patents tft lcd globally in stock

The present invention generally relates to a capacity allocation method, and more particularly to a system and method of planning global logistics for a TFT-LCD manufacturing industry.

Being aware of multiple competitors investing in next generational capacities and the labor costs involved, TFT-LCD panel manufacturers usually perform front-end manufacturing at the technology-intensive place. On the other hand, LCD Module (LCM) assembly is performed at the place of demand. Practically, experience dominates the capacity allocation strategy for specifying the appropriate products to produce at a specific manufacturing location. Therefore, the aforementioned techniques affect the performance of the enterprises.

The present invention is directed to a method and a system for planning a global logistics system of a TFT-LCD manufacturing industry, thereby obtain a global logistical and capacity allocation plan.

The present invention provides a global logistics system for a TFT-LCD manufacturing industry suitable for globally allocating among multiple front-end TFT-LCD manufacturing factories and multiple back-end LCM factories. The front-end TFT-LCD manufacturing factories generate multiple semi-finished products. The back-end LCM factories receive these semi-finished products for module assembly. The global logistics system includes an input module and an industry characteristic planning module that has a front-end process transformation module and a back-end transportation allocation module. The input module is used for selecting a performance index and for entering the related parameters. The industry characteristic planning module is used for receiving the performance index and the related parameters. Herein, the front-end process transformation module calculates each semi-finished product quantity at each of the front-end TFT-LCD manufacturing factories. The calculation is performed according to the manufacturing parameters in order to estimate a glass substrate input quantity for each of the front-end TFT-LCD manufacturing factories. The back-end transportation allocation module calculates a shipping quantity. The shipping quantity of each semi-finished product is transported from each front-end TFT-LCD manufacturing factory to each back-end LCM factory. The back-end transportation allocation module calculates the total input quantity of semi-finished products received by each of the back-end LCM factories from each of the front-end TFT-LCD factories.

In one embodiment of the present invention, the aforementioned front-end process transformation module includes a capacity equivalent transformation module, an economical cutting rate transformation module, a cutting area loss transformation module, a manufacturing feasibility evaluation module, a demand limitation module, and a front-end resource limitation module. The capacity equivalent transformation module references a resource consumption quantity for manufacturing standard product in order to convert the resource consumption quantity into a capacity equivalent. The economical cutting rate transformation module calculates a glass substrate input quantity according to the semi-finished product cutting rate. The cutting area loss transformation module calculates a glass substrate loss area. The manufacturing feasibility evaluation module is used for determining whether the semi-finished products can be produced in each of the front-end TFT-LCD manufacturing factories. The demand limitation module limits the semi-finished product quantity. The front-end resource limitation module limits the semi-finished product quantity.

In one embodiment of the present invention, the aforementioned back-end transportation allocation module includes a shipping quantity distribution module, an input quantity calculation module, an inventory transformation module, an inventory limitation module, and a back-end resource limitation module. Herein, the shipping quantity distribution module calculates the shipping quantity of each semi-finished product from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories. The input quantity calculation module calculates a total input quantity of the semi-finished products for each of the back-end LCM factories. The semi-finished product inventory transformation module calculates the inventory quantity of each semi-finished product. The inventory limitation module limits the inventory quantity according to a storage space. The back-end resource limitation module limits a product quantity according to the available capacity.

In another perspective, the present invention provides a method for planning global logistics of a TFT-LCD manufacturing industry that is suitable for multiple front-end TFT-LCD manufacturing factories and multiple back-end LCM factories, where the front-end TFT-LCD manufacturing factories produce multiple semi-finished products, and where the back-end LCM factories receive the semi-finished products for module assembly. In the method of the present invention, a performance index and a plurality of related parameters are entered. The related parameters include manufacturing parameters and shipping parameters. Thereafter, each semi-finished product quantity at each of the front-end TFT-LCD manufacturing factories is calculated. Thereafter, respective calculations of a shipping quantity of each semi-finished product to transport from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories are performed. Thereafter, the total input quantity of the semi-finished products is calculated.

In one embodiment of the present invention, the aforementioned process of the semi-finished product quantity calculation includes calculating the capacity equivalent. Furthermore, whether each semi-finished product is producible at each front-end TFT-LCD manufacturing factory is determined. A cutting area loss transformation module calculates a glass substrate loss area for the semi-finished products.

After the aforementioned process of calculating the shipping quantity of each semi-finished product, an inventory quantity at each of the front-end TFT-LCD manufacturing factories is calculated.

In one embodiment of the invention, the aforementioned inventory calculation process can be limited according to a storage space at each of the front-end TFT-LCD manufacturing factories.

In summary, embodiments of the present invention may generate a production plan for the front-end TFT-LCD manufacturing factories, a resource allocation plan for the back-end LCM factories, and a shipping plan for transportation between the front-end and back-end factories. Accordingly, production costs are substantially lowered due to more efficient global logistics planning.

Practically, production planning for the TFT-LCD manufacturing industry is usually performed by spreadsheet software while capacity allocation is determined by experience. The aforementioned technique results in performance limitations in businesses. In light of the foregoing, in order to more effectively reduce production costs, the present invention provides a system and a method of planning global logistics of a TFT-LCD manufacturing industry. In order to facilitate the descriptions, the embodiments below use the TFT-LCD manufacturing industry as an example.

FIG. 1 is a schematic view of a global logistics environment in accordance with one embodiment of the present invention. Referring to FIG. 1, an enterprise has determined a production quantity from analyzing customer orders and historical data. Input data is represented by various sized product quantities of each period. A production need is allocated to each of front-end TFT-LCD manufacturing factories.

The work environment of the TFT-LCD manufacturing industry can be partitioned into two stages: a first stage involves setting a glass substrate input quantity and a resource allocation for each of the front-end TFT-LCD manufacturing factories 1˜n; a second stage involves capacity logistics planning, which requires determining an optimal logistics allocation plan and thereafter, using the allocation plan to transport semi-finished products to the back-end LCM factories 1˜m for module assembly.

The first stage includes the following industry characteristics. A capacity calculation is based on a capacity for producing a standard product, as well as a capacity equivalent for producing other products. When producing a panel, capacity utilization takes into account an economical cutting rate. Moreover, various degrees of glass substrate loss can occur since different front-end TFT-LCD manufacturing factories utilize different economical cutting rates.

In addition, the second stage includes the following characteristics. The semi-finished products are produced by the array and cell processes, and they are stored as panels at the front-end TFT-LCD manufacturing factories awaiting transport to the back-end LCM factories for module assembly. A shipping quantity between the TFT-LCD manufacturing factories and LCM factories is determined.

In addition to the manufacturing parameters and the shipping parameters, the related parameters further includes a front-end TFT-LCD manufacturing factory generation number, economical cutting rate, and glass substrate cutting loss rate. In addition, a planning period index is included for determining the long-term capacity allocation. A factory index is included for determining each front-end TFT-LCD manufacturing factories and the back-end LCM factories. A product type index is applied for determining the number of product types to allocate.

In addition, the industry characteristic planning module 220 is adapted for receiving the performance index and the related parameters. Herein, the front-end process transformation module 221 calculates the semi-finished product quantity for estimating the glass substrate input quantity. The calculation references the performance index and is performed according to the manufacturing parameters. The back-end transportation allocation module 223 respectively calculates a shipping quantity of each semi-finished product to transport from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories. The back-end transportation allocation module 223 calculates the semi-finished product quantity received by each of the back-end LCM factories from each of the front-end TFT-LCD manufacturing factories.

The economical cutting rate transformation module 303 calculates the glass substrate input quantity according to the semi-finished product quantity. Since different generation manufacturing factories use specific size of panel, producing products of different sizes results in a different economical cutting rate. Accordingly, during resource allocation for the TFT-LCD manufacturing industry, utilizing rates are considered for their economical benefit. During production, conversion between the glass substrate input quantity and the semi-finished product quantity is performed by considering the glass substrate area, the product size, and the product quantity at each generation factory. The conversion can be described as:

A manufacturing feasibility evaluation module 307 is used for determining whether the semi-finished products can be produced. The determination is made by using a manufacturing feasibility parameter. In general, not all front-end TFT-LCD manufacturing factories have the capability to produce products of all sizes under the consideration of production technology.

In each planning period, the capacity used by each front-end TFT-LCD manufacturing factory should be less than or equal to ep,i, a capacity limiting quantity.

Furthermore, in the back-end transportation allocation module 223, the shipping quantity distribution module 313 respectively calculates a shipping quantity from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories. The shipping quantity distribution module 313 particularly emphasizes on parameters such as shipping feasibility, shipping quantity limitation, and back-end assembly feasibility in order to generate a workable shipping plan. For instance:

In each planning period, the capacity used by each back-end TFT-LCD manufacturing factory should be less than or equal to a capacity limitation quantity.

After inputting the related parameters and the performance index into the industry characteristic planning module 220, primary results received by the front-end process transformation module 221 and the back-end transportation allocation module 223. The primary results include the glass substrate input quantity, the shipping quantity to transport from the front-end TFT-LCD manufacturing factories to the back-end LCM factories, and the total input quantity of semi-finished products received by the back-end LCM factories. In other words, the resource allocation plan for the front-end TFT-LCD manufacturing factories is determined. Furthermore, the resource allocation plan for the back-end LCM factories is determined. In addition, the global logistics plan is determined by the shipping quantity.

Besides the aforementioned primary results, some secondary results are gathered from calculations performed by the module 221 and module 223. These secondary results include a resource remaining quantity, a glass substrate cutting loss area, and an inventory quantity. More specifically, the resource remaining quantity is calculated by using the economical cutting rate transformation module 303, and thereafter using the capacity equivalent transformation module 301 to convert the semi-finished product quantity to the resource remaining quantity. Accordingly, the resource remaining quantity represents a capacity that is available to receive more orders or bypass other orders. The glass substrate loss area for the front-end TFT-LCD manufacturing factories is determined by the cutting loss area transformation module 305. Furthermore, the inventory quantity of semi-finished products at the front-end TFT-LCD manufacturing factories is determined by the economical cutting rate transformation module 303.

FIG. 4 is a flow chart of the method for planning global logistics. Referring to FIG. 4, as depicted in Step S405, the performance index is defined, and a plurality of related parameters is inputted. Thereafter, in Step S410, the semi-finished product quantity is calculated. While calculating the semi-finished product quantity, the capacity equivalent is calculated. The calculation, which references a resource consumption quantity of a standard product, converts the resource quantity into the capacity equivalent. Furthermore, whether each semi-finished product is producible is determined by the manufacturing feasibility parameter. In addition, the glass substrate cutting loss area of each of the front-end TFT-LCD manufacturing factories is calculated by taking into account the glass substrate cutting loss rate.

Thereafter in Step S415, calculation of the shipping quantity for transport from each of the front-end TFT-LCD manufacturing factories to each of the back-end LCM factories is performed respectively. In addition, calculation of the inventory quantity of the semi-finished product at each of the front-end TFT-LCD manufacturing factories is performed. The inventory quantity is limited by the storage quantity at each of the front-end TFT-LCD manufacturing factories.

Thereafter, as shown in Step S420, the total input quantity is calculated according to the semi-finished product quantity received by each of the back-end LCM factories from each of the front-end TFT-LCD manufacturing factories.

FIG. 5A to FIG. 5K are schematic views showing a plurality of input and output data. The basic settings for the present embodiment are as follows: a unit of the planning period is a month (12 planning periods); 4 front-end TFT-LCD manufacturing factories (Fab1-Fab4); 4 back-end LCM factories (LCM1-LCM4); there are 47 products each needing a glass substrate input quantity for each month. Herein, FIG. 5A to FIG. 5H represent input data, while FIG. 5I to FIG. 5K represent output data. When the related parameters shown in FIG. 5A to FIG. 5H are entered into the module 220, calculation by the module 221 and the module 223 arrive at the results shown in FIG. 5I to FIG. 5K.

FIG. 5A, FIG. 5C, FIG. 5D, and FIG. 5E respectively show the economical cutting rate, the glass substrate cutting loss rate, the capacity equivalent, and the manufacturing feasibility of the front-end TFT-LCD manufacturing factories Fab1-Fab4. FIG. 5B shows the market demand. FIG. 5F, FIG. 5G, and FIG. 5H show the shipping parameters. FIG. 5F and FIG. 5G respectively show the shipping feasibility and the shipping quantity limitation for transport between the back-end LCM factories LCM1-LCM4 and the front-end TFT-LCD manufacturing factories Fab1-Fab4. FIG. 5H shows the shipping cost of each product for the back-end factories LCM1-LCM4.

On the other hand, FIG. 5I and FIG. 5J use January as example, while FIG. 5K uses the front-end TFT-LCD manufacturing factory Fab3 as an example. FIG. 5I shows the allocation plan for each product"s glass substrate input quantity at each of the front-end TFT-LCD manufacturing factories Fab1-Fab4. FIG. 5J shows each product"s total input quantity of semi-finished products after January at the back-end LCM factories LCM-LCM4. FIG. 5K shows the shipping quantity of each product that is transported from the front-end TFT-LCD manufacturing factory Fab3 to the back-end LCM factories LCM1-LCM4.

The present invention relates to Liquid Crystal Displays (LCDs), more specifically, to a Thin Film Transistor-Liquid Crystal Display (TFT-LCD) driver circuit and LCD devices. BACKGROUND

Current TFT-LCD technologies have been trending toward higher levels of integration, higher resolution and multi-grayscale capabilities. As such, the TFT-LCD driver circuit device area and power consumption have increased accordingly, leading to higher manufacturing costs. In a traditional TFT-LCD driver circuit, a source drive buffer or latch of the source drive chip occupies a large footprint and consumes a considerable amount of power.

An object according to an embodiment of the present invention is to eliminate the large area occupation and the high power consumption of the source drive buffer in the traditional TFT-LCD driver circuit. Accordingly, a first embodiment discloses a TFT-LCD driver circuit including: a gate driver adapted to control turning on of a Thin Film Transistor (TFT); a grayscale voltage generation circuit capable of providing a grayscale voltage for display points; a timing circuit configured to provide timing signals; a bias circuit configured to provide bias voltage signals; and a source driver operable to charge the display points according to the grayscale voltage. The source driver includes: a source drive latch configured to store data for the display points; a source drive buffer; and a Digital to Analog Converter (DAC) configured to output the grayscale voltage to the source drive buffer according to the stored display data. The source drive buffer includes an Operational Amplifier (OPA), which includes first and second differential amplifiers, The differential amplifiers operate alternatively according to the timing signals and bias voltage signals, and buffer and output voltage signals outputted from the DAC by means of a voltage follower mechanism for charging the display points.

Fig. 6 illustrates a diagram of a control circuit for bias voltages PBIASL and NBIASL of the TFT-LCD driver circuit according to an embodiment of the present invention;

Fig. 7 illustrates waveforms of the bias voltages PBIASL and NBIASL of the TFT-LCD driver circuit according to an embodiment of the present invention;

The source drive buffer of the TFT-LCD driver circuit of the presently disclosed embodiments can be formed with two basic differential amplifiers and a CMOS transmission gate. The two differential amplifiers can be turned on alternatively according to timing of control signals, adjust an output voltage through the COMS transmission gate, and charge pixels in a row to the required voltage level until scanning of the pixels in the row is completed.

Fig. 1 illustrates a typical circuit diagram of a TFT panel. The TFT panel provides a plurality of display points forming an n×m matrix with n rows (G1, G2, G3, ..., Gn) and m columns (S1, S2, S3, ...,Sm), wherein each display point represents a Twisted Nematic Liquid Crystal Display (TN-LCD) point and includes a TFT, a parallel plate capacitor (not shown) formed with upper and lower conductive glasses and a storage capacitor, the parallel plate capacitor and storage capacitor having parallel coupling. If a color filter has three basic colors, a basic pixel display unit needs to be provided with three such display points corresponding to red, green and blue, i.e. the three basic primary colors. At a specific time, the gate driver outputs a drive pulse to turn on all TFT"s in a row. At the same time, the source driver charges the display points in the row to the necessary voltage. When the charging of the row is completed, the gate driver turns off the TFT"s in the row, turns on TFT"s in the next row, and charges the display points in the next row.

Fig. 2 illustrates a circuit diagram of a TFT-LCD driver circuit according to the first embodiment of the present invention. For the sake of description, only TFT-components of the LCD driver circuit involved in the invention are shown in Figure 2. The TFT-LCD driver circuit includes gate and source drivers, a grayscale voltage generator with a timing generator (not shown), and a bias voltage generator (not shown).

As shown in Fig. 2, TFTs N1-Nm are provided in the row. A gate of each of the TFTs is turned on or off under the control of the dirve pulse outputted from the gate driver, m sources of the TFTs are respectively coupled to outputs of source drivers, and m drains of the TFTs are respectively coupled to storage capacitors Cs1-Csm. When the row is canned, all the TFTs of the row are turned on by the drive pulse outputted from the gate driver. At the same time, latch data stored within the source drive latch is decoded and converted by Digital to Analog Converters (DACs), to select a grayscale voltage generator to generate the grayscale voltage to be supplied to each display point. The grayscale voltage is transmitted through the source drive buffer and a corresponding one of the transmission gates T1-Tm to charge a display electrode of the respective display point, thereby driving the LCD panel. As shown in Fig. 2, m source drive buffers (within the dashed outline) corresponds to m display points in the row under scan, and each source drive buffer includes an operational amplifier (OPA).

Fig. 3 illustrates the relationship between input and output signals of the OPA of the source drive buffer as shown in Fig. 2. Specifically, the OPA receives the voltage signal PIN from the corresponding DAC, latches the voltage signal PIN and charges the corresponding display electrode through the corresponding one of the transmission gates T1-Tm (as shown in Fig. 2) under the control of timing signals PDP, PDP_N, PDN, PDN_N and bias voltage signals PBIASL and NBIASL. The output OUT of the OPA is short connected to a feedback NIN, causing the output voltage to be fed back to the feedback NIN of the OPA, and the entire OPA is equivalent to a voltage follower. The various timing signals are generated by the timing generators of the TFT-LCD driver circuit.

Figs. 6 and 7 respectively illustrate a control circuit diagram and waveforms of the bias voltages PBIASL and NBIASL in the TFT-LCD driver circuit according to an embodiment of the present invention. The generator which generates the bias voltage signals PBIASL and NBIASL serves as a global circuit module which provides the bias voltages for all source drive buffers in the TFT-LCD driver circuit, while the other circuit modules in the TFT-LCD driver circuit are provided with bias voltages by the bias voltage signals PBIAS and NBIAS.

In the embodiments described above, the first differential amplifier OPAN is effective when the voltage rises, i.e. dominant when the input voltage changes from a low level to a high level, while the second differential amplifier OPAP is effective when the voltage decreases, i.e. dominant when the input voltage changes from a high level to a low level. Therefore, only one differential amplifier is contributing to the system during the time for scanning one row, thereby causing differentiation between the output waveform and the actual input waveform of the buffer. However, after adjustments by the grayscale voltage, the differentiation will not influence the display on the LCD, because the voltage in the storage capacitor Cs of the LCD panel just before the TFT is turned off is stored, that is, the output of the cache has reached or been close to an ideal value when N1 is changed from the higher voltage to the lower voltage.

The patents cover driving circuits, backlights, RGB filters, and TFT array processes amongst other technologies, according to the Electronic Engineering Times.

AU Optronics and IBM also entered into a cross licence agreement about their relative LCD patents, allowing them to share those patents TFT LCD globally.

AUO Corporation ("AUO" or the "the Company") (TAIEX: 2409; NYSE: AUO), one of the world"s top manufacturers of TFT-LCD panels, announced the signing of a patent assignment agreement with International Business Machines Corp ("IBM") today. This transaction will allow AUO to own hundreds of TFT-LCD related patents developed by IBM, some technologies of which are widely adopted in the industry.

With this agreement, approximately 170 United States patents relating to TFT-LCD technology, together with the counterpart patents in Japan, Korea, Taiwan, and other countries, will be transferred to AUO. The patents cover almost all aspects of key TFT-LCD-related technology, including TFT Array process (TFT structure production), Cell process, such as One Drop Fill Technology, RBG Color Filter, Backlight and TFT driving circuit, among others.

Dr. Fan Luo, AUO "s Chief Technology Officer, stated that IBM, as a pioneer in the TFT-LCD industry, commenced research and development in the TFT-LCD technology since the 1980s, of which originated some fundamental key technologies. After IBM exited from TFT-LCD manufacturing in 2001, it still maintained the TFT-LCD related patents. Some of the patents transferred under this transaction were developed by IBM"s research lab in Japan as well as the Yasu manufacturing site, some of which are believed to be widely used in the industry. With the patents assigned, AUO will further strengthen its intellectual property position on both the defensive and offensive aspects.

During the era of Acer Display Technology, AUO has already entered into a technology transfer and license agreement with IBM since 1999, and built Taiwan"s first Generation 3.5 TFT-LCD fabrication facility. The successful partnership paved the way for AUO "s growth in the following years and strengthened the company’s TFT-LCD manufacturing process and development. In a few years thereafter, AUO went on to establish Generation 4, Generation 5, and Generation 6 fabrication production facility – all first in Taiwan.

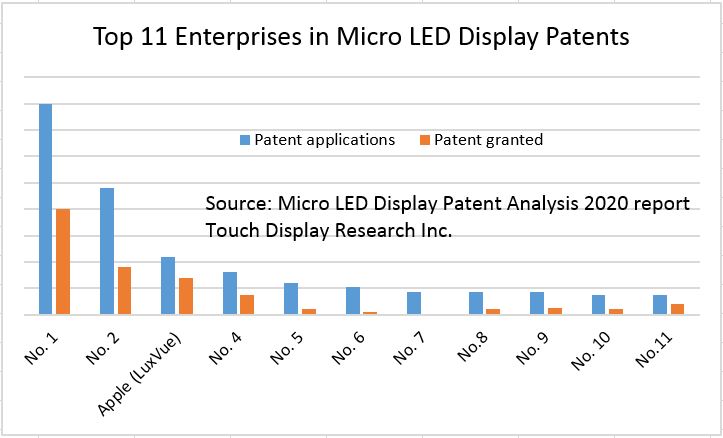

As Taiwan"s largest and world"s third largest TFT-LCD manufacturer, AU Optronics also leads in Taiwan in the area of intellectual property. As of May 2005, the company owns over 1,100 patents worldwide with over 2,800 patent applications pending. The company is one of the top patent applicants in Taiwan"s optoelectronics industry. Moreover, IFI Claims Patents Services placed AUO as the fifth fastest growing patent applicant in the United States in 2004 with a 98% annual increase. With the patents assigned, the number of AUO "s United States patents will increase from about 200 to about 370.

In recognition of the efforts of the company"s patent engineers and legal staff, the President of AUO, Mr. HB Chen stated, "the efforts made by the AUO Technology Center in developing technologies in flat panel displays are evident, and we have seen the accomplishment of our patent filings in recent years. The transfer of these important fundamental patents from IBM is the largest number of TFT-LCD related patents acquired in Taiwan. It not only elevates the company"s intellectual property position, but also helps us to preserve the interest of our customers."

AU Optronics and IBM also entered into a patent cross license agreement on the same day for a license of the relevant products under other patents owned by both companies.

Adding to its portfolio of flat-panel patents, Taiwan?s AU Optronics has signed an agreement with IBM Corp. to acquire hundreds of Big Blue?s TFT-LCD related patents.

Under the deal, approximately 170 U.S. patents -- as well as counterpart patents in Japan, Korea and Taiwan, among other countries -- will be transferred to AU Optronics. The patents cover various key TFT-LCD-related technology, including TFT array process (TFT structure production); cell process, such as one-drop fill technology; RBG color filter; and backlight and TFT driving circuits.

IBM ceased manufacturing TFT-LCDs in 2001, but it maintained its TFT-LCD patents. Armed with those patents, AUO is now poised to boost its intellectual property position.

?The transfer of these important fundamental patents from IBM is the largest number of TFT-LCD related patents acquired in Taiwan,? AU Optronics President HB Chen said in a statement. ?It not only elevates the company"s intellectual property position, but also helps us to preserve the interest of our customers."

A 1999 technology transfer and license agreement with IBM resulted in AU Optronics building Taiwan"s first Generation 3.5 TFT-LCD fabrication facility. Since then, the company went on to pioneer Generation 4, 5 and 6 fabs in Taiwan.

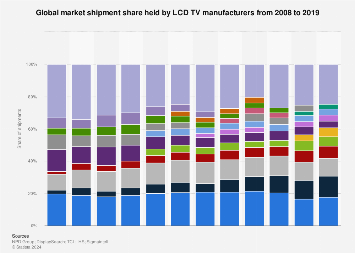

As a Zhongguancun enterprise, BOE has always adhered to technology-driven innovation. According to statistics, BOE"s 2018 shipments of LCD TV panels exceeded that of,LG Display Co, one of the world"s biggest manufacturers of display panels used in smartphones and televisions, ranking first in the world that year.

"The display shipments of BOE increased by 24 percent year-on-year in 2018, and its dispatch area increased by 45 percent year-on-year, which is the highest growth among the top five panel makers in the world," According to Sigmaintell Consulting analysts, who added that BOE achieved remarkable results in 2018: the world"s first 10.5 generation TFT-LCD mass production line was put into operation, and its TV panel production capacity increased by over 40 percent.

Global shipments of LCD TV panels in the first quarter of 2018 [Photo provided to chinadaily.com.cn]BOE accelerated its technology upgrading and achieved a new breakthrough in liquid crystal display technology in 2018. By applying megapixel partitioning technology, BOE 4K display achieved a 100,000-level ultra-high dynamic contrast ratio, with a color depth up to 12bits, so that the LCD display perfectly shows the ultra high definition display effect.

Recently, the US patent service agency IFI Claims released the 2018 US statistics report on patent authorization. BOE"s global ranking had jumped to 17th, with patents granted in America reaching 1,634, an increase of 16 percent. BOE is now the fastest-growing company among the TOP 20 enterprises listed by IFI Claims.

In 2018, BOE added 9,958 new patent applications, 90 percent of them invention patents and 38 percent overseas patents covering the United States, Europe, Japan, South Korea and other countries and regions. The total number of patents held by the company exceeds 70,000.

Over a decade ago, due to the lack of core technologies in the field of semiconductor displays, China"s electronic information industry was shrouded in the shadow of the "lack of LCD screens", and was even unable to independently manufacture a complete LCD TV.

Acquisition of Hyundai Electronics" LCD panel businesses gave Chinese semiconductor companies a chance to break through technological limitations. [Photo provided to chinadaily.com.cn]A group of semiconductor companies like BOE seized the opportunity to acquire Hyundai Electronics" LCD panel businesses. After digesting, absorbing and re-innovating, the companies mastered liquid crystal display technology and ended the dependence on imports in the Chinese semiconductor and display industries.

In 2006, it merged with Quanta Display Inc. to create a larger TFT-LCD manufacturer with a leading position in the world"s TFT-LCD market. AUO is the first TFT-LCD manufacturer to be successfully listed on the New York Stock Exchange (NYSE). AUO extended its market to the green energy industry in late 2008. The display and solar businesses were established as the company"s two core businesses in 2010.

“LCD is one opportunity for Taiwan in a hundred years. It is a sunrise industry, and it’s really important we make the best of it at the end of the day.” as commented Wen-long Shi, the former Chairman of Chi Mei Corporation. He went on to say, “For the 3C industry (computers, communication and consumer electronics), the LCD can be widely used on any electronic product, from refrigerators, air-conditioners, washing machines, to computers, notebooks or mobile phones, and even cars, traffic signs or wrist watches in the future. It’s not difficult to imagine why the industry is so competitive, as LCD is applied so widely.” In this gigantic industrial chain connected by LCD technology, tons of billion dollars change hands from upstream to downstream, and LCD global production value in 2011 alone exceeded one hundred billion dollars. In this completely open market, the frequent patent infringement disputes and licensing problems have become a patent game which every LCD player has to face.

This author has collected and compiled publicly available LCD patent cases published before July 2012, of which the patent infringement cases were from Westlaw database, while licensing information, due to confidentiality reasons, was obtained mainly from news media. LCD patent disputes came into public view in 2000 when the Japanese company Sharp sued Chunghwa Picture Tubes for LCD-related infringement in Taiwan. In 2002 it again sued Chunghwa in Japan for infringing three of its patented techniques in LCD driver programs and LSI setup, for an injunction against latter from importing, and against any sale, offer for sale, display, advertisement or promotion of LCDs using such technologies. Again in 2000, Plasma Physics and Solar Physics, an American NPE (non-practicing entity), sued 9 parties including Sharp and NEC in various courts for patent infringement.

First, there is a criss-cross multilayer game in the production chain. Generally speaking, direct competing relationship exists among business competitors, and players on the same level are more likely to be competitors, among whom patent suits take place. That is not the case in the LCD industry, however, where patent disputes among players on different levels are very constant. The LCD industry can be roughly divided into three levels, namely, the upstream suppliers, including suppliers of equipment, materials, glass strata, driver ICs, optical membranes, and backlight sources, such as Corning and Anvik; the midstream panel manufacturers, representative companies including Samsung, LG, Innolux, AUO and BOE; and the downstream OEM manufacturers, mostly those that mount LCD panels to display equipment, such as Sony, Vizio, as well as Samsung, LG and Sharp. On September 17th 2003, Sharp filed a lawsuit in Californian district court, alleging patent infringement of its LCD technology against BenQ and Viewsonic, which were downstream compani e s t h a t used pane l s from AUO. In 2005, the U.S. glass manufacturer, Guardian, sued AUO, Chi Mei Corporation, Chunghwa Picture Tubes, Dell, Acer and AOC in the U.S., which were all downstream LCD manufacturers. On January 24th 2011, Sharp took simultaneous actions both in the ITC and in federal district court in Delaware against BenQ, Haier, LG, Sanyo, TCL, TTE and Vizio, for using allegedly infringing panels from AUO. On June 6th 2011, a German backlight source manufacturer, OSRAM, filed complaints both at ITC and district court in Delaware against Samsung and LG for infringement of its LED patents. On April 7th 2011, Seiko Epson sued toymakers Leapfrog and Mattel for using LCD modules from Taiwanese Giantplus Technology.

Second, new aspects are added to the game. Generally the patent game can be either patent lawsuits or patent licensing. The LCD industry has fully expounded in these two aspects. In recent years, more is added to the game, including filing patent litigation, responding and counter claiming, as well as a Section 337 investigations and customs recording. For example, during a three-year patent duel, Samsung first requested a Section 337 investigation with ITC against Sharp on December 21st 2007. After a year and a half, Samsung prevailed at ITC which found Sharp infringing two of Samsung’s patents (US6937311 and US6771344). Patent licensing comes in a variety of forms. There are primarily three cooperative modes in the panel industry: 1. Technical licensing, which is the most commonly applied form of technical cooperation. Examples include AUO’s announcement of 170 IBM TFT-LCD licenses in the US on June 30th 2005, and Samsung’s cross-licensing with Sharp after the extended patent war. 2. Joint ventures. Examples are AUO and AOC that entered into a joint venture agreement to establish companies in Poland and Brazil for manufacturing and selling LCD modules; and Samsung and Sony that joint established the panel joint venture S-LCD (however, Sony announced its total withdrawal in December 2001 for the failure of the joint venture). 3. Strategic cooperation. Examples are Hon Hai Precision Industry and Vizio that formed a strategic alliance to jointly enter the TV market in the North America; and Sharp formed a strategic alliance with Hon Hai Corporation by selling to the latter 46.5% of the shares of its Sakai Display Products (SDP).

Third, friends or foes, it depends. In the business world, there are no permanent friends, nor permanent enemies. Participants in the LCD industry may be partners today, but start to sue each other tomorrow. In January 2006, Samsung entered into an extensive cross-licensing agreement with AUO with respects to TFT-LCD and OLED-related patents. But, just before the end of the agreement, it sued AUO, together with AUO’s downstream clients, for patents infringement, at the ITC and district courts in Delaware and North California. Through the actions, as it can be said, Samsung intended to urge AUO to enter into a new crosslicensing as soon as possible. Finally on January 6th 2012, AUO announced its settlement with Samsung, whereby the parties agreed to continue to grant licenses to each other and withdraw their actions against each other, to end their LCD patent controversy.

Settlement is the preferred option. This author notices upon study that there are 300,000 LCD patent applications globally, some of which carry multiple national applications. Any given LCD panel may incorporate up to 1,000 patents, which means no one manufacturer can keep walking within the territory of its own patents, without stepping on the domain of the competitors. The best way for the LCD players to navigate through these patent entanglements as fast as possible, is to get your own patents first, then bargain the litigation through negotiation for a balancing point so as to settle for a solution. From the Samsung and Sharp controversy, to the numerous lawsuits between Sharp and AUO, and to the dispute between Innolux and Sony, statistics show that nearly 55% of such cases were settled either in or out of court, regardless of the duration and the process involved.

Concentration is in U.S. forums. Because the U.S. market is most attractive to manufacturers for its revenue-generating ability on the global scale, its judicial system being well established, and its robust protection of intellectual property, all LCD manufacturers would like to get their cases in US courts. Sharp, LG, 02Micro, Anvik, Semiconductor Energy Lab of Japan and Atomic Energy Lab of France favor filing lawsuits in US district courts, while Samsung, Sharp, Innolux, AUO and BenQ are the mostly sued, 10 times on average, in the country.

NPEs are the more troublesome. The party that raises an action for patent infringement is mostly a midstream panel maker, an upstream supplier, an R&D institution or an NPE. NPEs (or patent trolls) are often deemed as patent licensing companies. They never produce or sell any product, but obtain patents independently or through acquisition. They aim to profit by collecting royalties or compensations from manufacturers, mostly by means of licensing negotiation or patent litigation. They are the most dangerous to manufacturers for two reasons. First, it is generally easy for a company to know the patent portfolio of its competitors, so that it can formulate a strategy to avoid those patents in advance. But, it is almost impossible to know how many cards an NPE has in hand, as it often registers a number of subsidiaries. Second, if sued by a competitor, a company may settle it through cross-licensing. But, an NPE, having no actual products but patents, is not interested in cross-licensing. It goes after monetary damages only.

The recent NPE stories include a few cases of Modis Technology Ltd. from Britain against Innolux in the US from 2007 to 2012, Thomson Licensing in France against Innolux or AUO under Section 337 in 2010, Advanced Display Technologies of Texas in the US against 13 top global manufacturers of panels, computers and mobile phones, including AUO, Sharp, Vizio, Viewsonic, Haier, ASUS and Apple in 2011, where ADT alleged that the 13 manufacturers infringed its display patents; Technology Licensing Corporation in the US vs. ASUS and Westinghouse Electric on account of 3 of its patents being infringed; Yield Boost Tech, a Californian technical consultation and solution provider, vs. Applied Materials, the world’s largest semiconductor equipment supplier, on account of one of its patents being infringed, at the Eastern Californian court.

In 2011, the top five LCD panel makers in the world, according to their market shares, were LG, Samsung, Innolux (the new Chi Mei), AUO and Sharp. As shown, they attack and are attacked the most often with respect to the patent game of the LCD industry. As this patent game cannot be avoided even by the industrial leaders, then how about the situation of enterprises in the Mainland China? It is a surprise to find that among representative Chinese LCD manufacturers, such as BOE, CSOT, Tianma, Panda and IVO, only BOE’s subsidiary in South Korea, BOEHYDIS, was ever sued by the glassmaker Guardian in the U.S. in 2005. No other Chinese enterprises are found in the patent game. Do they own all the intellectual property rights? Is their technical leadership so powerful as to keep themselves out of the patent wrestle? Both answers are absolutely “no.” This author considers a few possible reasons. Some of them purchase whole production lines, new or used, directly from foreign manufacturers, so that they pay the royalty up front. The others reach a technical licensing agreement with foreign manufacturers in private, so that they pay the royalty but do not publish the information due to confidentiality reasons. Moreover, as most Chinese enterprises have limited market shares and their products are at the lower end, they do not create a real threat to foreign competitors in overseas markets.

The market status determines whether a company is worth being sued by other companies for patent infringement. In other words, if a company has never encountered any patent lawsuit, it does not mean it’s litigation proof, but that its status is not high enough. After all, with respect to the 300,000 patent applications globally in the LCD industry every year, no one manufacturer could work within its own sphere of patents without stepping on the area of domain of the other competitors.

With the support in policy and finance from the government, Chinese LCD manufacturers have been growing up. As international panel makers, particularly Samsung and LG, begin to shift their attention to OLED panels, this will very likely leave an opportunity for Chinese enterprises to acquire the global LCD market. For their greater market shares and better profiting situation, Chinese LCD manufacturers will face more criticism in intellectual property from international competitors. They must get themselves ready for coming challenges.

The LCD industry is intensive in both finance and technology and its growth cannot be without government support. When arranging the industry from upstream to downstream or causing the industry to integrate, the government should focus on promoting technical consolidation among enterprises. For technical consolidation, the government should act early to collect relevant information and intelligence with respect to patenting strategies in the LCD area, and study and analyze patent-related litigations. It can be said that a core step of consolidation is to consolidate patent assets. To understand the industrial patent game in an overall way helps enhance Chinese enterprises’ ability to use and protect their patents.

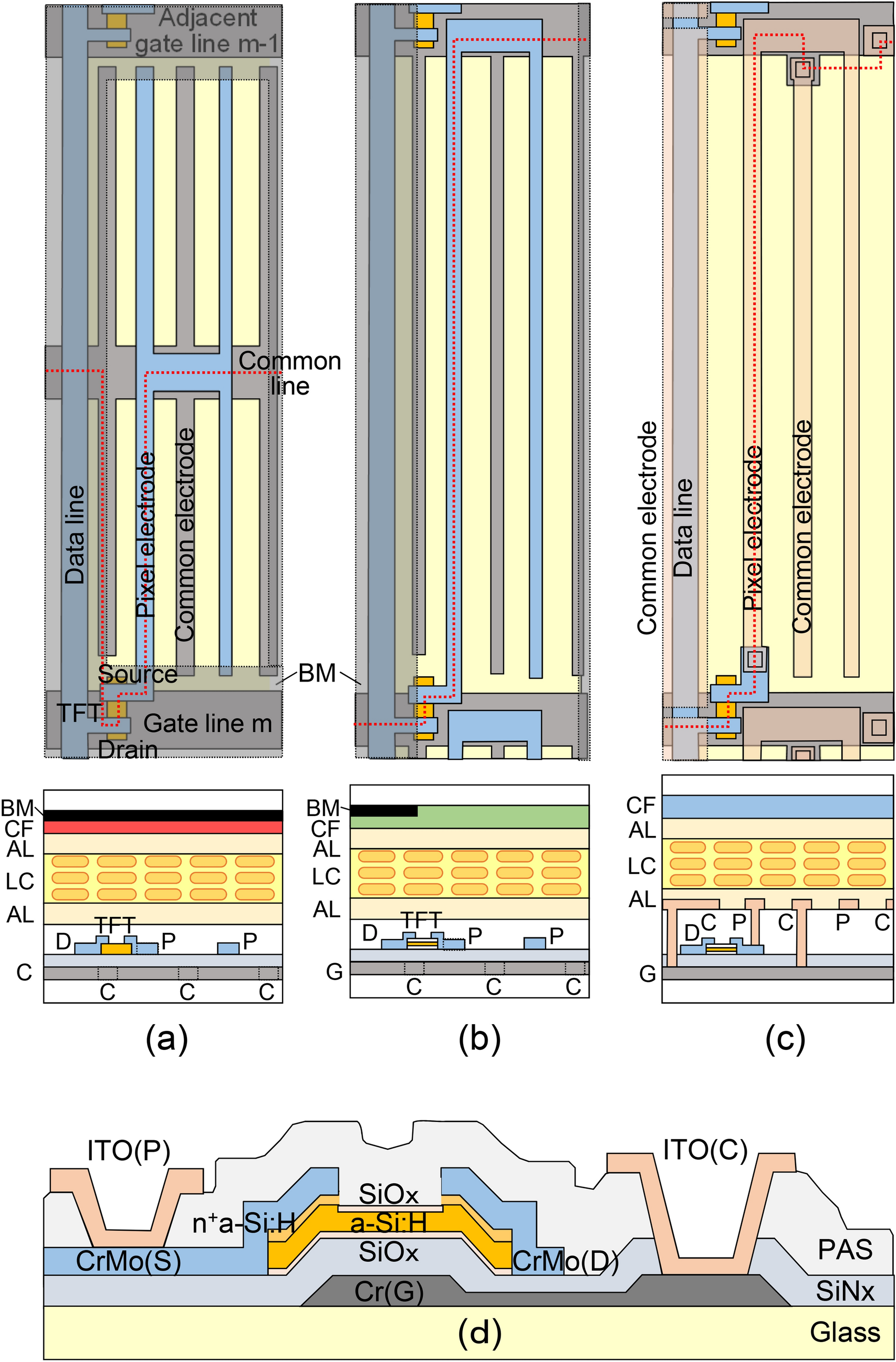

A thin-film-transistor liquid-crystal display (TFT LCD) is a variant of a liquid-crystal display that uses thin-film-transistor technologyactive matrix LCD, in contrast to passive matrix LCDs or simple, direct-driven (i.e. with segments directly connected to electronics outside the LCD) LCDs with a few segments.

In February 1957, John Wallmark of RCA filed a patent for a thin film MOSFET. Paul K. Weimer, also of RCA implemented Wallmark"s ideas and developed the thin-film transistor (TFT) in 1962, a type of MOSFET distinct from the standard bulk MOSFET. It was made with thin films of cadmium selenide and cadmium sulfide. The idea of a TFT-based liquid-crystal display (LCD) was conceived by Bernard Lechner of RCA Laboratories in 1968. In 1971, Lechner, F. J. Marlowe, E. O. Nester and J. Tults demonstrated a 2-by-18 matrix display driven by a hybrid circuit using the dynamic scattering mode of LCDs.T. Peter Brody, J. A. Asars and G. D. Dixon at Westinghouse Research Laboratories developed a CdSe (cadmium selenide) TFT, which they used to demonstrate the first CdSe thin-film-transistor liquid-crystal display (TFT LCD).active-matrix liquid-crystal display (AM LCD) using CdSe TFTs in 1974, and then Brody coined the term "active matrix" in 1975.high-resolution and high-quality electronic visual display devices use TFT-based active matrix displays.

The circuit layout process of a TFT-LCD is very similar to that of semiconductor products. However, rather than fabricating the transistors from silicon, that is formed into a crystalline silicon wafer, they are made from a thin film of amorphous silicon that is deposited on a glass panel. The silicon layer for TFT-LCDs is typically deposited using the PECVD process.

Polycrystalline silicon is sometimes used in displays requiring higher TFT performance. Examples include small high-resolution displays such as those found in projectors or viewfinders. Amorphous silicon-based TFTs are by far the most common, due to their lower production cost, whereas polycrystalline silicon TFTs are more costly and much more difficult to produce.

The twisted nematic display is one of the oldest and frequently cheapest kind of LCD display technologies available. TN displays benefit from fast pixel response times and less smearing than other LCD display technology, but suffer from poor color reproduction and limited viewing angles, especially in the vertical direction. Colors will shift, potentially to the point of completely inverting, when viewed at an angle that is not perpendicular to the display. Modern, high end consumer products have developed methods to overcome the technology"s shortcomings, such as RTC (Response Time Compensation / Overdrive) technologies. Modern TN displays can look significantly better than older TN displays from decades earlier, but overall TN has inferior viewing angles and poor color in comparison to other technology.

The transmittance of a pixel of an LCD panel typically does not change linearly with the applied voltage,sRGB standard for computer monitors requires a specific nonlinear dependence of the amount of emitted light as a function of the RGB value.

Less expensive PVA panels often use dithering and FRC, whereas super-PVA (S-PVA) panels all use at least 8 bits per color component and do not use color simulation methods.BRAVIA LCD TVs offer 10-bit and xvYCC color support, for example, the Bravia X4500 series. S-PVA also offers fast response times using modern RTC technologies.

TFT dual-transistor pixel or cell technology is a reflective-display technology for use in very-low-power-consumption applications such as electronic shelf labels (ESL), digital watches, or metering. DTP involves adding a secondary transistor gate in the single TFT cell to maintain the display of a pixel during a period of 1s without loss of image or without degrading the TFT transistors over time. By slowing the refresh rate of the standard frequency from 60 Hz to 1 Hz, DTP claims to increase the power efficiency by multiple orders of magnitude.

Due to the very high cost of building TFT factories, there are few major OEM panel vendors for large display panels. The glass panel suppliers are as follows:

External consumer display devices like a TFT LCD feature one or more analog VGA, DVI, HDMI, or DisplayPort interface, with many featuring a selection of these interfaces. Inside external display devices there is a controller board that will convert the video signal using color mapping and image scaling usually employing the discrete cosine transform (DCT) in order to convert any video source like CVBS, VGA, DVI, HDMI, etc. into digital RGB at the native resolution of the display panel. In a laptop the graphics chip will directly produce a signal suitable for connection to the built-in TFT display. A control mechanism for the backlight is usually included on the same controller board.

The low level interface of STN, DSTN, or TFT display panels use either single ended TTL 5 V signal for older displays or TTL 3.3 V for slightly newer displays that transmits the pixel clock, horizontal sync, vertical sync, digital red, digital green, digital blue in parallel. Some models (for example the AT070TN92) also feature input/display enable, horizontal scan direction and vertical scan direction signals.

New and large (>15") TFT displays often use LVDS signaling that transmits the same contents as the parallel interface (Hsync, Vsync, RGB) but will put control and RGB bits into a number of serial transmission lines synchronized to a clock whose rate is equal to the pixel rate. LVDS transmits seven bits per clock per data line, with six bits being data and one bit used to signal if the other six bits need to be inverted in order to maintain DC balance. Low-cost TFT displays often have three data lines and therefore only directly support 18 bits per pixel. Upscale displays have four or five data lines to support 24 bits per pixel (truecolor) or 30 bits per pixel respectively. Panel manufacturers are slowly replacing LVDS with Internal DisplayPort and Embedded DisplayPort, which allow sixfold reduction of the number of differential pairs.

Kawamoto, H. (2012). "The Inventors of TFT Active-Matrix LCD Receive the 2011 IEEE Nishizawa Medal". Journal of Display Technology. 8 (1): 3–4. Bibcode:2012JDisT...8....3K. doi:10.1109/JDT.2011.2177740. ISSN 1551-319X.

K. H. Lee; H. Y. Kim; K. H. Park; S. J. Jang; I. C. Park & J. Y. Lee (June 2006). "A Novel Outdoor Readability of Portable TFT-LCD with AFFS Technology". SID Symposium Digest of Technical Papers. AIP. 37 (1): 1079–82. doi:10.1889/1.2433159. S2CID 129569963.

HSINCHU, Taiwan, Nov. 26 /PRNewswire-Asia/ -- AU Optronics Corp. ("AUO" or the "Company") (TAIEX: 2409; NYSE: AUO) announced today that it is honored with the 2009 / 2010 Ocean Tomo 300(R) Patent Index. It indicates high recognition for the Company"s achievements and dedication to patents development. The Ocean Tomo Patent ratings system calculates a company"s innovation ratio, the value of their patent portfolio divided by total corporate book value. As of November 2009, AUO has successfully obtained nearly 6,000 patents while 5,500 patents applications are in progress. With this great achievement in patents, AUO ranks first in patent applications in Taiwan"s flat panel display industry.

As the TFT-LCD industry is characterized by rapid technological changes, AUO believes that effective research and development is essential to success and aims to offer clients comprehensive solutions with innovative technology. In 2002, AUO established its research center, "AUO Technology Center" (ATC). It is not only the largest optronics research center in Taiwan, but also one of the most specialized research centers in flat display technology globally. AUO has recently extended its R&D focus to green energy technology. Currently, AUO has a core force of more than 1,700 dedicated R&D engineers.

The Ocean Tomo 300(R) Patent Index, released by Ocean Tomo, LLC and the American Stock Exchange, is the industry"s first index based on the value of intellectual property, and represents a diversified portfolio of 300 companies that own the most valuable patents relative to their book value. From its inception in January 2007 through October 31, 2009, the Ocean Tomo 300(R) Patent Index has outperformed the S&P 500 by 10.02%. It is recognized by the American Stock Exchange as the first major, broad-based market equity index to be launched, following the progression from the Dow Jones Industrial Average in 1896, to the Standard & Poor"s 500 in 1957 and then to the NASDAQ Composite Index in 1971. It is well known as one of the most essential economic indexes, like the NASDAQ Composite Index, in the knowledge economy period (1970 until now).

AU Optronics Corp. (AUO) is a worldwide top three manufacturer* of thin film transistor liquid crystal display panels (TFT-LCD). AUO is able to provide customers with a full range of panel sizes and comprehensive applications, offering TFT-LCD panels in sizes ranging from 1.2 inches to greater than 65 inches. AUO generated NT$423.9 billion (US$12.9 billion) in sales revenue in 2008 and now houses a staff of more than 42,000 employees throughout its global operations in Taiwan, Mainland China, Japan, Singapore, South Korea, the U.S., and Europe. Additionally, AUO is the first pure TFT-LCD manufacturer to successfully list at the New York Stock Exchange (NYSE). AUO extended its market to green energy industry in the end of 2008, and formally founded The Solar Photovoltaic Business Unit in October, 2009. For more information, please visit http://www.AUO.com .

* DisplaySearch 3Q2009 WW Large-Area TFT-LCD Shipment Report. This data is used as reference only and AUO does not make any endorsement or representation in connection therewith. 2008 year end revenue converted by an exchange rate of NTD32.76:USD1.

of a technology market is not synchronous to technology [10] Pénin, J., “Strategic uses of patents in markets for technology: A story

takes into account information on patents granted by the U.S. directly observed patent value - An empirical analysis of Ocean Tomo

obtained for patents granted by non-U.S. organizations, this for exploiting patented technological knowledge assets in the markets

related technologies and applications using the same analysis of global patents and trademarks,” Technological Forecasting

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey