in re tft lcd flat panel antitrust factory

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

In the legal profession, information is the key to success. You have to know what’s happening with clients, competitors, practice areas, and industries. Law360 provides the intelligence you need to remain an expert and beat the competition.

*837 Jason C. Murray, Joshua Courtney Stokes, Crowell & Moring LLP, Los Angeles, CA, Jeffrey H. Howard, Jerome A. Murphy, Sanya Sarich Kerksiek, Crowell & Moring LLP, Washington, DC, R. Bruce Holcomb, Adams Holcomb LLP, Washington, DC, for Plaintiff.

Christopher Alan Nedeau, Nossaman LLP, San Francisco, CA, Christopher B. Hockett, Davis Polk & Wardwell, Micah Galvin Block, Neal Alan Potischman, Samantha Harper Knox, Sandra D. West, Menlo Park, CA, Gordon Pearson, Wilmer Cutler Pickering Hale and Dorr LLP, Michael Robert Lazerwitz, Cleary Gottlieb Steen & Hamilton, Derek Ludwin, Robert D. Wick, Covington & Burling LLP, Washington, DC, Patrick J. Ahern, Baker & McKenzie, Chicago, IL, Jeffrey Michael Davidson, Simon J. Frankel, Timothy C. Hester, Covington & Burling LLP, Anne Benton Kaldor, Erin Alysa Smart, Kristen A. Palumbo, Bingham McCutchen LLP, Stephen P. Freccero, Morrison & Foerster LLP, San Francisco, CA, John H. Chung, White & Case LLP, New York, NY, for Defendants.

On November 3, 2010, the Court held a hearing on defendants" motion to dismiss Motorola"s second amended complaint. For the reasons set forth below, the motion is DENIED.

Plaintiff Motorola, Inc. ("Motorola") is a technology company that is incorporated in Delaware with its principal place of business in Schaumburg, Illinois. Second Amended Complaint ("SAC") ¶ 24. Motorola is a leading manufacturer of mobile wireless devices. Id. From January 1, 1996 until December 11, 2006 (the "Relevant Period"), Motorola manufactured products that incorporated liquid crystal *838 display panels ("LCD Panels") for sale in the United States market and abroad. Id. ¶¶ 2, 26.

On October 20, 2009, Motorola filed a complaint in the Northern District of Illinois against numerous domestic and foreign defendants alleging a global price-fixing conspiracy by suppliers of LCD Panels. On December 8, 2009, the case was transferred to this district by order of the Judicial Panel on Multidistrict Litigation and, pursuant to this Court"s July 3, 2007 Pretrial Order # 1, was deemed related to MDL No. 1827 (M 07-1827). Motorola filed an amended complaint on January 29, 2010.

On February 23, 2010, defendants filed a joint motion to dismiss the amended complaint under Federal Rules of Civil Procedure 12(b)(1) and 12(b)(6). Among other things, defendants argued that the Court lacked subject matter jurisdiction under the Foreign Trade Antitrust Improvements Act ("FTAIA") to the extent that Motorola"s antitrust claims were based on injury suffered outside of the United States. On June 28, 2010, the Court granted defendants" motion to dismiss under the FTAIA. June 28, 2010 Order at 10, 2010 WL 2610641.

On July 23, 2010, Motorola filed a second amended complaint ("SAC"), which included a number of new allegations. The SAC alleges that defendants and their co-conspirators "conspired with the purpose and effect of fixing, raising, stabilizing, and maintaining prices for LCD Panels." Id. ¶ 2. Motorola alleges that senior executives of the defendants instructed subordinates in the United States to communicate with employees of their competitors to exchange pricing and other competitive information to be used in fixing prices for LCD Panels sold to U.S. companies. Id. Motorola alleges that "[a]t least seven LCD Panel manufacturers have admitted in criminal proceedings to participating in this conspiracy and conducting illegal price-fixing operations in the United States," including defendants LG Display Co. Ltd., Sharp Corporation, Chunghwa Picture Tubes, Ltd., Epson Imaging Devices Corporation, Chi Mei Optoelectronics Corporation and HannStar Display Corporation. Id. ¶ 7. Motorola further alleges that defendants Sharp and Epson specifically identified Motorola as a customer which was overcharged for LCD Panels. Id. ¶ 8.

Motorola alleges that it was an intended victim of the price-fixing conspiracy and that the conspiracy was carried out, in part, in the United States. Motorola alleges that "[d]efendants and their co-conspirators, using their U.S. affiliates, salespeople, and contacts entered into supply agreements with Motorola in Illinois to sell Motorola LCD Panels at unlawfully inflated prices." Id. ¶ 4. "During and after the [Relevant Period], procurement teams at Motorola based in the U.S. negotiated the prices, conditions, and quantities that governed all Motorola purchases of LCD Panels around the world for inclusion in Motorola devices." Id. ¶ 129. Motorola alleges that its U.S. procurement teams negotiated each LCD Panel purchase with defendants through a process that involved developing requests and preliminary specifications in collaboration with U.S. representatives for defendants and the final negotiation of the terms of purchase for LCD Panels. Id. ¶ 130. Motorola alleges that the prices set through this domestic negotiation process "directly and immediately impacted Motorola"s business plans, including its most basic business choices involving the production, pricing, and sales of its own products." Id. ¶ 132. After the price for LCD Panels was set, Motorola"s supply chain organization (also based in Illinois) used an automatic scheduling process to determine the quantity requirements for it and its subsidiaries. *839 Id. ¶ 133. This process was entirely directed by Motorola from the U.S., and "[t]he foreign affiliates issued purchase orders at the price and quantity determined by Motorola in the United States." Id.

Motorola seeks treble damages and injunctive relief under Section 1 of the Sherman Act. Motorola also seeks relief under the antitrust laws of Illinois, the state in which it maintains its principal place of business. Finally, Motorola asserts individual claims for breach of contract and unjust enrichment against Sharp, Epson, Toshiba, Samsung and AU Optronics.

Federal Rule of Civil Procedure 12(b)(1) allows a party to challenge a federal court"s jurisdiction over the subject matter of the complaint. As the party invoking the jurisdiction of the federal court, the plaintiff bears the burden of establishing that the court has the requisite subject matter jurisdiction to grant the relief requested. SeeKokkonen v. Guardian Life Ins. Co. of America, Thornhill Publishing Co., Inc. v. General Tel. & Elecs. Corp., SeeMiranda v. Reno, SeeRoberts v. Corrothers,

Under Federal Rule of Civil Procedure 12(b)(6), a district court must dismiss a complaint if it fails to state a claim upon which relief can be granted. To survive a Rule 12(b)(6) motion to dismiss, the plaintiff must allege "enough facts to state a claim to relief that is plausible on its face." Bell Atl. Corp. v. Twombly, Ashcroft v. Iqbal, ___ U.S. ___, Twombly, 550 U.S. at 555, 570,

In deciding whether the plaintiff has stated a claim upon which relief can be granted, the court must assume that the plaintiffs allegations are true and must draw all reasonable inferences in the plaintiff"s favor. SeeUsher v. City of Los Angeles, In re Gilead Sciences Sec. Litig.,

If the court dismisses the complaint, it must then decide whether to grant leave to amend. The Ninth Circuit has "repeatedly held that a district court should grant leave to amend even if no request to amend the pleading was made, unless it determines that the pleading could not possibly be cured by the allegation of other facts." Lopez v. Smith,

Defendants argue that the Court lacks subject matter jurisdiction over certain of Motorola"s federal antitrust claims under the Foreign Trade Antitrust Improvements Act, 15 U.S.C. § 6a ("FTAIA"), which amends the Sherman Act and "excludes from [its] reach much anti-competitive conduct that causes only foreign injury." F. Hoffmann-La Roche, Ltd. v. Empagran S.A. (Empagran I),

The FTAIA establishes a general rule that the Sherman Act "shall not apply to conduct involving trade or commerce (other than import trade or import commerce) with foreign nations." 15 U.S.C. § 6a. The FTAIA then "provides an exception to this general rule, making the Sherman Act applicable if foreign conduct `(1) has a `direct, substantial, and reasonably foreseeable effect" on domestic commerce, and (2) `such effect gives rise to a [Sherman Act] claim.""" In re Dynamic Random Access Memory (DRAM) Antitrust Litig., Empagran I and 15 U.S.C. § 6a). This is known as the "domestic injury exception" of the FTAIA. Id. The Supreme Court has stated:

This technical language initially lays down a general rule placing all (nonimport) activity involving foreign commerce outside the Sherman Act"s reach. It then brings such conduct back within the Sherman Act"s reach provided that the conduct both (1) sufficiently affects American commerce, i.e., it has a "direct, substantial, and reasonably foreseeable effect" on American domestic, import or (certain) export commerce, and (2) has an effect of a kind that antitrust law considers harmful, i.e., the "effect" must "giv[e] rise to a [Sherman Act] claim."

Defendants argue that as to any purchase that occurred outside the United States Motorola has not alleged sufficient facts to establish that its foreign injury and the injury of its foreign affiliates (paying higher prices abroad) was proximately caused by any domestic effect of the alleged conspiracy. Motion at 20-23. Defendants argue that it is insufficient to allege that Motorola "directed that purchases be made abroad by its foreign affiliates and third-party EMS providers." Id. at 21. As a result, defendants contend that Motorola has failed to allege sufficient facts to bring its foreign antitrust claims within the domestic injury exception to the FTAIA.

Empagran I is the leading case on the domestic injury exception. Empagran I, the plaintiffs filed a class action on behalf of *841 purchasers of vitamins and alleged that foreign and domestic vitamin manufacturers and distributors had conspired to fix the price of vitamin products in the United States and abroad. At issue were claims brought by foreign vitamin distributors who bought vitamins for delivery outside the United States. Id. at 159-60, Id. at 164, 175, Id. at 175,

On remand in Empagran S.A. v. F. Hoffmann-LaRoche, Ltd. (Empagran II), 417 F.3d 1267(D.C.Cir.2005), the plaintiffs relied on an "arbitrage" theory to argue that there was a causal link between the domestic effects of the conspiracy and the plaintiffs" foreign injury. Plaintiffs argued that "because vitamins are fungible and readily transportable, without an adverse domestic effect (i.e., higher prices in the United States), the sellers could not have maintained their international price-fixing arrangement and respondents would not have suffered their foreign injury." Id. at 1269. Rejecting this as a basis for the domestic injury exception, the D.C. Circuit held that such an arbitrage theory alleges, at best, a "but-for" relationship that fails to satisfy the proximate causation requirement of the FTAIA. Id. at 1270-71.

The Eighth Circuit addressed a similar argument in In re Monosodium Glutamate Antitrust Litigation, Id. at 536. The plaintiffs argued that their allegations satisfied the domestic injury exception to the FTAIA because the "United States market was included Within the scheme because the fungible nature and worldwide flow of these products made the domestic and foreign markets interconnected, such that super-competitive prices abroad could be sustained only by maintaining super-competitive prices in the United States." Id. at 536-37. Following Empagran II, the Eighth Circuit held that

The domestic effects of the price fixing scheme (increased U.S. prices) were not the direct cause of the appellants" injuries. Rather, it was the foreign effects of the price fixing scheme (increased prices abroad). Although United States prices may have been a necessary part of the appellees" plan, they were not significant enough to constitute the direct cause of the appellants" injuries, as they constituted merely one link in the causal chain. The theory proffered by the appellants therefore establishes at best only an indirect connection between the domestic prices and the prices paid by the appellants.

The Ninth Circuit addressed similar allegations in DRAM, DRAM, a British computer manufacturer, Centerprise, alleged that the defendant domestic and foreign manufacturers and sellers of dynamic random access memory ("DRAM") "engaged in a global conspiracy to fix DRAM prices, raising the price of DRAM to customers in both the United States and foreign countries." Id. at 984. Centerprise claimed that it satisfied the domestic injury exception to the FTAIA because the defendants could not have maintained the artificially inflated foreign prices without also fixing DRAM prices in the United States. Id. The Ninth Circuit held that such allegations *842 were insufficient to establish that the domestic effects "gave rise to" Center-prise"s foreign injury.

The defendants" conspiracy may have fixed prices in the United States and abroad, and maintaining higher U.S. prices might have been necessary to sustain higher prices globally, but Center-prise has not shown that the higher U.S. prices proximately caused its foreign injury of having to pay higher prices abroad. Other actors or forces may have affected the foreign prices. In particular, that the conspiracy had effects in the United States and abroad does not show that the effect in the United States, rather than the overall price-fixing conspiracy itself, proximately caused the effect abroad.

Id. at 988. The court also rejected allegations of "a direct correlation between the U.S. price and the prices abroad" and that "the Defendants" activities resulted in the U.S. prices directly setting the worldwide price." Id. at 989. The court ruled that "a direct correlation between prices does not establish a sufficient causal relationship" where the complaint does not "set forth a theory with any specificity of how this price-setting occurred or how it shows a direct causal relationship." See id. at 989-90.

Various district courts have similarly rejected the arbitrage theory of causation on the ground that it does not establish a proximate link between the domestic effects of the anticompetitive conduct and the foreign injury incurred. SeeIn re Rubber Chemicals Antitrust Litigation, Emerson Electric Co. v. Le Carbone Lorraine, S.A.,

This case is significantly different from the cases described above. Motorola is not a foreign company alleging injury based on wholly foreign transactions and conduct, unlike the plaintiffs in Empagran I. Motorola is a Delaware corporation with its principal place of business in Illinois and alleges a conspiracy between defendants that involved both domestic and foreign conduct. SAC ¶¶ 1-8, 24. Many of the comity concerns regarding interference with the sovereign authority of other nations identified in Empagran I are therefore less applicable. Perhaps more importantly, Motorola does not rely on an arbitrage theory to establish the domestic injury exception. Motorola instead alleges that an important domestic effect of the anticompetitive conspiracy was the setting of a global price for all LCD Panel purchases around the world. Id. ¶ 129. As the Court views these new allegations, the SAC alleges that the price and other terms of purchase were negotiated exclusively by Motorola"s procurement teams within the United States and applied worldwide, without regard to where the product was ultimately delivered. Id. ¶¶ 129-33. Moreover, Motorola"s foreign affiliates were bound by these negotiations and were not permitted to negotiate the price of LCD Panels nor alter the total quantity ordered. Id. ¶ 133. These allegations establish a concrete link between defendants" price-setting conduct (the collusion between the defendants to establish an artificially high price for LCD Panels), its domestic effect (the negotiations between Motorola and defendants that resulted in the setting of a global, anticompetitive price for all LCD Panels sold to Motorola) and the foreign *843 injury suffered by Motorola and its affiliates (payment of higher prices abroad). These allegations are far stronger than the arbitrage theory rejected in the cases above and cure the problem identified by the Ninth Circuit in DRAM by setting forth with specificity a direct causal relationship between the anticompetitive conduct, the domestic negotiations and Motorola"s foreign injury.

Defendants point to Sun Microsystems Inc. v. Hynix Semiconductor Inc. (Sun III), Sun III are not controlling here. The court in Sun III faced a subtly different question: whether proof that a domestic company and its foreign subsidiaries form a "single entity," by itself, can satisfy the domestic injury exception where the plaintiff cannot otherwise establish a proximate link between any domestic effect of the anticompetitive conduct and the foreign injury. Sun III, 608 F.Supp.2d at 1185-86. The court had previously ruled that the plaintiff failed to demonstrate that the higher prices set and established in the United States proximately caused the foreign entities associated with the plaintiffs to pay higher prices abroad. Sun Microsystems Inc. v. Hynix Semiconductor Inc. (Sun II), Sun II. As discussed above, the Court finds that Motorola has done so.[1]

The Court also disagrees with the Sun III court"s reading of the Ninth Circuit"s opinion in DRAM, 546 F.3d at 989-90. Citing DRAM, the Sun III court stated that "[b]oth this court and the Ninth Circuit have held that, to the extent plaintiff"s proximate causation theory rests on proof of a global procurement strategy, this is not a viable legal theory." Sun III, 608 F.Supp.2d at 1186. In this Court"s view, however, the holding in DRAM did not go so far. It is true that, in DRAM, the Ninth Circuit held that allegations of "a direct correlation between the U.S. price and the prices abroad" and that "the Defendants" activities resulted in the U.S. prices directly setting the worldwide price" were not sufficient for purposes of the domestic injury exception. DRAM, 546 F.3d at 989. However, the court based its holding on a determination that the plaintiff failed to "set forth a theory with any specificity of how this price-setting occurred or how it shows a direct causal relationship." Id. The court focused on particular allegations in the complaint that it found to be insufficient; the Ninth Circuit in DRAM stated:

Memory purchases are a 24 hour global business, dependent in large part on United States events. For example, Plaintiff and many Class members start *844 their days with communications to Defendants in Taiwan and Korea to understand what pricing is available for DRAM, and as the day goes on follow sales in the United States. Plaintiff and Class members were required to track the DRAM prices in dollars, which was the only available measure due to Defendants" sales and distribution practices, then work on dollar exchange rates in order to buy the DRAM at the best available price worldwide. The United States prices were the source of, and substantially affected the worldwide DRAM prices.

Id. at 990 n. 10. The court found that "[t]he significance of these assertions ... is not self-evident and Centerprise has not elaborated on how any of its asserted facts show that the higher U.S. DRAM prices proximately caused the excessive DRAM prices that Centerprise paid." Id. The allegations in this case offer far more detail than the allegations in DRAM. As discussed above, the SAC describes the method by which global prices were negotiated and set by Motorola"s procurement team in Illinois and the connection to Motorola"s foreign injury. According to the SAC, a single global price was effective worldwide, no matter where delivery of the product occurred. SAC ¶¶ 129-33. The U.S. prices therefore were not simply "the source of" the foreign prices; both the domestic and foreign prices were one and the same. These allegations address the problem identified in DRAM by alleging with specificity how the prices paid abroad were caused by the contractual terms negotiated inside the United States. Of course, whether this Court ultimately has jurisdiction over Motorola"s foreign injury claims will turn on whether Motorola can, in fact, prove such allegations. At this stage, however, Motorola has met its burden to allege facts that bring its claims within the domestic injury exception to the FTAIA. Accordingly, defendants" motion to dismiss the Sherman Act claim under the FTAIA is DENIED.[2]

Defendants also move to dismiss Motorola"s claim under the Illinois Antitrust Act, which has explicitly adopted the territorial limitations of the FTAIA. 740 Ill. Comp. Stat. 10/5(14). Section 10/5(14) of the Illinois Antitrust Act uses language that is essentially identical to the FTAIA and does not permit claims based on foreign injury unless the challenged conduct has a "direct, substantial, and reasonably foreseeable effect" on domestic commerce and such effect "gives rise to a claim" under the Illinois Antitrust Act. Id. Section 10/11 of the Illinois Antitrust Act states that "[w]hen the wording of this Act is identical or similar to that of a federal antitrust law, the courts of this State shall use the construction of the federal law by the federal courts as a guide in construing this Act." 740 Ill. Comp. Stat. 10/11.

Because the Court finds that the allegations in the Second Amended Complaint satisfy the domestic injury exception of the FTAIA, the Court also concludes that Motorola"s allegations satisfy the analogous provision of the Illinois Antitrust Act. Accordingly, defendants" motion to dismiss Motorola"s claims under the Illinois Antitrust Act is DENIED.

Defendants move to dismiss Motorola"s claims under the Illinois Antitrust Act and *845 for breach of contract and unjust enrichment because they do not comport with due process. Motion at 26-27. Defendants specifically argue that the SAC asserts state law claims on behalf of foreign affiliates of Motorola and other foreign manufacturers who do not allege that they purchased any relevant product in Illinois.

To determine whether the application of a particular state"s law comports with the Due Process Clause, the Court must examine "the contacts of the State, whose law [is to be] applied, with the parties and with the occurrence or transaction giving rise to the litigation." Allstate Ins. Co. v. Hague, Id. Such is not the case here. Each of the claims targeted by defendants is asserted under Illinois state law, the state in which Motorola alleges that it maintains its corporate headquarters and runs substantial operations. SAC ¶ 12. Motorola also alleges that "during and after the Conspiracy Period, Motorola purchased LCD Panels and LCD Products in Illinois" and that its procurement team "negotiated all prices, specifications, and quantities for all purchases of LCD Panels and LCD Products from Motorola offices in Illinois." Id. Motorola alleges that the negotiations by its Illinois-based procurement team "governed all Motorola purchases of LCD Panels around the world for inclusion in Motorola devices." Id. ¶ 129. These contacts establish significant ties between Illinois and the parties and claims in this litigation, and the application of Illinois law does not, therefore, violate due process.

Defendants" argument appears to turn on the way in which the SAC defines the term "Motorola," which includes certain foreign manufacturers and affiliates of Motorola that defendants maintain did not purchase any products in Illinois. Motion at 27; SAC ¶ 25. Contrary to defendants" argument, however, the SAC alleges clearly that "Motorola" (including" the foreign manufacturers and affiliates) purchased LCD Panels and LCD Products in Illinois. SAC ¶ 12. Reading the SAC as a whole, therefore, Motorola does allege that it and each the foreign entities on whose behalf it brings this action purchased product in Illinois. Moreover, even if certain of the foreign entities or manufacturers did not make such purchases, Motorola alleges that the terms of every purchase including price and quantity were negotiated by its procurement team in Motorola"s Illinois offices. By virtue of this Illinois-based negotiation process, even purchases that were consummated outside the United States by Motorola"s foreign affiliates have a clear and substantial tie to Illinois.

Defendants assert that Motorola"s state breach of contract claims are impermissibly vague because the SAC does not allege which contracts were supposedly breached or the terms of those contracts. Motion at 27-29. Defendants argue that "because the SAC does not specifically aver which contracts were allegedly breached, it is impossible to assess which transactions are the subject of the alleged breach of contract claims or what laws Defendants supposedly violated." Id. at 29. Motorola responds that its allegations identify Motorola"s general supply agreements with each of the defendants as well as individual purchase orders as the contracts at issue. Opposition at 40. Motorola argues that *846 these allegations are sufficient to put defendants on notice of its claims and that any further specificity is properly gained through discovery. Id. at 40-41.

Defendants contend and Motorola does not dispute that Illinois law applies to Motorola"s breach of contract claims. In Illinois, the elements of a claim for breach of contract are "(1) offer and acceptance, (2) consideration, (3) definite and certain terms, (4) performance by the plaintiff of all required conditions, (5) breach, and (6) damages." Village of South Elgin v. Waste Management of Illinois, Inc., 348 Ill.App.3d 929, 284 Ill. Dec. 868,

Under Federal Rule of Civil Procedure 8(a)(2), a complaint must contain "a short and plain statement of the claim showing that the pleader is entitled to relief." The pleading must state a claim that is "plausible on its face" and that contains factual allegations that are "enough to raise a right to relief above the speculative level." Twombly, 550 U.S. at 555, 570, Leatherman v. Tarrant County Narcotics Intelligence & Coordination Unit,

Motorola"s breach of contract claims against Sharp, Epson, Toshiba, Samsung and AU Optronics are set forth in claims Three, Five, Seven, Nine and Eleven of the SAC. These claims allege that Motorola and each defendant "entered into multiple contracts for the sale of LCD Panels and/or LCD Products by which [defendant] agreed to deliver LCD Panels and/or LCD Products to Motorola and Motorola agreed to pay [defendant] a price negotiated by Motorola and [defendant]." SAC ¶¶ 225, 236, 247, 258, 269. Motorola alleges that "[t]hese contracts between Motorola and [defendant] include purchase orders issued by Motorola to [defendant]." Id. Motorola further alleges that "[p]ursuant to each of these contracts, [defendant] agreed on behalf of it and its suppliers and subcontractors that all LCD Panels and/or LCD Products provided to Motorola would be produced, manufactured and supplied, and services rendered, in compliance with all applicable laws, rules, regulations, and standards." Id. ¶¶ 226, 237, 248, 259, 270. Motorola alleges that each defendant violated this provision and the covenant of good faith and fair dealing by agreeing to fix the price of LCD Panels sold to Motorola. Id. ¶¶ 228-29, 239-40, 250-51, 261-62, 272-73. Motorola further alleges that it performed all of its obligations under the contracts and that, as a result of defendants" breach of the contracts, Motorola suffered damages. Id. ¶¶ 230, 241, 252, 263, 274.

The SAC alleges sufficient facts to establish a claim for breach of contract under Illinois law. A plain reading of the SAC sets forth Motorola"s theory of relief in clear terms; that is, that each of the contracting defendants breached its contractual obligation to comply with the "applicable laws, rules, regulations, and standards" along with the implied covenant of good faith and fair dealing by engaging in a widespread price-fixing conspiracy. Motorola also alleges facts sufficient to establish each of the other elements of its claims, including offer and acceptance, consideration, Motorola"s performance and damages. For purposes of the pleading stage, these allegations are sufficient. Defendants correctly identify a number of ambiguities in Motorola"s claims, including the precise terms of the contracts at issue, which purchase orders are alleged to have been violated, and which "laws, rules, regulations, and standards" govern each of the contracts that Motorola is asserting. Motion at 28-29. Ambiguities of this type are properly explored in discovery.

Defendants argue that Motorola"s unjust enrichment claims must be dismissed because no unjust enrichment claim lies under Illinois law where, as here, there is a contract that allegedly governs the subject matter of the dispute. Motion at 30. Motorola argues that it is permitted to plead claims in the alternative. Opposition at 41 n. 22.

The Court agrees with Motorola. Federal Rule of Civil Procedure 8(d)(2) states that "[a] party may set out 2 or more statements of a claim or defense alternatively or hypothetically, either in a single count or defense or in separate ones." Rule 8(d)(3) provides that "[a] party may state as many separate claims or defenses as it has, regardless of consistency." Rule 8(a) does not require a plaintiff explicitly to designate alternative claims "as long as it can be reasonably inferred that this is what [the plaintiff was] doing." Coleman v. Standard Life Ins. Co., United States ex rel. Atkins v. Reiten,

For the foregoing reasons, defendants" motion to dismiss the second amended complaint is DENIED. (No. M 07-1827 SI, Dkt. 1989; No. C 09-5840 SI, Dkt. 54, 57).

[1] In making this determination, the Court departs from the ruling in Sun II that, although the act of negotiating an inflated global price might be a "domestic effect" of the conspiracy, such effect cannot proximately cause the payment of higher prices abroad. Sun II, 534 F.Supp.2d at 1115. Based on the allegations in the SAC, Motorola has alleged facts that would establish that the domestically negotiated price was identical for purchases both inside and outside the United States. This is sufficient to establish the necessary proximate link between the domestic effects of the conspiracy and Motorola"s foreign injury.

[2] Because the Court finds that it has jurisdiction over Motorola"s antitrust causes of action under the FTAIA, it need not reach defendants" argument based on the Supremacy Clause that the Court does not have jurisdiction over Motorola"s state law causes of action.

In May 2017, the State of Illinois reached a tentative settlement agreement with the last remaining Defendant in the last remaining proceeding in the multidistrict TFT-LCD price-fixing antitrust litigation. This capped roughly ten years of Compass Lexecon involvement, from the class certification phase of the case through this final settlement. Professor Dennis Carlton testified in three trials, and a number of arbitration hearings and depositions. Professor Janusz Ordover testified on behalf of the Joint Defense Group on class certification issues. In addition, Professor Bobby Willig testified on behalf of Sharp Corporation, and Professor Dan Rubinfeld testified on behalf of Samsung.

In the direct-purchasers class litigation, Professor Carlton testified for Defendant Toshiba at trial in 2012. While Plaintiffs and their economic experts argued for overcharges of nearly $900 million – and thus damages of more than $2.5 billion after trebling – the jury determined that overcharges were only $87 million. Polling of jurors revealed that Carlton’s testimony was “very influential in the deliberations.”

In the Best Buy LCD price fixing litigation, Carlton testified for Defendants Toshiba and Hannstar at trial in 2013. Plaintiff Best Buy’s economic expert argued for damages of roughly $900 million post-trebling, based on an overcharge percentage of approximately 20%. The jury found no liability for Toshiba, and, for HannStar, which admitted liability, the jury awarded only direct damages in precisely the amount based on Professor Carlton’s analysis – $7.47 million.

Throughout the many phases of the case, Compass Lexecon worked with teams from White & Case, LLP, Freitas Tseng & Kaufman (now Freitas Angell & Weinberg LLP), Covington & Burling LLP, Paul Hastings LLP, Cleary Gottlieb Steen & Hamilton LLP, Munger Tolles & Olson LLP, Nossaman LLP, Davis Polk & Wardell LLP, Simpson Thacher & Bartlett LLP, Morrison & Foerster LLP, Paul, Weiss, Rifkind, Wharton & Garrison LLP, Wilmer Cutler Pickering Hale & Dorr LLP, and Pillsbury Winthrop Shaw Pittman LLP, among others.

Professor Carlton was supported by many people over the years in teams at Compass Lexecon’s Washington D.C., Boston and Chicago offices, including Mark Israel, Ian MacSwain, Allan Shampine, Chris Cavanagh, Georgi Giozov, Guillermo Israilevich, Quinn Johnson, Joel Papke, Loren Poulsen, Chandni Raja, Theresa Sullivan, Ben Wagner, and many others. Professor Ordover was supported by a team including Mark Israel, Loren Poulsen, Joel Papke, and Jeff Raileanu. Professor Willig was supported by a team including Jay Ezrielev and Cathy Barron. Professor Rubinfeld was supported by a team including Dan Ingberman, Mark Rodini, and Kelvin Huang.

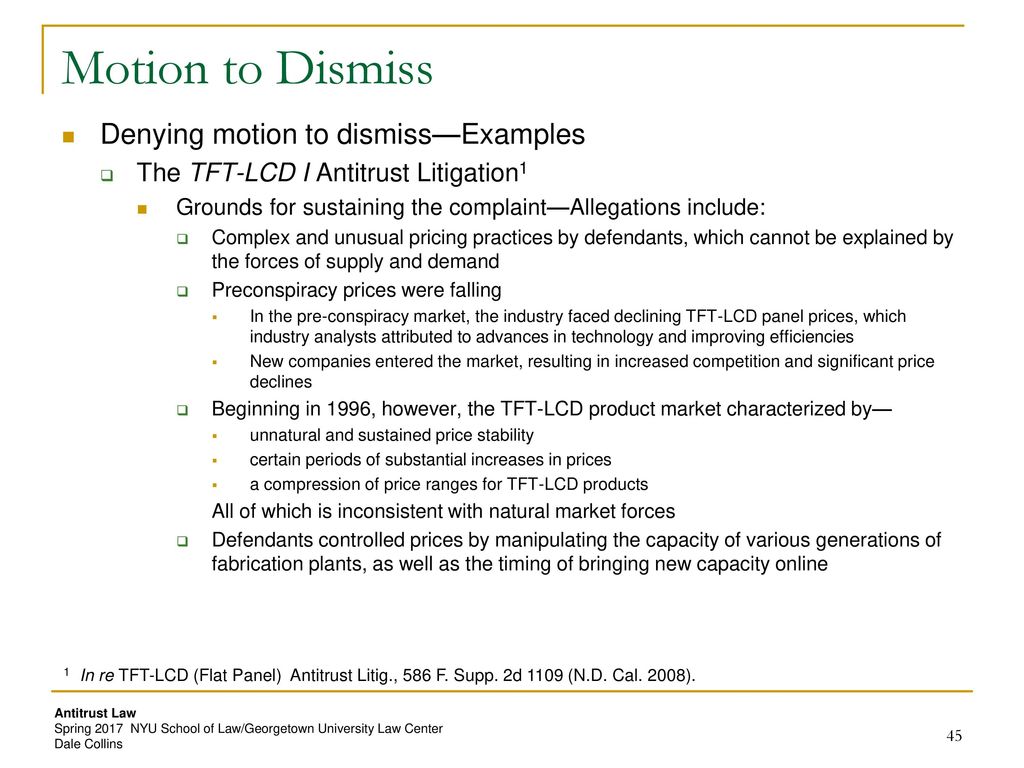

The TFT-LCD (Flat Panel) Antitrust Litigationclass-action lawsuit regarding the worldwide conspiracy to coordinate the prices of Thin-Film Transistor-Liquid Crystal Display (TFT-LCD) panels, which are used to make laptop computers, computer monitors and televisions, between 1999 and 2006. In March 2010, Judge Susan Illston certified two nationwide classes of persons and entities that directly and indirectly purchased TFT-LCDs – for panel purchasers and purchasers of TFT-LCD integrated products; the litigation was followed by multiple suits.

TFT-LCDs are used in flat-panel televisions, laptop and computer monitors, mobile phones, personal digital assistants, semiconductors and other devices;

In mid-2006, the U.S. Department of Justice (DOJ) Antitrust Division requested FBI assistance in investigating LCD price-fixing. In December 2006, authorities in Japan, Korea, the European Union and the United States revealed a probe into alleged anti-competitive activity among LCD panel manufacturers.

The companies involved, which later became the Defendants, were Taiwanese companies AU Optronics (AUO), Chi Mei, Chunghwa Picture Tubes (Chunghwa), and HannStar; Korean companies LG Display and Samsung; and Japanese companies Hitachi, Sharp and Toshiba.cartel which took place between January 1, 1999, through December 31, 2006, and which was designed to illegally reduce competition and thus inflate prices for LCD panels. The companies exchanged information on future production planning, capacity use, pricing and other commercial conditions.European Commission concluded that the companies were aware they were violating competition rules, and took steps to conceal the venue and results of the meetings; a document by the conspirators requested everybody involved "to take care of security/confidentiality matters and to limit written communication".

This price-fixing scheme manipulated the playing field for businesses that abide by the rules, and left consumers to pay artificially higher costs for televisions, computers and other electronics.

Companies directly affected by the LCD price-fixing conspiracy, as direct victims of the cartel, were some of the largest computer, television and cellular telephone manufacturers in the world. These direct action plaintiffs included AT&T Mobility, Best Buy,Costco Wholesale Corporation, Good Guys, Kmart Corp, Motorola Mobility, Newegg, Sears, and Target Corp.Clayton Act (15 U.S.C. § 26) to prevent Defendants from violating Section 1 of the Sherman Act (15 U.S.C. § 1), as well as (b) 23 separate state-wide classes based on each state"s antitrust/consumer protection class action law.

In November 2008, LG, Chunghwa, Hitachi, Epson, and Chi Mei pleaded guilty to criminal charges of fixing prices of TFT-LCD panels sold in the U.S. and agreed to pay criminal fines (see chart).

The South Korea Fair Trade Commission launched legal proceedings as well. It concluded that the companies involved met more than once a month and more than 200 times from September 2001 to December 2006, and imposed fines on the LCD manufacturers.

Sharp Corp. pleaded guilty to three separate conspiracies to fix the prices of TFT-LCD panels sold to Dell Inc., Apple Computer Inc. and Motorola Inc., and was sentenced to pay a $120 million criminal fine,

Chunghwa pleaded guilty and was sentenced to pay a $65 million criminal fine for participating with LG and other unnamed co-conspirators during the five-year cartel period.

In South Korea, regulators imposed the largest fine the country had ever imposed in an international cartel case, and fined Samsung Electronics and LG Display ₩92.29 billion and ₩65.52 billion, respectively. AU Optronics was fined ₩28.53 billion, Chimmei Innolux ₩1.55 billion, Chungwa ₩290 million and HannStar ₩870 million.

Seven executives from Japanese and South Korean LCD companies were indicted in the U.S. Four were charged with participating as co-conspirators in the conspiracy and sentenced to prison terms – including LG"s Vice President of Monitor Sales, Chunghwa"s chairman, its chief executive officer, and its Vice President of LCD Sales – for "participating in meetings, conversations and communications in Taiwan, South Korea and the United States to discuss the prices of TFT-LCD panels; agreeing during these meetings, conversations and communications to charge prices of TFT-LCD panels at certain predetermined levels; issuing price quotations in accordance with the agreements reached; exchanging information on sales of TFT-LCD panels for the purpose of monitoring and enforcing adherence to the agreed-upon prices; and authorizing, ordering and consenting to the participation of subordinate employees in the conspiracy."

On December 8, 2010, the European Commission announced it had fined six of the LCD companies involved in a total of €648 million (Samsung Electronics received full immunity under the commission"s 2002 Leniency Notice) – LG Display, AU Optronics, Chimei, Chunghwa Picture and HannStar Display Corporation.

On July 3, 2012, a U.S. federal jury ruled that the remaining defendant, Toshiba Corporation, which denied any wrongdoing, participated in the conspiracy to fix prices of TFT-LCDs and returned a verdict in favor of the plaintiff class. Following the trial, Toshiba agreed to resolve the case by paying the class $30 million.

On March 29, 2013, Judge Susan Illston issued final approval of the settlements agreements totaling $1.1 billion for the indirect purchaser’ class. The settling companies also agreed to establish antitrust compliance programs and to help prosecute other defendants, and cooperate with the Justice Department"s continuing investigation.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Judge Illston refused to exclude indirect purchaser plaintiffs’ economics experts. In doing so, the Court addressed the necessary quantum of proof for class impact in an indirect purchaser case.

The indirect purchaser plaintiffs indirectly purchased TFT-LCD panels made by the defendants. They allege price-fixing, and seek injunctive relief under federal law and damages under state antitrust law. Plaintiffs retained two experts, Drs. Janet Netz and William Comanor, who concluded that defendants’ alleged cartel increased prices to direct purchasers (by around 12%), who in turn passed on overcharges to indirect purchasers, resulting in some $3 billion in alleged damages.

Defendants argued that the case was not amenable to class treatment, because plaintiffs could not show “with certainty” that class members were impacted. However, the Court rejected this argument. “[P]laintiffs need not be able to articulate the precise degree to which every individual class member was injured; it suffices to show that it was more likely than not that classwide impact occurred.” According to the Court, the nature of the industry rendered defendants’ proposed standard inappropriately strict; plaintiffs asserted that TFT-LCD panels are fungible commodities. “It is therefore unnecessary for plaintiffs to provide evidence of panel-by-panel impact. Rather, plaintiffs may resort to generalized methods of proof.”

In short, the Court held that “[p]laintiffs need not identify the overcharge on each and every panel sold to direct purchasers, and they need not trace that specific overcharge through the manufacturing and retail chains to the ultimate purchaser. The fact that plaintiffs lack perfect proof does not mean that plaintiffs lack any proof at all.”

The Court then addressed defendants’ related argument that the experts’ economic regression analyses, while relevant to damages, cannot be used to establish either impact to direct purchasers or pass-through to indirect purchasers. Because the Court had determined that plaintiffs need not establish, to a certainty, class members’ injuries on an LCD panel-by-panel basis, the Court rejected this argument – at least in its categorical form. “Even if regression models are not enough, standing alone, to establish classwide impact, they may nevertheless be relevant to the issue. A large average overcharge, for example, might make it more likely that every direct purchaser was overcharged to some degree.” The Court declined to preclude the experts from testifying that their models establish impact, but agreed to let defendants renew their objections when the experts’ specific testimony is before the Court.

The Court then turned to, and rejected, defendants’ various specific arguments about the experts’ regression analyses, finding that they did not render the testimony inadmissible under the Daubert standard.

SAN FRANCISCO (Reuters) - South Korea"s LG Electronics Inchas agreed to pay $380 million to resolve a civil lawsuit over price fixing in the liquid crystal display market, the largest amount paid among the ten companies who similarly settled the litigation, a court filing showed on Thursday.

A class action lawsuit alleged a detailed conspiracy from the late 1990s through 2006 to fix LCD prices, resulting in higher costs for buyers of televisions, laptops and other electronics. Several companies also pleaded guilty to separate criminal charges and paid fines.

An attorney for the plaintiffs on Wednesday disclosed a settlement involving LG, AU Optronics Corpand Toshiba Corp. According to Thursday"s court filing, AU Optronics will pay $170 million, while Toshiba will pay $21 million.

AUO representative Freda Lee said the settlement should not cause material impact to the company’s finance or business in the current or future reporting periods.

Toshiba spokeswoman Deborah Chalmers said the company “denies any wrongdoing on its part in the LCD business, and it entered into the settlement to avoid further expense and the distraction of protracted litigation.”

A deal involving the other seven companies, including Samsung, Sharp and Hitachi, had previously been approved. If the latest deal becomes final, the total recovery for class members will top $1 billion, according to the court filing.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey