custom duty on lcd monitors in india pricelist

The main issue with this subject is that there are conflicting reports on different websites. Some websites are outdated, while some are providing the wrong info. Sadly, even the official website of Indian Customs doesn’t have easy-to-understand answers to these questions.

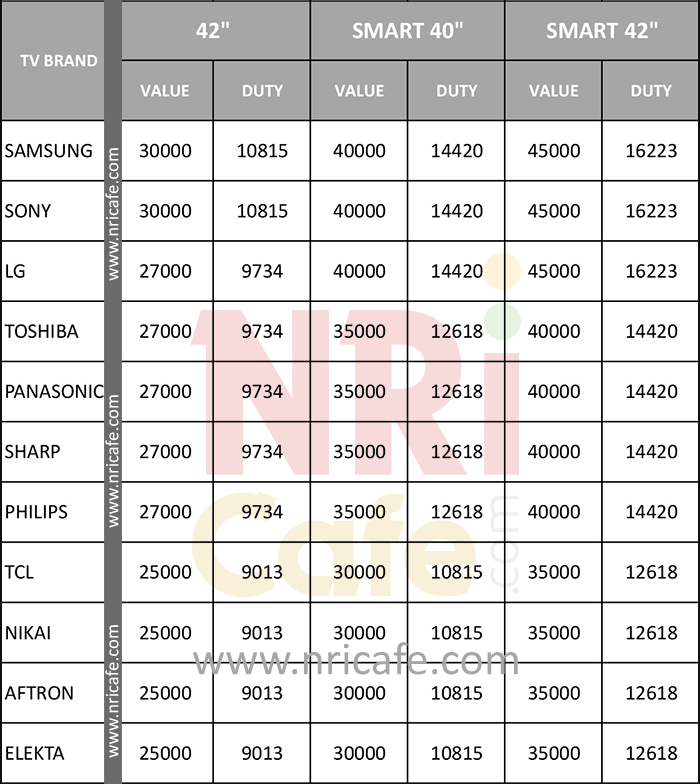

This article has an Online Calculator for Indian Customs Duty on LCD/LED TV and explains the procedures to be followed while carrying a television to India.

The guideline for Customs Officers says that the duty is 38.5% on “the assessed value”, which need not be the actual cost of the TV. The value will be assessed on arrival, based on parameters such as make, model, condition of the TV- whether new or old etc.

To help in assessment, Customs Officers have an internal database with popular TV models and their prices. This database is not published for the general public.

We have developed a calculator which you can use to get a rough estimate of the customs duty on LCD or LED TV. Since you cannot predict the assessed value, you can get an estimate by converting the cost into Indian Rupees.

The assessed value depends on the Officer’s judgement. Some Officers are strict and stick to the customs database, while some are flexible and may record a lower assessment value.

For example, you may have bought a 42″ LED TV for AED 2,500 (Rs 50,000) but the Officer may assess the value to be Rs 25,000. In this case, you have to pay only Rs 9,625 as a duty.

The Duty Receipt would show that the assessed value is Rs 25,000 and you paid 38.5% of the value. In reality, you have paid only 19% of the cost price. This is why most people feel they paid less than 20%.

The assessed value is not solely dependent on the cost price of the product. However, producing a purchase bill/invoice may help the Customs Officer in the assessment.

Note that it is not mandatory for the Officer to charge you based on the bill. He can use the Customs database and his personal judgement in assessing the value.

Here also it is not mandatory for the Officer to charge you based on the bill. He can use the customs database and his personal judgement in assessing the value.

For older and used TV sets, travellers can request depreciation. This is usually granted based on the number of years used. The assessed value will be lower for older TVs.

There are special allowances for professionals returning to India after completing a contract (You can read it here). However flat panel televisions are not included in such allowances.

The assessment and invoicing are usually done in Indian Rupees. However, you can pay in foreign currency as most currencies are accepted in all Indian airports.

However, airlines have their own policy for the maximum size that can be carried on their flights. Make sure to check the maximum baggage dimension for your flight, particularly if you are carrying 50 inches or bigger. The airline’s website should have the maximum dimension per box. Pay attention to the weight per piece also.

At the check-in counter, mention that you have a TV in baggage. Airline officials will label it as Fragile and pass it through a special conveyor belt for oversize luggage.

Yes, the new Customs Declaration Form has an additional field to declare any flat panel television you are carrying. You have to mention it there and show it to the Customs Officers and pay the duty before leaving.

Most Trading partners to import Lcd Display are China, TAIWAN, Rep. of Korea, KOREA DP RP, Viet Nam . Import duty is imposed by the government when Lcd Display is imported into India from any country. This tool helps you to find out duties one have to pay while importing Lcd Display

We offer customized business loans for small and medium businesses in India to trade internationally and grow their Lcd Display business. Connect2india helps you to find out import duty of Lcd Display from various countries. It also gives information about Lcd Display importing procedure in India, importing rules and regulations in India for importing Lcd Display.

Connect2India additionally explains varied duties and taxes obligated on import of Lcd Display in India. It additionally helps you with execution of import order for Lcd Display, paying tariff and taxes for Lcd Display, obtaining custom clearances for Lcd Display and assist you with different procedures relating to import of Lcd Display in India.

We offer customized business loans for small and medium businesses in India to trade internationally and grow their Used Lcd Monitor business. Connect2india helps you to find out import duty of Used Lcd Monitor from various countries. It also gives information about Used Lcd Monitor importing procedure in India, importing rules and regulations in India for importing Used Lcd Monitor.

Connect2India additionally explains varied duties and taxes obligated on import of Used Lcd Monitor in India. It additionally helps you with execution of import order for Used Lcd Monitor, paying tariff and taxes for Used Lcd Monitor, obtaining custom clearances for Used Lcd Monitor and assist you with different procedures relating to import of Used Lcd Monitor in India.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

India will levy a 5% basic customs duty on imports of picture tubes used in making open cells - used in display screens of LED or LCD televisions – from November 12, 2020. The move will encourage foreign companies to set up display manufacturing units in India, industry insiders said.

“Customs duty of 5% has been imposed on few items for manufacture of open cell for televisions like pure cell and printed circuit board for open cell which were earlier exempt from duties,” an official said.

The move follows a 5% basic customs duty on open cell television panel imports which was imposed from October 1 this year. The exemption was offered for a limited period of one year till September 30 in anticipation that the industry would build capacity for manufacturing critical components in India and move towards value addition from mere assembling.

Television makers had argued that prices of fully built panels have risen 50% and customs duty of 5% on open cell – a major component for TVs – would lead to increase in sale prices. They had also demanded that imports of parts of open cell should be levied with duties so as to create parity.

“The imposition of duty on the parts of open cell will give the domestic manufacturers a level field with the imports and incentivize the manufacture of these parts in India,” said Bipin Sapra, partner at EY.

Sunil Vachani, chairman of Dixon Technologies that makes LED and LCD televisions, said that the government has responded to industry’s demands for a level playing field.

“It’s a welcome step, it will encourage display fab manufacturing to come to India, in turn driving investments, and ensure that no unfair advantage is given to any player,” he said.

Government has given protection to local industry with 20% customs duty on imports of fully made TVs since 2017 and certain categories of TV imports have been put in the restricted category since July this year.

Smartphones will become more expensive as a result of the competition watchdog’s two recent adverse orders against Google. Its patent Android operating system for mobile phones would mean higher costs of ensuring user safety and security, which could, in turn, be passed on to customers.

Wipro posted a 2.8% growth in net profit for the fiscal third quarter, beating estimates, but the IT services major warned that the sector was slowing down amidst a challenging macroeconomic environment.

The National Company Law Tribunal (NCLT) on Friday allowed the ownership of Jet Airways to be transferred to the Jalan Kalrock Consortium (JKC), which had won the bid to resurrect the grounded carrier in 2021.

The Customs or A tax charged on certain goods which are brought into a coun... for Computer Monitor to India is classified under Computer & Office(cdf categories).

Extension of Closing date of Notice Inviting applications for the post of Additional Assistant Director in various Directorates under CBIC on a deputation basis- Reg.

Notification for Departmental Examination for promotion of Tax Assistants to the Grade of Executive Assistants of Central Taxes & Customs to be held in the month of March, 2023

Request for Expression of Interest (EOIs) for Empanelment of CAs/ICWAs for conducting Special Audit under Section 66 of the CGST Act, 2017 at CGST Audit-1 Commissionerate, Delhi

Marks of Deptt. Exam. for Inspectors of Central Tax held in 02.08.2022 to 05.08.2022 declared. Nodal Officers (Exam) may download marks-sheet along with forwarding letter from their e-Mail ID.

Notification issued to extend the due date for furnishing FORM GSTR-1 for November 2022 for registered persons whose principal place of business is in certain districts of Tamil Nadu.

Notification for Departmental Examination for promotion of Ministerial Officers to the Grade of Inspectors of Central Taxes, Inspectors of Customs (Preventive Officers) & Inspectors of Customs (Examiners) to be held in the month of February 2023. It also contains the Schedule, Syllabus, and Instructions for Examination along with the format (in Annexure II) for requesting Question Papers. The Notification can be viewed through this link -

CBIC has issued Postal Export (Electronic Declaration and Processing) Regulations, 2022 in furtherance of ease of doing business Notification No. 103/2022-Customs (NT)|Notification No. 104/2022-Customs (NT)|Circular No. 25/2022

DGTS is organizing an open house meeting with interested communication agencies for” Selection of Communication Agency for CBIC"s Taxpayer outreach programs on 01st December, 2022Click here

Manner of processing and sanction of IGST refunds, withheld in terms of clause (c) of sub-rule (4) of rule 96, transmitted to the jurisdictional GST authorities under sub-rule (5A) of rule 96 of the CGST Rules, 2017Click here

CBIC issued notifications to empower the Competition Commission of India to handle anti-profiteering cases under CGST Act, 2017 with effect from 01.12.2022Click here

The rate of duty on LCD Tv is 31.703%.The value of Tv will be determined by the Customs after examining it. The maximium depreciation for first year is 16% of the value.

The rate of duty on LCD Tv is 31.703%.The value of Tv will be determined by the Customs after examining it. The maximium depreciation for first year is 16% of the value.

hi im bringing in a new 24" LCD Monitor HP W2408H from UAE(i currently reside here) which is used only on computer. Is there going to be customs duty on this or is it better i try to get it in india itself

If it is LCD monitor and not LCD TV than there will be no Customs duty .But other duty like central excise duty 14%,education cess 3% and Additional duty of 4% will be collected.

The rate of duty on LCD monitor for computer is same whether it is imported or manufactured in India.The deciding factor is the price in India,service after sales and availability of particular brand in INDIA.

I am an NRI living in Malaysia with family since last more than 3 years. I am buying a 40" LCD TV worth about INR 85,000. I understand goods worth Rs. 25,000 is allowed free. Do I have to pay duty on the differential amount of INR 60,000 @ 31.7% - Depreciation; when I bring this to India ? What is the ebst way to bring this TV to India with minimum or no payment of duty etc. Is TR is the best way ?

Thanks for appreciations. Duty on Baggage goods,if value is more than Rs 25,000/- then ,duty is 35%, on the differential amount. Hence, Baggage import is best option.

I am planning to get 46 " lcd tv to India from USA. I am here for almost 2 yrs and I come under residence transfer category. The TV costs 96600 (2100 $). How much duty I have to pay and how much worth goods is duty free ?

I"m on a B1 visit to US and I have a portable projector which I use frequently in presentations, now can you tell me how much duty will I have to pay when I take this projector back to india?

I am planning to buy a LCD tv worth 475Euros but the same tv costs more in India say around 4 lakhs. Which amount will be used for taxation. The bill amount or the MRP of the LCD tv in India ?.Please advice.

I"m currently satying in dubai. On my next visist to india i would like to take one Sony Bravia 37"" LCD TV. Can you please tell me what will be the duty tax i have to pay.?

hi there... i want to bring used 24"lcd westinghouse monitor of value rs.13160 bought in 2007 from canada to india. how much the duty will be if carrying with me? can i carry in original packaging for safety?

Hi, I am thinking of importing a large amount of used computers and monitors to Kolkata from the UK. Can you please advice me what import tax I would have to pay in Kolkata.

I would like to take the 32 inch LCD TV from UAE to chennai, Indai. The price of the TV is 20000 INR. Could you please tell me what will be the import customs duty charges?

My question is regarding import of an LCD monitor, Dell Ultrasharp 2209WA, which I have bought in Australia for AUD 319 (approx. Rs. 11600). I will bring it back with my as checked baggage. I"ve heard that personal electronic equipment up to Rs. 25000 is exempt from duty. As such, will I have to pay anything when I bring the monitor with me?

I wish to buy a telescope weighing 20kg from Australia, and would like to bring it back with me when I come back to India. The cost of the telescope will be 4000 AUD. How much payment will have to be made for import?

I am an NRI living in Dubai, UAE with my family since last 14 years. As I would be relocating to Mumbai for good I am planning to buy a new 46" LCD TV worth about INR 76,000. I understand goods worth Rs. 25,000 is allowed free. I plan to send this TV along with all my other household stuff to Mumbai via sea. What would be duty, taxes and other charged that I would have to pay for the LCD TV specifically.

hi ravindra. im bringing a LCD from sinpapore worth 45k. What will be the customs (do i need to consider the weight of the LCD also ?) and also incase if i bring 2 small LCD worth 12k each would both be custom free.

hi ravindra kumar..i am on a social visit to singapore . i want to purchase a lcd monitor from singapore.can u give me details of how much duty will be collected from me..

I live in USA. I would like to bring a 46 inch TV to India that costed me $1200 (approximately Rs 57,000/-). I recently saw somewhere that the customs tax has been reduced to 5% from 10% in this year"s budget for LCD monitors and TVs. Is this correct? If not what will be my custom"s duty? Is it a straight forward way of clearing customs? I couldn"t follow the calulation method for central excise duty that you have mentioned above. And the last question is that the price of the TV in india is Rs. 50000 more than what I have purchased it for, how will this affect my total customs?

I intend to carry a 32" LCD TV from Muscat to Bangalore for which I have bill worth Rial Oman 100/USD 300, I dont have any other electronic item with me. Please confirm the applicable customs duty.

This is regarding bringing my personal plasma tv 42", a hi-fi music system and an xbox game console, all together valued at AU$2500. I have these items for almost 10 months now and I am planning on returning back from Australia with these items. My question is how much customs duty or any duty would I have to pay if I want to bring these items with me or have them courier to an address in India?

Duty on TV is @ 24.421% . As far Baggage Rule is concerned, it is advisable to visit CBEC website link given in the blog . Various conditions are involved for getting Baggage import benefits.

I am living in Dubai and I want to bring SAMSUNG 32” LCD TV with me in my next trip to India. Its value in Dubai is Dirham 1600.00 equaling to INR 21200.00 as per the current currency exchange rate AED v/s INR. So, how much custom duty or any other duty would I have to pay?

If you are coming after at least 365 days during the two years immediately precedings the date of arrival ,OR, under Transfer of Residence(TR) then 15% on colour TV.

i am on short leisure trip to singapore , i am planning to bring a sharp LCD 37" its cost in RS. is 65k. please suggest what custom duty will be charged on this.

i"m a NRI since 1999 every time i have been to India for vacation is not more then 2months(Annually) my question is i"m planing to carry these things in my checked baggage,

If you are coming under TR then One desktop computer ( your all items make one computer ,if assembled together) is allowed without customs duty. Further ,there is duty free allowance of Rs 25,000/- . If your used camera is falling in this limit, then, no duty.

You may my visit website www.globaltaxguru.in which is under construction. You may test import of LCD TV in this site.The Baggage portion is yet to be tested.Till ,i refine and test my site, i will be answering through blog.

If you are exporting to Canada then there is no duty. But if you are importing into India ,then there is duty. LCD tv customs classification varies as per size.

my parents are visiting me to kl, malaysia. tha want to buy lcd 40" from here. they are staying here for 1 month . how much duty they have to pay in india

as you have mentioned valued item of INR 25000 is allowed. So that item should be invoiced in Foregin currency equivalent to INR 25000 or that item should value in india for that certain amount.

I want to carry a 40"LCD TV AED 2800/-to india from dubai in April 2010, what is customs duty chargeble on it ??? what are the documents shall i carry ??

Pl see my website (under construction) www.globaltaxguru.in. Enter Lcd tv. Merit rate of duty @ 26.85%. If you are bringing as Baggage then duty varies as per your stay,your category as passenger,etc.

I have bought a LCD/LED tv (102 cms) by paying 250 euros.The cost of the tv in india is around 250,000 Rs.Can you please let me know how much charge i have to pay as customs and excise duty.I have tried to find the answer from your previous messages but could not understand anything.

There are different rate of duty, if you are importing through baggage or through air cargo/courier.pl specify for mode of import.Further, forward me my earlier message for clarification.

I am in dubai right now. I have recently purchased xbox360 and would like to take it to India. Its a second hand purchase worth 900dhs (around 11,000rs). Will i need to pay custom? thx alot

I am planning to buy 60 inch ( 150 cm) LED 3D TV from Europe and take as baggage with me. I will be going back to India after 30 days. The cost here is 50 % less then in India. Can you please advice me what will be import duty on LED 3D, your website globaltaxguru is giving size of 25 cm. Your advice will be high apreciated.

I am planing to start a import Computer hardware products from China. Can u plz tell me the taxes/duties I"ll need to pay. Is any license is need to import the things from china?? Plz reply on vkgarg05@gmail.com asap!!!

You need IEC from DGFT .Pl see my site www.globaltaxguru.in to know duty and licence conditions.If you wish to engage me as consultant then you have to pay for the same. Alternatively, you can register your self as premium user.

You are doing a fantastic job by providing the info, i tried registering as premium user on your site (to find out how much you charge) however it gives me server exception error, is there any other way i can get in touch with you?

Currently, i have given access to some Customs officers and person who are professionally in import and export related business. I can extend same to you. But you have to send me your exact requirement like , you would like to know total duty break up and duty with relevant notifications, etc,. It is in format similar to customs requirement.

I want to bring my lcd TV (26 inch) worth around 320 euros(19500 rupees) Indian cost used around 4months from Ireland .Am i need to pay any custom duty for this.

There are different duty exemption for different category of person ,if importing goods through Baggage. After exceeding your duty free limit,you have to pay duty @ 36.05%.

I am staying in Copenhagen, Denmark and I want to take a 32" LD TV for my sister in Delhi. The price of the LCD TV is approximately INR 20000 (DKK 2499). Since, there is a free limit of 25000, therefore do I need to pay any customs duty at Delhi airport for the TV. Also, I would be carrying a laptop (which I have been carrying during my past visits and never paid any duty). Since, this time I would be also carrying the TV therefore I am little sceptical whether I can carry both of them together without paying any duty.

Also, can you please let me know whether the price of the TV will be accessed by the customs officer or the price will be considered as writen on the invoice?

I bought a Sony 40 inc LED LCD for Rs35,000/- in indian rupees. But, the same model costs 1,20,000/- in India. I tried entering all the information in your globalguru site..but, I could not get the custom duty price in rupees.

Old TV ,you cannot import through baggage ,without paying fine and penalty ,in addition to duty @ 26.85%. There is freight charge and handling issues. In Courier, the shipping cost is also added in value for duty charging.

Other option ,you bring as Baggage,you may visit my site www.globaltaxguru.in for duty calculation .In Baggage module , you have to enter value in Rs and in courier , you have to enter in foreign currency.

I am working in KL, Malaysia. And I am coming to India within 2 months after coming here. I have an Employment Pass here. I want to bring a Samsung LCD TV (46") which costs RM 4000 here (Approx INR 56,000). Could you please let me know how much duty I will have to pay @ Mumbai Airport? I am planning to get it along with me with Access Luggage.

Duty liability on LCD TV will comes once you cross duty free allowance ,and that will be 35 % + 3% cess on this duty. The duty will be charged on value after allowing duty free limit of Rs 25,000/=.

Second hand personal goods importing through Courier will attract fine and penalty, additionally you have to pay customs duty. Goods will be valued by Customs as per conditions of the same.Further delay. Best option is baggage,as far customs is concerned.

I wud like to take a 32 inch lcd Sony Bravia to Chennai shortly. Cud u pls adv duty involved.... I am an Nri and purchased this TV in Dubai at Aed1500 equivalent to something around Rs20000 max. Pls adv urgently

I am in Australia on work permit visa .I came for the first time in August 2009 and went back to India in September 2009. Then again I came in March 2010 and may be going back in September 2011. So I am here for 2 years including a vacation of six moths and eleven days. C

respt sir myself abhijit ashtikar i just want to ask you that my sister stays in dubai and now she is coming back to india on mumbai airport, she is getting an LG LED tv 42" with an home theatre which costs 3000AED(INR37000) can you please tell me that how much she needs to pay .

my ques is can I bring 3 lcd tv sony of 9000 Inr each from bangkok. the total is 27000 . I also know the duty is calculated on excess allowance. But my quantity is 3 pc. Is it possible to pay duty on Rs 2000 only ??

Three LCD Tv by one person,may not be treated as bonafide baggage but may be viewed as commercial quantity.Therefore,you may be denied duty free allowance for all but allowed for one. This is very subjective ,therefore it depends on how do you convince that they are bonafide baggage.

I live in Australia, I just want to confirm that can i send used computer including CPU and LCD to india Or in other way can i import Used computers in india ? please let me know, and Thanks in Advance

I am planning to buy a LED TV (47" - 55" size) & a home theater system (around 20-25 kg) from Dubai. It will cost around 1.50 - 1.80 lakh. I will divide it in two passengers.

I am planning to buy a LED TV (32" - 42" size) from Dubai. It will cost around 20-80 thausand INR. im still working in dubai.im retain india after 2 year. pls advise me how much amoumt allow custom.

I want to buy a LED TV from China. The cost of TV is around $450 for 55 Inch LED TV. According to Indian Currency it will be INR 22300/-. Please let me know how much tax I will need to pay?

NEW DELHI: TV prices are set to come down by 3-4% ahead of the festive season with the government scrapping the import duty on open cell panels used to make television sets. The move will see companies such as Sony, Panasonic and LG revising their prices down while many of the new players such as Sansui and Detel plan to follow suit.

The decision to remove the 5% customs duty will help in reducing the manufacturing cost by around 3%, companies said, while also seeking a cut in GST rates for TVs above the 32 inch screen size.

“This move will surely help in improving the sentiments of both the buyers and the companies. The festival will be even sweeter if the government gets the GST rates on the larger screen size to 18% against the 28% now,” Sunil Nayyar, the MD of Sony India told TOI.

Manish Sharma, the CEO of Panasonic India, said that lower prices will come into force by the start of the festive season which begins towards the end of the year. "The move will ease the cost pressures on TV and the benefit once passed to the consumers will help the industry accelerate demand," Sharma said.

Finance ministry, in a notification, said that customs duty on "open-cell (15.6-inch and above), for use in the manufacture of liquid crystal display (LCD) and light emitting diode (LED) TV panels" will be nil as against 5% import duty previously.

Abhishek Garg, director at Jaina group which is introducing Japanese Sansui and Nakmichi TV brands, said that the measure will help get level-playing in the TV industry. “Due to certain free-trade agreements, panels from some countries were coming at no duty while from China, there was an import duty. Now there will be parity in the market.”

LG Electronics India also said that the government"s decision will boost domestic manufacturing. "This is a very positive development... it will certainly boost Make in India," LG Electronics India director (home entertainment) Younchul Park said.

Newer players also said that the measure will help create more volumes in the festive season. “The industry is poised to grow further on the back of this initiative as prices will turn out to be even more attractive in the festive period,” Yogesh Bhatia, MD of Detel brand, said.

In order to ship your TV safely to India, it is essential that they are packaged appropriately to minimize any chances of damage. To ensure secure packaging, it is best to use the original retail box that your TV arrived in. However if you did not save the original packaging, you need to purchase a box specifically designed to accommodate televisions. Our packing experts at Universal Relocations can further assist you with finding the apt boxes and wooden craters.Here are some other important guidelines to remember while packing your tv

In case you did not save your TV’s original packaging, we can provide you with the right box along with customized wooden crating and ensure it gets transported properly. If you require further assistance with any challenges that may arise while you prepare to move, do not hesitate to contact us and communicate your issues. Our team of experts are trained to ship your TV and other electronics safely to your destination with no hassle.Transporting your TV

Once your TV is packed appropriately, you may drop it off to any one of our warehouses located in New Jersey / Maryland / California / Texas / Georgia. Once shipped to India, you may then pick it up from any one of our warehouses located in Chennai / Bangalore / Hyderabad / Mumbai / Delhi

You may also opt to have your TV picked up and delivered to your residence at an additional charge.Warehouse to Warehouse TV shipping charges from USA to India

The guidelines for customs officers reports that the duty is 38.5% on “assessed value”. The value will be assessed on arrival, based on parameters such as make, model, condition of the TV- whether new or old.

NRI/PIO who are returning to India for an extended period should consider using the transfer of residency so that they can take advantage of relaxed customs duties. Transfer of Residence is a facility provided to persons who intend to transfer their residence to India after a stay abroad of at least two years. This facility allows the imported personal and household articles, free of duty and certain other listed items, on payment of a concessional rate of duty. Those taking transfer of residence is no longer subjected to any minimum stay requirements in India.

The requirements to qualify for transfer of residency concessions: A minimum stay of two years abroad, immediately preceding the date of arrival on transfer of residency is required. Total stay in India on short visits during the 2 preceding years, should not exceed 6 months, and such persons have not availed concessions under transfer of residency in the preceding three years.

hortfall of up to two months in stay abroad can be condoned by Deputy Commissioner of Customs or Assistant Commissioner of Customs if the early return is on account of terminal leave or vacation being availed of by the passenger or any other special circumstances for reasons which will be required in writing by the customs authorities. The Principal Commissioner of Customs or Commissioner of Customs may condone short visits in excess of six months in special circumstances for reasons to be recorded in writing.

The total combined value of such goods should not exceed rupees five lakh. NRIs should also be aware that, not more than one unit, of each item of such goods is allowed, per family. Items allowed duty free under transfer of residence are:Used personal and household articles up to an aggregate value of Rupees 5 Lakh. Jewelry up to Rs. 50,000 by a gentleman passenger or Rs. 100,000 for a lady passenger. Jewelry taken out earlier by the passenger or by a member of his family from India. (Proof may be required)Video Cassette Recorder or Video Cassette Player or Video Television Receiver or Video Cassette Disk Player. Washing Machine. Electrical or Liquefied Petroleum Gas Cooking Range Personal Computer( Desktop Computer)Laptop Computer( Notebook Computer)Domestic Refrigerators of capacity up to 300 liters or its equivalent.

For the following items, a reduced customs duty of 36% is charged. It does not matter whether these items are new or old. Color Television or Monochrome Television. Digital Video Disc Player. Video Home Theater System. Dish Washer. Music System. Air Conditioner. Domestic refrigerators of capacity above 300 liters or its equivalent. Deep Freezer. Microwave Oven. Video camera or the combination of any such video camera with one or more of the following goods, namely:- television Receiver; Sound recording or reproducing apparatus; Video reproducing apparatus. Word Processing Machine. Fax Machine. Portable Photocopying Machine.Vessel.Aircraft.Cinematographic films of 35 mm and above. Gold or silver, in any form, other than ornaments.

Due to security concerns, India no longer allows passengers to carry Drones to India. Effective April 1, 2016. Indian Customs Declaration Forms have been revised and Drones are on the prohibited list and not duty free.How to calculate customs duty in india on used items

In case a person knows the rate of duty for a particular item, it’s easy to calculate the duty that will be charged. However, for used items, the value is determined by allowing depreciation on a yearly basis.

TV’s are mostly packed in the original manufacturing TV Boxes, which is highly recommended. Roll up cords, wires and remotes are to placed/packed in a clear bag/box.

As per New customs rules , You need to Pay 38.5% customs duty on TV Purchase price or Indian market value . To pay duty on purchase price you need to produce the original purchase Receipt to customs officer at the time of Inspection. TV’s Purchased on open box value or on Thanks Giving Offer – Purchase Invoices/receipts would NOT be considered. TV’s Purchased from COSCO, BEST BUY, FRYS ELECTRONICS, AMAZON, TARGET with Original Invoices – Duty would be considered on the Purchase Invoices.

Yes , If you have original TV box and opt for wooden crating from Universal Relocations, you can get all risk insurance for your TV, which will cover for Lost and Damages. Minimum Premium $ 75 for a Value of $ 3000 and Less or 2.5% on the total declared value – whichever is Higher.

Though it is Optional, but it is highly recommended for the safe shipping and to activate all risk insurance coverage for the damage/breakage cost for Wooden Crating $ 125.

No , Insurance underwriter will not provide all risk insurance for Plasma TV ,but you can take Total loss insurance which will cover only if TV is missing .

Your presence in India is mandatory and Need original passport and Power of Attorney to clear customs on your behalf but your presence in Customs/Port not required .

All new Model TV’s coming with 110 /220 volts and NTC/PAL, And it works in india without any issue , however we recommend to check with the TV Dealer or Universal Relocations Sales Rep before Buying /Shipping.TV shipping from the US to India

Shipping a TV from the USA to India? we offer door-to-door shipping services from USA to anywhere in India. Our rate includes pickup /ocean freight insurance and customs clearance process in india, Excludes Customs duty and port charges if any in india.

By Press Trust of India: The government has scrapped import duty on open cell TV panel used to make television sets, as it aims to boost local manufacturing by lowering input costs for TV makers who have been complaining about a slump in demand.

The decision to remove 5 percent customs duty will help reduce manufacturing cost by around 3 percent but it wasn"t immediately clear if all TV makers will pass on the benefit to consumers.

Finance Ministry in a notification said customs duty on "open-cell (15.6-inch and above), for use in the manufacture of Liquid Crystal Display (LCD) and Light Emitting Diode (LED) TV panels" will be nil as against 5 percent import duty previously.

Besides, the government has also waived custom duty on import of Chip on Film, Printed Circuit Board Assembly (PCBA) and Cell (glass board/ substrate), which are used to manufacture open cell TV panels.

The other goods for use in the manufacture of open-cell of Liquid Crystal Display (LCD) and Light Emitting Diode (LED) TV panels of heading 8529 would also attract nil duty. These include Chip on Film, Printed Circuit Board Assembly (PCBA) and Cell (glass board/substrate).

"Industry welcomes this decision. This will ease the cost pressure on TV and the benefit once passed to the consumers will help the industry accelerate demand," Panasonic India and South Asia President and CEO Manish Sharma told PTI.

"The announcement comes at an opportune time considering the flat growth that TV"s have witnessed in the last year. Since open cells form a major share of the total manufacturing cost of TV"s, the move will allow us to pass the benefits to the end consumer which would be about 3-4 percent reduction in price thus providing the necessary thrust to the market," he said.

To further the push towards affordability for TV"s, he urged the government to also consider revising the GST slabs for TV"s above 32 inches from 28 percent slab to 18 percent.

"The company has long been committed to the government"s Make in India initiative. This withdrawal of duty on an open cell provides a strong boost to local manufacturing and will help us further enhance our efforts in this direction," said Sony India Managing Director Sunil Nayyar.

According to Haier India President Eric Braganza, the industry has been pushing for this for some time. The TV market is slow, so anything that could ignite the growth is welcome.

When asked whether it would have any impact on TV price, Manish Sharma said currently inventories for the festive season are already in place, however, for fresh imports, the cost impact will be about 3 percent.

"Our festival pricing is already in place which is attractive compared to the previous month"s. Hence postseason, this duty reduction will help us maintain the pricing at same levels with reduced cost pressures on the industry," Sharma said.

Besides removing 5 percent customs duty imposed on import of open-cell TV panel, the government has waived customs duty on import of chip on Film, Printed Circuit Board Assembly (PCBA) and Cell (glass board/ substrate), which are used to manufacture open cell TV panels.

The move seeks to bring certainty to businesses and avoid their disputes with the customs department. The clarification is based on inputs from ministry of electronics and information technology. The department said mis-declaration of products have in the past led to tax demand notices being sent to some importers.

As per the clarification, a display unit that includes ten specified items such as touch panel, cover glass, indicator guide light, LCD backlight and polarisers will attract a basic customs duty of 10%. However, if the product includes additional parts such as antenna pin, sim tray, speaker net, battery compartment or other items, then the whole assembly is liable to 15% duty.

Such assembly consisting of a display assembly of a mobile phone with or without back support frame, plus any other parts is not eligible for the concessional duty rate, CBIC said. The order provides display assembly pictures and schematic representations for the ease of identification.

This clarification brings in certainty of taxation on future imports to mobile phone manufacturers who have been at loggerheads with customs officials since long for determining appropriate basic customs duty (BCD) rate for display assembly modules, said Saurabh Agarwal, Tax Partner at EY.

“What needs to be assessed is how would this unfold in the courts and impact existing litigation as the additional BCD cost (if any) on past imports would not be recoverable from customers but would have to be borne by the manufacturer importers only," said Agarwal.

This circular is a big relief to the industry and will avoid unnecessary litigation, said Pankaj Mohindroo, Chairman of India Cellular & Electronics Association (ICEA).

In July, the Directorate of Revenue Intelligence (DRI) issued a notice to Oppo and accused them of allegedly evading customs duty worth ₹ 4,389 by not declaring the items correctly. Soon after, the customs department served notices to three Indian smartphone brands too.

Back then, Oppo had told Mint that it had a different view on the charges mentioned in the show cause notice. Oppo had called it an industry-wide issue impacting many corporations.

In March, the Ministry of Electronics and Information Technology (MeitY) had sent a letter to the Department of Revenue, to clarify that the part needed to make display assembly was exempt from import duty. In its letter MeitY had detailed the constituents of display assembly that were exempt from BCD.

BCD was imposed on display assembly in October 2020 as part of the phased manufacturing program (PMP) to expand local manufacturing capabilities. Some components used in display assembly were exempted from the tax. According to industry experts, display components account for 25-35% of the overall Bill of material (BOM) of a smartphone.

Gireesh has over 22 years of experience in business journalism covering diverse aspects of the economy, including finance, taxation, energy, aviation, corporate and bankruptcy laws, accounting and auditing.

The Central Board of Indirect Taxes and Customs (CBIC) notified that a 5% basic customs duty will apply on imported components that are used in liquid crystal displays (LCDs) and light emitting diode (LED) television panels from Friday. The duty will apply on chips, printed circuit board assemblies and glass boards.

The move comes immediately after the union cabinet extended production incentives for 10 sectors including technology products aimed at encouraging local manufacturing. The Narendra Modi administration is using both tariffs and incentives to encourage investments into local manufacturing but officials have in the past reiterated that these temporary measures are taken while remaining committed to an open global economy.

The government recently categorised television sets as a restricted item for the purposes of imports and have now increased the customs duty on specified components used in manufacture of open cell used in LED or LCD panels from zero to 5%, clearly conveying their intention that the value addition in respect of LED and LCD manufacturing should be centered in India, in line with the phased manufacturing programme, said Abhishek Jain, Tax Partner, EY.

A 20% customs duty has been in place on television imports since December 2017 and television import has been put on the restricted category with effect from end of July this year. BCD represents the tariff protection offered to competing local products. (ends

Gireesh has over 22 years of experience in business journalism covering diverse aspects of the economy, including finance, taxation, energy, aviation, corporate and bankruptcy laws, accounting and auditing.

Use this free Import Duty Calculator to calculate customs charge estimates for import duties. Customs Duties are determined in part by the product’s HS code.

Since Trump began to impose steep tariffs on a range of Chinese imports in the summer of 2018, the two countries have volleyed back and forth in what has come to be recognized as a trade war.

This is an ongoing and shifting landscape that directly impacts importers and exporters, especially as COVID-19 continues to disrupt global trade, making it vital to keep up with import duty regulations on the goods that you are shipping.

While our US Customs duty calculator provides an estimate, the customs authority determines the actual rate of duty applied to shipments. For professional advice, and to see whether your goods are affected by America-China import tariffs, consult a qualified customs broker.

‘Import to’ field: This import duty calculator only applies to imports into the US, but it will soon be extended to include the UK and other EU (European Union) countries.

‘I am importing field’: Type in one or two words that you feel most accurately hones in on your product. If more than one HS code is related to that word, a drop-down list will appear. Simply browse and select the HS code description that best fits your product.

The import duty calculator will automatically calculate whether duty is payable for that HS code. It will either return “Estimated to be exempt from duties” or a customs duty rate (cents/kg). If it returns a customs duty rate, the Estimate Duties button will become active. Input shipment weight and click on the button. The import duty calculator will calculate and return an estimate for the total customs duty payable for the shipment.

Please note, that these are estimates only. The customs authority determines the rate of duty applied to a shipment. For professional advice, consult a qualified customs broker.

Import duties or custom duty tax may be applied to protect local production, to penalize the country of import, to penalize a product that would be sold below fair market value (anti-dumping), or simply as a source of government revenue.

A confusion between international freight customs duties rules and two other rules has probably caused this mistaken impression. Those other rules are that shipments valued below $2,500 are eligible for “informal customs entry”, and that Customs are less stringent when checking express freight (international courier) shipments.

It is easy to get confused by customs charges because there are several different types of charges. Some are charged directly by the customs authority and some are indirect charges made by other parties involved in the customs process.

The following table brings together these charges, why they are charged, and who charges them so you can understand your custom duty charges in the USA, in China, or wherever else you may be shipping.

Our US customs duty calculator will help you calculate your upfront customs charges – brokerage and any potential penalties or additional fees will be added later

Fines applying when customs regulations are breached, ranging from minor charges, e.g. for mislabeled cargo, to heavy fines (and prison sentences) for fraud.

Pass-through fee from air or ocean carriers that covers shipment storage (demurrage and detention fees for FCL, warehouse fees for LCL). Shipments typically return from a customs inspection after the free period for these charges expires.

Service charge applying to ocean imports only, that covers filing in compliance with advance cargo reporting requirements. Often included as part of the Customs Clearance fee.

For more helpful freight tools and calculators, check out our freight rate calculator, freight class calculator, and chargeable weight calculator. And don’t forget to check out our ultimate guide tochoosing a freight forwarder.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey