lcd panel issue price

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

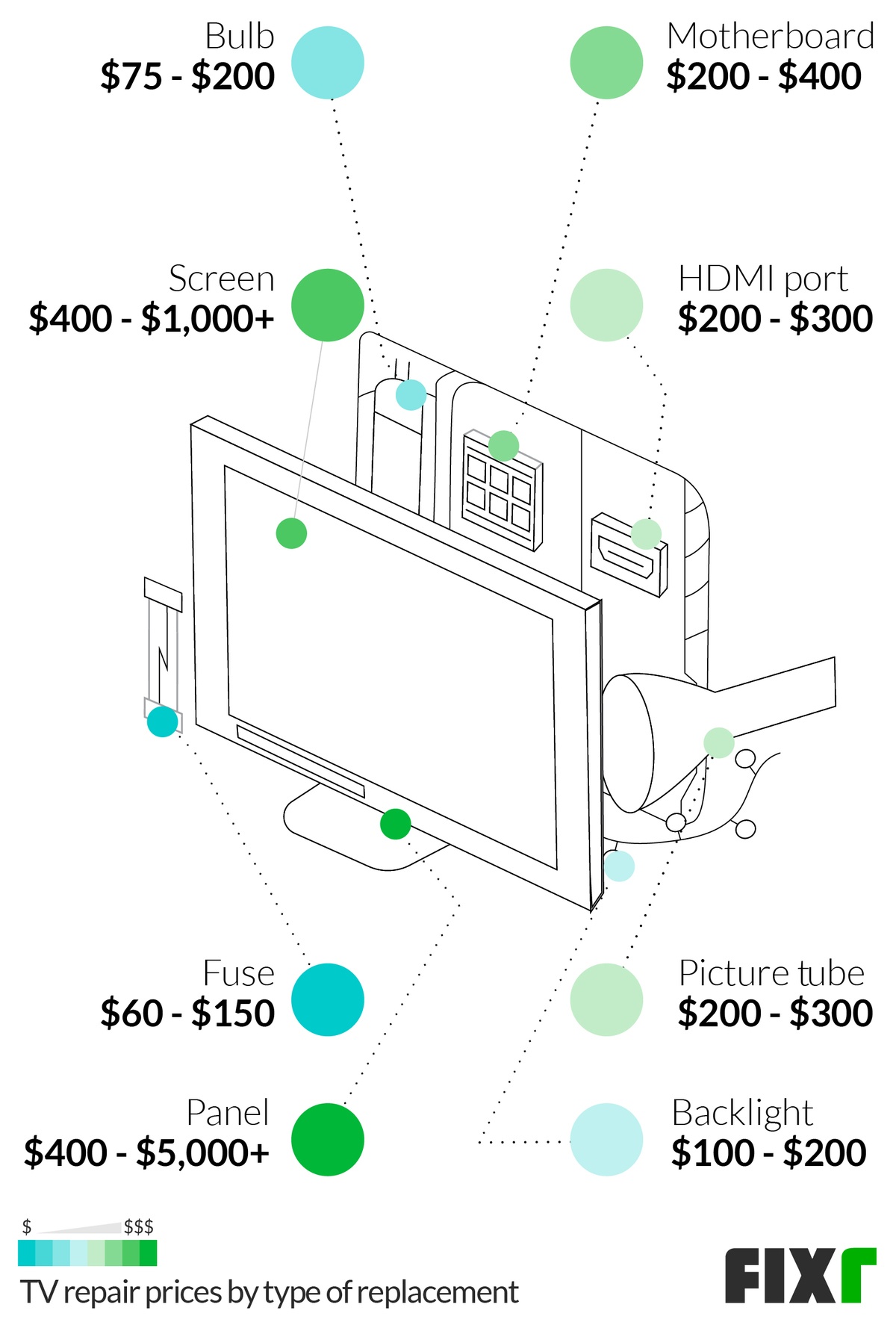

TV repair costs between $60 and $350 with most spending $207 on average for LCD, LED, plasma, and 4K TVs; costs are higher if repairing older DLP, projection, and HD TVs. TV problems like display issues, powering-on problems, or sound issues can be fixed. Pickup and delivery fees may apply.

For example, the price of a new Samsung 40-inch LED TV is about $400, yet the cost of a replacement display panel for this model is about $380. This price is only for the replacement part and does not cover diagnostic costs, labor costs, or travel or shipping fees.

Unless you are trying to fix a TV from the ’80s or earlier, cracked TV screen repair is not feasible; the entire display panel must be replaced instead. The cost of a replacement TV display panel is more than the cost of buying a new TV, and that’s before labor and other service costs.

TV manufacturers do keep replacement TV screen panels on hand to support products under warranty in case the screen malfunctions, due to manufacturer defect.

If you still want to replace a damaged or malfunctioning TV screen, your best option is to find a used replacement panel or a broken TV of the same model on which the screen is still functional. You might find one on eBay, and you can hire a technician to change out the panel.

The cost of a used replacement TV panel ranges from $50 to $350 or more, excluding shipping, depending on the brand and size. Note that the chances of finding exactly the part you need in excellent condition are slim, and the cost excludes the cost of installation by a repair shop.

Whether your TV is LCD, LED, plasma screen, or 4K (Ultra HD), the cost to fix common problems ranges from $60 to $350, depending on the repair type and the brand of TV being repaired.

If an older model LCD TV or projection TV powers on and has sound but no picture, this may be due to lamp burnout, which is both common and expected. In this case, replacing the bulb will fix the problem. An experienced technician should be able to replace the bulb quickly and easily.

Flat screen replacement glass is not available. The only option for flat-screen TV glass repair is to try optical glass glue, which costs $1.70 for a 5-ml. tube. This may be an option for TV glass repair if the crack is only a few inches or less. TV panels are built as one unit at the factory, with the glass adhered to the display panel.

LCD flat-panel repair is not considered cost-effective. If the glass is cracked or the display is physically damaged, it is cheaper to replace the entire TV than to repair or replace the display panel.

The cost of flat-screen TV repair ranges from $42 to $359. You cannot fix a broken screen, but the price of a new flat-panel TV starts from around $249 for a 1080-mp (non-4K) LED TV from LG to as much as $14,999 for an 85-inch 8K LED TV from Samsung. A TV referred to as a “flat TV” or “flat-screen” TV might be any of the following:

LCD TV repair typically costs $60 to $85 for diagnostics testing, and $200 to $300 to perform repairs. LCD TVs use backlighting, which may fail. Newer LCD TVs use LED strips for backlighting. Older ones might use CCFL. If CCFL backlighting fails, a technician can replace it with LED backlighting.

An LED TV is just an LCD TV that uses LED backlighting, which all newer models do (older models use CCFL backlighting). The cost to replace one LED backlighting strip ranges from $100 to $122, including parts and labor.

Circuit breaker - Check the circuit breaker for the power outlet that the TV plugs into. You can check the breakers by opening the door to your breaker panel and looking for circuit breakers that are in the OFF position.

Lamp burnout -In a projection TV or older LCD TV, no picture may be caused by lamp burnout. In this case, a technician can replace the bulb quickly and easily.

In most cases, a flat-screen TV can be fixed. The exception is a physically damaged display panel or screen. Most other issues including failing speakers, backlights, or power supply. Burned out fuses and damaged input ports can also be repaired.

Prices for all TV panel sizes fluctuated and are forecast to fluctuate between 2020 and 2022. The period from March 2020 to July 2021 saw the biggest price increases, when a 65" UHD panel cost between 171 and 288 U.S. dollars. In the fourth quarter of 2021, such prices fell and are expected to drop to an even lower amount by March 2022.Read moreLCD TV panel prices worldwide from January 2020 to March 2022, by size(in U.S. dollars)Characteristic32" HD43" FHD49"/50" UHD55" UHD65" UHD------

DSCC. (January 10, 2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph]. In Statista. Retrieved December 08, 2022, from https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars)." Chart. January 10, 2022. Statista. Accessed December 08, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. (2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars). Statista. Statista Inc.. Accessed: December 08, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "Lcd Tv Panel Prices Worldwide from January 2020 to March 2022, by Size (in U.S. Dollars)." Statista, Statista Inc., 10 Jan 2022, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC, LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) Statista, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/ (last visited December 08, 2022)

The term ‘flat screen’ applies to a wide range of TV types, from LCDs to the latest 4K and Smart models. A flat screen means the TV’s screen surface is flat rather than convex like older models. There can be several different types of flat-screen TVs, from older LCD to the newest Smart and 4K TVs. The type impacts the repair costs because more advanced and expensive TVs have more costly components to replace or fix. In addition, some TV repairs may not always be possible on that type. For example, it is not possible to replace the screen on a plasma TV if it cracks and begins to leak. The table below shows common television types and average repair costs for each:

Repairs for LCD TVs cost between $60 and $400. LCD televisions are one of the most popular options on the market, available in a wide range of sizes and styles. They use an LCD (liquid crystal display) with backlights to produce images. The backlights, screen, and other components may get damaged over time and need repairing.

LED TV repairs range from $60 to $400, depending on the scale of the problem. LED televisions are a specific type of LCD TV that use LED backlights to illuminate the liquid crystal display. These TVs usually produce more colorful and vibrant images and are more energy-efficient, but the LED backlights may need to be repaired or replaced over time.

Plasma TV repairs average $100 to $400. These televisions are made up of pixels filled with gas that light up when an electrical current is applied. They are less popular today, and most companies have stopped making them. But they can still be found in many homes and are subject to problems like screen burn and distorted colors. While some repairs on these TVs are possible, many issues cannot be repaired due to their design.

TV screen repairs cost between $200 and $400, but in many cases, repairing the screen is not possible. Since the screen is usually the most expensive part of the television and one of the most sensitive to impacts and other damage, an expert may advise you to simply buy a new television instead of having it repaired. It is worth getting a diagnosis if the screen issue is not too severe because issues like flashing pixels or distorted colors may be fixable.

TV panel repairs average $200 to $400 in some cases, but some panels cannot be repaired. For this reason, many companies do not offer panel repair. So if your television gets a crack in the panel, you may be better off buying a new unit instead.

In some cases, your TV components may not be able to be repaired, or it might be more cost-effective to replace them with new ones. The repair price includes the cost of new parts, plus the labor required to fit them into place and remove the broken components. While some components can be replaced, they may be extremely expensive or cost-prohibitive to do so. This is mainly in the case of panels and screens because they often contain too many parts to replace on their own. The table below shows average costs for a variety of common replacements:

Fuse replacement in a TV costs between $60 and $150 and is one of the easier replacement jobs for a repairman. Glass and ceramic fuses on your TV’s power supply board may blow in certain situations and need replacing. To replace a fuse, the repairman opens the TV to access the power panel and swaps out the fuse.

TV bulb replacement costs average $75 to $200. Bulbs are usually found only in older models of LCD TVs or projection TVs. They are used to illuminate the display so that the picture can be seen. Bulbs are relatively easy to replace, but the material costs are a little higher with bulbs when compared to other components, leading to varied replacement prices from model to model.

Picture tube replacements range from $200 to $300 on average. Picture tubes, also known as cathode ray tubes or CRTs, are only used in older TVs. So, this is not a replacement job you need to worry about with an LED or LCD TV.

TV screen replacement costs at least $400 to $1,000 and often much more. The screen is the most expensive part of a TV. So usually, the cost of replacing it is higher than just buying a new unit. In some cases, this is because the screen cannot be replaced without also replacing most of the other components, particularly for TVs like LED, LCD, or plasma. Most professional repair companies do not offer screen or panel replacement as a service.

TV panel replacement costs a minimum of $400 to $5,000 and often a lot more on some of the high-end 4K and Smart screen displays. Because the cost of a replacement panel is so high, it is usually more cost-effective to simply purchase a new television. Like the screen, this is due to the number of components involved. Therefore, most repair places will not offer panel replacement as a service.

You might not know exactly which part of your TV is broken or damaged at first. The symptoms of a broken television vary from vertical colored lines across the screen to audio issues, power problems, and even situations where the television starts normally but then turns itself off. For this reason, most repairs start with a diagnostic so that the problem can be found and a plan made for repair. For some repairs to be made, the part will need to be replaced, while in other cases, repair or replacement of that part may not be possible. The table below shows common problems and average repair costs for each.

Repairing a TV that will not turn on costs between $60 and $400 because there are many potential causes. It might be something as simple as a blown fuse, which can be replaced quite cheaply. Or, it could be a motherboard or power supply issue, which is more costly to fix.

Expect to pay between $75 and $400 to repair a television with no sound. There are various reasons why your TV’s sound stopped working. It is most likely a fault with a speaker, which can be repaired or replaced. Or, it could be a deeper issue associated with the motherboard, which may also need fixing or replacing.

Repairs for this problem cost between $100 and $200. If your TV’s picture appears for a moment and then vanishes, it is most likely an issue with the inverter. A repairman will open it up, diagnose the issue, and decide on the most efficient solution.

Repairing vertical lines on the screen averages $150 to $400. This is usually an issue associated with your TV’s control board or motherboard, which may be damaged and need to be either repaired or replaced. It could also be caused by a loose cable, but it will need to be opened up to diagnose the issue and repair it.

Repairing horizontal lines on your TV costs between $150 and $400. It might be an issue with the motherboard, or it could be a problem with loose cables between the panel and the control board. To fix this issue, the television needs to be opened up and analyzed by a professional repairman.

There are many different brands and companies that make TVs. Some brands specialize in certain types, while others make a wider range of products. It is common for the brand to impact the cost of repair because there may be specific issues or costs related to that brand.

The cost to fix a Philips TV is $60 to $100. The typical issue with Philips televisions seems to be that they have a mind of their own. They turn on and off and sign in and out of apps randomly. While a solution doesn’t seem to be forthcoming, Philips is steadily losing customers due to a firmware problem.

Damaged cables can cause a TV to flicker or grow dim. Repair prices for damaged cables are $75 to $200. Samsung TV owners cite this flickering or dimming of the screen as a common issue with this brand. Sometimes the settings for the eco sensor1 or the energy-saving feature create this problem. Turning either of those off may fix the issue.

Some of the most common issues with this brand are banding at a repair cost of $100 to $200 or sound with a cost of $150 to $400. Color problems may be related to adjustment and can be fixed for a low cost of $75 to $100, HDMI connections are often fixed at the cost of $200 to $300, and streaming problems may be corrected with a software update. Software updates can be done by the owner, but a repairman will most likely charge a minimum fee of $75 to $100. Banding presents as sections of bands where it should be smooth. Sound and color can go out over time in the LG brand. HDMI and streaming can become difficult as technology emerges and changes.

Often, you must decide whether it is worth repairing your TV because in many situations, the cost of repairs is higher than the price of a new TV. For example, when screens are cracked or damaged, the cost of replacing a panel is usually much higher than simply buying a new TV.

DIY issues. While DIY repair is often possible, it is not frequently recommended. There is some risk of electrocution, and you might also damage the TV even more by improperly installing a t-con board or ribbon connectors. If you are in doubt, it is best to leave this job to a professional.

Remote control. A set that powers on and off at random is sometimes caused by issues with the remote. Try removing and replacing the batteries or using a different remote if possible.

Yes, flat-screen TVs can frequently be fixed, including issues with the screen, sound, lighting, cables, and interior components. However, there are some situations where flat-screen TVs cannot be fixed, such as when the screen is severely cracked.How do you fix a broken TV screen?

Continuing strong demand for LCD products coupled with increasing concerns about shortages in key components have driven LCD TV panel prices to significant increases in Q1, and prices show no signs of slowing down in Q2. The widespread problems in the supply of Display Driver ICs (DDICs) and the recent announcement by Corning that glass prices will increase, add to the general logistics problems to create an atmosphere where price increases appear to be not only accepted but expected.

Large LCD panel prices have been continuously increasing for last 10 months due to an increase in demand and tight supply. This has helped the LCD industry to recover from drastic panel price reductions, revenue and profit loss in 2019. It has also contributed to the growth of Quantum Dot and MiniLED LCD TV.

Strong LCD TV panel demand is expected to continue in 2021, but component shortages, supply constraints and very high panel price increase can still create uncertainties.

LCD TV panel capacity increased substantially in 2019 due to the expansion in the number of Gen 10.5 fabs. After growth in 2018, LCD TV demand weakened in 2019 caused by slower economic growth, trade war and tariff rate increases. Capacity expansion and higher production combined with weaker demand resulted in considerable oversupply of LCD TV panels in 2019 leading to drastic panel price reductions. Some panel prices went below cash cost, forcing suppliers to cut production and delay expansion plans to reduce losses.

Panel over-supply also brought down panel prices to way lower level than what was possible through cost improvement. Massive 10.5 Gen capacity that can produce 8-up 65" and 6-up 75" panels from a single mother glass substrate helped to reduce larger size LCD TV panel costs. Also extremely low panel price in 2019 helped TV brands to offer larger size LCD TV (>60-inch size) with better specs and technology (Quantum Dot & MiniLED) at more competitive prices, driving higher shipments and adoption rates in 2019 and 2020.

While WOLED TV had higher shipment share in 2018, Quantum Dot and MiniLED based LCD TV gained higher unit shares both in 2019 and 2020 according to Omdia published data. This trend is expected to continue in 2021 and in the next few years with more proliferation of Quantum Dot and MiniLED TVs.

Panel suppliers’ financial results suffered in 2019 as they lost money. Suppliers from China, Korea and Taiwan all lowered their utilization rates in the second half of 2019 to reduce over-supply. Very low prices combined with lower utilization rates made the revenue and profitability situation for panel suppliers difficult in 2019. BOE and China Star cut the utilization rates of their Gen 10.5 fabs. Sharp delayed the start of production at its 10.5 Gen fab in China. LGD and Samsung display decided to shift away from LCD more towards OLED and QDOLED respectively. Both companies cut utilization rates in their 7, 7.5 and 8.5 Gen fabs. Taiwanese suppliers also cut their 8.5 Gen fab utilization rates.

An increase in demand for larger size TVs in the second half of 2020 combined with component shortages has pushed the market to supply constraint and caused continuous panel price increases from June 2020 to March 2021. Market demand for tablets, notebooks, monitors and TVs increased in 2020 especially in the second half of the year due to the impact of "stay at home" regulations, when work from home, education from home and more focus on home entertainment pushed the demand to higher level.

With stay at home continuing in the firts half of 2021 and expected UEFA Europe football tournaments and the Olympic in Japan (July 23), TV brands are expecting stronger demand in 2021. The panel price increase resulting in higher costs for TV brands. It has also made it difficult for lower priced brands (Tier2/3) to acquire enough panels to offer lower priced TVs. Further, panel suppliers are giving priority to top brands with larger orders during supply constraint. In recent quarters, the top five TV brands including Samsung, LG, and TCL have been gaining higher market share.

From June 2020 to January 2021, the 32" TV panel price has increased more than 100%, whereas 55" TV panel prices have increased more than 75% and the 65" TV panel price has increased more than 38% on average according to DSCC data. Panel prices continued to increase through Q1 and the trend is expected to continue in Q2 2021 due to component shortages.

Major increases in panel prices from June 2020, have increased costs and reduced profits for TV brand manufacturers. TV brands are starting to increase TV set prices slowly in certain segments. Notebook brands are also planning to raise prices for new products to reflect increasing costs. Monitor prices are starting to increase in some segments. Despite this, buyers are still unable to fullfill orders due to supply issues.

TV panel prices increased in Q4 2020 and are also expected to increase in the first half of 2021. This can create challenges for brand manufacturers as it reduces their ability to offer more attractive prices in coming months to drive demand. Still, set-price increases up to March have been very mild and only in certain segments. Some brands are still offering price incentives to consumers in spite of the cost increases. For example, in the US market retailers cut prices of big screen LCD and OLED TV to entice basketball fans in March.

Higher LCD price and tight supply helped LCD suppliers to improve their financial performance in the second half of 2020. This caused a number of LCD suppliers especially in China to decide to expand production and increase their investment in 2021.

New opportunities for MiniLED based products that reduce the performance gap with OLED, enabling higher specs and higher prices are also driving higher investment in LCD production. Suppliers from China already have achieved a majority share of TFT-LCD capacity.

BOE has acquired Gen 8.5/8.6 fabs from CEC Panda. ChinaStar has acquired a Gen 8.5 fab in Suzhou from Samsung Display. Recent panel price increases have also resulted in Samsung and LGD delaying their plans to shut down LCD production. These developments can all help to improve supply in the second half of 2021. Fab utilization rates in Taiwan and China stayed high in the second half of 2020 and are expected to stay high in the first half of 2021.

QLED and MiniLED gained share in the premium TV market in 2019, impacting OLED shares and aided by low panel prices. With the LCD panel price increases in 2020 the cost gap between OLED TV and LCD has gone down in recent quarters.

OLED TV also gained higher market share in the premium TV market especially sets from LG and Sony in the last quarter of 2020, according to industry data. LG Display is implimenting major capacity expansion of its OLED TV panels with its Gen 8.5 fab in China.Strong sales in Q4 2020 and new product sizes such as 48-inch and 88-inch have helped LG Display’s OLED TV fabs to have higher utilization rates.

Samsung is also planning to start production of QDOLED in 2021. Higher production and cost reductions for OLED TV may help OLED to gain shares in the premium TV market if the price gap continues to reduce with LCD.

Lower tier brands are not able to offer aggressive prices due to the supply constraint and panel price increases. If these conditions continue for too long, TV demand could be impacted.

Strong LCD TV demand especially for Quantum Dot and MiniLED TV is expected to continue in 2021. The economic recovery and sports events (UEFA Europe footbal and the Olympics in Japan) are expected to drive demand for TV, but component shortages, supply constraints and too big a price increase could create uncertainties. Panel suppliers have to navigate a delicate balance of capacity management and panel prices to capture the opportunity for higher TV demand. (SD)

Prices for large-sized LCD panels for notebooks and LCD monitors have begun declining this month, bringing an end to a five-quarter period of consecutive increases.

Panel makers are cutting prices, as they attempt to burn off their inventories, which are rising due to increased production levels and a slowdown in present and expected system demand, which partly reflects a disappointing outlook for back-to-school PC sales.

Panel prices began to increase in April 2003, and rose about 21-28% from that time until last month. The price of 15-inch notebook and LCD monitor panels in the XGA format increased to the US$230 to US$235 range in June, up from US$180 to US$190 last April.

In June, panel buyers’ biggest concerns were component shortages and cost increases, as well as hikes in panel prices. Concern over future supply constraints, combined with worries over further price increases, prompted notebook and LCD monitor makers to keep boosting their orders for panels in the second quarter, even though they had detected signs of a slowdown in demand.

However, by the end of June, the system suppliers started cutting down the size of their panel orders, as their inventory levels expanded to four to six weeks, which is much larger than their normal two-week stockpiles. Inventories have been building up both for systems and panels.

Combined with increasing production among panel suppliers, the inventory inflation has resulted in a 3-5% monthly price reduction in large-size panels in July.

The most surprising drop came in the 15-inch monitor panel area, where prices declined by US$13 from June to July, despite an acute shortage over the past few months. However, as demand softened for 17- and 19-inch products, suppliers were forced to increase production of 15-inch panels to drive down prices. Nonetheless, price reductions for 15-inch models are expected to boost demand for low-end products, especially those used as CRT replacements.

A similar situation is also occurring in the 14-inch notebook panel market, where prices declined on month by US$9 in July. iSuppli/Stanford Resources expects price reductions to continue in August, with declines ranging from US$8 to US$20 for notebook and LCD monitor panels and from US$20 to more than US$50 for TV panels. Average price reductions in the third quarter are expected to be 5-10% for notebook and monitor panels and 10-15% for TV panels.

Large-sized LCD panel supply increased 9% on quarter in the second quarter. Supply is expected to increase 14% by the third quarter because most panel suppliers are expanding their capacity, following establishment of new fifth-generation (5G) and 6G fabs.

The LCD TV market was slow in the first half due to high panel and system prices and the sluggish adoption of LCD TVs by consumers, compared to PDP (plasma display panel) or rear-projection microdisplay televisions (RPTVs) using LCD technology or Texas Instruments’ (TI) digital light processing (DLP).

Prices for 30-inch LCD TVs in the first half were in the same range as 42-inch PDP and 50-inch RPTV sets. Because end-user demand for 30-inch LCD TVs was lower than expected, manufacturers scaled back their expectations for the product and instead increased their focus on smaller-sized panels. Panels in the 20-inch and 26/27-inch range appeared to have better prospects in the market.

In the notebook area, panel demand was slow in the first quarter, following normal seasonal patterns. Although demand improved in the second quarter, lower-than-expected back-to-school sales have dampened the outlook for third-quarter demand.

In LCD monitors, panel demand was notably strong in the first quarter. Although end-user monitor demand declined in the second quarter, panel demand remained very high. However, in the third quarter, demand started to experience a slowdown due to the inventory buildup.

About 53% of large-size LCD panel unit demand and 56% of the area demand still come from monitor applications. Thus, any change in the level of monitor demand has a major impact on the large-size LCD market.

Although overall demand for large-size panels is expected to rise in the third quarter compared to the second quarter, sales will rise less than the planned increase in production capacity. Furthermore, it will take time to clear up inventories already accumulated in the supply chain.

Despite the present inventory and demand challenges, panel price reductions in the third quarter are expected to allow system makers to cut the cost of their wares in the coming months – particularly during the all-important holiday season. This will allow suppliers not only to reduce their inventories, but to stimulate demand during the fourth quarter holiday season.

Many suppliers are now raising capital in the stock market for their future expansion plans. However, panel price reductions and slides in stock prices are decreasing their capability to raise capital. This may further impact their production expansion plans for the fourth quarter.

Increasing demand, combined with production adjustments, may bring supply and demand into balance – thus stabilizing prices – by the end of the fourth quarter. iSuppli/Stanford Resources continues to predict higher revenue growth for the LCD market in 2004.

Recently, it was announced that the 32-inch and 43-inch panels fell by approximately USD 5 ~ USD 6 in early June, 55-inch panels fell by approximately USD 7, and 65-inch and 75-inch panels are also facing overcapacity pressure, down from USD 12 to USD 14. In order to alleviate pressure caused by price decline and inventory, panel makers are successively planning to initiate more significant production control in 3Q22. According to TrendForce’s latest research, overall LCD TV panel production capacity in 3Q22 will be reduced by 12% compared with the original planning.

As Chinese panel makers account for nearly 66% of TV panel shipments, BOE, CSOT, and HKC are industry leaders. When there is an imbalance in supply and demand, a focus on strategic direction is prioritised. According to TrendForce, TV panel production capacity of the three aforementioned companies in 3Q22 is expected to decrease by 15.8% compared with their original planning, and 2% compared with 2Q22. Taiwanese manufacturers account for nearly 20% of TV panel shipments so, under pressure from falling prices, allocation of production capacity is subject to dynamic adjustment. On the other hand, Korean factories have gradually shifted their focus to high-end products such as OLED, QDOLED, and QLED, and are backed by their own brands. However, in the face of continuing price drops, they too must maintain operations amenable to flexible production capacity adjustments.

TrendForce indicates, that in order to reflect real demand, Chinese panel makers have successively reduced production capacity. However, facing a situation in which terminal demand has not improved, it may be difficult to reverse the decline of panel pricing in June. However, as TV sizes below 55 inches (inclusive) have fallen below their cash cost in May (which is seen as the last line of defense for panel makers) and are even flirting with the cost of materials, coupled with production capacity reduction from panel makers, the price of TV panels has a chance to bottom out at the end of June and be flat in July. However, demand for large sizes above 65 inches (inclusive) originates primarily from Korean brands. Due to weak terminal demand, TV brands revising their shipment targets for this year downward, and purchase volume in 3Q22 being significantly cut down, it is difficult to see a bottom for large-size panel pricing. TrendForce expects that, optimistically, this price decline may begin to dissipate month by month starting in June but supply has yet to reach equilibrium, so the price of large sizes above 65 inches (inclusive) will continue to decline in 3Q22.

TrendForce states, as panel makers plan to reduce production significantly, the price of TV panels below 55 inches (inclusive) is expected to remain flat in 3Q22. However, panel manufacturers cutting production in the traditional peak season also means that a disappointing 2H22 peak season is a foregone conclusion and it will not be easy for panel prices to reverse. However, it cannot be ruled out, as operating pressure grows, the number and scale of manufacturers participating in production reduction will expand further and its timeframe extended, enacting more effective suppression on the supply side, so as to accumulate greater momentum for a rebound in TV panel quotations.

As the display industry stays in stagnation, Taiwan-based PMOLED panel makers, including Ritdisplay and Wisechip Semiconductor, have been venturing into new business segments.

PMOLED (passive matrix OLED) panel maker Ritdisplay has stepped into battery business by establishing subsidiary battery maker Ritwin and investing in Welltech Energy, and expects the battery business to mainly drive business growth in the future, according to the company.

Sales promotion of TVs at the Double 11 (November 11) online shopping festival in the China market and the Black Friday & Cyber Monday shopping festival in the US market has helped TV vendors lower inventory levels and, in turn, is conducive to a rebound in demand for TV-use LCD panels, according to president James Yang for TFT-LCD panel maker Innolux and president Frank Ko for fellow maker AUO.

Samsung Display (SDC) shipped 86.3 million OLED panels for smartphones and smart wearable devices globally in third-quarter 2022, taking a worldwide market share of 62.9%, down 5.9pp sequentially, iNews 24 cited Stone Partners statistics as indicating.

Channel retailers are launching significant price competition to stimulate TV sales during the Black Friday shopping season in the US, optimizing the availability of affordable TV panel prices, according to market sources.

China-based display panel maker BOE Technology recently made an investment in Chinese smartphone vendor Honor, a partnership that industry observers say will allow the former to increase handset-use OLED panel shipments and the latter to secure panel supply.

Display panel makers, with demand and product prices dropping, have temporarily stopped placing manufacturing equipment since mid-2022, according to panel inspection equipment maker Favite.

AU Optronics (AUO) shipped LCD panels totaling 1.281 million square meters in October, increasing 3.1% sequentially, while Innolux shipped 8.77 million large-size panels and 21.9 million small- to medium-size ones in the month, respectively decreasing 4.9% and 6.7% sequentially, according to the companies.

China-based display panel maker BOE Technology has become the largest shareholder of China-based LED epitaxial wafer and chip maker HC SemiTek via the latter"s private placement, according to industry sources.

Considering that the US has launched a tech war against China by prohibiting the exports of advanced semiconductors involving US-developed technologies and related manufacturing equipment to China, if the conflict spills over to display panels, the US is also able to take measures to stall OLED panel production in China.

Samsung Electronics plans to increase its purchases of LCD panels in 2023 from non-China suppliers, such as Taiwan-based AU Optronics and Innolux, according to industry sources.

Panel maker Innolux has begun providing e-paper module products to clients for multiple applications, according to company president James Yang, as the company transforms itself into a system integrator.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey