patents tft lcd globally brands

STONE Technologies is a proud manufacturer of superior quality TFT LCD modules and LCD screens. The company also provides intelligent HMI solutions that perfectly fit in with its excellent hardware offerings.

STONE TFT LCD modules come with a microcontroller unit that has a 1GHz Cortex-A8 CPU. Such a module can easily be transformed into an HMI screen. Simple hexadecimal instructions can be used to control the module through the UART port. Furthermore, you can seamlessly develop STONE TFT LCD color user interface modules and add touch control, features to them.

Becoming a reputable TFT LCD manufacturer is no piece of cake. It requires a company to pay attention to detail, have excellent manufacturing processes, the right TFT display technology, and have a consumer mindset.

Now, we list down 10 of the best famous LCD manufacturers globally. We’ll also explore why they became among the top 10 LCD display Manufacturers in the world.

In 2019, BOE’s yearly new-patent applications amounted to 9657, of which over 90% are invention patents, amounting to over 70,000 usable patents in total. Data from IFI Claims also shows that BOE has ranked 13th among the Top 50 USPTO (The United States Patent and Trademark Office), Patent Assignees, in 2019. According to the 2019 International PCT Applications of WIPO, BOE ranked No.6 with 1,864 applications.

LG Display is a leading manufacturer of thin-film transistor liquid crystal displays (TFT-LCD) panels, OLED, and flexible displays.LG Display began developing TFT-LCD in 1987 and currently offers Display panels in a variety of sizes and specifications using different cutting-edge technologies (IPS, OLED, and flexible technology).

With innovative and differentiated technologies, QINNOOptoelectronics provides advanced display integration solutions, including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch solutions. Qinnooptoelectronics sets specifications and leads the market. A wide range of product line is across all kinds of TFT LCD panel modules, touch modules, for example, TV panel, desktop and laptop computer monitor with panels, small and medium scale “panels, medical, automotive, etc., the supply of cutting-edge information and consumer electronics customers around the world, for the world TFT – LCD (thin-film transistor liquid crystal display) leading manufacturers.

AU Optronics Co., LTD., formerly AU Optronics Corporation, was founded in August 1996. It changed its name to AU Optronics after its merger with UNIOPtronics in 2001. Through two mergers, AU has been able to have a full range of generations of production lines for panels of all sizes.Au Optronics is a TFT-LCD design, manufacturing, and r&d company. Since 2008, au Optronics has entered the green energy industry, providing customers with high-efficiency solar energy solutions.

Sharp has been called the “father of LCD panels”.Since its founding in 1912, Sharp developed the world’s first calculator and LIQUID crystal display, represented by the living pencil, which was invented as the company name. At the same time, Sharp is actively expanding into new areas to improve people’s living standards and social progress. Made a contribution.

BYD IT products and businesses mainly include rechargeable batteries, plastic mechanism parts, metal parts, hardware electronic products, cell phone keys, microelectronics products, LCD modules, optoelectronics products, flexible circuit boards, chargers, connectors, uninterruptible power supplies, DC power supplies, solar products, cell phone decoration, cell phone ODM, cell phone testing, cell phone assembly business, notebook computer ODM, testing and manufacturing and assembly business, etc.

Tianma microelectronics co., LTD., founded in 1983, the company focus on smartphones, tablets, represented by high order laptop display market of consumer goods and automotive, medical, POS, HMI, etc., represented by professional display market, and actively layout smart home, intelligent wear, AR/VR, unmanned aerial vehicles (UAVs) and other emerging markets, to provide customers with the best product experience.IN terms of technology, the company has independently mastered leading technologies such as LTPS-TFT, AMOLED, flexible display, Oxide-TFT, 3D display, transparent display, and in-cell/on-cell integrated touch control. TFT-LCD key Materials and Technologies National Engineering Laboratory, national enterprise Technology Center, post-doctoral mobile workstation, and undertake national Development and Reform Commission, The Ministry of Science and Technology, the Ministry of Industry and Information Technology, and other major national thematic projects. The company’s long-term accumulation and continuous investment in advanced technology lay the foundation for innovation and development in the field of application.

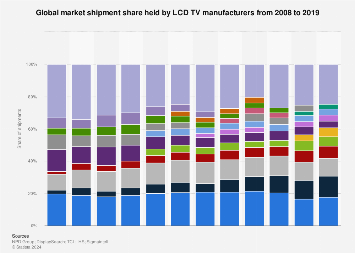

As a Zhongguancun enterprise, BOE has always adhered to technology-driven innovation. According to statistics, BOE"s 2018 shipments of LCD TV panels exceeded that of,LG Display Co, one of the world"s biggest manufacturers of display panels used in smartphones and televisions, ranking first in the world that year.

"The display shipments of BOE increased by 24 percent year-on-year in 2018, and its dispatch area increased by 45 percent year-on-year, which is the highest growth among the top five panel makers in the world," According to Sigmaintell Consulting analysts, who added that BOE achieved remarkable results in 2018: the world"s first 10.5 generation TFT-LCD mass production line was put into operation, and its TV panel production capacity increased by over 40 percent.

Global shipments of LCD TV panels in the first quarter of 2018 [Photo provided to chinadaily.com.cn]BOE accelerated its technology upgrading and achieved a new breakthrough in liquid crystal display technology in 2018. By applying megapixel partitioning technology, BOE 4K display achieved a 100,000-level ultra-high dynamic contrast ratio, with a color depth up to 12bits, so that the LCD display perfectly shows the ultra high definition display effect.

Recently, the US patent service agency IFI Claims released the 2018 US statistics report on patent authorization. BOE"s global ranking had jumped to 17th, with patents granted in America reaching 1,634, an increase of 16 percent. BOE is now the fastest-growing company among the TOP 20 enterprises listed by IFI Claims.

In 2018, BOE added 9,958 new patent applications, 90 percent of them invention patents and 38 percent overseas patents covering the United States, Europe, Japan, South Korea and other countries and regions. The total number of patents held by the company exceeds 70,000.

Over a decade ago, due to the lack of core technologies in the field of semiconductor displays, China"s electronic information industry was shrouded in the shadow of the "lack of LCD screens", and was even unable to independently manufacture a complete LCD TV.

Acquisition of Hyundai Electronics" LCD panel businesses gave Chinese semiconductor companies a chance to break through technological limitations. [Photo provided to chinadaily.com.cn]A group of semiconductor companies like BOE seized the opportunity to acquire Hyundai Electronics" LCD panel businesses. After digesting, absorbing and re-innovating, the companies mastered liquid crystal display technology and ended the dependence on imports in the Chinese semiconductor and display industries.

TCL was the first to introduce LCD TVs with a miniLED backlight in 2019. CSoT’s acquisition of LCD patents from Samsung Display signifies a shift of power in the global TV market, putting TCL at the forefront of LCD TV development.

TCL was the first to introduce LCD TVs with a miniLED backlight in 2019. CSoT’s acquisition of LCD patents from Samsung Display signifies a shift of power in the global TV market, putting TCL at the forefront of LCD TV development.

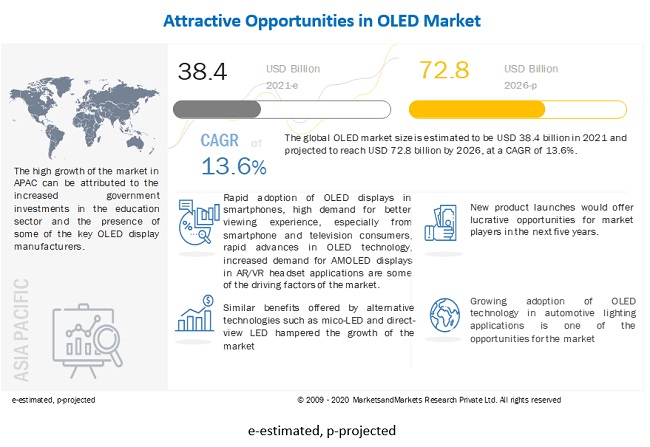

Universal Display Corporation is a developer and manufacturer of organic light emitting diodes (OLED) technologies and materials as well as provider of services to the display and lighting industries. It is also an OLED research company. Founded in 1994, the company currently owns or has exclusive, co-exclusive or sole license rights with respect to more than 3,000 issued and pending patents worldwide for the commercialization of phosphorescent based OLEDs and also flexible, transparent and stacked OLEDs - for both display and lighting applications. Its phosphorescent OLED technologies and materials are licensed and supplied to companies such as Samsung, LG, AU Optronics CMEL, Pioneer, Panasonic Idemitsu OLED lighting and Konica Minolta.

OLEDs can be printed onto any suitable substrate by an inkjet printer or even by screen printing,plasma displays. However, fabrication of the OLED substrate is more costly than that of a TFT LCD, until mass production methods lower cost through scalability. Roll-to-roll vapour-deposition methods for organic devices do allow mass production of thousands of devices per minute for minimal cost, although this technique also induces problems in that devices with multiple layers can be challenging to make because of registration, lining up the different printed layers to the required degree of accuracy.

OLEDs can enable a greater artificial contrast ratio (both dynamic range and static, measured in purely dark conditions) and a wider viewing angle compared to LCDs because OLED pixels emit light directly. OLED pixel colors appear correct and unshifted, even as the viewing angle approaches 90° from normal.

LCDs filter the light emitted from a backlight, allowing a small fraction of light through. So, they cannot show true black. However, an inactive OLED element does not produce light or consume power, thus allowing true blacks.

OLEDs also can have a faster response time than standard LCD screens. Whereas LCD displays are capable of between 1 and 16 ms response time offering a refresh rate of 60 to 480 Hz, an OLED theoretically can have a response time less than 0.01 ms, enabling a refresh rate up to 100,000 Hz . OLEDs also can be run as a flicker display, similar to a CRT, in order to eliminate the sample-and-hold effect that creates motion blur on OLEDs.

While an OLED will consume around 40% of the power of an LCD displaying an image that is primarily black, for the majority of images it will consume 60–80% of the power of an LCD. However, an OLED can use more than three times as much power to display an image with a white background, such as a document or web site.

"Phablets" are defined as a device that has a screen between 5 and 7 inches and is part phone-part tablet. Examples include the Galaxy Note I, II and III. Samsung unveiled their Galaxy Note 3 at the IFA electronics show in September 2013. The Galaxy Note 3 has a 5.7 inch AMOLED screen.Galaxy Note 3 and say it is the best OLED screen they have tested and is superior to all LCD screens they have tested.

With the arrival of Quantum Dot LCD displays, LG released an article describing why they still see OLED as the future of Television displays: "In fact, OLED technology is the technology that is so much advanced that it should not be compared to an LCD based QD. Hence, even though LG already has the technology to create QD backlighting, it is focusing on developing OLED".

Consumer Reports, an American Magazine covering reviews of consumer products, published their review of OLED televisions saying that their TV project leader, Claudio Ciacci, would pick LG"s OLED TV over every other TV model tested in 2014. "It has all the advantages of both LCD and Plasma Televisions without any of the weakness."

The Flexible Display Center announced that it has successfully manufactured the world"s largest flexible color AMOLED prototype using advanced mixed oxide thin film transistors (TFTs). Measuring 7.4 diagonal inches, the device was developed at the FDC in conjunction with Army Research Labs scientists. It also meets a critical target set by the U.S. Department of Defense to advance the development of full-color, full-motion video flexible OLED displays for use in thin, lightweight, bendable and highly rugged devices.

In 2012, UDC reported two favorable patent decisions. The first one is from Japan, regarding two patents (JP781 and JP158) relating to UDC"s L2MX technology. The patents were upheld as valid by the Japanese patent office. The second decision related to one of the OVJP patents in Korea. The Korean patent office issued a favorable decision which upheld the patent as valid.

Global Thin Film Transistor (TFT) Display Market, By Technology (Plasma Display (PDP), Organic Light Emitting Diode (OLED), Other), Type (Twisted Nematic, In-Plane Switching, Advanced Fringe Field Switching, Multi-Domain Vertical Alignment, Advanced Super View, Cell Technology), Panel Type (A_MVA, ASV, MVA, S_PVA, P-IPS), End Use (Domestic Use, Industrial Use) – Industry Trends and Forecast to 2029

Global Thin Film Transistor (TFT) Display Market was valued at USD 270.26 million in 2021 and is expected to reach USD 968.64 million by 2029, registering a CAGR of 17.30% during the forecast period of 2022-2029. Twisted Nematic accounts for the largest type segment in the respective market owing to its low cost. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

A thin-film-transistor display refers to a form of LCD that uses TFT technology for enhancing image quality including addressability and contrast. These displays are commonly utilized in mobile phones, handheld video game systems, projectors, computer monitors, television screens, navigation systems and personal digital assistants.

The increase in the smartphone and tablet proliferation acts as one of the major factors driving the growth of thin film transistor (TFT) display market. Technological advancements are leading a radical shift from traditional slow, bulky and imprecise resistive mono touch to highly sensitive multi-touch capacitive screen have a positive impact on the industry.

The increase in application areas of large e thin film transistor (TFT) display due to the advantages offered by these paper displays in terms of user experience, manufacturing cost, readability, and energy consumption further influence the market.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the thin film transistor (TFT) display market.

On the other hand, high cost associated with the manufacturing is expected to obstruct market growth. Also, lack of awareness and low refresh rate are projected to challenge the thin film transistor (TFT) display market in the forecast period of 2022-2029.

This thin film transistor (TFT) display market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on thin film transistor (TFT) display market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

The COVID-19 has impacted thin film transistor (TFT) display market. The limited investment costs and lack of employees hampered sales and production of electronic paper (e-paper) display technology. However, government and market key players adopted new safety measures for developing the practices. The advancements in the technology escalated the sales rate of the thin film transistor (TFT) display as it targeted the right audience. The increase in sales of devices such as smart phones and tablets across the globe is expected to further drive the market growth in the post-pandemic scenario.

The thin film transistor (TFT) display market is segmented on the basis of technology, type, panel type and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

The thin film transistor (TFT) display market is analysed and market size insights and trends are provided by country, technology, type, panel type and end-use as referenced above.

The countries covered in the thin film transistor (TFT) display market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

North America dominates the thin film transistor (TFT) display market because of the introduction of advanced technology along with rising disposable income of the people within the region.

The thin film transistor (TFT) display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies" focus related to thin film transistor (TFT) display market.

This author has collected and compiled publicly available LCD patent cases published before July 2012, of which the patent infringement cases were from Westlaw database, while licensing information, due to confidentiality reasons, was obtained mainly from news media. LCD patent disputes came into public view in 2000 when the Japanese company Sharp sued Chunghwa Picture Tubes for LCD-related infringement in Taiwan. In 2002 it again sued Chunghwa in Japan for infringing three of its patented techniques in LCD driver programs and LSI setup, for an injunction against latter from importing, and against any sale, offer for sale, display, advertisement or promotion of LCDs using such technologies. Again in 2000, Plasma Physics and Solar Physics, an American NPE (non-practicing entity), sued 9 parties including Sharp and NEC in various courts for patent infringement.

First, there is a criss-cross multilayer game in the production chain. Generally speaking, direct competing relationship exists among business competitors, and players on the same level are more likely to be competitors, among whom patent suits take place. That is not the case in the LCD industry, however, where patent disputes among players on different levels are very constant. The LCD industry can be roughly divided into three levels, namely, the upstream suppliers, including suppliers of equipment, materials, glass strata, driver ICs, optical membranes, and backlight sources, such as Corning and Anvik; the midstream panel manufacturers, representative companies including Samsung, LG, Innolux, AUO and BOE; and the downstream OEM manufacturers, mostly those that mount LCD panels to display equipment, such as Sony, Vizio, as well as Samsung, LG and Sharp. On September 17th 2003, Sharp filed a lawsuit in Californian district court, alleging patent infringement of its LCD technology against BenQ and Viewsonic, which were downstream compani e s t h a t used pane l s from AUO. In 2005, the U.S. glass manufacturer, Guardian, sued AUO, Chi Mei Corporation, Chunghwa Picture Tubes, Dell, Acer and AOC in the U.S., which were all downstream LCD manufacturers. On January 24th 2011, Sharp took simultaneous actions both in the ITC and in federal district court in Delaware against BenQ, Haier, LG, Sanyo, TCL, TTE and Vizio, for using allegedly infringing panels from AUO. On June 6th 2011, a German backlight source manufacturer, OSRAM, filed complaints both at ITC and district court in Delaware against Samsung and LG for infringement of its LED patents. On April 7th 2011, Seiko Epson sued toymakers Leapfrog and Mattel for using LCD modules from Taiwanese Giantplus Technology.

Second, new aspects are added to the game. Generally the patent game can be either patent lawsuits or patent licensing. The LCD industry has fully expounded in these two aspects. In recent years, more is added to the game, including filing patent litigation, responding and counter claiming, as well as a Section 337 investigations and customs recording. For example, during a three-year patent duel, Samsung first requested a Section 337 investigation with ITC against Sharp on December 21st 2007. After a year and a half, Samsung prevailed at ITC which found Sharp infringing two of Samsung’s patents (US6937311 and US6771344). Patent licensing comes in a variety of forms. There are primarily three cooperative modes in the panel industry: 1. Technical licensing, which is the most commonly applied form of technical cooperation. Examples include AUO’s announcement of 170 IBM TFT-LCD licenses in the US on June 30th 2005, and Samsung’s cross-licensing with Sharp after the extended patent war. 2. Joint ventures. Examples are AUO and AOC that entered into a joint venture agreement to establish companies in Poland and Brazil for manufacturing and selling LCD modules; and Samsung and Sony that joint established the panel joint venture S-LCD (however, Sony announced its total withdrawal in December 2001 for the failure of the joint venture). 3. Strategic cooperation. Examples are Hon Hai Precision Industry and Vizio that formed a strategic alliance to jointly enter the TV market in the North America; and Sharp formed a strategic alliance with Hon Hai Corporation by selling to the latter 46.5% of the shares of its Sakai Display Products (SDP).

Third, friends or foes, it depends. In the business world, there are no permanent friends, nor permanent enemies. Participants in the LCD industry may be partners today, but start to sue each other tomorrow. In January 2006, Samsung entered into an extensive cross-licensing agreement with AUO with respects to TFT-LCD and OLED-related patents. But, just before the end of the agreement, it sued AUO, together with AUO’s downstream clients, for patents infringement, at the ITC and district courts in Delaware and North California. Through the actions, as it can be said, Samsung intended to urge AUO to enter into a new crosslicensing as soon as possible. Finally on January 6th 2012, AUO announced its settlement with Samsung, whereby the parties agreed to continue to grant licenses to each other and withdraw their actions against each other, to end their LCD patent controversy.

Settlement is the preferred option. This author notices upon study that there are 300,000 LCD patent applications globally, some of which carry multiple national applications. Any given LCD panel may incorporate up to 1,000 patents, which means no one manufacturer can keep walking within the territory of its own patents, without stepping on the domain of the competitors. The best way for the LCD players to navigate through these patent entanglements as fast as possible, is to get your own patents first, then bargain the litigation through negotiation for a balancing point so as to settle for a solution. From the Samsung and Sharp controversy, to the numerous lawsuits between Sharp and AUO, and to the dispute between Innolux and Sony, statistics show that nearly 55% of such cases were settled either in or out of court, regardless of the duration and the process involved.

Concentration is in U.S. forums. Because the U.S. market is most attractive to manufacturers for its revenue-generating ability on the global scale, its judicial system being well established, and its robust protection of intellectual property, all LCD manufacturers would like to get their cases in US courts. Sharp, LG, 02Micro, Anvik, Semiconductor Energy Lab of Japan and Atomic Energy Lab of France favor filing lawsuits in US district courts, while Samsung, Sharp, Innolux, AUO and BenQ are the mostly sued, 10 times on average, in the country.

NPEs are the more troublesome. The party that raises an action for patent infringement is mostly a midstream panel maker, an upstream supplier, an R&D institution or an NPE. NPEs (or patent trolls) are often deemed as patent licensing companies. They never produce or sell any product, but obtain patents independently or through acquisition. They aim to profit by collecting royalties or compensations from manufacturers, mostly by means of licensing negotiation or patent litigation. They are the most dangerous to manufacturers for two reasons. First, it is generally easy for a company to know the patent portfolio of its competitors, so that it can formulate a strategy to avoid those patents in advance. But, it is almost impossible to know how many cards an NPE has in hand, as it often registers a number of subsidiaries. Second, if sued by a competitor, a company may settle it through cross-licensing. But, an NPE, having no actual products but patents, is not interested in cross-licensing. It goes after monetary damages only.

The recent NPE stories include a few cases of Modis Technology Ltd. from Britain against Innolux in the US from 2007 to 2012, Thomson Licensing in France against Innolux or AUO under Section 337 in 2010, Advanced Display Technologies of Texas in the US against 13 top global manufacturers of panels, computers and mobile phones, including AUO, Sharp, Vizio, Viewsonic, Haier, ASUS and Apple in 2011, where ADT alleged that the 13 manufacturers infringed its display patents; Technology Licensing Corporation in the US vs. ASUS and Westinghouse Electric on account of 3 of its patents being infringed; Yield Boost Tech, a Californian technical consultation and solution provider, vs. Applied Materials, the world’s largest semiconductor equipment supplier, on account of one of its patents being infringed, at the Eastern Californian court.

In 2011, the top five LCD panel makers in the world, according to their market shares, were LG, Samsung, Innolux (the new Chi Mei), AUO and Sharp. As shown, they attack and are attacked the most often with respect to the patent game of the LCD industry. As this patent game cannot be avoided even by the industrial leaders, then how about the situation of enterprises in the Mainland China? It is a surprise to find that among representative Chinese LCD manufacturers, such as BOE, CSOT, Tianma, Panda and IVO, only BOE’s subsidiary in South Korea, BOEHYDIS, was ever sued by the glassmaker Guardian in the U.S. in 2005. No other Chinese enterprises are found in the patent game. Do they own all the intellectual property rights? Is their technical leadership so powerful as to keep themselves out of the patent wrestle? Both answers are absolutely “no.” This author considers a few possible reasons. Some of them purchase whole production lines, new or used, directly from foreign manufacturers, so that they pay the royalty up front. The others reach a technical licensing agreement with foreign manufacturers in private, so that they pay the royalty but do not publish the information due to confidentiality reasons. Moreover, as most Chinese enterprises have limited market shares and their products are at the lower end, they do not create a real threat to foreign competitors in overseas markets.

The market status determines whether a company is worth being sued by other companies for patent infringement. In other words, if a company has never encountered any patent lawsuit, it does not mean it’s litigation proof, but that its status is not high enough. After all, with respect to the 300,000 patent applications globally in the LCD industry every year, no one manufacturer could work within its own sphere of patents without stepping on the area of domain of the other competitors.

With the support in policy and finance from the government, Chinese LCD manufacturers have been growing up. As international panel makers, particularly Samsung and LG, begin to shift their attention to OLED panels, this will very likely leave an opportunity for Chinese enterprises to acquire the global LCD market. For their greater market shares and better profiting situation, Chinese LCD manufacturers will face more criticism in intellectual property from international competitors. They must get themselves ready for coming challenges.

The LCD industry is intensive in both finance and technology and its growth cannot be without government support. When arranging the industry from upstream to downstream or causing the industry to integrate, the government should focus on promoting technical consolidation among enterprises. For technical consolidation, the government should act early to collect relevant information and intelligence with respect to patenting strategies in the LCD area, and study and analyze patent-related litigations. It can be said that a core step of consolidation is to consolidate patent assets. To understand the industrial patent game in an overall way helps enhance Chinese enterprises’ ability to use and protect their patents.

Taiwan-based makers shipped a total of 61.37 million large-size (9-inch and above) TFT-LCD panels during the fourth quarter of 2016, decreasing 1.5% on quarter but increasing 2% on...

China Star Optoelectronics Technology (CSOT) in late November 2016 started construction of an 11G LCD factory with monthly production capacity of 140,000 glass substrates in Shenzhen,...

Sakai Display Product"s (Sharp"s subsidiary) 10G using 2,880mm by 3,130mm glass substrates) TFT-LCD factory in Japan is currently one of the highest generation plants but four 10.5G...

AU Optronics"s (AUO) newly unveiled 6G LTPS LCD factory in Kunshan, eastern China, has obtained LEED (Leadership in Energy and Environmental Design) Platinum Certification from the...

AU Optronics (AUO) on November 16 kicked off volume production at a 6G LTPS (low-temperature poly-Si) TFT-LCD factory in Kunshan, eastern China, according to the company.

Taiwan-based makers shipped 62.29 million large-size (9-inch and above) TFT-LCD panels in the third quarter of 2016, increasing 6.7% on quarter and 6.2% on year, and accounting for...

Taiwan-based TFT-LCD panel makers shipped 309.749 million small- to medium-size panels in the third quarter of 2016, increasing 15.0% on quarter and 0.8% on year, according to Digitimes...

AU Optronics (AUO) will inaugurate a 6G LTPS TFT-LCD factory in Kunshan, eastern China, on November 16 and start production later in the fourth quarter. AUO expects production capacity...

Global production capacity for large-size TFT-LCD panels in 2016 is estimated at 208 million square meters, increasing 6.6% on year, and the capacity will increase 3.9% to 216 million...

Global shipments of large-size (9-inch and above) TFT-LCD panels will slightly increase from 673.37 million units in 2016 to 684.60 million units in 2021, equivalent to an annual...

As Samsung Display, LG Display and Japan Display have shut down mostly 5G to 6G TFT-LCD lines to gradually expand AMOLED production capacity since the beginning of 2015, global shipments...

Taiwan-based TFT-LCD panel makers generated total production value of NT$164.135 billion (US$5.13 billion) in the second quarter of 2016, increasing 1.90% on quarter but decreasing...

Taiwan-based TFT-LCD panel makers AU Optronics (AUO), Innolux and Chunghwa Picture Tubes (CPT), at the Touch Taiwan 2016 taking place in Taipei during August 24-26, showed that they...

AU Optronics (AUO) is a world leader in optoelectronic solutions and TFT-LCD manufacturing. Globally, AUO has a portfolio of approximately 18,000 granted patents and has engaged in around 40 patent litigation cases versus large MNCs during the last decade. AUO has a strong intellectual property (IP) management team with deep experience in patenting strategy, portfolio management, licensing and litigation.

For the majority of tech-companies, the creation and utilisation of high-value patents are essential components of effective IP management. For these tech companies, especially large scale enterprises with significant investments in R&D, what are the main challenges they face? How does AUO overcome these challenges?

Spencer: Most organisations’ IP departments face the same key challenge: how to get and keep buy-in from the senior management, to ensure sufficient financial resources and manpower are allocated to create high-value patents. In many companies, top management may not be aware of the importance of IP until the company becomes embroiled in patent infringement litigation, which may well be too late. To deal with this issue, at least two key elements are required to have the right attention of the senior management.

The first and most important element is efficient communication. An IP manager/director must articulate how and why IP and, in particular, high-value patents are important to the company in a simple, direct and effective manner. For instance, while the concept of a patent and its technical nature may deserve detailed description and explanation, for time-poor C-Suite executives, an IP manager/director must be able to explain the underlying concept(s) and their value to the business in a concise manner and layman’s terms. It is important to empathise with the position of the senior decision-makers and focus on how IP could contribute to the strategic developments and enhance the company’s business value.

Another key aspect is managing the expectations of the senior decision-makers on the time taken for IP or patents to show their values. Often, the top management would like to see an immediate impact or commercial return. However, the creation and utilisation of patents are inherently longer duration processes. Take, for example, patent litigations which are often argued as the best way to ascertain the value associated with a patent, statistics suggest that patent litigations typically take place 5-10 years from the date of filing the applications.

Although a high proportion of patents filed globally originate from universities, research institutions and other Institutes of Higher Learning (IHLs), successful technology transfer and commercialisation have always proved much more difficult to achieve. Given AUO’s track record of successful commercialisation collaborations with IHLs, such as ITRI and others, could you share some of the secrets to your success?

AUO has also been proactive in sharing our IP management experience with IHLs. Throughout our past collaborations, we have provided IP training and seminars to researchers and graduate students. This better enables IHLs to create high-value patents, and also provides the researchers, and especially students with opportunities to learn beyond the normal confines of the academic environment and understand how science and technology can be transformed into valuable industrial applications.

Spencer: The government’s guidance on the valuation of patents, brands, data and other intangible assets (IAs) should maintain sufficient flexibility and freedom. Rather than setting a simplistic and rough set of standards around the valuation methodology of IAs, the government may benefit from giving way to the market in price discovery and valuation. The government can further support innovators by providing flexible tax regimes and policy incentives that work in harmony to promote both the valuation process and trading of IAs while avoiding too great an administrative burden of valuation details.

Spencer: If one looks only at the absolute market size, Singapore may not be the most attractive place for foreign companies to register and seek protection for their IP. The Intellectual Property Office of Singapore (IPOS) has made great efforts to attract foreign filings including the accelerated examinations of patents in specific technology fields, as well as establishing the global Patent Prosecution Highway (PPH) with an extensive list of other countries and regions. These make Singapore a preferred choice of applying for patents.

On the other hand, when we view from the perspective that the value of IP protection is anchored in the ability of companies to effectively and efficiently enforce their IP rights, we can see that Singapore is in an advantageous position given its experience in international trading, financial and legal services. Building on its strong IP regime, which has consistently been rated as one of the best globally, Singapore is well placed to expand its influence as a hub for IP protection, via international arbitration, mediation and so on.

The first display production line in mainland China built with independent technology BOE"s 5th generation TFT-LCD production line in Beijing. It fills the gap of domestic TFT-LCD display industry [1].

The mass production of BOE"s 8.5 generation line ended the "no large size LCD era" in mainland China. Realize the localization of the whole series of LCDs in China.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey