semiconductor materials needed to manufacture display screens manufacturer

Technology trends in backplane technology are driving higher gas demand in display manufacturing. Specific gas requirements of process blocks are discussed, and various supply modes are reviewed.

Since its initial communalization in the 1990s, active matrix thin-film-transistor (TFT) displays have become an essential and indispensable part of modern living. They are much more than just televisions and smartphones; they are the primary communication and information portals for our day-to- day life: watches (wearables), appliances, advertising, signage, automobiles and more.

There are many similarities in the display TFT manufacturing and semiconductor device manufacturing such as the process steps (deposition, etch, cleaning, and doping), the type of gases used in these steps, and the fact that both display and semiconductor manufacturing both heavily use gases.

However, there are technology drivers and manufacturing challenges that differentiate the two. For semiconductor device manufacturing, there are technology limitations in making the device increasingly smaller. For display manufacturing, the challenge is primarily maintaining the uniformity of glass as consumers drive the demand for larger and thinner displays.

While semiconductor wafer size has maxed because of the challenges of making smaller features uniformly across the surface of the wafer, the size of the display mother glass has grown from 0.1m x 0.1m with 1.1mm thickness to 3m x 3m with 0.5mm thickness over the past 20 years due to consumer demands for larger, lighter, and more cost-effective devices.

As the display mother glass area gets bigger and bigger,so does the equipment used in the display manufacturing process and the volume of gases required. In addition, the consumer’s desire for a better viewing experience such as more vivid color, higher resolution, and lower power consumption has also driven display manufacturers to develop and commercialize active matrix organic light emitting displays (AMOLED).

In general, there are two types of displays in the market today: active matrix liquid crystal display (AMLCD) and AMOLED. In its simplicity, the fundamental components required to make up the display are the same for AMLCD and AMOLED. There are four layers of a display device (FIGURE 1): a light source, switches that are the thin-film-transistor and where the gases are mainly used, a shutter to control the color selection, and the RGB (red, green, blue) color filter.

The thin-film-transistors used for display are 2D transitional transistors, which are similar to bulk CMOS before FinFET. For the active matrix display, there is one transistor for each pixel to drive the individual RGB within the pixel. As the resolution of the display grows, the transistor size also reduces, but not to the sub-micron scale of semiconductor devices. For the 325 PPI density, the transistor size is approximately 0.0001 mm2 and for the 4K TV with 80 PPI density, the transistor size is approximately 0.001 mm2.

Technology trends TFT-LCD (thin-film-transistor liquid-crystal display) is the baseline technology. MO / White OLED (organic light emitting diode) is used for larger screens. LTPS / AMOLED is used for small / medium screens. The challenges for OLED are the effect of < 1 micron particles on yield, much higher cost compared to a-Si due to increased mask steps, and moisture impact to yield for the OLED step.

Mobility limitation (FIGURE 2) is one of the key reasons for the shift to MO and LTPS to enable better viewing experience from higher resolution, etc.

The challenge to MO is the oxidation after IGZO metalization / moisture prevention after OLED step, which decreases yield. A large volume of N2O (nitrous oxide) is required for manufacturing, which means a shift in the traditional supply mode might need to be considered.

Although AMLCD displays are still dominant in the market today, AMOLED displays are growing quickly. Currently about 25% of smartphones are made with AMOLED displays and this is expected to grow to ~40% by 2021. OLED televisions are also growing rapidly, enjoying double digit growth rate year over year. Based on IHS data, the revenue for display panels with AMOLED technol- ogies is expected to have a CAGR of 18.9% in the next five years while the AMLCD display revenue will have a -2.8% CAGR for the same period with the total display panel revenue CAGR of 2.5%. With the rapid growth of AMOLED display panels, the panel makers have accel- erated their investment in the equipment to produce AMOLED panels.

There are three types of thin-film-transistor devices for display: amorphous silicon (a-Si), low temperature polysilicon (LTPS), and metal oxide (MO), also known as transparent amorphous oxide semiconductor (TAOS). AMLCD panels typically use a-Si for lower-resolution displays and TVs while high-resolution displays use LTPS transistors, but this use is mainly limited to small and medium displays due to its higher costs and scalability limitations. AMOLED panels use LTPS and MO transistors where MO devices are typically used for TV and large displays (FIGURE 3).

This shift in technology also requires a change in the gases used in production of AMOLED panels as compared with the AMLCD panels. As shown in FIGURE 4, display manufacturing today uses a wide variety of gases.

These gases can be categorized into two types: Electronic Specialty gases (ESGs) and Electronic Bulk gases (EBGs) (FIGURE 5). Electronic Specialty gases such as silane, nitrogen trifluoride, fluorine (on-site generation), sulfur hexafluoride, ammonia, and phosphine mixtures make up 52% of the gases used in the manufacture of the displays while the Electronic Bulk gases–nitrogen, hydrogen, helium, oxygen, carbon dioxide, and argon – make up the remaining 48% of the gases used in the display manufacturing.

The key ga susage driver in the manufacturing of displays is PECVD (plasma-enhanced chemical vapor deposition), which accounts for 75% of the ESG spending, while dry etch is driving helium usage. LTPS and MO transistor production is driving nitrous oxide usage. The ESG usage for MO transistor production differs from what is shown in FIGURE 4: nitrous oxide makes up 63% of gas spend, nitrogen trifluoride 26%, silane 7%, and sulfur hexafluoride and ammonia together around 4%. Laser gases are used not only for lithography, but also for excimer laser annealing application in LTPS.

Silane: SiH4 is one of the most critical molecules in display manufacturing. It is used in conjunction with ammonia (NH3) to create the silicon nitride layer for a-Si transistor, with nitrogen (N2) to form the pre excimer laser anneal a-Si for the LTPS transistor, or with nitrous oxide (N2O) to form the silicon oxide layer of MO transistor.

Nitrogen trifluoride: NF3 is the single largest electronic material from spend and volume standpoint for a-Si and LTPS display production while being surpassed by N2O for MO production. NF3 is used for cleaning the PECVD chambers. This gas requires scalability to get the cost advantage necessary for the highly competitive market.

Nitrous oxide: Used in both LTPS and MO display production, N2O has surpassed NF3 to become the largest electronic material from spend and volume standpoint for MO production. N2O is a regional and localized product due to its low cost, making long supply chains with high logistic costs unfeasible. Averaging approximately 2 kg per 5.5 m2 of mother glass area, it requires around 240 tons per month for a typical 120K per month capacity generation 8.5 MO display production. The largest N2O compressed gas trailer can only deliver six tons of N2O each time and thus it becomes both costly and risky

Nitrogen: For a typical large display fab, N2 demand can be as high as 50,000 Nm3/hour, so an on-site generator, such as the Linde SPECTRA-N® 50,000, is a cost-effective solution that has the added benefit of an 8% reduction in CO2 (carbon dioxide) footprint over conventional nitrogen plants.

Helium: H2 is used for cooling the glass during and after processing. Manufacturers are looking at ways to decrease the usage of helium because of cost and availability issues due it being a non-renewable gas.

N2 On-site generators: Nitrogen is the largest consumed gas at the fab, and is required to be available before the first tools are brought to the fab. Like major semiconductor fabs, large display fabs require very large amounts of nitrogen, which can only be economically supplied by on-site plants.

Individual packages: Specialty gases are supplied in individual packages. For higher volume materials like silane and nitrogen trifluoride, these can be supplied in large ISO packages holding up to 10 tons. Materials with smaller requirements are packaged in standard gas cylinders.

Blended gases: Laser gases and dopants are supplied as blends of several different gases. Both the accuracy and precision of the blended products are important to maintain the display device fabrication operating within acceptable parameters.

In-fab distribution: Gas supply does not end with the delivery or production of the material of the fab. Rather, the materials are further regulated with additional filtration, purification, and on-line analysis before delivery to individual production tools.

The consumer demand for displays that offer increas- ingly vivid color, higher resolution, and lower power consumption will challenge display makers to step up the technologies they employ and to develop newer displays such as flexible and transparent displays. The transistors to support these new displays will either be LTPS and / or MO, which means the gases currently being used in these processes will continue to grow. Considering the current a-Si display production, the gas consumption per area of the glass will increase by 25% for LTPS and ~ 50% for MO productions.

To facilitate these increasing demands, display manufacturers must partner with gas suppliers to identify which can meet their technology needs, globally source electronic materials to provide customers with stable and cost- effective gas solutions, develop local sources of electronic materials, improve productivity, reduce carbon footprint, and increase energy efficiency through on-site gas plants. This is particularly true for the burgeoning China display manufacturing market, which will benefit from investing in on-site bulk gas plants and collaboration with global materials suppliers with local production facilities for high-purity gas and chemical manufacturing.

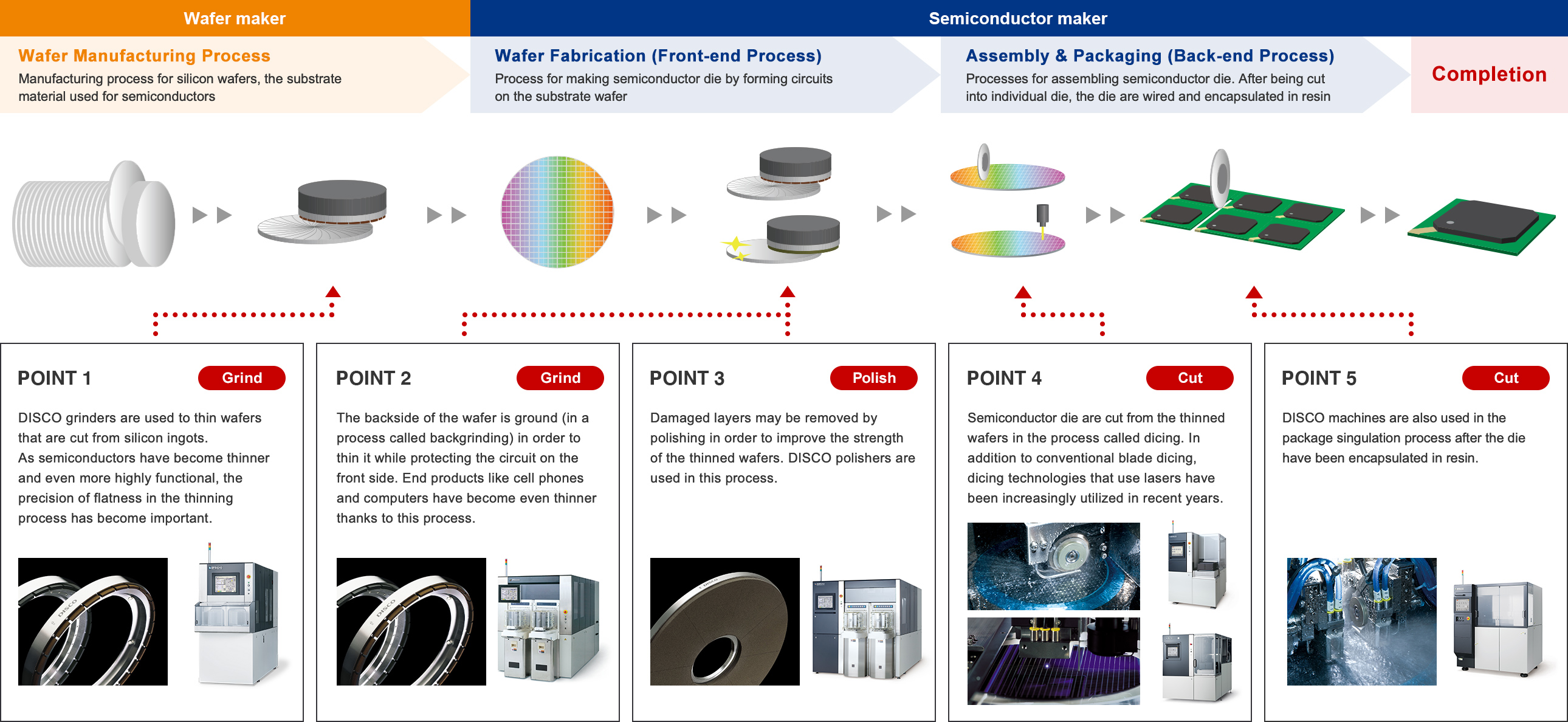

Semiconductor devices are built up in a series of nanofabrication processes performed on the surface of substrates made from highly pure single crystal silicon. These substrates are usually known as wafers.

Commonly used wafers include the 300 mm type, which offers the advanced miniaturization required for cutting-edge devices, and 200 mm type, which is better suited to the mixed, small lot production needed for devices for the Internet of Things (IoT).

The silicon wafers forming the base of the semiconductor are cleaned. Even slight contamination of a wafer will cause defects in the circuit. Therefore, chemical agents are used to remove all contamination, from ultra-fine particles to minute amounts of organic or metallic residues generated in the production process, or unwanted natural oxide layers generated due to exposure to air.

There are a variety of ways to form these thin films, including "sputtering", in which a target material, such as aluminum or other metal, is bombarded with ions, which knocks off atoms and molecules that are then deposited on the wafer surface, "electrodeposition", which is used to form copper wire layers (copper interconnect), chemical vapor deposition (CVD), in which special gases are mixed to cause a chemical reaction that forms a vapor containing the desired material, and then the mole-cules generated in the reaction are deposited onto the wafer surface to form a film, and thermal oxidation, in which the wafer is heated to form a silicon oxide film on the wafer surface.

Minute particles adhering to the wafer after the film deposition are removed using brushes or Nanospray with deionized water, or other physical cleaning methods.

The wafer surface is coated with resist (photosensitive chemical). Then the wafer is spun, causing a uniform layer of resist to be formed on the wafer surface by centrifugal force.

The wafer is exposed using short wavelength deep ultraviolet radiation projected through a mask on which the circuit pattern has been formed. Only the areas of the resist layer that are exposed to the light undergo a structural change, thereby transferring the pattern to the wafer. There are a variety of exposure units, including steppers, which expose several chips at a time, and scanners, which expose the wafer using a slit through which light is projected onto the wafer.

Developer is sprayed onto the wafer, dissolving the areas exposed to the light and revealing the thin film on the wafer surface. The remain-ing resist areas that are not exposed at this point become the mask for the next etching process, and that resist pattern becomes the pattern on the layer below.

In wet etching, the exposed thin film on the surface layer is dissolved using chemicals, such as hydrofluoric acid or phosphoric acid, and removed. This forms the pattern. There is also a dry etching method in which the wafer surface is bombarded with ionized atoms to remove the film layer.

Heat processing is performed using flash lamps or laser radiation to activate the doped ions implanted in the wafer. Instantaneous activation is required to create the micro transistors on the substrate.

The wafer is separated into individual chips (dicing), the chips are connected to a metal frame called a lead frame using metal wire (wire bonding) and then enclosed in epoxy resin material(packaging).

Today, semiconductor and LCD panel manufacturing equipment is essential for the production of all kinds of electric and electronic appliances, including PCs, cell phones and flat-panel televisions. Advances in this equipment promote enhancements to PC performance and cell phone functions, and enrich people"s lives by reducing the cost of flat panel TV sets. THK"s products can meet this kind of high-technology need for fine movement control.

Compact ball screws and Caged Ball LM Guides exhibiting very smooth movement are used in highly efficient production systems used for LCD panels for car navigation systems and mobile tools.

To transfer large crystal glass substrates over long distances quickly, high speed, superb accuracy and the ability to track even when long strokes are necessary. A combination of LM Guides and linear motor driving systems can deliver this.

In order to test the electrical characteristics of LCD panel substrates, the measuring instrument must be capable of positioning the substrates accurately over a wide area. LM Guides and ball screws, machined to a high level of accuracy, can provide this tracking control and contribute to efficient manufacturing even as the size of the substrates increases.

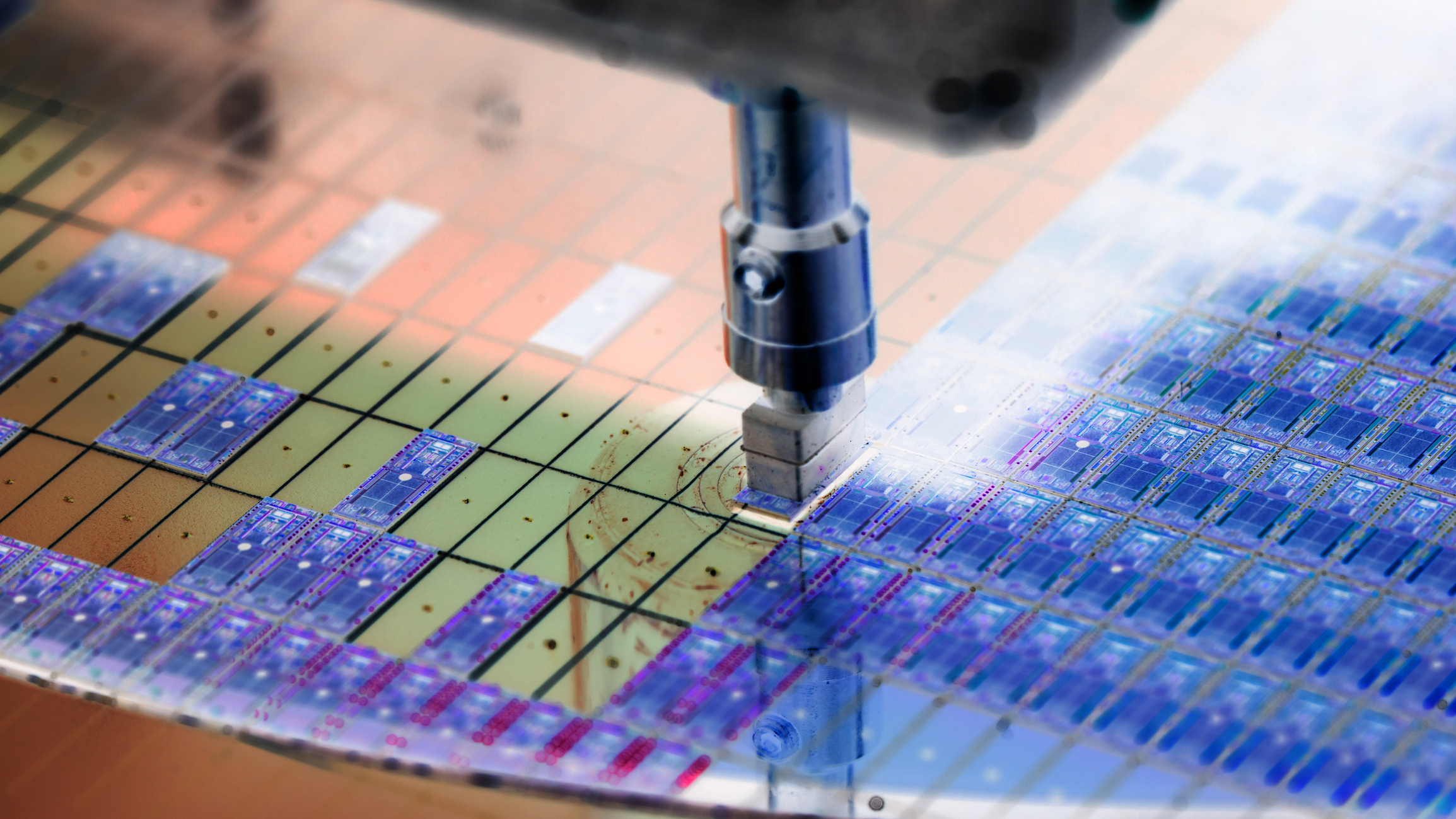

Dicing saws cut and separate each IC chip from its larger wafer. Laser cutting devices and very thin radial blades at the end of high-speed rotating spindles are used to accurately cut out the IC chips. LM Guides and Ball Screws are used in the guidance and driving sections, which must always operate with a high level of accuracy and stability. THK’s ultra precision technologies excel in this technology.

The LM Guide (Linear Motion Guide) is our main product, incorporating a part with a linear rolling motion into practical usage for the first time in the world.

![]()

A semiconductor chip is an electric circuit with many components such as transistors and wiring formed on a semiconductor wafer. An electronic device comprising numerous these components is called “integrated circuit (IC)”. The layout of the components is patterned on a photomask (reticle) by computer and projected onto a semiconductor wafer in the manufacturing processes described below.

The thin film is coated with photoresist. The circuit pattern of the photomask (reticle) is then projected onto the photoresist using Photolithography technology.

With this, one layer of the circuit is formed. The transistors are formed on the lowest layer. Similar process is then repeated, and many layers of circuits are formed on top of one another.

In the process of the integrated circuit creation, there are inspection and measurement steps to check whether or not the patterns are fabricated as designed. If defects are found, the fabrication will be interrupted to remove the defects from the process and to make small changes in the fabrication conditions for correction purposes. More than one hundred semiconductor dies are fabricated on a single wafer. At present, the largest silicon wafer is 300mm in diameter. Semiconductor manufacturers are looking into 450mm diameter silicon wafers for use in the future.

Semiconductor devices are completed through the front-end process (wafer processing operation) and the back-end process (assembly process) described below.

The finished semiconductor devices have been used in a variety of products such as personal computers, smartphones and cars in everyday life (see also “Semiconductors in everyday life”).

![]()

Right after the pandemic hit, I bought a new vacuum cleaner. I wanted to step up my housecleaning skills since I knew I’d be home a lot more. I was able to buy mine right away, but friends who wanted new appliances weren’t so lucky. My relatives had to wait months for their new refrigerator to arrive. And it wasn’t just appliances. New cars were absent from dealership lots, while used cars commanded a premium. What do all these things have in common? Semiconductor chips.

The pandemic disrupted the global supply chain, and semiconductor chips were particularly vulnerable. The chip shortage delivered a wakeup call for our country to make our supply chain more resilient and increase domestic manufacturing of chips, which are omnipresent in modern life.

“To an astonishing degree, the products and services we encounter every day are powered by semiconductor chips,” says Mike Molnar, director of NIST’s Office of Advanced Manufacturing.

Think about your kitchen. Dishwashers have chips that sense how dirty your loads are and precisely time their cleaning cycles to reduce your energy and water bills. Some rice cookers use chips with “fuzzy logic” to judge how long to cook rice. Many toasters now have chips that make sure your bread is perfectly browned.

We commonly think of chips as the “brains” that crunch numbers, and that is certainly true for the CPUs in computers, but chips do all sorts of useful things. Memory chips store data. Digital cameras contain chips that detect light and turn it into an image. Modern TVs produce their colorful displays with arrays of light emitting diodes (LEDs) on chips. Phones send and receive Wi-Fi and cellular signals thanks to semiconductor chips inside them. Chips also abound on the exteriors of homes, inside everything from security cameras to solar panels.

The average car can have upward of 1,200 chips in it, and you can’t make a new car unless you have all of them. “Today’s cars are computers on wheels,” an auto mechanic said to me a few years ago, and his words were never more on point than during the height of the pandemic. In 2021, the chip shortage was estimated to have caused a loss of $110 billion in new vehicle sales worldwide.

The chips in today’s cars are a combination of low-tech, mature chips and high-tech, state-of-the-art processors (which you’ll especially find in electric vehicles and those that have autonomous driving capabilities).

Whether mature or cutting-edge, chips typically need to go through a dizzying series of steps — and different suppliers — before they become finished products. And most of this work is currently done outside this country. The U.S., once a leader in chip manufacturing, currently only has about a 12% share in the market.

To reestablish our nation’s leadership in chip manufacturing, Congress recently passed, and President Joe Biden recently signed into law, the CHIPS Act. The CHIPS Act aims to help U.S. manufacturers grow an ecosystem in which they produce both mature and state-of-the-art chips at all stages of the manufacturing process and supply chain, and NIST is going to play a big role in this effort.

Silicon is the most frequently used raw material for chips, and one of the most abundant atomic elements on Earth. To give you a sense of its abundance, silicon and oxygen are the main ingredients of most beach sand, and a major component of glass, rocks and soil (which means that you can also find it in actual, not just metaphorical, dirt).

Silicon is a type of material known as a semiconductor. Electricity flows through semiconductors better than it does through insulators (such as rubber and cotton), but not quite as well as it does through conductors (such as metals and water).

But that’s a good thing. In semiconductors, you can control electric current precisely — and without any moving parts. By applying a small voltage to them, you can either cause current to flow or to stop — making the semiconductor (or a small region within it) act like a conductor or insulator depending on what you want to do.

The first step for making a chip is to start with a thin slice of a semiconductor material, known as a “wafer,” often round in shape. On top of the wafer, manufacturers then create complex miniature electric circuits, commonly called “integrated circuits” (ICs) because they are embedded as one piece on the wafer. A typical IC today contains billions of tiny on-off switches known as transistors that enable a chip to perform a wide range of complex tasks from sending signals to processing information. Increasingly, these circuits also have “photonic” components in which light travels alongside electricity.

Manufacturers typically mass-produce dozens of ICs on a single semiconductor wafer and then dice the wafer to separate the individual pieces. When each of them is packaged as a self-contained device, you have a “chip,” which can then be placed in smartphones, computers and so many other products.

Though silicon is the most commonly used raw material for chips, other semiconductors are used depending on the application. For example, gallium nitride is resistant to damage from cosmic rays and other radiation in space, so it’s commonly the material of choice for electronic devices in satellites. Gallium arsenide is frequently employed to make LEDs, because silicon typically produces heat instead of light if you try to make an LED with it.

Non-silicon semiconductors are used in the growing field of “power electronics” in vehicles and energy systems such as wind and solar. Silicon carbide can handle larger amounts of electricity and voltage than other materials, so it has been used in chips for electric vehicles to perform functions such as converting DC battery power into the AC power delivered to the motors.

Diamonds are semiconductors too — and they have the greatest ability to conduct heat of any known material. Artificial diamonds are currently used as the semiconductors in chips for aerospace applications, as they can draw heat away from the power loads generated in those chips.

Measurement science plays a key role in up to 50% of semiconductor manufacturing steps, according to a recent NIST report. Good measurements enable manufacturers to mass-produce high-quality, high-performance chips.

NIST has the measurement science and technical standards expertise that is needed by the U.S. chip industry, and our programs to advance manufacturing and support manufacturing networks across the U.S. mean we can partner with industry to find out what they need and deliver on it.

NIST researchers already work on semiconductor materials for many reasons. For example, researchers have developed new ways to measure semiconductor materials in order to detect defects (such as a stray aluminum atom in silicon) that could cause chips to malfunction. As electronic components get smaller, chips need to be increasingly free of such defects.

“Modern chips may contain over 100 billion complex nanodevices that are less than 50 atoms across — all must work nearly identically for the chip to function,” the NIST report points out.

NIST researchers also measure the properties of new materials that could be useful for future inventions. All of the semiconductor materials I mentioned above are brittle and can’t be bent. But devices with chips — from pacemakers to blood pressure monitors to defibrillators — are increasingly being made with flexible materials so they can be “wearable” and you can attach them comfortably to the contours of your body. NIST researchers have been at the forefront of the work to develop these “flexible” chips.

Researchers are also studying materials that could serve as “printable” chips that would be cheaper and more environmentally friendly. Instead of going through the complicated multistep process of making chips in a factory, we are developing ways to print circuits directly onto materials such as paper using technology that’s similar to ink-jet printers.

And while we’ve lost a lot of overall chip manufacturing share, U.S. companies still make many of the machines that carry out the individual steps for fabricating chips, such as those that deposit ultrathin layers of material on top of semiconductors. But what if, instead of these machines being shipped abroad, more domestic manufacturers developed expertise in using them?

To support this effort, NIST researchers are planning to perform measurements with these very machines in their labs. They will study materials that these machines use and the manufacturing processes associated with them. The information from the NIST work could help more domestic manufacturers develop the know-how for making chips. This work can help create an ecosystem with many domestic chip manufacturers, not just a few, leading to a more resilient supply chain.

“Reliance on only one supplier is problematic, as we saw with the recent shortage in baby formula,” NIST"s Jyoti Malhotra pointed out to me. Malhotra serves on the senior leadership team of the NIST Manufacturing Extension Partnership (MEP). MEP has been connecting NIST labs to the U.S. suppliers and manufacturers who produce materials, components, devices and equipment enabling U.S. chip manufacturing.

Last but not least, an area of major excitement at NIST is “advanced packaging.” No, we don’t mean the work of those expert gift-wrappers you may find at stores during the holiday season. When we talk about chip packaging, we’re referring to everything that goes around a chip to protect it from damage and connect it to the rest of the device. Advanced packaging takes things to the next level: It uses ingenious techniques during the chipmaking process to connect multiple chips to each other and the rest of the device in as tiny a space as possible.

But it’s more about just making a smartphone that fits in your pocket. Advanced packaging enables our devices to be faster and more energy-efficient because information can be exchanged between chips over shorter distances and this in turn reduces energy consumption.

One great byproduct of advanced packaging’s innovations can be found on my wrist — namely, the smartwatch I wear for my long-distance runs. My watch uses GPS to measure how far I ran. It also measures my heart rate, and after my workouts, it uploads my running data wirelessly to my phone. Its battery lasts for days; it had plenty of juice left even after I ran a full marathon last month.

Twenty years ago, running watches were big and clunky, with much less functionality. My friends and I had a particular model with a huge face and a bulky slab that fit over the insides of our wrists. When a friend and I opened up his watch to replace his battery, we saw that the GPS receiver was on a completely separate circuit board from the rest of the watch electronics.

Under the small and thin face of my current watch you will find all its electronics, including a GPS sensor, battery, heart-rate monitor, wireless communications device and so many other things.

Further development of advanced packaging could produce even more powerful devices for monitoring a patient’s vitals, measuring pollutants in the environment, and increasing situational awareness for soldiers in the field.

Advanced packaging is also a potential niche for domestic manufacturers to grow global market share (currently at 3% for this part of the chipmaking process). Chips are becoming so complex that design and manufacturing processes, once separate steps, are now increasingly intertwined — and the U.S. remains a world leader in chip design. NIST’s measurements to support advanced packaging in chips and standards for the packaging process could give domestic manufacturers a decisive edge in this area.

All the NIST experts I’ve spoken to talk about a future in which chip manufacturers work increasingly closely with their customers, such as automakers. The benefit of closer relationships would mean that customers could collaborate with manufacturers to create more customized chips that bring about completely new products.

And as we’ve seen, incorporating chips into existing products tends to make them “smart,” whether it’s an appliance figuring out how long to bake the bread, or solar panels that maximize electricity production by coordinating the power output from individual panels. With more domestic manufacturers on the scene, there are more opportunities to incorporate chips into products — that could also be manufactured in the U.S.A.

I first encountered semiconductor chips in the 1970s, when the U.S. was a dominant force in chip manufacturing. Inside a department store with my mom, I saw pocket calculators on display, and they fascinated me. You could punch their number keys and they would instantly solve any addition or multiplication problem. As a 6-year-old, I thought that they had little brains in them!

Since then, semiconductor chips have been a big part of my life. And after the pandemic, I realize I can’t take them for granted. I’m glad to be part of an agency that is working to create a more resilient supply chain — and bring back chip manufacturing in this country.

Transistor: Simple switch, made with a semiconductor material, that turns on or off depending on changes in voltage and can combine with other transistors to create complex devices

Chip: Self-contained piece including the semiconductor surface and integrated circuit, independently packaged for use in electronics such as cellphones or computers

![]()

The manufacturing of semiconductor wafers and flat panel glass substrates takes place in very tightly controlled environments. As such, the equipment used in the making of these products necessitates the highest quality materials.

Constellium’s extended experience in semiconductor and flat panel display equipment combined with world class manufacturing capabilities make it the ideal partner to manufacturers – both for functional parts (vacuum process and transfer chambers, vacuum valves and pumps, load locks, etc.) and consumable parts (showerheads, diffusers, etc.)

Exceptional dimensional capabilitiesin width and thickness – to meet increasing demand for larger machinery. Constellium operates some of the largest manufacturing assets worldwide for casting, rolling and stretching plates

Tightly controlled casting for optimum metal cleanliness and reduced porosity in thick plates, thus contributing to minimum outgassing issues and faster pump-down cycles

Enhanced rolling practices provide the ideal scenario to physically work the center of the plate and eliminate residual porosity from casting as much as possible

![]()

Our ozone generators and extra-pure water supply equipment supplemented with ozone are being used for advanced processes for manufacturing materials used in electronic devices such as semiconductors, flat panel displays, and functional materials.

We have been responding to the ever-increasing demand for removal of particles and impurities and to requests for higher ozone concentrations through ongoing efforts to develop new products. Our high-concentration ozone generators are world leaders in this market and have been chosen by our customers for applications such as new oxide film deposition processes (such as ALD) and environment-friendly cleaning and photoresist stripping processes featuring reduced consumption of chemical solutions and ultra pure water.

The Flat Panel Displays are thin and lightweight display screens that are used in laptops, monitors, televisions, smartphones, digital cameras, and other portable devices. Flat-panel size requirement varies as per the end device on which it is mounted. With the introduction of more innovative technology-based solutions, flat panel displays can be found in the majority of consumer and industrial display systems.

Today flat panel displays mostly use LCD (liquid crystal display) technology but in recent years there is a shift toward the use of the organic light-emitting diode display (OLED) technology which is gaining large momentum. OLED displays are not just thinner and more efficient than LCD displays - they provide superior image quality and they can also be made transparent, flexible, foldable, rollable, and stretchable.

Driven by end-user demands for increased product quality and lower costs, FPD manufacturers are constantly searching for improved processes and fab automation equipment. In addition, larger (G8 to G11) and thinner glass (<0.4mm) substrates are more complex to process and present ongoing precision and handling challenges for equipment manufacturers.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

Sony produces and sells commercial MicroLED displays called CLEDIS (Crystal-LED Integrated Displays, also called Canvas-LED) in small quantities.video walls.

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

2015, sold to giantplus and tce photomasks, gen 3 still operated by giantplus, gen 4 line sold to giantplus, equipment sold and line demolished, remainder operated by tce

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Business Place Information – Global Operation | SAMSUNG DISPLAY". www.samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

Byeonghwa, Yeon. "Business Place Information – Global Operation – SAMSUNG DISPLAY". Samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

www.etnews.com (30 June 2017). "Samsung Display to Construct World"s Biggest OLED Plant". Archived from the original on 2019-06-09. Retrieved 2019-06-09.

Colantonio, Andrea; Burdett, Richard; Rode, Philipp (2013-08-15). Transforming Urban Economies: Policy Lessons from European and Asian Cities. Routledge. ISBN 9781134622160. Archived from the original on 2019-01-01. Retrieved 2019-06-09.

Shilov, Anton. "LG"s New 55+ inch OLED Plant in China Opens: Over 1m+ per Year". www.anandtech.com. Archived from the original on 2019-09-14. Retrieved 2019-12-18.

www.wisechip.com.tw. "WiseChip History – WiseChip Semiconductor Inc". www.wisechip.com.tw. Archived from the original on 2018-02-17. Retrieved 2018-02-17.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

Shilov, Anton. "JOLED Starts Construction of New Printed OLED Facility". www.anandtech.com. Archived from the original on 2019-06-30. Retrieved 2019-06-30.

Pooler, Michael (29 September 2015). "Subscribe to read". Financial Times. Archived from the original on 2019-10-25. Retrieved 2019-10-25. Cite uses generic title (help)

![]()

Advantest (TSE: 6857) is the leading manufacturer of automatic test and measurement equipment used in the design and production of semiconductors for applications including 5G communications, the Internet of Things (IoT), autonomous vehicles, high performance computing (HPC) including artificial intelligence (AI) and machine learning, and more. Its leading-edge systems and products are integrated into the most advanced semiconductor production lines in the world. The company also conducts R&D to address emerging testing challenges and applications; develops advanced test-interface solutions for wafer sort and final test; produces scanning electron microscopes essential to photomask manufacturing; and offers system-level test solutions and other test-related accessories. Founded in Tokyo in 1954, Advantest is a global company with facilities around the world and an international commitment to sustainable practices and social responsibility.

Applied Materials, Inc. (Nasdaq: AMAT) is the leader in materials engineering solutions used to produce virtually every new chip and advanced display in the world. Our expertise in modifying materials at atomic levels and on an industrial scale enables customers to transform possibilities into reality. At Applied Materials, our innovations make possible a better future.

ASML is a leading supplier to the semiconductor industry. The company provides chipmakers with hardware, software and services to mass produce the patterns of integrated circuits (microchips). Together with its partners, ASML drives the advancement of more affordable, more powerful, more energy-efficient microchips. ASML enables groundbreaking technology to solve some of humanity"s toughest challenges, such as in healthcare, energy use and conservation, mobility and agriculture. ASML is a multinational company headquartered in Veldhoven, the Netherlands, with offices across Europe, the US and Asia. Every day, ASML’s more than 33,100 employees (FTE) challenge the status quo and push technology to new limits. ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML.

ASMPT (HKEX stock code: 0522) is a leading global supplier of hardware and software solutions for the manufacture of semiconductors and electronics. Headquartered in Singapore, ASMPT’s offerings encompass the semiconductor assembly & packaging, and SMT (surface mount technology) industries, ranging from wafer deposition, to the various solutions that organise, assemble and package delicate electronic components into a vast range of end-user devices, which include electronics, mobile communications, computing, automotive, industrial and LED (displays). ASMPT partners with customers very closely, with continuous investment in R&D helping to provide cost-effective, industry-shaping solutions that achieve higher productivity, greater reliability and enhanced quality.

Edwards is the leading developer and manufacturer of sophisticated vacuum products, exhaust management systems and related value-added services. These are integral to manufacturing processes for semiconductors, flat panel displays, LEDs and solar cells; are used within an increasingly diverse range of industrial processes including power, glass and other coating applications, steel and other metallurgy, pharmaceutical and chemical; and for both scientific instruments and a wide range of R&D applications. Edwards has around 7,000 employees worldwide engaged in the design, manufacture and support of high technology vacuum and exhaust management equipment and has state-of-the-art manufacturing facilities in Europe, Asia and North America. Edwards is part of the Atlas Copco Group (NASDAQ OMX Stockholm: ATCO A, ATCO B), a Sweden-based provider of industrial productivity solutions.

EV Group (EVG) is a leading supplier of equipment and process solutions for the manufacture of semiconductors, microelectromechanical systems (MEMS), compound semiconductors, power devices and nanotechnology devices. Key products include wafer bonding, thin-wafer processing, lithography/nanoimprint lithography (NIL) and metrology equipment, as well as photoresist coaters, cleaners and inspection systems. Founded in 1980, EV Group services and supports an elaborate network of global customers and partners all over the world.

FormFactor, Inc. (NASDAQ: FORM), is a leading provider of essential test and measurement technologies along the full IC life cycle - from metrology and inspection, characterization, modeling, reliability, and design de-bug, to qualification and production test. Semiconductor companies rely upon FormFactor"s products and services to accelerate profitability by optimizing device performance and advancing yield knowledge. The Company serves customers through its network of facilities in Asia, Europe, and North America.

Founded in 1980 for the development of Korea semiconductor-based industry, Hanmi Semiconductor has grown steadily into a world-class semiconductor manufacturer and now we are the leading designer, developer & manufacturer of semiconductor equipment industry. Our success has been based on a number of factors such as the best assembly systems, efficiency of production, ongoing R&D investment & high-tech modules through 25 years quality improvement.

Hitachi High-Tech, headquartered in Tokyo, Japan, is engaged in activities in a broad range of fields, including Analytical & Medical Solutions (manufacture and sales of clinical analyzers, biotechnology products, and analytical instruments), Nano-Technology Solutions (manufacture and sales of semiconductor manufacturing equipment and analysis equipment), and Industrial Solutions (providing high value-added solutions in fields of social & industrial infrastructures and mobility, etc.).

HORIBA, Ltd. manufactures and sells instruments and systems for various applications. It operates in five segments: Automotive, Process & Environmental, Medical-Diagnostic, Semiconductor, and Scientific. The Automotive segment offers automotive emission analyzers, emission measurement systems, drive line test systems, engine test and fuel cell test systems, and battery test systems; test systems for engines, chassis, powertrains, brakes, and catalysts; and vehicle development engineering and testing engineering services, as well as leases and manages R&D facilities.

Jiangsu ASIA Electronics is a wet process equipment manufacturer in the semiconductor wafer manufacturing industry. It focuses on the wet etching and cleaning technology of the wafer front-end. It is one of the first domestic enterprises to promote the localization of high-end semiconductor equipment. Based on independent innovation, the company has formed a business model integrating R&D, design, production and sales, providing efficient wet process solutions for domestic and foreign wafer manufacturers.

KOKUSAI ELECTRIC designs, manufactures, and services thermal thin film processing solution systems. Our diffusion and deposition systems can be found in the majority of semiconductor fabrication plants worldwide.

Lam Research Corporation is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam’s equipment and services allow customers to build smaller and better performing devices. In fact, today, nearly every advanced chip is built with Lam technology. We combine superior systems engineering, technology leadership, and a strong values-based culture, with an unwavering commitment to our customers. Lam Research (Nasdaq: LRCX) is a FORTUNE 500® company headquartered in Fremont, Calif., with operations around the globe.

Established in 1974, Plasma-Therm is a global manufacturer of advanced plasma processing equipment, providing etch, deposition, surface modification, and plasma dicing technologies to the specialty semiconductor markets, including wireless communication, power devices, MEMS, photonics, advanced packaging, memory and storage, and R&D. Plasma-Therm"s products have been adopted globally and have earned their reputation for value, reliability, and world-class support. Sales and service locations throughout North America, Europe and Asia-Pacific meet the diverse needs of Plasma-Therm’s global customer base.

Teradyne (NASDAQ:TER) brings high-quality innovations such as smart devices, life-saving medical equipment and data storage systems to market, faster. Its advanced test solutions for semiconductors, electronic systems, wireless devices and more ensure that products perform as they were designed. Its Industrial Automation offerings include collaborative and mobile robots that help manufacturers of all sizes improve productivity and lower costs. In 2021, Teradyne had revenue of $3.7 billion and today employs over 6,000 people worldwide.

Tokyo Electron Limited (TEL) is a leading global company of semiconductor and flat panel display (FPD) production equipment, TEL engages in development, manufacturing, and sales in a wide range of product fields. All of TEL"s semiconductor and FPD production equipment product lines provide the foundation for the information industry, and also serves as core technologies that support innovations and enable the evolution of wide-ranging electronic devices. TEL provides outstanding products and services to customers through a global network in the U.S., Europe, and Asia.

VAT is the leading global developer, manufacturer and supplier of high-end vacuum valves. VAT vacuum valves are mission-critical components for advanced manufacturing processes of innovative products used in daily life such as portable devices, flat screen monitors or solar panels. VAT is organized into two different reporting segments: Valves and Global Service offering high-end vacuum valves, multi-valve modules, edge-welded bellows and related value-added services for an array of vacuum applications. VAT Group is a global player with over 2’500 employees and main manufacturing sites in Haag (Switzerland), Penang (Malaysia) and Arad (Romania).

The US deputy assistant secretary, South and Central Asia, Afreen Akhter, is leading a trade mission of semiconductors industry to India and has had meetings with India’s top government officials. The US intends to support India overcome challenges in the semiconductor supply chain and boost its local semiconductor manufacturing capacity. The US publicly seeking to strengthen its partnerships with “like-minded countries” like India and Taiwan. In a related context, in October, the US Department of Commerce implemented new export controls on advanced computing and semiconductors sold to China.

The government and the India Semiconductor Mission is likely to start approving proposals to set up electronic chip and display manufacturing plants in the country in the next 30-60 days / over the next couple of months, as per Minister of State for Electronics and IT Rajeev Chandrasekhar’s comments during a virtual address at the IESA Vision Summit held on October 12, 2022.

The Ministry of Electronics and IT has plans to spend US$1.25-US$1.30 billion to modernize and upgrade its semiconductor laboratory (SCL) in Mohali. This spending is also targeted at strengthening intellectual property rights in India’s semiconductor sector. The SCL has now invited bids for the lab upgrade; qualified bidders must have a commercial partner on board to produce fabrication of chips designed by the lab. The last date for submitting bids to the SCL’s request for proposal (RFP) is October 25, 2022. The SCL aims to be able to produce 28-nm chips after upgradation.

The government has approved modifications to the “Program for Development of Semiconductors and Display Manufacturing Ecosystem in India”, including fiscal support for project cost and capital expenditure. Following discussion with potential investors, it is expected that work on setting up the first semiconductor facility will commence soon. More details below.

Vedanta-Foxconn are set to finalize a location for their facility in the next few weeks. The consortium are reportedly seeking a 800-1000 acre land parcel that is also well connected with Ahmedabad. The Gujarat government, as of media reports on September 16, showing sites at Sanand and Mandal-Becharaji in Ahmedabad district, two locations near Vadodara in central Gujarat, Dholera, Himmatnagar, Jamnagar, and Kutch. The plant has to be located at a distance from national and state highways so to cut off any vibration from heavy traffic movement. Further, no other major industry should be located in its vicinity.

Various investor-technology consortiums like IGSS are asking the Indian government to make a final decision by October on approving incentives for applicants to the semiconductor manufacturing incentives program.

Vedanta and Foxconn, in a 60-40 joint venture, will be setting up India’s first semiconductor production plant, a display fab unit, and a semiconductor assembling and testing unit over 1000 acres in Ahmedabad, state of Gujarat. The plant will begin production in two years as Foxconn plays the role of technical partner while Vedanta provides financial backing. The investment is worth over INR 1.54 trillion (approx. US$20 billion) and semiconductor manufacturing will be carried out by the holding company, Volcan Investments Limited.

International consortium ISMC (US$3 billion investment) and Singapore-based IGSS (investment worth INR 256 billion) will be setting up semiconductor plants in Karnataka and Tamil Nadu, respectively.

The Indian government confirmed it has received proposals from five companies to establish electronic chip and display manufacturing plants with an investment of INR 1.53 trillion (approx. US$20.5 billion). Given the time-intensive decision-making process and international travel disruptions due to COVID-19, there is currently no firm deadline in place for companies submitting their applications to India’s semiconductor chip design and manufacturing scheme: Rajeev Chandrasekhar, minister of state for electronics and IT, speaking toThe Economic Times.Initially, the first window for applications was until February 15.

The Ministry of Electronics and Information (MeitY) is seeking applications from 100 domestic companies, start-ups and MSMEs under its Design Linked Incentive (DLI) Scheme. The scheme has three components – Chip Design infrastructure support, Product Design Linked Incentive and Deployment Linked Incentive. C-DAC (Centre for Development of Advanced Computing), a scientific society operating under MeitY, will serve as the nodal agency for implementation of the DLI scheme. The DLI scheme aims to nurture at least 20 domestic companies involved in semiconductor design and facilitate them to achieve turnover of more than INR 15 billion in the next five years. A dedicated portal has been made available – www.chips-dli.gov.in – for inviting online applications from January 1, 2022 to December 31, 2024. The applicants can find the guidelines of the DLI Scheme on the portal and register themselves for availing support under the scheme.

The IT ministry has released guidelines for implementation of the scheme and a semiconductor portal is being prepared for accepting and processing applications from interested companies. See

India announced on December 30, 2021 that the government will start receiving proposals from companies for semiconductor and display manufacturing from January 1, 2022. Guidelines for the schemes have been notified. See here for information on the application process and fiscal support available: Semiconductor Companies Can Submit Proposals to Indian Govt. from January 1, 2022

To learn more about the Indian government’s fresh incentives and ambitious support agenda for semiconductors, read our article: What Can Chip Companies Expect from India’s New Semiconductor Incentives Package?

In order to drive long-term strategies for developing a sustainable semiconductors and display ecosystem, a specialized and independent “India Semiconductor Mission (ISM)” will be set up by the government. The India Semiconductor Mission will be led by global experts in semiconductor and display industry and act as the nodal agency for efficient and smooth implementation of the schemes on Semiconductors and Display ecosystem.

On December 15, 2021, the Indian government cleared a INR 760 billion (>US$10 billion) package to boost semiconductor and display manufacturing. The program aims to provide attractive incentive support to companies / consortia that are engaged in Silicon semiconductor fabs, display fabs, compound semiconductors / silicon photonics / sensors (including MEMS) fabs, semiconductor packaging (ATMP / OSAT), semiconductor design. Incentives worth INR 2.3 trillion (approx. US$30.16 billion)will be available to position India as global hub for electronics manufacturing.

Over 20 semiconductor manufacturing and designing companies in high-end, display, and specialty fabrication have reportedly submitted Expressions of Interest (EOIs) to set up manufacturing plants in India. The deadline was April 30, 2021.

The government is open to introducing new incentives for chipmakers, beyond those detailed in the PLI scheme. It will likely be based on the investment coming in and the company’s area of work, type of fab, and requirement. No further information has been put out yet.

India Briefing spotlights the latest developments in India’s nascent semiconductor industry, where the talent pool has focused, and recent government initiatives to boost investment growth.

Join us as Rohit Kapur, Dezan Shira & Associates’ Country Manager of India discusses opportunities for US businesses in India, direct investment policies, trade channels, and market entry routes in this informative webinar designed to support businesses diversifying or expanding to India.

Semiconductors or chipsets are used in all modern electronic devices and technologies, with a range of applications that range from electronic products and IT hardware to defense technology, industrial electronics, medical electronics, automation (workplace, healthcare, manufacturing etc.), and the Internet of Things (IoT).

Moreover, rapid developments in the capacity for intelligent computing and growth of AI in these applications and related industries has further expanded the dependency on semiconductor research and escalated the economic value of its manufacturing capacity.

According to the India Electronics and Semiconductor Association (IESA), semiconductor consumption in India was worth US$21 billion in 2019, growing at the rate of 15.1 percent. Research and development in this industry, which includes electronic products and embedded systems, generated about US$2.5 billion in revenue.

Yet, India lags in the establishment of semiconductor wafer fabrication (FAB) units – due to a weak ecosystem and shortage of resources as compared to more competitive bases like China and Vietnam.

Semiconductor FAB units require huge investments, gallons of water for production, uninterrupted electricity supply, high operating costs, and the need for frequent technology replacement.

This is why India’s contribution to the industry has focused on its technical competencies in R&D, design, etc. due to its talent pool in IT design and R&D engineers. The Indian semiconductor design market was projected to grow by a CAGR of 29.4 percent from US$14.5 billion in 2015 to US$52.6 billion in 2020.

As per the Ministry of Electronics and Information Technology (MeitY), R&D capabilities in very large-scale integration (VLSI) and chip design are showcased by the Centre of Excellence in Nanoelectronics at Indian Institute of Science, Bangalore and the Indian Institute of Technology, Bombay. India is setting up commercial semiconductor wafer fab units and two consortia have initiated work in this regard. The proposed location is Greater Noida in Uttar Pradesh (about 40 kms from New Delhi) and in Prantij in Gujarat (about 50 kms) from Gandhinagar.

In order to overcome the capital intensive hurdles, the Indian government is actively seeking foreign capital to set up semiconductor manufacturing facilities in the country.

In early 2021, the Indian government sought proposals from interested applicants to either setup (and/or expand) semiconductor wafer/device fabrication plants (FABs) in India or their acquisition outside India. The notification about the Expression of Interest was available in Korean, Japanese, Hebrew, and Chinese – an indication of the expected investment interest from foreign players. The deadline for these proposals (Expression of Interest) was extended from March 31, 2021 to April 30, 2021.

In December 2021, the Indian government unveiled the Program for Development of Semiconductors and Display Manufacturing Ecosystem in India, with an outlay of INR 760 billion (>US$10 billion) for the development of a sustainable semiconductor and display manufacturing ecosystem in India. The IT ministry has released guidelines for implementation of the scheme and a semiconductor portal is being prepared for accepting and processing applications from interested companies. See table below for government notified PDF links.

Scheme for setting up of Compound Semiconductors / Silicon Photonics / Sensors Fab and Semiconductor Assembly, Testing, Marking and Packaging (ATMP) / OSAT facilities in India

Link to Press Release dated January 16, 2022: Applications invited under the Design Linked Incentive (DLI) Scheme from domestic semiconductor chip design firms

A dedicated portal has been made available

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey