lcd panel technology comparison made in china

With the global industrial transfer and technology upgrade, a group of leading flat display panel manufacturers from mainland China is taking the opportunities and competing in the global market with their predecessors from South Korea and Taiwan.

Flat display panel (FDP) mainly refers to the display technology used for electronic devices such as televisions, desktops, laptops, and mobile phones. Today is the age of information. The role of information display technology in people’s social activities and daily life is increasing rapidly. 80% of human information is obtained from vision, and the interaction between various information system terminal devices and people needs to be realized through information display.

The panel industry has become the leader of the optoelectronic industry, second only to microelectronics in the information industry, and has become one of the most important industries.

Display panel products mainly include liquid crystal panels (LCD), plasma panels, and organic light-emitting diode panels (OLED). At present, plasma panels have been completely withdrawn from the market due to factors such as large thickness, low resolution, and high price.

On the other side, the display panel industry is a particularly typical case of the “Eastward spread of Western Culture ”. The production capacity is transferred from the United States to the Chinese mainland step by step, following the route of “the origin from the United States – the development byJapan – the overtaking by South Korea – the rise of Taiwan area – scale and further development in mainland China”.

In 1962, Radio Corporation of America(RCA) developed the first LCD display model, and then relevant technologies were introduced to Japan, which made a crazy investment in LCD. By the 1990s, Japanese enterprises had almost forestalled the entire LCD market. Enterprises with the spirit of “LCD craftsman” represented by Sharp have made contributions to the research and development of LCD technology.

In the mid-1990s, South Korea took advantage of the trough of the liquid crystal cycle to expand substantially and replaced Japan’s position around 2000. By 2009, BOE from mainland China announced the construction of the 8.5 generation line, breaking the technical blockade of Japan, South Korea, and Taiwan. Subsequently, Japanese and Korean companies such as Sharp, Samsung, and LG finalized the plan to build the 8th generation line in China at an alarming speed. Since then, mainland China’s LCD industry has entered a period of rapid expansion for ten years.

Until 2008, China’s LCD panels were still completely dependent on imports. Even in China’s annual consumption of imported materials, LCD panels ranked fourth after oil, iron ore, and chips.

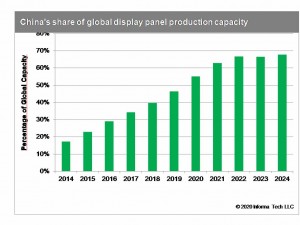

After development in recent years, China’s panel industry has caught up from behind. In 2015, the LCD panel production capacity accounted for 23% of the world in total. With the Korean manufacturers having announced to withdrawal from LCD and turn to OLED, the global LCD production capacity has further gathered in mainland China. In 2020, China’s LCD production capacity has already ranked first in the world, and mainland produced about half of the – LCD panels global.

At present, Chinese LCD manufacturers are mainly focusing on the further layouts of high-generation LCDs. From 2020 to 2021, in mainland China, BOE, TCL, HKC, and CEC will successively put into production a total of 8 important production lines larger than 7-generation.

In 2020, the outbreak of the global epidemic has led to the adoption of blockade measures around the world. The mode of remote working and learning has led to a consumption surge of laptop electronic terminal products, overlapping the shortage of upstream materials, the global panel entered a new round of price rise cycle in June 2020.

According to WitsView quotes, the average price of 55″W (3840 x 2160) panels has risen from $103 in June 2020 to $176 in early January 2020, up $73 in just seven months.

In order to ensure the normal panel supply to their own terminals, both Samsung and LGD have announced a delay in closing the LCD production line. At present, LG P7 and P8 production lines are definitely delayed to exit completely by the end of 2021. Samsung L7-2 is planned to be shut down in the first quarter of 2020, and has not given a clear exit schedule for the remaining two lines of L8-1 and L8-2.

The OLED market is currently dominated by Korean manufacturers. Samsung’s mature AMOLED technology and sufficient production capacity have absolute advantages, and the strategic cooperation with the brands goes more in-depth in 2019. According to Sigmaintell, its OLED market share reached 85.4% in 2019, of which the flexible OLED was also as high as 81.6%.

From the perspective of the regional distribution of enterprises in the panel supply chain, panel enterprises are mainly distributed in coastal provinces.

From the perspective of competitiveness, BOE and Tianma are currently more competitive in the panel industry both accounting for more than 98% of panel-related business.

BOE97.36%The business revenue of mainland China accounted for 48.13%, and other Asian countries accounted for 40.50%, the Americas 7.64%, and the rest of the region less than 5%.For TFT-LCD: 55,628 thousand square meters;

While in the TFT-LCD market, leading manufacturers include BOE, HKC, TCL, Innolux, AUO, Tianma Panda, CAIHONG, and IVO. Among them, BOE, TCL, Innolux, and AUO lead the Chinese TFT-LCD market due to their production capacity advantages.

China is the leader in producing LCD display panels, with a forecast capacity share of 56 percent in 2020. China"s share is expected to increase in the coming years, stabilizing at 69 percent from 2023 onwards.Read moreLCD panel production capacity share from 2016 to 2025, by countryCharacteristicChinaJapanSouth KoreaTaiwan-----

DSCC. (June 8, 2020). LCD panel production capacity share from 2016 to 2025, by country [Graph]. In Statista. Retrieved January 16, 2023, from https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "LCD panel production capacity share from 2016 to 2025, by country." Chart. June 8, 2020. Statista. Accessed January 16, 2023. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. (2020). LCD panel production capacity share from 2016 to 2025, by country. Statista. Statista Inc.. Accessed: January 16, 2023. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "Lcd Panel Production Capacity Share from 2016 to 2025, by Country." Statista, Statista Inc., 8 Jun 2020, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC, LCD panel production capacity share from 2016 to 2025, by country Statista, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/ (last visited January 16, 2023)

LCD panel production capacity share from 2016 to 2025, by country [Graph], DSCC, June 8, 2020. [Online]. Available: https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

Chinese display panel makers accounted for nearly half of the share in the global liquid crystal display TV panel market in the first half of this year, dominating the industry.

Beijing-based market researcher Sigmaintell Consulting said shipments of LCD TV panels worldwide totaled 140 million pieces in the year"s first half, up 3.6 percent compared with the same period a year ago.

The supply of TV panels though has surpassed demand due to the slowdown in the global economy and weaker consumer purchasing power. Manufacturers are facing severe challenges from falling panel prices, the Sigmaintell report said.

The shipment of BOE"s LCD TV panels stood at 27.6 million in the Jan-June period while LG Display followed with 22.7 million, down 4.5 percent year-on-year. Innolux Display Group was in third place, having shipped 21.9 million units.

Shenzhen China Star Optoelectronics Technology Co Ltd, a subsidiary of consumer electronics giant TCL Corp, ranked fourth, shipping 19.3 million pieces of TV panels. Chinese panel makers accounted for a 45.8 percent share in the global LCD TV panel market.

Sigmaintell estimated that the gap between supply and demand would widen further, and the panel market may face a long-term risk of oversupply. The industry may have to undergo a reshuffle given fierce market competition, it said.

The panel makers must reduce costs, optimize their internal structures, promote technological innovation and explore more innovative applications, the report by the consultancy said.

Separately, BOE"s Gen 10.5 TFTLCD production line has entered operation in Hefei, Anhui province. The plant will produce high-definition LCD screens of 65 inches and above.

CSOT also announced in November last year that its Gen 11 TFT-LCD and active-matrix OLED production line had officially began operation. The project will produce 43-inch, 65-inch and 75-inch liquid crystal display screens.

China is expected to replace South Korea as the world"s largest flat-panel display producer in 2019, a report from the China Video Industry Association and the China Optics and Optoelectronics Manufacturers Association said.

"The average size of TV panels is likely to increase 1.4 inches in 2019. The 65-inch dimension will become the most popular size of TV," Li Yaqin, general manager of Sigmaintell, said while adding the 65-inch TV will become the mainstream screen in people"s living rooms in the future.

Compared with traditional LCD display panels, OLED has a fast response rate, wide viewing angles, high-contrast images and richer colors. It is thinner and can be made flexible.

Attendees visit the booth of TV panel maker Shenzhen China Star Optoelectronics Technology during an international exhibition in Shanghai on July 11, 2019. [Photo by Lyu Liang/For China Daily]

Chinese companies have gained a competitive edge in the large-screen display industry and the exit of South Korean counterparts such as Samsung Electronics and LG Display from the liquid crystal display market will bring opportunities for China"s panel makers despite the challenges posed by the COVID-19 pandemic.

Market research firm Sigmaintell said BOE Technology Group Co Ltd-a leading Chinese supplier of display products and solutions-became the world"s largest shipper of LCD TV panels for the first time in 2019.

The Beijing-based company shipped 53.3 million units of LCD panels in 2019, with production capacity increasing by more than 20 percent on a yearly basis.

The consultancy said the LCD TV panel production area of Chinese manufacturers will account for more than 50 percent of the global total this year, surpassing South Korean competitors who are accelerating the shutdown of large-sized LCD panel production capacity due to competition from Chinese manufacturers.

It estimated the production capacity of large-sized LCD panels will continue to increase in China over the next three years. In addition, global LCD TV panel shipments stood at 283 million pieces last year, a slight decrease of 0.2 percent year-on-year. Meanwhile, the shipment area was 160 million square meters, an increase of 6.3 percent year-on-year.

"Chinese companies have gained an upper hand in large-screen LCD displays. Samsung and LG"s decision to exit from the LCD sector means Chinese panel makers will take a dominant position in this field," said Li Dongsheng, founder and chairman of Chinese tech giant TCL Technology Group Corp.

Li said South Korean firms will focus on organic LED screens and quantum dot LED displays, while Chinese TV panel makers are catching up at a rapid pace.

Data consultancy Digitimes Research said it comes as little surprise that Samsung has opted to withdraw from the LCD panel sector as its LCD business was losing money in every quarter of 2019 due to challenges from Chinese competitors.

BOE said its Gen 10.5 TFTLCD production line achieved mass production in Hefei, Anhui province, in March 2018. The plant mainly produces high-definition LCD screens of 65 inches and above. With a total investment of 46 billion yuan ($6.5 billion), the company"s second Gen 10.5 TFT-LCD production line launched operations in Wuhan, Hubei province, in December.

The Gen 11 TFT-LCD and active-matrix OLED production line of Shenzhen China Star Optoelectronics Technology, a subsidiary of TCL, officially entered operations in November 2018, producing 43-inch, 65-inch and 75-inch LCD screens.

Chen Lijuan, an analyst at Sigmaintell, said panel manufacturers should not just invest in production lines, but also pay more attention to the establishment of the whole supply chain, including raw materials, equipment and technology.

Bian Zheng, deputy director of research at AVC Revo, a unit of market consultancy firm AVC, said China will have a 51 percent market share in global TV shipments in 2020, while South Korea will have 25 percent, adding that large-screen TV panels will bolster healthy development of the industry.

Bian said the OLED and QLED will be the next-generation flat-panel display technologies to be in the spotlight. LG Display is currently the world"s only supplier of large-screen OLED TV panels.

OLED is a relatively new technology and part of recent display innovation. It has a fast response rate, wide viewing angles, super high-contrast images and richer colors. It is much thinner and can be made flexible, compared with traditional LCD display panels.

In this article, we are looking at the benefits of looking for Chinese TFT LCD manufacturers. Instead of resorting to other manufacturing means, opting for the Chinese is a much wiser and lucrative choice. If you are looking for Chinese LCD manufacturers, you should start with STONE Tech.

Handbags, wallets, phone cases, and other similar items have become the favorites of wholesalers and bulk buyers. These products are directly sold to end consumers. However, the fascinating thing about the Chinese production and manufacturing business is that it does not only cover the end-consumer products. Rather, you can also acquire raw and basic materials needed for the further manufacturing of goods and products. One such product is LCD displays.

LCD displays have become something of a necessity in today’s world of tech advancement. Many things in our daily life have been automated, and are operated using an interactive user interface. For these kinds of machines and gadgets, LCD displays are typically necessary.

In this article, we are looking at the benefits of looking for Chinese LCD manufacturers. Instead of resorting to other manufacturing means, opting for the Chinese is a much wiser and lucrative choice. If you are looking for Chinese LCD manufacturers, you should start with Stoneitech.com.

STONE Tech is an LCD manufacturer located in Beijing, China. It was founded back in 2010, and it has been developing TFT LCD display modules ever since. These modules can be used for a variety of different machines including electric equipment, precision instruments, and civil electronics etcetera.

The same applies to LCD displays. When you save up on costs when buying LCD displays, you can set a lower price for the whole machine or gadget that you are producing.

When it comes to LCD modules, the orders are not received by the hundreds or thousands as is the case with other smaller products such as handbags and wallets etcetera. One module can cost around $250, and it is for this reason that the dynamics are a little different with this business. That is why STONE offers single pieces for sale as well as multiple pieces. This encourages smaller businesses to make their purchases since they can easily purchase as many modules as they like. As long as you meet the limit stated by the supplier, you are good to go.

In the case of LCD modules, this benefit relates to a reselling business. For example, if you are planning on buying some modules to use in your machines etcetera, then there is not a very suitable opportunity for you to expand. If you want to start a business in another country, you will have to open a manufacturing unit there so that your products can be produced and then get sold. Or, you will have to transport your final products to the other country in order to run your business.

However, if you are buying the LCD modules to resale at a profit, you can use the Chinese markets to grow your business. You can buy the modules at a reduced price and then sell them at a profit in a different area or city where the people will be willing to pay more.

Now that we have seen the benefits of choosing Chinese manufacturers for LCD modules, let us narrow it down a bit and look at why you should choose STONE specifically.

With STONE, you get the option of buying a range of different-sized modules. If your business deals in making different electronics and machines that require panels of different sizes, you don’t have to look at multiple suppliers to fulfill your need. You could be making some products that require 3.5-inch panels, while some of your machines could be needing 15.1-inch modules. Instead of taking the trouble to go to different suppliers, you can enjoy an all-in-one experience from STONE.

One of the main things that you have to look at in any supplier is the level of reliability and trust. This is usually determined by the level of experience and the time that the supplier has spent in the market. STONE was founded in 2010 and has been producing LCD modules for the past 10 years.

If you are looking to buy LCD modules in bulk, look no further than the Middle Kingdom. China has become the hub of mass manufacturing and is the favorite spot for wholesalers and business owners.

In case you need some convincing about buying from the Chinese, we have compiled a list of benefits that you can enjoy when looking for TFT LCD manufacturers in China.

STONE Technologies is a proud manufacturer of superior quality TFT LCD modules and LCD screens. The company also provides intelligent HMI solutions that perfectly fit in with its excellent hardware offerings.

STONE TFT LCD modules come with a microcontroller unit that has a 1GHz Cortex-A8 CPU. Such a module can easily be transformed into an HMI screen. Simple hexadecimal instructions can be used to control the module through the UART port. Furthermore, you can seamlessly develop STONE TFT LCD color user interface modules and add touch control, features to them.

The famous china LCD display manufacturers. It is the world’s leading semiconductor display technology, products, and services provider. Products are widely used in mobile phones, tablets, laptops, monitors, televisions, cars, digital information displays, and other display fields.

Focus on the development and production of china HMI (Intelligent TFT LCD Module) LCD display manufacturers, production, and sales of LCD display modules for 16 years. The company master TFT LCD technology and software system. The main products are industrial electronic series, advanced series, and civil and commercial series. Application scenarios include automation systems, medical beauty equipment, vending machines, smart lockers, energy, and power equipment (refueling machines, charging piles), elevators, smart homes, and offices, measuring instruments, public transportation, etc.

Mainly committed to the r&d, production, and sales of TFT-LCD/stn-LCD /OLED display modules, it is a modern high-tech enterprise that provides a full range of product LCD module technology and manufacturing support services for TCL group member enterprises and international electronic enterprises.

Set an LCD display module (LCM), capacitive touch screen (CTP), fully integrated touch display module (TDM), LCD thin technology development, production, and service in one national high-tech company.

Domestic size of the top four small and medium-sized flat panel display manufacturers. The products cover medium and small-size TFT-LCD display modules and high-precision miniature cameras, which have been widely used in the fields of smartphones, medical treatment, and industrial display.

The LCD business division is specialized in the r&d, production, and sales of the LCD display (LCD) and LCD module (LCM) series of products. It has ten semi-automatic COG production lines, 1.5KK of monthly COG products, covering COG, TAB, COB, and other LCD module products, TFT, CSTN, and other color LCD display products, and OLED display products. touch screen manufacturers.

Byd IT products and business mainly include the establishment of rechargeable batteries, plastic parts, metal parts, hardware, and electronic products, mobile phone keys, microelectronics, LCD display module, optoelectronic products, flexible circuit board, chargers, connectors, uninterruptible power supply, dc power supply, solar energy products, mobile phone decoration, mobile phones ODM, mobile phone test, assembly operations, laptop, ODM, manufacturing, testing and assembly operations, etc.

Star source products cover backlight, LCD, optical diaphragm, etc., widely used in LCD modules, photo frames, tablets, portable, instruments, and meters.

The company has long invested in the research and development of the TFT-lcm LCD module, focusing on consumer products and industrial control products. Currently, 3.5-11.6 inch modules are available, among which 4.0, 4.3, 5, 6, and 10.1-inch products have reached the leading level in the industry. Products are mainly used in vehicles, mobile TV, PMP, DVD, EPC, security, and industrial control products.

Professional development, design, production, and sales of LCD display module (LCM), products cover COB, TAB, COG, and other LCD module products, TFT, CSTN, and other color LCD display products, as well as OLED display products. Products are widely used in mobile phones, communications, digital products, household appliances, industrial control, instrumentation, vehicle display, color screen display, and other fields.

Mainly engaged in research and development, manufacturing, and sales of the LCD display and LCD display module. Products are widely used in all kinds of electronic products and equipment HMI interface, such as medical equipment, instruments and meters, audio, household appliances, telephone and clocks, game machines, and other different types and use.

Focusing on the LCD module industry, is a collection of research and development, manufacturing, sales as one of the high-tech enterprises. TFT module size from 1.44 to 7 inches, product specifications cover QVGA, WVGA, qHD, HD, etc., the market prospects are broad.

The display manufacturers company mainly researches and develops the LCD display, charger, battery, and other products of mobile communication mobile phone, telephone, MP3, and other high-tech products.

The company integrates research and development, design, production, sales, and service into one, and provides comprehensive touch and display integrated solutions for the complete machine touch screen manufacturer of smartphones, specializing in the development and manufacture of Sensor sensors, capacitive touch screens (GFF/OGS/GG), small and medium-sized LCD (TN/HTN/STN/CSTN/TFT) and corresponding modules and glass cover plate products. The company’s products are widely used in communication terminals (smartphone, tablet computer, etc.), household appliances, car electronics, digital products, and other industries, exported to Europe and America, Japan and South Korea, Singapore, and other countries.

Mainly produces medium and small-size LCD display module (LCM), multi-point capacitive touch screen (CTP), and other high-tech products. At present, more than 1000 models of 1.2-12.1 inch products have been developed. Products are widely used in mobile phones, GPS, mobile TV, tablet computers, digital photo frames, e-books, and other consumer electronics.

It is a professional development and production of small and medium-sized flat panel display upstream materials manufacturers. The company’s main products include LCD display panels, color filter, ITO conductive glass (CF), TFT LCD panel, and capacitive touch screen with multi-touch control functions (sensor and the final module), can provide complete medium and small size flat-panel display device using the solution of raw materials, product specifications varieties complete, widely used in 10.4 inches below the smartphone, tablet, PMP, digital camera, digital camera, GPS and other products of the display panel.

Now it is divided into mobile phone business division: the main products are (2.8-6) inch and the LCD screen and capacitive screen all fit together.MID tablet computer and ultrabook computer division: the main production product size is (7-15) inch capacitive touch screen.

Committed to 3.5~4.3 inches, 5 inches, 5.88 inches, 6.2 inches, 7.0 inches, 8.0 inches, 9.7 inches, 10.1 inches, 12.1 inches medium size FOG, backlight process production, products should be widely used in high-end communication phones, tablets, notebook computers, car TV, navigator, and other display products. automotive LCD display touch screen manufacturers.

The company has an injection molding business division, SMT business division, FPC business division, backlight business division, irrigation crystal business division, TFT module business division, SIN module business division, products involving touch screen, LCD display module, backlight, black and white screen, flexible circuit board.

Engaged in the laptop, tablet, smartphone, computer high-performance board card, LCD module, and other electronic products research and development, production, and sales of high-tech private enterprises.

Is a professional engaged in LCD display module, electronic components, production, design, research and development, sales as one of the high-tech enterprises. Products are widely used in mobile phones, game consoles, PDA, portable DVDs, video phones, intercom doorbells, car video, industrial control medical, and other fields.

STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The TFT LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.

Samsung Display will stop producing LCD panels by the end of the year. The display maker currently runs two LCD production lines in South Korea and two in China, according to Reuters. Samsung tells The Verge that the decision will accelerate the company’s move towards quantum dot displays, while ZDNetreports that its future quantum dot TVs will use OLED rather than LCD panels.

The decision comes as LCD panel prices are said to be falling worldwide. Last year, Nikkei reported that Chinese competitors are ramping up production of LCD screens, even as demand for TVs weakens globally. Samsung Display isn’t the only manufacturer to have closed down LCD production lines. LG Display announced it would be ending LCD production in South Korea by the end of the 2020 as well.

Last October Samsung Display announced a five-year 13.1 trillion won (around $10.7 billion) investment in quantum dot technology for its upcoming TVs, as it shifts production away from LCDs. However, Samsung’s existing quantum dot or QLED TVs still use LCD panels behind their quantum dot layer. Samsung is also working on developing self-emissive quantum-dot diodes, which would remove the need for a separate layer.

Samsung’s investment in OLED TVs has also been reported by The Elec. The company is no stranger to OLED technology for handhelds, but it exited the large OLED panel market half a decade ago, allowing rival LG Display to dominate ever since.

Although Samsung Display says that it will be able to continue supplying its existing LCD orders through the end of the year, there are questions about what Samsung Electronics, the largest TV manufacturer in the world, will use in its LCD TVs going forward. Samsung told The Vergethat it does not expect the shutdown to affect its LCD-based QLED TV lineup. So for the near-term, nothing changes.

One alternative is that Samsung buys its LCD panels from suppliers like TCL-owned CSOT and AUO, which already supply panels for Samsung TVs. Last year The Elec reported that Samsung could close all its South Korean LCD production lines, and make up the difference with panels bought from Chinese manufacturers like CSOT, which Samsung Display has invested in.

Samsung has also been showing off its MicroLED display technology at recent trade shows, which uses self-emissive LED diodes to produce its pixels. However, in 2019 Samsung predicted that the technology was two or three years away from being viable for use in a consumer product.

We emphasize advancement and introduce new products and solutions into the market each year for Difference Between Ips And Tft Display, Tft Display, Touch Screen Panel, Whole Tft Lcd Monitor,Bar Lcd Panel. Our company maintains safe business mixed by truth and honesty to keep long-term relationships with our customers. The product will supply to all over the world, such as Europe, America, Australia,Lahore, Hungary,Brasilia, Finland.We have been sincerely looking forward to cooperate with customers all over the world. We believe we can satisfy you with our high-quality products and solutions and perfect service . We also warmly welcome customers to visit our company and purchase our products.

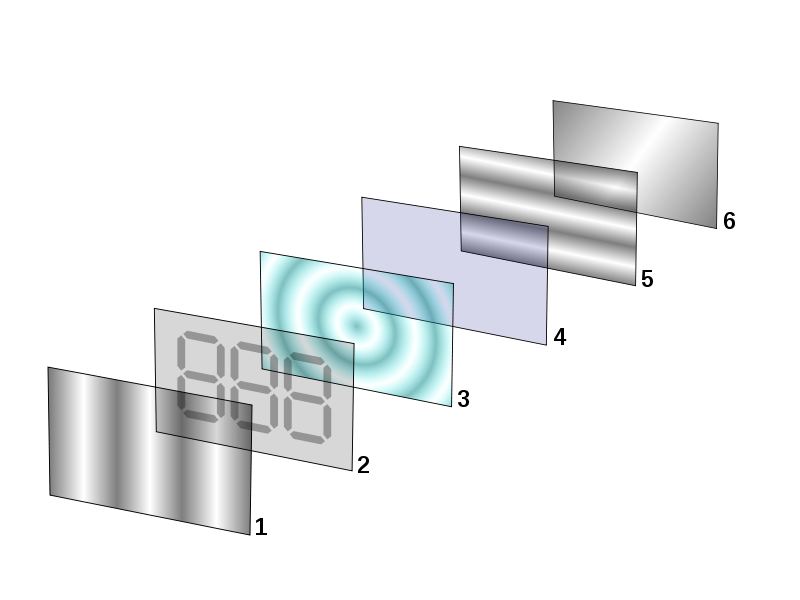

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

Liquid Crystal Display (LCD) screens are a staple in the digital display marketplace and are used in display applications across every industry. With every display application presenting a unique set of requirements, the selection of specialized LCDs has grown to meet these demands.

LCD screens can be grouped into three categories: TN (twisted nematic), IPS (in-plane switching), and VA (Vertical Alignment). Each of these screen types has its own unique qualities, almost all of them having to do with how images appear across the various screen types.

This technology consists of nematic liquid crystal sandwiched between two plates of glass. When power is applied to the electrodes, the liquid crystals twist 90°. TN (Twisted Nematic) LCDs are the most common LCD screen type. They offer full-color images, and moderate viewing angles.

TN LCDs maintain a dedicated user base despite other screen types growing in popularity due to some unique key features that TN display offer. For one,

Displays with VA screens deliver wide viewing angles, high contrast, and good color reproduction. They maintain high response rates similar to TN TFTs but may not reach the same sunlight readable brightness levels as comparable TN or IPS LCDs. VA displays are generally best for applications that need to be viewed from multiple angles, like digital signage in a commercial setting.

IPS (In-Plane Switching) technology improves image quality by acting on the liquid crystal inside the display screen. When voltage is applied, the crystals rotate parallel (or “in-plane”) rather than upright to allow light to pass through. This behavior results in several significant improvements to the image quality of these screens.

Based on current trends, IPS and TN screen types will be expected to remain the dominant formats for some time. As human interface display technology advances and new product designs are developed, customers will likely choose IPS LCDs to replace the similarly priced TN LCDs for their new projects.

AOC U27G3X is the smaller sibling of the AOC U32G3X which was unveiled in October last year. Both monitors share a lot of features in common including AOC"s gaming-centric ones - AOC G-Menu, AOC Game Color, AOC Shadow Control, Crosshair, Frame Counter, Game Mode, Game Tone Adjustment, Low Input Lag, Motion Blur Reduction (MBR), and Overdrive. They also support PiP, PbP, Dynamic Color Boost (DCB) technology, Dynamic...

AOC U27U2DP is a new desktop monitor for China. Featuring a design award-winning fully adjustable stand, the model is built around a 4-sided micro-bezel display with a 27-inch 4K Nano IPS panel that covers 100% of the sRGB and 98% of the DCI-P3 color space. It delivers 400 nits of brightness and is VESA DisplayHDR 400 certified. The GTG response time is 4 ms and the native refresh rate - 60Hz. The static contrast...

A celebrated CES® tradition was back this year – bigger and better after the pandemic hiatus – from LG Electronics, the global leader in OLED display technology, with the LG OLED Horizon, the latest exhibition welcoming visitors into the company"s massive CES booth. Constructed with 260 flexible and open-frame 55-inch displays, the showstopping CES 2023 installation demonstrated LG OLED"s unrivaled picture quality...

TCL has been recognized by the ADG for its technological achievements for contributions to advances display technologies during CES 2023. Among the distinctive titles, the Display Technology Innovation Gold Award goes to TCL C845 4K Mini LED TV. This award reflects TCL"s continuous dedication to advancing Mini LED and display technologies to deliver the ultimate home theater experience with incredible clarity...

TCL CSOT showcased its flagship products, including next-generation display technologies, at CES 2023. The flagship 65" 8K IJP-OLED Display, the world"s first 65" 8K printing OLED, was unveiled at the show. With up to 33 million ultra-high pixels, it is the market"s most extensive OLED display, with the highest resolution and refresh rate developed based on Inkjet printing OLED technology. Possessing the ultimate...

MSI MAG321QR-QD is the latest addition to the MSI MAG series of gaming monitors with Quantum Dot Color technology. Featuring a Rapid IPS display panel with a 31.5-inch diagonal size and a QHD resolution (2560 x 1440), this monitor delivers 97% Adobe RGB, 98% DCI-P3, and 140% sRGB color space coverage. That"s thanks to its Quantum Dot layer. The OSD menu offers specific settings in Premium Color Mode and MSI also...

Skyworth brought to CES 2023 a number of its leading TV products including the S1 Outdoor TV, the W82 Transformable OLED TV, the Q52 Mini LED TV, the G3B QLED+ TV, and the Coolita OS smart TV system, all of which were well received by the media and attendees. After releasing the Q72, the first Skyworth Smart Mini LED TV built using COG glass-based technology in 2021, Skyworth officially unveiled the S1, the world"s...

Another CES 2023 Innovation Award winner by MSI is the MSI MAG 275CQRX curved gaming monitor. With this model, MSI has found a solution for user to no longer compromise between a curvature or a monitor"s response time thanks to the latest advancements in Rapid VA technology. With a 1000R curvature, a 250Hz refresh rate, a 1ms response time, and a 2560 x 1440 resolution, users can take advantage of immersive gaming...

The MSI MEG 342C QD-OLED appeared for the first time when the CES 2023 awards were announced together with three other MSI monitors. Now this model has been officially unveiled at the show but again, MSI does not mention specific details except for the obvious 32" curved QD-OLED display panel. The same applies to the MSI 491C QD-OLED. It was teased on Nov 24, 2022 as "Project 491C". This model features a 49"...

In addition to its ULED X TVs, Hisense has also unveiled three new TV lineups. Hisense U8K Series: Big on technology, best-in-class value Last year"s U8 Series introduced Mini LED paired with Hisense"s ULED technology for the first time, and it has been the brand"s most award-winning TV to date thanks to its high-end performance and best-in-class price. This year, the flagship U8 Series is only getting better with...

For gamers looking for higher esports performance resolutions, refresh rates, and response times, Lenovo presented two gaming monitors from the Legion series - the Lenovo Legion Y27qf-30 and the Lenovo Legion Y27f-30 monitors. Both models feature Eyesafe Certified 2.0 Natural Low Blue Light technology to help reduce eyestrain and maintain eye health. The Lenovo Legion Y27qf-30 QHD monitor"s 2560×1440 display has a...

ASRock PG27F15RS1A is the third new curved Phantom Gaming presented by the brand. It sports a 27-inch VA display with a 1500R curvature and an FHD resolution. The typical brightness of the screen is 300 nits and it is HDR10 certified. The static contrast ratio is 3000:1 and it supports native 8-bit color. The monitor also has a native refresh rate of 240Hz with Adaptive-Sync technology supported by the two HDMI 2.0...

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey