revolution of the tft lcd technology in stock

The introduction of flat panel displays that are fabricated with thin-film-transistor liquid-crystal displays (TFT LCDs) has changed human"s lifestyle very significantly. Traditionally, the revolution of the TFT LCD technology has been presented by the timeline of product introduction. Namely, it first started with audio/video (AV) and notebook applications in the early 1990s, and then began to replace cathode-ray tubes (CRTs) for monitor and TV applications. Certainly, TFT LCDs will continue…Expand

“The increasing demand for ADAS, enhanced safety, comfort, and convenience in automobiles, especially in developing and mature economies, and other advanced functions, including navigation, multimedia systems, driver assistance, andconnected car features, is likely to propel the growth of Automotive Display Market. The rise in the demand for autonomous and semi-autonomous vehicle technology and the growth of the high-end and luxury car segments, especially in the emerging markets, coupled with the improving driver-to-vehicle communication is offering growth avenues to the smart display in the automotive sector. Asia Pacific region dominates the automotive smart display market with a revenue share of around 52% in 2021. North America and Europe are following closely with enhanced features and developments in the market.” Chandradeep Singh

The touch displays used in cars aim at providing comfort and convenience, and with technological advancement, vehicles will feature more automotive smart displays of a larger size and thereby play an essential role in making driver assistance functions available at a single-touchscreen platform. Center Stack- The center console is a surface located in the center of the front vehicle interior, and the center stacks of modern cars are equipped with interactive touch panels as the present generation of tech-savvy consumers demand larger-sized touch panels with a more responsive interface.

Digital Instrument Cluster-Digital dash at the automotive cockpit displays the screen"s full electronic information, including the speedometer. As the trend for larger digital instrument cluster screens is growing, modern car owners would appreciate the touch function for additional operability and ease of use.

Head-up Display (HUD)- It is a transparent display that presents data without requiring users to look away from their usual viewpoints, and reduces dangerous distractions by displaying the car"s speed, navigation directions, and other critical information and alerts.

Rear Seat Entertainment- Modern cars provide a comfort level not only to drivers but also for passages as rear seat entertainment that requires a touch panel interface, allows passengers in the second or third row to listen to music, watch movies and videos, and play games while on the road.

Along with the increasing use of wireless technology, the high-speed internet offered by 5G, helps in the integration of automotive smart display systems with innovative applications, such as Virtual Reality (VR), Augmented Reality (AR), cloud gaming, and media streaming. Since these applications require better quality display screens, it will trigger the demand for automotive smart displays.

Recent developments In October 2020, Hyundai Mobis announced a strategic investment in Envisics, a provider of Augmented Reality Head-up Display (AR HUD), and are together developing autonomous driving specialized AR HUD, targeting mass production by the year 2025.

In June 2021, Visteon Corporation developed a microZone display technology providing about 70% contrast ratio, which is more compared to LED displays, and the displays integrated with standard-sized microZones are predicted to be in the market by early 2024.

In June 2021, Pioneer corporation launched two new smart unit receivers for in-car entertainment. One tablet has an 8” high-resolution capacitive screen display and comes with an android, and the other sports a receiver equipped with a tablet mount cradle, a rear camera input, Bluetooth, and more.

Mercedes Benz launched its new cars with OLED panels developed by LG Display in dashboards and rear-seat monitors in 2020, becoming the first automaker to utilize OLEDs in its consumer models.

In October 2019, Nippon Seiki enhanced its development in Japan, and Tokyo for its head-up display (HUD) business. The R&D center in Tokyo may be responsible for cockpit development, new HUD development, enhancement, and development of the product.

The functions of our boards include, but are not limited to, adjustment of brightness, sound output, touch interface, extra data transmission, and gyroscope.

TFT Liquid crystal display products are diversified, convenient and versatile, simple to keep up, upgrade, update, long service life, and have many alternative characteristics.

The display range covers the appliance range of all displays from one to forty inches and, therefore, the giant projection plane could be a large display terminal.

Display quality from the most straightforward monochrome character graphics to high resolution, high colour fidelity, high brightness, high contrast, the high response speed of various specifications of the video display models.

In particular, the emergence of TFT LCD electronic books and periodicals will bring humans into the era of paperless offices and paperless printing, triggering a revolution in the civilized way of human learning, dissemination, and recording.

It can be generally used in the temperature range from -20℃ to +50℃, and the temperature-hardened TFT LCD can operate at low temperatures up to -80 ℃. It can be used as a mobile terminal display or desktop terminal display and can be used as a large screen projection TV, which is a full-size video display terminal with excellent performance.

The manufacturing technology has a high degree of automation and sound characteristics of large-scale industrial production. TFT LCD industry technology is mature, with a more than 90% mass production rate.

It is an ideal combination of large-scale semiconductor integrated circuit technology and light source technology and has good potential for more development.

From the beginning of flat glass plates, its display effect is flat right angles, letting a person have a refreshing feeling. LCDs are simple to achieve high resolution on small screens.

Antigua and Barbuda, Aruba, Australia, Austria, Bahamas, Bahrain, Barbados, Belgium, Belize, Bermuda, Bolivia, Brunei Darussalam, Bulgaria, Cambodia, Canada, Cayman Islands, Cyprus, Czech Republic, Denmark, Dominica, Estonia, Finland, France, French Guiana, Germany, Gibraltar, Greece, Grenada, Guadeloupe, Guernsey, Hungary, Iceland, Ireland, Israel, Italy, Japan, Jersey, Jordan, Kuwait, Latvia, Liechtenstein, Lithuania, Luxembourg, Macau, Malaysia, Maldives, Malta, Martinique, Mexico, Monaco, Montserrat, Netherlands, New Zealand, Norway, Oman, Pakistan, Paraguay, Poland, Portugal, Qatar, Republic of Croatia, Reunion, Romania, Saint Kitts-Nevis, Saint Lucia, Saudi Arabia, Singapore, Slovakia, Slovenia, South Korea, Spain, Sri Lanka, Sweden, Switzerland, Taiwan, Turks and Caicos Islands, United Arab Emirates, United Kingdom, United States

Recently, there is a lot of buzz about whether Apple will choose Mini-LEDover OLED, for the next round of iPads, MacBooks and other products. Regardless of the fascination analyzing current product releases, or one specific consumer-product company, the more significant movement over the last 5~10 years, has been the steep upwards ramp in Micro-LED Startups, IP, investments and acquisitions by: Apple, Facebook, and Google. And from the chip makers themselves such as Intel, Global-Foundries, in Startups such as Luxview, InfiniLED, Plessey, Aledia, Compound Photonics and more.

For an industry that is literally in the business of visualization, the display industry often seems rather opaque, mysterious, and even geo-politically contentious (refer: Foxconn"s LCD Fab in Wisconsin). These articles will cover aspects not well-elaborated in popular analysis, and also provide an update to the material presented 5yrs ago at the Bay-Area SID (Society for Information Displays), on why this technology, is so different, so disruptive, and how it will reach far beyond even the wildest market projections. But for a background on the basics of how & why, vision, the brain and displays work, recommend an easy to digest, and popular, book by Mark Changizi: The Vision Revolution. There are also excellent industry analysts, who cover displays professionally, and in much finer-grain detail, such as Yole Development (thanks to Eric Virey for source graphics) and DSCC (thanks to Ross Young & team for references, and feedback).

Firstly, to be clear: the flat-panel display industry is a semiconductor industry. This is the critical "border", where electrons of digital information, are turned into photons of visual information. And the pixels you see, while reading this article, are driven by transistors - Thin-Film Transistors (TFT) - somewhere between 3 and 12 transistors per pixel, depending on the type of display (OLED needs more than LCD), and the maker. The Transistor, Resistor, Capacitor circuits are built by nano-scale material deposition processes, on a glass substrate (the backplane), via semiconductor manufacturing equipment, from suppliers including US"s Applied Materials, Japan"s Canon Tokki, Korea"s SNU Precision, Wonik IPS and more. Yet it has not attracted the same strategic interest from within the US, as other semiconductor industry segments e.g. processor chips. While there is a drive to increase the number of (existing) semiconductor chip fabs on US soil, the fact is that the US has no significant domestic display manufacturing capability at all, effectivelyzero. And the same is true for most of the technology ingredients comprising the display, such as the film layers, LED’s & OLED and their ingredient materials, and the controller & driver chips - which is dominated entirely by non-US companies you probably never heard of, such as Taiwan Novatek (the 13th largest semi maker, worldwide), Taiwan Himax, Taiwan Parade, and Japan"s Renesas. That is, until one of them has a problem.

So if the geopolitical semiconductor war gets any rougher, you might be wondering, where is this chip (that Biden is holding) going to display it"s output ? On an etch-sketch ? (perhaps the only display device still made in the US ?)

Since more than 40% of our brain is devoted to vision, more than all of the other senses combined, this would seem an important gap. After all, light, color and contrast are the fundamentals of art, literature, civilization, as well as your next Zoom virtual meeting. Of course we need to see the results of the computation of AI, CPU, Memory, GPU, Network, 5G ... processors, appear on some display eventually, right ? So this article also aims to provide some more insights on key factors in the previous transition, what"s going on now, why it"s important, and how it may matter in real-life terms.

Secondly, (and this an easy bet) you’re more likely reading this article on an LCD flat-panel Display, rather than OLED or ePaper. But all 3 have been transformational technologies of the 21st century. Could modern society continue to communicate effectively, presenting a person in front of you from anywhere/anytime, productivity continuing virtually, during a Global Pandemic ? What would it have been like if we were still sharing the 20th century family’s TV ? (recap for millennials: the Cathode Ray Tube TV was a 50 ~ 100 lb, X-Ray-emitting, monster appliance, using electron beam scanning technology from the 1920"s, and with coarse interlaced video rendering designed to save 6MHz (3 Mbit/s by modern standards) of precious radio-frequency bandwidth). Even the 12yr old iPhone 3GS could muster more than that, on a bad day.

As for myself, am writing this article across two of my favorite consumer flat-panel devices: a newer 15” Retina MacBook Pro and an older 17” MacBook Pro. Partly because both are still the best, un-compromised, example of the portability & performance enabled by the Hybrid Graphics technology, a Display & GPU technology, drove across the laptop industry while working at NVIDIA. But mostly because Apple consistently aims for excellence in their displays. Am enjoying a large, bright, 300 “nit” (candela/meter2) LCD screen, an excellent 900~1000:1 contrast ratio, a full DCI-P3 color gamut, and sharp 220 ppi "retina" resolution that renders crisp text and beautiful images. The recurring theme: light, color, contrast.

However, at the 2019, 2020 and 2021 CES, Micro-LED and Mini-LED began appearing across more and more applications (e.g. TV, AR, Monitors, Digital Signage), and demo"s like the Samsung Wall and Sony MicroLED continue to attract the largest, most excited crowds, have ever seen at CES (before it went virtual). Back in 2017, I wrote this article about Micro-LED & Mini-LED"s, talking about potential applications, and specifically about the key challenges to this visual revolution, that PixelDisplay set out to solve: in the color conversion material needed to more economically create Red & Green from the high efficiency Blue. In November 2020, PixelDisplay publicly disclosed details of NanoBright™solution, at the Phosphor & QD Summit, and is now offered for sale on PixelDisplay.com

In the Mini-LED ecosystem, the role of NanoBright is often used the same as per regular white LED"s, which in 2018 PixelDisplay estimated to be worth $750m/yr, but this market is now projected to be worth $5b, for Mini-LED"s overall, by 2025. The color converter can be simply coated on the Mini-LED and surrounding backplane (providing a high efficiency, bright-contrast, High-Dynamic-Range with DCI-P3 wide-color gamut), but there are more interesting benefits e.g. eliminating existing LCD films to make thinner, borderless and more efficient.

But to put this in larger perspective, here"s the role NanoBright™fills in the Micro-LED ecosystem, as described in DSCC"s ( @Guillaume Chansin) excellent LinkedIn article.

But why should this Micro-LED technology be of any broader importance ? Why is it any different than OLED, or LCD ? How is it a disrupting technology ? What difference does it have from any of the other opaque display industry machinations that means it will have significant impact in our lives? It"s a great test to ask: "would my mother care ?".

To start with how it"s different, and how it is disruptive, we need to recap on how we got here on the glass backplane of LCD and OLED. And to fully appreciate the magnitude of the disruption represented by the Micro-LED revolution, we have to also understand the scale of the investment behind the commercializing flat-panel glass, and to the display TFT semiconductor industry.

Am not going to cover the long sordid history of display technologies, nor the detailed lineage of LCD, or OLED. But it is worth noting that both technologies were born in the US, the LCD from RCA, and the OLED from Kodak - and ironically, both pioneering companies are now just brands - non practicing entities. But there are other pioneers, such as UDC, who have persisted, and remain necessary ingredients in the ecosystem (we"ll touch on "why ?" later). But instead, will identify two key elements from the 1990"s, that were the major accelerators flat-panel displays to escape velocity in 2000"s, launched the FPD revolution into orbit, and led to the proliferation of what we enjoy today:

1) TFT follows Square-Rule Growth:To understand the explosion in the economics of producing glass flat panel displays covered in TFT pixels, we can start with the size increases of the glass processing fabrication itself. The term, "Gen" refers to the size generation, the capability of the TFT panel fab, by the dimensions of the glass sheet that it can process, which typically entails creating deposition layers stacked layer-by-layer, to build the TFT pixels - whether OLED or LCD, it starts with TFT pixels on a sheet of glass. In the late 90’s, massive government investments spurred the creation of ever larger display fabrication facilities, with ever larger deposition equipment based on the successful A-Si (amorphous Silicon) process, which grew quickly from Gen 3.5 (0.62 x 0.75m) to Gen 5 (1.1 x 1.3m) to Gen 6 (1.5 x 1.85m) glass substrates, in just a handful of years. Every sheet of glass processed in an LCD production line is cut into smaller panels, making TV’s, Monitors, laptops, tablets and phones.

But unlike Moore’s Law (which doubles transistors every 18months), the glass panel area increase (width x height) results in a faster, power-of-2 square-rule, increase in the number of pixels, and thus the number of TFT transistors. In fact, the number of semiconductor transistors on glass TFT was increasing at 2.5x Moore’s Law, during the last decade. While it took 10 years to go from 5mil transistors in Intel’s Pentium Pro 1995, to 169 mil transistors in the Prescott CPU 2005 – the LCD display industry made the same increase in the number of TFT transistors for 8K resolution, in roughly 5 years (from the PixelDisplay presentation at the 2018 DSCC Future Display Technology Conference).

By early 2000"s, Plasma was beyond hope, the transition from CRT"s was in full-swing, the IBM Thinkpad was a staple of corporate life, and laptops had crossed the 8hr battery-life mark thanks to display efficiency improvements (as we"ll discuss later the display is the key enabler of longer battery-life). The LCD plants were pumping out everything from laptop screens, to LCD monitors, to 60" large-screen LCD TV"s, at lower-and-lower price-points - from fabs based in Japan, then Taiwan, and Korea. By the late 2000"s, the Fab-depreciation (eff. cost of borrowed capital) was the most significant component of the LCD panel prices, and panel makers squeezed the margins out of everyone in the supply chain including films, LED, controller and driver chips. Major winners were the materials suppliers: Corning Inc (the Glass), Merck (the LCD material itself), Nichia (the backlight LED"s), and Canon Tokki & Applied Materials (TFT-glass deposition equipment).

Meanwhile in the US, Intel made a huge bet in 2001, that LCD would not scale, and that LCOS would provide solutions, and enable larger-screen, like the earlier (CRT-based TV) projection displays. But in just 3~4 years, it became clear the LCD square-rule economies were different, ever-larger ever-cheaper LCD panels seemed to be viral, ramping to fill the large-screen TV market. The LCOS & DLP were relegated to the projector market, and Intel exited LCOS in late 2004. It"s worth noting Intel has gradually become more active in the display industry, and Intel Capital has made multiple investments in the Micro-LED partnerships for GaN-on-Si (and we"ll come back to that later).

Outside the US, the display industry has been the target of massive strategic investments for Asia for over 3 decades. Starting with Japan government forcing the collaboration of Sony, Hitachi and Toshiba to create JDI (which made the first iPhone and iPad screens), and the INCJ (a government investment consortium) of Japan, then Korea and Taiwan Governments, and then China. Today this industry is dominated by China, as per the reports from analysts e.g. this one from Display Supply Chain Consultants. The government of China and private investors, aggressively funded the rise of China from sub 10% a decade ago, to owning more than 63% of the world’s display production. By 2017, the Taiwan government had publicly stated they were no longer going to invest in more LCD fabs, and in 2018 the chairman of LG got up in front of the entire company taking a sledge hammer to smash an LCD TV, in a symbolic communication of the company"s shift in focus to the highly profitable OLED (not facing competition from China) - the fate of LCD flat-panels was sealed.

One example of China"s investment in display leadership is Beijing Opto Electronics (BOE). And I have visited BOE’s Gen 6, 8.5, and 10.5 (2.9m x 3.4m) fabs in HeFei and Beijing. This picture below is a panorama I took standing outside one of the older (smaller, older) Gen 8.5 Fab"s from a visit to the BOE facility in HeFei. At the time, they had built a Gen 10 behind it, and building another beside that.

But when you’re outside looking at a factory that is literally over 1.3 kilometer per side, the staggering magnitude of China"s investment in display leadership, is simply breathtaking. The first Gen 10.5 fab located in Sakai Japan, was also Japan"s last one. But at last count there are seven (7) Gen 10.5 fabs in Mainland China, and still more are being built. There is no questioning China’s intent to seize control over the majority of eye-balls, from the source.

2) Inorganic Solid-State gives 4x increase in efficiency: The second important innovation was the In/GaN-based Blue LED. Invented in Japan (ironically, US-based CREE had a blue LED earlier, but failed to productize until much later), from which Nichia made White LED’s, by adding yellow-emitting YAG:Ce inorganic phosphor, they had left over from their CRT phosphor business. It was a cheap trick to synthesize something that looked White, from a psycho-visual hack of using two complementary colors: Blue + Yellow. But in short, the poor color was an acceptable tradeoff for higher-efficiency, smaller size, more robust inorganic solid-state solution. LED backlights quickly transformed the industry from (thicker, bulky, and very fragile) fluorescent tube (CCFL) backlights, into thin/efficient LED backlights, in the early-mid 2000"s. And the lead inventors, including Shuji Nakamora of Nichia, won the 2014 Nobel prize for the work on GaN LED.

This was an important step forward in the story. Originally, the CCFL backlit display was 70~80% of the total power consumption of an idle Laptop. In fact, back in 2001 while at Intel, together with Ying Cui we invented and implemented Intel’s Backlight Modulation Technology (called DPST(tm)) which was like an inverse-High-Dynamic Range, it proportionally increased pixel contrast, in order to allow decreasing the CCFL backlight brightness and provide huge system power-savings. That was the star feature of Intel’s EBL (Extended Battery Life) initiative, saving more system power than other, more publicized, Intel CPU features (e.g. Geyserville aka "SpeedStep"). For me, that was a first introduction to the value and importance of the flat-panel display technology, as the essential ingredient in portable platforms. But LED"s further helped enable the "implosion" of visual-compute portability into sub-8lb / sub-1inch Laptops. And the displays that appeared in Phones and Tablets, were using LED"s that are only 0.4~0.6 mm tall, fitting in the edge of the panel.

Today, LED efficiency is over 200 lm/W (4x the efficiency of older CCFL), but efficiency improvements in processor and memory technology means the display is still typically 50~70% of total system power for phone or laptop, and this is worse for OLED (than LCD) because of how poorly OLED technology handles mostly-white backgrounds (e.g. of browsers, text & productivity applications).

The LED industry has also been a source of massive investment and deeply geopolitical rifts as Japan (e.g. Nichia) vs Korea (e.g. Seoul Semi Conductor) vs Taiwan (e.g. Foxconn/AOT, LiteOn, Epistar) vs China (e.g. CSOT, SanAn). Initially dominated by IP held by Nichia, CREE and Osram, those players now have diminished roles, but it has remained a complex ecosystem.

Tiny efficient LED"s enable 2D-array backlighting on LCD to achieve HDR (High-Dynamic-Range). Higher-end LCD TV"s were the first consumer displays to use LED"s with better R-G Phosphors to create a wider DCI-P3 color gamut. Firstly, arranging the Edge-Backlight LED"s to control 1-Dimensional regions, from along the edge. And then advancing into 2D-array of LED"s, to create active-region backlight. This enabled LCD"s to increase the contrast ratio beyond 1000:1, and peak brightness beyond traditional edge illumination, creating the High-Dynamic Range (HDR) experience first popularized by BrightSide (later acquired by Dolby, to form DolbyVision, and which is now licensed-technology on the iPhone). Today HDR content leverages individual screen-region lighting, to create brighter highlights, and the deeper-blacks to create a more realistic and dynamic experience. In summary, HDR LCD TV with 2D backlight became commercially practical as a result of small (less than 3.0 x 3.0 mm) LED"s with over 220 Lm/W efficiency - 13x more efficient than incandescent bulbs Brightside originally used, which had required huge exotic water cooling solution.

Challenges of the "Crystal Cycle":the size of these glass-processing fab investments is so large, and the equipment CapEx expenditures are so huge, that this leads to massive disconnect between supply and demand, causing large cyclical swings in pricing, which became known as the "Crystal Cycle"

To ride the economies of scale requires increasing the glass handling size, which requires ever larger investments, just as the second of Moore’s Laws predicts. For example, BOE’s invested US$7 billion to make a Gen 10.5 fab. And in an interesting geopolitical twist, after the Taiwan (once a former colony of Japan) government declared they were not investing anymore in the LCD business, Terry Guo (Taiwan Foxconn CEO), acquired a majority of Sharp, and their huge LCD display production lines in Kameyama (which made the innovative IGZO-based LCD panels, which enabled the thinner/more-efficient iPhone 6, and iPad Air), and Japan’s only Gen 10.5 plant in Sakai, which is making 8K TV’s (was spun-off into Sakai Display Corporation). Foxconn was already a large player in the display industry owning Taiwan’s #2 maker, Innolux Optoelectronics. Far beyond merely being “the sport of king’s”, the display industry has been “the sport of nations”.

OLED is doubly challenged: and it has not become progressively cheaper with economies-of-scale as many expected. In LCD only a tiny current is needed to flip a pixel, all of the light is produced from a thin string of backlight LED"s. Whereas in OLED, every pixel is itself a light emitting organic-LED, with many orders of magnitude higher current required at every pixel. The high contrast emissive pixel design of OLED displays provides excellent contrast, but typically requires the use of the more expensive and complex LTPS (low-temperature polycrystalline silicon) process to produce the active TFT driving backplane. LTPS involves a more complex 11-step process, with much higher-temperatures that only a few materials (glass, clear polyamide) can sustain. LTPS requires a high-power excimer laser to anneal the surface, forming the layer of polycrystalline silicon - this is slow, and does not scale well into larger sizes. The OLED fabs have thus been limited to Gen 6 (1.5 x 1.85m) or smaller, in glass size. Even though this is big enough to make a few TV"s, the smaller starting glass size means the cost-curve is sub-optimal, unless partitioned into many smaller panels e.g. the higher-cost has lower impact for smaller smartphone screen. While an oxide deposition process called LTPO (a simpler Oxide process, borrowing from the IGZO process that delivered LCD efficiency improvements in iPhone 6 & iPad Air), offers some hope in the future, there’s another additional challenge.

The complexities of driving a large number of emitters from a thin layer on glass backplane has also meant limits on full-screen brightness, and limited ability to address higher resolutions. A full screen of white does not occur often on a OLED TV, as it does on an Tablet or Laptop, but if you do witness a larger amount of white (as in productivity apps on a Laptop) you"d notice the whole OLED screen goes dimmer, this is done in order to limit the total current across the thin conductor traces that feed the pixels on the glass.

Unlike LCD TFT (which only requires a single transistor and storage capacitor), a typical OLED driving circuit can have 3~6 transistor (and similar number of capacitors) per color i.e. 9~18 transistors per pixel. This driving complexity also limits the net active emitting area of the pixel, versus the inactive driving circuit, also called the "Fill-Ratio". And that"s part of the reason why the Oculus and Samsung Gear VR headsets look like watching everything through a thick fly-screen mesh - the amount of non-emitting "dark-area" per pixel is huge (much larger than LCD). Laying out complex circuits naturally extends the non-emitting pixel-area, horizontally outwards in width & length, that is of course a limitation of thin deposition layers on glass. This limits both the ability to go into finer pitch (>1000ppi and 40Kx16K resolution is the ultimate goal for x-Reality displays), and also to create larger emitters for higher brightness.

Furthermore, the front-plane of an OLED panel requires ultra-precise patterning with emissive organic phosphor materials, with tightly controlled size & depth-tolerances. This has switched from vapor deposition, to inkjet patterning to save some cost, but because of the non-uniformity it is limited in ability to go into very fine pitch, retina-quality displays. But either way, the OLED materials themselves remain very expensive, with Universal Display Corp (UDC) maintaining a tight grip on the materials supply chain, thanks to a portfolio of significant & early IP. The alternatives to UDC patents, such as HF (Hyper fluorescence e.g. KyuLux) or TADFL (thermally activated delayed fluorescence e.g. Cynora) are really 5~10yrs out, and merging QD on OLED aka "QD-OLED (e.g. Nanosys & Samsung) has consistently missed every promised demo/roll-out, and feels more like either a science project, or a ploy for negotiating UDC pricing.

But since OLED breaks-down with age, and even faster with moisture, heat, and higher-energy blue/uv photons (reminder, the “O” in OLED, stands for Organic), the use of glass (or expensive polyamide materials) with low gas & moisture permeability remains a requirement, since lifetime & brightness remain the bigger issues for OLED. In the phone industry, key manufacturers came to embrace OLED since it looks fantastic but wears out - after-all consumers are more motivated to buy a new phone, if it looks noticeably brighter and sharper, than the worn-out 2-year-old one in hand. While higher production costs, aging and burn-in problems of OLED have been acceptable (even desirable) in the phone business, they have hampered the progression of OLED into IT and Automotive applications. And while OLED came with the promise of more freedoms than LCD, in creating foldable and flexible displays, the fact remains: it lasts longer when hermetically encapsulated in glass the best barrier protecting from oxygen and moisture.

While OLED has not enjoyed the same cost-reduction curve, as in the LCD proliferation, the higher-end and visually-satisfying (initial) experience continue to feed hope & investment. Glass TFT has both enabled, and limited OLED"s ability to achieve higher brightness, and higher resolution. There"s frequently news of better OLED solution coming down the research pipeline, and we"ve already touched on the bigger ones (e.g. Hyperfluorescence, Thermally Activated Delayed Fluorescence, Quantum Dot on OLED), but the reality has fallen far short, nor is there anything helping to break-free from the most expensive TFT processes. OLED is very likely to continue to service the small display markets, products that have a shorter life expectancy, and only need a lower-brightness display (e.g. TV"s, which only need 100nits of brightness).

The industry is ripe for disruption from a brighter, more robust inorganic solution, that comes with a better (near-term) ability to reduce cost as it scales.

Unmet needs, in important niche markets: is the essential formula, for the beginning of disruption, as outlined by Clayton Christensen. Who described the formula for disruption as essentially: a niche market (of future importance) with unmet needs, that can afford to adopt a more expensive solution, where that solution has an ability to scale and leverage the niche-win to expand into broader markets, displacing incumbent technologies. Some example display niche markets:Automotive and Smartwatches displays have been over 1,000 nits for some time, but need much more to compete with typical daylight glare.

Autonomous vehicles (e.g. robo-taxis) are on the horizon, but pause for a moment to consider how they will visually communicate to passengers & pedestrians, when no human is present ? No driver to confirm name or usher in passenger, or gesticulate with body language to other less-patient human drivers. The solutions are being developed right now (and PixelDisplay is involved), they of course need to operate in bright daylight, and be colorful & robust as the painted bumper panel or shatter-resistant safety-glass, they"ll be integrated-into.

When the HDR standards were formed, they included a high peak-brightness of 10,000 nits (far beyond wildest dreams of OLED and Quantum Dots), and real-world contrast ratio"s (>10x that available on LCD with edge backlight). And studio-grade content-authoring displays can do well over 4,000 nits, but need constant recalibration to account for non-uniformity from wear, and sometimes replaced after only a year. We can expect this to migrate into more consumer displays over the next 5yrs, and the Gaming/TV/Video/Movie content standards (BluRay-UHD, VESA DisplayHDR and the Hollywood UHD-Alliance) already integrated that support.

These are markets that will pay for a more expensive solution, that can deliver unmet needs of bright, high (HDR) contrast, deep-black and defined shadows, and crisp-rich colors (like OLED), in a thin form-factor, but with higher brightness and longer lifetime (like LED-backlit LCD).

The value of the Flat Panel Display: the industry is worth over $120 billion (3x the value of the GPU market), and is project to grow to well over $200 billion by 2025. Yearly production (rough numbers): over 1.8 billion smartphone panels, 300 million laptop and tablet panels. This thin, complex, glass-stack, in the flat-panel module, still represents the single most expensive component in the phone & tablet (and many laptops also).

In the iPhone BOM, the display has, at times, been more than 2~3x the cost of the SoC (CPU & GPU) and RF BaseBand chips, combined. And in the iPhone 12, the new OLED display is responsible for 35% of the BOM cost increase vs iPhone 11. It should then, be unsurprising that Apple (unlike Intel, NVIDIA, AMD, DELL or any other OEM that I know), has multiple (large) divisions devoted just to display technology - one in each of their business verticals. Staffed with display architects, and engineers refining technologies, sourcing core materials (even the phosphors), creating new designs. Even custom-designing the display controller and driver chips, for the panel makers to insert inside displays made - exclusively for Apple - that are not available to any other panel customers. Perhaps because it is the most critical border of the Visual Information Age, and obviously because it is necessary to control the border to control your future, right ?

In summary,during this pandemic we"re able to adapt and continue our communications visually; collaborating, pitching, working efficiently, and remotely from anywhere; thanks to the internet, wireless connectivity, and the glass flat-panel visual interface. Long Zoom sessions can be taxing, but imagine if this had happened in the 1950"s, 1970"s or 1990"s ? Would our children have been able to engage in school remotely ? Would we have remained as connected, and as productive ?

The technology innovations may have US origins, but the major enablers of the last visual revolution were: a) execution driven by massive investments in manufacturing & commercialization from: Japan, Taiwan, Korea and China in flat-panel display leadership, b) faster than Moore’s Law growth in the economies-of-scale of glass-substrate TFT pixels, and c) the shift to cheaper/smaller/robustsolid-state In/GaN semiconductor LED technology.

Now there’s a another shift happening. With the Micro-LED & Mini-LED generation, there"s a new, and very different, formula. Unlike the past display technologies: Micro-LED are innately decoupled from the glass backplane, and that changes everything.

In the next article,more details of how this visual revolution is progressing, firstly re-igniting LCD 2.0 with Mini-LED"s, and breaking through the glass-barrier with Micro-LED"s, and what displays of the future will look like.

One of the industry’s leading oxide panel makers selected Astra Glass as its backplane substrate because it has the inherent fidelity to thrive in high-temperature oxide-TFT fabrication for immersive high-performance displays.

One of the industry’s leading oxide panel makers selected Astra Glass as its backplane substrate because it has the inherent fidelity to thrive in high-temperature oxide-TFT fabrication for immersive high-performance displays.

TFT stands for Thin Film Transistor. It is an active-matrix LCD with better image quality where one transistor for every pixel manages the illumination of the display which enables an easy view in bright environments. This technology presently represents the most prominent LCD technology and holds account for the majority of the global display market.

Additionally, the study also contains sections that specifically focus on the covid-19 outbreak in the global TFT LCD Display industry. These sections include market dynamics which have been up and down due to covid-19, historical and current market trends, and policies. Along with this, the report provides the research methodology and assumptions by various functional and analytical methods. It also throws light on the aftereffect of covid-19 by discussing application details, forecast predictions, data on sales and demand, recent technologies, various features of the market, and investment opportunities of the market. The report also discusses several growth drivers, challenges, and restraints of the market.

Furthermore, the global market has been fragmented into various segments that are based on Type (Twisted nematic (TN), In-Plane Switching (IPS), Advanced Fringe Field Switching (AFFS)), based on Applications (Consumer Electronics, Automotive, Aerospace, and Defense), and based on Region (North-America, Europe, Middle-East and Africa, Asia-pacific, South-America, and the rest of the world). The report discusses all the consequences of covid-19 for each segment separately. It also covers an in-depth analysis of different countries present in the above-mentioned regions. These countries are the United States, Canada, Mexico, Germany, the UK, France, Russia, China, Japan, South Korea, Australia, India, Saudi Arabia, Brazil, Argentina, Columbia, Chile, and many others.

The global market is supposed to increase and reach a substantial value in terms of revenue in USD million by the end of the year 2026. This value will be reached at a double-digit CAGR during the evaluation period 2020-2026. The market is fuelled by the rising demand for flat panel TVs, quality smartphones, and vehicle monitoring systems. Along with this the growing gaming industry and household demand for large-sized flat and slim panel TVs, and high-resolution smartphones with large screens have also been aiding the TFT-LCD displays market growth.

Every year, motorcycle manufacturers make various improvements to their lineup, everything from little internal details, to new paint, to full-on redesigns. Over the years we’ve watched these machines get better, faster, and safer. In the 2020 model year, though, the majority of motorcycle manufacturers seem to be hopping on the TFT wagon. What does that mean for us, the riders?

We are all familiar with the Thin Film Transistor, or TFT screen, on our smartphones, hand-held video game displays, computer monitors, and car “infotainment” systems. The technology has advanced rapidly in the last few years, and motorcycle manufacturers have suddenly determined that they are ready for the harsh environment a motorcycle display needs to endure. During an attentive walk around of the International Motorcycle Show in New York City this past weekend, we noticed that new bikeswithoutTFT screens are becoming the rare exception.

Some manufacturers began outfitting their newest bikes with TFT screens a couple of years ago, but the 2020 model year has seen a sudden industry-wide shift. Major manufacturers like BMW, Kawasaki, Honda, and Yamaha, and even smaller companies like Energica, outfit their bikes with a TFT.

All of us who have been riding for many years are used to analog dials and gauges. Some of us are concerned about the longevity of the TFT, and in my opinion, those concerns are valid. Certainly, we’ve all seen our smartphone screens give up the ghost after only a few years of use. Some of us have an affinity for older motorcycles and have repaired or restored those old analog speedometers and gauges. We know that they often work flawlessly for decades. When they need repair, it’s a question of fixing or replacing internal mechanical parts. Not so with the futuristic TFT screens.

Those of us who are not hopeless luddites tend to sing the praises of a screen that can and does change to show machine and engine speed, a navigation display, the state of the motorcycle’s electronic suspension, tire pressure, the traction control setting, and a whole host of other information. The versatility of a TFT over traditional analog gauges is unquestionable: we might soon be able to program them ourselves with our preferred screen settings, just like our smartphones.

From a manufacturing point of view, TFTs simplify the process. The same TFT can be used on every motorcycle in a manufacturer’s lineup, with only a change of software to make the screen bike-specific. Does that mean a TFT will eventually be extremely inexpensive and easy to replace, should it ever go bad? Right now they’re too new to know for sure, but manufacturers are installing them everywhere, so we will all find out soon enough!

Sportster® S is the first chapter of a whole new book of the Sportster saga. A legacy born in 1957 that outperformed the competition is now rebuilt to blow away the standards of today.

Features may include:THIS IS THE RIGHT BIKE FORRiders who desire top-of-the-line performance and stunning styleAggressive riding with sport bike agility and handlingMaking a statement and standing out from the crowdPOWERTRAINAll-new Revolution® Max 1250T

The next chapter in a century of legendary V-Twins is here. Revolution® Max is a liquid-cooled powertrain with double overhead camshafts and variable valve timing: offering ample torque and an immediate powerband tuned to maximize rider control.EXHAUSTHigh Mount Exhaust

Inspired by the glory days of H-D flat-track racing, the pipes are crafted from corrosion-resistant 304-series stainless steel and engineered to deflect exhaust heat away from the rider’s legs and tail section.INSTRUMENTATIONClassic Meets Modern: 4” Round Display

Everything you need to know is housed in a Bluetooth®-equipped, 4” round thin-film transistor LCD display: digital gauges, indicators, ride modes, and turn-by-turn navigation with the Harley-Davidson® app. All functions are accessed via buttons on the left- and right-hand controls.RIDER TECHNOLOGYChoose Your Ride Mode

Flick a switch and choose from 3 pre-programmed Ride Modes (Sport, Road, and Rain) or create your own custom mode— tuning your bike with a specific combination of power delivery, engine braking, Cornering Enhanced Antilock Braking System (C-ABS) and Cornering Enhanced Traction Control System (C-TCS) settings.CHASSISDUAL PURPOSE POWERTRAIN

The Revolution® Max 1250T is a structural component of the motorcycle chassis, eliminating a traditional frame —which significantly reduces overall weight and keeps handling precise. This is performance you can feel, with the center of gravity low and the chassis super rigid.Revolution® Max 1250T Powertrain94 ft. lbs. Torque121 HorsepowerWeight (As Shipped/Running Order): 487/502 pounds4-inch Round TFT Display ScreenBluetooth® Connectivity and Moving Maps NavigationCornering Rider Safety Enhancements including ABS and Traction ControlSelectable and Customizable Ride ModesAll LED Lighting Adjustable Performance SuspensionCruise ControlIn a Post-Covid Lockdown, now is the time to feel the wind on your face and enjoy freedom again on this 2022 RH1250S Sportster S!!!

H-D OF DANBURY FEELS LIKE A BIKE SHOP WHEN YOU WALK IN BECAUSE IT IS OWNED & RUN BY REAL MOTORCYCLE ENTHUSIASTS, & WE ARE RA1250 EXPERTS AND OFFER MORE REVOLUTION MAX BIKES THAN MOST OTHER HARLEY-DAVIDSON DEALERS BECAUSE DANBURY IS A TIER 1 DESIGNATED FACTORY DEALER, VISIT H-D OF DANBURY.

Before you get a new monition for your organization, comparing the TFT display vs IPS display is something that you should do. You would want to buy the monitor which is the most advanced in technology. Therefore, understanding which technology is good for your organization is a must. click to view the 7 Best Types Of Display Screens Technology.

Technology is changing and becoming advanced day by day. Therefore, when you are looking to get a new monitor for your organization, LCD advantages, and disadvantage, you have to be aware of the pros and cons of that monitor. Moreover, you need to understand the type of monitor you are looking to buy.

Now, understanding the technology from the perspective of a tech-savvy person may not be the ideal thing to do unless you are that tech-savvy person. If you struggle to understand technology, then understanding it in a layman’s language would be the ideal thing to do.

That is why it is important to break it down and discuss point by point so that you can understand it in a layman’s language devoid of any technical jargon. Therefore, in this very article, let’s discuss what exactly TFT LCDs and IPS LCDs are, and what are their differences? You will also find out about their pros and cons for your organization.

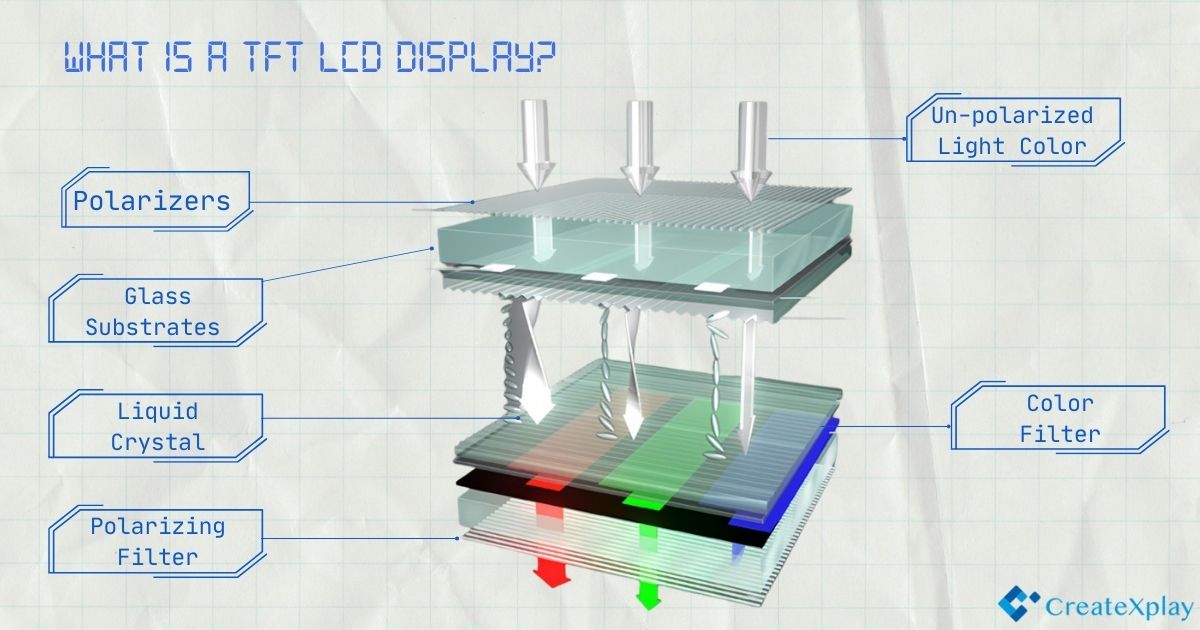

The word TFT means Thin-Film-Translator. It is the technology that is used in LCD or Liquid Crystal Display. Here you should know that this type of LCD is also categorically referred to as active-matrix LCDs. It tells that these LCDs can hold back some pixels while using other pixels. So, the LCD will be using a very minimum amount of energy to function. TFT LCDs have capacitors and transistors. These are the two elements that play a key part in ensuring that the display monitor functions by using a very small amount of energy without running out of operation.

Now, it is time to take a look at its features that are tailored to improve the experience of the monitor users significantly. Here are some of the features of the TFT monitor;

The display range covers the application range of all displays from 1 inch to 40 inches as well as the large projection plane and is a full-size display terminal.

Display quality from the simplest monochrome character graphics to high resolution, high color fidelity, high brightness, high contrast, the high response speed of a variety of specifications of the video display models.

No radiation, no scintillation, no harm to the user’s health. In particular, the emergence of TFT LCD electronic books and periodicals will bring humans into the era of a paperless office and paperless printing, triggering a revolution in the civilized way of human learning, dissemination, and recording.

It can be normally used in the temperature range from -20℃ to +50℃, and the temperature-hardened TFT LCD can operate at low temperatures up to -80 ℃. It can not only be used as a mobile terminal display, or desktop terminal display but also can be used as a large screen projection TV, which is a full-size video display terminal with excellent performance.

The manufacturing technology has a high degree of automation and good characteristics of large-scale industrial production. TFT LCD industry technology is mature, a mass production rate of more than 90%.

It is a perfect combination of large-scale semiconductor integrated circuit technology and light source technology and has great potential for further development.

TFT LCD screen from the beginning of the use of flat glass plate, its display effect is flat right angles, let a person have a refreshing feeling. And LCDs are easier to achieve high resolution on small screens.

The word IPS refers to In-Plane-Switching which is a technology used to improve the viewing experience of the usual TFT displays. You can say that the IPS display is a more advanced version of the traditional TFT LCD module. However, the features of IPS displays are much more advanced and their applications are very much widespread. You should also know that the basic structure of the IPS LCD is the same as TFT LCD if you compare TFT LCD vs IPS.

As you already know, TFT displays do have a very quick response time which is a plus point for it. But, that does not mean IPS displays a lack of response time. In fact, the response time of an IPS LCD is much more consistent, stable, and quick than the TFT display that everyone used to use in the past. However, you will not be able to gauge the difference apparently by watching TFT and IPS displays separately. But, once you watch the screen side-by-side, the difference will become quite clear to you.

The main drawback of the TFT displays as figured above is the narrow-angle viewing experience. The monitor you buy for your organization should give you an experience of wide-angle viewing. It is very much true if you have to use the screen by staying in motion.

So, as IPS displays are an improved version of TFT displays the viewing angle of IPS LCDs is very much wide. It is a plus point in favor of IPS LCDs when you compare TFT vs IPS. With a TFT screen, you cannot watch an image from various angles without encountering halo effects, blurriness, or grayscale that will cause problems for your viewing.

It is one of the major and remarkable differences between IPS and TFT displays. So, if you don’t want to comprise on the viewing angles and want to have the best experience of viewing the screen from wide angles, the IPS display is what you want. The main reason for such a versatile and wonderful viewing angle of IPS display is the screen configuration which is widely set.

Now, when you want to achieve wide-angle viewing with your display screen, you need to make sure it has a faster level of frequency transmittance. It is where IPS displays overtake TFT displays easily in the comparison because the IPS displays have a much faster and speedier transmittance of frequencies than the TFT displays.

Now the transmittance difference between TFT displays and IPS displays would be around 1ms vs. 25ms. Now, you might think that the difference in milliseconds should not create much of a difference as far as the viewing experience is concerned. Yes, this difference cannot be gauged with a naked eye and you will find it difficult to decipher the difference.

However, when you view and an IPS display from a side-by-side angle and a TFT display from a similar angle, the difference will be quite evident in front of you. That is why those who want to avoid lagging in the screen during information sharing at a high speed; generally go for IPS displays. So, if you are someone who is looking to perform advanced applications on the monitor and want to have a wider viewing angle, then an IPS display is the perfect choice for you.

As you know, the basic structure of the IPS display and TFT displays are the same. So, it is quite obvious that an IPS display would use the same basic colors to create various shades with the pixels. However, there is a big difference with the way a TFT display would produce the colors and shade to an IPS display.

The major difference is in the way pixels get placed and the way they operate with electrodes. If you take the perspective of the TFT display, its pixels function perpendicularly once the pixels get activated with the help of the electrodes. It does help in creating sharp images.

But the images that IPS displays create are much more pristine and original than that of the TFT screen. IPS displays do this by making the pixels function in a parallel way. Because of such placing, the pixels can reflect light in a better way, and because of that, you get a better image within the display.

As the display screen made with IPS technology is mostly wide-set, it ensures that the aspect ratio of the screen would be wider. This ensures better visibility and a more realistic viewing experience with a stable effect.

As you already know the features of both TFT and IPS displays, it would be easier for you to understand the difference between the two screen-types. Now, let’s divide the matters into three sections and try to understand the basic differences so that you understand the two technologies in a compressive way. So, here are the difference between an IPS display and a TFT display;

Now, before starting the comparison, it is quite fair to say that both IPS and TFT displays have a wonderful and clear color display. You just cannot say that any of these two displays lag significantly when it comes to color clarity.

However, when it comes to choosing the better display on the parameter of clarity of color, then it has to be the IPS display. The reason why IPS displays tend to have better clarity of color than TFT displays is a better crystal oriental arrangement which is an important part.

That is why when you compare the IPS LCD with TFT LCD for the clarity of color, IPS LCD will get the nod because of the better and advanced technology and structure.

IPS displays have a wider aspect ratio because of the wide-set configuration. That is why it will give you a better wide-angle view when it comes to comparison between IPS and TFT displays. After a certain angle, with a TFT display, the colors will start to get a bit distorted.

But, this distortion of color is very much limited in an IPS display and you may see it very seldom after a much wider angle than the TFT displays. That is why for wide-angle viewing, TFT displays will be more preferable.

When you are comparing TFT LCD vs. IPS, energy consumption also becomes an important part of that comparison. Now, IPS technology is a much advanced technology than TFT technology. So, it is quite obvious that IPS takes a bit more energy to function than TFT.

Also, when you are using an IPS monitor, the screen will be much larger. So, as there is a need for much more energy for the IPS display to function, the battery of the device will drain faster. Furthermore, IPS panels cost way more than TFT display panels.

1. The best thing about TFT technology is it uses much less energy to function when it is used from a bigger screen. It ensures that the cost of electricity is reduced which is a wonderful plus point.

2. When it comes to visibility, the TFT technology enhances your experience wonderfully. It creates sharp images that will have no problems for older and tired eyes.

1. One of the major problems of TFT technology is that it fails to create a wider angle of view. As a result, after a certain angle, the images in a TFT screen will distort marring the overall experience of the user.

Although IPS screen technology is very good, it is still a technology based on TFT, the essence of the TFT screen. Whatever the strength of the IPS, it is a TFT-based derivative.

Finally, as you now have a proper understanding of the TFT displays vs IPS displays, it is now easier for you when it comes to choose one for your organization. Technology is advancing at a rapid pace. You should not be surprised if you see more advanced display screens in the near future. However, so far, TFT vs IPS are the two technologies that are marching ahead when it comes to making display screens.

STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Liquid crystals (LCs) are state of matter that has properties between those of conventional liquids and those of solid crystals, in which the constituent molecules tend to align themselves relative to each other. Liquid crystal displays (LCD) use the unique character of Nematic LC which are optically active and align themselves with an applied field.

The character of Nematic phase LC: The center of gravity of the molecules in the Nematic phase lacks positional order, allowing it to flow free and their center of mass positions are randomly distributed as in a liquid, but the directors of the molecules are spontaneously aligned with their long axes roughly parallel.

There are two ways to drive the working of LC in the electric field, either with a passive matrix or an active matrix grid. Therefore, LCD can be classified as Passive Matrix LCD (PMLCD) and Active Matrix LCD (AMLCD).

Passive matrix display is the first commercialized LCD technology, which is designed with a simple grid of row and column electrodes respective on the top and bottom plates to address the pixels.

The working principle of the passive display is to use the input signal to drive the electrodes of each row in turn, so when a row is selected, the electrodes on the column will be triggered to turn on those pixels located at the intersection of the row and the column.

These switches are usually implemented through transistors, which are fabricated by using the current-carrying thin film (usually a film of silicon—Si) and therefore called thin film transistors, TFTs.

Similar to the passive matrix LCD, the upper and lower layers of the active matrix LCD are also arranged vertically and horizontally with transparent electrodes made ofindium tin oxide (ITO).

It allows the column voltages to be applied only to the row that is being addressed, while the storage capacitormaintains the pixel information for the whole frame also when the addressing signal is removed.

Thus, high contrastis possible and a fast LC mixture can be used, since the pixel no longer has to respond to the average voltage over a whole frame period, as in PMLCDs. For the same reason, the phenomenon of crosstalk is also minimized.

Early passive matrix screens relied on twisted nematic (TN)designs. The polarizing directions of the upper and lower polarizing plates are at 90°, so the liquid crystal in the middle is twisted at 90°.

The resulting LCD panels have low contrast and slow response times. This method works well for low-information displays but not for computer displays.

The Super Twisted Nematic (STN) method is improved by changing the chemical composition of LC so that the LC molecules are twisted more than once, therefore, the light twist reaches 180° to 270°, which can greatly improve the contract.

In the early 1980s, STN technology was very popular. But it comes along with a color shift in light, especially where the screen is off-axis. This is why early computer screens were always bluish and yellowish.

To solve the color shift problem, double layer STN (DSTN) and further improved technology Film-compensated STN (FSTN)were developed with comparable display quality and low cost.

And the dual scan concept for FSTN was proposed in the early 1990s, to solve the ghost phenomenon and significantly improve contrast, and graphic quality, and shorten the response time. It is still widely used in low-priced computers.

Drawbacks were the limited viewing angle and color gamut, poor black level, low peak luminance and slow response time of the LC-material, high cost, and low yield in production.

Since 2005, the picture quality of LCDs for TV surpassed that of CRTs, the milestone is Full High Definition (FHD) LC-modules with 1080 lines introduced into the market, which has good daylight contrast and high resolution.

The viewing angle could be enlarged spectacularly by applying new LC structures like In-Plane Switching (IPS)and Vertically Aligned Nematic (VAN) LCs.

Since the panel costof a TFT LCD module is relatively high, decreasing the cost of manufacturing an LC panel is one of the main issues. The most effective way is to enlarge the mother glass or substrate of the back and front plates.

Until 2021, Gen11 is in production, which can process the size of glass substrate 3000*3320(mm). (In the industry, “Gen” stands for generation, which is used to indicate the size of the glass substrate for an LC panel. )

Even though AMLCD (TFT LCD) takes advantage of the display technology and display quality, the cost of some modules can compete with the similar size of passive LCDs.

Passive Matrix LCDActive Matrix LCDWorking PrinciplePixels are addressed directly and they must retain their state between screen refreshes without the benefit of a steady electrical charge.A switch is placed at each pixel which decouples the pixel-selection function. Thin Film Transistor is the main technology of the AMLCD subgroup.

ApplicationNum

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey