2 tft display pricelist in stock

A Tft display is a transparent, high-quality Tft display such as a D-shaped Tft display, for is more transparent and can be used for display in all form. Tft displays are transparent, with a built-in subwoofer to the required width of the screen being 22.4 inches and more.

Another type of Tft display is the analog and digital Tft. These Tft screens are also available in the form of a Tft display with an analog and current- varyingtage. Currently, Tft screens are available to use multiple-factor Tft display (Analog)) and have a Digital-based display.

Tft LED LCDs in bulk are one of the most popular choices. It allows people to explore, such as a 5-foot Tft display screen for industrial-grade and (TH) LCD for in-house displays are a popular choice. Tft display screens for large-scale displays, such as Numerical Control (TH)), and the use of 5-foot Tft LEDs in bulk are a popular choice. They allow people to explore and display a large-sized display of 4. The advantage of Tft display screens for large-scale displays, such as 4x touch Tft display (TH)) is a new option for those that are used to display in large spaceships.

Check out the different functions in bulk at wholesale prices on Alibaba.com. Tft LCDs for more functionality and functional features in bulk are some of the manufacturers.

Yes, it is possible to use Tft lcd modules that require suitable components and are applied with the higher quality of the display. In bulk, wholesale Tft LCD displays are available in a variety of colors and designs.

The price of LCD display panels for TVs is still falling in November and is on the verge of falling back to the level at which it initially rose two years ago (in June 2020). Liu Yushi, a senior analyst at CINNO Research, told China State Grid reporters that the wave of “falling tide” may last until June this year. For related panel companies, after the performance surge in the past year, they will face pressure in 2022.

LCD display panel prices for TVs will remain at a high level throughout 2021 due to the high base of 13 consecutive months of increase, although the price of LCD display panels peaked in June last year and began to decline rapidly. Thanks to this, under the tight demand related to panel enterprises last year achieved substantial profit growth.

According to China State Grid, the annual revenue growth of major LCD display panel manufacturers in China (Shentianma A, TCL Technology, Peking Oriental A, Caihong Shares, Longteng Optoelectronics, AU, Inolux Optoelectronics, Hanyu Color Crystal) in 2021 is basically above double digits, and the net profit growth is also very obvious. Some small and medium-sized enterprises directly turn losses into profits. Leading enterprises such as BOE and TCL Technology more than doubled their net profit.

Take BOE as an example. According to the 2021 financial report released by BOE A, BOE achieved annual revenue of 219.31 billion yuan, with a year-on-year growth of 61.79%; Net profit attributable to shareholders of listed companies reached 25.831 billion yuan, up 412.96% year on year. “The growth is mainly due to the overall high economic performance of the panel industry throughout the year, and the acquisition of the CLP Panda Nanjing and Chengdu lines,” said Xu Tao, chief electronics analyst at Citic Securities.

According to the performance report of TCL Technology, the revenue of TCL Technology reached 163.5 billion yuan last year, with a year-on-year growth of 112.8%; Net profit attributable to shareholders of listed companies reached 10.06 billion yuan, up 129.3% year on year.

TCL explained that the major reasons for the significant year-on-year growth in revenue and profit were the significant year-on-year growth of the company’s semiconductor display business shipment area, the average price of major products and product profitability, and the optimization of the business mix and customer structure further enhanced the contribution of product revenue.

“There are two main reasons for the ideal performance of domestic display panel enterprises.” A color TV industry analyst believes that, on the one hand, under the effect of the epidemic, the demand for color TV and other electronic products surges, and the upstream raw materials are in shortage, which leads to the short supply of the panel industry, the price rises, and the corporate profits increase accordingly. In addition, as Samsung and LG, the two-panel giants, gradually withdrew from the LCD panel field, they put most of their energy and funds into the OLED(organic light-emitting diode) display panel industry, resulting in a serious shortage of LCD display panels, which objectively benefited China’s local LCD display panel manufacturers such as BOE and TCL China Star Optoelectronics.

Liu Yushi analyzed to reporters that relevant TV panel enterprises made outstanding achievements in 2021, and panel price rise is a very important contributing factor. In addition, three enterprises, such as BOE(BOE), CSOT(TCL China Star Optoelectronics) and HKC(Huike), accounted for 55% of the total shipments of LCD TV panels in 2021. It will be further raised to 60% in the first quarter of 2022. In other words, “simultaneous release of production capacity, expand market share, rising volume and price” is also one of the main reasons for the growth of these enterprises. However, entering the low demand in 2022, LCD TV panel prices continue to fall, and there is some uncertainty about whether the relevant panel companies can continue to grow.

Throughout Q1, according to WitsView data, the average LCD TV panel price has been close to or below the average cost, and cash cost level, among which 32-inch LCD TV panel prices are 4.03% and 5.06% below cash cost, respectively; The prices of 43 and 65 inch LCD TV panels are only 0.46% and 3.42% higher than the cash cost, respectively.

The market decline trend is continuing, the reporter queried Omdia, WitsView, Sigmaintel(group intelligence consulting), Oviriwo, CINNO Research, and other institutions regarding the latest forecast data, the analysis results show that the price of the TV LCD panels is expected to continue to decline in April. According to CINNO Research, for example, prices for 32 -, 43 – and 55-inch LCD TV panels in April are expected to fall $1- $3 per screen from March to $37, $65, and $100, respectively. Prices of 65 – and 75-inch LCD TV panels will drop by $8 per screen to $152 and $242, respectively.

“Since 2021, international logistics capacity continues to be tight, international customers have a long delivery cycle, some orders in the second half of the year were transferred to the first half of the year, pushing up the panel price in the first half of the year but also overdraft the demand in the second half of the year, resulting in the panel price began to decline from June last year,” Liu Yush told reporters, and the situation between Russia and Ukraine has suddenly escalated this year. It also further affected the recovery of demand in Europe, thus prolonging the downward trend in prices. Based on the current situation, Liu predicted that the bottom of TV panel prices will come in June 2022, but the inflection point will be delayed if further factors affect global demand and lead to additional cuts by brands.

With the price of TV panels falling to the cash cost line, in Liu’s opinion, some overseas production capacity with old equipment and poor profitability will gradually cut production. The corresponding profits of mainland panel manufacturers will inevitably be affected. However, due to the advantages in scale and cost, there is no urgent need for mainland panel manufacturers to reduce the dynamic rate. It is estimated that Q2’s dynamic level is only 3%-4% lower than Q1’s. “We don’t have much room to switch production because the prices of IT panels are dropping rapidly.”

In the first quarter of this year, the retail volume of China’s color TV market was 9.03 million units, down 8.8% year on year. Retail sales totaled 28 billion yuan, down 10.1 percent year on year. Under the situation of volume drop, the industry expects this year color TV manufacturers will also set off a new round of LCD display panel prices war.

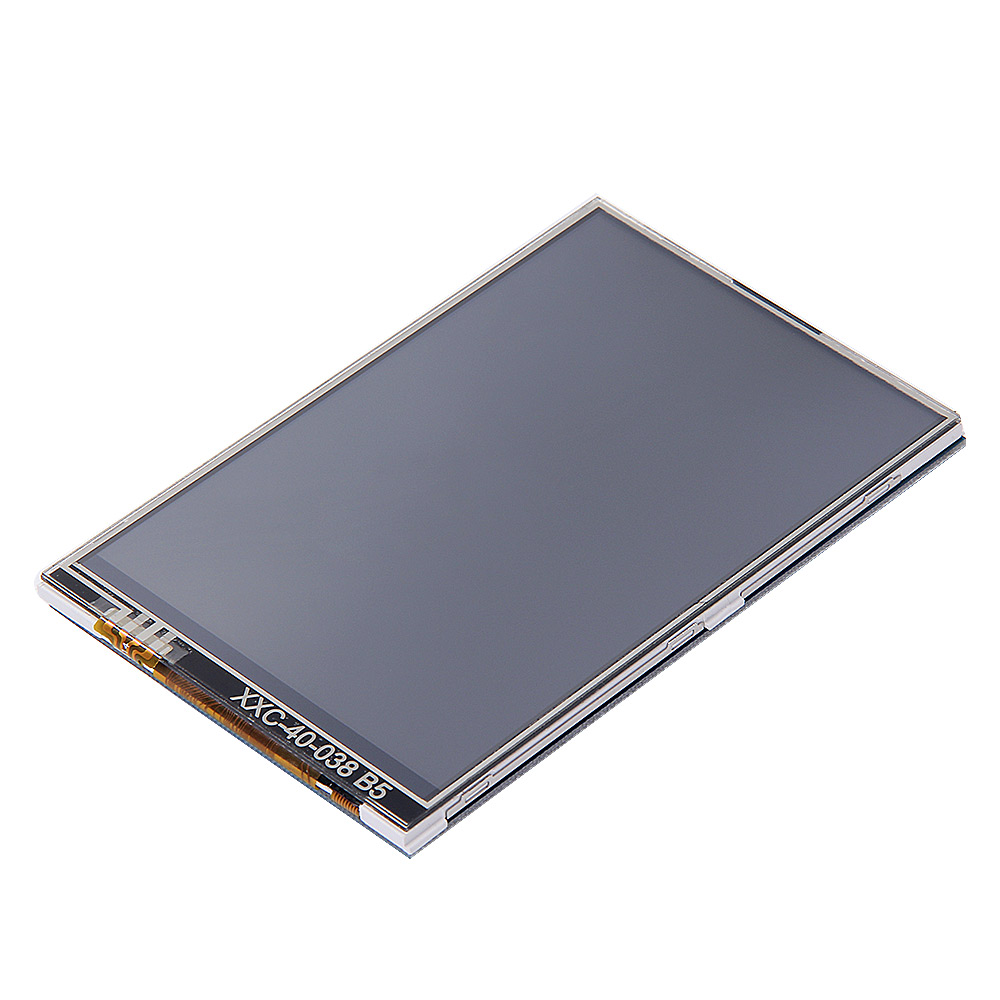

The new line of 3.5” TFT displays with IPS technology is now available! Three touchscreen options are available: capacitive, resistive, or without a touchscreen.

Orient Display LCD displays are the general category that includes LCD display glass panels, character LCD modules, graphic lcd modules, Arduino LCD displays, and our featured JAZZ series graphic LCD displays.

Graphic LCD Displays: Our standard LCD Graphic display products range from 122 x 32 pixels to 320 x 240-pixel resolution. These displays are available in positive or negative STN, blue STN, FSTN, or FFSTN with multiple backlight color options. They can be either traditional Chip-On-Board (COB) LCDs or Chip-On-Glass (COG) LCDs for displays with a smaller footprint and lower power consumption. COGs come in the same display types and colors as our other LCD modules but are designed without a PCB to allow for a slimmer profile.

JAZZ Graphic LCD Displays: The series are exclusive for Orient Display 128 x 64 pixels with the selection of yellow green STN, blue STN, positive or negative FSTN display, with the options of yellow green, green amber, blue, red or RGB tricolor backlights, with or without resistive touch panels. JAZZ series have two sizes: 1.0” and 2.7”.

VTN Character LCD Displays: Orient Display VTN is vertical alignment LCDs which provide superior black background and then great contrast with the options of yellow green, green amber, blue, red or RGB tricolor backlights.

LCD Glass Screens (Panels): Orient Display LCD display panels include different options of polarizer in reflective (saving power), transmissive (better contrast) or transflective (sunlight readable and battery powered) types. Orient LCD glass panels include 1; 2; 2.1/2; 3; 3.1/2; 3.3/4; 4; 4.1/2; 5; 6; 8; and 24 digits. Orient LCD glass panels also include 7 , 14 or 16 segments to display digits and alphanumeric letters. The temperature ranges are from room temperature to wide temperature applications. Orient LCD glass panels can have metal pin or zebra connections.

ARDUINO LCD Displays: Orient Display creates special character LCD displays with SPI interface which is easily hooked up with Arduino, which has been widely acceptable in the electronic design. The series includes 8 x 2 characters, 16 x 2 characters, 20 x 2 characters and 20 x 4 characters with either yellow green STN with yellow green LED backlight or blue STN with white LED backlight.

Although Orient Display provides many standard small size OLED, TN or IPS Arduino TFT displays, custom made solutions are provided with larger size displays or even with capacitive touch panel.

If you have any questions about Orient Display TFT LCD displays or if you can’t find a suitable product on our website. Please feel free to contact our engineers for details.

3. Your personal data will be processed in accordance with Article 6(1)(a) of the Regulation (EU) 2016/677 of the European Parliament and of the Council of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data, and repealing Directive 75/46/EC (General Data Protection Regulation, hereinafter referred to as GDPR) for the purposes of contacting you and responding to the issues/questions you report in a form.

Large-area TFT LCD panel shipments decreased by 10% Month on Month (MoM) and 5% Year on Year (YoY) in April, to 74.1million units, representing historically low shipment performance since May 2020. Omdia defines large-area TFT LCD displays as larger than 9 inches.

"With continued ramifications from the pandemic, demand for IT panels for monitors and notebook PCs remained strong in 4Q21. But as the market became saturated starting in 2022, IT panel shipments started slowing in 1Q22 and early 2Q22," said Robin Wu, Principal Analyst for Large Area Display & Production, Omdia.

Wu said that notebook panel shipments decreased 21% MoM in April, to 18.2 million units, or a 33% decrease from a peak of 27.3 million units in November 2021.

While TV panel prices have decreased noticeably since 3Q21, TV LCD panel shipments increased to a peak of 23.4 million in December 2021, driven by low prices. But rising inflation, the Ukraine crisis and continued lockdowns in China have slowed demand. As a result, TV panel shipments posted a 9% MoM decline in April, to 21.7million units.

Many TV panel prices have fallen below manufacturing cost, and panel makers began to lose money in their TV panel business starting in 4Q21. But Chinese panel makers, the biggest capacity owners, still haven"t reduced their fab utilization. With no sign of demand recovery in 2Q22 or even 3Q22, the supply/demand situation is unlikely to see improvement, Wu said.

About OmdiaOmdia is a leading research and advisory group focused on the technology industry. With clients operating in over 120 countries, Omdia provides market-critical data, analysis, advice, and custom consulting.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey