lcd panel size calculator in stock

A lot goes into determining the best viewing distance, and there are several different criteria you can use. Aside from size, things like resolution and even how strong your eyesight is can affect how you see the screen. Because everyone"s eyesight is different, this is less an exact science and more of a general guide based on scientific principles of vision and resolution.

Our size and distance tool above is based on the 30° guideline that is suitable for mixed usage, but you can find distances for a variety of sizes at 40° here.Learn more about the human visual field.

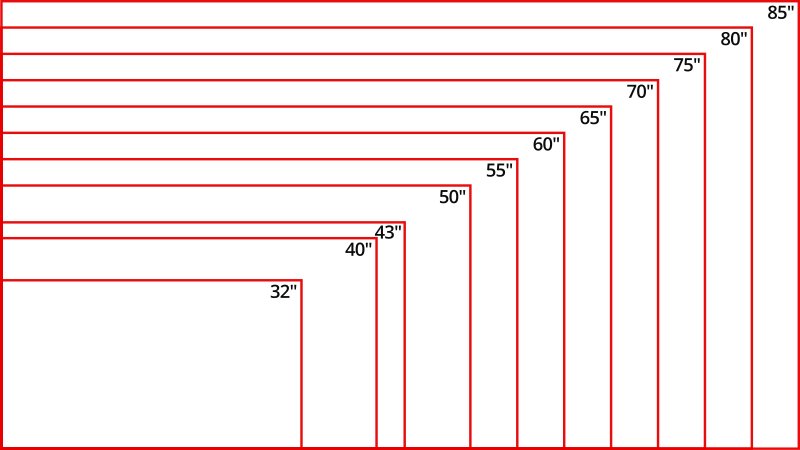

This chart shows the point at which an upgrade in resolution becomes worth it depending on size and distance to the TV. Each line represents the optimal viewing distance for each resolution, but any TV that falls within the range of that color will be suitable to notice a difference in picture quality. So, for example, if you have a 65 inch TV, the viewing distance at which the eye can actually process the details of 4k content is about 4 feet. However, any distance between 4 and about 8.5 feet will be enough to appreciate the difference between 4k and 1080p on a 65 inch TV. Go too far, and the image will look identical to 1080p HD.

The chart suggests that at a certain point, 4k UHD may not be worth the upgrade—if you"re sitting more than 7 feet away and have a 55" TV, for instance. Really, though, this chart is just a guide, and as 4k TVs have become the standard, the question of whether it"s worth it or not is a moot point. While your eyes may not be able to tell the difference at a certain point, your next TV will more than likely be a 4k TV anyway. Knowing the optimal viewing distance for the resolution can help you determine a living room setup that takes full advantage of your TV"s resolution, but since angular resolution is almost a non-issue with UHD content, we recommend using our calculator tool at the top of the page, which is based on the optimal field of vision.

You"re probably thinking something along the lines of "My couch is 10" away from my TV, which according to the chart means I need a 75 inch TV. This is insane!" It"s true that if you want to take full advantage of higher resolutions, that"s the ideal size you should get. That said, this may not be possible for everyone, which brings us to budget.

The price of a TV is usually exponential to its size. Size isn"t the only factor though, as resolution, panel type, and features all play into it as well. Looking at 65 inch TVs, for instance, an OLED like the LG CX OLED is inevitably going to cost more than a budget LED TV like the Hisense H8G, and both of these will seem downright cheap compared to an 8k TV like the Samsung Q900TS 8k QLED. Fortunately, though, as technology improves and the availability of higher resolution TVs expands, larger TVs have become more common and therefore more affordable. Feel free to compare the prices of our picks for the best 65 inch TVs, the best 70 to 75 inch TVs, and the best 80 to 85 inch TVs to really see the difference that size makes.

We recommend a field of vision of about 30 degrees for mixed usage. In general, we also recommend getting a 4k TV since lower resolution TVs are becoming harder to find. To easily find out what size you should buy, you can divide your TV viewing distance (in inches) by 1.6 (or use our TV size calculator above) which roughly equals a 30-degree angle. If the best size is outside your budget, just get the biggest TV you can afford. These are guidelines, after all, and since most TVs nowadays are 4k, you can"t really go wrong with the size that works for you, especially since picture quality also depends a lot on the content and viewing conditions. Ideally, you would optimize the capacity of your TV by getting one that"s large enough for you to notice all the visual detail that 4k has to offer, but ultimately, you should watch however feels most comfortable to you, whatever the size and distance may be.

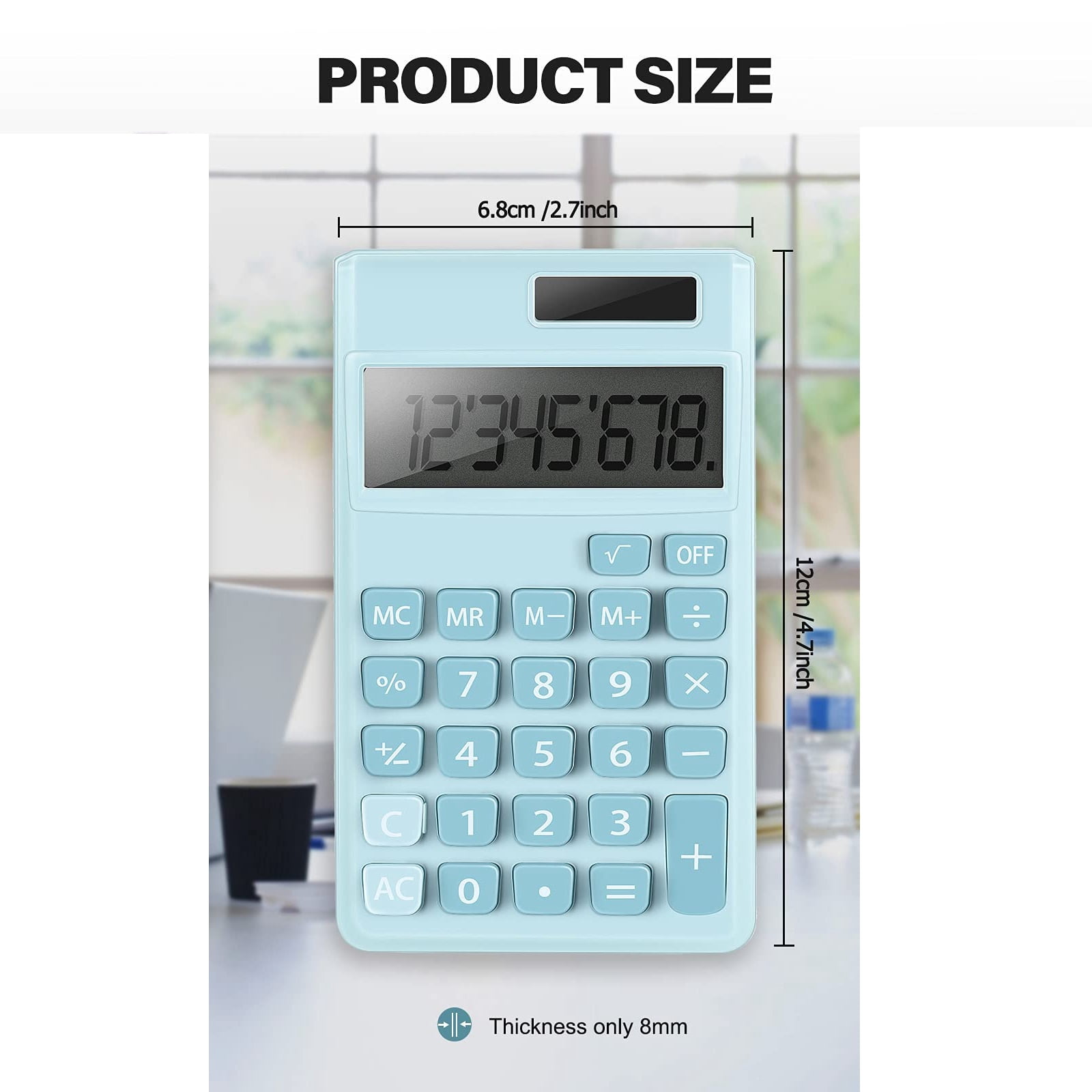

BRILLIANT DESIGN. LCD display. Measure: 3.75" x 2.25" x 0.25". 8 Digits display. Auto power off. Full function memory. Powered by batteries. Battery included.

MINISize. Pocket calculators, smallSize is suitable for your business travel use. This easy to use calculator takes up little space on your desktop and fits into your briefcase or desk drawer.

LONG LASTING POWER. Powered by batteries. Battery included. The calculator will function even in a dim place. The soft rubber button design in line with the use of human habits, comfortable for touch.

The Victor 1190 is perfect for desktop use either at home or in the office. Features a large LCD tilt display for easy viewing. Environmentally friendly, this calculator is manufactured with 40% recycled plastic. Cost/sell/margin keys make for quick and easy profit margin calculations (simply enter two variables and the third automatically appears).

About Emraw 8-Digit Dual Power Pocket Size Calculator Dual Power Pocket Size Calculator 8 digits display large clear display large contrasting buttons great viewing angle lightweight and cool looking, Easy plastic responsive buttons that never miss an input perfect for office primary school market or home use automatically power off save more energy large non-stick plastic button new material more durable, 8 digits display large numbers are easy to read big and sensitive keys for simple calculations perfect for office primary school market or home use

Comprehensive Counting: Comes with detachable nylon string portable and convenient design easy to carry around or works as a desktop calculator 8 digital display legible screen and large script clear for everyone to read, Strong plastic computing keyboard bouncy key buttons durable in use and comfortable to push responses really swiftly comprehensive counting and mathematical functions, Extra large 8 digit and tilted screen display for easy and accurate screen reading improve your working efficiency Common keys like mark up keys and grand total keys meet the standard function of the calculator

Multi Uses: Easy to use at home, school, office and for travel handheld desktop calculator for business finial use, accountant use, Perfect for students and classroom settings teach basic calculator and math skills, Perfect for worldwide, including teachers, professors, home school educators, hobbyists, and professionals in health and science-related fields, the best gift for elementary school students Features It is a light battery powered calculator convenient pocket size calculator Four functions with memory percent and square root and sign change Solar power switches to battery in low light situations Durable rubber keys and hard protective cover Classroom tested and ready for home or school

A position size calculator can help you focus on fundamental and technical analysis without getting bogged down in repetitive tasks such as determining the number of shares to buy and the resulting position size. Let me explain.

This is where the calculator comes in. Charting software, such as thinkorswim, can easily determine the value of a moving average. If you provide the amount willing to risk and portfolio size, all the stats can be calculated and displayed.

One last note on when a calculator may be helpful. There are times when a moving average is simply too far away to make for a reasonable stop. For example, a stock’s price may be 10% or more away from a moving average, yet the stock may otherwise make for a good risk/reward tradeoff. In a scenario such as this, if you keep the amount you are willing to risk the same, you can consider a stop that is greater than the traditional 7-8%. The calculator will account for a larger stop % by reducing the position size.

If you are viewing a daily chart, the calculator will use either the 21-day EMA or the 50-day SMA, based on which moving average you select in the configuration settings (see below).

If a stock price is below the relevant moving average, the calculations can result in some rather confusing numbers. To work around this, the calculator does not display any information if a stock is not at least 2% above the moving average.

AddLabel((movingAverage == movingAverage."21-day EMA" AND daily AND lastPrice > (_21DayMovingAverage * 1.02)), (if absOfAdditionalPercentBelowMA then absOfAdditionalPercentBelowMA+"% below" else "") + " 21-day as stop: " + Round(costOfShares21Day / lastPrice, 0) + " shares (" + AsDollars(costOfShares21Day) + ") | Position size: " + AsPercent(positionSize21Day) + " | Risk as % of equity: " + AsPercent(riskAsPercentOfEquity) + " | % from stop: " + AsPercent(pricePercentFromStop21Day), Color.GRAY);

AddLabel((movingAverage == movingAverage."50-day SMA" AND daily AND lastPrice > (_50DayMovingAverage * 1.02)), (if absOfAdditionalPercentBelowMA then absOfAdditionalPercentBelowMA+"% below" else "") + " 50-day as stop: " + Round(costOfShares50Day / lastPrice, 0) + " shares (" + AsDollars(costOfShares50Day) + ") | Position size: " + AsPercent(positionSize50Day) + " | Risk as % of equity: " + AsPercent(riskAsPercentOfEquity) + " | % from stop: " + AsPercent(pricePercentFromStop50Day), Color.GRAY);

AddLabel(!daily AND lastPrice > (_10WeekMovingAverage * 1.02), (if absOfAdditionalPercentBelowMA then absOfAdditionalPercentBelowMA+"% below" else "") + " 10-week as stop: " + Round(costOfShares10Week / lastPrice, 0) + " shares (" + AsDollars(costOfShares10Week) + ") | Position size: " + AsPercent(positionSize10Week) + " | Risk as % of equity: " + AsPercent(riskAsPercentOfEquity) + " | % from stop: " + AsPercent(pricePercentFromStop10Week), Color.GRAY);

This is a script to make calculating position size easier. It calculates position size as a percentage of account balance and Risk/Reward based on input values of entry, exit, stoploss and shows the R/R box similar to tradingview"s R/R tool. There is an option to toggle showing label and choosing of label text color.

After you entered Capital you have, how much you can Risk per Trade, Profit and Stoploss Levels, it calculates Number of Buys/Sells, Position Size and Reward/Risk ratio. you need to choose one of "Long" or "Short" position you will take.

Forex Lot Size Calculator based off stop loss (ticks), also shows the lot size needed for taking partials (based of % of trade to close partial position).

This indicator will calculate your position size, short or long, based on the ATR Trailing Stop indicator of mine, and are needed to be used together. General risk management suggests risking just 1 percent of your equity and using low leverage.

This indicator is an evolution of the free online tool by the same name. Position Size Calculator is available for both MT4 and MT5, but the MT5 version looks differently and provides better functionality because the platform itself is more advanced.

The main tab of the panel provides the primary control over the indicator"s functions and serves to output the most important calculation results — position size, risk, reward, and risk-to-reward ratio. The following controls and outputs are available:

Account size button switches between balance, equity, and "Balance - CPR"; the latter being account balance less the current portfolio risk as calculated on the Risk tab.

Account size asterisk signals that either custom account balance or additional funds are set via input parameters; the funds were added to the account size value.

Risk input — you can set your tolerated risk in percentage of the account size. If you set your risk via Risk money input, percentage risk will be calculated based on that input.

Max PS button to set the position size to the maximum value possible based on the account"s free margin. The button only appears if the ShowMaxPSButton input parameter is set to true.

The risk tab can help you assess current and potential risk and reward profile. Using simple algorithm, the indicator calculates the risk of the currently open positions and pending orders based on their stop-loss levels (or lack thereof). It also assesses the potential reward of already opened positions and the position calculated by the indicator based on take-profit levels. The employed risk analysis method does not account for complex situations involving hedged orders and positions. You can use the Risk Calculator indicator for a deeper portfolio risk analysis. You can control the Risk tab using two checkboxes and see the calculation results in ten output fields:

The margin tab provides information about the calculated position"s margin, amount of used and available margin after opening the calculated position, and the biggest possible position size considering the current available margin and leverage. The tab has only one input and five output fields:

Symbol leverage shows the actual leverage for the current trading instrument. It is calculated based on required margin and contract size/value. It may be inaccurate in some cases.

The swaps tab displays details on the overnight interest payments associated with the current trading instrument and calculated position size. It shows swaps type, nominal swaps, daily, yearly, per lot, per calculated position size, and both for long and short positions:

Daily swap per PS (Long) — daily swap paid or charged by a broker for long positions in account currency for calculated position size (on the Main tab).

Daily swap per PS (Short) — daily swap paid or charged by a broker for short positions in account currency for calculated position size (on the Main tab).

Yearly swap per PS (Long) — swap paid or charged by a broker for long positions in account currency for calculated position size (on the Main tab). Calculated for a period of 360 days.

Yearly swap per PS (Short) — swap paid or charged by a broker for short positions in account currency for calculated position size (on the Main tab). Calculated for a period of 360 days.

Subtract open positions volume — if checked, the script will calculate the total open volume for a given trading instrument and will subtract it from the calculated position size, so the resulting volume after a new trade opens is equal to the calculated position size.

Subtract pending orders volume — if checked, the script will calculate the total volume of all pending orders on a given trading instrument and will subtract it from the calculated position size, so the resulting volume after a new trade opens is equal to the calculated position size.

Attaching Position Size Calculator to a chart will automatically set an entry level to the current price, preparing for a market buy order. Stop-loss level will be set to the nearest low. Take-profit will be turned off.

Now, you can already use its position size output to enter a trade if you planned a market buy order with SL set to the low of the current bar and with 1% of balance risk. You can also change the position size field manually to calculate the risk based on its value.

If not, you can freely change the stop-loss — either by dragging the stop-loss line on chart or by entering the value into the stop-loss input in the panel. You can also set stop-loss as distance in points by turning on the respective input parameter.

Switching the type of order from Instant to Pending (and backwards) is done with the order type button. When Instant order is used, the Entry level will trail the current price (Bid or Ask) and cannot be manually changed. When Pending order is used, the Entry level can be set either via panel"s input or by dragging the chart line.

Switching account size from balance to equity or to balance minus portfolio risk can be useful in some cases and is done by a one or two clicks on the respective button.

Adjusting the risk tolerance can be done in two ways: by setting percentage risk value or by setting money risk value. Both are done via input fields in the panel. You can also use quick risk setting buttons if you need to switch risk per trade often.

Moving on to the Risk tab of the panel is completely optional and provides information about your current and potential risk and reward. You can control how pending orders and orders without stop-loss/take-profit are treated in this tab.

Margin tab is not necessary too if your goal is to calculate the optimal position size based on your risk and stop-loss. This tab will inform you on amount of free and used margin resulting from your position. It will also show you what is the biggest position size that you can open with your current free margin and leverage. A custom leverage can be entered if need arises.

The indicator has a set of input parameters besides the panel-based controls. Calculator"s display options and a number of default options are set via standard MetaTrader inputs.

ShowAdditionalTPLabel (default = false) — if true, percentage and money targets and a risk-to-reward ratios will be displayed above the take-profit lines. If multiple take-profits are used, the relevant trade size will also be displayed there.

PanelOnTopOfChart (default = true) — if true, the panel will be drawn on foreground, and the chart will be drawn as background. Setting it to false will uncover the chart behind the panel.

All default parameters can be changed via the panel. They are added here for the sake of convenience — you can save them to a settings file or to create chart templates.

SL (default = 0) — if non-zero, the stop-loss level of a newly attached Position Size Calculator will be set to this value in points. Will also turn on the Stop-loss button on the main tab.

ATRTimeframe (default = PERIOD_CURRENT) — if set to some specific timeframe, a newly attached Position Size Calculator will use this timeframe for ATR calculation.

AdditionalFunds (default = 0) — funds to be added to the account size for the purpose of risk and position size calculation. For example, this could be some funds you hold outside the broker"s account but consider a part of your Forex risk capital.

CustomBalance (default = 0) — you can set custom balance size for the calculator. For example, if you are calculating position size for another account. This parameter will override the AdditionalFunds parameter.

CalculateUnadjustedPositionSize (default = false) — if true, position size calculation result will not be adjusted using broker"s minimum/maximum volume and volume step parameters.

RoundDown (default = true) — if true, position size and potential reward are rounded down. If false, normal math rounding rule is used. Switching to false may lead you to risking more than you planned.

Black background color and chart grid do not interfere with the panel as you can see on this screenshot of the Risk tab. The risk outputs show Infinity as there is, apparently, a sell order without stop-loss.

Even the wildest color scheme works well with Position Size Calculator. In this case, cyan background is combined with green and red candlesticks. Stop-loss color is set to black.

When the panel is set to background, it becomes transparent and you can easily analyze the exposed chart. At the same time, you are able to see the values used for trading script management on this tab.

You can use the position size output of this indicator to open trades manually in the same or in some other platform. Additionally, you can use a custom trading script that will open trades based on the calculated position size and with the given entry, SL, and TP levels. Just copy it to /MQL4/Scripts/ (or /MQL5/Scripts/) subfolder of your platform"s data folder. After compilation, It will become available in the Navigator subwindow of your trading terminal under Scripts as PSC-Trader. You can also set a hotkey to run this script if you want to open orders really fast. The script"s behavior is controlled via Script tab of the Position Size Calculator.

Do you have any suggestions or questions regarding this indicator? You can always discuss Position Size Calculator with other traders and MQL programmers in the forum.

First, make sure that you are compiling the correct file — PositionSizeCalculator.mq4 in MetaTrader 4 or PositionSizeCalculator.mq5 in MetaTrader 5. Second, make sure that the other two files — Defines.mqh and PositionSizeCalculator.mqh — are placed in the same folder as the one you compile. If the problem isn"t solved, please post in the official discussion thread, stating the version of Position Size Calculator, version of MetaTrader, and providing a copy or a screenshot of the compilation errors.

Most likely, you need to compile it. To do this, left-click it in the list of indicators in MetaTrader"s Navigator window and press Enter. MetaEditor will open the calculator"s source code. Now press F7. See the answer to the question above if there are compilation errors.

Added a display of the current trade direction (long/short) as an arrow in the top-left corner of the panel (MT5) or as a word in the panel"s caption (MT4).

Fixed a bug in the PSC-Trader script that caused opening trades with random volume when the resulting calculated volume was below the broker"s minimum lot size in a multi-TP mode.

Added a Max PS button (turned on via the new ShowMaxPSButton input parameter) to quickly set the position size to the maximum value allowed by the account"s margin.

Fixed a bug when the panel"s position and minimization status got reset after another indicator is added to the chart"s main window and the user switches the timeframe or restarts the platform.

Added a warning for cases when calculated position size is greater than the maximum position size possible with current free margin — position size becomes red.

Fixed a bug in MT5 that resulted in some panel fields to appear when a chart timeframe was switched on a minimized panel in the locked take-profit mode.

Hotfix for a bug when panel got moved to another position after adding it to a specific corner and then interacting with the chart without first moving the panel.

Added input parameter (CalculateUnadjustedPositionSize) to let PSC calculate unadjusted position size. This can be useful if you are calculating in one platform and then executing the trade in another platform.

Changed how pip value calculation is done for position size, portfolio risk/reward, margin, and swaps. This should yield more accurate results for some trading instruments with some brokers while also eliminating the need for UseCFDMultiplier and DisableTickValueAdjustment input parameters. Margin calculation can still be off with some MT4 brokers.

Added ATR options to the calculator"s panel (turn on by setting ShowATROptions to true) to calculate stop-loss and take-profit based on the Average True Range indicator.

Fixed a bug when Position Size Calculator could not save its settings correctly when working with a trading symbol that had three periods in its name (for example, "EURUSD...").

Added an input parameter for adjusting CFD position size calculation (UseCFDMultiplier) when tick value is incorrectly set on the broker"s trading server.

Changed how script uses Maximum position size field — it will now open a trade even if the calculated position size exceeds the given maximum, but will bring the position size down to that maximum.

Fixed a bug that prevented proper panel initialization (e.g. wrong Pending/Instant button state, two panels appearing after template application, etc.).

Changing the indicator"s input parameters Risk, EntryType, Commission, and Commentary will now update the respective panel fields without the need to reattach the indicator.

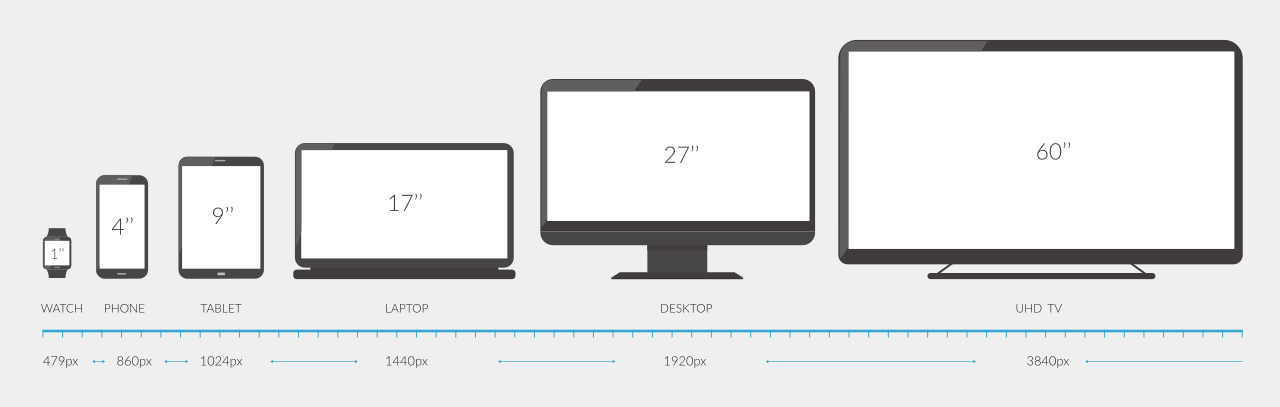

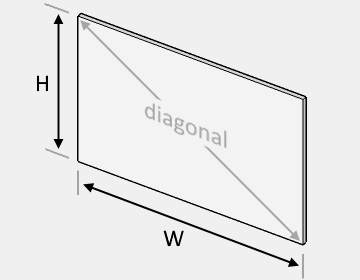

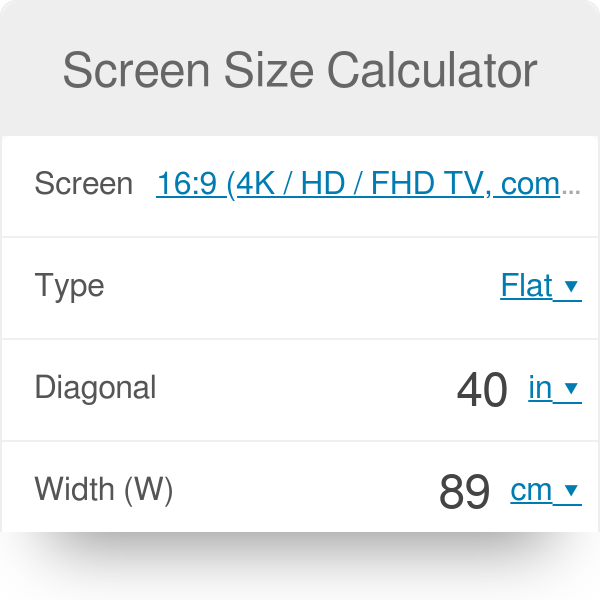

The display dimensions of a device, such as an HDTV or a laptop, are usually given as a screen 15" LCD, the diagonal size in inches. As I love the metric system and prefer to think about width and height, I wrote this calculator. It calculates the height, width, and area of the display, both inches, and centimeters, given its diagonal and aspect ratio.

We know the diagonal size, and we usually know the aspect ratio, which is 4:3 in many cases and 16:19 or 16:9 for wide screens. There are other aspect ratios, which you can choose from the list or add to the list using the handbook Display aspect ratio. If you do not know the aspect ratio or do not want to bother with it, you can enter display dimensions in pixels, and the calculator will find out the aspect ratio from width and height in pixels.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey