lcd panel manufacturers market share for sale

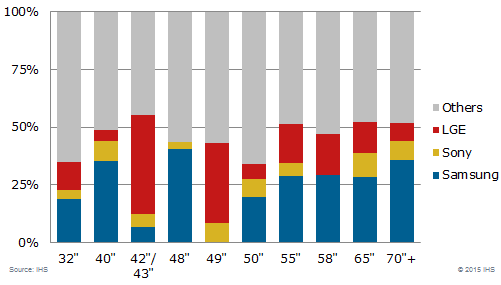

The global LCD TV (Liquid Crystal Display Television) market was dominated by Samsung and remained so in 2021 with a market share of over 19 percent by sales volume. LG Electronics takes second place with close to 13 percent in the same year, to beat TLC, one of the well-established brands in this segment.Read moreMarket share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volumeCharacteristic202120202019----

TCL. (March 11, 2022). Market share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volume [Graph]. In Statista. Retrieved January 02, 2023, from https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/

TCL. "Market share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volume." Chart. March 11, 2022. Statista. Accessed January 02, 2023. https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/

TCL. (2022). Market share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volume. Statista. Statista Inc.. Accessed: January 02, 2023. https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/

TCL. "Market Share of Leading Lcd Tv Manufacturers Worldwide from 2019 to 2021, by Sales Volume." Statista, Statista Inc., 11 Mar 2022, https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/

TCL, Market share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volume Statista, https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/ (last visited January 02, 2023)

LCD TV Panel Market Size is projected to Reach Multimillion USD by 2027, In comparison to 2021, at unexpected CAGR during the Forecast Period 2022-2028.

Considering the economic change due to COVID-19 and Russia-Ukraine War Influence, LCD TV Panel accounted for % of the global market of LCD TV Panel in 2022.

This LCD TV Panel Market Report offers analysis and insights based on original consultations with important players such as CEOs, Managers, Department Heads of Suppliers, Manufacturers, Distributors, etc.

The Global LCD TV Panel Market is anticipated to rise at a considerable rate during the forecast period, between 2022 and 2027. In 2021, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

LCD displays utilize two sheets of polarizing material with a liquid crystal solution between them. An electric current passed through the liquid causes the crystals to align so that light cannot pass through them. Each crystal, therefore, is like a shutter, either allowing light to pass through or blocking the light. LCD panel is the key components of LCD display. And the price trends of LCD panel directly affect the price of liquid crystal displays. LCD panel consists of several components: Glass substrate, drive electronics, polarizers, color filters etc. Only LCD panel applied for TV will be counted in this report

Samsung Display, LG Display, Innolux Crop and AUO captured the top four revenue share spots in the LCD TV Panel market in 2015. Samsung Display dominated with 22.11 percent revenue share, followed by LG Display with 19.72 percent revenue share and Innolux Crop Display with 19.30 percent revenue share.

The global LCD TV Panel market is valued at USD 51130 million in 2019. The market size will reach USD 59640 million by the end of 2026, growing at a CAGR of 2.2% during 2021-2026.

LCD TV Panel market is segmented by Size, and by Application. Players, stakeholders, and other participants in the global LCD TV Panel market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on production capacity, revenue and forecast by Size and by Application for the period 2016-2027.

The report focuses on the LCD TV Panel market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. The report considers key geographic segments and describes all the favorable conditions driving the market growth.

On the basis of the End Users/Applications, this report focuses on the status and outlook for major applications/end users, consumption (sales), market share, and growth rate for each application, including:

Geographically, the Major Regions Covered in LCD TV Panel Market Report Are:To comprehend LCD TV Panel market dynamics across major global regions. ● North America(United States, Canada)

Market is changing rapidly with the ongoing expansion of the industry. Advancement in technology has provided today’s businesses with multifaceted advantages resulting in daily economic shifts. Thus, it is very important for a company to comprehend the patterns of market movements in order to strategize better. An efficient strategy offers the companies a head start in planning and an edge over the competitors.Industry Researchis a credible source for gaining the market reports that will provide you with the lead your business needs.

Is there a problem with this press release? Contact the source provider Comtex at editorial@comtex.com. You can also contact MarketWatch Customer Service via our Customer Center.

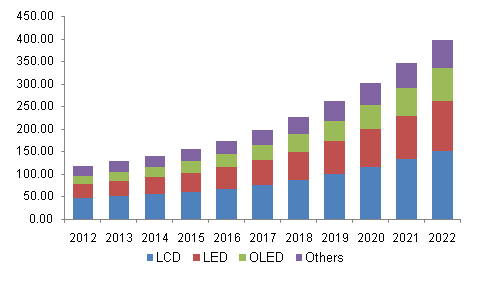

The global TFT-LCD display panel market attained a value of USD 181.67 billion in 2022. It is expected to grow further in the forecast period of 2023-2028 with a CAGR of 5.2% and is projected to reach a value of USD 246.25 billion by 2028.

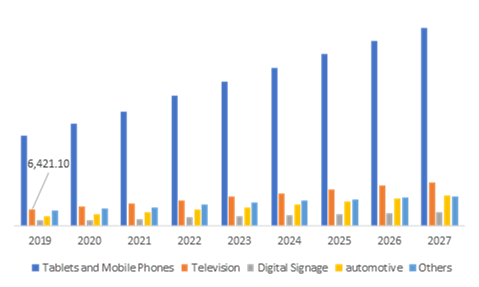

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

The upstream materials or components of the LCD panel industry mainly include liquid crystal materials, glass substrates, polarizing lenses, and backlight LEDs (or CCFL, which accounts for less than 5% of the market).

The middle reaches is the main panel factory processing and manufacturing, through the glass substrate TFT arrays and CF substrate, CF as upper and TFT self-built perfusion liquid crystal and the lower joint, and then put a polaroid, connection driver IC and control circuit board, and a backlight module assembling, eventually forming the whole piece of LCD module. The downstream is a variety of fields of application terminal-based brand, assembly manufacturers. At present, the United States, Japan, and Germany mainly focus on upstream raw materials, while South Korea, Taiwan, and the mainland mainly seek development in mid-stream panel manufacturing.

With the successive production of the high generation line in mainland China, the panel production capacity and technology level have been steadily improved, and the industrial competitiveness has been gradually enhanced. Nowadays, the panel industry is divided into three parts: South Korea, mainland China, and Taiwan, and mainland China is expected to become the no.1 in the world in 2019.

In the past decade, China’s panel display industryhas achieved leapfrog development, and the overall size of the industry has ranked among the top three in the world. Chinese mainland panel production capacity is expanding rapidly, although Japanese panel manufacturers master a large number of key technologies, gradually lose the price competitive advantage, compression panel production capacity. Panel production is concentrated in South Korea, Taiwan, and China, which is poised to become the world’s largest producer of LCD panels.

Up to 2016, BOE‘s global market share continued to increase: smartphone LCD, tablet PC display, and laptop display accounted for the world’s first market share, and display screen increased to the world’s second, while TV LCD remained the world’s third. In LCD TV panels, Chinese panel makers have accounted for 30 percent of global shipments to 77 million units, surpassing Taiwan’s 25.5 percent market share for the first time and ranking second only to South Korea.

In terms of the area of shipment, the area of board shipment of JD accounted for only 8.3% in 2015, which has been greatly increased to 13.6% in the first half of 2016, while the area of shipment of hu xing optoelectronics in the first half of 2015 was only 5.1%, which has reached 7.8% in the first half of 2016. The panel factories in mainland China are expanding their capacity at an average rate of double-digit growth and transforming it into actual shipments and areas of shipment. On the other hand, although the market share of South Korea, Japan, and Taiwan is gradually decreasing, some South Korean and Japanese manufacturers have been inclined to the large-size HD panel and AMOLED market, and the production capacity of the high-end LCD panel is further concentrated in mainland China.

Domestic LCD panel production line capacity gradually released, overlay the decline in global economic growth, lead to panel makers from 15 in the second half began, in a low profit or loss, especially small and medium-sized production line, the South Korean manufacturers take the lead in transformation strategy, closed in medium and small size panel production line, South Korea’s 19-panel production line has shut down nine, and part of the production line is to research and development purposes. Some production lines are converted to LTPS production lines through process conversion. Korean manufacturers are turning to OLED panels in a comprehensive way, while Japanese manufacturers are basically giving up the LCD panel manufacturing business and turning to the core equipment and materials side. In addition to the technical direction of the research and judgment, more is the LCD panel business orders and profits have been severely compressed, Korean and Japanese manufacturers have no desire to fight. Since many OLED technologies are still in their infancy in mainland China, it is a priority to move to high-end panels such as OLED as soon as possible. Taiwanese manufacturers have not shut down factories on a large scale, but their advantages in LCD technology and OLED technology have been slowly eroded by the mainland.

STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The TFT LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The TFT LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.

Westford,USA, Oct. 19, 2022 (GLOBE NEWSWIRE) -- The primary factors driving the growth of the Display Market are increasing demand from smartphone and tablet manufacturers, rising expenditure on smart Infra-Red (IR) sensors, and rapid expansion of digital media content. Smartphones are becoming more sophisticated and are using larger screens that require higher resolutions for better user experience. Tablets are also becoming increasingly popular as they offer a single device that can serve as both a computer and a mobile phone. This increase in demand for high-resolution displays is expected to drive the adoption of LED displays in the coming years.

Manufacturers in the global display market are starting to see the potential in displays as an important part of their product lines. Device manufacturers are looking for displays that can be used on a variety of devices, from laptops to smartphones and even cars. In addition, developers are creating more applications that require high-quality displays.

One key challenge facing manufacturers is making sure that their displays meet the requirements of multiple market segments. They need to make sure that their displays are suitable for usage on tablets as well as laptops, yet they also need to create displays that look good on smaller devices like smartphones and digital assistants.

The growth in demand for display market across various verticals such as healthcare, retail, automotive, appliance and others has led to an increasing demand for large sizes screens which can be cost effective owing to their mass production capabilities. Display manufacturers are also exploring new technologies such as flexible displays that can be rolled up like a traditional newspaper

Our report considers several factors such as market size estimation techniques, product segmentation analysis, expenditure Breakdown by Country and region; Porter"s Five Forces Analysis; and price trends analysis to give you a comprehensive view of the global display market.

Some of the key players in the global display market include LG Display Co., Ltd., Samsung Electronics Co., Ltd., and Sharp Corporation. These companies are focused on developing innovative products that meet the needs of various consumers in the marketplace. They also strive to improve their competitiveness by expanding their product lines into new markets and by creating partnerships with other companies to share technology and manufacturing resources.

Among global display market leaders, Samsung is presently dominating the industry with a share of 38% of the market. However, Apple is looming large as one of the largest competitors in smartphone sector. Other prominent players in this segment include LG Display, Sony Corp, and Toshiba Corporation. Among these companies, LG Display has been fastest expanding its business over recent years owing to its focus on emerging markets such as China and India.

For one, it"s heavily invested in research and development in the display market. According to analysts at SkyQuest, Samsung spends more than $13.7 billion a year on R&D, more than any other company in the world. That investment has paid off: The company"s displays are consistently among the best on the market.

Samsung also makes good use of its deep pockets. The company has poured money into forming joint ventures with major chipmakers like Qualcomm and Intel, which allows it to quickly bring new technologies to market. It doesn"t just rely on partnerships; Samsung also invests in its own technology centers, such as the foundry that produces screens for its smartphones.

One important technology that Samsung is investing in is AMOLED and QLED screens. QLEDs are generally considered to be more environmentally friendly than LCDs, since they use less power and create fewer byproducts.

The main drivers for Samsung"s strong performance in the display market are its diversification across product lines, continuous innovation across product categories, and excellent execution capabilities. The company has been able to expand into new markets such as automotive displays and smart watches, while continuing to focus on profitable core products.

Samsung has also been successful in pushing down prices for OLED displays over the past few years. This has made OLED panels more accessible to a wider range of customers, supporting growth at rival companies such as LG Electronics and Sony.

In recent years, there has been a shift in display technology as manufacturers across the global display market experiment with new and more innovative ways to create displays. The trend observed by SkyQuest worldwide is that display technologies are moving towards OLEDs and quantum dots, both of which have a number of advantages.

Quantum dots or QLED offer many advantages over traditional LCDs in the display market, such as better color reproduction, enhanced viewing angles, better response time, and lower power consumption. Their small size also makes them ideal for applications where sliding or tilting LCD panels are not possible or desirable. Quantum dot displays have already begun appearing in consumer electronics and will eventually replace traditional LCDs as the predominant type of display in devices like smartphones and tablets.

SkyQuest Technology is leading growth consulting firm providing market intelligence, commercialization and technology services. It has 450+ happy clients globally.

LCD TV Panel Market is 2022 Research Report on Global professional and comprehensive report on the LCD TV Panel Market. The report monitors the key trends and market drivers in the current scenario and offers on the ground insights. Top Key Players are – Samsung Display, LG Display, Innolux Crop., AUO, CSOT, BOE, Sharp, Panasonic, CEC-Panda.

Global “LCD TV Panel Market” (2022-2028) the report additionally centers around worldwide significant makers of the LCD TV Panel market with important data, such as, company profiles, segmentation information, challenges and limitations, driving factors, value, cost, income and contact data. Upstream primitive materials and hardware, coupled with downstream request examination is likewise completed. The Global LCD TV Panel market improvement patterns and marketing channels are breaking down. In conclusion, the attainability of new speculation ventures is surveyed and in general, the research ends advertised.

Global LCD TV Panel Market Report 2022 is spread across 117 pages and provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

The information for each competitor includes – Company Profile, Main Business Information, SWOT Analysis, Sales, Revenue, Price and Gross Margin, Market Share.

LCD displays utilize two sheets of polarizing material with a liquid crystal solution between them. An electric current passed through the liquid causes the crystals to align so that light cannot pass through them. Each crystal, therefore, is like a shutter, either allowing light to pass through or blocking the light. LCD panel is the key components of LCD display. And the price trends of LCD panel directly affect the price of liquid crystal displays. LCD panel consists of several components: Glass substrate, drive electronics, polarizers, color filters etc. Only LCD panel applied for TV will be counted in this report.

Due to the COVID-19 pandemic, the global LCD TV Panel market size is estimated to be worth USD 53490 million in 2021 and is forecast to a readjusted size of USD 53490 million by 2028 with a CAGR of 2.2% during the review period. Fully considering the economic change by this health crisis, by Size accounting for (%) of the LCD TV Panel global market in 2021, is projected to value USD million by 2028, growing at a revised (%) CAGR in the post-COVID-19 period. While by Size segment is altered to an (%) CAGR throughout this forecast period.

Global LCD TV Panel key players include Samsung Display, LG Display, Innolux Crop, AUO, CSOT, etc. Global top five manufacturers hold a share over 80%.

The global LCD TV Panel market is segmented by company, region (country), by Size and by Application. Players, stakeholders, and other participants in the global LCD TV Panel market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on sales, revenue and forecast by region (country), by Size and by Application for the period 2017-2028.

Global LCD TV Panel market analysis and market size information is provided by regions (countries). Segment by Application, the LCD TV Panel market is segmented into United States, Europe, China, Japan, Southeast Asia, India and Rest of World. The report includes region-wise LCD TV Panel market forecast period from history 2017-2028. It also includes market size and forecast by players, by Type, and by Application segment in terms of sales and revenue for the period 2017-2028.

The report introduced the LCD TV Panel basics: definitions, classifications, applications and market overview; product specifications; manufacturing processes; cost structures, raw materials and so on. Then it analyzed the world’s main region market conditions, including the product price, profit, capacity, production, supply, demand and market growth rate and forecast etc. In the end, the report introduced new project SWOT analysis, investment feasibility analysis, and investment return analysis.

LCD TV Panel market size competitive landscape provides details and data information by players. The report offers comprehensive analysis and accurate statistics on revenue by the player for the period 2017-2021. It also offers detailed analysis supported by reliable statistics on revenue (global and regional level) by players for the period 2017-2021. Details included are company description, major business, company total revenue and the sales, revenue generated in LCD TV Panel business, the date to enter into the LCD TV Panel market, LCD TV Panel product introduction, recent developments, etc.

The report offers detailed coverage of LCD TV Panel industry and main market trends with impact of coronavirus. The market research includes historical and forecast market data, demand, application details, price trends, and company shares of the leading LCD TV Panel by geography. The report splits the market size, by volume and value, on the basis of application type and geography. Report covers the present status and the future prospects of the global LCD TV Panel market for 2017-2028.

Global LCD TV Panel Market report forecast to 2028 is a professional and comprehensive research report on the world’s major regional market conditions, focusing on the main regions (North America, Europe and Asia-Pacific) and the main countries (United States, Germany, United Kingdom, Japan, South Korea and China).

The recent COVID-19 outbreak first began in Wuhan (China) in December 2019, and since then, it has spread around the globe at a fast pace. China, Italy, Iran, Spain, the Republic of Korea, France, Germany, and the US are among the worst-affected countries in terms of positive cases and reported deaths, as of March 2020. The COVID-19 outbreak has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global food and beverage industry is one of the major industries facing serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns as a result of this outbreak. China is the global manufacturing hub, with the presence of and the largest raw material suppliers. The overall market breaks down due to COVID-19 is also affecting the growth of thebaconmarket due to shutting down of factories, obstacle in supply chain, and downturn in world economy.

To Know How COVID-19 Pandemic Will Impact LCD TV Panel Market/Industry- Request a sample copy of the report-https://www.researchreportsworld.com/enquiry/request-covid19/21019731

The report offers exhaustive assessment of different region-wise and country-wise LCD TV Panel market such as U.S., Canada, Germany, France, U.K., Italy, Russia, China, Japan, South Korea, India, Australia, Taiwan, Indonesia, Thailand, Malaysia, Philippines, Vietnam, Mexico, Brazil, Turkey, Saudi Arabia, U.A.E, etc. Key regions covered in the report are North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

For the period 2017-2028, the report provides country-wise revenue and volume sales analysis and region-wise revenue and volume analysis of the global LCD TV Panel market. For the period 2017-2021, it provides sales (consumption) analysis and forecast of different regional markets by Application as well as by Type in terms of volume.

What are the market opportunities and threats faced by the vendors in the global LCD TV Panel market? What industrial trends, drivers, and challenges are manipulating its growth?

Comprehensive company profiles covering the product offerings, key financial information, recent developments, SWOT analysis, and strategies employed by the major market players.

With tables and figures helping analyze worldwide Global LCD TV Panel market trends, this research provides key statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

Research Reports World – is the credible source for gaining the market reports that will provide you with the lead your business needs. At Research Reports World, our objective is providing a platform for many top-notch market research firms worldwide to publish their research reports, as well as helping the decision makers in finding most suitable market research solutions under one roof. Our aim is to provide the best solution that matches the exact customer requirements. This drives us to provide you with custom or syndicated research reports.

The Liquid Crystal Display (LCD)-enabled electronic devices, such as television, mobile phones and others, is creating potential opportunities for the LCD panel market. In the past couple of years, LCD panels have gained popularity owing to their advanced properties that include less power consumption, compact size and low price.

Moreover, over the past two decades, the LCD technology of has made impressive progress. The electronic displays available at present make use of a wide variety of active LCD panels. The LCD panel market is one of the significantly growing markets due to the increasing demand for LCD displays & low power consumption electronic goods, as well as increase in the demand for touch-enabled displays.

An LCD panel is designed to project on-screen information. At present, LCD panels are suited with high-mobility electronic equipment. LCDs with improved video quality are gaining momentum in all developed and developing economies. These factors are projected to propel the global LCD panel market.

The major growth drivers of the LCD panel market include an increase in the demand for energy-efficient electronic products as well as for larger and 4K televisions. Furthermore, growth in the demand for energy-efficient electronic devices is surging the global LCD panel market.

Demand for high-quality screens, coupled with improving standards of living and inflating disposable income, are among key factors boosting the LCD Panel market. In addition, increase in the adoption of consumer electronic devices is projected to drive the global LCD panel market.

However, one of the major challenges of the LCD panel market are the higher cost and thickness of the display of these devices as compared to other modules. The LCD panel market is expected to witness sluggish and unpredictable growth owing to a quantitative decline in the number of LCD displays.

Moreover, financial uncertainty and macroeconomic situations around the world, such as fluctuating currency exchange rates and economic difficulties, are some of the major factors hindering the growth of the LCD panel market. However, increased competition from alternative technologies and LCD panel complex structure is likely to limit the growth of the LCD panel market.

At present, North America holds the largest market share for the LCD panel market due an increase in the demand for consumer electronic devices. Due to the presence of key LCD panel manufacturers in China and Japan, Asia Pacific is expected to become the prominent region for the LCD panel market.

In addition, the unorganized market of LCD panels in China, Japan and India is creating a competitive environment for global LCD panel manufacturers. Moreover, Europe is the fastest-growing market for LCD panels due to an increase in the adoption of consumer electronics devices. The demand for LCD panels has risen dramatically over the past 12 months globally. The usage of LCD displays in various industries in these regions is boosting the LCD panel market.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Due to an increase in the demand for large LCD displays, the large size LCD panel sub-segment is expected to register double-digit growth rate in the global market. In addition, due to an increase in the demand for portable electronic devices, the small size LCD panel sub-segment is projected to be the most attractive market sub-segment of the global LCD panel market.

The smart phones and tablets sub-segment held the largest market share for the LDC panel market in 2017, and the wearable devices sub-segment is expected to grow with a high CAGR during the forecast period.

The global pillar to pillar display market is expected to reach a valuation of US$ 36 million in 2022 and burst ahead at a CAGR of 46.2% to end up at US$ 1.65 billion by 2032.

The emerging technology of the OLED display market in smartphones and other smart gadgets has gained significant penetration. Now, OLED display manufacturers are channelizing their focus towards automotive displays.

Automotive displays have evolved over the years, projecting innovation, smart device integration, and robust offerings. The market is currently in the embryonic stage of development, as P2P displays are not commercialized. Yet, the technology is gaining high traction among luxury car brands.

Fact.MR, a market research and competitive intelligence provider, reveals that the market will exhibit growth at 261%CAGR between 2022 and 2024, growing from US$ 36 million in 2022 to US$ 470 million by 2024.

The market share for electric vehicles increased from approximately 2% in 2019 to 10% in 2021. As a result, there are now more than 16.5 million electric vehicles on the roads worldwide, which is an increase of 3X from 2018. The market for electric vehicles has continued to expand quickly, with 2 millionelectric vehicle sales in the first quarter of 2022, a 75% increase over the same period in 2021.

Automakers are marking the opportunity for integrating innovation through their EV segment, which entails significant developments across matured geography. EVs would be the first choice of preference for automakers for the installation of pillar to pillar displays. Thereby, exponential growth of the electric vehicle market will provide the stage for P2P suppliers, owing to which, the segment will create an absolute dollar opportunity of US$ 1.62 billion over the forecast period.

Due to the complex manufacturing process involved in pillar to pillar displays, the product in itself makes it expensive, which is not easily affordable by mass consumers in the market. Owing to this, the luxury cars segment would be one of the leading vehicle types marking its position for pillar to pillar display installation.

As auto infotainment systems have already captured significant market share in the U.S automobile market, the emergence of P2P displays would be a stepping stone for automakers to leverage and generate ample revenue opportunities.

The pillar to pillar display market in the United States is expected to capture a market share of nearly 32% in 2024, and further expand rapidly at 18.5%CAGR from 2024 to 2032.

As the maturity of the German automotive industry enables room for innovation, pillar to pillar display is one such technology. The Germany P2P display market is expected to capture nearly 45% of the European market share by the end of 2032.

For example, LG collaborated with Mercedes, while Continental has decided to integrate its offerings with leading automakers. During the short term, OEM sales would account for nearly 95%of the market share by 2024-end.

OEMs will dominate the market for P2P displays as these products would have exponential growth after mass production, which would be witnessed post-2024. OEM sales channel growth is projected to leap at 220.4%CAGR from 2022 to 2024, and then expand at 17.4% CAGR during the period of 2025-2032.

The scenario will change post-product adoption and reorganization across end users, wherein companies would provide patent services to vendors for the mass manufacturing of P2P displays, which would have the aftermarket as their sales channel. All in all, the integration of sales channels from automakers for the integration of pillar to pillar displays into their new and existing fleets would create huge opportunities for revenue generation.

As the automotive industry is taking innovation to the next scale, the adoption of high-end automotive displays is evident. Owing to this, the market for P2P displays is expected to grow 45Xover the forecast period. S displays have been the most prominent display type across the automotive sector, which will see higher penetration for P2P displays and the segment is projected to capture nearly 52% market share by 2032-end.

LG Display recently entered into a collaboration with Mercedes to launch pillar to pillar displays in the market. LG Electronics has installed pillar to pillar displays in Mercedes-Benz EQS EV sedans.

Fact.MR has provided detailed information about the price points of key manufacturers of pillar to pillar displays positioned across regions, sales growth, production capacity, and speculative technological expansion, in the recently published report.

The global display market size was valued at $114.9 billion in 2021, and is projected to reach $216.3 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031.

Display includes screen, computer output surface, and a projection surface that displays content, mainly test, graphics, pictures, and videos utilizing cathode ray tube (CRT), light-emitting diode (LED), liquid crystal display (LCD), and other technologies. These displays are majorly incorporated in devices such as televisions, smartphones, tablets, laptops, vehicles, and others. Emergence of advanced technologies offer enhanced visualizations in several industry verticals, which include consumer electronics, retail, sports & entertainment, and transportation. 3D displays are in trend in consumer electronics and entertainment sector.

In addition, flexible display technologies witness popularity at a high pace. Moreover, display technologies such as organic light-emitting diode (OLED) have gained increased importance in products such as televisions, smart wearables, smartphones, and other devices. Smartphone manufacturers plan to incorporate flexible OLED displays to attract consumers. Furthermore, the market is also in the process of producing energy saving devices, primarily in wearable devices. However, high cost of the transparent and quantum dot display technologies. Hence, need for such high costs associated with display products may hamper growth of the market. Furthermore, adoption of AR/VR devices and commercialization of autonomous vehicles are expected to provide lucrative display market opportunity for the growth of the market.

The COVID-19 pandemic is impacting the society and overall economy across the global. The impact of this outbreak is growing day-by-day as well as affecting the supply chain. It is creating uncertainty in the massive slowing of supply chain, and increasing panic among customers. European countries under lockdowns have suffered major loss of business and revenue due to shutdown of manufacturing units in the region. Operations of production and manufacturing industries have been heavily impacted by the outbreak of COVID-19, which led to slowdown in the display market growth.

By display type, the display market outlook is divided into flat panel display, flexible panel display, and transparent panel display. Flat panel display segment was the highest revenue contributor to the market, in 2021. The flexible panel display segment dominated the display market growth, in terms of revenue, in 2021, and is expected to follow the same trend during the forecast period.

By industry vertical, the market it is divided into healthcare, consumer electronics, retail, BFSI, military & defense, transportation, and others.Consumer electronics accounted for largest display market share in 2021.

Region wise, the display market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific, specifically the China, remains a significant participant in the global display industry. Major organizations and government institutions in the country are intensely putting resources into these displays.

Top impacting factors of the market include high demand for flexible display technology in consumer electronic devices, increase in adoption of electronic components in the automotive sector, and rise in trend of touch-based devices. Surge in adoption of displays in touch screen devices, rise in need for AR/VR devices, and commercialization of autonomous vehicles are expected to create lucrative in the future. Moreover, stagnant growth of desktop PCs, notebooks, and tablets hampers growth of the display market. However, each of these factors is expected to have a definite impact on growth of the display industry in the coming years.

The key players profiled in this report include LG Display Co. Ltd., Samsung Electronics Co. Ltd., AU Optronics, Japan Display Inc., E Ink Holdings Inc., Hannstar Display Corporation, Corning Incorporated, Kent Displays Inc., NEC Display Solutions, and Sony Corporation. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaborations to enhance their market penetration.

KEY BENEFITSFOR STAKEHOLDERSThis study comprises analytical depiction of the display market forecast along with the current trends and future estimations to depict the imminent investment pockets.

Key Market Players Samsung Electronics Co Ltd, Sharp Corporation, Japan Display Inc, Innolux Corporation, NEC CORPORATION, Panasonic Corporation, BOE Technology Group Co., Ltd., AUO Corporation, Sony Corporation, Leyard Optoelectronic Co., Ltd, LG Display Co Ltd

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

August 2, according to the Taiwan media “Economic Daily News” reported that the latest report of the research agency RUNTO (RUNTO) shows that the first half of 2022 Chinese mainland panel manufacturers to 84 million shipments as well as 67% market share claimed the title, a record high. Taiwan panel makers Guntron, AUO shipments have declined, a combined market share of 18%, slightly better than Japan and South Korea’s combined 15%. Market expectations, with the mainland domination of the LCD panel market, the next three years, the panel factory is afraid of a merger tide.

According to the “Global LCD TV panel market monthly tracking” released by LOTUS, the first half of this year, the world shipped 125 million LCD TV panels above 32 inches, an increase of 1.9% year-on-year, with mainland manufacturers BOE, Huaxing Optoelectronics and Huike firmly in the top three.

To strengthen the core position of the industry chain, the Chinese mainland TV panel factory to maintain a high crop rate, shipments in the first half of 84 million pieces, the global market share of 67%, an increase of 6.2 percentage points, compared with the second half of last year, an increase of 3.4 percentage points.

The top ten panel manufacturers in the analysis of the Luotu technology, land-based panel factory shipments are showing year-on-year growth, Huaxing photoelectric, rainbow photoelectric shipments were up 12% and 16%. Most of the non-China panel factory decline, Taiwan panel factory Grouptron decline by about 10%, AUO reduced by 14%, the two combined market share of 18% in the first half.

Samsung Display (SDC) began to gradually reduce production at the beginning of the year to a complete shutdown in June, resulting in a year-on-year reduction of 50%. Sharp because of the active adjustment of production capacity, production decreased by 28% year-on-year, Japan and South Korea panel factories in the first half of the combined market share fell to a low of 15%.

Accordingly, the top ten panel makers are divided into four camps, with BOE, which shipped more than 30 million pieces in the first half of the year, firmly taking the lead in the large-size LCD panel industry. Next, 20 million pieces of Huaxing photoelectric, Huike. 10 million pieces of camp for the grouptron and Lejin display (LGD). Million-chip rank AUO and Sharp, with 8 million and 6 million pieces shipped, fell to the tail camp with Rainbow Photoelectric, CEC Panda and Samsung Display SDC.

Looking ahead to the second half of the year, Luotu Technology expects that, as the TV panel each main size has fallen below the cash cost, the panel factory strives to stop bleeding, start large-scale production reduction operations, the panel market is expected to usher in a turnaround. It is expected that before September this year, the major panel factory crop rate will be less than 75%, as to whether the price can stabilize the key observation point also falls in September.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey