tft lcd glass substrate supplier

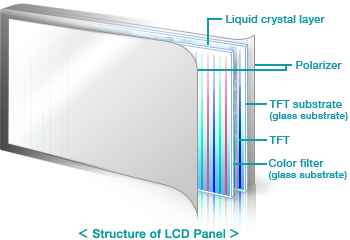

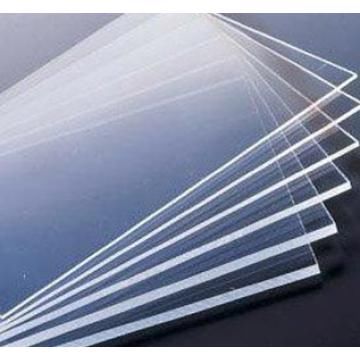

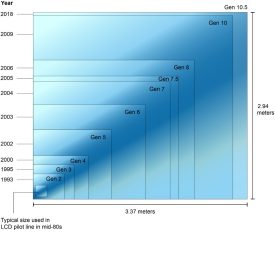

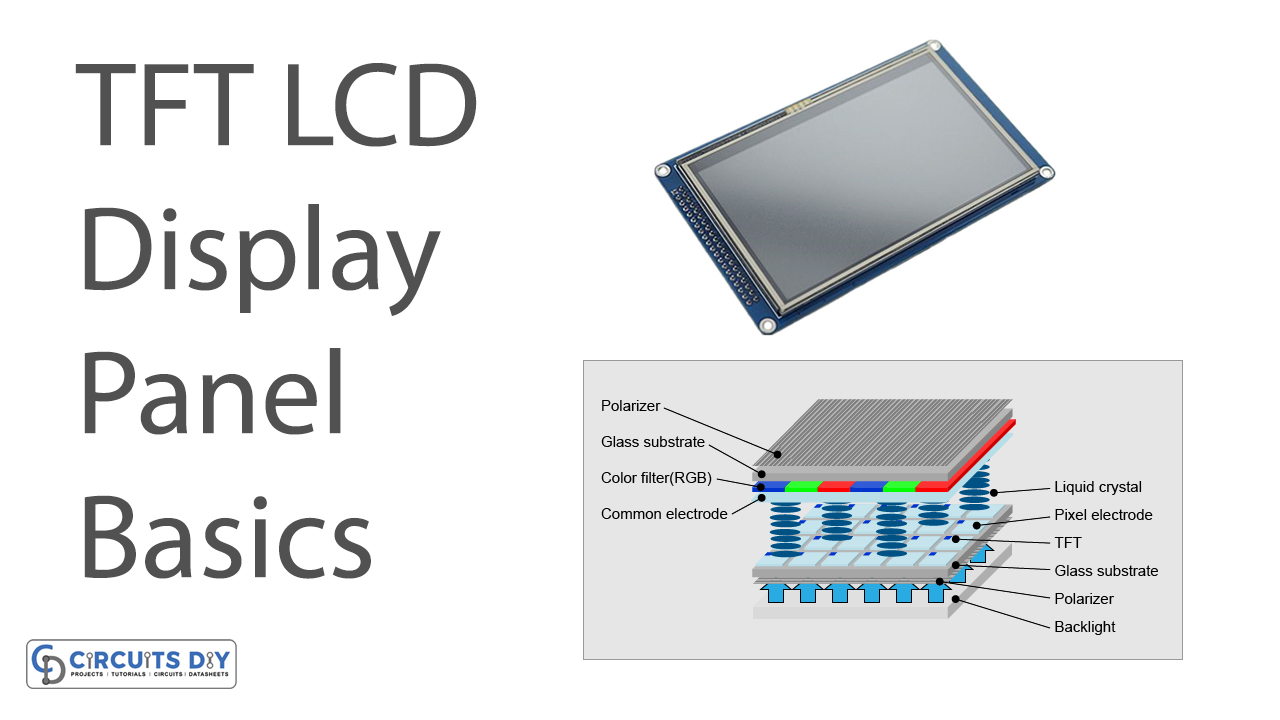

“LCD glass substrate” is a generic term for the special glass used for thin-film transistor (TFT) LCDs which form the display area of products including LCD televisions, personal computers and mobile phones. An LCD panel consists of various components stacked in a number of layers. These components include a polarizer, a color filter and a liquid crystal layer, with the glass substrate being the most important. Glass substrates are extremely thin – typically about 0.3-0.7 mm – and 8th-generation glass substrates (2,200 x 2,500 mm) are as large as three tatami mats in size.

In order to accurately display beautiful, high-definition images, LCD glass substrates must have super-smooth surfaces with irregularities reduced to the nano-level. It is also necessary to avoid the formation of internal bubbles and the intrusion of foreign matter (dust) too minute for the naked eye. Smooth and scratch-free glass substrates with the ultimate precision represent the maximum quality AvanStrate aims for.

One of the industry’s leading oxide panel makers selected Astra Glass as its backplane glass substrate because it has the inherent fidelity to thrive in high-temperature oxide-TFT glass fabrication for immersive high-performance displays.

One of the industry’s leading oxide panel makers selected Astra Glass as its backplane glass substrate because it has the inherent fidelity to thrive in high-temperature oxide-TFT glass fabrication for immersive high-performance displays.

In its display business, AGC holds the number-two global market share in glass substrates used for thin-film-transistor (TFT) liquid crystal displays (LCD) and OLEDs.

The glass substrate is one of the core layers of TFT LCD. It influences fundamental features of the display in the resolution, light transmittance, thickness, weight, and viewing angle.

The glass substrate is the core component of the TFT LCD and plays a significant role in the upstream of the TFT LCD industry, similar to the silicon wafer in the semiconductor industry.

Since the quality of the glass substrate decides the features of the display in the resolution, light transmittance, thickness, weight, viewing angle, and other important parameters.

The fundamental structure of the TFT LCD is similar to a sandwich, two layers of “bread” (TFT substrate and color filter) sandwiched with “jam” (liquid crystal).

Considering the unique environment in the manufacturing process of TFT-LCD, such as high temperature, high pressure, and environment switching among acidic-neutral-alkaline, the following characteristics of the glass must meet the challenge and quality requirement.

In the manufacturing process, the maximum temperature can reach above 600 ℃, which requires the glass substrate to remain rigid without any sticking even at such a high temperature.

After the etching process, the glass substrate needs to remain with minimal changes, and can’t be left with visible residue and interference with film deposition.

In the process the mother glass is cut into pieces in the required size, with a thickness of only 0.5-0.7mm, the glass needs to have high mechanical strength and elastic modulus >70GPa.

Usually, the size has doubled with each successive generation. From the initial generation 4 (G4) to the current G11, the size of the substrate has grown to 3000*3320mm.

In the global market of glass substrates for TFT-LCD, more than 90% are concentrated in several major manufacturers, such as Corning (America), Asahi Glass (Japan), Nippon Electric Glass (Japan), and AvanStrate (Taiwan).

However, there is still a gap and need for breakthroughs in the glass for high-generation LCD panel production lines and AMOLED alkali-free glass technology. It is hard to achieve high localization in a short time.

China Manufacturer and Supplier for Ultra-white glass substrate, ITO conductive film glass, TFT-LCD ultra-thin glass substrate, 0.2mm electronic information display glass substrate.

The project uses ultra-white glass substrates with independent intellectual property rights, and the second-generation float glass production technology. The entire set of technical equipment is at the international advanced and domestic leading position. It has created float glass wide plates, slow-thin glass, high-transparent, ultra-white glass substrates History of construction. This production line is the world"s first production line to produce 2mm, 3mm, and 1.6mm thin glass with a glass plate width of 5.2 meters. The light transmission rate is 99.8%. The product is mainly used in high-end building energy-saving glass exterior walls, solar photovoltaic backsheets, Automotive glass, etc. It is estimated that 660 tons of ultra-white glass substrates can be produced every day, and annual sales income can reach 560 million yuan.

In order to promote the transformation and upgrading of enterprises and enhance the added value of products, KSJH`s investment on the construction of 600T / D ultra-white substrate production lines,one 800T / D automobile glass raw film production line, and supporting construction of 4 million square meters of low-radiation Low-E glass deep processing production line, 7MW waste gas waste heat power station, and desulfurization, denitration and dust removal facilities. After the project is completed, the annual sales income will be over 5 billion yuan.

Research and development of solar photovoltaic glass, electronic information display glass, energy-saving glass and other internationally advanced technologies and industrialization. A number of technologies broke foreign monopolies, filled domestic gaps, and met the needs of the rapid development of solar photovoltaic industry, electronic information industry and building energy conservation .

(Yicai Global) June 19 -- China National Building Material has built the country"s first production line capable of producing 8.5th-generation TFT-LCD glass substrates, making China one of few nations to master the technology.

The central state-owned firm"s Bengbu Glass Industry Design and Research built the facility after three years of research, Science and Technology Daily reported. The plant aims to obtain certifications that will allow it to manufacture for domestic display makers.

TFT-LCD, or thin-film-transistor liquid-crystal displays, are classified by the size of their glass substrate. Sixth-generation displays are now widely considered out-dated while 8.5th-gen tech is the most advanced. The newer technologies use larger substrates, which are more efficient to make and can be used in larger screens.

Demand for glass substrates in China reached 260 million square meters in 2018, with demand for 8.5th-gen components making up 233 million, according to the China Optics & Optoelectronics Manufacturers Association. But domestic production is only about 40 million square meters and all below 6th-gen. American and Japanese companies mostly dominate the more advanced segment of the market.

"TFT-LCD Glass Substrate Market" report presents a comprehensive overview, market shares, and growth opportunities of TFT-LCD Glass Substrate market by product type, application, key manufacturers and key regions and countries. The global TFT-LCD Glass Substrate market size is projected to reach Multimillion USD by 2028, in comparision to 2021, at unexpected CAGR during 2022-2028.

TFT-LCD Glass SubstrateMarket Research Report is spread across 85 Pages with 130 Number of Tables and Figures that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

The Global TFT-LCD Glass Substrate market is anticipated to rise at a considerable rate during the forecast period, between 2022 and 2028. In 2020, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Due to the COVID-19 pandemic, the global TFT-LCD Glass Substrate market size is estimated to be worth USD million in 2022 and is forecast to a readjusted size of USD million by 2028 with a CAGR of % during the forecast period 2022-2028. Fully considering the economic change by this health crisis, Gen. 5 accounting for % of the TFT-LCD Glass Substrate global market in 2021, is projected to value USD million by 2028, growing at a revised % CAGR from 2022 to 2028. While Television segment is altered to an % CAGR throughout this forecast period.

North America TFT-LCD Glass Substrate market is estimated at USD million in 2021, while Europe is forecast to reach USD million by 2028. The proportion of the North America is % in 2021, while Europe percentage is %, and it is predicted that Europe share will reach % in 2028, trailing a CAGR of % through the analysis period 2022-2028. As for the Asia, the notable markets are Japan and South Korea, CAGR is % and % respectively for the next 6-year period.

The global major manufacturers of TFT-LCD Glass Substrate include Corning, AGC, NEG, Tunghsu Optoelectronic, AvanStrate, IRICO and LG Chem, etc. In terms of revenue, the global 3 largest players have a % market share of TFT-LCD Glass Substrate in 2021.

Report further studies the market development status and future TFT-LCD Glass Substrate Market trend across the world. Also, it splits TFT-LCD Glass Substrate market Segmentation by Type and by Applications to fully and deeply research and reveal market profile and prospects.

Geographically, this report is segmented into several key regions, with sales, revenue, market share and growth Rate of TFT-LCD Glass Substrate in these regions, from 2015 to 2027, covering ● North America (United States, Canada and Mexico)

Some of the key questions answered in this report: ● What is the global (North America, Europe, Asia-Pacific, South America, Middle East and Africa) sales value, production value, consumption value, import and export of TFT-LCD Glass Substrate?

● Who are the global key manufacturers of the TFT-LCD Glass Substrate Industry? How is their operating situation (capacity, production, sales, price, cost, gross, and revenue)?

● What are the upstream raw materials and manufacturing equipment of TFT-LCD Glass Substrate along with the manufacturing process of TFT-LCD Glass Substrate?

● What are the key drivers, restraints, opportunities, and challenges of the TFT-LCD Glass Substrate market, and how they are expected to impact the market?

This latest report researches the industry structure, sales, revenue, price and gross margin. Major producers" production locations, market shares, industry ranking and profiles are presented. The primary and secondary research is done in order to access up-to-date government regulations, market information and industry data. Data were collected from the Glass Substrates for TFT-LCD manufacturers, distributors, end users, industry associations, governments" industry bureaus, industry publications, industry experts, third party database, and our in-house databases.

The readers in the section will understand how the Glass Substrates for TFT-LCD market scenario changed across the globe during the pandemic, post-pandemic and Russia-Ukraine War. The study is done keeping in view the changes in aspects such as demand, consumption, transportation, consumer behavior, supply chain management, export and import, and production. The industry experts have also highlighted the key factors that will help create opportunities for players and stabilize the overall industry in the years to come.

Report Includes: ● This report presents an overview of global market for Glass Substrates for TFT-LCD, sales, revenue and price. Analyses of the global market trends, with historic market revenue/sales data for 2017 - 2021, estimates for 2022, and projections of CAGR through 2028.

● This report researches the key producers of Glass Substrates for TFT-LCD, also provides the sales of main regions and countries. Highlights of the upcoming market potential for Glass Substrates for TFT-LCD, and key regions/countries of focus to forecast this market into various segments and sub-segments. Country specific data and market value analysis for the U.S., Canada, Mexico, Brazil, China, Japan, South Korea, Southeast Asia, India, Germany, the U.K., Italy, Middle East, Africa, and Other Countries.

● This report focuses on the Glass Substrates for TFT-LCD sales, revenue, market share and industry ranking of main manufacturers, data from 2017 to 2022. Identification of the major stakeholders in the global Glass Substrates for TFT-LCD market, and analysis of their competitive landscape and market positioning based on recent developments and segmental revenues. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way.

Description The TFT-LCD Glass Substrate market report provides a detailed analysis of global market size, regional and country-level market size, segmentation market growth, market share, competitive Landscape, sales analysis, impact of domestic and global market players, value chain optimization, trade regulations, recent developments, opportunities analysis, strategic market growth analysis, product launches, area marketplace expanding, and technological innovations.

According to our (Global Info Research) latest study, due to COVID-19 pandemic, the global TFT-LCD Glass Substrate market size is estimated to be worth US$ million in 2021 and is forecast to a readjusted size of USD million by 2028 with a CAGR of % during forecast period 2022-2028. Television accounting for % of the TFT-LCD Glass Substrate global market in 2021, is projected to value USD million by 2028, growing at a % CAGR in next six years. While Gen. 5 segment is altered to a % CAGR between 2022 and 2028.

Global key manufacturers of TFT-LCD Glass Substrate include Corning, AGC, NEG, Tunghsu Optoelectronic, and AvanStrate, etc. In terms of revenue, the global top four players hold a share over % in 2021.

TFT-LCD Glass Substrate market is split by Type and by Application. For the period 2017-2028, the growth among segments provide accurate calculations and forecasts for sales by Type and by Application in terms of volume and value. This analysis can help you expand your business by targeting qualified niche markets.

Chapter 2, to profile the top manufacturers of TFT-LCD Glass Substrate, with price, sales, revenue and global market share of TFT-LCD Glass Substrate from 2019 to 2022.

Chapter 3, the TFT-LCD Glass Substrate competitive situation, sales, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the TFT-LCD Glass Substrate breakdown data are shown at the regional level, to show the sales, revenue and growth by regions, from 2017 to 2028.

Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales, revenue and market share for key countries in the world, from 2017 to 2022.and TFT-LCD Glass Substrate market forecast, by regions, type and application, with sales and revenue, from 2023 to 2028.

Chapter 13, 14, and 15, to describe TFT-LCD Glass Substrate sales channel, distributors, customers, research findings and conclusion, appendix and data source.

Table 6. Corning TFT-LCD Glass Substrate Sales (K Sqm), Price (US$/Sqm), Revenue (USD Million), Gross Margin and Market Share (2019, 2020, 2021, and 2022)

Table 10. AGC TFT-LCD Glass Substrate Sales (K Sqm), Price (US$/Sqm), Revenue (USD Million), Gross Margin and Market Share (2019, 2020, 2021, and 2022)

Table 14. NEG TFT-LCD Glass Substrate Sales (K Sqm), Price (US$/Sqm), Revenue (USD Million), Gross Margin and Market Share (2019, 2020, 2021, and 2022)

Table 18. Tunghsu Optoelectronic TFT-LCD Glass Substrate Sales (K Sqm), Price (US$/Sqm), Revenue (USD Million), Gross Margin and Market Share (2019, 2020, 2021, and 2022)

Table 22. AvanStrate TFT-LCD Glass Substrate Sales (K Sqm), Price (US$/Sqm), Revenue (USD Million), Gross Margin and Market Share (2019, 2020, 2021, and 2022)

Table 26. IRICO TFT-LCD Glass Substrate Sales (K Sqm), Price (US$/Sqm), Revenue (USD Million), Gross Margin and Market Share (2019, 2020, 2021, and 2022)

Table 30. LG Chem TFT-LCD Glass Substrate Sales (K Sqm), Price (US$/Sqm), Revenue (USD Million), Gross Margin and Market Share (2019, 2020, 2021, and 2022)

AGC has now decided to relocate a cutting-edge glass substrate production facility from within the AGC Group. This investment will significantly reduce the need for capital investment while maintaining the group"s total production capacity.

There has been a large increase in production of TFT-LCD panels in China in recent years which has resulted in an abrupt increase in demand for glass substrates. To accommodate demand growth, the AGC Group has established a supply system by setting up a processing facility in Kunshan, Jiangsu Province, and Shenzhen, Guangdong Province, and a furnace in Huizhou,Guangdong Province.

AGC has also decided to build an 11th generation dedicated glass substrate* furnace in order to address the anticipated growth in demand of TFT-LCD panels that will use similar-sized TFT-LCD glass substrates.

Recently, the Bengbu Glass Industry Design and Research Institute Holdings subsidiary, Chengdu Optoelectronics Technology Co., Ltd. production of the first ultra-thin 0.5mm the arsenic TFT-LCD glass substrate products passed the domestic core users - Tianma Microelectronics batch certification, and officially subsequent bulk purchases orders, successfully open up the market.

China"s first 8.5-generation tft-lcd glass substrate production line was successfully fired in bengbu, anhui province on Monday, entering the debugging stage of the equipment. The production is expected to reach mass production in September.

TFT-LCD glass substrate is the key strategic material of electronic information display industry.The 8.5 generation tft-lcd glass substrate has a size of 2.2m*2.5m and can be cut into 6 55-inch panels.At present, the 8.5 generation tft-lcd glass substrates for large-size LCD TVS in China are completely dependent on the technology and products of foreign companies, and they cannot be independently produced.

The ignition production line is the project result of the national key research and development program of ministry of science and technology "development and industrialization demonstration of core technology of high-generation electronic glass substrate and cover plate", which is led by China building materials bengbu glass industrial design and research institute.

According to the data of liquid crystal branch of China optical optoelectronics industry association, in 2018, the demand of glass substrate in mainland China is about 260 million square meters, among which the demand of 8.5 generation glass substrate is 233 million square meters, while the annual supply of domestic tft-lcd glass substrate is less than 40 million square meters, and all of them are 6 generation lines or below.

The 8.5 generation tft-lcd glass substrate production represents the high level of modern glass industry large-scale manufacturing, and its core technology has been monopolized by a few foreign enterprises for a long time.Supported by the national key research and development program, bengbu glass industry design and research institute of China building materials co., LTD., with years of accumulation and persistent research, has cooperated with several units to overcome the key technology of high-generation electronic glass, which will provide the key raw material guarantee for China"s LCD panel industry after mass production.

It is reported that after the project volume, China will become one of the few countries in the world to master the production technology of high-generation tft-lcd glass substrate.

TFT liquid crystal display is characterized by good brightness, high contrast, strong sense of hierarchy, bright colors, but there are also relatively power consumption and high cost deficiencies. TFT liquid crystal technology has accelerated the development of cell phone color screen. Many of the new generation of color screen cell phones support 65536 color display, some even support 160,000 color display, this time TFT’s high contrast, color-rich advantages are very important.

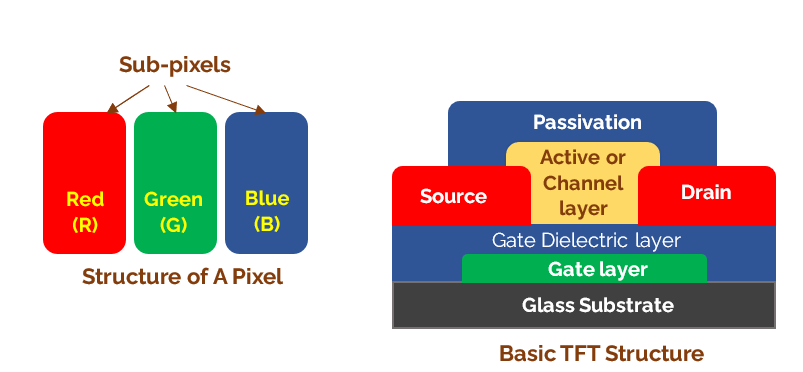

TFT technology is developed in the 1990s, using new materials and processes of large-scale semiconductor fully integrated circuit manufacturing technology, is the liquid crystal (LC), inorganic and organic thin film electroluminescent (EL and OEL) flat panel display basis. TFT is in the glass or plastic substrate and other non-monocrystalline wafer (of course, can also be on the wafer) through sputtering, chemical deposition process to form the necessary manufacturing circuit TFT is formed on a non-monocrystalline substrate such as a glass or plastic substrate (or, of course, on a wafer) by sputtering and chemical deposition processes to form the various films necessary for the manufacture of circuits. The use of non-monocrystalline substrates can significantly reduce costs and is an extension of conventional large-scale integrated circuits to large-area, multi-functional, low-cost direction. It is more technically difficult to manufacture TFTs that control the switching performance of image elements (LC or OLED) on large-area glass or plastic substrates than to manufacture large-scale ICs on silicon wafers. The requirements for the production environment (purification level 100), the requirements for the purity of raw materials (99.999985% purity of electronic special gas), the requirements for production equipment and production technology exceed those of semiconductor mass integration, which is the top technology of modern mass production. Its main features are.

(1) large area: the first generation of large-area glass substrate (300mm × 400mm) TFT-LCD production line put into operation in the early nineties, to the first half of 2000 the area of the glass substrate has been expanded to 680mm × 880mm), and 950mm × 1200mm glass substrate will also be put into operation. In principle, there is no area limitation.

(2) high integration: 1.3-inch TFT chip for LCD projection resolution of XGA contains millions of pixels. Resolution of SXGA (1280 × 1024) of 16.1-inch TFT array non-crystalline silicon film thickness of only 50nm, as well as TABONGLASS and SYSTEMONGLASS technology, the integration of its IC, the requirements of equipment and supply technology, technical difficulties are more than the traditional LSI.

(3) Powerful: TFT was first used as a matrix addressing circuit to improve the light valve characteristics of liquid crystals. For high-resolution displays, precise control of the object element is achieved through voltage regulation in the range of 0-6V (its typical value of 0.2 to 4V), thus making it possible for LCDs to achieve high-quality, high-resolution displays. TFT-LCD is the first flat panel display in human history that exceeds CRT in display quality. And people began to integrate the driver IC into the glass substrate, the whole TFT will be more powerful, which is unmatched by the traditional large-scale semiconductor integrated circuits.

(4) low cost: glass substrates and plastic substrates fundamentally solve the cost of large-scale semiconductor integrated circuits, the application of large-scale semiconductor integrated circuits to open up a wide application space.

(6) wide range of applications, TFT technology-based liquid crystal flat panel display is the pillar of the information society, but also technology can be applied to the rapid growth of thin-film transistor organic electroluminescent (TFT-OLED) flat panel display is also growing rapidly.

With the maturity of TFT technology in the early nineties, color LCD flat panel displays developed rapidly, and in less than 10 years, TFT-LCD grew rapidly into a mainstream display, which is inseparable from the advantages it has. The main features are.

(1) the use of good characteristics: low-voltage applications, low drive voltage, solidification of the use of security and reliability; flat, and thin, saving a lot of raw materials and use of space; low power consumption, its power consumption is about one tenth of the CRT display, reflective TFT-LCD is even only about one percent of the CRT, saving a lot of energy; TFT-LCD products and specifications models, the TFT-LCD products also have many features such as serialized specifications, various sizes, convenient and flexible usage, easy maintenance, updating and upgrading, and long service life. Display range covers the application range of all displays from 1 inch to 40 inches and projection of large planes, is a full-size display terminal; display quality from the simplest monochrome character graphics to high resolution, high color fidelity, high brightness, high contrast ratio, high response speed of various specifications of the model video display; display mode has a direct view type, projection type, see-through type, but also reflective type.

(2) Good environmental characteristics: no radiation, no flicker, no damage to the user’s health. Especially the emergence of TFT-LCD electronic books, will bring mankind into the paperless office, paperless printing era, triggering a revolution in the way humans learn, spread and record civilization.

(3) Wide range of application, from -20 ℃ to +50 ℃ temperature range can be used normally, after temperature reinforced processing of TFT-LCD low temperature working temperature can reach minus 80 ℃. It can be used as mobile terminal display, desktop terminal display, and large screen projection TV, which is a full-size video display terminal with excellent performance.

(4) The manufacturing technology is highly automated and has good characteristics for large-scale industrial production, and the technology of TFT-LCD industry is mature and the yield rate of large-scale production is over 90%.

(5) TFT-LCD is easy to integrate and update, and is a perfect combination of large-scale semiconductor integrated circuit technology and light source technology, with great potential for continued development. Currently there are amorphous, polycrystalline and monocrystalline silicon TFT-LCD, the future will have other materials TFT, both glass substrate and plastic substrate.

Our company specializes in developing solutions that arerenowned across the globe and meet expectations of the most demanding customers. Orient Display can boast incredibly fast order processing - usually it takes us only 4-5 weeks to produce LCD panels and we do our best to deliver your custom display modules, touch screens or TFT and IPS LCD displays within 5-8 weeks. Thanks to being in the business for such a noteworthy period of time, experts working at our display store have gained valuable experience in the automotive, appliances, industrial, marine, medical and consumer electronics industries. We’ve been able to create top-notch, specialized factories that allow us to manufacture quality custom display solutions at attractive prices. Our products comply with standards such as ISO 9001, ISO 14001, QC 080000, ISO/TS 16949 and PPM Process Control. All of this makes us the finest display manufacturer in the market.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey