flexible display screens ready for mass production manufacturer

Founded by a Stanford PhD graduate, Royole has designed and is starting to mass-produce a super-thin flexible screen that could be used in everything from t-shirts to portable speakers.

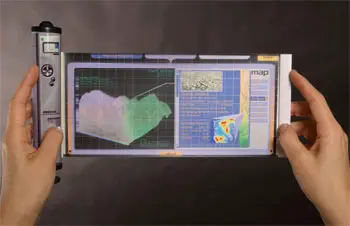

It"s the stuff of science fiction, and plenty of tech trade shows — a screen so thin and flexible that it can be rolled up into a cylinder as small as a cigarette or hung on a wall like wallpaper.

Royole just opened a new factory in China that is already mass producing the displays, and the company is working with partners to get them installed in everything from t-shirts to automobiles to smartphones.

Royole"s screens are based on OLED technology, in which the lighting elements are built into the display itself. Unlike the OLED screens that are in some higher-end televisions, which are typically placed on a rigid base like glass, the lighting elements in Royole"s screens are placed on a flexible plastic base, so they can bend or roll up.

"The cool thing here is that we"re not limited by the form factor of the surface," said Liu, who founded Royole with some friends from Stanford after graduating from there with a PhD in electrical engineering. "They could be anywhere."

Royole, which was founded in 2012 and has raised $1.1 billion in funding, just brought its new factory online in June. The plant will be able to produce up to 50 million panels a year once it"s at full capacity, Liu said. That could help it feed a potentially burgeoning market for bendable gadgets.

Researchers have been trying to develop flexible screen technology since at least the early 1970s — first in the form of monochrome displays that were intended to replace printed pages, and then, much later, in the form of color ones that might replace the screens in TV or portable devices.

For much of the last decade, display makers including Samsung and LG have been showing off their flexible OLED screens and prototype of products made with them at trade shows.

Samsung"s Galaxy Round, a relatively obscure smartphone that came out that year, was one of the first gadgets that used a flexible screen way back in 2013. Because the display was placed behind a fixed plate of glass, so you couldn"t really tell that it was bendable. The only clue was that the front of the phone was concave.

Other smartphones since the Galaxy Round have also employed flexible displays, including the LG G Flex and the Edge versions of the Samsung Galaxy S and Galaxy Note lines. More recently, the screens have started to make their way into even mainstream devices. Apple"s iPhone X, for example, has a flexible display behind its famously notched screen.

They were "a disappointing application of what that the technology could do," said Raymond Soneira, CEO of DisplayMate, a consulting firm for the display and TV industries.

Neither businesses nor consumers were ready for bendable or foldable gadgets when the first flexible displays started rolling off production lines five years ago, analysts said. Electronics makers generally hadn"t set up their supply chains to accommodate them or figured out how they might be able to take advantage of the screens" properties in new products. Apps hadn"t been written specifically for devices with bendable screens. And nobody had laid the groundwork for new kinds of flexible gadgets by marketing them to consumers.

Things may be different now. Next year, Samsung will reportedly introduce a phone with a foldable screen that"s built around its flexible display technology. Apple reportedly has a foldable phone in the works, too.

"You can"t make [phones] much bigger … and have them be carried by most consumers," Soneira said. "So you"ve got to move up to foldable, even rollable screens."

The release of foldable screen phones and other gadgets from major manufacturers will likely spur developers to start making apps designed specifically around those features. It"s also likely to inspire demand for other devices that take advantage of the properties of bendable screens.

Flexible screens will likely get their start by replacing other screens in devices we already recognize, including not just smartphones, but computer monitors and laptop computers, allowing manufacturers to make models that are slightly more innovative or resilient, said Ryan Martin, a principal analyst at ABI Research. But eventually, manufacturers are likely to get a lot more creative with them.

A flexible display "changes the realm of design as well as design thinking," Martin said. "You"re no longer confined to the four corners of a screen. You can make things more abstract."

At CES, the giant electronics trade show held in Las Vegas every January, LG has shown off a prototype for a car dashboard in which the speedometer, tachometer and other other gauges and buttons are displayed virtually on flexible screens that could be shaped to the contours of a car"s interior.

Although the company is going up against some of the biggest electronics companies around in LG and Samsung, Royole"s got several advantages, Liu said. Its displays are built on its own proprietary technology for which it has filed numerous patents, he said. That technology allows it to build screens that are a tenth as thick as those of competitors.

What"s more, because it"s using a different methodology for building its screens, it was able to get its factory up and running for about $1 billion, which is far less than what it would cost its competitors, he said.

The first devices with Royole"s screens should start showing up later this year. The company plans to sell T-shirts and hats with its flexible displays built in. Soon thereafter, it expects marketers to start using its screens to display advertisements in elevators, airports, shopping malls, and other places.

From there, the screens should start making its way into other products, both traditional and new, Liu said. When purchased in volume, they should be competitive in price to other types of displays, he said.

Our sheet-to-sheet screen printing process enables rapid prototyping with great flexibility. Multiple display design options can be manufactured simultaneously at no additional cost, provided they fit in the same printing toolset. We will provide support throughout the entire prototyping process with design for mass production in mind.

Kateeva’s YIELDjet system (pictured here) is a massive version of an inkjet printer. Large glass or plastic substrate sheets are placed on a long, wide platform. A head with custom nozzles moves back and forth, across the substrate, coating it with OLED and other materials.

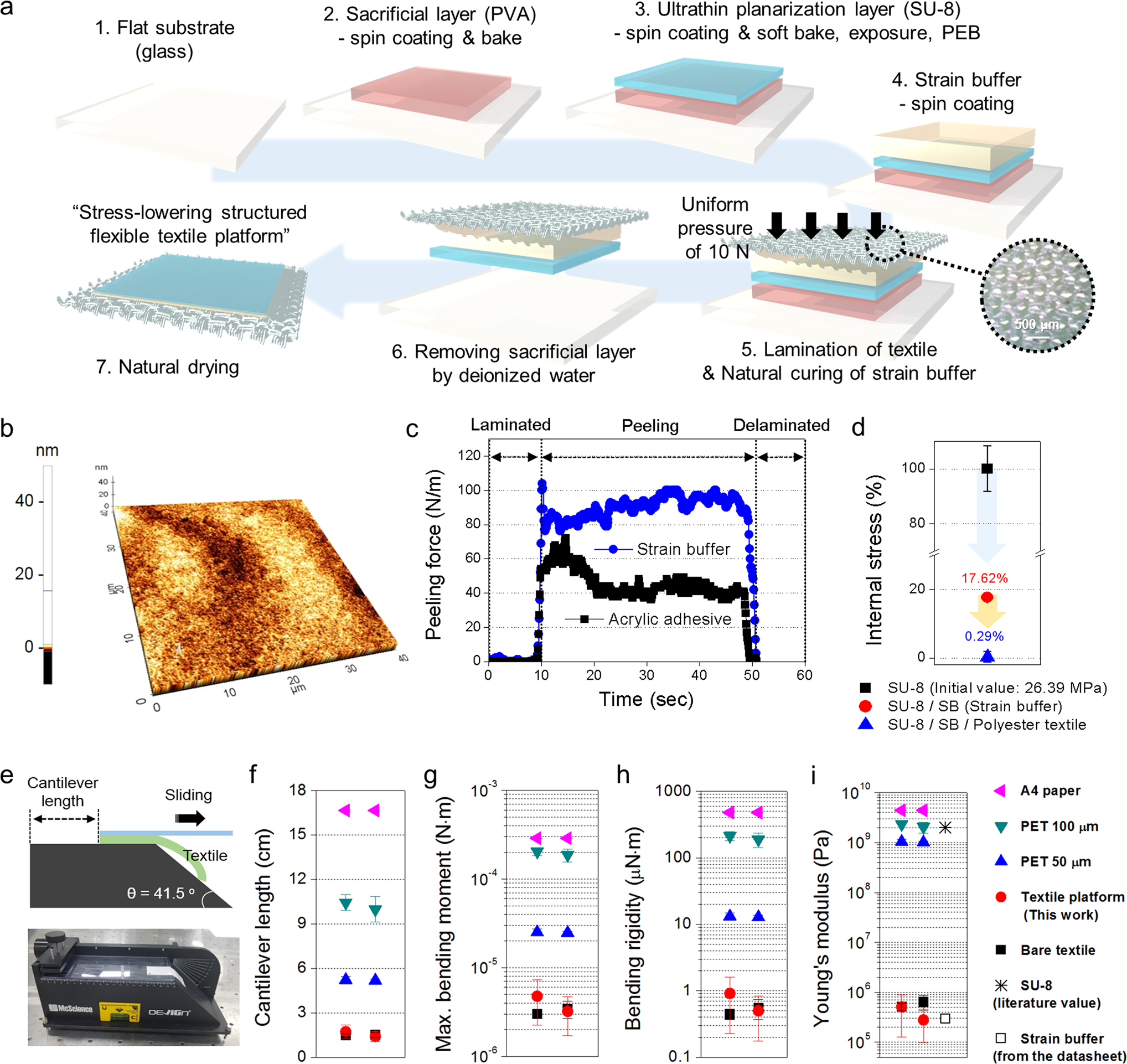

Based on years of Institute research, MIT spinout Kateeva has developed an “inkjet printing” system that could cut manufacturing costs enough to pave the way for mass-producing flexible and large-screen OLED displays.

Flexible smartphones and color-saturated television displays were some highlights at this year’s Consumer Electronics Showcase, held in January in Las Vegas.

Many of those displays were made using organic light-emitting diodes, or OLEDs — semiconducting films about 100 nanometers thick, made of organic compounds and sandwiched between two electrodes, that emit light in response to electricity. This allows each individual pixel of an OLED screen to emit red, green, and blue, without a backlight, to produce more saturated color and use less energy. The film can also be coated onto flexible, plastic substrates.

But there’s a reason why these darlings of the showroom are not readily available on shelves: They’re not very cost-effective to make en masse. Now, MIT spinout Kateeva has developed an “inkjet printing” system for OLED displays — based on years of Institute research — that could cut manufacturing costs enough to pave the way for mass-producing flexible and large-screen models.

In doing so, Kateeva aims to “fix the last ‘Achilles’ heel’ of the OLED-display industry — which is manufacturing,” says Kateeva co-founder and scientific advisor Vladimir Bulovic, the Fariborz Maseeh Professor of Emerging Technology, who co-invented the technology.

Called YIELDjet, Kateeva’s technology platform is a massive version of an inkjet printer. Large glass or plastic substrate sheets are placed on a long, wide platform. A component with custom nozzles moves rapidly, back and forth, across the substrate, coating it with OLED and other materials — much as a printer drops ink onto paper.

An OLED production line consists of many processes, but Kateeva has developed tools for two specific areas — each using the YIELDjet platform. The first tool, called YIELDjet FLEX, was engineered to enable thin-film encapsulation (TFE). TFE is the process that gives thinness and flexibility to OLED devices; Kateeva hopes flexible displays produced by YIELDjet FLEX will hit the shelves by the end of the year.

The second tool, which will debut later this year, aims to cut costs and defects associated with patterning OLED materials onto substrates, in order to make producing 55-inch screens easier.

By boosting yields, as well as speeding up production, reducing materials, and reducing maintenance time, the system aims to cut manufacturing costs by about 50 percent, says Kateeva co-founder and CEO Conor Madigan SM ’02 PhD ’06. “That combination of improving the speed, improving the yield, and improving the maintenance is what mass-production manufacturers want. Plus, the system is scalable, which is really important as the display industry shifts to larger substrate sizes,” he says.

Traditional TFE processing methods enclose the substrate in a vacuum chamber, where a vapor of the encapsulating film is sprayed onto the substrate through a metal stencil. This process is slow and expensive — primarily because of wasted material — and requires stopping the machine frequently for cleaning. There are also issues with defects, as the coating that hits the chamber walls and stencil can potentially flake off and fall onto the substrate in between adding layers.

But moisture, and even some air particles, can sneak into the chamber, which is deadly to OLEDs: When electricity hits OLEDs contaminated with water and air particles, the resulting chemical reactions reduce the OLEDs’ quality and lifespan. Any displays contaminated during manufacturing are discarded and, to make up for lost yield, companies boost retail prices. Only two companies now sell OLED television displays, with 55-inch models selling for $3,000 to $4,000 — about $1,000 to $3,000 more than their 55-inch LCD and LED counterparts.

YIELDjet FLEX aims to solve many TFE issues. A key innovation is encasing the printer in a nitrogen chamber, cutting exposure to oxygen and moisture, as well as cutting contamination with particles — notorious for diminishing OLED yields — by 10 times over current methods that use vacuum chambers. “Low-particle nitrogen is the best low-cost, inert environment you can use for OLED manufacturing,” Madigan says.

In its TFE process, the YIELDjet precisely coats organic films over the display area as part of the TFE structure. The organic layer flattens and smoothes the surface to provide ideal conditions for depositing the subsequent layers in the TFE structure. Depositing onto a smooth, clean surface dramatically improves the quality of the TFE structure, enabling high yields and reliability, even after repeated flexing and bending, Madigan says.

Kateeva’s other system offers an improvement over the traditional vacuum thermal evaporation (VTE) technique — usually somewhere in the middle of the production line — that uses shadow masks (thin metal squares with stenciled patterns) to drop red, green, and blue OLED materials onto a substrate.

This isn’t necessarily bad for making small, smartphone screens: “If a substrate sheet with, say, 100 small displays on its surface has five defects, you may toss five, and all the rest are perfect,” Madigan explains. And smaller shadow masks are more reliable.

But manufacturers start to lose money when they’re tossing one or two large-screen displays due to particle contamination or defects across the substrate.

Kateeva’s system, which, like its TFE system, is enclosed in a nitrogen chamber, precisely positions substrates — large enough for six 55-inch displays — beneath print heads, which contain hundreds of nozzles. These nozzles are tuned to deposit tiny droplets of OLED material in exact locations to create the display’s pixels. “Doing this over three layers removes the need for shadow masks at larger scales,” Madigan says.

As with its YIELDjet FLEX system, Madigan says this YIELDjet product for OLED TV displays can help manufacturers save more than 50 percent over traditional methods. In January, Kateeva partnered with Sumitomo, a leading OLED-materials supplier, to further optimize the system for volume production.

The idea for Kateeva started in the early 2000s at MIT. Over several years, Madigan, Bulovic, Schmidt, Chen, and Leblanc had become involved in a partnership with Hewlett-Packard (HP) on a project to make printable electronics.

They had developed a variety of methods for manufacturing OLEDs — which Madigan had been studying since his undergraduate years at Princeton University. Other labs at that time were trying to make OLEDs more energy efficient, or colorful, or durable. “But we wanted to do something completely different that would revolutionize the industry, because that’s what we should be doing in a place like MIT,” Madigan says.

A few years before, Bulovic had cut his teeth in the startup scene with QD Vision — which is currently developing quantum-dot technology for LED television displays — and was able to connect the group with local venture capitalists.

Madigan, on the other hand, was sharpening his entrepreneurial skills at the MIT Sloan School of Management. Among other things, the Entrepreneurship Lab class introduced him to the nuts and bolts of startups, including customer acquisition and talking to investors. And Innovation Teams helped him study markets and design products for customer needs. “There was no handbook, but I benefitted a lot from those two classes,” he says.

So in 2012, Kateeva pivoted, switching gears to its YIELDjet system. Today, the system is a platform, Bulovic says, that, in the future, can be tweaked to print solid stage lighting panels, solar cells, nanostructure circuits, and luminescent concentrators, among other things. “All those would be enabled by the semiconductor printer Kateeva has been able to develop,” he says. “OLED displays are just the first application.”

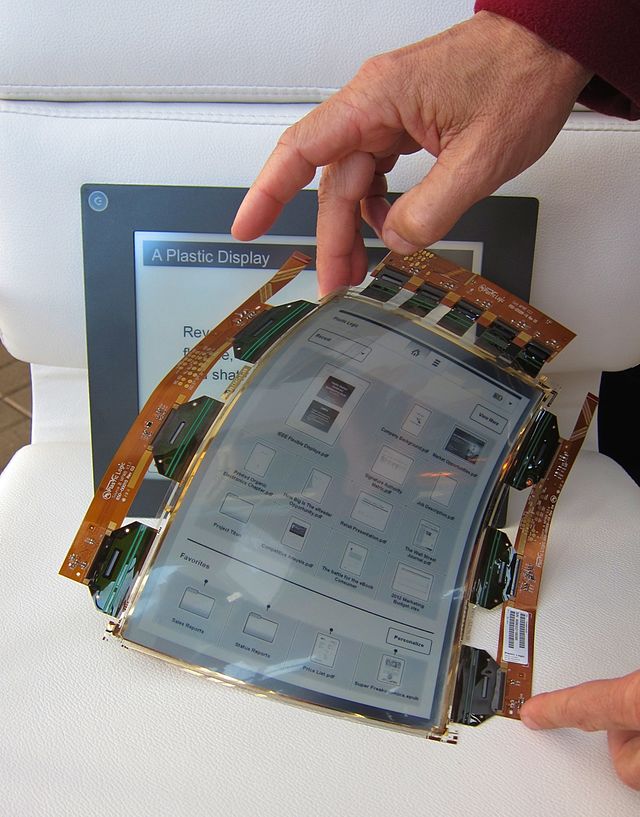

Ladies and gentlemen, our dreams of flexible digital newspapers are nearly within reach: LG just announced that it has begun mass production of a 6-inch, 1024 x 768 e-paper screen that can bend by up to 40 degrees. We haven"t been able to find a press release, but several Korean publications are reporting that the plastic-based screen is shipping to Chinese manufacturers to build e-readers right away, and devices based on the technology could be available in Europe as soon as early April. LG is boasting that at 0.7mm thick, the entire display is as thin as a protective film for a phone"s screen. According to the reports, LG conducted 1.5-meter (about 5 foot) drop tests with the screen and smacked it with a rubber mallet with no ill effect. We"re waiting for the other shoe (or e-reader) to drop, but that sounds positively fantastic. Maybe we"ll get some bendable batteries to go with the screen, some day.

Seoul, Korea (Oct. 7, 2013)– LG Display [NYSE: LPL, KRX: 034220], the world’s leading innovator of display technologies, today announced that it will start mass-production of the world’s first flexible OLED panel for smartphones. This state-of-the-art panel represents another milestone following the company’s commercial rollout of the world’s first 55-inch OLED TV display earlier this year.

“LG Display is launching a new era of flexible displays for smartphones with its industry-leading technology,” said Dr. Sang Deog Yeo, Executive Vice President and Chief Technology Officer of LG Display. “The flexible display market is expected to grow quickly as this technology is expected to expand further into diverse applications including automotive displays, tablets and wearable devices. Our goal is to take an early lead in the flexible display market by introducing new products with enhanced performance and differentiated designs next year.”

LG Display’s flexible OLED panel is built on plastic substrates instead of glass. By applying film-type encapsulation technology and attaching the protection film to the back of the panel, LG Display made the panel bendable and unbreakable. The new display is vertically concave from top to bottom with a radius of 700mm, opening up a world of design innovations in the smartphone market. And only 0.44mm thin, LG Display’s flexible OLED panel is the world’s slimmest among existing mobile device panels. What’s more, it is also the world’s lightest, weighing a mere 7.2g even with a 6-inch screen, the largest among current smartphone OLED displays.

In March 2012 LG Display developed the world’s first 6-inch Electronic Paper Display (EPD) based on e-ink which utilizes a plastic backplane. Having previously showcased the world’s first curved 55-inch OLED TV panel at CES 2013, today’s announcement highlights the company’s leading position in advanced flexible display technologies.

According to research firm IHS Display Bank, the global flexible display industry will see dramatic growth and become a USD 1.5 billion market by 2016, exceeding USD 10 billion by 2019. LG Display plans to advance flexible display technologies and bring innovation to consumers’ daily lives with the introduction of rollable and foldable displays in various sizes.

LG Display Co., Ltd. [NYSE: LPL, KRX: 034220] is a leading manufacturer and supplier of thin-film transistor liquid crystal display (TFT-LCD) panels, OLEDs and flexible displays. The company provides TFT-LCD panels in a wide range of sizes and specifications for use in TVs, monitors, notebook PCs, mobile products and other various applications. LG Display currently operates nine fabrication facilities and seven back-end assembly facilities in Korea, China, Poland, and Mexico. The company has a total of 56,000 employees operating worldwide. For more news and information about LG Display, please visit www.lgdnewsroom.com.

![]()

Royole recently began the mass production stage at its "Flexible Display Campus," the company"s division dedicated to creating innovative malleable display technologies. The company unveiled its first flexible display panel in 2014 with limited specifications, followed by its first full-color "flexible+" display in 2018. Now, the company has begun mass production of scalable, sizeable, flexible displays with full color gamuts and standard aspect ratios.

Companies can request panels through Royole"s sales inquiry system, which involves sending an email with necessary information such as size, quantity, and other specifications. According to Royole, its displays now boast a thickness of just 0.1mm and a peak bend radius of 1mm, meaning the displays can functionally be bent into a full circle, if desired.

As phones, tablets and even laptops move away from typical rigid slab-like constructions, display panels that can withstand the potential punishment of form-factors that are intended to fold (or worn, or maybe even roll up) regularly may become a component of demand.

BOE is one company that may stand to supply this need. A panel it has developed that has just won a Beijing Science and Technology Progress Special Award may be an example of the display material of the future. It is called R5 200,000, where R5 refers to its spec of a bending radius as low as 5mm and 200000 refers to the number of times it can withstand being folded to this extent.

Then again, this R5 200,000 is an outward-facing panel, which means its active (image-showing) side is still visible as it goes through all these folds, whereas most of the flexible-display devices of today do so in the opposite direction. Nevertheless, the company has reportedly announced that this same product is ready for manufacture at a commercial scale.

It will be no stranger to distributing it, either: BOE"s flexible AMOLED displays reportedly accounted for 20.3% of all shipments in this market since their own transition to mass production. Those panels have been bought by companies such as Huawei, LG, Motorola, Nubia and OPPO thus far. Therefore, R5 200.000 may see just as much success in the near future.

(Phys.org)—Is Samsung getting ready to release a line of flexible displays made of glass-replacing plastic? The right words in response may be "well, finally," or "well, maybe." The Wall Street Journalhas talked to a source who said that Samsung, in the words of the WSJ subheading, "Plans to Mass Produce Flexible Mobile-Device Screens" in the first half of next year. The source was not named and was only described as "a person familiar with the situation." Samsung has tantalized techies and consumers with its futuristic videos showing a beautiful-life day using wearable wrist computers, auto dashboard display screens, location-finding smartphones, and wall mounted computer screens of plastic rather than glass.

Expectations are that Samsung, as part of the grand mix, is to start mass production of smartphone screens using bendable plastic rather than glass. According to the WSJ report, Samsung"s flexible displays will incorporate OLEDs.

Analysts believe the move into mass production would be a real business advantage as smart-device makers in competition with Samsung scramble for attention and market share with their designs and feature sets. Some of the reasons why a Samsung customer would favor plastic rather than conventional glass would be lightness and durability. As for Samsung, the technology could also help lower manufacturing costs as well as differentiate its products from rivals, said an analyst at Shinyoung Securities in the WSJ report.

Hopes that Samsung would not miss the 2012 mark in flex displays for television were shelved this year with reports of problems preventing release of the 55-inch OLED TVs. The idea had been to sell them in time for the London Olympics.

Samsung is considered one of the leaders in OLED display research and the leader in (Active Matrix) AMOLED, where a transistor next to each pixel brings faster response time. OLED Displays are thinner, more efficient and offer better picture quality than LCD or Plasma displays.

As for smartphones, back in March, analysts were already talking about how Samsung was looking at its plastic-backed AMOLED devices to make lightweight, ultra-thin phones with foldable screens. Analysts said they expected to see Samsung apply plastic substrate-based, bendable or curved displays for smartphones with the first products carrying a design where a screen is folded over the edges of a phone, so that the display continues on to the sides. The display would be unbreakable.

LG has announced that their new flexible display technology is ready for prime time. With factories humming, the company will be releasing a six-inch black-and-white EPD (Electronic Paper Display) by the beginning of next month, starting with the European market.

The plastic device is bendable up to 40 degrees and utilizes e-ink technology, whereby black/white "pixels" are suspended in a substrate, so no power is drawn when the page is static. Previous attempts at creating flexible displays have resulted in a fragile product, but LG claims that despite being incredibly thin—just 0.7mm!—they"ve realized an unspecified manufacturing breakthrough that enables "strong durability."

OLED is an emerging display technology that enables beautiful and efficient displays and lighting panels. OLEDs are already being used in smartphones, laptops, wearables, tablets and TVs, and many of OLEDs are flexible ones.

A flexible OLED is based on a flexible substrate (usually polyimide). The first generation of OLEDs produced on these were not really flexible from the user perspective. The device maker bends the displays, or curves it - but the final user is not able to actually bend the device. These first-gen flexible OLEDs are adopted many premium smartphones, for example the Samsung edge-type Galaxy phones or Apple"s latest iPhones. A plastic-based OLED has several advantages especially in mobile devices - the displays are lighter, thinner and more durable compared to glass based displays.

Second generation flexible OLED displays can be bent by the user - these can be used for example to create foldable smartphones - the first range of which started shipping in 2019. Rollable OLEDs are also now entering the market for both TVs and smartphones.

While several companies (including Samsung, LG, BOE and others) are producing OLED displays, it is not straightforward to find a good and reliable supply of these displays.

If you are interested in buying a flexible OLED panel for your project or device, look no further. Our OLED Marketplace offers several flexible OLEDs, which can be ordered through us with ease.

After years of talk about producing a foldable smartphone, Samsung will be ready to start mass production on the Infinity Flex display in the coming months, the company announced Wednesday at the Samsung Developer Conference in San Francisco.

The Infinity Flex display "is the foundation for the smartphone of tomorrow," Justin Denison, Samsung"s SVP of mobile product marketing, said during the keynote address. "It"s a blank canvas for us to do something beautiful together."

Denison gave the audience a taste of what Samsung"s highly-anticipated foldable phone will look like, holding up a device largely shrouded in darkness to disguise certain elements of design. The display was visible to reveal a cover display that is a fully-functioning touchscreen. A user can unfold the device to access a larger main display. If a user is running an app on the cover display, they can open the device to find the app "right there waiting," Denison said, demonstrating the continuity. The device will allow three apps to run simultaneously, Denison said.

To create the display, Samsung has replaced the glass cover window with an advanced composite polymer that"s both flexible and tough, Denison explained. Samsung is also using a malleable adhesive, he said, "making this new display flexible and durable enough to be folded hundreds of thousands of times." To make the display foldable, it"s also thinner than any mobile display Samsung has ever made, thanks to a new polarizer that"s 45 percent thinner.

In addition to producing the Infinity Flex, Denison said, "Our innovation pipeline includes new technologies such as rollable and even stretchable displays."

Samsung has for years talked about introducing a foldable phone, and in September of this year, Koh declared that it was finally "time to deliver." The Korean company teased the Infinity Flex announcement a few days earlier, when it changed its logo so that the name "Samsung" is folded over itself.

At OTI Lumionics we are developing advanced materials—by design—using quantum simulations, machine learning and real-world testing in pilot production. We are currently focused on key enabling materials for OLED displays that will be used in next-generation consumer electronics and automotive. Our advanced electrode materials, and associated manufacturing technology, are being used to build transparent displays and lighting.

We work closely with our partners and customers to design new materials that are mass-production ready. Using our computational Materials Discovery Platform, we are able to rapidly iterate new materials, allowing fast turn around time to meet our customers’ needs.

Most display panels are sandwiched between layers of glass making them rigid and also pretty breakable. Samsung Display has just filed a patent application for a new flexible AMOLED display technology, called “Youm”, that does away with the glass layers, replacing them with a special plastic film. The result is a flexible display, which can even be rolled up or folded, that according to Samsung is unbreakable and lighter than conventional displays.

This isn’t the first flexible display technology we’ve seen and Samsung has been toying with flexible panels for a while, but the company is said to now be ready to mass produce the panels with a probable 2012 release.

Now as far as applications go you can put your imagination at work as the possibilities are endless. The screens can wrap around curvy gadgets and take all kinds of different shapes. We are also imagining foldable tablets or even ‘tube-form’ tablets where you pull the display out of the enclosure. The key is that now manufacturers could pretty much integrate a display into anything.

Korean media outlet Thelecreported on Monday that BOE, a Chinese electronic components firm, has recently converted the layout of its B12 OLED panel factory so that it can manufacture panels for IT products and automobiles, besides just smartphones. Rivals Samsung Display and LG Display are also at leading stages in the IT OLED panel technology field.

The phase three production line at the B12 facility in Chongqing, China will be able to manufacture OLED panels for smartphones, IT and automobiles. Phase three was initially designed to handle Gen 6 (1500x1850mm) flexible OLED panels for smartphones, as in phases one and two. The change of plan hints that BOE is likely aiming to supply OLED panels for Apple’s IT products, from tablets to PCs. The Chinese display giant has designed phase three of the B12 facility so that it can manufacture OLED panels of up to 15 inches in size, sources said.

BOE’s B12 factory started phase one operations last year during the fourth quarter; the second phase is expected to commence during the first half of this year. Equipment for phase three will enter installation in April.

On December 28, 2021, BOE’s official WeChat account showed that the company’s sixth-generation AMOLED (flexible) production line project in the southwestern city of Chongqing has now begun mass production.

This project further expands BOE’s flexible display technology reserves and production capacity and will round out the company’s link of flexible display production lines in Chengdu and Mianyang, two cities in nearby Sichuan Province.

At present, BOE has deployed six key projects in Chongqing, including the sixth-generation AMOLED (flexible) production line. It also has the 8.5-generation TFT-LCD production line, and the BOE Chongqing Smart System Innovation Center. These production lines have cumulative investment of over 86 billion yuan ($13.5 billion).

We have been hearing a lot about flexible displays over the past few years, but there haven"t been any free-standing flexible products to hit the market just yet. Many suggest flexible display technology just isn"t ready for mass production just yet so many of the major manufacturers are still just in the prototype phase. But now, a company known as Kateeva is introducing manufacturing equipment that might actually allow flexible displays to hit the market in a major way.

The OLEDs used in flexible displays require protection from things like water vapor and oxygen molecules at all times. Experts say that just a tiny amount of either can destroy the screen, so requirements for protection can be quite significant, a process Kateeva is looking to reduce in price and increase in efficiency.

The "flexible" display technology already available in Samsung phones, for example, are fixed and can"t be bent. Samsung said it does not utilize a protection layer of this nature in those products.

The company"s industrial printers can apparently cut costs in half and produce results at a faster pace. The room-sized printers, expected to begin shipping later this year, fit in with existing production lines as well. According to reports, just about every manufacturer is working on some kind of foldable or flexible display, so it looks as though early to mid 2015 is when the first products using this tech may begin to surface.

Airbus demonstrated three flexible display prototypes for aircraft cabins at Airshow China in Zhihai last week, which it says could represent the ‘human-machine interface of the future’. The flexible displays are ultra-thin and ultra-light, and can be adapted to any cabin surface with minimum integration efforts. Such displays can be used in new ways to improve the passenger experience, such as re-imagining inflight entertainment, and for creating new spaces and opportunities for advertisers to exploit.

The displays have been developed by Royole Corporation, a leader in flexible displays and sensors, with which Airbus partnered in 2018. The company is known for several flexible technologies, including developing the world’s thinnest, full-colour fully flexible display, the world’s first mass production facility for fully flexible displays, and the world’s first commercial foldable smartphone with flexible display to be brought to market: the FlexPai.

“Utilising fully flexible displays instead of traditional liquid-crystal displays (LCDs) in aircraft can reduce both cost and weight, saving fuel and reducing carbon emissions in airliners, which will provide new paths to improving the sustainability of our world,” said Hong Zhao, COO of Royole Corporation.

Royole’s flexible displays meet the aviation industry’s strict quality and safety standards, passing the AS9100 and DO160 tests for flammability, toxicity and smoke. Royole says it is the only flexible display manufacturer with hardware ready to install in aircraft cabins.

Oct. 7, 2013 — --For a long, long time rivals LG and Samsung have shown off their respective flexible displays at technology shows and in futuristic marketing videos, but those bendable screens might soon be more than just show things.

LG announced today that it has begun mass production of the "world"s first flexible OLED panel for smartphones." The company stated that it hopes that products with this flexible screen technology will arrive sometime next year.

And the curvy screen might not just be for smartphones. LG Chief Technology Officer Dr. Sang Deog Yeo said in a statement that the company expects the technology to "grow quickly" and that it is "expected to expand further into diverse applications, including automotive displays, tablets and wearable devices."

But LG hasn"t necessarily won the flexible display race. The company"s announcement comes as Samsung is rumored to announce a phone with a bendable screen soon. According to various sources, Samsung has been gearing up to announce its Galaxy Round in Korea, the first smartphone with a flexible display.

Samsung did not respond to ABC News" request for comment on the Galaxy Round rumors. However, the device isn"t supposed to be fully flexible. Samsung told Reuters in September that the display will be "curved" with some rigidity to the shell of the phone. There were also rumors that Samsung"s Galaxy Gear smartwatch would ship with a bendable screen. However, the watch has a normal, rigid LCD display. Apple has been rumored to be working on a curved-glass smartwatch, called the iWatch.

Both LG"s announcement and the rumors of Samsung"s phone set up an interesting future for our big- and small-screened gadgets. Curved displays will enable more comfortable wearable devices and compact tablets and computers.

The global flexible display market size is expected to reach 220.75 billion in 2030 and grow at a CAGR of 34.83% during the forecast period (2021–2030). A flexible display is a visual output surface that is designed to be able to withstand being folded, bent, and twisted. Typically screens that use flexible displays are made of OLED displays. Flexible displays are becoming more prevalent in foldable technology such as smartphones, designed to be folded or closed like a book. Flexible displays are useful as they allow the device to be stored in a smaller space, such as a pocket while providing a larger screen size for media display.

Some of the major factors driving the adoption of connected and innovative solutions across the consumer electronics sector are the growing trend of smart homes and buildings, as well as the increasing demand for connected technologies. The incorporation of smart sensors into residential devices has increased the replacement cycle of new consumer electronics. The use of displays to control and communicate with the device is growing significantly.

For example, in July 2020, Samsung released the connected refrigerator SpaceMax Family Hub. It automates meal planning, allows consumers to see inside the refrigerator from anywhere, and users can watch their favorite TV shows while working in the kitchen on the refrigerator"s massive entertainment screen.

Aside from that, residential devices such as televisions are undergoing revolutionary changes. For example, the global demand for new TVs is expected to be solely for smart TVs; with increased access to high-speed internet, demand for smart TVs with better picture quality is increasing. With so many viewers consuming media from OTT platforms like Netflix, Amazon, and others, the need to store data effectively is becoming critical. According to Bitmovin, the market is shifting toward a new generation of video codecs that offer 30 to 70% better compression than H.264.

With the proliferation of screen sizes, the number of pixels per inch in 8K decreases. Additionally, studies show that consumers are unable to distinguish 8K videos from 4K videos. However, due to cost reductions in the coming years, demand for 8K screens is expected to rise significantly in the coming years.

PC gaming has recently become a popular choice among millennial gamers. This shift is primarily due to a combination of factors, including improved gameplay quality, the availability of high-end hardware and software, and increased internet bandwidth. Today, more exciting and demanding technology, such as VR and 4K displays, is available. As a result, PC gamers are expected to upgrade their equipment accordingly, which is one of the factors driving sales of gaming-specific PCs and their accessories like gaming screens. Thus, increased demand for picture quality has boosted the demand for flexible displays.

With the increasing demand for higher picture quality and resolution, vendors are increasingly investing in product innovation. LG Display, for example, invested KRW 1,740 billion in 2020; large vendors with a larger market share can invest a larger share of revenues in innovation, which other vendors in this space do not have.

Aside from that, the flexible display market share is highly dynamic in terms of technology pricing. For example, in recent times, the market selling prices of TFT-LCD and OLED panels have been consistently falling, affecting the revenues of vendors operating in the market and posing a challenge to their growth in the product category.

The industry is highly competitive, and vendors operating in it face price and margin pressure as many vendors add production capacity to compete on price. Vendors from Korea, China, Taiwan, and Japan are investing in expanding their production capacities, which significantly impacts global vendors" ability to remain sustainable and profitable in the market.

Furthermore, the new 8K displays are expected to decrease prices and sell for around USD 3,500 to 4,000 by 2022, down from their current average selling price of around USD 4,500. This is expected to have a negative impact on the margins of vendors operating in this space.

The ongoing evolution of smartphones and computers has aided in developing display technologies, with foldable and flexible displays emerging as the most recent landscape component. Curved displays have already gained traction among users through innovative TV screens, desktop monitors, and phones, so the market is expected to grow over the forecast period.

Flexible displays, which are being seriously discussed as a potentially disruptive technology for future handheld and other devices, are being investigated by smartphone behemoths such as LG, Samsung, and Huawei to deliver revolutionary designs to users.

However, cost increases, decreased finished product rates, price increases, a lack of product differentiation, seasonal demand patterns, and uncertainty about economic prospects pose significant demand growth challenges. In 2020, there will be more opportunities for flexible OLED displays due to a focus on cost reduction, adding new functions, implementing product differentiation, a fresh appearance, and industry demand for 5G models.

Understandably, the introduction of 5G will bring the ability to perform more tasks on a single device than was previously possible on previous networks, owing to the enhanced capabilities of new phones and laptops. Currently, the industry believes that flexible OLED displays are the best solution for the next generation smartphone market.

OLED is a new display technology that allows for more efficient displays and lighting panels. OLEDs are already being used in a variety of mobile devices and televisions. OLEDs are the most recent generation of display technology, offering superior performance and improved optical characteristics over older LED and LCD technologies.

Furthermore, smartphone manufacturers such as Samsung Z fold and LG G8X have used second-generation flexible OLED displays that can be bent. OLEDs were mainly used to create a market impression of foldable smartphones. Rolled OLEDs, on the other hand, are now making their way into the TV and smartphone markets.

Compared to other options, flexible displays made of OLED are more energy efficient. OLEDs are available in a very small factor, allowing manufacturers to build them as individual pixels. These are already being used in a variety of consumer electronics, such as curved OLED TVs, and are in high demand.

Due to the global shutdown, production of flexible displays fell precipitously in 2020 due to the global supply chain disruption. COVID-19 had an impact on the operations of not only flexible display manufacturers but also their suppliers and distributors.

In the short term, the failure of export shipments and poor domestic semiconductor demand compared to pre-COVID-19 levels are expected to impact negatively and slightly stagnant demand for semiconductor devices, affecting the flexible display market growth.

As a result of the ongoing COVID-19 outbreak, several major economies have been placed on lockdown. Sales of electronic products have been hampered, and supply networks have been disrupted. Furthermore, many economies are losing a significant amount of revenue due to manufacturing plant closures. As a result, the general scenario has hampered the demand for flexible displays in 2020.

The market is expected to recover from mid of 2022 as people have made huge savings during the lockdown. The growing demand for high-quality pictures and the smart house is expected to drive the growth of the flexible display market.

However, the market faced challenges such as reduced workforce and delays in receiving components and materials. It caused an unexpected spike in panel pricing, with a month-to-month jump of more than 7%.

By display type, the OLED segment dominates the global market and is expected to grow at a CAGR of 35.87%, generating a revenue of USD 175.95 billion by 2030. This OLED display can be subjected to a high degree of flexibility, consumes less energy, and is prominent in the market. In addition, OLED offers the potential for vast improvements in image quality and opens up new possibilities for device design.

Based on the substrate material, plastic acquires the largest share of the market. Plastic-based flexible displays are the most recent advancements. Plastic AMOLED panels are substantially thinner and lighter than traditional glass-based displays, allowing for slimmer devices or larger batteries.

Based on application, smartphones and tablets hold a prominent share in the global flexible display market. The smartphone and tablet segment is expected to grow at a CAGR of 30.96%, generating a revenue of USD 116.14 billion by 2030. The smartphone industry has been steadily developing and growing, both in terms of market size and models.

By geography, Asia-Pacific accounted for thelargest market share of around 43.78% in 2021. The APAC flexible display market size is expected to grow at a CAGR of 36.01% generating revenue of USD 100.82 billion by 2030.

The Asia-Pacific market landscape is primarily driven by significant market consolidation, resulting in a plethora of advanced display technologies that have dominated the market. Furthermore, Asian countries are the home of display manufacturing foundries, giving this region a dominant market position.

The majority of display manufacturers are concentrated in the Asia-Pacific region, with South Korea, Taiwan, Japan, and China accounting for a sizable proportion of vendors operating and catering to various electronics manufacturers worldwide. Chinese panel manufacturers have continued to invest in new fabrication facilities and additional supplies due to Chinese government initiatives and support. Thus, Asia-Pacific is expected to be at the epicenter of the market due to the region"s growing penetration and consumer base for consumer electronics.

The initial market demand in the consumer electronics segment is expected to come primarily from emerging economies in APAC, North America, and Europe. The adoption of flexible OLED displays is anticipated to drive the market. The majority of the companies" manufacturing facilities and corporate offices are spread across Asia-Pacific, Europe, and North America. LG Display, Samsung Electronics, Motorola Inc., and Koninklijke Philips NV are just a few of the companies with manufacturing facilities all over the world.

The end-user application settings and subsequent demand for various television set heavily influence the European market landscape. In the current market, European TV OEMs and brands use either an IPS panel or a VA panel, depending on their models and sales regions. For example, the VA panel may have a higher contrast ratio in a comparatively darker environment, whereas consumers in some European countries prefer a darker living room.

On December 29th, 2021, LG Display, launched its newest OLED TV technology ‘OLED EX’. This next-generation OLED EX display implements LG Display’s deuterium and personalized algorithm-based ‘EX-Technology’.

On April 19th, 2022, Samsung launched its stunning Neo QLED 8K and Neo QLED TV range, offering the most pristine picture quality and immersive soundscapes to transform living spaces.

LG Display Co. Ltd, Samsung Electronics Co. Ltd, Royole Corporation, e-ink Holdings, BOE Technology Group Co. Ltd, Flexenable are the top players in the market.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey