new lcd panel technology factory

SHANGHAI - China"s BOE Technology Group, one of the world"s largest display manufacturers, plans to build a massive new factory in Beijing, as it looks to next-generation technology for new revenue streams.

BOE will invest 29 billion yuan ($4 billion) in the 600,000 sq. meter factory, according to Sunday"s announcement, with an eye toward expanding into markets for new technologies, such as panels for virtual reality (VR) devices, and a new type of high-end panel called mini-LED.

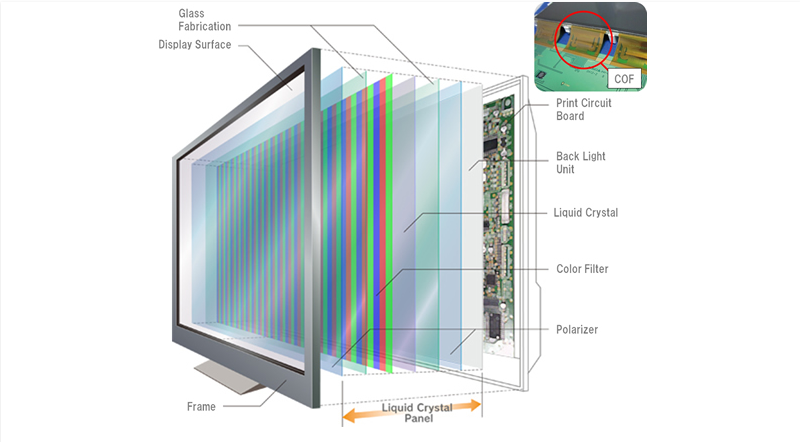

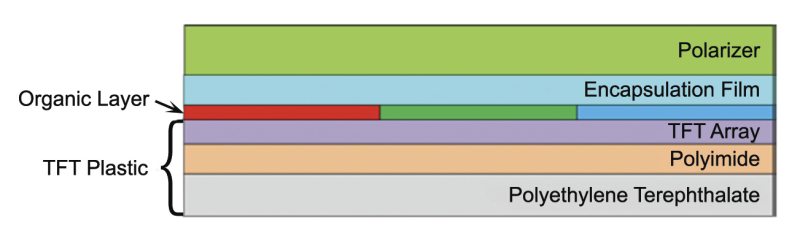

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

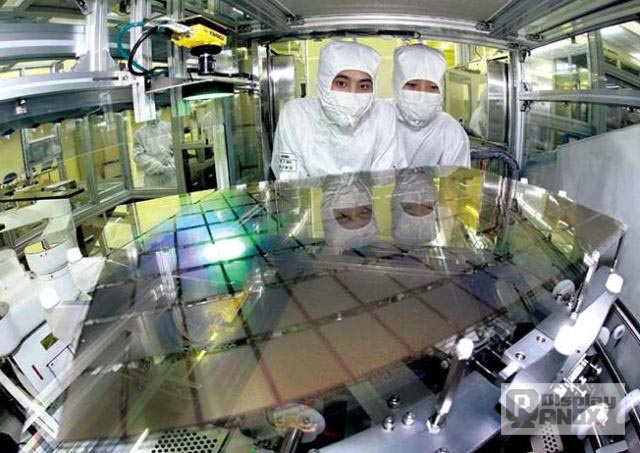

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

www.etnews.com (30 June 2017). "Samsung Display to Construct World"s Biggest OLED Plant". Archived from the original on 2019-06-09. Retrieved 2019-06-09.

Shilov, Anton. "LG"s New 55+ inch OLED Plant in China Opens: Over 1m+ per Year". www.anandtech.com. Archived from the original on 2019-09-14. Retrieved 2019-12-18.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

Shilov, Anton. "JOLED Starts Construction of New Printed OLED Facility". www.anandtech.com. Archived from the original on 2019-06-30. Retrieved 2019-06-30.

(Reuters) - Foxconn Technology Group is reconsidering plans to make advanced liquid crystal display panels at a $10 billion Wisconsin campus, and said it intends to hire mostly engineers and researchers rather than the manufacturing workforce the project originally promised.

Foxconn, which received controversial state and local incentives for the project, initially planned to manufacture advanced large screen displays for TVs and other consumer and professional products at the facility, which is under construction. It later said it would build smaller LCD screens instead.

Rather than a focus on LCD manufacturing, Foxconn wants to create a “technology hub” in Wisconsin that would largely consist of research facilities along with packaging and assembly operations, Woo said. It would also produce specialized tech products for industrial, healthcare, and professional applications, he added.

Rather than manufacturing LCD panels in the United States, Woo said it would be more profitable to make them in greater China and Japan, ship them to Mexico for final assembly, and import the finished product to the United States.

He said that would represent a supply chain that fits with Foxconn’s current “fluid, good business model.”FILE PHOTO: A shovel and FoxConn logo are seen before the arrival of U.S. President Donald Trump as he participates in the Foxconn Technology Group groundbreaking ceremony for its LCD manufacturing campus, in Mount Pleasant, Wisconsin, U.S., June 28, 2018. REUTERS/Darren Hauck

“Every step of the way Foxconn has overpromised and under-delivered,” Democrat Gordon Hintz, the minority party leader in the state assembly, said in a Wednesday statement. “This news is devastating for the taxpayers of Wisconsin.”

Foxconn CEO Gou plans to meet with Wisconsin’s new Democratic governor, Tony Evers, a past critic of the deal, later this year to discuss modifications of the agreement, according to the source familiar with the company’s thinking.

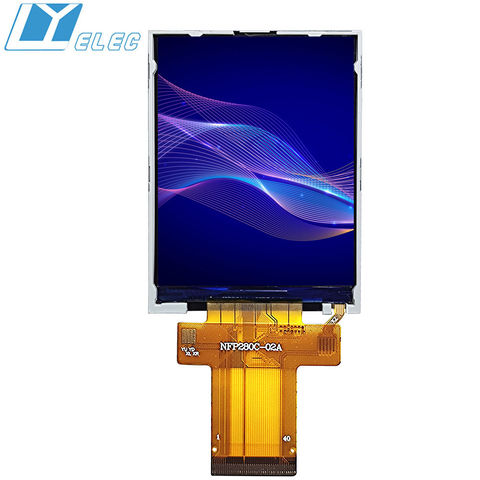

TFT displays are full color LCDs providing bright, vivid colors with the ability to show quick animations, complex graphics, and custom fonts with different touchscreen options. Available in industry standard sizes and resolutions. These displays come as standard, premium MVA, sunlight readable, or IPS display types with a variety of interface options including HDMI, SPI and LVDS. Our line of TFT modules include a custom PCB that support HDMI interface, audio support or HMI solutions with on-board FTDI Embedded Video Engine (EVE2).

The cutting-edge G10 production line is a result of cutting-edge technology. To consistently manufacture LCD panels using the G10 glass substrates, each individual manufacturing process incorporates a range of unique know-how. Developed in collaboration with several world-leading production equipment manufacturers, SDP"s large-scale, one-of-a-kind manufacturing equipment delivers state-of-the-art accuracy and performance levels. One example is the photolithography machine, which is about the size of a tennis court. Our master-craftsmen operate and monitor this machine with the utmost care, to manufacture next-generation products.

Flat panel displays use different backplane technologies. Small and medium OLEDs for mobile phones use a low temperature polysilicon (LTPS) backplane which is created by laser annealing amorphous silicon (a-Si). OLED TVs use a metal oxide backplane. Both backplanes use deposited thin films which must be highly uniform and contamination free to maximize electrical performance. The OLEDs are evaporated or deposited and encapsulated to reduce degradation caused by water vapor and oxygen exposure. Encapsulation uses either strengthened glass or thin films, depending on whether the OLED is rigid or flexible. Dissimilarity of materials within the rigid and flexible stacks make cutting and singulation of individual display devices a challenge. The highly complex nature of this process can induce defects, decreasing throughput and yield.

Surface cleanliness prior to a-Si deposition is important to ensure contaminates don’t negatively impact the thin film electrical properties. Our Ozonated Water Delivery Systems provide pure, high flow and high concentration ozone that rapidly oxidizes organics including metals and particles. Exposure to ozone at this stage of the manufacturing process improves the grain size and uniformity of the LTPS thin film layer improving the backplane’s electrical characteristics. It is important to clean with ozonated water after laser annealing to ensure no new contaminates have been deposited on the surface prior to the RGB evaporation step.

RGB pixels are evaporated on the LTPS backplane surface using an invar Fine Metal Mask (FMM). As OLED manufacturers push for >1000 pixels per inch (PPI) to support VR, a new way to create a fine metal mask with increased pixel density and feature accuracy is necessary. Our Micromachining Lasers, with picosecond or femtosecond pulses and small, focused beam widths, create completely vertical pixel holes with no material buildup that could negatively impact feature geometry. Ultrashort pulses reduce excess heat buildup providing a minimal heat affected zone. This reduces mask warp and ensures all pixel holes maintain their shape. The laser’s high output power, high beam quality and narrow bandwidth supports highly uniform beam splitting for parallel machining and increased throughput.

In May, the media reported that Samsung to sell L7-2 and L8-2-1 two LCD panel factory part of the equipment; June, the media reported that Panasonic decided to withdraw from the LCD panel business in 2021, its Himeji 8.5 generation plant production equipment will be auctioned for bidding.

For example, huaxing photoelectric investment of 35 billion yuan in guangzhou 8.6 generation line T9 project just completed “bidding “. This will be the world’s one-time planning of the largest single production capacity of one of the 8.6 generation LCD panel project. — In fact, the domestic mainstream large-size display panel manufacturers, BOE, Huaxing photoelectric and Huike are expanding “LCD” production capacity.

In accordance with the original industry chain planning, 2020 South Korea LG and Samsung have been prepared to completely withdraw and shut down all LCD panel manufacturing projects.

However, in the new crown epidemic, Europe and the United States lose money and house economic double push, the global display industry into the “fiercest ever” recovery period – price increases, so LG and Samsung “relaxed ” decision to stop production.

Even so, in 2021, with the launch of vaccination, the new crown epidemic into the “post-era”. Display panel demand growth tends to stagnate, the high price trend is eager to usher in a turnaround at the end of the year. LG and Samsung choose to finally implement the “LCD panel shutdown” decision, not surprisingly.

And Japan’s LCD panel industry chain has been in the “lowest level of operation N years”. Sharp sold out to Taiwan-invested enterprises, specializing in small and medium-sized LCD panels JDI has said to enter the OLED field, Panasonic can hold on to the possibility of “from the industry chain cluster perspective has been zero. Japanese display industry in the LCD panel continues to do subtraction, which is the expected thing.

In the last 5 years, China’s Taiwan region also did not “new planning” brand new large LCD panel project – Taiwan enterprises Honghai commitment to invest in the United States LCD panel project also “repeatedly shrink “, whether there will be the following and not fixed; Taiwan’s regional enterprises capacity changes are the most important in 2016 to put into operation an 8.6 generation line, and cooperation with Japan Sharp in Guangzhou construction of 10.5 generation line.

Therefore, it can be said that the global LCD panel new investment is almost all concentrated in China’s mainland region. Especially in 2021 is the trend of “others retreat, we advance” the reverse movement. What is the secret behind this? The answer is actually very obvious.

For example, huaxing photoelectric guangzhou T9 project is 8.6 generation line panel;is on the amount of juice Changsha project is also 8.6 generation line – before huike Chongqing and Chuzhou project, is also 8.6 generation line, as the world’s last rise of large-size LCD panel enterprises, huike to create the world’s largest 8.6 generation line cluster capacity; at the same time 2021 BOE and Huaxing photoelectric is also vigorously expanding 10.5 / 11 generation line capacity.

For example, Wuhanintends to combine the favorable conditions of 25,000 glass substrates/month plant space has been reserved at the beginning of construction, using self-financing 3.775 billion yuan in the existing Wuhan BOE plant for capacity expansion. Even, Japan-Taiwan cooperation in Guangzhou Sharp Foxconn Honghai 10.5 generation line are in 2020 for expansion – 2020-2021, the expansion scale of several 105/11 generation lines in the mainland, almost equivalent to a new 10.5/11 generation line.

The shutdown is 8.5 generation and the following generation panel line, the expansion is 10.5 / 11 generation and 8.6 generation panel line – of which, 10.5 / 11 generation line is more in line with the color TV, commercial display and other needs of the development trend of large size, which does not need to be said: 10.5 / 11 generation line, is still the industry shortage of capacity. 8.6 Generation line, although with 8.5 generation line most of the product capacity overlap is high, in 50 and 58 inches, it can cut 8 and 6 blocks; compared with 8.5 generation line 48 inches and 55 inches of 8 and 6 blocks, basically “cost unchanged”, the market competitiveness is enhanced. With an 8.6 generation line pressure 8.5 generation line head, these Taiwan panel companies invented the method, by mainland enterprises to play fire!

In fact, from IT panels to TV panels, 8.6 generation lines can be similar cost, in the cut display area pressure 8.5 generation line head. This pattern, if the “industry into a relative surplus cycle”, the competitiveness of the 8.5 generation line is obviously a little worse.

2020-2021 LCD panel out of the “most fierce ever strong cycle”, thereafter will certainly be in the “consumer overdraft” effect under the “production line efficiency” battle. At this time, the mainland enterprises by virtue of the total scale advantage, industry chain supporting advantages, and generation line leading advantage, competitiveness will be more prominent. In this context, Korean and Japanese enterprises take advantage of the second-hand equipment prices are okay, selling the corresponding equipment, is the best choice.

According to media reports, the Samsung panel line trend is a strategic decision. Samsung Electronics Vice President Lee Jae-yong personally involved in the decision to withdraw the LCD project. Lee also personally announced a plan to invest 13 trillion won in next-generation display technology development by 2025. Among them, the QD-OLED screen is an important direction.

Aiming at the next generation, a new round of competition for display panels has already begun. For example, BOE Chongqing 6 generation OLED line is moving in equipment; Huaxing photoelectric in Guangzhou planning a T8 printed OLED 8.5 generation line project; Huike is also preparing to validate OLED technology on the Changsha project. …… South Korea LG is currently upgrading Guangzhou 8.5 generation OLED production capacity, and accelerate the construction of South Korea 10.5 generation OLED project. It is reported that Samsung sold LCD panel project, the vacated plant, and equipment which will also be imported to the 6 generation OLED and future high generation QD-OLED production capacity.

A certain perspective, Japanese companies out of the LCD panel camp, is indeed a “retreat”; and Korean companies are making space for OLED LCD – is to “change the road to overtake the car “, its planning is to rival “new technology downgrade strike”.

This background, the domestic LCD industry, still expanding the LCD production capacity is “worth” and “wise” becomes a problem: in fact, OLED or MICRO-LED, QLED and so on, are facing two problems.

First, with the LCD shared glass substrate TFT capacity, that is, the LCD panel line more than half of the investment in the future display panel is universal.

There are color TV and commercial display products, the development of large size “demand fierce”. The latter needs “in line with the trend of large size” of new production capacity construction. Almost all of the domestic 5 years of LCD panel new line construction, and the current capacity enhancement project, are around this trend. Is also precisely the domestic mainland enterprises to take the lead in this step, to establish the “competitive advantage” of the LCD panel manufacturing industry in Japan, South Korea, and Taiwan, and other regions.

The immediate, short, and medium-term demand for large-size LCD is still growing rapidly, which is not contradictory to the long-term view that must be the world of next-generation technology.

Industry experts believe that even the next-generation display technology is considered the most mature OLED display, the large size is also facing printed display, W-OLED, QD-OLED screen and so on at least three routes of the battle: in the technical certainty to achieve before, the possibility of becoming the mainstream of the color TV market is almost zero.

The sooner the next-generation technology can not achieve the standardization of technical routes, the longer the life of the LCD large size market.” That is, the risk of the domestic LCD panel industry does not lie in the “next generation” itself, but in the next generation of technology process route selection and “capacity expansion direction of the switch” timing issues.

At present, the domestic display panel two leaders, BOE and Huaxing photoelectric have built a vapor deposition technology process of the 6th generation OLED line and carried out vapor deposition and printing process of large-size OLED technology verification experiments. Domestic display industry in the next generation of technology investment is not significantly behind – due to the domestic panel sector in the large size of the LCD lead, the actual result, the domestic display panel companies to actively introduce large-size OLED urgency is not strong, this aspect of the domestic enterprises can go more relaxed some.

In addition, in the direction of small and medium-sized OLED, flexible OLED, and silicon-based OLED three characteristic differentiation, the domestic display panel industry investment, in global China, Japan, Taiwan, and South Korea in the four camps, basically, maintain the lead.

Therefore, in the display panel industry chain and the future-oriented supply battle, the domestic display industry has advantages and disadvantages, the overall advantage is greater than the disadvantages, the recent advantages are particularly obvious. Korean and Japanese companies selling LCD panel equipment, which does not constitute a reason to deny the legitimacy of investment in the domestic LCD industry chain. However, the domestic LCD industry should also pay great attention to new technologies, next-generation display direction and the degree of development, and timely “to the new track”.

LG Display’s 8-inch 360-degree Foldable OLED is a revolutionary technology that successfully enables a device to fold both ways to bring greater utilization, as users can now choose different form factors according to their task. Its module structure guarantees durability even when folded more than 200,000 times, while its special folding mechanism minimizes wrinkles along the folding areas.

The company strives to expand its automotive display business as it represents a strong future growth engine and key contributor to its Order-to-Order business. LG Display will unveil a wide range of revolutionary automotive displays featuring key proprietary technologies such as P-OLED and LTPS (Low-Temperature Polycrystalline Silicon) LCD, innovations which enable larger, higher-resolution displays and more distinctive, practical designs.

The company’s LTPS LCD-based Head-Up Display (HUD), which achieves up to 5,000 nits, meets the driver’s needs while maintaining premium picture quality. Another innovation, glasses-free 3D display panel, maximizes the display’s 3D effect by utilizing cutting-edge eye-tracking technology to give viewers a level of visual satisfaction they have never experienced before.

The company will also showcase its Thin Actuator Sound Solution, a new technology designed to take the infotainment user experience to the next level. LG Display’s film-type exciter technology allows the device to vibrate off display panels or interior materials for a richer, 3D-immersive sound experience. This Thin Actuator Sound Solution even received a CES® 2023 Innovation Award (‘In-Vehicle Entertainment & Safety’ category) for its excellence in space efficiency, design innovation, sound experience innovation and eco-friendliness.

In the North Hall, LG Display will also unveil its third-generation OLED TV panel that achieves the most advanced picture resolution to date by applying ‘Meta Technology’.

LG Display will present its comprehensive OLED line-up, from the largest 97-inch OLED display to 77-, 65-, 45-, 42-, 27-inch OLED TV panels and ultra-small 0.42-inch OLEDoS.

New Movable OLED concept designs leveraging the technology’s thin and light qualities for future mobility will also feature at CES 2023 to bring greater utility to people’s distinctive lifestyles.

OLED Glow is a 27-inch OLED concept that is not only height and angle adjustable, but also comes with convenient touch technology. BeFit Trolly, which combines a wheeled storage design frame with a 48-inch OLED panel boasting CSO (Cinematic Sound OLED) technology that creates sound directly from the display without additional speakers, maximizes functionality, mobility, convenience and interior designs.

LG Display will also showcase its gaming-optimized 45-inch ultra-wide OLED and 27-inch OLED displays. Its gaming OLEDs boast the fastest response time while permitting the highest level of performance and the clearest picture quality by applying a special polarizer for gaming. Furthermore, LG Display’s groundbreaking Bendable display technology enables gaming OLEDs to bend up to 800R, so that avid players can experience the optimal curve for every game genre.

Starting this month, the company will mass produce the gaming OLED panels to be featured in premium gaming monitors by global tech companies such as LG Electronics, Asus, and Corsair.

Foxconn will build flat-screen LCD display panels at the new factory under the Sharp brand, which the company bought in 2016 for $1.5 billion. At the press event, Gou and Governor Walker emphasized LCD display manufacturing for the automotive, healthcare, and other industries, rather than OLED display manufacturing.

Currently iPhones still use LCD displays, which means the Wisconsin factory could potentially provide LCD panels for those handsets. However, Sharp President Tai Jeng-wu has suggested in the past that Apple could use OLED displays in the future. There have also been rumors of OLED displays being used in forthcoming iPhone 8 models, but nothing has been confirmed. Currently there"s no official word that any panels made in the new Wisconsin factory will be used in Apple products going forward.

Don"t expect Apple to fully produce iPhones in the US anytime soon either. President Trump announced this week that Apple plans to build three "big" manufacturing plants in the US, but Apple did not announce that with him, nor did the company comment publicly on that notion. There are a number of incentives keeping iPhone production in China, including tax breaks and subsidies. Even if the incentives provided to Foxconn in Wisconsin are a step in a new direction, much more negotiation and work would need to be done before iPhones or any Apple products are completely "made in the USA."

Today’s vivid, immersive displays rely on layers of Corning glass to provide a stunning viewing experience. Wherever you look for news and entertainment, chances are Corning glass is there, too. We are the science and engineering powerhouse behind revolutionary display inventions, including glass cathode-ray bulbs for the first televisions and the LCD glass that made smartphones and laptop computers commonplace. We set the standard for the industry with Corning® EAGLE XG® Slim Glass substrates, manufacturing over 25 billion square feet — enough to pave the Great Wall of China 25 times, or cover nearly 390,000 football fields — while eliminating the equivalent of 6,000 truckloads of heavy metals from entering the environment. Today, we continue to enable the display industry and emerging technologies with our three-glass portfolio.

New design freedoms are taking shape with Corning LotusTMNXT Glass. Thanks to Corning Lotus NXT Glass, devices with OLED displays that curve, flex, or extend edge-to-edge across a device are all within reach. Flexible OLED devices use a plastic backplane substrate, which calls for Corning’s high-tech display glass to enable the manufacturing process —to date, it"s enabled more than 2 billion OLED devices. Corning Lotus NXT Glass continues to emerge as the leader most-advantaged glass for rigid and flexible OLED panels – outperforming competitors and enabling the designs and performance that consumers love.

Looking beyond incumbent LCD and OLED display technology, Corning"s display portfolio is finding new opportunities in emerging technology applications, including Quantum Dot, Micro LED and Mini LED. With our proven track record of successfully navigating the display technology roadmap, our proprietary fusion manufacturing platform and reliable supply network, our commitment to our customers and innovation, and our innovative portfolio, we are excited to support the next generation of displays.

Tech observers and investors revel in lively discussions about the latest, greatest gadget and whose bottom line will get the greatest bounce. They enjoy debating the intricacies and details of materials that contribute to these devices, and the related trends and developments. For us at Corning, materials innovators for 165 years, it’s been great to see a recent uptick in discussions about OLED versus LCD display panel technology - a genuine #GlassAge debate.

Corning.com staff sat down with Mike Kunigonis, business director for Corning’s High Performance Displays Group, to understand key differences between OLED and LCD display technology.

Corning.com: Thanks for your time today, Mike. Let’s start with a key question: In the context of display panels, how does OLED technology work and what are the main differences between it and LCD technology?

MK: OLED stands for Organic Light-Emitting Diode, or Organic LED. It’s an alternative to LCDs for consumer electronic devices that range in size from wearable to TVs. Like LCD, OLED is a type of panel that enables the displays on device screens. An OLED display picture is generated by turning on and off millions of tiny individual LEDs, each forming the individual pixels of a display. Compare this to LCD, where an always-on backlight projects light through a liquid crystal, sandwiched between two pieces of glass. When the liquid crystal is excited by an electrical current, it lets the light of an individual pixel pass through like a shutter. LCD and OLED display panels both excel at delivering vibrant consumer displays, each in its own unique way.

Corning.com: We’ve heard industry analysts with varying opinions on the benefits an OLED device offers. So why would a consumer prefer a device with an OLED display over an LCD display?

MK: Adoption of OLED displays on smaller, mobile devices is the driver behind most of today’s OLED industry growth, so let me focus on that. A handheld OLED display is attractive to consumers because of the industrial design and display attributes that this technology can support. For example, OLED displays can be curved, or be thinner, or have narrower bezels – or no bezels at all – or flex and bend. Plus, an OLED display will be a great solution for virtual reality applications because it can provide high resolution and superior response time and latency.

Advanced LED video wall with MicroLED models in 0.6, 0.7 and 0.9mm pixel pitches, and 1.2mm pixel pitch standard LED; with powerful processing, proprietary alignment technology and off-board electronics.

From cinema content to motion-based digital art, Planar® Luxe MicroLED Displays offer a way to enrich distinctive spaces. HDR support and superior dynamic range create vibrant, high-resolution canvases for creative expression and entertainment. Leading-edge MicroLED technology, design adaptability and the slimmest profiles ensure they seamlessly integrate with architectural elements and complement interior décor.

From cinema content to motion-based digital art, Planar® Luxe Displays offer a way to enrich distinctive spaces. These professional-grade displays provide vibrant, high-resolution canvases for creative expression and entertainment. Leading-edge technology, design adaptability and the slimmest profiles ensure they seamlessly integrate with architectural elements and complement interior decor.

Advanced LED video wall with MicroLED models in 0.6, 0.7 and 0.9mm pixel pitches, and 1.2mm pixel pitch standard LED; with powerful processing, proprietary alignment technology and off-board electronics.

From cinema content to motion-based digital art, Planar® Luxe MicroLED Displays offer a way to enrich distinctive spaces. HDR support and superior dynamic range create vibrant, high-resolution canvases for creative expression and entertainment. Leading-edge MicroLED technology, design adaptability and the slimmest profiles ensure they seamlessly integrate with architectural elements and complement interior décor.

Advanced LED video wall with MicroLED models in 0.6, 0.7 and 0.9mm pixel pitches, and 1.2mm pixel pitch standard LED; with powerful processing, proprietary alignment technology and off-board electronics.

a line of extreme and ultra-narrow bezel LCD displays that provides a video wall solution for demanding requirements of 24x7 mission-critical applications and high ambient light environments

Since 1983, Planar display solutions have benefitted countless organizations in every application. Planar displays are usually front and center, dutifully delivering the visual experiences and critical information customers need, with proven technology that is built to withstand the rigors of constant use.

"Television is a key product category for Sony," Ken Kutaragi, executive deputy president of Sony, said in a statement. "S-LCD panels will be at the core of our flat-panel TV strategy, further strengthening our overall vision for television."

LCD technology allows for thinner and lighter televisions and monitors than traditional cathode-ray tube products. The market for LCD televisions is particularly promising, according to research firm iSuppli. The share of worldwide TV shipments that are LCD models will grow from 5 percent this year to 18 percent in 2008, iSuppli said. The total TV market is expected to jump from about 168 million units to roughly 203 million units during that period.

The new S-LCD plant is optimized for big panels that can fit into televisions, said iSuppli analyst Riddhi Patel. "It"s going to make the large-size LCDs available at a more reasonable rate," she said. Partly because of the new factory, the average price for LCD televisions that are 40 inches or larger should fall from about $8,000 to $1,500 by 2008, Patel said.

Sony and Samsung are vying with other LCD panel manufacturers such as LG.Philips LCD, a joint venture between Royal Philips Electronics of the Netherlands and Korea"s LG Electronics.

LCD technology is competing against plasma display technology, which also allows for thin televisions. Other display methods are emerging, including so-called liquid crystal on silicon rear-projection technology, which has been championed by

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey