sharp lcd panel factory in stock

OSAKA -- Sharp has turned LCD factory operator Sakai Display Products into a wholly owned subsidiary for an estimated 40 billion yen ($296 million), Sharp announced Monday.

Sharp previously held a 20% stake in SDP, which produces large display panels for televisions in the city of Sakai, near Osaka. It acquired the rest from a Samoa-based investment company by handing over 11.45 Sharp shares for each SDP share it received.

Through improvements in LCD parts and materials, monitor weight has been reduced over earlier models, making it easier to transport and install the display.

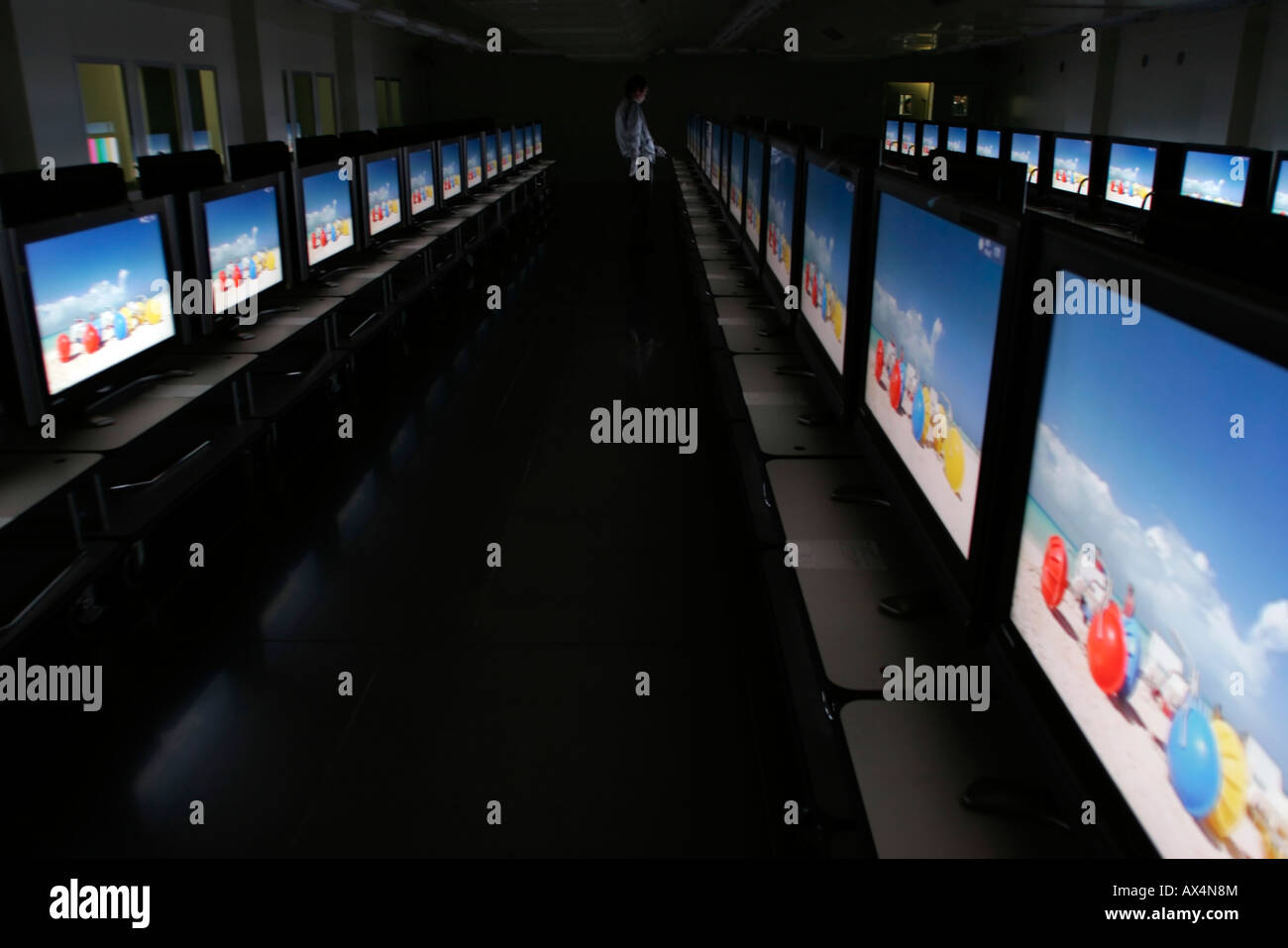

In March 2012 at Kameyama Plant No. 2, Sharp began producing the world’s first high-performance LCD panels incorporating IGZO oxide semiconductors. Sharp is expanding production scale through April to meet market demand.

Kameyama Plant No. 2 first started operations in August 2006, manufacturing highly advanced LCD panels for TVs. Production systems have subsequently been reorganized to focus on producing small- and medium-sized LCD panels for the world’s rapidly growing smartphone and tablet terminal markets.

Employing advanced IGZO oxide semiconductors enables Sharp to produce LCDs with smaller thin-film transistors and increased pixel transparency, thus allowing for lower energy consumption. In addition, proprietary UV2A*3 photo-alignment technology employed in Sharp’s AQUOS LCD TVs enables these displays to achieve high image quality.

Sharp will encourage the application of its new high-resolution LCD panels to high-definition notebook PCs and LCD monitors—which are both expected to grow in demand—as well as to mobile devices. Sharp will also contribute to creating markets for attractive new products.

*2 IGZO (InGaZnO) is an oxide comprising indium (In), gallium (Ga), and zinc (Zn). A thin-film transistor using this material has been developed by Sharp in collaboration with Semiconductor Energy Laboratory Co., Ltd. (a company based in Kanagawa, Japan, and led by President Shunpei Yamazaki).

*3 Ultraviolet-induced multi-domain Vertical Alignment (UV2A) is a photo-alignment technology that precisely controls the alignment of LCD molecules in a simple LCD panel structure.

LCD displays are still going to be around for a long time, at least for smart TVs such as the ones that use Android TV and other operating systems. Today, the massive electronic manufacturing company Foxconn announced a new partnership with Sharp to build and operate a new TV LCD flat-panel factory in China, which will cost $8.8 billion.AMOLED displays set to close in on LCD this year

Reuters reports that the new factory will help with the expected demand of new flat-screen TVs in Asia. Foxconn said that the LCD factory will make 10.5-generation 8K displays, along with screens for smart TVs and electronic whiteboards. Production is expected to begin in 2019.

This news comes even as other companies are embracing OLED displays for both TV as well as smartphones. However, there’s still some life in the LCD market. Panasonic recently announced an LCD IPS display with a 1,000,000:1 contrast ratio. It is supposed to have 600 times more contrast compared to normal LCD panels, and those levels are close to those found in OLED displays.

Sharp and Sony have reached a basic agreement to form an LCD manufacturing joint venture, in a move that continues a months-long realignment of key players in the LCD panel business.

The two companies aim to conclude a definitive deal by the end of September that will see a new LCD plant already under construction by Sharp taken over by the joint venture. The plant in Sakai in western Japan is being built at a cost of about ¥380 billion (US$3.5 billion), and under the joint venture plan Sony will shoulder 34 percent of the cost of the factory.

The move represents a major shift for Sony, which has previously been investing in LCD panel production with South Korea"s Samsung Electronics. The two companies currently compete with Sharp and produce LCD panels in South Korea through S-LCD, which has a factory at Samsung"s Tangjeong facility.

It will be a so-called "10th-generation" plant. That means it will be able to accept sheets of mother glass -- from which several panels can be made -- of 285 centimeters by 305 centimeters. Sharp said it will be able to produce six LCD panels in the 60-inch class, eight panels in the 50-inch class or 15 panels in the 40-inch class on each sheet.

The area of each sheet is 60 percent larger than the eighth-generation sheets used at Sharp"s current cutting-edge Kameyama factory in Japan. This will translate to a lower per-inch cost for panels produced on the line -- something of great importance in the highly competitive flat-panel TV business.

But in November, Samsung said it would invest 2 trillion Korean won (US$2.1 billion) in a new LCD production line at Tangjeong without participation from Sony. The line is scheduled to begin production in the third quarter of this year and will produce panels 50 inches and larger -- the same types of screens that Sharp is targeting with its new factory in Sakai in western Japan.

Japan"s Sharp said Thursday it will team with a large Chinese manufacturer to build a factory in Nanjing and mass-produce LCD screens for TVs, computers and tablets.

Sharp said it will form a joint venture with China Electronics Corp. (CEC) to manage the project, and aims to begin production in June 2015. The plant will eventually handle 60,000 LCD panels per month, each measuring 2.2 x 2.5 meters, which can then be divided into smaller sizes for consumer products.

Although Sharp is struggling with massive losses and going through a major restructuring to rebuild its finances, the company is still one of the largest LCD display makers in the world and possesses cutting-edge technology. Japan"s Nikkei newspaper reported that as part of the deal, Sharp will transfer its technology for producing IGZO (Indium Gallium Zinc Oxide) screens to the venture and will receive payment in the "tens of billions of yen" in return, part of which it will use to fund the new investment.

IGZO allows for higher resolutions and lower power drain than traditional LCD screens, and devices that use the technology are beginning to appear on the market. Sharp has launched smartphones and tablets with IGZO screens, and Samsung Electronics, Asustek Computer and Fujitsu are all releasing laptops that use the technology.

Rumors have long circulated that Samsung and Apple are looking to build smartphones using IGZO screens. A second factory that can produce the technology would help allay fears of being dependent on a single supplier.

The new venture will be called Nanjing CEC-Panda LCD Technology and will be funded by a 17.5 billion yuan (US$2.8 billion) investment, 92 percent from CEC Group and 8 percent from Sharp. It will be officially established in March of next year.

Sharp said the Chinese plant will allow production at lower costs than its current factories, and it will retain the right to buy the panels produced at the new facility.

Sharp has been aggressively pursuing deals with foreign partners to shore up its finances as it looks to recover from deep losses. Since last year it has signed deals with Samsung, Foxconn and Qualcomm for joint production and research.

As a result of a deal announced in August 2009, Sharp and CEC already operate a Chinese joint venture producing smaller LCD panels, to which Sharp transferred some of its older technology. They said at the time they would negotiate a deal to build larger panels in the future.

Sharp booked a ¥545 billion loss last fiscal year but forecasts it can rebound to a ¥5 billion profit during the current period. It said Thursday that the finances of the new deal are already factored into its current forecast.

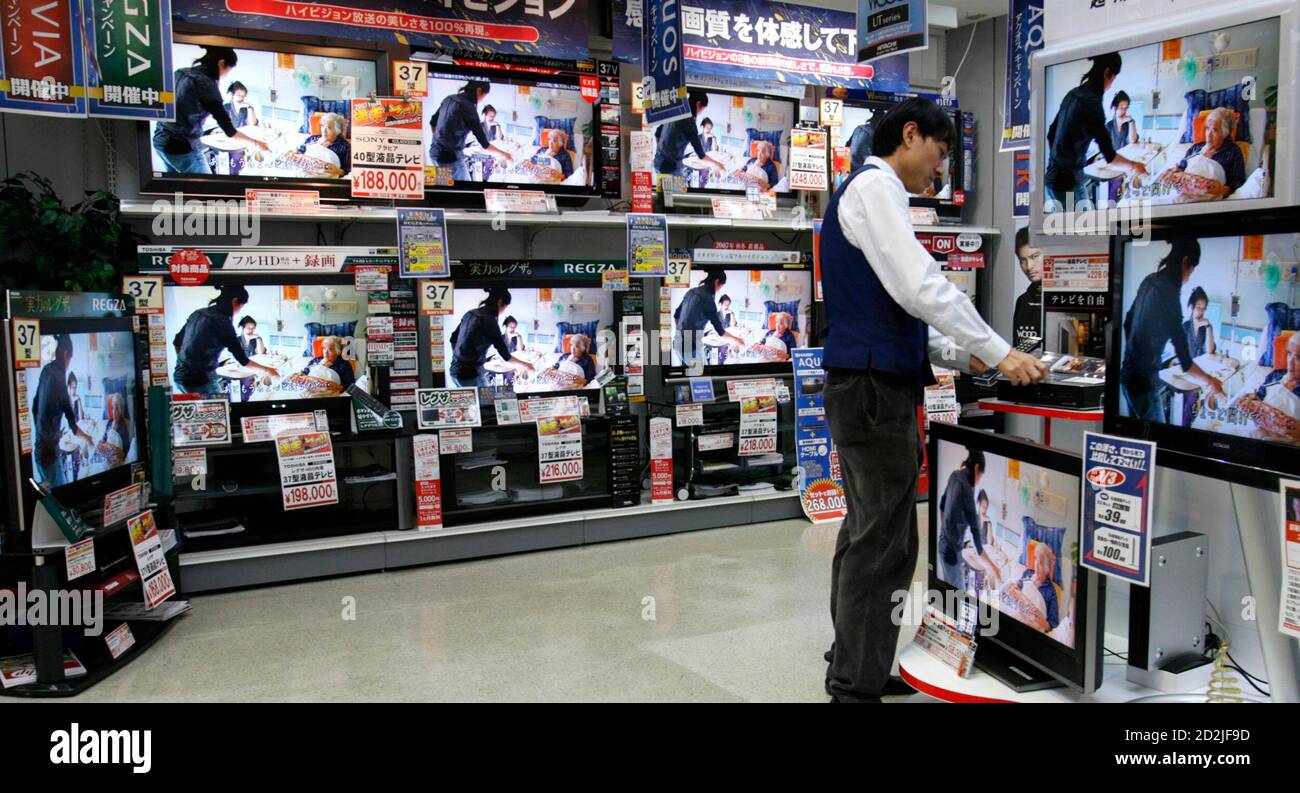

TOKYO -- Sharp Corp. is considering buying television-use liquid-crystal-display panels from such Taiwan makers as Quanta Display Inc. and Chi Mei Optoelectronics Corp., a senior executive said.

Sharp manufactures TV-use LCD panels and is the world"s largest LCD-TV maker with its "Aquos" brand models. But it is running short of TV-use panels because of strong global sales of LCD TVs. In November, Sharp President Katsuhiko Machida said his company was in talks with several Taiwan LCD makers to obtain supplies of TV-use LCD panels.

TOKYO, Dec 12 (Reuters) - Sharp Corpsaid on Friday it would close two LCD output lines making small and mid-sized panels in Japan, and move production to a newer and more cost-efficient plant as the global downturn hits demand for electronic goods.

Sharp plans to cut about 380 temporary workers due to the shift in production, but said it was unclear at the moment how much costs will be reduced through the planned move.

Sharp said the LCD lines set to be closed in January were built more than 10 years ago, while its Kameyama No.1 plant, which will shift from production of TV panels to output of smaller displays, is one of Sharp’s flagship factories.

The world’s third-largest LCD TV maker said it is on track to bring onstream its advanced LCD panel factory in the western Japan city of Sakai by March 2010.

Shares in Sharp were down 6.2 percent at 607 yen in afternoon trade, underperforming the Tokyo stock market"s electrical machinery index, which fell 5.3 percent. (Reporting by Yumi Horie and Kiyoshi Takenaka; Editing by Michael Watson)

This past Friday, Sharp Corp., President Katsuhiko Machida announced the firm will be building-up production capacity for manufacturing LCD panels at its main factory (Kameyama) from April. The total amount of capital involved in this ramp up is said to be approximately 15 billion yen or US$128 million (at an arbitrary exchange rate of Y117/US$1). This year’s much awaited World Cup Soccer tournament is one of the biggest reasons behind Sharp’s optimism. Sharp is the world"s largest manufacturer of LCD TVs and is aiming to increase its global market share currently at about 17 - 18% to 20%.

It is expected that global demand for LCD TVs will increase from the 20 million unit level achieved in 2005 to about 36 million units this year. Sharp, based on what it perceives to be robust consumer demand – especially from the spring – expects to increase its sales from the 4 million unit level recorded in 2005 to 6 million-plus units this year. World Cup Soccer is reason enough to expect strong LCD TV sales as soccer is a very popular sport in Japan and in many other countries throughout the world. At any rate, 2006 is a big year for sports with Torino Winter Olympics and the Baseball World Cup also taking place this year.

Sharp is not alone as Matsushita Electric Industrial (MC) and other rivals are also planning to boost production. Machida is well-aware of the cut-throat competitive nature of the business and he is already discussing an earlier launch of a second factory for production of LCD panels. The second factory had been planned to open this October.

Sony said it would take a one-third stake in Sharp"s $3.5 billion LCD panel plant set for completion by March 2010, in an effort to meet fast-growing demand for flat televisions.

The move is the latest in a wave of alliances among Japanese flat TV makers as they try to secure enough panels while keeping initial investments in check to fight steep price declines.

Sharp, which offers Aquos LCD TVs, plans to turn the liquid crystal display factory, which would be the world"s largest, into a joint venture, with the Osaka-based company owning 66 percent and Sony taking the remainder.

Besides LCD panels, the joint venture will also produce LCD modules, which are display panels equipped with components such as a backlight unit and LCD driver chips.

The two Japanese companies plan to hold a joint news conference on Tuesday where Sony President Ryoji Chubachi and Sharp President Mikio Katayama will speak.

"For Sharp, this is a positive step since it means a major buyer that would keep the 10th-generation factory busy," Daiwa Institute of Research analyst Kazuharu Miura said.

Sharp"s new factory would use so-called 10th-generation glass substrates, which can yield more panels than earlier-generation, smaller glass substrates, improving production efficiency and helping both firms offer attractively priced flat TVs.

Global LCD TV sales are likely to more than double to 155 million units by 2012, according to the Japan Electronics and Information Technology Association.

Sony, which aims to sell 10 million units of its Bravia LCD TVs in the current business year to March 31, runs another LCD joint venture, S-LCD, with Samsung.

The announcement follows Toshiba"s decision late last year to buy LCD panels from Sharp, while Panasonic maker Matsushita Electric Industrial said earlier this month it would spend $2.8 billion to build an LCD plant in the face of robust LCD TV demand and tight panel supplies.

"The problem will be 2010 and 2011. Just when TV demand is likely peaking, Sharp"s 10th-generation plant will come onstream, and so will Matsushita"s new factory," Shinko Securities analyst Hideki Watanabe said.

Shares in Sony closed up 1.2 percent at 5,200 yen, while Sharp was flat at 2,100 yen. The Tokyo stock market"s electrical machinery index IELEC.rose 0.3 percent.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

sharp lcd panels are easy to install and have the most basic features. When looking for lcd panels at wholesale prices, Alibaba.com offers a wide variety of sharp lcd panels that are easy to install and maintain, and are the perfect option for those looking for a new option.

Small lcd panels for sale are great for those looking for a new option, but be sure to stock a variety of sharp lcd panels for business owners. If you are looking for a sharp lcd panel for your business, consider buying smaller businesses.

sharp lcd panels are versatile and have the same functions as a flexible smartphone. It"s great for first-time buyers to find the lcd panels that are versatile and have the same functions as a flexible smartphone display. lcd panels are versatile and have a wide range of functions, such as displaying Tft displays, and for smart- screen displays.

Alibaba.com offers a wide variety of cheap lcd panels and lcd panel printing. different materials are available, such as wood, laminate, and glass, and metal lcd panels. Although different materials are available, different materials are used, and can be found to satisfy the needs of their customers.

Osaka, Mar 27, 2012 (JCN Newswire via COMTEX) -- Sharp Corporation (hereinafter "Sharp") entered into agreement today with Hon Hai group, the world"s leading EMS (electronic manufacturing service) company, to establish strategic global partnership to collaborate in various business fields, and to issue new shares to Hon Hai group through third-party allotment (hereinafter "the issuance of new shares through third-party allotment").

Looking at the business environment, Hon Hai Precision Industry, the key company of Hon Hai group, saw Sharp"s LCD technology with high reputation, and decided to procure ultimately up to 50% of large-size LCD panels and LCD modules manufactured at the LCD panel plant in Sakai-city, Osaka, Japan. The LCD panel plant will be mutually managed by one company set by partner companies.

In addition, this partnership allows each company to establish a new business model, combining each company"s strength, to launch cost competitive component and products fit to market demand by utilizing Sharp"s potential for the development of one-of-a-kind components and products with Hon Hai group"s mounting technology and cost competitiveness.

Sharp plans to enhance this partnership by broadening the collaboration field, to allocate funds received from Hon Hai group by the issuance of new shares through third-party allotment, to the investment for the new technology introduction, to increase mid-and long- term profitability, and to strengthen competitive edge in the global market.

Hon Hai Precision Industry will procure ultimately up to 50% of LCD panels and LCD modules manufactured by SDP. Both companies will mutually take in part of the management through one company set by partner companies, which enables stable operation of the LCD panel plant in Sakai.

The two companies will take advantage of the economy of scale and material procurement in LCD panel and LCD TV fields, and will further enhance cost competitiveness in the global market.

Back in 2016, to determine if the TV panel lottery makes a significant difference, we bought three different sizes of the Samsung J6300 with panels from different manufacturers: a 50" (version DH02), a 55" (version TH01), and a 60" (version MS01). We then tested them with the same series of tests we use in all of our reviews to see if the differences were notable.

Our Samsung 50" J6300 is a DH02 version, which means the panel is made by AU Optronics. Our 55" has an original TH01 Samsung panel. The panel in our 60" was made by Sharp, and its version is MS01.

Upon testing, we found that each panel has a different contrast ratio. The 50" AUO (DH02) has the best contrast, at 4452:1, followed by the 60" Sharp (MS01) at 4015:1. The Samsung 55" panel had the lowest contrast of the three: 3707:1.

These results aren"t really surprising. All these LCD panels are VA panels, which usually means a contrast between 3000:1 and 5000:1. The Samsung panel was quite low in that range, leaving room for other panels to beat it.

The motion blur results are really interesting. The response time of the 55" TH01 Samsung panel is around double that of the Sharp and AUO panels. This is even consistent across all 12 transitions that we measured.

For our measurements, a difference in response time of 10 ms starts to be noticeable. All three are within this range, so the difference isn"t very noticeable to the naked eye, and the Samsung panel still performs better than most other TVs released around the same time.

We also got different input lag measurements on each panel. This has less to do with software, which is the same across each panel, and more to do with the different response times of the panels (as illustrated in the motion blur section). To measure input lag, we use the Leo Bodnar tool, which flashes a white square on the screen and measures the delay between the signal sent and the light sensor detecting white. Therefore, the tool"s input lag measurement includes the 0% to 100% response time of the pixel transition. If you look at the 0% to 100% transitions that we measured, you will see that the 55" takes about 10 ms longer to transition from black to white.

All three have bad viewing angles, as expected for VA panels. If you watch TV at an angle, most likely none of these TVs will satisfy you. The picture quality degrades at about 20 degrees from the side. The 60" Sharp panel is worse than the other ones though. In the video, you can see the right side degrading sooner than the other panels.

It"s unfortunate that manufacturers sometimes vary the source of their panels and that consumers don"t have a way of knowing which one they"re buying. Overall though, at least in the units we tested, the panel lottery isn"t something to worry about. While there are differences, the differences aren"t big and an original Samsung panel isn"t necessarily better than an outsourced one. It"s also fairly safe to say that the same can be said of other brands. All panels have minute variations, but most should perform within the margin of error for each model.

Sharp Corp. engages in the manufacture and sale of electronic components and consumer electronic products. It operates through the following segments: Smart Homes, Smart Business Solutions, Internet of Things (IoT) Electronics Devices and Advance Display Systems. The Smart Homes segment includes mobile phones, tablets, electronic dictionaries, calculators, facsimiles, telephones, and network control unit. The Smart Business Solutions segment covers the POS systems, electronic cash registers, commercial projectors, information displays, digital MFPs (multi-function printers), options and consumables, software, FA equipment, and ultrasonic cleaners. The IoT Electronics Devices segment handles the camera modules, camera module production facilities, sensor modules, proximity sensors, dust sensors, CCD/CMOS sensors, laser diodes, and automotive cameras. The Advance Display Systems segment comprises of LCD color televisions, Blu-ray Disc recorders, indium gallium zinc oxide (IGZO) LCD modules, continuous grain (CG) Silicon LCD modules, and amorphous silicon LCD modules. The company was founded by Tokuji Hayakawa on September 15, 1912 and is headquartered in Osaka, Japan.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey