in re tft lcd flat panel antitrust quotation

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

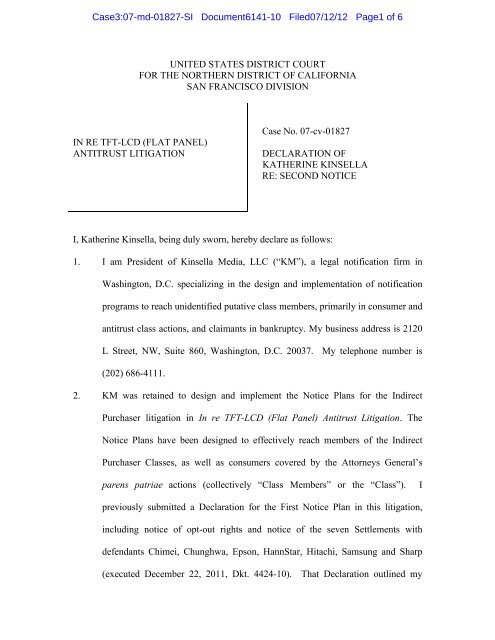

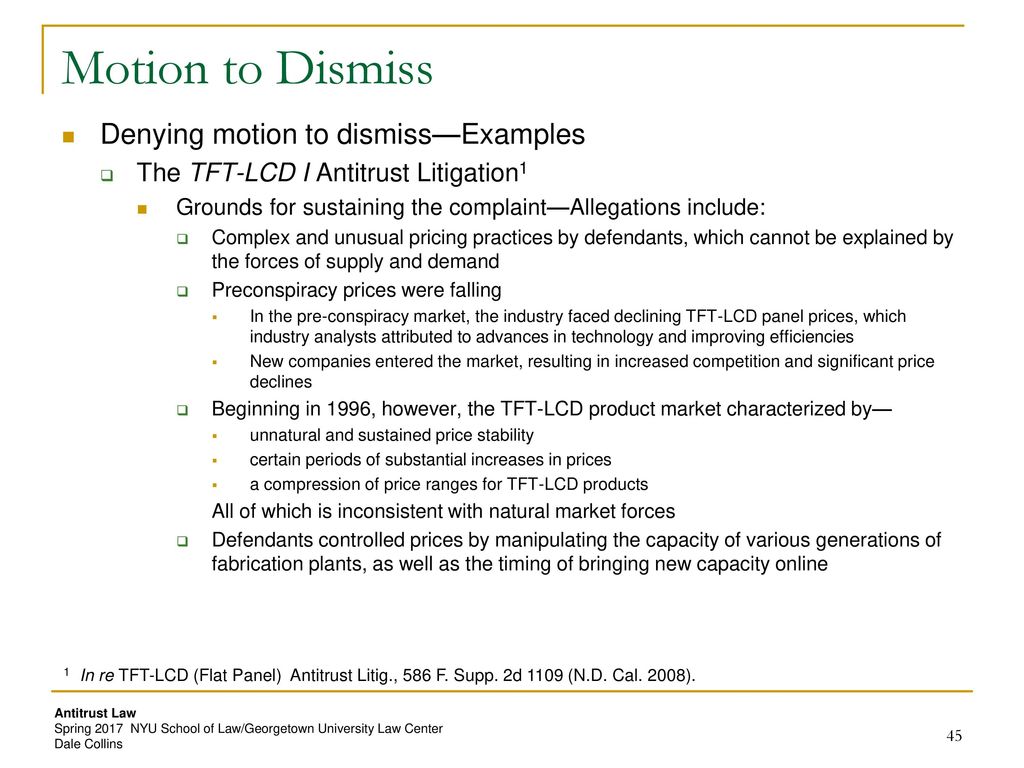

The TFT-LCD (Flat Panel) Antitrust Litigationclass-action lawsuit regarding the worldwide conspiracy to coordinate the prices of Thin-Film Transistor-Liquid Crystal Display (TFT-LCD) panels, which are used to make laptop computers, computer monitors and televisions, between 1999 and 2006. In March 2010, Judge Susan Illston certified two nationwide classes of persons and entities that directly and indirectly purchased TFT-LCDs – for panel purchasers and purchasers of TFT-LCD integrated products; the litigation was followed by multiple suits.

TFT-LCDs are used in flat-panel televisions, laptop and computer monitors, mobile phones, personal digital assistants, semiconductors and other devices;

In mid-2006, the U.S. Department of Justice (DOJ) Antitrust Division requested FBI assistance in investigating LCD price-fixing. In December 2006, authorities in Japan, Korea, the European Union and the United States revealed a probe into alleged anti-competitive activity among LCD panel manufacturers.

The companies involved, which later became the Defendants, were Taiwanese companies AU Optronics (AUO), Chi Mei, Chunghwa Picture Tubes (Chunghwa), and HannStar; Korean companies LG Display and Samsung; and Japanese companies Hitachi, Sharp and Toshiba.cartel which took place between January 1, 1999, through December 31, 2006, and which was designed to illegally reduce competition and thus inflate prices for LCD panels. The companies exchanged information on future production planning, capacity use, pricing and other commercial conditions.European Commission concluded that the companies were aware they were violating competition rules, and took steps to conceal the venue and results of the meetings; a document by the conspirators requested everybody involved "to take care of security/confidentiality matters and to limit written communication".

This price-fixing scheme manipulated the playing field for businesses that abide by the rules, and left consumers to pay artificially higher costs for televisions, computers and other electronics.

Companies directly affected by the LCD price-fixing conspiracy, as direct victims of the cartel, were some of the largest computer, television and cellular telephone manufacturers in the world. These direct action plaintiffs included AT&T Mobility, Best Buy,Costco Wholesale Corporation, Good Guys, Kmart Corp, Motorola Mobility, Newegg, Sears, and Target Corp.Clayton Act (15 U.S.C. § 26) to prevent Defendants from violating Section 1 of the Sherman Act (15 U.S.C. § 1), as well as (b) 23 separate state-wide classes based on each state"s antitrust/consumer protection class action law.

In November 2008, LG, Chunghwa, Hitachi, Epson, and Chi Mei pleaded guilty to criminal charges of fixing prices of TFT-LCD panels sold in the U.S. and agreed to pay criminal fines (see chart).

The South Korea Fair Trade Commission launched legal proceedings as well. It concluded that the companies involved met more than once a month and more than 200 times from September 2001 to December 2006, and imposed fines on the LCD manufacturers.

Sharp Corp. pleaded guilty to three separate conspiracies to fix the prices of TFT-LCD panels sold to Dell Inc., Apple Computer Inc. and Motorola Inc., and was sentenced to pay a $120 million criminal fine,

Chunghwa pleaded guilty and was sentenced to pay a $65 million criminal fine for participating with LG and other unnamed co-conspirators during the five-year cartel period.

In South Korea, regulators imposed the largest fine the country had ever imposed in an international cartel case, and fined Samsung Electronics and LG Display ₩92.29 billion and ₩65.52 billion, respectively. AU Optronics was fined ₩28.53 billion, Chimmei Innolux ₩1.55 billion, Chungwa ₩290 million and HannStar ₩870 million.

Seven executives from Japanese and South Korean LCD companies were indicted in the U.S. Four were charged with participating as co-conspirators in the conspiracy and sentenced to prison terms – including LG"s Vice President of Monitor Sales, Chunghwa"s chairman, its chief executive officer, and its Vice President of LCD Sales – for "participating in meetings, conversations and communications in Taiwan, South Korea and the United States to discuss the prices of TFT-LCD panels; agreeing during these meetings, conversations and communications to charge prices of TFT-LCD panels at certain predetermined levels; issuing price quotations in accordance with the agreements reached; exchanging information on sales of TFT-LCD panels for the purpose of monitoring and enforcing adherence to the agreed-upon prices; and authorizing, ordering and consenting to the participation of subordinate employees in the conspiracy."

On December 8, 2010, the European Commission announced it had fined six of the LCD companies involved in a total of €648 million (Samsung Electronics received full immunity under the commission"s 2002 Leniency Notice) – LG Display, AU Optronics, Chimei, Chunghwa Picture and HannStar Display Corporation.

On July 3, 2012, a U.S. federal jury ruled that the remaining defendant, Toshiba Corporation, which denied any wrongdoing, participated in the conspiracy to fix prices of TFT-LCDs and returned a verdict in favor of the plaintiff class. Following the trial, Toshiba agreed to resolve the case by paying the class $30 million.

On March 29, 2013, Judge Susan Illston issued final approval of the settlements agreements totaling $1.1 billion for the indirect purchaser’ class. The settling companies also agreed to establish antitrust compliance programs and to help prosecute other defendants, and cooperate with the Justice Department"s continuing investigation.

California has adopted an extensive statutory scheme that, with narrow exceptions, protects the confidentiality of mediation proceedings and precludes introduction in evidence of any communication made during the course of a mediation. Cal. Evid. Code §§ 1119; 1121; 1123. This scheme has been called essential to effective mediation “because it promotes a candid and informal exchange [that can be] achieved only if participants know that what is said in the mediation will not be used to their detriment through later court proceedings and other adjudicatory processes.” Rojas v. Superior Court, 33 Cal. 4th 407, 415–16 (2004) [internal quotes omitted]. There are consequences to the scope of California’s mediation privilege that warrant consideration. Notably, the prohibition against use of these communications can make it difficult, if not impossible, to gather evidence to pursue a claim against one’s attorney or insurer for misconduct during a mediation or to enforce or set aside a settlement reached in mediation.

In contrast, the Federal Rules of Evidence only protect matters disclosed in the course of compromise or settlement when offered at trial to prove liability, but do not preclude statements offered for other purposes. Fed. R. Evid. 408.

The recent Ninth Circuit decision in In re TFT–LCD (Flat Panel) Antitrust Litigation, 2016 WL 4547357 (9th Cir. Sept. 1, 2016) underscores the difference between California and federal law at to the scope of protection afforded to statements made during mediation.

In that case, Sony and HannStar participated in pre-lawsuit mediation of price fixing claims that Sony alleged against HannStar. The mediator made a mediator’s proposal by email to Sony and HannStar under a “double-blind” procedure where the parties would separately provide their acceptance or rejection to the mediator alone. Both parties accepted the proposal and the mediator notified the parties by email, concluding: “This case is now settled subject to agreement on terms and conditions in a written settlement document.” Subsequently, HannStar informed Sony that it did not intend to pay the settlement. Sony sued, alleging federal and state antitrust claims and breach of contract for HannStar’s alleged reneging on the settlement agreement.

Sony later dismissed its state and federal antitrust claims, but moved for summary judgment to enforce the settlement agreement under California law. The district court denied the motion, finding California’s mediation confidentiality statutes precluded admission of the email exchange with the mediator because it lacked a statement that the settlement was intended to be enforceable or binding.[1] A judgment was entered and Sony appealed.

The Ninth Circuit reversed and remanded, holding that the federal, rather than California, law of privilege applies. It first recognized that, under Rule 501 or the Federal Rules of Evidence, federal common law governs any claim of privilege in the federal courts, but in a civil case, state law governs a claim of privilege relating to state law claims or defenses. The Court then noted that, under Wilcox v. Arpaio, 753 F.3d 872 (9th Cir. 2014), federal privilege law governs where the evidence in question relates to both federal and state law claims. Finally, the Ninth Circuit held it was of no moment that Sony had dismissed all of its federal claims by the time its motion for summary judgment was filed. “[T]he eventual dismissal of federal claims does not govern whether the evidence related to federal law. Because, here, at the time the parties engaged in mediation, their negotiations concerned (and the mediated settlement settled) both federal and state law claims, the federal law of privilege applies. Accordingly, the district court erred in applying California privilege law to resolve this dispute.” In re TFT–LCD (Flat Panel) Antitrust Litigation, 2016 WL 4547357 at *3.[2]

The most critical lesson from this case is to understand the different treatment under federal and California law afforded to statements made in mediations. To ensure that evidence of a mediated settlement is admissible in a state court action to enforce that settlement, you need to keep the requirements of California Evidence Code section 1123 in mind. The written evidence of the agreement must state that it is “enforceable or binding or words to that effect.” Cal. Evid. Code § 1123(b). Otherwise, you may not be able to introduce evidence of the mediated settlement, such as the declaration testimony by a party or attorney that an agreement was reached, to enforce the settlement because of the expansive scope of California’s mediation privilege.

A second lesson is to recognize the potential impact of including federal claims in a mediation conducted in California. In this case, at least, the Ninth Circuit was amenable to applying the federal mediation privilege because federal claims were asserted at the time of the mediation. It may even be sufficient that a federal claim could have been asserted on the same facts or was simply threatened, as the mediation in In re TFT–LCDoccurred before a suit was filed and the parties consequently had not yet specifically asserted any federal claims or counter-claims against one another under federal law. Thus, litigants should be wary that statements made in a mediation, which the parties expected to be confidential, may be fair game in a subsequent federal lawsuit because a federal claim was or could have been asserted at the time of the mediation.

The Ninth Circuit’s remand to the district court to determine the impact of federal common law implies that a separate federal common law mediation privilege exists beyond Federal Rule 408 and that it differs from California law. However, the Ninth Circuit has had several opportunities to define the scope of such a federal mediation privilege and has so far declined to do so. See Wilcox v. Arpaio, 753 F.3d 872, 877; Babasa v. LensCrafters, Inc., 498 F.3d 972, 975 n. 1 (9th Cir. 2007). At least one district court has recognized a federal “mediation privilege.” Folb v. Motion Picture Indus. Pension & Health Plans, 16 F. Supp. 2d 1164, 1179–80 (C.D. Cal. 1998), aff’d, 216 F.3d 1082 (9th Cir. 2000) (“Accordingly, this Court finds it is appropriate, in light of reason and experience, to adopt a federal mediation privilege applicable to all communications made in conjunction with a formal mediation.”) Another has declined to do so. Molina v. Lexmark Int’l, Inc., 2008 WL 4447678, at *9 (C.D. Cal. Sept. 30, 2008) (“No Circuit court has ever adopted or applied such a [mediation] privilege; indeed, both the Ninth and the Fourth Circuits have expressly declined to consider whether such a privilege exists.”) It remains to be seen whether, after further proceedings on remand, In re TFT–LCDwill end up back in the Ninth Circuit for consideration of adoption of a federal mediation privilege, similar to California’s.

1. There is an exception to mediation confidentiality to allow for the introduction of a written settlement agreement into evidence that requires, in part, that the agreement provide, “it is enforceable or binding or words to that effect.” Cal. Evid. Code § 1123(b).

2. The Honorable Barbara M. G. Lynn, United States Chief District Judge for the Northern District of Texas, sitting by designation, dissented, stating the analysis should focus on the claims pending when the admission of evidence is sought. As the federal claims had been settled at the time of Sony’s motion, the dissent reasoned the evidence could not have related to any federal claim and state law should have applied.

Chad A. Westfall is a partner with Musick, Peeler & Garrett in its San Francisco office. His full bio and contact information can be found at: http://musickpeeler.com/professional/Chad_Westfall/

applEcon helped a class of U.S. consumers to obtain settlements totaling $1.082 billion from a cartel of manufacturers of liquid crystal display (LCD) panels. LCD panels are flat video displays used in computer monitors, laptop computers, and televisions. The nine manufacturers that comprised the cartel supplied approximately 98% of the worldwide market for large LCD panels during the period the cartel operated, 1999-2006. Sales of LCD panels at issue to class members were approximately $23.5 billion during this period. Representatives of the cartel’s member companies, including senior executives, met about once a month for years to collude on capacity and output, and to fix prices.

The value of applEcon’s approach to such cases, combining deep knowledge of the industry and information available in the case with strong analytical skills, are highlighted by this engagement. In July 2011, defendants submitted nine separate expert reports all responding to Dr. Netz’s analysis. Given only three weeks to file a reply, applEcon analyzed and responded to these reports with factual and analytical evidence countering their various claims. The depth of applEcon’s knowledge of the industry led class counsel to also rely on applEcon to provide critical assistance on issues related to both the Foreign Trade Antitrust Improvements Act of 1982 (FTAIA) and ascertainability, both of which are primarily legal, as opposed to economic, matters. applEcon’s depth of knowledge also led other firms in related litigation to rely on us for our understanding of the massive volume of disparate data produced by the various defendants.

Over the course of the four and a half year engagement, applEcon supported class attorneys at virtually every stage of this complex case. applEcon submitted nine expert reports and affidavits and helped class attorneys address a wide range of issues, including: class certification, discovery, damages, pass-through of overcharges to indirect purchasers, class de-certification, cartel effectiveness and causation of antitrust harm, class members’ ability to ascertain their claims, a Daubert challenge, a motion to dismiss based on FTAIA, and responses to several additional motions for summary judgment. applEcon was preparing trial testimony when the last of the defendants, AUO, LG, and Toshiba, settled with the indirect purchaser class shortly before trial was to begin.

Suit was brought by representatives of a putative class of U.S. purchasers of products containing large LCD panels, alleging that the cartel caused the prices they paid for LCD products to be above competitive levels, in violation of U.S. antitrust laws. Attorneys for the indirect purchaser class faced a myriad of complications: an LCD panel may change hands several times as it passes from the LCD manufacturer to product manufacturers, distributors, and retailers before an end consumer ultimately takes it home as a component of a monitor, laptop, or television. Proof of antitrust harm required establishing that defendants overcharged their direct customers and that the cartel’s overcharges were passed through the length of the distribution chain resulting in elevated prices for end consumers purchasing products containing LCD panels. Calculating damages to end consumers required quantifying both the overcharge to direct purchasers as well as the pass-through rate.

Because the cartel members were based in foreign countries, class attorneys also faced the challenge of demonstrating that the cartel’s actions had a “direct, substantial, and reasonably foreseeable effect on domestic commerce” in order to meet FTAIA requirements. applEcon drew upon its extensive experience in demonstrating pass-through and common proof of damages as it helped attorneys for the class to meet these challenges. Judge Susan Illston relied on applEcon’s pass-through analyses when she certified the indirect purchaser class, and cited Dr. Netz’s pass-through testimony in her order denying Defendants’ motion to dismiss based on FTAIA, writing that the “increased price of the components caused the prices of finished products in the United States to increase. If that’s not ‘direct,’ it’s difficult to imagine what would be.”

Complications multiplied due to the fact that the conspiracy involved nine defendants based in three foreign countries, with multiple divisions across the globe, some involved in multiple stages of production. For example, Samsung was a producer of both LCD panels and televisions containing LCD panels. Whereas applEcon has long been accustomed to large, complex cases, with mountains of documents and data, we soon discovered that ordinary complications are compounded by multiple defendants, multiple teams of opposing attorneys and expert witnesses, and multiple datasets, each with unique characteristics. We enjoy developing systems that improve the efficiency of our operations, and methods we developed in previous complex litigation allowed us to meet the challenges of this case in a cost-effective manner.

SAN FRANCISCO (Reuters) - South Korea"s LG Electronics Inchas agreed to pay $380 million to resolve a civil lawsuit over price fixing in the liquid crystal display market, the largest amount paid among the ten companies who similarly settled the litigation, a court filing showed on Thursday.

A class action lawsuit alleged a detailed conspiracy from the late 1990s through 2006 to fix LCD prices, resulting in higher costs for buyers of televisions, laptops and other electronics. Several companies also pleaded guilty to separate criminal charges and paid fines.

An attorney for the plaintiffs on Wednesday disclosed a settlement involving LG, AU Optronics Corpand Toshiba Corp. According to Thursday"s court filing, AU Optronics will pay $170 million, while Toshiba will pay $21 million.

AUO representative Freda Lee said the settlement should not cause material impact to the company’s finance or business in the current or future reporting periods.

Toshiba spokeswoman Deborah Chalmers said the company “denies any wrongdoing on its part in the LCD business, and it entered into the settlement to avoid further expense and the distraction of protracted litigation.”

A deal involving the other seven companies, including Samsung, Sharp and Hitachi, had previously been approved. If the latest deal becomes final, the total recovery for class members will top $1 billion, according to the court filing.

applEcon helped a class of U.S. consumers to obtain settlements totaling $1.082 billion from a cartel of manufacturers of liquid crystal display (LCD) panels. LCD panels are flat video displays used in computer monitors, laptop computers, and televisions. The nine manufacturers that comprised the cartel supplied approximately 98% of the worldwide market for large LCD panels during the period the cartel operated, 1999-2006. Sales of LCD panels at issue to class members were approximately $23.5 billion during this period. Representatives of the cartel’s member companies, including senior executives, met about once a month for years to collude on capacity and output, and to fix prices.

The value of applEcon’s approach to such cases, combining deep knowledge of the industry and information available in the case with strong analytical skills, are highlighted by this engagement. In July 2011, defendants submitted nine separate expert reports all responding to Dr. Netz’s analysis. Given only three weeks to file a reply, applEcon analyzed and responded to these reports with factual and analytical evidence countering their various claims. The depth of applEcon’s knowledge of the industry led class counsel to also rely on applEcon to provide critical assistance on issues related to both the Foreign Trade Antitrust Improvements Act of 1982 (FTAIA) and ascertainability, both of which are primarily legal, as opposed to economic, matters. applEcon’s depth of knowledge also led other firms in related litigation to rely on us for our understanding of the massive volume of disparate data produced by the various defendants.

Over the course of the four and a half year engagement, applEcon supported class attorneys at virtually every stage of this complex case. applEcon submitted nine expert reports and affidavits and helped class attorneys address a wide range of issues, including: class certification, discovery, damages, pass-through of overcharges to indirect purchasers, class de-certification, cartel effectiveness and causation of antitrust harm, class members’ ability to ascertain their claims, a Daubert challenge, a motion to dismiss based on FTAIA, and responses to several additional motions for summary judgment. applEcon was preparing trial testimony when the last of the defendants, AUO, LG, and Toshiba, settled with the indirect purchaser class shortly before trial was to begin.

Suit was brought by representatives of a putative class of U.S. purchasers of products containing large LCD panels, alleging that the cartel caused the prices they paid for LCD products to be above competitive levels, in violation of U.S. antitrust laws. Attorneys for the indirect purchaser class faced a myriad of complications: an LCD panel may change hands several times as it passes from the LCD manufacturer to product manufacturers, distributors, and retailers before an end consumer ultimately takes it home as a component of a monitor, laptop, or television. Proof of antitrust harm required establishing that defendants overcharged their direct customers and that the cartel’s overcharges were passed through the length of the distribution chain resulting in elevated prices for end consumers purchasing products containing LCD panels. Calculating damages to end consumers required quantifying both the overcharge to direct purchasers as well as the pass-through rate.

Because the cartel members were based in foreign countries, class attorneys also faced the challenge of demonstrating that the cartel’s actions had a “direct, substantial, and reasonably foreseeable effect on domestic commerce” in order to meet FTAIA requirements. applEcon drew upon its extensive experience in demonstrating pass-through and common proof of damages as it helped attorneys for the class to meet these challenges. Judge Susan Illston relied on applEcon’s pass-through analyses when she certified the indirect purchaser class, and cited Dr. Netz’s pass-through testimony in her order denying Defendants’ motion to dismiss based on FTAIA, writing that the “increased price of the components caused the prices of finished products in the United States to increase. If that’s not ‘direct,’ it’s difficult to imagine what would be.”

Complications multiplied due to the fact that the conspiracy involved nine defendants based in three foreign countries, with multiple divisions across the globe, some involved in multiple stages of production. For example, Samsung was a producer of both LCD panels and televisions containing LCD panels. Whereas applEcon has long been accustomed to large, complex cases, with mountains of documents and data, we soon discovered that ordinary complications are compounded by multiple defendants, multiple teams of opposing attorneys and expert witnesses, and multiple datasets, each with unique characteristics. We enjoy developing systems that improve the efficiency of our operations, and methods we developed in previous complex litigation allowed us to meet the challenges of this case in a cost-effective manner.

Currently before the Court is defendants" joint motion to dismiss Proview"s Second Amended Complaint. Pursuant to Civil Local Rule 7-1(b), the Court finds these matters suitable for disposition without oral argument and therefore VACATES the hearings currently scheduled for March 22, 2013. Having considered the moving papers and the arguments of the parties, and for good cause appearing, the Court hereby GRANTS in part and DENIES in part Defendants" motion. Docket No. 7607.

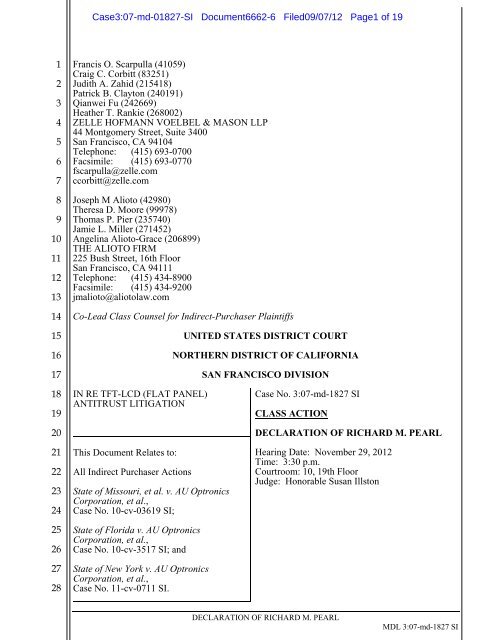

Plaintiffs include four entities: Proview Technology Inc. ("PTI"), a California corporation; and three of its affiliated Original Equipment Manufacturers ("OEMs") in Taiwan and China, Proview Technology Co., Ltd., Proview Group Limited, and Proview Optronics Co., Ltd. (collectively, "Proview OEMs"). PTI sells TFT-LCD products such as computer monitors and televisions to retailers in the United States. PTI receives the products from its affiliated OEMS through a process by which PTI instructs the Proview OEMs to purchase LCD Panels for delivery in Asia and manufacture into LCD products, which PTI purchases and imports into the United States. Second Amended Complaint ("SAC"), ¶¶ 14-15, 132-33. Plaintiffs filed this action on July 20, 2012, seeking to recover damages for a "a long-running conspiracy by manufacturers of liquid crystal display panels ("LCD Panels")." Complaint at ¶1. On October 17, 2012, Plaintiffs amended the complaint as of right, and on January 14, 2013, they further amended the complaint after seeking and receiving Defendants" consent. This Second Amended Complaint alleges that during the conspiracy period (January 1, 1996-December 11, 2006), plaintiffs directly and indirectly purchased LCD products from defendants and their co-conspirators. SAC, ¶ 2. As a result of defendants" and their co-conspirators" conspiracy, the complaint alleges, plaintiffs paid artificially-inflated prices for LCD panels. Id. Plaintiffs seek relief under the Sherman Act, the California Cartwright Act and Unfair Competition Laws, and an unjust enrichment theory. Id. at 160-78. Defendants move to dismiss Plaintiffs" claims based on a number of different theories, as detailed below.

Under Federal Rule of Civil Procedure 12(b)(6), a district court must dismiss a complaint if it fails to state a claim upon which relief can be granted. To survive a Rule 12(b)(6) motion to dismiss, the plaintiff must allege "enough facts to state a claim to relief that is plausible on its face." Bell Atl. Corp. v. Twombly, 550 U.S. 544, 570 (2007). This "facial plausibility" standard requires the plaintiff to allege facts that add up to "more than a sheer possibility that a defendant has acted unlawfully." Ashcroft v. Iqbal, 129 S.Ct. 1937, 1949 (2009). While courts do not require "heightened fact pleading of specifics," a plaintiff must allege facts sufficient to "raise a right to relief above the speculative level." Twombly, 550 U.S. at 544, 555.

In deciding whether the plaintiff has stated a claim upon which relief can be granted, the court must assume that the plaintiff"s allegations are true and must draw all reasonable inferences in the plaintiff"s favor. See Usher v. City of Los Angeles, 828 F.2d 556, 561 (9th Cir. 1987). However, the court is not required to accept as true "allegations that are merely conclusory, unwarranted deductions of fact, or unreasonable inferences." In re Gilead Scis. Sec. Litig., 536 F.3d 1049, 1055 (9th Cir. 2008).

If the court dismisses the complaint, it must then decide whether to grant leave to amend. The Ninth Circuit has "repeatedly held that a district court should grant leave to amend even if no request to amend the pleading was made, unless it determines that the pleading could not possibly be cured by the allegation of other facts." Lopez v. Smith, 203 F.3d 1122, 1130 (9th Cir. 2000) (citations and internal quotation marks omitted).

Defendants raise numerous challenges to Plaintiffs" SAC. In their Opposition, Plaintiffs do not oppose dismissal of certain claims alleged in the SAC, and thus, only four issues raised in the motion remain to be decided.1 First, Defendants argue that PTI, as an indirect purchaser, lacks standing to bring claims under the Sherman Act. Second, Defendants assert that the Proview OEMs, as foreign companies, are barred from bringing Sherman Act claims by the Foreign Trade Antitrust Improvements Act ("FTAIA"). Third, Defendants argue that PTI"s Cartwright Act claim does not comport with due process because no purchases were made within California. Lastly, Defendants argue that Plaintiffs" state claims are untimely, and their tolling theories do not cure the untimeliness.

Defendants argue that PTI lacks standing to pursue its Sherman Act claim because it indirectly purchased LCD products from the Proview OEMs and is thus barred by the "direct purchaser" rule in Illinois Brick Co. v. Illinois, 431 U.S. 720 (1977). Defendants allege that PTI cannot invoke the ownership/control exception to the Illinois Brick bar against standing for indirect purchasers, because it does not sufficiently allege "control" of the PTI OEMs by PTI. Defendants also allege that even if PTI were a direct purchaser, it never opted out of the DPP Class and therefore its claims have been extinguished by that action. Plaintiffs argue that PTI exercises sufficient control over the Proview OEMs to qualify for the ownership/control exception, and that Plaintiffs have sufficiently alleged this control in the SAC. See SAC, ¶¶ 14-15, 118, 132.

The ownership and control exception to the Illinois Brick bar against standing for indirect purchasers encompasses relationships involving "such functional economic or other unity between the direct purchaser and either the defendant or the indirect purchaser, that there effectively has been only one sale." Sun Microsystems, Inc. v. Hynix Semiconductor Inc., et al, 608 F.Supp.2d 1166, 1180 (N.D. Cal. 2009); see, e.g., Jewish Hosp. Ass"n v. Stewart Mech. Enters., 628 F.2d 971, 975 (6th Cir.1980); Royal Printing Co. v. Kimberly-Clark Corp., 621 F.2d 323, 326-27 (9th Cir.1980); In re Mercedes-Benz Anti-Trust Litig., 157 F.Supp.2d 355, 355 (D.N.J.2001) ("[T]he rationale of Illinois Brick"s bar to indirect purchaser suits does not apply where the supposed intermediary is controlled by one or the other of the parties"). The Ninth Circuit recently addressed the ownership and control exception in the context of the relationship between direct purchasers and defendants/co-conspirators. In Re ATM Fee Antitrust Litigation, 686 F.3d 741, 756-58 (9th Cir. 2012). The Court explained that "control" means "to exercise restraint or direction over; dominate, regulate, or command," United States v. Bennett, 621 F.2d 1131, 1139 n.2 (9th Cir. 2010) (quoting Webster"s College Dictionary 297 (Random House 1991)), or to have "the power or authority to guide or manage," id. (quoting Webster"s New Collegiate Dictionary 285 (9th ed. 1983)). ATM Fee, 686 F.3d at 757. The Ninth Circuit further described the "power or authority to guide or manage" that is required to demonstrate "the type of control necessary to meet the exception to Illinois Brick." Id. at 758. Paradigmatic examples of "situations where an ownership or control relationship between an indirect purchaser and a direct purchaser" may exist include parent-subsidiary relationships or one company"s stock ownership of another. Jewish Hosp. Ass"n, 628 F.2d at 975.

The Court finds that Plaintiffs" SAC fails to adequately allege that its claims fall within the control exception to Illinois Brick. Although Plaintiffs allege — conclusorily — that the Proview OEMs act as agents for PTI and that PTI has "control of" the Proview OEMs, the SAC fails to allege sufficient facts to support or explain the type of control exercised by PTI or to demonstrate that it is adequate to meet the exception. That PTI "instructed its affiliated OEMs . . . to purchase LCD panels" does not, by itself, demonstrate that PTI controlled the Proview OEMs. Accordingly, the Court GRANTS Defendants" motion to dismiss PTI"s Sherman Act claims and gives Plaintiffs leave to amend their complaint.2

Defendants argue that as foreign entities with no nexus to the U.S., the Proview OEMs made their direct purchases entirely in foreign commerce and are therefore barred by the FTAIA from bringing Sherman Act claims. Defendants argue that the Proview OEMs have failed to adequately plead any exception to FTAIA"s bar on foreign purchases, and that an amendment will not cure their claims in light of the fact that they did not opt out of the DPP Action. The Proview OEMs argue that the FTAIA does not bar its Sherman Act claims for "U.S.-related commerce not already included in PTI"s claims" because the alleged conspiracy "deliberately targeted the U.S. Market and involved both domestic and international conduct" and because the purchases were "based on contract terms and pricing negotiated by PTI specifically for U.S. bound LCD products." Opposition at 6. The Proview Plaintiffs largely rely on this Court"s orders in the Dell and Motorola cases. The Proview Plaintiffs argue that their claims are based on panel purchases which are "nearly identical" to the purchases by Dell and Motorola"s foreign affiliates, and that the Court should find here, as it did there, that the SAC adequately pleads an exception to the FTAIA.

The Court concludes that the Proview SAC does not allege enough facts to adequately plead an exception to the FTAIA. In both the Dell and Motorola cases, plaintiffs had alleged that a global price for all TFT-LCD products purchased from defendants had been negotiated in the U.S. at Dell"s and at Motorola"s U.S. offices. The Providew Plaintiffs" SAC does not allege similar facts. At most, the SAC alleges that "[t]he prices Plaintiffs used in purchase orders placed with Defendants were based on price and quantity determinations based on U.S. Negotiations." SAC, ¶¶ 136. The Court does not find this clear enough or specific enough to allege a domestic effect to qualify for an exception to the FTAIA. The lack of specificity is exacerbated by the SAC"s allegations that Defendants met with the Proview OEMs" representatives in Asia to negotiate contract terms and pricing. Id. at ¶ 134. Further, unlike the Dell and Motorola complaints, the SAC does not identify whether any "price and quantity determinations based on U.S. Negotiations" were binding on the Proview OEMs. Accordingly, the Court concludes that Plaintiffs have not alleged sufficient facts to bring the Proview OEMs" Sherman Act claims within the domestic injury exception to the FTAIA and GRANTS Defendants" motion to dismiss the Proview OEMs" Sherman Act claims on this ground, with leave to amend the complaint.

Defendants seek to dismiss Plaintiffs" state law claims on the grounds that they are time-barred and are barred by due process concerns. Because Plaintiffs concede that the Proview OEMs" state law claims are not tolled by class action tolling, they are untimely; only PTI"s state law claims remain to be decided.

Defendants argue that PTI"s Cartwright Act and UCL claims are untimely. Plaintiffs filed suit on July 20, 2012, some 5-1/2 years after the DOJ"s December 11, 2006 announcement of its investigation into the conspiracy. Because these claims have four-year statutes of limitations, Defendants contend that Plaintiffs" claims are untimely unless tolled; and they challenge the factual adequacy of the allegations supporting the various tolling theories alleged in the SAC. Plaintiffs conceded that certain claims were untimely and that certain tolling theories were inapplicable,3 but argue that PTI"s state law claims were tolled to the extent identified in this Court"s Order involving ViewSonic. See Docket No. 7255. In that Order, the Court found that ViewSonic, a reseller, could rely on the filings of Hee v. LG Philips LCD Co. Ltd. and Selfridge v. LG Philips Co., Ltd., to toll its California claims, but the tolling was limited to the defendants, products, and conspiracy periods identified in the Hee, Selfridge, and IPP-CAC actions. PTI contends that application of the same tolling principles to its complaint renders its claims timely.

The Court concludes that like ViewSonic, PTI may rely on Hee and Selfridge to toll its state claims, but the tolling will similarly be limited to the defendants, products, and conspiracy periods identified in Hee, Selfridge, and the IPP-CAC. Accordingly, the Court DENIES Defendants" motion to dismiss PTI"s state law claims on the grounds that they are barred by the statute of limitations.

Defendants argue that PTI has failed to make sufficiently individualized allegations of each Defendants" alleged conspiratorial activity, in light of the Ninth Circuit"s recent decision in AT&T Mobility LLC v. AU Optronics Corp., and its order directing that due process must be analyzed on an individualized, defendant-by-defendant basis. No. 11-16188, 2013 WL 540859 (9th Cir. Feb. 14, 2013). The Court agrees.

In AT&T Mobility, the Ninth Circuit held, "the Cartwright Act can be lawfully applied without violating a defendant"s due process rights when more than a de minimis amount of that defendant"s alleged conspiratorial activity leading to the sale of price-fixed goods to plaintiffs took place in California." AT&T Mobility LLC, at *6. The Court remanded to this Court to make an individual assessment "with respect to each Defendant as to whether Plaintiffs have alleged sufficient conspiratorial conduct within California, that is not `slight and casual," such that the application of California law to that Defendant is `neither arbitrary nor fundamentally unfair."" Id. at *7 (emphasis added). Based on the Ninth Circuit"s holding, the Court concludes that Plaintiffs must adequately allege conspiratorial conduct of each Defendant in California. Accordingly, because the SAC fails to do this, the Court GRANTS Defendants" motion to dismiss PTI"s Cartwright Act claims on due process grounds, and the Court gives Plaintiffs leave to amend the complaint.

Defendants challenged Plaintiff"s unjust enrichment claims for a number of reasons, including its timeliness. Plaintiffs concede that any claim for unjust enrichment is time-barred. See Opposition at 2, n.1. Accordingly, the Court GRANTS Defendants" motion to dismiss Plaintiffs" unjust enrichment claim.

For the foregoing reasons and for good cause shown, the Court hereby GRANTS in part and DENIES in part Defendants" joint motion. Any amended complaint must be filed by April 5, 2013. Docket No. 7607.

Defendants in indirect purchaser price-fixing and market allocation cases in federal court frequently challenge plaintiffs" claims for lack of antitrust standing.

Relying on the U.S. Supreme Court decision in Associated General Contractors of California v. California State Council of Carpenters,[1] defendants assert that such plaintiffs" injuries are too remote from the defendants" unlawful conduct or are not the type of injury the antitrust laws were intended to prevent.

Since we last addressed this topic in a 2012 Law360 Associated General Contractors, or AGC, case should be applied to indirect purchaser state law claims and, if applied, how to do so.

This article reviews court decisions that may portend diminished application of AGC to state law and others that make clear that practitioners" grasp of what is required to plead antitrust injury under AGC in indirect purchaser cases remains essential.

AGC directed federal courts to apply a five-factor test to "evaluate the plaintiff"s harm, the alleged wrongdoing by the defendants, and the relationship between them to determine whether a plaintiff is a proper party to bring an antitrust claim."[3]

(1) the nature of the plaintiff"s alleged injury; that is, whether it was the type the antitrust laws were intended to forestall; (2) the directness of the injury; (3) the speculative measure of the harm; (4) the risk of duplicative recovery; and (5) the complexity in apportioning damages.[4]

Since the Supreme Court decision in Illinois Brick Co. v. Illinois, which limited indirect purchasers" claims for damages under federal antitrust law, indirect purchasers in federal court generally rely on state antitrust and consumer protection statutes, i.e., from states known as Illinois Brick repealers, when asserting damages claims.

While AGC is the product of federal law, antitrust injury or standing under state law is a matter of state law, and "[s]tates are free to expand antitrust standing under their laws beyond what federal law permits."[5] Thus, courts must first determine whether, and to what extent, AGC has any application under the state"s antitrust laws.[6]

We previously reported that the vast majority of courts have (1) questioned the broad application of AGC to indirect purchaser claims under state law, (2) held that the relevant state"s rules of antitrust standing should be applied, and (3) held that AGC should not be applied in the absence of a clear directive from those states" legislatures or highest courts.[7]

With few exceptions, courts have continued to follow these guidelines in form or substance.[8] Recently, however, courts have gone further and drawn bright-line rules regarding the inapplicability of AGC to state-law antitrust claims.

Courts have recently recognized that, given the Supreme Court"s decision inCalifornia v. ARC America Corp.,[9] any state legislative or court decision to repeal Illinois Brick fundamentally conflicts with the application of AGC to state-law antitrust claims. These courts have held that AGC should not apply in Illinois Brick repealer states, while others have held that if applied, AGC does not defeat antitrust injury in Illinois Brickrepealer states.

The most emphatic statement of this bright-line rule can be found in In re: Broiler Chicken Antitrust Litigation, a sprawling multidistrict litigation involving indirect purchaser classes from numerous states alleging that defendant producers of chicken meat conspired to fix prices.

The indirect purchaser plaintiffs alleged violations of state antitrust laws and defendants moved to dismiss for lack of antitrust standing. In analyzing whether AGC applied to these claims, the court reviewed decisions of the highest courts in four of theIllinois Brickrepealer states at issue in the case.

The court reasoned that AGC"s proximate cause analysis "borrows from Illinois Brick"s concern with the unwieldy nature of indirect purchaser damages suits" and that enactment of "Illinois Brick repealers work[s] to save indirect purchaser damages suits, even from application of the AGC factors."[11]

The court called out a statement by the Minnesota Supreme Court that: "[b]y expressly permitting indirect purchaser suits, our legislature has rejected the notion that Minnesota courts are not to be burdened with the complex apportionment inherent in those suits."[12]

The court further reasoned that harmonization statutes passed by some states (i.e., "laws that require a state"s courts to interpret the state"s antitrust statutes in harmony with federal law") are not a basis to apply the AGC factors because such statutes do "not prevent the courts in those states from recognizing that Illinois Brick repealers work to save the claims of true indirect purchasers, like the Indirect Plaintiffs in this case."[13]

A similar holding can be found in the U.S. District Court for the District of New Jersey matter, In re: Liquid Aluminum Sulfate Antitrust Litigation, in which indirect purchasers of liquid aluminum sulfate, or Alum, sued manufacturers of Alum for price-fixing under 33 states" antitrust and consumer protection laws.[14]

The court, relying on ARC America and without engaging in any state-by-state analysis of whether AGC should be applied, held that the indirect purchaser plaintiffs "have pled facts sufficient to support antitrust standing under each of the state-specific antitrust statutes."[15]

Courts that have applied AGC to state-law antitrust claims have recognized essentially the same bright-line rule, i.e., that application of AGC to state antitrust law should not preclude claims in repealer states.

The U.S. District Court for the Eastern District of Pennsylvania in the In re: Suboxone (Buprenorphine Hydrochloride And Naloxone) Antitrust Litigation rejected the defendants" claim that indirect purchasers of the drug suboxone lacked antitrust standing.

The court reasoned that in Illinois Brick repealer states, AGC"s directness of injury factor "must either carry significantly less weight or directness must be analyzed more generously than under federal law," as it "would be inconsistent for a state to allow indirect purchasers to bring antitrust claims, only for the courts to cursorily dismiss those claims on antitrust standing grounds simply because they have been brought by indirect purchasers."[16]

The court held that "even applying the AGC factors, the End Payors have standing to bring antitrust claims under the state laws that have passed Illinois Brick repealer statutes."[17] A similar analysis can be found in the U.S. District Court for the Northern District of California decision In re: Lithium Ion Batteries Antitrust Litigation.[18]

These decisions recognize the incongruity of applying federal antitrust standing rules that focus on the directness of injury to state laws enacted to protect indirect purchasers. While it remains to be seen whether these authorities have started a broader trend, they are positive news for indirect purchaser plaintiffs facing antitrust standing challenges in federal court.

The Northern District of California has frequently addressed whether AGC should be applied to California antitrust law. While an early decision appliedAGC to bar indirect purchaser claims under California law,[19] that decision was later rejected by other courts.[20] Since our last report, numerous cases within[21] and without[22] the Northern District of California have held that AGC should not be applied to California law.

In the In re: Capacitors Antitrust Litigation, for example, the Norther District of California refused to apply AGC to California law, rejecting defendants" argument that California"s legislature or highest court has "indicated that federal antitrust law should be followed in determining standing."[23]

The court also emphasized recent California Supreme Court pronouncements that federal antitrust law interpretations are instructive at most, and not conclusive, as well as the U.S. Court of Appeals for the Ninth Circuit"s recognition that it is no longer the law in California that "the interpretation of California"s antitrust statute [is] coextensive with the Sherman Act."[24]

Another recent AGC-related development pertaining to California"s antitrust laws is the recognition that so-called umbrella damages are not barred by California"s Cartwright Act and that indirect purchasers seeking such damages may have antitrust standing under California law, whether AGC is applied or not.

Umbrella damages may be claimed "when a group of conspirators sets the price of a product at an artificially high level, a price umbrella is created that spreads throughout the market," and "nonconspirator sellers uninvolved in the anticompetitive conduct correspondingly raise prices."[25]

In County of San Mateo v. CSL Limited, the plaintiff alleged that manufacturers of blood plasma products conspired to restrict product supply and caused inflated prices for those products sold both by defendants and by nondefendants not alleged to have participated in the conspiracy.[26]

On the defendants" motion for partial summary judgment, the court ruled that umbrella damages sought by an indirect purchaser several steps down the chain of distribution from the defendants are not too speculative under California"s Cartwright Act and, for the same reasons, are not too speculative under the criteria set out in AGC.[27] A similar recent holding can be found in the U.S. District Court for the Eastern District of Pennsylvania decision In re: Domestic Drywall Antitrust Litigation.[28]

Since our last report, courts have more broadly recognized "that AGC should [not] be applied to a repealer statute based solely upon a general harmonization provision therein."[29] For example, the court in Lithium Ion Batteriesrecognized that "simply because a state statute encourages reference to federal law does not impose a mandate on state courts to conform in fact to federal law."[30]

Nevertheless, as more courts have taken on the task of deciphering dozens of states" laws on antitrust standing, some have applied AGC based solely on a harmonization provision.[31]

While courts have developed bright-line rules precluding the application of AGC to antitrust claims premised on state law, others have applied some form of AGC to certain states" antitrust laws or have simply assumed, arguendo, that AGC applies. These cases shed light on what product and market characteristics should be addressed to plead or prove antitrust standing under AGC.

Where an allegedly price-fixed stand-alone product travels essentially unchanged through the chain of distribution to indirect purchaser plaintiffs, defendants" arguments that the indirect purchasers are participating in a separate market and have no standing, generally, have continued to be unavailing.[32]

One exception to this broader conclusion is the U.S. District Court for the Southern District of New York decision In re: Keurig Green Mountain Single-Serve Coffee Antitrust Litigationcase, which involved Keurig Dr. Pepper Inc."s K-cups that remained unchanged through the chain of distribution.[33] Notably, that decision appeared to hinge on a lack of detailed allegations about the chain of distribution and pass-through.[34]

Where the indirect purchaser plaintiffs purchase allegedly price-fixed component products subsumed within another product, antitrust standing under AGC continues to be found when one or more of the following key product or market characteristics are alleged: The markets for the components and end products: Are "inextricably linked and intertwined" in that the component products "have no independent utility and have value only as components for other products;"[35] and/or

Component part prices can be traced to show that changes in the prices paid by direct purchasers of the component affect prices paid by indirect purchasers of products containing the components.[38]

In addition, the sprawling U.S. District Court for the Eastern District of Michigan decision In re: Automotive Parts Antitrust Litigation repeatedly addressed antitrust standing at the pleading stage and established that the fact that a component represents a small portion of the value of a finished product does not defeat antirust standing.[40]

As shown above, the applicability of AGC to antitrust standing under state antitrust law continues to evolve. Practitioners prosecuting or defending antitrust actions should carefully consider these recent trends and their impact on what is required to meet this threshold requirement under state laws.

The opinions expressed are those of the author(s) and do not necessarily reflect the views of the firm, its clients, or Portfolio Media Inc., or any of its or their respective affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal advice.

[2] We previously addressed these issues in 2012. See Competition Law360, Emerging Trends in Indirect Purchaser Cases by Chris Micheletti and Patrick Clayton, Jan. 19, 2012, available at https://www.law360.com/articles/298578/emerging-trends-in-indirect-purchaser-antitrust-cases.

[5] In re Lithium Ion Batteries Antitrust Litig. ("Batteries"), No. 13-MD-2420 YGR, 2014 WL 4955377, at *7 (N.D. Cal. Oct. 2, 2014) (emphasis in orig.) (citing Lorix v. Crompton Corp., 736 N.W.2d 619, 627 (Minn. 2007) and California v. ARC America ("ARC America"), 490 U.S. 93, 105-06 (1989)).

[7] See Emerging AGC Trends, n.5 (citing, among other cases, Stanislaus Food Products Co. v. USS–Posco Industries, 782 F. Supp. 2d 1059, 1070-72 (E.D. Cal. 2011) ("Stanislaus Food Products") (applying principles of antitrust standing under California"s Cartwright Act to indirect purchaser claims);In re Cathode Ray Tube (CRT) Antitrust Litig. ("CRTs"), 738 F. Supp. 2d 1011, 1024 (N.D. Cal. 2010) (application of AGC is a question of state law); In re Flash Memory Antitrust Litig. ("Flash"), 643 F. Supp. 2d 1133, 1151-53 (N.D. Cal. 2009) (holding that the applicability of AGC is a question of state law and questioning whether "a state"s harmonization provision, whether created by statute or common law, is an appropriate means of predicting how a state"s highest court would rule regarding the applicability of AGC"); In re: TFT-LCD (Flat Panel) Antitrust Litig. ("TFT-LCD (Flat Panel)"), 586 F. Supp. 2d 1109, 1123 (N.D. Cal. 2008) ("it is inappropriate to broadly apply the AGC test to plaintiffs" claims under the repealer states" laws in the absence of a clear directive from those states" legislatures or highest courts"); In re Graphics Processing Units Antitrust Litig., 527 F. Supp. 2d 1011, 1026 (N.D. Cal. 2007) ("Standing under each state"s antitrust statute is a matter of that state"s law. It would be wrong for a district judge, in ipse dixit style, to bypass all state legislatures and all state appellate courts and to pronounce a blanket and nationwide revision of all state antitrust laws"); D.R. Ward Constr. Co. v. Rohm and Haas Co., 470 F. Supp. 2d 485, 494-96 (E.D. Pa. 2006) (the court "finds that it need not use the AGC factors as the framework for analyzing whether federal prudential considerations permit standing under [state] antitrust statutes, unless relevant state law adopts these factors"); In re Aftermarket Filters Antitrust Litig., No. 08 C 4883, 2009 WL 3754041, at *7 (N.D. Ill. Nov. 5, 2009) ("any decision on whether a state has adopted the use of federal precedent in general, and the AGC factors in particular, to determine antitrust standing must be made on a state by state basis")).

[8] See, e.g.,In re Broiler Chicken Antitrust Litig., 290 F. Supp. 3d 772, 814-15 (N.D. Ill. 2017) ("In deciding whether to apply AGC to state-law antitrust claims, the Court will look to whether the relevant state high court or state legislature has spoken on the issue."); Los Gatos Mercantile, Inc. v. E.I. DuPont De Nemours and Co. ("Los Gatos Mercantile"), No. 13–cv–01180–BLF, 2015 WL 4755335, at *18-19 (N.D. Cal. Aug. 11, 2015) (holding that "this Court will apply AGC to claims brought under state antitrust laws whenever the state"s legislature, highest court, or intermediate court expressly has adopted AGC," and will not apply AGC based on "state court decisions indicating generally that federal law is consistent with or may inform interpretation of state antitrust statutes," or based on "a general harmonization provision in the state statute."); In re Pool Prod. Distribution Mkt. Antitrust Litig. ("Pool Prod. Distribution Mkt."), 946 F. Supp. 2d 554, 564 (E.D. La. 2013) (rejecting defendants" argument that "federal courts and inferior California courts" applied AGC and holding that "AGC factors apply to standing inquiries under state antitrust laws only to the extent that a state has adopted them.").

[9] The Supreme Court in California v. ARC America rejected a preemption challenge to Illinois Brick repealer provisions, and affirmed the right of the states to provide indirect purchasers with economic redress for their antitrust injuries. 490 U.S. 93 (1989).

[18] In Batteries, the court articulated a narrow view of when AGCshould be applied, reasoning, in part, that "even where some states" courts have specifically invoked AGC, they have perceived in their respective legislatures" passage of Illinois Brick repealer statutes an intent to extend antitrust standing to indirect purchasers and, accordingly, modified, or indicated they would modify, their application of AGC principles to accommodate indirect-purchaser suits more readily." 2014 WL 4955377, at *9; see also Los Gatos Mercantile, 2015 WL 4755335, at *18 (noting that the Batteries court took "a narrower approach" than requiring "clear direction from the state"s legislature or highest court" when it held that AGC could be applied "only when it can be determined that the state"s legislature or highest court would apply AGC in the same manner as it is applied by the federal courts").

[19] In re Dynamic Random Access Memory (DRAM) Antitrust Litig., 516 F. Supp. 2d 1072 (N.D. Cal. 2007) and DRAM II, 536 F. Supp. 2d 1129 (N.D. Cal. 2008).

[21] Batteries, 2014 WL 4955377, at *10-11 (stating after detailed analysis that "the Court cannot conclude on the authorities now before it that California applies AGC in the manner urged by defendants"). See alsoSidibe v. Sutter Health, No. C 12-04854 LB, 2013 WL 2422752, at *16 (N.D. Cal. June 3, 2013) (noting that courts in N.D. Cal. have reached different results, but that "[t]he court"s view is that the cases that do not require [application of the AGC] factors are persuasive.").

[22] See Broiler Chickens, 290 F. Supp. 3d at 816 n.15 (holding that AGC"s requirements are not applicable to California antitrust law because its Supreme Court has recognized that "California"s antitrust statute is "broader in range and deeper in reach that then [sic] Sherman Act"") (quoting In re Cipro Cases I & II, 61 Cal. 4th 116 (2015); In re Keurig Green Mountain Single-Serve Coffee Antitrust Litig. ("Keurig"), 383 F. Supp. 3d 187, 258 (S.D.N.Y. 2019) ("Although Vinci favorably cites AGC, subsequent cases from the Supreme Court of California cast doubt on the applicability of the AGC factors under California law. ... I cannot conclude, therefore, that the Supreme Court of California would apply the AGC factors in accordance with federal precedents, if at all, to determine indirect purchaser antitrust standing under the Cartwright Act."); Pool Prod. Distribution Mkt., 946 F. Supp. 2d at 564 ("These authorities cannot overcome the California Supreme Court"s decision in Clayworth to allow suit by indirect purchasers under the Cartwright Act and the UCL without applying the AGC factors."); but seeIn re Dairy Farmers of America, Inc. Cheese Antitrust Litig. ("Dairy Farmers"), No. 9 CV 3690, 2015 WL 3988488, at *8 (N.D. Ill. June 29, 2015).

[27] The court first reasoned that "[t]he California Legislature, unlike the United States Supreme Court, does not believe that a plaintiff"s attempt to estimate overcharges incurred through a multi-tiered distribution chain is unacceptably speculative and complex; rather, the California Legislature has expressly allowed such claims." Id. at *5. The court then explained that because "umbrella damages ... are calculated the same way as indirect purchaser non-umbrella damages," they "cannot be categorically barred under the Cartwright Act for failing to meet Illinois Brick"s benchmark for speculation and complexity." Id. The court then held that, even assuming AGC applies, "for the same reasons it is possible for Plaintiff to produce non-speculative evidence that Defendants" conduct caused a price umbrella, the Court concludes that the speculative nature of the alleged harm does not warrant a finding that Plaintiff lacks standing." Id. at *6.

[28] MDL No. 13-2437, 2019 WL 4918675 (E.D. Pa. Oct. 3, 2019). In Drywall, indirect purchasers of drywall alleged price-fixing claims under the California Cartwright Act against the defendant co-conspirators, and also sought damages for drywall purchased from non-conspirator manufacturers. Id. at *2. The court held that "[t]he Cartwright Act does not bar umbrella damages as a matter of law," rejected application of AGC, and held that the plaintiffs had antitrust standing. Id. at *9 (analyzing Cty. of San Mateo, CRT, and In re TFT-LCD Antitrust Litig., No. 07-1827, 2012 WL 6708866, at *8 (N.D. Cal. Dec. 26, 2012)). The court reasoned that "the Cartwright Act does not expressly prohibit umbrella damages (indeed, at least two federal courts interpreting the Act have concluded it does not, as a matter of law, bar plaintiffs from pursuing this theory), and . . . California judicial construction of the harmonization doctrine does not require application of the federal rule barring umbrella damages." Id. at

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey