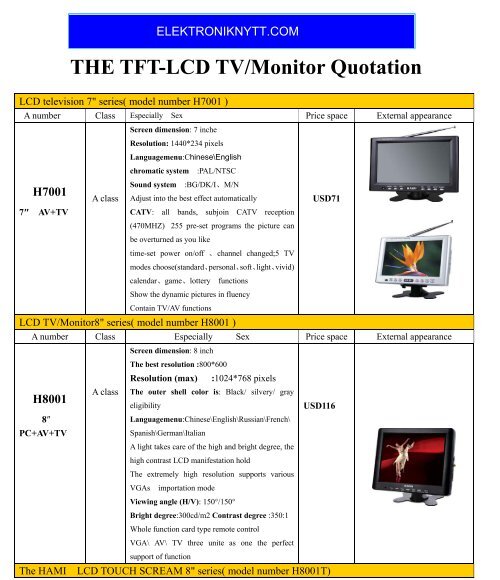

new lcd panel technology quotation

Liquid crystal display (LCD) is a flat panel display that uses the light modulating properties of liquid crystals. Liquid crystals do not produce light directly, instead using a backlight or reflector to produce images in colour or monochrome.

2.6. THE WEBSITE WILL USE THE COLLECTED INFORMATION FOR THE FOLLOWING PURPOSES, INCLUDING: IMPROVEMENTS TO ADVERTISING AND WEB CONTENTS; RESPONSES TO USERS" REQUESTS AND NOTIFICATIONS TO USERS ON NEW SERVICES, ACTIVITIES AND PRODUCTS.

d. WHEN PARTS OR ALL OF THE WEBSITE"S BUSINESS HAS MERGED WITH OR IS ACQUIRED BY A DIFFERENT COMPANY, AT WHICH POINT THE WEBSITE WILL NOTIFY USERS OF WHEN THEIR INFORMATION IS BEING TRANSFERRED AND WHETHER A NEW PRIVACY POLICY WILL TAKE EFFECT.

TFT displays are full color LCDs providing bright, vivid colors with the ability to show quick animations, complex graphics, and custom fonts with different touchscreen options. Available in industry standard sizes and resolutions. These displays come as standard, premium MVA, sunlight readable, or IPS display types with a variety of interface options including HDMI, SPI and LVDS. Our line of TFT modules include a custom PCB that support HDMI interface, audio support or HMI solutions with on-board FTDI Embedded Video Engine (EVE2).

Liquid Crystal Display (LCD) screens are a staple in the digital display marketplace and are used in display applications across every industry. With every display application presenting a unique set of requirements, the selection of specialized LCDs has grown to meet these demands.

LCD screens can be grouped into three categories: TN (twisted nematic), IPS (in-plane switching), and VA (Vertical Alignment). Each of these screen types has its own unique qualities, almost all of them having to do with how images appear across the various screen types.

This technology consists of nematic liquid crystal sandwiched between two plates of glass. When power is applied to the electrodes, the liquid crystals twist 90°. TN (Twisted Nematic) LCDs are the most common LCD screen type. They offer full-color images, and moderate viewing angles.

TN LCDs maintain a dedicated user base despite other screen types growing in popularity due to some unique key features that TN display offer. For one,

Displays with VA screens deliver wide viewing angles, high contrast, and good color reproduction. They maintain high response rates similar to TN TFTs but may not reach the same sunlight readable brightness levels as comparable TN or IPS LCDs. VA displays are generally best for applications that need to be viewed from multiple angles, like digital signage in a commercial setting.

IPS (In-Plane Switching) technology improves image quality by acting on the liquid crystal inside the display screen. When voltage is applied, the crystals rotate parallel (or “in-plane”) rather than upright to allow light to pass through. This behavior results in several significant improvements to the image quality of these screens.

Based on current trends, IPS and TN screen types will be expected to remain the dominant formats for some time. As human interface display technology advances and new product designs are developed, customers will likely choose IPS LCDs to replace the similarly priced TN LCDs for their new projects.

LCD stands for liquid crystal display. This display technology uses liquid crystals to form images on the screen which are then made visible through ambient light or a light emitting diode (LED) backlight. Liquid crystal displays are currently the most popular display type on the market. If you have a display on your device, there is a high likelihood that it is a liquid crystal display (LCD).

In recent years, China and other countries have invested heavily in the research and manufacturing capacity of display technology. Meanwhile, different display technology scenarios, ranging from traditional LCD (liquid crystal display) to rapidly expanding OLED (organic light-emitting diode) and emerging QLED (quantum-dot light-emitting diode), are competing for market dominance. Amidst the trivium strife, OLED, backed by technology leader Apple"s decision to use OLED for its iPhone X, seems to have a better position, yet QLED, despite still having technological obstacles to overcome, has displayed potential advantage in color quality, lower production costs and longer life.

Which technology will win the heated competition? How have Chinese manufacturers and research institutes been prepared for display technology development? What policies should be enacted to encourage China"s innovation and promote its international competitiveness? At an online forum organized by National Science Review, its associate editor-in-chief, Dongyuan Zhao, asked four leading experts and scientists in China.

Zhao: We all know display technologies are very important. Currently, there are OLED, QLED and traditional LCD technologies competing with each other. What are their differences and specific advantages? Shall we start from OLED?

Huang: OLED has developed very quickly in recent years. It is better to compare it with traditional LCD if we want to have a clear understanding of its characteristics. In terms of structure, LCD largely consists of three parts: backlight, TFT backplane and cell, or liquid section for display. Different from LCD, OLED lights directly with electricity. Thus, it does not need backlight, but it still needs the TFT backplane to control where to light. Because it is free from backlight, OLED has a thinner body, higher response time, higher color contrast and lower power consumption. Potentially, it may even have a cost advantage over LCD. The biggest breakthrough is its flexible display, which seems very hard to achieve for LCD.

Liao: Actually, there were/are many different types of display technologies, such as CRT (cathode ray tube), PDP (plasma display panel), LCD, LCOS (liquid crystals on silicon), laser display, LED (light-emitting diodes), SED (surface-conduction electron-emitter display), FED (filed emission display), OLED, QLED and Micro LED. From display technology lifespan point of view, Micro LED and QLED may be considered as in the introduction phase, OLED is in the growth phase, LCD for both computer and TV is in the maturity phase, but LCD for cellphone is in the decline phase, PDP and CRT are in the elimination phase. Now, LCD products are still dominating the display market while OLED is penetrating the market. As just mentioned by Dr Huang, OLED indeed has some advantages over LCD.

Huang: Despite the apparent technological advantages of OLED over LCD, it is not straightforward for OLED to replace LCD. For example, although both OLED and LCD use the TFT backplane, the OLED’s TFT is much more difficult to be made than that of the voltage-driven LCD because OLED is current-driven. Generally speaking, problems for mass production of display technology can be divided into three categories, namely scientific problems, engineering problems and production problems. The ways and cycles to solve these three kinds of problems are different.

At present, LCD has been relatively mature, while OLED is still in the early stage of industrial explosion. For OLED, there are still many urgent problems to be solved, especially production problems that need to be solved step by step in the process of mass production line. In addition, the capital threshold for both LCD and OLED are very high. Compared with the early development of LCD many years ago, the advancing pace of OLED has been quicker.While in the short term, OLED can hardly compete with LCD in large size screen, how about that people may change their use habit to give up large screen?

Liao: I want to supplement some data. According to the consulting firm HIS Markit, in 2018, the global market value for OLED products will be US$38.5 billion. But in 2020, it will reach US$67 billion, with an average compound annual growth rate of 46%. Another prediction estimates that OLED accounts for 33% of the display market sales, with the remaining 67% by LCD in 2018. But OLED’s market share could reach to 54% in 2020.

Huang: While different sources may have different prediction, the advantage of OLED over LCD in small and medium-sized display screen is clear. In small-sized screen, such as smart watch and smart phone, the penetration rate of OLED is roughly 20% to 30%, which represents certain competitiveness. For large size screen, such as TV, the advancement of OLED [against LCD] may need more time.

Xu: LCD was first proposed in 1968. During its development process, the technology has gradually overcome its own shortcomings and defeated other technologies. What are its remaining flaws? It is widely recognized that LCD is very hard to be made flexible. In addition, LCD does not emit light, so a back light is needed. The trend for display technologies is of course towards lighter and thinner (screen).

But currently, LCD is very mature and economic. It far surpasses OLED, and its picture quality and display contrast do not lag behind. Currently, LCD technology"s main target is head-mounted display (HMD), which means we must work on display resolution. In addition, OLED currently is only appropriate for medium and small-sized screens, but large screen has to rely on LCD. This is why the industry remains investing in the 10.5th generation production line (of LCD).

Xu: While deeply impacted by OLED’s super thin and flexible display, we also need to analyse the insufficiency of OLED. With lighting material being organic, its display life might be shorter. LCD can easily be used for 100 000 hours. The other defense effort by LCD is to develop flexible screen to counterattack the flexible display of OLED. But it is true that big worries exist in LCD industry.

LCD industry can also try other (counterattacking) strategies. We are advantageous in large-sized screen, but how about six or seven years later? While in the short term, OLED can hardly compete with LCD in large size screen, how about that people may change their use habit to give up large screen? People may not watch TV and only takes portable screens.

Some experts working at a market survey institute CCID (China Center for Information Industry Development) predicted that in five to six years, OLED will be very influential in small and medium-sized screen. Similarly, a top executive of BOE Technology said that after five to six years, OLED will counterweigh or even surpass LCD in smaller sizes, but to catch up with LCD, it may need 10 to 15 years.

Xu: Besides LCD, Micro LED (Micro Light-Emitting Diode Display) has evolved for many years, though people"s real attention to the display option was not aroused until May 2014 when Apple acquired US-based Micro LED developer LuxVue Technology. It is expected that Micro LED will be used on wearable digital devices to improve battery"s life and screen brightness.

Micro LED, also called mLED or μLED, is a new display technology. Using a so-called mass transfer technology, Micro LED displays consist of arrays of microscopic LEDs forming the individual pixel elements. It can offer better contrast, response times, very high resolution and energy efficiency. Compared with OLED, it has higher lightening efficiency and longer life span, but its flexible display is inferior to OLED. Compared with LCD, Micro LED has better contrast, response times and energy efficiency. It is widely considered appropriate for wearables, AR/VR, auto display and mini-projector.

However, Micro LED still has some technological bottlenecks in epitaxy, mass transfer, driving circuit, full colorization, and monitoring and repairing. It also has a very high manufacturing cost. In short term, it cannot compete traditional LCD. But as a new generation of display technology after LCD and OLED, Micro LED has received wide attentions and it should enjoy fast commercialization in the coming three to five years.

Interestingly, quantum dots as light-emitting materials are related to both OLED and LCD. The so-called QLED TVs on market are actually quantum-dot enhanced LCD TVs, which use quantum dots to replace the green and red phosphors in LCD’s backlight unit. By doing so, LCD displays greatly improve their color purity, picture quality and potentially energy consumption. The working mechanisms of quantum dots in these enhanced LCD displays is their photoluminescence.

For its relationship with OLED, quantum-dot light-emitting diode (QLED) can in certain sense be considered as electroluminescence devices by replacing the organic light-emitting materials in OLED. Though QLED and OLED have nearly identical structure, they also have noticeable differences. Similar to LCD with quantum-dot backlighting unit, color gamut of QLED is much wider than that of OLED and it is more stable than OLED.

Another big difference between OLED and QLED is their production technology. OLED relies on a high-precision technique called vacuum evaporation with high-resolution mask. QLED cannot be produced in this way because quantum dots as inorganic nanocrystals are very difficult to be vaporized. If QLED is commercially produced, it has to be printed and processed with solution-based technology. You can consider this as a weakness, since the printing electronics at present is far less precision than the vacuum-based technology. However, solution-based processing can also be considered as an advantage, because if the production problem is overcome, it costs much less than the vacuum-based technology applied for OLED. Without considering TFT, investment into an OLED production line often costs tens of billions of yuan but investment for QLED could be just 90–95% less.

Given the relatively low resolution of printing technology, QLED shall be difficult to reach a resolution greater than 300 PPI (pixels per inch) within a few years. Thus, QLED might not be applied for small-sized displays at present and its potential will be medium to large-sized displays.

Peng: Good questions. Ligand chemistry of quantum dots has developed quickly in the past two to three years. Colloidal stability of inorganic nanocrystals should be said of being solved. We reported in 2016 that one gram of quantum dots can be stably dispersed in one milliliter of organic solution, which is certainly sufficient for printing technology. For the second question, several companies have been able to mass produce quantum dots. At present, all these production volume is built for fabrication of the backlighting units for LCD. It is believed that all high-end TVs from Samsung in 2017 are all LCD TVs with quantum-dot backlighting units. In addition, Nanosys in the United States is also producing quantum dots for LCD TVs. NajingTech at Hangzhou, China demonstrate production capacity to support the Chinese TV makers. To my knowledge, NajingTech is establishing a production line for 10 million sets of color TVs with quantum-dot backlighting units annually.China"s current demands cannot be fully satisfied from the foreign companies. It is also necessary to fulfill the demands of domestic market. That is why China must develop its OLED production capability.

So, originally, OLED was only one of Samsung"s several alternative technology pathways. But step by step, it achieved an advantageous status in the market and so tended to maintain it by expanding its production capacity.

Liao: South Korean manufacturers including Samsung and LG Electronics have controlled 90% of global supplies of medium and small-sized OLED panels. Since Apple began to buy OLED panels from Samsung for its cellphone products, there were no more enough panels shipping to China. Therefore, China"s current demands cannot be fully satisfied from the foreign companies. On the other hand, because China has a huge market for cellphones, it would be necessary to fulfill the demands through domestic efforts. That is why China must develop its OLED production capability.

Huang: The importance of China"s LCD manufacturing is now globally high. Compared with the early stage of LCD development, China"s status in OLED has been dramatically improved. When developing LCD, China has adopted the pattern of introduction-absorption-renovation. Now for OLED, we have a much higher percentage of independent innovation.

Although we cannot say that our advantages triumph over ROK, where Samsung and LG have been dominating the field for many years, we have achieved many significant progresses in developing the material and parts of OLED. We also have high level of innovation in process technology and designs. We already have several major manufacturers, such as Visionox, BOE, EDO and Tianma, which have owned significant technological reserves.

units for LCD and electroluminescence in QLED. For the photoluminescence applications, the key is quantum-dot materials. China has noticeable advantages in quantum-dot materials.

After I returned to China, NajingTech (co-founded by Peng) purchased all key patents invented by me in the United States under the permission of US government. These patents cover the basic synthesis and processing technologies of quantum dots. NajingTech has already established capability for large-scale production of quantum dots. Comparatively, Korea—represented by Samsung—is the current leading company in all aspects of display industry, which offers great advantages in commercialization of quantum-dot displays. In late 2016, Samsung acquired QD Vision (a leading quantum-dot technology developer based in the United States). In addition, Samsung has invested heavily in purchasing quantum-dot-related patents and in developing the technology.

China is internationally leading in electroluminescence at present. In fact, it was the 2014 Nature publication by a group of scientists from Zhejiang University that proved QLED can reach the stringent requirements for display applications. However, who will become the final winner of the international competition on electroluminescence remains unclear. China"s investment in quantum-dot technology lags far behind US and ROK. Basically, the quantum-dot research has been centered in US for most of its history, and South Korean players have invested heavily along this direction as well.

For electroluminescence, it is very likely to co-exist with OLED for a long period of time. This is so because, in small screen, QLED’s resolution is limited by printing technology.

Huang: When OLED was compared with LCD in the past, lots of advantages of OLED were highlighted, such as high color gamut, high contrast and high response speed and so on. But above advantages would be difficult to be the overwhelming superiority to make the consumers to choose replacement.

It seems to be possible that the flexible display will eventually lead a killer advantage. I think QLED will also face similar situation. What is its real advantage if it is compared with OLED or LCD? For QLED, it seems to have been difficult to find the advantage in small screen. Dr. Peng has suggested its advantage lies in medium-sized screen, but what is its uniqueness?

Peng: The two types of key advantages of QLED are discussed above. One, QLED is based on solution-based printing technology, which is low cost and high yield. Two, quantum-dot emitters vender QLED with a large color gamut, high picture quality and superior device lifetime. Medium-sized screen is easiest for the coming QLED technologies but QLED for large screen is probably a reasonable extension afterwards.

Huang: But customers may not accept only better wider color range if they need to pay more money for this. I would suggest QLED consider the changes in color standards, such as the newly released BT2020 (defining high-definition 4 K TV), and new unique applications which cannot be satisfied by other technologies. The future of QLED seems also relying on the maturity of printing technology.

Peng: New standard (BT2020) certainly helps QLED, given BT2020 meaning a broad color gamut. Among the technologies discussed today, quantum-dot displays in either form are the only ones that can satisfy BT2020 without any optical compensation. In addition, studies found that the picture quality of display is highly associated with color gamut. It is correct that the maturity of printing technology plays an important role in the development of QLED. The current printing technology is ready for medium-sized screen and should be able to be extended to large-sized screen without much trouble.

Xu: For QLED to become a dominant technology, it is still difficult. In its development process, OLED precedes it and there are other rivaling technologies following. While we know owning the foundational patents and core technologies of QLED can make you a good position, holding core technologies alone cannot ensure you to become a mainstream technology. The government"s investment in such key technologies after all is small as compared with industry and cannot decide QLED to become mainstream technology.

Liao: Due to their lack of kernel technologies, Chinese OLED panel manufacturers heavily rely on investments to improve their market competitiveness. But this may cause the overheated investment in the OLED industry. In recent years, China has already imported quite a few new OLED production lines with the total cost of about 450 billion yuan (US$71.5 billion).Lots of advantages of OLED over LCD were highlighted, such as high color gamut, high contrast and high response speed and so on …. It seems to be possible that the flexible display will eventually lead a killer advantage.

The short of talent human resources perhaps is another issue to influence the fast expansion of the industry domestically. For an example, BOE alone demands more than 1000 new engineers last year. However, the domestic universities certainly cannot fulfill this requirement for specially trained OLED working forces currently. A major problem is the training is not implemented in accordance with industry demands but surrounding academic papers.

In the past decade, LCD monitors have replaced CRT screens for all but the most specialist applications. Although liquid crystal displays boast perfect

At TeleTraders, we want to buy your used LCD Displays from you in bulk. If you’re older LCD Displays are still usable, consider selling them to TeleTraders to help offset your equipment upgrade costs. Give TeleTraders a call at

When it comes time to update your office, offset your expenses and sell used LCD Displays. We will make you a competitive offer for your old monitors, LCDs, computers, modems, and laptops.

Our company is happy to purchase your old used, outdated LCD displays and monitors to free your business from the sometimes complicated electronics disposal processes. Please give us a call at 770-864-9179 or get a Free Online Quote to get started.

Our team utilizes industry experience to provide you with a fair and competitive price quote for your old used LCD displays and computer devices. We continue to upgrade our knowledge base as office equipment quickly becomes outdated in the constantly changing world of electronics. We team up with many companies around the world to quickly resell, repurpose, or recycle the LCD displays sent our way. Our efforts ensure the electronics remain in operation well beyond their initial run with your company.

When you sell your LCD displays and other office equipment to TeleTraders, we can also handle all of the packing, removal and transporting for the equipment, helping free up both your space and your time.

We understand that office technology needs change over time. The LCD displays and monitors that worked for your office a year or two ago may not be keeping pace anymore with your needs. We can help by offering you the best rates possible for your bulk LCD displays. Contact TeleTraders to get started right now.

When it’s time to upgrade your computer and LCD displays, you shouldn’t have to spend lots of time trying to figure out how to dispose of, sell or recycle your used LCD displays and office equipment – that’s where TeleTraders will be able to help you.

We request a detailed list of your used office LCD displays, including make, model, and quantity of units. Please, also include a photo of your equipment so we can gauge the current quality of the hardware.

TeleTraders is happy to accept most major and minor brands of common IT office LCD displays, office LCD display systems, and also other IT office equipment. If there is any question about whether we will accept your brand of equipment, feel free to contact us by phone or email at any time and we will respond to your inquiry as quickly as possible.

We are always looking to help businesses, small and large, offset the costs of upgrading their IT office LCD displays and IT office LCD display systems. In order to make an inquiry about a possible trade-in valuation, please Contact Us so we can work with you to evaluate used IT office LCD display gear. You may also Call Us directly for immediate assistance.

When one hears the term “flat-panel display,” the first thing that may come to mind is a modern 21st-century classroom where a teacher gives lessons on an interactive flipchart to students using smart whiteboards. And this vision would not be wrong. However, this technology is being adopted into many other industries, such as:

In fact, the flat-panel display market is booming. In a recent ResearchAndMarkets.com report, the global market for this technology was valued at $116.80 billion in 2018 and is projected to reach $189.60 billion by 2026.

Flat-panel displays are electronic viewing technologies used to enable people to see content (still images, moving images, text, or other visual material) in a range of entertainment, consumer electronics, personal computer, and mobile devices, and many types of medical, transportation and industrial equipment. They are far lighter and thinner than traditional cathode-ray tubes (CRT) television sets and video displays and are usually less than 10 centimeters (3.9 in.) thick.

The LCD is comprised of millions of liquid pixels (picture elements). The picture quality is described by the number of pixels. For example, the “4K” label indicates that the display contains 3840×2160 or 4096×2160 pixels. Each pixel is made up of three subpixels: red, green, and blue (called RGB for short). When the RGBs in a pixel change color combinations, a different color is produced (e.g., red and green produce yellow). With all the pixels working together, the display can make millions of different colors. And finally, a picture is created when the pixels are rapidly turned off and on.

LED displays are the second most common display technology. In essence, the LED display is an LCD as it uses the same liquid diode technology but uses light-emitting diodes to backlight instead of cold cathode fluorescent (CCFL) backlighting.

The “O” in OLED stands for “organic,” as these flat-panel displays are made of organic materials (like carbon, plastic, wood, and polymers) that are used to convert electrical current into light. With OLED technology, each pixel is capable of producing its own illumination. Whereas both LCD and LED technology uses a backlighting system.

PDPs contain an electrically charged gas (plasma) that is housed between two panels of glass. PDPs are known for their vivid colors and have a wider viewing angle. However, one disadvantage with this technology is that it tends to “burn” permanent images onto the viewing area. In addition, when compared to an LCD, the PDP tends to be heavier and thicker because of the two glass panels, and it typically uses more electricity.

EL Technology places electroluminescent material (such as gallium arsenide or GaAs) between two conductive layers. When an electric current is introduced to the layers, the electroluminescent material lights up, thus creating a pixel. EL displays are most typically used for instrumentation for rugged military, transportation, and industrial applications.

In today’s world, interactivity is king. Devices like mobile phones and tablets are everywhere, and people are looking for similar experiences in their workplace and as they go about their daily lives. As a result, multi-video walls, kiosks, and interactive flat-panel displays are cropping up in almost any place you can think of.

Automobile dealerships are installing interactive flat-panel displays that allow shoppers to view their line-up of cars. These panels have touchscreen features that enable customers to view a vehicle from all angles and even zoom in on different parts. With this technology, buyers can order a fully customized car by choosing the upholstery, trim, accessories, and even some of the engine features of their new car.

Doctors have many non-invasive diagnostic tools in their toolkits—things like x-rays, MRIs, CT scans, ultrasound, PET, etc. These days, new techniques have been developed that combine multiple scans into 3D renderings. These images require high-quality (medical-grade) flat-panel displays that provide the highest resolution possible. And because these displays are in constant use, they must be durable and long-lived. LCDs with edge-lit LED backlights are currently the industry standard with about 93 percent penetration.

One of the best weapons in peace and war is information. The Pentagon is placing flat-panel displays on almost every surface they can think of—war rooms, control rooms, ships, planes, trucks, and even helmets, rifle sights, and radios. The displays used by the military must be:

Brick and mortar retail stores’ biggest competition is e-commerce sites. Interactive flat-panel displays combine in-store and online selling with the use of self-service kiosks. Salespeople are using these kiosks to personalize customer service and enhance their product availability beyond what they stock in the store. This technology can also help retailers customize their products for their customers and are particularly helpful to boutiques and luxury retailers.

As we have demonstrated, there are many uses for flat-panel displays in a multitude of sectors. Flat-panel displays produce high-quality images, are stylish, consume less power, and give a maximum image in a minimum space. Best of all, they disperse information and help make our lives easier and safer.

Versa Technology’s objective is to keep our customers fully informed about a broad array of communication and networking technologies. We sincerely hope you found this article informative. Versa has over 25 years of experience in networking solutions. To learn more about our products and services, please visit ourhomepage.

MarketWatch Picks has highlighted these products and services because we think readers will find them useful; the MarketWatch News staff is not involved in creating this content. Prior to that, I had managed my investments passively. Is a variable annuity a good option for me?

Stocks were up this week, ahead of today’s inflation data. The gains reflected investor optimism that inflation will continue to scale back – a sentiment that was backed up by the actual numbers. The rate of price increases for December came in at a 0.1% decrease month-over-month, and at an increase of 6.5% annualized. These were exactly in-line with the forecasts, and mark a slowing down of inflation going forward. The slower pace is good news. With this scale-back – inflation’s annualized incr

One of the most important aspects of any display you can understand is the panel technology being used. Specifications alone won’t give you the full picture of a displays performance, and we all know that manufacturers can exaggerate specs on paper to suit their marketing. With an understanding of the panel technology being used you will get a feel for the overall performance characteristics of the display and how it should perform in real terms. Our extensive panel search database helps you identify the panel technology (and manufacturer and part number where known) of many screens in the market. This article which follows will help you understand what the different panel technologies can offer you. A lot of manufacturers now list the panel technology as well in their specs, something which wasn’t included a in the past.

TN Film panels are the mostly widely used in the desktop display market and have been for many years since LCD monitors became mainstream. Smaller sized screens (15″, 17″ and 19″) are almost exclusively limited to this technology in fact and it has also extended into larger screen sizes over the last 7 years or so, now being a popular choice in the 20 – 28″ bracket as well. The TN Film panels are made by many different manufacturers, with the big names all having a share in the market (Samsung, LG.Display, AU Optronics) and being backed up by the other companies including most notably Innolux and Chunghwa Picture Tubes (CPT). You may see different generations of TN Film being discussed, but over the years the performance characteristics have remained similar overall.

TN Film has always been so widely used because it is comparatively cheap to produce panels based on this technology. As such, manufacturers have been able to keep costs of their displays down by using these panels. This is also the primary reason for the technology to be introduced into the larger screen sizes, where the production costs allow manufacturers to drive down retail costs for their screens and compete for new end-users.

The other main reason for using TN Film is that it is fundamentally a responsive technology in terms of pixel latency, something which has always been a key consideration for LCD buyers. It has long been the choice for gaming screens and response times have long been, and still are today, the lowest out of all the technologies overall. Response times typically reach a limit of around 5ms at the ISO quoted black > white > black transition, and as low as 1ms across grey to grey transitions where Response Time Compensation (overdrive) is used. TN Film has also been incorporated into true 120Hz+ refresh rate desktop displays, pairing low response times with high refresh rates for even better moving picture and gaming experiences, improved frame rates and adding 3D stereoscopic content support. Modern 120Hz+ refresh rate screens normally also support NVIDIA 3D Vision 2 and their LightBoost system which brings about another advantage for gaming. You can use the LightBoost strobed backlight system in 2D gaming to greatly reduce the perceived motion blur which is a significant benefit. Some screens even include a native blur reduction mode instead of having to rely on LightBoost ‘hacks’, providing better support for strobing backlights and improving gaming experiences when it comes to perceived motion blur. As a result, TN Film is still the choice for gamer screens because of the low response times and 120Hz+ refresh rate support.

The main problem with TN Film technology is that viewing angles are pretty restrictive, especially vertically, and this is evident by a characteristic severe darkening of the image if you look at the screen from below. Contrast and colour tone shifts can be evident with even a slight movement off-centre, and this is perhaps the main drawback in modern TN Film panels. Some TN Film panels are better than others and there have been improvements over the years to some degree, but they are still far more restrictive with fields of view than other panel technologies. The commonly quoted 170/160 viewing angles are an unfair indication of the actual real-life performance really, especially when you consider the vertical contrast shifts. Where viewing angles are quoted by a manufacturer as 160/160 or 170/160 that is a clear sign that the panel technology will be TN Film incidentally.

Movie playback is often hampered by ‘noise’ and artifacts, especially where overdrive is used. Black depth was traditionally quite poor on TN Film matrices due to the crystal alignment, however, in recent years, black depth has improved somewhat and is generally very good on modern screens, often surpassing IPS based screens and able to commonly reach contrast ratios of ~1000:1. TN Film is normally only a true 6-bit colour panel technology, but is able to offer a 16.7 million colour depth thanks to dithering and Frame Rate Control methods (6-bit + FRC). Some true 8-bit panels have become available in recent years (2014 onwards) but given the decent implementation of FRC on other 6-bit+FRC panels, the real-life difference is not something to concern yourself with too much.

Most TN Film panels are produced with a 1920 x 1080 resolution, although some larger sizes have become available with higher resolutions. A new generation of Quad HD 2560 x 1440 27″ TN Film panels emerged in 2014. We’ve also seen the introduction of 28″ Ultra HD 3840 x 2160 resolution TN Film panels become available, and adopted in many of the lower cost “4k” models in the market. Where used, the Anti-Glare (AG) coating used on most TN Film panels is moderately grainy – not as grainy as some older IPS panel coatings, but not as light as modern IPS, VA or equivalents. Also at the time of writing there are no ultra-wide (21:9 aspect ratio) or curved format TN Film panels in production.

VA technology was first developed by Fujitsu in 1996. However the limited viewing angles were its main disadvantage, and so further investment focused on addressing this problem. It was eventually solved by dividing each pixel into domains which worked synchronously. This lead the birth of the following technologies:

MVA technology, was later developed by Fujitsu in 1998 as a compromise between TN Film and IPS technologies. On the one hand, MVA provided a full response time of 25 milliseconds (that was impossible at the time with IPS, and not easily achievable with TN), and on the other hand, MVA matrices had wide viewing angles of 160 – 170 degrees, and thus could better compete with IPS in that parameter. The viewing angles were also good in the vertical field (an area where TN panels suffer a great deal) as well as the horizontal field. MVA technology also provided high contrast ratios and good black depth, which IPS and TN Film couldn’t quite meet at the time.

In MVA panels, the crystals in the domains are oriented differently, so if one domain lets light pass through, the neighboring domain will have the crystals at an angle and will shutter the light (of course, save for the display of white color, in which case all the crystals are placed almost in parallel to the matrix plane).

As MVA developed over the years the problem became that the response times were not as good as TN film panels and was very difficult to improve. Sadly, the response time grows dramatically when there’s a smaller difference between the pixel’s initial and final states (i.e. the more common grey to grey transitions). Thus, such matrices were unsuitable for dynamic games. With the introduction of RTC and overdrive technologies, the manufacturers launched a new breed of MVA discussed in the following sections.

Premium MVA (P-MVA) panels were produced by AU Optronics, and Super MVA (S-MVA) panels by Chi Mei Optoelectronics (now Innolux) and Fujitsu from 1998 onwards. AU Optronics have since entered a more recent generation referred to as AMVA (see the next section) and S-MVA panels are rarely used in mainstream monitors nowadays. When they were launched they were able to offer improved response times across grey to grey (G2G) transitions which is a great improvement in the MVA market. While responsiveness was still not as fast as TN Film panels using similar RTC technologies, the improvement was obvious and quite drastic. This was really the first time that MVA matrices could be considered for gaming, and arrived at the time when overdrive was being more widely implemented in the market.

While some improvements have been made, the color-reproduction properties of these modern MVA technologies can still be problematic in some situations. Such panels give you vivid and bright colors, but due to the peculiarities of the domain technology many subtle color tones (dark tones often) are lost when you are looking at the screen strictly perpendicularly. When you deflect your line of sight just a little, the colors are all there again. This is a characteristic “VA panel contrast shift” (sometimes referred to as ‘black crush’ due to the loss of detail in dark colours) and some users pick up on this and might find it distracting. Thus, MVA matrices are somewhere between IPS and TN technologies as concerns color rendering and viewing angles. On the one hand, they are better than TN matrices in this respect, but on the other hand the above-described shortcoming prevents them from challenging IPS matrices, especially for colour critical work.

Traditionally MVA panels offered 8-Bit colour depth (a true 16.7 million colours) which is still common place today. We have yet to see any new breed of 10-bit capable MVA panel even using Frame Rate Control (8-bit + FRC). Black depth is a strong point of these P-MVA /S-MVA panels, being able to produce good static contrast ratios as a result of around 1000 – 1200:1 in practice. Certainly surpassing IPS matrices of the time as well as most TN Film panels. This has improved since with more recent AMVA panels to 3000 – 5000:1 (see next section).

MVA panels also offer some comparatively good movie playback with noise and artifacts quite low compared with other technologies. The application of overdrive doesn’t help in this area, but MVA panels are pretty much the only ones which haven’t suffered greatly in movie playback as a result. Many of the MVA panels are still pretty good in this area, sadly something which overdriven TN Film, IPS and PVA panels can’t offer. While CMO are still manufacturing some S-MVA matrices, AU Optronics no longer produce P-MVA panels and instead produce their newer generation of MVA, called AMVA (see below).

AU Optronics have more recently (around 2005) been working on their latest generation of MVA panel technology, termed ‘Advanced Multi Domain Vertical Alignment’ (AMVA). This is still produced today although a lot of their focus has moved to the similarly named, and not to be confused AHVA (Advanced Hyper Viewing Angle, IPS-type) technology. Compared with older MVA generations, AMVA is designed to offer improved performance including reduced colour washout, and the aim to conquer the significant problem of colour distortion with traditional wide viewing angle technology. This technology creates more domains than conventional multi-domain vertical alignment (MVA) LCD’s and reduces the variation of transmittance in oblique angles. It helps improve colour washout and provides better image quality in oblique angles than conventional VA LCD’s. Also, it has been widely recognized worldwide that AMVA technology is one of the few ways to provide optimized image quality through multiple domains.

AMVA provides an extra-high contrast ratio of greater than 1200:1, reaching 5000:1 in manufacturer specs at the time of writing for desktop monitor panels by optimized colour-resist implementation and a new pixel design and combining the panels with W-LED backlighting units. In practice the contrast ratio is typically nearer to 3000:1 from what we’ve seen, but still far beyond IPS and TN Film matrices. The result is a more comfortable viewing experience for the consumer, even on dimmer images. This is one of the main improvements with modern AMVA panels certainly, and remains way above what competing panel technologies can offer.

AMVA still has some limitations however in practice, still suffering from the off-centre contrast shift you see from VA matrices. Viewing angles are therefore not as wide as IPS technology and the technology is often dismissed for colour critical work as a result. As well as this off-centre contrast shift, the wide viewing angles often show more colour and contrast shift than competing IPS-type panels, although some recent AMVA panel generations have shown improvements here (see BenQ GW2760HS for instance with new “Color Shift-free” technology). Responsiveness is better than older MVA offerings certainly, but remains behind TN Film and IPS/PLS in practice. The Anti-Glare (AG) coating used on most panels is light, and sometimes even appears “semi glossy” and so does not produce a grainy image.

At the time of writing AMVA panels are typically offered with an HD 1920 x 1080 resolution, although some are available in sizes up to 32″ maximum, at a resolution of 2560 x 1440 (Quad HD). At this time there are no native 120Hz+ AMVA panels from AU Optronics in production although at one point AUO were looking into them. Also at the time of writing there are no ultra wide (21:9 aspect ratio) or curved format MVA-type panels in production.

AUO developed a series of vertical-alignment (VA) technologies over the years. This is specifically for the TV market although a lot of the changes experienced through these generations applies to monitor panels as well over the years. Most recently, the company developed its AMVA5 technology not only to improve the contrast ratio, but also to enable a liquid crystal transmission improvement of 30% compared to AMVA1 in 2005. This was accomplished by effectively improving the LC disclination line using newly developed polymer-stabilized vertical-alignment (PSA) technology. PSA is a process used to improve cell transmittance, helping to improve brightness, contrast ratio and liquid crystal switching speeds.

We have included this technology in this section as it is a modern technology still produced by Sharp as opposed to the older generations of MVA discussed above. Sharp are not a major panel manufacturer in the desktop space, but during 2013 began to invest in new and interesting panels using their MVA technology. Of note is their 23.5″ sized MVA panel which was used in the Eizo Foris FG2421 display. This is the first MVA panel to offer a native 120Hz refresh rate, making it an attractive option for gamers. Response times had been boosted significantly on the most part, bringing this MVA technology in line with modern IPS-type panels when it comes to pixel latency. The 120Hz support finally allowed for improved frame rates and motion smoothness from VA technology, helping to rival the wide range of 120Hz+ TN Film panels on the market.

Of particular note also are the excellent contrast ratios of this technology, reaching up to an excellent 5000:1 in practice, not just on paper. Viewing angles are certainly better than TN Film and so overall these MVA panels can offer an attractive all-round option for gaming, without some of the draw-backs of the TN Film panels. Viewing angles are not as wide as IPS panel types and there is still some noticeable gamma shift at wider angles, and the characteristic VA off-centre contrast shift still exists.

PVA was developed by Samsung as an alternative to MVA in the late 1990’s. The parameters and the development methods for PVA and MVA are so different that PVA can be truly regarded as an independent technology, although it is still a ‘Vertical Alignment’ technology type and has many similar characteristics. PVA is a Samsung only technology.

The liquid crystals in a PVA matrix have the same structure as in a MVA matrix – domains with varying orientation of the crystals allow keeping the same color, almost irrespective of the user’s line of sight and viewing angle. Viewing angles are not perfect though, as like with MVA matrices when you are looking straight at the screen, the matrix “loses” some shades, which return after you deflect your line of sight from the perpendicular a little. This ‘off-centre’ contrast shift, or ‘black crush’ as it is sometimes called is the reason why some colour enthusiasts prefer IPS-type displays. The overall viewing angles are also not as wide as IPS-type panels, showing more obvious colour and contrast shifts as you change your line or sight.

There was the same problem with traditional PVA matrices as with MVA offerings – their response time grew considerably when there’s a smaller difference between the initial and final states of the pixel. Again, PVA panels were not nearly as responsive as TN Film panels. With the introduction of MagicSpeed (Samsung’s overdrive / RTC) with later generations (see below), response times have been greatly improved and are comparable to MVA panels in this regard on similarly spec-ed panels. They still remain behind TN Film panels in gaming use, but the overdrive really has helped improve in this area. There are no PVA panels supporting native 120Hz+ refresh rates and Samsung have no plans to produce any at this time. In fact Samsung’s investment in PVA seems to have been cut back significantly in favour of their IPS-like PLS technology.

The contrast ratio of PVA matrices is a strong point, as it is with MVA. Older PVA panels offered contrast ratios of 1000 – 1200:1 typically, but remained true to their spec in many cases. As such at the time of their main production they were better than TN Film, IPS and even MVA in this regard. Movie playback is perhaps one area which is a weak point for PVA, especially on Samsung’s overdriven panels. Noise and artifacts are common unfortunately and the panels lose out to MVA in this regard. Most PVA panels were true 8-bit modules, although some generations (see below) began to use 6-bit+FRC instead. There are no 10-bit supporting PVA panels available, either native 10-bit or 8-bit+FRC. Panel coating is generally light on PVA panels, quite similar to a lot of MVA panels.

The introduction of overdrive to PVA panels lead to the next generation of Super Patterned Vertical Alignment (S-PVA) technology in 2004. Like P-MVA panels were to MVA, these are really just an extension of the existing PVA technology, but with the MagicSpeed (overdrive) technology, they have managed to make them more suitable for gaming than the older panels. One other difference is that the liquid crystal cell structure is a boomerang shape, splitting each sub pixel into two different sections with each aligned in opposite directions. This is said to help improve viewing angles and colour reproduction when viewed from the side. Limitations still exist with S-PVA and they don’t offer as wide viewing angles as IPS-type panels, and still suffer from the off-centre contrast shift we’ve described. Most S-PVA panels offered a true 8-bit colour depth, but some did feature Frame Rate Control (FRC) to boost a 6-bit panel (6-bit+FRC).

In late 2009 Samsung started to produce their latest generation of so called “cPVA” panels. These new panels featured a simpler sub-pixel structure in comparison with S-PVA, but allowed Samsung to produce the panels at a lower cost, and drive down the retail cost of their new screens. It’s unclear what the “c” stands for. This is a similar approach to e-IPS which we discuss a little later on.

In practice, cPVA do not look any worse than S-PVA panels and in fact offer even better contrast ratios in early cPVA panel tests. Other performance characteristics including the off-centre contrast shift remained the same as S-PVA panels. Some cPVA panels are in fact using Frame Rate Control to produce their 16.7m colour depth (6-bit+FRC) as opposed to true 8-bit panels. See this news piece for more information about these 6-bit + AFRC cPVA panels.

There is very little official information about this technology but some Samsung monitors started to be labelled as having an A-PVA panel around 2012 onwards. We suspect that nothing has really changed from S-PVA / cPVA panels, but that the term “Advanced” has been added in to try and distinguish the new models, and perhaps compete with LG.Display’s successful IPS technology and AU Optronics AMVA technology where they have also added the word “Advanced” for their latest generations (see AMVA and AH-IPS).

During 2014 Samsung started to label their PVA panels as SVA, although the definition is currently unknown. In fact these are probably the only remaining mass-produced PVA panels on the market. Little information is available regarding any possible changes although we expect some improvements to response times and contrast ratios. We believe PSA has been used for these panels as well, much like AU Optronics have used it for their more recent AMVA generations. PSA is a process used to improve cell transmittance, helping to improve brightness, contrast ratio and liquid crystal switching speeds.

At the time of writing we have only seen this term used for their latest curved VA panels, so it may be something linked to that format. Contrast ratios of 3000:1 are now quoted for modern VA panels like this. Resolutions are offered at 1920 x 1080 and also 3440 x 1440 in ultra-wide 21:9 aspect ratio and curved formats. High refresh rate support is not offered at the moment so PVA variants are limited to 60Hz maximum.

In Plane Switching (IPS – also known as ‘Super TFT’) technology was developed by Hitachi in 1996 to try and solve the two main limitations of TN Film matrices at the time, those being small viewing angles and low-quality color reproduction. The name In-Plane Switching comes from the crystals in the cells of the IPS panel lying always in the same plane and being always parallel to the panel’s plane (if we don’t take into account the minor interference from the electrodes). When voltage is applied to a cell, the crystals of that cell all make a 90-degrees turn. By the way, an IPS panel lets the backlight pass through in its active state and shutters it in its passive state (when no voltage is applied), so if a thin-film transistor crashes, the corresponding pixel will always remain black, unlike with TN matrices.

IPS matrices differ from TN Film panels not only in the structure of the crystals, but also in the placement of the electrodes – both electrodes are on one wafer and take more space than electrodes of TN matrices. This leads to a lower contrast and brightness of the matrix. IPS was adopted for colour professional displays due to its wide viewing angles, good colour reproduction and stable image quality. However, response times were very slow originally, making IPS unsuitable for dynamic content.

The original IPS technology became a foundation for several improvements: Super-IPS (S-IPS), Dual Domain IPS (DD-IPS), and Advanced Coplanar Electrode (ACE). The latter two technologies belong to IBM (DD-IPS) and Samsung (ACE) and are in fact unavailable in shops. The manufacture of ACE panels is halted, while DD-IPS panels are coming from IDTech, the joint venture of IBM and Chi Mei Optoelectronics – these expensive models with high resolutions occupy their own niche, which but slightly overlaps with the common consumer market. NEC is also manufacturing IPS panels under such brands as A-SFT, A-AFT, SA-SFT and SA-AFT, but they are in fact nothing more than variations and further developments of the S-IPS technology.

In 1998 production started for Super-IPS panels, and were mostly produced by LG.Philips (now LG.Display). They have gone through several generations since their inception. Initially S-IPS built upon the strengths of IPS by employing an advanced “multi-domain” liquid crystal alignmentt. The term S-IPS is actually still widely used in modern screens, but technically there may be subtle differences making them S-IPS, e-IPS, H-IPS, or p-IPS (etc) generations for example. See the following sections for more information.

Since their initial production in 1998 S-IPS panels have gained the widest recognition, mostly due to the efforts of LG.Philips LCD (now known as LG.Display), who were outputting rather inexpensive and high-quality 19″ – 30″ matrices. The response time was among the serious drawbacks of the IPS technology – first panels were as slow as 60ms on the “official” black-to-white-to-back transitions (and even slower on grey-to-grey ones!) Fortunately, the engineers dragged the full response time down to 25 ms and then 16ms later, and this total is equally divided between pixel rise and pixel fall times. Moreover, the response time doesn’t greatly grow up on black-to-gray transitions compared to the specification, so some older S-IPS matrices at the time could challenge TN Film panels in this parameter.

The IPS technology has always been at the top end when it comes to colour reproduction and viewing angles. Colour accuracy has always been a strong point, and even in modern displays the IPS matrices can surpass the performance of TN Film and VA equivalents. The viewing angles are a key part in this, since IPS matrices are free of the off-centre contrast shift that you can see from VA type panels. This is the reason why IPS is generally considered the preferred choice for colour critical work and professional colour displays, combining the excellent colour accuracy with truly wide viewing angles (178/178). S-IPS panels can show a purple colour when viewing dark images from a wide angle.

One main problem of the S-IPS technology traditionally was the low contrast ratio. Black depth was often a problem with S-IPS panels and contrast ratios of 500 – 600:1 were common for the early S-IPS offerings. However, these have been improved significantly, and contrast ratios are now much better as a result with modern IPS generations (see following sections). One other area which remains problematic for modern IPS panels is movie playback, again with noise being present, and only accentuated by the heavy application of overdrive technologies. S-IPS panels are sometimes criticized for their Anti-Glare (AG) coating, which can appear quite grainy and dirty looking, especially when viewing white/light backgrounds in office applications. Again that has been improved significantly in recent generations.

Moving Picture Image Sticking (MPIS) – S-IPS panels do not show any image sticking when touching a moving image. On the other hand severe image sticking happens in VA panel and lasts after the image is changed for a short time.

Sometimes you will see these terms being used, but S-IPS is still widely used as an umbrella for modern IPS panels. In 2002 Advanced Super IPS (AS-IPS) boosted the amount of light transmitted from the backlighting by around 30% compared with the standard Super IPS technology developed in 1998. This did help boost contrast ratios somewhat, but they could still not compete with VA panel types. In 2005 with the introduction of RTC technologies (Overdrive Circuitry – ODC) and dynamic contrast ratios, LG.Display started to produce their so called “Enhanced IPS” (E-IPS, not to be confused with e-IPS) panels. Pixel response times were reduced across G2G transitions to as low as 5ms on paper.

Enhanced S-IPS builds on S-IPS technology by providing the same 178° viewing angle from above and below and to the sides, and greatly improves the off-axis viewing experience by delivering crisp images with minimal colour shift, even when viewed from off-axis angles such as 45°. You will rarely see this E-IPS term being used to be honest. You may also occasionally see the name “Advanced S-IPS” (AS-IPS) being used, but this was just a name given specifically by NEC to the E-IPS panel developed and used in their very popular NEC 20WGX2 screen, released in 2006. The AS-IPS name was also (confusingly) used by Hitachi in some of their earlier IPS generations as shown below, back in 2002.

Above: Evolution of IPS as detailed by Hitachi Displays: “IPS technology was unveiled by Hitachi, Ltd. in 1995, and put to practical use in 1996. Since then, it has evolved into Super-IPS, Advanced-Super IPS, and IPS-Pro.”

In 2006 – 2007 LG.Display IPS panels have altered the pixel layout giving rise to ‘Horizontal-IPS’ (H-IPS) panels. In simple terms, the manufacturer has reportedly reduced the electrode width to reduce light leakage, and this has in turn created a new pixel structure. This structure features vertically aligned sub-pixels in straight lines as opposed to the arrow shape of older S-IPS panels.

In practice, it can be quite hard to spot the difference, but close examination can reveal a less ‘sparkly’ appearance and a slightly improved contrast ratio. Some users find a difference in text appearance as well relating to this new pixel structure but text remains clear and sharp. H-IPS will also often show a white glow from a wide angle when viewing black images, as opposed to the purple tint from S-IPS matrices. This is actually more noticeable than the S-IPS purple tint and is referred to as “IPS glow”. Some IPS panels in high end displays are coupled with an Advanced True Wide (A-TW) polarizer which helps improve blacks from wide viewing angles, and reduces some of the pale glow you can normally see. However, this A-TW polarizer is not included in every model featuring H-IPS and this should not be confused. It is very rarely used nowadays unfortunately. H-IPS panels from around this time are sometimes criticized for their Anti-Glare (AG) coating, which can appear quite grainy and dirty looking, especially when viewing white backgrounds in office applications.

Close inspection of modern IPS panels can show this new H-IPS pixel structure, although not all manufacturers refer to their models as featuring an H-IPS panel. Indeed, LG.Display don’t really make reference to this H-IPS version, although from a technical point of view, most modern IPS panels are H-IPS in format. As an example of someone who has referred to this new generation, NEC have used the H-IPS name in their panel specs for models such as the LCD2690WXUi2 and LCD3090WUXi screens.

The following technical report has feedback from the LG.Philips LCD laboratory workers: “Wedesigned a new pixel layout to improve the aperture ratioof IPS mode TFT-LCD (H-IPS). This H-IPS pixel layout design has reducedthe width of side common electrode used to minimize thecross talk and light leakage which is induced by interferencebetween data bus line and side common electrode of conventionalIPS mode. The side common electrodes of a pixel canbe reduced by horizontal layout of inter-digital electrode pattern whereconventional IPS pixel designs have vertical layout of inter-digital electrodes.We realized 15 inch XGA TFT LCD of H-IPS structurewhich has aperture ratio as much as 1.2 times ofcorresponding conventional IPS pixel design.” ©2004 Society for Information Display.

During

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey