custom duty on lcd monitors in india factory

Most Trading partners to import Lcd Display are China, TAIWAN, Rep. of Korea, KOREA DP RP, Viet Nam . Import duty is imposed by the government when Lcd Display is imported into India from any country. This tool helps you to find out duties one have to pay while importing Lcd Display

We offer customized business loans for small and medium businesses in India to trade internationally and grow their Lcd Display business. Connect2india helps you to find out import duty of Lcd Display from various countries. It also gives information about Lcd Display importing procedure in India, importing rules and regulations in India for importing Lcd Display.

Connect2India additionally explains varied duties and taxes obligated on import of Lcd Display in India. It additionally helps you with execution of import order for Lcd Display, paying tariff and taxes for Lcd Display, obtaining custom clearances for Lcd Display and assist you with different procedures relating to import of Lcd Display in India.

Most Trading partners to import Lcd Panel are China, Singapore, USA, TAIWAN, Germany . Import duty is imposed by the government when Lcd Panel is imported into India from any country. This tool helps you to find out duties one have to pay while importing Lcd Panel

We offer customized business loans for small and medium businesses in India to trade internationally and grow their Lcd Panel business. Connect2india helps you to find out import duty of Lcd Panel from various countries. It also gives information about Lcd Panel importing procedure in India, importing rules and regulations in India for importing Lcd Panel.

Connect2India additionally explains varied duties and taxes obligated on import of Lcd Panel in India. It additionally helps you with execution of import order for Lcd Panel, paying tariff and taxes for Lcd Panel, obtaining custom clearances for Lcd Panel and assist you with different procedures relating to import of Lcd Panel in India.

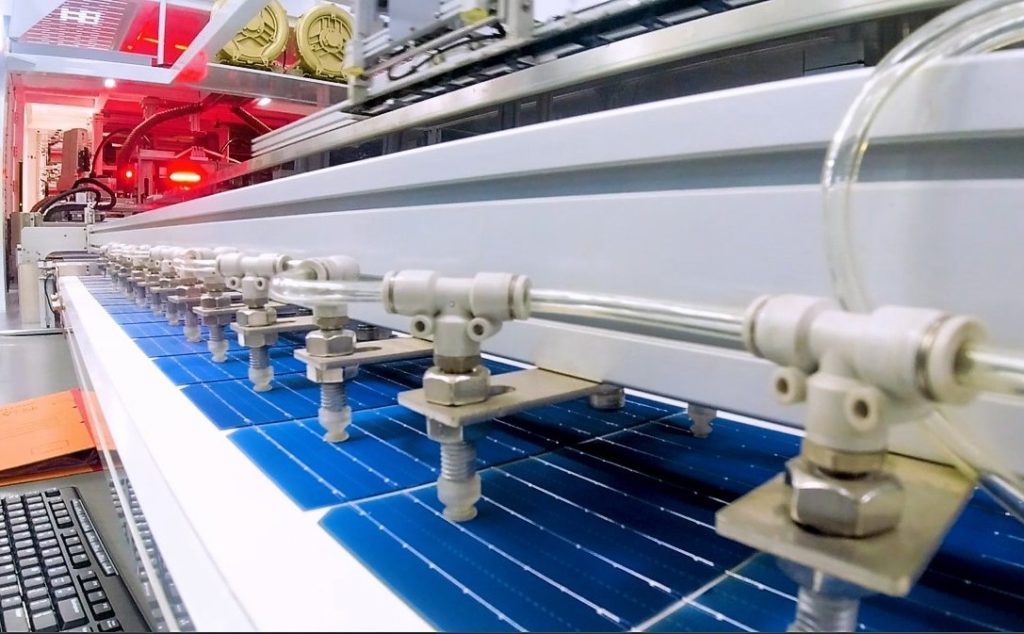

India will levy a 5% basic customs duty on imports of picture tubes used in making open cells - used in display screens of LED or LCD televisions – from November 12, 2020. The move will encourage foreign companies to set up display manufacturing units in India, industry insiders said.

“Customs duty of 5% has been imposed on few items for manufacture of open cell for televisions like pure cell and printed circuit board for open cell which were earlier exempt from duties,” an official said.

The move follows a 5% basic customs duty on open cell television panel imports which was imposed from October 1 this year. The exemption was offered for a limited period of one year till September 30 in anticipation that the industry would build capacity for manufacturing critical components in India and move towards value addition from mere assembling.

Television makers had argued that prices of fully built panels have risen 50% and customs duty of 5% on open cell – a major component for TVs – would lead to increase in sale prices. They had also demanded that imports of parts of open cell should be levied with duties so as to create parity.

“The imposition of duty on the parts of open cell will give the domestic manufacturers a level field with the imports and incentivize the manufacture of these parts in India,” said Bipin Sapra, partner at EY.

Sunil Vachani, chairman of Dixon Technologies that makes LED and LCD televisions, said that the government has responded to industry’s demands for a level playing field.

“It’s a welcome step, it will encourage display fab manufacturing to come to India, in turn driving investments, and ensure that no unfair advantage is given to any player,” he said.

Government has given protection to local industry with 20% customs duty on imports of fully made TVs since 2017 and certain categories of TV imports have been put in the restricted category since July this year.

Smartphones will become more expensive as a result of the competition watchdog’s two recent adverse orders against Google. Its patent Android operating system for mobile phones would mean higher costs of ensuring user safety and security, which could, in turn, be passed on to customers.

Wipro posted a 2.8% growth in net profit for the fiscal third quarter, beating estimates, but the IT services major warned that the sector was slowing down amidst a challenging macroeconomic environment.

The National Company Law Tribunal (NCLT) on Friday allowed the ownership of Jet Airways to be transferred to the Jalan Kalrock Consortium (JKC), which had won the bid to resurrect the grounded carrier in 2021.

India’s ministry of finance announced on the evening of September 17 that the abolition of the import tariff of 5% on open-cell LCD TV panels, which are needed to make LED TVS, will help revive the domestic TV manufacturing industry and reduce the price of TV panels by about 3%.

The government imposed a 5 percent tariff on LCD TV panels in June 2017, but The Consumer Electronics and Appliances Manufacturers Association (CEAMA), The country’s leading TV Manufacturers, has been demanding its abolition.

The finance ministry said imports of LCD panels for LCD and LED TVs (15.6 inches or more) would be exempt from tariffs, which affect TV makers because TFT LCD panels are an essential component for making TVs and account for more than half of the cost of making a complete TV. The government also scrapped import duties on components used in making TFT LCD TV panels, such as Chip on Film, PCBA, and Cell.

The decision by the Indian government ahead of the upcoming Diwali festival will help stimulate demand for LED TVs at the festival, and TV manufacturers are all for that. Manish Sharma, President, and chief executive of Panasonic in India and South Asia, said cost pressures on manufacturers would ease and the benefits would help stimulate demand once they were passed on to consumers. Sunil Nayyar, general manager of Japan’s Sony in India, said the panel exemption would help the company expand its TV production in India, where it supports the government’s “Make in India” policy.

Indian television market size estimates that about 220 billion rupees, but the industry is struggling due to slowing demand, due to the panel is Samsung (Samsung) company to impose tariffs, Indian television production line already moved to Vietnam, through the FTA between India and ASEAN imports in India, to reduce the cost.

By Press Trust of India: The government has scrapped import duty on open cell TV panel used to make television sets, as it aims to boost local manufacturing by lowering input costs for TV makers who have been complaining about a slump in demand.

The decision to remove 5 percent customs duty will help reduce manufacturing cost by around 3 percent but it wasn"t immediately clear if all TV makers will pass on the benefit to consumers.

Finance Ministry in a notification said customs duty on "open-cell (15.6-inch and above), for use in the manufacture of Liquid Crystal Display (LCD) and Light Emitting Diode (LED) TV panels" will be nil as against 5 percent import duty previously.

Besides, the government has also waived custom duty on import of Chip on Film, Printed Circuit Board Assembly (PCBA) and Cell (glass board/ substrate), which are used to manufacture open cell TV panels.

The other goods for use in the manufacture of open-cell of Liquid Crystal Display (LCD) and Light Emitting Diode (LED) TV panels of heading 8529 would also attract nil duty. These include Chip on Film, Printed Circuit Board Assembly (PCBA) and Cell (glass board/substrate).

"Industry welcomes this decision. This will ease the cost pressure on TV and the benefit once passed to the consumers will help the industry accelerate demand," Panasonic India and South Asia President and CEO Manish Sharma told PTI.

"The announcement comes at an opportune time considering the flat growth that TV"s have witnessed in the last year. Since open cells form a major share of the total manufacturing cost of TV"s, the move will allow us to pass the benefits to the end consumer which would be about 3-4 percent reduction in price thus providing the necessary thrust to the market," he said.

To further the push towards affordability for TV"s, he urged the government to also consider revising the GST slabs for TV"s above 32 inches from 28 percent slab to 18 percent.

"The company has long been committed to the government"s Make in India initiative. This withdrawal of duty on an open cell provides a strong boost to local manufacturing and will help us further enhance our efforts in this direction," said Sony India Managing Director Sunil Nayyar.

According to Haier India President Eric Braganza, the industry has been pushing for this for some time. The TV market is slow, so anything that could ignite the growth is welcome.

When asked whether it would have any impact on TV price, Manish Sharma said currently inventories for the festive season are already in place, however, for fresh imports, the cost impact will be about 3 percent.

"Our festival pricing is already in place which is attractive compared to the previous month"s. Hence postseason, this duty reduction will help us maintain the pricing at same levels with reduced cost pressures on the industry," Sharma said.

Besides removing 5 percent customs duty imposed on import of open-cell TV panel, the government has waived customs duty on import of chip on Film, Printed Circuit Board Assembly (PCBA) and Cell (glass board/ substrate), which are used to manufacture open cell TV panels.

The Central Board of Indirect Taxes and Customs (CBIC) notified that a 5% basic customs duty will apply on imported components that are used in liquid crystal displays (LCDs) and light emitting diode (LED) television panels from Friday. The duty will apply on chips, printed circuit board assemblies and glass boards.

The move comes immediately after the union cabinet extended production incentives for 10 sectors including technology products aimed at encouraging local manufacturing. The Narendra Modi administration is using both tariffs and incentives to encourage investments into local manufacturing but officials have in the past reiterated that these temporary measures are taken while remaining committed to an open global economy.

The government recently categorised television sets as a restricted item for the purposes of imports and have now increased the customs duty on specified components used in manufacture of open cell used in LED or LCD panels from zero to 5%, clearly conveying their intention that the value addition in respect of LED and LCD manufacturing should be centered in India, in line with the phased manufacturing programme, said Abhishek Jain, Tax Partner, EY.

A 20% customs duty has been in place on television imports since December 2017 and television import has been put on the restricted category with effect from end of July this year. BCD represents the tariff protection offered to competing local products. (ends

Gireesh has over 22 years of experience in business journalism covering diverse aspects of the economy, including finance, taxation, energy, aviation, corporate and bankruptcy laws, accounting and auditing.

The move seeks to bring certainty to businesses and avoid their disputes with the customs department. The clarification is based on inputs from ministry of electronics and information technology. The department said mis-declaration of products have in the past led to tax demand notices being sent to some importers.

As per the clarification, a display unit that includes ten specified items such as touch panel, cover glass, indicator guide light, LCD backlight and polarisers will attract a basic customs duty of 10%. However, if the product includes additional parts such as antenna pin, sim tray, speaker net, battery compartment or other items, then the whole assembly is liable to 15% duty.

Such assembly consisting of a display assembly of a mobile phone with or without back support frame, plus any other parts is not eligible for the concessional duty rate, CBIC said. The order provides display assembly pictures and schematic representations for the ease of identification.

This clarification brings in certainty of taxation on future imports to mobile phone manufacturers who have been at loggerheads with customs officials since long for determining appropriate basic customs duty (BCD) rate for display assembly modules, said Saurabh Agarwal, Tax Partner at EY.

“What needs to be assessed is how would this unfold in the courts and impact existing litigation as the additional BCD cost (if any) on past imports would not be recoverable from customers but would have to be borne by the manufacturer importers only," said Agarwal.

This circular is a big relief to the industry and will avoid unnecessary litigation, said Pankaj Mohindroo, Chairman of India Cellular & Electronics Association (ICEA).

In July, the Directorate of Revenue Intelligence (DRI) issued a notice to Oppo and accused them of allegedly evading customs duty worth ₹ 4,389 by not declaring the items correctly. Soon after, the customs department served notices to three Indian smartphone brands too.

Back then, Oppo had told Mint that it had a different view on the charges mentioned in the show cause notice. Oppo had called it an industry-wide issue impacting many corporations.

In March, the Ministry of Electronics and Information Technology (MeitY) had sent a letter to the Department of Revenue, to clarify that the part needed to make display assembly was exempt from import duty. In its letter MeitY had detailed the constituents of display assembly that were exempt from BCD.

BCD was imposed on display assembly in October 2020 as part of the phased manufacturing program (PMP) to expand local manufacturing capabilities. Some components used in display assembly were exempted from the tax. According to industry experts, display components account for 25-35% of the overall Bill of material (BOM) of a smartphone.

Gireesh has over 22 years of experience in business journalism covering diverse aspects of the economy, including finance, taxation, energy, aviation, corporate and bankruptcy laws, accounting and auditing.

NEW DELHI: India may refrain from levying import duties on display and touch panel assemblies — key components used in mobiles — in the upcoming budget to ensure supply of cheaper inputs and boost local manufacturing even as some component makers favour the levy as a measure of protection.

“Import duties on some components under the phased manufacturing programme (PMP) have not been recommended… the industry had asked for these changes,” a government official said.

The government has shelved its plan to levy 10% basic customs duty on display assemblies, touch panel assemblies and cover glass for mobiles from the next fiscal year as part of PMP.

In twin relief for India’s economy, retail inflation eased more than expected to a 12-month low in December while industrial growth swung to a five-month high in November from a contraction in the preceding month, separate data releases on Monday showed.

India’s capital-markets regulator has sent notices to several Alternative Investment Funds (AIFs), which include both private equity investors and venture capitalists, for alleged violation of specified tenure rules on their investment vehicles, people with direct knowledge of the development told ET.

Infosys posted a 13.4% growth in net profit for the fiscal third quarter, beating estimates and upgrading its annual revenue guidance, highlighting a strong pipeline of existing deals for India’s second-largest software exporter.

Stay on top of technology and startup news that matters. Subscribe to our daily newsletter for the latest and must-read tech news, delivered straight to your inbox....moreless

The Central government may not extend the policy of zero customs duty on open-cells for LCD/LED panels used in televisions. Television makers were hopeful of a temporary extension, at least till the end of December, to see them through the festival season. Sources said the government is keen on incentivising local manufacturing.

“The current zero customs duty regime for open cells will end on September 30. The idea is to enable TV makers to become self-reliant by sourcing these components locally. Hence, we are not keen to give an extension,” said an official.

The open-cell is a critical component in the manufacture of television sets. At present, there is no local manufacturing of open cells in India. The entire component is imported from markets such as China. These raw open cells are imported and then assembled in India for use in television sets.

Currently, the zero customs duty is applicable for open cells (15.6 inches and above) used in the manufacture of Liquid Crystal Display (LCD) and Light Emitting Diode (LED) TV panels.

Imposition of customs duty would lead to an immediate hike in prices of televisions. Television makers told Moneycontrol that even a three-month extension till December end would help them see festive season sales through.

“If we are forced to pay import duty from October onwards, there will be an immediate price increase by 3-5 percent for the finished goods. This would be a dampener because we are slowly seeing some revival in pent-up demand, which will be stalled if there is a price increase,” said the head of the home appliances division of an electrical goods firm.

LED TVs are one of the largest segments under the Appliance and Consumer Electronics domain, accounting for a volume of almost 15 million units, with an estimated sale value of almost Rs. 40,000 crore.

In September 2019, the Ministry of Finance had said open-cells for LCD/LED panels will not attract any customs duty. The ministry had said that it would be valid till September 30, this year, after which local manufacturing of open cells could be incentivised.

In her February 2020 budget speech, Finance Minister Nirmala Sitharaman said that it has been observed that imports under Free Trade Agreements (FTAs) are on the rise.

“Undue claims of FTA benefits have posed a threat to the domestic industry. Such imports require stringent checks. In this context, suitable provisions are being incorporated in the Customs Act. In the coming months we shall review Rules of Origin requirements, particularly for certain sensitive items, so as ensure that FTAs are aligned to the conscious direction of our policy," she had said.

The LED TV industry is also one of the biggest employers, with estimated employment of 50,000 people directly and many more indirectly through ancillary units.

Since the nationwide lockdown amidst the Coronavirus outbreak came into effect on March 25, there has been a slump in sale of appliances. From May, when a phased easing of the lockdown began, the business has seen a revival though sales are still at only 55 percent of their 2019 levels.TV makers are pinning their hopes on the festive season, which begins in September, to help restore revenue lost during the lockdown.

The main issue with this subject is that there are conflicting reports on different websites. Some websites are outdated, while some are providing the wrong info. Sadly, even the official website of Indian Customs doesn’t have easy-to-understand answers to these questions.

This article has an Online Calculator for Indian Customs Duty on LCD/LED TV and explains the procedures to be followed while carrying a television to India.

The guideline for Customs Officers says that the duty is 38.5% on “the assessed value”, which need not be the actual cost of the TV. The value will be assessed on arrival, based on parameters such as make, model, condition of the TV- whether new or old etc.

To help in assessment, Customs Officers have an internal database with popular TV models and their prices. This database is not published for the general public.

We have developed a calculator which you can use to get a rough estimate of the customs duty on LCD or LED TV. Since you cannot predict the assessed value, you can get an estimate by converting the cost into Indian Rupees.

The assessed value depends on the Officer’s judgement. Some Officers are strict and stick to the customs database, while some are flexible and may record a lower assessment value.

For example, you may have bought a 42″ LED TV for AED 2,500 (Rs 50,000) but the Officer may assess the value to be Rs 25,000. In this case, you have to pay only Rs 9,625 as a duty.

The Duty Receipt would show that the assessed value is Rs 25,000 and you paid 38.5% of the value. In reality, you have paid only 19% of the cost price. This is why most people feel they paid less than 20%.

The assessed value is not solely dependent on the cost price of the product. However, producing a purchase bill/invoice may help the Customs Officer in the assessment.

Note that it is not mandatory for the Officer to charge you based on the bill. He can use the Customs database and his personal judgement in assessing the value.

Here also it is not mandatory for the Officer to charge you based on the bill. He can use the customs database and his personal judgement in assessing the value.

For older and used TV sets, travellers can request depreciation. This is usually granted based on the number of years used. The assessed value will be lower for older TVs.

There are special allowances for professionals returning to India after completing a contract (You can read it here). However flat panel televisions are not included in such allowances.

The assessment and invoicing are usually done in Indian Rupees. However, you can pay in foreign currency as most currencies are accepted in all Indian airports.

However, airlines have their own policy for the maximum size that can be carried on their flights. Make sure to check the maximum baggage dimension for your flight, particularly if you are carrying 50 inches or bigger. The airline’s website should have the maximum dimension per box. Pay attention to the weight per piece also.

At the check-in counter, mention that you have a TV in baggage. Airline officials will label it as Fragile and pass it through a special conveyor belt for oversize luggage.

Yes, the new Customs Declaration Form has an additional field to declare any flat panel television you are carrying. You have to mention it there and show it to the Customs Officers and pay the duty before leaving.

The government has halved customs duty on "open cell" used in the manufacturing of LCD and LED television panels to 5 per cent, a move intended to boost domestic manufacturing.

"Open cell (15.6 and above) for use in the manufacture of Liquid Crystal Display (LCD) and Light Emitting Diode (LED) TV panels" would attract 5 per cent customs duty, the Central Board of Excise and Customs (CBEC) said in a notification.

Experts said the move is an extension of domestic manufacturing push by the government after it announced in Budget the hiking of import duty on LCD/LED TV panels to 15 per cent.

"The customs duty of 5 per cent on open cells used in the manufacturing of LCD panels is lower than other items mentioned is Chapter 8529, this could ostensibly be to encourage manufacturing of such panels in India," MS Mani, Senior Director at Deloitte India said.

Abhishek Jain, Partner, EY said the lowering of the customs duty rate on open cells used for manufacturing LCD and LED panels from 10 per cent to 5 per cent should boost domestic manufacturing of such panels vis-a-vis direct imports.

Concessions in customs duty will be given to certain consumer electronic devices to promote manufacturing across wearables, hearables and specific mobile phone components.

"Duty concessions being given to promote electronics manufacturing, wearables and hearables devices included. Duty concessions to parts of mobile phones including camera module etc," said finance minister Nirmala Sitharaman on Tuesday.

Finance Minister Nirmala Sitharaman on Tuesday announced cutting import duty on cut and polished diamonds and gemstones to 5 per cent while on sawn diamond to nil in order to boost the sector. At present, import duty on cut and polished diamonds as well as gemstones is 7.5 per cent.

The reduction in some of the component duties come at a time when the telecom sector has been facing a supply chain and component shortage and a drop in customs duty will give a boost to manufacturing.

" We believe the budget incentives around wearables and hearables will provide a further impetus to Make in India in electronics and contribute to the rise of Indian domestic champions in this sector," said Head – Industry Intelligence Group at CMR. "The pandemic has given a significant boost to hearables and wearables. Increased localization will enable these brands to build greater supply chain efficiencies and shorter time to market," he added.

Industry body Cellular Operators Association of India (COAI) had estimated that the high customs duty was disrupting the cost effectiveness of the telecom companies.

Smartphones will become more expensive as a result of the competition watchdog’s two recent adverse orders against Google. Its patent Android operating system for mobile phones would mean higher costs of ensuring user safety and security, which could, in turn, be passed on to customers.

Wipro posted a 2.8% growth in net profit for the fiscal third quarter, beating estimates, but the IT services major warned that the sector was slowing down amidst a challenging macroeconomic environment.

The National Company Law Tribunal (NCLT) on Friday allowed the ownership of Jet Airways to be transferred to the Jalan Kalrock Consortium (JKC), which had won the bid to resurrect the grounded carrier in 2021.

Peak rate of BCD for most of non-ITA electronic goods is 10% except goods inter-alia including Cellular Mobile Handsets , Set Top Box for Television, Colour Television, Microwave Ovens, Digital Video Recorder (DVR)/ Network Video Recorder (NVR), CCTV Camera/ IP Camera, Light Emitting Diode (LED) Lamps, Smart Meters on which BCD is 15% / 20%.

Extension of Closing date of Notice Inviting applications for the post of Additional Assistant Director in various Directorates under CBIC on a deputation basis- Reg.

Notification for Departmental Examination for promotion of Tax Assistants to the Grade of Executive Assistants of Central Taxes & Customs to be held in the month of March, 2023

Request for Expression of Interest (EOIs) for Empanelment of CAs/ICWAs for conducting Special Audit under Section 66 of the CGST Act, 2017 at CGST Audit-1 Commissionerate, Delhi

Marks of Deptt. Exam. for Inspectors of Central Tax held in 02.08.2022 to 05.08.2022 declared. Nodal Officers (Exam) may download marks-sheet along with forwarding letter from their e-Mail ID.

Notification issued to extend the due date for furnishing FORM GSTR-1 for November 2022 for registered persons whose principal place of business is in certain districts of Tamil Nadu.

Notification for Departmental Examination for promotion of Ministerial Officers to the Grade of Inspectors of Central Taxes, Inspectors of Customs (Preventive Officers) & Inspectors of Customs (Examiners) to be held in the month of February 2023. It also contains the Schedule, Syllabus, and Instructions for Examination along with the format (in Annexure II) for requesting Question Papers. The Notification can be viewed through this link -

CBIC has issued Postal Export (Electronic Declaration and Processing) Regulations, 2022 in furtherance of ease of doing business Notification No. 103/2022-Customs (NT)|Notification No. 104/2022-Customs (NT)|Circular No. 25/2022

DGTS is organizing an open house meeting with interested communication agencies for” Selection of Communication Agency for CBIC"s Taxpayer outreach programs on 01st December, 2022Click here

Manner of processing and sanction of IGST refunds, withheld in terms of clause (c) of sub-rule (4) of rule 96, transmitted to the jurisdictional GST authorities under sub-rule (5A) of rule 96 of the CGST Rules, 2017Click here

CBIC issued notifications to empower the Competition Commission of India to handle anti-profiteering cases under CGST Act, 2017 with effect from 01.12.2022Click here

Since January 1, 2022, foreign companies importing goods into France (from a non-EU country) must be registered for French VAT in order to be able to clear their goods for customs. A fiscal representative in France will be required for most non-EU companies. Since the VAT deferment scheme is now mandatory, no payment of import VAT will be made. Please contact us to apply for a French VAT number.

Products imported into France from a country that is not a member of the European Union are subject to customs duties and import taxes. These duties and taxes are calculated according to three specific criteria, namely the tariff classification, the customs origin and the value of the goods.

We will analyze throughout this article each assessing criterion in order to provide the reader with a better understanding of the exact method of calculation of import taxes levied on a product brought into France.

The tariff classification consists of determining the nature of the imported product (“tariff description”) and assigning it an identification customs code or a tariff subheading within the Combined Nomenclature (CN) of the European Union.

The CN is a sort of database for classifying goods under different headings and subheadings. An 8-digit nomenclature code is assigned to each subheading as well as the applicable customs duty rate. The Combined Nomenclature (CN) is a classification tool specific to the European Union, but it is based on the nomenclature of the Harmonized System (HS) of the World Customs Organization (WCO) which is applicable in almost all the countries of the world.

In the business practice, freight forwarders in France usually ask their customers to provide the exact description of the product to be cleared as well as the corresponding HS code (Harmonized System Code). The HS code is actually a 6-digit international customs code to which will be added either 2 digits to find the corresponding CN code (Combined Nomenclature Codeapplicable in all the EU countries) or 4 digits to find the TARIC code (Integrated Tariff of the European Union).

For example, the HS code for a computer screen (LCD Monitors) should be 8528 52 and its equivalent in the EU is 8528 52 91 (CN code) or 8528 52 91 00 (TARIC code). The customs duty rate applicable to this product is nil (i.e. 0%). However, if the LCD screen had a television receiver built-in, the HS code would rather be 8528 72 and its equivalent in the EU would be 8528 72 40 (CN code) or 8528 72 40 00 (TARIC code). In the latter case, the applicable customs duty rate is 14%.

We can notice that in the tariff classification, it is important to find the component that gives the product its essential character, that is to say the component which, when removed, causes the product to lose its real characteristics. Therefore, the commercial name of a product should not be a criterion to be taken into account for customs classification purposes because it can be misleading.

It is imperative that the products are properly classified in order to avoid an overestimation or an underestimation of the amount of customs duties to be paid in France. In the event of a payment lower than the actual amount of duties applicable, the customs authorities can chase the ‘Importer of record’ and request the remaining balance due with late payment penalties.

A correct tariff classification will also help to be aware of the customs regulations applicable to a specific product imported in France (prohibition, restriction, safety standards, anti-dumping duties, sanitary or phytosanitary formalities, etc.). In case a company is not completely sure of the exact subheading code under which its product should be classified, it has the possibility to apply for a Binding Tariff Information (BTI). Although the BTI procedure may last several weeks, the BTI decision offers the advantage that it binds all the EU customs administrations which cannot challenge the tariff classification (except in some rare cases) for a period of 3 years.

After the customs code corresponding to the product to bring into France has been found, the importer should also determine the origin of that product. In fact, even when the product is normally subject to the Most Favoured Nation (MFN) duty rate(i.e. the customs duty rate applicable by default to all non-EU countries), a reduced or a nil tariff rate can be applicable if there is a free trade agreement between the European Union and the country of origin. The reduction or cancellation of the duty rate is also possible when the European Union grants a unilateral trade preference to the exporting country.

From a customs perspective, the origin is the country in which a good was wholly manufactured or obtained. It is therefore critical to make a clear difference between the “customs origin” of a product and the “country of departure” of the transport, i.e. the last non-EU country from which the goods are shipped to the customs territory of the European Union.

For instance, specific goods can be manufactured in Malaysia (which is the country of customs origin) but shipped to the EU from the neighbouring country Singapore (which is in this case the “place of origin” or the last country of departure of the transport). After customs clearance upon arrival in France, the said goods will acquire the customs status of the European Union. However, this new EU customs status will not modify the intrinsic origin of the goods; we will have goods of Malaysian origin, coming from Singapore and released for free circulation in the European Union.

When the production of the goods involves more than one country or territory, the customs origin is deemed to be the country where “they underwent their last, substantial, economically-justified processing or working, in an undertaking equipped for that purpose, resulting in the manufacture of a new product or representing an important stage of manufacture.” – Article 60 (2) of the Union Customs Code (UCC).

The EU customs law makes a distinction between two types of origins, namely non-preferential origin and preferential origin.Non-preferential origin which is the customs origin applicable by default. When a good has a non-preferential origin, it means that there is no legal instrument between the European Union and the country of origin allowing the application of a reduced or nil customs duty rate. The rate of customs duty that will be used for the importation of that merchandise into France will be the MFN rate as defined by the Combined Nomenclature.

Preferential origin results from bilateral trade agreements between the European Union (EU) and non-EU countries, or from preferential measures granted unilaterally by the EU to certain third countries. These preferential arrangements enable the application of a reduced or a nil customs duty rate on goods imported into France and originating in beneficiary countries and territories.

When an importer wants to bring into France non-EU goods under a tariff preference scheme, he must normally provide evidence of the preferential origin before the customs clearance actually takes place in France.

In general terms, the proofs of origin are either a declaration of originon the invoice issued by the exporter in the third county for a consignment up to 6’000 Euros (registered exporters can make an invoice declaration for consignments beyond 6’000 Euros) or a certificate of origin signed and stamped by the customs authorities of the exporting country.

A certificate of origin known as FORM.A is used to import into France goods originating in countries benefiting from the GSP (Generalized System of Preferences) arrangements. As from January 1, 2021, FORM.A will be permanently replaced by the certification of origin issued directly on a commercial invoice by an approved exporter under the REX system (The Registered Exporter system).

The EUR.1 certificate is rather used for goods originating in third countries that do not benefit from the GSP, with the exception of cases where a cumulation of origin is applied under the Pan-Euro-Mediterranean system (use of the EUR-MED certificate).

It is worth noting that the A.TR certificate for the movement of industrial products between Turkey and the EU is not a proof of origin as such, but a certification of the Turkish or EU customs status of the goods.

Once the tariff classification of a product and its customs origin have been clearly defined, the last step is to determine the value on the basis of which any customs duties and French import VAT will be computed.

For a correct assessment of import duties and taxes, the customs declaration to be filed in France should mention the exact value of the consignment. The customs value is in principle determined on the basis of the “transaction value”, that is to say the total price of the goods actually paid or to be paid to the seller by the buyer who will import the said goods in the customs territory of the European Union.

Other ancillary charges such as cost related to packaging, transport and insurance up to the first point of entry of the goods into the European Union (non-comprehensive list) can be added to the “transaction value”. In the case of a transport by sea for example, the customs value will generally correspond to the C.I.F value (Cost, Insurance and Freight) up to the first port of entry into the EU.

Customs duties will be calculated on the basis of the C.I.F value, but not the French import VAT which is calculated on the basis of the D.D.P value (Delivered Duty Paid). Indeed, for the determination of the basis for calculating import VAT, it will be necessary to add to the customs value other domestic charges (such as the transport of goods from the port of entry into the EU to the final place of delivery in France), plus the amount of customs duties and other customs taxes except import VAT itself.

There are, however, some situations in which the “transaction value” cannot be used for the determination of the customs value. This is the case, for example, when:a foreign company brings into France its own goods either for a future sale (e.g. consignment stocks or e-Commerce inventories) or for a leasing with or without an option to purchase the same;

the buyer and the seller are legally or financially bound in such a way that their relationship influences the selling price of the goods (e.g. some transfer pricing between entities belonging to a same multinational group);

In such cases, the importer will have to use secondary methods of customs valuation in order to find the real value of the goods. Article 74 of the Union Customs Code (UCC) sets a precise order in which the alternative methods should be used, the goal being to reach to the first method of substitution under which the customs value can be determined.

The transaction value of identical or similar goods, produced in the same country, and sold for export to the EU at the same time or about the same time as the goods to be valued should be taken into account.

The “identical goods” are in all respects the same as the goods being valued (features, intrinsic quality and commercial reputation) while the “similar goods” only have close resemblance with imported goods in respect of their component materials and characteristics, allowing them to perform the same functions and to be commercially interchangeable.

The customs value is established on the basis of the unit price of the first sale in the EU, after customs clearance in France, of the greatest aggregate quantity of the imported goods or identical or similar goods. This price is acceptable only when there is no legal or financial link between the supplier and its customers. The amount of the commissions or margins usually charged, transport and insurance costs, import duties and taxes due in the European Union will be taken away from the sale price.

In this method, the customs value is obtained by performing an arithmetic operation whose result corresponds to the sum of the 3 following elements :the cost of raw materials and manufacturing operations necessary for the production of the imported goods ;

the amount of profit (minus the general expenses usually taken into account) realized by producers located in the same country from which the goods being valued are exported, who export goods of the same kind to the EU ;

the costs of loading, transport, handling associated with transport and insurance up to the first point of entry into the customs territory of the EU ;

Whenever it is not possible to determine the customs value of goods by the primary method (i.e. the transaction value) or using one of the secondary methods listed above, it shall be determined by reasonable means, based on objective and quantifiable data available in the customs territory of the Union.

The determination of the tariff classification, the customs origin and the commercial valueof a product is a fundamental step for a correct assessment of import duties and taxes levied in France.

While the trade agreements between the EU and certain third countries may lead to the application of a reduced or nil customs duty rate on goods imported into France (mainland), the Value Added Tax (VAT) still applies and a cash disbursement is necessary, except in very limited cases of exemption, suspension or reverse charge (deferment account).

The standard VAT rate for imports into France (mainland) is 20% in 2020. There is also an intermediate rate of 10% and a reduced rate of 5.5% which apply to certain products specifically targeted by the tax law.

In order to find the rate of customs duty applicable to a product you intend to import into France, you can use the simulator of the International Trade Center (ITC) which is a joint agency of the World Trade Organization (WTO) and the United Nations (UN). Please note that this tool does not indicate the French VAT rate which, except in specific cases, amounts to 20% of the DDP value of your import.

You are acting on behalf of a foreign company and you would like to reclaim French VAT paid on commercial imports in France up to December 31st, 2021, feel free to send us a message using the contact form or dial +33-261-536-544 to reach our English speaking line.

For commercial imports as from January 1st, 2022, no payment of import VAT is due in France as long as the Importer of Record has a valid French VAT identificaton number.

Go To TopThe content published here above is based on information timely as of the date of publication, unless otherwise indicated. Amendments to the tax laws in the EU country covered in this article could have been passed recently.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey