apple lcd panel manufacturer in stock

Apple is always looking to diversify its suppliers; this helps to improve existing technologies and make them less expensive. This time, TCL’s subsidiary CSOT wants to enter Apple’s LCD supply chain for upcoming Macs and iPads.

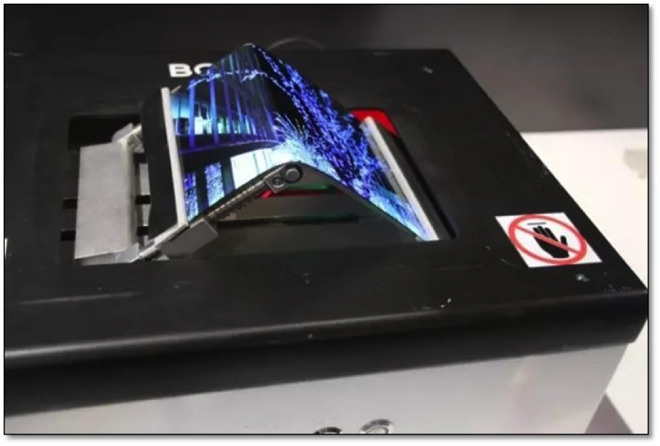

The publication says that CSOT is a “fierce competitor” to BOE in the global LCD market, but the company is ahead of CSOT in LCD panels for notebooks, tablets, and monitors as well as with the OLED technology for smartphones.

BOE, as you probably know, has for years been a third supplier of displays for Apple’s older LCD iPhones, but only started making OLED panels for Apple as of the iPhone 12. It was on track to pick up orders for 30-40M iPhones this year. It will also be responsible for around five million units of iPhone 14 OLED panels.

Not only that, but BOE is also supplying LCD panels to Apple for MacBooks and iPads. Analyst firm Omdia says the Chinese company will be the largest supplier of LCD panels for iPad this year.

CSOT also formed a team during the first half of the year to review building an OLED production line aimed at iPhones. CSOT’s expansion plan will, besides BOE, also threaten South Korean display maker LG Display, which leads the supply of LCD panels to Apple for high-end devices.

LG Display is expected to supply 14.8 million LCD panels to Apple for MacBooks this year, according to Omdia, making its share in this specific supply chain 55%. Having another competitor in the supply chain like CSOT could add pressure on LG Display to cut unit prices.

Typical LCDs are edge-lit by a strip of white LEDs. The 2D backlighting system in Pro Display XDR is unlike any other. It uses a superbright array of 576 blue LEDs that allows for unmatched light control compared with white LEDs. Twelve controllers rapidly modulate each LED so that areas of the screen can be incredibly bright while other areas are incredibly dark. All of this produces an extraordinary contrast that’s the foundation for XDR.

With a massive amount of processing power, the timing controller (TCON) chip utilizes an algorithm specifically created to analyze and reproduce images. It controls LEDs at over 10 times the refresh rate of the LCD itself, reducing latency and blooming. It’s capable of multiple refresh rates for amazingly smooth playback. Managing both the LED array and LCD pixels, the TCON precisely directs light and color to bring your work to life with stunning accuracy.

Apple Card Monthly Installments (ACMI) is a 0% APR payment option available only in the U.S. to select at checkout for certain Apple products purchased at Apple Store locations, apple.com, the Apple Store app, or by calling 1-800-MY-APPLE and is subject to credit approval and credit limit. See support.apple.com/kb/HT211204 for more information about eligible products. Variable APRs for Apple Card other than ACMI range from 13.99% to 24.99% based on creditworthiness. Rates as of October 1, 2022.

If you choose the pay‑in‑full or one‑time‑payment option for an ACMI‑eligible purchase instead of choosing ACMI as the payment option at checkout, that purchase will be subject to the variable APR assigned to your Apple Card. Taxes and shipping are not included in ACMI and are subject to your card’s variable APR. See the Apple Card Customer Agreement for more information. ACMI is not available for purchases made online at the following special stores: Apple Employee Purchase Plan; participating corporate Employee Purchase Programs; Apple at Work for small businesses; Government, and Veterans and Military Purchase Programs, or on refurbished devices. iPhone activation required on iPhone purchases made at an Apple Store with one of these national carriers: AT&T, Sprint, Verizon, or T‑Mobile.

To access and use all the features of Apple Card, you must add Apple Card to Wallet on an iPhone or iPad with the latest version of iOS or iPadOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install.

For most customers, visiting a professional repair provider with certified technicians who use genuine Apple parts is the safest and most reliable way to get a repair. These providers include Apple and Apple Authorized Service Providers, and Independent Repair Providers, who have access to genuine Apple parts.* Repairs performed by untrained individuals using nongenuine parts might affect the safety of the device or functionality of the display. Apple displays are designed to fit precisely within the device. Additionally, repairs that don"t properly replace screws or cowlings might leave behind loose parts that could damage the battery, cause overheating, or result in injury.

Depending on your location, you can get your iPhone display replaced—in or out of warranty—by visiting an Apple Store or Apple Authorized Service Provider, or by shipping your iPhone to an Apple Repair Center. Genuine Apple parts are also available for out-of-warranty repairs from Independent Repair Providers or through Self Service Repair.*

* Independent Repair Providers have access to genuine Apple parts, tools, training, service guides, diagnostics, and resources. Repairs by Independent Repair Providers are not covered by Apple"s warranty or AppleCare plans, but might be covered by the provider"s own repair warranty. Self Service Repair provides access to genuine Apple parts, tools, and repair manuals so that customers experienced with the complexities of repairing electronic devices can perform their own out-of-warranty repair. Self Service Repair is currently available in certain countries or regions for specific iPhone models introduced in 2021 or later. To view repair manuals and order parts for eligible models, go to the Self Service Repair page.

* Monthly pricing is available when you select Apple Card Monthly Installments (ACMI) as payment type at checkout at Apple, and is subject to credit approval and credit limit. Financing terms vary by product. Taxes and shipping are not included in ACMI and are subject to your card"s variable APR. See the Apple Card Customer Agreement(Opens in a new window) for more information. ACMI is not available for purchases made online at special storefronts. The last month"s payment for each product will be the product"s purchase price, less all other payments at the monthly payment amount.

◊Apple Card Monthly Installments (ACMI) is a 0% APR payment option available only in the U.S. to select at checkout for certain Apple products purchased at Apple Store locations, apple.com, the Apple Store app, or by calling 1-800-MY-APPLE, and is subject to credit approval and credit limit. See https://support.apple.com/kb/HT211204(Opens in a new window) for more information about eligible products. Variable APRs for Apple Card other than ACMI range from 13.99% to 24.99% based on creditworthiness. Rates as of October 1, 2022. If you choose the pay-in-full or one-time-payment option for an ACMI-eligible purchase instead of choosing ACMI as the payment option at checkout, that purchase will be subject to the variable APR assigned to your Apple Card. Taxes and shipping are not included in ACMI and are subject to your card’s variable APR. See the Apple Card Customer Agreement(Opens in a new window) for more information. ACMI is not available for purchases made online at the following special stores: Apple Employee Purchase Plan; participating corporate Employee Purchase Programs; Apple at Work for small businesses; Government, and Veterans and Military Purchase Programs, or on refurbished devices. iPhone activation required on iPhone purchases made at an Apple Store with one of these national carriers: AT&T, Sprint, Verizon, or T-Mobile.

To access and use all the features of Apple Card, you must add Apple Card to Wallet on an iPhone or iPad with the latest version of iOS or iPadOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install.

Use our “Get an Estimate” tool to review potential costs if you get service directly from Apple. The prices shown here are only for screen repair. If your iPhone needs other service, you’ll pay additional costs.

If you go to another service provider, they can set their own fees, so ask them for an estimate. For service covered by AppleCare+, your fee per incident will be the same regardless of which service provider you choose.

Your country or region offers AppleCare+ for this product. Screen repair (front) is eligible for coverage with a fee by using an incident of accidental damage from handling that comes with your AppleCare+ plan.

The Apple Limited Warranty covers your iPhone and the Apple-branded accessories that come in the box with your product against manufacturing issues for one year from the date you bought them. Apple-branded accessories purchased separately are covered by the Apple Limited Warranty for Accessories. This includes adapters, spare cables, wireless chargers, or cases.

Depending on the issue, you might also have coverage with AppleCare+. Terms and Conditions apply, including fees. Feature availability and options may vary by country or region.

We guarantee our service, including replacement parts, for 90 days or the remaining term of your Apple warranty or AppleCare plan, whichever is longer. This is in addition to your rights provided by consumer law.

Replacement equipment that Apple provides as part of the repair or replacement service may contain new or previously used genuine Apple parts that have been tested and pass Apple functional requirements.

While Samsung will continue to supply approximately 80 per cent of iPhone displays, rumours claim that a little-known company called BOE looks set to become Apple’s second-largest OLED supplier. Not only is this a sign that Apple’s lowest-cost iPhone 12 model will likely make the leap from LCD to OLED this year, but it’s also a sign that Apple is looking to diversify which manufacturers it uses, and potentially looking to ready itself for a move into the display market itself.

You, like many of us when we first read the rumours, are probably wondering who the hell BOE is, and how it managed to score such a big deal despite its relatively unknown status. However, BOE is, in fact, the largest display manufacturer in China, supplying screens for smartphones, TVs and other electronic devices and home appliances.

The company, which was founded in Bejing in 1993 and acquired SK Hynix"s STN-LCD and OLED businesses back in 2001, is ranked second in the world when it comes to flexible OLED shipments, holding a market share of 11 per cent during the first quarter of this year. It, naturally, is still a long way behind market leader Samsung, which owned 81 per cent market share of the OLED market in the same quarter. Still, with a sizable chunk of the OLED market already under its belt, it perhaps won’t come as too much of a surprise – now, at least – that the firm already has some big-name allies.

BOE’s display technology is currently being utilised in Huawei"s most popular smartphone models, including the high-end P and Mate series, and it reportedly will manufacturer the palm-stretching screen set to appear on this year’s Huawei Mate 40.

BOE’s surprising alliance with Apple isn’t the only time the two companies have worked together, either; the Chinese manufacturer already makes LCD screens for Apple"s older iPhones, and its tiny OLED panels are currently used in some Apple Watch models. It’s unclear how much BOE and Apple’s latest deal is worth, but it’s likely in the billions. According to online reports, Samsung’s deal with the iPhone maker is thought to be worth around $20 billion annually, so if BOE manages to secure 20 per cent of Apple’s display orders going forward, such a deal could be worth as much as $4bn.

Although BOE has managed to muscle its way into Apple’s exclusive list of OLED suppliers, and has invested heavily in facilities and equipment in order to meet the firm’s demands, the new partnership hasn’t got off to a flying start. According to reports, the company’s flexible OLED panels have not yet passed Apple’s final validation. This means, according to rumours, that BOE’s screens might not show up in the first batch of iPhone 12 models, and will instead start shipping on handsets at the beginning of 2021, with Apple instead set to re-increase its reliance on LG in the short term.

Scenarios like this, along with the fact that Apple is clearly looking to lessen its reliance on big-name display makers, makes us think that it won’t be long until the company ultimately stops relying on others altogether; after all, it’s no secret that Apple wants to control every aspect of its hardware development.

The display market could be Apple’s next target. Not only does the company already manufacturer screen technology in the form of its Pro Display XDR, but a recent Bloomberg report claims that Apple is “designing and producing its own device displays” and is making a “significant investment” in MicroLED panels. This technology utilises newer light-emitting compounds that make them brighter, thinner and less power-intense than the current OLED displays.

Apple’s efforts in MicroLED are reportedly in the “advanced stages”; the company has applied for more than 30 patents, and recent rumours suggest the firm is also considering investing over $330 million in a secretive MicroLED factory with the goal of bringing the technology to its future devices.

Chinese display manufacturer Beijing Oriental Electronics (BOE) could lose out on 30 million display orders for the upcoming iPhone 14 after it reportedly altered the design of the iPhone 13’s display to increase yield rate, or the production of non-defective products, according to a report from The Elec (via 9to5Mac).

Apple tasked BOE with making iPhone 13 displays last October, a short-lived deal that ended earlier this month when Apple reportedly caught BOE changing the circuit width of the iPhone 13’s display’s thin-film transistors without Apple’s knowledge. (Did they really think Apple wouldn’t notice?).

This decision could continue to haunt BOE, however, as Apple may take the company off the job of making the OLED display for the iPhone 14 as well. According to The Elec, BOE sent an executive to Apple’s Cupertino headquarters to explain the incident and says it didn’t receive an order to make iPhone 14 displays. Apple is expected to announce the iPhone 14 at an event this fall, but The Elec says production for its display could start as soon as next month.

In place of BOE, The Elec expects Apple to split the 30 million display order between LG Display and Samsung Display, its two primary display providers. Samsung will likely produce the 6.1 and 6.7-inch displays for the upcoming iPhone 14 Pro, while LG is set to make the 6.7-inch display for the iPhone 14 Pro Max.

According to MacRumors, BOE previously only manufactured screens for refurbished iPhones. Apple later hired the company to supply OLED displays for the new iPhone 12 in 2020, but its first batch of panels failed to pass Apple’s rigorous quality control tests. Since the beginning of this year, BOE’s output has also been affected by a display driver chip shortage.

The iPhone maker Apple’s (AAPL) next-gen model iPhone 13 is just weeks away from launching. And iPhone supplier stocks Broadcom (AVGO), Qorvo (QRVO), and LG Display (LPL) are well-positioned to benefit from this launch. So, we think it could be wise to bet on them now. Read on.

While the launch of the iPhone 12 series was delayed last year due to COVID-19 pandemic-related restrictions, Apple Inc. (AAPL) is expected tolaunch iPhone 13 by the end of September. In addition to a super-fast 5G modem, the model is expected to have a better display and a significantly improved camera. And according to a Bloomberg report, AAPL isboosting its production by 20% to 90 million units, anticipating high demand.

Headquartered in Seoul, South Korea, LPL designs, manufactures, and sells thin-film transistor liquid crystal display (TFT-LCD) and organic light-emitting diode (OLED) technology-based display panels. According to a Korean tech site, LPL will supply its flexible OLEDs for the iPhone 13.

Also, LPL announced in March 2021 that it had obtained "Discomfort Glare Free" marketing claim verification for all OLED TV panels from UL. This could lead to increasing demand for the products.

LPL’s revenue increased 31% year-over-year to KRW 6.97 trillion ($5.99 billion) for the second quarter, ended June 30, 2021. This all-time high second-quarter revenue was driven by increased sales in TV displays, including OLED, solid performance in IT products, and an increase in LCD panel prices. Its net income came in at KRW 424 billion ($364.46 million) compared to a KRW 504 billion ($433.23 million) loss in the year-ago period.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

Samsung"s OLED displays are used on its own flagship Galaxy devices, and the company is a market leader in the area. Apple is expected to launch three new iPhones later this year, with the anniversary edition iPhone 8 believed to have a slightly curved 5.2-inch OLED screen. This will be the most expensive model. The two other iPhones will have LCD displays.

Nikkei Asian Review quoted IHS Markit analyst David Hsieh as saying that the order for 70 million units of OLED panels is in line with his expectations. He added that Samsung is expecting to produce as many as 95 million units for Apple in 2017, in case demand exceeds expectations. Hsieh also said Samsung is likely to be the sole supplier.

The 70 million unit figure gives a sense of the kind of bullish demand Apple is expecting for the anniversary model, which some analysts are suggesting could cost $900 to $1,000.

But some analysts have said it"s not likely Apple will sell all 70 million OLED iPhones this year looking at previous performance. In the fiscal first quarter, which ended Dec. 31, Apple sold 78.2 million iPhones — latest iPhone 7 and 7 Plus models and older versions.

SEOUL (Reuters) - LG Display Co Ltdreported a second consecutive quarterly profit, beating forecasts by far on a rebound in television sales during the year-end holiday season and solid sales of screens used in Apple Inc"siPad and iPhone.

But concerns about slower growth for Apple products have risen, particularly in the wake of disappointing earnings from the U.S. company on Wednesday, and analysts have forecast earnings for the South Korean screen maker to slide in the first quarter.

The company, which provides about 70 percent of Apple iPad screens and vies with Samsung Electronics Co Ltd"spanel unit for the top position in liquid crystal display flat screens globally, reported 587 billion won ($550.6 million) in operating profit for the October-December quarter.

It also marks its highest quarterly profit since the second quarter of 2010 and a continuation of a turnaround that began in July-September after seven straight quarters of losses, mainly due to an industry oversupply of TV panels. Sales rose to 8.7 trillion won in the quarter, a quarterly record.

Apple sold 18 million more iPhones in the December quarter from the previous quarter, as it expanded iPhone 5 sales. The introduction of the iPad mini also boosted LG’s panel shipments.

But hit by growing worries about demand for Apple products, LG Display’s shares have lost about 17 percent since December after gaining 40 percent in the first 11 months of 2012. Prior to the results, they closed down 1.2 percent, underperforming a 0.8 percent decline in the broader market.

In forecasts made prior to Apple and LG Display’s results, analysts expect LG Display’s first-quarter operating profit to tumble to around 123 billion won.

CLSA analyst Matt Evans estimated this week that LG’s iPad panel shipments could tumble to as few as 2 million units in the first quarter, from the fourth-quarter’s 12 million, partly due to increased inventory following weak sales in December.

Apple’s Chief Financial Officer Peter Oppenheimer said iPad sales are expected to fall in the first-quarter, as they normally do after the year-end holiday season.

BOE gets its display driver ICs for Apple"s iPhone display panels from LX Semicon. LX Semicon is apparently supplying display driver ICs to LG Display before BOE. As a result, BOE is expected to drop its OLED panel production volume from three million units to two million units next month.

According to Reuters, the continued losses suffered by the company is due to "sagging prices" for LCD panels across the board. The company also said its production plans in South Korea and China could be impacted by the emerging trade war between the U.S. and China.

LG Display cited "concern for the global smartphone market," as well as the long-term decline of LG"s LCD panel business. The company has been shifting its emphasis towards OLED panels.

A report earlier this month stated that Apple has ordered between 3 and 4 million OLED panels from LG Display, for use in the 2018 generation of iPhones, with LG expected to become the majority supplier of OLED panels for iPhones for 2019, overtaking its rival Samsung.

There had been reports in April of manufacturing delays on LG"s side affecting Apple"s panel diversifaction plans. As of June, LG was expected to deliver 2 million and 4 million OLED panels to Apple for "a future iPhone," although it"s unclear whether they would be used in this year"s or next year"s models.

LG Display has long been a supplier of 4K and 5K panels for the iMac. LG Display and Samsung both supply screens for the Apple Watch, while LG Display supplies Pad screens as well.

How LG Display"s overall struggles will affect its relationship with Apple is unclear, but the Reuters report indicates that its plans for OLED investment by 2020 will not be affected.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey