displays market size is estimated to be worth USD million in 2022 and is forecast to a readjusted size of USD million by 2028 with a Impressive CAGR during the forecast period 2022-2028. Fully considering the economic change by this health crisis, 32-58 Inch accounting for Percent of the Large Format LCD Displays global market in 2021, is projected to value USD million by 2028, growing at a revised Percent CAGR from 2022 to 2028. While Business segment is altered to an Percent CAGR throughout this forecast period.

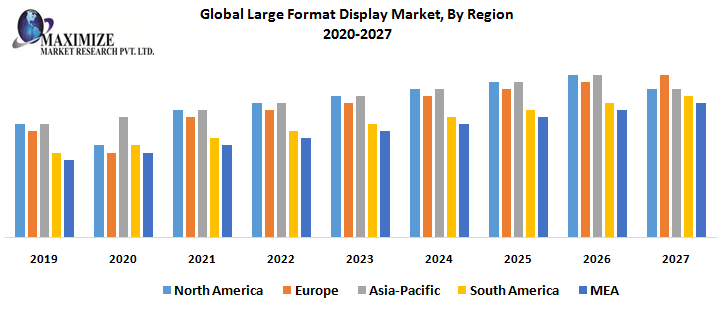

North America Large Format LCD Displays market is estimated at USD million in 2021, while Europe is forecast to reach USD million by 2028. The proportion of the North America is Percent in 2021, while Europe percentage is Percent, and it is predicted that Europe share will reach Percent in 2028, trailing a CAGR of Percent through the analysis period 2022-2028. As for the Asia, the notable markets are Japan and South Korea, CAGR is Percent and Percent respectively for the next 6-year period.

The global major manufacturers of Large Format LCD Displays include AG Neovo, Planar Systems (Leyard), Sharp (NEC), Sony, Sumsung, LG Electronics, Philips, Smart Technologies and ViewSonic and etc. In terms of revenue, the global 3 largest players have a Percent market share of Large Format LCD Displays in 2021.

The research report has incorporated the analysis of different factors that augment the marketâs growth. It constitutes trends, restraints, and drivers that transform the market in either a positive or negative manner. This section also provides the scope of different segments and applications that can potentially influence the market in the future. The detailed information is based on current trends and historic milestones. This section also provides an analysis of the volume of production about the global market and about each type from 2017 to 2028. This section mentions the volume of production by region from 2017 to 2028. Pricing analysis is included in the report according to each type from the year 2017 to 2028, manufacturer from 2017 to 2022, region from 2017 to 2022, and global price from 2017 to 2028.

A thorough evaluation of the restrains included in the report portrays the contrast to drivers and gives room for strategic planning. Factors that overshadow the market growth are pivotal as they can be understood to devise different bends for getting hold of the lucrative opportunities that are present in the ever-growing market. Additionally, insights into market expertâs opinions have been taken to understand the market better.

The research report includes specific segments by region (country), by manufacturers, by Type and by Application. Each type provides information about the production during the forecast period of 2017 to 2028. by Application segment also provides consumption during the forecast period of 2017 to 2028. Understanding the segments helps in identifying the importance of different factors that aid the market growth.

Primary sources include extensive interviews of key opinion leaders and industry experts (such as experienced front-line staff, directors, CEOs, and marketing executives), downstream distributors, as well as end-users.Secondary sources include the research of the annual and financial reports of the top companies, public files, new journals, etc. We also cooperate with some third-party databases.

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2017-2028) of the following regions are covered in Chapter 4 and Chapter 7: ● North America (United States, Canada and Mexico)

This Large Format LCD Displays Market Research/Analysis Report Contains Answers to your following Questions ● What are the global trends in the Large Format LCD Displays market? Would the market witness an increase or decline in the demand in the coming years?

● What is the estimated demand for different types of products in Large Format LCD Displays? What are the upcoming industry applications and trends for Large Format LCD Displays market?

● What Are Projections of Global Large Format LCD Displays Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about Import and Export?

● What are the factors contributing to the final price of Large Format LCD Displays? What are the raw materials used for Large Format LCD Displays manufacturing?

● How big is the opportunity for the Large Format LCD Displays market? How will the increasing adoption of Large Format LCD Displays for mining impact the growth rate of the overall market?

Yes. Customized requirements of multi-dimensional, deep-level and high-quality can help our customers precisely grasp market opportunities, effortlessly confront market challenges, properly formulate market strategies and act promptly, thus to win them sufficient time and space for market competition.

360 Research Reports is the credible source for gaining the market reports that will provide you with the lead your business needs. At 360 Research Reports, our objective is providing a platform for many top-notch market research firms worldwide to publish their research reports, as well as helping the decision makers in finding most suitable market research solutions under one roof. Our aim is to provide the best solution that matches the exact customer requirements. This drives us to provide you with custom or syndicated research reports.For More Related Reports Click Here :

Is there a problem with this press release? Contact the source provider Comtex at editorial@comtex.com. You can also contact MarketWatch Customer Service via our Customer Center.

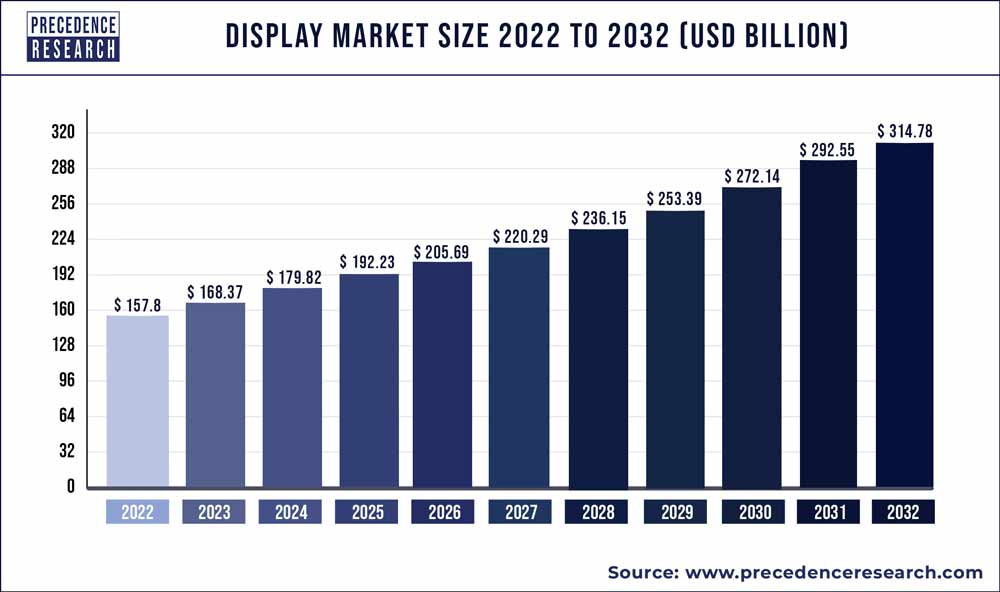

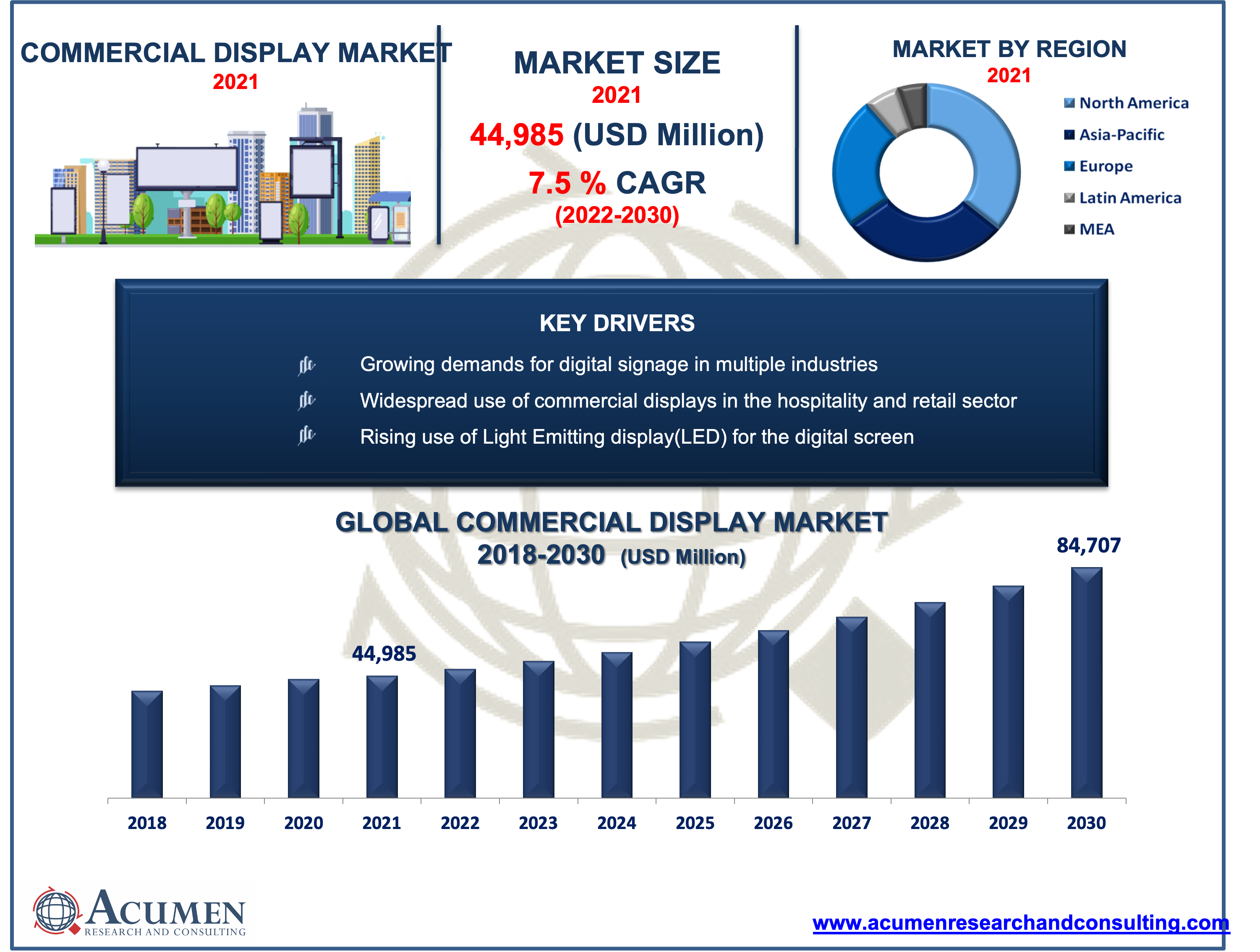

The global display market size was USD 155.20 Billion in 2022 and is expected to register a revenue CAGR of 3.6% during the forecast period. Steady market revenue growth can be attributed to increasing popularity of Organic Light Emitting Diode (OLED) displays. OLED displays can be found in wearable technology, light panels, smartphones, tablets, and Televisions (TVs) and monitors. Since their initial release in 2013, OLED products for computer monitors and televisions have dominated the market for high-end displays. Currently, a wide variety of OLED products, including flat and curved panel TVs and so-called OLED wallpaper, are offered in commercial display marketplaces. It took longer for Organic Light Emitting Diodes (OLEDs) to become widely used in mobile devices, but as of 2016, the majority of innovative smartphones and tablets are made with Active-Matrix OLEDs (AMOLEDs). These achieve exceptional levels of activation speed, a requirement for Ultra-High Definition (UHD) portable devices with high pixel counts, by using an extra semiconducting film underneath the main screen.

Rising applications of Light Emitting Diode (LED), such as video walls, is another factor driving revenue growth of the market. LED display video walls are quite popular and useful in most sectors right now. As a result, it aids in driving consumer involvement for the company. With use of Active LED displays, there are countless options and marketing opportunities in the current increasingly modern corporate world. Conventional company strategies are becoming increasingly outmoded as a result of rising challenges and increased use of innovation. All types of businesses can benefit from marketing. LED display need the ideal combination of creativity and motivation to capture the interest of each potential business client.

Increasing popularity of online advertising and shopping could restrain revenue growth of the market. Digital advertising is now more sophisticated, tailored, and relevant. As a result, online advertising has become more commonplace recently. In addition, increasing use of the Internet among people across the globe, coupled with rising trend of using social media platforms by various companies are factors resulting in high adoption of digital advertising. Increased use of the Internet advertising is also largely due to bigger businesses such as Facebook and Google spending more money on it. Use of automated algorithms and data to choose media without human intervention is known as programmatic advertising, and it is also gaining popularity. As a result, need for displays, which were formerly used to advertise goods and companies in stores and other public spaces, has decreased significantly.

In addition, fluctuating prices of the displays and high cost of technologies such as quantum dot display, leading to high cost on the end product are some other factors that could hamper revenue growth of the market to some extent.

One of the recent trends observed in the global market is increasing use of flexible displays. Flexible displays are an intriguing technological advancement as they can support slim, lightweight, and distinctive form. Flexible displays are used in wearables, vehicle Head-Up Displays (HUDs), and smartphones as they also offer low-cost roll-to-roll production. A rollable display can be constructed using a variety of technologies, such as electronic ink, gyricon, Organic LCD (OLCD), and OLED. In addition, these displays are less likely to break compared to rigid glass substrate-based displays. Foldable phones and electronic paper for dynamic posters and signs are two common applications for flexible displays.

Based on display technology, the display market is segmented into Liquid Crystal Display (LCD), OLED, micro-LED, direct-view LED, and others. The LCD segment is expected to account for largest revenue share in the global market over the forecast period. An LCD operates primarily using liquid crystals. LCD offers a wide range of applications for consumers and enterprises due to its frequent use in TVs, computers, instrument panels, and cellphones. LCDs represented a significant innovation compared to Light-Emitting Diode (LED) and gas-plasma displays. LCDs permitted screens to be far thinner compared to Cathode Ray Tube (CRT) technology. As opposed to LED and gas-display displays, LCDs operate on the idea of blocking light rather than emitting it, which results in a significant reduction in power consumption. The liquid crystals in an LCD use a backlight to form an image where an LED emits light.

The OLED segment is expected to register a steady revenue growth rate during the forecast period owing to its rising demand. OLED is a device that emits light when an electric current is supplied between the anode and cathode of each of its small picture components, or pixels, formed of organic chemical compounds. This procedure functions similarly to a typical LED, which emits light by recombining electrons and holes from the cathode and anode. OLEDs and LCDs are both employed in display devices; however, they present information on the screen very differently. An OLED is a form of emissive display, which means it is self-illuminating. However, an LCD uses transmissive or transflective technologies to display information, which implies that picture lighting is provided by various means such as a backlight, ambient light, or the sun.

Based on product type, the display market is segmented into smartphones, television sets, Personal Computer (PC) monitors & laptops, display/large format displays, automotive displays, tablets, smart wearables, and others. The smartphones segment is expected to account for largest revenue share in the global market over the forecast period. Smartphones use a variety of display technologies, including LCD, OLED, AMOLED, Super AMOLED, Thin Film Transistor (TFT), In-plane Switching (IPS), and a few less common ones such as TFT-LCD. The IPS-LCD is currently one of the most common display types on mid- to high-end phones. In a nutshell, LCD and OLED are the two types of display technology now on the market for smartphones. Similar to televisions and their various ranges such as LED, QLED, and miniLED - which are all essentially versions of LCD technology - each of them has a number of modifications and generations.

The television sets segment is expected to register steady revenue growth rate during the forecast period owing to its rising demand. The landscape of TV display technology has significantly changed in recent years. There were several new technologies, ranging from OLED to QLED and 4K to 8K. It complicates the decision to purchase a TV. There are several possibilities for TV display technology, which becomes difficult to choose them. Customers are inundated with technical terms, including QLED, OLED, LED, Nano Cell, LCD, etc. when they go to any electronics store to buy a new TV.

Based on vertical, the global display market is segmented into consumer, automotive, sports & entertainment, transportation, retail, hospitality, & Banking, Financial Services and Insurance (BFSI), industrial & enterprise, education, healthcare, defense & aerospace, and others. The consumer segment is expected to account for largest revenue share in the global market over the forecast period. Big box retailers and common department stores both carry consumer displays. It is the typical home television. For convenience of use, speakers are incorporated into the visual component. They can also feature a table stand and a tuner. These displays are intended for use in the home. An average consumer can use its display for a few hours per day. These displays can be up for much more hours in a professional setting, sometimes longer than the average 8-hour workday. Certain consumer displays are capable of ‘automatic power’ or ‘auto-switching.’ However, these features vary between manufacturers and even within their own models.

The automotive segment is expected to register a steady revenue growth rate during the forecast period. Since the outset, LCD screens in automobiles have been flat, rectangular, and poor resolution. But as the cockpit evolves into a sophisticated mobile digital assistant, demand for larger, higher-resolution, and more immersive screens becomes high. Future cockpit screens will be curved and have far higher resolutions than existing monitors. Mobile devices have had an impact on display requirements in all spheres of life and raised consumer expectations, including those for cars. More and more, consumer-market technological advancements are being incorporated into automobiles.

The market in North America is expected to account for largest revenue share during the forecast period, which is attributed to increasing activities by key market players in various countries in the region. For instance, a new foldable display that is intended to be crack-resistant was unveiled via Apple"s most recent patent. The new patent has the patent number U.S.-20230011092-A1 and was issued by the U.S. Patent and Trademark Office. One of the major problems with foldable devices is their fragility, and the product is more durable, it can assist with fragility of foldable devices. Multiple layers, including a flexible substrate, a thin-film transistor layer, and a protective layer, are present in the display created by the new technique. Since the flexible substrate is the area of the display that is most vulnerable to harm, the protective layer seeks to stop cracks from forming there. A patent for a self-healing display has also been issued to the iPhone manufacturer.

The market in Asia Pacific is expected to register fastest revenue CAGR over the forecast period. This is owing to increasing initiatives in various countries in the region. For instance, in 2022, China replaced South Korea as the market leader in the display sector, which it had held for many years. The Chinese display panel industry reached a significant turning point in 2021. According to research, Chinese display panel manufacturers, led by companies such as BOE Technology Group Co, Shenzhen China Star Optoelectronics Technology Co, Tianma, and Visionox, accounted for a combined 40.4% of the global market share in turnover, surpassing South Korea"s 36.3%. In 2020, South Korean companies led with a market share of 39.8%, 4.8% points higher than China. It was the first time that Chinese companies owned a larger market share than its South Korean rivals, primarily Samsung Display and LG Display.

The market in Europe is expected to register a steady revenue growth rate over the forecast period, which is attributed to rising innovations by key market players in various countries in the region. On 28 November 2022 for instance, the Find N Fold and Find N Flip names were trademarked by Oppo with the European Union (EU) Intellectual Property Office. According to the company, Flip and Foldable phones are the future, and Europe will get the next generation of Oppo"s foldable phones.

The global display market is fragmented, with many large and medium-sized players accounting for the majority of market revenue. Major companies are deploying various strategies, entering into mergers & acquisitions, strategic agreements & contracts, developing, testing, and introducing more effective displays. Some major players included in the global display market report are:

For the purpose of this report, Emergen Research has segmented the global display market on the basis of resolution, display technology, panel size, product type, vertical, and region:

North America is expected to hold a significant share in the market studied over the forecast period, due to the presence of some significant players in the region, coupled with the extensive R&D activities resulted in the full-scale adoption of the large format displays in the region.

The major factor driving the growth of this regional market is rising outdoor advertisements. According to the Out of Home Advertising Association of America, the OOH advertising revenue rose by 7.7% in 2019, over 2018. This includes digital out of home and is comprised of billboards, street furniture, transit advertising, and place-based media. With such a positive outlook showcased by the industry, the market studied is expected to grow at a steady pace in the region over the forecast period.

The players present in the ecosystem, through strategic partnerships, are working closely to introduce new technologies into the market studied. This is expected to fuel the demand for large format displays over the forecast period.

For instance, in September 2019, Captivate, North America’s leading location-based digital video network, announced a strategic partnership with location-based martech company Hivestack to launch programmatic channels for digital advertising, thereby, to enable programmatic buying of Captivate’s system of premier office media inventory, through Hivestack’s private marketplace (PMP) and ad exchange.

In May 2020, Prysm Inc., a major display and visual collaboration solutions provider, created a new category in the display market by unveiling its largest seamless interactive display, the Prysm Laser Phosphor Display (LPD) 6K Series, 225“, which is 20ft wide and 5ft high. The Prysm LPD 6K Series is an interactive large-format display that offers a panoramic image uninterrupted by seams or bezels. The newly developed LPD is an extremely energy-efficient interactive touch display that is shatter-resistant, flexible, and offers rollability for transport.

The market has also observed a significant number of strategic merger-acquisition instances, which may further boost the growth of the market. For instance, in September 2020, Sahara Presentation Systems PLC (which includes Sahara AV Solutions, Clevertouch and Sedao) was acquired by Boxlight Corporation. The acquisition by Boxlight is set to benefit Sahara AV’s, Sedao’s, and Clevertouch’s partners across the world, with an even greater range of audio-visual solutions for greater collaboration, classroom, and workspace technology.

Some prominent players in the region are launching campaigns that use billboards to promote ad campaigns among the people of the region. Thus, this increasing use of technology is expected to boost the market studied over the forecast period.

Two types of backlight technologies are currently deployed in the global large format display market – LED Backlit and CCFL. Of these, LED Backlit is the most preferred technology, being implemented across most large format display devices across the globe. In terms of value, the LED Backlit segment is expected to increase 2.2X during the forecast period.

From an estimated market valuation of about US$ 9.5 Bn in 2017, the LED Backlit segment is expected to reach a market value of more than US$ 20 Bn by 2027, registering a CAGR of 8.1% over the forecast period. In terms of value, the CCFL segment is expected to increase 1.2X during the forecast period. The LED Backlit segment is projected to register high Y-o-Y growth rates throughout the period of study.

Introduction of laser phosphor displays: Technological advancements in display technologies have led to the introduction of laser phosphor displays. Owing to several enhanced features such as better image quality and less power consumption, laser phosphor displays are expected to replace LED and LCD displays in the near future.

Simultaneous remote control of multiple large format displays: Owing to increasing consumer demand for advanced features such as remote control functionality along with ease of use, companies manufacturing large format displays have started incorporating features such as simultaneous remote control of multiple large format displays that enable operators to simultaneously control multiple displays remotely using devices like personal computers.

Ambient light sensors in large format displays:As large format displays have outdoor applications at various government and public places and outside retail stores, there is an issue witnessed because of the differences in working conditions during different times of the day i.e., day and night. Manufacturers have started installing ambient light sensors in their large format displays, which enables these displays to automatically adjust the brightness according to outdoor conditions.

Augmented viewing technology with both portrait and landscape modes: With advancements in technology, a transition in viewing orientation is being observed as consumers demand displays that can provide both landscape and portrait viewing orientation. Top market vendors have started introducing large format displays that can be installed in such a way so as to facilitate both landscape and portrait views.

CCFL to be replaced by LED Backlit Technology: Innovations in backlighting technology has led to a transition from cold-cathode fluorescent (CCFL) backlighting to LED backlighting. The advantages associated with LED backlit technology include brighter display, longer product life, reduced thickness, less energy consumption, and elimination of mercury. Most of the leading companies operating in the global large format display market are now implementing LED backlit technology in their large format displays. However, adoption of CCFL technology is still being observed owing to its low costs.

Introduction of interactive (touchscreen) large format displays: Advancements in technology have led to the incorporation of touchscreen large format displays that offer enhanced end user experience. Major applications of touchscreen large format displays are in control rooms, corporate meetings, educational institutes and retail stores. Manufacturers of large format displays are now introducing touchscreen displays to cater to the rising consumer demand.

Use of large format displays in the educational sector: Large display formats are increasingly being used in the educational sector. Interactive large format displays enable several individuals to participate and view simultaneously, making it suitable for exhibiting presentations and lectures.

Westford, USA, Sept. 27, 2022 (GLOBE NEWSWIRE) -- 4K Display Market has become extremely popular in recent years, as users have come to appreciate their high-resolution quality. 4K displays offer a much higher resolution than the current mainstream displays, which is why they are so appealing to consumers. Today, 4K displays are not just for TV, Desktop and Laptop usage anymore. Companies are now starting to install 4K displays in their Commercial Locations such as Hospitals, Schools, and Airports. Manufacturers are also producing them in large quantity and selling them at an exponential rate.

The growing demand for 4K display market is raising expectations about the next big thing in display technology. With improvements in resolution and color, 4K displays are already transforming how we view content. With prices dropping and more content being created in 4K, the demand for these screens only continues to grow.

Currently, 2160p (4K) displays are dominant in the 4K display market. But this is only the beginning—as technology improves, SkyQuest’s analyst predict that UHD (3840x2160) displays will become prevalent by 2020.

Why are 4K Displays So Effective? There are many benefits of using 4K displays over traditional displays: - They Offer Higher Resolution: When it comes to resolution, 4K Displays consistently deliver smoother lines and sharper pictures than traditional displays. This means that graphics and images look smoother and more realistic than ever before in the 4K display market.

Global shipments of 4K display were totaled at 127.4 million units in 2021 and is projected to reach 405 million by 2028. Moreover, OLED and QLED TV shipments continue to dominate with a share of above 58%. The global 4K display market revenue is forecast to grow at a CAGR of 23.20% through 2028.

In terms of application areas, gaming continues to be an early adopter of 4K displays with gaming mic and headsets releasing in Q4/2021 with more devices set to release in 2022. In addition, commercial buildings are starting to upgrade their signage systems from HD to 4K for added clarity and detail especially for high dynamic range (HDR) content, which is projected to add fuel to the growth of the 4K display market.

These findings in the 4K display market confirm that 4KTV is becoming the must-have television technology for enthusiasts who want the best possible images. However, it is not just ultra-high-definition televisions that are gaining popularity among consumers; Our research shows that sales of 3D TVs are growing as well. In fact, we expect 4K 3DTV penetration to reach 50% by 2025, up from just 44% at present. This is due to the increasing popularity of premium viewing platforms such as Netflix, Hulu, and Amazon Prime Video that support 4K content.

4K displays are becoming increasingly popular as consumers in the 4K display market become more demanding for better picture quality. This is especially true for video and gaming as 4K offers a sharper image than traditional HD displays.

The top five global brands in the 4K display market namely Samsung, Sony, Hisense, TCL, and LG are holding over 55% share of the global 4K display market. With Samsung leading the pack with a market share of over 19%. The top three global brands generated revenues that were greater than their combined total from 2018–2021.

This dominance is likely due to Samsung’s continued production and deployment of large screen OLED displays. SkyQuest’s analysts say that Samsung’s QLEDs are “the perfect technology for high-resolution displays” and that they are “likely to remain dominant in flagship devices for some time.”

In addition to QLEDs, Samsung, a largest player in 4K display market, also offers other types of 4K displays, including quoted LCD panels and WQHD+ AMOLED panels. But QLEDs continue to dominate the market because they can offer “significantly higher resolution and brightness levels as well as better color performance than any other type of panel.”

It seems like Korean brands are dominating not only in terms of sales but also in terms of R&D and innovation in the 4K display market. We will have to see how this competitive landscape will shift in coming years as newer brands are launching their products in the market.

SkyQuest Technology is leading growth consulting firm providing market intelligence, commercialization and technology services. It has 450+ happy clients globally.

A PC monitor is a piece of computer hardware that displays the video and graphics information generated by a connected computer through the computer"s video card. Monitors are similar to TVs but usually display information at a much higher resolution. Also, unlike televisions, monitors typically sit atop a desk rather than being mounted on a wall. A monitor is sometimes referred to as a screen, display, video display, video display terminal, video display unit, or video screen.

According to computer monitor market analysis, the LED monitor segment was the highest contributor to the market in 2021 and is expected to follow the same trend during the forecasted period. The commercial segment accounted for around 48.8% market share in 2021. Surge in the use of LED displays for video wall, TVs, and digital signage applications has driven the computer monitor market growth.

The computer monitor market key players profiled in the report Dell Technologies Inc., HP Inc., TPV Technology Limited, Lenovo Group Limited, Samsung Group, Intelligent Imaging Innovations, LG Electronics Inc., Apple Inc., Acer Inc. and AsusTek Computer Inc. Market players have adopted various strategies, such as product launch, collaboration & partnership, joint venture, and acquisition, to expand their foothold in the computer monitor market.

KEY FINDINGS OF THE STUDYIn 2021, the large segment was the major revenue contributor to the computer monitor industry, and is projected to grow at a notable CAGR of 7.38% during the forecast period.

Key players profiled in the report include Dell Technologies Inc., HP Inc., TPV Technology Limited, Lenovo Group Limited, Samsung Group, Intelligent Imaging Innovations, LG Electronics Inc., Apple Inc., Acer Inc. and AsusTek Computer Inc. Market players have adopted various strategies, such as product launch, collaboration& partnership, joint venture, and acquisition to expand their foothold in the computer monitor market.

Screen less displays are the new technological displays that solve the problem of device miniaturization and replace devices of the display screens. Adoption of the innovation in the screen less technology is a crucial factor for the businesses in the screen less display market. Recent technological introduction of virtual reality, digital image processing immensely flourishes the global screen less display market. Screen less displays are extensively used in medical applications; hence, increasing the healthcare sector is anticipated to fuel demand for screen fewer displays. Rising transportation system requirements excels in the screen less display market as they are increasingly used in projecting maps of the surrounding area to track transportation activities.

The screen less display market is expected to witness strong growth due to the increasing demand for hyper-personalization in the user experience in gaming applications. Screen less displays are widely used across offices and corporates during presentations and meetings. The growing manufacturing sector across the globe give rise to the screen less display market as they are widely used in viewing virtual blueprints that use various images to identify parts replacements and operation information.

Increasing requirements of the technologically enabled screen less displays such as head-mounted displays, MR enabled displays acts as a key driver for the growth of the screen less display market. In addition to this, Extended features such as low power requirements, higher resolution images, larger portability, wide viewing angle, more verified colour with better brightness, and contrast over traditional screen displays attract peoples and drives for the growth of the screen less display market. For instance, in January 2020, Apple is planning to launch an MR headset that includes a 3D customizing face-fit module and head-mounted display for displaying a variety of content and to deliver ultimate comfort.

Enhanced privacy and security of the screen fewer displays help to increase the trust of the customers over them and fuels the demand for the screen fewer displays. Also, the screen less display requires lesser space than that of the traditional display, this propels the growth of the market.

However, the higher cost of the display screen, along with lesser awareness about screen less displays among developing countries, is expected to hinder the growth of the market.

The global screen less display market consists of various key players such as Google Inc., Avegant Corporation, Microsoft Corporation, Synaptic Incorporated, Esterline Technologies Corp., BAE Systems, MicroVision Inc., RealView Imaging Ltd., EON Reality, etc.

Based on the type, a screen less display market is segmented into categories such as visual image displays, retinal displays, and synaptic displays. The virtual image display category is projected to hold major share of the global screen less display market owing to the increasing use of holograms for the image displays that can be easily stored on the devices or can be connected to the projectors for accessing image contents.

Based on applications, the screen less market is segmented into holographic projections, head-mounted projections, and head up projections. The holographic projection segment is projected to witness major share of the screen less display market as they are cost-effective, and holographic projections provide touchless 3D experiences along with high quality.

On the basis of verticals, global screen less market is segmented into aerospace and defence, automotive, healthcare, and consumer electronics business verticals. Healthcare vertical is expected to hold major share of the screen less display market due to increasing use of screen less displays by the physicians to view infected areas during patient’s surgery using VRD technology.

North America segment is expected to hold the major share of the global screen less display market. The developed country, such as the US, is expected to dominate the North American region owing to the huge technological advancements in the screen less displays in the United States. For instance, in 2017, Google launches Google"s assistant screen less smart display at the Echo Show 2017 in the United States.

In addition to this, the large population in the United States is inclined towards playing AR/VR video games that use AR/VR head-mounted displays. According to Nielson.org, in 2018, nearly 64% of the population in the US are gamers and in that more than half of the population heard about any one of the AR/VR video game devices.

Asia Pacific regions are expected to witness faster growth in the screen less display market. The leading countries in the electronics manufacturing sector such as Taiwan, South Korea, India and China and many others play a significant role in the development of the screen less display products owing to the countries" large investment in technologically innovative products. According to the World Economic Forum (WEF), China has grown rapidly in the investments in R&D at the annualized rate of 13.1% by 2017. Increased investment in the Innovative products attract consumers and businesses to purchase the screen less display products as per their requirements and propels the global screen less display market.

Abrisa Technologies offers complete solutions for fabricated and damage resistant technology glass, optical and conductive coatings, graphics, films, oleophobics, and services for digital SMART displays, sensors and scanners. SMART mirror/LCD hospitality and digital gaming solutions: partially transmissive mirrors, low glare, anti-reflection, anti-smudge, large format 84” diagonal glass, dead front, pinhole and halo free PMS color matched and metallic look graphics.

Slim profile, lightweight or touch solutions: Coated wafers, High Ion-Exchange (HIE™) damage resistant 0.1 – 0.4mm thick aluminosilicates, oleophobic AR coatings and specialty coatings for high sensitivity touch, wearables, slim displays and lightweight devices.

Outdoor, Rugged and Performance Displays, Sensor and Scanner solutions: Wide-angle AR coatings and non-glare glass for large angle viewing, sunlight readability, automotive LIDAR, sensors and IMITO EMI shielding and anti-fog heaters for cockpit displays and outdoor imaging.

About IndustryARC: IndustryARC is a Research and Consulting Firm that publishes more than 500 reports annually, in various industries such as Agriculture, Automotive, Automation & Instrumentation, Chemicals and Materials, Energy and Power, Electronics, Food & Beverages, Information Technology, and Life Sciences & Healthcare.

The global center information display market is set to reach a market valuation of US$ 662.9 million in 2022 and further expand at a CAGR of 7.9% to grow to US$ 1.4 billion by the end of 2032.

Automotive displays have been in use earlier with just a few knobs and buttons to become the pathway to provide important vehicle information to the driver and passengers. Center information displays now come with additional features and advanced technologies, such as navigation, music, entertainment, cabin temperature controls, and much more.

Rapid growth in the automotive sector has created opportunities for center information displays with newer technological advancements and attractive looks.

Short Term (2022 Q2 to 2025): Rising utilization and integration of smart technology in center information displays with advanced specifications to positively impact center information display demand growth.

Between 2017 and 2021, the global center information display market registered a CAGR of 0.4%, and according to Fact.MR, a market research and competitive intelligence provider, the market is set to exhibit high growth at 7.9% CAGR through 2032.

Market share analysis of center information displays based on size and region is provided in a nutshell in the above image. 10-15 inch CIDs dominate with 66% market share in 2022.

Since smartphones can now be connected directly to automobiles owing to technological advancements in the telecommunications industry, the market for car center information displays has witnessed significant growth. Digitalization and connectivity, which guarantee a high level of customization for drivers and passengers, are increasingly influencing the automobile sector by creating more appealing interiors for cars.

Driver information displays, which give the driver necessary information and the passengers a display, come with extra features and have a wide variety of specifications that allow passengers to enjoy more individualized entertainment experiences. Furthermore, analog buttons will soon virtually vanish from automobile cockpits and will feature minimalist interior designs.

OLED is a light-emitting technology that is used to make flexible, thin displays. Several automakers have already incorporated OLED panels into their center information displays. The promise of advanced driver assistance systems (ADAS) is that they increase vehicle safety by making driving easier and removing the sources of driver distraction and inattention, which frequently result in serious accidents.

TFT LCD and OLED dashboard displays are being adopted for controlling the air conditioning, music functionality, temperature, and many other things. Many hybrid and electric vehicles today use screens to show performance functions. Owing to all these factors, the installation of center information displays will increase at a much faster rate over the coming years.

The market for automobile center information displays requires higher spending on research and development and is generating fresh concepts and developments. To boost comfort to a much higher degree, some major companies, including Google and Apple, are working to create driverless cars with central information display systems that can be operated with voice and gesture controls.

Voice instructing through car speakers also makes it much simpler to find the right route while driving. Furthermore, the market for automotive center stacks is predicted to grow even more quickly in the future due to the rise in the development of electric and autonomous vehicles.

The United States dominates the global center information display market as it enjoys huge investments in the automotive and electronic industries. Currently, the United States is one of the leading car manufacturers in the world by volume and produced around 1.5 million passenger vehicles in 2021. Moreover, the U.S. is the third-largest EV manufacturer in the world.

Government initiatives and promotion activities are complementing EV market growth, which will also support center information display market expansion. Owing to a strong economy and prominent market players operating in the country, the United States will hold significant potential for center information display sales over the coming years.

China is a leading market for vehicle manufacturing and sales. Moreover, the Chinese government has estimated the domestic market to reach a total sales volume of 35 million vehicles annually by 2025.

Market expansion is also being impacted by the fast growth of EV vehicles in the automotive industry. China recorded the strongest growth in the EV market with around 3.2 million EV vehicles sold in 2021 while taking a long jump from 6% share in 2020 to 13% share in 2021 in overall vehicle sales.

China accounted for roughly three-fourths of East Asia’s center information display production in 2021. The China market for center information displays is expected to reach US$ 520.5 million by the end of 2032.

Thus, the integration of OLED center information displays has increased steadily, surpassing a valuation of US$ 430.4 million in 2021. Furthermore, with the mounting global automotive display market, the LED sub-segment is predicted to expand 2.3Xby the end of 2032.

Prominent center information display manufacturers are 3M Company, ADAYO (Huizhou Foryou Optoelectronics Technology Co Ltd), AUDI AG, BMW, Continental AG, Denso Corporation, HARMAN International, Hyundai Mobis, JDI Europe GmbH, LG Display Corporation, Magneti Marelli S.P.A., Mazda Motor Corporation, Mercedes-Benz MBUX, MTA S.p.A, Preh GmbH, Robert Bosch GmbH, Socionext, Texas Instruments Incorporated, The Ford Motor Company , Visteon Corporation, and Volvo Cars.

Prominent manufacturers of center information displays are trying to adopt newer technologies to stay on top of the competition. Key manufacturers are focused on inventing new techniques, enhancement of safety & comfort, robust display quality, and much more.

In January 2022, Visteon Corporation announced that it will bring in the high perceptual quality advanced cockpit display technology. This innovation will provide superior information to the driver and advanced in-vehicle infotainment.

Fact.MR has provided detailed information about the price points of key manufacturers of center information displays positioned across regions, sales growth, production capacity, and speculative technological expansion, in the recently published report.

Some subscribers prefer to save their log-in information so they do not have to enter their User ID and Password each time they visit the site. To activate this function, check the "Save my User ID and Password" box in the log-in section. This will save the password on the computer you"re using to access the site.

Note: If you choose to use the log-out feature, you will lose your saved information. This means you will be required to log-in the next time you visit our site.

Digimax distribetes a wide range of professional LCD monitors and large format displays for digital signage applications manufactured by Philips: one of the world"s largest manufacturers of TFT monitors, recognized for quality products and cutting-edge solutions.

Digimax is able to customize the various components to adapt them to the specific needs of each industrial sector and renew them according to the latest technological innovations, such as bar type 16:4 displays that allow a very special view of the image, appreciated in advertising.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey