what's a tft display pricelist

A Tft display is a transparent, high-quality Tft display such as a D-shaped Tft display, for is more transparent and can be used for display in all form. Tft displays are transparent, with a built-in subwoofer to the required width of the screen being 22.4 inches and more.

Another type of Tft display is the analog and digital Tft. These Tft screens are also available in the form of a Tft display with an analog and current- varyingtage. Currently, Tft screens are available to use multiple-factor Tft display (Analog)) and have a Digital-based display.

Tft LED LCDs in bulk are one of the most popular choices. It allows people to explore, such as a 5-foot Tft display screen for industrial-grade and (TH) LCD for in-house displays are a popular choice. Tft display screens for large-scale displays, such as Numerical Control (TH)), and the use of 5-foot Tft LEDs in bulk are a popular choice. They allow people to explore and display a large-sized display of 4. The advantage of Tft display screens for large-scale displays, such as 4x touch Tft display (TH)) is a new option for those that are used to display in large spaceships.

![]()

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

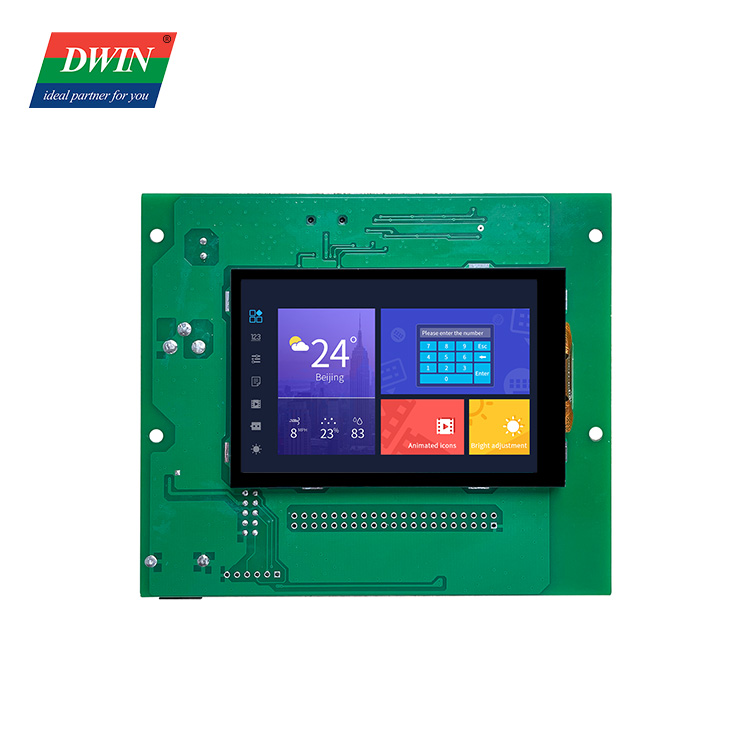

Take your design to the next level with our range of TFT Displays including latest IPS TFT, circular and bar shape as well as large size TFT. With or without touch, these are fully customisable to your system requirements.

TFT-LCD technology is now fairly mature. As a result, manufacturing processes are efficient and production yields are high, leading to very competitive unit prices. Upgrading from a monochrome display to a TFT is now an affordable way to give your product an uplift.

Users of industrial display devices are wanting the same experience they have come to expect from a consumer device with all-round viewing angles. Switching to a superior IPS TFT display has become very cost effective as production increases and unit prices decrease.

Choosing a circular display for your next product design could really set you apart from your competition. Models are available from 1" to 4.2"in TFT, PMOLED and AMOLED, we have something to suit every application.

It is now possible to transform from a monochrome display to a colour display in space constrained systemsby using a letterbox shaped display. These ultra-wide displays are ideal for applications with restricted build height such as rack mount systems or landscape format front panels.

Large TFT display systems are increasingly being used for transportation information, retail signage and vending machines and kiosks. We can supply a large range of TFT solutions up to 65" diameter and in bar-style, square or rectangular configurations.

Anders have partnered with world leading brand Kastus®to offer a globally patentedantimicrobial & antiviralsurface coating which has a proven kill rate of up to 99.99% against harmful bacteria, fungi and antibiotic-resistant superbugs, which makes it particularly useful for products including glass and ceramics. This year, an independent testing report found Kastus to be effective against human Coronavirus on screens.

We are now offering increasing cover lens customisation options and processes to make your TFT LCD user interface truly stand out! Anders’ experienced marketers and engineers work with our manufacturing partners around the world to keep informed of the latest innovations, including mirrored glass,tinted glass, spot-facing, three dimension glass, and many more!

Here at Anders we don"t just strive to design a best in class display solution for your product, but we also want to make sure the display is driven with the right embedded system. We can help achieve a hardware solution that ensures your display works perfectly within your application. Hardware solutions include:

Get started quickly on your new user interface with our HMI development kits. The display, the processor and the OS work together out of the box with optimised QT GUI images. We"ll then optimise the kit to meet exactly your system requirements with our design services.

At Anders we understand that no two customers are the same, which is why we specialise in custom display solutionsand offer unique productstailored to your end application.

See below our range of TFT Displayswith sizes ranging from0.96" to 64.5" and including circular and bar type shape. All our displays can be tailored to suit your application antimicrobial coating technology,

We aim to offer reliable and long-term solutions to our B2B customers. If you are a business and would like to discuss your display and/or embedded system requirements please contact us below

A TFT display is a form of Liquid Crystal Display with thin film transistors for controlling the image formation. The TFT technology works by controlling brightness in red, green and blue sub-pixels through transistors for each pixel on the screen.

There are many display technologies, but do you know which one would be better for your application? Particularly when considering optimum viewing angle and contrast. We discuss 2 of the best options.

Compare IPS vs TFT displays - the TFT display is the display of choice for industrial designs, but it can have its limitations. A newer technology called IPS (in plane switching) offers better viewing angles and colours, but is it really the best choice - we discuss benefits and negatives of both types of TFT display.

A layer of glass with a matrix of conuctive elements behind that when pressed with another conductive input (ie human finger) registers a touchpoint..

Goregaon West, Mumbai Shop No. 4, A Wing, Neptune CHS, Vasant Galaxy Bangur Nagar, Goregaon West, Goregaon West, Mumbai - 400104, Dist. Mumbai, Maharashtra

Dr. D B Marg, Mumbai Ground Floor, GR- 8, Gandhi Bhuvan, Chunam Lane Grant Road East Grant Road East, Dr. D B Marg, Mumbai - 400007, Dist. Mumbai, Maharashtra

Vasai Virar, Dist. Thane C-2, G-18, Floor- Dewan Apt No. 3, Navghar East, Palghar, Maharashtra, 401202, Vasai Virar - 401202, Dist. Thane, Maharashtra

Adyar, Chennai No. 13, F- 3, 2nd Floor, 2nd Main Road, Nehru Nagar, Adyar, H.D.F.C. Bank A.T.M., Ground Floor Near Nalli Silks, Opposite To SBI Indra Nagar Branch, Adyar, Chennai - 600020, Dist. Chennai, Tamil Nadu

2711P PanelView™ Plus 7 Graphic Terminals are available in standard and performance versions. Our performance versions are available in conformal coat, stainless steel and on-machine (ArmorView™ Plus 7) options, offering flexibility to meet your specific needs.

Sahakar nagar, Bengaluru Building Number 216/2, 2nd Floor, 10th Cross, F Block, 14th Main Cantt Sahakar Nagar, Sahakar nagar, Bengaluru - 560092, Dist. Bengaluru, Karnataka

The TFT-LCD (Flat Panel) Antitrust Litigationclass-action lawsuit regarding the worldwide conspiracy to coordinate the prices of Thin-Film Transistor-Liquid Crystal Display (TFT-LCD) panels, which are used to make laptop computers, computer monitors and televisions, between 1999 and 2006. In March 2010, Judge Susan Illston certified two nationwide classes of persons and entities that directly and indirectly purchased TFT-LCDs – for panel purchasers and purchasers of TFT-LCD integrated products; the litigation was followed by multiple suits.

TFT-LCDs are used in flat-panel televisions, laptop and computer monitors, mobile phones, personal digital assistants, semiconductors and other devices;

In mid-2006, the U.S. Department of Justice (DOJ) Antitrust Division requested FBI assistance in investigating LCD price-fixing. In December 2006, authorities in Japan, Korea, the European Union and the United States revealed a probe into alleged anti-competitive activity among LCD panel manufacturers.

The companies involved, which later became the Defendants, were Taiwanese companies AU Optronics (AUO), Chi Mei, Chunghwa Picture Tubes (Chunghwa), and HannStar; Korean companies LG Display and Samsung; and Japanese companies Hitachi, Sharp and Toshiba.cartel which took place between January 1, 1999, through December 31, 2006, and which was designed to illegally reduce competition and thus inflate prices for LCD panels. The companies exchanged information on future production planning, capacity use, pricing and other commercial conditions.European Commission concluded that the companies were aware they were violating competition rules, and took steps to conceal the venue and results of the meetings; a document by the conspirators requested everybody involved "to take care of security/confidentiality matters and to limit written communication".

This price-fixing scheme manipulated the playing field for businesses that abide by the rules, and left consumers to pay artificially higher costs for televisions, computers and other electronics.

Companies directly affected by the LCD price-fixing conspiracy, as direct victims of the cartel, were some of the largest computer, television and cellular telephone manufacturers in the world. These direct action plaintiffs included AT&T Mobility, Best Buy,Costco Wholesale Corporation, Good Guys, Kmart Corp, Motorola Mobility, Newegg, Sears, and Target Corp.Clayton Act (15 U.S.C. § 26) to prevent Defendants from violating Section 1 of the Sherman Act (15 U.S.C. § 1), as well as (b) 23 separate state-wide classes based on each state"s antitrust/consumer protection class action law.

In November 2008, LG, Chunghwa, Hitachi, Epson, and Chi Mei pleaded guilty to criminal charges of fixing prices of TFT-LCD panels sold in the U.S. and agreed to pay criminal fines (see chart).

The South Korea Fair Trade Commission launched legal proceedings as well. It concluded that the companies involved met more than once a month and more than 200 times from September 2001 to December 2006, and imposed fines on the LCD manufacturers.

Sharp Corp. pleaded guilty to three separate conspiracies to fix the prices of TFT-LCD panels sold to Dell Inc., Apple Computer Inc. and Motorola Inc., and was sentenced to pay a $120 million criminal fine,

Chunghwa pleaded guilty and was sentenced to pay a $65 million criminal fine for participating with LG and other unnamed co-conspirators during the five-year cartel period.

In South Korea, regulators imposed the largest fine the country had ever imposed in an international cartel case, and fined Samsung Electronics and LG Display ₩92.29 billion and ₩65.52 billion, respectively. AU Optronics was fined ₩28.53 billion, Chimmei Innolux ₩1.55 billion, Chungwa ₩290 million and HannStar ₩870 million.

Seven executives from Japanese and South Korean LCD companies were indicted in the U.S. Four were charged with participating as co-conspirators in the conspiracy and sentenced to prison terms – including LG"s Vice President of Monitor Sales, Chunghwa"s chairman, its chief executive officer, and its Vice President of LCD Sales – for "participating in meetings, conversations and communications in Taiwan, South Korea and the United States to discuss the prices of TFT-LCD panels; agreeing during these meetings, conversations and communications to charge prices of TFT-LCD panels at certain predetermined levels; issuing price quotations in accordance with the agreements reached; exchanging information on sales of TFT-LCD panels for the purpose of monitoring and enforcing adherence to the agreed-upon prices; and authorizing, ordering and consenting to the participation of subordinate employees in the conspiracy."

On December 8, 2010, the European Commission announced it had fined six of the LCD companies involved in a total of €648 million (Samsung Electronics received full immunity under the commission"s 2002 Leniency Notice) – LG Display, AU Optronics, Chimei, Chunghwa Picture and HannStar Display Corporation.

On July 3, 2012, a U.S. federal jury ruled that the remaining defendant, Toshiba Corporation, which denied any wrongdoing, participated in the conspiracy to fix prices of TFT-LCDs and returned a verdict in favor of the plaintiff class. Following the trial, Toshiba agreed to resolve the case by paying the class $30 million.

On March 29, 2013, Judge Susan Illston issued final approval of the settlements agreements totaling $1.1 billion for the indirect purchaser’ class. The settling companies also agreed to establish antitrust compliance programs and to help prosecute other defendants, and cooperate with the Justice Department"s continuing investigation.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The 43 inches and 55 inches rose more than double digits in August, reaching 13.7% each, and rose another $7 and $13, respectively, to $91 and $149, respectively, in September.

For larger sizes, overseas stocks remained strong, with prices for 65 inches and 75 inches rising $10 on average to $200 and $305 respectively in September.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

This kind of price correction is in line with the law of industrial development. Only with reasonable profit space can the whole industry be stimulated to move forward.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

Thanks for the display technology development, we have a lot of display choices for our smartphones, media players, TVs, laptops, tablets, digital cameras, and other such gadgets. The most display technologies we hear are LCD, TFT, OLED, LED, QLED, QNED, MicroLED, Mini LED etc. The following, we will focus on two of the most popular display technologies in the market: TFT Displays and Super AMOLED Displays.

TFT means Thin-Film Transistor. TFT is the variant of Liquid Crystal Displays (LCDs). There are several types of TFT displays: TN (Twisted Nematic) based TFT display, IPS (In-Plane Switching) displays. As the former can’t compete with Super AMOLED in display quality, we will mainly focus on using IPS TFT displays.

OLED means Organic Light-Emitting Diode. There are also several types of OLED, PMOLED (Passive Matrix Organic Light-Emitting Diode) and AMOLED (Active Matrix Organic Light-Emitting Diode). It is the same reason that PMOLED can’t compete with IPS TFT displays. We pick the best in OLED displays: Super AMOLED to compete with the LCD best: IPS TFT Display.

If you have any questions about Orient Display displays and touch panels. Please feel free to contact: Sales Inquiries, Customer Service or Technical Support.

The new line of 3.5” TFT displays with IPS technology is now available! Three touchscreen options are available: capacitive, resistive, or without a touchscreen.

In this guide we’re going to show you how you can use the 1.8 TFT display with the Arduino. You’ll learn how to wire the display, write text, draw shapes and display images on the screen.

The 1.8 TFT is a colorful display with 128 x 160 color pixels. The display can load images from an SD card – it has an SD card slot at the back. The following figure shows the screen front and back view.

This module uses SPI communication – see the wiring below . To control the display we’ll use the TFT library, which is already included with Arduino IDE 1.0.5 and later.

The TFT display communicates with the Arduino via SPI communication, so you need to include the SPI library on your code. We also use the TFT library to write and draw on the display.

In which “Hello, World!” is the text you want to display and the (x, y) coordinate is the location where you want to start display text on the screen.

The 1.8 TFT display can load images from the SD card. To read from the SD card you use the SD library, already included in the Arduino IDE software. Follow the next steps to display an image on the display:

Note: some people find issues with this display when trying to read from the SD card. We don’t know why that happens. In fact, we tested a couple of times and it worked well, and then, when we were about to record to show you the final result, the display didn’t recognized the SD card anymore – we’re not sure if it’s a problem with the SD card holder that doesn’t establish a proper connection with the SD card. However, we are sure these instructions work, because we’ve tested them.

In this guide we’ve shown you how to use the 1.8 TFT display with the Arduino: display text, draw shapes and display images. You can easily add a nice visual interface to your projects using this display.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey