lcd panel manufacturer price

lcd display manufacturer provide the touch interface in smartphones, which are vital for them to function. Alibaba.com stocks a stunning range of high-tech lcd display manufacturer with vibrant color depictions. Truly crystal-clear displays of lcd display manufacturer are available covering various brands and models such as the Samsung Galaxy Edge 2, OnePlus 7T, Samsung Galaxy C5, and many more.

lcd display manufacturer are the most commonly used displays, as they produce great image quality while consuming low power. Rather than emitting light directly, they use back lights or reflectors to produce images, which allows for easy readability even under direct sunlight. lcd display manufacturer are energy-efficient, and are comparatively safer to dispose of, than CRTs. lcd display manufacturer are much more efficient when it comes to usage in battery-powered electronic equipment, due to their minimal power consumption.

Some other advantages of lcd display manufacturer over the CRT counterparts are - sharper images, little to no heat emission, unaffected by magnetic fields, narrow frame borders, and extreme compactness, which make them very thin and light. Some types of lcd display manufacturer are transmissive, reflective, and transflective displays. Transmissive displays provide better image quality in the presence of low or medium-light, while reflective displays work best in the presence of bright light. The third type of lcd display manufacturer, transflective, combine the best features of both the other types and provide a well-balanced display.

Whether as an individual purchaser, supplier or wholesaler, browse for an extensive spectrum of lcd display manufacturer at Alibaba.com if you don"t want to stretch a dollar yet find the best fit.

lcd panel (Liquid crystal display) are made of liquid crystals that form digital images made visible through ambient light or through LED backlight. LCDs are used in the place of other displays that are less efficient such as cathode ray tubes (CRTs) and have become the most popular display type on the market.

Lcd panel enable metal and position detection without having to physically contact the metal object. They offer a wide range of applications in robotics, rail, material handling, aerospace, military, as well as heavy machinery. Choose from different lcd panel types, from the shielded versions that have electromagnetic fields concatenated in the front and unshielded versions which allow wider sensing distances. Whether you want to use your sensors for industrial purposes or source for your brand, there is a wide selection of wholesale lcd panels to choose from. will allow you to customize the applications of your parts in the market. Unlike other packaging materials, plastic bottles are durable, cost-effective, and easy to use, enhancing the efficiency of your business. If you are a retailer, you can also order bulk plastic bottles at Alibaba.com and keep your business running smoothly.

Alibaba.com features a broad collection of smart and advanced lcd panel equipped with bright, capacitive screens for the most affordable prices. These lcd panel are made implying the latest technologies for a better, enhanced, and smart viewing experience. These products are of optimal quality and are sustainable so that they can last for a long time. Buy these lcd panel from the leading wholesalers and suppliers at discounted prices and fabulous deals. The smart and capacitive lcd panel offered on the site are applicable for all types of ads displaying, mobile screens, LCD monitors, and many more. You can use them both for commercial as well as residential purposes. These marvellous lcd panel are provided with bright and strong backlights available in distinct colors for a wonderful screen viewing experience. These lcd panel are not just used for LCD screens but also are used for TFT, LED, and other screen variations.

Prices for all TV panel sizes fluctuated and are forecast to fluctuate between 2020 and 2022. The period from March 2020 to July 2021 saw the biggest price increases, when a 65" UHD panel cost between 171 and 288 U.S. dollars. In the fourth quarter of 2021, such prices fell and are expected to drop to an even lower amount by March 2022.Read moreLCD TV panel prices worldwide from January 2020 to March 2022, by size(in U.S. dollars)Characteristic32" HD43" FHD49"/50" UHD55" UHD65" UHD------

DSCC. (January 10, 2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph]. In Statista. Retrieved November 26, 2022, from https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars)." Chart. January 10, 2022. Statista. Accessed November 26, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. (2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars). Statista. Statista Inc.. Accessed: November 26, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "Lcd Tv Panel Prices Worldwide from January 2020 to March 2022, by Size (in U.S. Dollars)." Statista, Statista Inc., 10 Jan 2022, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC, LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) Statista, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/ (last visited November 26, 2022)

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

According to TrendForce, LCD TV panel quotations bore the brunt of continuous downgrades in the purchase volume of TV brands and pricing for most panel sizes have fallen to record lows.

As Chinese panel makers account for nearly 66% of TV panel shipments, BOE, CSOT, and HKC are industry leaders. When there is an imbalance in supply and demand, a focus on strategic direction is prioritized. According to TrendForce, TV panel production capacity of the three aforementioned companies in 3Q22 is expected to decrease by 15.8% compared with their original planning, and 2% compared with 2Q22. Taiwanese manufacturers account for nearly 20% of TV panel shipments so, under pressure from falling prices, allocation of production capacity is subject to dynamic adjustment. On the other hand, Korean factories have gradually shifted their focus to high-end products such as OLED, QDOLED, and QLED, and are backed by their own brands. However, in the face of continuing price drops, they too must maintain operations amenable to flexible production capacity adjustments.

TrendForce indicates, in order to reflect real demand, Chinese panel makers have successively reduced production capacity. However, facing a situation in which terminal demand has not improved, it may be difficult to reverse the decline of panel pricing in June. However, as TV sizes below 55 inches (inclusive) have fallen below their cash cost in May (which is seen as the last line of defense for panel makers) and is even flirting with the cost of materials, coupled with production capacity reduction from panel makers, the price of TV panels has a chance to bottom out at the end of June and be flat in July. However, demand for large sizes above 65 inches (inclusive) originates primarily from Korean brands. Due to weak terminal demand, TV brands revising their shipment targets for this year downward, and purchase volume in 3Q22 being significantly cut down, it is difficult to see a bottom for large-size panel pricing. TrendForce expects that, optimistically, this price decline may begin to dissipate month by month starting in June but supply has yet to reach equilibrium, so the price of large sizes above 65 inches (inclusive) will continue to decline in 3Q22.

TrendForce states, as panel makers plan to reduce production significantly, the price of TV panels below 55 inches (inclusive) is expected to remain flat in 3Q22. However, panel manufacturers cutting production in the traditional peak season also means that a disappointing 2H22 peak season is a foregone conclusion and it will not be easy for panel prices to reverse. However, it cannot be ruled out, as operating pressure grows, the number and scale of manufacturers participating in production reduction will expand further and it timeframe extended, enacting more effective suppression on the supply side, so as to accumulate greater momentum for a rebound in TV panel quotations.

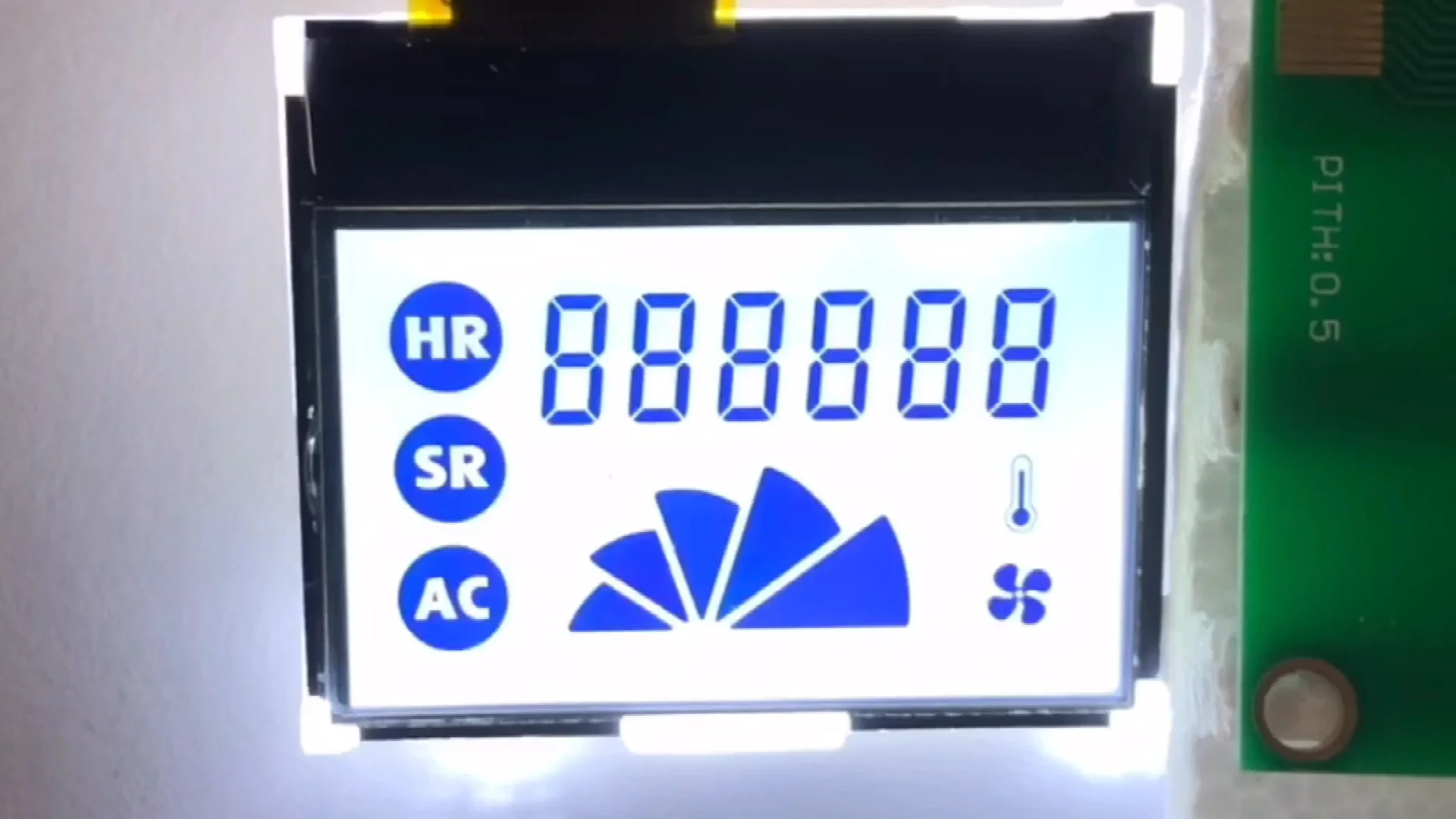

New Vision Display is a custom LCD display manufacturer serving OEMs across diverse markets. One of the things that sets us apart from other LCD screen manufacturers is the diversity of products and customizations we offer. Our LCD portfolio ranges from low-cost monochrome LCDs to high-resolution, high-brightness color TFT LCDs – and pretty much everything in between. We also have extensive experience integrating LCD screen displays into complete assemblies with touch and cover lens.

Sunlight readable, ultra-low power, bistable (“paper-like”) LCDs. Automotive grade, wide operating/storage temperatures, and wide viewing angles. Low tooling costs.

Among the many advantages of working with NVD as your LCD screen manufacturer is the extensive technical expertise of our engineering team. From concept to product, our sales and technical staff provide expert recommendations and attentive support to ensure the right solution for your project.

In addition, our extensive technology portfolio and manufacturing capabilities enable us to deliver high-quality products that meet the unique specifications of any application. To learn more about what makes us the display manufacturer for your needs, get in touch with us today.

As a leading LCD panel manufacturer, NVD manufactures custom LCD display solutions for a variety of end-user applications: Medical devices, industrial equipment, household appliances, consumer electronics, and many others. Our state-of-the-art LCD factories are equipped to build custom LCDs for optimal performance in even the most challenging environments. Whether your product will be used in the great outdoors or a hospital operating room, we can build the right custom LCD solution for your needs. Learn more about the markets we serve below.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey