lcd panel meaning pricelist

A lot of consumers wonder how manufacturers determine the LCD display panel prices. After all, display solutions such as TFT LCDs and HMI touch screens do not always come cheap. And sometimes, a few products that can indeed be purchased for lower prices may come with several quality issues.

Hence, we’ve rounded up a list of factors that influence how to display modules such as TFTs, LCD, and touch screens are priced. You can also use these factors to evaluate to whom you should place your next orders for your display solutions.

LCD fluids are used in altering the light orientation passing through glass substrates. Hence, this causes the panel’s active pixels to darken. Different kinds of LCD panel fluids provide unique characteristics and change a panel’s viewing angle, temperature range, and display clarity.

The viewing angle is limited in a panel containing TN fluid. This means that the text or image display becomes harder to read if you rotate the device away from its center. The display is also not that sharp compared to displays using other technologies.

Another characteristic of this fluid is that it works well even in colder temperatures. It’s because TN fluid has the quickest response time among the other LCD fluid types.

TN fluid is considered the cheapest LCD fluid type. However, this doesn’t mean that TN isn’t widely used. The display technology is greatly utilized in digital clocks, pagers, and gas pumps.

LCD modules with STN fluid enjoy a wider display angle, greater multiplexing, higher image contrast, and sharper response than devices using TN fluids. However, modules with STN fluids may have slower response times when used in lower temperatures due to the fluid freezing inside the device.

STN fluid falls under the moderately cheap LCD module price. Furthermore, STN fluid is widely utilized in several monochrome LCD devices such as POS machines, inexpensive feature phones, and informational screens of some devices.

CSTN is a bit pricier than TN and STN fluids. But it’s a good choice if you need to display color images on your LCD device. In fact, a lot of color feature phones use CSTN as an alternative to the TFT displays, saving almost half the manufacturing costs.

In terms of cost, the LCD display module price of a unit with FSTN is higher compared to TN and STN. But this is concerning the better visual quality that FSTN offers.

To cap off this part, the fluids used in a screen is a big factor in determining the overall LCD screen display panel price. As you can see, the four fluid types often used in LCD screens rise in costs with respect to the visual quality produced by each technology.

The temperature range in which LCD screen displays may work varies intensely. Some displays continue to work at optimal performance even when used in cold or hot outdoor temperatures. Lower-quality LCD panels may start having glitches at the slightest change of temperature and humidity. Hence, the temperature range may have a huge impact on the LCD display panel price as well.

Now, most LCD screen panels don’t experience such temperature extremes. In fact, a typical LCD TV can operate properly between approximately o°C and 32°C (32° – 90° F). Meanwhile, other screen modules (usually the industrial-grade ones) have unique capabilities to work in even more extreme ends of the temperature scale.

If you want to look for the most cost-effective type of LCD panel for your device, then you must consider the following standard LCD unit temperature types:

Normal temperature units work well in environments that have indoor temperatures at approximately 20-35°C (68-95°F). Some LCD modules may work well above up to 50°C (122°F). Such LCD modules can be used in daily settings by the typical consumer public.

LCD units under this type are made to withstand lower and higher temperature ranges. Extreme operating temperatures may range anywhere from -30°C to 85°C (-22-185°F). Most LCD modules with wide/extreme temperature capabilities are used in extremely cold areas such as Artic places and ski resorts, as well as humid and moisture-rich hot outdoor areas.

Generally, the LCD module price goes up if the entire display unit can withstand higher temperature ranges. Those who can operate under normal temperature ranges only are usually cheaper.

Hence, you must consider the places where you’ll be installing your LCD display devices. You can’t just use cheaper LCD modules for an industrial-grade display machine. Treat your LCD panel as an investment and select a panel that will yield better screen performance that’ll last several years for you and your business.

Color LCDs have three subpixels that hold red, blue, and green color filters. Each subpixel can have as much as 256 color shades, depending on the variation and control of the voltage applied to it.

Now, when you combine 256 shades of both red, blue, and green subpixels, color LCDs can display a color palette of up to 16.8 million colors. And all these are made possible by millions of transistors etched onto the glass modules.

Display size also plays a large role in an LCD device’s color capability. Smaller screens need fewer pixels and transistors since they have smaller display sizes. These screens are also less costly to make. Now, larger screens with high color resolution and huge display sizes require more transistors and pixels, justifying the higher prices of such monitors.

Resistive touch screen panels are used in most bank ATMs and some older models of cellular phones. They carry the lowest HMI touch screen price among all other touch screen technologies.

Capacitive touch screens are the most common in the display industry today. This technology uses transparent conductors, insulators, and glass to create the panel. An electrostatic field change in the screen’s module happens when a human finger touches the screen surface. This ultimately creates signals that are sent to the touch screen controller for processing.

We’ve explained the following factors at length for both public consumers and business clients to understand the variations in TFT, LCD, and HMI touch screen prices.

Cheap doesn’t necessarily mean low-quality. Also, expensive options aren’t always a wise choice, either. You can maximize your buying or manufacturing options if you know how to compare LCD modules and panels depending on the specifications you truly need for your display machines and devices.

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market smoke. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel pricesare already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The price of LCDS for large-size TVs of 70 inches or more hasn"t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panel was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China"s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using "dig through old bonus - selling high price - the development of new technology" the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China"s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as "upstart" flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. "LCD will still be the mainstream in this decade," he said.

On the other hand, there is no risk of neck jam in China"s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

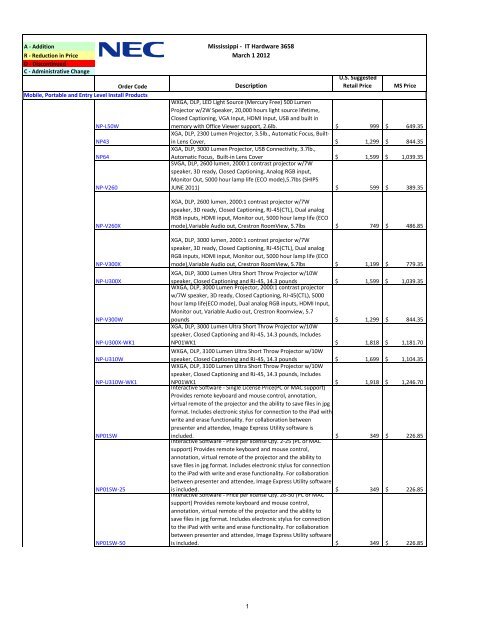

60 inch Class (60.1 inch diagonal) Commercial LCD Display - Brilliant Ultra High Definition (3840 x 2160) resolution with 300 cd/m2 Brightness and 4,000:1 Contrast Ratio. Built-in USB Media Player, Digital Tuner, and 10W per Channel Stereo Audio System. 3-Year Limited Warranty

70 inch Class (69.5 inch diagonal) Commercial LCD Display - Brilliant Ultra High Definition (3840 x 2160) resolution with 300 cd/m2 Brightness and 4,000:1 Contrast Ratio. Built-in USB Media Player, Digital Tuner, and 10W per Channel Stereo Audio System. 3-Year Limited Warranty

80 inch Class (80.0 inch diagonal) Commercial LCD Display - Brilliant Ultra High Definition (3840 x 2160) resolution with 300 cd/m2 Brightness and 4,000:1 Contrast Ratio. Built-in USB Media Player, Digital Tuner, and 10W per Channel Stereo Audio System. 3-Year Limited Warranty

Sharp 60" Class (60" Diagonal) Edge-Lit LED Backlight color Professional LCD Monitor with high sensitivity interactive touch screen. 24/7 Rated with 3-year On Site Limited Warranty (covering parts, labor and backlight). All in one electronic whiteboard solution.

Sharp 60" Class (60" Diagonal) Full Color Professional LCD Monitor with high sensitivity interactive whiteboard touch screen, original user-intuitive pen software and Whiteboard PC. 24/7 Rated with 3-year On Site Limited Warranty (covering parts, labor and backlight).

42" Class (42" Diagonal) Full Color Professional LCD Display Monitor - 24/7 Rated with 3-year On Site Limited Warranty. Offers compatibility with PN-ZB01 optional input/output expansion board. Portrait and landscape compatible.

47" Class (47" Diagonal) Full Color Professional LCD Display Monitor - 24/7 Rated with 3-year On Site Limited Warranty. Offers compatibility with PN-ZB01 optional input/output expansion board. Portrait and landscape compatible.

52" Class (52" Diagonal) Full Color Professional LCD Display Monitor - 24/7 Rated with 3-year On Site Limited Warranty. Offers compatibility with PN-ZB01 optional input/output expansion board. Portrait and landscape compatible.

60" Class (60" Diagonal) Full Color Professional LCD Display Monitor - 24/7 Rated with 3-year On Site Limited Warranty. Offers compatibility with PN-ZB01 optional input/output expansion board. Portrait and landscape compatible.

60" Class (60" Diagonal) Full Color Professional LCD Display Monitor - 24/7 Rated with 3-year On Site Limited Warranty. Offers compatibility with PN-ZB01 optional input/output expansion board. Portrait and landscape compatible.

65" Class (64.5 diagonal) Smart Signage LCD Monitor - Brilliant Ultra-HD (3840 x 2160) resolution with 350 cd/m2 Brightness and 5000:1 Contrast Ratio. Built-in Android based SoC controller, Mini OPS Expansion slot and built-in 10W per Channel Stereo Audio System. Landscape, Portrait, Face-up, and Tilt Operation. 3-Year Limited Warranty

75" Class (74.6 diagonal) Smart Signage LCD Monitor - Brilliant Ultra-HD (3840 x 2160) resolution with 350 cd/m2 Brightness and 5000:1 Contrast Ratio. Built-in Android based SoC controller, Mini OPS Expansion slot and built-in 10W per Channel Stereo Audio System. Landscape, Portrait, Face-up, and Tilt Operation. 3-Year Limited Warranty

65" Class (64.5 diagonal) Smart Signage LCD Monitor - Brilliant Ultra-HD (3840 x2160) resolution with 500 cd/m2 Brightness and 5000:1 Contrast Ratio. Built-in Android based SoC controller, Mini OPS Expansion slot and built-in 10W per Channel Stereo Audio System. Landscape, Portrait, Face-up, and Tilt Operation. Engineered for 24/7 Commercial Use. 3-Year Limited Warranty

75" Class (74.6 diagonal) Smart Signage LCD Monitor - Brilliant Ultra-HD (3840 x2160) resolution with 500 cd/m2 Brightness and 5000:1 Contrast Ratio. Built-in Android based SoC controller, Mini OPS Expansion slot and built-in 10W per Channel Stereo Audio System. Landscape, Portrait, Face-up, and Tilt Operation. Engineered for 24/7 Commercial Use. 3-Year Limited Warranty

Sharp 60" Class (60" Diagonal) Edge-Lit LED Backlight color Professional LCD Monitor with high sensitivity interactive touch screen. 24/7 Rated with 3-year On Site Limited Warranty (covering parts, labor and backlight).

VIEWING ANGLELCD televisions tend to have smaller viewing angles than plasma sets. So if your friends are over to watch the game, those sitting on the left and right of the screen will see an image with blacks that look gray; whites that are darker; reduced contrast; and colors that have shifted.

To counter that effect, Mr. Merson said, consumers should look for LCD televisions that use I.P.S., or in-plane switching technology. I.P.S. is available on Hitachi and Panasonic sets; Samsung and Sony have a similar technology called S-PVA.

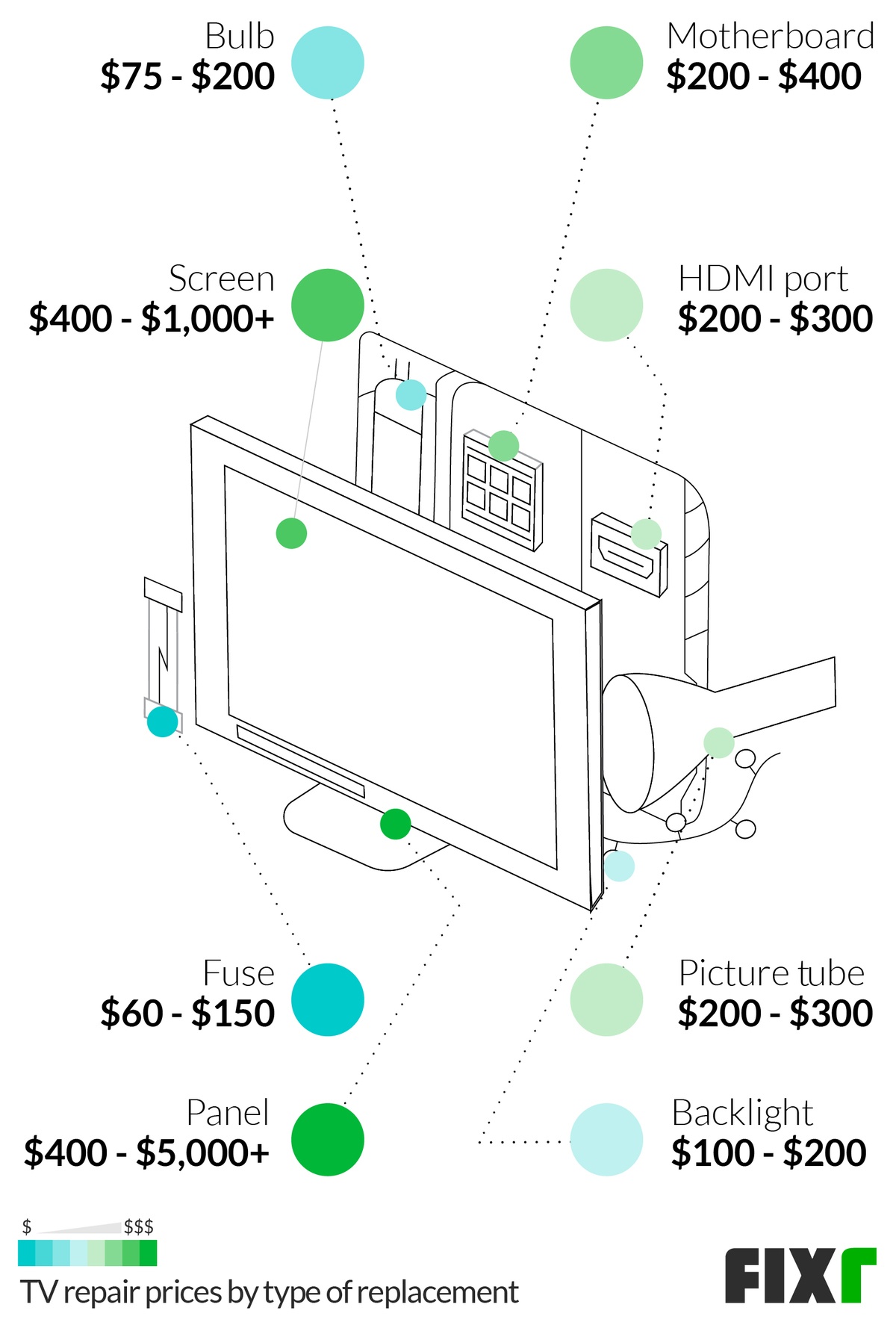

If you have two 4Ks that are the same size and were made in the same year, but one costs significantly more than the other, it boils down to picture quality and specifically the technology being used to put the colors on the screen. All 4K TVs have the same number of pixels (3840 x 2160), but the difference in picture quality comes from how they are lit. The best 4K displays are the ones that have the most control over each individual pixel, to light them up in different colors or even turn them off completely without affecting adjacent pixels of a different color. That’s where display technologies come in, and when it comes to 4K TVs, you’re either talking about LCD or OLED.

The lesser of the two displays is the LCD (liquid crystal display). LCD TVs control the brightness of their picture with an LED backlight that covers a lot more space than a single pixel. Instead, they control groups or clusters of pixels that are known as dimming zones. The more dimming zones an LCD TV has, the more control it has over the pixels and the better picture it’s going to be able to produce.

The ultimate dimming zone, however, is a single pixel, and that is what an OLED TV delivers. Each pixel on an OLED screen is its own backlight. The result is that OLED TVs are able to get brighter and darker while in close proximity to each other, which generates much better contrast. Additionally, OLED TVs are generally able to be thinner and lighter than LCD TVs because they don’t require an extra panel of back-lighting. The problem is OLED is a newer technology and it will be responsible for the bulk of the price differential between two otherwise identical-looking TVs. One of LG’s 65-inch entry-level 4K OLED TVs costs $2,300, for example, while one of the company’s 65-inch 4K LCD TVs costs $650.

It’s not just OLED or LCD though. More expensive LCD TVs will shore up their display technology weakness with other technologies, like a brighter backlight, or a larger number of smaller dimming zones. More expensive TVs will often also boast a higher refresh rate, the number of times per second that the screen updates what it is showing. Higher rates mean a higher price, but less motion blur. Higher-end TVs are also more likely to support high dynamic range (HDR) technologies, such as Dolby Vision and HDR10, which help create deeper blacks and more vivid colors on any display.

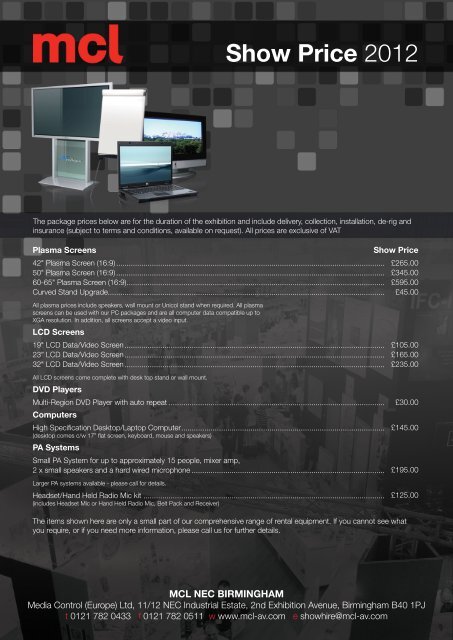

Now, one more note before I start breaking down options and prices. When I talk about video walls, I’m not referring to buying four TVs from a big box store and hanging them together. TVs are problematic as video walls for a number of reasons. Their bezels are usually larger and have logos, they’re usually not bright enough to serve as commercial displays, and they can’t meet the demand of 24/7 usage. You’ll hear me discuss LCDs and LEDs, but when I do, I’ll be referring to monitors, not TVs. It’s an important distinction.

While blended front projections and rear projection cubes are viable options for video walls, LED and LCDs are the most common display technology used for video walls.

Generally, LEDs are more expensive than LCDs (for models that deliver the same image quality), making the latter the budget-friendly choice. The major tradeoff is the LCD’s bezel lines for the line-free LED array.

For simple video walls, a basic 2×2 high-quality LCD unit can cost as little as $4800, while larger, more elaborate setups with more advanced features (touchscreen capabilities) can go as high as $30,000.

A 1.2mm pixel pitch LED video wall costs approximately $2K sq./ft. This figure translates into $200K for a video wall with 160” x 90” outside dimensions. This includes the mounts, panels and installation costs without taking into account the cost of infrastructure, installation and programming and other ancillary costs (like tax and shipping).

While LEDs are more expensive than LCDs, they lend themselves to more customization in terms of size and shape, with the added benefit of being bezel-less.

It’s best not to scrimp on mounts. You should choose a mount that is sufficiently rigid to prevent sagging and able to provide alignment adjustments in all axes when needed. Most importantly, use mounts that permit front serviceability of individual panels. This prevents the need to remove other panels to service just one failed panel, thus reducing the cost of maintenance and repairs.

Also, custom content needs to be created (or scaled to fit) for video walls that don’t come in standard resolutions like 1080P, 2K,4K, etc. You might want to avoid such non-standard walls since it can be quite expensive to create such custom content. Instead, try to use a video wall layout that maintains standard aspect ratios. For LED walls, this means a 16:10, 16:9, or other cinema aspect ratios while LCD arrays should come in 2×2, 3×3, 4×4, and other standard array sizes.

OLED displays have higher contrast ratios (1 million : 1 static compared with 1,000 : 1 for LCD screens), deeper blacks and lower power consumption compared with LCD displays. They also have greater color accuracy. However, they are more expensive, and blue OLEDs have a shorter lifetime.

OLED displays offer a much better viewing angle. In contrast, viewing angle is limited with LCD displays. And even inside the supported viewing angle, the quality of the picture on an LCD screen is not consistent; it varies in brightness, contrast, saturation and hue by variations in posture of the viewer.

There are no geographical constraints with OLED screens. LCD screens, on the other hand, lose contrast in high temperature environments, and lose brightness and speed in low temperature environments.

With current technology, OLED displays use more energy than backlit LCDs when displaying light colors. While OLED displays have deeper blacks compared with backlit LCD displays, they have dimmer whites.

LCDs use liquid crystals that twist and untwist in response to an electric charge and are lit by a backlight. When a current runs through them, they untwist to let through a specific amount of light. They are then paired with color filters to create the display.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey