lcd panel custom clearance free sample

The "Admission Temporaire - Temporary Admission", or the ATA Carnet, is an international customs document which may be used for the temporary duty free importation of merchandise. This is in-lieu-of the usual customs documents required for entry. The carnet serves as a guarantee against the payment of duties which may become due if the merchandise is not re-exported.

When importing art into the U.S. for commercial use, you must complete CBP Form 7523. If the value of the art is over $2,500, an ACE Manifest must be submitted and a customs broker needs to process the import. When importing art for personal use, an oral declaration is sufficient.

Value of the artwork-Different rules apply depending on the cost of the items being imported. Always be as accurate as possible when providing the value. Typically, the customs duty or import tax applied to an import is based on a percentage of the overall value of the items. For this reason, border agents are on the lookout for misrepresentation of value when it comes to artwork. Be sure to obtain and provide official documentation confirming the value of your imported items.

Tariff Classification-Imported items that pass through U.S. customs must have the correct associated tariff code listed for each item. These codes arelisted and organized in the Harmonized Tariff Schedule of the United States(HTSUS). Each specific code relates to a category of goods that determines the duty rate for all imported items. Listing the wrong HTSUS code can lead to potential delays for your import.

Antiques are exempt from import duties. To qualify, antiques must be at least 100 years old and have documentation included that confirms the age. Imported antiques found to not be at least 100 years old can be subject to an import duty between 5.2 and 25 percent depending on where the antique came from. CBP Form 7523 must be submitted with the antique. If the value of the item(s) is over $2,500 an ACE manifest needs to be submitted and a customs broker must complete the import.

Regardless of the type of payment method used when importing art, it’s important to consider a number of factors including the specific situation and the seller’s preferred method of payment. Working with a Licensed Customs Broker can simplify the payment process.

Be sure to save all documents related to your claim even after it’s been completed. If you’re having difficulty during the claims process, your Licensed Customs Broker may be able to assist you. Another precious item that should be handled with the utmost care is gold. Check out our article on importing gold to the U.S. to learn about the specifics for bringing in this valuable commodotiy.

When importing art into the U.S., if the total value of your shipment exceeds $2500a customs bond is required. Having a customs bond will ensure that all taxes and fees are paid and reduce the likelihood that your shipment will face delays at the border.

When a customs bond is required, there are a couple of options to choose from. It helps to know the differences between the two to be sure you select the best choice for your situation.

You can purchase a customs bond through USA Customs Clearance powered by AFC International. Your Licensed Customs Broker may also suggest using their bond to cover your imports.

Needless to say, there are many important details to consider when importing art. Navigating all of this information can be time-consuming and stressful. For this reason, many art importers work with a Licensed Customs Broker. During the import process, a customs broker can assist with the following:

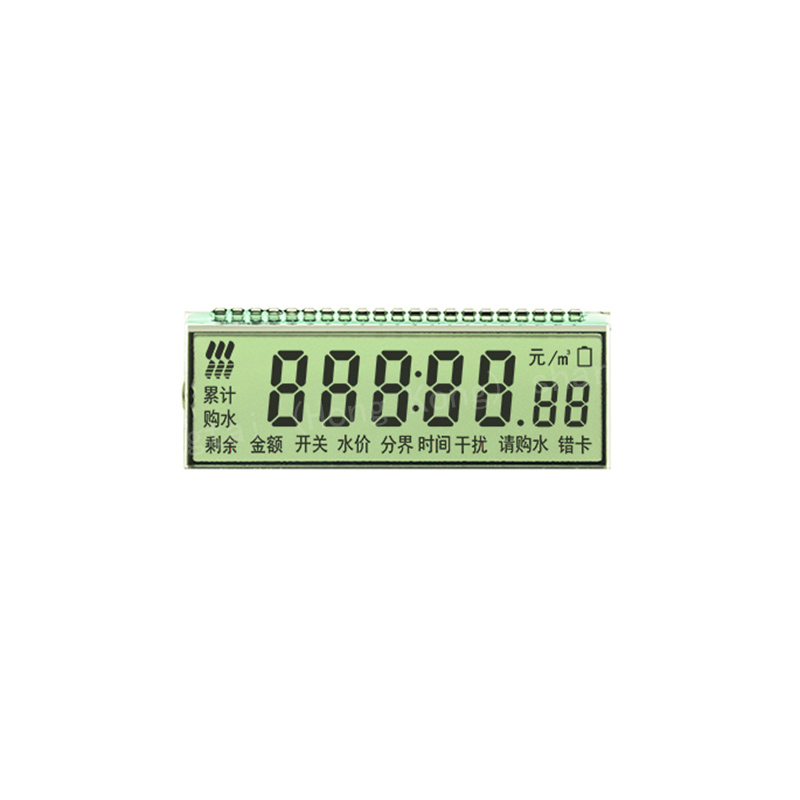

This is in response to your letter, dated December 02, 2008, to the National Commodity Specialists Division of U.S. Customs and Border Protection (“CBP”) in which you requested a binding ruling, on behalf of Optrex America, Inc., on the tariff classification of certain liquid crystal display (“LCD”) modules under the Harmonized Tariff Schedule of the United States (“HTSUS”). Your request was forwarded to this office for a response. In reaching this decision, we reviewed the product samples and schematics included with the submission.

The “A” prefix modules are LCD character displays used in automobiles. They contain drive circuitry capable of illuminating segments, characters or icons, but require an external microprocessor to instruct the drive circuitry to turn on or off. Model A-55362GZU-T-ACN is an automotive LCD radio display with message center capacity for Bluetooth connection status, climate control, a clock, and a compass. It contains approximately 25 segment-style characters, most of which display a full range of numbers and letters, and 50 permanently etched icons. The display measures approximately 7 inches in length, 2.5 inches in height, and 1 mm in thickness. Model A-55361GZU-T-ACN is an automotive LCD message display with radio, climate, and other limited display capabilities. It contains approximately 72 segment-style characters, most of which are capable of displaying a full range of numbers and letters, and 60 permanently etched icons. The display measures approximately 7 inches in length, 2.75 inches in height, and 1 mm in thickness.

The “T” prefix modules are thin-film transistor (“TFT”) LCD graphic displays for monitors of various types. As imported, the devices are not complete monitors; they contain drive circuitry, but lack a controller chip or card required to process signals. Models T-51863D150J-FW-A-AA and T-55336D175J-FW-A-AAN also lack an external power supply. Model T-51440GL070H-FW-AF is a 7 inch, 480 x 234 color display for automobile entertainment monitors. It is composed of a TFT cell, driver integrated circuits (“ICs”), a timing controller IC, a backlight unit, an inverter DC/DC converter, and a video circuit. Model T-51863D150J-FW-A-AA, is a 15 inch, 1034 x 768 XGA color display for monitors used in aviation and marine applications. It is composed of a TFT cell, driver ICs, a control circuit, a backlight unit, and a DC/DC converter. Model T-55336D175J-FW-A-AAN, is a 17.5 inch, 1280 x 768 WXGA color display for monitors used in medical and aviation applications. It is composed of a TFT cell, driver ICs, a control circuit, a backlight unit, and a DC/DC converter.

8531Electric sound or visual signaling apparatus (for example, bells, sirens, indicator panels, burglar or fire alarms), other than those of heading 8512 or 8530; parts thereof:

LCDs are prima facie classifiable in the following HTSUS headings: 8528, which provides for monitors and projectors not incorporating television reception apparatus; 8531, which provides for electric sound or visual signaling apparatus; and 9013, which provides for liquid crystal devices not provided for more specifically in other headings. By the terms of heading 9013, HTSUS, CBP first considers classification in headings 8528 and 8531, HTSUS. If an LCD does not meet the terms of those headings, it is classified in heading 9013, HTSUS. See Sharp Microelectronics Technology, Inc. v. United States, 932 F.Supp. 1499 (Ct. Int’l. Trade 1996), aff’d, 122 F.3d 1446 (Fed. Cir. 1997). See also Headquarters Ruling Letter (“HQ”) 959175, dated November 25, 1996.

You submit that the “A” prefix LCD character modules are classified in subheading 8531.20.00, HTSUS, as “Electric sound or visual signaling apparatus …: Indicator panels incorporating liquid crystal devices (LCD’s).”

It is well established that only those LCDs which are limited by design and/or principal use to “signaling” are classifiable in heading 8531, HTSUS. See Optrex America, Inc. v. United States, 427 F. Supp. 2d 1177 (Ct. Int’l Trade 2006), aff’d, 475 F.3d 1367 (Fed. Cir. 2007) (“Optrex”). See also, HQ H02661, dated July 8, 2008, HQ H012694, dated August 31, 2007, and HQ H003880, dated March 27, 2007. In Optrex, the Court of International Trade (“CIT”) explained that to be classified as an indicator panel incorporating LCDs under heading 8531, HTSUS, “the article must belong to the class or kind of merchandise that is principally used to display limited information that is easily understood by the person viewing it.” Optrex, 427 F. Supp. 2d at 1198. Further, the CIT accorded the “80 character rule” – guidance developed by CBP to determine whether a character display module is principally used for signaling – “some deference” under Skidmore v. Swift & Co., 323 U.S. 134 (1944), as a reasonable interpretation. According to the 80 character rule, if a character display module can display no more than 80 characters, then, in the absence of any information to the contrary, it is deemed to belong to the class or kind of merchandise that is principally used for signaling. Optrex, at 1199.

In addition, the Harmonized Commodity Description and Coding System Explanatory Notes (“ENs”) to heading 8531 are fairly descriptive and restrictive as to the type of “signaling” indicator panels and the like must perform in order to be classified in that provision. EN 85.31 states, in relevant part:

(D) Indicator panels and the like. These are used (e.g., in offices, hotels and factories) for calling personnel, indicating where a certain person or service is required, indicating whether a room is free or not. They include:

In Optrex, the court classified LCD segmented character modules with permanently etched icons capable of displaying no more than 80 characters, and containing drive circuitry, in heading 8531, HTSUS, as signaling apparatus. See Optrex, 427 F. Supp. 2d at 1199, aff’d, 475 F.3d 1367 (Fed. Cir. 2007). The instant “A” prefix LCD character modules are similarly operationally limited to performing signaling functions. They contain permanently etched icons that display, in 80 characters or less, limited information of the type an automobile driver would easily understand, e.g., velocity in miles per hour, the time, the temperature, music controls, etc. Moreover, they include the drive circuitry necessary to illuminate a particular segment, character or icon in the LCD based on signals transmitted from an external microprocessor. The functions performed by these modules are akin to those performed by the products listed as exemplars in the ENs to heading 8531. As such, we conclude that the “A” prefix modules are classified in heading 8531, HTSUS, as signaling apparatus.

You submit that the “T” prefix TFT graphic display modules are classified in subheading 9013.80.70, HTSUS, as “Liquid crystal devices not constituting articles provided for more specifically in other headings; …: Other devices, appliances and instruments: Flat panel displays other than for articles of heading 8528, except subheadings 8528.51 or 8528.61 [of a kind solely or principally used in an automatic data processing (“ADP”) system of heading 8471].” As noted above, an LCD can only be classified in 9013, HTSUS, if it is not more specifically described elsewhere, namely, in heading 8528, HTSUS, as monitors, or in heading 8531, HTSUS, as signaling apparatus.

Heading 9013, HTSUS, provides, in pertinent part, for “Liquid crystal devices not constituting articles provided more specifically in other headings.” LCDs of heading 9013, HTSUS, can be classified under one of two subheadings: 9013.80.70 or 9013.80.90. Subheading 9013.80.70, HTSUS, provides for: “Other devices, appliances and instruments: Flat panel displays other than for articles of heading 8528, except subheadings 8528.51 or 8528.61 [of a kind solely or principally used in ADP system of heading 8471].”

The “T” prefix modules are flat panel displays for use in monitors of heading 8528, HTSUS. You did not provide sufficient evidence to show that the modules are “for” articles of subheadings 8528.51 (of a kind solely or principally used with an ADP system) or 8528.61 (projection monitors). Accordingly, the exception to subheading 9013.80.70, HTSUS, does not apply. We conclude that the modules are classified in subheading 9013.80.90, HTSUS, as: “Liquid crystal devices not constituting articles provided for more specifically in other headings; …: Other devices, appliances and instruments: Other.”

By application of GRI 1, the “A” prefix LCD modules, models A-55362GZU-T-ACN, A-55361GZU-T-ACN, are classified in heading 8531, specifically in subheading 8531.20.00, HTSUS, which provides for “Electric sound or visual signaling apparatus (for example, bells, sirens, indicator panels, burglar or fire alarms), other than those of heading 8512 or 8530; parts thereof: Indicator panels incorporating liquid crystal devices (LCD’s) for light emitting diodes (LED’s).” The 2009 column one, general rate of duty is Free.

I hope this article about import customs clearance procedures and formalities in India helps importers in India and abroad to learn about import customs clearance procedures.

In this article you will learn step by step procedures and formalities on import customs clearance which includes - filing of import documents electronically, Bill of Entry, IGM and Line number, Documentation in import clearance, Examination procedures of imported goods, value appraisement / assessment procedures under import clearance, Import Pass Out procedures, Delivery order by carrier etc.

Once the cargo arrives in port, carrier of goods files Import General Manifest (IGM) with customs department. IGM is the details of import of goods to be filed with customs mandatory, by all carriers once goods arrived. Normally, each aircraft or vessel has one IGM number and each of consignments carries ‘line numbers’. So, each shipment carries a ‘line number’ and the total load of the said vessel or aircraft has an IGM number. Here, you will have one IGM number (common for one lot of goods arrived) and a ‘liner number’ for your particular shipment. You need to enter this numbers in the specified column of Bill of Entry while filing. This number will be automatically linked with your document while filing uploading the bill of entry details with customs web software. The Bill of Entry number is generated at one place for all over the ports of country as per software queue automatically. If your goods are under green channel clearance, you can directly take delivery of cargo with simple procedures at port.

You may get bill of entry number, once after filing the required soft data of bill of entry application. You need not go physically with customs department to get the same, as I have already explained. Generating Bill of Entry number means the number of bill of entry allotted by customs on filing as per serial order. So the said bill of entry details will be in queue in soft system of concerned customs officer who process the bill for import clearance. If all information are in order with proper documentation, he approves and pass over for inspection of cargo by software. Of if he requires more documents or further clarification; the same ‘query’ will be mentioned in the software system.

You or your customs broker can view the status of bill of entry online whether any ‘query’ is there and blocked the process or already ‘passed’ over to next procedures. If any ‘query’ for further documentation or personal meeting, you can follow the same. The importer or his agent may be called for personal hearing for any clarification required by customs officials under certain types of goods imported where in customs requires more clarification. Once the bill of entry assessment completed by customs official, the document pass over for inspection procedures as explained. You or your customs broker arranges examination of goods by ‘goods registration’ electronically at customs department software system.

The inspection is carried out under the supervision of necessary customs officials and enters examination report in the system. Once approving the inspection report by concerned officer, bill is ‘passed out of customs’ for delivery, if no duty amount is involved. If duty involved, you can arrange to pay the same and produce with the deputed customs officials. The customs department updates the duty amount and ‘pass out’ order is generated by software. If you pay customs duty online with the electronic arrangements of customs, the details of import duty paid is reflected in customs website within a specified period of time of deposit. This facility introduced recently helps importers minimize the formalities to pay customs import duty.

Prints of processed bill of entry are generated and customs officer signs physically on the said bill of entry. You can arrange delivery of cargo once after submitting the bill of entry of ‘passed out of customs’ with the carrier of goods. The carrier, after collecting necessary charges if any, issued delivery order to the custodian of cargo. The custodian of cargo delivers cargo to you or your authorized customs broker. You move the cargo to your place.

In this article, I hope I could explain step by step procedures and formalities on import customs clearance which includes - filing of import documents electronically, Bill of Entry, IGM and Line number, Documentation in import clearance, Examination procedures of imported goods, value appraisement / assessment procedures under import clearance, Import Pass Out procedures, Delivery order by carrier etc. Do you wish to add more information about import customs clearance procedures and formalities in India? Share below your experience in completing import customs clearance procedures and formalities to move imported goods out of customs area.

Specific Annex B of the RKC defines “clearance for home use” as the Customs procedure which provides that imported goods enter into free circulation in the Customs territory upon the payment of any import duties and taxes chargeable and the accomplishment of all the necessary Customs formalities. It further defines “goods in free circulation to” mean goods which may be disposed of without Customs restriction.

“Customs warehousing procedure” means the Customs procedure under which imported goods are stored under Customs control in a designated place (a Customs warehouse) without payment of import duties and taxes. Customs can establish public and private customs warehouses, for which Customs shall lay down the requirements for the establishment, suitability and management and the arrangements for Customs control. The arrangements for storage of goods in Customs warehouses and for stock keeping and accounting shall be subject to the approval of the Customs. As mentioned above, the authorized operations are strictly defined. Goods are allowed to stay in the warehouse for at least one year, unless the goods are perishable.

“Free zone” means a part of the territory of a Contracting Party where any goods introduced are generally regarded, insofar as import duties and taxes are concerned, as being outside the Customs territory. National legislation shall specify the requirements relating to the establishment of free zones, the kinds of goods admissible to such zones and the nature of the operations to which goods may be subjected in them. Customs shall lay down the arrangements for Customs control, including appropriate requirements as regards the suitability, construction and layout of free zones, and have the right to carry out checks at any time on the goods stored in a free zone.

“Inward processing” is defined as the Customs procedure under which certain goods can be brought into a Customs territory conditionally relieved from payment of import duties and taxes, on the basis that such goods are intended for manufacturing, processing or repair and subsequent exportation. Specific Annex F further defines that inward processing shall not be limited to goods imported directly from abroad, but shall also be granted for goods already placed under another Customs procedure and that it should not be refused solely on the grounds of the country of origin of the goods, the country from which they arrived or the country of destination.

“Processing of goods for home use” means the Customs procedure under which imported goods may be manufactured, processed or worked, before clearance for home use and under Customs control, to such an extent that the amount of the import duties and taxes applicable to the products thus obtained is lower than that which would be applicable to the imported goods. The granting of the procedure of processing of goods for home use shall be subject to the conditions that:

(a) the Customs are able to satisfy themselves that the products resulting from the processing of goods for home use have been obtained from the imported goods;

“Goods exported with notification of intended return” means goods specified by the declarant as intended for re-importation, in respect of which identification measures may be taken by the Customs to facilitate re-importation in the same state.

“Re-importation in the same state” means the Customs procedure under which goods which were exported may be taken into home use free of import duties and taxes, provided they have not undergone any manufacturing, processing or repairs abroad and provided that any sums chargeable as a result of repayment or remission of or conditional relief from duties and taxes or of any subsidies or other amounts granted in connection with exportation must be paid. The goods that are eligible for re-importation in the same state can be goods that were in free circulation or were compensating products.

Specific Annex C states that “outright exportation” means the Customs procedure applicable to goods which, being in free circulation, leave the Customs territory and are intended to remain permanently outside it. The Customs shall not require evidence of the arrival of the goods abroad as a matter of course.

“Outward processing” means the Customs procedure under which goods which are in free circulation in a Customs territory may be temporarily exported for manufacturing, processing or repair abroad and then re-imported with total or partial exemption from import duties and taxes.

“Drawback” means the amount of import duties and taxes repaid under the drawback procedure. “Drawback procedure” means the Customs procedure which, when goods are exported, provides for a repayment (total or partial) to be made in respect of the import duties and taxes charged on the goods, or on materials contained in them or consumed in their production.

According to the RKC, clearance of goods in postal traffic “shall be carried out as rapidly as possible" and customs control shall be restricted to the minimum”.a

The RKC stipulates that clearance of relief consignments for export, transit, temporary admission and import shall be carried out as a matter of priority. In the case of relief consignments the Customs shall provide for: (a) lodging of a simplified Goods declaration or of a provisional or incomplete Goods declaration subject to completion of the declaration within a specified period; (b) lodging and registering or checking of the Goods declaration and supporting documents prior to the arrival of the goods, and their release upon arrival; (c) clearance outside the designated hours of business or away from Customs offices and the waiver of any charges in this respect; and (d) examination and/or sampling of goods only in exceptional circumstances.b

we are exporting weekly goods to Shenzhen district, but in last months it happens that a lot of containers have been stopped to Customs since Customs agents request specific declaration on the amount od Insurance Premium. For us it’s extremely difficult to declare this amount for each invoice since we pay a yearly premium.

Moreover in February we increased some prices and Customs rejected our invoices!!! They told us to declare the reason of the increasing!! So, in accordance with customer, we decided to change all the commercial names of the items in order to avoid confusion!

Customs does not accept annual insurance declarations. However the Customs officer should advise the exporter how to make the declaration, so that this technicality can be resolved easily.

The exporter has the right adjust the prices of products. Customs does however check and asks for explanation of the adjustment. This is done to understand the reason for the change and to avoid human error.

As mentioned in the article, export duties are only imposed on a small number of certain goods. In order to confirm the duties on export for polyester, we can check with the Customs Bureau. We will follow-up with you about this in a separate email.

We are a boat building company based in Indonesia. We plan to export a newly built 32 meter luxury yacht into Hainan, China. We will cruiser her straight from Jakarta into Hainan. What sort of taxes will my customer come across with the importation of this yacht? Just keeping a heads up for my client.

@Astrid – There is a search function on the official website of China Customs and Import duties of various goods abd their respective HS codes that can be found here:

@Haluk: There are four different kinds of aluminum ingots listed under the China Custom’s Online Service Center. The site is in Chinese but does have a search function. It’s here: http://service.customs.gov.cn/default.aspx?tabid=9409

i was trying to use link (http://www.customs.gov.cn/publish/portal0/tab9409/) for seaching HS codes by myself but i was not succesful. That page did not let me trough its verification code. So i decided to ask here and i would be grateful for any reply to my email.

Our China site has been importing goods from different countries. We had encountered an issue where in the China Customs is taxing us base on a higher value. We bought the goods from Singapore for like .05/unit. China customs is taxing us base on 0.162/unit. They do not accept that the real price for the item is just 0.05/unit.

I am administrating an international school in mainland china, and I want to order some textbooks from America. The American textbook publisher requires me to provide my customs registration number before I can complete the order, but I’m finding it very difficult to find out how to get such a number.

@Herbie: You need to provide proof to China customs that the goods were purchased at the amount you said. However they do keep a database of prices on gloablly traded products to ensure the correct amount is being declared, and they can and do impose what they feel is the correct dutiable value on the goods if they wish. You need to negotiate with them and provide hard evidence of proof of the true cost. – Chris

@Nathan: Bringing in school textbooks from overseas can be very difficult as the Chinese government monitor very carefully the publications that can be brought in. It’s not just a matter of customs, it’s also a matter for several other Government departments as well, including the Ministry of Education and the Ministry of Propaganda. You will need professional assitance with this. I have sent you a personal email to discuss. – Chris

@Kian – this China Ministry of Customs website lists all the applicable duties on HS codes for goods imported into China: http://www.customs.gov.cn/publish/portal0/tab9409/

@John Scott: According to China’s customs regulations, gold, silver and the products made from them are duty-free and do not need to be declared if they are less than 50g (2 ounce) in weight. If the amount exceeds the limitation, you should declare it, and duty will be payable. On another note, I wouldn’t be sending gold or valuables through the post or even courier to China. It would be far safer to collect in UK and bring it back in personal luggage.

Our company is supplying business partners in China with special metal goods of purpose for car industry produced and developed in EU. Just recently custom in a way blocked one of last shipment and making complete due diligance of supplier and importer and finialy asking for paying of waranty fee, extra duty tax.

I propose exporting rooibos tea(indigenous to South Africa) to China.As part of the BRICS’s trading block what are the import and or customs duties from South Africa to China?

There’s no tax due when you buy product from China, just the purchase amount and the shipping costs which your supplier should be able to advise. However you may face import (customs) duties in the US.

There is an international system in place so that customs officials across each country and around the world can understand each other in relation to specific products. It is called the “Harmonized Tariff Schedule” (commonly referred to as the HS Code) and means nearly all products have a specific code number. If you know that number you can refer to the import duty as applicable in any country.

@Em: When exporting boats from China to other countries, the enterprises need to apply with the Chinese customs and submit all the required materials, including the application form, information of the ship and names of the crew. If such application has been approved, the customs will issue a certificate that allows the boat to exit the Chinese port. In terms of the type of the certification, it depends on the imported country of the boat. For example, CE certification is required for all recreational boats entering or sold in the European Union, while CCS certification may be required for importing boats to China.

This is quite a complicated procedural process. If you need assistance please contact one of our China offices for professional assistance with customs: china@dezshira.com

What is the China Customs duty rate for the importation by individuals (entering at the airport with said items in possession not intended for sale) for gold and silver coins and bullion that exceed 50 grams. And, how is the dutiable value determined on the coins, by their face value or weight??

@Mr. G: Gold and silver coins and bullion that exceed 50 grams in weight being brought into China are required to go through custom declaration. Chinese customs will determine how many quantities of gold and silver exceed their “reasonable range for self-use” based on relevant criteria. For excess self-use they items may be subject to import duties at 10% on their recent market value.

recently some of my competitors have tried to contact my custom agent in china and tried to get the information of the invoices i submit for custom clearance of my goods

@Jorge – No, your customs agent should NOT be divulging this information to your competitors. But that doesn’t mean that he isn’t. If you think he is leaking this data then I suggest changing your customs agent. It would be difficult to bring a legal case in this instance, although I agree it is wrong it would be a very hard case to prove. – Best regards – Chris

@Titus: Hong Kong is a free port and does not impose any customs tariff on imports and exports except for four types of dutiable commodities: liquor, tobacco, hydrocarbon oil, and methyl alcohol. So you have no customs duties to pay when shipping the items described to HK.

@Yuni – You need to find out the HS code for the product. This is an internationally recognized code that customs officials worldwide use to identify specific products. If you don’t have this you will be unable to export it from China or import it into Indonesia as no-one will be able to identify what it is. So you need to find this out. I suggest you visit http://www.hscode.org to help identify the relevant number.

@Bill – The common rate and minimum rate for import duty of Centrifugal fans are 30 percent and 8 percent respectively, and 50 percent and 0 percent for fans with power less than 125w. Tax rate is usually lower for importing components and then assembling in China. However, the customs of China will assess the value of the components, and if the total price of the components accounted for more than 60 percent of the price for a complete equipment, tax rate for complete equipment will be applied.

@Sam – Well that’s really an India import tax question. But we can answer that we have offices in India. On the hard disks imported into India, Basic Customs Duty is zero. However, a Counter-Vailing duty @ 6% and Central excise and customs education cess are imposed @ 3%, each. Further there is Special duty imposed @ 4%.

If the lithium carbonate failed to be re-imported within six months, you can apply for extension with relevant customs and such period can be extended for another three months upon approval. However, if the lithium carbonate failed to be re-imported within nine months after being exported, the regular import duties shall apply.

hi , I have export out good frequently to china, and every time I stuck with china custom, due to import licence in china, how should we go about applying for this licence, and as for custom duty is there any bench mark or how percent charge ??

You have a wonderful resource here with Asia Briefing and I’m a regular reader of the magazine and newsletter. My situation is I live in Shanghai and am interested in having 8 oil paintings shipped to me from a friend in the States. Will there be any trouble with customs, and if so how do I go about taking care of this ahead of time and avoiding any hassle? How would any import duty rate be implemented on something like artwork where prices are largely speculative?

@Art Collector: Personal articles will be considered as import and subject to import duty when the value of a single article exceeds 1000 RMB and has been determined by the customs as “not for personal use”. Once the paintings are considered imported goods, the import duty = duty paying value * import duty rate. The import duty rate is temporarily reduced to 6% for oil paintings since 2012, and the duty paying value of the paintings will be determined by either the price on the invoice or the recent market price of similar goods from the same source, whichever is applicable.

@Ian: This type of processing service is characterized as “processing with supplied material” (PSM) by the Custom and the Tax bureau. Under PSM, no tariff, VAT, or consumption tax will be imposed as long as the quantity of the parts imported match the export quantity of the processed parts. The relevant information of the parts will be put into a manual issued by the Custom when the parts coming into the country. Also the processing company in China must have the qualification approved by relevant government authorities to conduct PSM.

@Mike – It depends upon where the assembly is taking place. Ideally this should be based in a free trade or other bonded zone – the engines are imported into the zone (but not into the mainland as they do not pass through customs). Then they can be re-exported as a finished item with the lawn machinery. VAT can also be claimed back upon export on the Chinese sourced component as well.

Can you kindly advice what procedures I have to do to apply for tax exemptions? Recently purchased a LCD monitor from China and it arrived faulty. Seller informed to send it back but I have checked and the cost to send it back plus the duties and taxes already outweighs the cost of the item. Is there a term that returned goods can be exempted? I only received the item about a week ago. Any documents I can provide to help? The third party courier did not hand me any invoice from the seller in the first place.

@Raf – You could declare the device as a temporarily imported good to the Chinese Customs and obtain an ATA (Admission Temporaire/Temporary Admission) carnet. In order to be granted ATA, certain amounts of deposit or other types of guarantee will be required by the customs. In addition, to be qualified for temporarily imported goods, the goods should be exported generally within 6 months, any extension will need approval from the customs. The import and export duty and VAT are exempted for temporarily imported goods.

I don’t think there will be any taxes imposed on the LCD monitor as long as the customs are convinced this product is for personal use instead of sales purpose.

In your case, the supplier can claim the VAT back based on the valid tax certificates (for components) they should have. The refund rates are not available online, they will need to check with the customs for detailed information.

@Anil: The major taxes you will be subject to are value-added taxes and customs duties. You’ll need help with planning all this out, together with planning your registered capital and all these issues properly to cater accurately for the start up costs. For more information, please contact china@dezshira.com let us know where you’ll be establishing operations and our relevant regional office will be pleased to assist.

I need your help Chris. i have been searching Chinese taxes for week. I would like to know import sunflower oil to third country China from Russia and what would be the taxes and custom duties. Is it legal to Import sunflower oil to china? because last time we try to import arabseed from Russia but china don’t allow to buy arabseed from Russia .

2)When they apply to temporarily export artworks, they are required to pay a deposit fee that is equivalent to the amount of export duties for exporting the artwork. The deposit fee will be returned if the artwork is reimported to China within the stipulated period. But if the artwork is not returned to China within the period stipulated, the deposit fee will automatically be converted into export duties and paid to the Customs, regardless of whether the work has been sold, returned late, or not returned at all.

Could you please help me to know that in which category cotton linter pulp comes and what will be the custom duty on this when importing from china to India. Also please advise me the whole process for importing any material from China to India.

My email in April used the wrong terminology. The food additive I am exporting to China will be PIM, not PSM. I plan on shipping product to bonded warehouse wherein the food processor will receive product. I am advised that the processors have the Processing Trade Agreeement “handbook” on file with customs. Is any VAT or Duty the responsibility of the processor to have them exempt? Do I need a Trading License is it unnecessary? Thank you.

My company is based in Singapore and we are planning to export electronics components (Capacitors, resistors etc) to a new China customer in Beijing. Assuming the value of the goods is worth USD$10,000 what is the import taxes and other costs of importing into China?

how is the Chinese custom handling if a foreigner takes standard/ regular coins (no historic or bullions – just regular current currency e.g. USD or EUR) out of the country? Especially if exceeding the USD 5.000 threashold?

•If the foreign currency you take does not exceed the amount of declared in your last entry into China, you shall not be required to apply for the Permit for Bringing Foreign Exchange out of China and the Customs shall refer to the records of the amount of cash in foreign currencies declared by you for your last entry into China and allow exit.

– Where the amount of cash in foreign currencies to be brought out of China exceeds US$10,000 equivalent, you shall be required to apply to a branch of the State Administration of Foreign Exchange at the location of the account opening bank of foreign currency deposit or the bank selling such foreign currencies to you. The Customs shall allow exit upon presentation of the Permit bearing the seal of the SAFE bureau.

@Susan: As the value is under USD5000 you may not need to declare it. However, customs may still challenge you and ask you if these are to be resold. That would break a number of laws, and consequently could cause some issues as regards why you are carrying such unusual personal belongings with you.

Generally speaking, reclaiming import VAT and custom duty may be allowed within 1 year from the date of import custom clearance, if the the imported goods are genuinely of poor quality or poor standards, and is returned intact. This fact of poor quality or standards needs to be supported by quality inspection report issued by relevant quality inspection authorities.

Re your kind reply of 4th Jan to my question about importing perfume (thanks a million!), well it’s still stuck in storage in Hong Kong because the customer ran out of money… Anyway things should move again in early April. The question I need to ask you is about the difference between general and preferential duties. I was led to believe by some locals that general was for finished products (ready for retail sales) and preferential was for bulk product (i.e. still to be bottled and packaged). I understand from your e-mail that this is not the case. Therefore, my question is: in what cases is the preferential tariff applied, particularly with reference to finished perfumes and raw materials to make perfumed and cosmetics in China?

I would like to buy a hydroelectric turbine and generator from China for my personal use to be installed on my property. I have a quote that includes shipment to Port of NY. I have no experience dealing with the Chinese and no experience importing. If this unit is shipped to the Port of NY, I am concerned about customs, duties, tariffs, entry fees and whatever else I may not even know about.

@Mark Henson: Your question relates to import duties levied by the United States, not by China. You are best advised to contact a US Customs Agent in NY to assist with this type of question. There are several listed if you search google.

@Santo: We had to work a bit to get an answer to you on the issue you raised, hence the delay. It is a complicated subject you raise. However, to answer you in detail, customs duty rates for imports shall include most-favored-nation tariff rates, conventional tariff rates, preferential tariff rates, general tariff rates and tariff rates for quota items. Provisional rates of import duties may be implemented for a specified period of time.

Based on a preliminary search, the following two categories of products (might be close to the packed minced tuna) with their corresponding HS code, import customs duty (tariff) and applicable taxes were found. Please keep in mind that the information below is an estimate only and the actual import customs duty and tax rates may vary.

The correct way of price adjustment will depend on the reason for why there is a price adjustment in the first place. There can be a considerable impact on value-added tax (VAT) and corporate income (CIT) – especially for VAT if your company has already collected the VAT rebate on export of the goods. Taken this into account, the customs, tax and foreign exchange authorities will need to thoroughly understand the reason for the price adjustment.

Can VAT taxes be refunded/credited on returned goods? We mistakenly shipped products to our Chinese customer that need to be returned (unused). Are the taxes applicable if the products were never used?

Based on section 61 of “Order 124 of General Administration of Customs of the People’s Republic of China”, return imported goods and claim refund on the import VAT paid is possible under the following grounds:

If you shipped the goods to your Chinese customer by mistake, then we would presume that the goods are not meeting the specification / requirements for your Chinese customer.

In addition, I am at a point where I need to rush items to China and I will be going there next week – is there a process where I can bring these items through the border and clear customer, or do I have to send them separately by courier?

If the incoterm is DDP, and I know that duty and VAT are based on CIF price. How do I present the CIF price in document (commercial invoice) for customs for calculation of duty and tax?

Hello Reed, sounds like the factories are referring to a Customs Handbook. This is required by PRC Customs for management what is called “processing trade” in China. Companies eligible for PTR (Processing Trade Relief) are allowed to import materials, parts, sub-assemblies, etc. that will be used in the manufacture of goods for export, with the customs duties/import VAT suspended. Such companies, which are under the supervision of PRC Customs, are required to maintain records to track the receipt of materials, storage, use and ultimate export of products manufatured from these imported materials. The “book” is what is used to record the in and out of the goods as well as to track the process.

Some issues that you could face would be valuing the machinery and declaring them as fixed assets. This would be easier to achieve through purchasing new machinery, and would also avoid customs and inspection.

we have a branch company in Guangzhou (a trading company for sales and service) which import goods in China and resell in China. this company also works as service centre for Chinese customers, but sometime we will need to send the good back to italy (to the headquarter) for repairing and then re-import the repaired good in China (it is mainly electronics product).

I hear that for China, imported brand from another country straight into free trade zone and sold on-line and delivered direct to the customer only incurs 10% duty not the normal 15% plus 17% vat. Do you know anything about this? I’m not clear if the goods need to be sold elsewhere or it is sold within china? Where can I get more information on it? thanks

We would like to understand what kind of taxes, VAT, custom expenses we’ll see if we buy new machinery for electronic manufacturing from China and import it into Switzerland. The machinery is built originally in South Korea HS code 8479.89-9092 (Korean)

What kind of Taxes & Custom duties applicable for the above and what are all the documents we need’s to produce while materials entering and leaving China.

i wish to send some broken bulldozer housings to China from Australia, to see if they can remake them for me what custom charges and duties will i have to pay and how do i pay them? many thanks Colin

Hi, I am not able to open the link for tariffs(http://www.customs.gov.cn/publish/portal0/tab9409/) given by Chris. Has the link changed. Please help me out with the correct link or the document itself.

I exported Evaluation Equipment to China. My TIB request was denied. To get the product to my customer for a trial, I paid the duties and taxes. The customer is now returning the evaluation equipment to me. How do I request a refund of the duties and taxes that I paid to facilitate the delivery for the evaluation?

I’m not sure you can help me, but I ordered skincare products from South Korea to the value of USD$120. China Customs are refusing to release it until I pay USD$50. Could you advise if this is correct and how they calculated such a large amount?

We purchase mould in india from china for production purpose but few mould not working in proper condition, we intimate our supplier for repairing our mould but supplier not agree for repairing due to tired for china customs. please see the warding from our supplier (As discussed that mould maker talk with his agent for old mould import. So his agent told him it is not possible to import old mould or old machine).

Ge is offering me cif rate for india port please email me and is there any problem with aluminium scrap to import from china , no china customs problem right for aluminium ingots and scrap ????

This is Jayashankar from india. If the Customer from China ask us to ship aluminium castings automotive parts then what will be the import duty at China Customs on arrival. HS Code 76169990

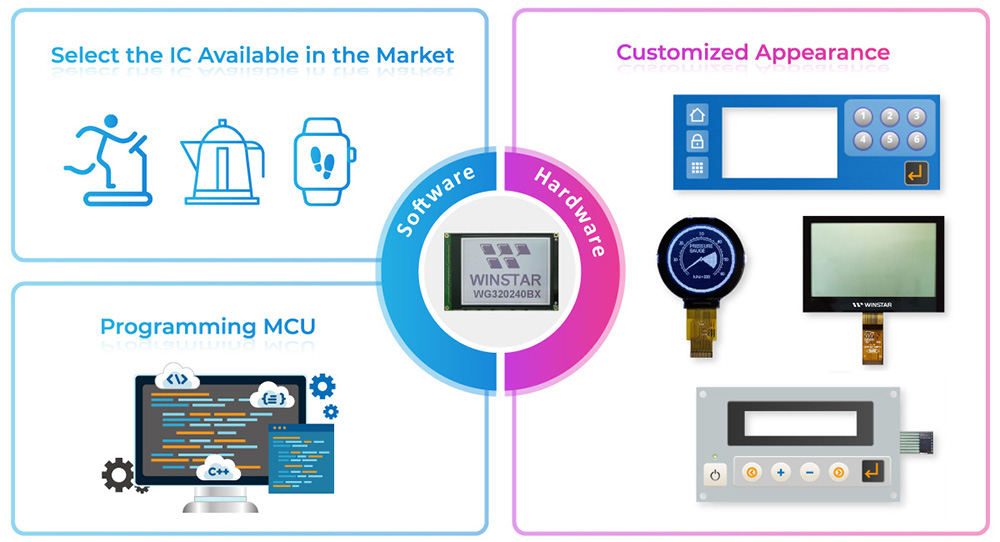

Typical LCDs are edge-lit by a strip of white LEDs. The 2D backlighting system in Pro Display XDR is unlike any other. It uses a superbright array of 576 blue LEDs that allows for unmatched light control compared with white LEDs. Twelve controllers rapidly modulate each LED so that areas of the screen can be incredibly bright while other areas are incredibly dark. All of this produces an extraordinary contrast that’s the foundation for XDR.

For even greater control of light, each LED is treated with a reflective layer, a highly customized lens, and a geometrically optimized reflector that are all unique to Pro Display XDR. Through a pioneering design, light is reflected, mixed, and shaped between two layers to minimize blooming and provide uniform lighting.

With a massive amount of processing power, the timing controller (TCON) chip utilizes an algorithm specifically created to analyze and reproduce images. It controls LEDs at over 10 times the refresh rate of the LCD itself, reducing latency and blooming. It’s capable of multiple refresh rates for amazingly smooth playback. Managing both the LED array and LCD pixels, the TCON precisely directs light and color to bring your work to life with stunning accuracy.

Whenimporting products from China, it is important to understand import duties, customs fees and clearance documents. As an importer, Chinese manufacturing is a good choice for many products that can be sold locally or online and reap huge profits. Tariffs depend on the products and commodities you import from China to the United States, which makes the entire international trade process for new importers seem complicated. This article will help you understand the tariffs on goods imported from China to the United States and how to check each product tariff. Let us delve into the import tax from China to the United States.

As a new importer, you must be aware that US Customs imposes tariffs on all imported goods valued at $800 or more. Values below $800 are tax-free. However, since June 30, 2018, the United States has increased the tariff on China’s 50 billion goods by 25%, which has increased the cost of American consumers.

Since February 24, 2016, former U.S. President Barack Obama signed the Trade Facilitation and Trade Enforcement Act of 2015, which will increase import tax exemption from 200 U.S. dollars to 800 U.S. dollars, The act was implemented by the United States Customs and Border Protection Agency on March 10, 2016. The amount of tax exemption means that the goods that meet the conditions are less than the stated dollar amount of USD 800, and can be exempted from making customs declaration without paying customs duties or taxes. This means that most goods shipments of less than 800 U.S. dollars will be exempt from customs clearance and import duties.

This move not only motivated the US consumers but also inspired a lot of e-commerce sellers to consider shipping with express delivery. However, the exemption rules are conditional and exceptional, and under the United States Customs regulations (U.s.customs regulation 19cfr10.151), the goods subject to this exemption need to meet the following requirements:

If the Customs considers that the goods are one of several batches under a single order or contract and are shipped separately for the purpose of free entry (tax exemption) or to avoid compliance with any relevant laws and regulations, this situation cannot be exempted tax. Goods that are part of a tariff quota cannot be tax-free (for example, products that are tariff quotas cannot be exempt from taxation). Goods that are regulated if one or more of the cooperating government agencies require information are not exempt from taxation (for example, goods subject to FDA regulation are not exempt from taxation).

Even if you declare less than $800, US Customs still has the right to request a formal customs clearance. As long as Customs suspects that the low value of the shipment is to avoid compliance with certain relevant laws, the goods may be denied a tax exemption. Also, if you are declaring less than $800, but US Customs suspects that you have deliberately underreported and a re-evaluation of the goods is done, if the valuation is higher than $800, then it is still taxable.

Tariffs are not based entirely on declared value – it also varies from product to product. However, customs officials are busy people. They don’t have time to open each carton and sort it by itself. Instead, the HS code specifies the type of product. HS coding (coordinating commodity description and coding systems) is part of the international classification system, making the process very simple.

However, you can be sure to specify the correct HS code on the commercial invoice. Otherwise, you will end up paying a customs tax rate based on the wrong product. Regarding the correct coding of HS, you can check it online on the US Customs, or let your customs clearance agent provide it to you. If you use a customs clearance agent to help you clear customs, you should do it according to the requirements of the customs clearance agent.

Tariffs and taxes are calculated as a percentage of customs value. The value of the customs is based on the declared value, and the declared value should be indicated on the commercial invoice – the document issued by the supplier. Declaring the correct value on a commercial invoice is critical, otherwise, you may end up paying the wrong amount. It is always the responsibility of the importer to ensure that the correct declared value is indicated on the commercial invoice. This responsibility cannot be transferred to Chinese suppliers. You must confirm with your Chinese supplier the value of all declared products before shipping.

Tip: As we all know, low declarations can reduce the cost of goods entering the customs and enhance the competitiveness of products. However, customs is not a fool. Every product is declared by the customs according to the market price when it enters the customs system. If your goods are significantly lower than the customs-defined price, then the goods will be directly transferred to the inspection department by the customs, and the customs will charge hundreds to thousands of dollars for inspection fees.

US tariffs are a problem that every Chinese-to-American express parcel cannot avoid. US airfreight and US shipping will have US tariffs, with a minimum of 30 USD and no limit. Goods value below 800USD is duty-free. Of course, there are also many customers who choose to use the US express channel to avoid tariffs.

Customers who have worked in the apparel industry know that the tariff classification of clothing is simply too much. It is possible to have clothing of the same style, different materials but the tariffs will be different. There are also gaps in the tariffs for men’s wear women’s wear and children’s wear, there are also gaps between formal wear and casual wear, and there are also gaps before the different tariffs on apparel fabrics.

At present, solar energy products are in the anti-dumping stage in the United States, so many customers who export such products are discouraged from seeing this high anti-dumping tariff.

A: After receiving the ARRIVAL NOTICE, the customs broker must have the documents required by the customs (please refer to B) to be able to arrive at the port or arrive at the inland station within 5 days (5 DAYS PRIOR TO ETA). Apply to customs for customs clearance. Customs usually will decide whether to release or not (sea freight) within 48 hours. Air cargo will be notified within 24 hours. (US Customs actually works at any time so air cargo can be cleared even if it arrives on Saturdays and Sundays, but it must be taken care of by companies that are on duty over the weekend. Some cargo ships have not arrived in the US, and the customs have decided to check? Most inland stations can make a pre-declaration (PRE-CLEAR) before the arrival of the goods, but will only show the results after ARRIVAL IT.

1. The first one is an online declaration. The customs broker enters the contents that the customs need to know, into the US Customs Network (ABI), including what kind of goods and materials, value, number of pieces, bill of lading and container number, and extracts terminal information, and then send to the customs. If the customs release, you will get a notice from ABI. Most brokers are now used to online customs declaration. This method is quickly and usually, you will be notified by the ABI system within 48 hours, whether it is released or needs further inspection.

2. Customs needs to review documents. In this case, the customs broker must send the original or a copy of all the documents, including the original documents of the importer, to the customs, and the customs officers will review whether to release or check after checking all of your documents, the release will be very slow, and it may be around three days. Many precision electronic products, as well as most food products, such as textiles, are required to send customs documents. Products with quotas need to pass the original VISA and customs duties to the customs, and the customs will release them.

If there is wood packaging, Funimation CERTIFICATE or NON-WOOD PACKING STATEMENT. The name of the consignee on the bill of lading (CONSIGNEE) needs to be unified with the consignee shown on the last three documents. If there is any inconsistency, the consignee on the bill of lading must write the LETTER OF TRANSFER, and then the third party can go to customs clearance. The name, address and phone number of S/ & C/ are also required on the invoice and packing list. Some of the information on the S/ files in China if missing and will be required to be filled.

A: If it is heavy, the customs will determine that there must be a wooden package, you need to provide a fumigation certificate. If there is no wooden packaging, you must declare non-wood packaging (NON-WOOD PACKING) on all documents. Although the shipping company’s weight limit for the container is 44,000 pounds, the standard weight of the shipping company’s is 38,000 pounds. If the weight exceeds this weight in the US inland transportation, the truck company will require the use of its own special triangular or four-corner car frame. To ensure safe driving. In many states in the United States, this restriction is very strict and requires the transport of ultra-heavy container trucks for applications and permits. Since the cost of own car frame and license is extra, please note that the price is applicable to goods below 38,000 pounds when making inland-to-door service quotations. If the container exceeds 43,000 pounds, many inland states are not allowed to go on the road, and a special triangle or four-corner car frames must be used.

B: There must be a “MADE IN CHINA” label on the product. If not, the Customs will require a label to be sold, especially for mass consumer goods, so please be prepared.

The import requirements for food and food-related goods in the United States are very strict. In addition to reporting customs, it is also required to declare that the FDA (FOOD & DRUG ADMINISTRATION) will release the goods before both parties can pick up the goods. Customs agencies will usually add FDA service fees.

D: For customs clearance in the inland, you need to do a customs transit (cut I.T.—Immediate Transit). We need to provide I.T.#, DATE ISSUED, PLACE ISSUED AND ENDED. Inland Customs will use I.T# to control and release.

E: Since March 2003, U.S. Customs has been testing the AMS system. It was sent by NVOCC to the U.S. Customs through AMS within 24 hours of the ship’s departure. Some of the goods NVOCC still commissioned by the shipping company VOCC to do AMS. So we need to pay special attention to who does the AMS, the United States customs only use AMS No. to identify different goods, AMS No. includes an important part of the AMS FILER code SCAC Code, in the declaration is indispensable.

(1) In the former ABI system, the shipping company and the terminal were directly connected to the customs, which means that if the customs is released in the ABI, the shipping company and the terminal can see it. After the trial of AMS, large-scale shipping companies such as EVERGREEN, APL, MAERSK, COSCO, CSCL, etc. are also connected to AMS, but the terminal is not. Therefore, customs can clear an AMS, these shipping companies and NVOCC AMS FILER can be seen simultaneously, the shipping company helps the terminal system to be updated at the same time; small shipping companies such as SINOTRANS, LYKES, GWS, etc. do not have networked AMS, so the only way it can be released is by NVOCC AMS FILER fax. NVOCC guarantees a letter and a copy of customs pass (CUSTOMS FORM 3461). These shipping companies will receive the fax and manual update through the terminal system. It is conceivable that manual release will result in a multiplication of workload, as well as human error and leakage of customer data.

Terminals and shipping companies are networked, if the freight is prepaid, the bill of lading is telex released. as long as the customs clears, the dock will automatically release the goods to the truck company. In the United States, customers do not need to exchange bills of lading, so the US agent has no way to help detain the goods. This is quite different from China.

To the inland cargo, after the customs clearance, the shipping company will give a PICKUPnumber, the agent will get the PICKUP number and notify C/, then the truck company will pick up the goods by this number.

VSSL ARRIVAL: Notify Customs on the day the ship arrives at the port of destination. This is calculated by the actual arrival port, not counting when the previous port arrived.

AMS IC: When customs clearance is released, the AMS system will automatically display the IC, indicating customs clearance. Almost all of the goods to the port can be declared before the ship arrives and the customs clearance results are displayed. Although many inland goods can be used as PRE-CLEAR, the shipping company needs to know whether to release it after ARRIVAL I.T. After doing AMS, many NVOCCs forget ARRIVAL I.T. which leads to goods not being released after customs clearance.

If the customs duties are not paid on time, the customs will impose a fine and collect interest. It must be declared to the customs within 15 days of the goods. If there is still no one to report to the customs after 15 days, the customs will question the safety of the goods and transfer the goods to the supervision warehouse ( GO WAREHOUSE) Unloading to inspect the container. At this time, the customs clearance needs to be cleared by the supervision number (GONO). If the goods enter the supervision warehouse (G..O.WHSE-General Order). the following costs will be incurred.

Only pay these fees and pay the shipping fee to the shipping company in exchange for the LIEN notice to pick up the goods. If the goods are not cleared by customs within six months, the customs will confiscate them and then auction to collateralize the storage costs.

Under normal circumstances, most shipping companies can contact the customs and auction after

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey