flexible display screens ready for mass production pricelist

The LED chip’s role is to ensure the display stability of the LED display, eliminate the LED flicker phenomenon, and provide a high-quality content display.

The global flexible display market size is expected to reach 220.75 billion in 2030 and grow at a CAGR of 34.83% during the forecast period (2021–2030). A flexible display is a visual output surface that is designed to be able to withstand being folded, bent, and twisted. Typically screens that use flexible displays are made of OLED displays. Flexible displays are becoming more prevalent in foldable technology such as smartphones, designed to be folded or closed like a book. Flexible displays are useful as they allow the device to be stored in a smaller space, such as a pocket while providing a larger screen size for media display.

Some of the major factors driving the adoption of connected and innovative solutions across the consumer electronics sector are the growing trend of smart homes and buildings, as well as the increasing demand for connected technologies. The incorporation of smart sensors into residential devices has increased the replacement cycle of new consumer electronics. The use of displays to control and communicate with the device is growing significantly.

For example, in July 2020, Samsung released the connected refrigerator SpaceMax Family Hub. It automates meal planning, allows consumers to see inside the refrigerator from anywhere, and users can watch their favorite TV shows while working in the kitchen on the refrigerator"s massive entertainment screen.

Aside from that, residential devices such as televisions are undergoing revolutionary changes. For example, the global demand for new TVs is expected to be solely for smart TVs; with increased access to high-speed internet, demand for smart TVs with better picture quality is increasing. With so many viewers consuming media from OTT platforms like Netflix, Amazon, and others, the need to store data effectively is becoming critical. According to Bitmovin, the market is shifting toward a new generation of video codecs that offer 30 to 70% better compression than H.264.

With the proliferation of screen sizes, the number of pixels per inch in 8K decreases. Additionally, studies show that consumers are unable to distinguish 8K videos from 4K videos. However, due to cost reductions in the coming years, demand for 8K screens is expected to rise significantly in the coming years.

PC gaming has recently become a popular choice among millennial gamers. This shift is primarily due to a combination of factors, including improved gameplay quality, the availability of high-end hardware and software, and increased internet bandwidth. Today, more exciting and demanding technology, such as VR and 4K displays, is available. As a result, PC gamers are expected to upgrade their equipment accordingly, which is one of the factors driving sales of gaming-specific PCs and their accessories like gaming screens. Thus, increased demand for picture quality has boosted the demand for flexible displays.

With the increasing demand for higher picture quality and resolution, vendors are increasingly investing in product innovation. LG Display, for example, invested KRW 1,740 billion in 2020; large vendors with a larger market share can invest a larger share of revenues in innovation, which other vendors in this space do not have.

Aside from that, the flexible display market share is highly dynamic in terms of technology pricing. For example, in recent times, the market selling prices of TFT-LCD and OLED panels have been consistently falling, affecting the revenues of vendors operating in the market and posing a challenge to their growth in the product category.

The industry is highly competitive, and vendors operating in it face price and margin pressure as many vendors add production capacity to compete on price. Vendors from Korea, China, Taiwan, and Japan are investing in expanding their production capacities, which significantly impacts global vendors" ability to remain sustainable and profitable in the market.

Furthermore, the new 8K displays are expected to decrease prices and sell for around USD 3,500 to 4,000 by 2022, down from their current average selling price of around USD 4,500. This is expected to have a negative impact on the margins of vendors operating in this space.

The ongoing evolution of smartphones and computers has aided in developing display technologies, with foldable and flexible displays emerging as the most recent landscape component. Curved displays have already gained traction among users through innovative TV screens, desktop monitors, and phones, so the market is expected to grow over the forecast period.

Flexible displays, which are being seriously discussed as a potentially disruptive technology for future handheld and other devices, are being investigated by smartphone behemoths such as LG, Samsung, and Huawei to deliver revolutionary designs to users.

However, cost increases, decreased finished product rates, price increases, a lack of product differentiation, seasonal demand patterns, and uncertainty about economic prospects pose significant demand growth challenges. In 2020, there will be more opportunities for flexible OLED displays due to a focus on cost reduction, adding new functions, implementing product differentiation, a fresh appearance, and industry demand for 5G models.

Understandably, the introduction of 5G will bring the ability to perform more tasks on a single device than was previously possible on previous networks, owing to the enhanced capabilities of new phones and laptops. Currently, the industry believes that flexible OLED displays are the best solution for the next generation smartphone market.

OLED is a new display technology that allows for more efficient displays and lighting panels. OLEDs are already being used in a variety of mobile devices and televisions. OLEDs are the most recent generation of display technology, offering superior performance and improved optical characteristics over older LED and LCD technologies.

Furthermore, smartphone manufacturers such as Samsung Z fold and LG G8X have used second-generation flexible OLED displays that can be bent. OLEDs were mainly used to create a market impression of foldable smartphones. Rolled OLEDs, on the other hand, are now making their way into the TV and smartphone markets.

Compared to other options, flexible displays made of OLED are more energy efficient. OLEDs are available in a very small factor, allowing manufacturers to build them as individual pixels. These are already being used in a variety of consumer electronics, such as curved OLED TVs, and are in high demand.

Due to the global shutdown, production of flexible displays fell precipitously in 2020 due to the global supply chain disruption. COVID-19 had an impact on the operations of not only flexible display manufacturers but also their suppliers and distributors.

In the short term, the failure of export shipments and poor domestic semiconductor demand compared to pre-COVID-19 levels are expected to impact negatively and slightly stagnant demand for semiconductor devices, affecting the flexible display market growth.

As a result of the ongoing COVID-19 outbreak, several major economies have been placed on lockdown. Sales of electronic products have been hampered, and supply networks have been disrupted. Furthermore, many economies are losing a significant amount of revenue due to manufacturing plant closures. As a result, the general scenario has hampered the demand for flexible displays in 2020.

The market is expected to recover from mid of 2022 as people have made huge savings during the lockdown. The growing demand for high-quality pictures and the smart house is expected to drive the growth of the flexible display market.

However, the market faced challenges such as reduced workforce and delays in receiving components and materials. It caused an unexpected spike in panel pricing, with a month-to-month jump of more than 7%.

By display type, the OLED segment dominates the global market and is expected to grow at a CAGR of 35.87%, generating a revenue of USD 175.95 billion by 2030. This OLED display can be subjected to a high degree of flexibility, consumes less energy, and is prominent in the market. In addition, OLED offers the potential for vast improvements in image quality and opens up new possibilities for device design.

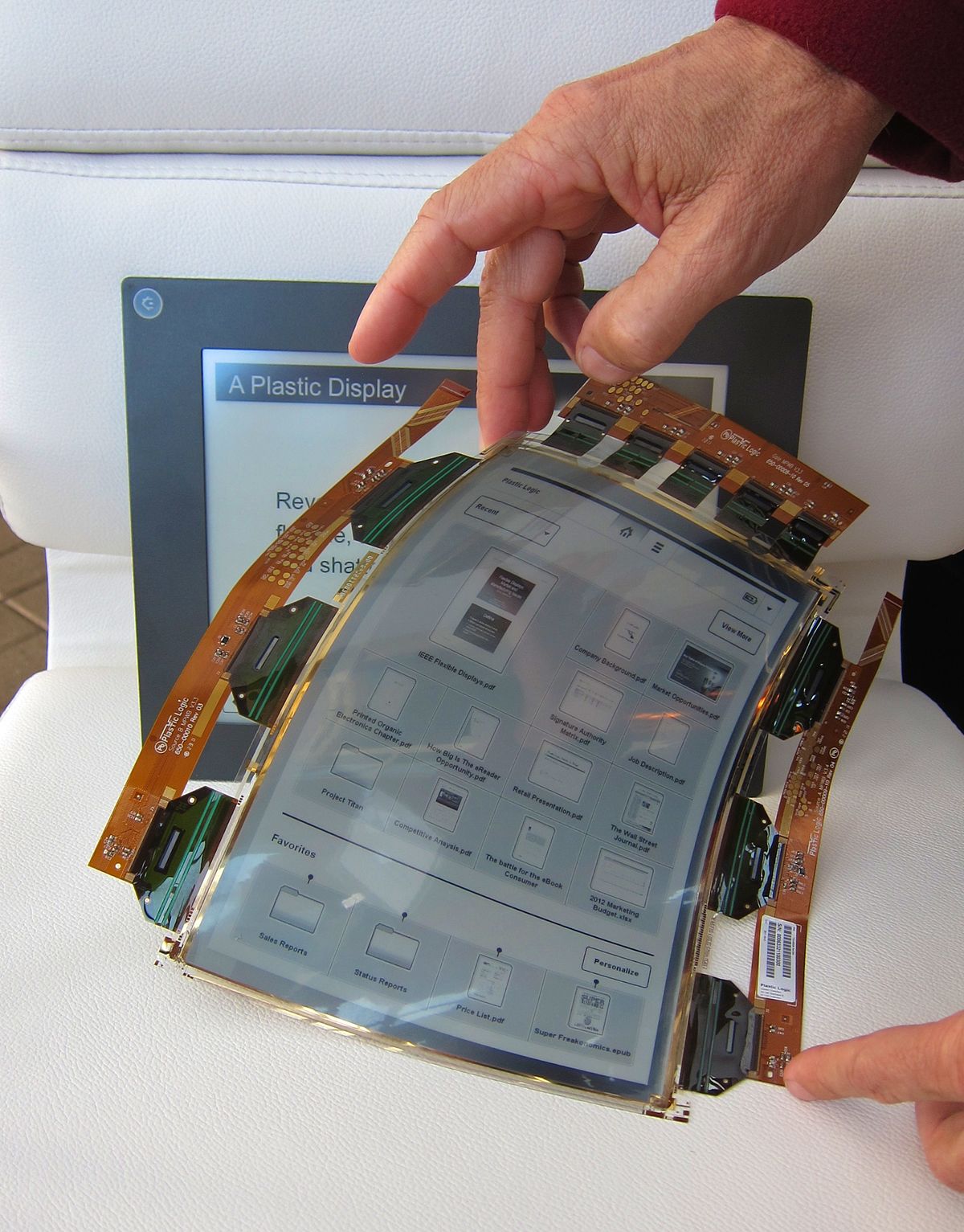

Based on the substrate material, plastic acquires the largest share of the market. Plastic-based flexible displays are the most recent advancements. Plastic AMOLED panels are substantially thinner and lighter than traditional glass-based displays, allowing for slimmer devices or larger batteries.

Based on application, smartphones and tablets hold a prominent share in the global flexible display market. The smartphone and tablet segment is expected to grow at a CAGR of 30.96%, generating a revenue of USD 116.14 billion by 2030. The smartphone industry has been steadily developing and growing, both in terms of market size and models.

By geography, Asia-Pacific accounted for thelargest market share of around 43.78% in 2021. The APAC flexible display market size is expected to grow at a CAGR of 36.01% generating revenue of USD 100.82 billion by 2030.

The Asia-Pacific market landscape is primarily driven by significant market consolidation, resulting in a plethora of advanced display technologies that have dominated the market. Furthermore, Asian countries are the home of display manufacturing foundries, giving this region a dominant market position.

The majority of display manufacturers are concentrated in the Asia-Pacific region, with South Korea, Taiwan, Japan, and China accounting for a sizable proportion of vendors operating and catering to various electronics manufacturers worldwide. Chinese panel manufacturers have continued to invest in new fabrication facilities and additional supplies due to Chinese government initiatives and support. Thus, Asia-Pacific is expected to be at the epicenter of the market due to the region"s growing penetration and consumer base for consumer electronics.

The initial market demand in the consumer electronics segment is expected to come primarily from emerging economies in APAC, North America, and Europe. The adoption of flexible OLED displays is anticipated to drive the market. The majority of the companies" manufacturing facilities and corporate offices are spread across Asia-Pacific, Europe, and North America. LG Display, Samsung Electronics, Motorola Inc., and Koninklijke Philips NV are just a few of the companies with manufacturing facilities all over the world.

The end-user application settings and subsequent demand for various television set heavily influence the European market landscape. In the current market, European TV OEMs and brands use either an IPS panel or a VA panel, depending on their models and sales regions. For example, the VA panel may have a higher contrast ratio in a comparatively darker environment, whereas consumers in some European countries prefer a darker living room.

On December 29th, 2021, LG Display, launched its newest OLED TV technology ‘OLED EX’. This next-generation OLED EX display implements LG Display’s deuterium and personalized algorithm-based ‘EX-Technology’.

On April 19th, 2022, Samsung launched its stunning Neo QLED 8K and Neo QLED TV range, offering the most pristine picture quality and immersive soundscapes to transform living spaces.

LG Display Co. Ltd, Samsung Electronics Co. Ltd, Royole Corporation, e-ink Holdings, BOE Technology Group Co. Ltd, Flexenable are the top players in the market.

Kateeva’s YIELDjet system (pictured here) is a massive version of an inkjet printer. Large glass or plastic substrate sheets are placed on a long, wide platform. A head with custom nozzles moves back and forth, across the substrate, coating it with OLED and other materials.

Based on years of Institute research, MIT spinout Kateeva has developed an “inkjet printing” system that could cut manufacturing costs enough to pave the way for mass-producing flexible and large-screen OLED displays.

Flexible smartphones and color-saturated television displays were some highlights at this year’s Consumer Electronics Showcase, held in January in Las Vegas.

Many of those displays were made using organic light-emitting diodes, or OLEDs — semiconducting films about 100 nanometers thick, made of organic compounds and sandwiched between two electrodes, that emit light in response to electricity. This allows each individual pixel of an OLED screen to emit red, green, and blue, without a backlight, to produce more saturated color and use less energy. The film can also be coated onto flexible, plastic substrates.

But there’s a reason why these darlings of the showroom are not readily available on shelves: They’re not very cost-effective to make en masse. Now, MIT spinout Kateeva has developed an “inkjet printing” system for OLED displays — based on years of Institute research — that could cut manufacturing costs enough to pave the way for mass-producing flexible and large-screen models.

In doing so, Kateeva aims to “fix the last ‘Achilles’ heel’ of the OLED-display industry — which is manufacturing,” says Kateeva co-founder and scientific advisor Vladimir Bulovic, the Fariborz Maseeh Professor of Emerging Technology, who co-invented the technology.

Called YIELDjet, Kateeva’s technology platform is a massive version of an inkjet printer. Large glass or plastic substrate sheets are placed on a long, wide platform. A component with custom nozzles moves rapidly, back and forth, across the substrate, coating it with OLED and other materials — much as a printer drops ink onto paper.

An OLED production line consists of many processes, but Kateeva has developed tools for two specific areas — each using the YIELDjet platform. The first tool, called YIELDjet FLEX, was engineered to enable thin-film encapsulation (TFE). TFE is the process that gives thinness and flexibility to OLED devices; Kateeva hopes flexible displays produced by YIELDjet FLEX will hit the shelves by the end of the year.

The second tool, which will debut later this year, aims to cut costs and defects associated with patterning OLED materials onto substrates, in order to make producing 55-inch screens easier.

By boosting yields, as well as speeding up production, reducing materials, and reducing maintenance time, the system aims to cut manufacturing costs by about 50 percent, says Kateeva co-founder and CEO Conor Madigan SM ’02 PhD ’06. “That combination of improving the speed, improving the yield, and improving the maintenance is what mass-production manufacturers want. Plus, the system is scalable, which is really important as the display industry shifts to larger substrate sizes,” he says.

Traditional TFE processing methods enclose the substrate in a vacuum chamber, where a vapor of the encapsulating film is sprayed onto the substrate through a metal stencil. This process is slow and expensive — primarily because of wasted material — and requires stopping the machine frequently for cleaning. There are also issues with defects, as the coating that hits the chamber walls and stencil can potentially flake off and fall onto the substrate in between adding layers.

But moisture, and even some air particles, can sneak into the chamber, which is deadly to OLEDs: When electricity hits OLEDs contaminated with water and air particles, the resulting chemical reactions reduce the OLEDs’ quality and lifespan. Any displays contaminated during manufacturing are discarded and, to make up for lost yield, companies boost retail prices. Only two companies now sell OLED television displays, with 55-inch models selling for $3,000 to $4,000 — about $1,000 to $3,000 more than their 55-inch LCD and LED counterparts.

YIELDjet FLEX aims to solve many TFE issues. A key innovation is encasing the printer in a nitrogen chamber, cutting exposure to oxygen and moisture, as well as cutting contamination with particles — notorious for diminishing OLED yields — by 10 times over current methods that use vacuum chambers. “Low-particle nitrogen is the best low-cost, inert environment you can use for OLED manufacturing,” Madigan says.

In its TFE process, the YIELDjet precisely coats organic films over the display area as part of the TFE structure. The organic layer flattens and smoothes the surface to provide ideal conditions for depositing the subsequent layers in the TFE structure. Depositing onto a smooth, clean surface dramatically improves the quality of the TFE structure, enabling high yields and reliability, even after repeated flexing and bending, Madigan says.

Kateeva’s other system offers an improvement over the traditional vacuum thermal evaporation (VTE) technique — usually somewhere in the middle of the production line — that uses shadow masks (thin metal squares with stenciled patterns) to drop red, green, and blue OLED materials onto a substrate.

This isn’t necessarily bad for making small, smartphone screens: “If a substrate sheet with, say, 100 small displays on its surface has five defects, you may toss five, and all the rest are perfect,” Madigan explains. And smaller shadow masks are more reliable.

But manufacturers start to lose money when they’re tossing one or two large-screen displays due to particle contamination or defects across the substrate.

Kateeva’s system, which, like its TFE system, is enclosed in a nitrogen chamber, precisely positions substrates — large enough for six 55-inch displays — beneath print heads, which contain hundreds of nozzles. These nozzles are tuned to deposit tiny droplets of OLED material in exact locations to create the display’s pixels. “Doing this over three layers removes the need for shadow masks at larger scales,” Madigan says.

As with its YIELDjet FLEX system, Madigan says this YIELDjet product for OLED TV displays can help manufacturers save more than 50 percent over traditional methods. In January, Kateeva partnered with Sumitomo, a leading OLED-materials supplier, to further optimize the system for volume production.

The idea for Kateeva started in the early 2000s at MIT. Over several years, Madigan, Bulovic, Schmidt, Chen, and Leblanc had become involved in a partnership with Hewlett-Packard (HP) on a project to make printable electronics.

They had developed a variety of methods for manufacturing OLEDs — which Madigan had been studying since his undergraduate years at Princeton University. Other labs at that time were trying to make OLEDs more energy efficient, or colorful, or durable. “But we wanted to do something completely different that would revolutionize the industry, because that’s what we should be doing in a place like MIT,” Madigan says.

A few years before, Bulovic had cut his teeth in the startup scene with QD Vision — which is currently developing quantum-dot technology for LED television displays — and was able to connect the group with local venture capitalists.

Madigan, on the other hand, was sharpening his entrepreneurial skills at the MIT Sloan School of Management. Among other things, the Entrepreneurship Lab class introduced him to the nuts and bolts of startups, including customer acquisition and talking to investors. And Innovation Teams helped him study markets and design products for customer needs. “There was no handbook, but I benefitted a lot from those two classes,” he says.

So in 2012, Kateeva pivoted, switching gears to its YIELDjet system. Today, the system is a platform, Bulovic says, that, in the future, can be tweaked to print solid stage lighting panels, solar cells, nanostructure circuits, and luminescent concentrators, among other things. “All those would be enabled by the semiconductor printer Kateeva has been able to develop,” he says. “OLED displays are just the first application.”

Getting tired of flexible OLED prototypes that are about as ready for retail as that cold fusion reactor your uncle Harry is building in his garage? Yeah, we are too, but it seems the industry is getting a little closer to reality, the latest step coming courtesy of Arizona State University"s Flexible Display Center and Universal Display. Researchers at the pair have managed to produce flexible OLED displays using the same production techniques used to create standard, rather less bendy LCD displays, enabling the transistors that control the pixels to be applied to plastic, rather than the glass they typically find themselves embedded within. They glue a piece of plastic onto glass, feed it through the LCD manufacturing process, then peel the two apart like a high-tech Fruit Roll-Up. That technique was used to create the 4.1-inch monochrome display shown above -- which is for now just another prototype that won"t be showing up in any devices any time soon. [Warning: PDF read link]

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Everyone is excited about the upcoming smartphones with flexible displays. There are many speculations as to what it would look like – a transparent slab or a rubbery mass. It may be a familiar form factor with a shock-absorbent display. It can also be something more akin to a folding map rather than a smartphone. People are fascinated by a mobile form which can be carried in the pocket and also have a large screen display. There is a great chance that such a device will soon be available for consumers.

According to experts in the field, the initial prototypes are ready and new products will be commercially available by the middle or the end of 2019. More advanced products will be made after the development of a few years based on market feedbacks and consumers liking. Companies like Royale are already set with manufacturing systems ready with them but they need to build more factories if large-scale production of foldable displays is needed. Market leaders like Samsung and LG are planning to launch smartphones using such displays. These companies may prefer to focus on curved displays at the moment rather than fully flexible displays.

The smartphones with a flexible or foldable device may assume many forms. It can be a portable mobile device that unfolds into two screens. Consumers here may have to watch the video with a seam in the middle of the screen. The vendors believe that along with the multitasking features, larger displays will attract the customers.

Some of the people who possess knowledge on the matter also say that these designs can make a smartphone heavier and thicker. One trend indicates that the smartphone market has been currently driven more by the screen size than any other factor. Consumers are going to like the larger screens if they come in portable formats.

What public actually wants is a way to combine portability and a large-screen audiovisual experience into a single device. They may even agree to a rigid and portable device. This can be a good choice for most people because they just want a larger screen on which they watch movies. Screen size remains the key feature for mobile and other styles may remain the same.

Consumers currently want one device to have all the functions of traditional computers and smartphones. Flexible displays are likely to combine all of those functions into one device. This will require the electronics industry to reshape the landscape of its working.

Another thing that consumers expect is foldable and flexible displays in smartphones or tablets to bring the same quality and benefits as compared to current premier devices. The features like scratch-resistant screen covers, superior optics, touch sensitivity, durability, and long battery life may not be compromised. Consumers won’t accept any shortcomings in these qualities instead of them expect these flexible displays to deliver in terms of these features.

Eventually, whether these devices will be popular in the market is a big question. Cost of producing these mobiles is high and can pose a deterrent in these new form factors. Smartphones or hybrid tablets will be priced high initially just in the same way as most of the premium range devices. Prices will gradually reduce so that a larger population can buy them.

There are diverse materials to be used for flexibility. The insulators, barriers, substrates, semiconductors, conductors and many more delicate components need to combine into an extremely thin film. Change of a single material will in most probable circumstances lead to change in many others to make everything compatible, efficient and long-lasting. Because of the familiarity of displays in routine use, the complex technology involved in producing a flexible display is often downplayed.

The entire product has to be designed from the beginning and therefore it takes time. The corresponding processes of device utility design, digital circuit design, and product design need to be done differently. Flexible displays are being discussed throughout the world in trade shows, but companies have not tried them as yet. Even if the know-how is very different and fascinating, companies do not want to accept the risk. The investment will be heavy for a fraction of change in the user experience which may or may not result in sales afterward.

For some of the prototypes of the foldable and flexible displays use screen covers made of plastic. Plastic is low in optical clarity, highly susceptible to scratches and it can also develop cracks easily. Using glass for flexible displays is challenging as it is fragile and it becomes necessary to modify it through costly processes. Processed glass, therefore, can deliver the kind of quality experience consumers may expect in any next-generation mobile devices.

But there are many more issues with components of the phone like adhesive material, cover film, polarizer, and touch sensor layers. These materials can’t function well and withstand the number of times folding up to thousands expected from them. Thus, the real problem is in basic physics that has to provide with alternative materials and suitable methods to work with entirely new technologies. Various smartphone and tablet companies are really interested in flexible displays, but if volumes are not large enough it will be unfeasible for them to produce it with entirely new methods.

Experts believe that folding and unfolding is just the first step toward achieving the next transformation in digital devices. In the future, as things mature, there will be displays rolled up in a pen-like device that unrolls to provide a massive screen whenever needed.

The timing is also very significant for any innovative products to get set for commercial reality. A few years ago there were a few companies trying to create this type of device, but it was too early for the ecosystem to materialize. The technology, supply chain, equipment, and material companies were not mature enough. But now things are changing fast and the entire digital economy as a whole is matured to make use of technology.

People need some time to get used to a new way of using the devices and new technology. The only thing about flexible displays is that they are quite new to consumers. Once the large volumes become feasible there are immense opportunities. The market already exists, companies are interested and the technology is also available for flexible displays to transform the use of digital devices like smartphones.

Foldable OLED displays can be bent by the user. These innovative displays enable new form factors, such as - such as phones that open into tablets, smart bands that open into smartphones and laptops with large displays. In 2019 the first foldable smartphones were launched, and after a rocky start, device markers are now introducing new devices to market as analysts expect increased adoption in the future.

In 2019 Samsung finally introduced the first device, the Galaxy Fold - which had a problematic launch. Since then Samsung followed up with several new foldable phones, for example the Galaxy Z Fold 2 which sports an internal foldable display at 7.6" 1768x2208 HDR10+ 120Hz Dynamic AMOLED and also a larger 6.23" 816x2260 Super AMOLED cover display. Samsung also launched the clamshell-style Galaxy Z Flip.

Several companies offer foldable phones besides Samsung, including Motorola, Huawei and others. Huawei for example launched the Mate X2 in 2021, which features an inside-folding AMOLED display, a 8-inch 90Hz 2480 x 2200 one. There is also an external 6.45-inch 1160 x 2700 90Hz (240Hz touch sampling rate) AMOLED display.

Foldable OLED laptops is another promising market segment. In 2021 Lenovo started shipping the $2,499 foldable ThinkPad X1 Fold laptop, with its 13.3" 2048x1536 foldable OLED display (produced by LG Display). Hopefully more companies will follow suit and we"ll see more such devices on the market soon.

If you want to learn more about the foldable OLED technology, industry and market, check out ourWhy flexible displays and lighting panels are so exciting

The report package also provides a complete list of flexible OLED developers and makers and their current (and future) products, and a lot more. Read more here!

Flexible electronics, a technology for assembling circuits by mounting devices on plastic substrates that can bend, stretch and twist un-tethered by wires, offers important advantages over conventional electronics built on rigid substrates.

Among the products that this technology is rapidly making possible are folding smartphones with wraparound displays that can fit into a pocket but unfold into a full-sized tablet, photovoltaic sheets and wearable or implantable devices that are better able to interact with the human body; conventional rigid electronics cannot be worn comfortably and do not do well when a body moves or when a sensor is placed on the soft tissue of an internal organ.

At the Consumer Electronics show last month Chinese startup Royole showed off the world’s first commercial smartphone with a flexible display. Called FlexPai it is a combination of mobile phone and tablet (it has the portability of a smartphone plus the screen size of a tablet). Unfolded, FlexPai provides a 7.8” color display screen with 4:3 aspect ratio and a 1920 x 1440 resolution.

FlexPai can be folded from 0 to 180 degrees to easily fit into a pocket. It Includes two cameras with 20 and 16 megapixels that can be bent to capture objects at unique angles. Royole’s flexible displays are produced at the company’s mass production campus in Shenzhen, China, a 100% self-designed, R&D and manufacturing facility with a total investment of around $1.7billion.

Royole further showed how the same flexible displays could be used for automotive dashboards, wearables and for various other commercial and industrial uses.

Also at CES LG unveiled a 65-inch OLED television that that rolls into and out of a base stand. It can be furled and unfurled on demand, extend part way to display photos or act as a control screen for smart devices, or unfold completely for full viewing. The company also showcased an “LG waterfall” formed from dozens of curved displays at the entrance to its CES booth.

The academic community is engaged in a broad range of research topics directly relevant to flexible electronics and associated production. In a paper published Feb. 1 in Science Advances, researchers from the University of Houston reported significant advances in stretchable, rubbery semiconductors, including integrated electronics, logic circuits and arrayed sensory skins, moving these applications closer to commercialization.

Carrier mobility, or the speed at which electrons can move through a material, is critical for an electronic device to work successfully because it governs the ability of the semiconductor transistors to amplify the current. The University of Houston researchers discovered that adding minute amounts of metallic carbon nanotubes to the rubbery semiconductor P3HT (polydimethylsiloxane composite) leads to improved carrier mobility by providing what they described as “a highway” to speed up the carrier transport across the semiconductor.

At the University of Southampton researchers are collaborating with industrial partner PragmatIC on a Process Design Kit (PDK) that will expand the potential for the mass market uses of flexible electronics.

PragmatIC creates flexible integrated circuits (FlexICs) that can be embedded into packaging to personalize product information and present promotional offers. The prototype PDK developed through the project applies the school’s design flow expertise to PragmatIC’s flexible transistor technology.

Integrating silicon components, printing with conductive inks and pasting on stretchable substrates yields so-called flexible hybrid electronics (FHE). The term refers to curved and variable form factor integrated devices with both printed components and conventional (although slimmed down) CMOS-based devices. FHE’s advantage is that it preserves the full operation of traditional electronic circuits but in conformable architectures.

Over the past few years and in recognition that it is important to share information as well as collaborate with multiple entities on FHE projects, major U.S. and international companies have formed public/private consortiums to launch targeted, large-scale programs with significant government funding to develop these new technologies.

For example, to advance the growth of the FHE ecosystem, the public/private partnership SEMI-FlexTech recently issued a Request for Proposal (RFP) for a demonstrable, modular multi-disciplinary FHE sensing system applicable to flexible, lightweight mobile and/or curved constructions. Another RFP asks for renewable, sustainable power systems employing flexible hybrid electronic components.

Approximately $5 million is allocated for these projects. Primary funding will be provided by the U.S. Army Research Laboratory (ARL) through SEMI-FlexTech.

NextFlex is another consortium of companies, academic institutions, non-profits and state, local and federal governments with a shared goal of advancing U.S. manufacturing of FHE. Formed in 2015 through a cooperative agreement between the US Department of Defense (DoD) and the FlexTech Alliance, the consortium is currently developing an FHE PDK and a Modeling and Design Roadmap.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

From the company that created the world’s first folding phone comes an open-source kit to help anyone build their own products with flexible displays!

Royole has shown an incredible ability to find the right niche and pivot at the right time with their technological offerings. The company arguably built the first-ever flexible smartphone – the FlexPai – outpacing even Samsung, and their RoKit now aims at helping democratize the fully flexible display (FFD), so creatives and designers can tinker with it, building their own products too.

The kit comes packaged in a pretty impressive aluminum briefcase, containing everything you need to bring your unique tech idea to life. The upper part of the briefcase houses Royole’s 3rd Generation Cicada Wing 7.8-inch fully flexible touch-sensitive display, while the lower half of the briefcase contains a development motherboard running Android 10, an HDMI adapter (in case you want to connect your flexible display to an existing computer like a Raspberry Pi, smartphone, laptop, or any other gadget), and a bunch of power cables for good measure.

The idea behind the RoKit, says Royole Founder and CEO Dr. Bill Liu, is to “invite every industry to imagine and design with flexibility in mind, unfolding new possibilities for creators and accelerating the development of flexible solutions in all walks of life.” Envisioned as the world’s first open platform flexible electronics development kit, the RoKit allows other creators to do exactly what Royole did with the FlexPai in 2018 – create electronic products that the world has never seen before.

To show how limitless their flexible displays can be, Royole’s even created a few conceptual products that highlight exactly how folding screens can make products sleeker, smaller, and better. The examples include (as shown below) handheld gimbals/cameras with slide-out displays, a slick monolithic computer that transitions magically from keyboard to screen (I wonder where they got that idea from), and even a helmet with a rear display that contours perfectly to the shape of the head, allowing you to communicate efficiently with drivers behind you.

For now, the RoKit is available for purchase on the Royole website in the United States, United Kingdom, Germany, Japan, and China. Priced at $959, it definitely isn’t cheap, although one could make the case that it’s just about affordable for being able to test out and prototype a product before you actually develop it with mass-produced flexible displays.

(Phys.org)—Is Samsung getting ready to release a line of flexible displays made of glass-replacing plastic? The right words in response may be "well, finally," or "well, maybe." The Wall Street Journalhas talked to a source who said that Samsung, in the words of the WSJ subheading, "Plans to Mass Produce Flexible Mobile-Device Screens" in the first half of next year. The source was not named and was only described as "a person familiar with the situation." Samsung has tantalized techies and consumers with its futuristic videos showing a beautiful-life day using wearable wrist computers, auto dashboard display screens, location-finding smartphones, and wall mounted computer screens of plastic rather than glass.

Expectations are that Samsung, as part of the grand mix, is to start mass production of smartphone screens using bendable plastic rather than glass. According to the WSJ report, Samsung"s flexible displays will incorporate OLEDs.

Analysts believe the move into mass production would be a real business advantage as smart-device makers in competition with Samsung scramble for attention and market share with their designs and feature sets. Some of the reasons why a Samsung customer would favor plastic rather than conventional glass would be lightness and durability. As for Samsung, the technology could also help lower manufacturing costs as well as differentiate its products from rivals, said an analyst at Shinyoung Securities in the WSJ report.

Hopes that Samsung would not miss the 2012 mark in flex displays for television were shelved this year with reports of problems preventing release of the 55-inch OLED TVs. The idea had been to sell them in time for the London Olympics.

Samsung is considered one of the leaders in OLED display research and the leader in (Active Matrix) AMOLED, where a transistor next to each pixel brings faster response time. OLED Displays are thinner, more efficient and offer better picture quality than LCD or Plasma displays.

As for smartphones, back in March, analysts were already talking about how Samsung was looking at its plastic-backed AMOLED devices to make lightweight, ultra-thin phones with foldable screens. Analysts said they expected to see Samsung apply plastic substrate-based, bendable or curved displays for smartphones with the first products carrying a design where a screen is folded over the edges of a phone, so that the display continues on to the sides. The display would be unbreakable.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Visionox is one of the biggest OLED manufacturers in China, providing panels for Xiaomi flagships like Mi 10 and Mi Note 10. Today, the Chinese media revealed the company is ready to begin mass production of displays with under-screen cameras.

The technology is not new per se - Oppo already showcased their way of battling the problem with bezels, notches and punch holes during MWC Shanghai 2019. Back then the company revealed the key hurdle screen manufacturers will have to tackle is the brightness and color difference that is caused by diffraction from the protective glass.

Visionox claims this can be fixed with a different organic and non-organic film materials that allow for higher transparency. The hardware might be new, but it still needs the software to support it - the company claims it has an algorithm that fixes brightness, color gamut, and viewing angle issues and removes the glare that was seen in the prototype Oppo demoed back in 2019.

There is also an optimization of the pixel arrangement around the camera’s lens that on paper is allowing the shooter to “look through” the display, but this might bring a disruption of the quality of images - if everything else is in Full HD, this small circle might scale image quality back to HD or even SD.

The Chinese maker has made this possible through hundreds of new technologies, most of which are already patented, giving a green light for mass production. The last step before seeing such displays on the market is the adoption by smartphone manufacturers - we expect to see some demo units by the end of the year and official product launches at Q1 2021 - either at CES in Las Vegas or MWC in Barcelona.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey