patents tft lcd globally supplier

The present invention generally relates to a capacity allocation method, and more particularly to a system and method of planning global logistics for a TFT-LCD manufacturing industry.

Being aware of multiple competitors investing in next generational capacities and the labor costs involved, TFT-LCD panel manufacturers usually perform front-end manufacturing at the technology-intensive place. On the other hand, LCD Module (LCM) assembly is performed at the place of demand. Practically, experience dominates the capacity allocation strategy for specifying the appropriate products to produce at a specific manufacturing location. Therefore, the aforementioned techniques affect the performance of the enterprises.

The present invention is directed to a method and a system for planning a global logistics system of a TFT-LCD manufacturing industry, thereby obtain a global logistical and capacity allocation plan.

The present invention provides a global logistics system for a TFT-LCD manufacturing industry suitable for globally allocating among multiple front-end TFT-LCD manufacturing factories and multiple back-end LCM factories. The front-end TFT-LCD manufacturing factories generate multiple semi-finished products. The back-end LCM factories receive these semi-finished products for module assembly. The global logistics system includes an input module and an industry characteristic planning module that has a front-end process transformation module and a back-end transportation allocation module. The input module is used for selecting a performance index and for entering the related parameters. The industry characteristic planning module is used for receiving the performance index and the related parameters. Herein, the front-end process transformation module calculates each semi-finished product quantity at each of the front-end TFT-LCD manufacturing factories. The calculation is performed according to the manufacturing parameters in order to estimate a glass substrate input quantity for each of the front-end TFT-LCD manufacturing factories. The back-end transportation allocation module calculates a shipping quantity. The shipping quantity of each semi-finished product is transported from each front-end TFT-LCD manufacturing factory to each back-end LCM factory. The back-end transportation allocation module calculates the total input quantity of semi-finished products received by each of the back-end LCM factories from each of the front-end TFT-LCD factories.

In one embodiment of the present invention, the aforementioned front-end process transformation module includes a capacity equivalent transformation module, an economical cutting rate transformation module, a cutting area loss transformation module, a manufacturing feasibility evaluation module, a demand limitation module, and a front-end resource limitation module. The capacity equivalent transformation module references a resource consumption quantity for manufacturing standard product in order to convert the resource consumption quantity into a capacity equivalent. The economical cutting rate transformation module calculates a glass substrate input quantity according to the semi-finished product cutting rate. The cutting area loss transformation module calculates a glass substrate loss area. The manufacturing feasibility evaluation module is used for determining whether the semi-finished products can be produced in each of the front-end TFT-LCD manufacturing factories. The demand limitation module limits the semi-finished product quantity. The front-end resource limitation module limits the semi-finished product quantity.

In one embodiment of the present invention, the aforementioned back-end transportation allocation module includes a shipping quantity distribution module, an input quantity calculation module, an inventory transformation module, an inventory limitation module, and a back-end resource limitation module. Herein, the shipping quantity distribution module calculates the shipping quantity of each semi-finished product from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories. The input quantity calculation module calculates a total input quantity of the semi-finished products for each of the back-end LCM factories. The semi-finished product inventory transformation module calculates the inventory quantity of each semi-finished product. The inventory limitation module limits the inventory quantity according to a storage space. The back-end resource limitation module limits a product quantity according to the available capacity.

In another perspective, the present invention provides a method for planning global logistics of a TFT-LCD manufacturing industry that is suitable for multiple front-end TFT-LCD manufacturing factories and multiple back-end LCM factories, where the front-end TFT-LCD manufacturing factories produce multiple semi-finished products, and where the back-end LCM factories receive the semi-finished products for module assembly. In the method of the present invention, a performance index and a plurality of related parameters are entered. The related parameters include manufacturing parameters and shipping parameters. Thereafter, each semi-finished product quantity at each of the front-end TFT-LCD manufacturing factories is calculated. Thereafter, respective calculations of a shipping quantity of each semi-finished product to transport from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories are performed. Thereafter, the total input quantity of the semi-finished products is calculated.

In one embodiment of the present invention, the aforementioned process of the semi-finished product quantity calculation includes calculating the capacity equivalent. Furthermore, whether each semi-finished product is producible at each front-end TFT-LCD manufacturing factory is determined. A cutting area loss transformation module calculates a glass substrate loss area for the semi-finished products.

After the aforementioned process of calculating the shipping quantity of each semi-finished product, an inventory quantity at each of the front-end TFT-LCD manufacturing factories is calculated.

In one embodiment of the invention, the aforementioned inventory calculation process can be limited according to a storage space at each of the front-end TFT-LCD manufacturing factories.

In summary, embodiments of the present invention may generate a production plan for the front-end TFT-LCD manufacturing factories, a resource allocation plan for the back-end LCM factories, and a shipping plan for transportation between the front-end and back-end factories. Accordingly, production costs are substantially lowered due to more efficient global logistics planning.

Practically, production planning for the TFT-LCD manufacturing industry is usually performed by spreadsheet software while capacity allocation is determined by experience. The aforementioned technique results in performance limitations in businesses. In light of the foregoing, in order to more effectively reduce production costs, the present invention provides a system and a method of planning global logistics of a TFT-LCD manufacturing industry. In order to facilitate the descriptions, the embodiments below use the TFT-LCD manufacturing industry as an example.

FIG. 1 is a schematic view of a global logistics environment in accordance with one embodiment of the present invention. Referring to FIG. 1, an enterprise has determined a production quantity from analyzing customer orders and historical data. Input data is represented by various sized product quantities of each period. A production need is allocated to each of front-end TFT-LCD manufacturing factories.

The work environment of the TFT-LCD manufacturing industry can be partitioned into two stages: a first stage involves setting a glass substrate input quantity and a resource allocation for each of the front-end TFT-LCD manufacturing factories 1˜n; a second stage involves capacity logistics planning, which requires determining an optimal logistics allocation plan and thereafter, using the allocation plan to transport semi-finished products to the back-end LCM factories 1˜m for module assembly.

The first stage includes the following industry characteristics. A capacity calculation is based on a capacity for producing a standard product, as well as a capacity equivalent for producing other products. When producing a panel, capacity utilization takes into account an economical cutting rate. Moreover, various degrees of glass substrate loss can occur since different front-end TFT-LCD manufacturing factories utilize different economical cutting rates.

In addition, the second stage includes the following characteristics. The semi-finished products are produced by the array and cell processes, and they are stored as panels at the front-end TFT-LCD manufacturing factories awaiting transport to the back-end LCM factories for module assembly. A shipping quantity between the TFT-LCD manufacturing factories and LCM factories is determined.

In addition to the manufacturing parameters and the shipping parameters, the related parameters further includes a front-end TFT-LCD manufacturing factory generation number, economical cutting rate, and glass substrate cutting loss rate. In addition, a planning period index is included for determining the long-term capacity allocation. A factory index is included for determining each front-end TFT-LCD manufacturing factories and the back-end LCM factories. A product type index is applied for determining the number of product types to allocate.

In addition, the industry characteristic planning module 220 is adapted for receiving the performance index and the related parameters. Herein, the front-end process transformation module 221 calculates the semi-finished product quantity for estimating the glass substrate input quantity. The calculation references the performance index and is performed according to the manufacturing parameters. The back-end transportation allocation module 223 respectively calculates a shipping quantity of each semi-finished product to transport from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories. The back-end transportation allocation module 223 calculates the semi-finished product quantity received by each of the back-end LCM factories from each of the front-end TFT-LCD manufacturing factories.

The economical cutting rate transformation module 303 calculates the glass substrate input quantity according to the semi-finished product quantity. Since different generation manufacturing factories use specific size of panel, producing products of different sizes results in a different economical cutting rate. Accordingly, during resource allocation for the TFT-LCD manufacturing industry, utilizing rates are considered for their economical benefit. During production, conversion between the glass substrate input quantity and the semi-finished product quantity is performed by considering the glass substrate area, the product size, and the product quantity at each generation factory. The conversion can be described as:

A manufacturing feasibility evaluation module 307 is used for determining whether the semi-finished products can be produced. The determination is made by using a manufacturing feasibility parameter. In general, not all front-end TFT-LCD manufacturing factories have the capability to produce products of all sizes under the consideration of production technology.

In each planning period, the capacity used by each front-end TFT-LCD manufacturing factory should be less than or equal to ep,i, a capacity limiting quantity.

Furthermore, in the back-end transportation allocation module 223, the shipping quantity distribution module 313 respectively calculates a shipping quantity from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories. The shipping quantity distribution module 313 particularly emphasizes on parameters such as shipping feasibility, shipping quantity limitation, and back-end assembly feasibility in order to generate a workable shipping plan. For instance:

In each planning period, the capacity used by each back-end TFT-LCD manufacturing factory should be less than or equal to a capacity limitation quantity.

After inputting the related parameters and the performance index into the industry characteristic planning module 220, primary results received by the front-end process transformation module 221 and the back-end transportation allocation module 223. The primary results include the glass substrate input quantity, the shipping quantity to transport from the front-end TFT-LCD manufacturing factories to the back-end LCM factories, and the total input quantity of semi-finished products received by the back-end LCM factories. In other words, the resource allocation plan for the front-end TFT-LCD manufacturing factories is determined. Furthermore, the resource allocation plan for the back-end LCM factories is determined. In addition, the global logistics plan is determined by the shipping quantity.

Besides the aforementioned primary results, some secondary results are gathered from calculations performed by the module 221 and module 223. These secondary results include a resource remaining quantity, a glass substrate cutting loss area, and an inventory quantity. More specifically, the resource remaining quantity is calculated by using the economical cutting rate transformation module 303, and thereafter using the capacity equivalent transformation module 301 to convert the semi-finished product quantity to the resource remaining quantity. Accordingly, the resource remaining quantity represents a capacity that is available to receive more orders or bypass other orders. The glass substrate loss area for the front-end TFT-LCD manufacturing factories is determined by the cutting loss area transformation module 305. Furthermore, the inventory quantity of semi-finished products at the front-end TFT-LCD manufacturing factories is determined by the economical cutting rate transformation module 303.

FIG. 4 is a flow chart of the method for planning global logistics. Referring to FIG. 4, as depicted in Step S405, the performance index is defined, and a plurality of related parameters is inputted. Thereafter, in Step S410, the semi-finished product quantity is calculated. While calculating the semi-finished product quantity, the capacity equivalent is calculated. The calculation, which references a resource consumption quantity of a standard product, converts the resource quantity into the capacity equivalent. Furthermore, whether each semi-finished product is producible is determined by the manufacturing feasibility parameter. In addition, the glass substrate cutting loss area of each of the front-end TFT-LCD manufacturing factories is calculated by taking into account the glass substrate cutting loss rate.

Thereafter in Step S415, calculation of the shipping quantity for transport from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories is performed respectively. In addition, calculation of the inventory quantity of the semi-finished product at each of the front-end TFT-LCD manufacturing factories is performed. The inventory quantity is limited by the storage quantity at each of the front-end TFT-LCD manufacturing factories.

Thereafter, as shown in Step S420, the total input quantity is calculated according to the semi-finished product quantity received by each of the back-end LCM factories from each of the front-end TFT-LCD manufacturing factories.

FIG. 5A to FIG. 5K are schematic views showing a plurality of input and output data. The basic settings for the present embodiment are as follows: a unit of the planning period is a month (12 planning periods); 4 front-end TFT-LCD manufacturing factories (Fab1-Fab4); 4 back-end LCM factories (LCM1-LCM4); there are 47 products each needing a glass substrate input quantity for each month. Herein, FIG. 5A to FIG. 5H represent input data, while FIG. 5I to FIG. 5K represent output data. When the related parameters shown in FIG. 5A to FIG. 5H are entered into the module 220, calculation by the module 221 and the module 223 arrive at the results shown in FIG. 5I to FIG. 5K.

FIG. 5A, FIG. 5C, FIG. 5D, and FIG. 5E respectively show the economical cutting rate, the glass substrate cutting loss rate, the capacity equivalent, and the manufacturing feasibility of the front-end TFT-LCD manufacturing factories Fab1-Fab4. FIG. 5B shows the market demand. FIG. 5F, FIG. 5G, and FIG. 5H show the shipping parameters. FIG. 5F and FIG. 5G respectively show the shipping feasibility and the shipping quantity limitation for transport between the back-end LCM factories LCM1-LCM4 and the front-end TFT-LCD manufacturing factories Fab1-Fab4. FIG. 5H shows the shipping cost of each product for the back-end factories LCM1-LCM4.

On the other hand, FIG. 5I and FIG. 5J use January as example, while FIG. 5K uses the front-end TFT-LCD manufacturing factory Fab3 as an example. FIG. 5I shows the allocation plan for each product"s glass substrate input quantity at each of the front-end TFT-LCD manufacturing factories Fab1-Fab4. FIG. 5J shows each product"s total input quantity of semi-finished products after January at the back-end LCM factories LCM-LCM4. FIG. 5K shows the shipping quantity of each product that is transported from the front-end TFT-LCD manufacturing factory Fab3 to the back-end LCM factories LCM1-LCM4.

The patents cover driving circuits, backlights, RGB filters, and TFT array processes amongst other technologies, according to the Electronic Engineering Times.

AU Optronics and IBM also entered into a cross licence agreement about their relative LCD patents, allowing them to share those patents TFT LCD globally.

STONE Technologies is a proud manufacturer of superior quality TFT LCD modules and LCD screens. The company also provides intelligent HMI solutions that perfectly fit in with its excellent hardware offerings.

STONE TFT LCD modules come with a microcontroller unit that has a 1GHz Cortex-A8 CPU. Such a module can easily be transformed into an HMI screen. Simple hexadecimal instructions can be used to control the module through the UART port. Furthermore, you can seamlessly develop STONE TFT LCD color user interface modules and add touch control, features to them.

Becoming a reputable TFT LCD manufacturer is no piece of cake. It requires a company to pay attention to detail, have excellent manufacturing processes, the right TFT display technology, and have a consumer mindset.

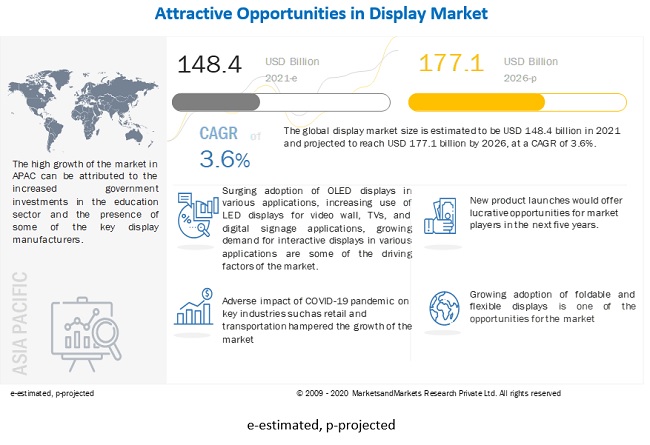

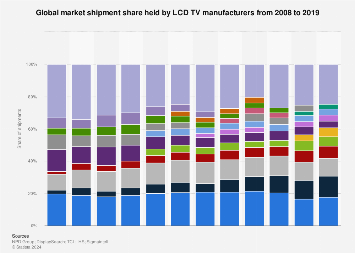

Now, we list down 10 of the best famous LCD manufacturers globally. We’ll also explore why they became among the top 10 LCD display Manufacturers in the world.

In 2019, BOE’s yearly new-patent applications amounted to 9657, of which over 90% are invention patents, amounting to over 70,000 usable patents in total. Data from IFI Claims also shows that BOE has ranked 13th among the Top 50 USPTO (The United States Patent and Trademark Office), Patent Assignees, in 2019. According to the 2019 International PCT Applications of WIPO, BOE ranked No.6 with 1,864 applications.

LG Display is a leading manufacturer of thin-film transistor liquid crystal displays (TFT-LCD) panels, OLED, and flexible displays.LG Display began developing TFT-LCD in 1987 and currently offers Display panels in a variety of sizes and specifications using different cutting-edge technologies (IPS, OLED, and flexible technology).

With innovative and differentiated technologies, QINNOOptoelectronics provides advanced display integration solutions, including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch solutions. Qinnooptoelectronics sets specifications and leads the market. A wide range of product line is across all kinds of TFT LCD panel modules, touch modules, for example, TV panel, desktop and laptop computer monitor with panels, small and medium scale “panels, medical, automotive, etc., the supply of cutting-edge information and consumer electronics customers around the world, for the world TFT – LCD (thin-film transistor liquid crystal display) leading manufacturers.

AU Optronics Co., LTD., formerly AU Optronics Corporation, was founded in August 1996. It changed its name to AU Optronics after its merger with UNIOPtronics in 2001. Through two mergers, AU has been able to have a full range of generations of production lines for panels of all sizes.Au Optronics is a TFT-LCD design, manufacturing, and r&d company. Since 2008, au Optronics has entered the green energy industry, providing customers with high-efficiency solar energy solutions.

Sharp has been called the “father of LCD panels”.Since its founding in 1912, Sharp developed the world’s first calculator and LIQUID crystal display, represented by the living pencil, which was invented as the company name. At the same time, Sharp is actively expanding into new areas to improve people’s living standards and social progress. Made a contribution.

BYD IT products and businesses mainly include rechargeable batteries, plastic mechanism parts, metal parts, hardware electronic products, cell phone keys, microelectronics products, LCD modules, optoelectronics products, flexible circuit boards, chargers, connectors, uninterruptible power supplies, DC power supplies, solar products, cell phone decoration, cell phone ODM, cell phone testing, cell phone assembly business, notebook computer ODM, testing and manufacturing and assembly business, etc.

Tianma microelectronics co., LTD., founded in 1983, the company focus on smartphones, tablets, represented by high order laptop display market of consumer goods and automotive, medical, POS, HMI, etc., represented by professional display market, and actively layout smart home, intelligent wear, AR/VR, unmanned aerial vehicles (UAVs) and other emerging markets, to provide customers with the best product experience.IN terms of technology, the company has independently mastered leading technologies such as LTPS-TFT, AMOLED, flexible display, Oxide-TFT, 3D display, transparent display, and in-cell/on-cell integrated touch control. TFT-LCD key Materials and Technologies National Engineering Laboratory, national enterprise Technology Center, post-doctoral mobile workstation, and undertake national Development and Reform Commission, The Ministry of Science and Technology, the Ministry of Industry and Information Technology, and other major national thematic projects. The company’s long-term accumulation and continuous investment in advanced technology lay the foundation for innovation and development in the field of application.

AUO Corporation ("AUO" or the "the Company") (TAIEX: 2409; NYSE: AUO), one of the world"s top manufacturers of TFT-LCD panels, announced the signing of a patent assignment agreement with International Business Machines Corp ("IBM") today. This transaction will allow AUO to own hundreds of TFT-LCD related patents developed by IBM, some technologies of which are widely adopted in the industry.

With this agreement, approximately 170 United States patents relating to TFT-LCD technology, together with the counterpart patents in Japan, Korea, Taiwan, and other countries, will be transferred to AUO. The patents cover almost all aspects of key TFT-LCD-related technology, including TFT Array process (TFT structure production), Cell process, such as One Drop Fill Technology, RBG Color Filter, Backlight and TFT driving circuit, among others.

Dr. Fan Luo, AUO "s Chief Technology Officer, stated that IBM, as a pioneer in the TFT-LCD industry, commenced research and development in the TFT-LCD technology since the 1980s, of which originated some fundamental key technologies. After IBM exited from TFT-LCD manufacturing in 2001, it still maintained the TFT-LCD related patents. Some of the patents transferred under this transaction were developed by IBM"s research lab in Japan as well as the Yasu manufacturing site, some of which are believed to be widely used in the industry. With the patents assigned, AUO will further strengthen its intellectual property position on both the defensive and offensive aspects.

During the era of Acer Display Technology, AUO has already entered into a technology transfer and license agreement with IBM since 1999, and built Taiwan"s first Generation 3.5 TFT-LCD fabrication facility. The successful partnership paved the way for AUO "s growth in the following years and strengthened the company’s TFT-LCD manufacturing process and development. In a few years thereafter, AUO went on to establish Generation 4, Generation 5, and Generation 6 fabrication production facility – all first in Taiwan.

As Taiwan"s largest and world"s third largest TFT-LCD manufacturer, AU Optronics also leads in Taiwan in the area of intellectual property. As of May 2005, the company owns over 1,100 patents worldwide with over 2,800 patent applications pending. The company is one of the top patent applicants in Taiwan"s optoelectronics industry. Moreover, IFI Claims Patents Services placed AUO as the fifth fastest growing patent applicant in the United States in 2004 with a 98% annual increase. With the patents assigned, the number of AUO "s United States patents will increase from about 200 to about 370.

In recognition of the efforts of the company"s patent engineers and legal staff, the President of AUO, Mr. HB Chen stated, "the efforts made by the AUO Technology Center in developing technologies in flat panel displays are evident, and we have seen the accomplishment of our patent filings in recent years. The transfer of these important fundamental patents from IBM is the largest number of TFT-LCD related patents acquired in Taiwan. It not only elevates the company"s intellectual property position, but also helps us to preserve the interest of our customers."

AU Optronics and IBM also entered into a patent cross license agreement on the same day for a license of the relevant products under other patents owned by both companies.

“LCD is one opportunity for Taiwan in a hundred years. It is a sunrise industry, and it’s really important we make the best of it at the end of the day.” as commented Wen-long Shi, the former Chairman of Chi Mei Corporation. He went on to say, “For the 3C industry (computers, communication and consumer electronics), the LCD can be widely used on any electronic product, from refrigerators, air-conditioners, washing machines, to computers, notebooks or mobile phones, and even cars, traffic signs or wrist watches in the future. It’s not difficult to imagine why the industry is so competitive, as LCD is applied so widely.” In this gigantic industrial chain connected by LCD technology, tons of billion dollars change hands from upstream to downstream, and LCD global production value in 2011 alone exceeded one hundred billion dollars. In this completely open market, the frequent patent infringement disputes and licensing problems have become a patent game which every LCD player has to face.

This author has collected and compiled publicly available LCD patent cases published before July 2012, of which the patent infringement cases were from Westlaw database, while licensing information, due to confidentiality reasons, was obtained mainly from news media. LCD patent disputes came into public view in 2000 when the Japanese company Sharp sued Chunghwa Picture Tubes for LCD-related infringement in Taiwan. In 2002 it again sued Chunghwa in Japan for infringing three of its patented techniques in LCD driver programs and LSI setup, for an injunction against latter from importing, and against any sale, offer for sale, display, advertisement or promotion of LCDs using such technologies. Again in 2000, Plasma Physics and Solar Physics, an American NPE (non-practicing entity), sued 9 parties including Sharp and NEC in various courts for patent infringement.

First, there is a criss-cross multilayer game in the production chain. Generally speaking, direct competing relationship exists among business competitors, and players on the same level are more likely to be competitors, among whom patent suits take place. That is not the case in the LCD industry, however, where patent disputes among players on different levels are very constant. The LCD industry can be roughly divided into three levels, namely, the upstream suppliers, including suppliers of equipment, materials, glass strata, driver ICs, optical membranes, and backlight sources, such as Corning and Anvik; the midstream panel manufacturers, representative companies including Samsung, LG, Innolux, AUO and BOE; and the downstream OEM manufacturers, mostly those that mount LCD panels to display equipment, such as Sony, Vizio, as well as Samsung, LG and Sharp. On September 17th 2003, Sharp filed a lawsuit in Californian district court, alleging patent infringement of its LCD technology against BenQ and Viewsonic, which were downstream compani e s t h a t used pane l s from AUO. In 2005, the U.S. glass manufacturer, Guardian, sued AUO, Chi Mei Corporation, Chunghwa Picture Tubes, Dell, Acer and AOC in the U.S., which were all downstream LCD manufacturers. On January 24th 2011, Sharp took simultaneous actions both in the ITC and in federal district court in Delaware against BenQ, Haier, LG, Sanyo, TCL, TTE and Vizio, for using allegedly infringing panels from AUO. On June 6th 2011, a German backlight source manufacturer, OSRAM, filed complaints both at ITC and district court in Delaware against Samsung and LG for infringement of its LED patents. On April 7th 2011, Seiko Epson sued toymakers Leapfrog and Mattel for using LCD modules from Taiwanese Giantplus Technology.

Second, new aspects are added to the game. Generally the patent game can be either patent lawsuits or patent licensing. The LCD industry has fully expounded in these two aspects. In recent years, more is added to the game, including filing patent litigation, responding and counter claiming, as well as a Section 337 investigations and customs recording. For example, during a three-year patent duel, Samsung first requested a Section 337 investigation with ITC against Sharp on December 21st 2007. After a year and a half, Samsung prevailed at ITC which found Sharp infringing two of Samsung’s patents (US6937311 and US6771344). Patent licensing comes in a variety of forms. There are primarily three cooperative modes in the panel industry: 1. Technical licensing, which is the most commonly applied form of technical cooperation. Examples include AUO’s announcement of 170 IBM TFT-LCD licenses in the US on June 30th 2005, and Samsung’s cross-licensing with Sharp after the extended patent war. 2. Joint ventures. Examples are AUO and AOC that entered into a joint venture agreement to establish companies in Poland and Brazil for manufacturing and selling LCD modules; and Samsung and Sony that joint established the panel joint venture S-LCD (however, Sony announced its total withdrawal in December 2001 for the failure of the joint venture). 3. Strategic cooperation. Examples are Hon Hai Precision Industry and Vizio that formed a strategic alliance to jointly enter the TV market in the North America; and Sharp formed a strategic alliance with Hon Hai Corporation by selling to the latter 46.5% of the shares of its Sakai Display Products (SDP).

Third, friends or foes, it depends. In the business world, there are no permanent friends, nor permanent enemies. Participants in the LCD industry may be partners today, but start to sue each other tomorrow. In January 2006, Samsung entered into an extensive cross-licensing agreement with AUO with respects to TFT-LCD and OLED-related patents. But, just before the end of the agreement, it sued AUO, together with AUO’s downstream clients, for patents infringement, at the ITC and district courts in Delaware and North California. Through the actions, as it can be said, Samsung intended to urge AUO to enter into a new crosslicensing as soon as possible. Finally on January 6th 2012, AUO announced its settlement with Samsung, whereby the parties agreed to continue to grant licenses to each other and withdraw their actions against each other, to end their LCD patent controversy.

Settlement is the preferred option. This author notices upon study that there are 300,000 LCD patent applications globally, some of which carry multiple national applications. Any given LCD panel may incorporate up to 1,000 patents, which means no one manufacturer can keep walking within the territory of its own patents, without stepping on the domain of the competitors. The best way for the LCD players to navigate through these patent entanglements as fast as possible, is to get your own patents first, then bargain the litigation through negotiation for a balancing point so as to settle for a solution. From the Samsung and Sharp controversy, to the numerous lawsuits between Sharp and AUO, and to the dispute between Innolux and Sony, statistics show that nearly 55% of such cases were settled either in or out of court, regardless of the duration and the process involved.

Concentration is in U.S. forums. Because the U.S. market is most attractive to manufacturers for its revenue-generating ability on the global scale, its judicial system being well established, and its robust protection of intellectual property, all LCD manufacturers would like to get their cases in US courts. Sharp, LG, 02Micro, Anvik, Semiconductor Energy Lab of Japan and Atomic Energy Lab of France favor filing lawsuits in US district courts, while Samsung, Sharp, Innolux, AUO and BenQ are the mostly sued, 10 times on average, in the country.

NPEs are the more troublesome. The party that raises an action for patent infringement is mostly a midstream panel maker, an upstream supplier, an R&D institution or an NPE. NPEs (or patent trolls) are often deemed as patent licensing companies. They never produce or sell any product, but obtain patents independently or through acquisition. They aim to profit by collecting royalties or compensations from manufacturers, mostly by means of licensing negotiation or patent litigation. They are the most dangerous to manufacturers for two reasons. First, it is generally easy for a company to know the patent portfolio of its competitors, so that it can formulate a strategy to avoid those patents in advance. But, it is almost impossible to know how many cards an NPE has in hand, as it often registers a number of subsidiaries. Second, if sued by a competitor, a company may settle it through cross-licensing. But, an NPE, having no actual products but patents, is not interested in cross-licensing. It goes after monetary damages only.

The recent NPE stories include a few cases of Modis Technology Ltd. from Britain against Innolux in the US from 2007 to 2012, Thomson Licensing in France against Innolux or AUO under Section 337 in 2010, Advanced Display Technologies of Texas in the US against 13 top global manufacturers of panels, computers and mobile phones, including AUO, Sharp, Vizio, Viewsonic, Haier, ASUS and Apple in 2011, where ADT alleged that the 13 manufacturers infringed its display patents; Technology Licensing Corporation in the US vs. ASUS and Westinghouse Electric on account of 3 of its patents being infringed; Yield Boost Tech, a Californian technical consultation and solution provider, vs. Applied Materials, the world’s largest semiconductor equipment supplier, on account of one of its patents being infringed, at the Eastern Californian court.

In 2011, the top five LCD panel makers in the world, according to their market shares, were LG, Samsung, Innolux (the new Chi Mei), AUO and Sharp. As shown, they attack and are attacked the most often with respect to the patent game of the LCD industry. As this patent game cannot be avoided even by the industrial leaders, then how about the situation of enterprises in the Mainland China? It is a surprise to find that among representative Chinese LCD manufacturers, such as BOE, CSOT, Tianma, Panda and IVO, only BOE’s subsidiary in South Korea, BOEHYDIS, was ever sued by the glassmaker Guardian in the U.S. in 2005. No other Chinese enterprises are found in the patent game. Do they own all the intellectual property rights? Is their technical leadership so powerful as to keep themselves out of the patent wrestle? Both answers are absolutely “no.” This author considers a few possible reasons. Some of them purchase whole production lines, new or used, directly from foreign manufacturers, so that they pay the royalty up front. The others reach a technical licensing agreement with foreign manufacturers in private, so that they pay the royalty but do not publish the information due to confidentiality reasons. Moreover, as most Chinese enterprises have limited market shares and their products are at the lower end, they do not create a real threat to foreign competitors in overseas markets.

The market status determines whether a company is worth being sued by other companies for patent infringement. In other words, if a company has never encountered any patent lawsuit, it does not mean it’s litigation proof, but that its status is not high enough. After all, with respect to the 300,000 patent applications globally in the LCD industry every year, no one manufacturer could work within its own sphere of patents without stepping on the area of domain of the other competitors.

With the support in policy and finance from the government, Chinese LCD manufacturers have been growing up. As international panel makers, particularly Samsung and LG, begin to shift their attention to OLED panels, this will very likely leave an opportunity for Chinese enterprises to acquire the global LCD market. For their greater market shares and better profiting situation, Chinese LCD manufacturers will face more criticism in intellectual property from international competitors. They must get themselves ready for coming challenges.

The LCD industry is intensive in both finance and technology and its growth cannot be without government support. When arranging the industry from upstream to downstream or causing the industry to integrate, the government should focus on promoting technical consolidation among enterprises. For technical consolidation, the government should act early to collect relevant information and intelligence with respect to patenting strategies in the LCD area, and study and analyze patent-related litigations. It can be said that a core step of consolidation is to consolidate patent assets. To understand the industrial patent game in an overall way helps enhance Chinese enterprises’ ability to use and protect their patents.

China is home to various TFT LCD panel manufacturers, all offering exceptional services and high-end products. China remains one of the top sources for TFT LCD panel manufacturing, as they have been producing some of the best quality panels available on the market. Many Chinese technology companies specialize in providing these superior TFT LCDs, and several of them have even managed to make it into the top ten list of China"s leading TFT LCD panel producers. These companies are known for their efficient service, impressive product lineup, reliability, innovative approach to design, and customer service excellence. If you are looking for an excellent China-based supplier for TFT LCD panels, it would be wise to consider one of these top 10 China TFT LCD manufacturers.

China is a leading producer of TFT LCD panels, with industry leaders such as BOE Technology Group Co., Ltd. (BOE) at the forefront of innovation. Founded in 1993, BOE has developed a comprehensive business structure featuring port products and services for information exchange as well as healthcare solutions like its revolutionary MLED technology. In 2021, BOE boasted an impressive 70,000 independent patent applications, and more than 90% of its new patent applications are for invention patents. Additionally, over 35% of those inventions" patents can be found overseas in the United States, Europe, Japan, South Korea, and other countries. China"s TFT LCD panel manufacturers continue developing their technology by innovating on existing models such as LCD screens and LCD panels to provide better solutions for customers worldwide.

China-based Tianma is a highly reputable TFT LCD panel manufacturer with over 30 years of expertise in the display solutions industry. Since 1983, the company has grown to become a trusted China TFT LCD panel provider, and in 1995, it obtained a public listing on China"s Shenzhen Stock Exchange. With tech and production capabilities at the top of their game, Tianma specializes in SLT-LCD, LTPS TFT-LCD, AMOLED, In-cell/On-cell integrated touch technology, Flexible Displays, Force Touch TED Plus, fingerprint recognition under/on-screen and Mini/Micro LED segments. They have set the benchmark for future innovative developments in terms of LCD panels, LCD screens, and more. Offering unbeatable support services around the globe that are coupled with advanced technology makes Tianma a forerunner for China TFT LCD panel manufacturers.

China"s IVO is one of the top 10 China TFT LCD panel manufacturers and has been making a name for itself since 2005. From its Kunsan Jiangsu base, it now employs more than 3000 staff, including 400 dedicated R&D employees. IVO also boasts a G-5 TFT panel production line, and its products are used in a variety of cutting-edge applications: 60% for notebook displays, 23% for smartphones, and 11% for automotive uses. This makes it an important player in the China TFT LCD market as well as gaining great recognition worldwide in the notebook display industry.

With China being one of the leading suppliers in the global TFT LCD market, 4th in the top 10 manufacturers is TCL CSOT. This China TFT LCD panel manufacturer has been expanding its production capacity with continuous developments in technology and gaining a more solid global presence. According to the latest TV shipment stats, China"s CSOT has ranked 3rd in the world for producing TVs and 1st for supplying domestic 6 major brands since 2014. Furthermore, it holds strong places on the world scale when it comes to 55-inch UD product shipments (1st worldwide) and 32-inch UD product shipments (2nd). G6 LTPS-LCD production line is also amongst its highly lauded products, boasting second place in small and medium sizes with the most accelerated growth rate. Focused on independent innovation-driven development, TCLCSOT reinforces its position as China"s leader in TFT LCD screen technology by accumulating 12185 patent applications since 2019.

China"s TFT LCD panel manufacturer, Truly Semiconductor Co., Ltd., was established in 1991 and dedicated to TN-LCD production and became the first China-based CSTN/LCD line producer in 1995. In 2003 they obtained the OLED patents from Kodak, followed by mass production of TFT-LCD modules in 2012 and breakthrough technology in mobile 3D displays. Their 2013 production launch of naked-eye 3D displays for phones and tablet computers solidified their position as China"s top 10 TFT LCD manufacturers. To expand its portfolio further, it invested in Truly (Huizhou) Smart Display Co., Ltd., which specializes in G4.5 AMOLED and TFT displays. Truly sets an example for China"s other TFT LCD panel manufacturers through its sustained 25 years of research and development, innovation, and brand recognition.

Foxconn Technology Group founded China’s TFT LCD panel manufacturing company, Innolux, in 2003. With its headquarters and factory located in Longhua Foxconn Technology Park in Shenzhen and over 14 production bases situated across China like Nanjing, Ningbo and Foshan, Innolux is known for its comprehensive vertical integration that enables cutting-edge display technology research and development. The high quality and reliability of TFT LCD panels manufactured by Innolux have made them available to be used by some of the major global electronics giants like Apple, Lenovo, Hewlett-Packard Panda, Nokia, and Motorola. Furthermore, its amalgamation with Chi Mei Electronics and Tong Bao Optoelectronics in March 2010 has led to a significant improvement in the level of the world plane display industry.

Founded in 2001, China"s top 3 TFT LCD panel manufacturer HKC has come a long way since its inception. The company designs, manufactures, and markets a full range of TFT LCDs from 1 inch to 60 inches with an annual sales amount reaching up to half a billion USD. As it looks for global expansion opportunities, HKC has established branch companies in Russia and India and formed strategic relationships with customers worldwide. In 2010, the China-based firm moved into a new industrial park and is now capable of producing 1 million displays per month. Thanks to advanced technologies and excellent quality control standards, HKC has been praised by its customers both at home and abroad and continues to prove itself as a reliable China TFT LCD panel manufacturer.

Panda is one of China"s top 10 TFT LCD manufacturers, utilizing cutting-edge technology from China Electronics (CEC) to offer a wide range of products such as crystal resonators, thermal-sensitive crystals, ordinary oscillators, voltage-controlled oscillators, and temperature-compensated oscillators. These are used in various applications of TFT LCD screens that can be found in products like LCD TVs, monitors, and laptops. Panda studies customers" requirements with utmost care and provides reliable services and quality products. With the help of its diverse pricing strategy, it assists its clients in finding value for their money across global markets.

China has a flourishing automotive technology industry, and Eagle Tech is one of China"s top ten TFT LCD panel manufacturers. They understand the special requirements of their use environment, such as moisture-proof, dust-proof, anti-glare, high brightness, sun leakage resistance, and temperature resistance, in order to ensure the optimal performance of their displays. Having years of experience in providing Resistive touch screens, PCAP touch screens, and IPS panels make Eagle Tech the trusted electronic display manufacturer for automotive technologies to meet consumer expectations.

China is the leading source of TFT LCD panel manufacturers, and Eagle Tech has been making a name for itself as one of China"s top 10 TFT LCD manufacturers. Not only do they offer quality automotive TFT LCDs in sizes ranging from 3.5" to 21.5", but their products boast excellent durability as well; if you are looking for a reliable China TFT LCD provider that can deliver quality products for your applications, look no further than Eagle Tech.

TFT LCD manufacturing is an incredibly important part of the technology industry, and Century Technology (Shenzhen) Co., Ltd. (CTC) is one of China"s top 10 TFT LCD manufacturers. In addition, CTC invests in global optoelectronics industry personnel who specialize in TFT-LCD research and development, as well as manufacturing display panel products such as laptops, PCs, monitors, and LCD TVs. The production line project was installed during the eleventh five-year plan to position CTC at the forefront of TFT-LCD production lines for the Pearl River Delta region. Looking ahead to late 2008, this ambitious project will be put into action – it is sure to leave a lasting impact on the growth of TFT production globally.

China is the world"s largest producer and exporter of TFT LCD panels, making it a great resource for any company looking to purchase them. China is home to some of the world"s most respected TFT LCD manufacturers, with the top 10 China-based TFT LCD panel manufacturers providing displays that consistently exceed industry requirements. All ten have been commended for their amazing product designs, expertise, and quality standards. Collectively, these companies serve customers all over the world by producing panels that are reliable and high-performance – making China an important resource for businesses seeking out cost-effective TFT LCD panels.

China is quickly becoming the leader in TFT LCD technology. The top 10 China TFT LCD manufacturers are a testament to this, as they provide outstanding quality at competitive prices without sacrificing any of the standards that people have grown to expect from China"s expertise and craftsmanship.

It"s clear that China is fast becoming an unstoppable force when it comes to LCD panel production and innovative screen solutions. With its ability to make efficient panels for various applications, China is respected around the world for its skillful production of TFT LCD panels and screens. Additionally, with these reliable manufacturers trying to ensure maximum customer satisfaction with competitive pricing and high-quality products, China has become a trusted source of LCD screens worldwide.

In 2006, it merged with Quanta Display Inc. to create a larger TFT-LCD manufacturer with a leading position in the world"s TFT-LCD market. AUO is the first TFT-LCD manufacturer to be successfully listed on the New York Stock Exchange (NYSE). AUO extended its market to the green energy industry in late 2008. The display and solar businesses were established as the company"s two core businesses in 2010.

In China. The biggest LCD panel manufacturer in the world now. BOE has G4 (Chengdu), G5 (Beijing), G5.5 (Ordos), G6 (Hefei, Chengdu, Mianyang, Dalian), G8 (Beijing, Hefei, Chongqing), Fuqing, Dalian, Chongqing) and 10.5 (Hefei) production lines.

In Taiwan. One of the daughter company of Foxconn/Hon Hai. In 2010, it bought the then famous LCD manufacturer, ChiMei, then changed its name to Innolux. It has G7.5 production lines.

In Korea and China. It is used to be the 2nd biggest TFT LCD manufacturers. LG also planned to stop the production but delayed the plan after the price increased. LG has G7.5 and G8.5 (Guangzhou) production lines.

In Korea. It used to be the biggest TFT LCD manufacturers before it was dethroned by BOE in 2019. Because of tough competition, Samsung planned to stop the production in 2021 but delayed because the price increase during the pandemic. Samsung has G7 and G8.5 production lines.

In Japan and China. The pioneer and queen of LCD industry. Because of high cost and tough competitor, Sharp was acquired by Foxconn/Hon Hai in 2016. Sharp has G8, G8.5(Suzhou), G10, G10.5 (Guangzhou) production lines.

This author has collected and compiled publicly available LCD patent cases published before July 2012, of which the patent infringement cases were from Westlaw database, while licensing information, due to confidentiality reasons, was obtained mainly from news media. LCD patent disputes came into public view in 2000 when the Japanese company Sharp sued Chunghwa Picture Tubes for LCD-related infringement in Taiwan. In 2002 it again sued Chunghwa in Japan for infringing three of its patented techniques in LCD driver programs and LSI setup, for an injunction against latter from importing, and against any sale, offer for sale, display, advertisement or promotion of LCDs using such technologies. Again in 2000, Plasma Physics and Solar Physics, an American NPE (non-practicing entity), sued 9 parties including Sharp and NEC in various courts for patent infringement.

First, there is a criss-cross multilayer game in the production chain. Generally speaking, direct competing relationship exists among business competitors, and players on the same level are more likely to be competitors, among whom patent suits take place. That is not the case in the LCD industry, however, where patent disputes among players on different levels are very constant. The LCD industry can be roughly divided into three levels, namely, the upstream suppliers, including suppliers of equipment, materials, glass strata, driver ICs, optical membranes, and backlight sources, such as Corning and Anvik; the midstream panel manufacturers, representative companies including Samsung, LG, Innolux, AUO and BOE; and the downstream OEM manufacturers, mostly those that mount LCD panels to display equipment, such as Sony, Vizio, as well as Samsung, LG and Sharp. On September 17th 2003, Sharp filed a lawsuit in Californian district court, alleging patent infringement of its LCD technology against BenQ and Viewsonic, which were downstream compani e s t h a t used pane l s from AUO. In 2005, the U.S. glass manufacturer, Guardian, sued AUO, Chi Mei Corporation, Chunghwa Picture Tubes, Dell, Acer and AOC in the U.S., which were all downstream LCD manufacturers. On January 24th 2011, Sharp took simultaneous actions both in the ITC and in federal district court in Delaware against BenQ, Haier, LG, Sanyo, TCL, TTE and Vizio, for using allegedly infringing panels from AUO. On June 6th 2011, a German backlight source manufacturer, OSRAM, filed complaints both at ITC and district court in Delaware against Samsung and LG for infringement of its LED patents. On April 7th 2011, Seiko Epson sued toymakers Leapfrog and Mattel for using LCD modules from Taiwanese Giantplus Technology.

Second, new aspects are added to the game. Generally the patent game can be either patent lawsuits or patent licensing. The LCD industry has fully expounded in these two aspects. In recent years, more is added to the game, including filing patent litigation, responding and counter claiming, as well as a Section 337 investigations and customs recording. For example, during a three-year patent duel, Samsung first requested a Section 337 investigation with ITC against Sharp on December 21st 2007. After a year and a half, Samsung prevailed at ITC which found Sharp infringing two of Samsung’s patents (US6937311 and US6771344). Patent licensing comes in a variety of forms. There are primarily three cooperative modes in the panel industry: 1. Technical licensing, which is the most commonly applied form of technical cooperation. Examples include AUO’s announcement of 170 IBM TFT-LCD licenses in the US on June 30th 2005, and Samsung’s cross-licensing with Sharp after the extended patent war. 2. Joint ventures. Examples are AUO and AOC that entered into a joint venture agreement to establish companies in Poland and Brazil for manufacturing and selling LCD modules; and Samsung and Sony that joint established the panel joint venture S-LCD (however, Sony announced its total withdrawal in December 2001 for the failure of the joint venture). 3. Strategic cooperation. Examples are Hon Hai Precision Industry and Vizio that formed a strategic alliance to jointly enter the TV market in the North America; and Sharp formed a strategic alliance with Hon Hai Corporation by selling to the latter 46.5% of the shares of its Sakai Display Products (SDP).

Third, friends or foes, it depends. In the business world, there are no permanent friends, nor permanent enemies. Participants in the LCD industry may be partners today, but start to sue each other tomorrow. In January 2006, Samsung entered into an extensive cross-licensing agreement with AUO with respects to TFT-LCD and OLED-related patents. But, just before the end of the agreement, it sued AUO, together with AUO’s downstream clients, for patents infringement, at the ITC and district courts in Delaware and North California. Through the actions, as it can be said, Samsung intended to urge AUO to enter into a new crosslicensing as soon as possible. Finally on January 6th 2012, AUO announced its settlement with Samsung, whereby the parties agreed to continue to grant licenses to each other and withdraw their actions against each other, to end their LCD patent controversy.

Settlement is the preferred option. This author notices upon study that there are 300,000 LCD patent applications globally, some of which carry multiple national applications. Any given LCD panel may incorporate up to 1,000 patents, which means no one manufacturer can keep walking within the territory of its own patents, without stepping on the domain of the competitors. The best way for the LCD players to navigate through these patent entanglements as fast as possible, is to get your own patents first, then bargain the litigation through negotiation for a balancing point so as to settle for a solution. From the Samsung and Sharp controversy, to the numerous lawsuits between Sharp and AUO, and to the dispute between Innolux and Sony, statistics show that nearly 55% of such cases were settled either in or out of court, regardless of the duration and the process involved.

Concentration is in U.S. forums. Because the U.S. market is most attractive to manufacturers for its revenue-generating ability on the global scale, its judicial system being well established, and its robust protection of intellectual property, all LCD manufacturers would like to get their cases in US courts. Sharp, LG, 02Micro, Anvik, Semiconductor Energy Lab of Japan and Atomic Energy Lab of France favor filing lawsuits in US district courts, while Samsung, Sharp, Innolux, AUO and BenQ are the mostly sued, 10 times on average, in the country.

NPEs are the more troublesome. The party that raises an action for patent infringement is mostly a midstream panel maker, an upstream supplier, an R&D institution or an NPE. NPEs (or patent trolls) are often deemed as patent licensing companies. They never produce or sell any product, but obtain patents independently or through acquisition. They aim to profit by collecting royalties or compensations from manufacturers, mostly by means of licensing negotiation or patent litigation. They are the most dangerous to manufacturers for two reasons. First, it is generally easy for a company to know the patent portfolio of its competitors, so that it can formulate a strategy to avoid those patents in advance. But, it is almost impossible to know how many cards an NPE has in hand, as it often registers a number of subsidiaries. Second, if sued by a competitor, a company may settle it through cross-licensing. But, an NPE, having no actual products but patents, is not interested in cross-licensing. It goes after monetary damages only.

The recent NPE stories include a few cases of Modis Technology Ltd. from Britain against Innolux in the US from 2007 to 2012, Thomson Licensing in France against Innolux or AUO under Section 337 in 2010, Advanced Display Technologies of Texas in the US against 13 top global manufacturers of panels, computers and mobile phones, including AUO, Sharp, Vizio, Viewsonic, Haier, ASUS and Apple in 2011, where ADT alleged that the 13 manufacturers infringed its display patents; Technology Licensing Corporation in the US vs. ASUS and Westinghouse Electric on account of 3 of its patents being infringed; Yield Boost Tech, a Californian technical consultation and solution provider, vs. Applied Materials, the world’s largest semiconductor equipment supplier, on account of one of its patents being infringed, at the Eastern Californian court.

In 2011, the top five LCD panel makers in the world, according to their market shares, were LG, Samsung, Innolux (the new Chi Mei), AUO and Sharp. As shown, they attack and are attacked the most often with respect to the patent game of the LCD industry. As this patent game cannot be avoided even by the industrial leaders, then how about the situation of enterprises in the Mainland China? It is a surprise to find that among representative Chinese LCD manufacturers, such as BOE, CSOT, Tianma, Panda and IVO, only BOE’s subsidiary in South Korea, BOEHYDIS, was ever sued by the glassmaker Guardian in the U.S. in 2005. No other Chinese enterprises are found in the patent game. Do they own all the intellectual property rights? Is their technical leadership so powerful as to keep themselves out of the patent wrestle? Both answers are absolutely “no.” This author considers a few possible reasons. Some of them purchase whole production lines, new or used, directly from foreign manufacturers, so that they pay the royalty up front. The others reach a technical licensing agreement with foreign manufacturers in private, so that they pay the royalty but do not publish the information due to confidentiality reasons. Moreover, as most Chinese enterprises have limited market shares and their products are at the lower end, they do not create a real threat to foreign competitors in overseas markets.

The market status determines whether a company is worth being sued by other companies for patent infringement. In other words, if a company has never encountered any patent lawsuit, it does not mean it’s litigation proof, but that its status is not high enough. After all, with respect to the 300,000 patent applications globally in the LCD industry every year, no one manufacturer could work within its own sphere of patents without stepping on the area of domain of the other competitors.

With the support in policy and finance from the government, Chinese LCD manufacturers have been growing up. As international panel makers, particularly Samsung and LG, begin to shift their attention to OLED panels, this will very likely leave an opportunity for Chinese enterprises to acquire the global LCD market. For their greater market shares and better profiting situation, Chinese LCD manufacturers will face more criticism in intellectual property from international competitors. They must get themselves ready for coming challenges.

The LCD industry is intensive in both finance and technology and its growth cannot be without government support. When arranging the industry from upstream to downstream or causing the industry to integrate, the government should focus on promoting technical consolidation among enterprises. For technical consolidation, the government should act early to collect relevant information and intelligence with respect to patenting strategies in the LCD area, and study and analyze patent-related litigations. It can be said that a core step of consolidation is to consolidate patent assets. To understand the industrial patent game in an overall way helps enhance Chinese enterprises’ ability to use and protect their patents.

With $19 billion in revenue, they are the world’s second largest OLED vendor and the biggest seller of flat panel displays. They are China"s most advanced display technologies company - the only one equipped to produce LCDs in the 6th generation category or above.

Compared to their predecessors, TFT-LCDs are capable of delivering better contrast ratios and refresh rates. Today, they are widely used in televisions, laptops displays, monitors, and mobile phones.

The Americans pioneered the technology at RCA and Westinghouse, but the Japanese and South Koreans were the first to commercialize it. Thus they held first-mover advantage and their firms do

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey