chinese lcd panel manufacturers in stock

LCD manufacturers are mainly located in China, Taiwan, Korea, Japan. Almost all the lcd or TFT manufacturers have built or moved their lcd plants to China on the past decades. Top TFT lcd and oled display manufactuers including BOE, COST, Tianma, IVO from China mainland, and Innolux, AUO from Tianwan, but they have established factories in China mainland as well, and other small-middium sizes lcd manufacturers in China.

China flat display revenue has reached to Sixty billion US Dollars from 2020. there are 35 tft lcd lines (higher than 6 generation lines) in China,China is the best place for seeking the lcd manufacturers.

The first half of 2021, BOE revenue has been reached to twenty billion US dollars, increased more than 90% than thesame time of 2020, the main revenue is from TFT LCD, AMoled. BOE flexible amoled screens" output have been reach to 25KK pcs at the first half of 2021.the new display group Micro LED revenue has been increased to 0.25% of the total revenue as well.

Established in 1993 BOE Technology Group Co. Ltd. is the top1 tft lcd manufacturers in China, headquarter in Beijing, China, BOE has 4 lines of G6 AMOLED production lines that can make flexible OLED, BOE is the authorized screen supplier of Apple, Huawei, Xiaomi, etc,the first G10.5 TFT line is made in BOE.BOE main products is in large sizes of tft lcd panel,the maximum lcd sizes what BOE made is up to 110 inch tft panel, 8k resolution. BOE is the bigger supplier for flexible AM OLED in China.

Technology Co., Ltd), established in 2009. CSOT is the company from TCL, CSOT has eight tft LCD panel plants, four tft lcd modules plants in Shenzhen, Wuhan, Huizhou, Suzhou, Guangzhou and in India. CSOTproviding panels and modules for TV and mobile

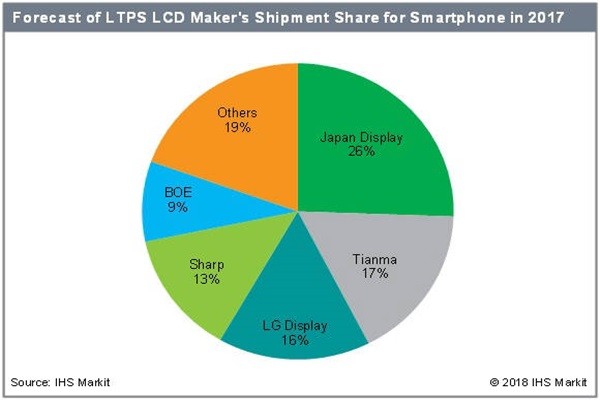

three decades.Tianma is the leader of small to medium size displays in technologyin China. Tianma have the tft panel factories in Shenzhen, Shanhai, Chendu, Xiamen city, Tianma"s Shenzhen factory could make the monochrome lcd panel and LCD module, TFT LCD module, TFT touch screen module. Tianma is top 1 manufactures in Automotive display screen and LTPS TFT panel.

Tianma and BOE are the top grade lcd manufacturers in China, because they are big lcd manufacturers, their minimum order quantity would be reached 30k pcs MOQ for small sizes lcd panel. price is also top grade, it might be more expensive 50%~80% than the market price.

Panda electronics is established in 1936, located in Nanjing, Jiangshu, China. Panda has a G6 and G8.6 TFT panel lines (bought from Sharp). The TFT panel technologies are mainly from Sharp, but its technology is not compliance to the other tft panels from other tft manufactures, it lead to the capacity efficiency is lower than other tft panel manufacturers. the latest news in 2022, Panda might be bougt to BOE in this year.

Established in 2005, IVO is located in Kunsan,Jiangshu province, China, IVO have more than 3000 employee, 400 R&D employee, IVO have a G-5 tft panel production line, IVO products are including tft panel for notebook, automotive display, smart phone screen. 60% of IVO tft panel is for notebook application (TOP 6 in the worldwide), 23% for smart phone, 11% for automotive.

Besides the lcd manufacturers from China mainland,inGreater China region,there are other lcd manufacturers in Taiwan,even they started from Taiwan, they all have built the lcd plants in China mainland as well,let"s see the lcd manufacturers in Taiwan:

Innolux"s 14 plants in Taiwan possess a complete range of 3.5G, 4G, 4.5G, 5G, 6G, 7.5G, and 8.5G-8.6G production line in Taiwan and China mainland, offering a full range of large/medium/small LCD panels and touch-control screens.including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch-control solutions,full range of TFT LCD panel modules and touch panels, including TV panels, desktop monitors, notebook computer panels, small and medium-sized panels, and medical and automotive panels.

AUO is the tft lcd panel manufacturers in Taiwan,AUO has the lcd factories in Tianma and China mainland,AUOOffer the full range of display products with industry-leading display technology,such as 8K4K resolution TFT lcd panel, wide color gamut, high dynamic range, mini LED backlight, ultra high refresh rate, ultra high brightness and low power consumption. AUO is also actively developing curved, super slim, bezel-less, extreme narrow bezel and free-form technologies that boast aesthetic beauty in terms of design.Micro LED, flexible and foldable AMOLED, and fingerprint sensing technologies were also developed for people to enjoy a new smart living experience.

Hannstar was found in 1998 in Taiwan, Hannstar display hasG5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, providing various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

driver, backlight etc ,then make it to tft lcd module. so its price is also more expensive than many other lcd module manufacturers in China mainland.

Maclight is a China based display company, located in Shenzhen, China. ISO9001 certified, as a company that more than 10 years working experiences in display, Maclight has the good relationship with top tft panel manufacturers, it guarantee that we could provide a long term stable supply in our products, we commit our products with reliable quality and competitive prices.

Maclight products included monochrome lcd, TFT lcd module and OLED display, touch screen module, Maclight is special in custom lcd display, Sunlight readable tft lcd module, tft lcd with capacitive touch screen. Maclight is the leader of round lcd display. Maclight is also the long term supplier for many lcd companies in USA and Europe.

If you want tobuy lcd moduleorbuy tft screenfrom China with good quality and competitive price, Maclight would be a best choice for your glowing business.

In recent time, China domestic companies like BOE have overtaken LCD manufacturers from Korea and Japan. For the first three quarters of 2020, China LCD companies shipped 97.01 million square meters TFT LCD. And China"s LCD display manufacturers expect to grab 70% global LCD panel shipments very soon.

BOE started LCD manufacturing in 1994, and has grown into the largest LCD manufacturers in the world. Who has the 1st generation 10.5 TFT LCD production line. BOE"s LCD products are widely used in areas like TV, monitor, mobile phone, laptop computer etc.

TianMa Microelectronics is a professional LCD and LCM manufacturer. The company owns generation 4.5 TFT LCD production lines, mainly focuses on making medium to small size LCD product. TianMa works on consult, design and manufacturing of LCD display. Its LCDs are used in medical, instrument, telecommunication and auto industries.

TCL CSOT (TCL China Star Optoelectronics Technology Co., Ltd), established in November, 2009. TCL has six LCD panel production lines commissioned, providing panels and modules for TV and mobile products. The products range from large, small & medium display panel and touch modules.

Established in 1996, Topway is a high-tech enterprise specializing in the design and manufacturing of industrial LCD module. Topway"s TFT LCD displays are known worldwide for their flexible use, reliable quality and reliable support. More than 20 years expertise coupled with longevity of LCD modules make Topway a trustworthy partner for decades. CMRC (market research institution belonged to Statistics China before) named Topway one of the top 10 LCD manufactures in China.

The Company engages in the R&D, manufacturing, and sale of LCD panels. It offers LCD panels for notebook computers, desktop computer monitors, LCD TV sets, vehicle-mounted IPC, consumer electronics products, mobile devices, tablet PCs, desktop PCs, and industrial displays.

Our company specializes in developing solutions that arerenowned across the globe and meet expectations of the most demanding customers. Orient Display can boast incredibly fast order processing - usually it takes us only 4-5 weeks to produce LCD panels and we do our best to deliver your custom display modules, touch screens or TFT and IPS LCD displays within 5-8 weeks. Thanks to being in the business for such a noteworthy period of time, experts working at our display store have gained valuable experience in the automotive, appliances, industrial, marine, medical and consumer electronics industries. We’ve been able to create top-notch, specialized factories that allow us to manufacture quality custom display solutions at attractive prices. Our products comply with standards such as ISO 9001, ISO 14001, QC 080000, ISO/TS 16949 and PPM Process Control. All of this makes us the finest display manufacturer in the market.

Without a shadow of a doubt, Orient Display stands out from other custom display manufacturers. Why? Because we employ 3600 specialists, includingmore than 720 engineers that constantly research available solutions in order to refine strategies that allow us to keep up with the latest technologiesand manufacture the finest displays showing our innovative and creative approach. We continuously strive to improve our skills and stay up to date with the changing world of displays so that we can provide our customers with supreme, cutting-edge solutions that make their lives easier and more enjoyable.

China’s share of the world"s large display market is expected to exceed 50 percent for the first time ever. This year, Samsung Display and LG Display pull the plug on their LCD panel businesses due to declining profitability, letting China further strengthened its LCD market dominance.

Omdia said IT displays, such as those for tablet PCs, notebook PCs and monitors, led the decline in shipments this year. TV manufacturers have also reduced panel procurement since the second quarter.

Chinese companies are strengthening their stranglehold on the large-size display market. China’s large-size display shipments are projected to account for 55.2 percent this year, outdistancing 24.9 percent of Taiwanese display makers and 14.7 percent of Korean display makers. In area-based shipments, China’s share is expected to reach 61.3 percent. During the same period, only 17.1 percent was projected for Taiwan and 15.4 percent for Korea.

Chinese display makers are in hot pursuit of Korean display makers in the OLED panel domain, where Korean display makers have technological prowess. DSCC, a market research firm, predicted that China will account for 47 percent of OLED panel production in 2025, running shoulder to shoulder with Korea.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

China-based LCD panel maker HKC is applying for listing on ChiNext market under the Shenzhen Stock Exchange to raise CNY9.5 billion (US$1.42 billion), according to industry sources.

HKC invested CNY24 billion to set up its first 8.6G LCD line in Chongqing, China in 2015, and has since built another three 8.6G lines, with the one in Changsha coming into operation in April 2022.

The funds to be raised via IPO will be used to enhance R&D of medium- to large-size OLED panels and expand production capacity for miniLED fine-pitch displays and miniLED-backlit LCD panels for smartphones, notebooks and TVs at the Changsha plant, integrate R&D with production for oxide TFT technology at its Mianyang plant, and develop IoT-based smart display solutions.

China-based panel maker BOE Technology in June 2021 acquired a 2% stake in HKC for strategic partnership in assembly of LCD displays and TVs. BOE has three flexible OLED panel production lines and has fully utilized production capacities at two of them and is undertaking trial production at the third.

BOE shipped about 60 million flexible OLED panels in 2021, hiking nearly 60% on year. According to forecast by Omdia, BOE will ship 100 million flexible OLED panels in 2022. Besides, BOE has begun production of miniLED-backlit panels for AOC, Skyworth and Konka.

China-based panel maker CSOT has fully utilized first-phase production capacity for flexible OLED panels at a factory in central China and is expanding the capacity in the second phase with operation to begin by the end of 2022.

In both LCD and OLED displays, producing these cells – which are highly complex – is by far the most difficult element of the production process. Indeed, the complexity of these cells, combined with the levels of investment needed to achieve expertise in their production, explains why there are less than 30 companies in the whole world that can produce them. China, for instance, has invested more than 300 billion yuan (approximately $45 billion USD) in just one of these companies – BOE – over the past 14 years.

Panox Display has been involved in the display industry for many years and has built strong and long-term partner relationships with many of the biggest OLED and LCD panel manufacturers. As a result, we are able to offer our clients guaranteed access to display products from the biggest manufacturers.

LG Display was, until 2021, the No. 1 display panel manufacturer in the world. Owned by LG Group and headquartered in Seoul, South Korea, it has R&D, production, and trade institutions in China, Japan, South Korea, the United States, and Europe.

Founded in 2001, AUO – or AU Optronics – is the world’s leading TFT-LCD panel manufacturer (with a 16% market share) that designs, develops, and manufactures the world’s top three liquid crystal displays. With panels ranging from as small as 1.5 inches to 46 inches, it boasts one of the world"s few large-, medium -and small-sized product lines.

AUO offers advanced display integration solutions with innovative technologies, including 4K2K ultra-high resolution, 3D, ultra-thin, narrow bezel, transparent display, LTPS, OLED, and touch solutions. AOU has the most complete generation production line, ranging from 3.5G to 8.5G, offering panel products for a variety of LCD applications in a range of sizes, from as small as 1.2 inches to 71 inches.

Now Sharp is still top 10 TV brands all over the world. Just like BOE, Sharp produce LCDs in all kinds of size. Including small LCD (3.5 inch~9.1 inch), medium LCD (10.1 ~27 inch), large LCD (31.5~110 inch). Sharp LCD has been used on Iphone series for a long time.

Beside those current LCDs, the industrial LCD of Sharp is also excellent and widely used in public facilities, factories, and vehicles. The Sharp industrial LCD, just means solid, high brightness, super long working time, highest stability.

Since its establishment, Truly Semiconductors has focused on researching, developing, and manufacturing liquid crystal flat panel displays. Now, after twenty years of development, it is the biggest small- and medium-sized flat panel display manufacturer in China.

Truly’s factory in Shanwei City is enormous, covering an area of 1 million square meters, with a net housing area of more than 100,000 square meters. It includes five LCD production lines, one OLED production line, three touch screen production lines, and several COG, LCM, MDS, CCM, TAB, and SMT production lines.

Its world-class production lines produce LCD displays, liquid crystal display modules (LCMs), OLED displays, resistive and capacitive touch screens (touch panels), micro camera modules (CCMs), and GPS receiving modules, with such products widely used in the smartphone, automobile, and medical industries. The LCD products it offers include TFT, TN, Color TN with Black Mark (TN type LCD display for onboard machines), STN, FSTN, 65K color, and 262K color or above CSTN, COG, COF, and TAB modules.

In its early days, Innolux attached great importance to researching and developing new products. Mobile phones, portable and mounted DVD players, digital cameras, games consoles, PDA LCDs, and other star products were put into mass production and quickly captured the market, winning the company considerable market share.

Looking forward to the future, the group of photoelectric will continue to deep LCD display field, is committed to the development of plane display core technology, make good use of global operations mechanism and depth of division of labor, promise customers high-quality products and services, become the world"s top display system suppliers, in 2006 in the global mobile phone color display market leader, become "Foxconn technology" future sustained rapid growth of the engine.

Founded in June 1998, Hannstar specializes in producing thin-film transistor liquid crystal display panels, mainly for use in monitors, notebook displays and televisions. It was the first company in Taiwan to adopt the world’s top ultra-wide perspective technology (AS-IPS).

The company has three LCD factories and one LCM factory. It has acquired state-of-the-art TFT-LCD manufacturing technology, which enables it to achieve the highest efficiency in the mass production of thin-film transistor liquid crystal display production technology. Its customers include many of the biggest and most well-known electronics companies and computer manufacturers in Taiwan and overseas.

TCL CSOT – short for TCL China Star Optoelectronics Technology (TCL CSOT) – was founded in 2009 and is an innovative technology enterprise that focuses on the production of semiconductor displays. As one of the global leaders in semiconductor display market, it has bases in Shenzhen, Wuhan, Huizhou, Suzhou, Guangzhou, and India, with nine panel production lines and five large modules bases.

TCL CSOT actively produces Mini LED, Micro LED, flexible OLED, printing OLED, and other new display technologies. Its product range is vast – including large, medium, and small panels and touch modules, electronic whiteboards, splicing walls, automotive displays, gaming monitors, and other high-end display application fields – which has enabled it to become a leading player in the global panel industry.

In the first quarter of 2022, TCL CSOT’s TV panels ranked second in the market, 55 inches, 65 " and 75 inches second, 8K, 120Hz first, the first, interactive whiteboard and digital sign plate; LTPS flat panel, the second, LTPS and flexible OLED fourth.

EDO (also known as EverDisplay Optonics) was founded in October 2012 and focuses on the production of small- and medium-sized high-resolution AMOLED semiconductor display panels.

Tianma Microelectronics was founded in 1983 and listed on the Shenzhen Stock Exchange in 1995. It is a high-tech enterprise specializing in the production of liquid crystal displays (LCD) and liquid crystal display modules (LCM).

After more than 30 years of development, it has grown into a large publicly listed company integrating LCD research and development, design, production, sales, and servicing. Over the years, it has expanded by investing in the construction of STN-LCD, CSTN-LCD, TFT-LCD and CF production lines and module factories across China (with locations in Shenzhen, Shanghai, Chengdu, Wuhan and Xiamen), as well R&D centers and offices in Europe, Japan, South Korea and the United States.

JDI (Japan Display Inc.) was established on November 15, 2011, as a joint venture between the Industrial Innovation Corporation, Sony, Hitachi, and Toshiba. It is dedicated to the production and development of small-sized displays. It mainly produces small- and medium-sized LCD display panels for use in the automotive, medical, and industrial fields, as well as personal devices including smartphones, tablets, and wearables.

Although Sony’s TVs use display panels from TCL CSOT (VA panel), Samsung. Sony still produces the world’s best micro-OLED display panels. Sony has many micro OLED model such as 0.23 inch, 0.39 inch, 0.5 inch, 0.64 inch, 0.68 inch, 0.71 inch. Panox Display used to test and sell many of them, compare to other micro OLED manufacuturers, Sony`s micro OLEDs are with the best image quality and highest brightness (3000 nits max).

Workers manufacture display panels on an assembly line in Huainan High-Tech Industrial Development Zone in East China"s Anhui Province, on April 24, 2022. Photo: VCG

As South Korean media lament another of the country"s prized claims is losing to China, industry experts said Chinese companies have closed the gap with South Korean rivals in the past decade, while they emphasized that cooperation is still needed to push the industry forward.

The year 2021 was a milestone for China"s display panel industry. Chinese display panel makers, led by companies such as BOE Technology Group Co, Shenzhen China Star Optoelectronics Technology Co, Tianma, and Visionox, accounted a combined 40.4 percent of global market share in turnover, outstripping South Korea"s 36.3 percent, data from Beijing-based market research provider Sigmaintell revealed.

It is the first time that Chinese companies held a larger market share that their South Korean rivals, mainly Samsung Display and LG Display, as in 2020, South Korean companies led with 39.8 percent of market share, 4.8 percentage points higher than China.

A different set of data published by market research firm Omdia showed the same pattern. China recorded $64.8 billion in sales including liquid crystal display (LCD) and OLED in the global display market in 2021. China overtook South Korea"s No. 1 spot with a market share of 41.5 percent while South Korea"s market share fell to 33.2 percent.

On March 30, BOE, the world"s largest flat-panel display manufacturer, said its total revenue stood at 219.31 billion yuan ($33.57 billion) in 2021, up 61.79 percent from a yearly basis, while its net profit surged 412.96 percent year-on-year to hit 25.83 billion yuan.

Market competition in display panel, an indispensable part for consumer electronics, is fierce. And the competing relations between Chinese and South Korean companies exist in display panels for smartphones, televisions, monitors, among other product segments.

Display panel are comparable to today"s high-end semiconductors, for years the production of display panels had been monopolized by foreign companies. But after a decade of strenuous work to catchup, experts said that Chinese players now dominate today"s display panel manufacturing and the proliferation of display panel technology benefited global consumers by reducing the cost of a wide range of downstream electronic components and has in recent years caused domestic upstream business such as material-supplying company to flourish.

In terms of LCD, Chinese companies have long surpassed their South Korean counterparts in shipments, and in recent years Chinese companies also invested heavily in advanced production lines for small-size OLED screens that is used in smartphones.

Len Lee, chief analyst of display industry of ijiwei.com, said Chinese companies have been playing catch-up during the past decade and the report by South Korean media nevertheless showed a transformation process in which the Chinese players move from that of a runner-up to that of a front runner.

Etnews suggested South Koran companies reduce OLED panel prices by mass producing OLED, which requires substantial investment in production capacity, only then can South Korea replace the LCD market led by China. The battlefield of choice for South Korean firms would be in large TV panel market, in which they still enjoy large technological gap with China.

Even as South Korean companies seek to entrench their lead position in large-size OLED, their efforts may not turn out to be as effective as imagined, Lee said, as large OLED may not prove to be a worthy barrier behind which South Korean companies could fall back upon as it does not have unique functions that could not be fulfilled by LCD.

In 2021, shipments of large-size OLED display panels were just 6.7 million units while in the same period the shipments of LCD reached 210 million units.

"Back in the days of LCD phasing out cathode ray tube and plasma display panel, LCD could fulfill unique functions the other two types could not. That is something we don"t see in OLED. The things OLED can do, LCD can also do and are being constantly perfected," Lee said. "That means fall back behind the OLED castles may not be enough to fend off challenges lurched out by Chinese players."

Sigmaintell"s Li said although Chinese companies outpaced South Korean rivals in turnover in 2021, whether they could hold on to their combined lead this year is a question open to debate as the industry might face a slowdown after the volatile prices last year, and a decline in sales will dent turnover.

Lee said as the display panel industry moves forward, Chinese companies are betting big on research & development in new emerging display technologies such as mini-LED and micro-LED.

"In these cutting-edge fields of competition, the South Korean advantage is even smaller and companies are competing head-to-head to gain the position of the leader," Lee said. "This is the current stage of China-South Korean in the display sector, with Chinese companies already outperformance their global rivals in certain fields."

The upstream materials or components of the LCD panel industry mainly include liquid crystal materials, glass substrates, polarizing lenses, and backlight LEDs (or CCFL, which accounts for less than 5% of the market).

The middle reaches is the main panel factory processing and manufacturing, through the glass substrate TFT arrays and CF substrate, CF as upper and TFT self-built perfusion liquid crystal and the lower joint, and then put a polaroid, connection driver IC and control circuit board, and a backlight module assembling, eventually forming the whole piece of LCD module. The downstream is a variety of fields of application terminal-based brand, assembly manufacturers. At present, the United States, Japan, and Germany mainly focus on upstream raw materials, while South Korea, Taiwan, and the mainland mainly seek development in mid-stream panel manufacturing.

With the successive production of the high generation line in mainland China, the panel production capacity and technology level have been steadily improved, and the industrial competitiveness has been gradually enhanced. Nowadays, the panel industry is divided into three parts: South Korea, mainland China, and Taiwan, and mainland China is expected to become the no.1 in the world in 2019.

In the past decade, China’s panel display industryhas achieved leapfrog development, and the overall size of the industry has ranked among the top three in the world. Chinese mainland panel production capacity is expanding rapidly, although Japanese panel manufacturers master a large number of key technologies, gradually lose the price competitive advantage, compression panel production capacity. Panel production is concentrated in South Korea, Taiwan, and China, which is poised to become the world’s largest producer of LCD panels.

Up to 2016, BOE‘s global market share continued to increase: smartphone LCD, tablet PC display, and laptop display accounted for the world’s first market share, and display screen increased to the world’s second, while TV LCD remained the world’s third. In LCD TV panels, Chinese panel makers have accounted for 30 percent of global shipments to 77 million units, surpassing Taiwan’s 25.5 percent market share for the first time and ranking second only to South Korea.

In terms of the area of shipment, the area of board shipment of JD accounted for only 8.3% in 2015, which has been greatly increased to 13.6% in the first half of 2016, while the area of shipment of hu xing optoelectronics in the first half of 2015 was only 5.1%, which has reached 7.8% in the first half of 2016. The panel factories in mainland China are expanding their capacity at an average rate of double-digit growth and transforming it into actual shipments and areas of shipment. On the other hand, although the market share of South Korea, Japan, and Taiwan is gradually decreasing, some South Korean and Japanese manufacturers have been inclined to the large-size HD panel and AMOLED market, and the production capacity of the high-end LCD panel is further concentrated in mainland China.

Domestic LCD panel production line capacity gradually released, overlay the decline in global economic growth, lead to panel makers from 15 in the second half began, in a low profit or loss, especially small and medium-sized production line, the South Korean manufacturers take the lead in transformation strategy, closed in medium and small size panel production line, South Korea’s 19-panel production line has shut down nine, and part of the production line is to research and development purposes. Some production lines are converted to LTPS production lines through process conversion. Korean manufacturers are turning to OLED panels in a comprehensive way, while Japanese manufacturers are basically giving up the LCD panel manufacturing business and turning to the core equipment and materials side. In addition to the technical direction of the research and judgment, more is the LCD panel business orders and profits have been severely compressed, Korean and Japanese manufacturers have no desire to fight. Since many OLED technologies are still in their infancy in mainland China, it is a priority to move to high-end panels such as OLED as soon as possible. Taiwanese manufacturers have not shut down factories on a large scale, but their advantages in LCD technology and OLED technology have been slowly eroded by the mainland.

STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The TFT LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The TFT LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.

BOE Technology Group and TCL China Star Optoelectronics Technology (TCL CSOT) are among the Chinese panel makers to have ramped up output since around 2019 with generous state subsidies. China is gaining on South Korea, whose share of capacity is seen reaching 55% for 2022 in an October estimate by U.S. market intelligence firm Display Supply Chain Consultants (DSCC).

August 2, according to the Taiwan media “Economic Daily News” reported that the latest report of the research agency RUNTO (RUNTO) shows that the first half of 2022 Chinese mainland panel manufacturers to 84 million shipments as well as 67% market share claimed the title, a record high. Taiwan panel makers Guntron, AUO shipments have declined, a combined market share of 18%, slightly better than Japan and South Korea’s combined 15%. Market expectations, with the mainland domination of the LCD panel market, the next three years, the panel factory is afraid of a merger tide.

According to the “Global LCD TV panel market monthly tracking” released by LOTUS, the first half of this year, the world shipped 125 million LCD TV panels above 32 inches, an increase of 1.9% year-on-year, with mainland manufacturers BOE, Huaxing Optoelectronics and Huike firmly in the top three.

To strengthen the core position of the industry chain, the Chinese mainland TV panel factory to maintain a high crop rate, shipments in the first half of 84 million pieces, the global market share of 67%, an increase of 6.2 percentage points, compared with the second half of last year, an increase of 3.4 percentage points.

The top ten panel manufacturers in the analysis of the Luotu technology, land-based panel factory shipments are showing year-on-year growth, Huaxing photoelectric, rainbow photoelectric shipments were up 12% and 16%. Most of the non-China panel factory decline, Taiwan panel factory Grouptron decline by about 10%, AUO reduced by 14%, the two combined market share of 18% in the first half.

Samsung Display (SDC) began to gradually reduce production at the beginning of the year to a complete shutdown in June, resulting in a year-on-year reduction of 50%. Sharp because of the active adjustment of production capacity, production decreased by 28% year-on-year, Japan and South Korea panel factories in the first half of the combined market share fell to a low of 15%.

Accordingly, the top ten panel makers are divided into four camps, with BOE, which shipped more than 30 million pieces in the first half of the year, firmly taking the lead in the large-size LCD panel industry. Next, 20 million pieces of Huaxing photoelectric, Huike. 10 million pieces of camp for the grouptron and Lejin display (LGD). Million-chip rank AUO and Sharp, with 8 million and 6 million pieces shipped, fell to the tail camp with Rainbow Photoelectric, CEC Panda and Samsung Display SDC.

Looking ahead to the second half of the year, Luotu Technology expects that, as the TV panel each main size has fallen below the cash cost, the panel factory strives to stop bleeding, start large-scale production reduction operations, the panel market is expected to usher in a turnaround. It is expected that before September this year, the major panel factory crop rate will be less than 75%, as to whether the price can stabilize the key observation point also falls in September.

China is the leader in producing LCD display panels, with a forecast capacity share of 56 percent in 2020. China"s share is expected to increase in the coming years, stabilizing at 69 percent from 2023 onwards.Read moreLCD panel production capacity share from 2016 to 2025, by countryCharacteristicChinaJapanSouth KoreaTaiwan-----

DSCC. (June 8, 2020). LCD panel production capacity share from 2016 to 2025, by country [Graph]. In Statista. Retrieved January 06, 2023, from https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "LCD panel production capacity share from 2016 to 2025, by country." Chart. June 8, 2020. Statista. Accessed January 06, 2023. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. (2020). LCD panel production capacity share from 2016 to 2025, by country. Statista. Statista Inc.. Accessed: January 06, 2023. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "Lcd Panel Production Capacity Share from 2016 to 2025, by Country." Statista, Statista Inc., 8 Jun 2020, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC, LCD panel production capacity share from 2016 to 2025, by country Statista, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/ (last visited January 06, 2023)

BOE Technology Group, the Chinese electronic components producer, is expected to be the leader in producing LCD display panels in the coming years, with a forecast capacity share of 24 percent by 2022. China is the country that has the largest LCD capacity, with a 56 percent share in 2020.Read moreLCD panel production capacity share from 2016 to 2022, by manufacturerCharacteristicBOEChina StarInnoluxAUOLGDHKCCEC PandaSharpSDCOther-----------

DSCC. (June 8, 2020). LCD panel production capacity share from 2016 to 2022, by manufacturer [Graph]. In Statista. Retrieved January 06, 2023, from https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC. "LCD panel production capacity share from 2016 to 2022, by manufacturer." Chart. June 8, 2020. Statista. Accessed January 06, 2023. https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC. (2020). LCD panel production capacity share from 2016 to 2022, by manufacturer. Statista. Statista Inc.. Accessed: January 06, 2023. https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC. "Lcd Panel Production Capacity Share from 2016 to 2022, by Manufacturer." Statista, Statista Inc., 8 Jun 2020, https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC, LCD panel production capacity share from 2016 to 2022, by manufacturer Statista, https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/ (last visited January 06, 2023)

China has become the world"s largest LCD panel manufacturing base and is investing in a complete Mini/Micro-LED industry chain. Li Leiguang, JW Insights" chief analyst of the display industry, shared this information at a Mini/Micro-LED industry forum held in Shenzhen in late October.

With over 16 years of experience in the display industry, Li Leiguang has a deep understanding of China"s domestic display industry from materials and panel technologies to industrial policies. He has written industrial research and planning reports for various government departments in Shenzhen, Zhaoqing, Meishan, and Chengdu as well as customized reports for corporate clients in the display industry chain. This article is an excerpt from his speech.

China had long depended on imports of IC and display screens in the manufacturing of display products. IC and display screens are the two pillar sectors of the ICT Industry. The trend has been changing. With the continuous increase of high-generation production lines and capacity of domestic panel manufacturers and the gradual closure of LCD production lines by South Korean manufacturers, China"s LCD panel market share has increased year by year.

In 2020, China achieved a trade surplus in LCD panels for the first time. Meanwhile, the TFT-LCD has become a mainstream choice in the display panel industry after nearly 30 years of development.

JW Insights data shows that China has invested a total of RMB1.2 trillion($187.56 billion) in TFT-LCD and AMOLED panel production lines; Some 50 TFT-LCD and AMOLED panel production lines have been built, with 197 million m2/year TFT-LCD production capacity, 8.9 million m2/year AMOLED production capacity.

China"s LCD production capacity accounted for 50% of the global production capacity in 2020, becoming the world"s largest LCD panel production center; It will reach more than 75% of the world"s total by 2025.

China"s mainland is currently the only region that maintains continuous growth in LCD panel production capacity. With Japanese and South Korean manufacturers gradually withdrawing from the LCD panel, China is becoming the dominant player.

Chinese domestic display panel manufacturers are also embracing new display technologies such as Mini LED, Mirco LED, OLED and Micro OLED (silicon-based OLED), which are in an explosive market growth phase.

Chinese screen manufacturers plan to invest nearly RMB 30 billion($4.7 billion) in silicon-based OLED products lines, with more than 15 planned production lines and the total production capacity equivalent to 95 million units 1-inch screen, according to JW Insights statistics.

Meanwhile, China is leading the world in Micro LED research and development. Chinese players have actively invested in the Mini/Micro-LED, geared up for a new round of capacity ramps. The total investments in this field have amounted to RMB100 billion($15.6 billion), expected to accelerate Mini/Micro LED commercialization.

Unlike LCD technology that originated overseas, China has kept pace with the world in Mini/Micro-LED and has established a relatively complete industrial chain in it. Currently, the Mini LED is mainly used for LCD panel backlighting; It will be an inevitable trend for the direct LED display with Mini LED in large-screen in the future.

Regarding the Micro-LED technological progress choices, Chinese display manufacturers are facing challenges in mass transfer and full-color display. They are exploring and verifying multiple technical routes.

However, TFT-LCD technology will remain the mainstay for a long time in the future, because of its maturity and competitive prices. Multiple display technologies will coexist in the future; Micro-LED panels mass production will not be achieved in the short term.

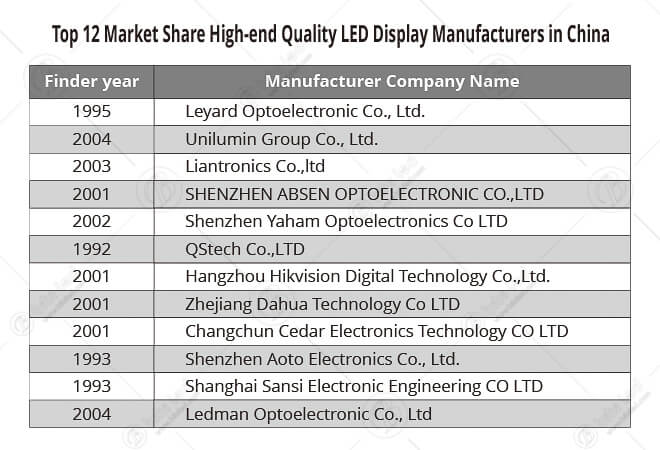

Founded in 2012, as a LED display brand of Unilumin which is focusing on channel distributions.Lamp is the world’s leading provider of large-screen digital display systems and comprehensive solutions for big data information visualization.Focus on new display panels, big data information visualization, optical electronics, image processing, signal transmission, etc. In the field of technology, it is committed to improving the visual experience of human display technology.Products mainly in HD LED screens,fixed LED screens,rental LED screens and creative LED screens.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey