tft lcd glass substrate in stock

In its display business, AGC holds the number-two global market share in glass substrates used for thin-film-transistor (TFT) liquid crystal displays (LCD) and OLEDs.

For its transparency, flat and smooth surface, and excellent heat resistance, this product is used as a substrate for various types of displays such as televisions, personal computers, smart phones, tablet devices, and in-vehicle infotainment. It is an alkali-free aluminosilicate glass that was developed by using the float process.

Recently, screen sizes of LCD TVs have become wider and larger. The glass substrates from AGC enable this trend of larger LCD TV sizes. Glass substrates also play a key role to reproduce clear and beautiful screen images as one of the core components of LCDs.

It is necessary for TFT-LCD glass to meet many strict quality requirements. Unlike window pane glass, glass for TFT-LCDs is not allowed to contain alkalis. This is because alkali-ions contaminate liquid crystal materials and even adversely affect the characteristics of the TFT. Additionally, the glass should not exhibit large sagging even though its thickness is just 0.3 to 0.7 mm and should have excellent heat resistance while assuring dimensional stability even after being heated at high temperature. The glass also should have properties that its composition does not dissolve during the fabrication process using chemicals. "AN100", non-alkali glass developed by us, is the one that has fulfilled those various requirements. Furthermore, since "AN100" does not contain hazardous materials such as arsenic or antimony, it has high reputation for being an environment-friendly glass. Our technologies are supporting the design of thin, large, and environmentally friendly LCD TVs.

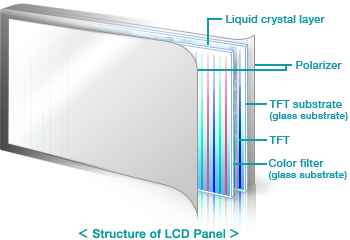

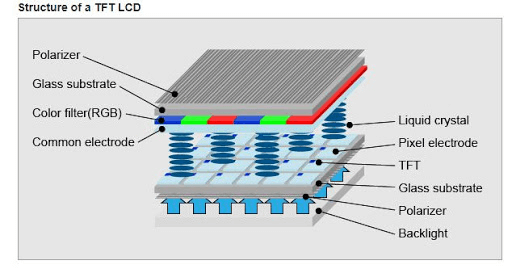

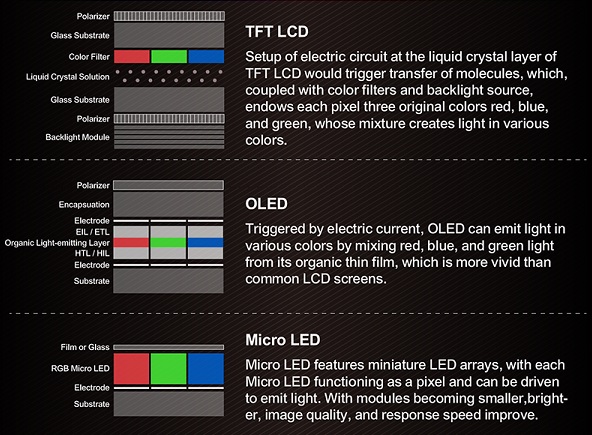

An LCD has a layer of liquid crystal sandwiched between two sheets of glass. The most remarkable feature of liquid crystal is its optical characteristics of being both a liquid and a solid. Applying voltage to the layer of liquid crystal causes the orientation of the molecules in the liquid crystal to change relative to each other. This molecule rearrangement controls the light transmission from the backlight; the light passes through color filters of red, blue, and green, and eventually rich images appear on the screen.

Majority of LCDs in wide use now are TFT-LCDs. In a TFT-LCD, a layer of thin film that forms transistors is used as a device that applies voltage to the liquid crystal layer, and those transistors control the voltage supplied to each pixel. The advantages of a TFT-LCD are high resolution and quick response time that enables motion image to be fine and clear.

It is AGC’s display glass substrates, developed using its distinctive precision glass processing technologies, that support these higher resolution TVs.

Smartphones and tablets can now be considered life necessities, and the LCD screen is the most frequently used interface whenever such devices are used. Without the LCD display, it is not possible to send email or view pictures taken by the camera function.

Furthermore, LCDs play an important role in a variety of applications such as in-vehicle displays, e.g. navigation systems and center information displays, and digital signage.

Through production and supply of LCD glass substrates, which is a key material of LCDs, AGC helps create a more convenient and comfortable life through integrating various technologies within the Group.

"TFT-LCD Glass Substrate Market" report presents a comprehensive overview, market shares, and growth opportunities of TFT-LCD Glass Substrate market by product type, application, key manufacturers and key regions and countries. The global TFT-LCD Glass Substrate market size is projected to reach Multimillion USD by 2028, in comparision to 2021, at unexpected CAGR during 2022-2028.

TFT-LCD Glass SubstrateMarket Research Report is spread across 85 Pages with 130 Number of Tables and Figures that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

The Global TFT-LCD Glass Substrate market is anticipated to rise at a considerable rate during the forecast period, between 2022 and 2028. In 2020, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Due to the COVID-19 pandemic, the global TFT-LCD Glass Substrate market size is estimated to be worth USD million in 2022 and is forecast to a readjusted size of USD million by 2028 with a CAGR of % during the forecast period 2022-2028. Fully considering the economic change by this health crisis, Gen. 5 accounting for % of the TFT-LCD Glass Substrate global market in 2021, is projected to value USD million by 2028, growing at a revised % CAGR from 2022 to 2028. While Television segment is altered to an % CAGR throughout this forecast period.

North America TFT-LCD Glass Substrate market is estimated at USD million in 2021, while Europe is forecast to reach USD million by 2028. The proportion of the North America is % in 2021, while Europe percentage is %, and it is predicted that Europe share will reach % in 2028, trailing a CAGR of % through the analysis period 2022-2028. As for the Asia, the notable markets are Japan and South Korea, CAGR is % and % respectively for the next 6-year period.

The global major manufacturers of TFT-LCD Glass Substrate include Corning, AGC, NEG, Tunghsu Optoelectronic, AvanStrate, IRICO and LG Chem, etc. In terms of revenue, the global 3 largest players have a % market share of TFT-LCD Glass Substrate in 2021.

Report further studies the market development status and future TFT-LCD Glass Substrate Market trend across the world. Also, it splits TFT-LCD Glass Substrate market Segmentation by Type and by Applications to fully and deeply research and reveal market profile and prospects.

Geographically, this report is segmented into several key regions, with sales, revenue, market share and growth Rate of TFT-LCD Glass Substrate in these regions, from 2015 to 2027, covering ● North America (United States, Canada and Mexico)

Some of the key questions answered in this report: ● What is the global (North America, Europe, Asia-Pacific, South America, Middle East and Africa) sales value, production value, consumption value, import and export of TFT-LCD Glass Substrate?

● Who are the global key manufacturers of the TFT-LCD Glass Substrate Industry? How is their operating situation (capacity, production, sales, price, cost, gross, and revenue)?

● What are the upstream raw materials and manufacturing equipment of TFT-LCD Glass Substrate along with the manufacturing process of TFT-LCD Glass Substrate?

● What are the key drivers, restraints, opportunities, and challenges of the TFT-LCD Glass Substrate market, and how they are expected to impact the market?

One of the industry’s leading oxide panel makers selected Astra Glass as its backplane glass substrate because it has the inherent fidelity to thrive in high-temperature oxide-TFT glass fabrication for immersive high-performance displays.

One of the industry’s leading oxide panel makers selected Astra Glass as its backplane glass substrate because it has the inherent fidelity to thrive in high-temperature oxide-TFT glass fabrication for immersive high-performance displays.

Display glass substrate is a special glass used for supporting TFT (Thin Film Transistor), LCD (Liquid Crystal Display) and OLED panels forming display units for products including televisions, personal computers and mobile phones. Ever display panel consists of various components stacked in a number of layers, which includes a color filter, a polarizer and a liquid crystal display with the glass substrate being the most important.

In 2016, the display glass substrate market was valued at US$ 1.42 Billion and is projected to reach US$ 1.97 Billion by 2028, growing at a CAGR of 5.7%. With the expanding demand for consumer grade electronic devices such as smartphones, laptops and personal computers, the global display glass substrate market is expected to grow during the forecast period.

The expanding use of LCD’s in smart handheld devices, consumer durables, and other automotive applications is one of the most powerful factors projected to drive the growth of the display glass substrate market. Moreover, the advancements in the electronics and semiconductor industries are further projected to drive the increasing demand for display glass substrates.

The electronics industry is the largest end-using commerce segment that suitably utilizes display glass substrates and the general growth for the display glass substrate market is heavily dependent on it. Increasing in manufacturing of display devices, electronic components, semiconductor devices, MEMS (Microelectronic Mechanical System) devices, and computing & telecommunication devices is expected to drive the growth of the display glass substrate market.

However, the immense manufacturing cost of display glass substrates acts as a restraint to the expansion of the display glass substrate market. Manufacturers of display glass substrates are focusing on directing their earnings through several process control techniques with the aim of optimizing production costs to a certain level.

Asia Pacific is accredited to be the largest market for display glass substrates. The display glass substrate market in the Asia Pacific region is estimated to grow at the highest CAGR during the forecast period owing to the occupancy of numerous electronics manufacturers in this region.

China, Hong Kong and South Korea are expected to account for the largest share of the glass substrate market in the Asia Pacific region in 2028 as most of the major producers of display glass substrates such as Nippon Sheet Glass (Japan) and The Tungshu Group (China) are located in the Asia Pacific region. The Asia Pacific region accounts for over 37% of the total display glass substrate market. Other regions include North America and Europe with a market share of 8% and 3% in the global display glass substrate market.

Some of the key players in the global display glass substrate market are Corning Incorporated, LG Chem, AGC Incorporated, AvanStrate Incorporated, SCHOTT Ag, Tungshu Optoelectronics, IRICO Group New Energy Company Limited and CGC Glass.

The research report presents a comprehensive assessment of the display glass substrate market and contains thoughtful insights, facts, historical data and statistically supported and industry validated market data. It also includes projections using a suitable set of assumptions and methodologies. The research report of display glass substrate market provides analysis and information according to the different market segments such as geographies, grade type and application.

The display glass substrate market report is a compilation of first-hand information, qualitative and competitive assessment industry analysts, inputs from industry experts and industry participants across the value chain. The report for display glass substrate market provides an in depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Global TFT-LCD Glass Substrate Market Dynamics 2022-2028, Regional Analysis, Segmentation, Competitive Landscape, COVID-19 Impact, Recent Developments and SWOT Analysis of Key Players

London, UK — (SBWIRE) — 05/25/2022 — TFT-LCD Glass Substrate Market Report includes qualitative insights, historical data, and verifiable market size predictions. The report"s estimates are based on well-established research methodology and assumptions. TFT-LCD Glass Substrate market size, share, market growth rates, and analysis of the main players/companies/manufacturers are also covered in the research. This report examines the global market in depth. The research study includes both qualitative and quantitative data in terms of growth rate, market segmentation, market size, future trends, and geographical perspective. The study looks at the current state of the industry and how that may affect its future potential.

For tracking the global TFT-LCD Glass Substrate market revenue and performance in recent years, we analyzed various data points such as product price trends, consumer purchase patterns, company annual sales performance, and COVID-19 impact on distribution channels, parent industry performance, regional trends, and technological innovations. The report will help major academic institutions, start-ups, and businesses throughout the world measure and comprehend changing worldwide and regional business environments.

To begin, substantial secondary research was conducted using both internal and external sources to gather qualitative and quantitative market knowledge. The entire TFT-LCD Glass Substrate market size was calculated using primary and secondary data. The plan also enables the production of a regional market overview and forecast for each category.

The report examines the global TFT-LCD Glass Substrate industry in both new and existing markets, including North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. Market sizing and forecasting were done on the basis of value for each segment.

The report is divided into qualitative and quantitative industrial characteristics for each of the study"s sections and countries. The study also looks into key topics like driving forces and constraints that will define the market"s future development. A complete analysis of the competitive landscape and large enterprises" product offerings, as well as micro market investment potential for stakeholders, will be included in the study. The purpose of the TFT-LCD Glass Substrate market analysis is to anticipate market numbers for the coming years by estimating market sizes for various sectors and areas in prior years.

TFT-LCD was invented in 1960 and successfully commercialized as a notebook computer panel in 1991 after continuous improvement, thus entering the TFT-LCD generation.

Simply put, the basic structure of the TFT-LCD panel is a layer of liquid crystal sandwiched between two glass substrates. The front TFT display panel is coated with a color filter, and the back TFT display panel is coated with a thin film transistor (TFT). When a voltage is applied to the transistor, the liquid crystal turns and light passes through the liquid crystal to create a pixel on the front panel. The backlight module is responsible for providing the light source after the TFT-Array panel. Color filters give each pigment a specific color. The combination of each different color pixel gives you an image of the front of the panel.

The TFT panel is composed of millions of TFT devices and ITO (In TI Oxide, a transparent conductive metal) regions arranged like a matrix, and the so-called Array refers to the region of millions of TFT devices arranged neatly, which is the panel display area. The figure below shows the structure of a TFT pixel.

No matter how the design of TFT display board changes or how the manufacturing process is simplified, its structure must have a TFT device and control liquid crystal region (if the light source is penetration-type LCD, the control liquid crystal region is ITO; but for reflective LCD, the metal with high reflection rate is used, such as Al).

The TFT device is a switch, whose function is to control the number of electrons flowing into the ITO region. When the number of electrons flowing into the ITO region reaches the desired value, the TFT device is turned off. At this time, the entire electrons are kept in the ITO region.

The figure above shows the time changes specified at each pixel point. G1 is continuously selected to be turned on by the driver IC from T1 to TN so that the source-driven IC charges TFT pixels on G1 in the order of D1, D2, and Dn. When TN +1, gATE-driven IC is selected G2 again, and source-driven IC is selected sequentially from D1.

Many people don’t understand the differences between generations of TFT-LCD plants, but the principle is quite simple. The main difference between generations of plants is in the size of glass substrates, which are products cut from large glass substrates. Newer plants have larger glass substrates that can be cut to increase productivity and reduce costs, or to produce larger panels (such as TFT display LCD TV panels).

The TFT-LCD industry first emerged in Japan in the 1990s, when a process was designed and built in the country. The first-generation glass substrate is about 30 X 40 cm in size, about the size of a full-size magazine, and can be made into a 15-inch panel. By the time Acer Technology (which was later merged with Unioptronics to become AU Optronics) entered the industry in 1996, the technology had advanced to A 3.5 generation plant (G3.5) with glass substrate size of about 60 X 72 cm.Au Optronics has evolved to a sixth-generation factory (G6) process where the G6 glass substrate measures 150 X 185 cm, the size of a double bed. One G6 glass substrate can cut 30 15-inch panels, compared with the G3.5 which can cut 4 panels and G1 which can only cut one 15-inch panel, the production capacity of the sixth generation factory is enlarged, and the relative cost is reduced. In addition, the large size of the G6 glass substrate can be cut into large-sized panels, which can produce eight 32-inch LCD TV panels, increasing the diversity of panel applications. Therefore, the global TFT LCD manufacturers are all invested in the new generation of plant manufacturing technology.

The TRANSISTor-LCD is an acronym for thin-film TFT Display. Simply put, TFT-LCD panels can be seen as two glass substrates sandwiched between a layer of liquid crystal. The upper glass substrate is connected to a Color Filter, while the lower glass has transistors embedded in it. When the electric field changes through the transistor, the liquid crystal molecules deflect, so as to change the polarization of the light, and the polarizing film is used to determine the light and shade state of the Pixel. In addition, the upper glass is fitted to the color filter, so that each Pixel contains three colors of red, blue and green, which make up the image on the panel.

– The Array process in the front segment is similar to the semiconductor process, except that thin-film transistors are made on glass rather than silicon wafers.

– The middle Cell is based on the glass substrate of the front segment Array, which is combined with the glass substrate of the color filter, and liquid crystal (LC) is injected between the two glass substrates.

-The rear module assembly process is the production operation of assembling the glass after the Cell process with other components such as backlight plate, circuit, frame, etc.

The organic light display can be divided into Passive Matrix (PMOLED) and Active Matrix (AMOLED) according to the driving mode. The so-called active driven OLED(AMOLED) can be visualized in the Thin Film Transistor (TFT) as a capacitor that stores signals to provide the ability to visualize the light in a grayscale.

Although the production cost and technical barriers of passive OLED are low, it is limited by the driving mode and the resolution cannot be improved. Therefore, the application product size is limited to about 5″, and the product will be limited to the market of low resolution and small size. For high precision and large picture, the active drive is mainly used. The so-called active drive is capacitive to store the signal, so when the scanning line is swept, the pixel can still maintain its original brightness. In the case of passive drive, only the pixels selected by the scan line are lit. Therefore, in an active-drive mode, OLED does not need to be driven to very high brightness, thus achieving better life performance and high resolution.OLED combined with TFT technology can realize active driving OLED, which can meet the current display market for the smoothness of screen playback, as well as higher and higher resolution requirements, fully display the above superior characteristics of OLED.

The technology to grow The TFT on the glass substrate can be amorphous Silicon (A-SI) manufacturing process and Low-Temperature Poly-Silicon (LTPS). The biggest difference between LTPS TFT and A-SI TFT is the difference between its electrical properties and the complicated manufacturing process. LTPS TFT has a higher carrier mobility rate, which means that TFT can provide more current, but its process is complicated.A-si TFT, on the other hand, although a-Si’s carrier movement rate is not as good as LTPS’s, it has a better competitive advantage in cost due to its simple and mature process.Au Optronics is the only company in the world that has successfully combined OLED with LTPS and A-SI TFT at the same time, making it a leader in active OLED technology.

Polysilicon is a silicon-based material about 0.1 to several um in size, composed of many silicon particles. In the semiconductor manufacturing industry, polysilicon should normally be treated by Low-Pressure Chemical Vapor Deposition. If the annealing process is higher than 900C, this method is known as SPC. Solid Phase Deposition. However, this method does not work in the flat display industry because the maximum temperature of the glass is only 650C. Therefore, LTPS technology is specifically applied to the manufacture of flat displays.

The LTPS membrane is much more complex than a-SI, yet the LTPS TFT is 100 times more mobile than A-SI TFT. And CMOS program can be carried out directly on a glass substrate. Here are some of the features that p-SI has over A-SI:

2. Vehicle for OLED: High mobility means that the OLED Device can provide a large driving current, so it is more suitable for an active OLED display substrate.

3. Compact module: As part of the drive circuit can be made on the glass substrate, the circuit on the PCB is relatively simple, thus saving the PCB area.

LCD screens are backlit to project images through color filters before they are reflected in our eye Windows. This mode of carrying backlit LCD screens, known as “penetrating” LCD screens, consumes most of the power through backlit devices. The brighter the backlight, the brighter it will appear in front of the screen, but the more power it will consume.

Different from the traditional manufacturing process, COG technology directly assumes the drive IC on the glass substrate. The advantages of this technology include:

The display glass substrate is a particular type of protective covering over the surfaces of TFT (thin-film transistors), LCD (Liquid crystal displays) and OLED panels. This display glass substrate forms the part of the display units for the products including mobile phones, laptops,and LED TVs. The display unit in every electronic device is assembled by using the following components such as a color filter, a polarizer and a display coated with a glass substrate which forms the most important protective layer.The color filter is used to enhance the image quality while the thin film transistors (TFT) are used to transmit the signals to the liquid crystal displays (LCD).

The key benefits of using the display glass substrate along with the display units are thatit avoids energy loss, provides ultra-sensitivity, flexibility, and scratchproof properties. All these benefits are expected to lead the way for the increase in demand for the display glass substrate in the market.

The display glass substrate market share is segmented on the basis of type, industry verticals and region. Based on type, the market is bifurcated into borosilicate-based glass substrates, silicon-based glass substrates, ceramic-based glass substrates, fused silica/quartz-based glass substrates, and others. By industry verticals, it is categorized into electronics, automotive, medical, aerospace, defense, and solar. Based on region, the market is analyzed across North America (the U.S. and Canada), Europe (Germany, the UK, France, and Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Key players operating in the display glass substrate market include Corning Incorporated, LG Chem, AGC Incorporated, AvanStrate Incorporated, SCHOTT Ag, Tungshu Optoelectronics, IRICO Group New Energy Company Limited and CGC Glass. These players adopt collaboration, partnership, and agreement as their key developmental strategies to increase revenue of the display glass substrate industry and develop new products for enhancing product portfolio.

The COVID-19 pandemic has been declared a global public health emergency by the World Health Organization (WHO). This pandemic has significantly affected almost all the industries worldwide by the strict lockdowns and travel bans imposed by the governing bodies. The display glass substrate market has also been substantially affected by the COVID-19 pandemic outbreak.

The COVID-19 pandemic has forced many manufacturing companies to work with minimal workforce abiding by the guidelines of the local administrations. In addition, the disruption of the supply chain has adversely affected the display glass substrate market growth.

Due to the COVID-19 pandemic outbreak,many employees have lost their jobs because of heavy losses faced by the companies due to lockdowns and supply chain disruptions.All thesehavecreated a panic situation in the market. Therefore, these uncertainties that prevail in the market have negatively impacted the growth of the display glass substrate market.

The advancement in the demand for electronic devices such as a mobile phone, laptops, and smart watches which havea display unit coupled with it is thriving to increase the demand for the display glass substrate in the market.

Some of the properties of the display glass substrate are that it provides protection to the display units, prevents breakage, protects from scratches, and provides high sensitivity. All these properties boost the demand for the need of display glass substrate.

The major restraining factor for the growth of the display glass substrates market being the massive investment and skilled workforce required for setting up the manufacturing plant.

As the electronic industry isthemost dominatingenduser industry segment of the display glass substrates and the increase in the demand for electronic devices such as LCD TV, inverters backup indicators, digital clocks, and speedometers have significantly contributed to the rise in demand for the installation of display glass substrates for the protection ofdisplay units.

Furthermore, the rapid advancement of new technologies has contributed to the demand for new electronic devices with latest technologies that have resulted in the demand for display glass substrates. In addition, the growth of the semiconductor and electronics industry is expected tolead the way for the growth of display glass substrate market.

In the past decade, the e-commerce industry has been one of the flourishingindustries across the globe. This e-commerce industry has seen tremendous changes in the past decade and the users worldwide are easily adapting and availing the services of this e-commerce industry. Thee-commerce platforms are accessible through the electronics devices such as mobile phones and laptops. Therefore, this has resulted in the demand for mobile phones and laptops which in turn has paved the way for the display glass substrate market growth.

Companies CoveredCorning Incorporated, LG Chem, AGC Incorporated, AvanStrate Incorporated, SCHOTT Ag, Tungshu Optoelectronics, IRICO Group New Energy Company Limited and CGC Glass.

Key Benefits of the ReportThis study presents the analytical depiction of the display glass substratemarket along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the display glass substratemarket share.

The report provides a detailed display glass substratemarket analysis based on competitive intensity and how the competition will take shape in coming years.

Questions Answered in the Display Glass Substrate Market Research ReportWhichare the leading market players active in the display glass substratemarket?

Our Research’s latest report provides a deep insight into the global TFT Display Glass Substrate market covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and accessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global TFT Display Glass Substrate Market, this report introduces in detail the market share, market performance, product situation, operation situation, etc. of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the TFT Display Glass Substrate market in any manner.

Chapter 2 is an executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the TFT Display Glass Substrate Market and its likely evolution in the short to mid-term, and long term.

a b s t r a c t Due to lack of efficient approaches of mixed production, the present production approach of the TFT-LCD industry is batch production that each glass substrate is cut into LCD plates of one size only. This study proposes an optimization algorithm for cutting stock problems of the TFT-LCD industry. The proposed algorithm minimizes the number of glass substrates required to satisfy the orders, therefore reducing the production costs. Additionally, the solution of the proposed algorithm is a global optimum which is different from a local optimum or a feasible solution that is found by the heuristic algorithm. Numerical examples are also presented to illustrate the usefulness of the proposed algorithm. Ó 2009 Elsevier Ltd. All rights reserved.

1. Introduction This study considers the cutting stock problem (CSP) of TFT-LCD (thin-film transistor liquid–crystal display) industry which aims to seek an optimal production schedule of cutting several LCD panels with different sizes from a given glass substrate to meet the orders. The glass substrate is one of important raw materials in the whole manufacturing process of LCD. If an enterprise designs a production scheme using the minimum number of glass substrates based on the orders received, it can reduce the manufacturing costs and increase the product’s competitiveness in the market. The CSP attempts to plan the optimal production schedule for minimizing the production costs, i.e. minimum trim loss. Different variants of CSP are available. An important variant of the CSP is the one-dimensional CSP. Many approaches for this problem have been proposed. For instance, Holthaus (2002) considered the integer one-dimensional cutting stock problem with different types of standard lengths and the objective of cost minimization. Umetani, Yagiura, and Ibaraki (2003) designed an approach which is based on meta-heuristics, and incorporates an adaptive pattern generation technique. Gradisar and Trkman (2005) also proposed a combined method for the solution to the general one-dimensional cutting stock problem (G1D-CSP). Another variant of CSP is the two-dimensional CSP. In this variant, a set of order pieces is cut from a large supply of rectangular stock sheets of fixed size in a way that minimizes the total cost. Based on this goal, we are interested in finding ‘cutting patterns’ that minimize the unused area (trim loss). The problem is called * Corresponding author. Tel.: +886 2 27712171x3420; fax: +886 2 27763964. E-mail address: [email protected] (J.-F. Tsai). 0360-8352/$ - see front matter Ó 2009 Elsevier Ltd. All rights reserved. doi:10.1016/j.cie.2009.03.006

two-dimensional cutting problem. Cutting and Packing problems belong to an old and very well-known family, called CP in Dyckhoff (1990) and Sweeney and Paternoster (1992). This is a family of natural combinatorial optimization problems. The two-dimensional cutting and packing problem is widely applied in optimally cutting raw materials such as glass, steel and paper, in two-dimensional bin packing, and in layout designing problems. Many scholars have devoted themselves to developing many methods one after another to solve the problem; these methods can be grouped into two major types. (i) Deterministic: Deterministic methods take advantage of analytical properties of the problem to generate a sequence of points that converge to a global solution. For example, Chen, Sarin, and Balasubramanian (1993) presented a mixed integer programming model for a class of assortment problems. Li and Tsai (2001) proposed a new method which finds the optimum of cutting problems by solving few linear mixed 0–1 problems. Li, Chang, and Tsai (2002) developed an approach using the piecewise linearization technique of the quadratic objective function to improve an approximate model for two-dimensional cutting problems. (ii) Heuristic: Heuristic algorithms can obtain a solution quickly, but the quality of the solution cannot be guaranteed. G and Kang (2001) developed a heuristic that finds efficient layouts with low complexity for two-dimensional pallet loading problems of large size. Wu, Huang, Lau, Wong, and Young (2002) introduced an effective deterministic heuristic, Less Flexibility First, for solving the classical NP-complete rectangle-packing problem. Leung, Chan, and Troutt (2003) proposed an application of a mixed simulated annealing–

genetic algorithm heuristic for the two-dimensional orthogonal packing problem. Beasley (2004) also presented a heuristic algorithm for the constrained two-dimensional non-guillotine cutting problem. The main defect of these heuristic algorithms is that they fail to claim the solution obtained is a global optimum unless the whole solution space is completely searched. Toward TFT-LCD industry involving mass production, the costs can be further reduced substantially if a global optimum can be derived instead of a local optimum or a feasible solution. For more detailed articles about the cutting optimization problem, readers can consult Lodi, Martello, and Monaci (2002) and Valério de Carvalho (2002). Many approaches for two-dimensional cutting stock problem have also been proposed. Hifi (1997) discussed one of the bestknown exact algorithms, due to Viswanathan and Bagchi (1993), for solving constrained two-dimensional cutting stock problem optimally. They proposed a modification of this algorithm in order to improve the computational performance of the standard version. Cung, Hifi, and Cun (2000) developed a new version of the algorithm in Hifi (1997) for solving exactly some variants of (un)weighted constrained two-dimensional cutting stock problems. Leung, Yung, and Troutt (2001) applied a genetic algorithm and a simulated annealing approach to the two-dimensional non-guillotine cutting stock problem and carried out experimentation on several test cases. Vanderbeck (2001) developed a nested decomposition approach for two-dimensional cutting stock problem. Burke, Kendall, and Whitwell (2004) presented a new bestfit heuristic for the two-dimensional rectangular stock-cutting problem and demonstrated its effectiveness. The two-dimensional cutting stock problem considered in this study is to derive the minimum number of glass substrates based on the available cutting combinations to meet the order demands. Due to lack of efficient approaches of mixed production, the present production approach is batch production that each glass substrate is cut into LCD plates of one size only. However, the computational result shows that the mixed production has a higher utilization of a glass substrate. Moreover, the proposed optimization algorithm can significantly reduce production costs to enhance the competitiveness of products. The main advantages of the proposed method are listed as follows: 1. In comparison with the batch production, the proposed method presents a mixed production approach that generates LCD plates of various sizes in a glass substrate to increase the utilization of glass substrates (i.e. total area of produced products/ total area of glass substrates). 2. The proposed method provides the optimal production scheme according to the quantities of the orders. 3. The proposed method is able to find out all the alternative solutions with the same optimal objective value (i.e., different cutting combinations under the same utilization of a material substrate). The rest of this paper is organized as follows: in Section 2, the mathematical models of a cutting optimization problem are formulated. In Section 3, a cutting stock optimization algorithm is proposed. Section 4 presents numerical examples to illustrate the proposed method and concluding remarks are included in Section 5. 2. Mathematical models Since the mixed production has a higher utilization of a glass substrate than batch production, herein we construct some models

to find out all cutting combinations in a glass substrate. To facilitate the discussion, the following notations are introduced first: (l0, w0): The length and width of the glass substrate. Z: Number of LCD products with different sizes which have to be produced. (lz, wz): The length and width of the zth LCD product, lz wz lzþ1 wzþ1 , z = 1, 2, . . ., Z. J: Index of multiple solutions with the same objective value. T: Number of possible cutting combinations with different objective values. ctzj : The cutting quantity of the zth product of the jth alternative solution with the same objective value in the tth iteration, z = 1, 2, . . ., Z, t = 1, 2, . . ., T, j = 1, 2, . . ., J. First, let Obj(0) = l0w0, consider the following model: 2.1. Model 1.1

This model aims to find the possible cutting combinations with different objective values. For t = 1, the constraint Obj(1) 6 Obj(0) represents to use the maximum portion of a glass substrate. For t = 2, 3, . . . T, the constraint Obj(t) 6 Obj(t 1) represents that the utilization of a glass substrate decreases as t increases. After each t iteration, we can obtain a solution and an objective value. Because distinct solutions may exist under the same objective value, we develop the following model for finding multiple solutions: 2.2. Model 1.2

where az are 0–1 variables, M is a large constant and the other variables are defined as before. Model 1.3 is a linear programming problem solvable to obtain a global optimum and capable of finding out all possible cutting combinations even there are multiple solutions. According to the above discussions, for the iteration of t (t = 1, 2, . . ., T), Model 1.1 is applied to solve the possible cutting combinations with different utilizations of a glass substrate. For the iteration of j, Model 1.3 is applied to solve the multiple solutions under a certain utilization derived from Model 1.1. Therefore some possible cutting combinations can be acquired by Model 1.1 and Model 1.3. However Models 1.1 and 1.3 only check the total measure of the LCD plates is less than that of a glass substrate. Next this study aspires to verify all rectangles of each cutting combination can be allocated into a glass substrate. Suppose the lengths and widths of n rectangles are given. A two-dimensional cutting optimization problem is to allocate all of these rectangles within an enveloping rectangle on x-axis and y-axis which occupies minimum area. The concept of the problem is stated as follows: 2.4. Model 2.1

By using Model 2.2 to examine all possible cutting combinations, we can get the feasible cutting combinations for designing m m the optimal production plan. Assume that cm ¼ ðcm 1 ; c2 ; . . . ; c Z Þ denotes the mth feasible cutting combination, oz represents the quantity ordered of the zth product and gm denotes the number of glass substrates that have to be cut by the mth feasible cutting combination. In order to minimize the total quantity of glass substrates required for fulfilling the demand of orders, the optimal production model is formulated as follows:

where g m 2 integer. According to the solution of Model 3, we can know the minimal number of the required glass substrates and how many glass substrates are cut by each feasible cutting combination, respectively.

According to the above algorithm, we can obtain the optimal production scheme to produce plates most efficiently. The process of the algorithm is depicted in Fig. 1. 4. Example In a TFT-LCD plant, assume the dimension of the glass substrate is 150 cm 180 cm. This plant wants to produce three kinds of products (40 in., 42 in. and 46 in.). The ratio of length to width of the LCD plates is 16:10. The information of these products is listed in Table 1. To enhance the understanding of the proposed algorithm, the following illustrates the solution process of the example problem step by step. Initial: Let t = 1 and m = 1. Step 1-1: Let j = 1. By using Model 1.1, we find the solution (2, 1, 2) with the objective value 26,620. Step 1-2: Because current feasible cutting combination set is empty, proceed straight to Step 3. Step 1-3: Verify the possible cutting combination (2, 1, 2) by model 2.2. The result reveals that (2, 1, 2) is infeasible. Therefore, remove (2, 1, 2). Step 1-4: Let j=2 and add the constraint jc112 2j þ jc122 1j þ jc132 2j 1 to Model 1.2 for finding alternative solutions. By solving Model 1.3, we find that the objective obtained is no equal to 26,620. Then let t = 2 and go to Step 1. Step 2-1: Let j = 1 and solve Model 1.1. We find another possible cutting combination (0, 4, 1) with the objective value 26,360. Step 2-2: The feasible cutting combination set is empty, then proceed to Step 3. Step 2-3: Verify the feasibility of (0, 4, 1) by Model 2.2. The result shows that it is infeasible. Therefore, remove (0, 4, 1).

According to the orders of products and the obtained set of feasible cutting combination as shown in Table 2, we solve Model 3 with LINGO (2004) to find the best objective value 700 and the optimal solution g1 = 200, g7 = 500 and the other variables are zero. The solution process of this problem takes 546 s by using a Pentium 4 CPU 3.2 G PC. The graphic solutions of the optimal solutions are shown in Figs. 2 and 3. If the plant adopts the production way suggested by the proposed algorithm, it can use g1 and g7 to achieve the highest utilization of the glass substrate and only consume 700 glass substrates to accomplish the orders. By the batch production approach, the number of glass substrates needed to fulfill the orders is 734. Additionally, the difference of the order quantities does not change the result that the proposed method is superior to the batch produc-

tion. Table 3 lists results compared between the proposed method and the batch production of four examples with different order quantities. Since the computational time is not affected by the order quantities very much, the computation times of these four problems are all about 550 s. The results demonstrate that the proposed algorithm can solve the cutting stock problems of big size products in the TFT-LCD industry effectively. In the proposed algorithm, the process of finding all feasible cutting combinations is the most time-consuming according to our testing. The computational time mainly depends on how many various LCD plates can be cut from a glass substrate. Therefore, the proposed method is suitable for the cutting stock problem of big size LCD products. The problems with more than 30 various small LCD plates that have to be cut from a glass substrate may integrate some heuristic or distributed algorithms to reduce the computational time for finding the feasible cutting combinations and that is an interesting issue for further research. The extended problems with the same size of glass substrate 180 cm 150 cm and eight products listed in Table 4 are solved within 10 min. The results shown in Table 5 reveal that the proposed method utilizes fewer glass substrates than the batch method and has significant saving ratios. Table 3 Differences between the mixed production and the batch production.

5. Conclusions This study proposes a cutting stock optimization method for TFT-LCD industry, which can find the optimal cutting way according to the quantities of orders. The optimization techniques for finding alternative solutions and the approach for linearizing absolute terms are also presented. The results of numerical examples illustrate the usefulness of the proposed method. Especially to the TFT-LCD industry which needs mass production, an effective method can reduce production costs and promote the competitiveness of products. The directions for further research are to take more production situations and factors into consideration, such as the costs, the defect rate and the time of delivery and to integrate heuristic or distributed algorithms to enhance the computational efficiency. Using column generation techniques to solve this problem is also a very interesting topic for further investigation.

The glass substrate is one of the core layers of TFT LCD. It influences fundamental features of the display in the resolution, light transmittance, thickness, weight, and viewing angle.

The glass substrate is the core component of the TFT LCD and plays a significant role in the upstream of the TFT LCD industry, similar to the silicon wafer in the semiconductor industry.

Since the quality of the glass substrate decides the features of the display in the resolution, light transmittance, thickness, weight, viewing angle, and other important parameters.

The fundamental structure of the TFT LCD is similar to a sandwich, two layers of “bread” (TFT substrate and color filter) sandwiched with “jam” (liquid crystal).

Considering the unique environment in the manufacturing process of TFT-LCD, such as high temperature, high pressure, and environment switching among acidic-neutral-alkaline, the following characteristics of the glass must meet the challenge and quality requirement.

In the manufacturing process, the maximum temperature can reach above 600 ℃, which requires the glass substrate to remain rigid without any sticking even at such a high temperature.

After the etching process, the glass substrate needs to remain with minimal changes, and can’t be left with visible residue and interference with film deposition.

In the process the mother glass is cut into pieces in the required size, with a thickness of only 0.5-0.7mm, the glass needs to have high mechanical strength and elastic modulus >70GPa.

Usually, the size has doubled with each successive generation. From the initial generation 4 (G4) to the current G11, the size of the substrate has grown to 3000*3320mm.

In the global market of glass substrates for TFT-LCD, more than 90% are concentrated in several major manufacturers, such as Corning (America), Asahi Glass (Japan), Nippon Electric Glass (Japan), and AvanStrate (Taiwan).

However, there is still a gap and need for breakthroughs in the glass for high-generation LCD panel production lines and AMOLED alkali-free glass technology. It is hard to achieve high localization in a short time.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey