largest lcd panel manufacturers quotation

Asia has long dominated the display module TFT LCD manufacturers’ scene. After all, most major display module manufacturers can be found in countries like China, South Korea, Japan, and India.

However, the United States doesn’t fall short of its display module manufacturers. Most American module companies may not be as well-known as their Asian counterparts, but they still produce high-quality display products for both consumers and industrial clients.

In this post, we’ll list down 7 best display module TFT LCD manufacturers in the USA. We’ll see why these companies deserve recognition as top players in the American display module industry.

STONE Technologies is a leading display module TFT LCD manufacturer in the world. The company is based in Beijing, China, and has been in operations since 2010. STONE quickly grew to become one of the most trusted display module manufacturers in 14 years.

Now, let’s move on to the list of the best display module manufacturers in the USA. These companies are your best picks if you need to find a display module TFT LCD manufacturer based in the United States:

Planar Systems is a digital display company headquartered in Hillsboro, Oregon. It specializes in providing digital display solutions such as LCD video walls and large format LCD displays.

Microtips Technology is a global electronics manufacturer based in Orlando, Florida. The company was established in 1990 and has grown into a strong fixture in the LCD industry.

What makes Microtips a great display module TFT LCD manufacturer in the USA lies in its close ties with all its customers. It does so by establishing a good rapport with its clients starting from the initial product discussions. Microtips manages to keep this exceptional rapport throughout the entire client relationship by:

Displaytech is an American display module TFT LCD manufacturer headquartered in Carlsbad, California. It was founded in 1989 and is part of several companies under the Seacomp group. The company specializes in manufacturing small to medium-sized LCD modules for various devices across all possible industries.

The company also manufactures embedded TFT devices, interface boards, and LCD development boards. Also, Displaytech offers design services for embedded products, display-based PCB assemblies, and turnkey products.

Displaytech makes it easy for clients to create their own customized LCD modules. There is a feature called Design Your Custom LCD Panel found on their site. Clients simply need to input their specifications such as their desired dimensions, LCD configuration, attributes, connector type, operating and storage temperature, and other pertinent information. Clients can then submit this form to Displaytech to get feedback, suggestions, and quotes.

A vast product range, good customization options, and responsive customer service – all these factors make Displaytech among the leading LCD manufacturers in the USA.

Products that Phoenix Display offers include standard, semi-custom, and fully-customized LCD modules. Specifically, these products comprise Phoenix Display’s offerings:

Clients flock to Phoenix Display because of their decades-long experience in the display manufacturing field. The company also combines its technical expertise with its competitive manufacturing capabilities to produce the best possible LCD products for its clients.

True Vision Displays is an American display module TFT LCD manufacturing company located at Cerritos, California. It specializes in LCD display solutions for special applications in modern industries. Most of their clients come from highly-demanding fields such as aerospace, defense, medical, and financial industries.

The company produces several types of TFT LCD products. Most of them are industrial-grade and comes in various resolution types such as VGA, QVGA, XGA, and SXGA. Clients may also select product enclosures for these modules.

All products feature high-bright LCD systems that come from the company’s proprietary low-power LED backlight technology. The modules and screens also come in ruggedized forms perfect for highly-demanding outdoor industrial use.

LXD Incorporated is among the earliest LCD manufacturers in the world. The company was founded in 1968 by James Fergason under the name International Liquid Xtal Company (ILIXCO). Its first headquarters was in Kent, Ohio. At present, LXD is based in Raleigh, North Carolina.

We’ve listed the top 7 display module TFT LCD manufacturers in the USA. All these companies may not be as well-known as other Asian manufacturers are, but they are equally competent and can deliver high-quality display products according to the client’s specifications. Contact any of them if you need a US-based manufacturer to service your display solutions needs.

We also briefly touched on STONE Technologies, another excellent LCD module manufacturer based in China. Consider partnering with STONE if you want top-of-the-line smart LCD products and you’re not necessarily looking for a US-based manufacturer. STONE will surely provide the right display solution for your needs anywhere you are on the globe.

LG Display is currently the world"s number one LCD panel manufacturer, affiliated to the LG Group, headquartered in Seoul, South Korea, and has R & D, production and trade institutions in China, Japan, South Korea, the United States and Europe.

Samsung Electronics is the largest electronics industry company in South Korea and the largest subsidiary of Samsung Group. Its product development strategy not only emphasizes the matching principle of "leading technology, using the most advanced technology to develop new products in the import stage to meet the needs of the high-end market", but also emphasizes "leading technology, developing new products with the most advanced technology." the matching principle of creating new demand and new high-end markets.

INNOLUX Optoelectronics is a professional TFT-LCD panel manufacturing company founded by Foxconn Technology Group in 2003. The factory is located in Shenzhen Longhua Foxconn Science and Technology Park. INNOLUX Optoelectronics has a strong display technology research and development team, coupled with Foxconn"s strong manufacturing capacity to effectively play the benefits of vertical integration, which will make an instructive contribution to improving the level of the world flat panel display industry. In March 2010, it merged with Chi Mei Electronics and Tongbao Optoelectronics.

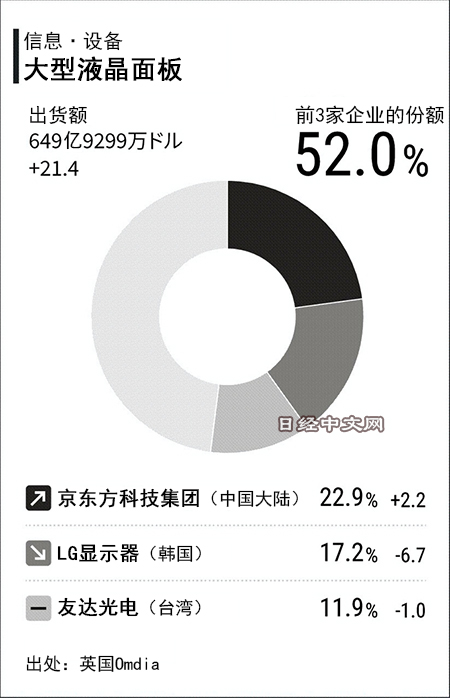

Founded in April 1993, Chinese mainland is the largest manufacturer of display panels and a provider of Internet of things technology, products and services. At present, BOE has reached the first place in the world in the fields of notebook LCD screen, flat panel LCD screen, mobile phone LCD screen and so on. With its successful entry into Apple"s supply chain, it will soon become the top three LCD panel manufacturers in the world.

BOE was the leading LCD TV panel vendor during the first half of 2020, having shipped approximately 23.26 million units worldwide. In that period, global shipments of LCD TV panels totaled over 115 million units.

BOE Technology, founded in 1993, has become China’s largest TV panel maker and it continues to make a name for itself in the global consumer electronics market. It was the first company to introduce a gen 10.5 LCD plant in late 2017. Since then, BOE’s LCD panel production capacity has grown annually, surpassing former leading manufacturer LG Display. In recent years, BOE accounted for over 20 percent of large-area TFT LCD display unit shipments worldwide.

Chinese panel makers accelerate worldwide LCD TV panel shipmentsChina became the leading LCD panel producer worldwide in 2017, overtaking powerhouses South Korea and Taiwan. Chinese shipments of LCD TV panels 60-inch and larger have also increased significantly in recent years, with roughly 2.24 million units sold in the first quarter of 2019 worldwide, in comparison to just 117,000 units a year before. This figure is forecast to increase in the future, paving the way for Chinese panel makers’ worldwide success. At the same time, the concurrent specialization on large LCD panels by Chinese and South Korean suppliers will likely push down panel prices.Read moreGlobal LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor(in millions)tablecolumn chartCharacteristicBOELGDInnoluxCSOTSDCAUOCEC GroupOthers1H 202023.2611.7920.3421.312.1310.14-16.17

TrendForce. (July 28, 2020). Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions) [Graph]. In Statista. Retrieved December 09, 2022, from https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce. "Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions)." Chart. July 28, 2020. Statista. Accessed December 09, 2022. https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce. (2020). Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions). Statista. Statista Inc.. Accessed: December 09, 2022. https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce. "Global Lcd Tv Panel Unit Shipments from H1 2016 to H1 2020, by Vendor (in Millions)." Statista, Statista Inc., 28 Jul 2020, https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce, Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions) Statista, https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/ (last visited December 09, 2022)

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

For over 20 years we"ve been helping clients worldwide by designing, developing, & manufacturing custom LCD displays, screens, and panels across all industries.

Newhaven Display has extensive experience manufacturing a wide array of digital display products, including TFT, IPS, character displays, graphic displays, LCD modules, COG displays, and LCD panels. Along with these products, we specialize in creating high-quality and affordable custom LCD solutions. While our focus is on high-quality LCD products, we also have a variety of graphic and character OLED displays we manufacture.

As a longtime leader in LCD manufacturing, producing top-quality LCD modules and panels is our highest priority. At Newhaven Display, we’re also incredibly proud to uphold our reputation as a trusted and friendly custom LCD manufacturing company.

As a custom LCD manufacturing company, we ensure complete control of our custom displays" reliability by providing the industry"s highest quality standards. Our design, development, production, and quality engineers work closely to help our clients bring their products to life with a fully custom display solution.

Our excellent in-house support sets Newhaven Display apart from other display manufacturers. Modifications in the customization process are completed at our Illinois facility, allowing us to provide an exceptionally fast turnaround time.

Customer support requests sent by phone, email, or on our support forum will typically receive a response within 24 hours. For custom LCD project inquiries, our response time can take a few days or weeks, depending on the complexity of your display customization requirements. With different production facilities and a robust supply chain, we are able to deliver thefastest turnaround times for display customizations.

Our excellent in-house support and custom display modifications set Newhaven Display apart from other LCD display manufacturers. From TFTs, IPS, sunlight readable displays, HDMI modules, EVE2 modules, to COG, character, and graphic LCDs, our modifications in the customization process are completed at our Illinois facility, allowing us to provide quality and fast turnaround times.

As a display manufacturer, distributor, and wholesaler, we are able to deliver the best quality displays at the best prices. Design, manufacturing, and product assembly are completed at our headquarters in Elgin, Illinois. Newhaven Display International ensures the best quality LCD products in the industry in this newly expanded facility with a renovated production and manufacturing space.

Recently, it was announced that the 32-inch and 43-inch panels fell by approximately USD 5 ~ USD 6 in early June, 55-inch panels fell by approximately USD 7, and 65-inch and 75-inch panels are also facing overcapacity pressure, down from USD 12 to USD 14. In order to alleviate pressure caused by price decline and inventory, panel makers are successively planning to initiate more significant production control in 3Q22. According to TrendForce’s latest research, overall LCD TV panel production capacity in 3Q22 will be reduced by 12% compared with the original planning.

As Chinese panel makers account for nearly 66% of TV panel shipments, BOE, CSOT, and HKC are industry leaders. When there is an imbalance in supply and demand, a focus on strategic direction is prioritised. According to TrendForce, TV panel production capacity of the three aforementioned companies in 3Q22 is expected to decrease by 15.8% compared with their original planning, and 2% compared with 2Q22. Taiwanese manufacturers account for nearly 20% of TV panel shipments so, under pressure from falling prices, allocation of production capacity is subject to dynamic adjustment. On the other hand, Korean factories have gradually shifted their focus to high-end products such as OLED, QDOLED, and QLED, and are backed by their own brands. However, in the face of continuing price drops, they too must maintain operations amenable to flexible production capacity adjustments.

TrendForce indicates, that in order to reflect real demand, Chinese panel makers have successively reduced production capacity. However, facing a situation in which terminal demand has not improved, it may be difficult to reverse the decline of panel pricing in June. However, as TV sizes below 55 inches (inclusive) have fallen below their cash cost in May (which is seen as the last line of defense for panel makers) and are even flirting with the cost of materials, coupled with production capacity reduction from panel makers, the price of TV panels has a chance to bottom out at the end of June and be flat in July. However, demand for large sizes above 65 inches (inclusive) originates primarily from Korean brands. Due to weak terminal demand, TV brands revising their shipment targets for this year downward, and purchase volume in 3Q22 being significantly cut down, it is difficult to see a bottom for large-size panel pricing. TrendForce expects that, optimistically, this price decline may begin to dissipate month by month starting in June but supply has yet to reach equilibrium, so the price of large sizes above 65 inches (inclusive) will continue to decline in 3Q22.

TrendForce states, as panel makers plan to reduce production significantly, the price of TV panels below 55 inches (inclusive) is expected to remain flat in 3Q22. However, panel manufacturers cutting production in the traditional peak season also means that a disappointing 2H22 peak season is a foregone conclusion and it will not be easy for panel prices to reverse. However, it cannot be ruled out, as operating pressure grows, the number and scale of manufacturers participating in production reduction will expand further and its timeframe extended, enacting more effective suppression on the supply side, so as to accumulate greater momentum for a rebound in TV panel quotations.

A liquid-crystal display (LCD) is a flat-panel display or other electronically modulated optical device that uses the light-modulating properties of liquid crystalsread more...

According to the relevant information, Samsung shows that the sales should be L7-2 and L8-2-1. In Samsung"s large-size LCD production line layout, L7-1 has been closed in 2012, while L7-2 has not invested in glass substrates since March this year; in the 8.5-generation line, L8-1 has been closed earlier, and L8-2 has not been high recently, maintaining around 60K per month.

In terms of product structure, the two production lines are mainly large-size LCD TV panels and display panels. Among them, the panel size of L7-2 production line covers 20-82 inches, and the panel size of L8-2-1 covers 23.6 inches-55 inches, and the two production lines support panel production with the highest 8KQUHD resolution.

Horse, an analyst at Loto Technology, believes that Samsung is facing an awkward situation. On the one hand, it needs to concentrate resources to speed up the production of QDOLED prototypes. The schedule is to provide prototypes to VD, Sony and others in June and to achieve mass production by the end of the year after completing the market evaluation in September. This needs to reduce and give up the investment in LCD LCD panel technology. On the other hand, Samsung shows that it also needs to grasp the short period of the panel to ensure the supply of high-end LCD TV panels it needs.

Since mid-2020, the demand side of the large-size LCD panel industry as a whole has benefited from the epidemic housing economy ushered in a deep V reversal.

According to the latest quotation survey released by panel professional research agency WitsView on May 5, the prices of the three major application panels for TV, laptop and display continued to rise in early May, reaching a touchdown for 12 months, setting a record of "rising for a whole year in a row." it is expected that prices will continue to rise in June.

Huatai Securities analyst Hu Jian team believes that in the context of the improvement of the long-term supply and demand pattern brought about by the withdrawal of South Korean manufacturers, considering the out-of-stock market that drives IC throughout the year, LCD out-of-stock price increases are expected to continue to be interpreted, while the Chinese mainland LCD industry from scratch, from have to large, from big to strong, has now achieved global leadership, with the industry periodically weakening, leading manufacturers have officially entered the harvest period.

Compared with the rapid development of domestic panel manufacturers in the LCD production line, Korean manufacturers who monopolized the market in the past began to aim at high-end panels, such as OLED, QLED, microLED and QD-OLED. Samsung and LGDisplay have said that they will reduce the production of LCD panels and will release orders for LCD display panels to Chinese enterprises in the future.

According to Omdia data, South Korea"s local old LCD capacity still accounts for 16% of the total large-size panels, and Xu Xingjun, an analyst with Guangfa Securities, said it was only a matter of time before this part of the capacity was withdrawn. In terms of new production capacity, there are almost no investment plans for new production lines in the industry. According to the existing plans, the proportion of new production capacity in the industry in the future is only about 15%. Taking into account the withdrawal of Korean factories and the limited new capacity, the future growth rate of large-size panel capacity will remain below 3%, and the overall industry supply and demand pattern will continue to improve.

In addition, in the field of high-generation LCD panels, industry concentration ushered in a rapid increase. In 2020, more than one high-generation production line began to be integrated by leading manufacturers. After TCL Huaxing"s acquisition of Samsung"s Suzhou G8.5 production line and BOE"s acquisition of CLP"s Nanjing G8.5 and Chengdu G8.6 production lines were completed, considering the withdrawal of Korean factory capacity, the share of the two leading manufacturers, Jingdong and TCL, will rise to more than 50%.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey