lcd panel manufacturers market share free sample

The global TFT-LCD display panel market attained a value of USD 181.67 billion in 2022. It is expected to grow further in the forecast period of 2023-2028 with a CAGR of 5.2% and is projected to reach a value of USD 246.25 billion by 2028.

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

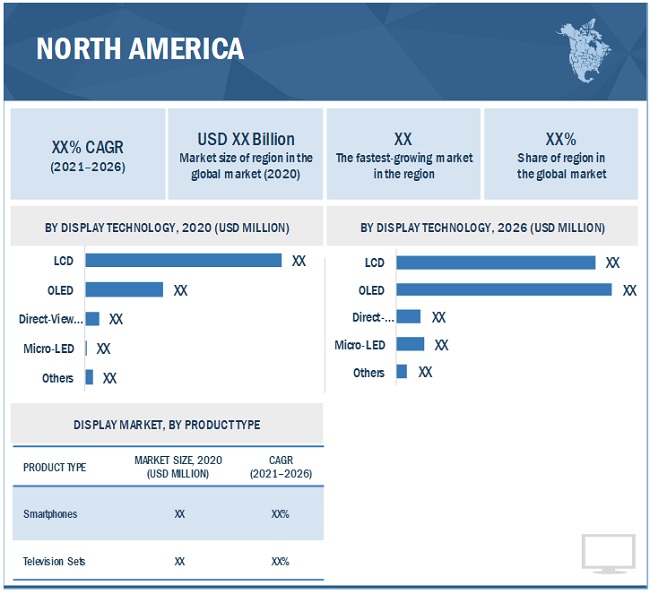

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

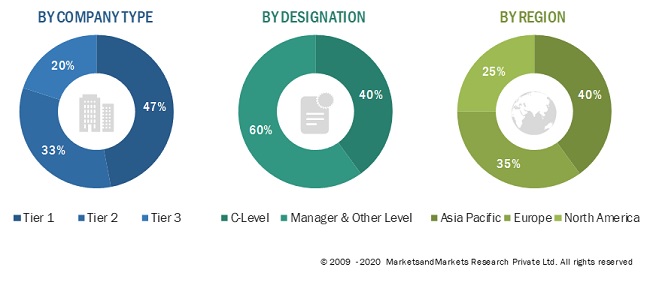

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

New York, United States, Nov. 10, 2022 (GLOBE NEWSWIRE) -- A Smart Display is a sophisticated digital product controlled by the Internet of Things (IoT)-enabled gadgets or voice-activated remote controls. The smart mirror is one cutting-edge tool that might track customer personal information and buying behavior in the retail and automobile industries. Smart devices are also getting interactive and advanced controlling features, expanding as a cutting-edge technical solution. Applications for smart displays project the desired content onto the display using technologies like LED, LCD, and others. A smart display is often used in retail, sport and entertainment, and healthcare due to the rise in demand for cutting-edge advertising and monitoring systems. Additionally, smart display applications like signage and mirrors designed to enhance consumer shopping experiences, welcome customers, and display advertisements in retail establishments drive the use of machine vision technology in the medical and healthcare sector.

Over the forecast year, it is predicted that the smart display market will grow due to the demand for the Internet of Things and artificial intelligence-based smart applications in the residential sector brought on by rising purchasing power in developing countries. The market for smart displays is also expected to benefit from the rising demand for smart mirror systems in the automotive sector. The demand for smart displays is also expected to increase as digital advertising becomes more and more popular in the corporate, retail, and healthcare sectors. Due to these factors, the market will likely grow in the following years.

There has been a rise in the use of smart home apps due to advances in basic technology and fast internet globally. The rise in smartphone usage has facilitated the emergence of smart home apps. Another outcome of global home automation improvement is using smart home application technologies, such as smart displays in the residential sector, to control digital applications like smart lights, thermostats, and more. The development of AI-powered smart display technology in the home market, which will further fuel demand for smart display technology internationally, is also expected to increase demand for smart automation technology for controlling lights, fans, security cameras, and other devices.

The need for increased safety, comfort, and convenience has led to the global expansion of smart mirror applications, which are now a crucial part of the automotive industry. The smart displays used in the automotive sector are designed for various purposes, including Bluetooth and wi-fi, temperature, navigation, turn signals, back cameras, and more. Owing to the rising demand for smart display mirrors in the automotive industry, it is projected that the market for smart displays will grow. Additionally, because the required hardware is easily accessible, the growth of electronically connected cars is swiftly adopting smart display technology. Consequently, expected to fuel the development of the smart display market in the upcoming years.

The E-commerce platform has wholly destroyed the retail industry because of accessibility and the internet. Customers" increasing purchasing power and disposable income on a global scale have raised the demand for smart signage solutions, such as smart displays. Major retailers like Alibaba, Walmart, and Amazon are integrating digital solutions like smart signage. Additionally, the smart display can be utilized as a payment method to reduce line waiting during checkout because clients can use their cell phones to pay at the sign. Therefore, it is projected that each of these factors will create opportunities for the market for smart displays in the coming years.

The Asia Pacific will command the market with the largest share. One of the factors boosting the growth of the smart display market in Asia-Pacific is the rise in the use of smart signage and mirror displays in the retail, residential, and healthcare sectors. Additionally, it is predicted that the market will expand significantly throughout the projection period due to increased demand for digital communication systems. In addition, it is projected that the Asia-Pacific smart display market will gain from the high demand for surveillance and smart home displays in the automobile sector. Furthermore, it is projected that the future growth of smart display technology in this region will be influenced by the technological advancements made in smart signs and mirrors by China, Japan, South Korea, and others, including the digital wall and 8K signage technology. The market for smart displays is expanding in Asia-Pacific due to these forces working together.

North America is anticipated to maintain a dominant position in the global market for smart displays due to the presence of major competitors and the accessibility of cutting-edge smart home solutions. The market for smart displays has recently been driven by the adoption of smart signage technology across the commercial and industrial sectors. For instance, it is anticipated that over the forecast period, a rise in government initiatives in North America to build smart infrastructure across airports, railway stations, and other commercial sectors will be a crucial driver of the smart display market.

The area"s rise has also been aided by the creation of new smart display technology by significant industry participants like Google, Amazon, Apple, and Facebook. The demand for customer contact and digital communication in the healthcare, retail, sports, and entertainment industries is one factor driving the growth of smart signage solutions in this region"s smart display market.

Key Highlights The global smart display market had a revenue share of USD 1.80 billion in 2021, presumed to reach USD 17.81 billion, expanding at a CAGR of 29% during the forecast period.

Market News In 2022, Samsung launched a second-generation SmartSSD. Samsung"s SmartSSD can analyze data directly, reducing the time that data must be transferred between the CPU, GPU, and RAM compared to other SSDs.

Smart Transportation Market: Information by Product Type, Transportation Mode (Roadways, Railways, Airways and Maritime), and Region — Forecast till 2030

Smart Card Market: Information by Type (Contact, Contactless), Component (Software, Hardware), Access Type (Physical, Logical), Industry Vertical, and Region — Forecast till 2030

Smart Lock Market: Information by Lock Type (Deadbolts, Lever Handles, Padlocks), Communication Protocol, Application, and Region — Forecast till 2030

StraitsResearch is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

The global commercial display market size was valued at USD 51.17 billion in 2021. It is projected to reach USD 88.90 billion by 2030, growing at a CAGR of 7.2% during the forecast period (2022–2030). The commercial display is a subset of electronic displays that can manage centrally and individually to display text, animation, or video messages to an international audience. Commercial displays use technologies such as organic light-emitting diode (OLED), liquid crystal display (LCD), light-emitting diode (LED), quantum light-emitting diode (QLED), and projection for showing media and digital material, web pages, weather data, and text in a professional setting. Commercial displays are utilized extensively in the retail and hotel industries due to their extended warranties and ability to operate between 16 and 24 hours daily. In addition, this technology optimizes brightness in high-ambient-light circumstances and is integrated with a specific technology that contributes to superior onboard cooling, picture preservation, and resolution concerns.

In the commercial display industry, technological breakthroughs such as holographic displays, tactile touchscreens, and outdoor 3D screens raise product quality requirements and outweigh financial benefits. The commercial display market share is anticipated to increase steadily due to technological advancements and the widespread adoption of new technologies such as OLED and QLED.

The increasing need for digital signage in the healthcare and transportation industries is anticipated to propel the worldwide commercial display market"s expansion. Rapid industrialization, rising government spending on infrastructure development, and changing consumer lifestyles all contribute to the global expansion of the commercial display industry. Moreover, the increasing adoption of digital technologies by market participants for advertising products and services to make a strong impression on customers" minds is a major factor boosting the demand for commercial displays. In addition, the increasing integration of technologies such as AI and machine learning into commercial displays is driving the global market growth. The introduction of 4K and 8K displays accelerates the manufacturing of ultra-HD advertising content, contributing significantly to market expansion.

Increased urbanization and population growth, rising government spending on infrastructure building, and shifting consumer lifestyles are driving the rise of the commercial display market. Display technology developments and rising demand for energy-efficient panels are driving the expansion of the global commercial display industry. In addition, the increasing incorporation of technologies such as artificial intelligence and deep learning into commercial displays contributes to the market"s global growth.

The significant financial and energy costs associated with maintaining displays could impede the market growth. In addition, COVID-19 and its negative impact are a significant barrier to market expansion. As a result of these factors, display manufacturing has been halted all over the world. It is anticipated that an increase in commercial displays in industries such as hospitality, entertainment, banking, healthcare, education, and transportation will fuel the expansion of the market. Due to technological advancements and significant investments in research and development made by important companies to produce distinctive displays with sophisticated features, there is a sizable potential for market expansion.

In addition, the most recent low-cost display solutions are projected to penetrate a variety of commercial units such as restaurants, bars, and cafes at a faster rate. This is anticipated to give lucrative opportunities for the market. The growing popularity of contemporary technologies such as QLED, OLED, mini-LED, and micro-LED will give the sector multiple opportunities for growth in the years to come.

The digital signage segment dominates the market during the forecast period. The market category is divided into video walls, displays, transit LED screens, digital posters, and kiosks. In addition, the increasing preference for digital display solutions in business settings is also fueling the segment"s growth. The segment of display televisions is anticipated to grow at a CAGR of 4.23% during the forecast period. Manufacturers like SAMSUNG and LG Display Co., Ltd. are incorporating cutting-edge technology such as mini-LED and micro-LED into their most recent commercial-grade televisions. In addition, competitors are introducing many forms of TV panels, including rollable and flexible panels. These products are utilized extensively in hospitals, clinics, and multi-specialty healthcare institutions.

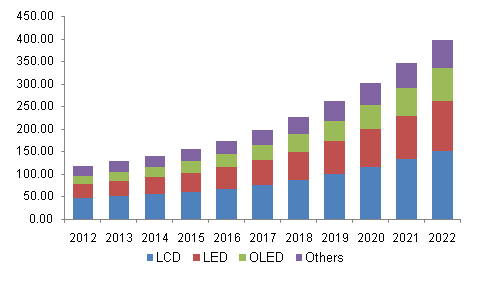

LCD is the most dominant segment during the forecast period. Several industry sectors, including corporate offices and banks, currently utilize LCD-based devices. One of the principal factors driving the widespread use of LCD technology is the decline in LCD production costs. However, the LED technology category is anticipated to account for a sizable market revenue share by 2030. LED technology improvements have led to the development of numerous LED displays, including OLED and QLED. Manufacturers widely employ these energy-efficient solutions in their commercial displays.

The hardware category retained the most significant market share during the forecast period. The segment"s expansion can be attributable to the greater demand for hardware than software. Displays, extenders and cables, accessories, and installation equipment are examples of hardware components. With the introduction of new and advanced software for digital signage, the software category had a significant market share. The software segment is expected to grow at an impressive CAGR of 6.26% during the forecast period. Due to the higher maintenance and repair requirements of commercial televisions and monitors, the services category experienced a substantially greater demand in 2021 than the software segment.

The flat panel display sector dominates the market during the forecast period. Numerous end-use sectors extensively employ flat-panel displays such as video walls, digital posters, monitors, and televisions. Entertainment, gaming, design, automotive, and manufacturing applications utilize curved panels extensively. These panels are widely utilized in TVs, monitors, smartphones, and wearable devices to satisfy various consumer demands.

Based on application, the market has been categorized into retail, hotel, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, and transportation.

The retail sector held the most significant market share during the forecast period. The central area requires digital advertisements for product and service marketing and promotion. Retailers are implementing a contemporary advertising strategy which is causing an increase in demand for commercial-grade televisions and digital signage. Due to the increasing number of hotels, motels, restaurants, QSRs, cafes, and bars, the hospitality industry is another significant contributor to the market expansion.

The sub-32-inch and 32-to-52-inch categories are expected to dominate the market during the forecast period. Customers prefer huge displays because of enhanced display clarity, energy-efficient technologies like OLED and micro-LED, and superior content quality. However, the sector of displays more significant than 75 inches is anticipated to have the highest CAGR due to the increasing demand for large-format displays. Retail, transportation, and healthcare industries use huge displays for signage purposes. In the past few years, leading players like SAMSUNG and LG Display Co., Ltd. have developed a plethora of commercial-grade televisions with displays more significant than 75 inches due to their growing popularity.

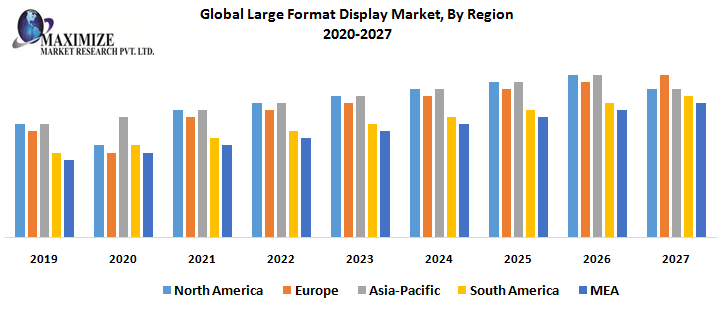

The global market for commercial displays has been classified by geography into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa.

North America accounted for more than 32.45% of the market share and is anticipated to dominate during the forecast period. Companies such as SAMSUNG, TCL North America, and others have developed a substantial consumer base in the area. In addition, the widespread usage of advanced display solutions across various industries is anticipated to stimulate regional market growth further. Asia-Pacific will experience the highest CAGR of 7.23% during the forecast period. Rapid urbanization and the increasing use of commercial displays in the healthcare, hotel, transportation, and retail sectors have contributed to the region"s expansion. In addition, the region is distinguished by the presence of manufacturers, original equipment manufacturers, and an extensive client base.

The expansion of production LCD displays and their increased importance in automotive products drive the growth of the global automotive LCD display market.

The expansion of production LCD displays and their increased importance in automotive products drive the growth of the global automotive LCD display market. However, restricted view angle of LCD displays restricts the market growth. Moreover, increase in use of AR and VR devices in displays present new opportunities for the market in the coming years.

COVID-19 Scenario:The outbreak of the COVID-19 pandemic had a negative impact on the global automotive LCD display market, owing to temporary closure of manufacturing firms and disruptions in the supply chain during the prolonged lockdown.

European countries under lockdowns suffered major loss of businesses and revenues due to shutdown of manufacturing units in the region. Operations of production and manufacturing industries were heavily impacted by the outbreak of COVID-19, which led to the slowdown in the market growth.

Partnership/collaboration agreements with key stakeholders acted as a key strategy to sustain in the market. In the recent past, many leading players opted for product launch or partnership strategies to strengthen their foothold in the market.

Based on display size, the upto 7 inch segment held the highest market share in 2021, accounting for more than half of the global automotive LCD display market, and is estimated to maintain its leadership status throughout the forecast period. Moreover, the same segment is projected to manifest the

Based on vehicle type, the passenger car segment held the highest market share in 2021, accounting for nearly two-thirds of the global automotive LCD display market, and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the huge demand for passenger cars throughout the world. However, the light commercial vehicle segment is projected to manifest the highest CAGR of 7.2% from 2022 to 2031, due to the adoption of advanced technologies.

Based on region, Asia-Pacific held the highest market share in terms of revenue in 2021, accounting for more than one-third of the global automotive LCD display market, and is likely to dominate the market during the forecast period. Moreover, the same region is expected to witness the fastest CAGR of 6.2% from 2022 to 2031. Surge in demand for interactive display, video walls, and touchscreen technology in this region, is expected to boost the market growth. The report also discusses other regions including the North America, Europe, and LAMEA.

Key Benefits For Stakeholders:This study comprises an analytical depiction of the market size along with the current trends and future estimations to depict the imminent investment pockets.

By Application (Smartphone & Tablet, Smart Wearable, Television & Digital Signage, PC & Laptop, Vehicle Display, and Others), Technology (OLED, Quantum Dot, LED, LCD, E-PAPER, and Others), Industry Vertical (Healthcare, Consumer Electronics, BFSI, Retail, Military & Defense, Automotive, and Others), Display Type (Flat Panel Display, Flexible Panel Display, and Transparent Panel Display): Global Opportunity Analysis and Industry Forecast, 2021-2031

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

GlobalLiquid Crystal Display (LCD) Market, By Product (LCD Character Drivers, LCD Graphic Drivers, LCC Segment Drivers), Application (Automotive, Industrial, Medical, Small Appliance, Others) – Industry Trends and Forecast to 2029

Liquid crystal display (LCD) are widely being used in various sectors such as entertainment, corporate, transport, retail, hospitality, education, and healthcare, among others. These allow organizations in engaging with a broader audience. They also help in creating a centralized network for digital communications.

Global Liquid Crystal Display (LCD) Market was valued at USD 148.60 billion in 2021 and is expected to reach USD 1422.83 billion by 2029, registering a CAGR of 32.63% during the forecast period of 2022-2029. Small Appliance is expected to witness high growth owing to the rise in demand for devices such as smartphones. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Liquid-crystal display is defined as aflat-panel display or other electronically modulated optical device which uses the light-modulating properties of liquid crystals combined with polarizers. Liquid crystals do not emit light directly, instead using a backlight or reflector to produce images in colour or monochrome.

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

The increase in demand for the digitized promotion of products and services for attracting attention of the target audience acts as one of the major factors driving the growth of liquid crystal display (LCD) digital market.

The rise in demand for 4K digitized sign displays with the embedded software and media player accelerate the market growth. These signs deliver customers an affordable Ultra HD digital signage solution has a positive impact on the market.

The emergence of innovative products, such as leak detector systems, home monitoring systems and complicated monetary products further influence the market.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the liquid crystal display (LCD)digital market.

Furthermore, adoption of AMOLED displays, especially due to introduction of 5G and adoption of foldable and flexible displays extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, rise in demand for Micro-LED and mini-LED technologies will further expand the market.

On the other hand, decline in demand for displays from retail sector due to drastic shift towards online advertisement, and high costs associated with new display technology-based products are expected to obstruct market growth. Also, deployment of widescreen alternatives, such as projectors and screenless displays is projected to challenge the liquid crystal display (LCD) digital market in the forecast period of 2022-2029.

This liquid crystal display(LCD) digital market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on liquid crystal display (LCD) digital market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

The COVID-19 has impacted liquid crystal display (LCD) digital market. The limited investment costs and lack of employees hampered sales and production of liquid crystal display (LCD) technology. However, government and market key players adopted new safety measures for developing the practices. The advancements in the technology escalated the sales rate of the li liquid crystal display (LCD) digital as it targeted the right audience. The increase in sales of devices across the globe is expected to further drive the market growth in the post-pandemic scenario.

Sharp launched the new massive 8K Ultra-HD professional LCD in November’2020. This display packs in 33 million pixels and employs a wide color gamut color filter coupled with optimized LED backlight phosphors.

The liquid crystal display (LCD) digital market is segmented on the basis of product and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

The liquid crystal display (LCD) digital market is analysed and market size insights and trends are provided by country, type, component, location, content category, end-user, size, display technology, brightness, and application as referenced above.

The countries covered in the liquid crystal display (LCD) digital market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

North America dominates the liquid crystal display (LCD) digital market because of the presence of dedicated suppliers of the product and rise in demand for these displays in the retail industry within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 because of the rise in awareness regarding the benefits of LCD in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter"s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

The liquid crystal display (LCD) digital market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies" focus related to liquid crystal display (LCD) digital market.

The global next-generation display materials market size was valued at USD 185.92 billion in 2021 and is projected to register a valuation of USD 430.03 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 10.8% over the forecast period 2022-2030.

Increasing demand for laptops, smartphones, Televisions, tablet devices, and other display devices are driving the revenue growth of the global next-generation display market.

Rising preference for more thin and light display systems and devices and rapid technological advancements in the electronics industry are some of the vital factors that are currently driving the growth of the next-generation display market.

Other factors projected to drive the revenue growth of the global next-generation display market include changing trends in the display market, wide viewing angles and high-resolution tablets, smartphones and displays, projectors, digital cameras, smart TVs, and camcorders.

The Global next generation display materials market is segmented by product type, application, and region. On the basis of product type, the market is segmented as, Thin-Film Transistors LCD (TFT-LCD), Organic Light Emitting Diode (OLED), and others. On the basis of application, the market is segmented as Smartphones, Automotive Displays, Laptops and Tablets, and Others.

The Asia-Pacific presents a very lucrative market for the holographic display market due to the presence of highly advanced countries in developing economies as well as consumer electronics industries such as China, Taiwan, and South Korea.

Market Business Insights is a leading global market research and consulting firm. We focus on business consulting, industry chain research, and consumer research to help customers provide non-linear revenue models. We believe that quality is the soul of the business and that is why we always strive for high-quality products. Over the years, with our efforts and support from customers, we have collected inventive design methods in various high-quality market research and research teams with extensive experience.

The global smartwatch display panel market size was valued at $1.21 billion in 2020, and is projected to reach $4.06 billion by 2030, registering a CAGR of 14.1% from 2021 to 2030. Smartwatch is a next-generation wearable computer in the form of a watch. It offers some of the prominent features such as text messaging, emails, appointments, app alerts, and voice calls. Hence, to have seamless experience of smartwatch, smartwatch display panel is the most important and key component of the watch.

The smartwatch display panel is generally less than 2 inches, which increases the need for high resolution in pixels per inch to provide sharp and easy-to-read fine text and graphics. In addition, it needs to produce fairly bright images, as watches are often viewed in high ambient light. A larger color gamut is required to counteract color washout from ambient light. Moreover, vibrant saturated colors are helpful while reading text and graphics information. Thus, smartwatch display panel market plays a crucial role in sales of smartwatches globally.

Emergence of large number of players in the smartwatch industry is the prime reason that drives the growth of the smartwatch display panel industry. Furthermore, high demand for flexible display technology accelerates the growth of the smartwatch display panel market. Moreover, increase in health awareness among consumers is opportunistic for the market growth. Considering these factors, the smartwatch display panel market is anticipated to witness substantial growth in the future.

Increase in pixel density is expected to offer lucrative growth opportunities for the market during the forecast period. However, smartwatch display panels consume significant energy, which is expected to hamper the market growth during the forecast period. On the contrary, some of the other factors driving the market growth are rise in demand for connected devices and increase in disposable income.

COVID-19 notably impacted both consumers and the economy. Electronics manufacturing hubs have been temporarily working at low efficiency to curb the spread of COVID-19. This has majorly affected the supply chain of semiconductor market by creating shortages of materials, components, and finished goods. Lack of business continuity has negatively impacted the revenue and shareholder returns, which are expected to create financial disruptions in the smartwatch display panel industry. However, the smartwatch display panel market is estimated to recover by the mid of 2021 with rapid technological advancements. Moreover, market players are deploying various strategies such as product launch, partnership, and agreement to boost the smartwatch display panel market growth during the forecast period.

The global smartwatch display panel market is segmented into panel type, display technology, display type, application, and region. On the basis of panel type, the market is bifurcated into rigid display and flexible display. The rigid display segment is further classified into round and square. The rigid display segment dominated the market, in terms of revenue in 2020, and is expected to follow the same trend during the forecast period. Depending on display technology, the market is segregated into LED-backlit LED and OLED. The LED-backlit LCD segment was the major revenue contributor in 2020, and is anticipated to witness significant market share during the forecast period. By display type, the market is fragmented into monochrome and colored. The market share for the colored segment was highest in 2020, and is expected to grow at a high CAGR from 2021 to 2030.

As per application, the market is differentiated into personal assistance, medical & health, fitness, and personal safety. The market share for the personal assistance segment was highest in 2020, however, the medical & health segment is expected to grow at a high CAGR from 2021 to 2030.

Significant factors that impact the growth of the smartwatch display panel market include emergence of large number of players in the smartwatch industry, high demand for flexible display technology, and increase in health awareness among the consumers. However, high energy consumption of smartwatch display panels hampers the market growth. On the contrary, increase in pixel density is expected to offer lucrative opportunities for the smartwatch display panel market during the forecast period.

Competitive analysis and profiles of the major smartwatch display panel market players such as AU Optronics, BOE Technology Group Co., Ltd., Everdisplay Optronics (Shanghai) Co., Ltd., Futaba Corporation, Japan Display, LG Electronics, Samsung Electronics Co., Ltd., Sharp Electronics, Truly Opto-electronics Ltd., and Visionox are provided in this report. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaboration, to enhance their market penetration.

Key Benefits for StakeholdersThis study comprises analytical depiction of the smartwatch display panel market trends along with the current trends and future estimations to depict the imminent investment pockets.

Key Market Players AU Optronics Corp, BOE Technology Group Co., Ltd., Everdisplay Optronics (Shanghai) Co.,Ltd. (EDO), Futaba Corporation, JAPAN DISPLAY, LG Electronics Inc, Samsung Electronics, Sharp Corporation, Truly International Holdings Limited, Visionox Technology Inc.

The global interactive display market size was USD 9.46 Billion in 2021 and is expected to register a revenue CAGR of 8.1% during the forecast period. Market revenue growth is primarily driven by burgeoning smart appliance user base and growing public requirements for premium display panels. Advancements in OLED technology and component simplification also help to improve technology owing to a developing trend in the interactive display panel sector. Display panels are being used as a digital signage in various industries including sports, media, and entertainment. For instance, on January 6, 2021, Samsung debuted NeoQLED line as a way to improve the QLED series, which combines micro-LED illumination with quantum dot technology. Furthermore, Samsung has implemented very thin microlayers loaded with extra LEDs in place of a lens to disperse light, resulting in manufacturing of devices, which is 1/40th height of a standard LED. The manufacturer offers this functionality for both 8K and 4K versions.

Furthermore, expanding use of smart displays in residential and public facilities including retail stores, increase in number of infrastructural improvements such as smart homes, and surge in demand for smart cars, are contributing to market revenue growth. Growing use of smart displays in the healthcare industry to show hospital maps and instructions to assist patients or visitors in getting to their preferred location is driving global market revenue growth. In addition, rising internet penetration, digitalization, rising consumer preference for smart home appliances such as smart speakers, smart TVs and other smart home devices and high demand for smart mirrors in automotive and retail sectors are driving interactive display market revenue growth.

Apart from this, technological developments and rising acceptance across a number of applications, including tablets, smartphones, laptops, and smart TVs, are expected to drive market revenue growth. Increased Over-The-Top (OTT) content availability is propelling the wireless display sector for consumer applications. Another important factor driving market growth for interactive displays in corporate applications is cost savings, which can be realized through easy setup and reduced time spent setting up meeting rooms. In addition, compatibility of wireless displays with 4K technology, enables higher quality content and is driving up usage in consumer electronics devices. Moreover, increased adoption of various wireless display technologies as a result of firms introducing innovative products is driving market growth.

Global expansion of COVID-19 has had a significant influence on the interactive displays business. Lockdowns have been implemented across various countries, disrupting supply lines and shutting down several manufacturing sites as a result of epidemic. The slowdown in interactive display production has had a significant influence on growth of end-use businesses. Furthermore, to survive in interactive displays business, industry participants all over the world are focusing on cutting operational expenses. The market is expected to develop owing to restart production activities by these industry participants in post-lockdown phase. Over the forecast period, supportive government policies and trade relaxations post-pandemic are expected to drive demand for interactive displays. Implementation of remote working rules by industry participants to limit spread of COVID-19 at workplaces is expected to have a beneficial impact on the interactive displays market. As a result of increased use of modern technologies in transportation, retail, sports & events, and media & entertainment, among other industries, demand for interactive displays is expected to increase.

However, cost of mechanical systems and technology required to make a display panel has always been high and as a result of the COVID-19 pandemic, industrial production facilities were shut down in most countries and supply networks were disrupted, further driving manufacturing prices. Supply chains for chips and conductors completely dried up, which had a negative impact on production of display units. Additionally, as technology develops, manufacturing processes grow more delicate and complex, increasing cost of developing technologies such as flexible or foldable substrate panels. Market revenue growth is being constrained by all of these issues.

Based on technology, the interactive display market has been segmented into LCD, LED, OLED, and others. The LCD segment accounted for largest revenue share in 2021. Technological advancements in LCD have made it possible to produce screens three to four times better. Virtual Reality (VR) uses higher-resolution LCDs and LCD-based devices are being employed in a range of settings, including retail, corporate offices, and banking. The segment is expected to grow owing to disruption in supply-demand ratio and decline in average selling prices of LCD display panels. Despite lower LCD production costs, this segment is expected to grow at a modest pace throughout the forecast period, owing to increased competition from new breakthroughs and growing adoption of new technologies. For example, on 13th April 2022, TCL Electronics, which is considered one of the dominant players in the television industry, announced that it had maintained its 2nd position in global LCD TV market share in 2021, with 24.6 million units of LCD TV shipment. Furthermore, on 9 March 2021, View Sonic, which is a leading global provider of visual solutions, launched a new LCD-based interactive display ViewBoard 50-3, a successor to ViewBoard 50-2.

The OLED segment is expected to register a significantly fast revenue CAGR over the forecast period. Most recent breakthrough in display technology is creation of organic light-emitting diodes, which are considered significantly better than current generation of LED screens. OLED panels are gaining popularity, and as their prices decrease, a larger spectrum of people will be able to afford them. Previously only found in high-end smartphones and appliances, organic light-emitting diode displays, such as active-matrix organic light emitting diode screens, are now available in mid-tier smartphones and appliances. Moreover, foldable display panels have become common in tablets, smartphones, and laptops and they are manufactured from flexible substrates that allow them to bend such as plastic, metal, or flexible glass. Plastic and metal panels are lightweight, thin, strong, and are almost shatterproof. Flexible display technology based on OLED panels is utilized to produce foldable phones and businesses, such as Samsung and LG, are mass-producing flexible OLED display panels for smartphones, televisions, and smartwatches to suit customer demand. For instance, on 14 December 2021, LG Communication announced to launch LG B1 OLED TV, which is made of the newest NanoCell LCD with a7 processing chip and affordability of its B series OLED.

Based on end-use, the global interactive display market is segmented into retail & hospitality, BFSI, industrial, healthcare, corporate & government, transportation, education, sports and entertainment, and others. The retail & hospitality segment accounted for largest revenue share in 2021. Demand for touch-enabled displays in the retail sector is expected to surge over the forecast period owing to popularization of interactive devices, as well as increased use of self-service kiosks and interactive tables. For instance, several major retail chains, such as Walmart, started to use interactive machines to display products, enhancing customers" in-store experiences. In retail businesses, interactive video walls allow customers to browse the inventory and verify stock of a specific location. For instance, on 23 May 2022 MAXHUB, the world"s leading interactive and collaborative solutions brand, launched a new digital signage line-up to solve several display industry pain issues.

The Asia Pacific market accounted for largest revenue share in the interactive display market in 2021. Rapid economic expansion, technical improvements, wider customer base, and rising acceptance of contemporary lifestyles are all driving regional market revenue growth. In addition, growing use of smart homes, as well as improvements in electronics and automotive industries are fueling growth of the market. Wide-resoluteness LCD development has seen major investment from China, whereas development of novel OLED technologies has seen significant investment from South Korean businesses. Additionally, region’s revenue is strengthening as a consequence of rising demand for screens and expansion of region"s display panel manufacturing facilities. Besides this, owing to lower labor costs in Asia Pacific, new OLED and LCD panel manufacturing facilities have been established by a number of businesses. Industries that are expected to fuel growth of the display panel market in Asia-Pacific are consumer electronics, retail, BFSI, healthcare, transportation, sports, and entertainment. For instance, on 30 July 2021, TCL Group announced establishment of mobile and television display panel manufacturing unit in Andhra Pradesh, India.

The Europe market is expected to register fastest revenue CAGR during the forecast period. As the continent continues to embrace digital signage as a key form of advertising, demand for display panels in Europe is increasing. Europe is recognized for its big soccer games and many other significant competitions that necessitate the installation of enormous display panels for many purposes such as advertising and broadcasting highlights and replays. Additionally, Pixel FLEX True FLEX, is an extremely high-resolution, flexible rubber substrate LED device that can produce compound curves and rapidly and firmly connects through magnets to practically any surface, providing for a unique no-fan, no-noise design certain to capture attention. Integration of digital and physical worlds is accomplished through the use of FLEX Lite NXG displays, curved and flexible displays such as True FLEX and Lumi FLEX interactive LED floor.

The North America market is expected to grow at a moderate rate over the forecast period owing to surging innovations and research in technological developments. Market participants in the region are investing in new materials to create more flexible and durable display panels. Furthermore, region"s high disposable income allows consumers to invest in cutting-edge technology with advance features, which contributes to market revenue growth in this region. Moreover, the region has a well-established infrastructure that allows for fast implementation of contemporary technologies. Another major aspect driving market expansion is increased use of smart TVs, smartphones, tablets, and PCs.

The global interactive display market is fairly consolidated, with a number of large and medium-sized players accounting for a majority of market revenue. Major players are deploying various strategies, entering into mergers & acquisitions, strategic agreements & contracts, developing, testing, and introducing more effective products. Some major companies included in the global interactive display market report are:

On 23 April 2021, Optoma, announced the launch of Creative Touch 5-Series Interactive Flat Panels (IFPs) which are available in sizes from 65″, 75″ to 86″. The new 5-Series interactive flat panels provide stunning 4K UHD resolution, multiple easy-to-use annotations tools, as well as extensive connectivity features for enhanced learning, sharing, and collaboration in classrooms, lecture halls, boardrooms, and other professional environments.

For the purpose of this report, Emergen Research has segmented the global interactive display market based on product type, panel type, panel size, technology, end-use, and region:

A flat panel display (FPD) is an electronic view device that allows people to see content such as text or moving images in different consumer electronics, mobile devices, and a range of entertainment. FPDs are thinner and lighter than conventional cathode ray tubes (CRT), which is usually less than 10 centimeters. There are two different categories of FPDs namely emissive displays and non-emissive displays. LED is an example of an emissive display, while LCD is an example of non-emissive display. These displays are majorly used in TV monitors, laptop computers, portable electronics, digital cameras, packet video games, etc. FPDs offer high pixel resolution, enhanced contrast setting, and lower power consumption.

The global flat panel display market is estimated to be valued at US$ 142,155 million in 2021 and is expected to exhibit a CAGR of 5.8 % over the forecast period (2021-2028).

In August 2019, LG Display announced the opening of its 8.5th generation (2,200mm x 2,500mm) OLED panel production plant in Guangzhou, China, to produce 10 million large-size OLED panels a year.

Asia Pacific excluding Japan held dominant position in the global mobile phone accessories market in 2020, accounting for 84.8% share in terms of Value, followed by Europe and Americas, respectively.

Rising government support to FPD industry is expected to drive growth of the global flat panel display market during the forecast period. Rising government initiatives and proactive support have led to rapid development of flat panel industry in major economies including Japan, Canada, and the U.S. For instance, the government of Japan has shown keen interest in the development of high-resolution screens. On the contrary, the U.S. Government is supporting FPD industry, which is primarily channeled through the Department of Defense. Moreover, the Korean government provides support for development of the high tech industry.

Growing adoption of FPD in mobile devices is expected to propel the global flat panel display market growth over the forecast period. Increasing demand for smartphones with augmented features is a major driving factor in the market. Smartphone manufacturers are focused on adopting FPD technology, in order to cater to increasing demand for high-quality image and clarity. FPD offers enhanced picture quality with improved contrast setting and low power consumption.

FPDs are being increasingly deployed in various application areas, especially in retail segment. Major demand for LCD and PDP technologies is arising from the retail segment for application in flat digital signage Majority of small flat panel digital signage installations are taking place in retail stores and Quick Service Restaurants (QSRs).

LCD manufacturers are innovating their LCD product line and introducing new technology to sustain in the LCD panel market. For instance, in 2012, Samsung commercialized production of a transparent LCD panel for a wide variety of display applications such as platform doors of subways, commercial freezer doors, e-Boards, medical equipment, and mobile devices.

By Application: Consumer Electronics (LCD Television (TV), Mobile Phone, Personal Computer (PC)), Automotive Application, Others (Healthcare, Defense, Military, Aviation, Automotive)

Development in glass OLED panels has led to next-generation displays such as plastic OLED panels. These OLED panels utilize plastic substrate instead of a conventional glass substrate that has various applications. For instance, in 2013, LG Display introduced the world’s first display manufacturer to provide mass-produced flexible OLED panels for smartphones. It is expected to expand further into diverse applications including automobile displays, tablets, etc.

The liquid crystal display (LCD) segment held dominant position in the market and accounted for 38% share in the global flat panel display market in 2020. The segment is expected to reach US$ 124,042.18 million in 2028. This is owing to the wider angles and large display area offered by LCD.

The consumer electronics segment held a dominant position and accounted for 87% share in the global flat panel display market in 2020. This is segment is expected to be valued US$ 99,939.82 million by 2028, owing to growing demand for television and smartphones.

Saturation in the market is expected to restrain growth of the global flat panel display market during the forecast period. Popularity of LCDs is high due to engagement of some of the top players such as Samsung, LG, Panasonic, etc. However, the trend is rapidly changing, owing to the introduction of more powerful technologies such as OLED, which is gaining popularity among major players in the market. Key companies in the market such as Apple are shifting towards OLED displays for application in its products such as iPad, iPhone, iTV, iWatch, etc.

Restricted view angle of LCD is expected to hinder the global flat panel display market growth over the forecast period. LCD technologies have a major drawback, restricted viewing angle. As a result of this, images and brightness on a television screen do not appear in true color when viewed from every angle. Several technologies have been developed to address this issue; however, OLED televisions seem to be the best option in this regard.

Key companies involved in the global flat panel display market are Sony Corporation, AU Optronics Corp., Panasonic Corporation, Emerging Display Technologies Corp., LG Display Co. Ltd., Innolux Corp., Universal Display Corporation, Japan Display Inc., and Samsung Electronics Co. Ltd.

Major companies in the market are focused on product launches, in order to expand product portfolio. For instance, in January 2020, Sony Corporation launched Bravia displays and a crystal LED display at ISE 2020.

Key players in the market are involved in partnerships and collaborations, in order to gain a competitive edge in the market. For instance, August 2019, Universal Display Corporation partnered with Eternal Material Technology Company to commercialize OLED host materials.

Most of the Smartphone Displays of modern phones, when initially introduced, were in the range of 3 to 4 inches that were sleek with a lesser resolution and high pixel density. Currently, the consumer demands smartphones with a high-quality display which is similar to the display and resolution of laptops, with higher brightness, amazing displaying HD images and HD videos. The primary smartphone displays are divided into resistive and capacitive. An Advanced capacitive screen is a typical control display that has the conductive touch of a human finger. And when the user tries a capacitor display to touch, the amount of electrostatic field or charge passed to the varied point of contact becomes a functional capacitor. However, the advanced resistive screen is actually made up of two thin layers of extra polyethylene terephthalate (PET) coated with indium tin oxide (ITO). When these two particular layers connect to each other, a high voltage is surpassed through the advanced system that actually initiates the monitor touch process at the desired point. Presently, the advanced capacitive touchscreen display shows a larger market size than the traditional type due to rising touch sensitivity and high clarity.

The COVID 19 has affected 215 countries. To combat the negative effects, countries lead lockdown, which has adversely affected the smartphone display market share brands. The pandemic leads to numerous challenges. There are many factors like the risk of continuing production, supply, distribution of work, lack of workforce, and fewer development activities that have affected the demand and supply. North America and Asia account for 68% of the total world production of smartphones.

The TV Display Market is a huge topic, but to sum it up in short, one can expect significant growth during the forecast period till 2030. There are many attributes linked with the consumption of smartphones and the rising demand for them. It is one of the best to connect to each other, and prototypes are readily available in the market today. It is a proven scientific fact the market for smartphone displays is huge. It is like an addiction. Also, a very amazing alternative for entertainment. People are getting more conscious. This is also boosting the market for smartphone displays.

The market is booming for Smartphone displays. The consumer market is expected to rise at a CAGR of 8.30%; the estimated value is around USD 123.7 billion by 2030. The packaging of phones is a very important and integral part of the whole process. There is a growing demand for smartphones and tablets along with usual comfort and possible convenience features that drive the smartphone display market significantly. However, the demand-supply ratio equilibrium has been well balanced. Without a doubt, in the coming years, the consumption of phones is expected to grow; thus, boosting the market in taking over the existing growth constraints.

The outbreak of COVID-19 has hard severely knocked out the growing pace of the Smartphone Display Market 2020 market share. Because of mandatory closures of consumer markets and farming across the globe, the revenues of the companies have been falling apart. COVID19 has disrupted the entire supply chain. Continuous lockdown created a negative impact and affected the morale of the manufacturers. The major retailers, such as supermarkets & hypermarkets whose main job is selling the phones, have gone through acute shortage despite having demand in certain areas across the globe.

During the forecasted period, there has been an estimated to reach USD 123.7 billion by 2030. The global market has been divided on the basis of type, packaging type, distribution channel, and region. The 3D display market can be divided as follows: On the basis of technology, the market is divided into different types such as light-emitting diode (LED), advanced organic LED (OLED), modern digital light processing (DLP), and the affordable plasma display panel (PDP). On the basis of applications, the market is divided into modern TV, super trendy Smartphones, high-quality display Monitors, Head-mounted displays, and others. On the basis of region, the market is divided into a big portion of North America, Europe, major countries of Asia-Pacific, and the rest of the world.

The primary market claims to have a CAGR of 8.30% to reach USD 123.7 billion by 2030. The demand for smartphones has risen because of globalization. The Asian and North American countries are focusing on expanding the production of smartphone displays to meet the demand and supply chain.

There has been a growing demand for the TV Display Market, the demand for these types of products is rising everywhere, including the U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, etc. North America was the biggest market in 2016 and is estimated to rise at the highest CAGR of 8.30% during the forecast period. Europe imports these types of products. Europeans and Americans love buying HQ phones and TV, which is accelerating the growth of the market in Europe. Another lucrative market in North America.

The major geographical distribution of the modern smartphone display market consisting of Big portion of North America, major parts of Asia Pacific (APAC), Europe, along with Rest of the World (RoW).

Samsung has recently launched Galaxy On8, a not very expensive smartphone in the Indian market that has an advanced 6-inch HD+ Super AMOLED display with better flexibility, high-resolution image quality, and advanced image resolution. Samsung has also innovated an advance buy a remarkable unbreakable screen for its Samsung Galaxy Note 8 new smartphone.

The primary stakeholders in the phone market are manufacturers who are the suppliers and traders, Government agencies, partners and industrial bodies, Investors, and Trade experts.

The global market for smartphone displays is projected to develop at an advanced rate during the estimated period. The growing geographical analysis of the modern smartphone display market is huge for North America, Europe, Asia-Pacific, and the rest of the countries of the world. The major Asia-Pacific is projected to dominate the smartphone mar

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey