semiconductor materials needed to manufacture display screens quotation

What have ‘green’ energy, semiconductors and LCD displays got in common? It is the extraordinary high precision tolerance material requirements of the machines that they are being manufactured with.

The ground-breaking alimex aluminum cast materials ACP 5080S and ACP 5080RS are the result of 10 years of research and development and they meet these high requirements perfectly. Furthermore, our core products ACP 5080 and ACP 5080R are also used in the challenging markets mentioned above.

You have any questions regarding our products or are still looking for the perfect solution to meet your requirements, feel free to contact us directly by clicking on the request a quote button on this website, or send an email to sales@alimexamericas.com. We would be pleased to contribute our knowledge and experience to your companies needs.

Right after the pandemic hit, I bought a new vacuum cleaner. I wanted to step up my housecleaning skills since I knew I’d be home a lot more. I was able to buy mine right away, but friends who wanted new appliances weren’t so lucky. My relatives had to wait months for their new refrigerator to arrive. And it wasn’t just appliances. New cars were absent from dealership lots, while used cars commanded a premium. What do all these things have in common? Semiconductor chips.

The pandemic disrupted the global supply chain, and semiconductor chips were particularly vulnerable. The chip shortage delivered a wakeup call for our country to make our supply chain more resilient and increase domestic manufacturing of chips, which are omnipresent in modern life.

“To an astonishing degree, the products and services we encounter every day are powered by semiconductor chips,” says Mike Molnar, director of NIST’s Office of Advanced Manufacturing.

Think about your kitchen. Dishwashers have chips that sense how dirty your loads are and precisely time their cleaning cycles to reduce your energy and water bills. Some rice cookers use chips with “fuzzy logic” to judge how long to cook rice. Many toasters now have chips that make sure your bread is perfectly browned.

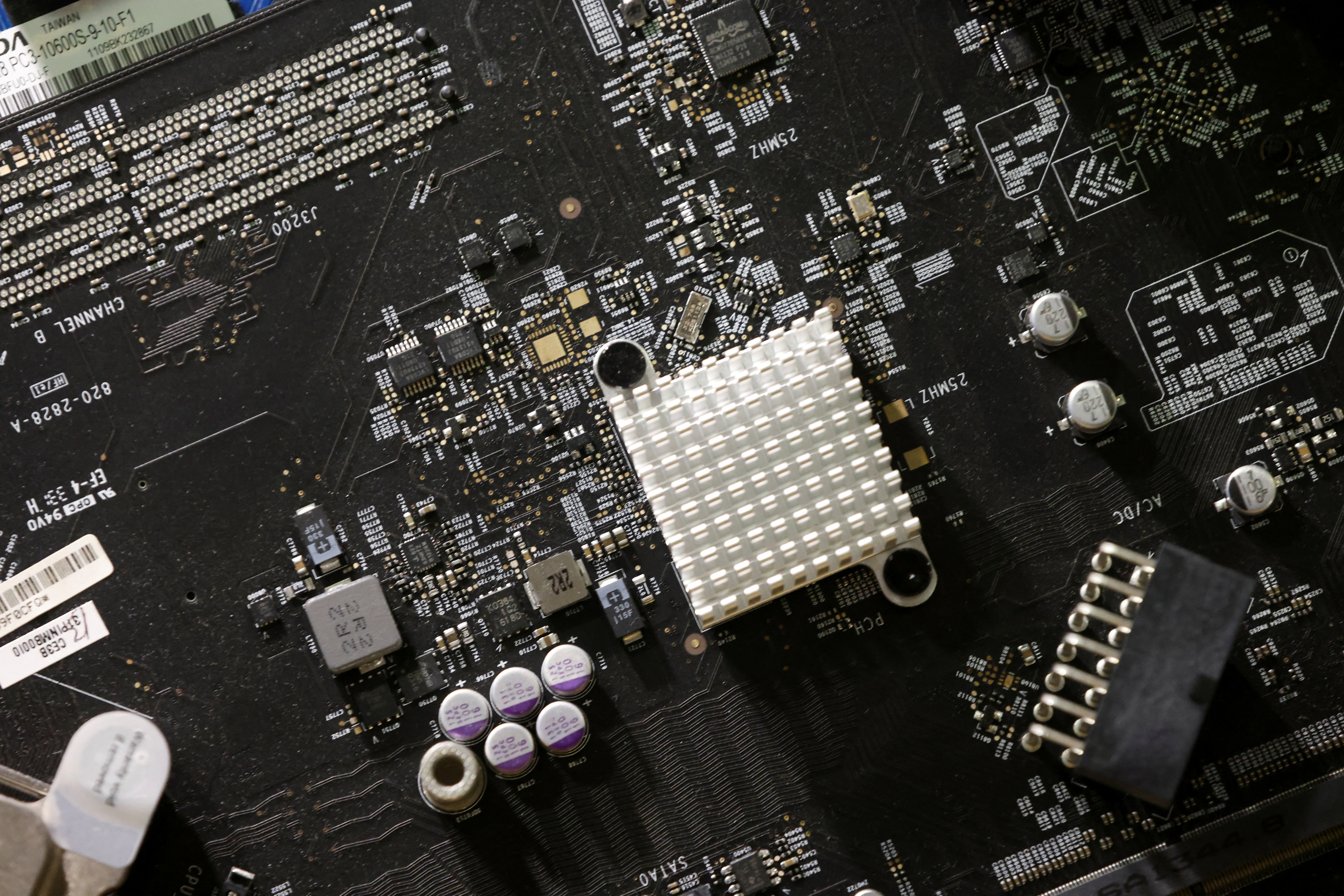

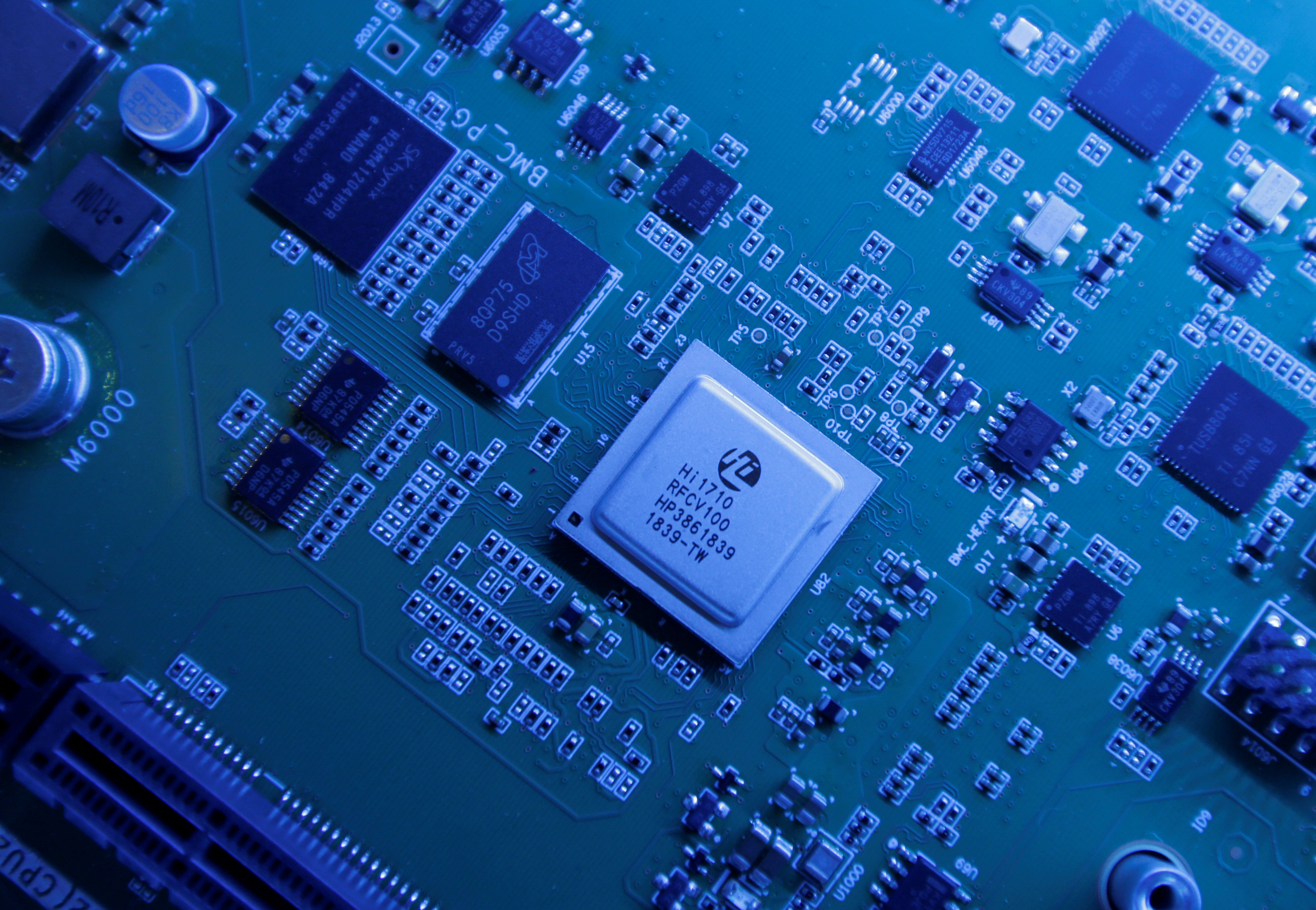

We commonly think of chips as the “brains” that crunch numbers, and that is certainly true for the CPUs in computers, but chips do all sorts of useful things. Memory chips store data. Digital cameras contain chips that detect light and turn it into an image. Modern TVs produce their colorful displays with arrays of light emitting diodes (LEDs) on chips. Phones send and receive Wi-Fi and cellular signals thanks to semiconductor chips inside them. Chips also abound on the exteriors of homes, inside everything from security cameras to solar panels.

The average car can have upward of 1,200 chips in it, and you can’t make a new car unless you have all of them. “Today’s cars are computers on wheels,” an auto mechanic said to me a few years ago, and his words were never more on point than during the height of the pandemic. In 2021, the chip shortage was estimated to have caused a loss of $110 billion in new vehicle sales worldwide.

The chips in today’s cars are a combination of low-tech, mature chips and high-tech, state-of-the-art processors (which you’ll especially find in electric vehicles and those that have autonomous driving capabilities).

Whether mature or cutting-edge, chips typically need to go through a dizzying series of steps — and different suppliers — before they become finished products. And most of this work is currently done outside this country. The U.S., once a leader in chip manufacturing, currently only has about a 12% share in the market.

To reestablish our nation’s leadership in chip manufacturing, Congress recently passed, and President Joe Biden recently signed into law, the CHIPS Act. The CHIPS Act aims to help U.S. manufacturers grow an ecosystem in which they produce both mature and state-of-the-art chips at all stages of the manufacturing process and supply chain, and NIST is going to play a big role in this effort.

Silicon is the most frequently used raw material for chips, and one of the most abundant atomic elements on Earth. To give you a sense of its abundance, silicon and oxygen are the main ingredients of most beach sand, and a major component of glass, rocks and soil (which means that you can also find it in actual, not just metaphorical, dirt).

Silicon is a type of material known as a semiconductor. Electricity flows through semiconductors better than it does through insulators (such as rubber and cotton), but not quite as well as it does through conductors (such as metals and water).

But that’s a good thing. In semiconductors, you can control electric current precisely — and without any moving parts. By applying a small voltage to them, you can either cause current to flow or to stop — making the semiconductor (or a small region within it) act like a conductor or insulator depending on what you want to do.

The first step for making a chip is to start with a thin slice of a semiconductor material, known as a “wafer,” often round in shape. On top of the wafer, manufacturers then create complex miniature electric circuits, commonly called “integrated circuits” (ICs) because they are embedded as one piece on the wafer. A typical IC today contains billions of tiny on-off switches known as transistors that enable a chip to perform a wide range of complex tasks from sending signals to processing information. Increasingly, these circuits also have “photonic” components in which light travels alongside electricity.

Manufacturers typically mass-produce dozens of ICs on a single semiconductor wafer and then dice the wafer to separate the individual pieces. When each of them is packaged as a self-contained device, you have a “chip,” which can then be placed in smartphones, computers and so many other products.

Though silicon is the most commonly used raw material for chips, other semiconductors are used depending on the application. For example, gallium nitride is resistant to damage from cosmic rays and other radiation in space, so it’s commonly the material of choice for electronic devices in satellites. Gallium arsenide is frequently employed to make LEDs, because silicon typically produces heat instead of light if you try to make an LED with it.

Non-silicon semiconductors are used in the growing field of “power electronics” in vehicles and energy systems such as wind and solar. Silicon carbide can handle larger amounts of electricity and voltage than other materials, so it has been used in chips for electric vehicles to perform functions such as converting DC battery power into the AC power delivered to the motors.

Diamonds are semiconductors too — and they have the greatest ability to conduct heat of any known material. Artificial diamonds are currently used as the semiconductors in chips for aerospace applications, as they can draw heat away from the power loads generated in those chips.

Measurement science plays a key role in up to 50% of semiconductor manufacturing steps, according to a recent NIST report. Good measurements enable manufacturers to mass-produce high-quality, high-performance chips.

NIST has the measurement science and technical standards expertise that is needed by the U.S. chip industry, and our programs to advance manufacturing and support manufacturing networks across the U.S. mean we can partner with industry to find out what they need and deliver on it.

NIST researchers already work on semiconductor materials for many reasons. For example, researchers have developed new ways to measure semiconductor materials in order to detect defects (such as a stray aluminum atom in silicon) that could cause chips to malfunction. As electronic components get smaller, chips need to be increasingly free of such defects.

“Modern chips may contain over 100 billion complex nanodevices that are less than 50 atoms across — all must work nearly identically for the chip to function,” the NIST report points out.

NIST researchers also measure the properties of new materials that could be useful for future inventions. All of the semiconductor materials I mentioned above are brittle and can’t be bent. But devices with chips — from pacemakers to blood pressure monitors to defibrillators — are increasingly being made with flexible materials so they can be “wearable” and you can attach them comfortably to the contours of your body. NIST researchers have been at the forefront of the work to develop these “flexible” chips.

Researchers are also studying materials that could serve as “printable” chips that would be cheaper and more environmentally friendly. Instead of going through the complicated multistep process of making chips in a factory, we are developing ways to print circuits directly onto materials such as paper using technology that’s similar to ink-jet printers.

And while we’ve lost a lot of overall chip manufacturing share, U.S. companies still make many of the machines that carry out the individual steps for fabricating chips, such as those that deposit ultrathin layers of material on top of semiconductors. But what if, instead of these machines being shipped abroad, more domestic manufacturers developed expertise in using them?

To support this effort, NIST researchers are planning to perform measurements with these very machines in their labs. They will study materials that these machines use and the manufacturing processes associated with them. The information from the NIST work could help more domestic manufacturers develop the know-how for making chips. This work can help create an ecosystem with many domestic chip manufacturers, not just a few, leading to a more resilient supply chain.

“Reliance on only one supplier is problematic, as we saw with the recent shortage in baby formula,” NIST"s Jyoti Malhotra pointed out to me. Malhotra serves on the senior leadership team of the NIST Manufacturing Extension Partnership (MEP). MEP has been connecting NIST labs to the U.S. suppliers and manufacturers who produce materials, components, devices and equipment enabling U.S. chip manufacturing.

Last but not least, an area of major excitement at NIST is “advanced packaging.” No, we don’t mean the work of those expert gift-wrappers you may find at stores during the holiday season. When we talk about chip packaging, we’re referring to everything that goes around a chip to protect it from damage and connect it to the rest of the device. Advanced packaging takes things to the next level: It uses ingenious techniques during the chipmaking process to connect multiple chips to each other and the rest of the device in as tiny a space as possible.

But it’s more about just making a smartphone that fits in your pocket. Advanced packaging enables our devices to be faster and more energy-efficient because information can be exchanged between chips over shorter distances and this in turn reduces energy consumption.

One great byproduct of advanced packaging’s innovations can be found on my wrist — namely, the smartwatch I wear for my long-distance runs. My watch uses GPS to measure how far I ran. It also measures my heart rate, and after my workouts, it uploads my running data wirelessly to my phone. Its battery lasts for days; it had plenty of juice left even after I ran a full marathon last month.

Twenty years ago, running watches were big and clunky, with much less functionality. My friends and I had a particular model with a huge face and a bulky slab that fit over the insides of our wrists. When a friend and I opened up his watch to replace his battery, we saw that the GPS receiver was on a completely separate circuit board from the rest of the watch electronics.

Under the small and thin face of my current watch you will find all its electronics, including a GPS sensor, battery, heart-rate monitor, wireless communications device and so many other things.

Further development of advanced packaging could produce even more powerful devices for monitoring a patient’s vitals, measuring pollutants in the environment, and increasing situational awareness for soldiers in the field.

Advanced packaging is also a potential niche for domestic manufacturers to grow global market share (currently at 3% for this part of the chipmaking process). Chips are becoming so complex that design and manufacturing processes, once separate steps, are now increasingly intertwined — and the U.S. remains a world leader in chip design. NIST’s measurements to support advanced packaging in chips and standards for the packaging process could give domestic manufacturers a decisive edge in this area.

All the NIST experts I’ve spoken to talk about a future in which chip manufacturers work increasingly closely with their customers, such as automakers. The benefit of closer relationships would mean that customers could collaborate with manufacturers to create more customized chips that bring about completely new products.

And as we’ve seen, incorporating chips into existing products tends to make them “smart,” whether it’s an appliance figuring out how long to bake the bread, or solar panels that maximize electricity production by coordinating the power output from individual panels. With more domestic manufacturers on the scene, there are more opportunities to incorporate chips into products — that could also be manufactured in the U.S.A.

I first encountered semiconductor chips in the 1970s, when the U.S. was a dominant force in chip manufacturing. Inside a department store with my mom, I saw pocket calculators on display, and they fascinated me. You could punch their number keys and they would instantly solve any addition or multiplication problem. As a 6-year-old, I thought that they had little brains in them!

Since then, semiconductor chips have been a big part of my life. And after the pandemic, I realize I can’t take them for granted. I’m glad to be part of an agency that is working to create a more resilient supply chain — and bring back chip manufacturing in this country.

Transistor: Simple switch, made with a semiconductor material, that turns on or off depending on changes in voltage and can combine with other transistors to create complex devices

Chip: Self-contained piece including the semiconductor surface and integrated circuit, independently packaged for use in electronics such as cellphones or computers

While governments and manufacturers address the semiconductor shortage, it’s worth getting to know why the technology is worth the fuss. It comes down to the fact that semiconductors power almost everything in our daily lives.

From smartphones to planes, semiconductors evolved to improve technologies and do wonders for your entertainment and convenience. Let’s go into more detail about what makes them special, including eight areas semiconductor chips influence the most.

Before the popular silicon-based chips came to be, computers were big machines made of tubes and dials. They were impressive but fragile, not to mention a liability because of the amount of electricity they needed.

Semiconductor chips replaced the tubes, managing machines faster, cheaper, and more efficiently. Advances in design and size led us to light and sleek modern phones and smart equipment in a range of industries.

The global chip shortage highlights the importance of semiconductor chips and why restoring and increasing their production is essential to modern living.

Machines great and small rely on semiconductor chips. You’ll not just find them in the palm of your hand, but at the other end of your internet connection and even behind your steering wheel.

Microchips and computers are usually the first connection people make. Depending on the type of chip, a semiconductor uses binary code to direct the commands you give it, whether it’s to launch a program or download and save a document.

Microprocessors, memory, and graphic processing units (GPUs) are common semiconductors for computers. All-in-all, they help your machine run smoothly, for example, by protecting your battery and whole system from burning up while you play video games.

The principle of semiconductors for telecommunication is the same: to control machine functions. The difference is the types of chips used and what they"re used for. At the same time, their design differs from device to device.

A smartphone’s semiconductor chips affect its display, navigation, battery use, 4G reception, and more. Even taking pictures and using different apps taps into one chip or another.

But it’s not just about phones. Consider routers, answering machines, and pagers. The range of technologies that depend on telecommunication semiconductors really is broad.

Fridges, microwaves, washing machines, air conditioners, and other machines around the home and office operate thanks to semiconductors. Different chips control temperatures, timers, automated features, and so on.

Our spaces are already full of appliances to make everyday habits easier, while smart technology and the Internet of Things (IoT) add to them. As a result, semiconductor chips constantly evolve to respond to rising standards, mainly demanding instant, multifunctional, and durable services.

Once you understand what semiconductors can do, it’s easier to imagine how different parts of our high-tech world benefit from them. Banks are major investors, especially in the best microchips manufacturers have to offer.

Computers and their banking systems for online communication, digital accounting, cloud platforms, and more are key. But banks also need semiconductors for ATMs, security cameras, and even automated locking mechanisms.

This is also a case where the more powerful the technology, the better. Semiconductor chips can help banks keep your money and personal information safe, even more so as AI and machine learning evolve within banking.

When it comes to security, semiconductors have both improved and hindered it. The evolution of microchips alongside many other parts of digital technology has opened the way to new and intelligent threats. However, these same innovations also help defend against them.

A semiconductor chip’s contribution to cybersecurity starts from the hardware. The effectiveness of any programs you install later depends on how well your machine supports them.

The medical field uses advanced technology. Complex and risky surgeries are safer with the help of machines, operating with precision. Monitors and pacemakers are popular too. Even talking to patients and diagnosing symptoms is possible through video conferencing alone.

And none of this equipment can do its job right without semiconductor chips directing the power, sensors, temperatures, pressures, calculations, and many other functions. Just like with security, a lot of care goes into designing the parts for medical devices and ensuring they don’t malfunction.

Cars, buses, trains, and planes are just much bigger devices that also use semiconductors. If you value GPS, free Wi-Fi, or the polite voice alerting you about each stop, then you can appreciate how these tiny but wonderful chips enhance everyday habits.

In general, electronic vehicles have more features than analog models. They take the stress out of travel and replace it with a smooth experience and handy tools for navigation, roadside assistance, parking, and more.

It’s because semiconductors are so widespread today that manufacturers need to focus on specific industries. Aviation is another major interest, enjoying super-efficient cockpit avionics, engine control systems, and power conversion, among other functions.

The benefits of semiconductors come full circle to improve their own manufacturing and that of every other commercial product. Machines in factories do specific and repetitive work, the result of carefully set up hardware and software.

So, whether a device is self-sufficient or needs someone to control it, its abilities must be trustworthy, which largely depends on its semiconductor chips. Several practical and economic factors are linked to a business’s trouble-free operation and production.

With so many gadgets and innovations around, it isn’t easy to keep track of everything. Overindulging in technology you don’t fully understand is also risky. Semiconductor chips are smart, but they can’t stop you from making mistakes.

A semiconductor is a material product usually comprised of silicon, which conducts electricity more than an insulator, such as glass, but less than a pure conductor, such as copper or aluminum. Their conductivity and other properties can be altered with the introduction of impurities, called doping, to meet the specific needs of the electronic component in which it resides.

Also known as semis, or chips, semiconductors can be found in thousands of products such as computers, smartphones, appliances, gaming hardware, and medical equipment.

Found in thousands of electronic products, a semiconductor is a material that conducts electricity more than an insulator but less than a pure conductor.

Aside from investing in specific companies that manufacture semiconductors, there are also ETFs, index funds, and indices that break the sector down to chip makers and chip equipment makers.

Semiconductor devices can display a range of useful properties such as showing variable resistance, passing current more easily in one direction than the other, and reacting to light and heat. Their actual function includes the amplification of signals, switching, and energy conversion.

Therefore, they find widespread use in almost all industries, and the companies that manufacture and test them are considered to be excellent indicators of the health of the overall economy.

The semiconductor industry is a hugely important sector for both the U.S. and world economies, with semiconductor components found in a wide range of consumer and commercial products from vehicles to computers to mobile devices and personal electronics.

Semiconductors come in two main types based on the elements that are included alongside silicon, a process known as "doping." These "impurities" are introduced to the crystalline silicon to alter the properties of the finished semiconductor:

A p-type semiconductor has dopants with five electrons in its valence layer. Phosphorus is commonly used for this purpose, as well as arsenic, or antimony.

Memory chips serve as temporary storehouses of data and pass information to and from computer devices" brains. The consolidation of the memory market continues, driving memory prices so low that only a few giants like Toshiba, Samsung, and NEC can afford to stay in the game.

These are central processing units that contain the basic logic to perform tasks. Intel"s domination of the microprocessor segment has forced nearly every other competitor, with the exception of Advanced Micro Devices, out of the mainstream market and into smaller niches or different segments altogether.

Sometimes called "standard chips", these are produced in huge batches for routine processing purposes. Dominated by very large Asian chip manufacturers, this segment offers razor-thin profit margins that only the biggest semiconductor companies can compete for.

"System on a Chip" is essentially all about the creation of an integrated circuit chip with an entire system"s capability on it. The market revolves around the growing demand for consumer products that combine new features and lower prices. With the doors to the memory, microprocessor, and commodity integrated circuit markets tightly shut, the SOC segment is arguably the only one left with enough opportunity to attract a wide range of companies.

Success in the semiconductor industry depends on creating smaller, faster, and cheaper products. The benefit of being tiny is that more power can be placed on the same chip. The more transistors on a chip, the faster it can do its work. This creates fierce competition in the industry and new technologies lower the cost of production per chip.

This gave rise to the observations calledMoore"s Law, which states that the number of transistors in a dense integrated circuit doubles approximately every two years. The observation is named after Gordon Moore, the co-founder of Fairchild Semiconductor and Intel, who wrote a paper describing it in 1965. Nowadays, the doubling period is often quoted as 18 months—the figure cited by Intel executive David House.

As a result, there is constant pressure on chipmakers to come up with something better and even cheaper than what was defined as state-of-the-art only a few months beforehand. Therefore, semiconductor companies need to maintain large research and development budgets. The semiconductor market research association IC Insights reported semiconductor companies are expected to increase the research and development budgets by 9% in 2022. They also forecasted the compound annual growth rate (CAGR) will also grow by about 5.5% between 2022 and 2026.

Traditionally, semiconductor companies controlled the entire production process, from design to manufacture. Yet many chip makers are now delegating more and more production to others in the industry. Foundry companies, whose sole business is manufacturing, have recently come to the fore, providing attractive outsourcing options. In addition to foundries, the ranks of increasingly specialized designers and chip testers are starting to swell. Chip companies are emerging leaner and more efficient. Chip production now resembles a gourmet restaurant kitchen, where chefs line up to add just the right spice to the mix.

In the 1980s, chip makers lived with yields (number of operational devices out of all manufactured) of 10-30%. Chip makers now shoot for yields (number of operational devices out of all manufactured) no less than 90%. This requires very expensive manufacturing processes.

As a result, many semiconductor companies carry out design and marketing but choose to outsource some or all of the manufacturing. Known as fabless chip makers, these companies have high growth potential because they are not burdened by the overhead associated with manufacturing, or "fabrication."

Aside from investing in individual companies, there are several ways to monitor the investment performance of the overall sector. These include the benchmark PHLX Semiconductor Index, known as the SOX, as well as its derivative forms in exchange-traded funds. There are also indices that break the sector down to chip makers and chip equipment makers. The latter develops and sells machinery and other products used to design and test semiconductors.

In addition, certain markets overseas, such as Taiwan, South Korea, and to a lesser extent Japan, are highly dependent on semiconductors and therefore their indices also provide clues to the health of the global industry.

If semiconductor investors can remember one thing, it should be that the semiconductor industry is highly cyclical. Semiconductor makers often see "boom and bust" cycles based on the underlying demand for chip-based products. When times are good, profit margins can run very high for chipmakers; when demand falls through, however, chip prices can fall dramatically and have a major effect on many industries" supply chains.

Demand typically tracks end-market demand for personal computers, cell phones, and other electronic equipment. When times are good, companies like Intel and Toshiba can"t produce microchips quickly enough to meet demand. When times are tough, they can be downright brutal. Slow PC sales, for instance, can send the industry—and its share prices—into a tailspin.

At the same time, it doesn"t make sense to speak of the "chip cycle" as if it were an event of singular nature. While semiconductors are still a commodity business at heart, its end markets are so numerous—PCs, communications infrastructure, automotive, consumer products, etc.— that it is unlikely that excess capacity in one area will bring the whole house down.

Surprisingly, the cyclicality of the industry can provide a degree of comfort for investors. In some other technology sectors, like telecom equipment, one can never be entirely sure whether fortunes are cyclical or secular. By contrast, investors can be almost certain that the market will turn at some point in the not-so-distant future.

While cyclicality offers some comfort, it also creates a risk for investors. Chipmakers must routinely take part in high-stakes gambling. The big risk comes from the fact that it can take many months, or even years, after a major development project for companies to find out whether they"ve hit the jackpot, or blown it all. One cause of the delay is the intertwined but fragmented structure of the industry: Different sectors peak and bottom out at different times.

For instance, the low point for foundries frequently arrives much sooner than it does for chip designers. Another reason is the industry"s long lead time: It takes years to develop a chip or build a foundry, and even longer before the products make money.

Semiconductor companies are faced with the classic conundrum of whether it"s the technology that drives the market or the market that drives the technology. Investors should recognize that both have validity for the semiconductor industry.

Because companies spend a large amount of revenue on research and development that can take several months or even years to pay off—and sometimes not even then if the technology is faulty—investors should be wary of statements made by companies who claim to have the latest and greatest technology in the semiconductor industry.

A semiconductor essentially functions as a hybrid of a conductor and an insulator. Whereas conductors are materials with high conductivity that allow the flow of charge when applied with a voltage, and insulators do not allow current flow, semiconductors alternately act as an insulator and conductor where necessary.

A p-type semiconductor is a type of extrinsic semiconductor that contains trivalent impurities such as boron and aluminum which increases the level of conductivity of a normal semiconductor made purely of silicon.

An intrinsic or pure semiconductor is a semiconductor that does not have any impurities or dopants added to it, as in the case of p-type and n-type semiconductors. In intrinsic semiconductors, the number of excited electrons and the number of holes are equal: n = p.

Semiconductors literally make the world go "round these days. Without semiconductors, we wouldn"t have computers, the internet, mobile phones, or flat-screen TVs. It is no surprise then that the semiconductor industry plays a prominent role in the global economy. The sector also remains a hub of innovation, as Moore"s law continues to work its magic, producing more powerful microchips that are cheaper to produce over time.

Semiconductor materials are nominally small band gap insulators. The defining property of a semiconductor material is that it can be compromised by doping it with impurities that alter its electronic properties in a controllable way.computer and photovoltaic industry—in devices such as transistors, lasers, and solar cells—the search for new semiconductor materials and the improvement of existing materials is an important field of study in materials science.

Most commonly used semiconductor materials are crystalline inorganic solids. These materials are classified according to the periodic table groups of their constituent atoms.

Different semiconductor materials differ in their properties. Thus, in comparison with silicon, compound semiconductors have both advantages and disadvantages. For example, gallium arsenide (GaAs) has six times higher electron mobility than silicon, which allows faster operation; wider band gap, which allows operation of power devices at higher temperatures, and gives lower thermal noise to low power devices at room temperature; its direct band gap gives it more favorable optoelectronic properties than the indirect band gap of silicon; it can be alloyed to ternary and quaternary compositions, with adjustable band gap width, allowing light emission at chosen wavelengths, which makes possible matching to the wavelengths most efficiently transmitted through optical fibers. GaAs can be also grown in a semi-insulating form, which is suitable as a lattice-matching insulating substrate for GaAs devices. Conversely, silicon is robust, cheap, and easy to process, whereas GaAs is brittle and expensive, and insulation layers can not be created by just growing an oxide layer; GaAs is therefore used only where silicon is not sufficient.

By alloying multiple compounds, some semiconductor materials are tunable, e.g., in band gap or lattice constant. The result is ternary, quaternary, or even quinary compositions. Ternary compositions allow adjusting the band gap within the range of the involved binary compounds; however, in case of combination of direct and indirect band gap materials there is a ratio where indirect band gap prevails, limiting the range usable for optoelectronics; e.g. AlGaAs LEDs are limited to 660 nm by this. Lattice constants of the compounds also tend to be different, and the lattice mismatch against the substrate, dependent on the mixing ratio, causes defects in amounts dependent on the mismatch magnitude; this influences the ratio of achievable radiative/nonradiative recombinations and determines the luminous efficiency of the device. Quaternary and higher compositions allow adjusting simultaneously the band gap and the lattice constant, allowing increasing radiant efficiency at wider range of wavelengths; for example AlGaInP is used for LEDs. Materials transparent to the generated wavelength of light are advantageous, as this allows more efficient extraction of photons from the bulk of the material. That is, in such transparent materials, light production is not limited to just the surface. Index of refraction is also composition-dependent and influences the extraction efficiency of photons from the material.

III–V semiconductors: Crystallizing with high degree of stoichiometry, most can be obtained as both n-type and p-type. Many have high carrier mobilities and direct energy gaps, making them useful for optoelectronics.

A compound semiconductor is a semiconductor compound composed of chemical elements of at least two different species. These semiconductors form for example in periodic table groups 13–15 (old groups III–V), for example of elements from the Boron group (old group III, boron, aluminium, gallium, indium) and from group 15 (old group V, nitrogen, phosphorus, arsenic, antimony, bismuth). The range of possible formulae is quite broad because these elements can form binary (two elements, e.g. gallium(III) arsenide (GaAs)), ternary (three elements, e.g. indium gallium arsenide (InGaAs)) and quaternary alloys (four elements) such as aluminium gallium indium phosphide (AlInGaP)) alloy and Indium arsenide antimonide phosphide (InAsSbP). The properties of III-V compound semiconductors are similar to their group IV counterparts. The higher ionicity in these compounds, and especially in the II-VI compound, tends to increase the fundamental bandgap with respect to the less ionic compounds.

Metalorganic vapor-phase epitaxy (MOVPE) is the most popular deposition technology for the formation of compound semiconducting thin films for devices.metalorganics and/or hydrides as precursor source materials in an ambient gas such as hydrogen.

Used in conventional crystalline silicon (c-Si) solar cells, and in its amorphous form as amorphous silicon (a-Si) in thin-film solar cells. Most common semiconductor material in photovoltaics; dominates worldwide PV market; easy to fabricate; good electrical and mechanical properties. Forms high quality thermal oxide for insulation purposes. Most common material used in the fabrication of Integrated Circuits.

Used in early radar detection diodes and first transistors; requires lower purity than silicon. A substrate for high-efficiency multijunction photovoltaic cells. Very similar lattice constant to gallium arsenide. High-purity crystals used for gamma spectroscopy. May grow whiskers, which impair reliability of some devices.

Piezoelectric. Not used on its own as a semiconductor; AlN-close GaAlN possibly usable for ultraviolet LEDs. Inefficient emission at 210 nm was achieved on AlN.

problematic to be doped to p-type, p-doping with Mg and annealing allowed first high-efficiency blue LEDsblue lasers. Very sensitive to ESD. Insensitive to ionizing radiation. GaN transistors can operate at higher voltages and higher temperatures than GaAs, used in microwave power amplifiers. When doped with e.g. manganese, becomes a magnetic semiconductor.

Used in early low to medium brightness cheap red/orange/green LEDs. Used standalone or with GaAsP. Transparent for yellow and red light, used as substrate for GaAsP red/yellow LEDs. Doped with S or Te for n-type, with Zn for p-type. Pure GaP emits green, nitrogen-doped GaP emits yellow-green, ZnO-doped GaP emits red.

second most common in use after silicon, commonly used as substrate for other III-V semiconductors, e.g. InGaAs and GaInNAs. Brittle. Lower hole mobility than Si, P-type CMOS transistors unfeasible. High impurity density, difficult to fabricate small structures. Used for near-IR LEDs, fast electronics, and high-efficiency solar cells. Very similar lattice constant to germanium, can be grown on germanium substrates.

Commonly used as substrate for epitaxial InGaAs. Superior electron velocity, used in high-power and high-frequency applications. Used in optoelectronics.

Used for infrared detectors for 1–3.8 µm, cooled or uncooled. High electron mobility. InAs dots in InGaAs matrix can serve as quantum dots. Quantum dots may be formed from a monolayer of InAs on InP or GaAs. Strong photo-Dember emitter, used as a terahertz radiation source.

Used in infrared detectors and thermal imaging sensors, high quantum efficiency, low stability, require cooling, used in military long-range thermal imager systems. AlInSb-InSb-AlInSb structure used as quantum well. Very high electron mobility, electron velocity and ballistic length. Transistors can operate below 0.5V and above 200 GHz. Terahertz frequencies maybe achievable.

Nanoparticles used as quantum dots. Intrinsic n-type, difficult to dope p-type, but can be p-type doped with nitrogen. Possible use in optoelectronics. Tested for high-efficiency solar cells.

Used in photoresistors and solar cells; CdS/Cu2S was the first efficient solar cell. Used in solar cells with CdTe. Common as quantum dots. Crystals can act as solid-state lasers. Electroluminescent. When doped, can act as a phosphor.

Used in solar cells with CdS. Used in thin film solar cells and other cadmium telluride photovoltaics; less efficient than crystalline silicon but cheaper. High electro-optic effect, used in electro-optic modulators. Fluorescent at 790 nm. Nanoparticles usable as quantum dots.

Photocatalytic. Band gap is tunable from 3 to 4 eV by alloying with magnesium oxide and cadmium oxide. Intrinsic n-type, p-type doping is difficult. Heavy aluminium, indium, or gallium doping yields transparent conductive coatings; ZnO:Al is used as window coatings transparent in visible and reflective in infrared region and as conductive films in LCD displays and solar panels as a replacement of indium tin oxide. Resistant to radiation damage. Possible use in LEDs and laser diodes. Possible use in random lasers.

Used for blue lasers and LEDs. Easy to n-type doping, p-type doping is difficult but can be done with e.g. nitrogen. Common optical material in infrared optics.

Can be grown on AlSb, GaSb, InAs, and PbSe. Used in solar cells, components of microwave generators, blue LEDs and lasers. Used in electrooptics. Together with lithium niobate used to generate terahertz radiation.

Mineral galena, first semiconductor in practical use, used in cat"s whisker detectors; the detectors are slow due to high dielectric constant of PbS. Oldest material used in infrared detectors. At room temperature can detect SWIR, longer wavelengths require cooling.

Tin sulfide (SnS) is a semiconductor with direct optical band gap of 1.3 eV and absorption coefficient above 104 cm−1 for photon energies above 1.3 eV. It is a p-type semiconductor whose electrical properties can be tailored by doping and structural modification and has emerged as one of the simple, non-toxic and affordable material for thin films solar cells since a decade.

Efficient thermoelectric material near room temperature when alloyed with selenium or antimony. Narrow-gap layered semiconductor. High electrical conductivity, low thermal conductivity. Topological insulator.

N-type intrinsic semiconductor. Very high electron mobility. Used in infrared detectors, photodetectors, dynamic thin-film pressure sensors, and magnetoresistors. Recent measurements suggest that 3D Cd3As2 is actually a zero band-gap Dirac semimetal in which electrons behave relativistically as in graphene.

High Seebeck coefficient, resistant to high temperatures, promising thermoelectric and thermophotovoltaic applications. Formerly used in URDOX resistors, conducting at high temperature. Resistant to radiation damage.

direct band gap for x<0.4 (corresponding to 1.42–1.95 eV); can be lattice-matched to GaAs substrate over entire composition range; tends to oxidize; n-doping with Si, Se, Te; p-doping with Zn, C, Be, Mg.QWIP). AlGaAs with composition close to AlAs is almost transparent to sunlight. Used in GaAs/AlGaAs solar cells.

Well-developed material. Can be lattice matched to InP substrates. Use in infrared technology and thermophotovoltaics. Indium content determines charge carrier density. For x=0.015, InGaAs perfectly lattice-matches germanium; can be used in multijunction photovoltaic cells. Used in infrared sensors, avalanche photodiodes, laser diodes, optical fiber communication detectors, and short-wavelength infrared cameras.

used for HEMT and HBT structures and high-efficiency multijunction solar cells for e.g. satellites. Ga0.5In0.5P is almost lattice-matched to GaAs, with AlGaIn used for quantum wells for red lasers.

Buffer layer in metamorphic HEMT transistors, adjusting lattice constant between GaAs substrate and GaInAs channel. Can form layered heterostructures acting as quantum wells, in e.g. quantum cascade lasers.

Used in blue laser diodes, ultraviolet LEDs (down to 250 nm), and AlGaN/GaN HEMTs. Can be grown on sapphire. Used in heterojunctions with AlN and GaN.

InxGa1–xN, x usually between 0.02–0.3 (0.02 for near-UV, 0.1 for 390 nm, 0.2 for 420 nm, 0.3 for 440 nm). Can be grown epitaxially on sapphire, SiC wafers or silicon. Used in modern blue and green LEDs, InGaN quantum wells are effective emitters from green to ultraviolet. Insensitive to radiation damage, possible use in satellite solar cells. Insensitive to defects, tolerant to lattice mismatch damage. High heat capacity.

also InAlGaP, InGaAlP, AlInGaP; for lattice matching to GaAs substrates the In mole fraction is fixed at about 0.48, the Al/Ga ratio is adjusted to achieve band gaps between about 1.9 and 2.35 eV; direct or indirect band gaps depending on the Al/Ga/In ratios; used for waveengths between 560–650 nm; tends to form ordered phases during deposition, which has to be prevented

Efficient solid-state x-ray and gamma-ray detector, can operate at room temperature. High electro-optic coefficient. Used in solar cells. Can be used to generate and detect terahertz radiation. Can be used as a substrate for epitaxial growth of HgCdTe.

Known as "MerCad". Extensive use in sensitive cooled infrared imaging sensors, infrared astronomy, and infrared detectors. Alloy of mercury telluride (a semimetal, zero band gap) and CdTe. High electron mobility. The only common material capable of operating in both 3–5 µm and 12–15 µm atmospheric windows. Can be grown on CdZnTe.

Used in infrared detectors, infrared imaging sensors, and infrared astronomy. Better mechanical and thermal properties than HgCdTe but more difficult to control the composition. More difficult to form complex heterostructures.

Jones, E.D. (1991). "Control of Semiconductor Conductivity by Doping". In Miller, L. S.; Mullin, J. B. (eds.). Electronic Materials. New York: Plenum Press. pp. 155–171. doi:10.1007/978-1-4615-3818-9_12. ISBN 978-1-4613-6703-1.

Yu, Peter; Cardona, Manuel (2010). Fundamentals of Semiconductors (4 ed.). Springer-Verlag Berlin Heidelberg. p. 2. doi:10.1007/978-3-642-00710-1. ISBN 978-3-642-00709-5.

Patel, Malkeshkumar; Indrajit Mukhopadhyay; Abhijit Ray (26 May 2013). "Annealing influence over structural and optical properties of sprayed SnS thin films". Optical Materials. 35 (9): 1693–1699. Bibcode:2013OptMa..35.1693P. doi:10.1016/j.optmat.2013.04.034.

Syrbu, N. N.; Stamov, I. G.; Morozova, V. I.; Kiossev, V. K.; Peev, L. G. (1980). "Energy band structure of Zn3P2, ZnP2 and CdP2 crystals on wavelength modulated photoconductivity and photoresponnse spectra of Schottky diodes investigation". Proceedings of the First International Symposium on the Physics and Chemistry of II-V Compounds: 237–242.

Botha, J. R.; Scriven, G. J.; Engelbrecht, J. A. A.; Leitch, A. W. R. (1999). "Photoluminescence properties of metalorganic vapor phase epitaxial Zn3As2". Journal of Applied Physics. 86 (10): 5614–5618. Bibcode:1999JAP....86.5614B. doi:10.1063/1.371569.

Shin, S.; Suga, S.; Taniguchi, M.; Fujisawa, M.; Kanzaki, H.; Fujimori, A.; Daimon, H.; Ueda, Y.; Kosuge, K. (1990). "Vacuum-ultraviolet reflectance and photoemission study of the metal-insulator phase transitions in VO 2, V 6 O 13, and V 2 O 3". Physical Review B. 41 (8): 4993–5009. Bibcode:1990PhRvB..41.4993S. doi:10.1103/physrevb.41.4993. PMID 9994356.

Arora, Himani; Jung, Younghun; Venanzi, Tommaso; Watanabe, Kenji; Taniguchi, Takashi; Hübner, René; Schneider, Harald; Helm, Manfred; Hone, James C.; Erbe, Artur (2019-11-20). "Effective Hexagonal Boron Nitride Passivation of Few-Layered InSe and GaSe to Enhance Their Electronic and Optical Properties". ACS Applied Materials & Interfaces. 11 (46): 43480–43487. doi:10.1021/acsami.9b13442. ISSN 1944-8244.

HODES; Ebooks Corporation (8 October 2002). Chemical Solution Deposition of Semiconductor Films. CRC Press. pp. 319–. ISBN 978-0-8247-4345-1. Retrieved 28 June 2011.

Hussain, Aftab M.; Fahad, Hossain M.; Singh, Nirpendra; Sevilla, Galo A. Torres; Schwingenschlögl, Udo; Hussain, Muhammad M. (2014). "Tin – an unlikely ally for silicon field effect transistors?". Physica Status Solidi RRL. 8 (4): 332–335. Bibcode:2014PSSRR...8..332H. doi:10.1002/pssr.201308300.

Trukhan, V. M.; Izotov, A. D.; Shoukavaya, T. V. (2014). "Compounds and solid solutions of the Zn-Cd-P-As system in semiconductor electronics". Inorganic Materials. 50 (9): 868–873. doi:10.1134/S0020168514090143.

Arushanov, E. K. (1992). "II3V2 compounds and alloys". Progress in Crystal Growth and Characterization of Materials. 25 (3): 131–201. doi:10.1016/0960-8974(92)90030-T.

Screen-reader optimization:we run a background process that learns the website’s components from top to bottom, to ensure ongoing compliance even when updating the website. In this process, we provide screen-readers with meaningful data using the ARIA set of attributes. For example, we provide accurate form labels; descriptions for actionable icons (social media icons, search icons, cart icons, etc.); validation guidance for form inputs; element roles such as buttons, menus, modal dialogues (popups), and others. Additionally, the background process scans all of the website’s images and provides an accurate and meaningful image-object-recognition-based description as an ALT (alternate text) tag for images that are not described. It will also extract texts that are embedded within the image, using an OCR (optical character recognition) technology. To turn on screen-reader adjustments at any time, users need only to press the Alt+1 keyboard combination. Screen-reader users also get automatic announcements to turn the Screen-reader mode on as soon as they enter the website.These adjustments are compatible with all popular screen readers, including JAWS and NVDA.

Keyboard navigation optimization:The background process also adjusts the website’s HTML, and adds various behaviors using JavaScript code to make the website operable by the keyboard. This includes the ability to navigate the website using the Tab and Shift+Tab keys, operate dropdowns with the arrow keys, close them with Esc, trigger buttons and links using the Enter key, navigate between radio and checkbox elements using the arrow keys, and fill them in with the Spacebar or Enter key.Additionally, keyboard users will find quick-navigation and content-skip menus, available at any time by clicking Alt+1, or as the first elements of the site while navigating with the keyboard. The background process also handles triggered popups by moving the keyboard focus towards them as soon as they appear, and not allow the focus drift outside of it.Users can also use shortcuts such as “M” (menus), “H” (headings), “F” (forms), “B” (buttons), and “G” (graphics) to jump to specific elements.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

![]()

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This should only be necessary once for each IP address you access the site from.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

Semiconductor devices are built up in a series of nanofabrication processes performed on the surface of substrates made from highly pure single crystal silicon. These substrates are usually known as wafers.

Commonly used wafers include the 300 mm type, which offers the advanced miniaturization required for cutting-edge devices, and 200 mm type, which is better suited to the mixed, small lot production needed for devices for the Internet of Things (IoT).

The silicon wafers forming the base of the semiconductor are cleaned. Even slight contamination of a wafer will cause defects in the circuit. Therefore, chemical agents are used to remove all contamination, from ultra-fine particles to minute amounts of organic or metallic residues generated in the production process, or unwanted natural oxide layers generated due to exposure to air.

There are a variety of ways to form these thin films, including "sputtering", in which a target material, such as aluminum or other metal, is bombarded with ions, which knocks off atoms and molecules that are then deposited on the wafer surface, "electrodeposition", which is used to form copper wire layers (copper interconnect), chemical vapor deposition (CVD), in which special gases are mixed to cause a chemical reaction that forms a vapor containing the desired material, and then the mole-cules generated in the reaction are deposited onto the wafer surface to form a film, and thermal oxidation, in which the wafer is heated to form a silicon oxide film on the wafer surface.

Minute particles adhering to the wafer after the film deposition are removed using brushes or Nanospray with deionized water, or other physical cleaning methods.

The wafer surface is coated with resist (photosensitive chemical). Then the wafer is spun, causing a uniform layer of resist to be formed on the wafer surface by centrifugal force.

The wafer is exposed using short wavelength deep ultraviolet radiation projected through a mask on which the circuit pattern has been formed. Only the areas of the resist layer that are exposed to the light undergo a structural change, thereby transferring the pattern to the wafer. There are a variety of exposure units, including steppers, which expose several chips at a time, and scanners, which expose the wafer using a slit through which light is projected onto the wafer.

Developer is sprayed onto the wafer, dissolving the areas exposed to the light and revealing the thin film on the wafer surface. The remain-ing resist areas that are not exposed at this point become the mask for the next etching process, and that resist pattern becomes the pattern on the layer below.

In wet etching, the exposed thin film on the surface layer is dissolved using chemicals, such as hydrofluoric acid or phosphoric acid, and removed. This forms the pattern. There is also a dry etching method in which the wafer surface is bombarded with ionized atoms to remove the film layer.

Heat processing is performed using flash lamps or laser radiation to activate the doped ions implanted in the wafer. Instantaneous activation is required to create the micro transistors on the substrate.

The wafer is separated into individual chips (dicing), the chips are connected to a metal frame called a lead frame using metal wire (wire bonding) and then enclosed in epoxy resin material(packaging).

We have followed Moore’s Law to once unimaginable levels, and semiconductors have revolutionized the way we work, communicate, travel, entertain, harness energy, and treat illness, just to name a few.

And our greatest potential still lies ahead. As the building blocks of technology, semiconductors will continue to enable the world’s greatest breakthroughs. From aerospace and consumer electronics to energy and medicine, entire industries will be transformed.

The semiconductor industry has a longstanding tradition of partnering with government to spur innovation and build a bridge to the future. In the 1980s, the industry teamed with the government to establish SEMATECH, which sponsors advanced semiconductor manufacturing research and is now recognized by many as the ideal model of public-private collaboration.

The industry also helps fund cutting-edge university research through the Semiconductor Research Corporation (SRC), the world’s leading university research consortium for semiconductors and related technologies. SRC has launched hugely successful

U.S. semiconductor companies annually invest about one-fifth of total revenue in R&D – among the highest rates of any industry. The semiconductor industry has consistently prioritized R&D – even during difficult economic times and throughout fluctuations in sales revenue – because chip designers and manufacturers know that these investments will pay off down the road. The federal government should maintain its share of the partnership and fund scientific research at sustainable levels.

Through collaboration, and effective government policies, America will continue to lead the world and the semiconductor industry will continue to create jobs, drive economic growth, and develop the technologies needed to build our future.

WASHINGTON, Feb 11 (Reuters) - The White House is warning the chip industry to diversify its supply chain in case Russia retaliates against threatened U.S. export curbs by blocking access to key materials, people familiar with the matter said.

The potential for retaliation has garnered more attention in recent days after Techcet, a market research group, published a report on Feb. 1 highlighting the reliance of many semiconductor manufacturers on Russian and Ukrainian-sourced materials like neon, palladium and others.

According to Techcet estimates, over 90% of U.S. semiconductor-grade neon supplies come from Ukraine, while 35% of U.S. palladium is sourced from Russia.

Peter Harrell, who sits of the White House"s National Security Council, and his staff have been in touch with members of the chip industry in recent days, learning about their exposure to Russian and Ukrainian chipmaking materials and urging them to find alternative sources, the people said.

The White House declined to comment on the specifics of the conversations, but a senior official reiterated that the administration was prepared if Russia invaded Ukraine.

"Part of that is working with companies to make sure that if Russia takes actions that interfere with supply chains, companies are prepared for disruptions," the person said.

"We understand that other sources of key products are available and stand ready to work with our companies to help them identify and diversify their supplies."

Joe Pasetti, vice president of global public policy at the chip and electronics manufacturing suppliers group SEMI, sent an email to members this week gauging exposure to the vital chipmaking supplies, according to a copy obtained by Reuters.

"As discussed on today"s call, please see the attached document ... regarding Russian/Ukrainian production of a number of semiconductor materials," he wrote, referencing a summary by Techcet on C4F6, Palladium, Helium, Neon and Scandium from the troubled region. "Please let me know if potential supply disruptions to any of them are a concern for your company."

Neon, critical for the lasers used to make chips, is a biproduct of Russian steel manufacturing, according to Techcet. It is then purified in Ukraine. Palladium is used in sensors and memory, among other applications.

The Biden administration has threatened to impose sweeping export controls against Russia if it invades Ukraine. Russia, which has massed over 100,000 troops along Ukraine"s border, denies it plans to attack.

Some chipmakers have been reviewing their supply chains to scan for potential fallout from conflict in Ukraine. One person at a chipmaking company who declined to be named acknowledged that it has been looking into its supply of neon and other gases, some of which originate in Ukraine.

"Even if there was a conflict in Ukraine it wouldn"t cut off supply. It would drive prices up," the person said. "The market would constrict. Those gases would become pretty scarce. But it wouldn’t stop semiconductor manufacturing," he added.

According to one power chip design startup executive, unrest in Ukraine has caused rare gas prices to increase and could cause supply issues. Fluorine is another gas that has a large supply from that part of the world and could be affected, the executive added.

But the issue is still concerning, because global chip supplies are tight and chip orders are only expected to pick up. Techcet estimates demand for all the materials will rise by more than 37% over the next 4 years, pointing to recent announcements by Intel, Samsung (005930.KS), and Taiwan"s TSMC in Ohio, Arizona and Texas.

Neon prices rose 600% in the runup to Russia"s 2014 annexation of the Crimean peninsula from Ukraine, since chip firms relied on a few Ukrainian companies, according to the U.S. International Trade Commission.

The Epyc 2nd generation chip, manufactured by Advanced Micro Devices Inc. (AMD) is arranged for a photograph during a launch event in San Francisco, California, U.S., on Wednesday, Aug. 7, 2019.

As technology has advanced, semiconductor chips have spread from computers and cars to toothbrushes and tumble dryers — they now lurk beneath the hood of a surprising number of products.

Alan Priestley, an analyst at Gartner, told CNBC that the average person on the street is bound to be impacted by the chip shortage in one form or another.

"Due to the global semiconductor shortage, we are also experiencing some effects especially around certain set products and display production," said Ben Suh, head of Samsung"s investor relations, on a call with analysts.

"We are discussing with retailers and major channels about supply plans so that we are able to allocate the components to the products that have more urgency or higher priority in terms of supply."

Samsung"s co-chief executive and mobile chief, Koh Dong-jin, said at a shareholder meeting in March that there"s a serious imbalance in supply and demand of chips in the IT sector. At the time, the company said it might skip the launch of the next Galaxy Note smartphone.

LG said it is "closely monitoring the situation as no manufacturer can be free of the problem if it gets prolonged," according to The Financial Times. LG did not immediately respond to a CNBC request for comment.

Production of low-margin processors, such as those used to weigh clothes in a washing machine or toast bread in a smart toaster, has also been hit. While most retailers are still able to get their hands on these

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey