lcd display market made in china

China’s share of the world"s large display market is expected to exceed 50 percent for the first time ever. This year, Samsung Display and LG Display pull the plug on their LCD panel businesses due to declining profitability, letting China further strengthened its LCD market dominance.

Large-area display shipments this year are estimated at 894 million units, down 8 percent from 976 million units in the previous year, said market research firm Omdia on Dec. 16. Shipments based on display areas are also expected to decrease by 3 percent on year.

Omdia said IT displays, such as those for tablet PCs, notebook PCs and monitors, led the decline in shipments this year. TV manufacturers have also reduced panel procurement since the second quarter.

Chinese companies are strengthening their stranglehold on the large-size display market. China’s large-size display shipments are projected to account for 55.2 percent this year, outdistancing 24.9 percent of Taiwanese display makers and 14.7 percent of Korean display makers. In area-based shipments, China’s share is expected to reach 61.3 percent. During the same period, only 17.1 percent was projected for Taiwan and 15.4 percent for Korea.

Chinese display makers are in hot pursuit of Korean display makers in the OLED panel domain, where Korean display makers have technological prowess. DSCC, a market research firm, predicted that China will account for 47 percent of OLED panel production in 2025, running shoulder to shoulder with Korea.

Data from China Optics and Optoelectronics Manufactures Association Liquid Crystal Branch (CODA) shows that in 2021, the output value of China"s display industry was about 586.8 billion yuan (about $84.05 billion), nearly eight times higher than 10 years ago while delivered display panels totaled about 160 million square meters, more than seven times that of a decade ago.

According to CODA, China"s proportion of industry scale and display panel delivered area in the global market has increased to 36.9 percent and 63.3 percent respectively, ranking first in the world.

As for the organic light-emitting diode (OLED), domestic enterprises have mastered the core technologies and are making technological innovations in high refresh rate and pixel geometry and other fields. Meanwhile, production scale has expanded rapidly, and the market share of small- and medium-sized OLED increased.

Statistics show that in the third quarter of 2022, the market share of OLED panels for domestic smart phones accounted for 30 percent of the global market, an increase of 10 percent over the same period last year.

China’s new display industry has become the largest in the world, with an annual production capability reaching 200 million square meters, making it a vital force in upgrading information consumption and strengthening the digital economy, according to the Ministry of Industry and Information Technology (MIIT).

In 2021, the output value of China’s display industry reached about 586.8 billion yuan, a figure nearly eight times that of 10 years ago, data from the China Optics and Optoelectronics Manufactures Association LCB, or CODA, showed. The area of the country’s display panel shipments stood at about 160 million square meters, over seven times larger than 10 years ago. The size of China’s display industry and the area of its display panel shipments both ranked first in the world.

China has made breakthroughs in some core technologies in key fields. Chinese liquid crystal display (LCD) enterprises have broken technical barriers and taken 70 percent of the global market share. Chinese companies have also acquired key technologies in organic light emitting diode (OLED) and rapidly expanded their production scale. China is also catching up in new-generation display technologies.

China will make greater efforts to gain a foothold in the medium and high ends of the industrial chain of the new display industry, said an official with the MIIT.

LCD manufacturers are mainly located in China, Taiwan, Korea, Japan. Almost all the lcd or TFT manufacturers have built or moved their lcd plants to China on the past decades. Top TFT lcd and oled display manufactuers including BOE, COST, Tianma, IVO from China mainland, and Innolux, AUO from Tianwan, but they have established factories in China mainland as well, and other small-middium sizes lcd manufacturers in China.

China flat display revenue has reached to Sixty billion US Dollars from 2020. there are 35 tft lcd lines (higher than 6 generation lines) in China,China is the best place for seeking the lcd manufacturers.

The first half of 2021, BOE revenue has been reached to twenty billion US dollars, increased more than 90% than thesame time of 2020, the main revenue is from TFT LCD, AMoled. BOE flexible amoled screens" output have been reach to 25KK pcs at the first half of 2021.the new display group Micro LED revenue has been increased to 0.25% of the total revenue as well.

Established in 1993 BOE Technology Group Co. Ltd. is the top1 tft lcd manufacturers in China, headquarter in Beijing, China, BOE has 4 lines of G6 AMOLED production lines that can make flexible OLED, BOE is the authorized screen supplier of Apple, Huawei, Xiaomi, etc,the first G10.5 TFT line is made in BOE.BOE main products is in large sizes of tft lcd panel,the maximum lcd sizes what BOE made is up to 110 inch tft panel, 8k resolution. BOE is the bigger supplier for flexible AM OLED in China.

As the market forecast of 2022, iPhone OLED purchasing quantity would reach 223 million pcs, more 40 million than 2021, the main suppliers of iPhone OLED screen are from Samsung display (61%), LG display (25%), BOE (14%). Samsung also plan to purchase 3.5 million pcs AMOLED screen from BOE for their Galaxy"s screen in 2022.

Technology Co., Ltd), established in 2009. CSOT is the company from TCL, CSOT has eight tft LCD panel plants, four tft lcd modules plants in Shenzhen, Wuhan, Huizhou, Suzhou, Guangzhou and in India. CSOTproviding panels and modules for TV and mobile

three decades.Tianma is the leader of small to medium size displays in technologyin China. Tianma have the tft panel factories in Shenzhen, Shanhai, Chendu, Xiamen city, Tianma"s Shenzhen factory could make the monochrome lcd panel and LCD module, TFT LCD module, TFT touch screen module. Tianma is top 1 manufactures in Automotive display screen and LTPS TFT panel.

Tianma and BOE are the top grade lcd manufacturers in China, because they are big lcd manufacturers, their minimum order quantity would be reached 30k pcs MOQ for small sizes lcd panel. price is also top grade, it might be more expensive 50%~80% than the market price.

Established in 2005, IVO is located in Kunsan,Jiangshu province, China, IVO have more than 3000 employee, 400 R&D employee, IVO have a G-5 tft panel production line, IVO products are including tft panel for notebook, automotive display, smart phone screen. 60% of IVO tft panel is for notebook application (TOP 6 in the worldwide), 23% for smart phone, 11% for automotive.

Besides the lcd manufacturers from China mainland,inGreater China region,there are other lcd manufacturers in Taiwan,even they started from Taiwan, they all have built the lcd plants in China mainland as well,let"s see the lcd manufacturers in Taiwan:

Innolux"s 14 plants in Taiwan possess a complete range of 3.5G, 4G, 4.5G, 5G, 6G, 7.5G, and 8.5G-8.6G production line in Taiwan and China mainland, offering a full range of large/medium/small LCD panels and touch-control screens.including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch-control solutions,full range of TFT LCD panel modules and touch panels, including TV panels, desktop monitors, notebook computer panels, small and medium-sized panels, and medical and automotive panels.

AUO is the tft lcd panel manufacturers in Taiwan,AUO has the lcd factories in Tianma and China mainland,AUOOffer the full range of display products with industry-leading display technology,such as 8K4K resolution TFT lcd panel, wide color gamut, high dynamic range, mini LED backlight, ultra high refresh rate, ultra high brightness and low power consumption. AUO is also actively developing curved, super slim, bezel-less, extreme narrow bezel and free-form technologies that boast aesthetic beauty in terms of design.Micro LED, flexible and foldable AMOLED, and fingerprint sensing technologies were also developed for people to enjoy a new smart living experience.

Hannstar was found in 1998 in Taiwan, Hannstar display hasG5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, providing various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

driver, backlight etc ,then make it to tft lcd module. so its price is also more expensive than many other lcd module manufacturers in China mainland.

Maclight is a China based display company, located in Shenzhen, China. ISO9001 certified, as a company that more than 10 years working experiences in display, Maclight has the good relationship with top tft panel manufacturers, it guarantee that we could provide a long term stable supply in our products, we commit our products with reliable quality and competitive prices.

Maclight products included monochrome lcd, TFT lcd module and OLED display, touch screen module, Maclight is special in custom lcd display, Sunlight readable tft lcd module, tft lcd with capacitive touch screen. Maclight is the leader of round lcd display. Maclight is also the long term supplier for many lcd companies in USA and Europe.

If you want tobuy lcd moduleorbuy tft screenfrom China with good quality and competitive price, Maclight would be a best choice for your glowing business.

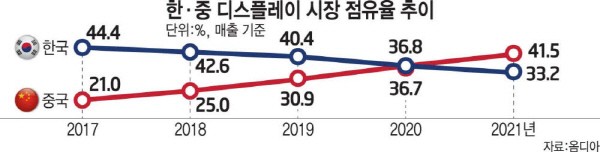

It is the first time that China took over the No. 1 spot in the display market, which Korea has always been a leader in. The title of “the strongest country in display market” is lost after 17 years. It would not be possible to reclaim the No. 1 spot if Korea cannot find a way to expand investment in next-generation displays such as organic light emitting diodes (OLED).

According to market research firm Omdia, China recorded $64.8 billion in sales including LCD and OLED in the global display market last year. China took over Korea’s No. 1 spot with a market share of 41.5%. Korea"s market share fell 8.3 points (p) to 33.2%. This is the first time since 2004, in 17 years, that Korea had to hand over the No. 1 spot. Korea had a 9.4 p advantage in market share over China up until 2019.

China overtook Korea and seized power in the LCD market by offering a low-priced products. BOE, China"s largest panel manufacturer, has become the world"s largest LCD manufacturer with help of the subsidy from the Chinese government. LCD sales was $28.6 billion last year, accounting for 26.3% of the total LCD market. The sales of Chinese companies such as BOE, CSOT, Tianma, and Visionox increased significantly as demand for TV and information technology (IT) devices increased with the prolonged COVID 19 and increased price of LCD panel.

After taken over in the LCD market, Korea is focusing on the highly-valued OLED market. Samsung Display and LG Display are transforming their LCD production lines to OLED. Korea is the No. 1 with 82.3% of the global OLED market shares according to Omdia, and China’s market share only accounts for16.6%.

China"s dominance is expected to continue for some time because the large display market such as TVs and laptops still depends on LCD. Only when Korea starts to reduce OLED panel prices by mass producing OLED, then Korea can replace the LCD market led by China.

Samsung Display and LG Display were not able to make a decision on investment plans for large OLED plants due to problems with yield and investment funds. Samsung and LG are expected to invest more than KRW 7 trillion in OLED facilities this year according to the industry. Mass production from these companies is expected to begin in the second half of next year even when new and expanding existing investments are made this year.

China has also started to narrow the gap with Korea in OLED industry. BOE and other companies have commercialized OLED for small and medium-sized displays such as mobile, laptop, and tablet. Following LCD market, China is threatening Korea in OLED market as well as China expands OLED market share mainly in the Chinese smartphone market.

Critics are pointing out that Korea needs to expand in OLED market and develop new technologies in order to maintain the OLED gap with China. Korea must take control over the large TV panel market, which has a large technological gap with China, and create a new form factor with new technologies such as flexible, rollable, and bendable panels.

Some criticizes that R&D support and interest are required even if Korean government does not provide subsidies like the Chinese. It is daunting that the government seems to have lost interest in the display industry by giving support for the government’s national talent developing project, and cutting the support for the next-generation display field.

An official from the display industry said, “With the government-led industrial promotion policy and copious domestic market, China is making an effort to solidify its leading position in the display industry. There is a neglect on display industry in Korea since the display promotion policy is almost non-existent compared to semiconductors and batteries.”

In recent time, China domestic companies like BOE have overtaken LCD manufacturers from Korea and Japan. For the first three quarters of 2020, China LCD companies shipped 97.01 million square meters TFT LCD. And China"s LCD display manufacturers expect to grab 70% global LCD panel shipments very soon.

BOE started LCD manufacturing in 1994, and has grown into the largest LCD manufacturers in the world. Who has the 1st generation 10.5 TFT LCD production line. BOE"s LCD products are widely used in areas like TV, monitor, mobile phone, laptop computer etc.

TianMa Microelectronics is a professional LCD and LCM manufacturer. The company owns generation 4.5 TFT LCD production lines, mainly focuses on making medium to small size LCD product. TianMa works on consult, design and manufacturing of LCD display. Its LCDs are used in medical, instrument, telecommunication and auto industries.

TCL CSOT (TCL China Star Optoelectronics Technology Co., Ltd), established in November, 2009. TCL has six LCD panel production lines commissioned, providing panels and modules for TV and mobile products. The products range from large, small & medium display panel and touch modules.

Everdisplay Optronics (Shanghai) Co.,Ltd.(EDO) is a company dedicated to production of small-to-medium AMOLED display and research of next generation technology. The company currently has generation 4.5 OLED line.

Established in 1996, Topway is a high-tech enterprise specializing in the design and manufacturing of industrial LCD module. Topway"s TFT LCD displays are known worldwide for their flexible use, reliable quality and reliable support. More than 20 years expertise coupled with longevity of LCD modules make Topway a trustworthy partner for decades. CMRC (market research institution belonged to Statistics China before) named Topway one of the top 10 LCD manufactures in China.

The Company engages in the R&D, manufacturing, and sale of LCD panels. It offers LCD panels for notebook computers, desktop computer monitors, LCD TV sets, vehicle-mounted IPC, consumer electronics products, mobile devices, tablet PCs, desktop PCs, and industrial displays.

Founded in 2008,Yunnan OLiGHTEK Opto-Electronic Technology Co.,Ltd. dedicated themselves to developing high definition AMOLED (Active Matrix-Organic Light Emitting Diode) technology and micro-displays.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey