flexible display screens ready for mass production free sample

Founded by a Stanford PhD graduate, Royole has designed and is starting to mass-produce a super-thin flexible screen that could be used in everything from t-shirts to portable speakers.

It"s the stuff of science fiction, and plenty of tech trade shows — a screen so thin and flexible that it can be rolled up into a cylinder as small as a cigarette or hung on a wall like wallpaper.

Royole just opened a new factory in China that is already mass producing the displays, and the company is working with partners to get them installed in everything from t-shirts to automobiles to smartphones.

Royole"s screens are based on OLED technology, in which the lighting elements are built into the display itself. Unlike the OLED screens that are in some higher-end televisions, which are typically placed on a rigid base like glass, the lighting elements in Royole"s screens are placed on a flexible plastic base, so they can bend or roll up.

"The cool thing here is that we"re not limited by the form factor of the surface," said Liu, who founded Royole with some friends from Stanford after graduating from there with a PhD in electrical engineering. "They could be anywhere."

Royole, which was founded in 2012 and has raised $1.1 billion in funding, just brought its new factory online in June. The plant will be able to produce up to 50 million panels a year once it"s at full capacity, Liu said. That could help it feed a potentially burgeoning market for bendable gadgets.

Researchers have been trying to develop flexible screen technology since at least the early 1970s — first in the form of monochrome displays that were intended to replace printed pages, and then, much later, in the form of color ones that might replace the screens in TV or portable devices.

For much of the last decade, display makers including Samsung and LG have been showing off their flexible OLED screens and prototype of products made with them at trade shows.

Samsung"s Galaxy Round, a relatively obscure smartphone that came out that year, was one of the first gadgets that used a flexible screen way back in 2013. Because the display was placed behind a fixed plate of glass, so you couldn"t really tell that it was bendable. The only clue was that the front of the phone was concave.

Other smartphones since the Galaxy Round have also employed flexible displays, including the LG G Flex and the Edge versions of the Samsung Galaxy S and Galaxy Note lines. More recently, the screens have started to make their way into even mainstream devices. Apple"s iPhone X, for example, has a flexible display behind its famously notched screen.

They were "a disappointing application of what that the technology could do," said Raymond Soneira, CEO of DisplayMate, a consulting firm for the display and TV industries.

Neither businesses nor consumers were ready for bendable or foldable gadgets when the first flexible displays started rolling off production lines five years ago, analysts said. Electronics makers generally hadn"t set up their supply chains to accommodate them or figured out how they might be able to take advantage of the screens" properties in new products. Apps hadn"t been written specifically for devices with bendable screens. And nobody had laid the groundwork for new kinds of flexible gadgets by marketing them to consumers.

Things may be different now. Next year, Samsung will reportedly introduce a phone with a foldable screen that"s built around its flexible display technology. Apple reportedly has a foldable phone in the works, too.

"You can"t make [phones] much bigger … and have them be carried by most consumers," Soneira said. "So you"ve got to move up to foldable, even rollable screens."

The release of foldable screen phones and other gadgets from major manufacturers will likely spur developers to start making apps designed specifically around those features. It"s also likely to inspire demand for other devices that take advantage of the properties of bendable screens.

Flexible screens will likely get their start by replacing other screens in devices we already recognize, including not just smartphones, but computer monitors and laptop computers, allowing manufacturers to make models that are slightly more innovative or resilient, said Ryan Martin, a principal analyst at ABI Research. But eventually, manufacturers are likely to get a lot more creative with them.

A flexible display "changes the realm of design as well as design thinking," Martin said. "You"re no longer confined to the four corners of a screen. You can make things more abstract."

At CES, the giant electronics trade show held in Las Vegas every January, LG has shown off a prototype for a car dashboard in which the speedometer, tachometer and other other gauges and buttons are displayed virtually on flexible screens that could be shaped to the contours of a car"s interior.

Although the company is going up against some of the biggest electronics companies around in LG and Samsung, Royole"s got several advantages, Liu said. Its displays are built on its own proprietary technology for which it has filed numerous patents, he said. That technology allows it to build screens that are a tenth as thick as those of competitors.

What"s more, because it"s using a different methodology for building its screens, it was able to get its factory up and running for about $1 billion, which is far less than what it would cost its competitors, he said.

The first devices with Royole"s screens should start showing up later this year. The company plans to sell T-shirts and hats with its flexible displays built in. Soon thereafter, it expects marketers to start using its screens to display advertisements in elevators, airports, shopping malls, and other places.

From there, the screens should start making its way into other products, both traditional and new, Liu said. When purchased in volume, they should be competitive in price to other types of displays, he said.

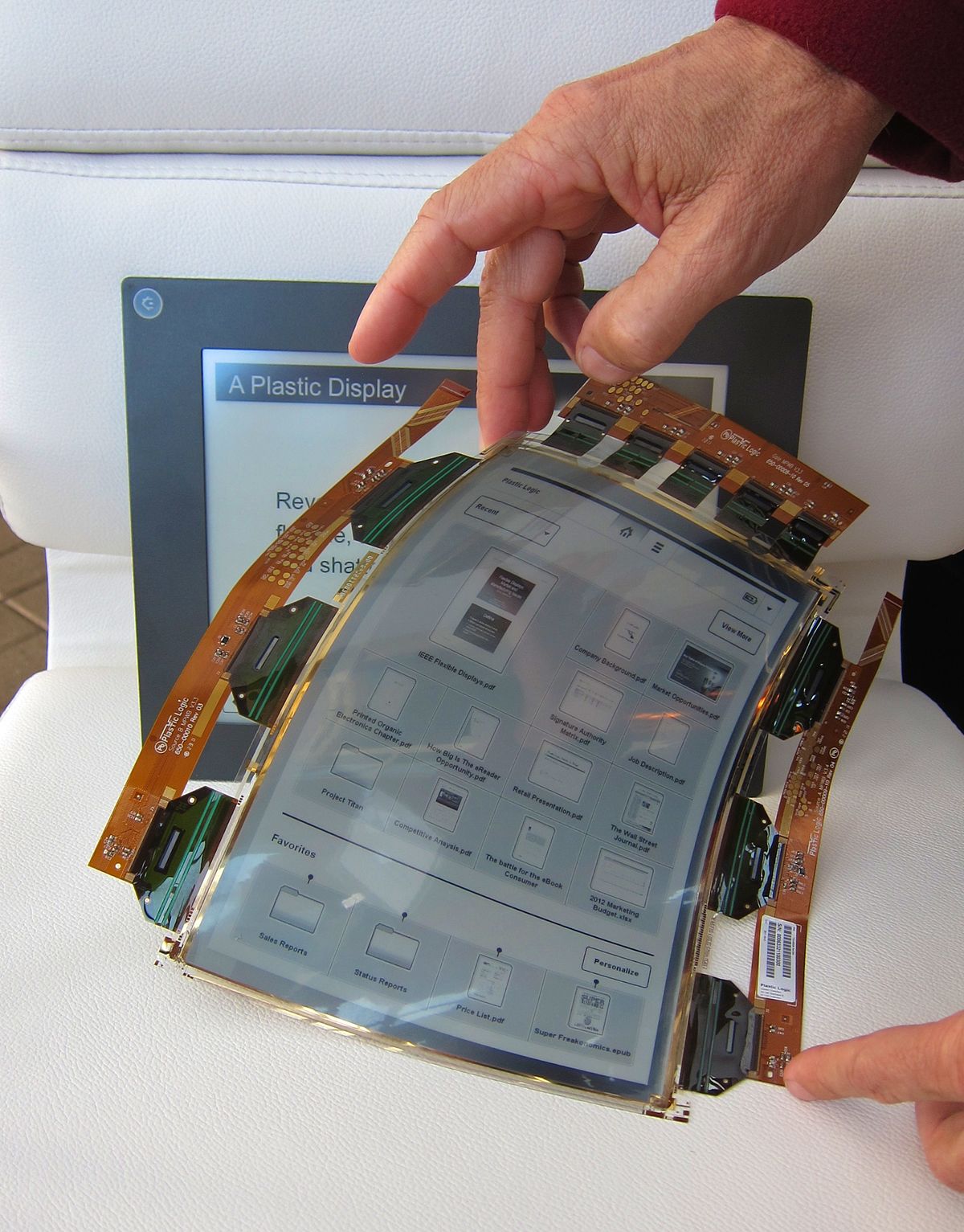

Being completely made of plastic, Lectum® displays are much more rugged than standard glass-based EPDs. They are also thinner and lighter per square inch than conventional EPDs and are inherently low-power, which is vital in today’s increasingly mobile world.

Royole recently began the mass production stage at its "Flexible Display Campus," the company"s division dedicated to creating innovative malleable display technologies. The company unveiled its first flexible display panel in 2014 with limited specifications, followed by its first full-color "flexible+" display in 2018. Now, the company has begun mass production of scalable, sizeable, flexible displays with full color gamuts and standard aspect ratios.

Companies can request panels through Royole"s sales inquiry system, which involves sending an email with necessary information such as size, quantity, and other specifications. According to Royole, its displays now boast a thickness of just 0.1mm and a peak bend radius of 1mm, meaning the displays can functionally be bent into a full circle, if desired.

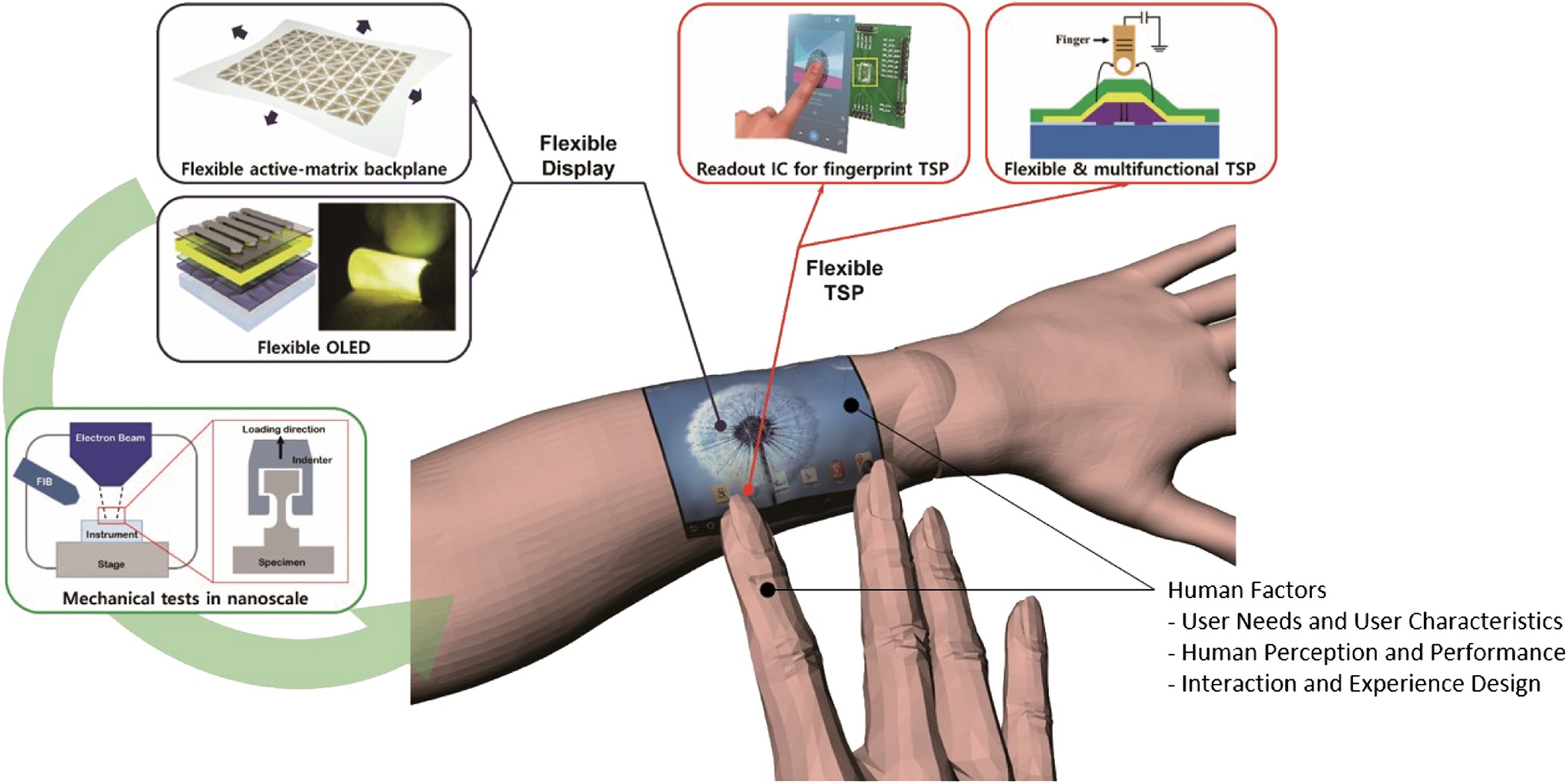

The global flexible display market size is expected to reach 220.75 billion in 2030 and grow at a CAGR of 34.83% during the forecast period (2021–2030). A flexible display is a visual output surface that is designed to be able to withstand being folded, bent, and twisted. Typically screens that use flexible displays are made of OLED displays. Flexible displays are becoming more prevalent in foldable technology such as smartphones, designed to be folded or closed like a book. Flexible displays are useful as they allow the device to be stored in a smaller space, such as a pocket while providing a larger screen size for media display.

Some of the major factors driving the adoption of connected and innovative solutions across the consumer electronics sector are the growing trend of smart homes and buildings, as well as the increasing demand for connected technologies. The incorporation of smart sensors into residential devices has increased the replacement cycle of new consumer electronics. The use of displays to control and communicate with the device is growing significantly.

For example, in July 2020, Samsung released the connected refrigerator SpaceMax Family Hub. It automates meal planning, allows consumers to see inside the refrigerator from anywhere, and users can watch their favorite TV shows while working in the kitchen on the refrigerator"s massive entertainment screen.

Aside from that, residential devices such as televisions are undergoing revolutionary changes. For example, the global demand for new TVs is expected to be solely for smart TVs; with increased access to high-speed internet, demand for smart TVs with better picture quality is increasing. With so many viewers consuming media from OTT platforms like Netflix, Amazon, and others, the need to store data effectively is becoming critical. According to Bitmovin, the market is shifting toward a new generation of video codecs that offer 30 to 70% better compression than H.264.

With the proliferation of screen sizes, the number of pixels per inch in 8K decreases. Additionally, studies show that consumers are unable to distinguish 8K videos from 4K videos. However, due to cost reductions in the coming years, demand for 8K screens is expected to rise significantly in the coming years.

PC gaming has recently become a popular choice among millennial gamers. This shift is primarily due to a combination of factors, including improved gameplay quality, the availability of high-end hardware and software, and increased internet bandwidth. Today, more exciting and demanding technology, such as VR and 4K displays, is available. As a result, PC gamers are expected to upgrade their equipment accordingly, which is one of the factors driving sales of gaming-specific PCs and their accessories like gaming screens. Thus, increased demand for picture quality has boosted the demand for flexible displays.

With the increasing demand for higher picture quality and resolution, vendors are increasingly investing in product innovation. LG Display, for example, invested KRW 1,740 billion in 2020; large vendors with a larger market share can invest a larger share of revenues in innovation, which other vendors in this space do not have.

Aside from that, the flexible display market share is highly dynamic in terms of technology pricing. For example, in recent times, the market selling prices of TFT-LCD and OLED panels have been consistently falling, affecting the revenues of vendors operating in the market and posing a challenge to their growth in the product category.

The industry is highly competitive, and vendors operating in it face price and margin pressure as many vendors add production capacity to compete on price. Vendors from Korea, China, Taiwan, and Japan are investing in expanding their production capacities, which significantly impacts global vendors" ability to remain sustainable and profitable in the market.

Furthermore, the new 8K displays are expected to decrease prices and sell for around USD 3,500 to 4,000 by 2022, down from their current average selling price of around USD 4,500. This is expected to have a negative impact on the margins of vendors operating in this space.

The ongoing evolution of smartphones and computers has aided in developing display technologies, with foldable and flexible displays emerging as the most recent landscape component. Curved displays have already gained traction among users through innovative TV screens, desktop monitors, and phones, so the market is expected to grow over the forecast period.

Flexible displays, which are being seriously discussed as a potentially disruptive technology for future handheld and other devices, are being investigated by smartphone behemoths such as LG, Samsung, and Huawei to deliver revolutionary designs to users.

However, cost increases, decreased finished product rates, price increases, a lack of product differentiation, seasonal demand patterns, and uncertainty about economic prospects pose significant demand growth challenges. In 2020, there will be more opportunities for flexible OLED displays due to a focus on cost reduction, adding new functions, implementing product differentiation, a fresh appearance, and industry demand for 5G models.

Understandably, the introduction of 5G will bring the ability to perform more tasks on a single device than was previously possible on previous networks, owing to the enhanced capabilities of new phones and laptops. Currently, the industry believes that flexible OLED displays are the best solution for the next generation smartphone market.

OLED is a new display technology that allows for more efficient displays and lighting panels. OLEDs are already being used in a variety of mobile devices and televisions. OLEDs are the most recent generation of display technology, offering superior performance and improved optical characteristics over older LED and LCD technologies.

Furthermore, smartphone manufacturers such as Samsung Z fold and LG G8X have used second-generation flexible OLED displays that can be bent. OLEDs were mainly used to create a market impression of foldable smartphones. Rolled OLEDs, on the other hand, are now making their way into the TV and smartphone markets.

Compared to other options, flexible displays made of OLED are more energy efficient. OLEDs are available in a very small factor, allowing manufacturers to build them as individual pixels. These are already being used in a variety of consumer electronics, such as curved OLED TVs, and are in high demand.

Due to the global shutdown, production of flexible displays fell precipitously in 2020 due to the global supply chain disruption. COVID-19 had an impact on the operations of not only flexible display manufacturers but also their suppliers and distributors.

In the short term, the failure of export shipments and poor domestic semiconductor demand compared to pre-COVID-19 levels are expected to impact negatively and slightly stagnant demand for semiconductor devices, affecting the flexible display market growth.

As a result of the ongoing COVID-19 outbreak, several major economies have been placed on lockdown. Sales of electronic products have been hampered, and supply networks have been disrupted. Furthermore, many economies are losing a significant amount of revenue due to manufacturing plant closures. As a result, the general scenario has hampered the demand for flexible displays in 2020.

The market is expected to recover from mid of 2022 as people have made huge savings during the lockdown. The growing demand for high-quality pictures and the smart house is expected to drive the growth of the flexible display market.

However, the market faced challenges such as reduced workforce and delays in receiving components and materials. It caused an unexpected spike in panel pricing, with a month-to-month jump of more than 7%.

By display type, the OLED segment dominates the global market and is expected to grow at a CAGR of 35.87%, generating a revenue of USD 175.95 billion by 2030. This OLED display can be subjected to a high degree of flexibility, consumes less energy, and is prominent in the market. In addition, OLED offers the potential for vast improvements in image quality and opens up new possibilities for device design.

Based on the substrate material, plastic acquires the largest share of the market. Plastic-based flexible displays are the most recent advancements. Plastic AMOLED panels are substantially thinner and lighter than traditional glass-based displays, allowing for slimmer devices or larger batteries.

Based on application, smartphones and tablets hold a prominent share in the global flexible display market. The smartphone and tablet segment is expected to grow at a CAGR of 30.96%, generating a revenue of USD 116.14 billion by 2030. The smartphone industry has been steadily developing and growing, both in terms of market size and models.

By geography, Asia-Pacific accounted for thelargest market share of around 43.78% in 2021. The APAC flexible display market size is expected to grow at a CAGR of 36.01% generating revenue of USD 100.82 billion by 2030.

The Asia-Pacific market landscape is primarily driven by significant market consolidation, resulting in a plethora of advanced display technologies that have dominated the market. Furthermore, Asian countries are the home of display manufacturing foundries, giving this region a dominant market position.

The majority of display manufacturers are concentrated in the Asia-Pacific region, with South Korea, Taiwan, Japan, and China accounting for a sizable proportion of vendors operating and catering to various electronics manufacturers worldwide. Chinese panel manufacturers have continued to invest in new fabrication facilities and additional supplies due to Chinese government initiatives and support. Thus, Asia-Pacific is expected to be at the epicenter of the market due to the region"s growing penetration and consumer base for consumer electronics.

The initial market demand in the consumer electronics segment is expected to come primarily from emerging economies in APAC, North America, and Europe. The adoption of flexible OLED displays is anticipated to drive the market. The majority of the companies" manufacturing facilities and corporate offices are spread across Asia-Pacific, Europe, and North America. LG Display, Samsung Electronics, Motorola Inc., and Koninklijke Philips NV are just a few of the companies with manufacturing facilities all over the world.

The end-user application settings and subsequent demand for various television set heavily influence the European market landscape. In the current market, European TV OEMs and brands use either an IPS panel or a VA panel, depending on their models and sales regions. For example, the VA panel may have a higher contrast ratio in a comparatively darker environment, whereas consumers in some European countries prefer a darker living room.

On December 29th, 2021, LG Display, launched its newest OLED TV technology ‘OLED EX’. This next-generation OLED EX display implements LG Display’s deuterium and personalized algorithm-based ‘EX-Technology’.

On April 19th, 2022, Samsung launched its stunning Neo QLED 8K and Neo QLED TV range, offering the most pristine picture quality and immersive soundscapes to transform living spaces.

LG Display Co. Ltd, Samsung Electronics Co. Ltd, Royole Corporation, e-ink Holdings, BOE Technology Group Co. Ltd, Flexenable are the top players in the market.

As shown in TEM images in Fig. 1a, as-obtained Ag NPs are composed of spherical particles with a mean diameter of 68.4 nm (statistical size histogram is present in Fig. S1 of Support Information). And the corresponding selected area electron diffraction (SAED) pattern shows that as-obtained Ag NPs have face centered cubic (fcc) crystallographic structure. The different diffraction planes are indexed as shown in the insert of Fig. 1a. The high-resolution TEM (HRTEM) image is shown in Fig. 1b revealing the lattice spacing of the Ag nanocrystal is 0.236 nm that corresponds to the (111) plane of Ag. More interestingly, most of the spherical Ag NPs have no structural defects and are single-entry crystals. The corresponding Fast Fourier Transforms (FFT) patterns (see the insets in Fig. 1b) show the generation of hexagonal diffraction pattern demonstrating that as-prepared Ag NPs are single crystals. In addition, some NPs clearly exhibit platelet structures with a preferential growth occurring on the (111) plane as shown in Fig. 1a. Surface plasmon bands appearing in the visible region are the characteristics of noble metal NPs. Ag NPs are often present a strong SPR absorption peak at ca. 400 -500 nm depending on its size, shape and dielectric properties of the surrounding mediaFig. 1c, the broad absorption bands at about 452 nm are considered to be due to surface plasmon resonance absorption of the electrons in the conduction bands of silver. The color of the Ag ink solution is dark yellow (see the insert photo). It is worth noting that the colloidal Ag NPs are found to be stable with no sedimentation for a month and also no shift in SPR absorption peak is observed. Figure 1d shows the XRD pattern of the as-prepared Ag NPs in which four clear diffraction peaks are observed and indexed to the (111), (200), (220) and (311) planes of the fcc Ag. The XRD pattern further confirms the generation of Ag NPs and it is crystalline in nature.

Screen printing is a fantastic artistic technique which is especially useful for printing on various substrates and the process is easy, versatile and relatively cheap. In this work, screen plate is made up of a piece of porous, finely nylon mesh stretched over an aluminum frame. As shown in Fig. 2, the screen is placed over a PET substrate and Ag ink is placed on top of the screen and a filling bar is used to fill the screen with ink. The movement of squeegee with a pressure can let the Ag inks through the pattern area and appear on the PET. And then we obtain the designed Ag dot arrays on the PET substrate to determine various chemicals by SERS technique.

Schematic illustration of the fabrication process for large-scale SERS dot array substrates by screen printing: (a) preparing the Ag nanoparticle inks; (b) printing of Ag inks as dot arrays on PET by a designed scree plate; (c) dried and printed dot arrays for the determination of various chemicals via SERS techniques.

Figure 3a shows the photograph of the screen printed dots array substrate, the circles of printed Ag NPs are designed to be 1 mm in diameter. During the printing process, the silver NPs appear brown on the PET initially and progressively become dark in color. Upon drying at 80 °C, the dots appear metallic gold yellow (see the insert photo). As is obvious from the insert of Fig. 3a, there is no chipping of Ag paint after bending or rolling the substrate, which demonstrate that as-printed Ag patterns are flexible and mechanically robust. This feature implies possible application of the product in flexible electronics. Figure 3b shows the top-view SEM image of the surface of printed dots with small and large particles. There is no aggregation and a homogeneous dispersion is seen over the large area. Clearly, the surface roughness and nanometer scale structure of printed Ag films is beneficial to the SERS measurementsFig. 3c, the thickness is about 672 nm. If each dot is cylindrical, through estimation each dot requires an amount of 5.5 × 10−7 g of Ag, making it as low cost SERS detection technique.

Because the printed patterns need to be dried and the effect of drying temperature (Td) on SERS performance has been analyzed. For R6G dyes, various SERS vibration modes can be found because R6G is nearly a planar molecule containing xanthene ringa in Fig. 4a shows the representative feature peaks of R6G. While these SERS peak intensity (SPI) and location is different, all the peaks can be indexed to vibrational bands of R6GFig. 4a, the normalized SPI of as-printed Ag dots under different drying temperature is different. Among the four samples, a strongest SPI is observed for the drying temperature of Td = 80 °C, followed by the samples Td = 120 °C and Td = 160 °C and the sample dried at Td = 200 °C possesses the weakest SPI. The surface morphology as well as the average size of the silver particles are proved to be important in realizing high-performance SERS detection. Many studies reveal that the diameter of Ag NPs for acquiring optimal SERS effect is in the range of 20 to 70 nmFig. 4b–d. In comparison with Fig. 3b, the change of surface morphology for Td = 120 °C is not clear. When the Td is elevated to 160 °C, many small Ag grains are segregated from Ag NPs (arrows labeled in Fig. 4c). If the Td is elevated to 200 °C, the Ag NPs are sintered and welded together. The above results reveal that higher drying temperature is not beneficial for SERS application.

The SERS performance of the printed patterns under different drying temperature for R6G detection (1 × 10−6 M, the intensity have been normalized, the laser excitation is 532 nm) (a) and the representative SEM images of the samples dried at 120 °C (b) 160 °C (c) and 200 °C (d) respectively.

Owing to the best SERS performance of the sample with Td = 80 °C, we used as-obtained dot array under this parameter to detect various chemicals, which are often used in different field and the results are shown in Fig. 5. To ensure a better match between the localized surface plasmon resonance peak position of Ag nanoparticle of 452 nm, the incident light of laser was tuned from 532 to 514 nm. Among the five chemicals, R6G is often used as a tracer dye within water to determine the rate and direction of flow and transport and also used extensively for biotechnology applications. MG is a carcinogenic and mutagenic agent and banned in many countries, such as the European Union, USA and ChinaTable 1. The above results reveal that as-printed Ag patterns are effective to detect various chemicals by screen printed SERS substrates.

Arithmetically averaged SERS performance of the screen printed patterns for R6G (1 × 10−6 M), Malachite green (MG, 1 × 10−6 M), 4-aminothiophenol (ATP, 1 × 10−3 M), 2-Mercapto-5-nitrobenzimidazole (MNB, 1 × 10−4 M) and Brilliant Blue R (BBR, 1 × 10−5 M) (all the chemicals is dissolved in ethanol and the laser excitation is at 514 nm).

A good SERS substrate exhibits not only high enhancement ability but also good reproducibility−6 M. As shown in Fig. 6a, Raman waterfall plots of R6G (1 × 10−6 M) recorded from a randomly selected area of the screen printed Ag pattern (784 signals). Figure 6b shows the corresponding contour plots of every Raman peaks with the excitation lines at 610, 774, 1185, 1362, 1507 and 1649 cm−1. These results reveal that the intensity and reproducibility of 784 points are stable and uniform. According to the statistics of predominant peaks’ intensity, the relative standard deviation (RSD) for the band vibrations of R6G at 1362, 1507, 1574 and 1649 cm−1 are 12.1%, 11.3%, 11.4% and 11.7%, respectively (Fig. 6c). Figure 6d,e shows the Raman waterfall plots and corresponding contour plots of 784 points and the excitation line is at 1175, 1218, 1291, 1362, 1396, 1592 and 1616 cm−1. And Fig. 6f shows the RSD for the band vibrations of MG at 1362, 1396, 1592 and 1616 cm−1 are 14.9%, 15.9%, 16.6% and 15.5%, respectively. The RSD results (Table 2) of 784 points revealing clearly that screen printed Ag patterns are highly reproducible for various chemicals determination. Moreover, SERS intensity mapping of R6G (Fig. S2 in Support Information) and MG (Fig. S3 in Support Information) at different wave numbers also show the distribution of the band vibration intensity that is well-distributed. This further demonstrates that our screen printed Ag patterns are uniform in a large area and capable of generating SERS signals with good reproducibility.

Raman waterfall plots, contour plots and RSD (the result was statistically analyzed from the original intensity of every predominate peaks) of different predominant bands conveying both the intensity and reproducibility of 784 points (a randomly selected area, the integration time was 2 s, step width is 3 μm) from the screen printed Ag patterns for R6G (1 × 10−6 M, a, b, c) and MG (1 × 10−6 M, d, e, f).

Furthermore, the practical detection limit and reproducibility of the detection of R6G molecules have been analyzed using our screen printed Ag patterns. Figure 7a shows the SERS spectra of R6G with different concentration from 1 × 10–7 to 1 × 10–14 M, the intensity and resolution of R6G signal is decreased with the decreasing concentration. Spectrum f (1 × 10–14 M) is same as the blank Raman spectrum of the printed Ag substrate which shows only a broad background with no detectable Raman signals of R6G (Figure S4 in Support Information). The partial characteristic peaks (1396 cm−1 and 1507 cm−1) of R6G still can be found in spectrum e. However, the spectrum resembles the features of R6G spectra and thus the detection limit for R6G using our screen printed Ag substrate is higher than 1 × 10−10 M. Moreover, we use time evolution SERS spectra to monitor the signal output and study the reproducibility of the screen printed Ag patterns for R6G at different concentration. Figure 7b shows the Raman contour plots of recorded from a randomly selected area of the screen printed Ag pattern (102 points). Obviously, there are fluctuations on some band vibrations when the concentration of R6G reached at 1 × 10–9 M. The intensity and reproducibility of the band vibrations are improved if the concentration of R6G is gradually increased. Clearly, the spectrum of R6G with the concentration of 1 × 10–7 and 1 × 10–8 M is stable over time with high reproducibility. The above results demonstrate that the fluctuations depend on the concentration of R6G. Additionally, there are reports on coupled NPs improving the detection abilities by the generation of large number of hot-spots10 M, the estimated number of molecules is about 5 (the estimation is provided at the Support Information). Above results illustrate that as-printed Ag substrate possesses high-sensitivity for the detection of R6G molecules. Indeed, R6G molecules can also adsorbed on the surface of Ag NPs and gaps between neighboring Ag NPs during the evaporation of ethanol solution

Melamine (2,4,6-triamino-1,3,5-triazine) is known for milk powder adulteration in China, which caused lives and severe economic loss for the dairy industry. Hence, we study the SERS performance of the screen printed Ag patterns for the melamine contaminated fresh milk (with no pretreatment process) and the results are shown in Fig. 8. As shown in Fig. 8a, no signal is detected in pure fresh milk (curve a) and two peaks located at ∼699 cm−1 and ∼1071 cm−1 in pure melamine (curve b), which could be assigned to the ring breathing and ring deformation, respectively. When melamine is mixed in the milk (curve c and d), the two peaks at ∼573 cm−1 and ∼979 cm−1, could be seen and assigned to the δ (NCN)+τ (NH2) and δ (CNC) + δ (NCN), respectively (δ is bending vibration and τ is twisting vibration)−1 and 686 cm−1, respectively. Compare with the SERS spectrum of pure MA, the position is downshifted about 16 cm−1, which is caused by the different environment of MA in solution phase and in dried solid stateFigure 8b show the SERS waterfall plots of MA collected from randomly selected area of the screen printed pattern with the concentration of 1 × 10−4 M and an integration time of 2 s. The corresponding Raman contour plots show both the intensity and reproducibility of 702 signals as depicted in Fig. 8c. The results illustrate that an important feature of the screen printed Ag patterns is the excellent reproducibility of the SERS signals. Each spot shows distinctive Raman intensity, thus revealing excellent capability to enhance the Raman signals of the MA molecules in milk, a relatively complex system. The strong SERS signals demonstrate that screen printed Ag dot arrays possess high density “hot spots”, resulting in high reproducibility. As shown in Fig. 8d, the RSD of the Raman intensity of the 686 cm−1 (702 signals) is calculated and the value is 18.8%, which further demonstrate the high reproducibility of the screen printed Ag patterns. The relatively low RSD variation of the SERS band illustrates the screen printed Ag patterns can be as a promising substrate for high-sensitivity SERS detectionFig. S5 in Support Information) at 686 cm−1 also shows the uniform distribution of the Raman peaks intensities and which reveal that the screen printed Ag patterns have the capacity of producing reproducible and large-area homogeneous SERS signal for a complex system. Indeed, the fresh milk is a mixture of various components and generates a solid milk film once the milk evaporates from the surface of SERS substrate. The solid milk film the SERS sensitivity of the as-printed Ag layer

(a) The SERS performance of screen printed Ag patterns for melamine contaminated fresh milk (curve a: a commercial fresh milk; curve b: pure melamine in ethanol; curve c: 1 × 10−2 M of MA in milk; curve d: 1 × 10−4 M of MA in milk); (b) The waterfall plot of SERS spectra (integration time was 2 s, step width is 2 μm); (c) Raman contour plot shows both the intensity and reproducibility of 702 signals (randomly selected an area) from the printed patterns for MA contaminated fresh milk (1 × 10−4 M); (d) The intensity distributions of the main Raman vibrations of MA (at 686 cm−1) in 702 spots (RSD indicates).

We’ve all heard about flexible displays coming…coming…coming—but where are they? Rollable and foldable displays could create more possibilities for developers, who could create software to take advantage of dynamically reconfigurable screens. Do technical hurdles make these devices a mirage, or are they really on the horizon, and if so, what’s the ETA? Here’s a (flexible) look into the future.

Flexible displays are still around the corner, but it’s a sharp-angled corner in a dangerous intersection. Producing flexible displays poses more daunting physical and economic problems than its early enthusiasts anticipated. Stated or implied production dates have been quietly ignored and future ones pointedly left unspecified.

Nevertheless, the technology is making real progress, and a few prototypes displayed at January’s International Consumer Electronics Show (CES) in Las Vegas have taken it several steps closer to hand-held reality.

Perhaps the most impressive is Samsung’s new prototype, which actually has been given a name—the Youm. Brian Berkeley, senior vice president of in charge of OLED research at Samsung’s display lab, demonstrated the technology at CES on a cell-phone-sized device, and attendees "oohed, ahhed," and applauded as he showed a message popping up along the thin-edged side of the device, instead of on the front. If this were a cell phone, you could set it on a table and send and receive texts or emails while preserving the entire real estate of the main screen. Another prototype showed wraparounds on the bottom. Berkeley also briefly showed a thin, flexible, bendable screen.

However, Berkeley didn’t provide a release date or price for the Youm, only saying that the company was planning on shipping it to its partners in the future. Of course, that didn’t stop rumors (which proved to be false) that it might be available on the Galaxy S4. Samsung also showed flexible display models at last year"s CES, as did Sony and Nokia.

Still, OLED technology, whether it’s on the Youm or some other OLED device, could be the key to bridging the gap between prototype and reality, though obstacles remain, according to Mark Fihn, a consultant and publisher of Veritas et Visus, a group of newsletters about the flat panel display industry.

“Right now, the biggest problem is that liquid crystal display, which dominates in every product, requires a very high-temperature manufacturing process and can only be done on a substrate like glass,” Fihn said. Flexible display is mostly being created using a batch process, doing the manufacturing on glass, then peeling off the flexible plastic substrate. But that’s complex and expensive. To bring down the cost for wide-scale distribution, flexible display devices would need to be manufactured in rolls instead.

With OLED, that could happen. Manufacturing could be done at lower temperatures, enabling plastic to be used and eliminating the need for glass. But there’s another problem: what about all the existing multi-billion-dollar batch LCD factories? Shifting to roll-to-roll could put them at risk, and manufacturers aren’t exactly eager to do that.

Another complication is layers. Most displays have multiple layers of glass, and replacing all of them with something flexible poses problems of its own.

For example, an LCD phone or tablet display might have a black layer, a color filter layer, an anti-glare layer, and an anti-smudge layer. On a TV, you need an anti-reflection layer. Hospitals might want an anti-microbial layer.

Think of a stack of papers that you pick up, then put down someplace else. Some of the papers may slide out of place. With plastic, that translates to adhesion, cracking, and overall performance issues, Fihn said. Moisture could be another problem, since water causes OLED to decay quickly. Moisture from the air or from your fingertips can permeate plastic, whereas glass keeps it out.

“They getting bigger and bigger, including a 6-inch display shown by the Chinese company Huawei,” says Chris Jones, principal mobile analyst at the technology analyst firm Canalys in Palo Alto.

Though they’re selling quickly, to some people’s minds large-screen cell phones are already too big: awkward to hold up to your ear, impossible to jam in your back pocket. A display that wraps around the device or folds or rolls up would create more room without the extra size and heft.

“Clearly, there is pressure on Apple and everyone else to increase screen size. But you want to keep it practical, so if you can use every possible millimeter and wrap around for display, that would be a good thing,” Jones said. He thinks we may see some flex devices come to market in the next year or so.

Not everyone agrees. “It may take a number of years,” according to Carl Taussig, director of display research at HP Labs in Palo Alto. “There’s a huge investment and overcapacity for manufacturing glass. A transition would take the better part of the next decade.” HP is not announcing any plastic-based products coming to market. Eventually, however, Taussig sees plastic taking over, and “glass will seem as anachronistic as cathode ray tubes do today.”

In the future, rollable and foldable displays will create more possibilities for software developers, who will be able to create apps for a dynamically reconfigurable screen.

Or screens. Plastic Logic, a company building on the science developed by Queen’s University’s Human Research Lab in England and Canada, demonstrated a prototype at CES called PaperTab. It’s a “paper tablet PC” that functions not as a single device, but as a series of e-ink plastic sheets, each capable of displaying a separate document or app. Tapping together two of the sheets, or “tabs,” allows them to share information. Bending parts of a tab can enable it to, say, open an email, or fast-forward through a video. Each tab is an app. You kind of have to see it to understand it.

In the demo, the tabs are connected by cables to wiring under a desktop. But the idea is to someday connect them via the cloud, said Rachel Lichten, business communications manager for Plastic Logic.

When might we see it? Maybe in the next 10 years if they can get the circuit boards and processors to be flexible, perhaps by using chips connected by flexible ribbons.

One company that demonstrated at CES has announced concrete plans to bring a flexible technology component to market. Atmel has developed a new kind of touch sensor that Asus is now using in some of its MeMO Pad tablets.

Atmel’s XSense touch sensor is a thin plastic film that fits like a sandwich between a glass or plastic top and an LCD beneath. It doesn’t enable a device to roll up or fold into your pocket, but it does allow manufacturers to use curved, “edgeless” designs, with display on the curve.

“What we see is only the beginning stages,” said Mariel van Tatenhove, Atmel’s marketing director. “Over time, it will enable developers to come up with completely new designs not possible before.”

TransPrint is a method for fabricating flexible, transparent free-form displays based on electrochromism. Using screen-printing or inkjet printing of electrochromic ink, plus a straightforward assembly process, TransPrint enables rapid prototyping of displays by nonexperts. The displays are nonlight-emissive and only require power to switch state and support the integration of capacitive touch sensing for interactivity. We present instructions and best practices on how to design and assemble the displays and discuss the benefits and shortcomings of the TransPrint approach. To demonstrate the broad applicability of the approach, we present six application prototypes.

Decreasing price and the widespread adoption of mobile and wearable devices have driven a dramatic increase in the amount of digital displays we encounter in our everyday lives. However, our environment still contains far more nondigital printed graphics, such as labels, signs, posters, and books, than digital displays. Static text and graphics printed on paper and other objects have been one of our major information sources for many years and will continue to be so. While, in many applications, digital displays aim to emulate the properties of printed graphics, they are limited to a rigid flat rectangular form factor. This limitation restricts the possibilities to seamlessly integrate such displays into our surroundings.

Recently, the field of printed electronics has developed to the point at which thin and deformable interactive prototypes can be created at low cost, e.g., as design prototypes [1–3]. Prior work has focused on extending printing methods to create interactive materials such as flexible touch sensors, thin film displays, and even haptic feedback [4–7]. Especially, printed electronics displays have the potential to overcome the limitations of current digital display technologies, enabling more interactivity and new form-factors. Moving away from the square pixel-based architecture, which is dominant in today’s display technologies, has been highlighted as a key factor to deliver truly ubiquitous technologies [8].

In this paper, we present TransPrint, an adaptable method that enables the production of flexible, transparent displays in highly customizable shapes by the maker community and other nonexperts (see Figure 1). TransPrint is based on electrochromism (EC), i.e., the property of materials to reversibly switch their optical properties, e.g., colour, through electrochemical oxidization. For TransPrint, this switch is between near-transparency and a dark blue opaque colour.

One of the key traits of displays based on electrochromic systems is that they are nonlight-emissive. This distinguishes them from LED and electroluminescence (EL) based displays [4, 6]. Given the negative impact of artificial light on human sleep patterns [9], this property is particularly beneficial for ubiquitous always-on displays, e.g., as part of Internet of Things (IoT) solutions. Together, the properties of TransPrint displays enable smart solutions that are embedded to the existing objects and surfaces of our environment, fulfilling Mark Weiser’s vision of technologies that “weave themselves into the fabric of everyday life” [10].

While EC-based displays have been well established and most characteristics of the different materials have been well investigated in the past, constructing these displays usually required laboratory settings [11]. With TransPrint we present a method that allows nonexperts to produce EC-based displays with commercially available materials. We present two ways of printing such displays using either screen-printing or inkjet printing. Both methods are rapid and inexpensive and only require a limited amount of hardware and technical knowledge. We show how to integrate these printed displays with static printed elements as well as new application scenarios stemming from the unique traits of TransPrint displays. Furthermore, we discuss how support for capacitive touch input can be easily incorporated. With this we hope to enable the community to adapt such displays and embed them in future research, e.g., in the realm of printed electronics for interaction.

In this paper, we firstly discuss related work in the fields of printed electronics and displays, focusing on electrochromic systems and transparent displays. We then provide background on the operation of electrochromic displays in general and describe the TransPrint approach to design, print, and assemble displays. Following this, we present an analysis of the key characteristics of the created displays. Finally, we present a set of application cases that demonstrate the possibilities of TransPrint displays.

Recently, an increasing amount of research has focused on using printed electronics in Human Computer Interaction (HCI) and UbiComp applications. Printed electronics allow the fabrication of thin and deformable electronic systems that can cover large areas and be integrated with other materials, thus challenging our traditional view of electronic circuits as flat and rigid [3], to the level of printed circuits for temporary rub-on tattoos [12]. Initial work conducted by Gong et al. leveraged inkjet printed conductive materials for a wide variety of sensing applications [13]. Savage et al. introduced the Midas platform enabling the fabrication of custom touch sensing circuits utilizing vinyl cutting [14]. Following on from this, Kawahara et al. proposed a method to print circuit patterns designed using standard inkjet printers and software [2]. This method has been adopted to create a wide variety of different applications such as, e.g., customizable touch sensors [15, 16], which can be cuttable [5], epidermal pressure sensors [17], deformation sensors [18], and even energy harvesting devices [19]. Recently Kato et al. used double-sided conductive ink printing to fabricate paper gloves that deliver electrical stimulus to create a pseudo-tactile sensation [20]. Olberding et al. combined many of these fabrication and sensing mechanisms with actuation capabilities into their Foldio approach [21], which Wessely et al. recently extended, to reusable origami style elements [22]. Furthermore, there are even self-actuated paper prototypes that can be printed using conductive PLA [23].

A variety of different approaches to print these new materials have been presented, the most common being inkjet printing and screen-printing. Recently hydroprinting—printing via water transfer—has been employed to print touch screens on highly curved organic geometries [24]. Kuznetsov et al. analysed the potential of screen-printing as a DIY fabrication technique for embedding interactive behaviour onto a range of substrates [25]. They conducted workshops in Science, Technology, Engineering, Arts, and Mathematics (STEAM) contexts and found that it has a relatively low barrier to entry for smart material fabrication and supports collaboration and creative engagement.

Building on these previous approaches, TransPrint employs inkjet and screen-printing in the creation of our displays and aims to enable the combination of printed EC displays with other printed electronics prototyping techniques, hence, enabling easy integration into wider printed electronics prototyping pipeline.

A major distinction when it comes to thin film display technologies is whether the display is pixel-addressable such as OLED and E-Ink, or a graphical segment-based display in which only predefined shapes can be switched. Although the second category offers less visual dynamicity, it provides advantage in other areas, such as ease of fabrication and possibility of creating displays in a variety of shapes and forms. Common technologies to realize thin film displays are, e.g., ultraviolet [26], thermochromism [27, 28], electroluminescence (EL) [4, 6, 29], and electrochromism (EC) [4, 30, 31], each having relative advantages and disadvantages. Ultraviolet-based displays require an additional light source and can suffer from low visibility in daylight conditions. Thermochromism is hard to control, due to the need for exact temperature control and the potential influence of ambient temperature. EC and EL displays are easy to fabricate at low cost and are flexible, robust, and low-power consuming. EL displays have a relatively long lifetime of up to 50,000 hours and, in comparison to EC, have faster switching times [6], making EL suitable for lighting applications [6, 32]. (Switching time here refers to the time it takes to switch from on state, e.g., an off state where nothing is shown to another state where something else is shown.) Different techniques have been proposed for the production of EL displays, such as cutting segments from a larger EC film [33], and screen- and inkjet printing the substrate layers [6]. Olberding et al. demonstrated the possibilities of such displays with a design space that included different materials as well as a variety of application cases [6]. Additionally, screen-printed EL displays can be integrated with textiles [34]. Klamka and Dachselt extended the EL design space with their exploration into the possibilities of added pen interaction [4]. EC-based displays have several promising properties; for example, they can hold their display content for an amount of time without a battery, like e-ink displays. As with e-ink displays, they do not emit any light themselves and they have a comparably slow switching time between states. Previous work on EC displays investigated the capabilities for mass-manufacturing [35], manual manufacturing processes [30], and even developed multilayered colour displays [31]. One of the main application cases for electrochromism so far is smart windows [36–38], while, more recently, other HCI applications have been explored. Klamka and Dachselt used an EC-based 8-segment display in their IllumiPaper prototype and Vyas et al. used an EC-based display that changed opacity with the increasing dust level of a vacuum cleaner [4, 39]. With TransPrint, we extend this line of work by presenting a fabrication process that enables nonexperts to produce such displays and demonstrating the capabilities of EC-based displays for a wider range of mobile and wearable UbiComp and HCI prototypes. Compared to previous work, we specifically provide detailed instruction on the design, printing, and assembly processes for transparent EC displays, which are based on commercially available materials and can be fabricated in nonlaboratory settings with simple prototyping equipment.

Electrochromism is the capability of some materials to reversibly change colour stimulated by redox reactions. This means that EC materials can change their optical absorption characteristics or colour when an electrical voltage is applied. A variety of different materials exist that can switch between different colour combinations and intensities. For TransPrint we are using the PEDOT:PSS (the chemical name poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) mixture for printing, which can change its colour from nearly transparent to a darker blue. The PEDOT:PSS mixture exhibits EC properties because it is electrochemically active which makes it suitable as electrodes in EC displays and operates at low voltages (1-5 volt). Additionally it takes few seconds (< 3s) and requires low current draws (< 3mA) to switch a 5x5cm display fabricated with PEDOT:PSS. However, one thing to note is switch time and current draw heavily depends on size and graphics design (amount of PEDOT:PSS used).

EC displays have several characteristic properties that enable a variety of applications [11]. They exhibit open circuit memory where its state stays the same when there is no short circuit, similar to electrical batteries, and can maintain their optical state and electrical charge for extended periods of time while drawing comparably little energy. This means that once the display reaches the desired visual state, no further energy is required to maintain the state. Energy is only needed to create a state change. The optical absorption (or in practice the strength of colouration) can be calibrated and set to any level between the states of minimum and maximum absorption; see Figure 2. Compared to EL displays, the optical state transitions of EC displays are slow, typically lasting a few seconds, depending on physical dimensions and used materials. While some EC materials can take tens of minutes to switch, the PEDOT:PSS employed for TransPrint switches in less than 10 seconds even at A4 size prints. EC displays do not emit any light; they only change the amount of light they absorb. Given that the increasing amount of artificial light in our daily life—especially from digital displays—has been shown to lead to disrupted sleep patterns and increased sleep deficiency [9], the nonlight-emissivity of EC displays presents an opportunity for more ubiquitous display deployment.

To date, EC technology has predominantly been used in windows and smart glass, enabling dynamic change of optical and thermal characteristics [36–38]. This is because the change of the absorption happens on an atomic level and therefore allows EC windows to switch without visible haze [40]. Recent advances have shown EC to be usable as an anticounterfeiting method by applying electrochromic materials to paper [41]. While EC is a rather old and well-established technology in the field of organic chemistry, it has so far mostly been neglected for HCI research [4, 38, 39]. One possible factor for this is the problem of fabricating such displays, which we try to overcome with the TransPrint method.

A functioning EC display is composed of the following components: two conductors (electrodes) each connected to a field of EC material or ‘ink’, and electrolyte which separates the two fields of EC material (see Figure 3). The conductors create an electrical circuit by allowing electrons and ions to move when an electrical current is applied through the EC material. The electrolyte is a gel substance with electrically conductive properties and is responsible for the ion exchange between the two fields of EC ink when a voltage is applied at the conductors. Insertion or extraction of ions into the EC ink changes the optical characteristics through reduction and oxidization, and as little as 1V is sufficient for this change to occur. An EC system needs two fields of EC ink that are connected to two different conductors so that an exchange of ions from one field to the other can happen when a voltage is applied. One field will be oxidized while the other is reduced, and vice versa when the polarity of the voltage is reversed. Visually, this redox causes one EC field to become transparent while the other gains colour. Alternatively, one of the EC ink fields can also be replaced by any other ion storage material that does not exhibit colour change on redox, as shown in Figure 3.

While theoretically not needed for functionality, the display components need to be contained by elements that will insulate and protect them. Thus, top and bottom substrates are required. To be able to observe the visual change, at least the upper substrate should be transparent. Typically, glass has been used, but more recently, polymer-based plastics, e.g., polyethylene terephthalate (PET) and polycarbonate (PC), have been employed as well. In some implementations, the lower substrates can even be replaced with paper [42].

In this section, we present the design and fabrication process of TransPrint displays, which are transparent, flexible EC displays. This includes two alternative structures or stack designs, vertical and coplanar (see Figure 4), a detailed description of the fabrication process using screen-printing and inkjet printing as well as design considerations.

Firstly, TransPrint displays can be produced in two different ways: either a vertical or a coplanar stack of the different elements. In the vertical stack all elements are stacked vertically, meaning both electrodes with EC ink are on top of each other divided by the electrolyte (compare Figure 4 (left)). So that the ions would flow from the top layer EC ink through the electrolyte to the bottom layer EC ink or vice versa (when the polarity is switched). For the coplanar stack both EC ink fields are on the same layer with two separated electrodes (compare Figure 4 (right)). This means that the ions move from one of the EC ink fields to the other through the electrolyte. The main difference between these two construction methods is that in the vertical stack the ink fields, e.g., can overlap while in the coplanar stack they must be next to each other.

For TransPrint we selected to use transparent PET film as the substrates onto which displays are constructed. In the vertical stack configuration, one EC ink field is printed on both substrate layers, whereas in the coplanar stack, both EC ink fields are printed on a single substrate. In both cases the two EC ink fields each have their own conductor and are connected only by the electrolyte layer. The EC ink used in TransPrint displays is itself conductive; thus it is only required to configure the conductors to connect to the edges of the EC ink fields. However, to reduce potential design limitations and ensure consistent switching performance, in TransPrint we utilize substrates coated with a conductive Indium Tin Oxide (ITO) layer which is one of the most commonly used transparent conductors and is also used as the conductor on smartphone touch panels.

Thus, TransPrint utilizes PET film precoated with ITO (PET-ITO) as substrates. For the vertical stack, both base and top layer are PET-ITO whereas for the coplanar structure PET-ITO is used for the base layer and noncoated PET for the upper layer. When using precoated PET-ITO where the whole piece is one conductor (e.g., the Adafruit ITO Coated PET (https://www.adafruit.com/product/1309) with a thickness of 175μm) for the coplanar stack, electrical separation of the two ink fields must be ensured, e.g., by scratching away the ITO coating from the PET to create a gap. Graphical display designs can be printed directly onto the ITO side of the PET-ITO using either screen- or inkjet printing. The PET-ITO material used is a thin film, which can easily be cut to different shapes, increasing the options for customization and flexibility of the displays. To prevent electrical short circuits between the top and bottom layers and to provide a container for the electrolyte, the PET-ITO substrate layers must be held apart.

In TransPrint this separation is created using double-sided adhesive sheets in which spaces have been cut out around the ink printed area, specifically 3M 9495 LE 300LSE, with a thickness of 170μm (see Figure 5). The amount of electrolyte required is calculated as the cubic volume of the container that is created between the two substrates and the spacer. For example, a display with a 5x5cm area using the previously mentioned adhesive sheets give the container a height of 170μm and therefore require 0.425mL of electrolyte (5cm x 5cm x 0.017cm = 0.425 cm3 = 0.425ml). This means that the average amount of needed electrolyte is dependent on the size of the display.

Either inkjet or screen-printing can be used to transfer the graphical design onto the PET-ITO substrates. For rapid and precise prints inkjet is optimal; however, it allows for less control over the amount of EC ink deposited during the printing process which can potentially lead to lower quality prints. For both, inkjet and screen-printing we used PEDOT:PSS based EC inks supplied by Ynvisible Interactive Inc. (https://www.ynvisible.com/ec-kit). While not completely identical, we expect comparable results from PEDOT:PSS based inks supplied, e.g., by Sigma-Aldrich (https://www.sigmaaldrich.com/catalog/product/aldrich/483095). Screen-printing utilizes a stencil of the graphic design on a frame-mounted mesh to transfer the ink onto the substrate [25]. Screen-printing meshes have different thread densities, depending on how much detail is required, or how much ink has to pass through it. Additionally, the type of emulsion used to create the stencil affects the print detail. As an alternative to using emulsion, stencils may be cut out from vinyl.

Figure 2 shows the transition between the two maximum states of a vertical stack EC display, caused by the reversal of the polarity of the voltage applied across the display conductors. For this 5x5cm display the full transition takes approximately 2.5s. Applying power to the display for shorter times will place the display in an intermediate state where the maximum opacity is not reached. Switching time and required voltage are dependent on the EC design, size, and used ink and electrolyte. For the Ynvisible EC-SC ink a maximum voltage of 3V is recommended; however the ITO layer on the PET-ITO will degrade if a voltage of more than 1.5V is used, which in turn sets the maximum voltage for driving the display. Given these low voltage levels, the displays can easily be controlled using, e.g., an Arduino microcontroller, and could be even activated using wireless energy sources such as NFC, as demonstrated by Dierk et al. [44]. Furthermore, the active operation temperature of these displays’ ranges from -100°C to +100°C and they continue to be functional after structural damage (e.g., a corner cut off) if the two conductors are not creating a short circuit. The displays are also bendable up to 7.5mm radius (see Figure 1) while remaining functional. The bend radius is limited by the fact that the ITO layer on the PET-ITO will break with a lower radius and thus increase the resistance. This also means that the mechanical endurance of the displays when repeatedly bends is only dependent on the quality of the PET-ITO. A bend radius of 0.75cm-1cm has been shown to have no influence on the resistance of the PET-ITO [45]. However, not only the bend radius is increasing the resistance of the PET-ITO but also repetitive bending as it leads to microcracks [46, 47]. Given results presented by Li and Lin it is expected that after ca. 300 bends with 17.3N strain the PET-ITO would reach a level were a significant increase in switching time would be visible and after 2000 bends being most likely be unusable due to the number of microcracks [47].

Furthermore, it should be noted that the printing of TransPrint displays does not require a completely dust free work environment. Although any dust particles etc. that made it onto the materials during the construction process will be visible on the display, they will not impede the display’s functionality. Nevertheless, it is advised to work in an as clean environment as possible and use gloves through the whole procedure to not leave fingerprints on the display.

When designing the graphics for a TransPrint display several factors should be considered. Vertical stack structures have two layers overlaid on each other, allowing a large degree of creativity in how the finished display will

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey